Freelance Invoice Template for Canada Customizable and Easy to Use

Managing finances and ensuring timely payments is a crucial part of any independent professional’s workflow. A well-structured document that outlines the terms of service and payment details helps streamline the process and maintain a professional image. Whether you’re providing a service or delivering a product, having the right tool to formalize transactions can significantly improve cash flow and reduce the chances of misunderstandings with clients.

Creating a professional billing document requires a clear understanding of what needs to be included. From specifying the amount due to setting payment deadlines, the details on these forms play a vital role in fostering trust and transparency. A properly designed document not only ensures clients know exactly what they owe, but it also makes it easier for you to track your income and manage your finances.

Tailoring these documents to suit your unique business needs is essential. This allows you to reflect your branding, customize payment terms, and even incorporate legal requirements specific to your location. By having an adaptable framework in place, you can focus more on your work and less on administrative tasks, ensuring you maintain a steady flow of income while minimizing errors or delays in payments.

Billing Document for Independent Professionals in Canada

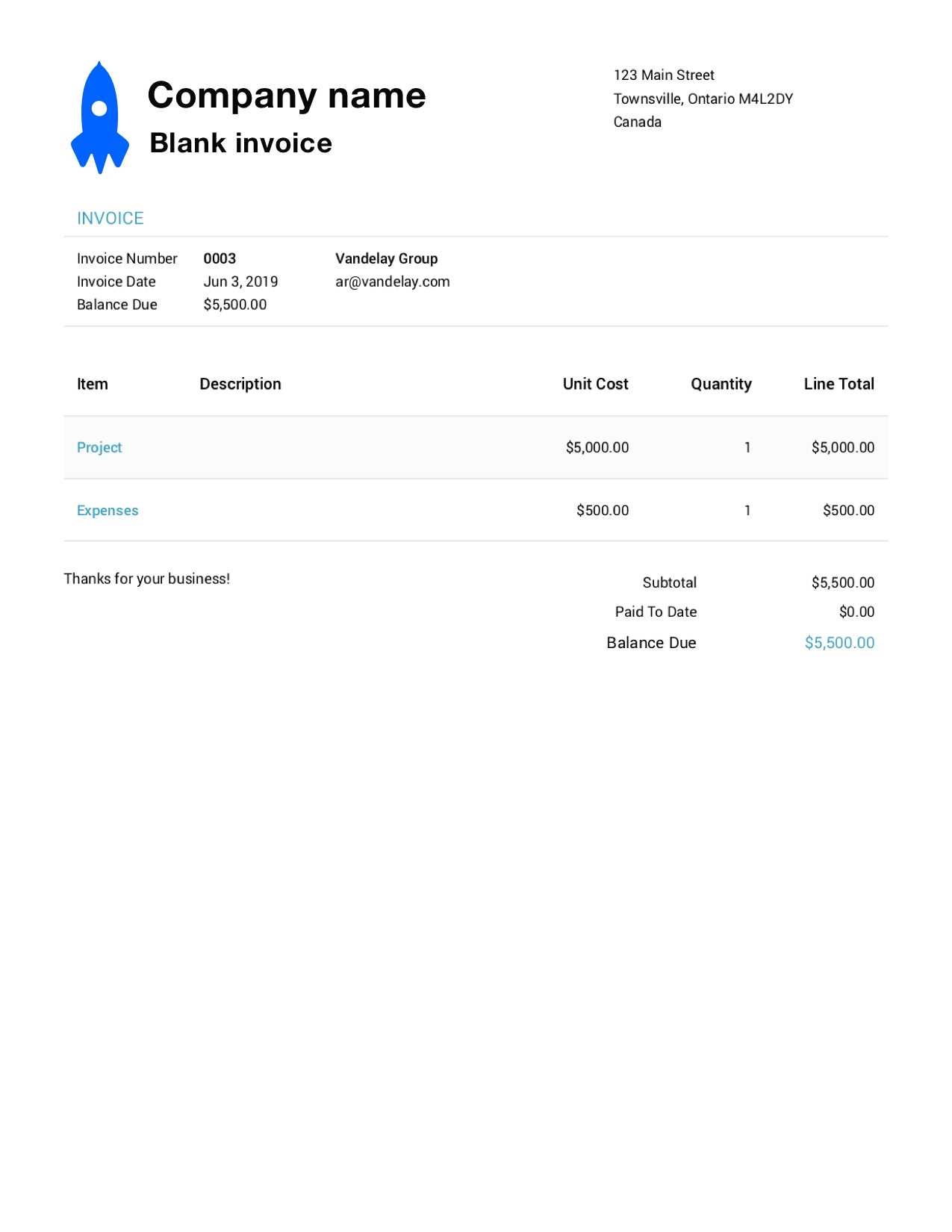

For independent professionals, having a structured and easily customizable billing document is essential to ensuring smooth transactions with clients. This document not only specifies the work completed and the agreed payment terms, but also helps maintain a professional appearance and establishes clear expectations. With the right framework, you can streamline your financial processes and avoid potential misunderstandings over payments.

In the Canadian context, there are specific legal and tax requirements to consider when drafting your billing documents. Including the correct details, such as applicable taxes and your business registration information, ensures compliance with local regulations. This approach minimizes errors and makes your payment requests more transparent to clients.

Whether you work on a project basis, hourly rate, or another pricing model, having a standardized yet flexible document simplifies the entire process. By using a well-organized format, you can easily adapt to different client needs while keeping track of payments and services rendered in a consistent manner.

What is a Billing Document for Independent Workers?

A billing document is a formal request for payment issued by a service provider to a client. It serves as a detailed record of the work completed, the agreed-upon rate, and the total amount due. This document helps ensure that both parties are clear about the terms of the transaction, providing transparency and reducing the likelihood of disputes over payment.

