Freelance Translator Invoice Template for Streamlined Billing

As a self-employed individual providing specialized services, one of the most important tasks is managing financial transactions smoothly and efficiently. A well-structured billing document ensures clarity between you and your clients, helping to avoid misunderstandings and delays. With the right format, creating and sending these documents becomes a hassle-free process, giving you more time to focus on your work.

Designing the right billing format for your business needs is key. While there are many options available, using a customizable solution allows you to reflect your unique services and branding while keeping things professional. This document should clearly outline the agreed-upon payment details, deadlines, and any additional fees to ensure transparency and prompt payments.

Whether you’re working on short-term projects or long-term collaborations, having a reliable way to request payment is essential. A streamlined process helps you maintain positive client relationships, ensuring they understand the terms and are more likely to pay on time. This guide will show you how to create an effective document that meets both your needs and your clients’ expectations.

Billing Document Creation Guide

Creating an effective payment request form is essential for any independent professional offering specialized services. It helps outline the financial details of the project, ensuring both parties are on the same page about the agreed terms. A well-constructed document not only boosts your professionalism but also streamlines the payment process, making it easier for clients to understand what they owe and by when.

The key to a successful billing request is its clarity. It should include all necessary information, such as the services provided, rates, and deadlines. Using a consistent structure allows you to maintain a level of professionalism while minimizing errors or confusion. The right format also helps you stay organized and ensures that payments are processed efficiently.

In this guide, you will learn how to create a custom payment request form that fits your business model and client needs. By following these simple steps, you can ensure that every transaction is handled smoothly and professionally, allowing you to focus on delivering quality services without worrying about administrative tasks.

Why You Need an Invoice Template

When running your own business, managing finances effectively is crucial for maintaining a steady cash flow and building a trustworthy reputation with clients. A standardized payment request document can save you time, reduce errors, and ensure that your billing process is both professional and efficient. Instead of creating a new document from scratch for each project, using a pre-designed structure helps you stay organized and focused on your work.

Benefits of Using a Structured Billing Document

- Saves Time: A pre-made format means you don’t have to start from zero each time, allowing you to send out requests faster.

- Minimizes Errors: With all essential information already included, you reduce the chance of forgetting important details, like payment terms or contact information.

- Professional Appearance: A polished, consistent billing method boosts your credibility with clients and reinforces your professionalism.

- Easy to Customize: Many pre-made options allow for quick modifications to fit each specific project, ensuring flexibility without losing structure.

How It Helps in Financial Organization

- Tracking Payments: Having a consistent way to record transactions makes it easier to track who has paid and who still owes you money.

- Ensures Legal Compliance: Some regions require specific information on financial documents. A structured format ensures you meet those legal requirements.

- Streamlines Record-Keeping: With a standardized approach, it’s easier to organize your records for tax purposes or future reference.

In summary, using a standardized payment request form helps maintain an efficient, professional, and organized approach to managing your finances, ensuring a smoother experience for both you and your clients.

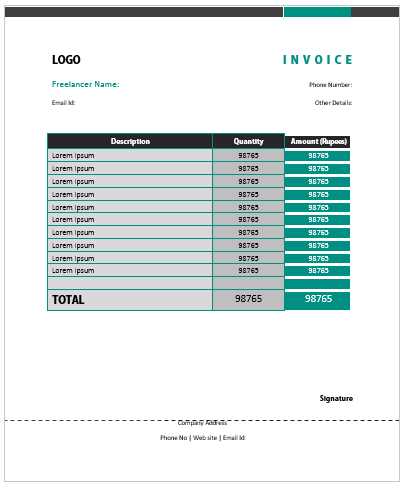

How to Customize Your Billing Document

Customizing your payment request form is essential for tailoring it to the specific needs of each client and project. While it’s important to maintain a consistent format, personalizing certain elements can help ensure clarity and professionalism. By adjusting details like payment terms, service descriptions, and rates, you can create a document that accurately reflects the unique aspects of each job while maintaining an organized structure.

Essential Elements to Personalize

There are several key components that you may need to adjust to suit each individual assignment:

| Section | Customizable Details |

|---|---|

| Client Information | Enter the client’s name, address, and contact details. |

| Project Description | Specify the services provided and the scope of work. |

| Payment Terms | Adjust the due date and any specific payment instructions. |

| Rates | Enter the agreed-upon rates for services, whether hourly or per word. |

| Additional Fees | Add any extra charges, like late fees or rush processing costs. |

Formatting for Clarity and Professionalism

While personalizing the content, it’s crucial to keep the document easy to read and professionally formatted. Use clear headings, bullet points, and concise descriptions. This will help clients quickly locate important information like the total amount due, payment methods, and deadlines. Consider using bold text or color to highlight key sections, but keep the design simple and clean.

By customizing your payment request document effectively, you ensure that each transaction is clearly documented and presented in a way that fosters trust and reduces the chance of confusion.

