Freelance Model Invoice Template for Simplified Billing and Payment Management

For independent professionals managing their own business, proper documentation of work completed and payments due is essential. Creating clear and professional records ensures smooth transactions and helps maintain good relationships with clients. Having an effective system in place for managing financial aspects is crucial to long-term success and stability.

In this guide, we explore how to streamline the process of requesting payments for your services. From essential components to customizing your own documents, we cover all the necessary steps to help you create a system that works efficiently for your business needs. A well-organized approach can save you time, reduce errors, and ultimately improve your cash flow management.

Fre

Why You Need an Invoice Template

When you work independently, managing payments and financial records becomes an essential part of maintaining a successful business. Without a proper system in place, tracking payments and ensuring you receive what you are owed can quickly become a time-consuming and confusing task. Using a pre-made document format designed for billing helps to streamline this process and make it more efficient.

Having a ready-to-use document ensures that all important details are included and consistently presented. With a standardized approach, you reduce the risk of missing critical information or making mistakes that could delay payments or cause misunderstandings with clients. Here are some key reasons why having a standardized billing form is crucial:

- Time Efficiency: A pre-designed document saves you the hassle of creating one from scratch every time you need to request payment. This allows you to focus more on your core work.

- Consistency: Using a set format for all billing requests helps maintain uniformity in how you present your financial details, building trust with clients.

- Professionalism: A well-structured, clear document reflects positively on your business, enhancing your credibility and ensuring clients view you as organized and serious.

- Clarity and Transparency: By outlining all necessary information, such as payment terms, due dates, and service descriptions, you make it easier for clients to understand the amounts due and the terms of the transaction.

- Fewer Errors: Pre-made options often include all the required fields, reducing the chances of forgetting critical information or inputting incorrect details.

By adopting a reliable system for your financial documentation, you’ll not only make your payment process smoother but also contribute to the overall professionalism and efficiency of your business operations.

Key Elements of a Billing Document

When requesting payment for services rendered, it’s important to include all relevant information in a clear and organized manner. A well-structured document ensures that both you and your client are on the same page regarding the terms of the transaction. The right details not only help avoid confusion but also make it easier to track payments and maintain accurate records.