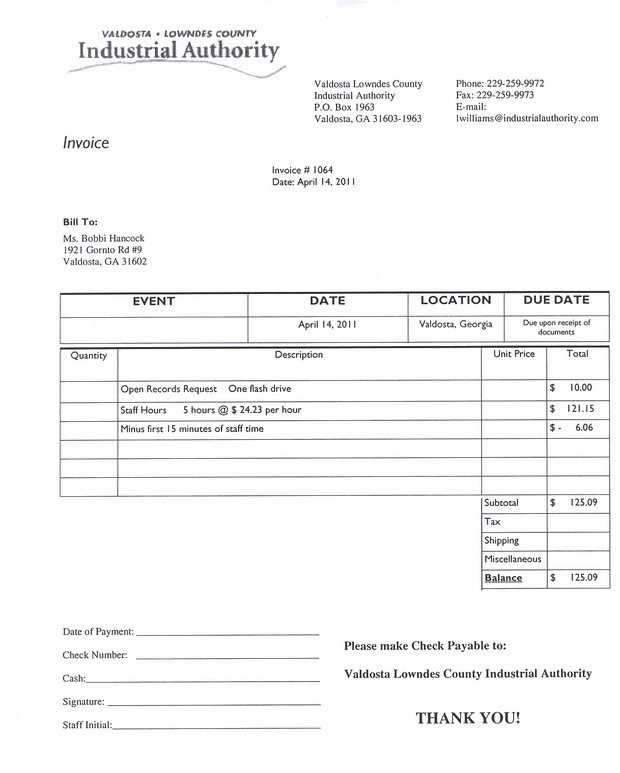

Key Components of a Billing Document

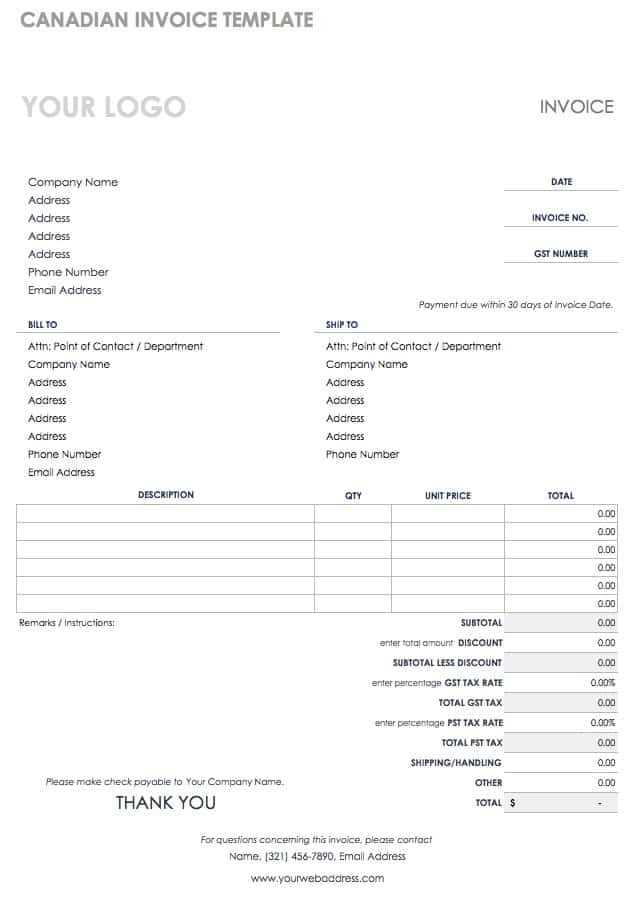

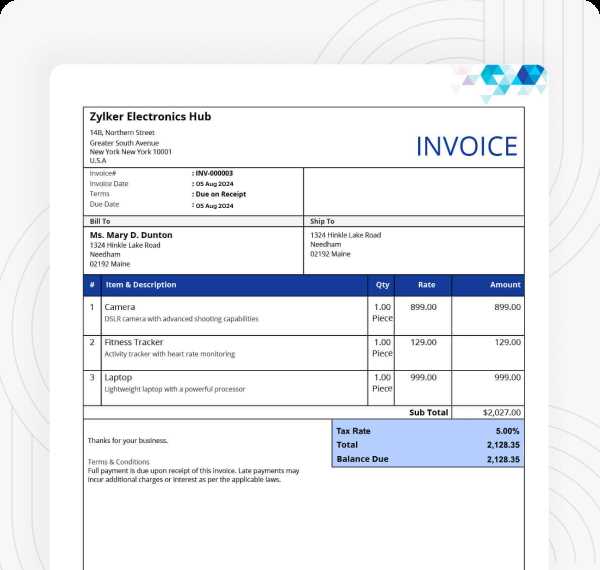

Typically, a billing document will include several key elements: the service provider’s contact information, a description of the work performed, the date the service was rendered, the amount owed, and the payment due date. It may also contain additional details such as applicable taxes, business registration numbers, and payment methods accepted. This structure makes it easy for clients to understand the charges and for service providers to maintain proper financial records.

Why is It Important for Independent Workers?

For independent workers, a well-crafted billing document not only facilitates payment but also helps maintain professionalism in business dealings. It serves as a legal record in case of disputes and ensures compliance with tax regulations. By using a standardized format, workers can save time, reduce administrative burden, and focus on their work rather than worrying about payment issues.

Why Independent Workers in Canada Need a Structured Document

For professionals who operate on their own, having a reliable, pre-designed document to request payment is crucial for efficiency and professionalism. A well-structured record not only saves time but ensures accuracy, making the entire process of billing clients smoother. Without a standardized approach, individuals risk confusion over payment terms, missed deadlines, and even non-payment. Utilizing a consistent framework helps mitigate these issues and promotes a more organized workflow.

In the context of Canadian workers, there are additional factors to consider, such as compliance with local tax regulations and the inclusion of required legal information. A ready-made structure that can be easily customized to meet these specific needs simplifies the billing process and reduces the chances of costly errors.

Benefits of Using a Structured Billing Document

| Benefit | Description |

|---|---|

| Time Efficiency | A consistent format reduces the amount of time spent on creating documents from scratch for each client. |

| Legal Compliance | Including necessary tax and business details ensures compliance with Canadian regulations. |

| Professionalism | Sending a well-organized document presents a more polished and trustworthy image to clients. |

| Reduced Errors | A fixed structure reduces the chance of mistakes, ensuring accurate billing details every time. |

