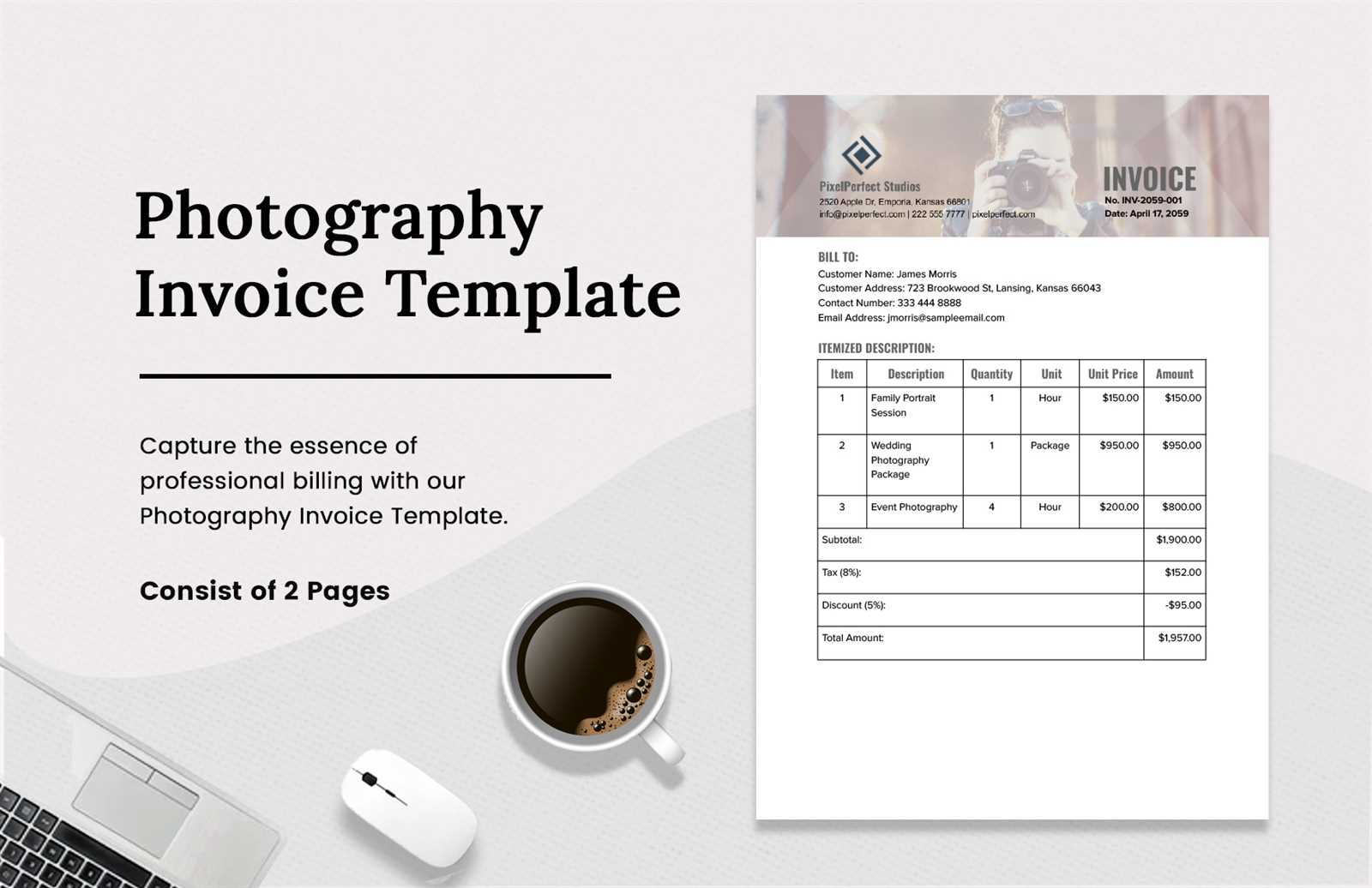

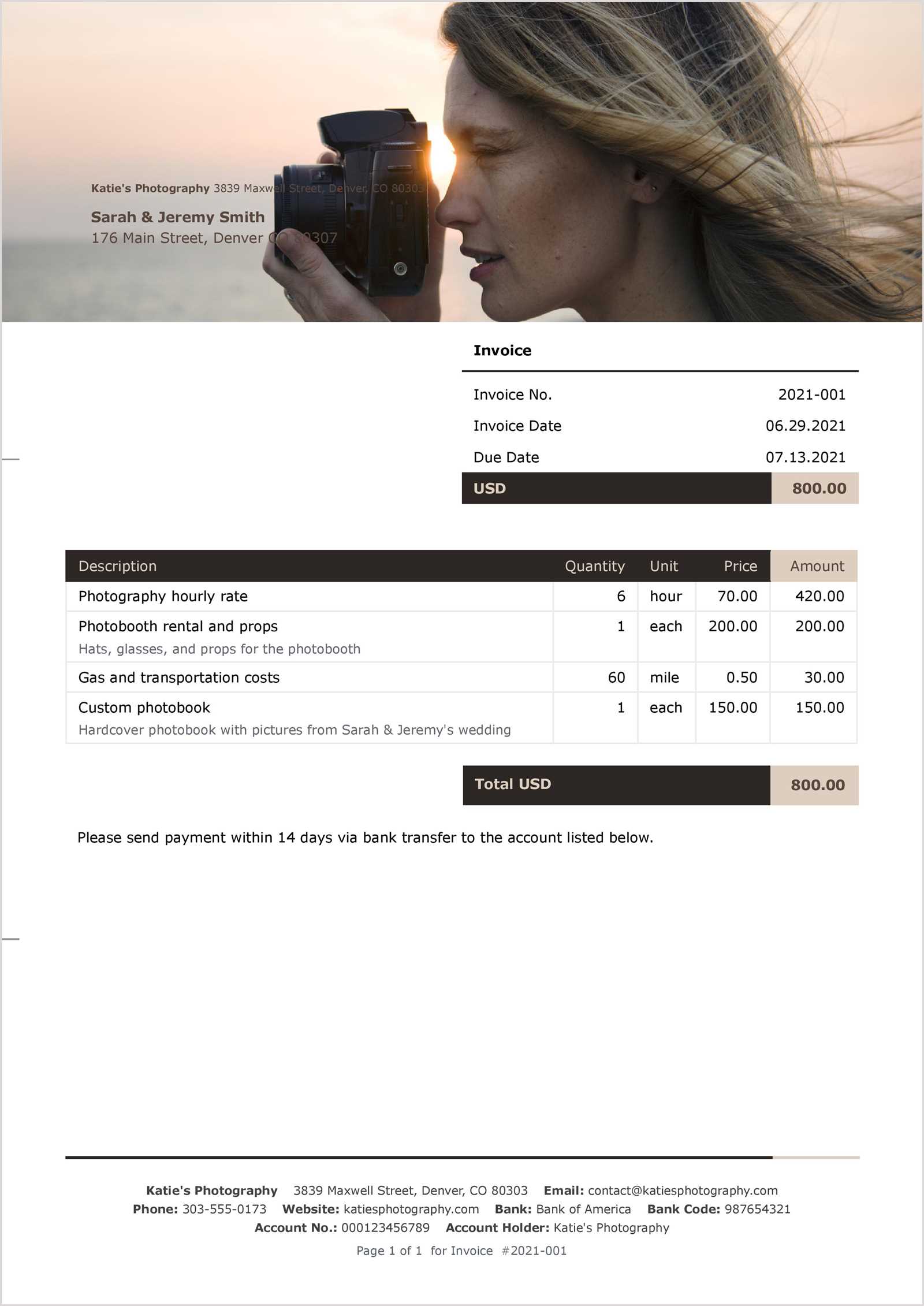

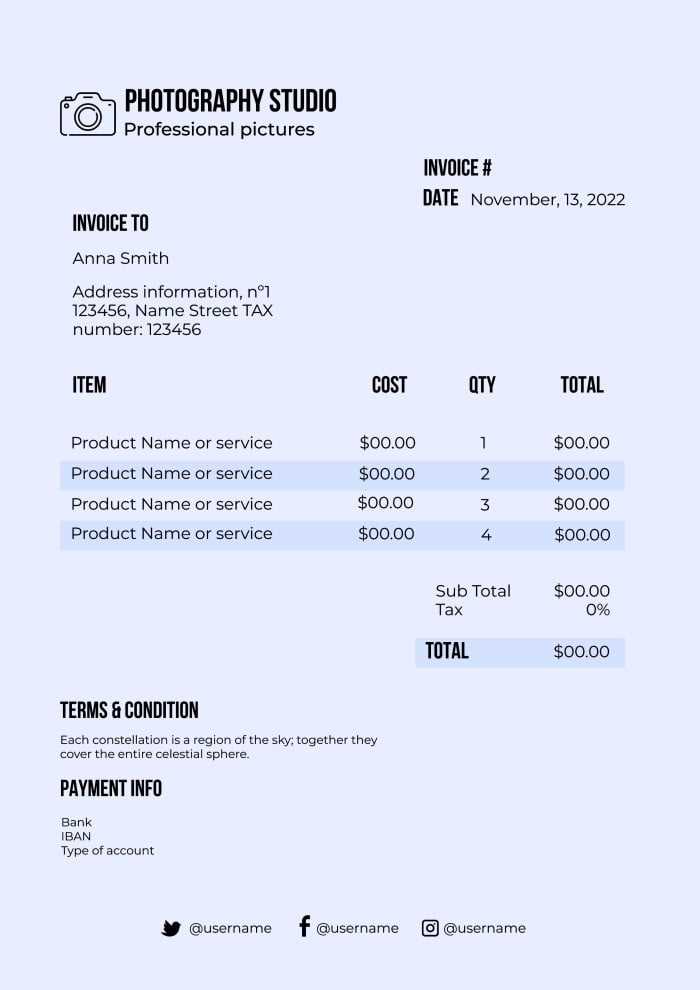

Freelance Photographer Invoice Template for Easy Billing and Payments

For anyone providing creative services, having a streamlined method of requesting payment is crucial for maintaining professionalism and ensuring timely compensation. A clear, well-structured billing document not only reflects the quality of your work but also builds trust with clients. Whether you’re a visual artist, designer, or content creator, the right paperwork helps avoid misunderstandings and keeps your business running smoothly.

