Guide to Editing Invoice Templates in FreshBooks for a Personalized Touch

Personalizing your billing documents is essential for any business aiming to establish a unique and professional presence. Tailored documents not only reinforce your brand identity but also make the payment process clearer and more efficient for clients. By adjusting various elements, you can create a custom billing format that aligns perfectly with your business image and client expectations.

From adding logos and selecting fonts to adjusting fields for detailed descriptions, customizing these forms allows flexibility in both design and functionality. Each feature you enhance helps convey a polished look while ensuring that all necessary details are included. Tailoring these elements helps set a professional tone and assures clients of your commitment to quality and transparency.

Beyond appearance, fine-tuning specific settings can simplify communication about payment terms, due dates, and any special conditions. Such improvements make it easier for clients to process payments quickly and accurately. This guide will walk you through each step of transforming your billing layout, helping you create polished, user-friendly documents that support your business

Understanding FreshBooks Invoice Templates

Creating structured billing documents that reflect your brand’s professionalism is crucial for effective financial management. These documents serve not only as a formal record of transactions but also as a valuable communication tool between you and your clients. Knowing how to make the most of these documents can help your business appear organized and credible.

The Role of Customizable Billing Formats

Customizable formats allow you to modify each aspect of your billing document to suit specific needs. With options to adjust layouts, integrate logos, and include essential details like due dates and contact information, these adaptable designs provide flexibility. This ensures that every document you send represents your brand consistently and professionally.

Why Customization Matters for Professionalism

Adjusting elements to suit your business’s style can make a positive impression on clients, reinforcing trust and professionalism. A well-organized billing format signals attention to detail and can even help minimize payment errors. By taking advantage of these customizable features, you

Why Customize Your Invoices in FreshBooks

Tailoring your billing documents provides more than just a professional appearance; it’s an effective way to streamline your financial interactions and ensure clarity in every transaction. By making these adjustments, you can align each document with your brand’s style and specific needs, offering clients a consistent experience that enhances trust and reliability.

Here are some key reasons to consider adapting your billing format:

- Enhanced Branding: Customization allows you to add logos, colors, and fonts that match your business’s unique identity, making each document instantly recognizable to clients.

- Improved Clarity: By adjusting field placements, you can highlight essential information, such as payment terms or contact details, making it easier for clients to understand payment expectations.

- Reduced Errors: Personalized layouts allow for clear itemization of services, helping to minimize miscommunications and billing errors.