How to Create a Custom Billing Document

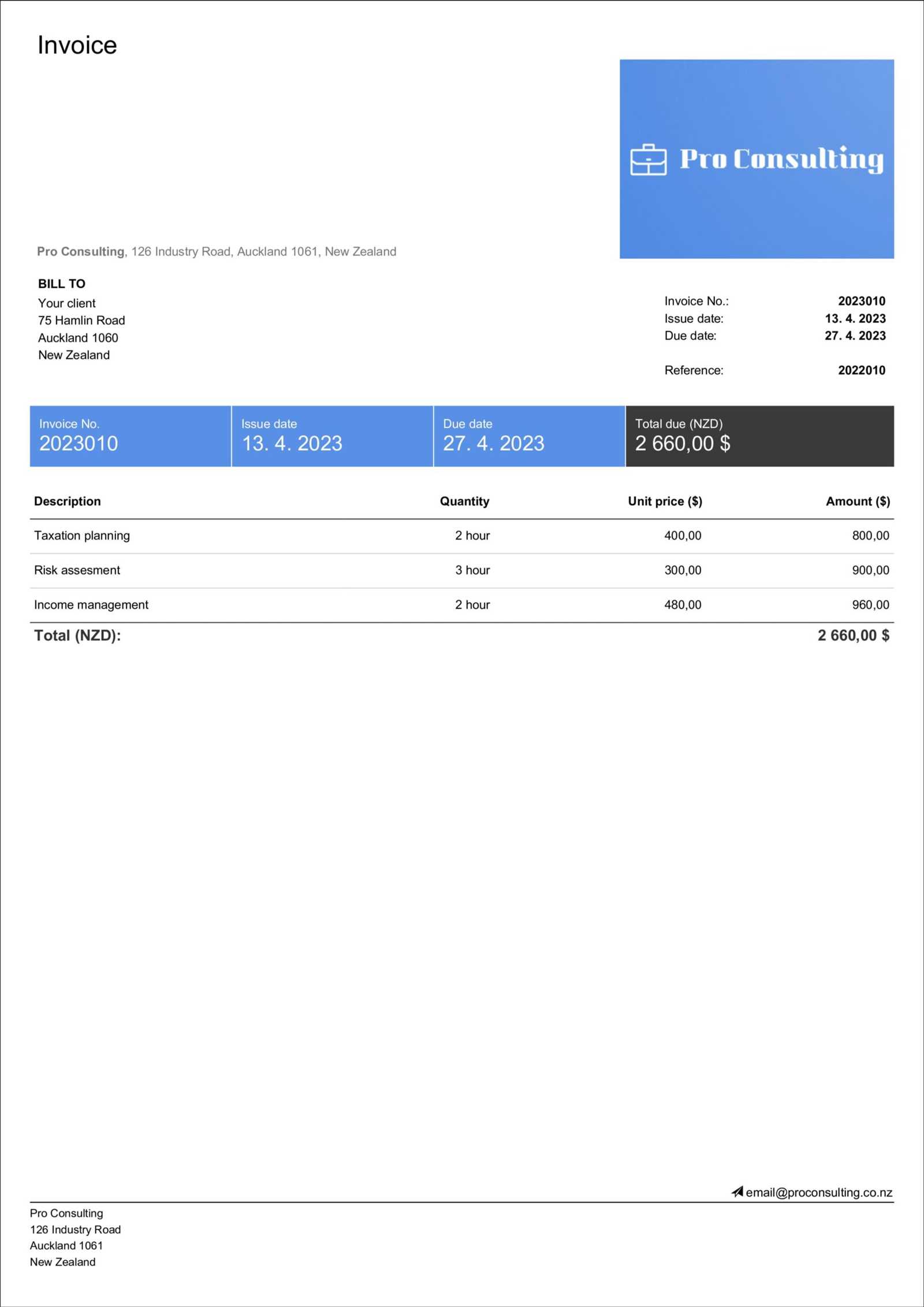

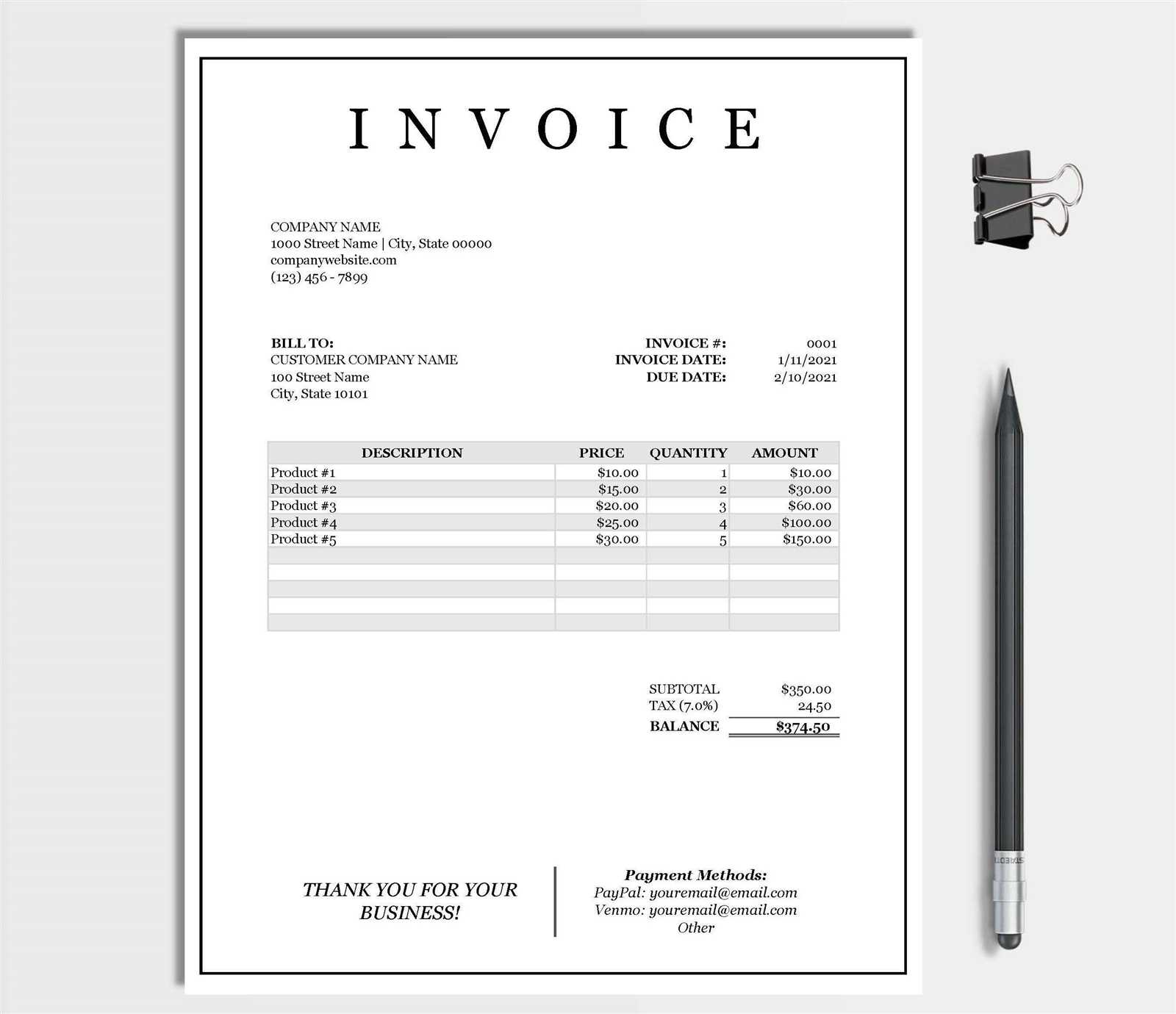

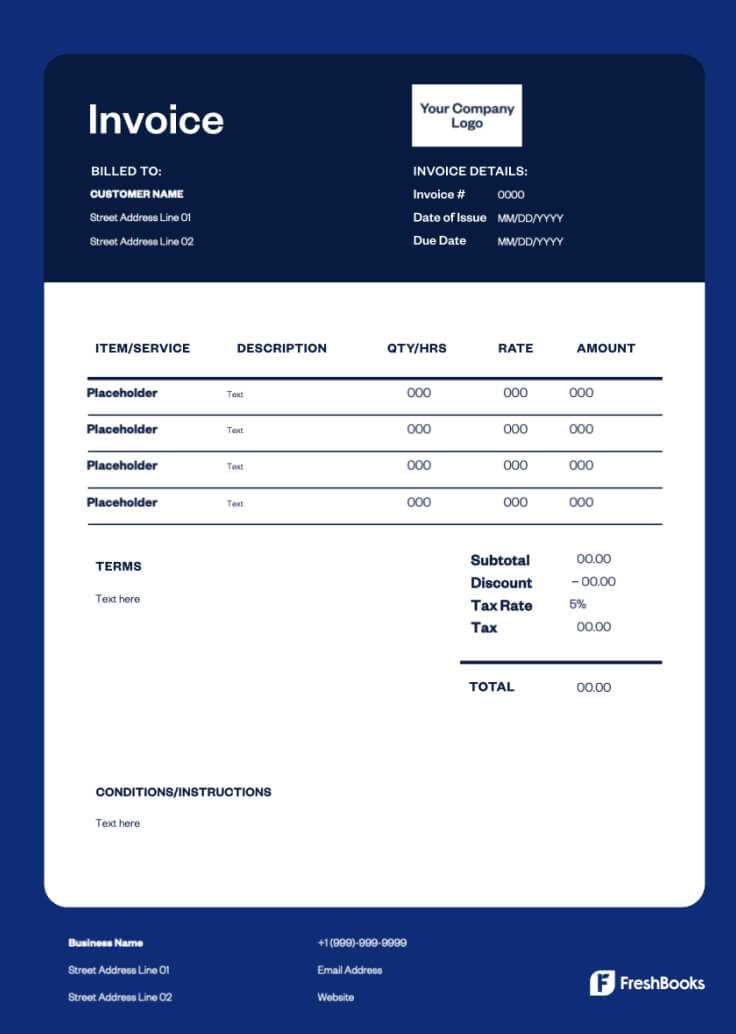

Creating a customized billing document allows independent professionals to tailor their requests according to the specific needs of each project and client. A well-designed document not only makes the payment process clearer but also enhances professionalism. By following a few straightforward steps, you can create a custom document that includes all necessary details while reflecting your unique business style.

Steps to Create a Custom Document

Follow these essential steps to design your own billing document:

- Include Your Business Information: At the top, provide your full name or business name, address, phone number, and email. This ensures the client knows who the document is from and how to reach you for any questions.

- Client Information: List the client’s name or business name, their address, and contact details. This makes the document personal and specific to the transaction.

- Describe the Services: Clearly explain the services or products provided. Break down the work in detail, including hours worked or units delivered, to avoid any confusion.

- Specify Payment Terms: Include the total amount due, the payment deadline, and your preferred payment method. You may also want to outline late fees or other charges if applicable.

- Include Taxes: If applicable, include any required taxes such as GST or HST, ensuring the correct tax rates are applied for your region.

- Numbering the Document: Assign a unique identification number to each billing document for easy tracking. This is especially important for record-keeping and future reference.

Customization Tips

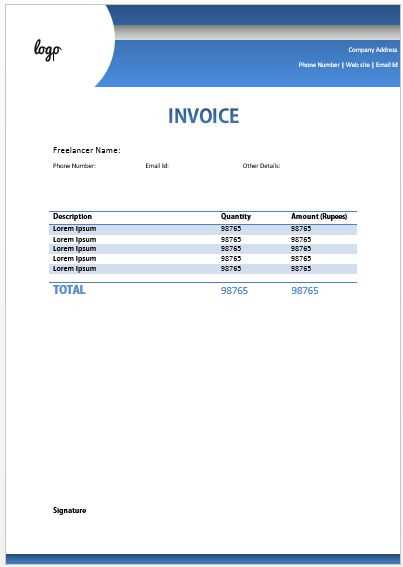

To make your billing document stand out and suit your business style, consider the following customizations:

- Branding: Add your logo or choose a color scheme that matches your brand. This helps present a cohesive and professional image to clients.

- Personal Touch: Include a thank-you note or a personalized message to make the document feel more professional and considerate.

- Adjust Payment Methods: Depending on the client, offer different payment options such as bank transfer, PayPal, or checks.

Essential Elements of a Canadian Billing Document

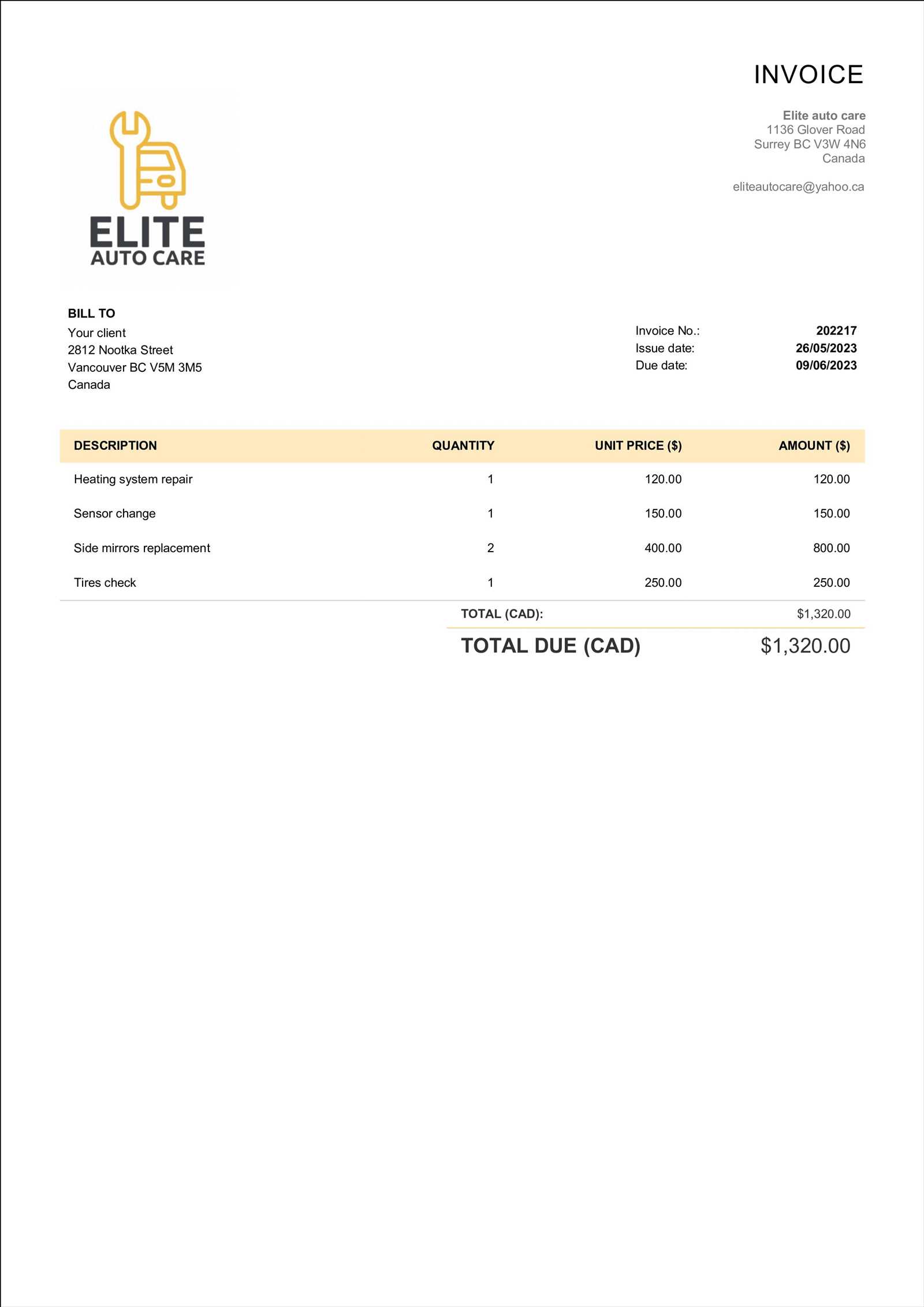

For professionals working independently, having the right components in a billing document is crucial for clarity and legal compliance. In addition to basic details such as the amount due, a properly formatted document must include specific information required by local tax laws and business regulations. Understanding what to include in your billing request ensures smooth transactions and helps avoid potential legal or financial issues.