Creating a custom form for tracking services rendered, costs, and payment terms doesn’t need to be complicated. With the right approach, you can easily generate a document that looks professional, reduces errors, and speeds up the payment process. Having all necessary information in one place ensures both you and your client are on the same page, making transactions simpler and more transparent.

In this article, we’ll guide you through the key components and best practices for crafting an effective payment request document. From understanding what details are essential to knowing how to personalize your forms for different clients, you’ll have everything you need to handle your financial transactions efficiently.

Billing Document Guide for Creative Professionals

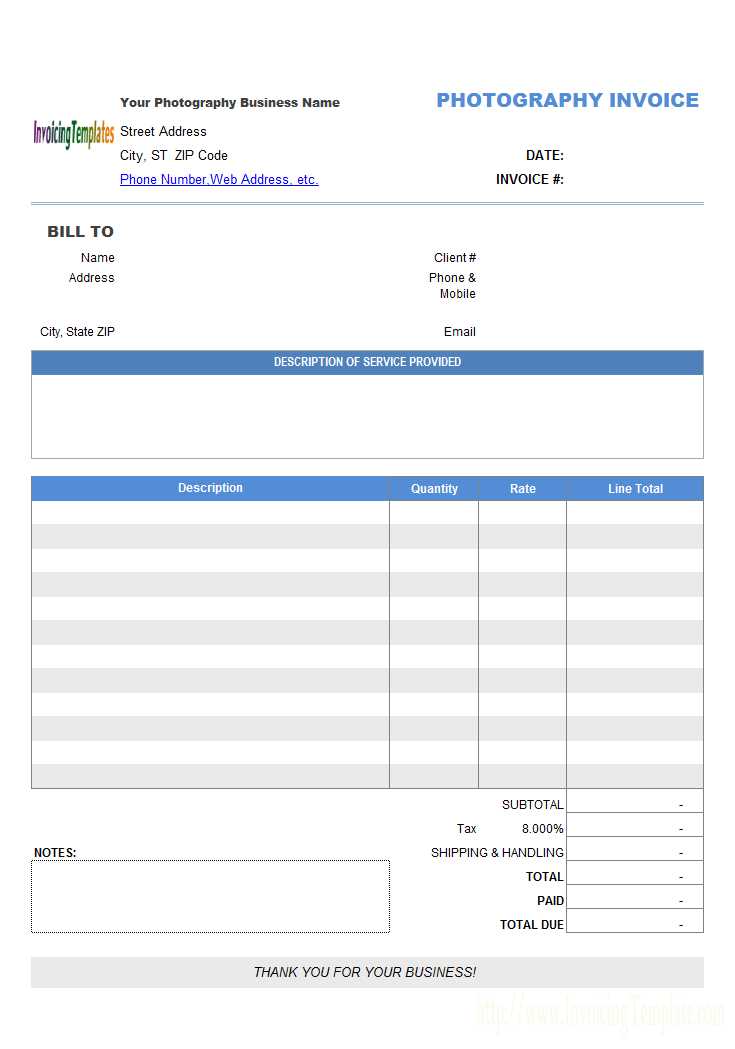

Creating a structured and professional document to request payment is a fundamental part of running a successful business. Whether you’re offering visual work or other creative services, an organized form ensures clear communication and smooth transactions. This guide will walk you through the key components of an effective billing document and show you how to customize it for your needs.

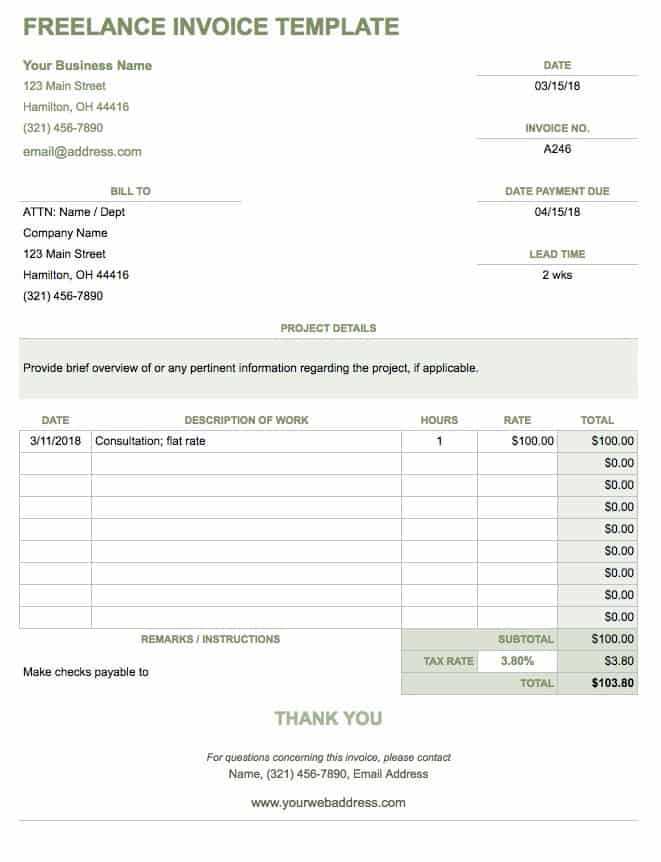

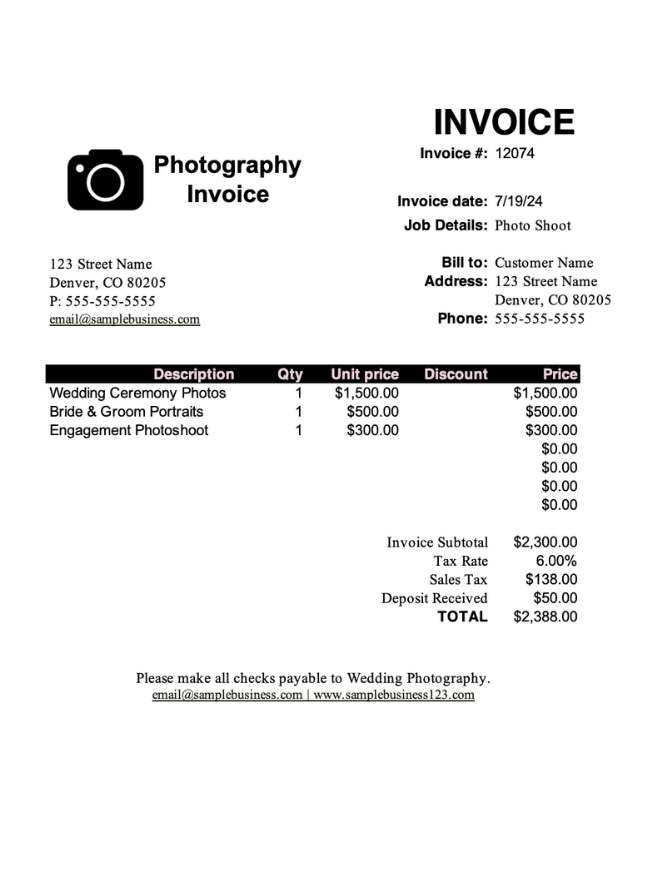

Start by focusing on the essential details that should be included to make your form clear and legally sound. A well-crafted document not only outlines the cost of services but also sets expectations for both parties involved. Here are the main sections that should be present:

- Your Contact Information: Include your name, business name, phone number, and email address.

- Client’s Details: Add the client’s name or company, along with their contact details.

- Project Description: Provide a brief but clear summary of the work completed, including the scope and deliverables.

- Payment Amount: Clearly state the total cost, including any applicable taxes or discounts.

- Payment Terms: Specify when payment is due and any late fee policies or installment options.

- Unique Reference Number: Include a reference number for easy tracking and future reference.

- Payment Methods: List accepted payment methods, such as bank transfer, PayPal, or check.

These key elements help to ensure the document is both functional and professional. Once you have these details in place, you can focus on customizing the layout to suit your personal brand. A clean, simple design makes it easier for clients to review and process payments without confusion.

Next, consider using software or online tools to generate your forms. These platforms often offer customizable fields and pre-made structures that simplify the creation process. With just a few clicks, you can produce a polished document ready for sending to your clients.

By following these guidelines and using the right tools, you can create an efficient and professional billing process that minimizes errors and maximizes timely payments.

Why You Need a Billing Document

Having a standardized form for requesting payment is essential for any service-based business. It ensures that both you and your clients have a clear record of the work completed, payment terms, and any other important details. A consistent and professional approach to billing not only speeds up the payment process but also helps maintain a positive working relationship with clients.

Clarity and Professionalism

Using a pre-designed document allows you to communicate important payment details clearly and professionally. It helps avoid confusion and makes it easier for clients to understand exactly what they are being charged for. A well-organized form reinforces your professionalism and shows that you take your work and client relationships seriously.

Time-Saving and Efficiency

Without a standardized form, creating payment requests from scratch each time can be time-consuming and prone to error. A ready-to-use document allows you to quickly fill in the relevant details and send it off. This efficiency allows you to focus more on your core business activities rather than administrative tasks.

- Consistency: Having a template ensures each document follows the same format, making your financial records easy to track and compare.

- Accuracy: Pre-made fields and sections reduce the chance of errors in calculations and missing information.

- Customization: A customizable form lets you tailor each request to specific clients or projects while maintaining a professional layout.

In conclusion, using a billing document not only simplifies the process but also contributes to a smooth financial workflow, giving both you and your clients peace of mind and helping you get paid faster.

