Freelance Software Developer Invoice Template for Efficient Billing

When you’re offering your technical expertise as an independent professional, having a clear and well-structured financial record is essential. This document serves as a formal agreement between you and your clients, ensuring that both parties are on the same page regarding the services provided, payment terms, and due dates. Crafting an efficient and straightforward billing record can help avoid misunderstandings and foster trust with your clients.

Accurate and timely payments depend on the clarity of the document you send. It’s not just about listing the work you’ve done but also about creating a professional impression that showcases your attention to detail and reliability. With the right approach, this tool becomes an essential part of your business operations, helping you maintain smooth financial transactions and stay organized.

In this guide, we’ll explore the best practices for creating such a document, covering essential details like pricing structures, deadlines, and payment methods. Whether you’re handling one-off projects or ongoing collaborations, having a standardized approach to billing can save you time and reduce the chances of errors.

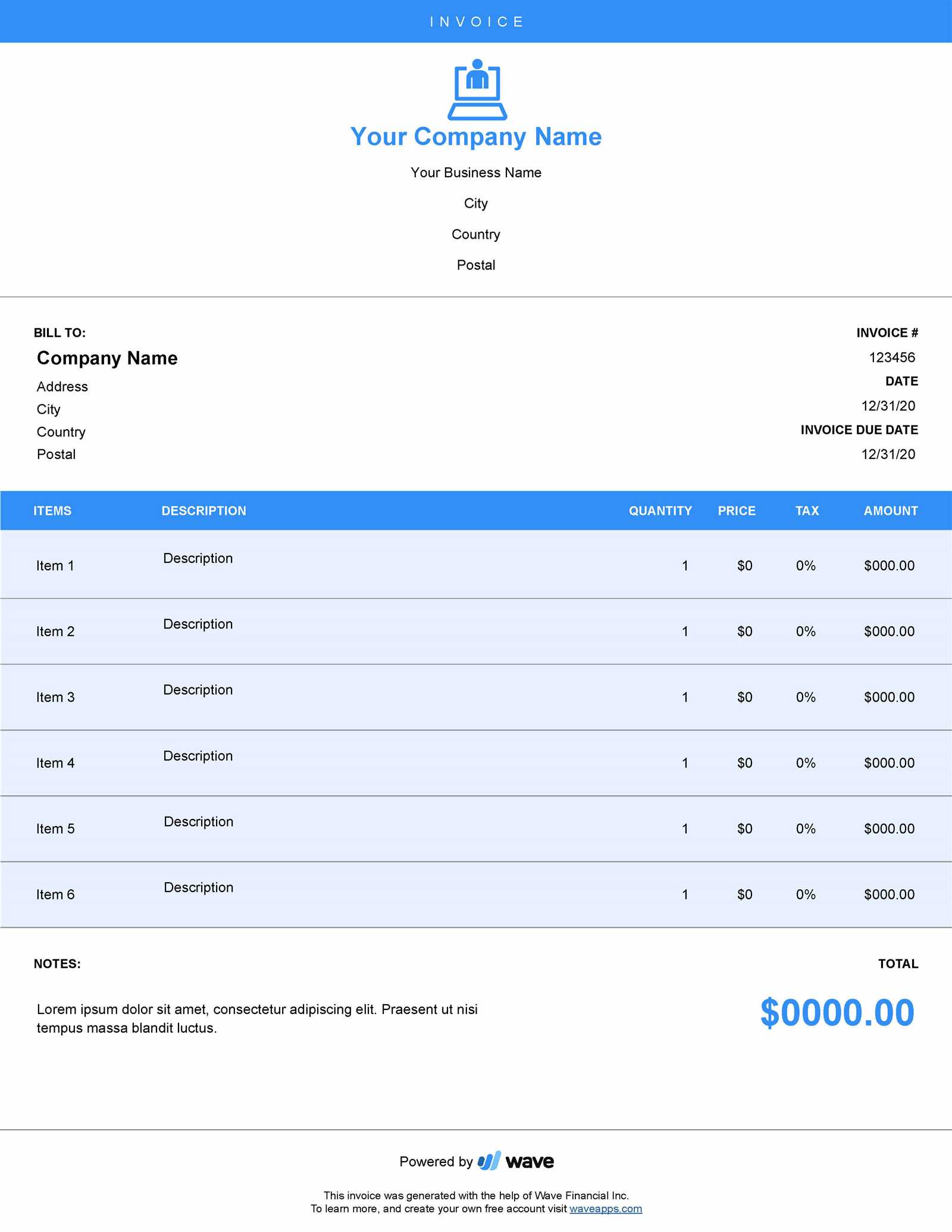

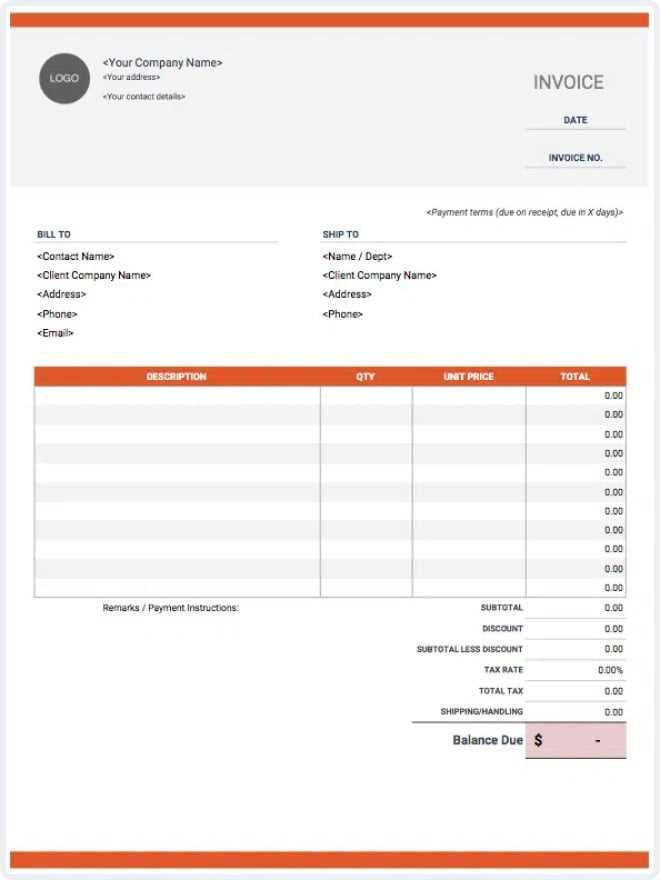

Freelance Software Developer Invoice Template

When managing your independent technical work, it’s crucial to have a standardized document that facilitates clear communication about payment expectations. This document not only outlines the work you’ve completed but also ensures a transparent understanding of the payment terms. Having a well-structured record makes it easier for clients to process payments promptly and for you to maintain accurate financial records.

