Get Your Free French Invoice Template for Easy Billing

Managing billing and payments can be a complex task for any business, especially when dealing with different standards and regulations. Ensuring consistency, accuracy, and legal compliance in your financial documents is crucial for maintaining trust with clients and avoiding potential legal issues.

By using a structured and pre-designed format, you can save time and reduce errors while creating professional and compliant documents. These ready-made solutions provide all the necessary fields, allowing you to quickly fill in the details relevant to each transaction. Whether you’re a freelancer or running a large business, utilizing such tools can significantly simplify your administrative tasks.

Efficiency is key in today’s fast-paced world, and adopting a digital or downloadable solution offers the flexibility to customize each document while ensuring that all mandatory information is included. With a well-organized layout, you can focus on what matters most–providing quality services to your clients and growing your business.

Understanding Billing Document Requirements

When creating a formal billing document, it’s important to be aware of the legal and regulatory standards that apply in each country. Different regions have specific guidelines to ensure that all transactions are properly documented, meet tax requirements, and are easy to process by both businesses and clients. Compliance with these rules not only ensures smooth business operations but also helps avoid penalties and disputes.

In certain jurisdictions, the document must include particular details such as identification numbers, clear descriptions of goods or services provided, and the applicable tax rates. These legal elements are essential for maintaining transparency and preventing any misunderstandings. A properly structured record helps both parties track payments, confirm agreements, and resolve issues if they arise.

Accurate documentation is critical for any business, as it serves as an official record of transactions. Failure to include required information could lead to delays in payment processing or even legal challenges. Therefore, understanding the precise elements needed in these records is key for businesses that want to stay compliant with local laws and regulations.

Why Use a Structured Billing Document

Utilizing a pre-designed billing format can simplify the process of managing transactions and ensure consistency across all records. By having a ready-made structure, you can focus on the details of each specific sale without worrying about formatting or missing critical information. This approach saves time, reduces errors, and improves professionalism.

Here are some key advantages of using a standardized format:

- Efficiency: Quickly create and send documents without starting from scratch every time.

- Compliance: Ensure all required fields and legal information are included, reducing the risk of mistakes.

- Professionalism: Provide clients with clear, well-organized records that enhance your business image.

- Consistency: Maintain a uniform style and structure across all transactions, making record-keeping easier.

- Time-saving: Automate repetitive tasks and streamline your administrative workload.

In addition to these benefits, using a digital or downloadable solution allows for easy customization, enabling you to tailor the format to suit your specific needs while still adhering to required guidelines. This balance of flexibility and structure ensures both accuracy and efficiency in your business operations.

