Freight Invoice Template Word for Simple Billing

Organizing payment records is essential for any business involved in logistics or transport. A well-structured document that outlines the details of a transaction can help ensure smooth communication between companies and clients. In this section, we will explore how to design clear and functional billing sheets to streamline financial processes.

By utilizing customizable formats, businesses can easily adapt the document to meet specific needs, ensuring all necessary information is included for accurate processing. Whether for small shipments or large deliveries, having a standardized format offers consistency and professionalism, which is crucial for maintaining trust and efficiency in financial dealings.

Efficient management of these documents reduces errors and enhances clarity, ultimately benefiting both parties involved. In this guide, we will cover essential elements to include, the flexibility of document designs, and tips for creating professional-looking records that can be edited to fit any particular scenario.

Freight Invoice Template Word Overview

When it comes to handling financial records for delivery and transport services, having a clearly structured document is essential. A well-organized format helps streamline the billing process, ensuring both the service provider and the client have all the necessary information in one place. This section will provide an overview of how to create and utilize such documents, focusing on essential elements and benefits.

Key Elements of a Billing Document

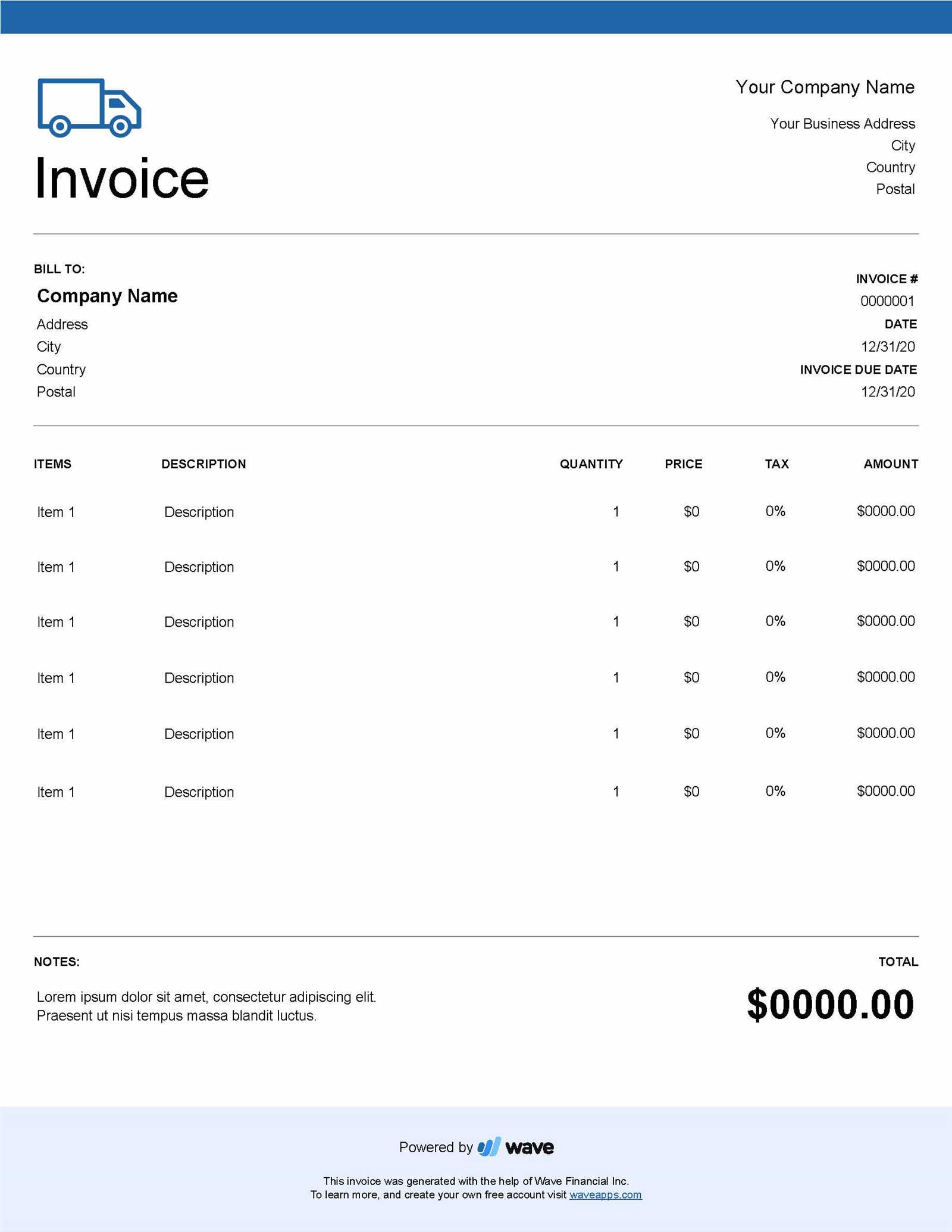

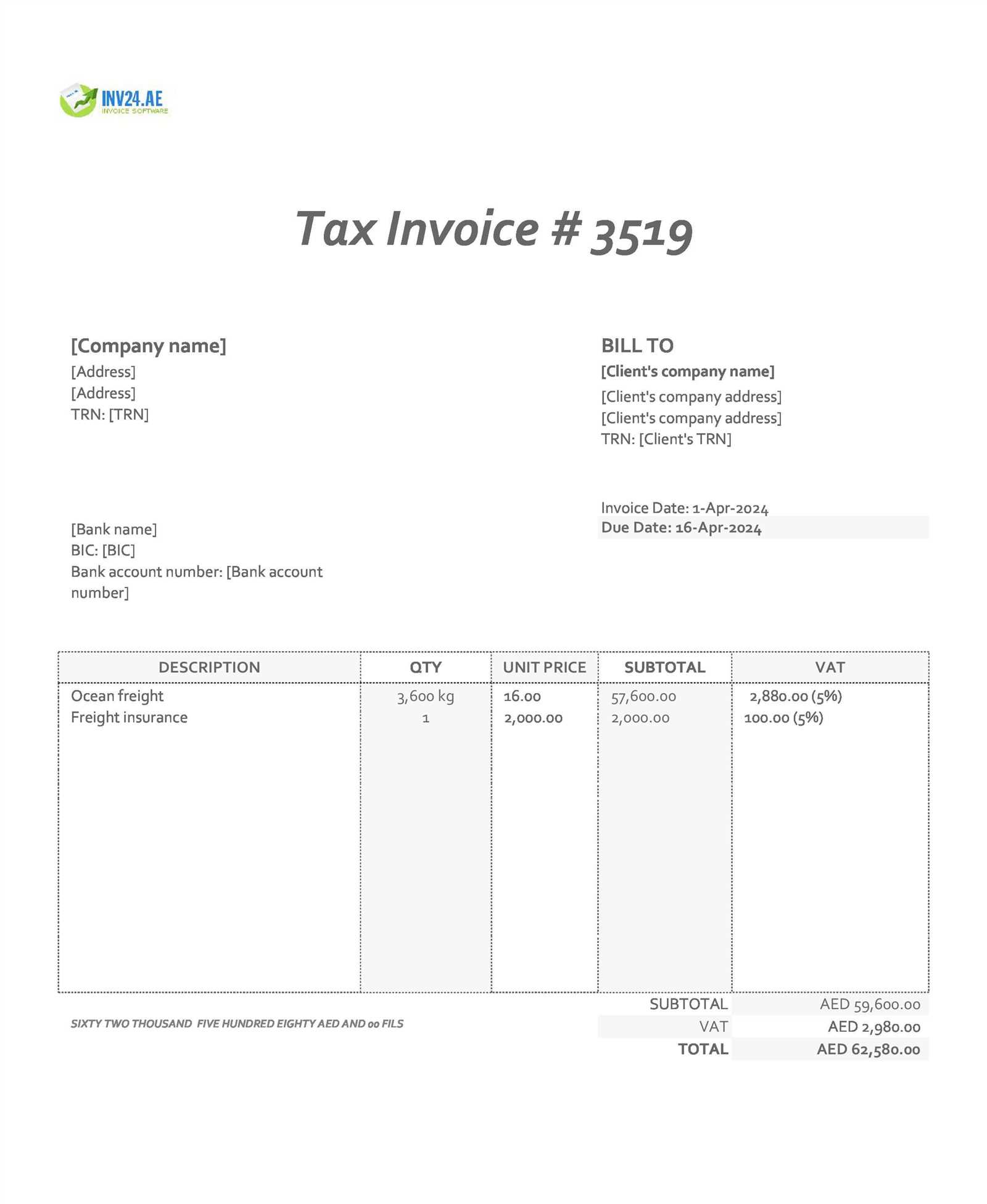

The structure of a proper billing document includes several key pieces of information. From the sender’s and recipient’s details to the specific services rendered and the amounts owed, each section should be carefully designed to minimize confusion and errors. Below is a simple breakdown of the common sections in these documents:

| Section | Description |

|---|---|

| Sender’s Details | Includes the name, address, and contact information of the company providing the service. |

| Recipient’s Information | Details of the customer receiving the goods or services, including their address and contact details. |

| Service Description | A clear list of the services or goods delivered, including quantities, rates, and any additional charges. |

| Total Amount | The sum of all charges, including taxes, discounts, and any other applicable fees. |