Key Features of an Effective Billing Document

A good billing record should include several essential components that make the process smooth for both parties. Here are some of the key elements:

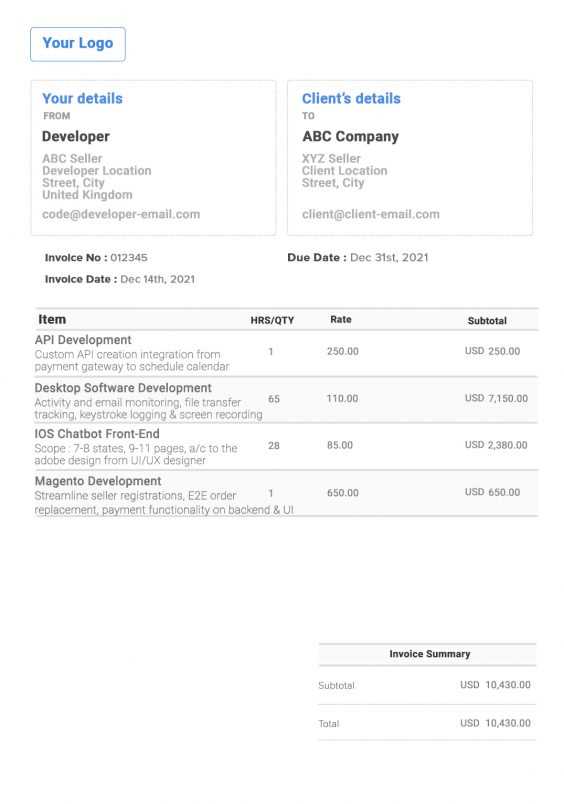

- Client and Contractor Information: Clearly list the names, addresses, and contact details for both you and the client.

- Work Description: Provide a detailed breakdown of the tasks completed or services provided. This helps avoid confusion later on.

- Payment Terms: Outline when and how payment should be made, including due dates and any late fee policies.

- Hourly or Fixed Rate: Specify whether the payment is based on an hourly rate, flat project fee, or milestone-based compensation.

- Taxes and Discounts: Include any applicable taxes, as well as discounts or adjustments if offered.

- Invoice Number: Assign a unique number to each billing document for tracking and organization.

Why Use a Pre-designed Format?

Opting for a pre-designed format can save you time and reduce the chances of missing any critical information. These formats are specifically tailored to meet the needs of independent professionals, with fields and sections that are relevant to technical work. By using a ready-made structure, you ensure consistency across all your records, making them easier to manage and present to clients.

Having a ready-to-use framework can also give you peace of mind, knowing that every important aspect of the financial agreement has been considered and clearly documented. Whether you work with multiple clients or handle several projects simultaneously, a standardized approach to creating these documents will help keep your business organized and professional.

Why Invoices Are Crucial for Freelancers

For independent professionals, having a formal document that specifies the work completed and the payment terms is essential to ensure that both parties are clear on their financial obligations. This document not only serves as a record of the work provided but also sets expectations for payment, helping to avoid misunderstandings and delays. Without such a structure, it becomes challenging to keep track of payments and establish a professional reputation.

Benefits of Clear Financial Documentation

Using a structured financial record offers numerous advantages for independent professionals. It simplifies the payment process, reduces administrative burdens, and ensures a smoother business operation. Here are some key reasons why having a proper document is vital:

| Benefit | Explanation |

|---|---|

| Ensures Transparency | Clear details about the scope of work, payment terms, and deadlines help both parties stay on the same page. |

| Reduces Disputes | A detailed document minimizes the risk of disagreements about payment amounts or expectations. |

| Maintains Professionalism | Providing a formal record helps build trust with clients, making them more likely to return for future work. |

| Aids in Tax Reporting | Properly documented transactions help in accurate record-keeping for tax purposes. |

Why Clients Appreciate a Structured Record

Clients prefer clear and organized financial documents as they make the payment process more straightforward. When you provide a well-organized record, you’re demonstrating professionalism and reliability, which encourages timely payment and fosters a positive working relationship. Additionally, having a clear structure helps avoid the back-and-forth communication that can occur when details are unclear or missing.

In the long term, a solid record-keeping practice not only boosts your credibility but also enhances the efficiency of your financial management, allowing you to focus on delivering quality work rather than chasing overdue payments.

Key Elements of a Developer Invoice

A well-crafted financial record is more than just a request for payment; it is a comprehensive document that clearly outlines the work completed and the terms of compensation. This record ensures that both you and your client are aligned on the agreed terms, fostering trust and minimizing the potential for misunderstandings. A strong financial record will typically include several key elements that help establish clarity and structure in the payment process.

Essential Components of a Billing Record

To create a professional and effective document, it is important to include the following elements:

- Contact Information: Include both your details and the client’s, such as names, addresses, phone numbers, and email addresses. This makes it easier to refer back to the record if needed.

- Work Description: Provide a clear and detailed breakdown of the services rendered or tasks completed, ensuring the client knows exactly what they are paying for.

- Payment Amount: Specify the total amount due, including the rates or fees for individual tasks or hours worked. If applicable, list any additional costs such as materials or expenses.

- Payment Terms: Clearly state the agreed payment terms, including the due date and the accepted payment methods (e.g., bank transfer, PayPal).

- Unique Identifier: Assign a unique number to each document to help with tracking and organization. This can also serve as a reference for the client in case of any future inquiries.

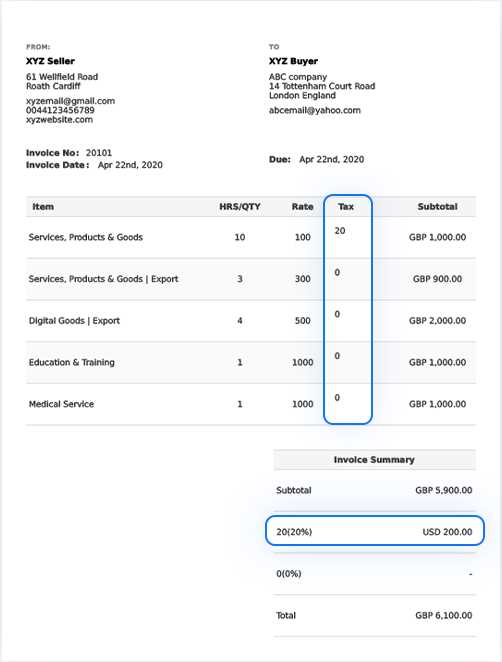

- Tax Information: If applicable, include the required tax details, such as tax rates and the total tax amount, to comply with local laws and regulations.

- Late Payment Policies: If there are any penalties for late payments, outline them clearly to ensure that clients understand the potential consequences.

Why These Elements Matter

Each of these elements plays a crucial role in making your financial record both professional and effective. By including all the necessary information, you minimize the chances of disputes, ensure prompt payment, and create a clear record for both parties. Furthermore, presenting a detailed and organized document shows your clients that you are serious about your business and their satisfaction.

Incorporating these elements into your records will also help you maintain a clean and efficient accounting system, making it easier to track payments and manage your business finances over time.

How to Create a Professional Invoice

Creating a professional billing document is essential to ensure that your clients understand the work completed and the payment required. A well-structured document not only helps with clear communication but also builds trust with your clients, encouraging timely payments. Whether you are managing a single project or multiple assignments, knowing how to create an effective financial record will keep your business organized and streamline your payment process.