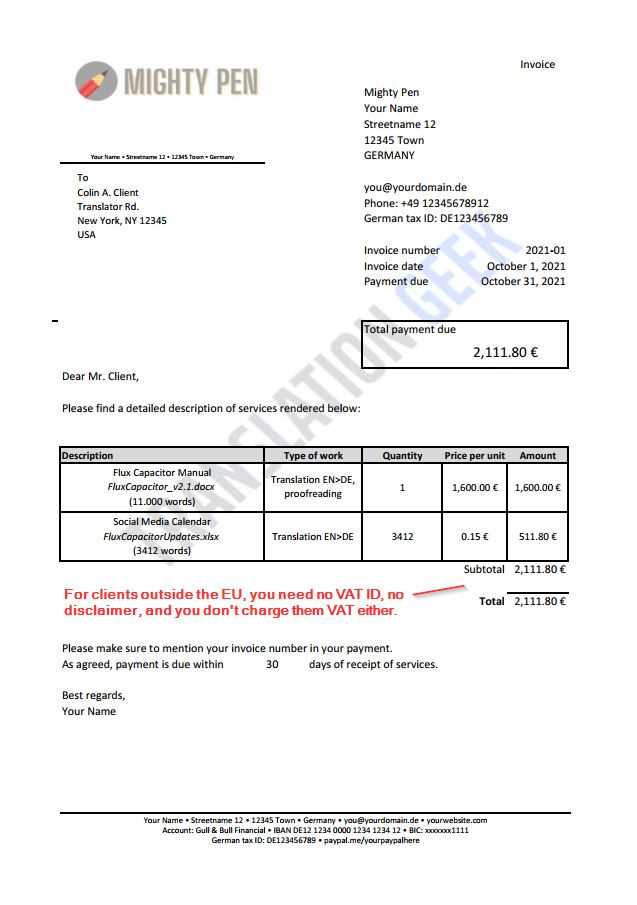

Key Elements of a Professional Billing Document

A well-crafted billing document serves as a formal record of the services rendered and the payment expected. To ensure clarity and prevent confusion, it’s essential that certain key elements are included in every financial request. These elements not only make your document look professional but also provide important information to your client, facilitating smooth and prompt payment transactions.

Essential Components to Include

- Your Business Information: This includes your name, business name (if applicable), address, and contact details, so clients know how to reach you if needed.

- Client’s Details: Include the client’s full name, address, and any other relevant contact information for clarity and reference.

- Unique Identification Number: Give each document a unique reference number. This helps both you and the client track the payment and organize records.

- Description of Services: Clearly list the services provided, including the scope, duration, and any specific tasks completed. This helps avoid misunderstandings about what is being charged.

- Rates and Payment Terms: Specify your rates (hourly, per word, project-based) and the total amount due. Also, include payment terms, such as the due date, accepted payment methods, and any late fees or discounts for early payment.

- Taxes and Additional Charges: If applicable, outline any taxes or additional fees, such as processing or handling charges, to avoid surprises for your client.

- Due Date: Be sure to include the date by which the payment must be made. This establishes clear expectations and can help prevent delays.

Formatting Tips for Professionalism

- Consistent Structure: Ensure that all the key sections are easy to navigate by using clear headings and bullet points.

- Readable Fonts: Use clean, professional fonts and adequate spacing to enhance readability and make the document visually appealing.

- Branding: If applicable, include your logo or brand colors to add a personal touch and make the document look more polished.

By including these essential elements in your billing document, you ensure that it not only meets professional standards but also helps establish a transparent and efficient payment process.

Creating Clear Payment Terms

Establishing clear payment terms is essential for any service-based business. When both you and your client understand the expectations regarding payment, it reduces the likelihood of disputes and delays. A well-defined payment schedule not only clarifies when and how payment should be made but also helps set professional boundaries. Clear terms ensure that both parties are on the same page from the beginning, making the transaction smooth and efficient.

Key Elements of Payment Terms

- Due Date: Clearly specify when payment is expected. Whether it’s a set number of days after the project completion or a fixed date, defining this upfront is critical.

- Accepted Payment Methods: List the payment methods you accept, such as bank transfers, credit card payments, or online platforms like PayPal or Stripe. This ensures clients know how to pay you.

- Late Payment Penalties: If you charge a late fee, make sure it is specified, including the percentage or flat fee and the timeframe after the due date when it will apply.

- Discounts for Early Payment: Offer incentives for clients who pay ahead of schedule. This can encourage prompt payments and improve your cash flow.

- Partial Payments: If your project involves multiple stages, outline any conditions for partial payments, including when these payments are due and how much is expected at each stage.

Tips for Clarity and Transparency

- Use Simple Language: Avoid complicated terms or jargon. Keep the language straightforward to prevent any misunderstandings.

- Be Specific: Instead of general terms like “due in two weeks,” specify the exact date to avoid confusion.

- Repeat Key Points: Reiterate important information like payment methods and due dates in both the body of the document and in a prominent section for quick reference.

By creating clear and concise payment terms, you help foster trust with your clients and ensure that both parties understand their responsibilities. This leads to smoother transactions and a more professional business experience.