Why Use a Customizable Format?

Customizable formats allow businesses to easily adjust the document according to the specific needs of each transaction. This flexibility ensures that each bill accurately reflects the nature of the services provided and avoids the need for complex manual calculations. By choosing an adaptable structure, companies can save time and maintain consistency across multiple transactions.

Why Use a Freight Invoice Template

Maintaining an efficient billing system is crucial for any business involved in the delivery or transport of goods. A well-organized billing document ensures that all relevant details are captured accurately, providing clarity for both the service provider and the client. Using a pre-designed structure can greatly simplify this process, allowing for faster and error-free creation of records.

By adopting a flexible and customizable format, businesses can ensure consistency across all transactions, reducing the risk of mistakes and misunderstandings. A standardized format also saves time, as essential sections are already laid out, leaving only the specific details to be filled in. This can be especially useful when dealing with multiple clients or large volumes of transactions.

Consistency in billing is key to maintaining a professional image, and a predefined structure helps businesses maintain a uniform approach. Furthermore, it allows for quick adjustments and ensures that all necessary fields are included, preventing omissions that could lead to disputes or delayed payments.

Time-saving benefits come from eliminating the need to design a new document for each transaction, allowing staff to focus on other tasks. By using a streamlined structure, companies can focus on delivering quality services rather than spending time on administrative tasks.

Key Features of Freight Invoice Templates

When creating a billing document for goods and services, having certain features in place can make the process smoother and more efficient. A well-designed record includes all the necessary information, presented in a way that is both clear and easy to navigate. These essential components ensure that transactions are processed without confusion, benefiting both the service provider and the client.

Essential Information Sections

To ensure the document is complete, certain sections must be included. These sections provide all the necessary details for both parties to understand the terms of the transaction. Here are the most critical elements:

- Service Provider’s Information: Includes the name, address, and contact details of the company offering the service.

- Client’s Details: Information about the recipient, such as name, address, and contact details.

- Description of Services: A breakdown of the products or services provided, including quantities, prices, and any applicable taxes.

- Total Amount Due: The final amount owed, including all additional fees or charges.

- Payment Terms: Clear terms outlining when and how payments should be made, including any late fees or discounts.

Customizability and Flexibility

A significant advantage of using a flexible structure is the ability to tailor it to specific business needs. Whether it’s adjusting for different types of services, adding custom fields, or modifying the layout, this feature allows for easy customization to suit any scenario. It helps businesses maintain consistency while also adapting to unique client requirements.

- Editable Fields: Fields that can be updated quickly, such as pricing, services, and dates, ensure the document is always accurate.

- Branding Options: Customization options to add logos, color schemes, and other branding elements to maintain a professional look.

- Compatibility: Easily adjustable for use with other software or systems, making integration simple.

How to Customize Freight Invoices

Customizing billing documents allows businesses to tailor them to specific needs and preferences. By adjusting key elements such as layout, content, and branding, companies can ensure that the document aligns with their professional image while also meeting the requirements of each transaction. This section will guide you through the process of personalizing these records for maximum efficiency and clarity.

The most important aspect of customization is ensuring that the document includes all relevant details in a clear and easy-to-read format. By making the layout more intuitive and the sections more relevant, businesses can reduce confusion and errors. Below is a simple guide on how to approach customization.

| Customizable Element | How to Adjust |

|---|---|

| Layout | Modify the positioning of sections, such as moving the payment terms or adjusting the size of the service description. |

| Branding | Insert your company’s logo, change color schemes, and use custom fonts to match your brand identity. |

| Content Fields | Adjust fields to suit specific services or products, such as adding additional columns for service descriptions or shipping information. |

| Payment Terms | Include custom payment conditions, such as early payment discounts, penalties for late payments, or specific payment methods. |

Once you’ve made these adjustments, it’s important to review the document for clarity and completeness. The goal is to provide the recipient with all necessary information while maintaining a professional and straightforward appearance. Regularly updating the design ensures that the document remains relevant and effective for each new transaction.