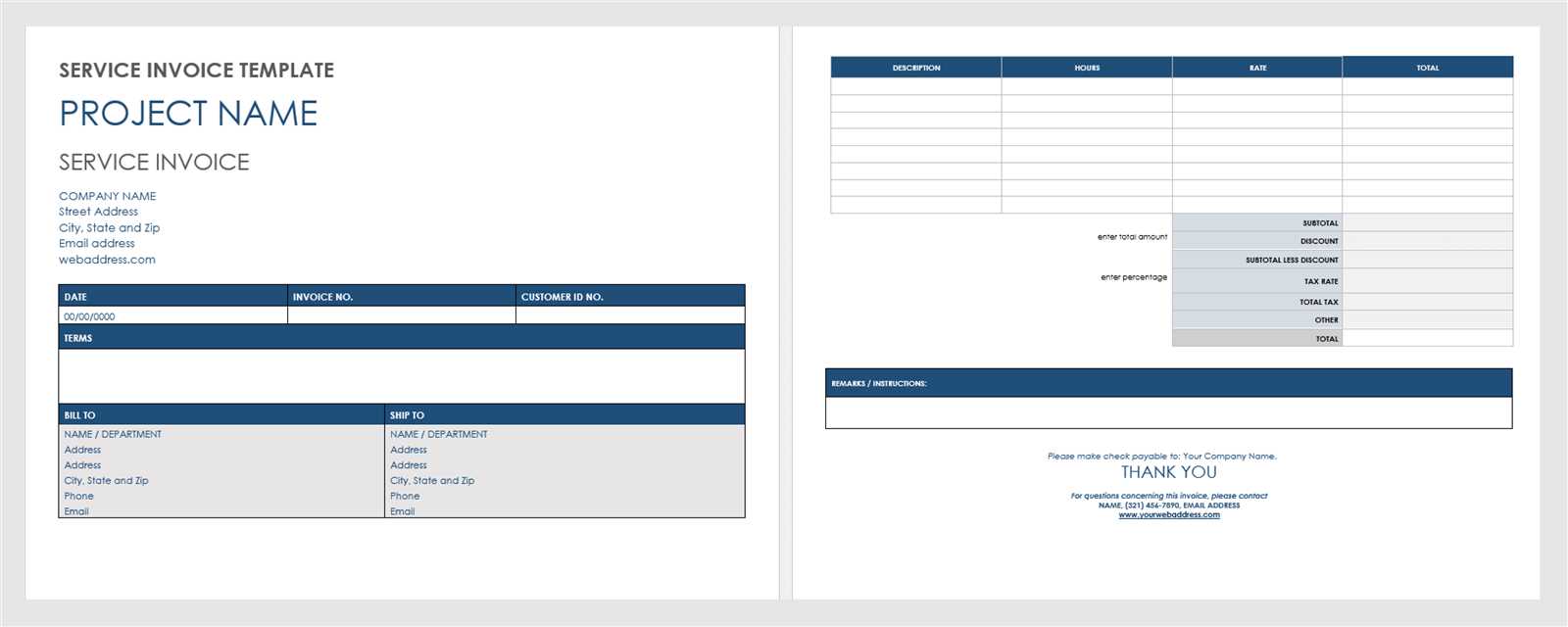

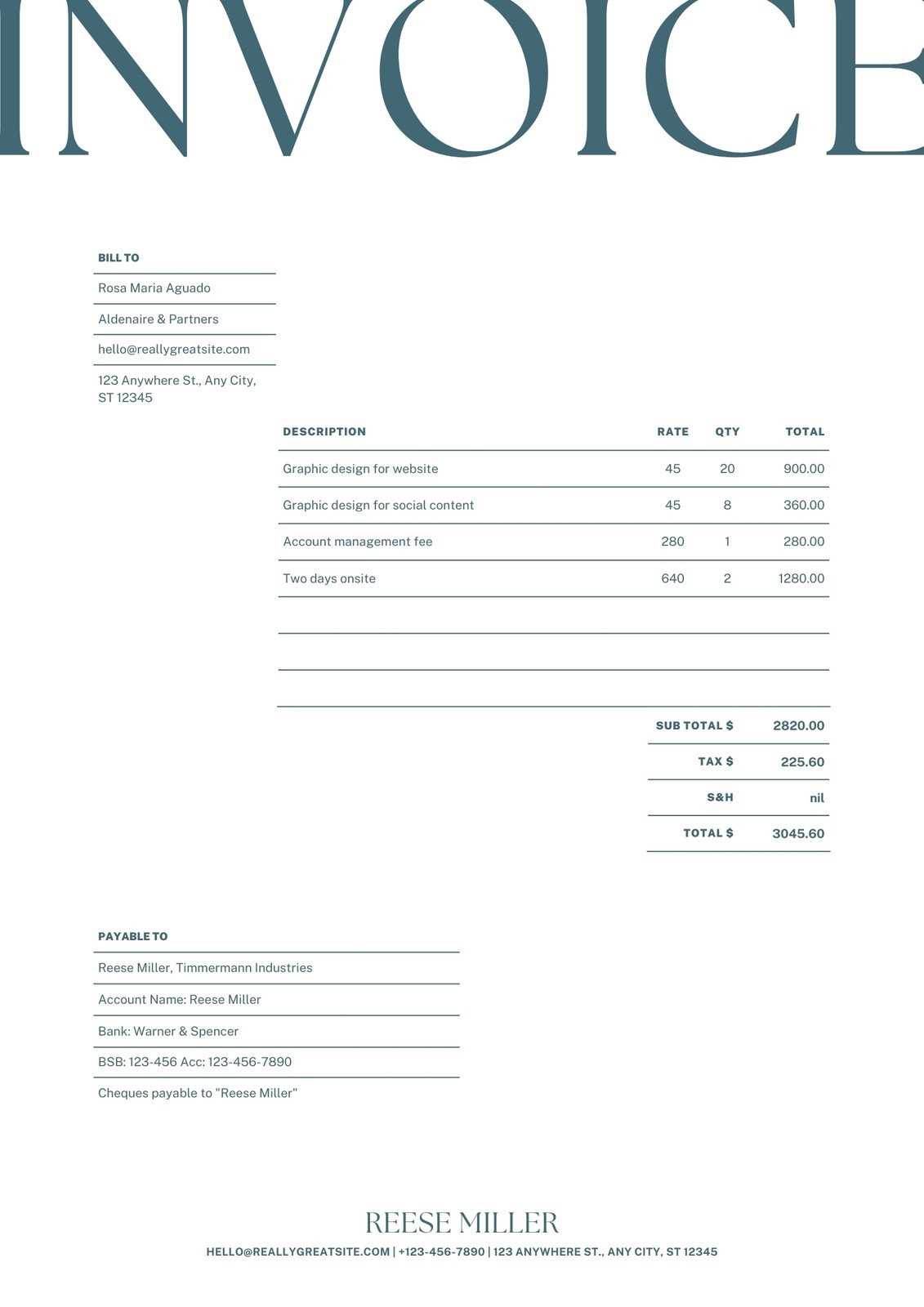

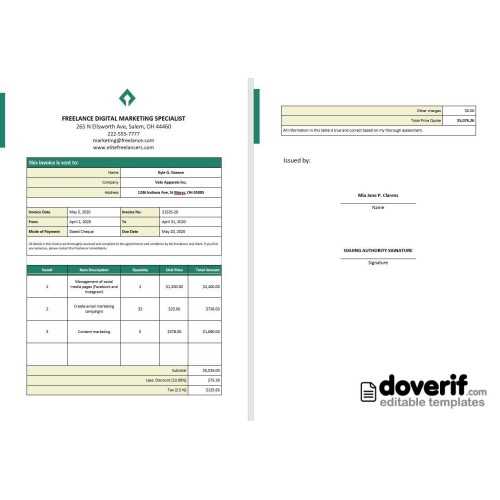

Here are the essential components to include in your payment request to ensure it is complete and professional:

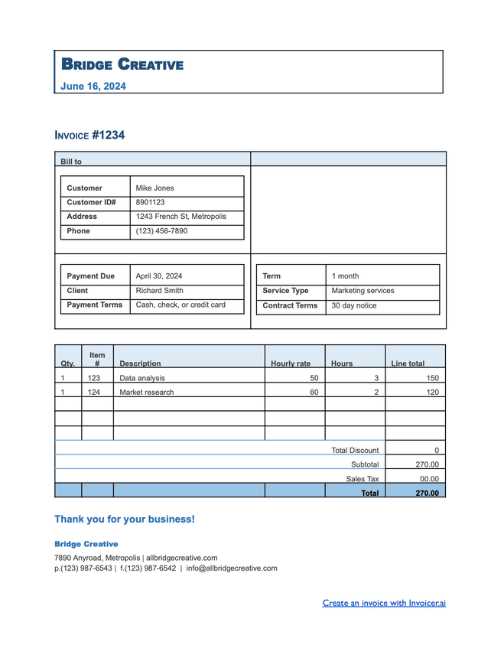

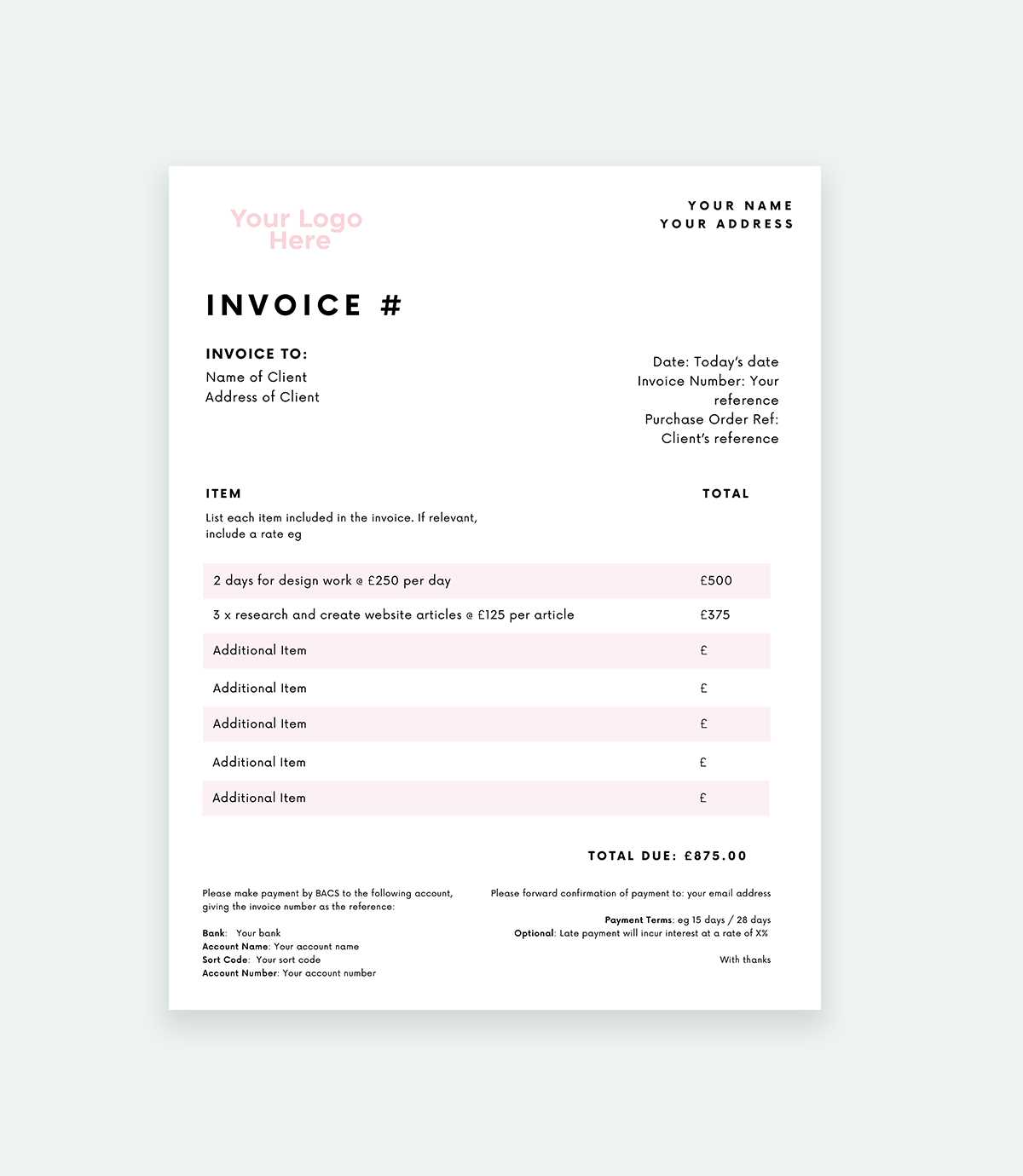

- Your Business Information: Always include your name, address, email, and phone number. If applicable, also add your business logo or brand name to make the document more personalized.

- Client’s Information: Include the client’s full name or company name, address, and contact details. This ensures clarity in identifying who the document is addressed to.

- Unique Reference Number: Assigning a unique number to each document allows for easy tracking, both for you and your client. This helps avoid confusion, especially when dealing with multiple transactions.