Key Components of a Billing Document

Here are the essential elements that should be included in any billing request for Canadian professionals:

| Element | Description |

|---|---|

| Service Provider Information | Your full name, business name, address, and contact details should appear at the top of the document. This allows the client to easily identify who the payment is being requested from. |

| Client Information | The client’s name or business name, address, and contact information must be listed. This ensures the document is properly addressed and is specific to the transaction. |

| Detailed Description of Services | Clearly describe the services or goods provided, including quantities, rates, and work hours. This breakdown helps both parties confirm the details of the transaction. |

| Amount Due | The total amount owed, including any applicable taxes, should be clearly stated. This ensures there is no confusion about the expected payment. |

| Tax Information | In Canada, it’s necessary to include any relevant taxes such as GST or HST. Make sure to list the tax rates used and provide a total of taxes owed. |

| Payment Terms | Clearly state the due date and payment methods. Indicate if there are any penalties for late payments or early payment discounts. |

| Document Number | Assign a unique identification number to each billing document for easy tracking and reference. |

Additional Optional Elements

While not mandatory, you may choose to include the following to further personalize your billing document:

- Notes or Special Instructions: You can add a personal note or instructions for the client regarding the payment process.

- Business Registration Number: Including your business registration number may be required depending on your location or business type.

- Late Fee Information: If applicable, you can specify any fees that will be charged for overdue payments.

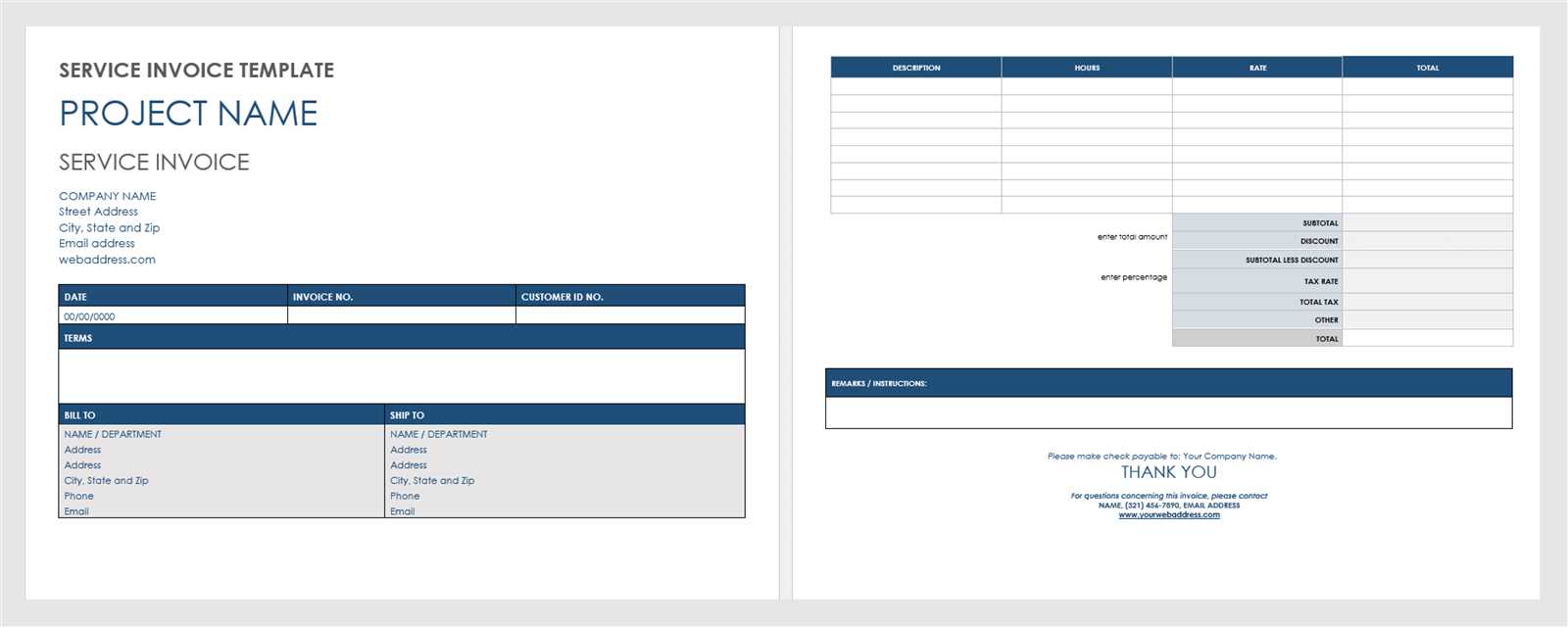

Choosing the Right Format for Billing Documents

When creating a billing document, selecting the correct format is crucial for ensuring clarity and ease of use. The format you choose should be professional, simple to understand, and adaptable to various business needs. Whether you’re sending the document via email or printing it for physical delivery, the layout should reflect your brand while meeting both your and your client’s expectations.

Factors to Consider When Choosing a Format

There are several key factors to keep in mind when deciding on the best structure for your billing documents:

| Factor | Consideration |

|---|---|

| Clarity | The format should be clean and straightforward, with clear headings, descriptions, and totals to avoid confusion. |

| Compatibility | The document should be easily viewable and editable in widely used file formats such as PDF, Word, or Excel. This makes sharing and editing easier. |

| Customization | The format should allow for customization, enabling you to add your branding, modify payment terms, and include specific service details for each client. |

| Professional Appearance | The layout should be neat and well-organized, conveying professionalism. A poorly structured document can undermine your reputation. |

| Accessibility | Ensure the document can be easily accessed by your client on multiple devices, from smartphones to desktop computers. |

Popular Formats for Billing Documents

Here are a few popular formats that professionals use for creating billing documents:

- PDF: The most commonly used format for formal billing documents. It preserves the layout and design regardless of the device used to view it.

- Excel: Ideal for more complex billing needs, such as tracking multiple line items or calculating totals automatically.

- Word: Useful for simpler billing documents, especially if you need to customize the content often or if you’re working with clients who prefer editable files.

How to Add Taxes to Your Billing Document

Including taxes in a billing document is essential for ensuring compliance with local tax regulations. Whether you are charging for services or products, taxes must be clearly outlined to avoid confusion and ensure the correct amount is paid. It is important to understand the tax rates applicable in your region and how to calculate and present them on your document. This process helps both you and your client understand the financial breakdown and ensures you remain compliant with local laws.

Types of Taxes to Include

There are various types of taxes that may apply depending on your location and the nature of the goods or services provided. In Canada, for example, you might encounter:

- GST (Goods and Services Tax): A federal tax applied to most goods and services in Canada.

- HST (Harmonized Sales Tax): A combined federal and provincial tax applied in certain provinces.

- PST (Provincial Sales Tax): A tax specific to certain provinces that is added to the total cost of goods and services.

Steps for Adding Taxes to Your Billing Document

To accurately calculate and add taxes to your billing document, follow these steps:

- Determine the Tax Rate: Research and confirm the appropriate tax rate based on your location and the nature of your services or products. For example, GST or HST rates may vary depending on your province.

- Calculate the Tax Amount: Multiply the total amount of the service or product by the applicable tax rate. For example, if the rate is 5% and the total is $100, the tax amount would be $5.

- Clearly Display the Tax: On your document, include a separate line or section where the tax amount is displayed. This ensures transparency and helps clients understand how the final total is calculated.

- Show the Total Amount: Add the calculated tax to the original amount for a total that includes both the cost and the applicable taxes.

Example: If you are charging $200 for a service and the applicable tax rate is 5%, your tax amount would be $10. The total due would be $210.