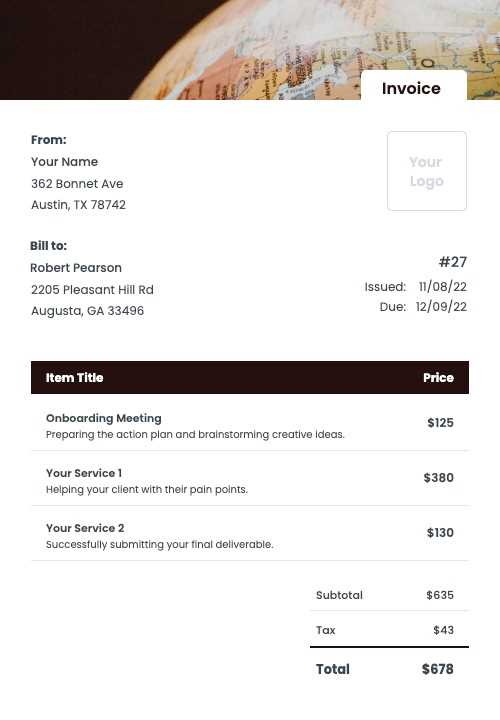

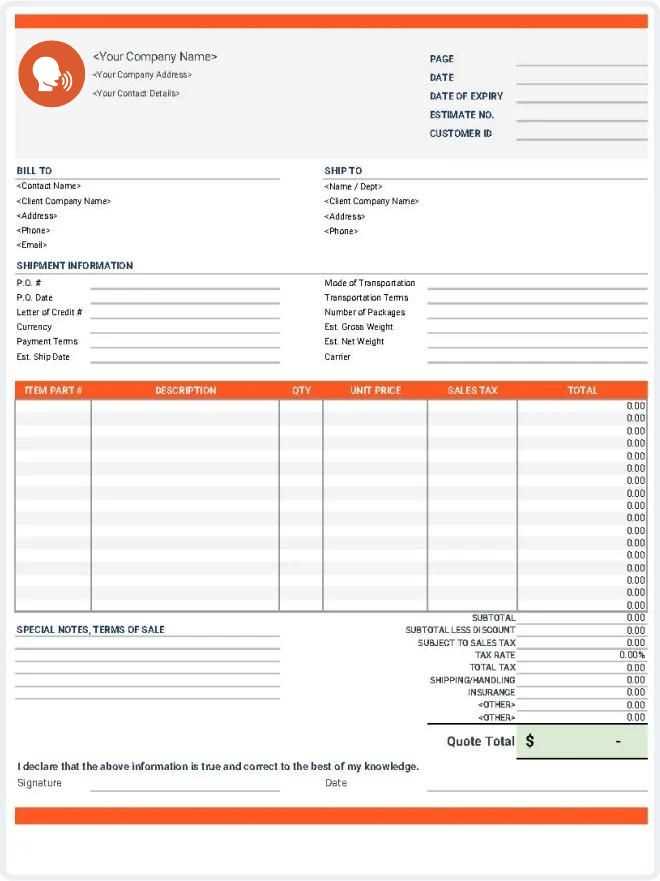

Choosing the Right Billing Format

Selecting the appropriate format for your payment request document is crucial for ensuring clarity and professionalism. The right format can enhance your communication with clients and streamline the payment process. A well-organized and easy-to-read document not only reflects your business standards but also makes it easier for clients to understand the details of the transaction and make payments promptly.

There are different formats available, each with its own advantages. Whether you prefer a simple text document, a spreadsheet, or a more sophisticated design, it’s important to choose the one that suits your style and your clients’ needs. Here are a few key considerations when making your decision:

Factors to Consider When Choosing a Format

- Ease of Use: The format should be simple for you to update and customize for each project. Look for options that allow you to input information quickly without compromising professionalism.

- Client Preferences: Some clients may have specific preferences for receiving payment requests, whether in PDF, Word, or spreadsheet format. Understanding their preferred method can help ensure a smooth process.

- Design Flexibility: A format that allows for easy customization in terms of layout, fonts, and colors can be valuable if you want to personalize your documents and add a professional touch.

- Compatibility with Software: Ensure that the format you choose is compatible with the tools you use, such as accounting software, document editors, or online payment platforms.

Popular Billing Document Formats

- Word Documents: Easy to customize, suitable for simple layouts and text-based requests.

- PDF Files: Ideal for final versions of your documents, as they preserve formatting and ensure consistency when viewed by clients.

- Spreadsheets: Great for tracking multiple projects or clients, and helpful if you need to calculate totals automatically.

- Online Tools and Platforms: Many accounting or billing software programs provide templates and allow for seamless integration with payment systems.

Choosing the right format will depend on your business needs and the preferences of your clients. A well-organized, easy-to-read payment request can make a significant difference in your billing efficiency and client satisfaction.

Common Mistakes to Avoid on Billing Documents

Creating a billing document may seem straightforward, but small errors can lead to confusion, delays, and even payment disputes. To ensure a smooth transaction, it’s important to be aware of common mistakes that can undermine your professionalism or complicate the payment process. Avoiding these pitfalls will help establish trust with your clients and ensure timely payments.

