Free Freelancer Invoice Template Word Download

When you’re managing your own business or working on independent projects, organizing your payments becomes essential. A well-structured billing document helps you maintain professionalism while ensuring you get compensated on time. It’s important to have a reliable format that fits your needs and can be easily adjusted as required.

Effective payment management relies on clarity and simplicity. Having a standard form to track services rendered, amounts due, and payment deadlines allows you to focus on your work instead of worrying about the administrative side. A properly designed document not only facilitates smooth transactions but also enhances trust with clients.

For anyone looking to streamline their payment process, there are numerous resources available that allow you to access customizable templates. These tools ensure that your documents are professional, easy to use, and tailored to your specific business requirements. Whether you’re new to self-management or have years of experience, adopting the right format can make a significant difference in your financial operations.

Essential Freelancer Invoice Templates

For independent professionals and small business owners, having a clear and professional document for billing clients is crucial. These forms not only ensure that payments are tracked properly but also reflect the professionalism of your business. When designing such a document, simplicity and clarity are key, as it must convey the necessary details without overwhelming the client. A well-organized format can help build trust and maintain healthy working relationships.

Why a Structured Document Matters

A well-structured document allows for quick communication of the payment details between you and your clients. It should clearly outline services rendered, payment terms, and deadlines to prevent any confusion. Clients appreciate transparency, and using a standardized form makes it easier for both parties to refer back to important details if needed.

Customizing for Different Services

No two businesses or clients are the same, which is why it’s important to have a document that can be tailored to various projects. The ability to easily adjust the content, whether it’s adding a project description, adjusting payment terms, or changing your contact details, can save you valuable time and effort. Having a flexible format allows you to cater to different types of clients while maintaining consistency.

Why Use Word for Invoices

When it comes to creating billing documents, flexibility and accessibility are essential. A text-based program provides a versatile environment for designing and adjusting forms quickly. With its wide availability and ease of use, such software allows anyone to create customized documents that are both professional and simple to update as needed.

One of the primary advantages is the familiarity that many people have with the program. Most users are already comfortable with the interface, making it easier to focus on content rather than learning how to navigate complex software. Additionally, these programs offer a variety of formatting options, ensuring that the document looks polished and organized, whether for print or digital delivery.

Benefits of Free Invoice Templates

Using readily available billing documents offers a range of advantages for those managing their own businesses or handling client projects. These ready-made forms help save valuable time by eliminating the need to create a new document from scratch. With pre-built structures, users can focus on adding relevant details instead of formatting and design, ensuring efficiency in their workflow.

One of the key benefits is the accessibility they provide. You don’t need to invest in expensive software or tools to create professional-looking statements. Many of these resources are available for immediate use, making them an ideal solution for small businesses and individuals looking for a cost-effective way to manage transactions. Additionally, these documents can be easily customized to meet your specific needs, whether you’re working on a one-off project or establishing a long-term business relationship.

Another important advantage is consistency. By using a uniform structure for all your billing documents, you maintain a level of professionalism that clients will recognize. This consistency can help streamline communication and avoid misunderstandings, as both parties will always be working from the same format. With minimal effort, you can ensure that every statement looks polished and includes all the necessary information, from payment terms to service descriptions.