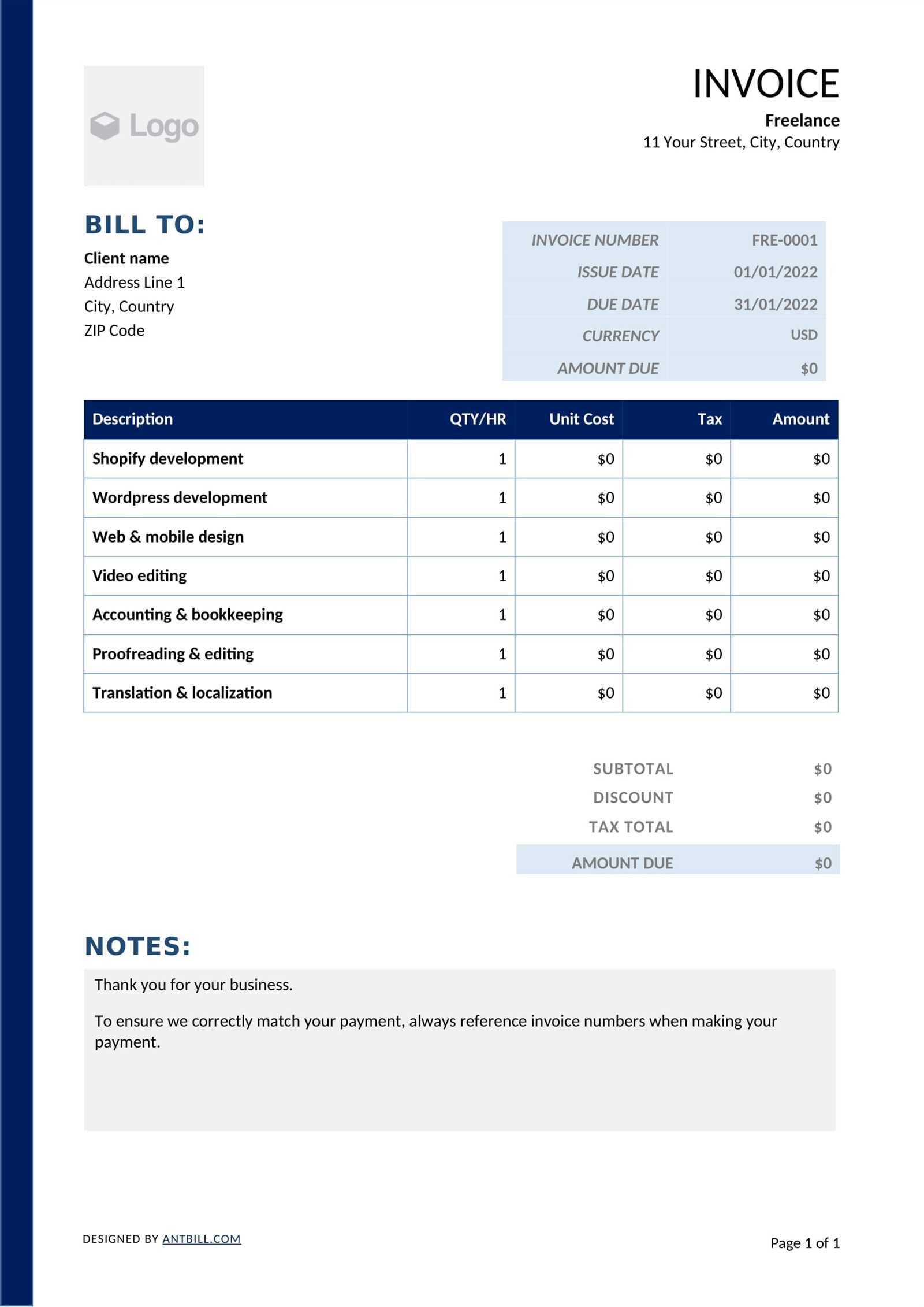

Essential Elements of a Billing Document

When creating a payment request, it’s important to include all the necessary details to ensure clarity and avoid any confusion. A well-structured form helps both you and your client stay on the same page, and it serves as a formal record of the transaction. Below are the key components that should be included in every payment document.

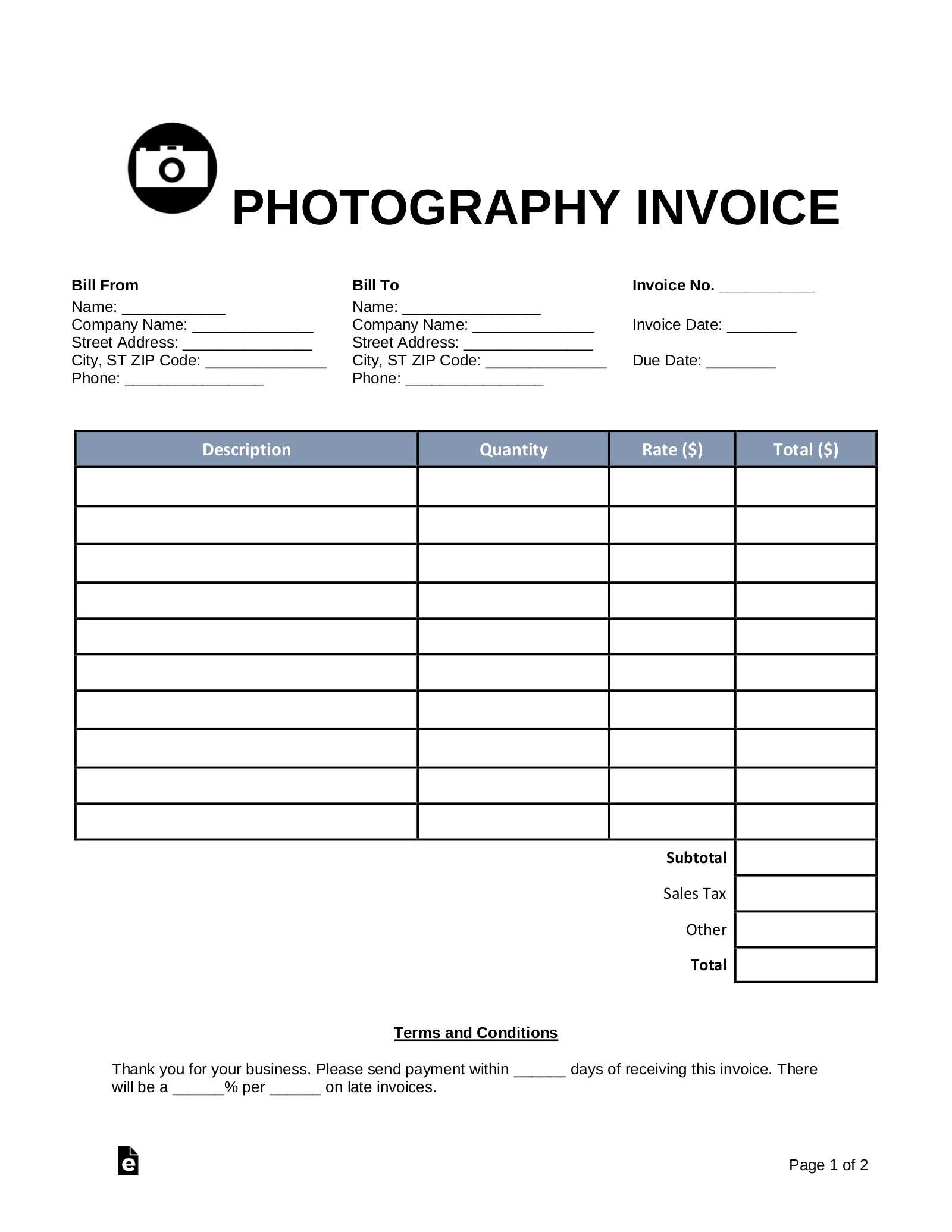

- Your Contact Information: Include your full name, business name (if applicable), phone number, email address, and physical address. This allows your client to easily contact you with any questions or concerns.

- Client’s Details: Include the client’s name, company name (if applicable), and contact information. This helps identify who the payment is being made to and ensures that no errors occur in the billing process.

- Unique Reference Number: A unique identifier for each payment request. This helps both parties track the document and avoid confusion if multiple transactions are involved.