Choosing the Right Format for Invoices

Selecting the proper structure for billing documents is crucial to ensuring that both parties understand the terms of the transaction. A well-chosen format can help streamline the process, avoid confusion, and ensure that all necessary details are included. This section will explore different formats and help you determine which one is best suited for your needs.

Factors to Consider When Choosing a Format

When deciding on the right format for your records, several key factors must be taken into account. These include the type of business, the complexity of the services provided, and the preference for manual or digital record-keeping. Choosing a format that aligns with your operational needs will make it easier to create and manage these documents over time.

- Business Requirements: Consider the nature of the services or products provided. Simpler transactions may require a more basic format, while more complex services might need a detailed breakdown of charges.

- Software Compatibility: Choose a format that integrates easily with your existing systems, whether it’s for manual filling or digital processing.

- Client Preferences: Some clients may have specific formatting needs or software requirements, so understanding their preferences is essential.

Popular Format Options

There are various formats available for creating these documents, each offering different benefits depending on the business environment. The most common options include:

- Spreadsheet Format: Useful for businesses that need to calculate totals or track payments over time.

- Text Document Format: Best for businesses that want a simple and customizable layout without the need for complex calculations.

- Online Tools: Many businesses now use cloud-based tools that provide pre-designed structures with options for customization and automatic updates.

Choosing the right format ultimately depends on the volume of transactions, the level of detail required, and how the document will be shared with clients. Whatever format you choose, ensure it is clear, comprehensive, and suitable for your specific business needs.

Essential Information in Freight Invoices

When creating billing records, it is essential to ensure that all necessary details are included to avoid confusion or delays in payment. A well-structured document must clearly outline the terms of the transaction, the services provided, and the amounts owed. In this section, we will highlight the key pieces of information that should always be included to create a clear and professional document.

The information in a billing document not only serves as a summary of the transaction but also acts as a reference point for both the service provider and the client. Ensuring accuracy in these details helps streamline communication and provides a foundation for any future inquiries or disputes. The most important elements include:

- Sender’s Contact Details: This section should include the full name, address, phone number, and email address of the service provider or company issuing the document.

- Recipient’s Information: Include the client’s full name, address, and contact details to ensure the recipient is clearly identified.

- Description of Services: A detailed list of the services or products provided, including quantities, rates, and any additional charges.

- Total Amount Due: The total cost of the services or products, along with any applicable taxes, discounts, or additional fees.

- Payment Terms: Outline the due date, acceptable payment methods, and any late fees or early payment discounts.

- Invoice Number and Date: Unique reference numbers and the date of issue help to track the transaction and prevent confusion with other documents.

Including these key elements ensures that the document is complete and serves its purpose effectively. A clearly structured record not only improves efficiency but also helps build a professional image and fosters trust between the business and the client.

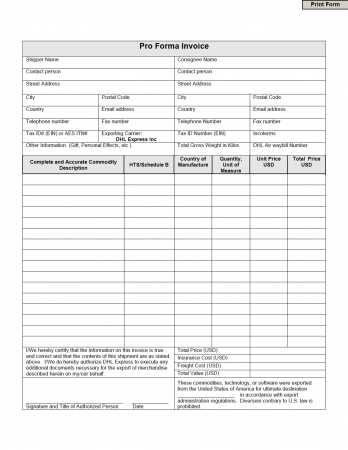

How to Add Shipping Details to Invoices

Including shipping information in billing records is essential to provide clarity about how and when goods or services will be delivered. By properly documenting these details, businesses can avoid misunderstandings and ensure both the service provider and the client are on the same page. This section will explore how to effectively add shipping information to your documents.

Key Shipping Information to Include

Shipping details should cover several key elements to ensure a comprehensive and accurate description of the delivery process. These details help to define the responsibilities of both parties and clarify any additional costs or conditions related to the shipment.

- Shipping Address: Include the full delivery address, ensuring accuracy to avoid delays or misdeliveries.

- Shipping Method: Specify the chosen delivery service or shipping carrier, such as ground, air, or expedited shipping.

- Tracking Number: Provide a tracking number if available, allowing the client to monitor the shipment’s progress.