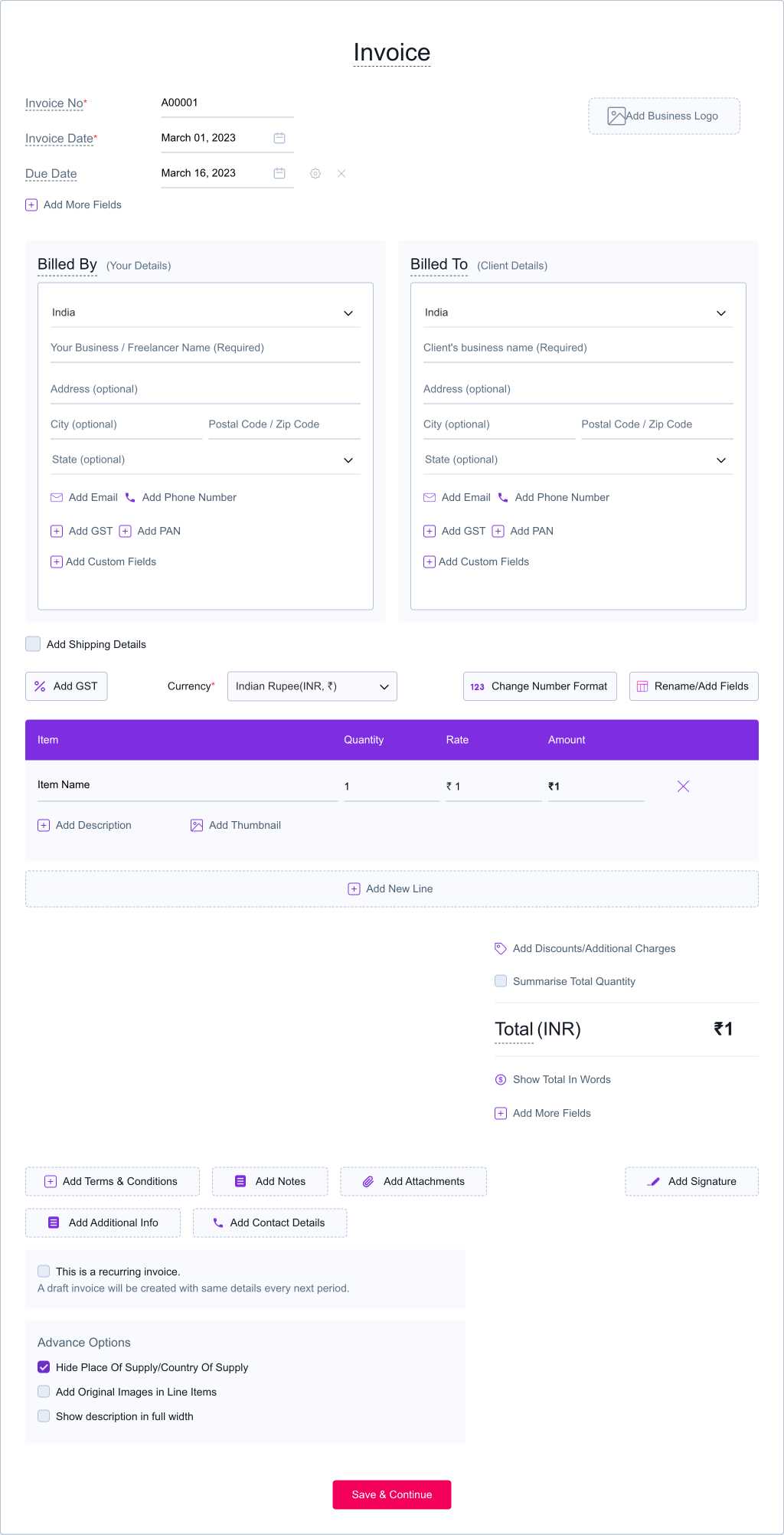

Customizing Your Invoice Template

Personalizing your billing documents is essential for tailoring them to your specific needs and brand identity. By customizing the layout and content, you ensure that the form reflects the unique aspects of your services while maintaining clarity for your clients. Adjustments can be made to include specific details such as your logo, payment terms, and any other important information that can help make the document both functional and professional.

Here are a few key areas you can modify to enhance your document:

| Element | Customization Tips |

|---|---|

| Header Section | Add your business logo, name, and contact details for a personalized touch. |

| Service Description | Customize the section to clearly describe each service or product provided. |

| Payment Terms | Adjust payment deadlines, methods, and any late fees according to your preferences. |

| Footer Section | Include your business address, tax identification number, or social media handles for added professionalism. |

By making these adjustments, you can create a document that not only suits your business requirements but also helps maintain a consistent and professional image when dealing with clients. Customization allows for flexibility in managing various projects while ensuring all necessary information is clearly communicated and easily accessible.

How to Download Invoice Templates

Accessing ready-made billing documents is a simple and efficient way to streamline your payment processes. Whether you need a template for a one-time project or a long-term contract, there are numerous platforms that offer these documents for quick use. By following a few easy steps, you can easily find, obtain, and start customizing these forms to suit your business needs.

Finding the Right Document

To begin, search for platforms that specialize in offering professional billing forms. There are a variety of websites that offer downloadable formats in various styles, from minimalistic to more detailed designs. Many of these resources allow you to filter by industry, so you can choose one that best fits the services you provide. Once you’ve identified the right form, check if it’s compatible with your preferred software before proceeding.