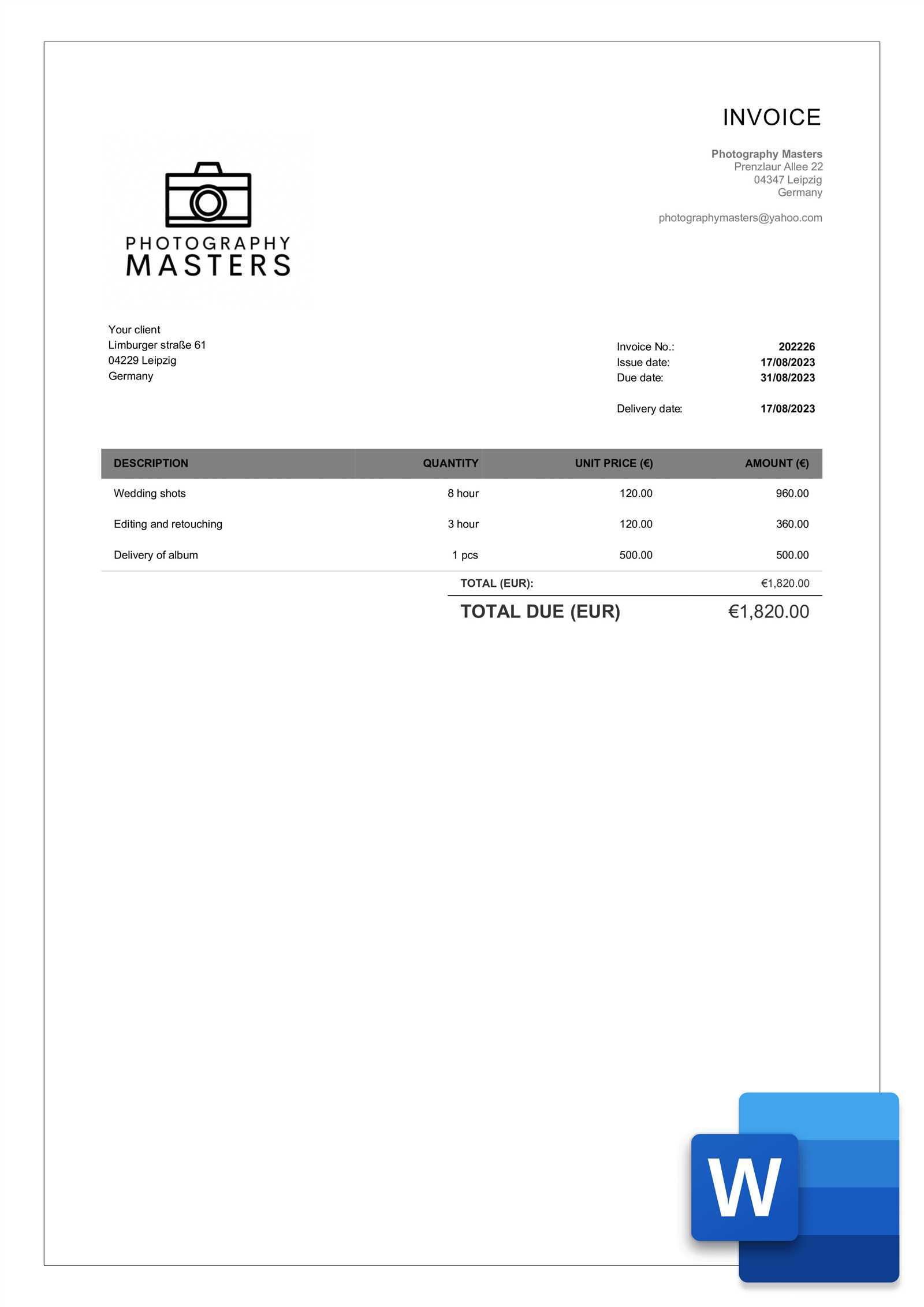

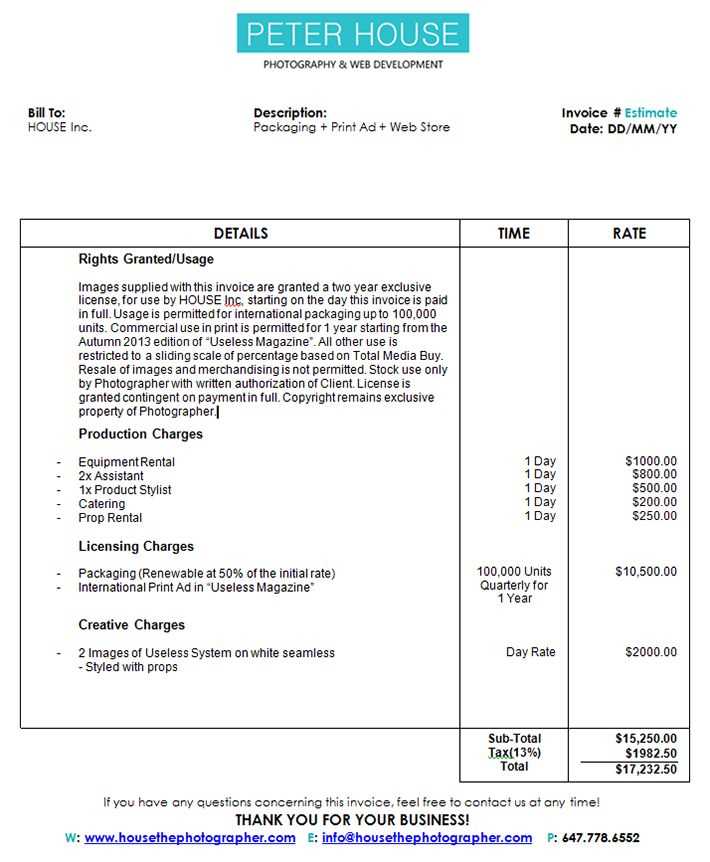

- Description of Services: Provide a detailed list of services provided, including dates, duration, and any specific tasks completed. This ensures your client understands exactly what they are paying for.

- Payment Amount: Clearly state the total amount owed, including the cost of each service or product. If applicable, break down the total into individual charges for transparency.

- Taxes and Additional Fees: If taxes or other fees are applicable, list them separately to avoid any misunderstandings. Make sure the client knows what they are being charged beyond the base cost.

- Payment Due Date: Clearly indicate when the payment is due. Providing a specific deadline helps to avoid delays and ensures both parties are aligned on the payment timeline.

- Payment Methods: List all accepted forms of payment, such as bank transfer, PayPal, credit card, or check. This gives the client clear instructions on how to complete the payment.

- Terms and Conditions: Include any relevant terms, such as late payment fees, cancellation policies, or installment options. This ensures both you and the client are clear on the agreement and avoids potential disputes.

By including all these essential details, you ensure that your payment requests are professional, transparent, and easy to understand. This reduces the chances of errors and delays and helps build trust with your clients.

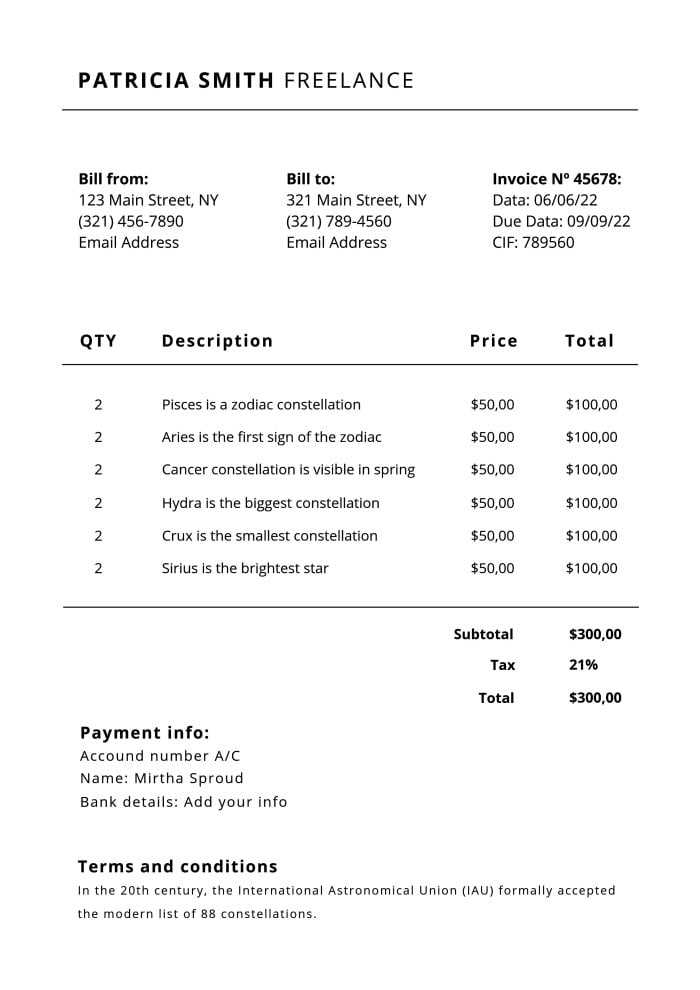

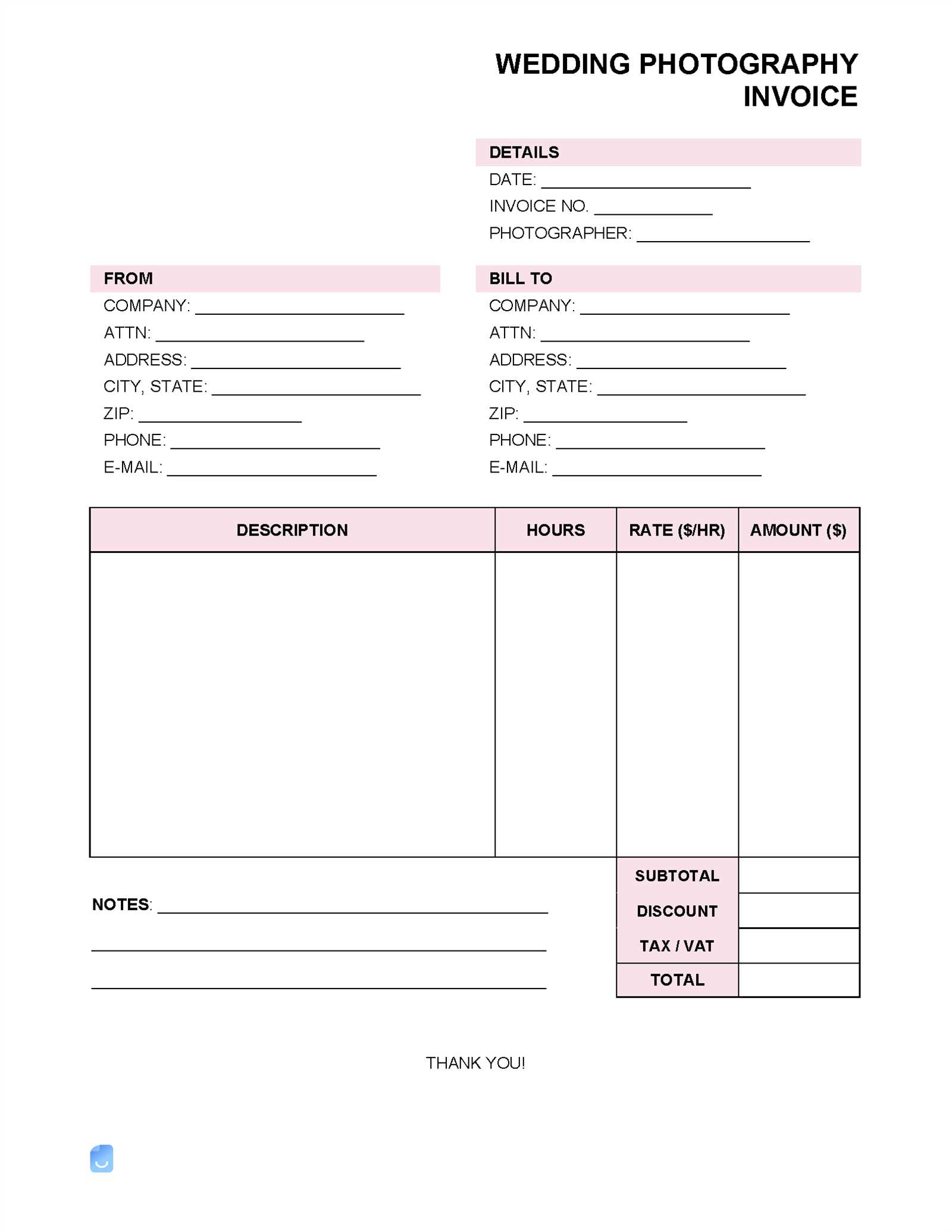

How to Create a Billing Document for Creative Work

Creating a payment request document is an essential part of managing your business, especially when you’re offering creative services. A well-designed payment request helps to clearly outline the work you’ve done and ensures that both you and your client are aligned on the cost and payment terms. Here’s a step-by-step guide to help you create a professional payment request form.

