Essential Freelance Writer Invoice Template for Smooth Payment Management

When managing your own business, keeping track of payments and ensuring timely compensation is crucial. For those offering services on a contract basis, creating accurate, clear documents for billing is an essential part of the process. These documents not only outline the work completed but also ensure a smooth transaction between you and your clients.

Customized billing documents can help streamline the payment process, reduce errors, and maintain a professional relationship with clients. Using a well-structured format ensures that you include all necessary details, such as payment terms, services provided, and contact information. A good system for invoicing can also prevent misunderstandings or delays in payment.

In this guide, we’ll explore the best practices for designing and using such billing documents. We’ll cover how to tailor them to your specific needs, provide helpful tips on what to include, and offer guidance on how to send them efficiently. Whether you’re just starting or looking to refine your process, mastering this aspect of business management is a key step toward ensuring your financial success.

Billing Document Guide for Independent Professionals

For anyone working as an independent contractor, creating a clear, professional billing document is essential. This guide will walk you through the key steps to help you set up a structure that works for your business, ensuring all necessary information is included and the document is easy to read and understand. Whether you’re sending invoices to clients or preparing for future projects, a well-organized document will save you time and reduce confusion.

Key Components of a Professional Billing Document

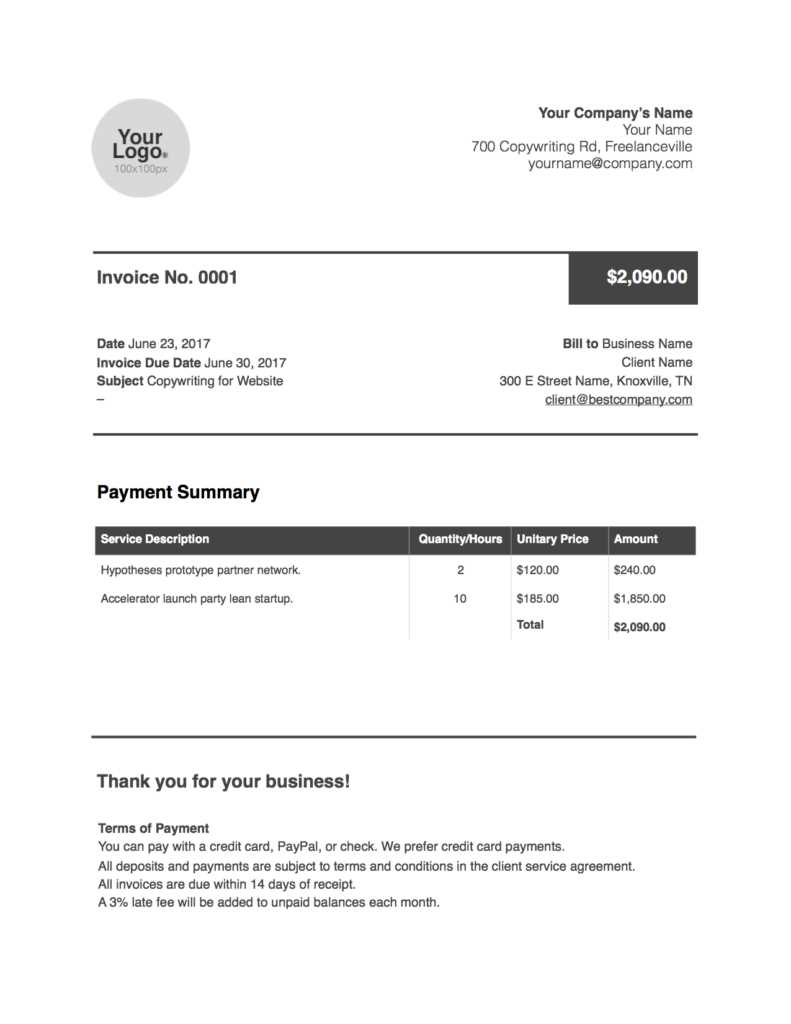

To ensure your billing documents are effective, they should contain the following essential elements:

- Contact Information: Include both your details and those of your client, such as names, addresses, and phone numbers.

- Services Provided: Clearly list the tasks or projects completed along with any relevant descriptions or quantities.

- Payment Terms: Specify the due date, accepted payment methods, and any penalties for late payments.

- Total Amount Due: Clearly show the amount being charged, with a breakdown of rates, taxes, or additional charges.

- Invoice Number: Use a unique number for each document for easy tracking and reference.

How to Organize Your Billing Process

Consistency and organization are key to managing your payments and ensuring you get paid on time. Follow these steps to optimize your workflow:

- Prepare your billing document as soon as the work is completed or milestones are achieved.

- Double-check the details for accuracy, ensuring there are no errors in the amounts or descriptions.

- Send the document promptly to avoid delays in payments.

- Keep a copy of each billing document for your records, and track payments regularly.

- Follow up if payment is not received by the specified date.

By following these guidelines, you’ll be able to create clear, professional documents that not only improve your financial management but also reinforce your reputation as a reliable and organized professional.

Why Use an Invoice Document Format

Utilizing a pre-designed format for billing is a smart way to streamline the process and maintain professionalism. Whether you’re working on a one-off project or handling multiple clients, having a consistent structure for your financial documents helps to ensure that important details are not overlooked. A well-organized billing structure saves time, reduces mistakes, and helps you get paid on time without unnecessary back-and-forth with clients.

Benefits of Using a Pre-made Structure

Here are some reasons why using a pre-designed document format is essential for smooth business operations:

- Efficiency: With a set format, you can quickly fill in the necessary information, reducing time spent creating documents from scratch.

- Consistency: Using the same structure every time ensures all documents are uniform, which makes managing finances easier and more organized.

- Professional Appearance: A neat, well-structured document shows clients you are organized and serious about your work, helping to build trust.

- Error Reduction: Pre-designed formats often include all required sections, which reduces the likelihood of forgetting crucial details.

- Compliance: A consistent format ensures that you’re meeting legal and contractual obligations regarding billing and payment terms.

How to Choose the Right Format

When selecting a format for your documents, it’s important to consider both your needs and the expectations of your clients. Here’s a simple comparison to help you decide:

| Option | Pros | Cons |

|---|---|---|

| Free Templates | Quick and easy

Key Elements of a Billing Document

For any professional providing services, creating a clear and comprehensive document for payment is essential. This document should not only outline the work completed but also ensure that all necessary details are included for clarity and smooth processing. By including the key elements, you can avoid misunderstandings and ensure your clients are informed about the payment process. Essential Information to IncludeA well-structured billing document should contain the following crucial components to ensure everything is clear:

Why These Elements MatterEach of these elements plays a key role in ensuring your document is clear and professional. Missing any important details can cause confusion, delays in payment, or disputes. By consistently including all necessary information, you maintain a standard that not only aids your clients but also enhances your reputation as How to Customize Your Billing DocumentTailoring your billing document to suit your specific needs and preferences can significantly improve the efficiency of your financial management. Customizing ensures that the document reflects your business identity and meets the requirements of both you and your clients. By adjusting various elements, you can create a professional and effective document that aligns with your workflow. Here are some key ways to personalize your document:

By taking the time to customize your billing document, you ensure that all necessary information is presented clearly and in a way that aligns with your business needs. A personalized document not only looks professional but also enhances communication with clients, helping to build trust and streamline the payment process. Free vs Paid Invoice TemplatesChoosing between free and paid document designs for billing can be challenging, as each has its distinct benefits and limitations. Both types cater to different needs, often based on budget, customization options, and specific features. Below is a comparison of the advantages and potential downsides of each option to help guide your decision.

|