Freelance Writing Invoice Template for Easy Payment Processing

As a freelancer, managing your finances is an essential aspect of running a successful business. One crucial part of this process is the ability to efficiently request payment for your services. Having a well-structured document that outlines the work completed and the amount owed not only ensures that you get paid on time but also portrays professionalism to your clients.

Creating a clear, organized request for payment can save you time and prevent confusion down the road. By utilizing a standardized format, you ensure that all the necessary details are included, from work description to payment terms. This approach helps you avoid misunderstandings and ensures your clients are clear on the expectations.

In this article, we will explore how to craft a professional payment request, covering the key components to include, best practices for formatting, and how to customize your document for different types of projects and clients. With the right tools and knowledge, you can streamline your payment processes and focus more on your creative work.

Essential Guide to Freelance Writing Invoices

For independent professionals, ensuring timely payment for completed work is vital to maintaining a steady income and building lasting client relationships. One of the most effective ways to request payment is by providing a clear and detailed document that outlines the services rendered and the associated costs. A well-crafted request helps avoid misunderstandings and creates a professional image that can strengthen trust with clients.

Key Elements to Include

When creating a payment request, there are several critical components to consider. First and foremost, the document should contain your personal details, including your name or business name, contact information, and any registration numbers if applicable. It’s equally important to include the client’s details, ensuring that both parties are easily identifiable.

Next, list a clear description of the services provided. This can include specific tasks completed, the time spent on each, or any other relevant details that justify the amount being requested. Payment terms are another essential part of this document. Be sure to specify when payment is due, whether it’s within a certain number of days or upon receipt of the request.

Formatting for Clarity and Professionalism

Organization is key when drafting a payment request. Break down the information into clearly labeled sections, making it easy for the client to understand. Use bold or underlined text to highlight important details, such as the total amount due or the due date. A neat and structured layout not only helps ensure that all necessary information is present but also presents you as a professional.

By following these simple steps and customizing the document to fit each project, you can streamline your payment process and avoid potential delays or confusion with clients. A well-organized request for payment is a small effort that yields significant benefits in the long run.

Why Every Writer Needs an Invoice Template

For independent professionals, organizing and streamlining financial transactions is essential to running a successful business. Having a standardized method to request payment not only helps ensure timely compensation but also adds a level of professionalism to your work. A structured document for payments can save valuable time, reduce errors, and enhance communication with clients.

Without a proper format, keeping track of payments can become chaotic, especially when juggling multiple projects. An easy-to-use and consistent method of outlining services, payment amounts, and deadlines helps eliminate confusion and sets clear expectations between you and your clients. By using a set format, you minimize the risk of missing important details or making costly mistakes.

Moreover, a professionally designed document can reflect your attention to detail and commitment to high standards. Clients are more likely to respond positively to a neatly organized, clear request for payment, and it increases the likelihood of prompt settlement. Consistency in the way you present your work can lead to better client relations and more repeat business.

Additionally, having a reliable format ready for each project allows you to focus on what you do best: delivering quality work. With less time spent on administrative tasks, you can improve your overall workflow and concentrate on meeting deadlines and growing your client base. Whether you’re working with new clients or long-term partners, having a standardized document makes financial interactions smoother and more efficient.

How to Create a Simple Invoice

Creating a payment request document doesn’t have to be complicated. A well-structured and easy-to-read document ensures that both you and your client are on the same page regarding the services provided and the amount due. By following a few basic steps, you can quickly put together a professional-looking payment statement that is clear and effective.

Key Information to Include

Start by adding your contact details at the top of the document, including your name, email address, and phone number. Right below, include the client’s information, which should consist of their name, company name (if applicable), and contact details. This ensures that both parties are easily identified.

Next, list a brief description of the services or tasks completed. Be concise but specific enough so that the client knows exactly what they are paying for. After this, include the total amount due, along with any applicable taxes or additional charges. Make sure to clarify whether the payment is due upon receipt or within a specific time frame, such as 30 days.

Formatting for Clarity

Organizing your document properly is key. Use clear headings and sections, such as “Services Provided,” “Amount Due,” and “Payment Terms.” This helps the client easily navigate through the document. Don’t forget to include a unique reference number for your request. This can be helpful for tracking purposes, both for you and the client.

By keeping your document simple and well-organized, you make it easier for your clients to process payments promptly, ensuring smoother transactions and reducing the chance of errors or delays.

Key Elements of a Freelance Invoice

When creating a document to request payment, it’s important to include specific details that make the process clear and professional. A well-structured document not only outlines the work completed but also ensures there are no ambiguities regarding payment terms or deadlines. Below are the essential elements that should be included in any payment request document:

- Your contact information: Start by including your name, business name (if applicable), address, email, and phone number. This ensures your client knows exactly who the payment request is coming from.

- Client’s details: Include your client’s name, company name, and contact information. This is important for clarity and to avoid any mix-ups with other clients.

- Unique document number: Assign a unique reference number to each payment request for easy tracking. This helps both you and the client keep a record of transactions.

- Description of work completed: Clearly outline the services provided or tasks completed. Be specific but concise, so the client knows exactly what they are paying for.

- Dates: Include the date the work was completed and the date the payment is due. This provides clarity on when the payment should be made and helps avoid confusion.

- Amount due: Clearly state the amount the client needs to pay, breaking it down into smaller details if necessary (e.g., hourly rate, flat fee, taxes, or additional costs).

- Payment terms: Specify the payment method (e.g., bank transfer, PayPal, etc.), and any other terms regarding late fees or discounts for early payments.

By incorporating these key components into your payment request, you help ensure that both you and your client understand the expectations and avoid any potential issues down the line.

Customizing Your Invoice Template for Clients

When working with multiple clients, it’s important to personalize your payment request document for each one. Customizing your request ensures that it meets the specific needs of each project and client while maintaining a consistent level of professionalism. Tailoring the content allows you to include relevant details and provide a seamless, efficient payment process.

Personalizing the Document for Each Client

Each client may have different requirements or preferences regarding the format and details included in your payment request. For example, some clients may prefer a detailed breakdown of services, while others might only require a summary. Consider including the following when customizing:

- Client-specific information: Always ensure that the correct client name, company details, and contact information are included. This prevents confusion, especially when dealing with multiple clients.

- Project-specific descriptions: Tailor the list of services or deliverables to reflect the exact work completed for that client. Customizing this section shows attention to detail and reinforces your professionalism.

- Custom payment terms: Depending on the client, you may need to adjust the payment terms, such as payment deadlines, early payment discounts, or agreed-upon late fees.

