Free Freelancer Invoice Template for Easy and Professional Billing

Effective billing is a crucial part of maintaining a smooth working relationship with clients. Having a clear, organized method for tracking payments ensures that you get paid on time and prevents any misunderstandings. The right tools can make this process effortless, saving you time and ensuring professionalism in every transaction.

By utilizing a structured document, you can easily customize important details such as services rendered, payment terms, and due dates. This document not only simplifies your workflow but also adds a layer of credibility, showing clients that you take your work seriously. With just a few simple steps, you can create a professional and functional record that enhances your business operations.

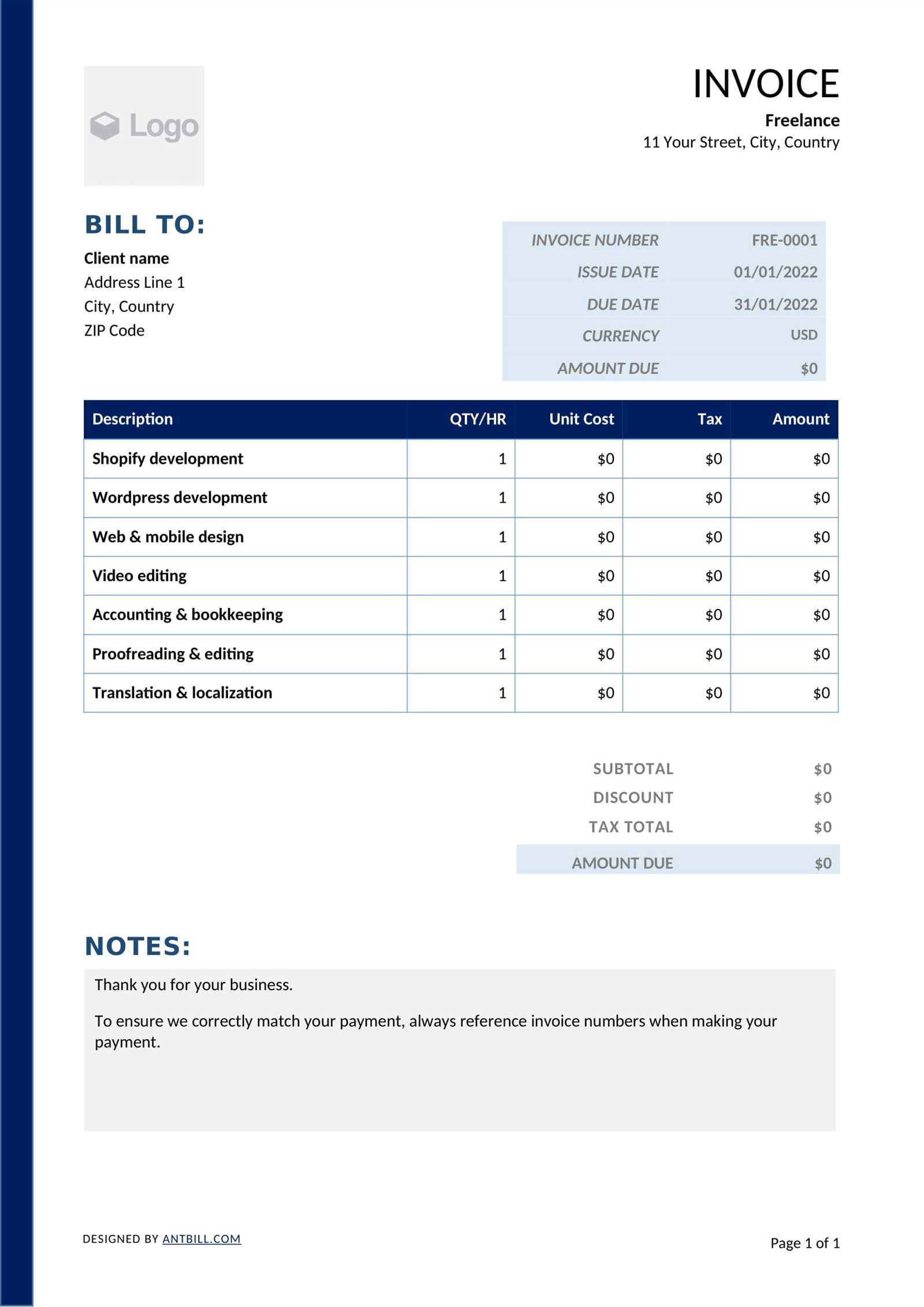

Freelancer Invoice Template Essentials

Creating a well-structured document for billing is an essential part of any independent worker’s business practice. This document serves as a formal request for payment and clearly outlines the terms of the transaction. Without a proper structure, there’s a risk of confusion, delayed payments, and even potential disputes. A good framework ensures both you and your clients are on the same page.