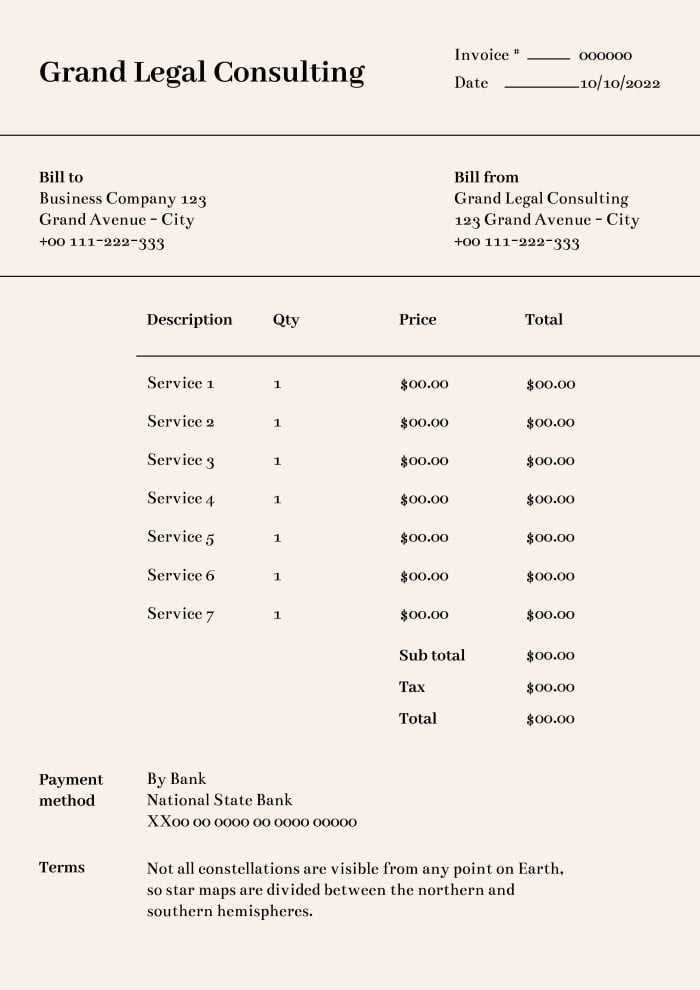

Key Elements of a Billing Document

To ensure that a formal transaction record is complete and meets legal requirements, certain details must be included. These details help both the business and the customer verify the transaction, understand the terms of payment, and fulfill tax obligations. A well-structured document serves as a reference for both parties and provides clear evidence of the sale or service provided.

Mandatory Information

A properly formatted transaction record must include specific data to be considered valid and legally binding. Below are the key elements that must be present:

| Element | Description |

|---|---|

| Seller’s Information | Company name, address, and contact details of the business issuing the document. |

| Buyer’s Information | Details of the recipient, such as name, address, and contact information. |

| Unique Identification Number | A sequential number or reference code that helps track the record. |

| Description of Goods or Services | Clear and detailed explanation of what was provided, including quantities and unit prices. |

| Payment Terms | Conditions such as payment due dates, methods of payment, and any discounts or late fees. |

| Tax Information | Applicable tax rates, tax identification numbers, and total tax amount. |

Optional Elements

In addition to the mandatory fields, there are optional details that can enhance clarity and professionalism. These may include:

- Payment instructions or bank account details

- Purchase order number

- Additional notes, such as terms and conditions or warranty information

Including all relevant details ensures that the document is comprehensive, reducing the chance of disputes or confusion in the future. It also helps streamline administrative processes and ensures smooth business operations.

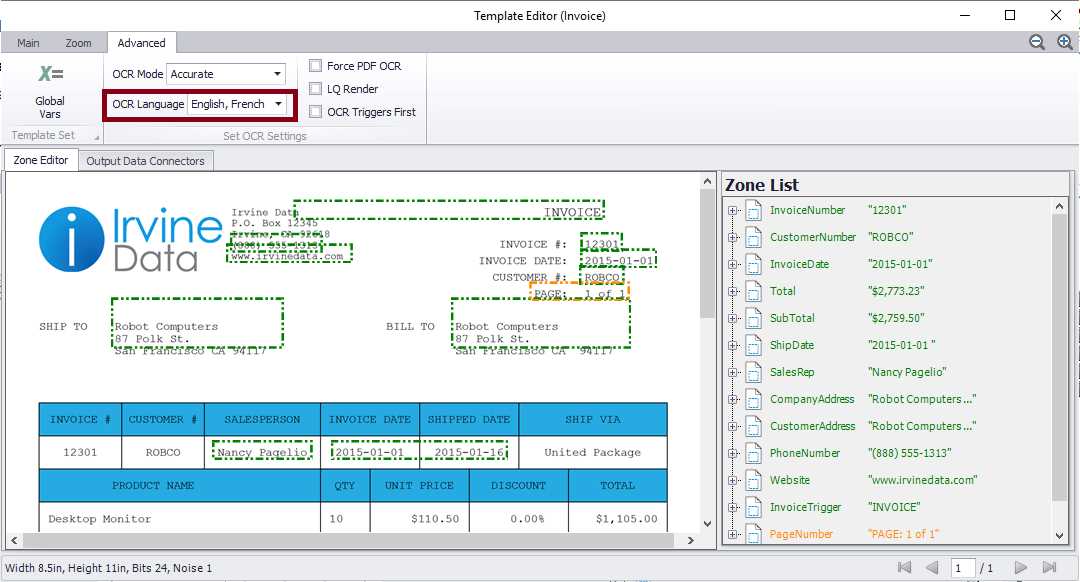

How to Customize a Billing Document

Customizing a formal transaction record allows you to tailor it to your specific business needs while ensuring all necessary information is included. The ability to modify certain elements lets you create a document that reflects your company’s branding, services, and unique requirements. Whether you are handling a one-time transaction or creating a reusable format, customization ensures that the document aligns with both legal standards and your business practices.