- Increased Professionalism: A well-organized document signals pr

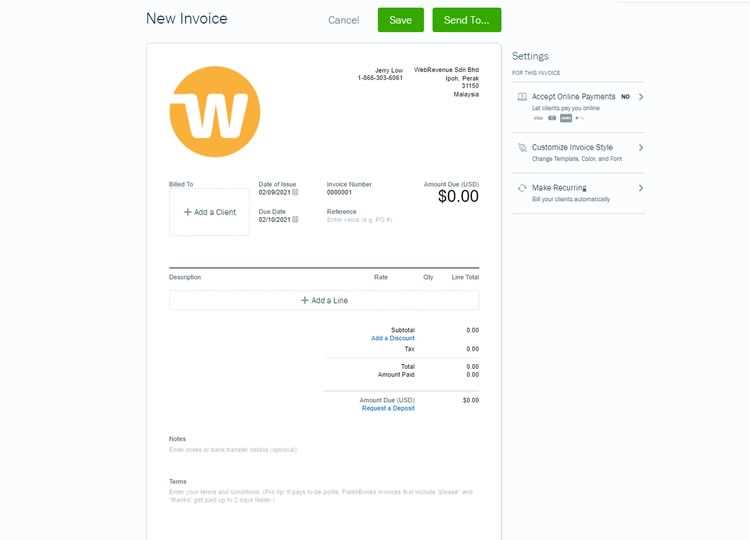

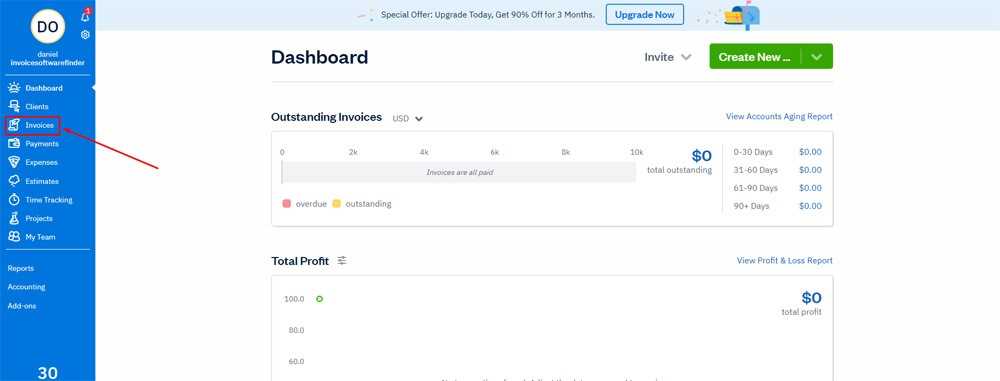

Steps to Access Template Settings

To create a professional and personalized billing experience, accessing and configuring the design options for your financial documents is essential. This process allows you to adjust various elements, ensuring that each document aligns with your brand and meets specific client needs. Navigating to these settings is simple and can be done in just a few steps.

Locating the Document Customization Area

Begin by logging into your account dashboard, where you manage your business operations. In the main navigation panel, look for the settings section dedicated to document customization. Within this area, you’ll find multiple options that allow you to adjust appearance, fields, and layouts, helping you craft a document that represents your business well.

Exploring Available Design Features

Once inside the customization section, you’ll see options to change colors, add logos, and modify fields to fit your business’s specific needs. Take time to explore these settings; you can preview how each change will l

Choosing the Right Layout for Invoices

Selecting an effective format for your billing documents is crucial for clear communication and a professional appearance. The layout you choose influences how clients interpret and navigate the information, helping them understand details like services provided, amounts due, and payment terms. An organized, thoughtfully designed structure can reduce confusion and streamline the payment process.

Assessing Layout Options for Clarity

When deciding on a layout, consider the nature of your business and the type of services you offer. If your work involves multiple items or service categories, a format with clearly defined sections is ideal. This structure allows for easy itemization, helping clients see each charge clearly. For straightforward services, a simpler layout may work best, focusing primarily on essential details like contact information and payment due dates.

Emphasizing Key Information

Regardless of the format you choose, it’s essential to emphasize

How to Add Business Branding

Incorporating your business’s unique brand elements into billing documents is a valuable step for enhancing professionalism and building brand recognition. By adding logos, colors, and other design touches, you make each document more recognizable and reinforce your brand identity. This customization creates a cohesive experience for clients, fostering trust and consistency in every transaction.

Adding Your Logo and Colors

Your company’s logo is a key visual that represents your brand. To include it, navigate to the customization area of your account, where you can upload an image file of your logo. Position it strategically, often at the top or in a header section, so it stands out without overwhelming the document. Selecting colors that align with your brand further enhances visual appeal, as cohesive color schemes contribute to a polished and unified appearance.

Incorporating Contact and Brand Information

Along with visual elements, consider adding other essential brand det

Personalizing Invoice Colors and Fonts

Customizing the color scheme and typography of your billing documents is an essential aspect of enhancing their overall aesthetic and aligning them with your brand identity. The right colors can evoke specific emotions and responses, while fonts can convey professionalism and readability. By tailoring these elements, you create a distinctive look that reflects your business values and makes a lasting impression on clients.

When selecting colors, consider a palette that complements your brand. Utilizing your brand colors throughout the document not only reinforces recognition but also creates a cohesive visual experience. For example, you might use a primary color for headings and accents, while keeping the background neutral to ensure readability. Additionally, ensure that there is enough contrast between text and background colors to facilitate easy reading.