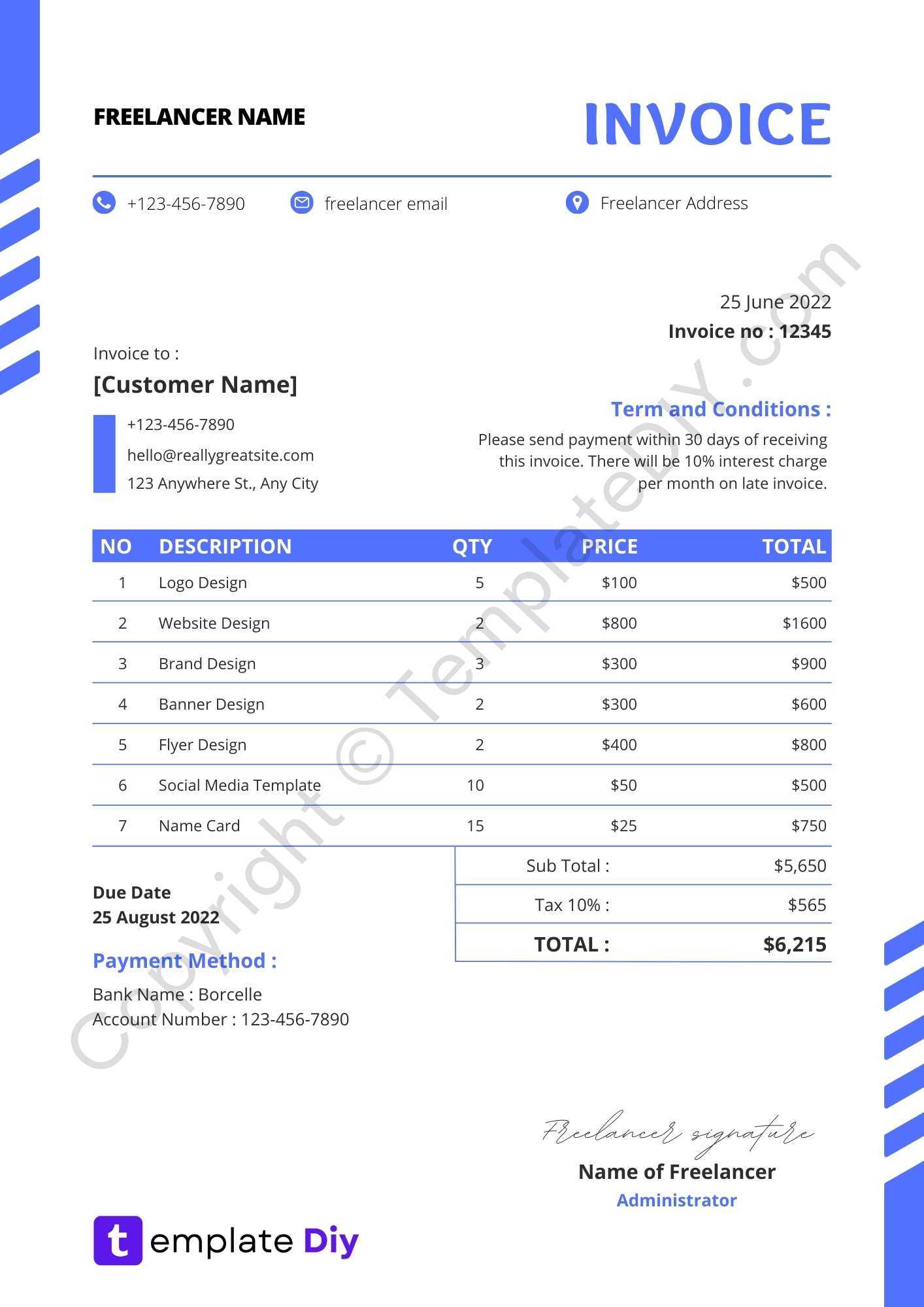

There are key elements that should always be included in such a document. These components not only provide clarity but also contribute to the professionalism of your business. Here are the most important sections to include:

Key Components of a Billing Document

| Component | Description |

|---|---|

| Header | Include your name or company name, contact details, and the document title to identify it clearly. |

| Client Information | Ensure the client’s name, address, and contact information are correctly listed. |

| Description of Services | Provide a detailed list of the services you’ve provided, including hours worked or flat rates. |

| Payment Terms | State the due date, payment method, and any late fees or discounts for early payment. |

| Total Amount | Clearly display the total amount due, breaking it down by individual services if needed. |

Why These Elements Matter

Each part of the document plays a crucial role in ensuring that all details are captured and that both parties understand their obligations. By including these components, you enhance the likelihood of receiving prompt payment and maintain a professional reputation.

What Is a Freelancer Invoice?

A payment request document is a formal record that independent workers use to bill clients for services rendered. It serves as a detailed summary of the work completed and outlines the agreed-upon costs, payment terms, and deadlines. This document not only ensures that both parties are clear about the transaction but also acts as a legal record in case of disputes or audits.

The main purpose of such a document is to request payment for services provided. It helps the client understand what they are being charged for, the total amount due, and when payment is expected. A well-crafted document reduces confusion and promotes timely compensation, fostering trust and professionalism in business relationships.