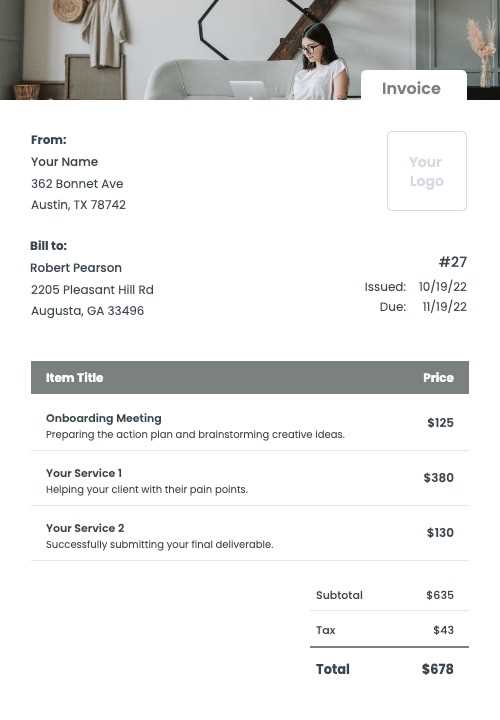

Branding and Professionalism

In addition to content, it’s also important to maintain a cohesive branding approach. Customize the appearance of your request by including your logo, business colors, or specific fonts to create a polished and branded look. This adds a professional touch and makes the document feel more personalized and aligned with your business identity.

By customizing your payment request for each client, you not only cater to their specific needs but also demonstrate your commitment to providing high-quality service. This extra effort can go a long way in building stronger client relationships and enhancing your reputation.

Best Tools for Generating Invoices

Creating payment requests can be time-consuming, but with the right tools, the process becomes faster, easier, and more professional. There are many software options and online platforms available to help you create, send, and manage payment statements. These tools often include customizable features and automation options that save time and reduce errors, allowing you to focus on your core work.

Top Invoice Creation Tools

Here is a list of some of the best tools to help you generate professional payment requests:

| Tool Name | Key Features | Pricing |

|---|---|---|

| Wave | Free, customizable templates, automatic reminders, tax tracking | Free for basic use |

| FreshBooks | Time tracking, automated billing, expense management | Starts at $15/month |

| Zoho Invoice | Multi-currency support, recurring billing, client portal | Free for up to 5 clients |

| QuickBooks Online | Invoice creation, accounting integration, payment tracking | Starts at $25/month |

| PayPal Invoicing | Easy integration with PayPal, custom branding, payment tracking | Free (with PayPal fees for payments) |

Choosing the Right Tool for Your Needs

When selecting a tool, consider factors such as your business size, the complexity of your transactions, and your preferred payment methods. For simple projects, free tools like Wave or Zoho Invoice may be sufficient. However, for larger businesses or those requiring more advanced features, tools like FreshBooks or QuickBooks Online may offer more robust solutions. No matter the tool, ensure that it meets your specific needs and integrates smoothly with your workflow.

How to Calculate Your Freelance Writing Rate

Setting the right rate for your services is crucial for maintaining a sustainable business. Your rate should reflect the value you provide, the time you invest, and the market demand for your skills. It’s important to calculate your rate in a way that ensures you are fairly compensated while remaining competitive in the industry. Here’s a step-by-step guide to help you determine an appropriate rate for your services.

Factors to Consider When Setting Your Rate

When calculating your rate, several factors should influence your decision. These include your level of experience, the complexity of the work, and your target income. Additionally, consider the market rates for similar services, the cost of living in your area, and how much time you can realistically allocate to projects. Here’s a breakdown of some important considerations:

| Factor | Explanation |

|---|---|

| Experience | Higher experience often justifies higher rates, as it reflects expertise and reliability. |

| Complexity of Task | More detailed or specialized tasks should command a higher rate due to the additional effort required. |

| Market Rates | Research industry standards to ensure your rates are competitive while still reflecting your expertise. |

| Time Commitment | Consider how much time a project will take and make sure the rate compensates you for that time. |

| Living Costs | Ensure your rate covers both business expenses and personal living costs, providing you with a sustainable income. |

Calculating Your Hourly or Project Rate

To calculate your rate, you can either set an hourly rate or a flat project rate, depending on the type of work you do. To determine an hourly rate, calculate your desired annual income, then divide it by the number of hours you plan to work per year. For a project rate, estimate the total time required and multiply it by your hourly rate, adding any additional fees for complexity or expertise.

By considering these factors and calculating your rate based on your specific needs and goals, you’ll ensure that your rates are both fair and profitable, allowing you to grow your business and maintain a steady flow of work.

Choosing Between Fixed Rates and Hourly Billing

When setting up your payment structure, you may find yourself deciding between charging a fixed fee for a project or billing by the hour. Each approach has its benefits and challenges, and the best choice depends on the type of work, your client’s preferences, and your own working style. Understanding the pros and cons of both methods will help you make an informed decision that suits your business model.

Fixed Rates: Predictability and Efficiency

Charging a fixed rate for a project is often preferred by clients because it provides clarity on the total cost upfront. This method works well for well-defined projects with clear deliverables, such as creating a specific number of articles or completing a set task. It allows you to set a price based on the value you provide, rather than the time spent.

Benefits of fixed rates:

- Predictability: Both you and your client know the exact cost from the start.

- Efficiency: Once the project is completed, you get paid the agreed amount, regardless of how long it takes.

- Incentive for efficiency: If you complete the project quickly and efficiently, you can increase your effective hourly rate.

Challenges of fixed rates:

- Scope creep: If the project expands beyond what was initially agreed upon, you may end up working more hours without additional compensation.

- Underestimating time: If you underestimate the time required to complete a project, you may end up earning less than expected.

Hourly Billing: Flexibility and Fairness

Billing by the hour offers more flexibility for both you and the client. It’s a good option for projects where the scope isn’t fully defined or may change over time. With hourly billing, you get compensated for every hour you work, ensuring that you are paid for all the time spent on a task.

Benefits of hourly billing:

- Fair compensation: You are paid for the exact amount of time you work, so there’s less risk of underpayment.

- Flexibility: Hourly billing is ideal for ongoing projects or tasks that may evolve as you work.

- Clear tracking: It’s easy to track hours worked, and you can charge clients accordingly if the project grows.

Challenges of hourly billing:

- Less predictability: Clients may be hesitant about an open-ended cost structure, as they can’t easily estimate the total cost of the project.

- Incentive to slow down: There may be less incentive for you to work efficiently if you’re paid by the hour.

Ultimately, the decision between fixed rates and hourly billing depends on the nature of the work, client expectations, and your personal preferences. For well-defined tasks with clear boundaries, fixed rates might be the better choice, while hourly billing offers more flexibility for ongoing or evolving projects.