Choosing the right font is equally important. Opt for a font that is clear and professional, avoiding overly decorative styles that can distract from the content. Consistency in font choice throughout the document enhances its visual appeal and ensures a polished look. By personalizing colors and fonts, you make each billing document not only functional but also an extension of your brand identity.

Adding Your Logo to Invoices

Incorporating your business logo into billing documents is a vital step in establishing a professional presence and enhancing brand recognition. A logo serves as a visual representation of your company, helping clients associate your services with your brand identity. By featuring your logo prominently, you create a more personalized experience for clients and reinforce your brand each time they review a document.

Steps to Upload Your Logo

To add your logo, follow these simple steps:

- Log in to your account and navigate to the settings menu.

- Locate the section dedicated to customizing your billing documents.

- Find the option to upload your logo, usually indicated by an “Upload” button.

- Select the image file from your computer and confirm the upload.

- Position the logo appropriately on the document, ensuring it’s visible but not overpowering.

Best Practices for Logo Integration

When integrating your logo, consider the following best practices:

- Use a high-resolution image to maintain clarity when printed or viewed digitally.

- Choose a logo size that fits well within the document without overwhelming other content.

- Ensure the logo’s colors are consistent with your overall document design for a cohesive look.

- Test the final document to confirm that the logo displays correctly across various devices.

Adjusting Invoice Fields for Specific Needs

Customizing the fields in your billing documents is essential for meeting the unique requirements of your business and your clients. Different industries have varying needs when it comes to information presentation, and adjusting these fields allows you to tailor documents to accurately reflect your services. This flexibility ensures that each document effectively communicates all necessary details, enhancing clarity and professionalism.

Identifying Essential Information

Begin by determining what information is crucial for your clients and your operations. Common fields include:

- Client details, such as name and contact information

- Service descriptions and corresponding costs

- Payment terms and due dates

- Tax details, if applicable

- Notes or comments for additional context

Modifying Fields to Fit Your Business

Once you’ve identified essential information, adjust the fields accordingly. Most billing platforms allow for:

- Adding new fields to capture additional information relevant to your services

- Removing unnecessary fields to streamline the document

- Rearranging fields to improve the logical flow of information

By personalizing these elements, you create documents that not only look professional but also serve your specific business needs effectively.

Editing Payment Terms and Conditions

Clearly defined payment terms and conditions are crucial for maintaining healthy cash flow and fostering trust with clients. These details outline the expectations regarding payment timelines and methods, ensuring both parties understand their responsibilities. By personalizing these terms, you can better align them with your business practices and client needs, creating a smoother transaction process.

Key Components of Payment Terms

When adjusting your payment details, consider including the following elements:

- Due Date: Specify when payment is expected to be made.

- Payment Methods: List accepted payment options such as credit cards, bank transfers, or online payment services.

- Late Fees: Clearly outline any penalties for overdue payments to encourage timely settlement.

- Discounts for Early Payment: Consider offering incentives for clients who pay before the due date.