Steps to Craft a Professional Billing Record

Follow these steps to ensure your document is clear, comprehensive, and easy for your clients to understand:

| Step | Details |

|---|---|

| 1. Include Contact Information | Ensure both your name, business details, and your client’s contact information are clearly visible at the top of the document. This makes it easier to reference the record later. |

| 2. Add a Unique Reference Number | Assign a unique identification number to each record for easy tracking and to help with organization. This also allows both you and the client to quickly locate the document in the future. |

| 3. Provide a Detailed Work Breakdown | Include a detailed description of the work performed, hours worked, or the milestones reached. This section ensures that the client knows exactly what they are paying for. |

| 4. State Payment Amount | Clearly indicate the total amount due, itemizing any costs, hourly rates, or additional fees. Transparency in this section prevents confusion later. |

| 5. Specify Payment Terms | Outline the payment terms, including the due date, accepted payment methods, and any applicable late fees. Make sure these terms are straightforward and easy to follow. |

| 6. Include Tax Information | If applicable, add any required tax rates or other legal obligations. Ensure the total amount reflects taxes appropriately so there are no surprises for your client. |

Why Attention to Detail Matters

Including all these elements in your billing record shows professionalism and ensures that there is no ambiguity regarding the terms of payment. Clients are more likely to pay on time if everything is clearly outlined, and you minimize the chances of disputes or confusion. Moreover, keeping a consistent format and following these steps for each project creates a streamlined process that enhances the efficiency of your business operations.

By following these steps, you create a professional and organized financial docume

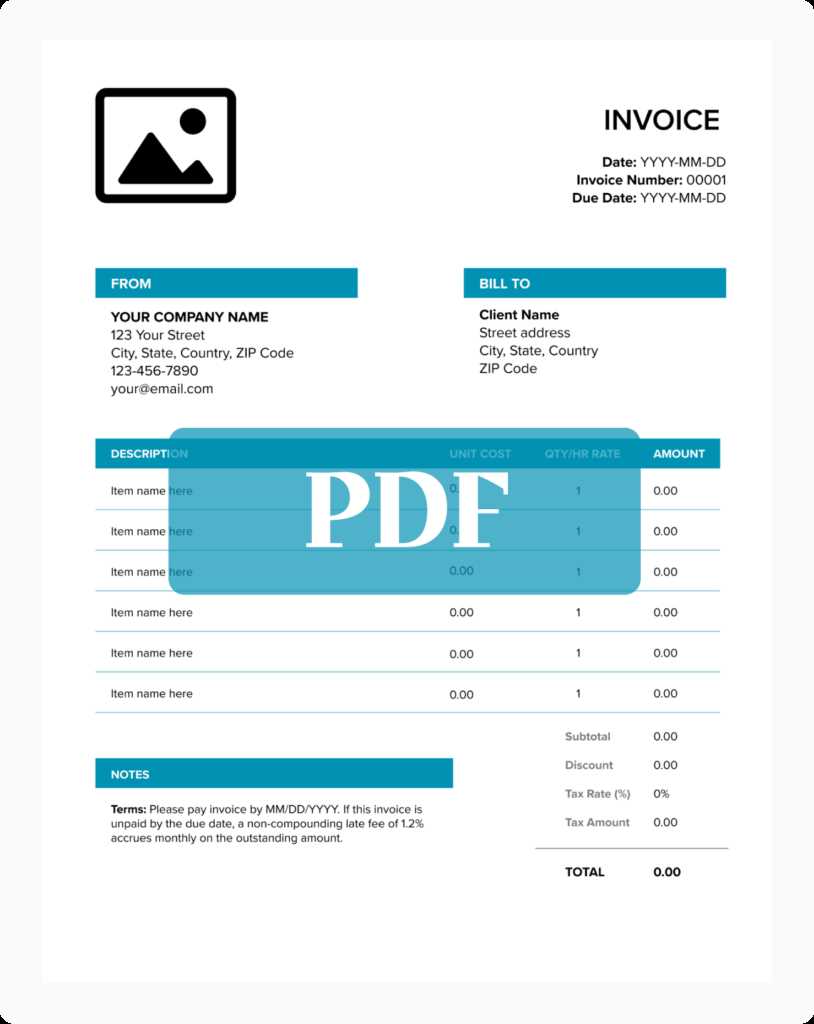

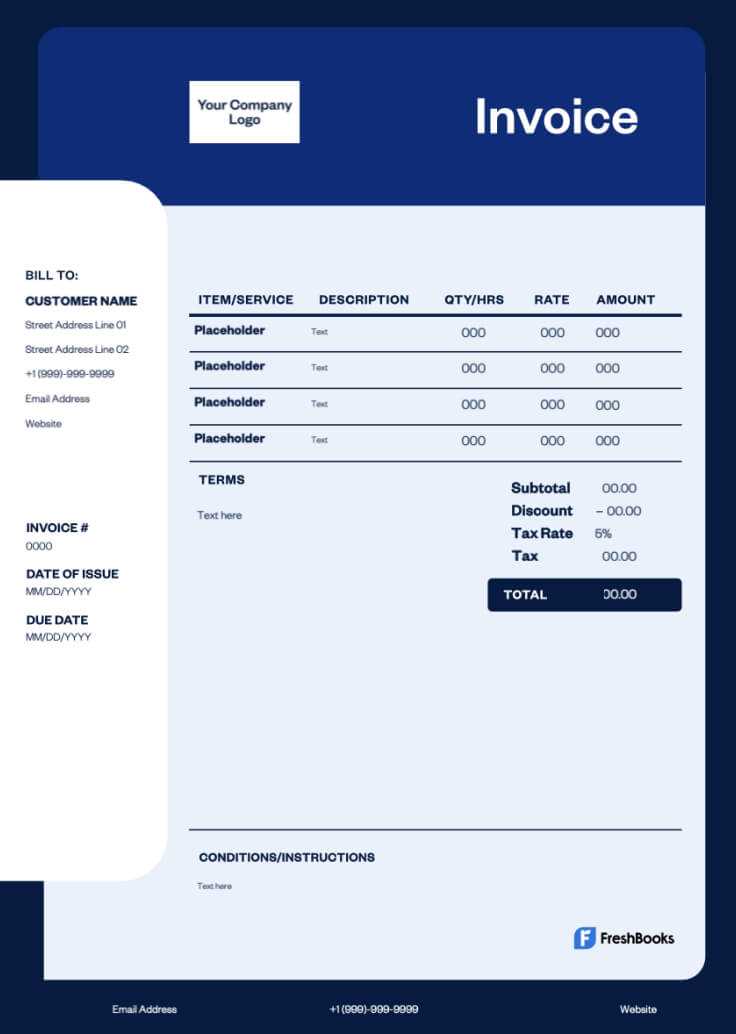

Customizable Templates for Developers

Having a flexible and easy-to-use document structure is essential for independent professionals who need to quickly generate records that fit different types of projects. A customizable format allows you to tailor the document to suit each client’s specific needs while maintaining a professional appearance. With such a structure, you can easily adjust details like the scope of work, payment terms, and rates to match the requirements of every assignment.