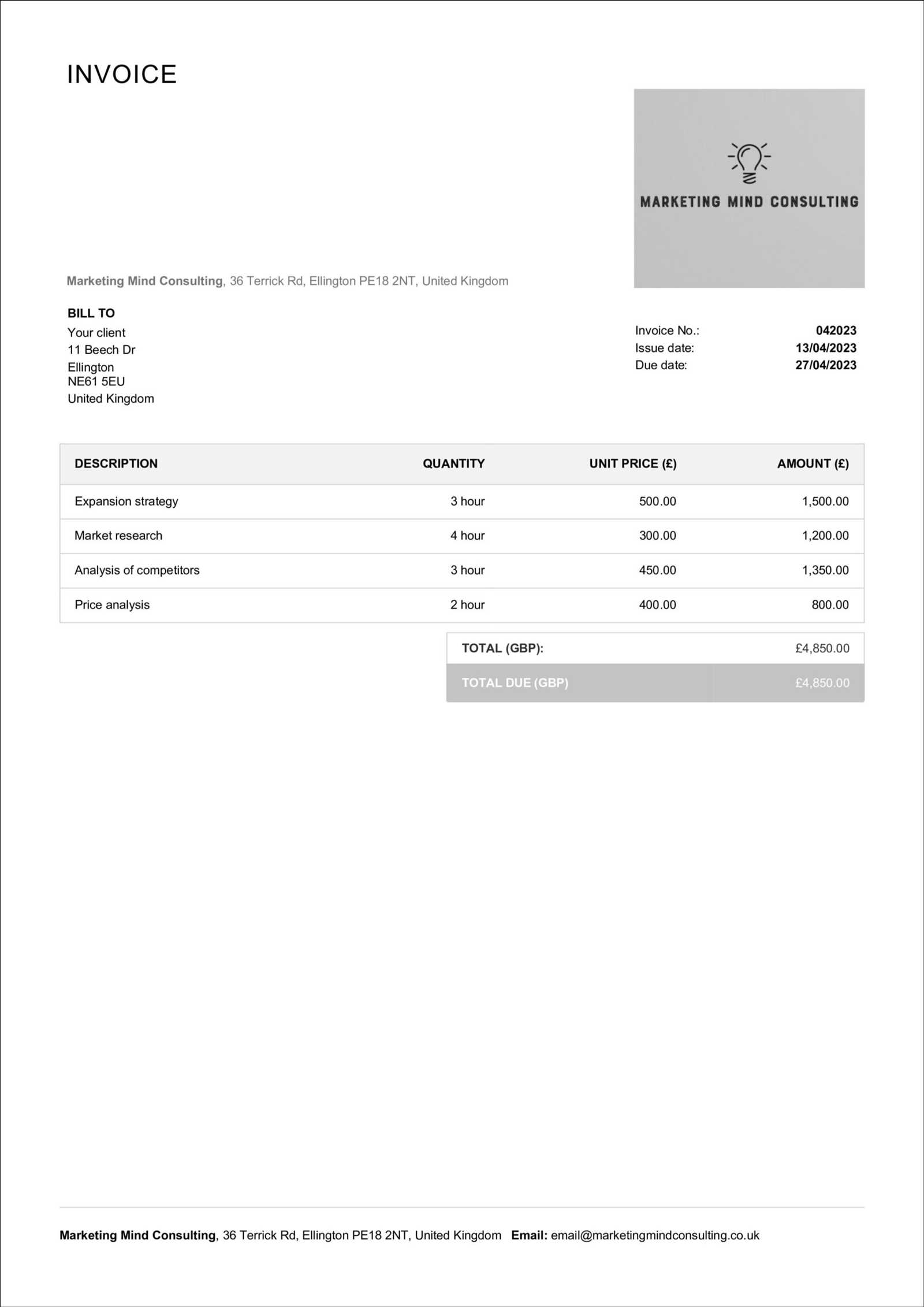

Including Payment Terms in Your Billing Document

Clearly outlining payment terms in your billing document is essential to ensure both you and your client are on the same page regarding payment expectations. This section of the document establishes the due date, payment methods, and any additional conditions for late payments, helping to prevent confusion and delays. Well-defined terms protect both parties and contribute to smooth financial transactions.

Key Payment Terms to Include

Here are some important details to consider when outlining payment terms in your billing document:

- Due Date: Clearly specify the date by which payment should be received. Common practice is to allow 30 days from the issue date, but this may vary depending on your agreement with the client.

- Accepted Payment Methods: List all the payment methods you accept, such as bank transfers, credit cards, PayPal, or checks. This ensures the client knows how to proceed with payment.

- Late Payment Fees: If you plan to charge a penalty for late payments, include this information. Be specific about the fee structure (e.g., a fixed fee or a percentage of the total amount) and how long after the due date it will be applied.

- Early Payment Discounts: If applicable, offer a discount for early payment. For example, a 2% discount if paid within 10 days.

- Payment Installments: For larger amounts, you may consider allowing payment in installments. Clearly outline the amounts and due dates for each installment.

How to Phrase Payment Terms

To make the payment terms clear and professional, you can use straightforward language. Here are some examples of how to phrase common payment terms:

- “Payment is due within 30 days from the date of this document.”

- “A late fee of 2% will be applied for payments made after the due date.”

- “A 5% discount will be applied if the total amount is paid within 10 days.”

- “Payments can be made via bank transfer, PayPal, or credit card.”

Clearly stating these terms helps prevent misunderstandings and sets expectations for both you and your client. Be sure to keep the language professional and concise, focusing on what both parties need to know to ensure timely and correct payment.

Legal Requirements for Independent Professionals in Canada

When working independently, it’s essential to comply with local laws and regulations to avoid potential legal issues. In Canada, there are several key requirements that professionals need to be aware of, including tax obligations, business registration, and the proper documentation for financial transactions. Ensuring that you meet these legal standards not only protects you but also builds trust with your clients.

Key Legal Considerations

As an independent worker, there are several important legal aspects you must consider when issuing documents for payment or conducting business:

| Legal Requirement | Description |

|---|---|

| Business Registration | If your business income exceeds a certain threshold, you may be required to register your business with the government. This ensures you’re legally recognized and can operate professionally. |

| Tax Collection | Independent professionals are required to collect taxes, such as GST or HST, depending on the province. These taxes must be included in billing documents, and accurate records must be kept for tax purposes. |

| Incorporation | While not mandatory, incorporation may be beneficial for those looking to protect personal assets and gain certain tax advantages. It’s important to understand the benefits and legal implications of incorporating your business. |

| Record Keeping | Professionals must keep detailed and accurate records of all transactions for tax reporting. This includes maintaining copies of all documents related to business income and expenses. |

Taxation and Financial Documentation

Understanding the taxation process and ensuring that your financial records are accurate is vital for compliance. As an independent worker, you may need to remit taxes to the Canada Revenue Agency (CRA) periodically, depending on your earnings and the nature of your business. It’s essential to clearly outline taxes on any billing documents and keep track of all tax-related information for filing purposes.

Consulting a professional accountant or tax advisor can help ensure you’re meeting all legal obligations and avoid costly mistakes. By adhering to these legal requirements, you not only stay compliant with the law but also demonstrate professionalism in your business practices.

Common Mistakes to Avoid in Billing Documents

When creating billing documents, attention to detail is crucial to avoid common errors that can lead to confusion, delayed payments, or strained client relationships. Even seemingly small mistakes can have significant consequences, from incorrect totals to missing legal information. Being aware of these pitfalls can help ensure your documents are clear, professional, and effective in securing timely payment.

Common Errors in Billing Documents

Here are some common mistakes that professionals often make when preparing billing documents:

- Incorrect Calculation of Totals: One of the most common mistakes is failing to calculate totals accurately. Double-check all amounts, including taxes, discounts, and the final sum, to avoid errors that could delay payment.

- Missing or Incorrect Client Information: Failing to include the correct client name, address, or contact details can lead to confusion and even disputes. Always ensure that all information is up to date and accurate.

- Not Including Payment Terms: Without clearly defined payment terms, clients may not understand when payment is expected or how to submit it. Make sure to specify due dates, payment methods, and any late fees or discounts.

- Failure to Include Tax Details: Not listing taxes properly or omitting tax information altogether can lead to confusion or legal issues. Be sure to include the applicable tax rates (such as GST or HST) and clearly state the total amount of tax charged.

- Unclear Descriptions of Services: If the services or products provided are not clearly described, clients may question the charges. Include detailed descriptions and break down the work performed so the client knows exactly what they’re paying for.

How to Avoid These Mistakes

To avoid these common errors, follow these best practices:

- Double-Check Your Calculations: Always review your math before sending the document to the client. Consider using digital tools that can help automate calculations.

- Keep Client Information Up to Date: Ensure you have the correct and most current contact details for your client. This helps maintain a professional and reliable image.

- Clearly Outline Payment Terms: Be specific about when payments are due, accepted payment methods, and any additional terms or penalties for late payments.

- Include Tax Information: Research and apply the correct tax rates, and clearly show the breakdown of any taxes charged on your document.

- Provide Detailed Descriptions: Avoid ambiguity by thoroughly explaining the work performed or products delivered, listing the time spent or quantity sold as needed.

By being aware of these common mistakes and taking proactive steps to avoid them, you can ensure that your billing documents are accurate, professional, and effective in securing payment from your clients.

Free vs Paid Billing Document Formats

When it comes to preparing billing documents, many professionals face the choice between using free or paid formats. Each option comes with its own set of benefits and limitations, and understanding these differences can help you decide which solution best fits your needs. Whether you’re just starting or have an established business, the right format can streamline your financial processes and ensure your documents are professional and compliant.