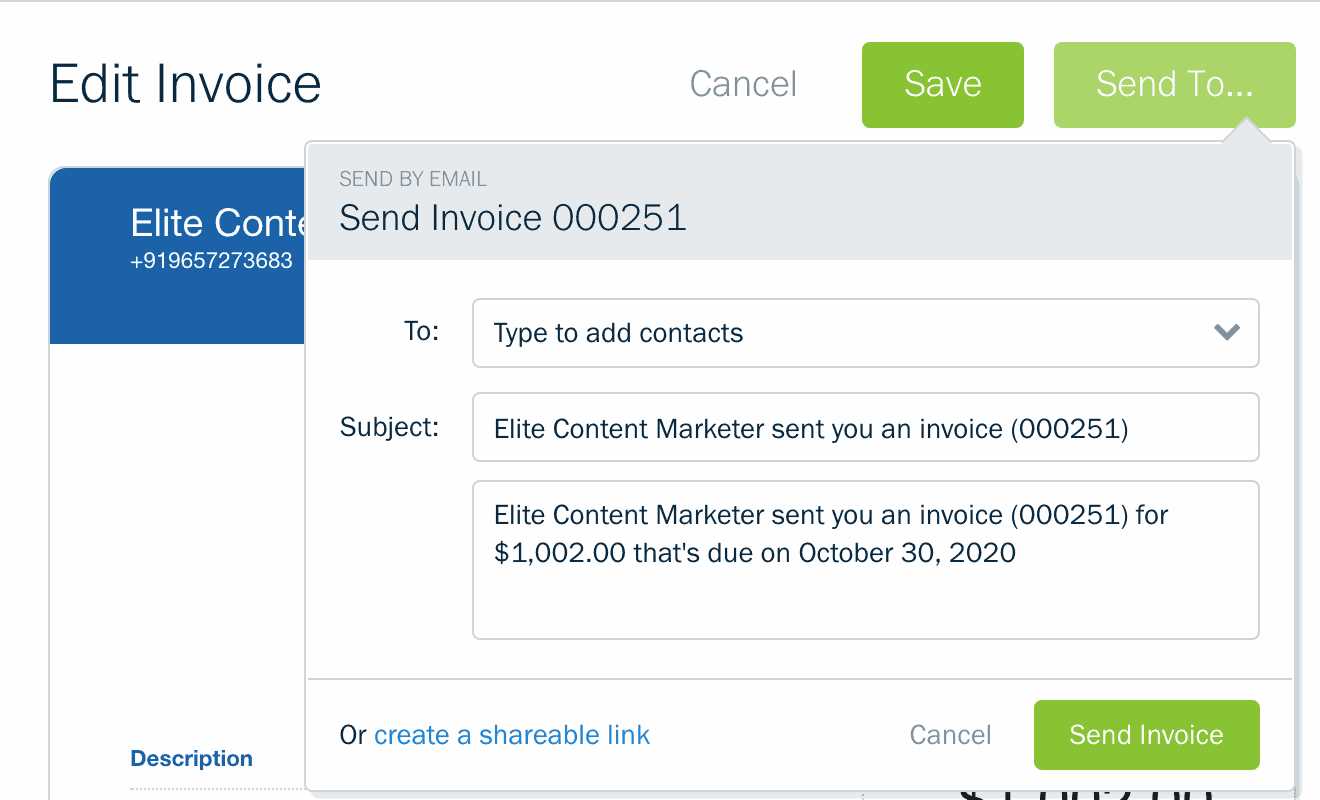

Steps to Update Payment Information

To modify your payment conditions, follow these steps:

- Access the settings section of your billing platform.

- Navigate to the payment terms or conditions area.

- Make the necessary adjustments to reflect your updated policies.

- Save your changes to ensure they apply to future documents.

By clearly articulating your payment terms, you set the stage for positive client relationships and effective financial management.

Tips for Setting Due Dates on Invoices

Establishing clear and reasonable deadlines for payments is essential for maintaining a steady cash flow and ensuring client satisfaction. The due date not only indicates when payment is expected but also influences how clients perceive the urgency and importance of their obligations. Thoughtful consideration in setting these dates can lead to more efficient transactions and stronger relationships.

Here are some helpful tips for determining effective payment deadlines:

1. Consider Your Business Cycle: Align due dates with your operational cash flow to ensure that payments coincide with your expenses. This helps prevent financial strain.

2. Be Realistic: Evaluate the typical payment habits of your clients. Setting a deadline that is too short may lead to delays and frustration, while an excessively long timeframe might result in forgotten obligations.

3. Offer Flexible Options: Where appropriate, provide different due date options that cater to various client preferences. This can enhance client satisfaction and encourage prompt payments.

4. Communicate Clearly: Ensure that the due date is prominently displayed on all documents and that clients are reminded of it well in advance. Clear communication helps avoid misunderstandings.

5. Use Payment Terms Wisely: Incorporate terms such as “Net 30” or “Due on Receipt” to clarify expectations regarding payment timelines and avoid ambiguity.

