How to Use the FreshBooks Free Invoice Template for Your Business

Managing payments and financial records efficiently is a crucial part of any business. Whether you’re a freelancer, a small business owner, or an entrepreneur, having a structured method to request payment from clients can save you time and reduce errors. Luckily, there are tools available to simplify this process, allowing you to focus on what matters most–growing your business.

One of the most effective ways to streamline billing is by using professionally designed documents that are easy to customize and track. These resources help you create clear, concise records of transactions that are both visually appealing and legally sound. With the right approach, you can ensure timely payments and maintain a professional image with minimal effort.

In this guide, we will explore how to take advantage of these helpful resources to enhance your billing practices. From customizing content to sending and tracking payments, you’ll learn everything you need to get started quickly and effectively. Whether you are new to this or simply looking to improve your current system, you’ll find useful tips and insights to make the process as seamless as possible.

FreshBooks Free Invoice Template Overview

Managing payments and billing tasks can be a time-consuming and complex process for many small businesses and freelancers. Simplifying this process with a pre-designed solution can save valuable time and ensure accuracy. This system offers an intuitive and easy-to-use tool that helps users create clear and professional billing documents with minimal effort. It provides a wide range of customizable options that meet the needs of businesses in various industries.

By utilizing this resource, users can quickly produce documents that reflect their brand’s style while maintaining a high standard of professionalism. Here’s an overview of what this tool has to offer:

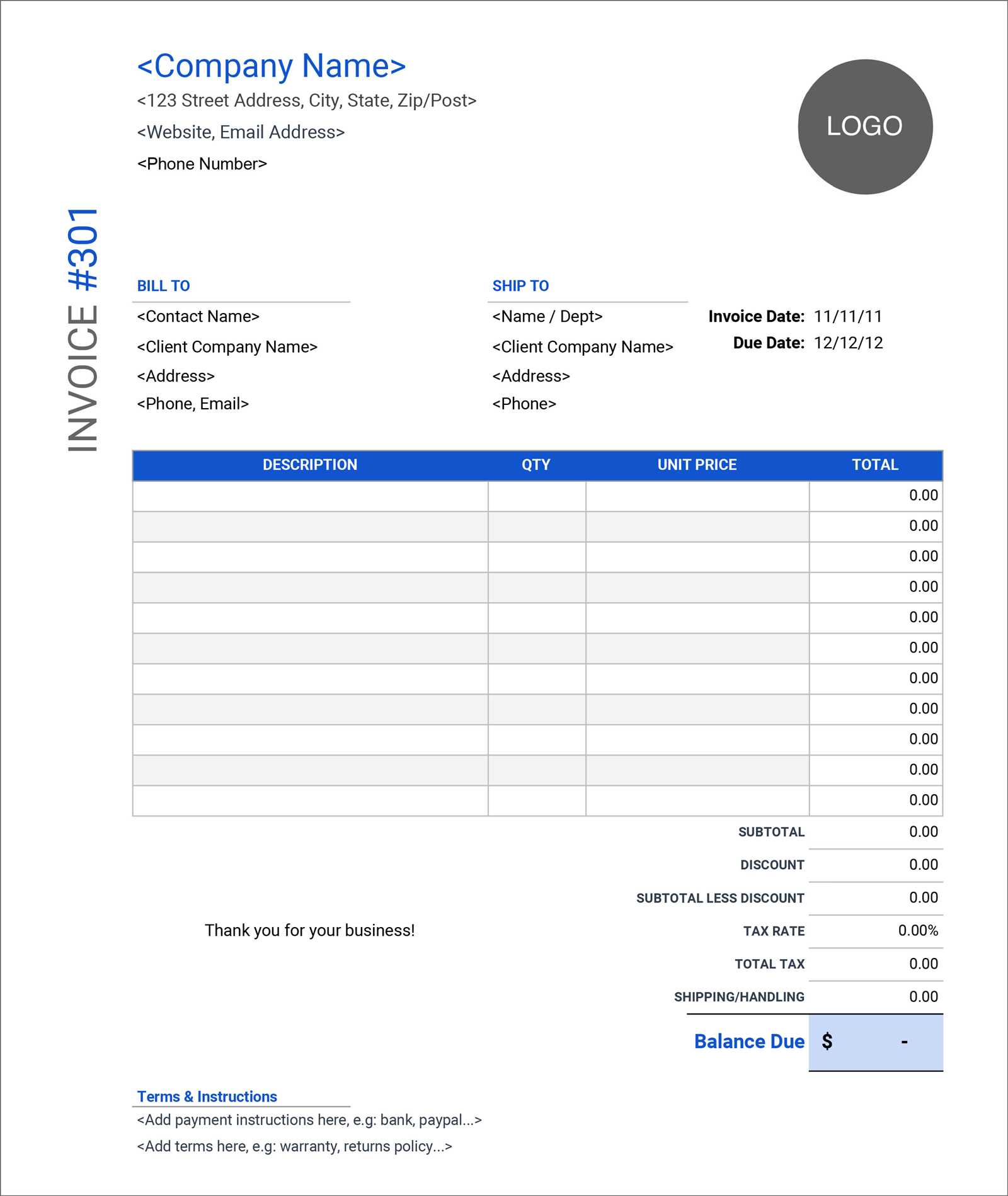

- Easy Customization: Modify fields for client information, services, taxes, and payment terms.

- Professional Design: Templates are created with a clean and modern layout that ensures clarity.

- Time-saving Features: Automated calculations for taxes, discounts, and totals allow for error-free documents.

- Instant Access: Create and send documents directly from the platform with just a few clicks.

- Track Payments: Monitor the status of your documents to stay on top of outstanding payments.

This tool is ideal for small businesses and freelancers who want to maintain a polished image and improve their billing workflow. Whether you are invoicing for services, products, or both, it helps you streamline your accounting tasks and ensure timely payments.