Advantages of Free Billing Document Formats

Free formats are an attractive option for those looking to save on costs while still maintaining a professional appearance. These options are widely available and can be easily customized to suit basic business needs.

- Cost-Effective: The most obvious advantage is that they cost nothing, making them ideal for those just starting out or working with a limited budget.

- Easy to Access: Free formats are often readily available online and can be downloaded quickly, allowing you to start using them without any delays.

- Basic Functionality: For simple needs, free formats provide all the essential elements required to create a billing document, including space for service details, amounts, and payment terms.

Disadvantages of Free Billing Document Formats

While free formats are convenient, they may not offer all the features that paid versions provide. Here are some potential drawbacks:

- Lack of Customization: Free formats may have limited customization options, meaning you may not be able to fully match the design with your branding or business identity.

- Basic Design: The design of free formats is often simple and may not convey a highly professional image, which can be important for building trust with clients.

- Limited Support: Free formats typically do not come with customer support or advanced features, such as automated calculations or integrations with accounting software.

Benefits of Paid Billing Document Formats

Paid formats, on the other hand, offer a broader range of features and enhanced customization, making them suitable for businesses that need more advanced solutions.

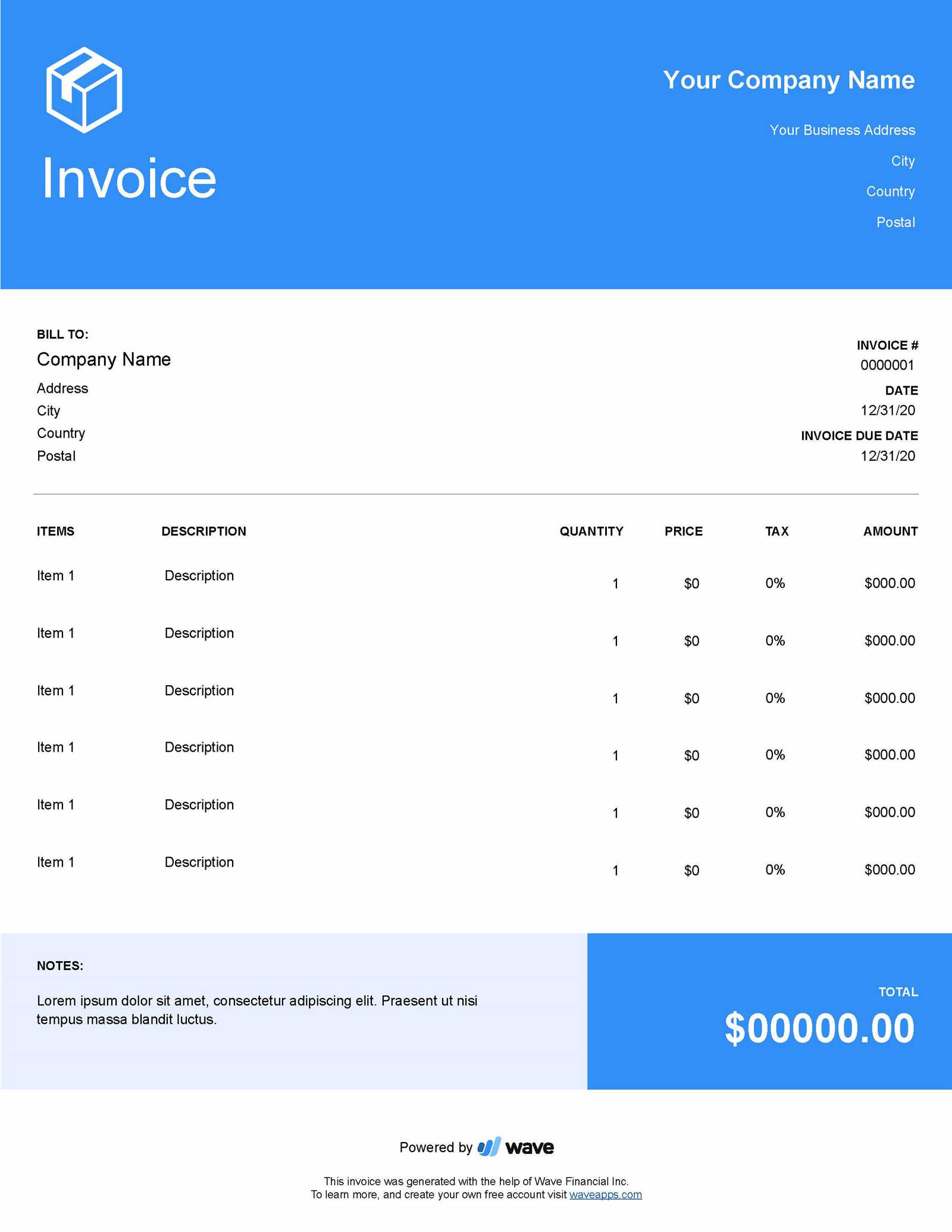

- Professional Design: Paid formats often come with sleek, polished designs that are tailored to create a more professional appearance, which can help build credibility with clients.

- Advanced Features: Paid options may include additional functionalities such as automatic tax calculations, customizable fields, and integration with accounting or payment systems.

- Ongoing Support: Many paid formats offer customer support, ensuring that you can get assistance if you encounter any issues or need help with customization.

While paid formats require an investment, they can save you time and effort in the long run by providing a more efficient and customizable solution.

How to Automate Billing Document Creation

Creating billing documents manually can be time-consuming, especially for independent professionals with multiple clients. Automation tools allow you to streamline the process, reducing the amount of time spent on repetitive tasks while ensuring accuracy and consistency. By automating the creation of your billing documents, you can focus more on your core work and less on administrative duties.

Steps to Automate Your Billing Document Creation

To automate the creation of your billing documents, follow these steps:

- Choose the Right Software: Select an automation tool or software that suits your business needs. Options like accounting software, cloud-based platforms, or invoicing applications often come with built-in automation features.

- Set Up Client Information: Input all relevant client details, such as names, addresses, payment methods, and billing preferences. Many tools allow you to store this information for future use, saving time on each new document.

- Configure Your Payment Terms: Define your payment terms, such as due dates, late fees, and accepted payment methods. This ensures that all future documents include the correct terms without needing to input them manually each time.

- Automate Calculations: Most automation tools can automatically calculate totals, taxes, and discounts based on the data you input. This eliminates the risk of human error in your financial calculations.

- Create Document Templates: Customize a document template within the software, specifying the layout, colors, and font styles. This ensures that all generated documents maintain a professional and consistent appearance.

Benefits of Automating Billing Document Creation

Automating your billing process offers several advantages:

- Time-Saving: Automation eliminates repetitive tasks, allowing you to focus on more important aspects of your business.

- Consistency: Automated documents maintain a consistent format, ensuring that all your records are uniform and professional.

- Improved Accuracy: By relying on software to handle calculations and data entry, you reduce the risk of errors in totals, taxes, and client information.

- Efficient Record Keeping: Automated systems often include features for organizing and storing documents, making it easier to track past transactions and manage financial records.

By incorporating automation into your workflow, you can simplify the process of creating billing documents, reduce errors, and save valuable time.