By applying these strategies, businesses can enhance their billing processes and improve the likelihood of timely payments.

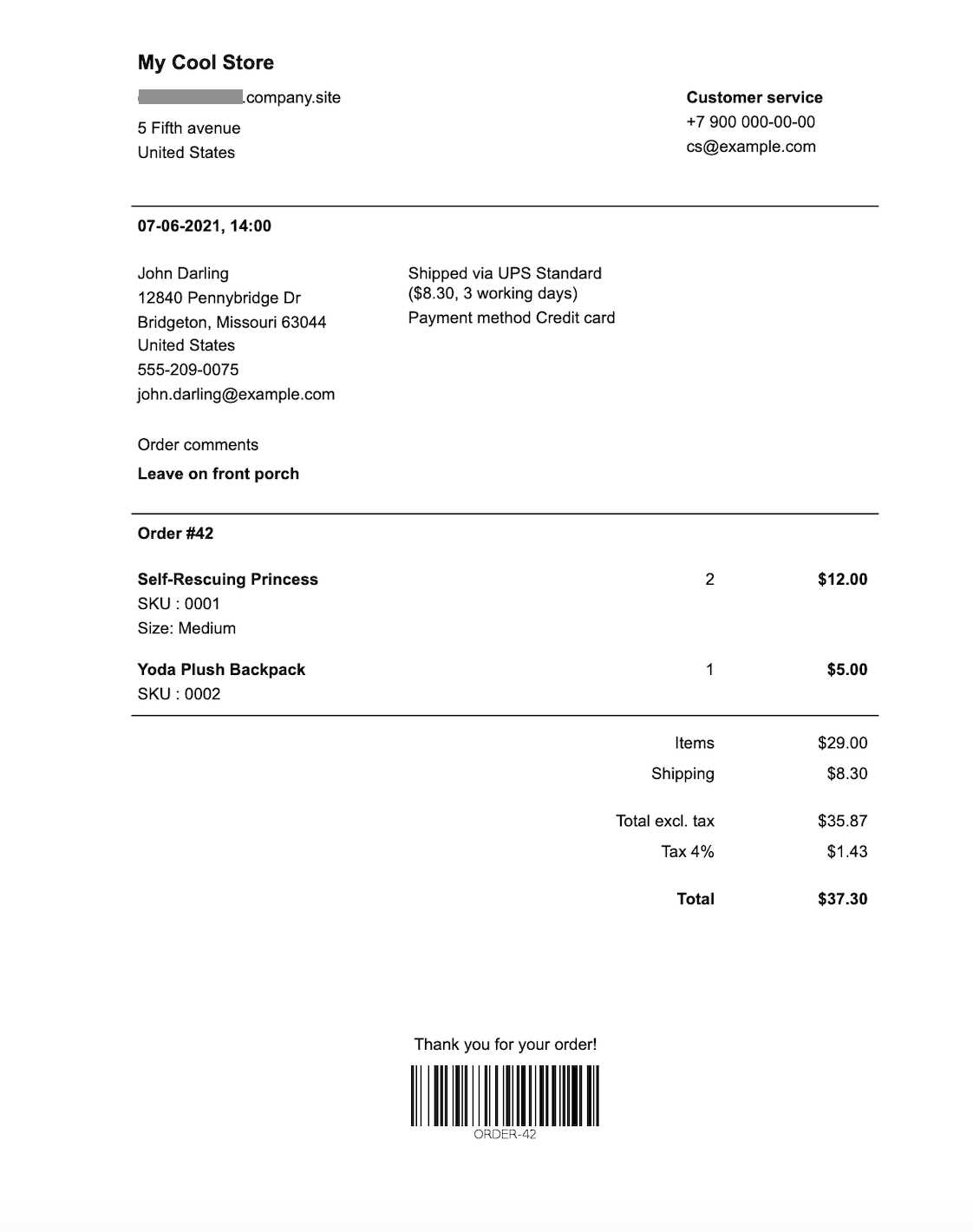

Including Tax and Discount Details

Incorporating accurate tax and discount information in financial documents is crucial for maintaining transparency and ensuring compliance with regulatory requirements. Properly detailing these elements not only enhances clarity but also fosters trust between businesses and their clients. Clear presentation of such details can lead to smoother transactions and reduce potential disputes.