Here are the main steps to follow when customizing a billing document:

| Step | Description |

|---|---|

| 1. Add Your Business Branding | Incorporate your company logo, color scheme, and any other branding elements that represent your business. |

| 2. Adjust the Layout | Rearrange sections and fields to match your preferences or specific industry standards. Ensure it’s easy to read and logical. |

| 3. Update Contact Details | Make sure your contact information, including phone number, email, and physical address, are correct and clearly visible. |

| 4. Modify Payment Terms | Adjust payment methods, due dates, discounts, and penalties for late payments according to your business practices. |

| 5. Include Additional Fields | Depending on your business needs, you can add fields for purchase order numbers, project codes, or other specific details. |

| 6. Personalize the Description | Customize the item or service descriptions to ensure they match your offerings and provide clear details for the client. |

By following these steps, you can create a professional, customized document that represents your business while meeting all necessary legal and regulatory requirements. Tailoring the design and content to your specific needs not only increases efficiency but also enhances your business’s credibility and client relationships.

Top Benefits of Using Pre-Designed Formats

Using a pre-designed structure for your business documents can greatly simplify the process of creating formal records. These ready-made solutions ensure consistency, accuracy, and efficiency by providing a framework that meets essential requirements while saving time on formatting and layout. Whether for one-time use or recurring tasks, adopting such a system brings numerous advantages that improve both operational workflow and professionalism.

1. Time-Saving and Efficiency

One of the primary benefits of using a pre-designed structure is the significant amount of time it saves. Instead of creating a document from scratch every time, you simply fill in the necessary details. This streamlining of the process means you can generate records much faster, allowing more time for other critical tasks within your business.

2. Consistency and Accuracy

With a set layout, you can ensure that all required information is consistently included in every document. This reduces the risk of omitting essential details, such as tax identification numbers or payment terms. The accuracy that comes with these formats helps prevent errors that could otherwise lead to delays or confusion with clients and financial institutions.

3. Professionalism

Using a polished, well-organized design enhances the image of your business. Clients receive a clear, easily readable document that reflects your attention to detail and commitment to professionalism. This can boost your credibility and foster trust with both new and existing customers.

4. Compliance with Regulations

Pre-designed formats are often created with legal and regulatory guidelines in mind, ensuring that all necessary information is included. This compliance helps avoid legal issues and ensures that your records are accepted without question by tax authorities or financial bodies.

In conclusion, the use of pre-structured formats not only simplifies the process of generating official documents but also offers efficiency, accuracy, and professionalism, all while ensuring compliance with legal standards.