Common Errors to Watch Out For

- Missing Client Information: Always ensure that the client’s full name, address, and contact details are clearly stated. Omitting this can lead to confusion or delay in processing.

- Incorrect Payment Details: Double-check that your payment instructions are correct, including bank account information, online payment platform details, and accepted methods. Incorrect or outdated payment information can delay the transaction.

- Failure to Include Payment Terms: Be explicit about when payment is due and any penalties for late payments. Leaving these details unclear can lead to confusion and delay payments.

- Not Itemizing Services: Always break down the work completed or services provided. A vague description like “work completed” does not help clarify what the client is paying for, potentially leading to disputes.

- Overlooking Taxes and Fees: If taxes or additional fees apply, make sure to clearly list them on the document. Failing to include these can result in underpayment or disputes over the total amount due.

Formatting Issues That Can Cause Problems

- Cluttered Layout: A document that’s hard to read due to poor formatting can make it difficult for your client to quickly find the important information, such as the total amount due or the due date.

- Lack of a Unique Reference Number: Without a unique identifier, both you and your client may have trouble tracking the payment, especially if multiple transactions occur.

- Inconsistent Fonts or Styles: Use a clean, professional font and keep the design consistent. Mixing different fonts or colors can make the document look unprofessional and hard to read.

By paying attention to these details and avoiding common mistakes, you will present a professional image, reduce the risk of misunderstandings, and make the payment process as smooth as possible for your clients.

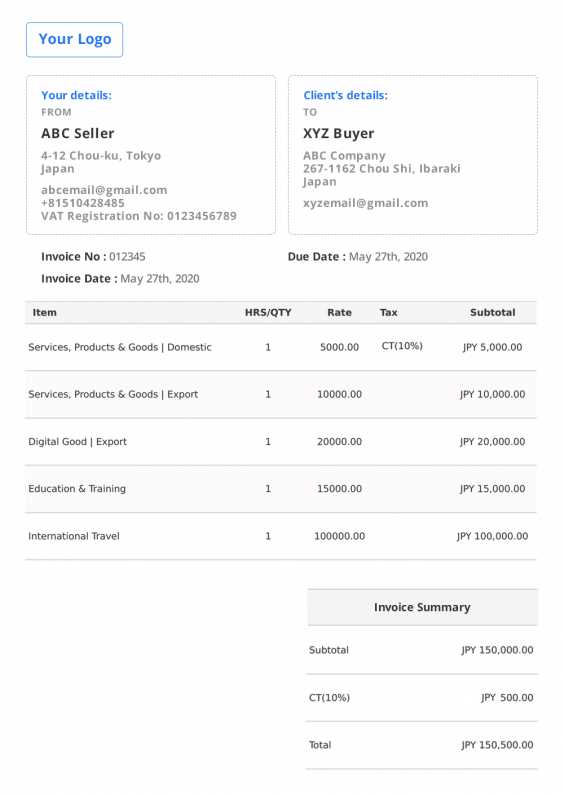

How to Add Taxes and Fees

When providing services, it’s important to include any applicable taxes or additional charges to ensure you’re paid the full amount you’re owed. Adding taxes and fees properly not only ensures compliance with local regulations but also helps avoid misunderstandings with your clients. Whether it’s sales tax, VAT, or handling fees, clearly itemizing these amounts ensures transparency and accuracy in your payment requests.

Steps to Include Taxes and Fees

- Determine Applicable Taxes: Research the tax rates in your region or the client’s location. Sales tax, VAT, or service-specific taxes may vary, so ensure you calculate the correct amount based on the relevant laws.

- List Taxes Separately: Make sure to show taxes as a separate line item on the document. This allows the client to easily see the breakdown and prevents confusion over the total amount due.

- Include the Tax Rate: Clearly state the tax rate being applied. For example, if you are charging a 10% VAT, list this percentage next to the tax amount for clarity.

- Account for Additional Fees: If there are other charges, such as a rush fee, administrative fees, or delivery costs, make sure they are outlined clearly. These should be listed as distinct line items so clients understand what they are paying for.

- Calculate Total Amount Due: After adding taxes and fees, sum the amounts and list the total. Double-check the calculations to avoid any errors in the final total.

Best Practices for Clarity

- Use Simple Language: Clearly label each section (e.g., “Sales Tax,” “Rush Fee,” “VAT”) so that the client understands what each charge refers to.

- Be Transparent: If your service is exempt from taxes or if certain fees only apply under specific conditions, note this clearly to avoid misunderstandings.

- Include a Subtotal: Before listing taxes or fees, show the subtotal of the services provided, ensuring transparency in how the final amount is calculated.

Including taxes and fees properly not only ensures that you comply with financial regulations but also builds trust with your clients by offering clear and transparent billing. This attention to detail helps maintain a professional image and fosters smooth payment transactions.