Start by gathering all the necessary details about the job you completed and the payment you are requesting. These details will form the foundation of your document and help avoid any confusion later on. Once you have everything you need, follow these steps to create a clear and effective form:

- Step 1: Include Your Contact Information – At the top of the document, list your full name or business name, address, phone number, and email. This ensures that your client can reach out to you easily if there are any questions or issues.

- Step 2: Add Client’s Information – Include the client’s name, company name (if applicable), and contact details. This allows both parties to know exactly who is being billed and who is responsible for the payment.

- Step 3: Provide a Clear Description of the Work – Outline the work completed, including specific tasks, dates, and deliverables. Be detailed enough to avoid any misunderstandings, ensuring that both you and your client are on the same page regarding what was provided.

- Step 4: Specify the Payment Amount – Break down the total amount being charged, listing individual services or products and their corresponding prices. This helps your client understand what they are paying for and makes it easier to spot any errors.

- Step 5: Set Payment Terms – Include the payment due date, preferred payment methods, and any other terms, such as late fees or installment options. Be clear about the expectations to avoid confusion or delays in payment.

- Step 6: Add a Unique Reference Number – For easy tracking, assign a unique reference number to each payment request. This will make it easier for both you and your client to reference the specific transaction in future communications.

Once you have all these components in place, your payment request form will be clear, professional, and easy to process. Whether you’re working with individual clients or businesses, this approach ensures that every payment request is organized

Customizing Your Payment Request for Clients

When you’re requesting payment for your services, it’s important to tailor your documents to fit the specific needs of each client. A personalized approach can improve client relationships and help avoid confusion about the details of the work completed and the agreed-upon costs. Customizing your document shows that you are attentive to the specifics of the project and that you value your client’s business.

Customizing your payment request is simple and can be done in several ways. Here are a few key adjustments you can make to better suit each client’s needs:

- Client-Specific Details: Ensure that each document includes accurate and up-to-date client information. This might include the client’s name, address, and company details. It’s important that there are no errors in contact details so your client can easily reach you or process the payment.

- Personalized Project Descriptions: Instead of using a generic description, include a detailed summary of the specific services you provided for that particular client. Tailor the text to reflect the unique aspects of the project and clarify any special requests or adjustments made during the job.

- Adjusting Payment Terms: Some clients may have different preferences when it comes to payment schedules or methods. Be flexible and ensure that the terms–whether it’s a lump sum payment or installments–are clearly outlined. If your client has specific requirements or payment conditions, make sure these are reflected in the document.

- Offer Discounts or Custom Rates: If you’ve agreed on a special rate or discount for a specific client, be sure to include this in your document. Customizing your rates for returning clients or large projects can help foster ongoing relationships and make clients feel appreciated.

- Client-Specific Payment Methods: If a client prefers a particular payment method, such as bank transfer, credit card, or an online service like PayPal, make sure to offer these options and clearly specify how they can complete the payment.

By customizing each payment request to suit your client’s needs, you help create a more professional and efficient process. Tailoring your forms to reflect the specific work and preferences of the client builds trust and improves communication, leading to smoother transactions and satisfied customers.

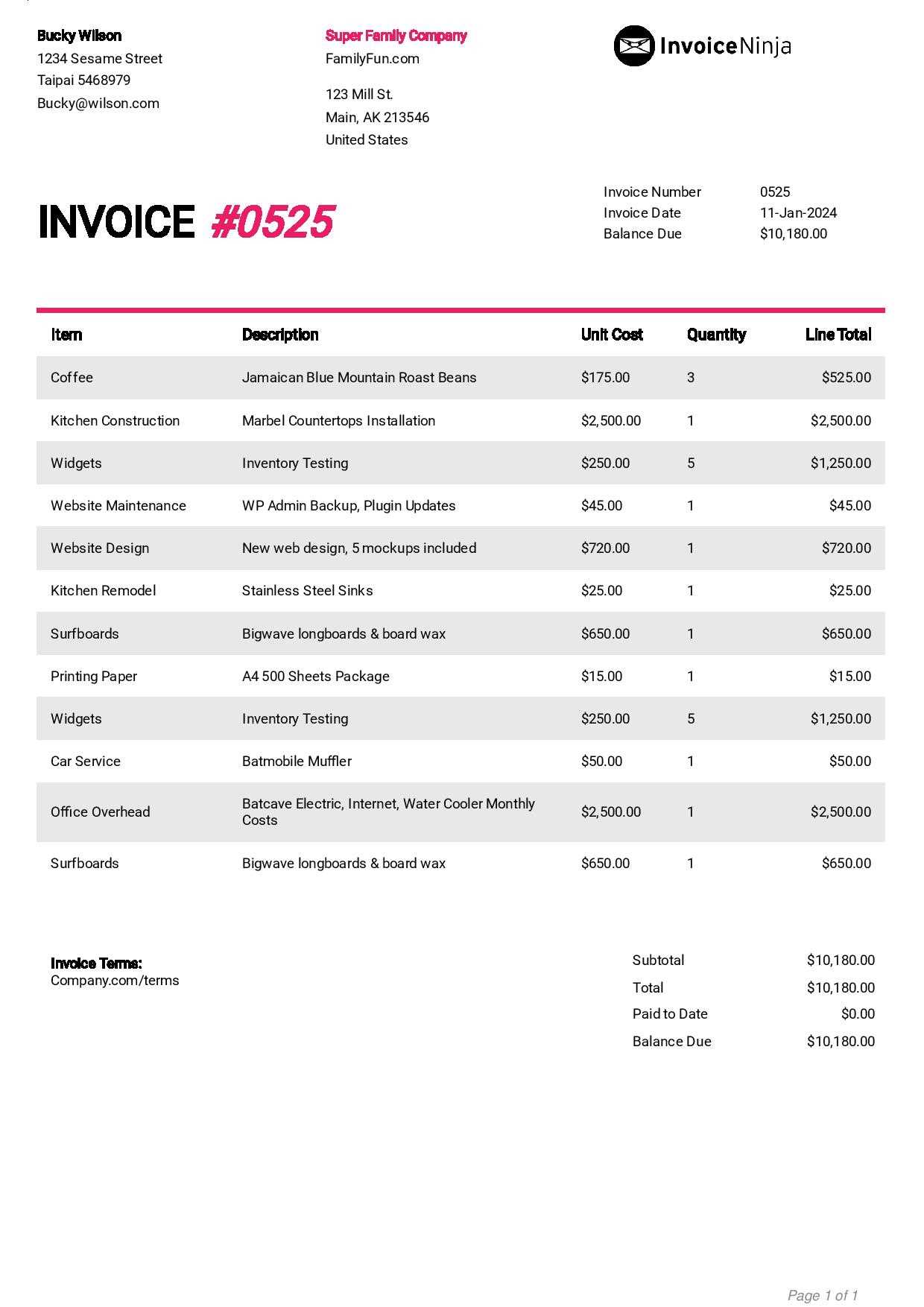

Choosing the Right Billing Format

When creating a document to request payment, the format you choose plays a crucial role in ensuring that the information is clear, professional, and easy to process. The right layout can help both you and your client stay organized, avoid confusion, and expedite the payment process. There are several formats to consider, each offering different advantages depending on your needs and preferences.

Considerations for Choosing the Best Format

To select the right layout for your billing document, keep these key factors in mind:

- Ease of Use: The format should be simple and straightforward, with clearly defined sections. You want to ensure that both you and your client can easily read and understand the information without unnecessary complications.

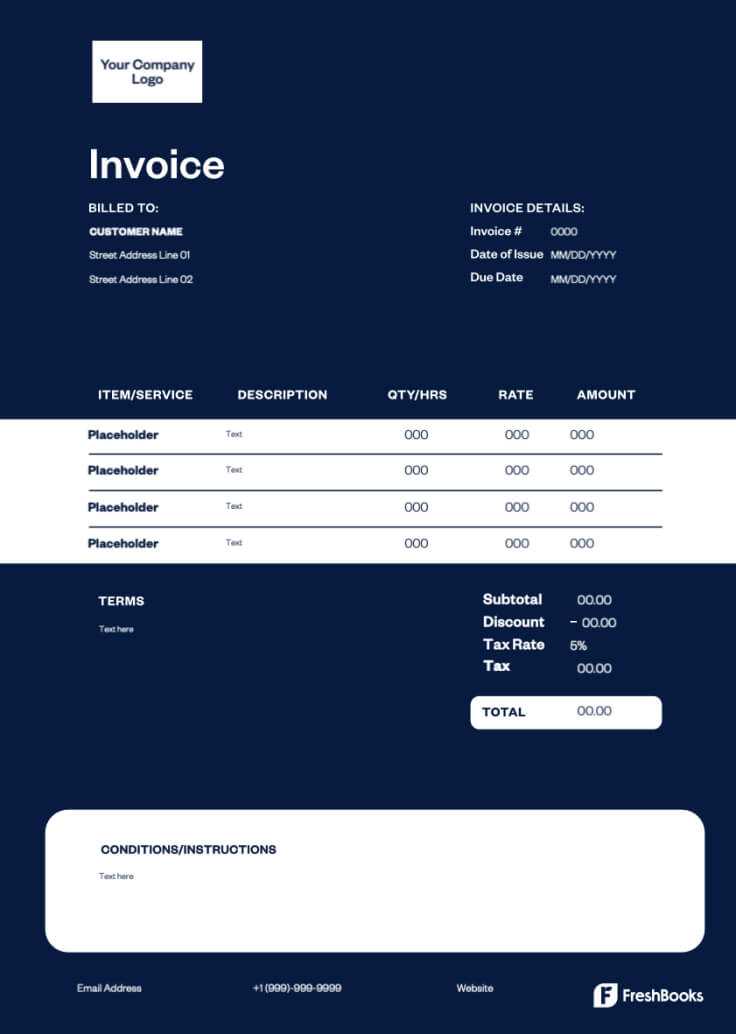

- Professional Appearance: Your payment request should reflect your business standards. A clean, modern layout with consistent fonts and spacing will enhance your professionalism and make a lasting impression on your clients.