1. Clearly State Tax Rates: Always specify the applicable tax rates and whether they are included in the total amount or added separately. This helps clients understand the final cost breakdown.

2. Itemize Discounts: If offering a discount, clearly list it alongside the original price. This practice not only highlights the savings for the client but also serves as an incentive for future business.

3. Use Clear Labels: Ensure that labels for tax and discounts are distinct and easy to understand. Using terms like “Sales Tax” and “Promotional Discount” eliminates confusion.

4. Maintain Consistency: Consistently apply tax and discount policies across all documents to avoid discrepancies that may lead to customer dissatisfaction.

5. Provide a Summary: At the end of the document, summarize the total amount due, including a breakdown of taxes and discounts. This overview allows clients to quickly grasp their financial obligations.

By following these guidelines, businesses can effectively manage tax and discount details, ensuring that clients receive clear and accurate financial information.

Creating Itemized Billing Descriptions

Providing detailed descriptions for each charge in financial documents is essential for clarity and transparency. Itemized billing helps clients understand exactly what they are being charged for, reducing the likelihood of misunderstandings or disputes. Clear descriptions not only convey professionalism but also reinforce the value of the services provided.

Importance of Detailed Descriptions

When charges are itemized, clients can easily see the breakdown of services or products rendered. This practice not only enhances transparency but also demonstrates accountability. Detailed descriptions can include:

- Service or Product Name: Clearly identify what is being billed.

- Quantity: Specify the number of items or hours of service provided.

- Rate: Include the price per unit or hourly rate to justify the total amount.

- Description: Provide a brief explanation of the service or product, highlighting its importance or benefits.

Tips for Writing Effective Descriptions

To ensure that billing descriptions are effective and informative, consider the following tips:

- Be Clear and Concise: Use simple language and avoid jargon to make it accessible to all clients.

- Use Bullet Points: For multiple items, bullet points can help in organizing information and making it easily readable.

- Highlight Key Details: Emphasize important aspects that justify the cost, such as unique features or additional benefits.

- Consistency: Maintain a uniform format for descriptions to enhance professionalism.

By creating clear and itemized billing descriptions, businesses can foster better communication with their clients and ensure that financial transactions are understood and accepted.

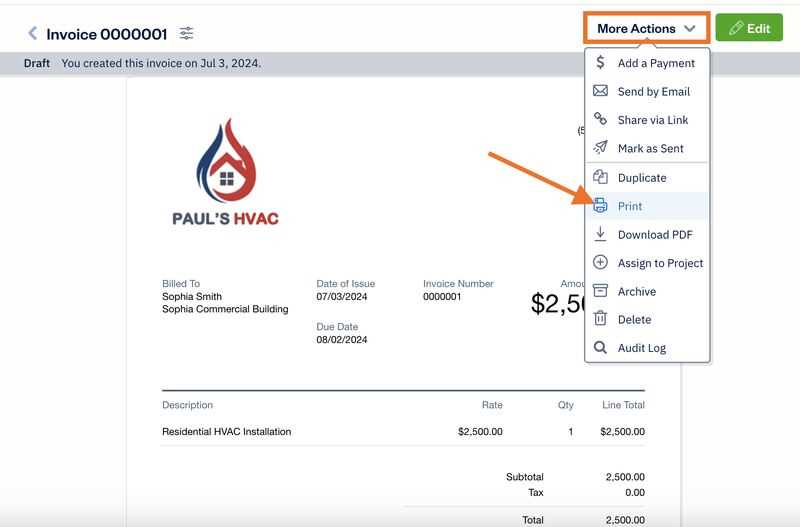

Previewing Changes to Your Invoice

Before finalizing any financial documents, it is essential to review and ensure that all modifications meet your expectations. Previewing allows you to see how the alterations will appear to clients, helping you identify any issues and make necessary adjustments. This step can enhance the professionalism of your documents and ensure clarity for your recipients.