Essential Contact Information to Include

Including accurate and comprehensive contact details in your payment request document is crucial for effective communication between you and your client. These details ensure that both parties can easily reach each other in case of questions, clarifications, or issues regarding the transaction. By providing the right contact information, you help build trust and make the payment process more efficient.

Key Contact Information to Add

- Your Full Name or Business Name: Clearly state your name or the name of your business at the top of the document. This helps the client easily identify the sender and adds a professional touch.

- Your Address: Include your physical or business address, especially if it’s required for legal or tax purposes. It can also help the client know where to send checks or any physical correspondence.

- Email Address: Provide an active email address where the client can reach you for any questions or follow-ups. Make sure it’s regularly checked to avoid communication delays.

- Phone Number: If appropriate, include a contact number for urgent queries or further clarifications. This is particularly useful for clients who may prefer direct communication over email.

- Payment Details: Include any payment-related information such as your bank account number, PayPal email, or other accepted methods. Make it clear and easy for clients to understand how to pay you.

Additional Information to Consider

- Website or Portfolio: If applicable, you can add a link to your professional website or online portfolio. This is particularly useful if clients need to verify your work or wish to browse your services further.

- Social Media Handles: Some clients prefer to reach out via social media. If relevant, you can include your professional social media profiles, but make sure they are business-oriented and active.

Including these essential contact details ensures that your clients can reach you easily and quickly. By making your payment request document clear and professional, you foster stronger client relationships and avoid potential delays in communication.

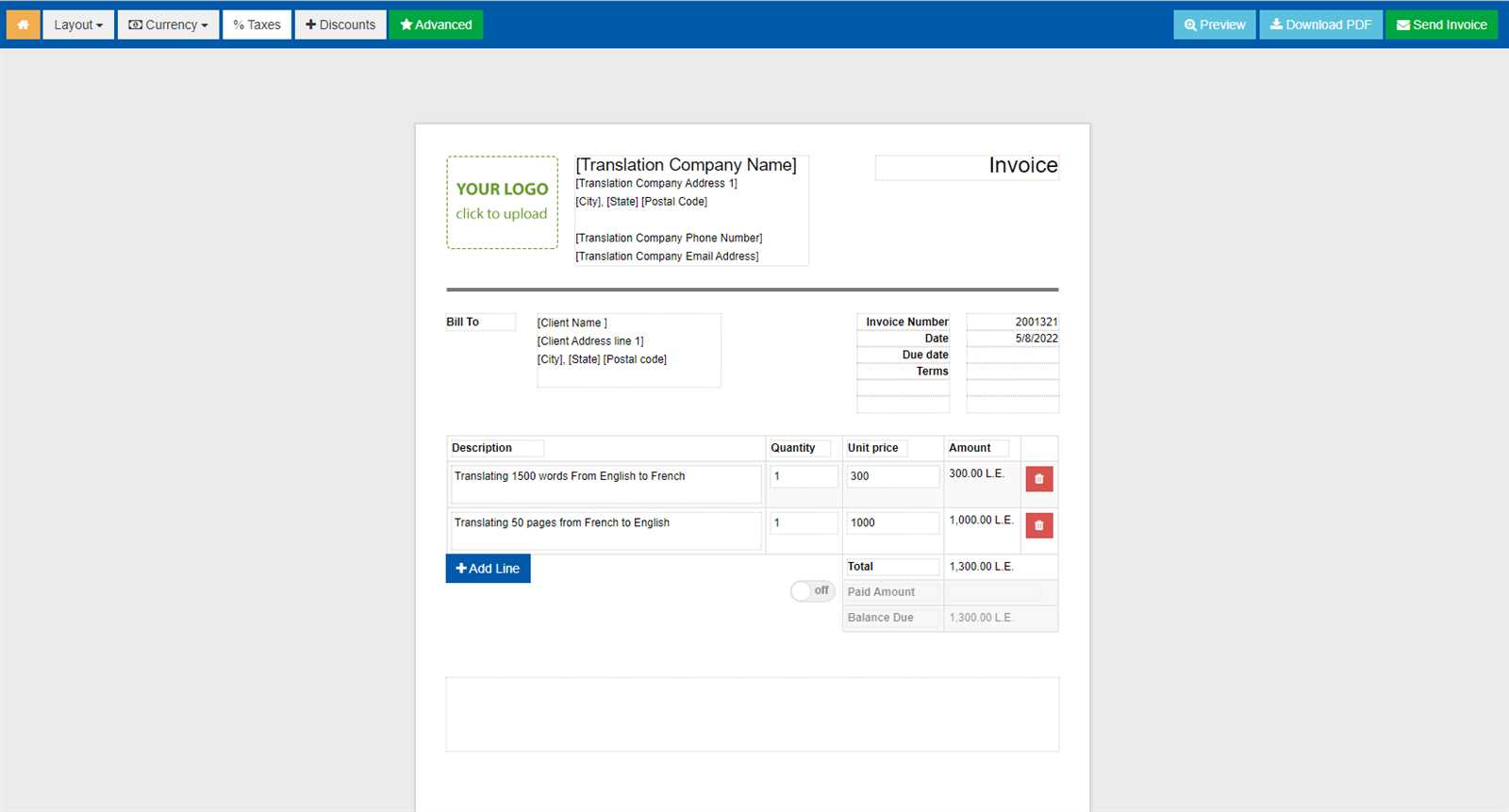

How to Use Billing Software for Independent Contractors

Using specialized software for creating and managing payment requests can greatly simplify administrative tasks for independent professionals. These tools not only automate many aspects of the billing process but also help ensure accuracy, save time, and maintain a professional appearance. By streamlining the creation, sending, and tracking of payment documents, such software enables you to focus more on your core work while ensuring that your financial records are organized and up-to-date.