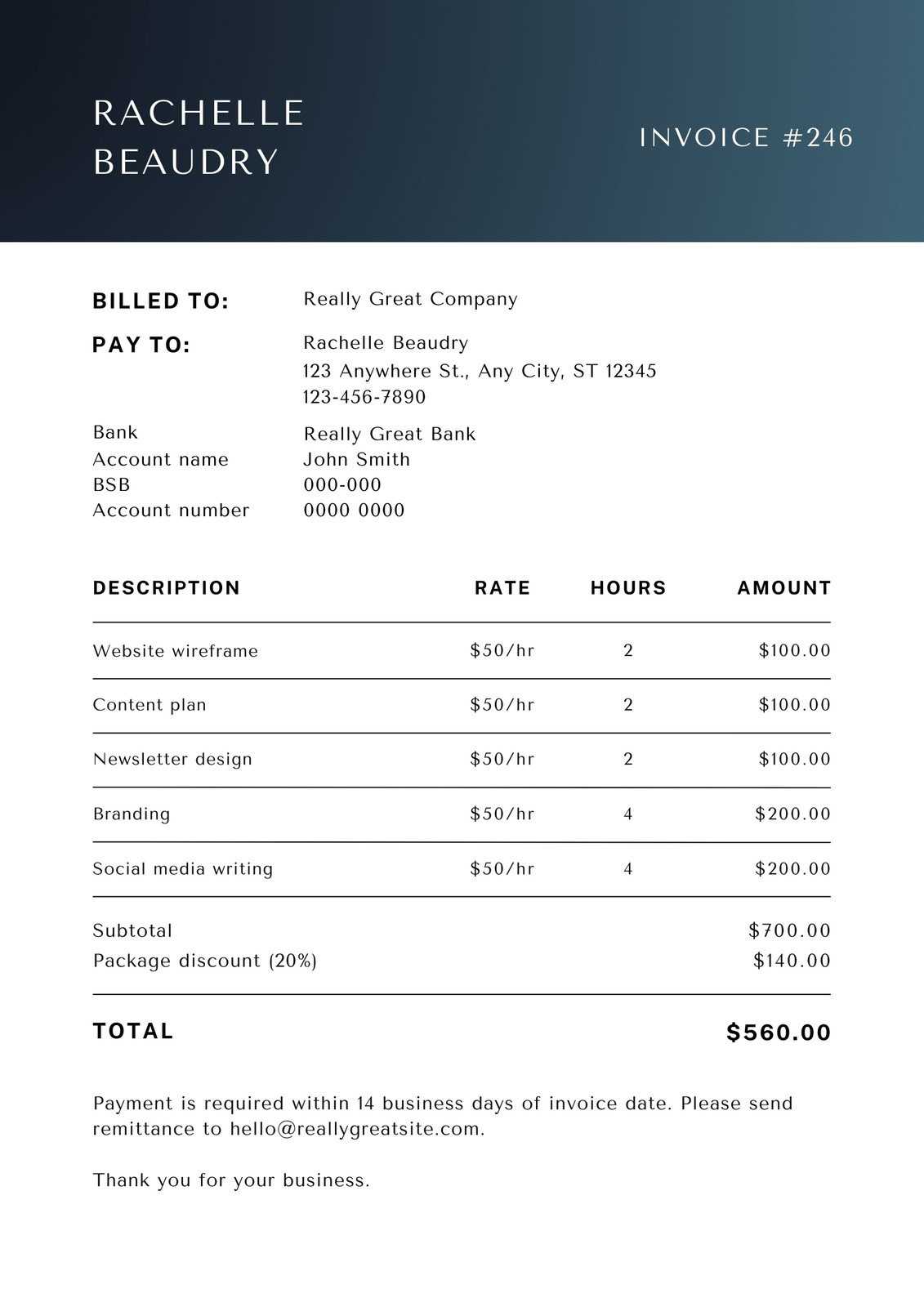

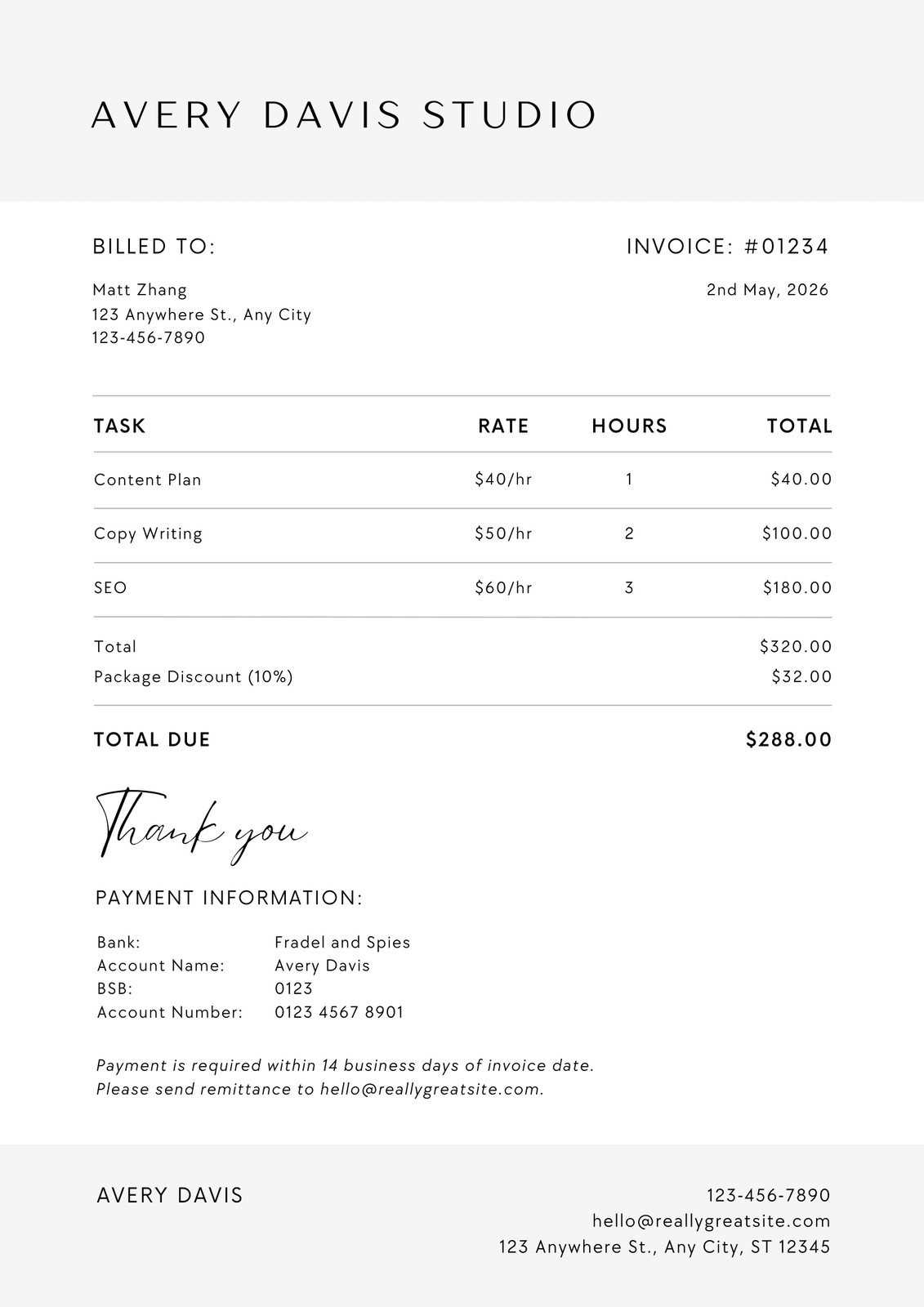

- Clear Description of Services: Provide a breakdown of the services you’ve provided, including any project milestones or hourly work. Be as detailed as necessary to avoid ambiguity.

- Payment Amount: Clearly state the total amount due. If applicable, break it down by service, rate, or hours worked to provide full transparency.

- Payment Terms: Specify the payment due date, late fees (if any), and acceptable payment methods (e.g., bank transfer, PayPal, credit card). This helps set expectations for both parties.

- Tax Information: If applicable, include relevant taxes such as sales tax or VAT. This ensures the client is aware of any additional fees beyond the service cost.

- Thank You Message: A brief note of gratitude goes a long way in fostering positive relationships and encourages timely payments.