- Customization: Depending on your specific services or the nature of the work, you may need flexibility in how you present your charges. Choose a format that allows you to easily add or remove sections, such as discounts, taxes, or special terms.

- Accessibility: Consider how your client will be receiving and viewing the document. A digital format (such as a PDF or an online service) is often more convenient for both parties, but a paper format might be appropriate for certain clients or industries.

Popular Formats to Consider

There are several options to consider when selecting the right layout for your billing request:

- Simple Text Format: A basic, no-frills approach with the key information laid out in clear sections. This format is best for straightforward transactions where you just need to communicate essential details like amounts and deadlines.

- Pre-Made Online Tools: There are many online platforms that offer customizable forms for generating payment documents. These tools often include built-in calculations, making it easier to create and send documents quickly. They also tend to look professional and can be personalized with your business branding.

- Spreadsheet Formats: For clients with complex billing needs or large projects, a spreadsheet can be an effective choice. Spreadsheets allow for detailed breakdowns of services, hours worked, or multiple items with automatic calculations, making them ideal for long-term projects or large clients.

By carefully choosing the right format, you can ensure that your billing documents are efficient, professional, and easy for your clients to process. The key is to find a balance between simplicity, clarity, and the flexibility to meet your unique needs.

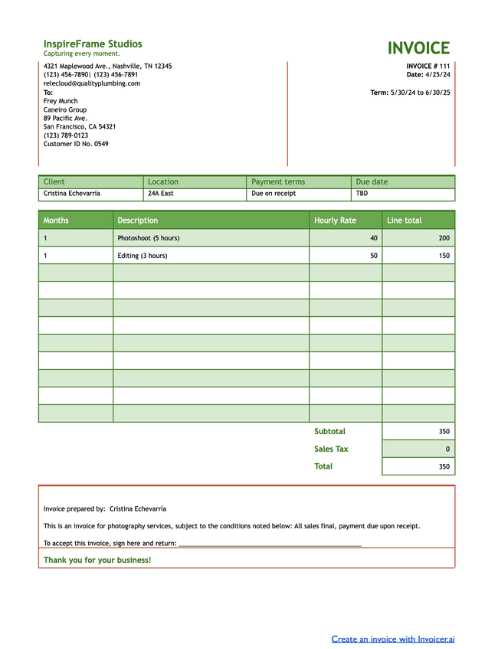

Best Tools for Generating Payment Requests

Generating a professional and accurate document to request payment doesn’t have to be time-consuming. There are several online tools and software options available that can help you create, customize, and send payment requests with ease. These tools automate many aspects of the billing process, allowing you to focus on your work while ensuring your clients receive clear and accurate statements. Below are some of the best tools to consider when creating payment documents.

Top Online Platforms for Creating Payment Requests

- FreshBooks: FreshBooks is a popular accounting and invoicing platform designed for small business owners and service providers. It allows you to create customized billing documents with ease, track expenses, and accept online payments. Its user-friendly interface and automation features make it a great choice for those looking to streamline their payment process.

- QuickBooks: QuickBooks is another comprehensive tool for managing your finances. It offers easy-to-use templates for generating billing documents, tracking payments, and managing your finances. Its integration with accounting features allows you to have a full overview of your business’s financial health.

- Wave: Wave is a free online tool that offers an intuitive platform for generating and managing payment requests. It includes customizable designs, automatic calculations, and a simple dashboard for tracking outstanding payments. It’s especially suitable for small businesses or solo entrepreneurs looking for a cost-effective solution.

- Zoho Invoice: Zoho Invoice is an online service that allows you to create, customize, and send payment documents quickly. With multiple templates and automatic reminders for overdue payments, Zoho Invoice can save you time and help maintain a professional image.

- AND.CO: AND.CO offers a range of tools designed to simplify administrative tasks for independent contractors. It includes customizable billing forms, time tracking, and expense management all in one platform. It’s a great solution for those who want a simple, efficient way to manage payments.

Offline Tools for Payment Document Creation

- Microsoft Excel or Google Sheets: For those who prefer working offline, spreadsheet programs like Excel or Google Sheets are an excellent option. You can create custom payment documents, including detailed breakdowns of services, hourly rates, or additional fees, and track payments manually. While not as automated as some online platforms, it offers a high level of customization and control.

- Microsoft Word or Google Docs: If you need a simple,

Billing Tips for Creative Professionals

Sending out clear and professional payment requests is essential for ensuring that you receive timely compensation for your work. Whether you’re handling a one-time project or long-term collaborations, certain practices can help avoid confusion, streamline your payment process, and build strong relationships with clients. Here are some practical tips to help you make the most of your billing process.

Best Practices for Crafting Your Payment Request

- Be Clear About Your Rates: Make sure your pricing is transparent and easy to understand. Break down the charges so that clients can clearly see what they’re paying for, whether it’s for hourly work, packages, or individual services. This reduces any potential misunderstandings later on.

- Use Professional Language: Keep your tone polite and professional in the document. While it’s important to be friendly, your payment request should also reflect your business standards. Use formal language and avoid slang to ensure clarity and professionalism.

- Include Detailed Descriptions of Work: List out the specific tasks completed, the time spent on each task, and any additional details. This not only helps your client understand the scope of work but also provides a record in case there are any questions about what was delivered.

- Provide Payment Instructions: Clearly state how clients can complete the payment. Include accepted payment methods, such as bank transfers, online services like PayPal, or credit cards. Providing multiple options can make the process more convenient for your client.

- Set Clear Deadlines: Specify when payment is due and outline any late fees if applicable. A clear due date helps ensure that clients pay on time and helps you manage your cash flow more effectively.

How to Keep Track of Your Payments

- Use a Unique Reference Number: Assign a unique reference number to each request. This makes it easier to track payments and avoid confusion, especially if you’re working with multiple clients or handling several transactions at once.

- Follow Up on Outstanding Payments: If a payment is overdue, follow up promptly. Send a polite reminder, including the original payment request and the new due date, to ensure that your client is aware of the outstanding amount.

- Organize Your Records: Keep copies of all your payment requests, whether they’re dig

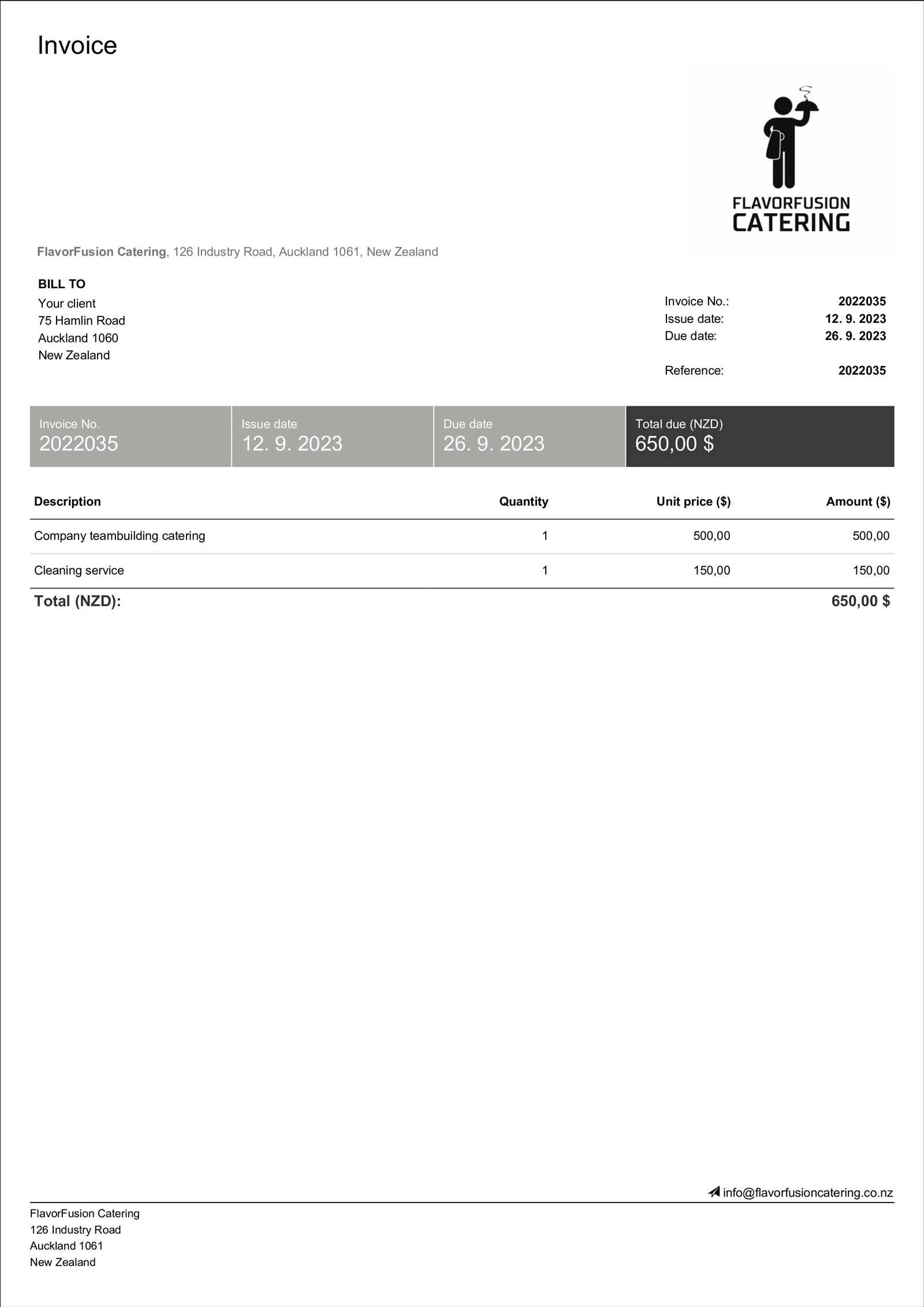

How to Include Taxes in Your Payment Request

Including taxes in your payment request is an essential step to ensure that you comply with tax regulations and that your clients are aware of the total amount due. Whether you’re charging sales tax, VAT, or any other applicable tax, it’s important to clearly outline these charges to avoid confusion. By including the right tax information, you also maintain transparency and professionalism in your billing process.