Steps to Using Billing Software Effectively

- Choose the Right Software: There are many billing tools available with various features. Consider factors such as ease of use, cost, customization options, and integrations with other tools you use (like accounting or payment platforms).

- Create a Client Profile: Most software allows you to store client information. Input the client’s name, contact details, and payment preferences to save time on future billing cycles.

- Set Up Service Rates: Input your hourly rate, per-project fee, or other pricing structures. This allows the software to automatically calculate totals for each payment request.

- Generate and Customize Documents: Once the basic information is set up, you can generate a new payment request. Most tools offer customizable templates where you can adjust the details such as services rendered, taxes, and due dates.

- Automate Recurring Billing: For long-term projects or ongoing services, billing software can automate recurring payments, sending out reminders to both you and your client before the due date.

- Track Payment Status: Many tools provide the ability to track whether a payment has been made, is pending, or is overdue. This allows you to follow up promptly without manual tracking.

Additional Features to Look For

- Customizable Reminders: Automated reminders for overdue payments can be a huge help. Look for software that allows you to set up gentle reminders before and after the payment deadline.

- Multiple Payment Options: Some billing software integrates with payment processors like PayPal, Stripe, or bank transfers. This gives your clients flexibility in how they pay you.

- Reports and Analytics: Many platforms offer reporting tools that help you analyze income, expenses, and trends over time. These features are particularly useful for long-term financial planning.

By using billing software, you not only improve the efficiency of your business operations but also present a more organized and professional image to your clients. Whether you’re handling one-time projects or long-term engagements, this software is a valuable tool for any independe

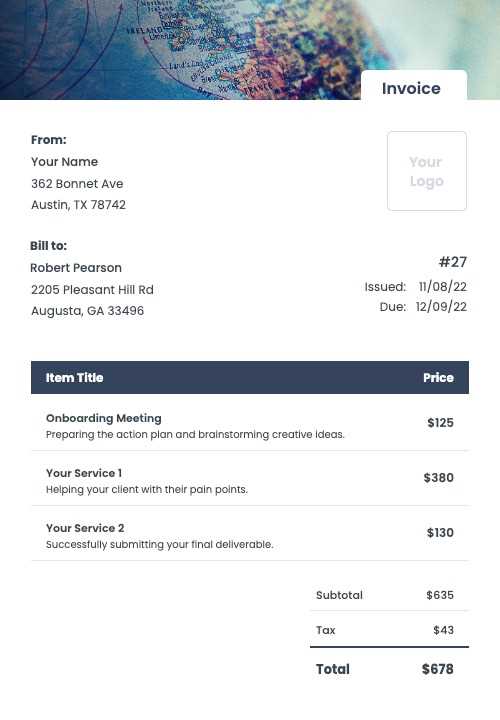

Managing Multiple Clients with One Template

Handling several clients at once can be a challenge, especially when it comes to organizing your payment requests. However, by using a standardized document for all your transactions, you can save time and maintain consistency. The key is to create a flexible structure that allows you to customize each request while keeping the format uniform. This approach helps you stay organized and ensures that your clients receive professional, clear, and accurate payment documents every time.

How to Adapt One Document for Multiple Clients

- Use Predefined Sections: Create a document with fixed sections like your business name, contact information, and payment terms. These remain the same across all clients, which allows you to focus on customizing other parts like services and amounts.

- Customize Client-Specific Information: For each client, change details like the project description, agreed-upon rates, and due dates. Having fields that you can quickly update reduces time spent on creating new documents from scratch.

- Automate Client Names and Addresses: Many document-editing tools allow you to save client information, so you only need to input it once. This feature makes it easy to generate payment documents for each client with minimal manual input.

- Use Variables for Flexibility: With some document creation tools, you can insert placeholders for specific data such as service names, quantities, and rates. This allows you to quickly adjust documents for different clients while maintaining the same layout.

Benefits of Using One Format for All Clients

- Consistency: A standardized format ensures that all your documents look professional and follow the same structure, making it easier for clients to review and process them.

- Time Savings: By reusing the same basic structure, you can speed up the process of generating new documents, freeing up time for other tasks.

- Easy Tracking: Using one format makes it simpler to track payments and outstanding requests across multiple clients. You’ll have a clearer overview of who has paid and who still owes money.