Steps to Get Your Document

Once you’ve found the ideal format, the download process is typically straightforward. Most websites will have a clearly marked button or link to obtain the document. After downloading, open the file in your preferred editing software to make any necessary changes, such as adding your business details, modifying the layout, or adjusting payment terms. Many documents are provided in editable formats, so customization is quick and hassle-free.

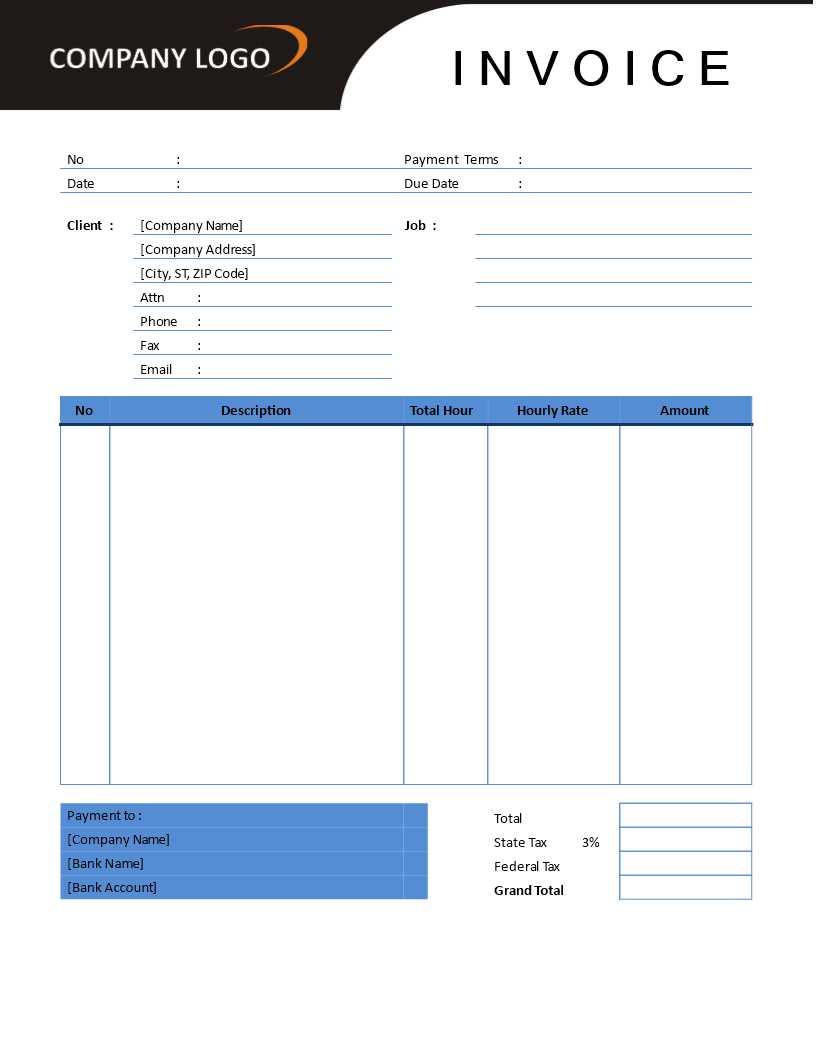

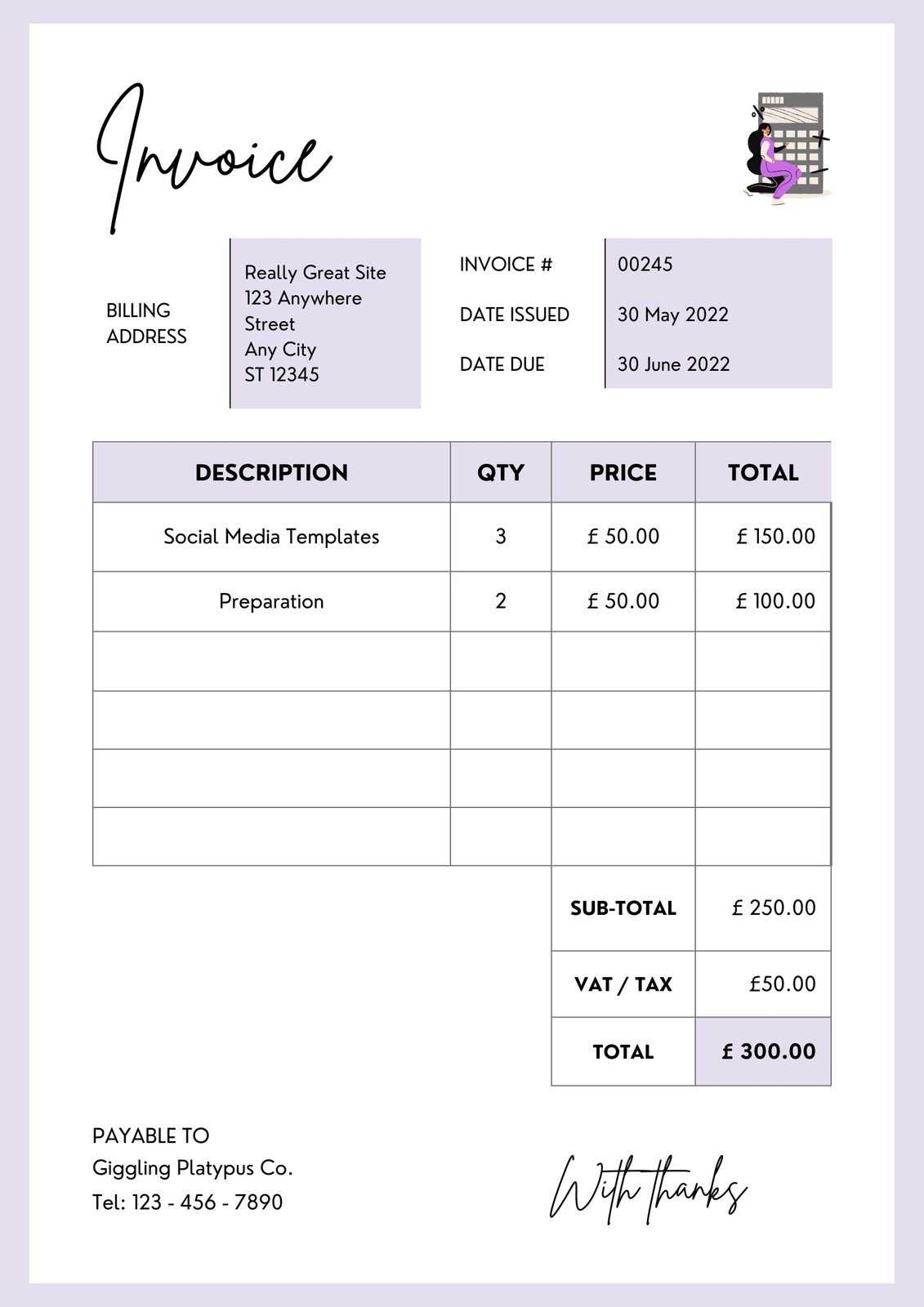

Top Features of a Freelancer Invoice

When creating a billing document for your services, certain elements are crucial to ensure clarity, professionalism, and smooth transactions. A well-structured form should include specific details that make it easy for clients to understand the payment terms and process. By incorporating the right features, you ensure that both parties are on the same page, minimizing any potential confusion.

Here are the top features that should be included in every billing statement:

- Clear Header – Your name, business name, and contact information should be at the top to ensure your client knows immediately who the document is from.

- Client Information – Including the client’s name, company, and contact details helps to personalize the document and ensures there are no mix-ups with other clients.

- Detailed Service Description – List each service or product provided with a short description to ensure clarity and avoid disputes.

- Itemized Pricing – Break down the costs for each service or product to give clients a clear understanding of how the total amount is calculated.

- Payment Terms – Clearly state the payment due date, preferred methods of payment, and any late fees or discounts to set expectations.

- Invoice Number – A unique reference number makes it easy to track and reference specific transactions.

- Payment Instructions – Include instructions for how to complete the payment, whether via bank transfer, online payment system, or check.

By including these features, your document will not only look professional but will also help to avoid misunderstandings and ensure timely payments. A well-constructed billing statement serves as both a record and a communication tool for both you and your client.

Creating a Professional Invoice in Word

Designing a polished billing document requires attention to detail and an understanding of what information is most important for both you and your client. By using a text-editing program, you can easily create a professional-looking form that is both clear and easy to customize. The key to success is ensuring that all necessary fields are included while maintaining a clean and organized layout.