By including essential information such as service descriptions, payment terms, and contact details, this document becomes an invaluable tool for independent contractors, ensuring that they get compensated fairly and on time. Without it, it can be difficult to maintain proper financial records and uphold a professional reputation.

Why You Need an Invoice Template

Having a standardized document for billing is essential for anyone providing services to clients. It not only streamlines the payment process but also ensures consistency and professionalism in every transaction. By using a pre-designed structure, you eliminate the need to start from scratch each time, saving valuable time and effort.

One of the main benefits of using such a document is accuracy. With a ready-made format, it’s easy to include all necessary information, from the client’s details to a breakdown of charges. This reduces the chance of missing important elements, which could lead to misunderstandings or delays in payments. Moreover, a professional layout creates a positive impression, helping to strengthen your client relationships.

Additionally, a standardized document can help you keep track of all payments received and organize your financial records. This is especially helpful for tax purposes, providing clear documentation of income earned over time. In short, using a pre-designed form simplifies your billing process, ensures timely payments, and helps maintain a professional image in your business dealings.

Key Features of a Freelancer Invoice

When creating a document to request payment for services, it’s important to include specific elements that make the record clear, professional, and easy to understand. These features help both parties–service providers and clients–ensure that the terms of the agreement are met and that there is no confusion regarding payment details.

Key components include your personal or business information, the client’s contact details, a description of the services provided, the total amount due, and the payment terms. Each of these elements helps to outline the transaction fully and reduces the chance of misunderstandings. Additionally, payment instructions, deadlines, and any applicable taxes or discounts should be clearly stated to avoid delays.

By including these important features, you not only ensure that the payment process goes smoothly, but you also maintain a professional appearance. This clarity is essential for fostering trust with your clients and ensuring timely compensation for your work.

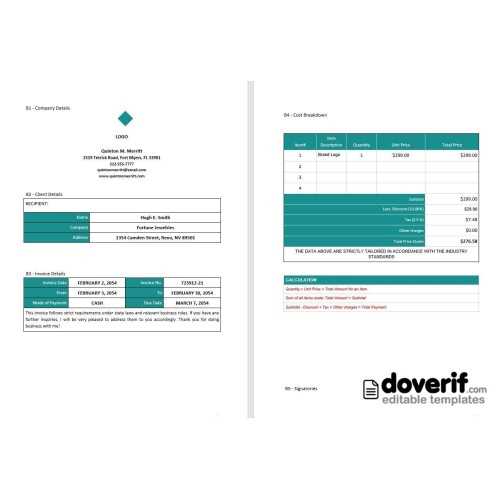

How to Customize Your Invoice Template

Customizing your billing document allows you to reflect your unique brand identity while ensuring that all necessary details are clearly presented. By personalizing the layout and content, you can make the process more efficient and professional, ensuring that your clients understand the charges and payment terms. Customization also helps to streamline your workflow, saving you time with each new payment request.

Essential Customization Areas

Start by adjusting the header of the document to include your business name, logo, and contact details. This establishes your brand and makes the document instantly recognizable. The next step is to modify the client section with their name and contact information. Accurate client details are crucial for maintaining proper records and ensuring no errors in communication.

Personalizing Services and Payment Details

Next, tailor the description of services provided. Include a detailed breakdown of the work performed, hours worked (if applicable), and individual rates or fees. This transparency helps avoid confusion later on. Finally, adjust payment terms, including due dates, accepted payment methods, and any late fees or discounts. By customizing these areas, you ensure the document is fully aligned with the specific needs of each transaction.

Tips for Writing Professional Invoices

Creating a polished and well-structured payment request is essential for maintaining professionalism and ensuring timely payment. A professional document not only provides clarity but also fosters trust with your clients, which can lead to repeat business and positive referrals. Below are some key tips to help you craft effective and professional billing records every time.

Be Clear and Detailed

One of the most important aspects of a professional billing document is clarity. Include a detailed description of the services provided, the time spent on each task (if applicable), and the agreed-upon rate. Avoid vague language, and break down the charges in a way that is easy for your client to understand. This helps prevent disputes and confusion.

Use a Consistent Format

Consistency is key to creating a professional look. Use the same layout and design for every billing document, including uniform fonts, colors, and styles. This consistency not only makes your documents more recognizable but also helps you stay organized. Be sure to include all necessary fields, such as client details, payment terms, and due dates, in the same order for every request. A clean, organized format ensures the document is easy to read and reduces the likelihood of errors.

Common Mistakes in Freelance Invoices

When preparing a payment request document, even small errors can lead to confusion, delays, and sometimes even non-payment. It’s crucial to avoid common mistakes that can affect the professionalism of the record and the clarity of the transaction. Here are a few of the most frequent issues that can occur when creating such documents.

Missing or Incorrect Client Details

One of the most common errors is failing to include accurate client information or entering it incorrectly. This could lead to communication issues or cause payment delays. Always double-check the client’s name, address, and contact information before finalizing the document.