Using a customizable format can save time and reduce the chances of missing important details. Instead of starting from scratch each time, you can modify an existing framework to include the unique aspects of each project, ensuring consistency across all your financial records. Whether it’s for hourly work, fixed fees, or project milestones, a versatile format gives you the flexibility to adapt as needed.

Key Advantages of Customizable Formats:

- Time-saving: Avoid re-entering the same information repeatedly by reusing a basic structure that you can adjust as needed.

- Consistency: Maintain a professional and uniform approach with every client, ensuring all records follow the same clear format.

- Flexibility: Modify sections based on the nature of each job, whether it’s a one-time project or an ongoing collaboration.

- Scalability: Easily adapt the document as your business grows or as you take on a wider variety of projects.

Whether you’re managing one-off assignments or long-term contracts, using a customizable framework ensures that your billing records are not only professional but also tailored to your specific needs. This approach helps you stay organized and efficient while providing clients with a polished and clear financial document every time.

Choosing the Right Invoice Format

Selecting the appropriate structure for your billing records is essential to ensuring clarity, professionalism, and efficiency. The format you choose should align with both the complexity of your work and the preferences of your clients. Whether you’re working on small projects or large, long-term assignments, the right format will streamline the payment process, helping you get paid on time while maintaining a strong relationship with your clients.

Factors to Consider When Choosing a Format

There are several key aspects to consider when selecting the best format for your financial documents:

| Factor | Considerations |

|---|---|

| Project Scope | For large, complex projects, you may need a more detailed document with multiple sections, while smaller assignments can often be handled with a simpler structure. |

| Client Preferences | Some clients may have specific requirements for how the document should look or what details should be included, so it’s important to customize the format based on their needs. |

| Payment Terms | If you work on an hourly basis, a time-tracking system format may be ideal. For fixed-rate projects, a flat-fee structure works best. |

| Legal and Tax Requirements | Ensure that the format you choose includes space for necessary tax details, registration numbers, and other legal elements specific to your location or industry. |

| Ease of Use | Choose a format that is easy to complete and understand, both for you and your client. Avoid overly complicated structures that might confuse or delay payments. |

Why Format Matters

The right structure not only helps present your work in a professional manner but also ensures that you and your clients have the same expectations for payments. A well-organized record can prevent misunderstandings, streamline the payment process, and ultimately improve your business’s financial management. Whether you opt for a minimalist design or a more detailed layout, the format should always facilitate clear communication and prompt payment.

Essential Payment Terms to Include

Clearly defined payment terms are crucial to ensuring smooth financial transactions between you and your clients. These terms outline when and how payments should be made, as well as any conditions that apply. By including precise payment terms, you reduce the risk of misunderstandings and delays, making the process transparent and efficient for both parties.

Key Payment Conditions to Specify

Here are the most important payment terms to include in any financial document:

- Due Date: Specify the exact date by which payment should be made. This helps establish a clear timeline and encourages timely payment.

- Payment Methods: Clearly indicate which payment methods are accepted, such as bank transfer, PayPal, credit card, or any other options. This ensures clients know how to proceed with payments.

- Late Payment Fees: If you have a policy for late payments, outline the additional charges that will apply if the payment is delayed. This could include a flat fee or an interest percentage based on the overdue amount.

- Deposit or Upfront Payment: For large or ongoing projects, it’s common to request an upfront payment or a deposit. This secures your work and ensures the client is committed to the agreement.

- Currency: Indicate the currency in which payments should be made, especially if you work with international clients. This avoids confusion and potential discrepancies in payment amounts.

- Payment Frequency: If you’re working on a retainer or long-term project, specify whether payments should be made on a weekly, monthly, or milestone-based schedule.

- Tax Responsibilities: Clarify whether taxes will be added to the total amount or if the client is responsible for handling tax duties, particularly if there are specific requirements based on your location or industry.

Why Payment Terms Matter

Including these essential terms helps ensure that both parties are aligned on expectations and responsibilities. Clear payment terms protect you from delays and ensure that you get paid on time for your work. They also foster a professional relationship by showing that you have a structured approach to business dealings.

Establishing well-defined payment terms is one of the most important steps in managing client relationships and maintaining financial stability. By setting clear guidelines upfront, you reduce the likelihood of confusion and ensure a smoother transaction process.