Steps to Include Taxes Correctly

- Know the Applicable Tax Rates: Before adding taxes, ensure that you are aware of the tax rates that apply to your services or products. Tax rates can vary depending on your location, your client’s location, or the type of service you provide. Research local tax laws or consult a tax professional to determine the correct rates.

- Separate Taxes from Base Charges: To ensure clarity, list taxes as a separate line item on your payment request. This makes it clear to your client what portion of the payment is for the service or product and what portion is for taxes.

- Provide Clear Tax Descriptions: Clearly label the taxes being applied, whether it’s “Sales Tax,” “VAT,” or any other relevant tax. Include the percentage rate next to the description, so your client can easily see how the tax was calculated.

- Calculate Taxes Accurately: When adding taxes, double-check your calculations. Use the correct percentage for the specific service and apply it to the appropriate subtotal. This ensures that your payment request is accurate and avoids any potential issues with your client.

- Include Tax Identification Information: In some jurisdictions, it’s important to include your tax identification number or other relevant tax details on your payment request. Make sure to include this information if required by local laws to stay compliant with tax authorities.

Example of Tax Breakdown

- Service Fee: $500.00

- Sales Tax (10%): $50.00

- Total Amount Due: $550.00

Including taxes in your payment requests is not only a legal requirement in many cases but also an important part of maintaining clear and professional communication with your clients. By following these steps, you can ensure that taxes are properly accounted for and that your client understands the full payment breakdown.

Pricing Your Photography Services Accurately

Setting the right price for your services is essential for building a sustainable business. Underpricing can lead to financial struggles, while overpricing may drive potential clients away. Accurately pricing your work requires careful consideration of several factors, including the value of your time, your expertise, and the specific needs of each client. By understanding how to price your services correctly, you can ensure that both you and your clients are satisfied with the transaction.

Factors to Consider When Setting Your Rates

- Time and Effort: Consider how much time you spend on each project, from initial consultations to editing and post-production. Ensure that your pricing reflects the amount of work you put in, including any preparation or travel time involved in the job.

- Experience and Expertise: Your level of skill and experience plays a significant role in determining your rates. If you have a strong portfolio and years of experience, you can charge higher rates than someone just starting. Make sure your pricing reflects the value you bring to the table.

- Cost of Equipment and Software: Don’t forget to account for the cost of maintaining and upgrading your equipment, as well as any software or subscriptions you use. These are ongoing expenses that should be factored into your pricing to ensure that your business remains profitable.

- Market Rates: Research what others in your field are charging for similar services. Look at competitors in your area or within your niche to ensure that your prices are competitive while still reflecting your unique value.

- Client Budget: Understanding your client’s budget can help you adjust your offerings or find ways to scale your services accordingly. Be flexible when possible, offering different packages or options that meet the client’s needs while staying within their budget.

Methods for Pricing Your Services

- Hourly Rates: Charging by the hour is a common method for services that require variabl

How to Handle Late Payments

Late payments can be a frustrating part of running a business, especially when you’ve delivered quality work and expect timely compensation. Managing overdue payments efficiently is crucial to maintaining cash flow and ensuring that your clients understand the importance of paying on time. A clear and professional approach can help resolve these situations amicably, while also protecting your business interests.

Steps to Take When Payments Are Overdue

- Review Payment Terms: Before taking any action, double-check the payment terms that were agreed upon with the client. Make sure that the due date has passed and that you are within your rights to follow up on the payment.

- Send a Friendly Reminder: Often, late payments are the result of simple oversight. Send a polite reminder email or message to your client, including the original payment request and highlighting the due date. Keep the tone professional and understanding.

- Be Specific About the Consequences: If a payment remains overdue, clearly outline any late fees or interest charges in your communication. Remind your client that these charges were part of the original agreement, and ensure they understand that prompt payment is expected to avoid further penalties.

- Offer Payment Options: Sometimes clients are late because they are having difficulty with the payment method or need more time. Offering alternative payment options or breaking the payment into installments can encourage them to settle the balance more quickly.

- Set a Final Deadline: If the client has still not paid after the initial reminder, set a firm final deadline for payment. Be clear about the next steps, which may include pausing work or escalating the matter to a collection agency if necessary.

Preventing Late Payments in the Future

- Clear Payment Terms: Ensure that your payment terms are outlined clearly in all agreements, contracts, or payment requests. This includes specifying payment due dates, late fees, and accepted payment methods to avoid misunderstandings.

- Upfront Payments or Deposits: For larger projects, consider requesting a deposit upfront or full payment before work begins. This can significantly reduce the likelihood of delayed payments, as clients are already financially committed.

- Automate Reminders: Many online billing platforms allow you to set up automatic reminders for upcoming or overdue payments. This can help ensure that clients are remi

Common Mistakes in Billing Documents

Creating clear and accurate payment requests is essential for maintaining smooth business operations. However, even experienced professionals can make mistakes when preparing these documents, which can lead to confusion, delayed payments, or strained client relationships. Avoiding common errors is key to ensuring that your billing process is efficient and professional. Below are some of the most frequent mistakes that can occur when preparing your payment requests.

Common Errors to Avoid

- Missing or Incorrect Client Details: One of the most basic but significant mistakes is failing to include or inaccurately listing your client’s details, such as their name, address, or contact information. These details are crucial for both the client’s records and for any legal or tax purposes.

- Unclear Payment Terms: Vague or missing payment terms can lead to confusion regarding when and how the payment is expected. Always specify the due date, accepted payment methods, and any late fees or penalties for overdue payments.

- Not Itemizing Services: Failing to break down the services provided into individual line items can result in a lack of transparency. Ensure that each service, including any additional charges like travel fees or extra hours, is clearly listed with its corresponding price. This helps clients understand exactly what they are paying for.

- Forgetting to Include Taxes: Taxes can be complicated, but failing to include them or miscalculating them can create issues with both your clients and tax authorities. Be sure to include the applicable tax rate, whether it’s sales tax, VAT, or another type, and list it clearly as a separate line item.

- Not Using a Unique Reference Number: Using the same reference number for multiple documents can cause confusion and make it difficult to track payments. Always assign a unique number to each payment request to keep your records organized and easily identifiable for both you and the client.

- Missing Payment Instructions: If you don’t provide clear instructions on how to pay, clients may delay payment due to uncertainty. Make sure to include specific details such as your bank account information, online payment options, or any other methods you accept.

- Overcomplicating the Format: A cluttered or overly complex payment request can confuse clients and result in delayed payments. Keep the design clean, with a clear breakdown of charges, payment terms, and client information. Simplicity is key.

How to Avoid These Mistakes

- Double-Check Client Information: Always verify that your

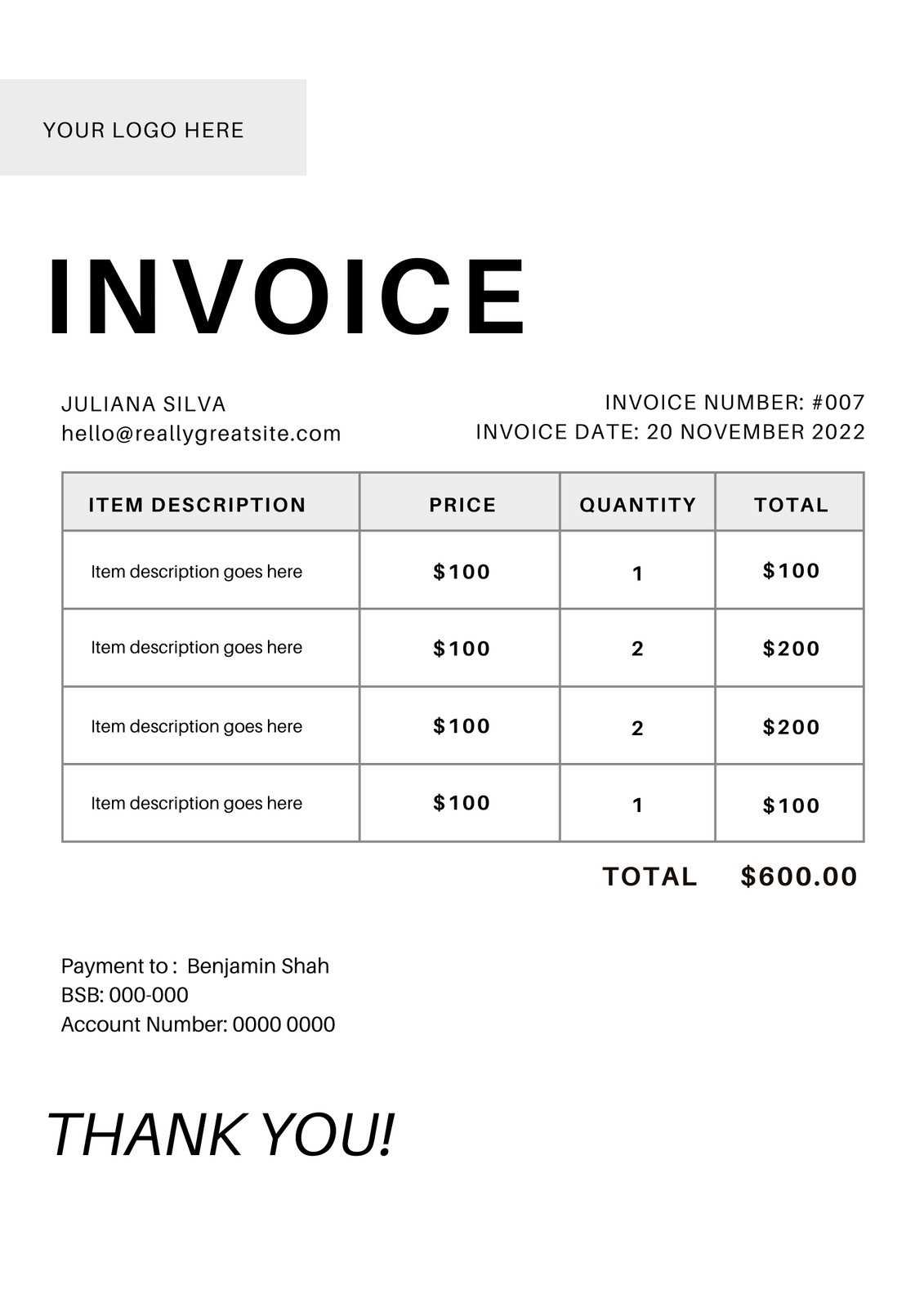

Designing a Professional Payment Request

A well-designed payment document not only helps to ensure prompt payment but also reflects your professionalism and attention to detail. The way you structure and present your payment request can have a significant impact on how your clients perceive you. A clean, organized, and visually appealing format can make the entire process more efficient and create a positive impression, setting the tone for future business interactions.