Unclear Payment Terms

Another mistake is leaving payment terms vague or unclear. Failing to specify the due date, late fees, or accepted payment methods can create confusion and result in delayed payments. Be explicit about the deadlines and preferred methods of payment to avoid misunderstandings.

Not Itemizing Services or Charges

It’s essential to provide a detailed breakdown of the services rendered or work completed. Omitting this information or listing only a lump sum can cause clients to question the charges or delay the process. Always ensure that each service, its cost, and any applicable taxes are clearly outlined.

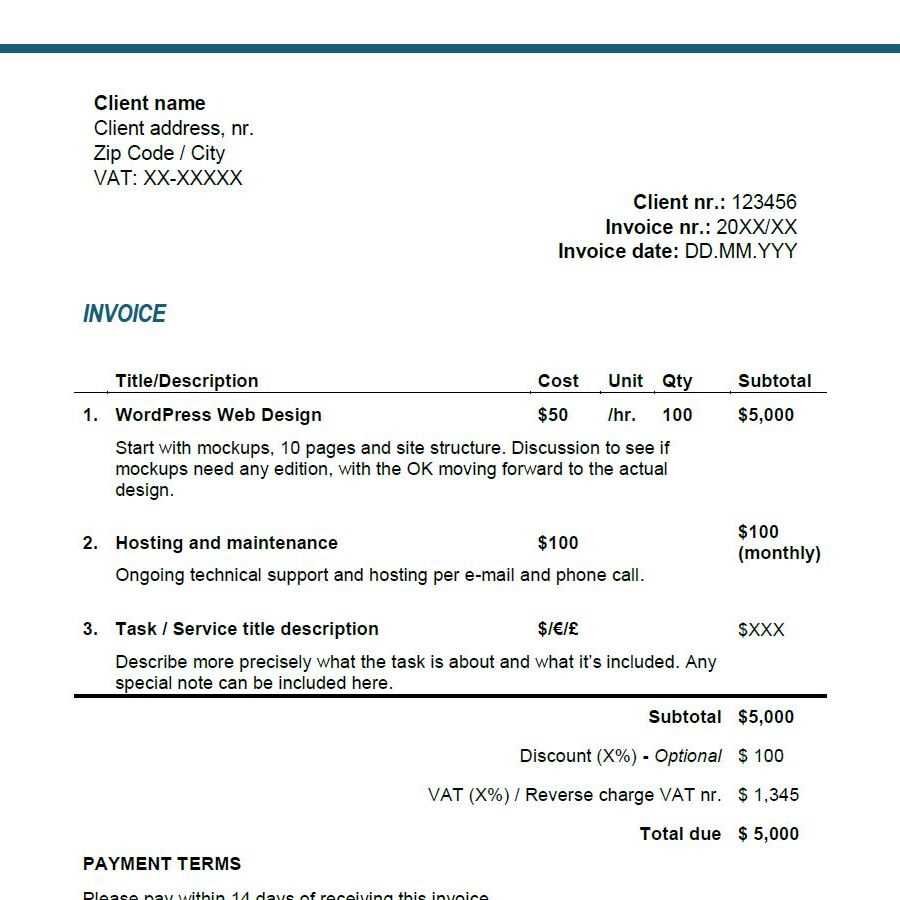

Understanding Invoice Payment Terms

Payment terms are a crucial element of any billing document, as they define when and how a client is expected to pay for the services rendered. Clear and precise terms not only help avoid misunderstandings but also ensure that payments are made on time. Understanding and setting the right payment terms can also help maintain professional relationships and prevent unnecessary delays.

Due Dates and Deadlines

One of the most important aspects of payment terms is the due date. This specifies the date by which payment must be made. Whether it’s 7, 14, or 30 days after receiving the document, clearly stating this date helps manage expectations and encourages timely payment.

Late Fees and Penalties

To further ensure prompt payments, many professionals include late fees or penalties in their payment terms. These fees are typically a percentage of the total amount due and are added if the payment is not received by the specified due date. Including this provision can discourage late payments and motivate clients to settle their accounts on time.

Accepted Payment Methods

Another important consideration is specifying the methods of payment you accept. Whether it’s bank transfer, PayPal, credit card, or another method, listing these options clearly helps avoid confusion. Clients will appreciate knowing what payment channels are available and can choose the most convenient one for them.