By using a single document structure that can be customized for each client, you streamline your billing process and maintain a level of professionalism across your client base. This efficient approach allows you to focus more on delivering quality work rather than spending time on administrative tasks.

Best Practices for Sending Payment Requests

Sending a payment request document is more than just a financial transaction; it’s an opportunity to demonstrate professionalism and ensure timely payment. Following best practices when sending these documents helps maintain clear communication, reduce the risk of delays, and enhance client relationships. By adhering to a structured process, you can streamline your billing and foster trust with your clients.

Key Practices to Follow When Sending Payment Requests

- Send Promptly: As soon as the work is completed, send the payment request without delay. This ensures that the client receives the document while the project is still fresh in their mind, helping to avoid any confusion later on.

- Choose the Right Format: Depending on your client’s preferences, send the payment request in a format they are most comfortable with, such as PDF, Word document, or through an online billing platform. Ensure that the format is easy for the client to access and view.

- Include Clear Payment Terms: Be explicit about the payment due date and any late fees or penalties. Ensure that your client understands when the payment is expected and the consequences of delayed payments.

- Double-Check Details: Before sending, review the document carefully. Check that all figures are accurate, client information is correct, and there are no typographical errors that could cause confusion or delays.

- Use Professional Language: Always use polite, professional language in your communication. A well-written message that accompanies the document can help establish trust and show that you are serious about your work and the payment process.

- Follow Up on Outstanding Payments: If a payment is overdue, follow up promptly. Send a polite reminder and offer assistance if there are any issues with the document or the payment method.

Additional Tips for Efficient Payment Processing

- Send Electronically for Faster Payments: Whenever possible, send the payment request electronically through email or an online platform. This method is faster, more reliable, and allows for quicker processing.

- Offer Multiple Payment Options: Providing your clients with various ways to pay, such as through bank transfer, credit card, or online payment platforms, makes it more convenient for them and can lead to faster payments.

- Keep Records: Always keep a copy of the sent document for your records. This will help you track payments and provide proof of the transaction if any issues arise.

By following these best practices, you ensure that your payment request process is clear, professional, and efficient. Taking the time to create well-structured documents and communicate clearly with your clients can help you receive payments promptly and maintain positive business relationships.

Tracking Payments and Due Dates

Effectively managing payment deadlines and tracking outstanding balances is essential for maintaining healthy cash flow and preventing payment delays. By staying organized and keeping a clear record of when payments are due and when they have been made, you can avoid unnecessary stress and keep your financials in check. Implementing a solid tracking system not only helps ensure timely payments but also provides transparency for both you and your clients.

How to Track Payments Efficiently

- Use a Payment Tracking System: Whether through dedicated accounting software or simple spreadsheet tools, it’s crucial to have a system in place that allows you to record payment dates, amounts, and outstanding balances. This helps you stay organized and ensures no payments slip through the cracks.

- Record Due Dates: Clearly document the payment due date for each project. Mark it in your calendar or tracking system to avoid missing deadlines. You may also consider setting a reminder a few days before the due date to send follow-up notifications if needed.

- Monitor Payment Status: Keep track of whether payments have been made on time. Most accounting tools will automatically update the status of payments, but if you’re manually tracking, make sure to note when the payment is completed and whether any issues arise.

- Generate Payment Reports: Use your tracking system to generate regular reports that provide a snapshot of your financial status, including overdue payments. This helps you quickly assess whether you need to take any action or follow up with clients.

How to Handle Late Payments

- Send Payment Reminders: If a payment is overdue, send a polite reminder to your client. You can automate these reminders through billing software, or manually follow up via email. Make sure to mention the due date and provide clear instructions on how they can settle the outstanding balance.

- Set Clear Terms for Late Fees: When creating payment terms, clearly define any late fees or interest that will be applied if a payment is not made on time. This will help discourage delayed payments and keep your clients informed of any additional charges they may incur.

- Offer Payment Plans: In some cases, clients may have difficulty making a full payment upfront. Offering payment plans can help them settle the balance over time, while still ensuring that you receive your money in manageable installments.

By actively tracking payments and due

Invoice Templates for Different Languages

When working with clients from various countries, it’s essential to adapt your payment request documents to the preferred language of each client. Providing these documents in the client’s native language not only ensures clarity but also helps build trust and professionalism. Tailoring the language of your documents can prevent misunderstandings and ensure that all details are accurately communicated, from payment terms to service descriptions.

Key Considerations When Creating Multilingual Payment Requests

- Accurate Translations: It’s crucial that all elements of your document, including payment terms, descriptions of services, and contact details, are accurately translated. Avoid using automated translation tools without proper verification to ensure that your message is clear and professional.

- Local Tax and Legal Requirements: Different countries may have specific legal or tax information that needs to be included in your documents. Research local regulations to ensure your payment requests are compliant with local laws, such as tax identification numbers or VAT rates.

- Cultural Sensitivity: Be mindful of cultural differences when drafting your documents. Certain phrases or formats that are common in one language or culture may not be appropriate or well-received in another. Ensure that your document maintains a respectful and professional tone suitable for the client’s background.