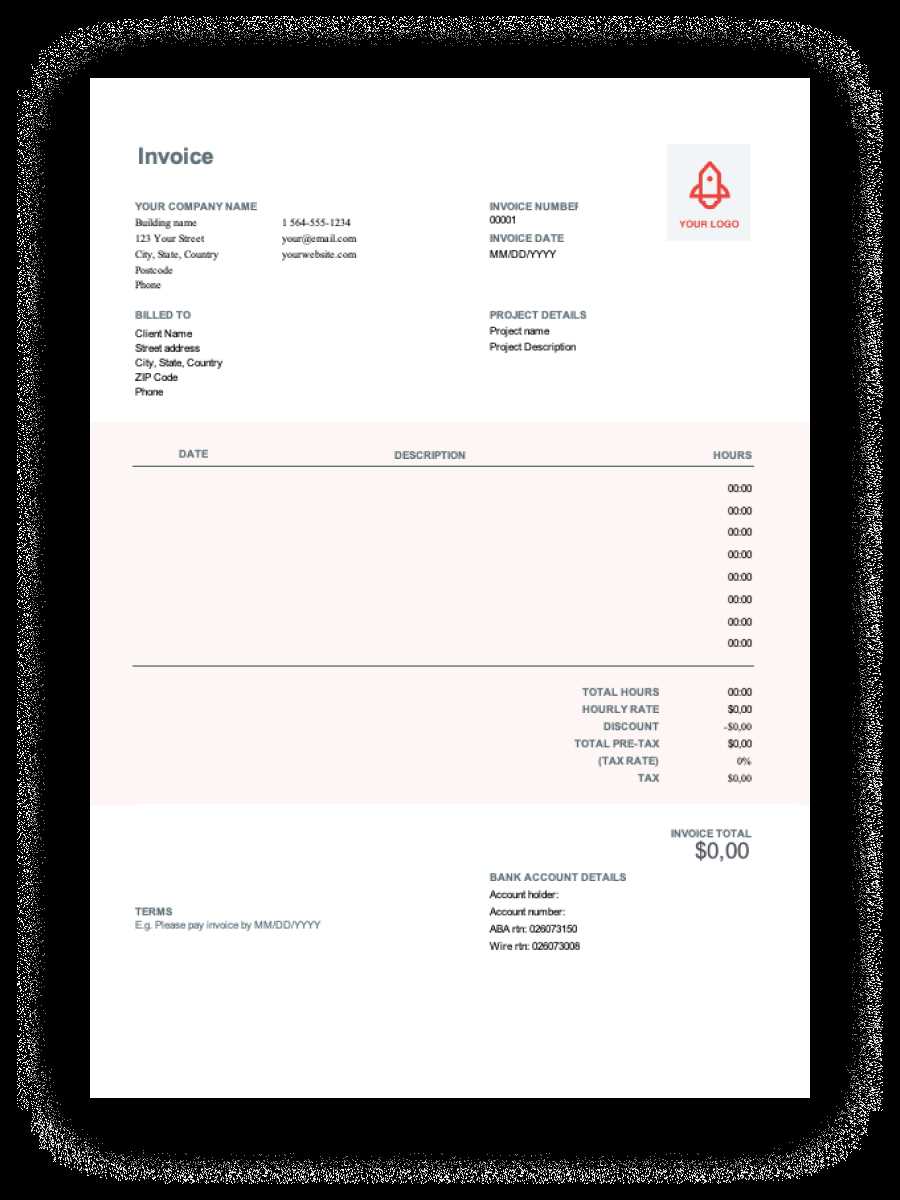

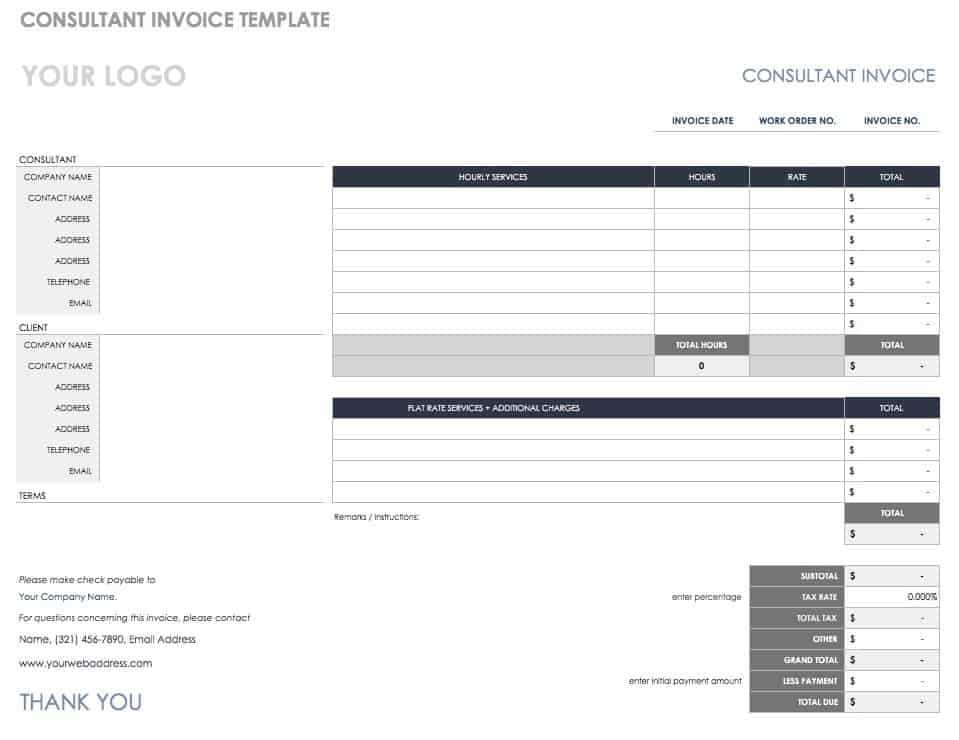

Setting Your Hourly Rate on Billing Documents

Determining the right hourly rate is a crucial aspect of any independent professional’s pricing structure. It ensures that you are compensated fairly for your time and expertise. When you include your hourly rate on a billing document, it not only reflects your worth but also helps your clients understand the basis of the charges. Setting the right rate requires careful consideration of various factors, from your experience to the nature of the work and industry standards.

There are several key elements to consider when setting your hourly rate:

- Market Research: Understand what others in your field and region are charging. Researching industry standards helps you stay competitive while ensuring that your rate aligns with what clients expect to pay for similar services.

- Experience and Skill Level: Your level of expertise should directly influence your rate. Professionals with years of experience or specialized skills typically charge more than those who are just starting out.

- Project Complexity: The complexity of the task should also impact your rate. More intricate or high-responsibility projects may justify a higher hourly charge, reflecting the additional time and expertise required.

- Client Type: Consider the client’s size and budget. Larger companies or high-profile clients may be able to afford higher rates than smaller businesses or individuals.

- Overhead Costs: Factor in any overhead costs you incur while working, such as software subscriptions, equipment, or business expenses. These should be considered when determining an appropriate rate to ensure you’re covering costs while making a profit.

Once you have determined your hourly rate, it’s important to clearly communicate it on your billing documents. This transparency helps clients understand the cost breakdown, fostering trust and reducing the likelihood of misunderstandings.

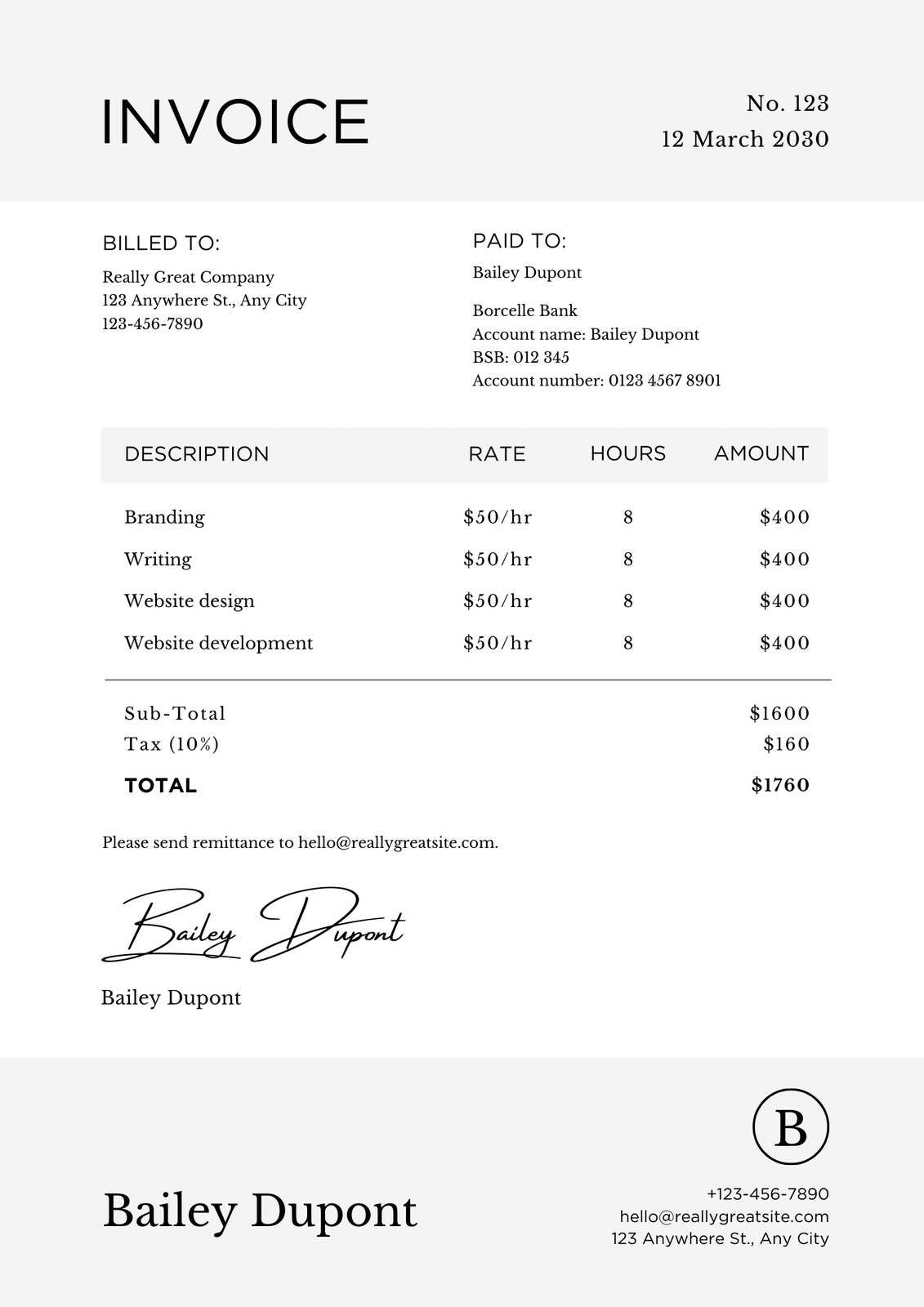

Example: If your rate is $50 per hour, and the client is billed for 10 hours of work, the total should be clearly outlined, along with the hourly rate, like this:

- Hourly Rate: $50/hour

- Total Hours Worked: 10 hours

- Tot

Understanding Canadian GST/HST on Billing Documents

When conducting business in Canada, understanding how Goods and Services Tax (GST) and Harmonized Sales Tax (HST) apply to your billing documents is essential for compliance and accuracy. Both of these taxes are applied to goods and services provided, and how they are handled on your documents can impact the overall amount due. It’s important to understand when and how to charge these taxes, as well as how to report them to the appropriate authorities.