How to Add Taxes to Your Invoice

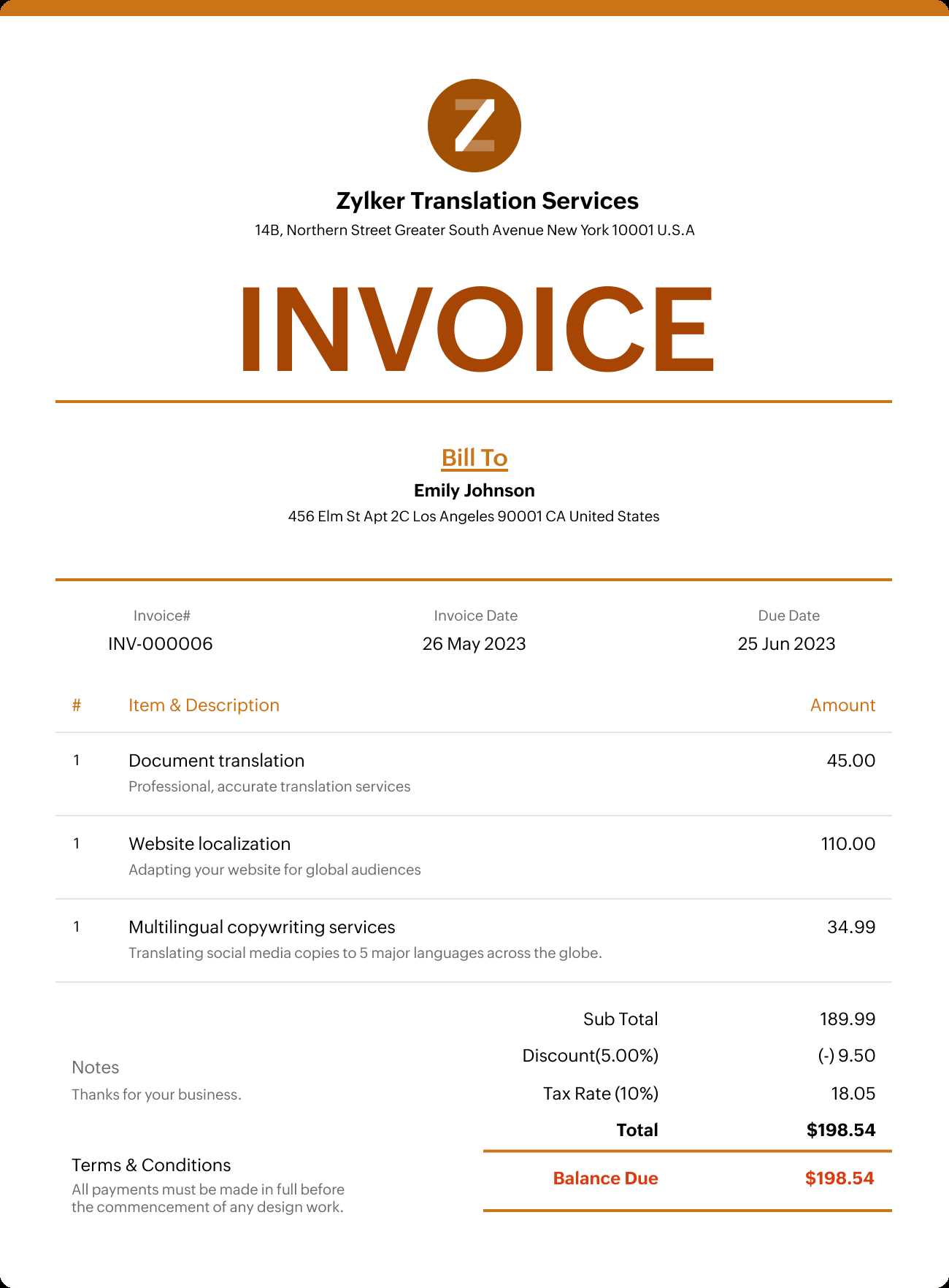

When providing services, it’s essential to correctly calculate and include applicable taxes in your payment request document. Taxes are a standard part of most business transactions, and ensuring that they are properly applied helps you comply with legal requirements while maintaining transparency with your clients. Whether it’s sales tax, VAT, or other levies, adding taxes correctly is an important part of the billing process.

Determine the Tax Rate

Before adding taxes, it’s important to know the appropriate tax rate based on your location and the services you provide. Tax rates can vary by country, state, or even city, so make sure you are applying the correct rate for your area and the type of service. You may also need to consider whether your services are taxable at all.

Clearly List the Tax on the Document

Once you know the tax rate, you should clearly state the tax amount separately from the total cost of the services. Include a line item on the document that specifies the tax rate and the total tax amount being added to the final sum. This ensures that your client understands exactly how much they are being charged in taxes and helps avoid confusion.

Include a Tax Identification Number

In many jurisdictions, it’s also necessary to include your tax identification number (TIN) or VAT number on the billing document. This adds legitimacy and helps your clients validate the tax charges, especially for businesses that may need to claim tax refunds or deductions. Including this information further reinforces the professionalism of your payment request.