- Delivery Date: Indicate the expected or actual date of delivery to manage client expectations.

- Shipping Costs: Clearly outline any shipping charges, whether they are included in the total amount or listed separately.

Best Practices for Organizing Shipping Information

Organizing shipping information in a clear and logical format is key to maintaining professionalism and avoiding errors. Consider the following tips:

- Separate Shipping and Billing Information: Clearly distinguish between billing and shipping details to prevent confusion.

- Use Tables for Clarity: Present the shipping details in a table format for easy reading and organization.

- Include Additional Notes: If there are any special shipping instructions, include them in a dedicated section or field.

By consistently adding comprehensive shipping details to your documents, you ensure that both the service provider and the client have all the necessary information to facilitate a smooth and successful transaction.

Tracking Payments with Freight Invoices

Effectively managing and tracking payments is crucial for maintaining cash flow and ensuring that all transactions are properly settled. Accurate records not only help monitor outstanding balances but also serve as a reference for both the service provider and the client in case of discrepancies. This section will discuss how to track payments and ensure that your records are up-to-date and reliable.

By keeping a systematic record of payments, businesses can stay organized and reduce the risk of errors or missed payments. Tracking payments accurately also helps identify overdue balances and allows businesses to follow up promptly with clients. Below are some important steps and tips for tracking payments efficiently.

Essential Payment Tracking Information

To successfully track payments, certain information must be documented clearly in your records. The more comprehensive the details, the easier it is to reconcile accounts and identify any issues.

- Payment Date: Record the exact date when a payment is made to keep track of due dates and payment terms.

- Amount Paid: Always note the amount paid, ensuring that it matches the agreed-upon total or partial payment.

- Payment Method: Specify how the payment was made, such as via bank transfer, credit card, or cash, to ensure proper reconciliation.

- Transaction Reference Number: Include any reference number or confirmation code to identify the specific payment.

- Balance Remaining: Track the remaining balance after each payment to see how much is still owed.

Best Practices for Payment Tracking

Maintaining accurate and organized records is key to smooth payment tracking. Here are some best practices to ensure you stay on top of payments:

- Use Accounting Software: Leverage accounting tools or platforms to automate and simplify the process of tracking payments and generating reports.

- Set Up Reminders: Use reminders to follow up on overdue payments to prevent delays and maintain timely cash flow.

- Regularly Reconcile Accounts: Regularly review and reconcile your accounts to ensure that all payments are correctly recorded and that there are no discrepancies.

By effectively tracking payments, you not only ensure that your business stays financially organized but also foster trust and transparency with your clients.

Common Mistakes to Avoid in Invoices

Creating billing documents involves careful attention to detail to ensure accuracy and clarity. However, even the smallest mistake can lead to misunderstandings, delayed payments, or disputes. It is important to avoid common errors that could affect the integrity of your transaction records. This section will highlight the typical mistakes made during the creation of these documents and how to prevent them.

Whether it’s a simple typo or a more complex error involving amounts or dates, these mistakes can create confusion for both the service provider and the client. Ensuring that each document is thorough and accurate from the start can prevent delays and promote trust between both parties.

Key Errors to Avoid

Below are some of the most common mistakes made when preparing these important documents and tips on how to avoid them:

| Mistake | How to Avoid |

|---|---|

| Incorrect Contact Information | Double-check all contact details for both the sender and recipient to avoid errors in communication. |

| Missing or Incorrect Payment Terms | Clearly outline payment terms such as due dates, penalties for late payments, and accepted methods of payment. |

| Failure to Itemize Charges | Provide a detailed breakdown of services or goods provided, including quantity, price, and any additional charges. |

| Wrong Dates or Invoice Number | Ensure that the date of issue is accurate and that each document has a unique reference number for tracking purposes. |

| Omitting Taxes or Discounts | Clearly display any taxes, discounts, or special charges to prevent confusion when reconciling payments. |

Best Practices for Error-Free Documents

To minimize the risk of mistakes, follow these best practices:

- Use Templates: Pre-designed structures can help ensure that all necessary information is included and that formatting is consistent.

- Proofread: Always review the document for errors before sending it to the client. A second set of eyes can also help catch mistakes.

- Automate Where Possible: Using software or tools that automatically generate these records can reduce the chance of human error.