By ensuring that these key elements are included, you can create a clear, pro

How to Customize Your Billing Document

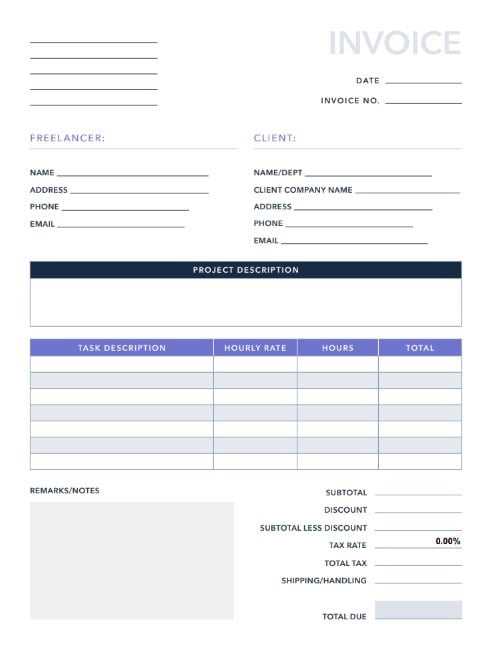

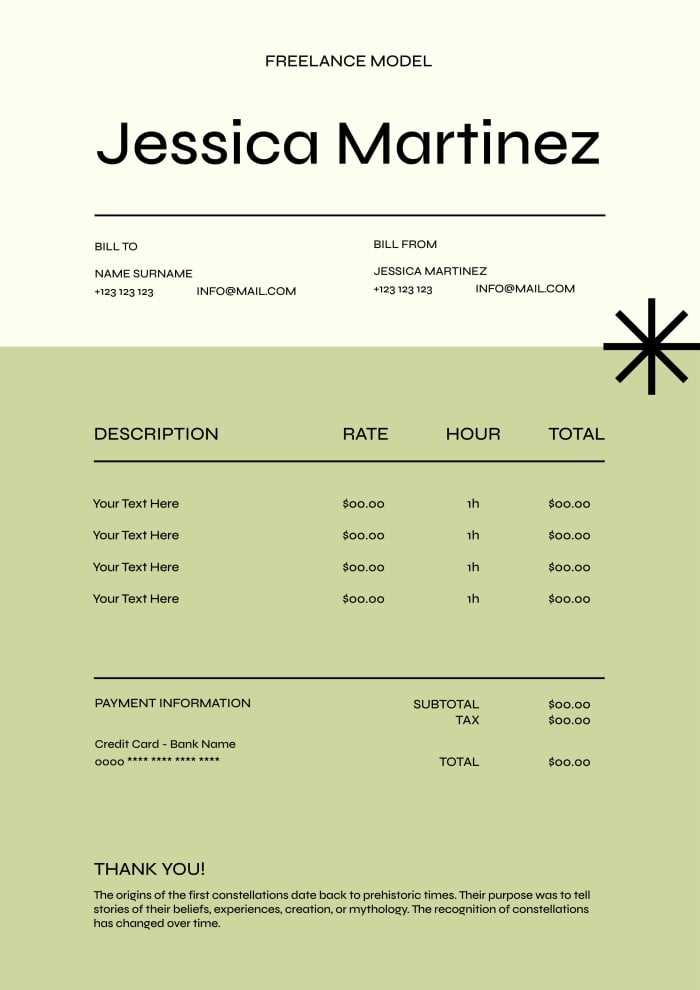

Tailoring your payment request forms to suit your specific business needs is essential for creating a professional and streamlined process. Customizing your documents not only helps reinforce your brand identity but also ensures that all necessary information is presented clearly and consistently. A personalized approach allows you to include any unique elements or terms that are relevant to your services.

Here are several ways you can modify your billing form to make it your own:

- Branding: Add your business logo, colors, and fonts to give the document a polished, cohesive look that aligns with your brand. This helps to create a professional image and build trust with clients.

- Client-Specific Information: Customize each document with specific details for the client, such as their company name, address, and a unique reference number for each transaction. This ensures clarity and helps with future tracking.

- Service Descriptions: If your offerings vary, make sure to adjust the service descriptions for each client. Break down the services provided into clear, understandable terms, whether by hours worked, project milestones, or specific tasks completed.

- Payment Terms: Customize payment terms based on your business preferences. You may want to include specific due dates, offer discounts for early payments, or set penalties for late payments. Make sure to clearly outline any fees or terms that apply.

- Custom Fields: Depending on the nature of your work, you may need to add specific fields like project code, job category, or additional notes. Adjust the layout to accommodate these additional fields without overcrowding the document.

- Tax Information: If your business is subject to taxes or other fees, include relevant tax rates and amounts. Ensure that this information is clearly visible to avoid confusion during the payment process.

- Language & Tone: Depending on your relationship with the client, you may want to adjust the tone of your message. A polite “thank you” note or a brief reminder of payment terms can make the document feel more personal and client-friendly.

By making these customizations, you can create a billing document that reflects your unique business needs and enhances the overall client experience. A well-crafted and personalized document helps reinforce your professionalism and ensures that all aspects of your transaction are clearly understood by both parties.

Choosing the Right Billing Format

Selecting the appropriate format for your payment request is essential to ensure clarity and professionalism. The right structure not only makes the document easy to read but also helps in organizing all necessary details in a logical and effective manner. With various formats available, it’s important to pick one that aligns with your business needs and client preferences.

Here are some factors to consider when deciding on the best structure for your billing documents:

- Clarity and Simplicity: Choose a layout that is simple, clean, and easy to navigate. Avoid cluttering the document with unnecessary details, as this can confuse clients and delay payments.

- Customization Options: Some formats allow you to add custom fields, such as specific project codes, discounts, or terms. Select a format that can accommodate these unique details to make the document more tailored to your business.

- Compatibility: Consider whether the format is compatible with the tools you use. If you’re using software to manage your billing process, opt for a format that integrates well with it, whether it’s a spreadsheet, PDF, or online tool.

- Professional Appearance: Choose a design that reflects the image you want to project. A well-organized and aesthetically pleasing document can improve your business’s reputation and help foster trust with clients.

- Tracking and Organization: If you manage multiple clients or projects, consider a format that includes reference numbers or allows for easy tracking of paid and unpaid invoices. This helps keep your records in order and makes follow-ups easier.

- Flexibility: The format you choose should be versatile enough to handle different types of transactions. Whether you’re charging by the hour, by project, or with additional expenses, ensure the layout can accommodate varying billing scenarios.

By carefully evaluating these factors, you can select a format that streamlines the billing process, enhances communication with your clients, and supports your business operations. The right format ensures both you and your client have a clear understanding of the payment terms, making it easier to keep everything organized and on track.

Common Mistakes to Avoid in Billing Documents

Creating a payment request document may seem straightforward, but even small errors can lead to confusion or delays in payment. Whether it’s missing critical information or presenting unclear terms, mistakes can impact your professionalism and cause unnecessary back-and-forth with clients. Being mindful of these common pitfalls ensures that your documents are clear, accurate, and effective.

Here are some frequent mistakes to avoid when preparing your payment request:

| Mistake | Consequences | How to Avoid |

|---|---|---|

| Missing Contact Information | Delays in communication or payment if the client can’t reach you. | Always include your full name, business address, email, and phone number. |

| Unclear Service Descriptions | Confusion about what was delivered, leading to disputes or non-payment. | Provide detailed, itemized descriptions for each service or product provided. |

| Omitting Payment Terms | Uncertainty about due dates, late fees, or accepted payment methods. | Clearly state payment deadlines, late fees, and available payment methods. |

| Incorrect or Missing Amounts | Errors in the payment amount can result in underpayment or overpayment. | Double-check all figures and break down the amounts clearly. |

| Failure to Include Tax Information | Potential legal or financial issues if taxes are not accounted for. | If applicable, include tax rates and amounts in the document. |

| Ambiguous Due Date | Late payments if the due date is unclear or missing. | Always specify an exact due date, and clarify any grace periods. |

Avoiding these common mistakes will not only make your payment requests clearer and more professional but also improve your chances of getting paid on time. By paying attention to the details, you create a smoother transaction process and build better relationships with your clients.

Free vs Paid Billing Document Formats

When it comes to creating payment requests, you have the option to choose between free and paid document formats. Both options offer distinct benefits, depending on the complexity of your business needs and your available resources. Understanding the differences between these choices can help you make the best decision for your workflow and client relationships.