What is GST/HST?

The Goods and Services Tax (GST) is a federal tax applied to most goods and services sold in Canada. The Harmonized Sales Tax (HST) is a combination of the GST and provincial sales taxes, and it applies in specific provinces that have harmonized their sales tax system with the federal government. Whether you need to charge GST or HST on your billing documents depends on your business location and the location of your clients.

- GST: This is a 5% tax that applies across Canada, excluding certain provinces where HST is applied instead.

- HST: This is a blended tax rate that combines the federal GST with provincial sales tax, ranging from 13% to 15%, depending on the province (e.g., 13% in Ontario, 15% in Nova Scotia).

When Do You Need to Charge GST/HST?

Not all businesses are required to charge GST or HST. The obligation depends on your annual revenue and whether you are considered a “small supplier.” Generally, if your revenue exceeds $30,000 per year, you must register for GST/HST collection. Below are key points to understand:

- Small Supplier Exemption: If your business earns less than $30,000 annually, you may not be required to register for GST/HST. However, you can voluntarily register to reclaim input tax credits on your business expenses.

- Taxable Services: If the services you offer are taxable, GST/HST must be applied to your billing documents. This includes most goods and services unless specifically exempted by the government.

- International Clients: If you are providing services to clients outside of Canada, GST/HST generally does not apply to i

Tips for Professional Billing Documents

Creating a professional and clear billing document is essential for maintaining strong client relationships and ensuring timely payments. The way you present your billing information speaks volumes about your business and can have a significant impact on your client’s perception of you. By following a few key tips, you can ensure that your documents are both functional and professional, leaving a positive impression while avoiding confusion or misunderstandings.

Key Tips for Crafting Professional Billing Documents

Here are some practical tips to enhance the professionalism of your billing documents:

- Include All Essential Information: Always ensure that the document includes crucial details, such as your business name, contact information, client’s details, an itemized list of services or products provided, the amount due, and payment terms.

- Use a Clear, Organized Layout: A cluttered or disorganized document can make it difficult for clients to understand. Use a clean layout with distinct sections and enough white space to make the document easy to read.

- List Services or Products Clearly: Be specific about what services or products were provided, including quantities, hourly rates, or per-item prices. A clear breakdown avoids confusion and ensures clients understand exactly what they are paying for.

- Use Professional Language: Use polite, professional language when writing your documents. Clearly outline the payment terms, including deadlines and any penalties for late payments. For example: “Payment is due within 30 days of receipt of this document.”

- Be Consistent with Your Branding: Your billing documents should reflect your business’s branding, including logo, colors, and fonts. This consistency reinforces professionalism and trustworthiness.

- Specify Payment Methods: Clearly state the acceptable payment methods (e.g., bank transfer, PayPal, credit card). If applicable, provide the necessary payment details or links to facilitate easy transactions.

Example of a Well-Structured Billing Document

Here is an example of how to structure a professional billing document:

Item Description Rate Quantity Total Service 1 Consultation on marketing strategy $100/hour 5 hours $500 Service 2 Design of promotional materials $200/hour 3 hours $600 Total Due $1,100 This structure is clear, easy to understand, and ensures your client knows exactly what they are being charged for. By adopting these strategies, you will foster trust, encourage prompt payments, and maintain a high level of professionalism in all your billing processes.

How to Track Your Billing Documents Effectively

Managing your financial transactions is a vital part of running a successful business. Keeping track of payments, deadlines, and outstanding amounts helps ensure that you stay organized and receive timely payments. Effectively tracking your documents not only helps you monitor cash flow but also simplifies tax preparation and reduces the chances of mistakes or missed payments. By implementing a system to track your billing documents, you can maintain a professional approach to your financial management.

Steps to Effectively Track Your Billing Documents

Here are some effective methods to help you stay on top of your billing and payments:

- Create a Centralized Record System: Organize all your billing documents in one place, whether it’s a physical file system or a digital folder. This ensures that you can easily reference past transactions and track any outstanding payments.

- Use a Tracking Software: Accounting or billing software tools allow you to automate the tracking process. These tools can notify you of overdue payments, generate reports, and offer detailed insights into your cash flow.

- Assign Unique Numbers: Give each document a unique reference number for easy identification. This allows you to track specific transactions and reduces confusion when searching for past documents.

- Record Payment Dates: Make sure to note the date on which each payment is due. This allows you to monitor whether clients are meeting deadlines and helps you manage any follow-ups if payments are late.

- Set Up Reminders: Schedule reminders to check on unpaid documents before the due date. Many software tools offer automatic reminders, but you can also set manual reminders on your calendar to stay proactive.

Using Automation to Track Billing Documents

Automation can significantly enhance your ability to track and manage your documents. Many accounting tools come with features that allow you to:

- Automate Follow-Ups: Automatically send payment reminders to clients after a certain period. This ensures that your follow-up process is consistent and timely.

- Generate Reports: Use software to generate reports that show overdue payments, payment history, and overall revenue. This helps you analyze your financial situation at a glance.

- Integrate Payment Systems: Some tools allow you to integrate your payment processor directly with your system, making it easier to track which documents have been paid and which are still pending.

By setting up an efficient tracking system, either manually or through automation, you ensure that your financial records are well-organized, reducing stress and improving the overall financial management of your business.

Customizing Billing Documents for Different Clients

Tailoring your financial documents to meet the specific needs of each client is an essential practice in professional business management. Every client may have different preferences, requirements, or expectations when it comes to how they receive and process payments. Customizing your documents ensures clarity, builds trust, and maintains professionalism while making the billing process smoother for both parties. Understanding how to adjust details such as payment terms, item descriptions, and even formatting can have a positive impact on your client relationships.

Key Aspects to Customize for Different Clients

Here are some important elements to consider customizing when preparing billing documents for various clients:

- Payment Terms: Different clients may require different payment schedules. Some may prefer to pay immediately, while others may request net 30, 60, or 90-day terms. Be sure to specify these details clearly on the document.

- Services or Products Description: Customize the descriptions of the services or products provided. Some clients may need more detail, while others might prefer a simplified version. Tailor your approach to what works best for each client.

- Client-Specific Discounts or Rates: If you offer special rates, discounts, or packages for specific clients, ensure that these are clearly indicated on the document. This will prevent misunderstandings and ensure that both parties are on the same page.

- Currency and Tax Rates: For international clients or those in different provinces, adjust the currency and tax rates accordingly. This ensures compliance and avoids confusion over payments.

- Personalized Branding: While your overall branding should remain consistent, some clients might appreciate documents that are specifically tailored to reflect their branding or business tone. You can adapt colors, logos, or fonts to match their preferences.

Example of a Customized Billing Document

Here’s an example of how you might structure a customized billing document for a specific client:

Item Description Rate Quantity Total Consultation Marketing strategy meeting $150 How to Send Billing Documents Securely

When sending financial documents to clients, ensuring their security is crucial. Sensitive information such as payment details, personal contact information, and pricing must be protected to prevent unauthorized access or fraud. By taking proper precautions, you can confidently send your billing documents while minimizing the risk of data breaches or errors. Implementing secure methods not only protects your business but also builds trust with your clients.

There are several approaches to securely sending your financial documents, depending on your tools and preferences. Here are some key steps to follow:

- Use Encrypted Email: If you are sending your document via email, make sure to encrypt it. This ensures that only the intended recipient can open and view the file. Email encryption services like PGP (Pretty Good Privacy) or S/MIME (Secure/Multipurpose Internet Mail Extensions) are reliable options.

- Send via Secure Cloud Storage: Services like Google Drive, Dropbox, or OneDrive allow you to store documents in the cloud and share secure links. You can set permissions to ensure only authorized users can access the file. Always use a password to protect the link, especially for confidential documents.

- Use Secure Payment Platforms: Some invoicing software and platforms like PayPal, Stripe, or QuickBooks offer built-in document delivery and payment options. These platforms typically ensure your documents are transmitted securely, and they offer encryption during both transmission and storage.

- Leverage Digital Signatures: Adding a digital signature to your document ensures its authenticity and integrity. This technology verifies that the document has not been altered and guarantees the identity of the sender. Tools such as Adobe Sign or DocuSign can help you integrate digital signatures into your documents.

- Double-Check Recipient Details: Before sending any document, always verify that the contact information (email address or physical address) for the recipient is correct. This reduces the risk of sending the document to the wrong person.

By using these secure methods, you can protect sensitive information, enhance professionalism, and ensure your billing process remains smooth and reliable. Securing your documents not only safeguards your business but also reassures clients that their personal and financial data is handled responsibly.