Common Mistakes When Sending Invoices

When requesting payment for services rendered, there are several common mistakes that can delay the process or create confusion for both you and your client. These errors can lead to payment disputes, missed deadlines, or even damaged professional relationships. Being aware of these pitfalls can help you streamline the process and ensure that your requests are clear, timely, and effective.

1. Missing Key Information

One of the most frequent mistakes is failing to include essential details in your payment request. Omitting important information can cause delays as clients may need to reach out for clarification. Ensure that every document contains the following:

- Client’s details: Double-check the client’s name, address, and contact information.

- Clear description of services: Provide a detailed breakdown of the work completed.

- Payment terms: Specify when payment is due and any applicable late fees.

- Unique reference number: Assign a reference number to make tracking and communication easier.

2. Incorrect or Unclear Payment Terms

Another common mistake is not clearly defining the payment terms. This can lead to confusion or disagreements about deadlines, payment methods, and additional charges. To avoid this, be sure to:

- Specify the due date: Always include the exact date by which payment should be made.

- Clarify payment methods: Indicate the methods you accept (bank transfer, PayPal, check, etc.).

- State penalties for late payment: If applicable, clearly outline any late fees or interest charges for overdue payments.

3. Sending Payment Requests Too Late or Too Early

Timing plays a crucial role in managing payment requests. Sending them too early or too late can disrupt your cash flow. Aim to send the request at an appropriate time, such as:

- After the completion of work: Make sure the project is fully finished before sending a payment request.

- Within a reasonable timeframe: Don’t wait too long after the project is completed to send the request, but don’t send it prematurely either.

4. Not Foll

How to Format Your Invoice for Clarity

Clear and professional formatting is key when creating a payment request document. A well-organized layout makes it easier for your client to understand the charges, due date, and payment instructions. By following a simple structure, you ensure that your client can quickly review the document and process the payment without confusion or delay.

Essential Formatting Tips

Here are some key tips to help you format your payment request document in a way that’s easy to read and understand:

- Use Clear Section Headings: Divide your document into clear sections with headings such as “Client Information,” “Services Provided,” “Total Amount Due,” and “Payment Instructions.” This makes it easier for your client to navigate through the content.

- Include Enough White Space: Avoid clutter by leaving adequate space between sections and line items. This helps the reader focus on important details without being overwhelmed by too much text.

- Use a Simple, Professional Font: Choose a clean, easy-to-read font, such as Arial or Times New Roman, in a standard size (e.g., 10-12 pt). This ensures your document looks professional and is legible on any device or when printed.

- Align Text Properly: Ensure that all text is aligned properly. For example, align numbers in the “Amount” column to the right to make them easy to compare. Left-align the descriptions to create a clean and consistent appearance.

Structuring the Content for Maximum Clarity

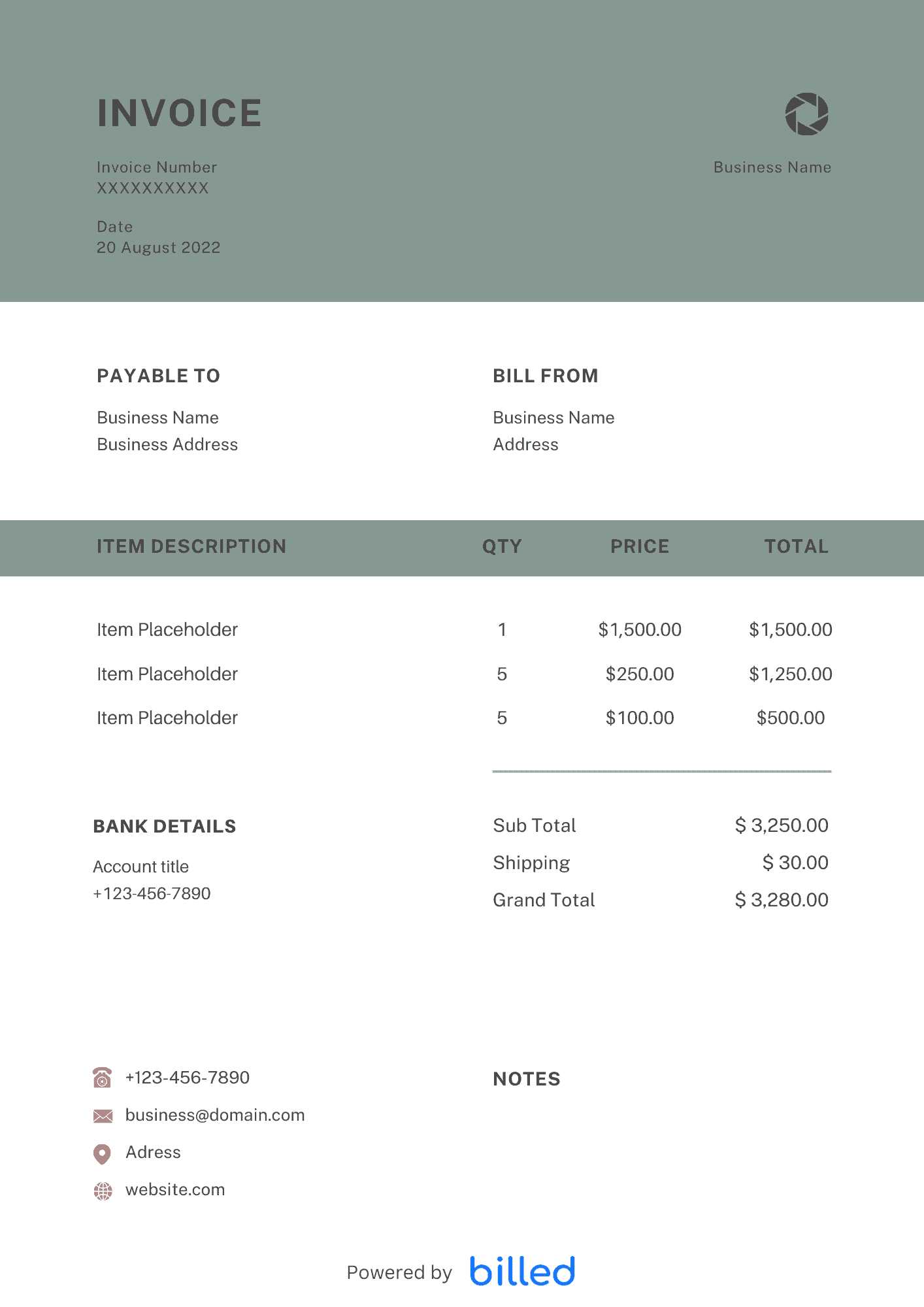

In addition to formatting, it’s important to structure the content so that all necessary information is easily accessible. Here’s a simple order to follow for each payment request:

- Header: Include your business name, logo (if applicable), and contact information at the top of the document, followed by the client’s details.