Why Choose FreshBooks for Invoicing

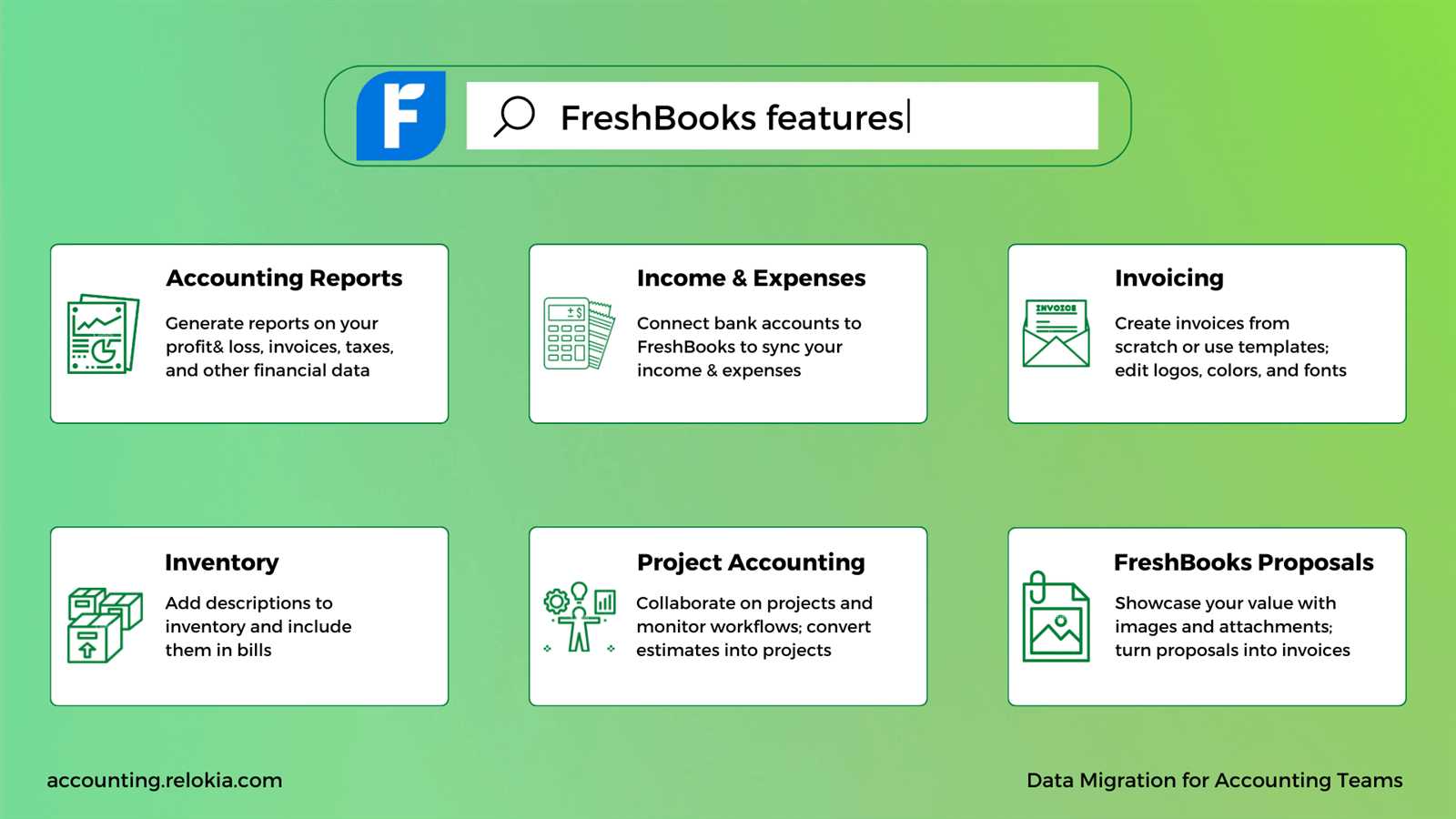

When it comes to managing financial documents, businesses need a reliable and efficient solution that saves time and reduces the risk of errors. A well-designed tool can automate many aspects of the billing process, allowing business owners to focus on growing their operations rather than managing paperwork. This platform offers a variety of features that make it a top choice for individuals and small businesses seeking a streamlined and professional approach to managing payments.

Here are some key reasons why this solution stands out for generating and managing billing documents:

- User-Friendly Interface: With a simple and intuitive design, even those with little experience in accounting can quickly generate professional documents.

- Customizable Features: Adjust fields, branding, and layout to match your business identity and specific needs, ensuring every document is personalized.

- Automated Calculations: The platform handles all the math, from taxes to totals, reducing the chance for manual errors.

- Payment Tracking: Easily monitor outstanding payments and send reminders to clients, ensuring you stay on top of cash flow.

- Cloud-Based Access: Manage all your records from anywhere, on any device, without the need for complex installations or software updates.

Whether you’re a freelancer handling a few clients or a growing business managing multiple projects, this platform helps ensure that your billing process is smooth, professional, and stress-free.

How to Download FreshBooks Invoice Template

Accessing and using pre-designed documents for billing purposes has never been easier. This platform allows users to quickly obtain customizable resources that help simplify the billing process. Whether you need a basic document or one with advanced features, downloading it is a straightforward process that can be completed in just a few simple steps.

To get started, follow these steps:

- Create an Account: First, sign up for an account on the platform. You will need to provide basic details such as your name, email address, and business information.

- Log In to Your Dashboard: Once registered, log in to your account to access the dashboard where all your tools and resources are located.

- Navigate to Billing Section: Look for the section dedicated to financial documents or billing options. This is where you will find a variety of formats ready for use.

- Select Your Preferred Document: Browse through the available options and choose the one that best suits your needs. There are multiple designs and layouts to pick from.

- Download the Document: After selecting the layout, simply click the download button. The document will be available in an editable format, ready for customization.

Once downloaded, you can begin personalizing the document with your business and client information, services offered, and payment terms. The entire process is designed to save you time and effort while ensuring the highest level of professionalism in your business communications.