Why Preview is Important

Reviewing changes provides several advantages, including:

- Accuracy: Verify that all details are correct, including amounts, descriptions, and terms.

- Visual Appeal: Assess the overall layout and design to ensure it reflects your brand image effectively.

- Client Understanding: Ensure that all information is clear and easily understandable for your clients.

- Feedback Opportunity: Identify areas for improvement before sending out documents.

Steps to Preview Your Document

To effectively preview your document, follow these steps:

- Access the Preview Option: Locate the preview feature in your document management system.

- Check Layout: Review the positioning of text, images, and other elements to ensure everything is well organized.

- Examine Details: Look through each line item to confirm accuracy and completeness of information.

- Make Adjustments: If necessary, return to the editing section to modify any parts that do not meet your standards.

- Save Changes: Once satisfied, save the final version to ensure that all updates are retained.

By taking the time to preview changes, you enhance the quality and professionalism of your financial documents, ultimately leading to better client relationships.

Saving Customized Invoice Formats

Once you have tailored your financial documents to align with your brand and meet your specific needs, it is crucial to save these customized designs for future use. This not only saves time but also ensures consistency across all communications with clients. Properly saving your formats allows for quick access and easy modifications as needed.

Benefits of Saving Customized Formats

Maintaining your personalized styles offers several advantages:

- Time Efficiency: Quickly create new documents without starting from scratch each time.

- Brand Consistency: Ensure that all materials reflect your branding guidelines uniformly.

- Streamlined Workflow: Simplify the process of generating documents, allowing for more focus on other business tasks.

- Easy Updates: Make adjustments to the format and save changes to keep everything up to date with minimal effort.

How to Save Your Customized Formats

To effectively save your personalized designs, follow these steps:

- Finalize Your Design: Ensure all elements are in place and meet your specifications.

- Locate the Save Function: Find the option within your document management system to save your current format.

- Name Your Format: Give your format a clear and descriptive name to easily identify it later.

- Choose a Save Location: Select a directory or section where you want to store the saved formats for easy access.

- Confirm and Save: Review your choices and finalize the saving process to ensure everything is stored correctly.

By following these steps, you can efficiently create and maintain a library of customized financial documents, enhancing your operational effectiveness and improving client interactions.

Best Practices for Professional Invoice Design

Creating visually appealing and functional financial documents is essential for maintaining professionalism and clarity in business communications. Adopting effective design strategies ensures that your documents are not only aesthetically pleasing but also convey important information clearly. Here are some best practices to consider when designing your financial documents.

Key Design Elements

When crafting your documents, focus on the following elements:

Element Description Best Practice Branding Incorporating your logo and brand colors enhances recognition. Use consistent colors and fonts that reflect your brand identity. Clarity Ensure all information is easy to read and understand. Use a clean layout with ample white space to avoid clutter. Organization Structure the content logically to guide the reader. Group related information together and use headings for sections. Legibility Font choice can affect readability significantly. Select fonts that are easy to read in various sizes; avoid overly decorative styles. Detailing Including itemized information enhances transparency. Break down charges clearly, showing each service or product with descriptions. Final Considerations

By following these guidelines, you can create professional financial documents that not only look great but also serve their purpose effectively. Remember to regularly update your design to reflect any changes in your branding or business practices, ensuring your documents remain relevant and engaging for your clients.