- Reference Number and Date: Always assign a unique reference number to the request and include the date the document is issued.

- Detailed Breakdown of Services: List each service or task completed, with a brief description and associated charge. This allows the client to see exactly what they are paying for.

- Total Amount Due: Clearly state the total amount, breaking it down into subtotals if necessary, and highlight any taxes or additional fees.

- Payment Instructions: Include the preferred payment method(s), due date, and any penalties for late payment.

By formatting your payment request with these principles in mind, you create a clear, professional document that will help prevent misunderstandings and ensure smooth, t

What to Include in Payment Terms

When you set the conditions for how and when a client should pay you, it’s essential to be clear and precise. Well-defined payment terms help prevent confusion and ensure that both you and your client are on the same page regarding the expectations for payment. These terms should cover important aspects like due dates, payment methods, and any penalties for late payments.

Here are the key elements to include in your payment terms:

- Due Date: Specify when payment is expected. This can be a fixed date or a time period after the completion of the work (e.g., 30 days after delivery).

- Accepted Payment Methods: Clearly state which payment methods you accept, such as bank transfer, PayPal, credit card, or checks. Providing multiple options can make it easier for the client to pay promptly.

- Late Payment Penalties: Outline any fees or interest charges that will apply if the payment is not made by the due date. This serves as a reminder to clients to pay on time.

- Deposits or Upfront Payments: If you require a deposit before starting work, make sure to include this in the terms. It’s common for larger projects to require an initial payment, such as 25% or 50% of the total amount.

- Currency: If you work with international clients, specify the currency in which the payment should be made. This avoids misunderstandings and ensures the correct amount is paid.

- Terms of Dispute Resolution: Include a statement about how disputes will be handled. For instance, you might specify that any disagreements will be settled through mediation or arbitration.

Including these details in your payment terms ensures that there are no misunderstandings when it comes to receiving compensation for your work. Clear payment terms also help to build trust with clients and protect your interests in case of delays or disputes.

When to Send Your Payment Request

Timing is a crucial aspect of managing your financial transactions. Sending a payment request at the right moment can help you maintain a smooth cash flow and avoid delays. However, if you send it too early or too late, it could lead to confusion or missed payments. Understanding the best time to submit your request can ensure you get paid on time and maintain good relations with your clients.

Best Timing for Sending Payment Requests

There are several factors to consider when deciding when to send your payment request:

- Upon Completion of the Project: If the work is project-based, it’s ideal to send your payment request immediately after completing the agreed-upon tasks. This ensures that you are compensated for your efforts while the work is still fresh in the client’s mind.

- At the End of a Billing Cycle: For ongoing work, sending a payment request at the end of a regular billing cycle (e.g., weekly, biweekly, or monthly) is a common practice. This gives clients a predictable schedule and helps you manage your finances more consistently.

- After Delivering Results or Milestones: If you’re working on a project with multiple stages, it’s a good practice to send payment requests after each milestone is completed. This approach ensures you get paid incrementally as work progresses.

Factors to Keep in Mind

In addition to the work’s completion, here are some other factors that can affect the timing of your payment request:

- Client’s Payment Schedule: Understand your client’s payment process. Some clients may have internal procedures that require invoices to be submitted by a specific day of the month or require time to process payments.

- Contractual Agreement: Follow any payment terms specified in your contract. If your agreement states that payment is due within 30 days after delivery, make sure to send your request accordingly.

- Promptness and Professionalism: Sending a payment request promptly after the work is complete shows professionalism and encourages your clients to pay on time. It’s also a good idea to send reminders if the due date is approaching and payment hasn’t been made yet.

By choosing the right time to send your payment request, you can ensure timely payments and maintain healthy professional relationships with your clients. Make sure to stay organized and follow up as needed to keep the process on track.

How to Handle Late Payments Professionally

Late payments can be frustrating, but how you handle them can make a significant difference in maintaining a positive relationship with your clients. It’s important to approach this situation professionally, using clear communication and a structured follow-up process. Handling overdue payments with grace can ensure that your cash flow remains intact while preserving the client relationship.

1. Review Your Terms and Agreement

Before taking any action, review the payment terms outlined in your agreement. This will help you confirm the due date, any late fees, and the process for addressing overdue payments. Ensuring you have all the details on hand will help you communicate more effectively and confidently with your client.

2. Send a Friendly Reminder

When the payment deadline has passed, it’s important to follow up promptly. Start by sending a polite reminder to your client. Keep the tone friendly and professional, offering them the benefit of the doubt. It’s possible that the payment was simply overlooked or delayed due to internal processes.

- Be clear: Mention the specific amount due and the original due date.

- Offer payment details: Reiterate your accepted payment methods and provide any necessary information, such as bank account details or PayPal instructions.

- Express understanding: Politely acknowledge that delays can happen, and ask if there are any issues on their end that you can assist with.

3. Send a Second Reminder with a Firm Tone

If the first reminder doesn’t result in payment, send a second follow-up that’s more direct. Be firm but still professional in your tone. Remind them of the agreed-upon payment terms and let them know that continued delays may result in late fees or further action.

- State your policies: If you have a late fee or interest charges for overdue payments, remind them of this stipulation in the contract.

- Set a final deadline: Specify a clear deadline for payment, and mention the consequences if payment is not received by that time.

4. Consider Offering Payment Plans

If the client is experiencing financial difficulties or is unable to pay the full amount, consider offering a payment plan. This can help both parties avoid conflict while ensuring you still receive the money owed over time. Make sure to outline the agreed payment schedule and any adjustments to your terms in writing.

5. Take Further Action if Needed

If your client continues to ignore payment requests, you may need to take further action. This could involve sending a formal letter of demand or involving a collections agency, depending on the severity of the situation. Make sure to document all communication throughout the process to maintain a clear record of your attempts to resolve the issue.

Remember, professionalism is key at every stage of this process. By handling overdue payments with a calm, structured appr

Importance of Invoice Tracking for Writers

Tracking payments and keeping a record of financial documents is crucial for managing your business operations effectively. For those in creative professions, staying on top of pending payments helps ensure a steady cash flow and prevents confusion about which clients have paid or still owe. By organizing and monitoring these records, you can avoid missed payments, streamline your accounting process, and maintain professionalism in your client relationships.

Why Tracking is Essential

Tracking financial transactions is not just about keeping an eye on payments; it’s also about ensuring you meet tax and legal obligations. Here’s why it’s so important:

- Prevents Missed Payments: When you track every request for payment, you can easily spot overdue balances and follow up promptly with clients. This proactive approach helps avoid cash flow interruptions.