Customizing Your FreshBooks Invoice Template

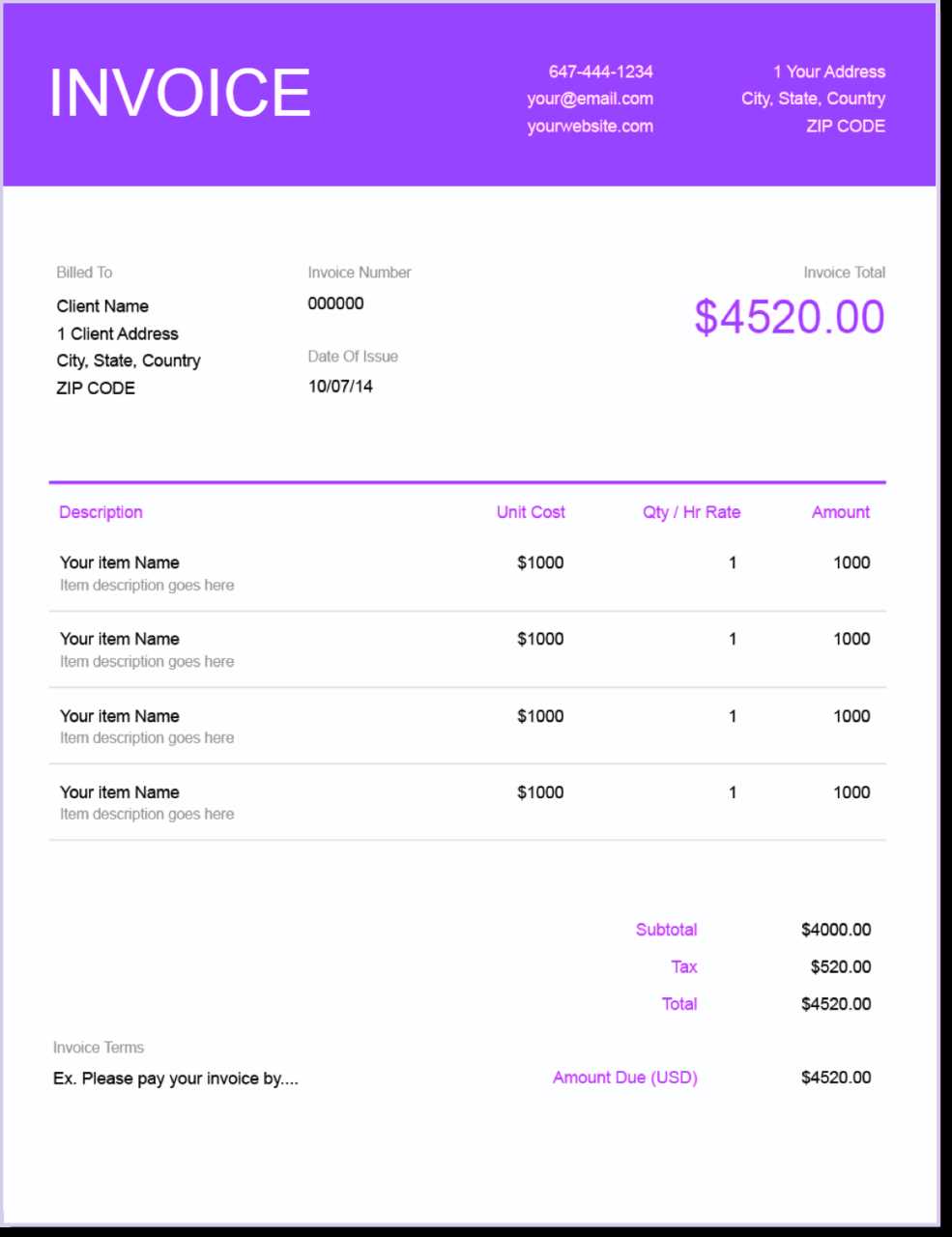

One of the main advantages of using pre-designed billing documents is the ability to tailor them to suit your business’s unique needs. Customization allows you to add personal touches that reflect your brand while ensuring all essential details are accurately represented. Whether you want to update your business logo, modify the layout, or include specific terms, the process is simple and flexible, providing you with a professional result every time.

Adding Personal Information and Branding

Start by including your business name, logo, and contact information at the top of the document. This helps clients easily identify your company and establishes a sense of professionalism. You can also modify the color scheme to match your brand’s identity, ensuring the document aligns with your overall aesthetic.

Modifying Itemized Details

Once the basic layout is set, focus on customizing the section where services or products are listed. You can adjust the descriptions, prices, quantities, and any other relevant details for each item. Additionally, you can add or remove fields depending on the nature of your services, such as taxes, discounts, or additional notes to ensure all necessary information is captured accurately.

These easy-to-use customization features allow you to create a document that is both functional and aligned with your business’s identity. With just a few adjustments, you can streamline your billing process and present your company in the best possible light.

Essential Features of FreshBooks Invoices

When managing billing processes, having an efficient and user-friendly document is crucial for smooth transactions. The right set of functionalities can streamline the creation, delivery, and management of financial records, ensuring clarity and professionalism in every exchange. A well-designed billing system offers a range of key features that not only enhance usability but also help maintain accuracy and consistency across all client communications.

Customizable Layouts: The ability to tailor the format according to business needs allows for a more personalized presentation. From adjusting logos to selecting specific fields, customization enhances brand identity while keeping the document simple and intuitive for clients.