By avoiding these common mistakes, you ensure that your billing documents remain accurate, professional, and clear, helping to maintain positive relationshi

Benefits of Using Word for Templates

Utilizing document creation software to design and customize professional records can significantly streamline your business operations. When opting for a structured format, it becomes easier to maintain consistency, accuracy, and efficiency in creating formal documents. This section will explore the advantages of using document-processing programs for generating repeatable layouts and customizable forms.

One of the key benefits of using this type of software is its versatility. It allows users to create and modify documents without requiring advanced technical skills, offering a simple yet powerful solution for creating professional-looking files. Additionally, the ability to save and reuse custom formats reduces the time spent on repetitive tasks.

Advantages of Using Document Processing Software

- Ease of Use: Document software typically offers an intuitive interface, making it accessible for people with varying levels of expertise.

- Customization Options: Users can easily modify fonts, colors, and layouts to match their brand identity or personal preferences.

- Time-Saving: Once a layout is created, it can be reused for future records, saving valuable time in document preparation.

- Professional Appearance: The software provides predefined templates and formatting tools that help maintain a polished and professional look in every document.

- Easy Sharing and Distribution: Digital documents can be shared via email or stored in cloud platforms, allowing easy access and distribution across teams and clients.

How to Maximize Efficiency with Document Programs

To fully leverage the potential of document-processing software, consider the following strategies:

- Use Pre-Designed Layouts: Take advantage of built-in layouts that are designed for various types of business records to save time.

- Automate Updates: Use features like auto-numbering and date fields to automatically update information with each new record.

- Standardize Formatting: Set up consistent styles and formatting for different sections of your document, ensuring uniformity across all files.

By adopting document creation programs, you can enhance your productivity, maintain consistency, and ensure that your records are professionally designed with minimal effort.

Creating a Professional Invoice Design

Designing a professional document layout plays a crucial role in the communication between businesses and clients. A well-structured document not only improves clarity but also enhances the overall brand image. In this section, we will explore how to create an aesthetically pleasing and functional document that reflects professionalism while conveying all necessary details in a clear and organized manner.

The key to a professional design lies in simplicity and organization. A clean layout, with well-defined sections, helps clients quickly understand the details of the transaction. Using appropriate fonts, colors, and spacing ensures the document is easy to read and visually appealing.

Key Elements of a Professional Design

- Clear Branding: Include your company’s logo, name, and contact information at the top to make the document easily identifiable.

- Well-Defined Sections: Separate important information into logical sections like contact details, service descriptions, and payment terms.

- Consistent Formatting: Use uniform fonts, colors, and text alignment to maintain a professional appearance and readability.

- Spacing and Alignment: Ensure enough white space between sections to avoid overcrowding, making the document easy to scan.

Best Practices for Layout Design

- Use Simple and Legible Fonts: Choose easy-to-read fonts such as Arial or Times New Roman for the body text, while reserving bold or larger fonts for headers.

- Include Visual Hierarchy: Emphasize key information such as due dates or amounts due using bold text or larger font sizes.

- Align Text Properly: Use left alignment for readability and avoid overly complex formatting that could distract from the content.

By focusing on clear structure, consistency, and branding, you can design a document that not only meets functional requirements but also presents your business in a professional light, ensuring clients recognize the quality of your work.

Tips for Ensuring Invoice Accuracy

Maintaining accuracy in business documentation is critical for building trust and ensuring smooth financial transactions. Errors in details such as pricing, terms, or client information can lead to confusion, delayed payments, or even disputes. This section provides essential tips to help ensure your documents are precise and error-free, enabling clear communication between businesses and clients.

By double-checking key fields and using proper tools, you can significantly reduce the risk of mistakes. Below are several strategies for ensuring the accuracy of your documents from start to finish.

Key Practices for Accurate Document Creation

- Verify Client Information: Always check that your client’s name, address, and contact details are correct before finalizing any document.

- Confirm Pricing and Quantities: Cross-check the amounts and quantities listed to ensure they align with agreements and actual services or products provided.

- Review Payment Terms: Ensure that payment terms, such as due dates and late fees, are clearly stated and accurate.

- Use Automatic Calculations: Many document programs allow for automatic calculations of totals and taxes to minimize human error.