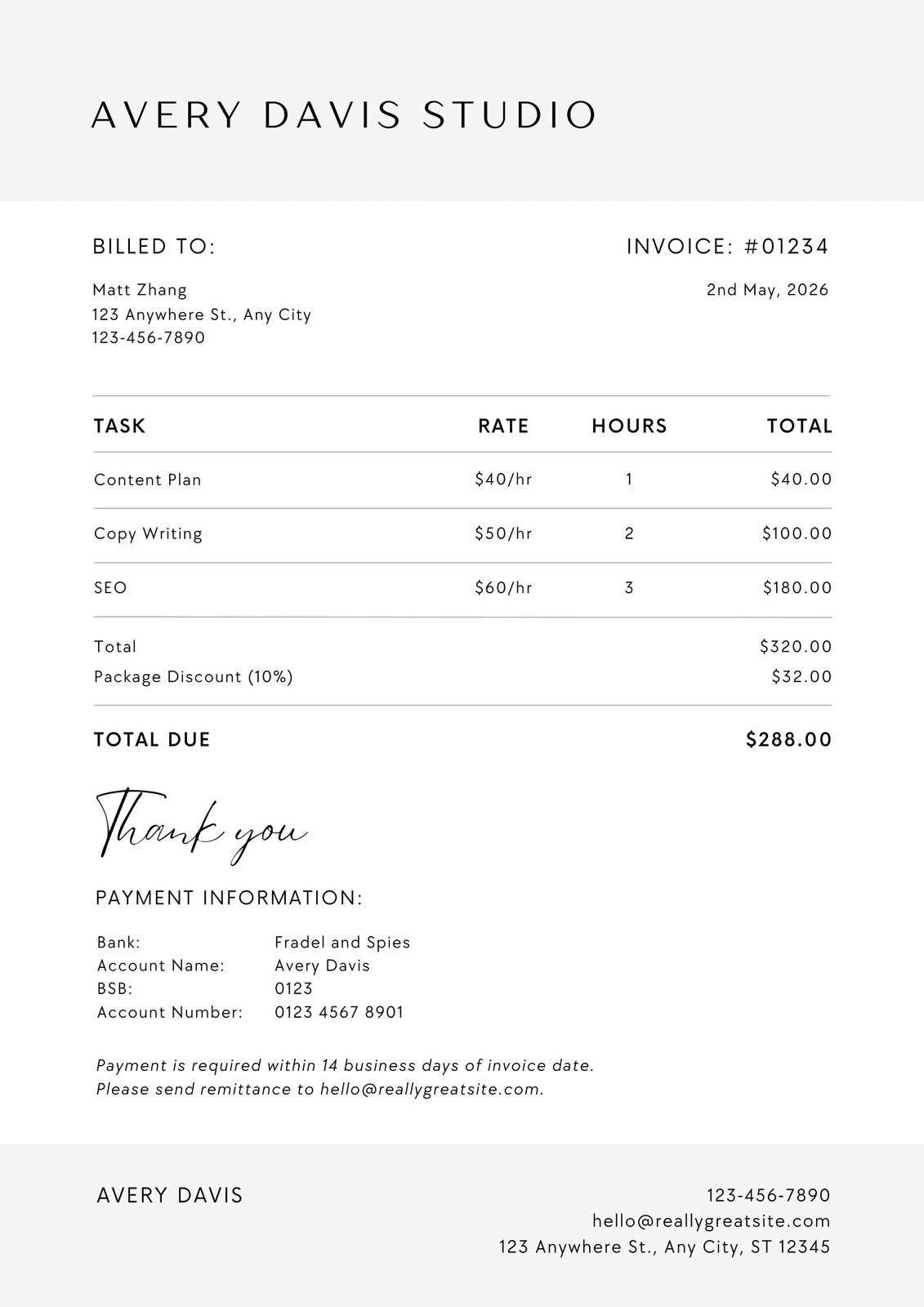

Setting Clear Rates and Fees

Establishing clear and transparent pricing is essential for any independent professional. By setting precise rates and fees from the outset, you ensure that clients understand the cost of your services and avoid any confusion when it’s time for payment. Transparent pricing also fosters trust and can prevent potential disputes regarding compensation. Whether you charge by the hour, per project, or on a milestone basis, it’s important that your pricing structure is clear and well-communicated to your clients.

Types of Rates to Consider

There are several common ways to charge for your work. Each method has its benefits and is suitable for different types of projects:

- Hourly Rate: Charging by the hour is ideal for tasks where the time commitment is uncertain or varies. It’s common in situations where the scope of work is not clearly defined at the outset.

- Project-Based Rate: For more defined projects with a clear scope and timeline, charging a flat fee for the entire project can be more efficient. This gives the client a fixed price and allows you to budget your time accordingly.

- Retainer Fee: In cases where you provide ongoing support or services, a retainer model is useful. This involves a fixed monthly or quarterly fee to ensure continued access to your expertise.

- Milestone Payments: For larger projects, breaking the payment into milestones tied to specific deliverables is common. This helps the client feel secure that they are paying as the work progresses.

Factors to Consider When Setting Rates

When determining your rates, there are several factors to consider to ensure you’re charging appropriately for your time and expertise:

- Experience and Skill Level: The more experience you have, the higher the value you bring to clients. Your rates should reflect your expertise and track record in the field.

- Project Complexity: More complex or specialized tasks require more time, knowledge, and effort, which should be reflected in your pricing. Be sure to account for the level of skill and problem-solving required.

- Market Rates: Research what others in your industry are charging. While you should not undercut your services, it’s helpful to stay competitive with the going rates for similar work.

- Client Budget: Consider your client’s financial capacity. Some clients may have fixed budgets, and you may need to adjust your rates to accommodate their needs while still ensuring fair compensation.

By setting clear rates and fees, you make the payment process straightforward for both you and your clients. Transparency in pricing builds trust and ensures that there are no surprises when it’s time to settle accounts. Always be prepared to explain your pricing structure, as this helps clients understand the value they’re receiving and promotes a long-lasting professional relationship.

Managing Multiple Projects with One Invoice

When handling several tasks or projects simultaneously, it can be challenging to keep track of all the billing details for each one. However, managing multiple projects under a single financial document can streamline the process, reduce administrative work, and maintain clarity for both you and your clients. By consolidating the charges into one document, you ensure all work completed is accounted for, and you simplify payment tracking for all parties involved.

How to Organize Multiple Projects in One Document

To efficiently manage multiple assignments in one document, break down each project separately while keeping everything clearly outlined. Here’s how to structure it:

- Project Breakdown: List each project as a separate line item, with a clear description of the work completed. This ensures that the client understands what they are being charged for each specific task.

- Itemized Costs: For each project, include the corresponding cost–whether it’s an hourly rate or a fixed fee–along with any additional charges, such as materials or travel expenses.

- Payment Schedule: If each project has different due dates or payment terms, make sure to specify these for each task within the same document, keeping the client informed of when each payment is expected.

- Total Summary: After listing each project’s charges, include a total amount at the end of the document to give the client a quick overview of the total due for all completed work.

Why Consolidating Makes Sense

Consolidating multiple projects into a single financial record can simplify the billing process and save time. For clients managing many different contracts, receiving one comprehensive document instead of multiple invoices can be more convenient and less overwhelming. Additionally, by including detailed breakdowns of each project’s cost, you maintain transparency and prevent confusion about the charges.

Managing multiple assignments through one record allows you to stay organized and ensures that nothing is overlooked. It also encourages quicker payments by making it easier for the client to understand the full scope of your work and the corresponding costs.

How to Track Hours Accurately

Accurately recording the time spent on different tasks is crucial for maintaining fair billing and ensuring transparency with clients. Whether you charge by the hour or need to keep track of time for project-based work, having a reliable system for tracking your hours helps you stay organized and ensures you’re compensated appropriately for the work you do. Misreporting or losing track of time can lead to payment discrepancies and misunderstandings.

Best Practices for Time Tracking

To track hours accurately and efficiently, consider implementing the following strategies:

- Use Time Tracking Software: There are numerous tools available that can help you track your hours with precision. Programs like Toggl, Harvest, or Clockify provide automated features that make it easy to start and stop timers while you work, reducing the risk of forgetting to log your time.

- Break Tasks Into Segments: Instead of tracking one block of time for an entire project, break down your tasks into smaller segments. This allows for more accurate reporting of the time spent on specific activities, making it easier to explain to clients and manage different aspects of your workload.

- Record Time in Real Time: Try to record your hours as you work, rather than at the end of the day or week. The more immediate your time tracking, the less likely you are to forget important details or miscalculate the hours worked.

- Review and Adjust: At the end of the day or week, review your recorded hours. Make sure everything adds up and that you haven’t overlooked any smaller tasks or adjustments. You may need to update or modify the time logs based on additional information or clarifications.

Why Accurate Time Tracking Matters

Precise time tracking not only ensures you get paid fairly but also helps build trust with clients. When clients see that you are diligent and transparent about the hours worked, they are more likely to feel confident in your services and are less likely to dispute charges. Additionally, detailed time records allow you to assess your efficiency and make adjustments to improve productivity.

Moreover, accurate time logs provide you with valuable insights into your workflow, helping you refine your processes for future projects. Whether you’re tracking billable hours or just assessing how long certain tasks take, understanding your time usage can help you optimize your business practices and increase profitability.

Payment Methods to Specify in Invoices

Clearly outlining the accepted payment methods in your financial documents is essential to avoid confusion and ensure smooth transactions. Different clients may prefer different ways of paying for services, and by providing a list of acceptable options, you can cater to their preferences while also streamlining the payment process. Including a variety of payment methods can also expedite the settlement of accounts, helping you get paid faster.