Here’s a comparison of the two options:

- Free Options: Free document formats are typically basic, offering simple structures that are easy to use. They’re ideal for those just starting out or for individuals with straightforward billing needs.

- Paid Options: Paid formats usually come with additional features, such as advanced customization, integration with accounting software, or pre-built templates for various industries. These options are well-suited for businesses that require more advanced functionality or branding capabilities.

Below are some pros and cons to help you decide which option is right for you:

Free Formats

- Pros:

- No cost involved.

- Easy to use with minimal setup.

- Great for those with simple needs or who are just starting out.

- Cons:

- Limited customization and design options.

- Fewer features or integrations available for advanced needs.

- May lack professional polish or advanced tracking capabilities.

Paid Formats

- Pros:

- Highly customizable to fit your specific business needs.

- Advanced features like automation, tracking, and integration with other business tools.

- More polished design options that reflect a professional image.

- Cons:

- Cost associated with purchasing or subscribing to premium options.

- May require more time to set up and learn how to use effectively.

Ultimately, the choice between free and paid formats depends on the complexity of your billing needs. If you are just getting started and have a limited budget, free formats may be sufficient. However, if your business is growing or you need more advanced features, investing in a paid o

Best Software for Creating Billing Documents

When managing payments, using the right software can greatly simplify the process of generating and sending payment requests. The best tools offer a range of features that help streamline the creation, customization, and tracking of financial records. With so many options available, selecting the right software depends on your specific business needs, from basic templates to advanced integrations with accounting systems.

Top Software Options

Here are some of the most popular software tools that can help you create clear and professional payment requests:

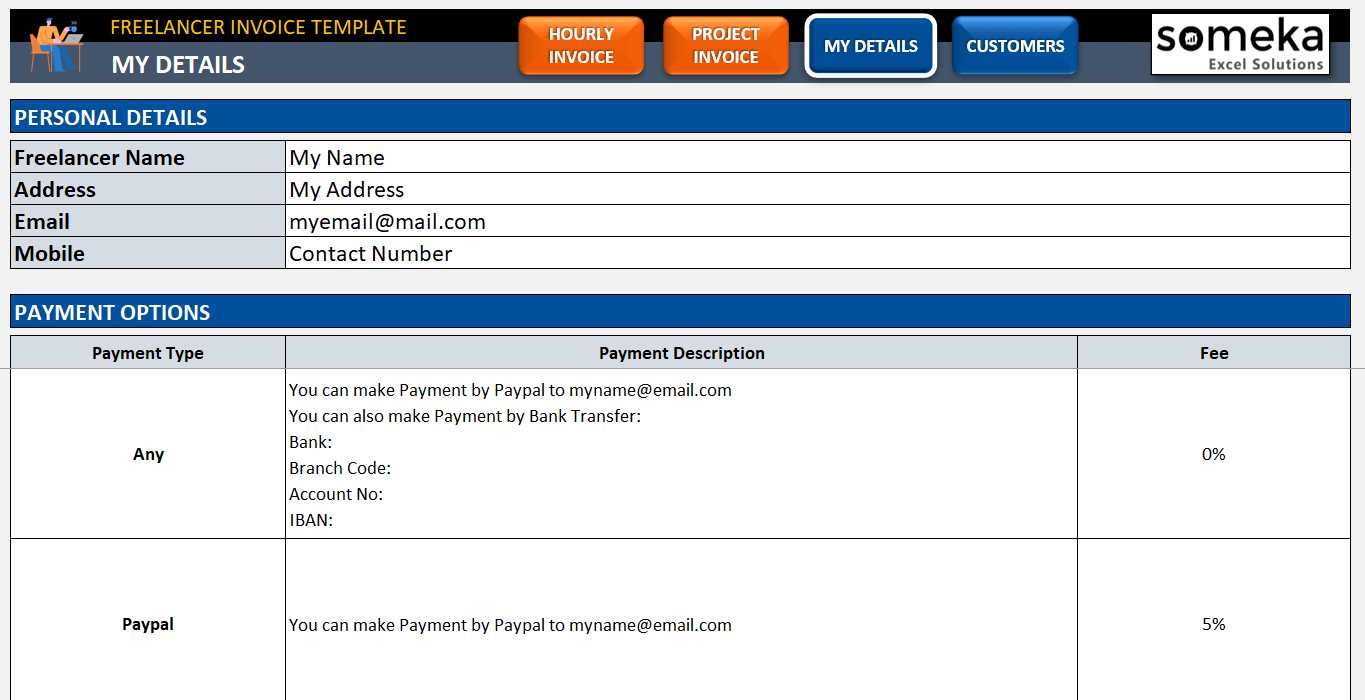

- QuickBooks: Known for its comprehensive accounting features, QuickBooks also allows you to generate customizable payment requests. It offers advanced tracking, integration with bank accounts, and easy tax management.

- FreshBooks: Ideal for small businesses and independent workers, FreshBooks makes billing simple with its user-friendly interface. It includes customizable templates, automatic payment reminders, and time-tracking features.

- Wave: A free option with robust features, Wave is great for small businesses and solo entrepreneurs. It allows users to create professional payment requests, manage payments, and even generate financial reports.

- Zoho Invoice: Zoho offers a highly customizable platform with templates that can be tailored to various industries. It also supports recurring billing, project management, and online payment collection.

- Invoicely: With both free and paid plans, Invoicely lets you create, send, and track payment requests easily. It integrates with other platforms like PayPal and Stripe for seamless transactions.

Key Features to Look For

When choosing software for creating your billing documents, consider the following features:

- Customization: The ability to personalize the design and layout of your documents is key to making them align with your brand.

- Automation: Automatic reminders and recurring payment options can save you time and ensure timely payments.

- Integration: Look for software that integrates with other tools you use, such as accounting systems or payment processors.

- Reporting: Detailed reports and analytics can help you track your earnings, expenses, and unpaid balances.

By using the right software, you can create professional and accurate billing documents, making the process of receiving payments faster and more efficient for both you and your clients.

How to Track Payments with Billing Documents

Tracking payments efficiently is crucial for maintaining a healthy cash flow and ensuring that you are compensated for your work in a timely manner. Without a clear system for monitoring which transactions have been completed and which are still outstanding, it’s easy to lose track of payments and let overdue balances accumulate. Using a well-organized structure for your financial documents can significantly streamline this process and help you stay on top of your receivables.

Here are several methods to help you track payments effectively:

- Assign Unique Reference Numbers: Each payment request should have a unique reference number. This allows you to quickly identify each transaction and track its status, whether it’s been paid or is still pending.