To begin, open your text-editing software and create a new document. Start by including your business information, such as your name or company name, address, email, and phone number. This ensures the client knows where to reach you if they have any questions. Next, make space for the client’s details, including their name, address, and any reference number associated with the project.

Important elements to include are:

- Itemized list of services – Provide a clear description of each service or product delivered, including the associated cost.

- Payment terms – Specify when payment is due, the accepted methods, and any late fees or discounts that apply.

- Unique reference number – This makes tracking payments and managing multiple transactions easier.

- Subtotal, taxes, and total – Break down the charges to make it easy for the client to see how the final amount is calculated.

Once these key components are in place, you can focus on formatting the document. Use clear headings and organized sections to make the information easy to navigate. To add a professional touch, consider using a simple logo or business branding at the top. Finally, review the document for accuracy and completeness before sending it to your client.

Common Invoice Mistakes to Avoid

When preparing billing documents, small errors can lead to confusion, delays, or even missed payments. It’s essential to ensure that each detail is accurate and clearly communicated. Even though creating a professional document may seem straightforward, certain mistakes can undermine its effectiveness. By being aware of common pitfalls, you can avoid costly mistakes and maintain smooth business transactions.

Common Errors and How to Fix Them

Below are some of the most frequent mistakes people make when preparing billing statements, along with tips on how to avoid them:

| Error | How to Avoid It |

|---|---|

| Missing Contact Information | Always include both your and your client’s complete contact details, ensuring the document is personalized and traceable. |

| Unclear Payment Terms | Be specific about due dates, accepted payment methods, and any penalties for late payments to avoid misunderstandings. |

| Incorrect Pricing | Double-check your service rates and ensure all costs are listed accurately to prevent discrepancies. |

| Lack of Unique Reference Number | Always assign a unique reference number for each document to make tracking easier for both you and your client. |

| Failure to Proofread | Take time to carefully proofread the document for any spelling errors, typos, or incorrect calculations. |

How to Ensure Accuracy

To prevent these mistakes, it’s always a good idea to have a second pair of eyes review the document before sending it out. Using a consistent format and making sure all required information is present will ensure that you maintain a professional image while avoiding costly oversights.