Automatic Calculations: Simplifying complex arithmetic with built-in tools ensures no errors when summing amounts. These tools can automatically calculate totals, taxes, and discounts, saving time and reducing the risk of mistakes.

Itemized Breakdown: Providing a clear, item-by-item listing of charges fosters transparency. It allows clients to understand exactly what they are being billed for, which can lead to faster payments and fewer disputes.

Recurring Billing: For businesses with regular clients, setting up recurring cycles saves time. Automated schedules can generate regular documents without additional input, ensuring that nothing is missed.

Payment Integration: Direct integration with payment gateways speeds up the transaction process. Clients can settle their dues with a single click, improving overall efficiency and customer satisfaction.

Tax Handling: Efficient tax calculation based on regional laws and predefined rules ensures that all documents are compliant. This feature simplifies the process for businesses operating in multiple locations, helping to avoid costly errors.

Benefits of Using Free Invoice Templates

Utilizing pre-designed documents for financial transactions offers a variety of advantages for businesses. These ready-made solutions help streamline the process of billing and ensure that all necessary elements are included, without the need to create a document from scratch. By choosing a well-constructed layout, users can save time, reduce errors, and maintain a professional appearance in their dealings with clients.

One of the primary benefits is the time-saving aspect. Pre-made formats eliminate the need to design and structure each document individually, allowing businesses to focus on other important tasks. This is particularly valuable for small businesses or freelancers who may not have the resources to dedicate to administrative work.

Consistency and Professionalism are also key advantages. Using standardized formats ensures that each transaction is presented in a clear, organized manner. Clients are more likely to trust and pay quickly when they receive well-structured, easy-to-read records that clearly outline the terms of the agreement.

Customization options allow for some level of personalization, enabling users to adapt the design to match their brand identity. With minor adjustments, businesses can incorporate logos, specific payment terms, and personalized fields, giving the document a unique touch while maintaining its functionality.

Another significant benefit is the error reduction provided by automated fields and pre-set calculations. Many pre-built documents come with formulas that help avoid manual mistakes when adding up totals or applying taxes, thus improving accuracy and reliability.

Additionally, these tools often offer easy accessibility, enabling users to access and send documents quickly, even from mobile devices. This ensures a smoother and faster billing cycle, leading to improved cash flow and client satisfaction.

How FreshBooks Simplifies Billing

Managing financial documentation can be a time-consuming and complex task for businesses of all sizes. However, there are solutions that streamline this process, reducing the administrative burden and ensuring accuracy. With the right set of tools, generating and sending clear, organized records becomes fast and hassle-free, enabling businesses to focus on growth and client relationships.

One way this process is simplified is through automated features that eliminate the need for manual entry and calculations. These tools handle everything from arithmetic to applying taxes, ensuring that documents are accurate every time. Here are some key ways the system makes billing easier:

- Automatic Calculations: With pre-set formulas, totals, taxes, and discounts are calculated instantly, removing the chance of human error.

- Recurring Billing: For clients with regular payments, recurring billing cycles automatically generate and send statements on a set schedule, freeing up time for other tasks.

- Customizable Designs: Easily tailor documents with logos, payment terms, and branding elements, maintaining a professional appearance without the need for design skills.

- Multiple Payment Options: Clients can choose their preferred method of payment, whether through credit cards, bank transfers, or online payment systems, all directly integrated within the document.

Additionally, the system enables businesses to track payments and send reminders for outstanding balances, reducing the time spent on follow-ups. By simplifying each step of the process, businesses can maintain a smooth cash flow and strengthen their client relationships.

Setting Up Your Business Information

Establishing clear and accurate details about your business is a crucial step in ensuring smooth financial operations. Having all the relevant information readily available helps present a professional image to clients while also streamlining administrative tasks. Proper setup allows for easy customization of financial documents, ensuring consistency across all transactions.

Basic Information to Include

When setting up your business profile, it’s essential to include the following key details:

- Business Name: Ensure the official name of your company is accurate and matches your registered records.

- Address: Include the physical location of your business, which is often required for legal purposes.

- Contact Information: Provide your phone number, email, and website so clients can reach you easily.

- Tax Identification Number: Include this number for tax compliance and reporting purposes.

Additional Customization Options

In addition to the basic details, you can further personalize your business profile with the following:

- Logo: Adding your company logo helps maintain brand consistency and makes your financial records more recognizable.

- Payment Terms: Clearly define the terms of payment, including due dates, late fees, and accepted methods of payment.