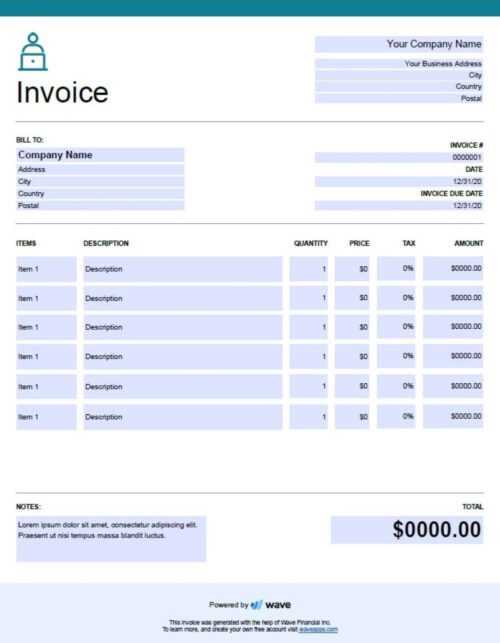

Best Software for Creating Invoices

Creating a professional billing document doesn’t have to be a complicated process. With the right software, you can quickly generate clean, accurate records that reflect your services and streamline the payment process. There are numerous tools available, each offering unique features to make billing easier, more efficient, and more organized. Below are some of the best options to consider when selecting software to generate your payment request documents.

Top Software for Billing

| Software | Key Features | Pricing |

|---|---|---|

| FreshBooks | Easy-to-use, customizable templates, time tracking, automatic reminders, and payment integration | Starting at $15/month |

| QuickBooks | Comprehensive financial management, invoicing, expense tracking, and reporting tools | Starting at $25/month |

| Wave | Free invoicing tool with customizable templates, financial tracking, and reports | Free (additional paid features available) |

| Zoho Invoice | Automated billing, recurring invoices, multi-currency support, and detailed reporting | Starting at $9/month |

Why Choose the Right Software?

Using the right billing software can save you time and ensure that your payment requests are accurate, professional, and easy to process. These tools offer features such as customizable templates, automatic payment reminders, and integrations with other platforms, allowing you to automate much of the billing process. By choosing the right software, you can improve the efficiency of your business and reduce the chances of errors in your records.

How to Track Unpaid Invoices

Keeping track of unpaid payment requests is essential for maintaining cash flow and ensuring you get compensated for your work. With multiple clients and various payment deadlines, it’s easy to lose track of which amounts are still outstanding. By implementing an effective tracking system, you can stay organized and follow up with clients in a timely manner without missing a beat.

Effective Methods for Tracking Unpaid Amounts

- Use a Dedicated Spreadsheet – Create a simple spreadsheet to log all payment requests, including the amount, due date, and payment status. This can be a quick and efficient way to monitor overdue payments.

- Leverage Accounting Software – Many accounting programs allow you to track payments automatically, send reminders, and even generate reports on outstanding balances. This system can save you time and reduce the chances of errors.

- Set Up Alerts or Reminders – Schedule automatic reminders for unpaid balances. This way, you won’t forget to follow up, and your clients will be gently prompted to pay on time.

Steps for Managing Unpaid Requests

- Review Your Records Regularly – Check your payment logs weekly to identify any overdue amounts. Being proactive helps you catch missed payments early and resolve them quickly.

- Follow Up Professionally – When payments are overdue, reach out to your clients with a polite but firm reminder. Include details like the amount due, the original payment terms, and the revised due date.

- Offer Payment Options – If a client is struggling to pay, consider offering them an installment plan or another method of payment to help ease the process. This can help maintain a positive relationship while still ensuring you get paid.

By staying organized and following up on unpaid amounts promptly, you can ensure a smoother payment process and reduce the risk of missed payments in the future.