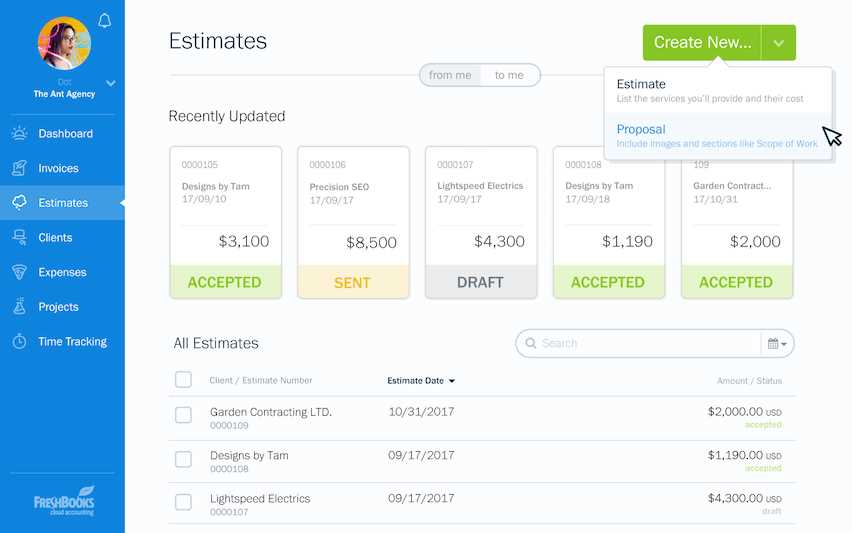

How to Duplicate Templates Quickly

Creating multiple versions of your financial documents can streamline your workflow and save valuable time. Whether you’re aiming to modify existing designs or simply need to produce similar versions for various clients, knowing how to efficiently replicate your layouts is essential. Below are steps and tips for accomplishing this task with ease.

Steps to Duplicate Your Designs

- Access the Document Library: Navigate to your collection of documents where your existing layouts are stored.

- Select the Desired Format: Choose the specific layout you wish to replicate.

- Initiate Duplication: Look for an option such as “Duplicate” or “Copy.” This may vary based on the software you’re using.

- Rename the New Document: Give the duplicated version a unique name to avoid confusion in the future.

- Make Adjustments: Open the duplicated version and modify any sections that need updates, such as client information or specific details.

Tips for Effective Duplication

- Maintain Consistency: Ensure that any changes you make align with your overall branding for a cohesive look.

- Use Predefined Fields: Where possible, incorporate fields that can be easily populated to save time during future modifications.

- Organize Your Library: Keep your document collection well-organized to facilitate quick access and duplication in the future.

- Review Regularly: Periodically assess your templates to determine if they require updates or further customization.

By following these steps and tips, you can quickly create multiple variations of your documents, allowing for greater efficiency in your financial processes.

Troubleshooting Common Template Issues

When working with design layouts for your financial documents, you may encounter various issues that can disrupt your workflow. Recognizing and addressing these challenges promptly ensures a smooth experience and maintains professionalism in your communications. Below are some typical problems you might face and effective strategies to resolve them.

Common Problems and Solutions

- Missing Fields:

If certain information does not appear in your layout, ensure that all necessary fields are included in the design. Check for any hidden or disabled elements that may need to be activated.

- Formatting Errors:

Inconsistent font styles or sizes can detract from the overall appearance. Review your formatting settings and apply consistent styles across all sections.

- Alignment Issues:

Elements may not align correctly, leading to a disorganized look. Use alignment tools within your software to ensure that all components are properly positioned.

- Color Problems:

If colors appear different than intended, check your color settings and make sure you’re using the correct palette that aligns with your branding.

- File Compatibility:

Sometimes, issues arise due to file format incompatibility. Ensure that the formats you are using are supported by your software to avoid any disruptions.

Steps for Effective Troubleshooting

- Review Documentation: Check the help resources or user guides provided by your software to understand common issues and their solutions.

- Test with a Sample Document: Create a basic layout to see if the issue persists. This can help isolate the problem to a specific design.

- Seek Community Support: Engage with online forums or user groups for insights from others who may have faced similar challenges.

- Contact Support: If problems continue, reach out to the customer support team for further assistance and guidance.

By being proactive and following these strategies, you can effectively troubleshoot issues and enhance your experience with document creation.