By ensuring that your business information is correctly entered and well-organized, you set the foundation for efficient and professional transactions with clients, reducing the chance of errors and misunderstandings.

Adding Client Details in FreshBooks

Accurately storing client information is essential for efficient financial record-keeping and smooth communication. Properly inputting and organizing client data ensures that each transaction is clearly associated with the right individual or business. This process also helps streamline invoicing, payment tracking, and client relationship management.

Key Client Information to Include

When adding a new client, it’s important to include all relevant details to ensure that future communications and transactions are seamless. Below are the essential pieces of information to enter:

| Client Name | Business Name | Contact Number | Email Address |

|---|---|---|---|

| John Doe | John’s Design Studio | (123) 456-7890 | [email protected] |

| Jane Smith | Smith Consulting | (987) 654-3210 | [email protected] |

Additional Information for Better Client Management

Beyond basic contact details, there are other fields that help provide a comprehensive profile of each client:

- Billing Address: Essential for ensuring that the client’s location is accurately reflected in financial records.

- Payment Terms: Include specific payment agreements or preferences for each client, such as due dates and methods.

- Notes: Add any important reminders or custom details that may help when communicating with the client in the future.

By keeping this information organized and up-to-date, businesses can ensure a more efficient and professional experience for both clients and staff.

How to Add Products and Services

Adding your offerings to a billing system helps streamline the process of generating and managing financial records. By clearly defining each product or service, businesses can ensure accurate documentation for clients and easily track sales and expenses. This step is essential for keeping inventory organized and maintaining transparency in every transaction.

Steps to Add Products or Services

To begin, you’ll need to input details about each product or service you offer. This ensures that every charge is correctly represented and can be easily accessed when creating financial records. Here are the essential steps to follow:

- Product or Service Name: Clearly define the item or service, ensuring it matches the description you typically use when discussing it with clients.

- Unit Price: Enter the cost per unit for the product or service. This helps in calculating totals based on the quantity provided.

- Description: Add a brief description of the product or service. This provides context for clients, clarifying exactly what they are being charged for.

- Tax Rates: Specify the applicable tax rate for each item. This is essential for maintaining compliance and calculating accurate totals.

- SKU or Service Code: If applicable, include the stock keeping unit (SKU) or any internal reference code for easier inventory management.

Organizing Your Offerings

Once your products or services are added, it’s important to categorize them effectively to make future access easier. You can organize them by type, price range, or category to quickly find and apply them during the billing process. Here’s how you can optimize your setup:

- Categories: Group similar products or services together. This makes it easier to manage and track sales over time.

- Templates: Create preset options for frequently used products or services to quickly add them to financial records.

- Inventory Tracking: For physical g

Applying Taxes and Discounts on Invoices

Calculating the correct tax and applying appropriate discounts ensures that financial documents are accurate and comply with local regulations. By integrating these elements, businesses can maintain transparent pricing, provide value to customers, and avoid issues related to overcharging or undercharging. This process is essential for keeping billing consistent and professional across all transactions.

Tax Calculation

Taxes are an important part of the billing process, and it’s essential to apply them correctly based on regional laws and the type of goods or services provided. Below is an example of how taxes can be applied:

Item Price Tax Rate Tax Amount Total Web Design Service $500.00 10% $50.00 $550.00 Logo Design $200.00 10% $20.00 $220.00 As shown above, applying the correct tax rate ensures that the total amount due reflects the proper charges. Be sure to adjust tax rates based on the client’s location or any exemptions that may apply.

Applying Discounts

Discounts can be a great way to incentivize customers or reward long-term clients. When applying discounts, ensure that they are calculated on the correct subtotal before tax is added, or after, depending on your business model.

Item Setting Payment Terms and Due Dates Establishing clear payment terms and due dates is vital for maintaining healthy cash flow and fostering professional relationships with clients. By clearly outlining expectations for payment timelines, businesses can reduce misunderstandings and ensure timely compensation for services or products provided. Well-defined terms also promote a sense of security and trust between both parties.

Common Payment Terms

When setting payment conditions, there are several options you can consider based on your business model and the client’s needs. Below are some common payment terms used in various industries:

- Net 30: Payment is due within 30 days from the date the document is issued.

- Net 60: Payment is due within 60 days of the document date, commonly used for larger projects or corporate clients.

- Due on Receipt: Payment is expected as soon as the document is received, often used for short-term services or products.