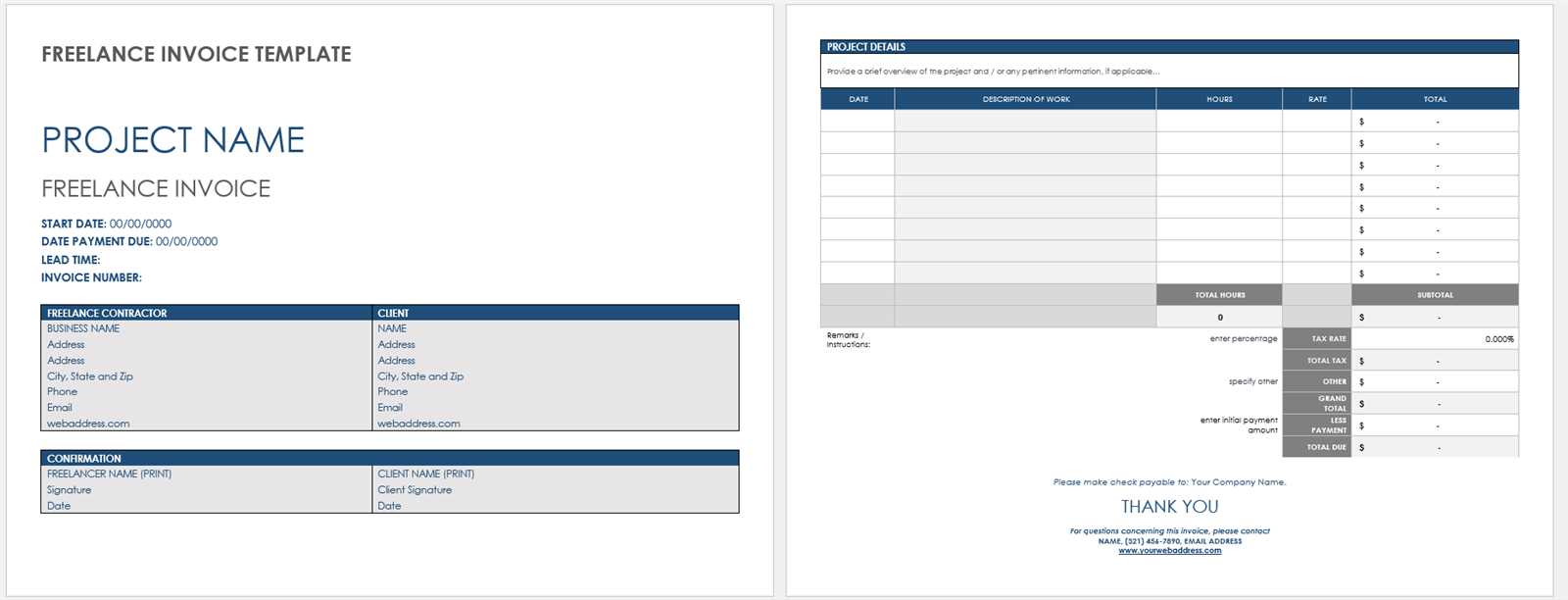

Using Freelance Invoice Templates for Efficiency

Using pre-designed billing documents can greatly enhance your workflow, saving you time and effort while maintaining a professional appearance. These ready-to-use formats allow you to quickly fill in the details for each transaction without starting from scratch every time. By utilizing a standardized structure, you can ensure that every request is accurate and includes all necessary information, streamlining the payment process for both you and your clients.

Benefits of Using Pre-Designed Billing Documents

- Time Savings – Instead of creating a new record from the ground up, you can fill in the relevant details in a pre-made structure, significantly speeding up the billing process.

- Consistency – With a uniform format, every payment request you send looks professional and follows the same structure, making it easier for clients to understand and pay on time.

- Minimized Errors – A consistent layout reduces the chances of forgetting important information or misplacing details. Pre-designed forms include all the necessary fields, helping ensure you don’t overlook anything.

- Customization – Although the basic structure is fixed, many pre-made documents allow for customization, so you can adjust them to fit your unique needs and preferences.

How to Maximize Efficiency with Pre-Made Formats

- Choose the Right Format – Select a layout that fits your business needs. Whether you prefer a minimalist style or a more detailed structure, there’s a format for every type of service.

- Update Information Automatically – Many systems allow you to save client details, payment terms, and service descriptions, so you don’t need to manually input the same information repeatedly.

- Set Up Reminders – Some systems allow you to create automatic reminders or recurring billing schedules, reducing the need for constant follow-ups and ensuring timely payments.

By incorporating pre-designed pay

How to Handle Multiple Clients on One Invoice

Managing multiple clients on a single payment request document can be a challenge, but with the right approach, it can be done efficiently and clearly. When working with more than one client for different projects or services, it’s essential to break down each charge clearly to avoid confusion and ensure that all parties understand what they are being billed for. Proper organization and attention to detail are key when creating a multi-client document.

How to Structure a Multi-Client Billing Document

When including multiple clients on one request, it’s important to provide a detailed breakdown of the services provided to each one. A well-structured document will help your clients easily identify which charges correspond to them and will minimize the risk of any disputes. Below are a few essential tips for structuring the billing document:

- Separate Sections for Each Client: Divide the document into distinct sections for each client, clearly listing the services provided, rates, and any applicable taxes. This makes it easy for each client to review their specific charges.

- Itemize Each Service: For each client, ensure that services are listed separately with corresponding rates. This transparency helps avoid confusion over what was billed and ensures that both you and the client are on the same page.

- Provide Total Amounts for Each Client: Summarize the total for each client at the end of their section. This ensures clarity on what each client is expected to pay.

Example of a Multi-Client Billing Document

| Client Name | Service Provided | Amount |

|---|---|---|

| Client A | Web Design | $1,500 |

| Client A | SEO Services | $500 |

| Total for Client A | $2,000 | |

| Client B | Content Writing | $800 |

| Total for Client B | $800 |

By clearly separating the details for each client and including itemized charges, you can handle multiple clients on a single document while maintaining clarity and professionalism.

Incorporating Your Brand into Invoices

Incorporating your brand identity into your payment request documents is an effective way to create a lasting impression on your clients. A well-branded document not only looks more professional but also reinforces your business’s image and helps maintain consistency across all communication channels. By adding elements like logos, colors, and unique fonts, you can make your billing documents align with your overall branding strategy.

Key Elements to Add for Branding

- Logo – Including your logo at the top of the document establishes immediate recognition and reinforces your brand identity. Make sure it’s positioned clearly, and if necessary, use a high-quality image to ensure it appears sharp and professional.

- Brand Colors – Integrating your brand’s color scheme into the design of the document, such as in headers, borders, or background elements, can help create a cohesive look that matches your business’s aesthetic.