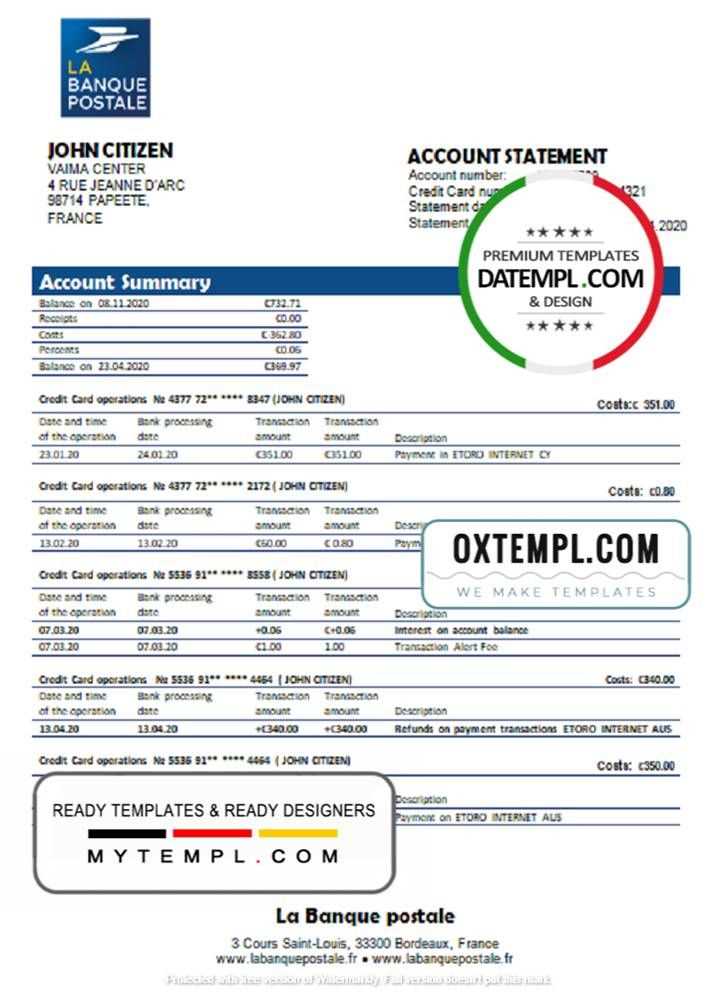

Billing Document Format and Structure

To ensure clarity and compliance, a formal transaction record should follow a structured layout that organizes the necessary details in a logical and easy-to-read manner. The format should be simple yet comprehensive, including all required information for both parties to confirm the terms of the transaction. A well-structured document improves efficiency, helps prevent errors, and ensures consistency across all business dealings.

The overall structure of a billing document typically includes several key sections, each serving a specific purpose. These sections help break down the information in a way that is easy to follow and ensures no critical details are overlooked.

1. Header Section

The header is where your business details, such as the company name, address, contact information, and tax identification number, should be listed. This section should also include the recipient’s information, providing clear identification for both parties involved in the transaction.

2. Transaction Details

This section contains the specific details about the goods or services provided. Each item should be listed with a clear description, including quantities, unit prices, and total amounts. If applicable, discounts, taxes, and shipping fees should also be clearly stated.

3. Terms and Conditions

It’s essential to outline the terms of payment clearly. This may include the payment due date, methods of payment accepted, and any late fees or discounts for early payment. Having these terms outlined upfront helps prevent misunderstandings and ensures that both parties are on the same page.

4. Legal Information

Depending on the jurisdiction, certain legal information may be required. This could include tax rates, a breakdown of the applicable VAT (if any), and any other region-specific data necessary for compliance. Including this information from the outset helps avoid potential disputes or legal complications.

In summary, a well-organized structure ensures that all essential information is presented clearly and logically, making the document both professional and compliant with legal standards. Proper formatting not only speeds up processing but also improves communication between all parties involved.

Essential Information for Billing Documents

To ensure a formal transaction record is both clear and legally binding, there are several key pieces of information that must be included. These details not only serve to verify the transaction but also help comply with regional tax and regulatory standards. A well-documented record minimizes the risk of errors, disputes, or legal issues and ensures both parties are fully informed about the terms of the agreement.

Each document should contain specific mandatory elements, which may vary depending on the region but are generally consistent across most formal transaction records. Below are the most crucial details to include:

1. Seller’s and Buyer’s Information

Clear identification of both the seller and the buyer is essential. This includes names, addresses, and contact details. In some cases, the business registration or tax identification numbers may also be required for legal and tax purposes.

2. Document Number

Each record should have a unique identifier or reference number. This allows both parties to track the transaction, maintain accurate records, and avoid confusion in case of multiple transactions over time.

3. Description of Goods or Services

Detailed descriptions of the products or services provided should be included. This section should outline the quantity, unit price, and total cost, ensuring both parties understand exactly what has been delivered. It also helps clarify pricing for accounting and tax purposes.

4. Payment Terms

Clearly state the payment terms, including the due date, accepted payment methods, and any applicable discounts or late fees. These terms help ensure there is no confusion about the timing or method of payment, facilitating smooth transactions.

5. Tax Information

If applicable, the document must include the relevant tax rates and the total tax amount. This ensures that both parties understand the final price, including any taxes due. It also guarantees compliance with local tax regulations.

6. Date of Issue

The date the record was created is vital for keeping track of timelines, especially for payment due dates and for tax filing purposes. This date should be clearly stated and easy to identify.

In conclusion, including these essential details in each formal transaction record ensures that all parties have a clear understanding of the terms, helps maintain legal compliance, and makes it easier to resolve any potential issues. Properly documenting each transaction builds trust and professionalism, benefiting both businesses and clients.

Common Mistakes in Billing Documents

When creating formal transaction records, even small errors can lead to confusion, delays in payment, or legal issues. Many businesses overlook certain details, leading to mistakes that could have been easily avoided with careful attention. Understanding the most common errors can help prevent problems and ensure that your documents are clear, accurate, and compliant with legal standards.