- Installments: The total amount is split into smaller, scheduled payments over time.

Setting Due Dates

Setting a specific due date helps clients understand when their payment is expected, preventing delays and confusion. A clearly stated due date also allows you to plan your financial operations more effectively. Here are a few guidelines for setting due dates:

- Consider the Project Length: For longer projects, you might prefer a longer payment window or installment plan.

- Client Preferences: Some clients may prefer extended payment terms, while others may need faster payment cycles. Flexibility can help secure deals.

- Clear Communication: Ensure that both you and the client are on the same page regarding the due date, especially if special conditions apply (e.g., holidays, weekends).

By setting appropriate payment terms and clearly indicating due dates, businesses can ensure that they are compensated on time while maintaining positive relationship

How to Send Invoices via Email

Sending financial documents through email is a fast and effective way to ensure that your clients receive their billing statements promptly. This method not only reduces the chances of lost documents but also provides a clear, easily accessible record for both you and the client. Properly sending these documents through email ensures smooth communication and avoids delays in payment.

Steps to Send Documents by Email

Follow these simple steps to efficiently send your billing statements to clients via email:

- Prepare the Document: Ensure that all the details are accurate, including the services provided, payment terms, and due dates. Double-check for any errors before proceeding.

- Choose the Right Format: Save the document in a universally accepted format, such as PDF. This ensures that your client can open it easily on any device.

- Compose a Clear Email: Write a professional email to accompany the document. Be sure to briefly explain the attachment and include the due date and any other relevant information.

- Attach the Document: Attach the prepared document to your email. Double-check that the correct file is attached before hitting send.

- Send the Email: Address the email to the correct recipient, and ensure that the subject line is clear (e.g., “Billing Statement for [Client Name] – Due [Date]”).

Best Practices for Emailing Billing Statements

To maintain professionalism and ensure successful communication, consider the following best practices:

- Clear Subject Line: Use a concise subject line that indicates the purpose of the email, such as “Payment Reminder” or “Billing Statement for [Month].”

- Use a Professional Tone:

Tracking Billing Status

Keeping track of the status of your financial documents is an essential part of managing your business’s cash flow. Monitoring whether a payment has been made, is pending, or overdue allows you to take appropriate actions to follow up with clients and ensure that your records are up to date. An effective system for tracking the status of these documents ensures that nothing is missed and that you stay on top of your financial responsibilities.

How to Track the Status of Financial Documents

To efficiently monitor the status of your financial documents, follow these steps:

- Check Payment Status: Most platforms allow you to view the current status of each document, including whether it’s been paid, is still pending, or is overdue.

- Set Notifications: Enable notifications to be alerted when a payment is made, or when a document becomes overdue. This will help you act quickly when necessary.

- Review Document History: Access detailed histories of transactions, including the payment date, amount, and any associated notes, to better understand the status of each document.

Understanding Common Document Statuses

There are several key statuses that indicate the current state of each billing document:

- Paid: The amount due has been fully paid, and the document is closed.

- Unpaid: No payment has been received yet, and the document is still open.

- Overdue: The payment due date has passed, and payment has not yet been made.

- Partially Paid: A partial payment has been received, and the remaining balance is still due.

By keeping a close eye on these statuses, you can ensure that you are up to date with payments and can quickly follow up with clients when necessary. Effective trac

Managing Payments and Overdue Documents

Effectively managing payments and addressing overdue documents is essential for maintaining healthy cash flow and ensuring your business remains financially stable. Properly tracking payments helps prevent misunderstandings with clients and ensures that you can take timely actions when payments are delayed. Having clear procedures in place for overdue documents can also help you maintain professional relationships while securing timely payments.

How to Handle Payments

Once you send out your financial documents, it’s important to track payments and mark them accordingly. Here’s how to manage payments efficiently:

- Monitor Payment Status: Regularly check the status of payments to ensure that funds are received on time. Set up notifications to track any incoming payments automatically.

- Record Payments Promptly: When a payment is received, update the status of the document to reflect that it’s been paid. This keeps your records accurate and prevents confusion later.

- Offer Multiple Payment Methods: Allow clients to pay through different channels such as bank transfers, credit cards, or online payment systems. The more payment options you provide, the more likely clients are to pay on time.

Dealing with Overdue Documents

If a document becomes overdue, it’s important to handle the situation professionally and promptly. Here’s how to manage overdue documents effectively:

- Send a Reminder: Politely remind the client of the overdue payment. You can send an email or call them directly to follow up on the outstanding balance.