- Set Clear Payment Due Dates: Always specify a clear due date for payment. This helps both you and your clients know when the payment should be made and provides a clear point of reference when following up on overdue payments.

- Use Payment Status Indicators: Clearly mark the status of each payment, such as “Paid,” “Pending,” or “Overdue,” on the document. This makes it easier to visually track the progress of each transaction.

- Leverage Software Tools: Many online tools and accounting software platforms offer automated payment tracking features. These platforms can automatically update the payment status, send reminders to clients, and provide real-time reports on unpaid balances.

- Maintain a Payment Log: Keep a separate record or log where you track payments manually. Include details such as the payment date, amount received, method of payment, and any relevant notes about the transaction. This will serve as a backup and give you a clear overview of your payment history.

- Send Payment Reminders: If a payment becomes overdue, send a polite reminder to your client with a reference to the outstanding document. You can automate this process with certain tools, or send reminders manually on a set schedule (e.g., 7 days before and 7 days after the due date).

By implementing these strategies, you can ensure that your payment process runs smoothly, reduce the risk of missed payments, and maintain better control over your finances. Clear tracking also strengthens your relationship with clients, as it shows your professionalism and attention to detail.

Incorporating Taxes into Billing Documents

When requesting payment for services rendered, it’s essential to include taxes in your payment request if applicable. Failing to account for taxes can lead to compliance issues or cause misunderstandings with clients regarding the total amount due. Properly incorporating taxes into your billing ensures transparency and helps avoid disputes while maintaining legal compliance.

Here are several steps to consider when adding taxes to your billing documents:

- Understand Tax Requirements: Research the tax laws in your location and any jurisdictions where you do business. Different regions may have different rates for sales tax, value-added tax (VAT), or other business-related taxes. Knowing these requirements is crucial to determining which taxes to apply.

- Specify Tax Rates: Clearly state the tax rate applied to your services. For example, if you are charging a 10% sales tax, make sure to list it separately on your document, and show the calculation for clarity.

- Break Down Tax Amounts: Break down the tax amount separately from the base amount for your services. This ensures that the client understands how the tax was calculated and makes it easier for them to review the total cost.

- Include a Tax ID Number: If required by your jurisdiction, make sure to include your tax identification number (TIN) or VAT number on the payment request. This provides legitimacy to the document and allows your clients to claim the appropriate deductions if needed.

- Indicate Tax Exemptions: If your client is tax-exempt, make sure to specify this on the document. You may need to provide documentation to support their exemption, so ensure this is handled correctly in your payment request.

- Stay Updated on Tax Changes: Tax laws and rates can change over time, so it’s important to stay informed about any updates that may impact your billing. Ensure that your tax rates are always current to avoid overcharging or undercharging your clients.

By incorporating taxes into your payment requests in a clear and organized manner, you not only ensure compliance but also build trust with your clients. Properly itemizing tax charges also makes it easier for clients to understand the total cost, minimizing any potential confusion or disputes.

Creating Professional and Clean Billing Documents

A well-designed payment request reflects professionalism and helps build trust with your clients. A clean and easy-to-read structure ensures that the client clearly understands the charges and payment terms, which can lead to faster payments and a smoother working relationship. Achieving a polished look for your billing documents is not only about aesthetics but also about making the financial details clear and straightforward.

Here are some key tips for creating professional and clean payment requests:

- Simple Layout: Avoid cluttering the document with unnecessary information. Use clear headings, proper spacing, and organized sections for each detail, such as services rendered, amounts, and payment terms.

- Consistent Branding: Include your company logo, name, and contact details in a prominent location. Use your brand colors and fonts to give the document a cohesive, branded look. This not only makes the document look professional but also reinforces your brand identity.

- Readable Fonts: Choose fonts that are easy to read, such as Arial or Times New Roman. Keep the font size large enough to be legible, especially for key details like amounts and dates.

- Itemized Details: Clearly list the services or products provided, along with their respective costs. Use bullet points or numbered lists to make this information easy to scan. Clients appreciate when they can quickly understand what they’re being charged for.

- Payment Terms: Clearly state your payment terms, including due dates, accepted payment methods, and any late fees or discounts for early payment. This eliminates any ambiguity and helps prevent payment delays.

- Professional Language: Always use polite, professional language in the document. Keep the tone respectful and avoid any jargon that might confuse the client.

- Clear Totals: Ensure that the final amount due is clearly marked and easy to locate. This could be in bold or underlined to stand out from the rest of the details.

- Proper Alignment: Align the text and numbers neatly to create a visually appealing and structured document. Ensure that all columns are even, and that there is enough white space to avoid a cramped look.

- Proofread: Always proofread your document before sending it. Small errors, such as typos in amounts or dates, can reduce the document’s professionalism and lead to confusion.

By following these tips, you can create a polished and clean payment request that reflects your professionalism and ensures clarity. A well-crafted document not only makes it easier for clients to understand their payment obligations but also reinforces your credibility and attention to detail.

Payment Terms Every Professional Should Include

When creating payment requests, it’s crucial to establish clear terms that set expectations for both parties. These terms not only help avoid confusion and misunderstandings but also ensure that you are compensated fairly and on time. Including the right information in your payment requests builds professionalism and streamlines the payment process, making it easier for your clients to understand the conditions of your services.

Essential Payment Terms to Include

Here are the key elements that should always be included in your payment requests:

- Payment Due Date: Always specify when the payment is due. This sets clear expectations and helps prevent delays. Be sure to state a specific date and avoid ambiguous wording like “ASAP.”

- Late Fees: If you intend to charge a fee for late payments, be sure to include the details. For example, “A 2% late fee will be applied for payments made after 30 days.” This encourages timely payments and prevents clients from delaying the process.

- Accepted Payment Methods: List the methods through which you accept payment, whether it’s bank transfer, PayPal, credit card, or another option. Make it easy for clients to choose the most convenient method for them.

- Discounts for Early Payment: Offering a discount for early payment can encourage quicker settlements. If you provide such incentives, clearly state the terms (e.g., “5% discount for payments made within 7 days”).

- Service Descriptions: A brief description of the services or products provided helps the client understand exactly what they’re paying for. This reduces the likelihood of disputes over what was delivered.

Additional Considerations

- Taxes: Clearly specify any applicable taxes, such as sales tax or VAT, and ensure these amounts are calculated correctly. If you’re registered for tax purposes, include your tax ID number as required.

- Payment Currency: If you work internationally or with clients from different regions, specify the currency in which the payment should be made. This prevents confusion and ensures accurate payments.