1. Missing or Incorrect Information

One of the most frequent mistakes is omitting crucial details or providing incorrect information. This can include things like an incomplete address, missing contact details, or errors in the buyer’s name or tax identification number. Failing to list the correct product descriptions, quantities, or prices is also common. These errors can cause confusion and delay payments, as clients may question the accuracy of the document.

2. Not Following Legal Requirements

Each region or country may have specific legal requirements for formal records, such as mandatory tax details, required document numbers, or the correct format for payment terms. Not adhering to these regulations can lead to non-compliance issues, which might result in fines or other legal consequences. It’s important to stay informed about the latest legal requirements and make sure your documents meet those standards.

3. Incorrect Tax Calculation

Another common mistake is not properly calculating or applying taxes, such as VAT. Errors can occur when businesses either forget to apply the correct tax rate or fail to break down the tax amount clearly for the client. Incorrect tax handling can lead to issues with tax authorities, including audits or fines.

4. Formatting Issues

A disorganized or hard-to-read layout can also create problems. If the sections are not clearly separated, or if the document is cluttered and difficult to navigate, it may confuse the client or lead to overlooked details. Using a clean, consistent layout is essential to ensure clarity and professionalism.

By being mindful of these common mistakes and double-checking each document before sending it out, you can avoid unnecessary complications, maintain smooth transactions, and build stronger client relationships.

Legal Aspects of Billing Documents

When preparing formal transaction records, it is essential to ensure that the document complies with local legal and tax regulations. Each region has specific rules about the necessary information that must be included, as well as the format and timing of issuing such records. Non-compliance can lead to delays, fines, or other legal complications, which is why businesses must pay close attention to these legal aspects.

Here are the key legal considerations when creating billing documents:

- Document Identification: Every formal record must have a unique identifier or reference number. This helps track the transaction and is essential for bookkeeping and auditing purposes.

- Seller and Buyer Information: Both parties must be clearly identified, including their names, addresses, and, in some cases, their tax identification numbers. This ensures proper identification in case of legal disputes or tax audits.

- Tax Information: The document must clearly indicate the applicable tax rate(s) and the total amount of tax charged. Tax identification numbers for both parties may also be required, particularly for businesses operating across borders.

- Payment Terms: Legal records should include specific payment conditions, such as the due date, any discounts, and the penalties for late payment. These terms help avoid misunderstandings and ensure compliance with commercial laws.

- Legal Compliance: Certain jurisdictions may require specific language, such as the inclusion of certain mandatory disclaimers or terms that acknowledge the sale’s compliance with local laws. Make sure you understand and follow these rules to avoid penalties.

In conclusion, creating legally compliant records requires attention to detail and an understanding of the relevant rules. These legal aspects are not only crucial for ensuring smooth business operations but also help avoid costly legal issues down the line.

How to Create a Compliant Billing Document

Creating a compliant formal transaction record involves following specific guidelines to ensure that the document meets all legal, tax, and business requirements. This helps ensure that the record is both valid and accepted by authorities, as well as clear for both parties involved in the transaction. By adhering to these essential steps, you can avoid legal complications and ensure your business stays in good standing.

Here’s how to create a compliant billing document:

- Include Essential Information:

Ensure that both the seller and buyer’s full details are clearly stated, including names, addresses, and tax identification numbers if necessary. Each document must also include a unique reference number. - Provide Accurate Descriptions:

Include detailed descriptions of the goods or services provided. This should include quantities, unit prices, and total amounts. Being specific and clear prevents any confusion and helps with tax reporting. - Apply Correct Tax Information:

If taxes apply, make sure to indicate the applicable tax rates and the total amount of tax charged. Include your tax identification number, especially if your business is registered for VAT or other local taxes. - Set Clear Payment Terms:

Clearly outline payment terms, including the due date, payment methods accepted, and any penalties for late payments. This helps avoid misunderstandings and ensures both parties know the expectations. - Use a Standard Format:

Follow the common layout and format standards, ensuring that the record is easy to read and all sections are clearly organized. Include all mandatory fields and adhere to any specific format required by local regulations. - Issue the Record Promptly:

The formal document should be issued as soon as the transaction is completed. Late issuance could lead to potential issues, especially when it comes to tax reporting and payment deadlines.