Common Areas to Double-Check

| Section | What to Check |

|---|---|

| Client Details | Ensure the name, address, and contact details are correct. |

| Product or Service Description | Double-check product/service descriptions and quantities for accuracy. |

| Payment Information | Verify payment terms and ensure any taxes or discounts are calculated correctly. |

| Dates and Deadlines | Confirm the accuracy of the issue date and payment due date. |

By following these guidelines and regularly reviewing your documentation process, you can ensure that your records are accurate, professional, and free from costly mistakes, leading to smoother transactions and stronger business relationships.

Freight Invoice Template Download Options

There are various methods available for obtaining ready-made document layouts that can streamline the billing process for businesses. These pre-designed formats help reduce the time spent creating documents from scratch, allowing for quick customization and use. In this section, we will explore the different ways to download and use these customizable formats to fit your business needs.

With many online platforms offering easy access to a range of document options, businesses can quickly find a layout that suits their requirements. Below are some of the popular sources and download options available to users looking to create accurate and professional documents efficiently.

Popular Sources for Document Downloads

- Free Online Platforms: Websites that offer free downloadable formats, typically with basic functionality and customizable sections.

- Premium Templates: Subscription-based services providing more advanced document formats with additional features, often with a focus on branding and design.

- Business Software Programs: Many business software applications come with pre-designed layouts that can be customized and exported in various formats like PDF or Excel.

Download Formats and Customization Options

| Source | Available Formats | Customization Features |

|---|---|---|

| Free Online Resources | PDF, Excel, Word | Basic customization options such as adding text, changing fonts, and adjusting layout. |

| Paid Services | PDF, Excel, Word, Google Docs | Advanced customization such as automatic calculations, adding logos, and full design options. |

| Business Software | PDF, Excel | Integration with other tools, automated data entry, and advanced reporting features. |

By exploring the different download options, businesses can easily select the best format to suit their operations. Whether opting for a free or paid option, the ability to quickly access and customize a layout can significantly enhance operational efficiency.

Integrating Freight Invoices with Accounting Software

In today’s fast-paced business environment, automating financial processes is crucial for maintaining accuracy and efficiency. Integrating billing documents with accounting systems allows companies to streamline their operations, reduce manual entry, and improve the accuracy of financial reporting. This section outlines the key steps and benefits of connecting your billing system with accounting software for seamless data transfer and improved workflow.

Benefits of Integration

- Time Efficiency: Automating the transfer of billing data to accounting software eliminates the need for manual data entry, saving time and reducing errors.

- Accuracy: Automated integration ensures that financial data is consistently accurate and up-to-date, reducing the chances of discrepancies.

- Improved Reporting: Integrated systems allow for better tracking and reporting of financial transactions, enabling businesses to generate detailed reports more easily.

- Seamless Workflow: Linking the two systems reduces the need to switch between multiple platforms, making the process faster and more streamlined.

Steps to Integrate Billing Systems with Accounting Software

- Choose Compatible Software: Select accounting software that supports integration with your current billing platform. Many popular software tools offer built-in integration features or third-party apps.

- Enable API Access: If your accounting software supports it, enable API access to allow data transfer between the two platforms. This step often requires some technical setup or assistance from a specialist.

- Configure Data Mapping: Define how data from the billing documents (e.g., amounts, dates, customer details) should be mapped to corresponding fields in the accounting software.

- Test the Integration: Before going live, run tests to ensure that the integration works as expected, checking for any errors or inconsistencies.

- Monitor and Update: After integration, monitor the system for any potential issues and update it as necessary to maintain compatibility with future software updates.

By integrating your billing system with accounting software, businesses can improve efficiency, reduce errors, and achieve greater financial clarity. The process may require some initial setup, but the long-term benefits in terms of time savings and accuracy make it a worthwhile investment for companies looking to optimize their operations.

How to Handle Invoice Disputes

Disputes over billing can arise for a variety of reasons, such as incorrect amounts, miscommunication, or discrepancies in the services or products provided. Effectively managing these disputes is essential for maintaining healthy client relationships and ensuring the accuracy of financial records. This section provides practical strategies for addressing and resolving such conflicts professionally and efficiently.

Steps to Resolve Billing Disputes

- Review the Details: Before responding to the dispute, thoroughly review the transaction details, including all relevant documents such as contracts, communications, and previous payments. Ensure that the claim is valid by cross-checking all figures and terms.

- Communicate Promptly: Reach out to the client as soon as possible to acknowledge the dispute. A prompt response helps demonstrate professionalism and a willingness to resolve the issue.