- Streamlines Accounting: Keeping a record of each payment request and transaction simplifies tax filing and expense management. You’ll have clear documentation for deductions and financial reports.

- Builds Professionalism: Clients appreciate when you maintain a systematic and organized approach. Clear tracking signals that you run your business professionally, which can foster trust and future business.

How to Track Effectively

There are various tools and methods available for tracking financial documents and payments. Here are some ways you can stay on top of your financial records:

- Spreadsheets: A simple, cost-effective option is to create a spreadsheet where you track issued payment requests, payment dates, and outstanding amounts.

- Accounting Software: For more advanced tracking, accounting software such as QuickBooks or Xero can help automate the process and generate reports, saving you time and effort.

- Project Management Tools: Many project management platforms, like Trello or Asana, allow you to track both project milestones and payments in one place, providing easy access to all related information.

By implementing effective tracking methods, you can ensure that all payments are accounted for and your financial management remains organized. This not only reduces stress but also boosts the efficiency and reliability of your business operations.

How to Automate Your Payment Request Process

Automating your payment request process can save time, reduce errors, and improve your overall workflow. By streamlining tasks such as creating and sending documents, tracking payments, and following up on overdue balances, you can focus more on your work and less on administrative tasks. Automating these processes not only enhances efficiency but also ensures consistency in your financial operations.

Steps to Automate Your Payment Request Process

Here are the key steps to automate your payment request workflow:

- Choose the Right Tools: Select software or platforms that allow you to generate and send payment requests automatically. Tools like QuickBooks, FreshBooks, or Zoho Invoice offer features for customizing and automating payment documents.

- Set Up Recurring Requests: For regular clients or ongoing projects, set up recurring payment requests to be sent automatically at set intervals (e.g., weekly, monthly, or per project milestone). This eliminates the need for manual entry every time you need to bill.

- Integrate Payment Gateways: Link your payment processing systems (e.g., PayPal, Stripe, or bank transfers) directly to your software to automatically update the status of payments. This helps track the payments in real time without any additional steps.

Additional Tips for Streamlining Your Payment Process

In addition to automating document creation and payment tracking, consider these additional strategies to further streamline your process:

- Set Payment Reminders: Many tools allow you to set up automatic reminders for both you and your clients. This ensures clients are notified of due payments and reduces the need for manual follow-ups.

- Use Templates: Even when automation is in place, using pre-made, customizable templates for each payment request type can save you time. Having a consistent format for your documents makes it easier to communicate expectations clearly.

- Sync with Your Accounting System: Automate the syncing of payment requests with your accounting software, so you always have up-to-date financial records. This integration can help you create accurate reports and avoid manual entry errors.

By automating your payment request process, you can reduce the time spent on administrative tasks and increase your productivity. Not only will you be able to focus more on your work, but your clients will also appreciate the smoother, more professional transaction experience.