By carefully following these steps, you can create formal records that are legally sound, tax-compliant, and clear for both parties involved in the transaction. This reduces the risk of errors, delays, or legal issues, and contributes to a smooth, efficient business operation.

Understanding VAT on Billing Documents

Value Added Tax (VAT) is an essential component of many formal transaction records, especially in regions where it is required by law. Businesses need to understand how VAT applies to their transactions to ensure that it is correctly calculated and documented. This ensures that businesses remain compliant with tax regulations and that clients are charged accurately.

In many countries, VAT is applied to goods and services at various rates, depending on the type of product or service being sold. Understanding how VAT should be included on billing documents is vital to avoid potential legal issues or discrepancies. Here’s what you need to know about including VAT in your transaction records:

1. How VAT is Applied

VAT is usually a percentage of the sale price of the goods or services provided. The percentage can vary depending on the type of product or service being sold and the applicable VAT rate in your country or region. It is important to correctly calculate and apply the VAT to ensure the correct amount is charged.

2. Breakdown of VAT on Billing Documents

For transparency and accuracy, VAT must be broken down clearly on formal transaction records. It should be shown as a separate line item, indicating the rate applied, the amount of VAT charged, and the total value including VAT.

| Item Description | Price (Excl. VAT) | VAT Rate | VAT Amount | Total Price (Incl. VAT) |

|---|---|---|---|---|

| Product A | €100 | 20% | €20 | €120 |

| Service B | €150 | 10% | €15 | €165 |

Note: The VAT rate will depend on the jurisdiction and the type of goods or services sold. In some cases, certain items may be exempt from VAT or subject to reduced rates.

In summary, understanding VAT and how to apply it correctly on formal transaction records is essential for both business owners and clients. This ensures compliance with tax regulations, accurate billing, and

Pre-Designed Billing Records vs. Manual Billing

When it comes to generating formal transaction documents, businesses typically have two options: using pre-designed formats or creating records manually. Each approach has its own advantages and drawbacks, and the choice largely depends on the needs and preferences of the business. Understanding the differences between these methods can help determine which one best suits your operations and ensures accuracy, compliance, and efficiency.

Here’s a comparison of using pre-designed billing formats versus manually creating records:

1. Time and Efficiency

Using a pre-designed format significantly speeds up the process of creating formal records. With a ready-made layout, businesses only need to input the details of the transaction, reducing the time spent on formatting and organizing the document.

- Pre-designed formats: Quick to fill out, reducing manual effort and errors. Ensures a consistent format every time.

- Manual billing: Requires creating the document from scratch, which can be time-consuming and prone to formatting mistakes.

2. Consistency and Accuracy

Pre-designed formats ensure that all necessary sections are included, and the layout remains consistent across all records. This reduces the risk of missing crucial information and ensures uniformity across documents.

- Pre-designed formats: Eliminates human error in the layout and structure. Automatically includes all required sections.

- Manual billing: Increased chance of missing key details or making errors, especially if templates aren’t used consistently.

3. Customization and Flexibility

Manual billing allows for complete customization, enabling the business to tailor each document to specific needs or preferences. This is ideal for businesses with unique or complex billing requirements.

- Pre-designed formats: Limited flexibility. Customization is possible, but it may require additional effort to modify the layout.

- Manual billing: Offers full control over the document’s appearance and content, which is useful for businesses with specific needs or personalized billing styles.

4. Compliance and Legal Requirements

Ensuring compliance with legal requirements can be challenging when manually creating documents, as businesses need to stay updated on changi

How to Save Time with Billing Templates

Creating formal transaction documents can be time-consuming, especially when they need to be generated frequently. Using pre-designed formats can drastically reduce the time spent on creating each document. These ready-made layouts allow businesses to quickly input transaction details without worrying about formatting or structure, thus increasing productivity and minimizing the risk of errors.

Here are several ways you can save time by using pre-designed billing layouts:

1. Consistency Across Documents

One of the main advantages of using a pre-designed format is the consistency it provides. Every time you generate a new record, the structure and layout remain the same, which eliminates the need to manually adjust the format each time. This consistency helps save time on formatting and ensures that all necessary information is included every time.