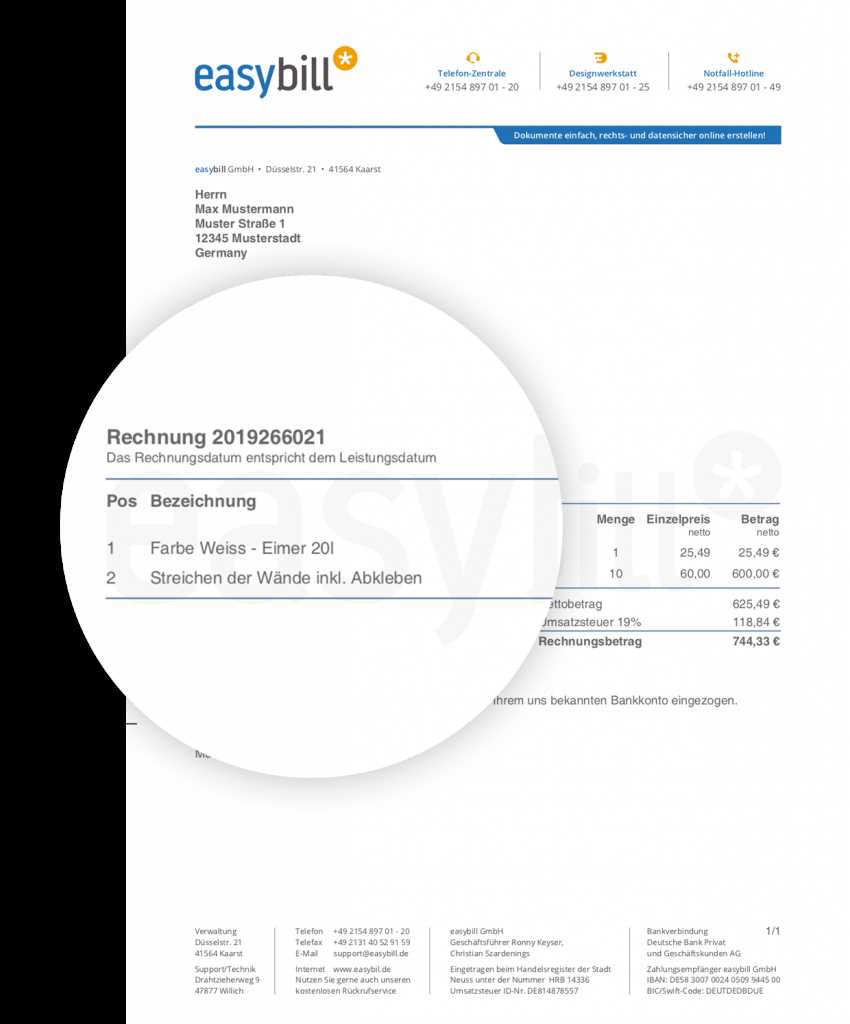

Invoice Template for Different Freelancers

When creating billing documents, it’s important to understand that different types of work require different approaches. Whether you’re providing creative services, consulting, or technical expertise, the way you present your charges can vary based on the nature of the work. A one-size-fits-all approach rarely works, so customizing your forms to suit the specific requirements of your industry is crucial for clarity and professionalism.

Key Considerations for Various Industries

Each profession has its unique set of needs when it comes to billing documents. Here are a few examples of what might need to be included depending on the type of work you do:

- Creative Services (Designers, Writers, Photographers)

- Detailed descriptions of each project milestone

- Clear hourly or project-based rates

- Rights and ownership details for any creative work produced

- Consulting

- Clear breakdown of time spent on consultations

- Hourly rates and retainer fees, if applicable

- Specific deliverables or milestones to be met during the consultation period

- Technical Work (Developers, Engineers, IT Professionals)

- Itemized list of services provided, such as coding, troubleshooting, or implementation

- Detailed project timelines or deadlines

- Payment terms related to progress milestones or completion

Customizing for Your Specific Needs

Regardless of the type of services you provide, customizing your billing documents to reflect the specifics of your work will help you maintain clarity with clients. Always ensure that the document includes accurate descriptions of the services, clear payment terms, and any important legal details such as ownership rights or confidentiality clauses. Customizing your form shows professionalism and helps to build trust with your clients.

How to Set Payment Terms on Invoices

Establishing clear payment terms is essential for maintaining healthy business relationships and ensuring timely compensation for your work. When creating a billing document, specifying how and when payments should be made helps set expectations for both you and your client. Well-defined terms also reduce the chances of confusion or disputes and make it easier to manage finances.

Here are the key elements to include when setting payment terms:

- Payment Due Date

- Set a clear deadline for when the payment should be made. Common options include “Net 30” (30 days from the date of the bill), “Net 15,” or “Due on Receipt.”

- Consider the nature of the project when determining the timeline–short-term work may require faster payment terms than longer projects.

- Accepted Payment Methods

- List all the methods you accept for payments, such as bank transfer, credit card, PayPal, or checks.

- Include any relevant details, like account numbers, payment links, or instructions for each method.

- Late Fees

- If a payment is overdue, specify any penalties you will apply, such as a fixed fee or interest on the outstanding amount.

- Make sure the late fee is reasonable and clearly communicated to your client before the agreement is made.

- Discounts for Early Payment

- Offering a small discount for early payments can encourage clients to settle their bills sooner.

- Specify the percentage or amount off the total price for payments made before the due date.

By establishing clear and concise payment terms, you ensure that both parties are on the same page, and you can avoid unnecessary delays or misunderstandings. It’s always a good idea to communicate these terms upfront and to have them included in every billing document to create a smooth and professional process for both you and your clients.

Tracking Payments with Invoice Templates

Keeping track of payments is an essential aspect of managing any business, especially when you handle multiple clients and projects. A well-organized billing document not only facilitates the collection of payments but also makes it easier to monitor the status of outstanding amounts. By using an effective system, you can track received payments, identify overdue amounts, and manage cash flow with ease.

Key Features for Payment Tracking

When creating your billing documents, it’s important to include certain elements that will help you track payments efficiently:

- Unique Reference Number

- Each billing document should have a unique identifier, making it easier to track and reference specific transactions.

- Using a consistent numbering system will also help you organize records for future reference.

- Payment Status Section

- Include a section where you can mark the status of the payment, such as “Paid,” “Pending,” or “Overdue.”

- This allows you to quickly see which transactions have been completed and which are still outstanding.

- Dates and Deadlines

- Clearly list the date when payment is due, and update the document once the payment has been received to keep track of when it was completed.