- Offer Payment Plans: If the client is experiencing financial difficulties, consider offering a payment plan to help them settle the balance in smaller installments.

- Charge Late Fees: If outlined in your agreement, applying a late fee can encourage timely payments and help cover the costs of any delays.

- Escalate the Matter:

Exporting Documents for Accounting Purposes

Exporting financial records is an important step in maintaining accurate accounting records and ensuring your business stays compliant with tax regulations. By exporting these documents, you can easily integrate them into your accounting software, provide detailed reports to your accountant, or store them for future reference. This process streamlines the management of your financial data, making tax filing and audits simpler and more efficient.

Steps for Exporting Documents

To successfully export your financial records, follow these steps:

- Select the Documents: Choose the specific records or transactions you wish to export. Ensure you include all relevant documents that need to be accounted for.

- Choose the File Format: Decide on the file format, such as CSV, PDF, or Excel, that is compatible with your accounting software or preferred storage method.

- Review the Data: Before exporting, double-check the details to ensure the information is accurate and up-to-date. This will help avoid mistakes during the accounting process.

- Export the Files: Once you’re satisfied with the selection and the format, click the export option to save or send the documents to the desired location.

Important Considerations

When exporting financial records, it’s important to keep the following in mind:

- Consistency: Regularly export your documents to keep your accounting records up-to-date. This ensures that your financial statements are always accurate.

- Backup Your Files: Always create backups of exported documents to ensure you don’t lose critical information in case of technical issues or system failures.

- Security: Make sure the exported files are securely stored and only accessible by authorized personnel. Protect sensitive financial data from potential breaches.

Example of Exported Data

Here’s an example of how exported financial data might appear in a spreadsheet:

Mobile Access to Billing Documents

Having the ability to manage your financial documents from anywhere is essential for business owners on the go. With mobile access, you can quickly view, send, and track your transactions, ensuring that you’re always in control of your financial processes, even when you’re away from the office. Whether you’re meeting clients, traveling, or working remotely, mobile access makes it easy to stay on top of your business’s financial operations.

Key Features of Mobile Access

Accessing your financial documents through a mobile device offers several convenient features:

- Real-Time Updates: Instantly view the status of your transactions, whether they’re pending, paid, or overdue, giving you up-to-date information at any time.

- Easy Document Management: Create, send, and manage your financial documents directly from your mobile device, allowing you to stay productive no matter where you are.

- Notifications: Receive notifications for actions such as payment receipts, overdue documents, and other important updates, ensuring that you never miss a key event.

- Secure Access: Access your documents securely with encryption and authentication protocols to protect sensitive financial data on the go.

How to Access Billing Information on Your Mobile Device

To start managing your financial documents on your mobile device, follow these steps:

- Download the App: Install the mobile app that supports access to your financial records from your app store.

- Log In: Use your account credentials to log into the app and gain secure access to your documents.

- Navigate the Interface: Familiarize yourself with the mobile interface, where you can easily view, create, and track your documents in a user-friendly e

Alternatives to Billing Document Templates

There are several options available for businesses looking to streamline their billing processes without relying on pre-designed forms. These alternatives offer flexibility and customization, allowing users to create financial records that fit their specific needs. Whether you prefer using specialized software, online tools, or manual methods, there is an option that can help you manage your transactions more effectively.

Some of the most popular alternatives include:

- Custom Software Solutions: Tailored applications designed specifically for your business can offer advanced features such as integration with accounting systems, recurring payments, and automated reminders. These solutions often allow for full control over document design and functionality.

- Online Platforms: Many cloud-based platforms offer simple and intuitive ways to generate financial records with minimal effort. These tools often provide templates that can be customized, but with the added benefit of being accessible from any device with an internet connection.

- Spreadsheets: For those who prefer a more hands-on approach, spreadsheets can be used to manually create and manage financial documents. With customizable cells and built-in functions, spreadsheets are a flexible option for businesses with simple billing needs.

- Word Processing Programs: Software like Microsoft Word or Google Docs can also be used to create billing documents. These programs allow for complete design freedom, enabling users to craft professional-looking records without specialized software.

Each of these alternatives provides distinct advantages depending on your business size, budget, and specific needs. While some require more manual effort, others offer automation features that can save you time and improve accuracy in your financial management.