- Custom Fonts – Using fonts that reflect your brand’s style can enhance the overall appearance of your document. Choose a readable, professional font that complements your logo and other brand materials.

- Tagline or Business Name – Adding a tagline or your business name in a prominent spot reinforces your brand’s messaging and reminds clients of the services you offer.

Why Branding Your Billing Documents Matters

- Professionalism – A branded document looks more polished and trustworthy, showing clients that you take your business seriously and are committed to delivering quality service.

- Recognition – Consistent use of your logo, colors, and style helps clients recognize your business, even when they’re reviewing your payment request document, creating a connection between the services they received and your brand.

- Trust and Credibility – A well-branded document can build trust with clients, showing that you have an established, professional business identity. It signals that you pay attention to detail and care about your clients’ experience.

By including these elements, you not only create a more memorable experience for your clients but also promote your brand in every interaction, even during the payment process.

Legal Aspects of Freelancer Invoicing

When creating payment requests for your services, it’s essential to understand the legal requirements that govern these documents. Properly formatted and legally compliant records not only ensure that your rights are protected but also help you avoid potential disputes with clients. Knowing what information to include and how to handle taxes, payment terms, and legal language can make a significant difference in the effectiveness and legality of your billing practices.

Firstly, it’s crucial to understand the importance of clear and accurate details in each document. This includes including both your contact information and that of the client, a description of the services rendered, the agreed-upon payment amount, and any applicable taxes. You must also state the payment terms clearly, including due dates, accepted methods of payment, and any late fees or penalties for overdue payments.

Another critical aspect is the inclusion of the correct tax information. Depending on your location, taxes such as sales tax or VAT may need to be added to your service fees. Make sure you are aware of any specific tax laws that apply to your business, as failing to charge the correct amount of tax can result in penalties. If applicable, include your tax identification number (TIN) or VAT number on the payment request as required by local laws.

Additionally, it’s advisable to consult with a legal professional to ensure that your payment request documents comply with the specific regulations in your region, especially when working with international clients. Different countries have different requirements for business transactions, and understanding these laws can help you stay compliant and avoid potential legal challenges.

How to Send Your Invoice to Clients

Sending a payment request to your clients is just as important as creating it. How you deliver it can influence not only how quickly you get paid but also the overall professionalism of your business. There are various methods for sending these documents, and choosing the right one depends on the preferences of your clients, as well as your own workflow. Whether through email, online platforms, or even physical mail, ensuring your document reaches your client in the most effective and secure manner is crucial.

Methods for Sending Payment Requests

There are several ways you can send your payment request, each with its own set of advantages. The method you choose may depend on your client’s preferences, the size of your business, and the formality of your relationship with the client.

- Email: The most common and efficient method. Attach the document as a PDF file or use an online invoicing service to send it directly to your client’s email address.

- Online Payment Platforms: Services like PayPal or Stripe allow you to generate and send payment requests directly to your clients through their platform, which can include secure payment links.

- Physical Mail: For more formal business relationships or when requested by the client, you can print and send a hard copy of the payment request via postal service.

Example of Sending a Payment Request via Email

When sending the request by email, ensure you include all necessary information in your message. Below is an example of how to structure the email:

| Section | Example |

|---|---|

| Subject Line | Payment Request for Services Rendered – [Your Business Name] |

| Greeting | Dear [Client’s Name], |

| Email Body | I hope this message finds you well. Attached, please find the payment request for the services provided. Kindly review the details, and let us know if you have any questions. We look forward to receiving your payment by [due date]. |

| Attachment | Attach the payment request document (PDF format preferred). |

| Closing | Best regards, [Your Name] [Your Business Name] |

By clearly stating the purpose of the email and attaching the relevant document, you make it easy for your client to understand and process the payment. Always ensure that your

Benefits of Using Free Invoice Templates

Using pre-designed documents for payment requests offers several advantages, particularly for small businesses and individuals who may not have the resources to create custom documents from scratch. These ready-made solutions provide an easy, professional way to streamline the billing process while ensuring consistency and accuracy in every transaction. Whether you’re just starting your business or need a quick and efficient way to manage your billing, free resources can save you time and reduce errors.

Time and Cost Savings

One of the biggest benefits of using free resources for creating payment requests is the time and money saved. Rather than spending hours designing a new document or hiring someone to create one, you can use a ready-made solution that only requires minimal adjustments. This can be especially helpful for entrepreneurs, small businesses, or independent contractors who need to focus on delivering their services rather than spending too much time on administrative tasks.

Professional Look and Consistency

Pre-designed documents often come with professional layouts and formatting, ensuring that your payment requests look polished and credible. Using these templates helps maintain a consistent style for all your documents, which can improve your reputation and brand image. Clients are more likely to take your business seriously when they see a well-structured, uniform format with clear information.

By using these ready-made solutions, you can ensure that your documents meet basic legal requirements, such as including your business name, contact details, and a breakdown of services provided. This reduces the chances of missing important elements that could cause confusion or delay payments.