- Adding the payment date helps maintain a chronological record of your transactions.

Using a Payment Tracking System

To further simplify the tracking process, you can use a payment tracking system. By using an organized spreadsheet or accounting software, you can log each payment’s details, track payment progress, and generate reports at any time. Some advanced tools even allow you to automate reminders for overdue payments, helping you stay on top of your financial obligations.

By incorporating these elements into your billing documents, you can maintain a more organized and professional payment process. Tracking payments becomes easier, and you can ensure that you never miss an outstanding balance or forget to follow up on overdue amounts.

Tips for Designing Your Invoice

Creating an effective billing document involves more than just listing services and amounts due. The design of the document plays a critical role in making sure it looks professional, is easy to read, and clearly communicates essential details. A well-designed document can improve client trust and help ensure smooth transactions. Here are some key design tips to keep in mind when creating your billing statement.

First, focus on clarity and simplicity. Your document should be organized, with clear headings and easy-to-follow sections. Avoid cluttering the page with unnecessary details, and keep your fonts and colors consistent for a polished, professional look.

| Design Tip | Why It’s Important |

|---|---|

| Keep it Simple | A clean design with ample white space ensures that the document is easy to read and not overwhelming to the client. |

| Use Clear Section Headings | Headings like “Services Provided,” “Payment Terms,” and “Total Due” help organize the document and make it easier to navigate. |

| Incorporate Branding | Including your business logo and colors reinforces your brand identity and adds a touch of professionalism. |

| Choose Legible Fonts | Opt for easy-to-read fonts such as Arial or Helvetica, and avoid using too many different styles or sizes to maintain consistency. |

| Use Tables for Itemized Listings | Tables help present services and pricing clearly, making it easier for the client to understand what they are being charged for. |

Incorporating these design elements will not only help create a visually appealing billing document but also enhance the overall client experience. A well-organized statement will not only look professional but also increase the likelihood of timely payments and fewer misunderstandings.

Legal Considerations for Freelance Invoices

When preparing any billing statement, it’s essential to consider the legal aspects to protect both yourself and your clients. A properly structured document not only ensures you get paid on time but also safeguards you from potential legal disputes. By including the right information and adhering to local regulations, you can create a legally sound document that meets both business and legal requirements.

Essential Legal Elements to Include

Incorporating specific details into your billing statement can help avoid misunderstandings and provide legal protection. Here are some key elements to include:

| Legal Element | Why It’s Important |

|---|---|

| Business Name and Contact Details | Including your full business name, address, and contact information is vital for identification and establishing a formal agreement with the client. |

| Clear Payment Terms | Outlining the terms for payment, including deadlines, accepted methods, and late fees, prevents disputes and ensures mutual understanding. |

| Tax Information | Depending on the region, certain taxes may apply to your services. Including the tax rate and your tax ID number ensures compliance with local tax laws. |

| Service Descriptions and Terms | Clearly define the scope of services provided, including any specific conditions, deadlines, or deliverables, to avoid confusion and set expectations. |

| Legal Clauses | Including terms such as intellectual property rights, confidentiality agreements, and cancellation policies can protect you from future legal issues. |

Ensuring Legal Compliance

It’s important to familiarize yourself with any local, state, or national regulations that may affect your billing documents. For instance, some countries require specific details such as tax identification numbers or formal agreements about payment terms. If you’re unsure about any legal aspects, it’s advisable to consult with a legal professional or accountant to ensure your documents are fully compliant with the laws that apply to your business.

By considering these legal factors, you can create billing statements that not only ensure payment but also protect your rights and build a professional relationship with your clients.

Best Free Tools for Invoices

Creating a well-structured billing document doesn’t always require expensive software or services. There are numerous free tools available that offer intuitive features, helping you streamline the process of generating professional statements without spending a dime. These tools can automate many aspects of your billing process, saving you time and effort while ensuring accuracy and consistency.

Top Tools for Creating Billing Documents

Here are some of the best free tools available for generating billing documents:

- Invoice Generator

- Simple, user-friendly tool with pre-designed templates that allow you to create and send professional statements in minutes.

- Offers basic customization options, including fields for company details, pricing, and payment terms.

- Zoho Invoice

- Comprehensive tool that offers free invoicing for businesses with up to five clients, making it ideal for small businesses or sole traders.