Payment Request Examples and Samples

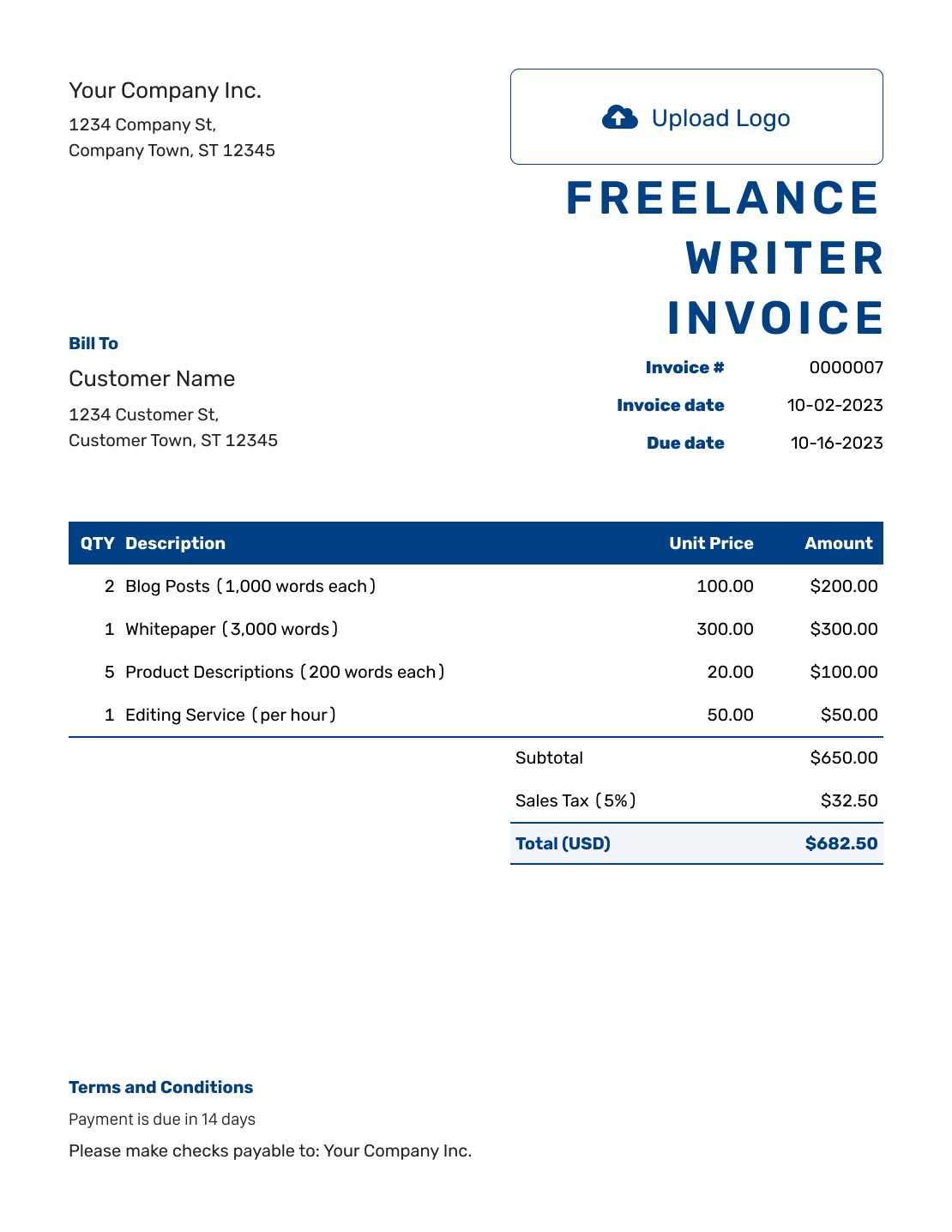

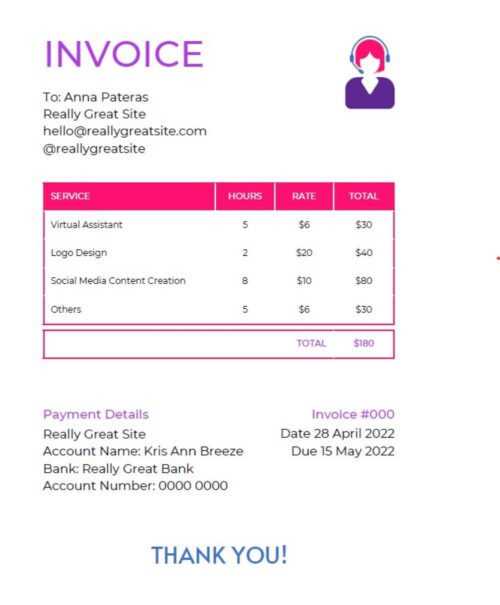

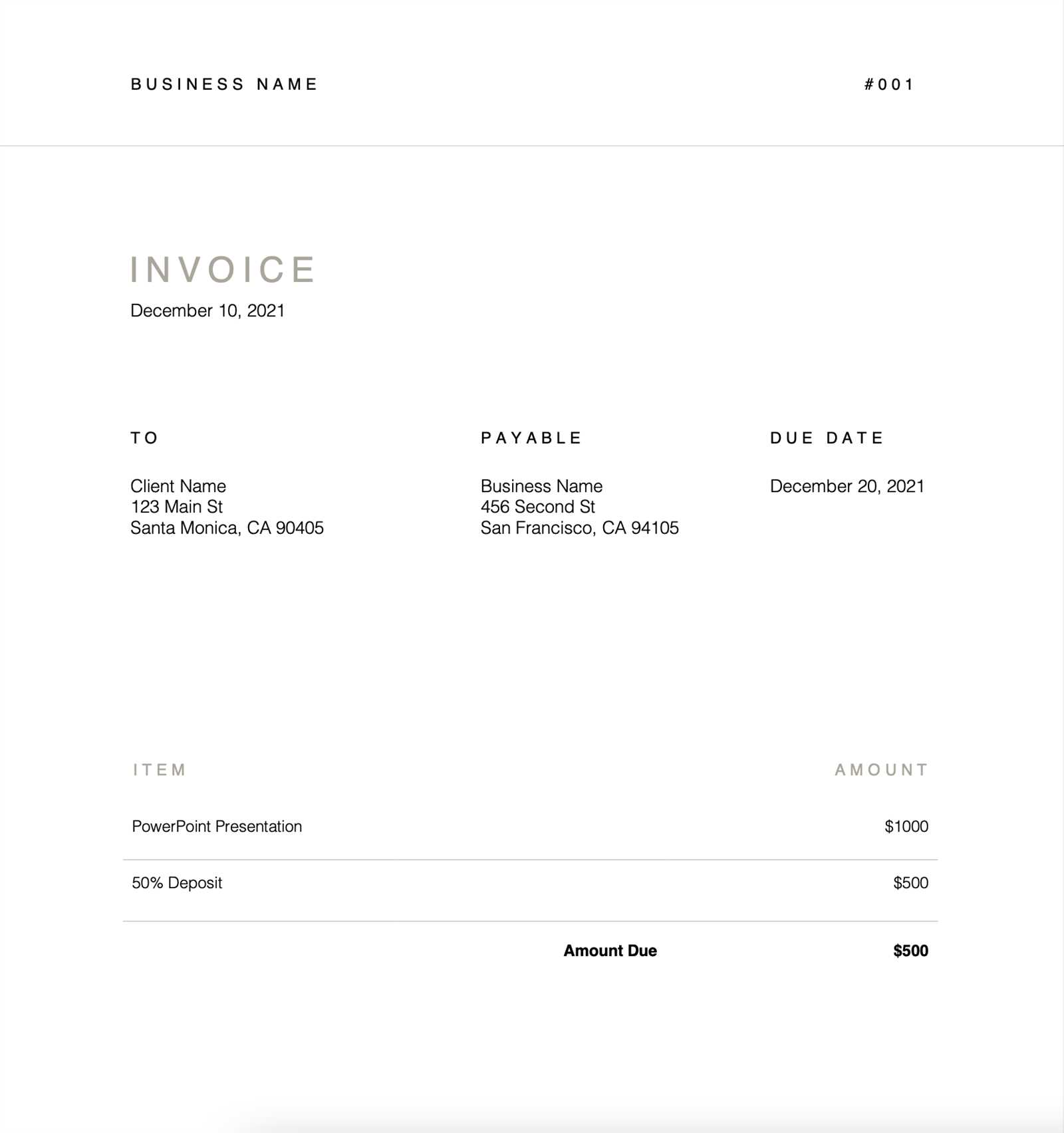

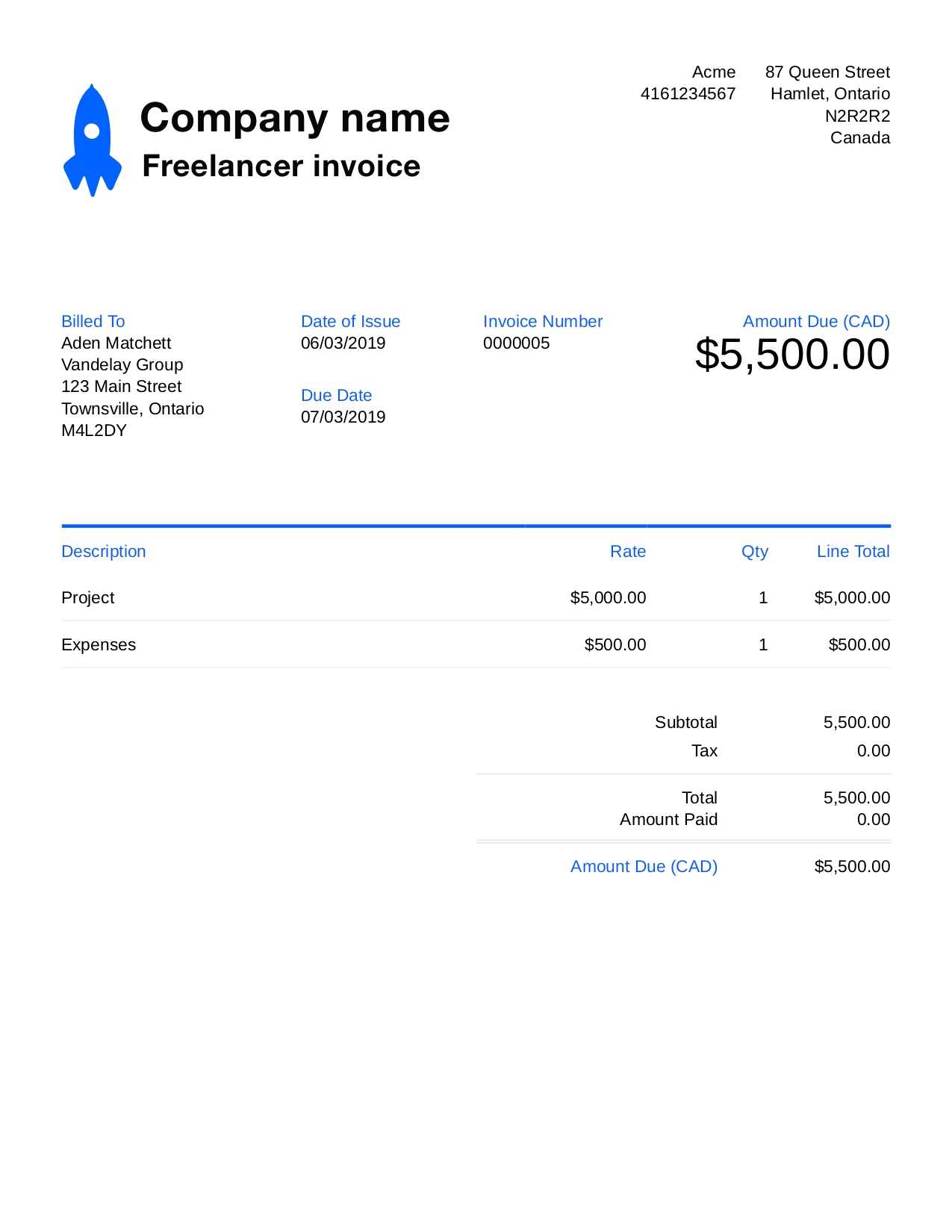

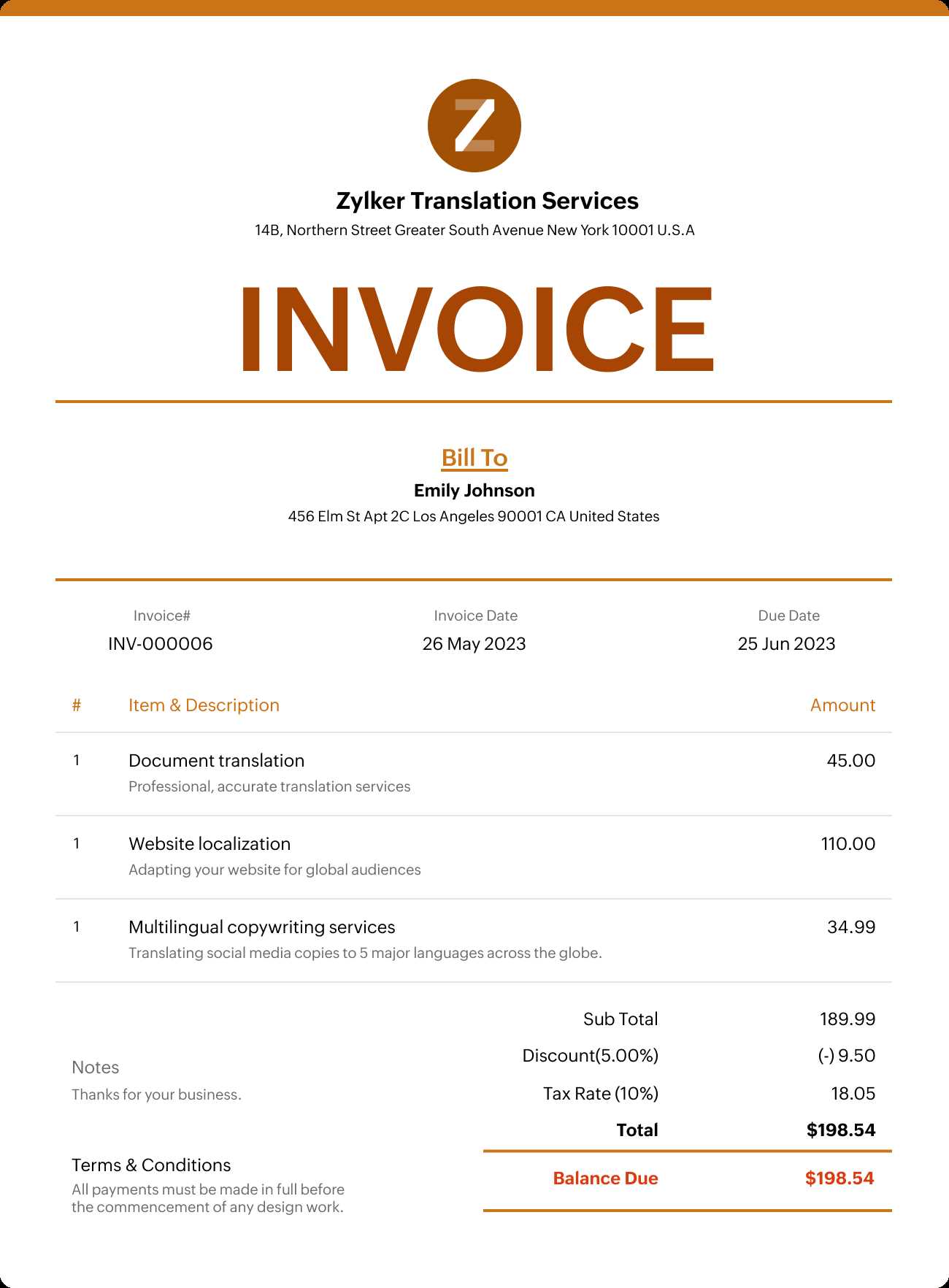

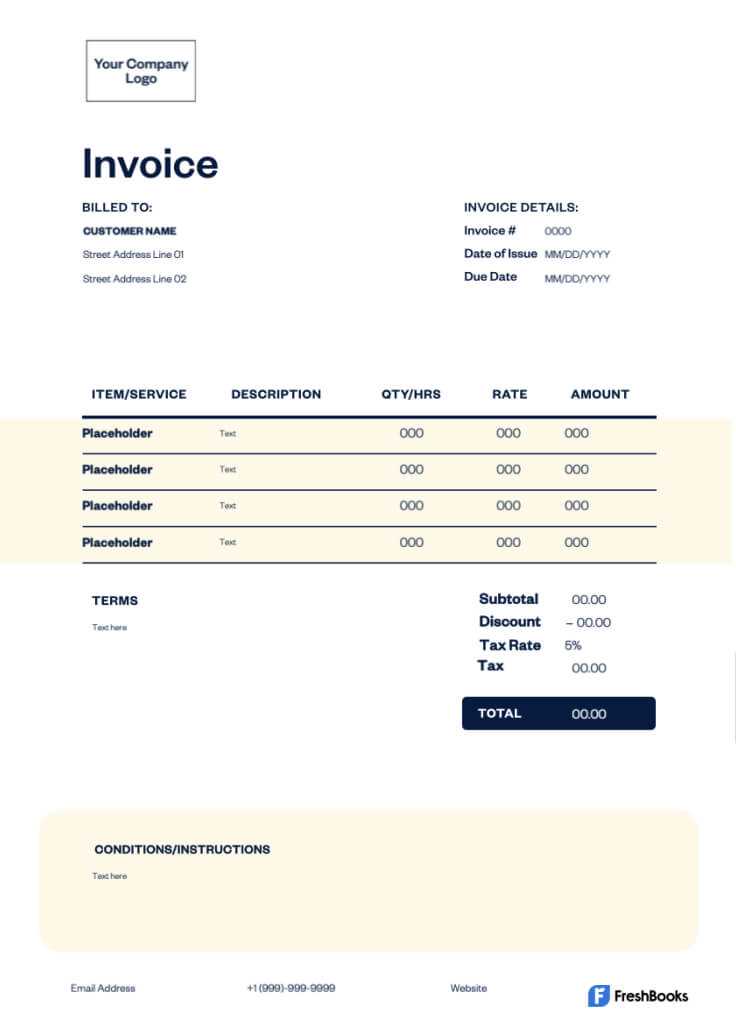

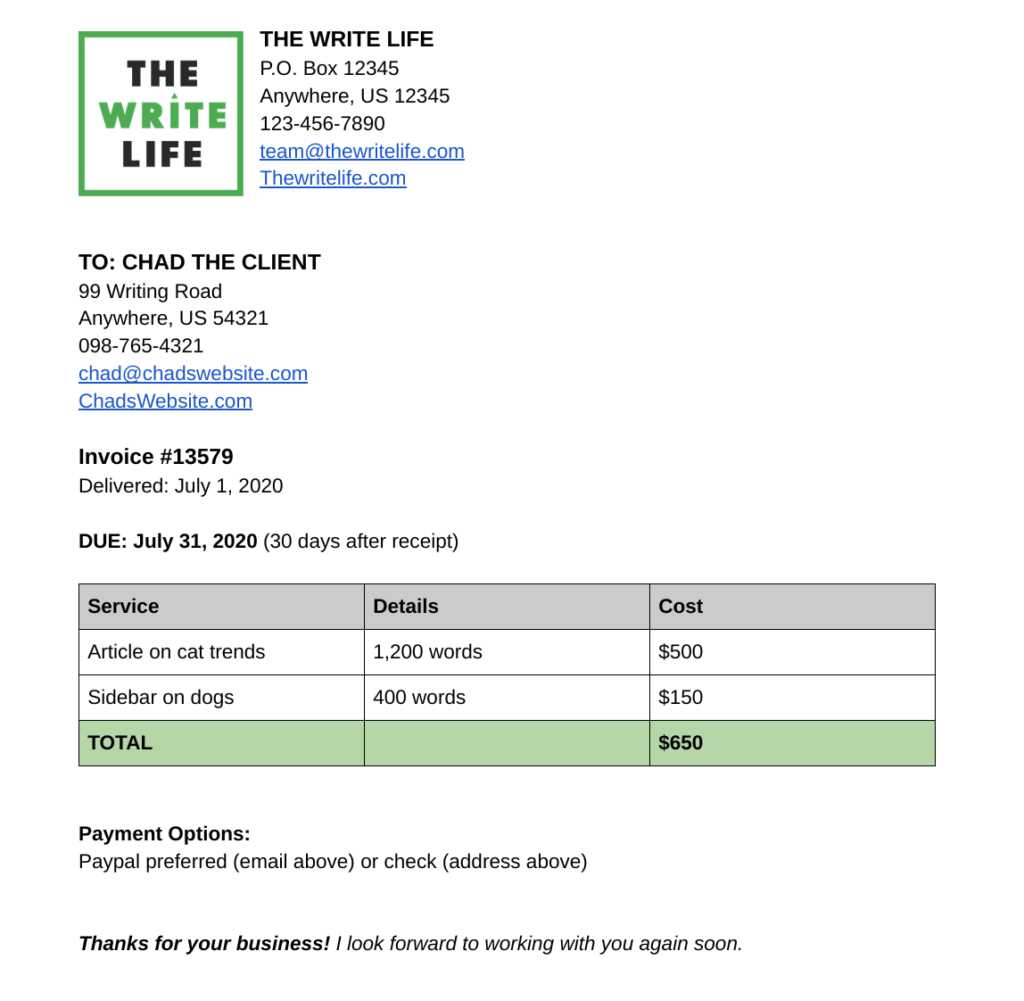

Having a well-structured document for requesting payment is essential for any professional service provider. Clear and professional examples can guide you in crafting your own payment requests, ensuring all the necessary information is included and formatted correctly. Below, we’ll explore several different examples and samples, illustrating how to create clear, comprehensive, and professional payment requests for your clients.

Basic Payment Request Example

This is a simple example that includes all the basic details needed for a straightforward transaction. It’s perfect for one-time services or small projects:

- Client Information: Name, Address, Email, and Contact Number

- Service Provider Information: Your Name, Address, Email, and Contact Number

- Payment Details: A description of the service provided, rate, and total amount due

- Payment Instructions: Accepted payment methods (e.g., bank transfer, PayPal, etc.)

- Due Date: Clear and precise payment deadline

Recurring Payment Request Example

If you’re working with clients on an ongoing basis, a recurring payment request might be more appropriate. This type of document includes specific dates, billing cycles, and recurring charges:

- Service Period: Start and end date for the billing cycle (e.g., “October 1 – October 31”)

- Recurring Amount: The agreed amount for each billing cycle

- Discount or Taxes: Any applicable taxes or discounts should be clearly itemized

- Billing Frequency: Weekly, biweekly, or monthly payment cycles

- Payment Instructions: Detailed instructions on how to make the payment

Detailed Payment Request Example with Milestones

For larger projects or jobs with several stages, you may want to include a detailed breakdown of the services provided at each milestone. Here’s an example of how you might format this:

- Client and Provider Information: As above

- Milestone Breakdown: List eac