Key Design Elements for a Professional Payment Document

- Branding and Personalization: Incorporating your business logo, colors, and fonts into your payment request helps to create a cohesive brand identity. Personalize it with your name, business name, or brand, along with your contact information, to make the document feel unique and professional.

- Clear Structure and Layout: The document should be easy to read and understand at a glance. Use headings, bullet points, and clear sections to organize the information logically. Important details such as the payment amount, due date, and services rendered should stand out, while secondary details like payment methods can be listed more subtly.

- Readable Fonts and Formatting: Choose fonts that are easy to read and keep your formatting consistent throughout. Stick to classic fonts like Arial or Times New Roman, and ensure that text is appropriately sized. Avoid using too many different font styles, which can make the document look cluttered.

- White Space: Don’t overcrowd the document. Adequate white space between sections makes it easier for the client to read and helps important information stand out. A clean design ensures that your payment request doesn’t feel overwhelming.

- Professional Language: Even though the document may include specific amounts and numbers, ensure that the language is polite and professional. Use clear and concise wording that leaves no room for ambiguity. Terms and conditions should be easy to understand, and you should avoid jargon or overly complicated language.

Additional Tips for Enhancing the Design

- Include a Payment Breakdown: To avoid confusion, always break down the charges for each service. Listing them individually helps the client understand exactly what they’re paying for and can reduce the chance of disputes.

- Highlight Important Details: Make the total amount due and the due date stand out. You can use bold text or larger font sizes to draw attention to these crucial elements.

Payment Terms to Include in Your Billing Document

Establishing clear payment terms is crucial for ensuring timely and accurate compensation for your services. These terms set expectations for both you and your clients, outlining when and how payments should be made, and what actions will be taken if payments are delayed. Including comprehensive payment conditions in your billing documents helps prevent misunderstandings and can streamline the entire payment process.

Essential Payment Terms to Consider

- Due Date: Clearly state the date by which the payment is expected. This is the foundation of your payment terms and helps the client understand when they are required to settle their balance. Be specific and avoid vague terms like “ASAP” or “soon.” A firm due date provides clarity.

- Accepted Payment Methods: Specify which payment methods you accept, such as bank transfer, credit card, online payment systems, or checks. The more options you provide, the easier it will be for the client to pay promptly.

- Late Fees or Penalties: Outline the penalties that will apply if the payment is late. This could be a flat fee or a percentage of the total amount due, often applied per day or week after the due date. Make sure to include this information clearly to encourage timely payments.

- Deposits or Upfront Payments: If applicable, include terms for deposits or upfront payments. This is especially useful for larger projects or long-term engagements. A deposit can help ensure that clients are committed before work begins and protects you from cancellations or non-payment.

- Early Payment Discounts: Offering a discount for early payments can incentivize clients to settle their balances before the due date. Be sure to state the percentage or amount of the discount and the time frame in which it applies.

- Payment Installments: If the total payment is substantial, consider offering payment in installments. Specify the amount and frequency of each installment, along with the dates when payments are due. This can make larger payments more manageable for clients.

- Currency: Make sure to specify the currency in which the payment is expected. This is particularly important i

Digital vs Paper Billing Documents

When it comes to sending payment requests, professionals often face the decision of whether to opt for digital or paper documents. Each method has its own advantages and drawbacks, and choosing the right one depends on your business needs, client preferences, and efficiency goals. Understanding the benefits and limitations of both formats can help you decide which one best suits your workflow.

Advantages of Digital Billing Documents

- Faster Delivery: Digital payment requests can be sent instantly via email or online platforms, ensuring that clients receive them without delay. This speed can be especially important when working with tight deadlines or in industries where quick turnaround is expected.

- Environmental Benefits: Sending electronic documents helps reduce paper waste, making it a more sustainable choice. By going digital, you can contribute to environmental conservation while maintaining a paperless office.

- Easy Record Keeping: Digital documents are easier to store, search, and manage. You can organize them in folders or cloud storage, allowing you to quickly access past payment requests, track payments, and maintain organized financial records.

- Integration with Accounting Software: Many digital payment systems and platforms offer easy integration with accounting software. This feature allows for automated tracking of payments, tax calculations, and financial reporting, streamlining your bookkeeping processes.

- Security Features: Digital documents can be encrypted or password-protected, adding an extra layer of security when handling sensitive financial information. Additionally, you can track when the document was received and opened by the client, offering more transparency.

Advantages of Paper Billing Documents

- Personal Touch: Some clients prefer receiving a physical document as it can feel more formal or personal. Paper documents can add a sense of

How to Track Outstanding Payments

Managing unpaid balances is an essential part of running any business. Keeping track of pending payments helps ensure that cash flow remains steady and that you can take appropriate action if payments are delayed. Implementing an effective system for monitoring outstanding balances allows you to stay organized and ensures that you don’t miss any due payments.

Strategies for Tracking Pending Payments

- Use Accounting Software: Modern accounting software allows you to easily track pending payments. These tools often provide a dashboard that displays overdue amounts, payment statuses, and upcoming due dates. Some platforms even send automated reminders to clients, saving you time and effort.

- Create a Payment Schedule: Establishing a clear payment schedule for each client helps you monitor due dates and expected payments. If your clients are on payment plans, ensure that the payment schedule is documented, and set reminders for each installment.

- Maintain a Payment Log: If you’re not using accounting software, maintaining a manual log (either digital or physical) can help. List each project, the agreed amount, payment terms, and the date the payment is due. This log can serve as a reference when following up on outstanding amounts.

- Mark Payments as Received: As soon as a payment is made, mark it as “paid” in your system. This way, you can easily differentiate between outstanding and settled payments. Keeping this record up-to-date is crucial for maintaining financial clarity.

Follow-Up Techniques for Unpaid Balances

- Set Up Reminder Alerts: Many clients tend to forget about upcoming or overdue payments. Setting up automated reminders can help prompt clients to pay before things become more complicated. You can customize reminders to be sent a few days before the due date or when the payment is past due.

- Send Polite Payment Requests: When a payment is overdue, send a polite but firm reminder to your client. Make sure your message is professional and direct, listing the amount due, the due date, and any applicable late fees. The tone of your communication should encourage prompt payment without sounding confrontational.

- Use a Payment Tracking Spreadsheet: If you prefer a more hands-on approach, a spreadsheet can be an excellent tool for tracking outstanding payments. List all payments received

Managing Multiple Client Billing Documents

Handling numerous billing requests for various clients can become overwhelming if not organized effectively. The key to managing multiple payment requests is keeping track of each client’s specific terms, due dates, and payment statuses. A structured approach can help you stay on top of your finances, ensuring that all clients are invoiced accurately and that no payments are missed.

Organizing Client Billing Requests

- Use Client-Specific Records: For each client, maintain a separate record or folder, whether digital or physical. Include all relevant details such as the agreed amounts, due dates, and payment history. This helps avoid confusion and ensures that all information is easily accessible.

- Create a Master Calendar: Set up a master calendar where you can track all payment due dates. This will give you a clear overview of your outstanding payments and allow you to follow up in a timely manner. Color-coding or categorizing by client can help you quickly identify which payments are due.

- Batch Your Billing Process: If you work with multiple clients on a regular basis, batching your billing process at regular intervals can be an efficient approach. For example, send all client requests out at the end of each week or month. This helps streamline the process and reduces the risk of missing any deadlines.

Tracking and Follow-Up

- Payment Tracking Software: Investing in software that tracks all client payments is an excellent way to stay organized. Many tools allow you to see a comprehensive list of all outstanding payments, helping you identify clients who need follow-up and preventing late fees or missed payments.

- Automate Reminders: Many digital payment platforms offer automatic reminders for both you and your clients. These reminders can be sent before and after the due date to help ensure payments are made on time. This feature saves you time and effort, reducing the need for manual follow-up.

- Set Clear Payment Terms: Clearly define your payment terms with each client to avoid misunderstandings later. Ensure that your clients know exactly when payments are due and any penalties for late payments. This can prevent delays and encourage prompt payments.

By setting up effective systems and using the right tools, managing multiple client billi

How to Avoid Payment Disputes

Payment disputes are a common issue that can arise when expectations are not clearly defined or when communication between parties is lacking. To avoid these conflicts, it is essential to establish clear terms from the start, maintain open communication throughout the project, and ensure that all financial agreements are well-documented. By taking proactive steps, you can minimize the risk of misunderstandings and create a smoother process for both you and your clients.

Steps to Prevent Payment Disputes

- Set Clear Terms and Conditions: Always outline payment terms, such as rates, deadlines, and payment schedules, before beginning any work. This reduces the likelihood of confusion later on. Ensure that your clients understand what is expected of them regarding payments and deliverables.

- Provide Detailed Estimates: Offering a clear and detailed estimate before starting work can help set expectations around pricing and project scope. Be transparent about any potential additional charges, such as rush fees or extra work beyond the agreed scope.

- Keep Clients Informed: Regular communication with clients throughout the project is key. Inform them of any changes, delays, or additional costs in advance. By maintaining transparency, you build trust and reduce the likelihood of surprises that could lead to disputes.

- Get Agreement in Writing: Whenever possible, make sure that agreements, including payment schedules and terms, are documented in writing–whether in a contract or email. This gives both parties a reference point if any disagreements arise later on.

Handling Potential Disputes

- Address Issues Early: If a client expresses concerns or questions about payment, address them as soon as possible. Avoiding or ignoring the issue can escalate the situation. Take the time to understand their concerns and resolve them promptly.

- Offer Flexible Payment Options: Providing multiple payment options, such as credit cards, bank transfers, or digital payment platforms, can help avoid friction with clients who may prefer certain methods over others. Offering flexibility can reduce the chance of non-payment due to technical issues or preferred payment methods.

- Be Professional in Your Communication: If a disput