- Features include automatic reminders, recurring billing options, and customizable templates.

- Wave

- All-in-one accounting software that offers easy-to-use tools for managing billing and tracking payments.

- Includes customizable templates, expense tracking, and financial reporting, all available without any subscription fees.

- PayPal Invoicing

- A great tool for businesses that already use PayPal, allowing you to create and send statements directly from your PayPal account.

- Supports payment via PayPal, credit card, or debit card and automatically updates payment status.

Why Choose These Tools?

These tools not only provide the essentials needed to generate billing documents but also include features such as payment tracking, recurring billing, and email reminders, which simplify the process. By using any of these services, you can create professional and accurate statements without the need for expensive software or a complex setup.

Whether you’re a small business owner or working independently, these tools will help you maintain efficiency and professionalism in your financial transactions.

When to Send an Invoice

Knowing the right moment to issue a billing document is crucial for maintaining a smooth cash flow and ensuring that you’re compensated in a timely manner. Sending a bill at the wrong time can delay payments or cause confusion. Timing is not only important for securing payment but also for establishing a professional relationship with your clients. The key is to send your statement at a time that aligns with the completion of your work and your agreed terms with the client.

Common Scenarios for Sending a Billing Document

Here are several common situations when you should send a billing document:

- Upon Completion of a Project or Milestone

- If your project is divided into phases, consider sending a bill once each milestone is completed. This ensures you receive compensation for each stage of work.

- For full project completions, send the document immediately after the work is delivered to maintain cash flow.

- According to an Agreed-Upon Schedule

- If you and the client have agreed to recurring billing (e.g., weekly, bi-weekly, or monthly), send your statement on the agreed date to keep a consistent payment cycle.

- For long-term contracts, it is advisable to send invoices according to the intervals established in your agreement.

- After Delivering Goods or Services

- If your work involves delivering physical products or providing services, send the statement as soon as the goods are handed over or the services are rendered.

- Consider including delivery confirmation or sign-offs from the client to clarify the exact date when the transaction is complete.

- Upon Client Request

- Some clients may request a bill at a particular time, for example, at the end of a month or after a certain task is finished. Always be responsive to such requests to maintain good business relations.

Timing Tips for Efficient Payment Collection

To improve your chances of timely payments, keep these tips in mind:

- Be Prompt

- Send your billing document as soon as the work is completed or according to the agreed schedule. The longer you wait, the more difficult it may be to collect payment.

- Send Early Payment Reminders

- If your client has not made the payment by the due date, send a polite r

Managing Multiple Clients with Invoices

Handling several clients at once can be a challenge, especially when it comes to keeping track of payments and maintaining organized financial records. Efficient management is crucial not only for ensuring timely compensation but also for fostering long-term, professional relationships with each client. By organizing and streamlining the process of issuing and tracking billing documents, you can stay on top of payments, avoid errors, and ensure you get paid for all the work you do.

Organizing Billing for Multiple Clients

When working with multiple clients, it’s important to stay organized and keep each billing document separate. Here are some practical strategies for managing your billing efficiently:

- Create a Separate Record for Each Client

- Maintain individual records or spreadsheets for each client, listing all services rendered, agreed payment terms, and due dates. This will help you track each client’s payments independently and avoid any confusion.

- Set Clear Payment Deadlines

- Establish and track specific payment deadlines for each client. By marking the due dates clearly on your records, you can ensure you follow up on overdue payments promptly.

- Use Consistent Formats

- Adopt a consistent format for your billing documents so that you can quickly update and customize them for each client without needing to start from scratch every time.

Tracking Payments and Reducing Errors

Managing multiple clients means you’ll need to track several payments at once. Here are some tips to avoid mistakes and keep everything on track:

- Use Digital Tools

- Utilize digital tools like accounting software or online platforms to keep track of payments, send reminders, and manage overdue bills. These tools can also help you generate detailed financial reports.

- Monitor Payment Status Regularly

- Check the status of each payment frequently to ensure you’re aware of any pending or overdue payments. Timely follow-ups can help reduce delays.

- Keep Communication Open

- Maintain clear communication with each client, ensuring they are aware of upcoming payments or any issues related to payment status. If problems arise, address them promptly to avoid disputes later on.

By following these strategies, you can more

- Create a Separate Record for Each Client

- If your client has not made the payment by the due date, send a polite r