Common Payment Methods to Consider

When specifying how clients can pay for your services, consider including these popular methods:

- Bank Transfer: One of the most common and secure payment methods. Make sure to include your bank account details, including the IBAN and SWIFT code, if working internationally.

- PayPal: A widely used online payment platform. Many clients prefer this method for its speed and ease of use. Ensure you provide the correct PayPal email address to avoid payment issues.

- Credit/Debit Cards: Many clients prefer to pay with credit or debit cards, especially for smaller transactions. Payment gateways like Stripe or Square can be used to process card payments securely.

- Checks: While becoming less common, some clients still prefer to pay by check. If you accept checks, be sure to specify the payee name and mailing address.

- Cryptocurrency: For international clients or tech-savvy customers, accepting cryptocurrency like Bitcoin or Ethereum can be an attractive option. Ensure both parties agree on the payment amount and current exchange rate.

- Mobile Payments: Apps like Venmo, Zelle, or Apple Pay are becoming increasingly popular for quick transactions. These options are often ideal for smaller amounts or local clients.

Why Offering Multiple Payment Options Helps

Providing various payment methods not only accommodates client preferences but also reduces the chances of delayed payments. By giving clients options that they are comfortable with, you make it easier for them to settle bills on time, improving your cash flow. Additionally, clear and transparent payment methods prevent misunderstandings, ensuring that both you and your clients are on the same page.

When you specify the available payment options upfront, you also reduce administrative time and potential issues later on. Clients can easily choose the method that works best for them, while you benefit from receiving payments in a way that suits your own needs as well.

How to Handle Late Payments

Dealing with overdue payments is an inevitable part of working with clients. While most clients are prompt with their payments, some may delay due to various reasons. It’s important to address late payments professionally, ensuring that you are paid for your work while maintaining a good relationship with your clients. Setting clear expectations and taking appropriate steps when payments are delayed can prevent frustration and protect your financial stability.

Steps to Take When Payments Are Delayed

There are several key actions you can take to handle late payments effectively:

| Step | Action |

|---|---|

| Step 1: Send a Friendly Reminder | Start by sending a polite reminder as soon as the payment is overdue. Sometimes clients simply forget, and a gentle nudge can resolve the situation quickly. |

| Step 2: Follow Up with a Formal Request | If the payment is still not received after the reminder, follow up with a more formal request. Restate the amount due, the original due date, and any additional late fees that may apply. |

| Step 3: Discuss the Issue Directly | If the payment delay persists, consider discussing the matter directly with the client. This can often clear up any confusion or issues they may have with the payment process. |

| Step 4: Apply Late Fees | Include a late fee clause in your agreements to encourage timely payments. If a payment is late, apply the agreed-upon fee, which should be clearly stated in your initial contract or payment terms. |

| Step 5: Consider Stopping Work | If a client continually delays payments, it may be necessary to pause or stop ongoing work until the overdue balance is cleared. This action should be taken with caution and professionalism. |

Why It’s Important to Set Clear Payment Terms

Preventing late payments starts with setting clear expectations from the beginning. By outlining payment terms and deadlines upfront, you ensure that both parties are on the same page. If clients are aware of your payment policies, including any penalties for late payments, they are more likely to pay on time. Always make sure to communicate payment expectations clearly and reinforce these terms in writing.

Handling late payments promptly and professionally not only ensures you get paid but also helps you maintain strong client relationships. By establishing a clear policy, following up consistently, and applying reasonable consequences for late payments, you can safeguard your cash flow and reduce the chances of delayed payments in the future.

Invoice Delivery Best Practices

Delivering payment requests efficiently and professionally is essential for maintaining a smooth working relationship with clients. The way you send your billing details can influence the timeliness of payments and impact client satisfaction. By following best practices for delivery, you ensure that your payment requests are clear, easy to understand, and received promptly by the right person. A well-organized and timely payment reminder also helps avoid any confusion or delays when it’s time for clients to settle their bills.

Preferred Delivery Methods

Choosing the right method for sending your payment requests is key to ensuring that they are received and processed without issues. Consider these options:

- Email: Email is the most commonly used and preferred method of sending billing requests. It allows you to attach a detailed document and gives the recipient easy access to the payment information.

- Online Payment Systems: Platforms like PayPal, Stripe, or Square offer built-in invoicing tools that can automatically send payment requests to clients. These systems often allow clients to pay directly through the platform, making the process quicker and more efficient.

- Postal Mail: For clients who prefer traditional methods or if the client is located in a region where digital communication is less common, mailing a physical payment request is an option. Be sure to include all necessary details for easy processing.

Best Practices for Sending Payment Requests

In addition to selecting the right delivery method, there are a few best practices to follow to ensure your payment requests are received promptly and are professional:

- Clear and Concise Subject Line: When sending an email, use a clear subject line such as “Payment Request for [Project Name]” or “Amount Due for Services Rendered.” This helps the client quickly identify the message’s purpose.

- Send at the Right Time: Timing matters when sending payment requests. Aim to send your billing details at least a few days before the due date to allow the client time to process it. If you’re sending a reminder, do so a few days after the due date.

- Include All Payment Information: Ensure that the payment details are easy to find, including the total amount due, payment methods, and due dates. If you use a digital platform, make sure the client has all necessary login information or a direct link to make a payment.

- Personalize the Message: Personalize your payment request with the client’s name, a polite reminder of the work completed, and a clear explanation of the terms. This creates a more professional tone and helps reinforce your relationship with the client.

By adopting these best practices for delivering your payment requests, you increase the likelihood of timely payments while maintaining a professional image. A well-organized and transparent approach to delivery ensures that clients can easily understand the payment process, leading to smoother transactions and a stronger business relationship.

Tips for Using Invoice Software

Using automated tools for creating and managing payment requests can greatly simplify the billing process. These tools save time, reduce human error, and ensure that your records are organized. However, to make the most of these tools, it’s important to understand their features and capabilities. By using invoicing software effectively, you can streamline your operations, maintain a professional image, and reduce administrative burden.

Essential Features to Look For

Different invoicing platforms offer a range of features. It’s important to choose the right one based on your needs and preferences. Here are some essential features to look for when using invoicing software:

| Feature | Benefit |

|---|---|

| Customizable Templates | Allows you to create personalized billing documents that match your brand’s style, including your logo and color scheme. |

| Automated Payment Reminders | Helps you follow up on overdue payments automatically, saving time and reducing the chances of missed reminders. |

| Multiple Payment Options | Enables you to offer various payment methods (e.g., bank transfer, online platforms) for greater convenience to clients. |

| Time Tracking Integration | If you bill by the hour, this feature integrates time tracking into the invoicing system, ensuring accurate charges for the hours worked. |

| Tax Calculation | Helps calculate taxes based on your location or client’s location, reducing the risk of errors and ensuring compliance. |

Best Practices for Using Invoice Tools

To get the most out of invoicing platforms, here are some best practices to follow:

- Stay Consistent: Use the same format and layout for all billing documents to create a professional and consistent look for your clients.

- Set Up Recurring Payments: If you work on retainer or have ongoing contracts, automate recurring payments to reduce manual work and ensure regular cash flow.