2. Quick Data Entry

Instead of creating each document from scratch, you only need to fill in the specific details of the transaction. Pre-designed formats often include fields for common information such as product descriptions, quantities, and pricing. By simply entering the relevant data, you can create a complete, professional document in minutes.

In conclusion, using pre-designed billing layouts not only saves time but also ensures accuracy and uniformity across all documents. This is particularly beneficial for businesses that handle a high volume of transactions or need to generate records quickly and efficiently.

Choosing the Best Billing Layout

When selecting a pre-designed format for your transaction records, it’s important to choose one that meets your specific needs while adhering to local business and legal requirements. The best layout will not only streamline your billing process but also ensure clarity and professionalism. Finding the right layout can save you time and reduce errors, ultimately improving your overall business efficiency.

Here are some key factors to consider when choosing the best billing layout for your business:

- Legal Compliance:

Ensure that the format complies with local tax laws and regulations. Different regions may require specific information, such as VAT rates or certain legal disclaimers. A good layout will automatically include these details or allow for easy customization. - Customization Options:

Choose a format that allows you to easily adjust for different types of transactions. Whether you need to modify the layout for large orders, different services, or multiple payment terms, the format should be flexible enough to meet your needs. - Clarity and Professionalism:

The format should be clean and easy to read. Well-organized sections and clear headings are crucial for ensuring that your clients understand the document quickly and accurately.

Additionally, consider whether the format supports multiple currencies or languages if you’re working with international clients. Some layouts are designed specifically for cross-border transactions and can handle varying formats and tax systems.

Here’s a sample of how key information might appear in a properly designed layout:

| Item | Description | Quantity | Price | Total | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Product A | High-quality item | 2 | $50 | $100 | ||||||||||||

| Service B | Consulting session | 1 | $150 | $150 | ||||||||||||

| Subtotal | $250

Free Billing Layouts Available OnlineFinding a reliable and easy-to-use billing document format doesn’t have to be a costly endeavor. Many websites offer free pre-designed layouts that can be downloaded and customized to suit your business needs. These layouts provide a simple solution for businesses looking to create professional records without having to design them from scratch. Here are some key benefits of using free billing layouts available online:

Here are some places where you can find free downloadable billing layouts:

In conclusion, free billing layouts are an excellent resource for businesses looking to save time and money while ensuring their documents are both professional and compliant. Take advantage of these resources to streamline your billing process and focus on growing your business. How to Handle Multiple Currency Billing DocumentsWhen dealing with clients from different countries or conducting international transactions, businesses often need to create records in multiple currencies. Managing these transactions correctly ensures that both the seller and the buyer are on the same page regarding amounts owed. Handling multiple currencies effectively requires understanding how to calculate, convert, and present prices in different monetary units while maintaining clarity and accuracy in the documents. Here are some key strategies for managing multiple currency transactions: 1. Use Real-Time Exchange RatesTo ensure that the amounts are accurate, it’s crucial to use real-time exchange rates when converting prices from one currency to another. Exchange rates can fluctuate frequently, so using up-to-date rates ensures that both parties are getting the correct values. You can easily find exchange rate data on financial websites or use automated currency conversion tools to calculate and display the correct amounts. 2. Clearly Display Currency InformationWhen creating a transaction document in multiple currencies, it’s important to clearly indicate the currency being used for each amount. This reduces any confusion and helps the client understand exactly how much they owe. Make sure to include the currency symbol (such as $ for USD, € for EUR, etc.) next to the amount and specify the exchange rate if applicable. Here’s an example of how a multi-currency transaction could be structured:

Tip: If you are converting from one currency to another, always double-check the rate before finalizing the document to avoid discrepancies. In conclusion, handling multiple currencies in your billing records requires careful attention to detail and accuracy. By using real-time exchange rates and clearly displaying the amounts, you can maintain transparency and professionalism in your transactions. When to Use Digital vs. Paper Billing DocumentsChoosing between digital and paper records for your transactions depends on various factors, such as the nature of your business, client preferences, and legal requirements. Both formats have their advantages and disadvantages, and understanding when to use each one is essential for streamlining your processes and maintaining efficiency. In this section, we’ll explore the benefits of both approaches and offer guidance on selecting the best option for your needs. Here’s when to consider using each method: 1. When to Use Digital Billing Documents

2. When to Use Paper Billing Documents

|

|||||||||||||||