- Currency and Payment Methods: Specify the currency in which the payment should be made, especially when working with international clients. If possible, provide payment options that are widely used in the client’s country, such as PayPal, bank transfer, or regional online payment platforms.

Using Multilingual Payment Request Documents

- Include Language Selection: If you are working with clients from various linguistic backgrounds, consider creating documents with a language selection option. Some invoicing software allows you to create versions of your document in different languages, ensuring you can easily switch between them when needed.

- Offer Bilingual Versions: If you work with clients from regions where two languages are commonly spoken (e.g., English and Spanish in the United States), offering a bilingual payment request can help ensure no details are overlooked. Each version should be side-by-side to avoid confusion.

- Use International-Friendly Formats: Ensure your payment documents are formatted in a way that works internationally, such as including both date formats and numerical styles that are universally understood or region-specific.

Adapting your payment documents for different languages not only improves communication but also demonstrates your commitment to providing a smooth and professional experience for clients worldwide. By ensuring that your documents are culturally and linguistically appropriate, you enhance your professional reputation and increase the likelihood of timely payments.

When to Update Your Payment Request Document

Over time, it may become necessary to revise your payment request structure to keep it up-to-date with changes in your business, tax laws, or client preferences. Regularly updating your documents ensures that they remain accurate, professional, and compliant with the latest regulations. Knowing when to make adjustments will help you avoid errors and maintain clear communication with your clients.

Key Indicators for Updating Your Document

- Changes in Your Business Details: If there is any update to your business name, contact information, or legal structure, it’s important to revise your document to reflect these changes. Accurate information on payment documents is essential for professionalism and clarity.

- Regulatory or Tax Updates: Local or international tax regulations may change over time, affecting how payments are processed or reported. Always ensure that your document complies with current tax rules, such as including the correct VAT rates or tax identification numbers.

- Changes in Payment Terms: If you adjust your payment terms–such as the introduction of late fees, discounts for early payment, or revised due dates–make sure these updates are reflected in your documents to avoid confusion with clients.

- Expansion into New Markets: If you begin working with clients in new countries or regions, you may need to update your document to include relevant information such as different currencies, international payment methods, or localized terms.

- Client Feedback: Sometimes clients may request specific modifications to your payment documents for clarity or convenience. Taking their suggestions into account can help improve your communication and make the process smoother for everyone.

How to Effectively Update Your Payment Request

- Review the Entire Document: Each time you make an update, go over your entire document carefully to ensure that all information is accurate and consistent. Look for areas where improvements can be made, such as formatting or wording.

- Test for Usability: Make sure the updated document is easy to understand and use. Test it by sending it to yourself or a trusted colleague for feedback before sending it to clients.

- Keep a Version History: As your documents evolve, it’s a good idea to keep track of the different versions. This way, you can easily refer back to earlier formats if necessary or ensure that you are using the most up-to-date version when sending requests.

By regularly reviewing and updating your payment documents, you ensure

How to Ensure Timely Payments

Receiving payments on time is critical for maintaining smooth cash flow and ensuring the stability of your business. While it’s not always in your control, there are several proactive steps you can take to encourage punctual payments from your clients. By setting clear expectations, maintaining communication, and using efficient systems, you can increase the likelihood of receiving your funds promptly and avoid unnecessary delays.

Effective Strategies for Timely Payments

- Set Clear Payment Terms: From the outset, clearly communicate your payment expectations to clients. Specify the due date, the accepted payment methods, and any late fees that might apply. Having these terms written out in your agreements or contracts ensures there is no confusion later on.

- Send Payment Requests Promptly: Don’t wait until the last minute to send your payment request. Once the project is completed, send the document as soon as possible. The earlier you send it, the more likely it is that clients will process the payment on time.

- Offer Convenient Payment Options: Provide your clients with multiple payment methods, such as bank transfers, online payment systems, or credit cards. The easier it is for your clients to pay, the more likely they are to do so promptly.

- Set Up Automated Reminders: Use invoicing software or reminders on your calendar to notify clients about upcoming due dates. Sending automated reminders a few days before the due date helps prompt action without requiring manual effort.

- Be Consistent with Follow-Ups: If a payment is overdue, don’t hesitate to follow up. A polite reminder, along with a clear explanation of the payment terms and consequences of delay, can encourage clients to pay quickly. Be firm but professional in your communication.

- Establish a Payment Schedule: If a client is unable to pay the full amount upfront, offer the option of installment payments. Having a set schedule for these installments can ensure that you receive partial payments while continuing to work with the client.

Additional Tips for Reducing Delays

- Send Detailed and Accurate Payment Requests: Ensure that every payment request is clear, with all the necessary information included. Double-check for accuracy, such as the correct amounts, due dates, and payment methods. A well-organized document reduces the chances of delays caused by misunderstandings.

- Build Strong Client Relationships: Establish trust with your clients by providing high-quality work and being responsive to their needs. A strong working relationship often results in prompt payments, as clients are mo