- Keep Records Organized: Use the software to track your payments and maintain an organized record of past transactions. This will make tax filing and financial tracking easier.

- Double-Check Client Information: Before sending out a payment request, make sure that all client details, such as contact information and payment terms, are correct.

- Use Cloud-Based Systems: Opt for cloud-based invoicing tools that allow you to access your records from anywhere and share documents easily with clients.

By util

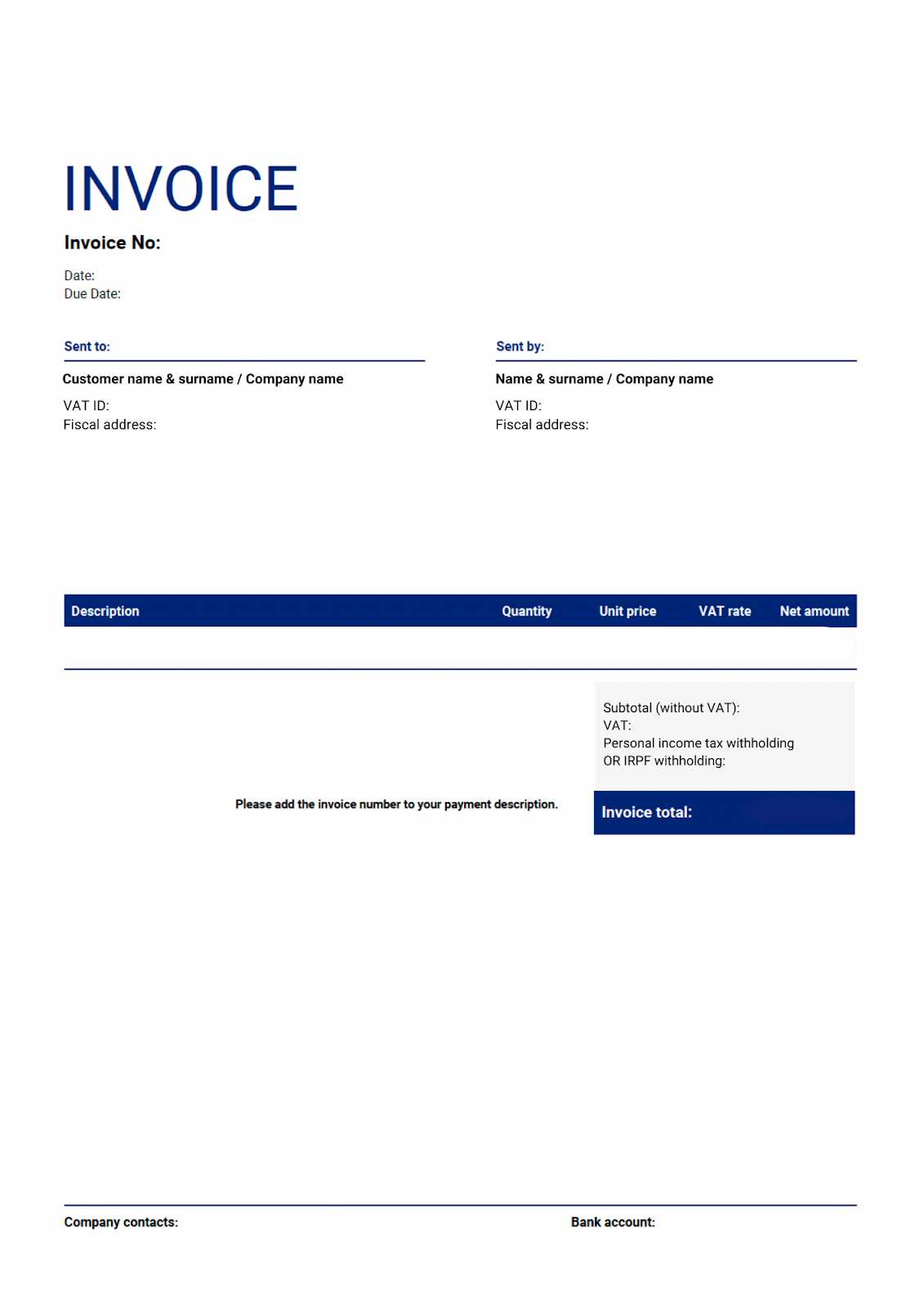

How to Include Taxes on Your Invoice

When requesting payment for your services, it is essential to include taxes as part of the total amount due. Taxes are a legal requirement and must be accounted for accurately to ensure compliance with local regulations. Including taxes in your payment requests helps you avoid potential issues with the authorities and ensures that clients understand the full breakdown of the charges. The process of adding taxes involves knowing the applicable tax rates for your location or your client’s location and clearly outlining them in your billing statement.

Here are some key steps to properly include taxes in your billing documentation:

- Identify Applicable Taxes: First, you need to know which taxes apply to your work. This will vary depending on the type of service provided, as well as the tax laws in your location and the client’s location. Common taxes include sales tax, value-added tax (VAT), and goods and services tax (GST).

- Calculate the Tax Rate: Once you know which taxes apply, calculate the applicable rate. Ensure you are using the correct percentage based on your jurisdiction or your client’s country. For example, if the VAT rate is 20%, multiply the total service cost by 0.20 to calculate the tax amount.

- Clearly Show the Tax Breakdown: Transparency is key. Include a line item in your payment request that clearly specifies the tax amount separately from the service cost. This helps your client understand how the total amount is calculated.

- Include Your Tax ID (if applicable): Some jurisdictions require businesses to include a tax identification number (TIN) or VAT registration number. This ensures your business is recognized as a legitimate entity for tax purposes.

Here’s an example of how to display the tax information on your payment request:

| Description | Amount |

|---|---|

| Service Fees | $1,000 |

| Sales Tax (10%) | $100 |

| Total Amount Due | $1,100 |

By clearly showing how taxes are calculated and providing a transparent breakdown, you can build trust with your clients and avoid any confusion regarding the final payment amount. Additionally, including taxes correctly in your billing documentation ensures that you stay compliant with tax laws and can avoid fines or other legal complications.