- Stay Calm and Professional: Keep the tone of the conversation respectful and objective. Avoid emotional responses and focus on facts, as this will help maintain a constructive dialogue.

- Offer a Solution: Depending on the nature of the dispute, propose a fair solution that addresses the client’s concerns while protecting your interests. This may involve correcting errors, offering a discount, or negotiating a payment schedule.

Preventing Future Disputes

- Clear Documentation: Ensure all terms of the agreement are clearly outlined in contracts and billing documents. Detailed descriptions of services or products, as well as pricing, can help avoid misunderstandings.

- Regular Communication: Maintain open lines of communication with clients throughout the process, especially when expectations or terms change. Regular updates can prevent confusion later on.

- Use Reliable Software: Utilize reliable billing or financial software that minimizes human error. Such tools can help automate calculations and generate accurate records, reducing the likelihood of mistakes.

Effectively managing billing disputes requires a proactive and solution-oriented approach. By addressing issues quickly, maintaining clear communication, and taking steps to prevent future conflicts, businesses can foster better relationships with their clients and ensure smoother financial operations.

Legal Considerations in Freight Invoicing

When managing transactions and billing within the logistics and transportation industry, it is essential to understand the legal framework that governs financial documentation. Properly structured and compliant billing not only protects both parties involved but also ensures that businesses adhere to applicable laws and regulations. This section outlines key legal considerations for businesses creating billing documents related to shipping and transport services.

Firstly, it is important to ensure that all agreements regarding payment terms are clearly stated and legally binding. Contracts should specify when payments are due, any penalties for late payments, and the terms under which disputes will be resolved. Having these terms in writing can prevent misunderstandings and provide legal protection in case of a payment issue.

Additionally, businesses should be mindful of the inclusion of tax information in the documentation. Depending on jurisdiction, different taxes may apply to the services provided, such as sales tax or value-added tax (VAT). Failing to include the correct tax rates or not providing sufficient tax information can lead to legal complications or fines.

Furthermore, businesses should be aware of the statute of limitations related to billing disputes. In many regions, there is a set period within which a dispute can be legally addressed. Once this period has passed, businesses may lose the ability to pursue legal action for payment recovery, so it is crucial to act within these timeframes.

Finally, businesses should ensure that their billing documentation complies with data protection and privacy regulations. Customer details, shipping addresses, and payment information must be handled securely and in compliance with applicable data privacy laws, such as the GDPR in Europe or CCPA in California, to avoid legal liabilities.

In conclusion, understanding the legal aspects of creating billing documents in the logistics sector is crucial for ensuring compliance and avoiding legal disputes. By incorporating clear terms, tax information, and privacy protections, businesses can mitigate risks and maintain a solid legal foundation in their financial operations.

Optimizing Freight Invoice Workflow

Streamlining the billing process is essential for improving efficiency and ensuring accurate financial records in the transportation and logistics industry. Optimizing the workflow not only reduces the time spent on administrative tasks but also minimizes errors and improves overall productivity. In this section, we explore various strategies for enhancing the billing process to ensure smooth operations and timely payments.

Automating Repetitive Tasks

One of the key ways to optimize the workflow is by automating routine tasks. Manual data entry can be time-consuming and prone to mistakes. By using software solutions that automatically populate billing information from previous records, you can reduce the chances of errors and speed up the process.

- Automated data input: Software that automatically pulls information from other systems or databases eliminates the need for manual input, improving accuracy and speed.

- Recurring billing cycles: Set up automated recurring billing for clients with regular shipments or services to save time and ensure consistency.

- Payment reminders: Automated reminders for upcoming payments help to reduce late payments and improve cash flow.

Standardizing Documentation and Processes

Creating standardized processes for document generation and management can also help optimize the workflow. By using consistent formats, businesses can ensure that all required information is included, reducing the likelihood of disputes and rework. Standardization also allows employees to work more efficiently, as they will be familiar with the process and the information required.

- Uniform document layout: Using a consistent layout for all billing documents makes it easier for both staff and clients to review the information.

- Clear communication: Standardized communication templates, such as emails or follow-up messages, can be used to notify clients about the status of their payments or upcoming due dates.

- Electronic document management: Using cloud-based document management systems allows quick access to past records and eliminates the need for physical storage.

By implementing these strategies, companies can ensure that the billing process becomes more efficient, less error-prone, and quicker, leading to faster payment cycles and improved cash flow management.