- Retainers and Deposits: If you require a deposit or retainer before starting work, include this in the payment terms, along with the amount and due date for the full balance.

How to Send Payment Requests to Clients

Sending payment requests to clients is a crucial step in ensuring you are paid for your work. The way you send these documents can influence how quickly the payment is processed and how professional you appear to your clients. It’s essential to follow a clear and efficient process to make the payment request as smooth and seamless as possible for both parties.

Here are the steps to follow when sending payment requests to clients:

- Choose the Right Delivery Method: Decide on the most effective way to send your payment request. Email is the most common and efficient method, but some clients may prefer physical copies or documents uploaded to a client portal.

- Attach the Document: When sending via email, attach the payment request as a PDF file. PDFs are universally accessible and prevent alterations to the document, ensuring that the client receives it exactly as intended.

- Include a Clear Subject Line: The subject line should clearly state the purpose of the email, such as “Payment Request for [Service/Product] – [Amount Due].” This makes it easy for the client to identify and prioritize your request.

- Personalize the Message: Write a brief, professional email body introducing the payment request. Mention any specific details, such as the due date and the services provided, and include a friendly note of appreciation for the client’s business.

- Double-Check the Details: Before sending, review the payment request to ensure all details are correct, including the amount due, payment terms, and client contact information. Ensure that your bank or payment details are accurate.

If sending through other methods:

- Using Client Portals: If the client uses a dedicated platform, follow their instructions for uploading documents. Ensure the document is correctly uploaded and labeled for easy reference.

- Postal Mail: For clients who prefer hard copies, print the payment request on professional letterhead and mail it to the client’s address. This method is slower, but it can sometimes be preferred for formal transactions.

It’s also essential to set reminders for follow-ups if the payment is not received by the agreed-

Setting Payment Due Dates in Billing Documents

Establishing a clear payment due date is an essential part of any financial document. A well-defined due date helps manage expectations for both you and your client, ensuring timely payment and preventing misunderstandings. Without a clear deadline, clients may delay payments, which can impact your cash flow and cause unnecessary stress. By setting appropriate due dates, you create a professional and organized process for both parties to follow.

When setting a payment due date, consider the following factors:

- Industry Standards: Certain industries or service types may have standard payment terms. For example, many service-based businesses typically use 30-day payment terms. However, always assess your client’s preferences and your own needs when determining the due date.

- Client Relationship: If you’re working with a long-term client who has a strong payment history, you may want to offer more flexible terms. Conversely, for new clients or those with inconsistent payment histories, shorter payment terms can be helpful to encourage prompt payment.

- Project Scope: The size and complexity of the project may also affect the payment due date. Large projects might warrant longer payment windows, while smaller or one-time services may require faster due dates to maintain cash flow.

Below is a sample table outlining various payment due date options and common practices:

Payment Term Typical Use Pros Cons Due on Receipt Immediate payment required, often for smaller services or products Quick payment, encourages immediate settlement May be perceived as too strict by some clients Net 30 Standard for many service providers Provides clients with a clear timeframe (30 days) Payment may be delayed if client has cash flow issues Net 15 Used for faster cash flow, often with smaller projects Faster payment than Net 30 May not be suitable for all clients 50% Upfront, 50% Upon Completion How to Follow Up on Unpaid Billing Documents

It’s not uncommon for payments to be delayed, even after you’ve submitted a clear and professional payment request. However, following up on overdue payments is a necessary part of managing your finances. The key to successful follow-ups is maintaining professionalism while ensuring that clients understand the importance of timely payments. A well-crafted reminder can help you get paid without damaging your business relationships.

Steps to Follow When Sending a Reminder

If the payment due date has passed, it’s time to send a follow-up. Here’s a step-by-step guide on how to approach the situation:

- Check the Details: Before contacting the client, verify that the payment due date has indeed passed and check if any payment was made. Sometimes, payments can be delayed due to bank processing or technical issues.

- Send a Friendly Reminder: If it’s only a few days past the due date, start with a friendly email reminding the client of the payment. Keep the tone polite and professional. Mention the due date and the outstanding balance without being confrontational.

- Offer Payment Methods: Sometimes the delay is due to issues with the payment process. Be sure to offer clear payment methods and offer assistance if they encounter difficulties. This could help expedite the process.

- Set a New Deadline: If the payment is still not received after your first follow-up, set a clear new deadline for when the payment is expected. Politely mention any late fees or consequences of further delays.

- Send a Formal Notice: If payment continues to be delayed, escalate the tone of the message. A formal notice that outlines the payment terms and includes information on late fees or legal consequences can be effective in pushing for a resolution.

Best Practices for Sending Payment Reminders

- Be Clear and Direct: Always be clear about the amount due, the due date, and the consequences of non-payment. Providing all this information in your reminders helps prevent confusion and makes it more difficult for clients to ignore the request.

- Use Professional Language: Always maintain a professional tone, even if the client is unresponsive. A calm, composed message reflects well on your business and keeps the door open for future collaboration.

- Use Automated Reminders: Many acco

Benefits of Automating Your Billing Process

Automating your billing process can significantly streamline the way you handle payments, saving time and reducing the risk of errors. By using automated systems, you can simplify routine tasks, ensure timely payments, and focus more on growing your business. Whether you’re managing a few clients or a large portfolio, automating these processes brings efficiency and professionalism to your financial management.

Here are some key benefits of automating your billing process:

- Time Savings: One of the most significant advantages of automation is the time saved. Instead of manually creating and sending payment requests for each client, automation tools can handle this for you, freeing up time for other important tasks.

- Accuracy and Consistency: Automation reduces human error, ensuring that details such as payment amounts, due dates, and client information are always correct. This leads to fewer mistakes and less time spent on correcting errors.

- Faster Payments: With automated reminders and payment tracking, you can ensure that clients are promptly reminded of upcoming payments or overdue balances. This increases the likelihood of receiving timely payments and improves cash flow.

- Professional Appearance: Automated systems often include professionally designed templates, which can improve the overall presentation of your billing documents. This helps reinforce your business’s professionalism and builds trust with clients.

- Recurring Billing: For clients with ongoing projects or subscriptions, automation makes it easy to set up recurring billing schedules. This ensures you don’t have to manually create a new request each month, saving you time and effort.

By automating your billing process, you’re not only making your workflow more efficient but also creating a smoother experience for your clients. With automatic reminders, tracking, and payment collection, you can focus on delivering quality work, while the system handles the financial side of things.