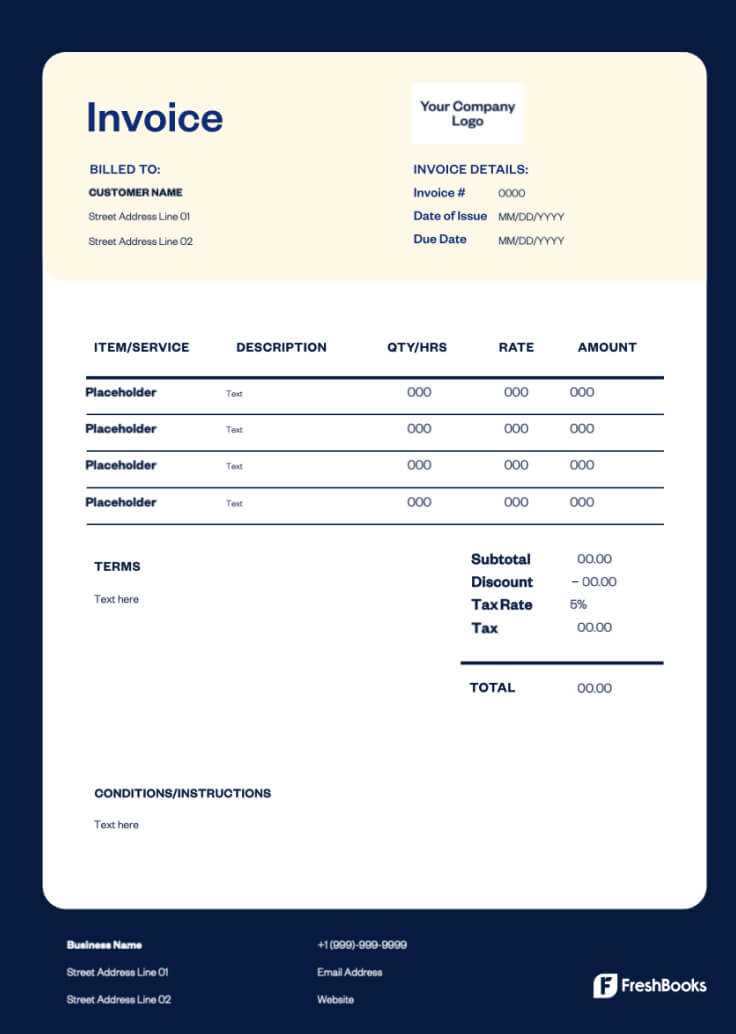

Incorporating Discounts and Adjustments

When billing clients for your services, there may be times when adjustments need to be made to the total amount due. Whether it’s offering a discount for early payment, correcting an overcharge, or providing a promotional price, these modifications should be clearly reflected in your payment request. Properly incorporating discounts and adjustments not only helps you maintain client satisfaction but also ensures transparency and accuracy in your financial transactions.

Here are a few ways to effectively incorporate discounts and adjustments into your payment requests:

- Offer Early Payment Discounts: Many businesses provide a discount if clients pay within a specific time frame. For example, a 5% discount if the bill is paid within 7 days. This encourages timely payments and helps maintain cash flow.

- Provide Volume or Bulk Discounts: If a client purchases a large number of hours or services, you can apply a discount based on the total quantity. This can incentivize clients to commit to larger projects.

- Correcting Errors: If you’ve made an error in your initial calculation or pricing, it’s important to issue an adjustment to correct the mistake. Always clearly outline what was adjusted and why, so clients can understand the reason for the change.

- Promotional Pricing: When running a special promotion or offering a package deal, you can apply a discounted price directly to the billing. Be sure to include details about the promotion in the payment request to avoid confusion.

When incorporating these changes, make sure to clearly outline the discount or adjustment in the breakdown of your charges:

| Description | Amount |

|---|---|

| Service Fees | $1,000 |

| Discount (5% for early payment) | -$50 |

| Total Amount Due | $950 |

Be transparent about the changes by providing clear descriptions and itemizing the discounts and adjustments on the billing document. This not only avoids confusion but also reinforces a professional and trustworthy relationship with your clients. Always double-check the adjusted figures to ensure that everything is calculated correctly and that the final amount reflects the agreed-upon terms.

Protecting Your Work with Legal Clauses

When providing services to clients, it is essential to protect your intellectual property and outline the terms of your working relationship clearly. Legal clauses in your agreements help ensure that both parties understand their rights and obligations, reducing the risk of disputes. Including such clauses in your payment requests or contracts not only safeguards your interests but also establishes professional boundaries, ensuring both you and your client are aligned on important matters such as ownership, payment terms, and responsibilities.

Here are several key legal clauses you should consider incorporating into your agreements or billing documents:

- Intellectual Property Rights: Clearly state who owns the work once it’s completed. This protects your creations and ensures the client does not misuse or distribute your work without permission.

- Payment Terms and Late Fees: Specify when payment is due and what happens if the client does not pay on time. For example, you might include a late fee clause that adds a percentage to the total amount if payment is not received within a set number of days.

- Confidentiality Agreements: If your work involves sensitive information, include a confidentiality clause that ensures the client will not share or misuse proprietary details. This clause is especially important when dealing with private data or business strategies.

- Cancellation and Refund Policies: Outline the circumstances under which the client can cancel the project and whether a refund is applicable. This protects both you and the client in case the project does not proceed as planned.

- Dispute Resolution: In case a disagreement arises, it’s helpful to include a dispute resolution clause that outlines the process for resolving conflicts, such as through mediation or arbitration, before resorting to legal action.

For example, your agreement might include the following clauses:

| Clause | Details |

|---|---|

| Intellectual Property Rights | All work produced remains the property of the service provider until full payment is received, at which point ownership is transferred to the client. |

| Late Payment Fees | A 5% fee will be applied for every 7 days the payment is overdue beyond the agreed-upon due date. |

| Cancellation Terms | In the event of project cancellation, a 50% cancellation fee will be charged for any work completed prior to the cancellation. |

By including these important legal clauses, you not only protect your work but also foster trust with your clients. Clear, legally sound agreements help avoid confusion and ensure that both parties are aware of their responsibilities, providing a strong foundation for a successful working relationship.

How to Stay Organized with Invoices

Staying organized with payment requests is essential for maintaining a smooth workflow and avoiding financial confusion. Proper organization helps ensure that you never miss a payment, that all details are accurate, and that you can quickly reference past transactions when needed. By using the right systems and practices, you can keep track of payments, due dates, and amounts due, allowing you to focus more on your work and less on administrative tasks.

Here are some strategies to help you stay organized with your billing process:

- Create a Consistent System: Develop a system for creating and storing all payment requests, whether it’s a specific naming convention, date-based filing, or categorizing by client. For example, label each request with the client name and date for easy tracking.

- Track Due Dates: Always note the due dates for each payment and set reminders well in advance. This ensures you won’t miss a payment deadline, and you can follow up promptly if needed.

- Use Accounting Software: Invest in accounting or billing software that automates much of the organization process. These tools can help you track all payments, create professional payment requests, and generate reports to see an overview of your finances.

- Keep Digital and Physical Records: Organize your records in both digital and physical formats. While digital records are easier to access and back up, physical records can provide extra peace of mind in case of technological issues.

- Maintain Client Communication: Establish a communication process for discussing payment terms with clients. Regular follow-ups and clear communication about the amounts due and deadlines can help prevent confusion and ensure timely payments.

- Archive Completed Requests: Once a payment has been received, archive the related documents. This allows you to keep a historical record that can be useful for tax purposes, future reference, or potential disputes.

Here’s an example of how you could organize your records:

| Client | Amount Due | Due Date | Status |

|---|---|---|---|

| Client A | $500 | 01/15/2024 | Paid |

| Client B | $750 | 02/01/2024 | Pending |

| Client C | $300 | 02/10/2024 | Overdue |

By implementing these strategies and tools, you can ensure that your billing process is efficient and stress-free. Staying organized not only makes it easier to manage payments but also helps you build a professional reputation and maintain a healthy financial flow.