Freelance Hours Invoice Template for Effortless Billing and Time Tracking

Managing payments for services rendered is a crucial task for anyone working outside of traditional employment. For those offering specialized skills, creating accurate and professional records of completed tasks ensures both clarity and trust with clients. This process goes beyond simply requesting payment; it involves maintaining detailed accounts of work performed, ensuring proper compensation for time and effort.

Using the right tools to streamline this process can significantly improve efficiency. By customizing documents that clearly outline the scope of work, rate, and duration, independent workers can avoid confusion and minimize errors. Whether working on a short-term project or an ongoing collaboration, having a consistent and well-structured system can help maintain a smooth flow of business transactions.

Effective management of financial records not only supports transparent communication with clients but also plays a vital role in managing cash flow and ensuring timely compensation. Understanding the components that make up these records is key to optimizing the overall process and ensuring a positive professional relationship.

Freelance Hours Invoice Template Benefits

Having a structured document to outline the details of the services provided brings numerous advantages to professionals managing their own businesses. This tool not only helps in organizing payment requests but also ensures that all the necessary information is presented clearly to clients. It acts as both a professional representation of work completed and a record for future reference.

Clarity and Transparency

A well-organized record of work completed offers transparency, making it easier for both parties to understand the terms of payment. Clients can quickly verify the scope of the work, the time invested, and the agreed-upon rate, reducing the chances of misunderstandings or disputes. The clarity this document provides helps in fostering trust and a professional relationship between the contractor and the client.

Time-Saving Efficiency

Using a predefined structure to document completed tasks saves valuable time. Rather than creating records from scratch for each project, the ability to use a ready-made format speeds up the entire process. Professionals can focus more on their work and less on administrative tasks, leading to increased productivity.

Organizing records effectively also reduces the likelihood of errors and helps to track payments more efficiently. This system simplifies the process of following up on unpaid amounts and provides a clear overview of past transactions, making financial management smoother and more efficient.

Why Time Tracking Matters for Freelancers

Accurately monitoring the time spent on various tasks is essential for professionals working independently. Whether managing multiple clients or juggling several projects, keeping track of the time invested ensures that each task is properly accounted for and that payment is aligned with the actual work completed. Without a clear method to monitor time, it becomes difficult to assess project progress or evaluate personal productivity.

Time tracking not only helps with managing tasks efficiently but also aids in making informed decisions about workload and pricing. It provides insights into how much time is being spent on each aspect of a project, helping individuals adjust their schedules and better allocate resources. Additionally, tracking time allows for a more accurate assessment of the value of services provided, enabling professionals to set fair rates and improve overall profitability.

| Task | Time Spent | Billable Amount |

|---|---|---|

| Design Website | 10 hours | $500 |

| Client Meeting | 2 hours | $100 |

| Revisions | 3 hours | $150 |

Having a reliable system to track work ensures that professionals are paid fairly for the time they invest. It also helps build trust with clients, as they can clearly see how the time was allocated and whether it aligns with their expectations. By making time tracking a routine part of the workflow, individuals can improve their efficiency and maintain a transparent approach to their business operations.

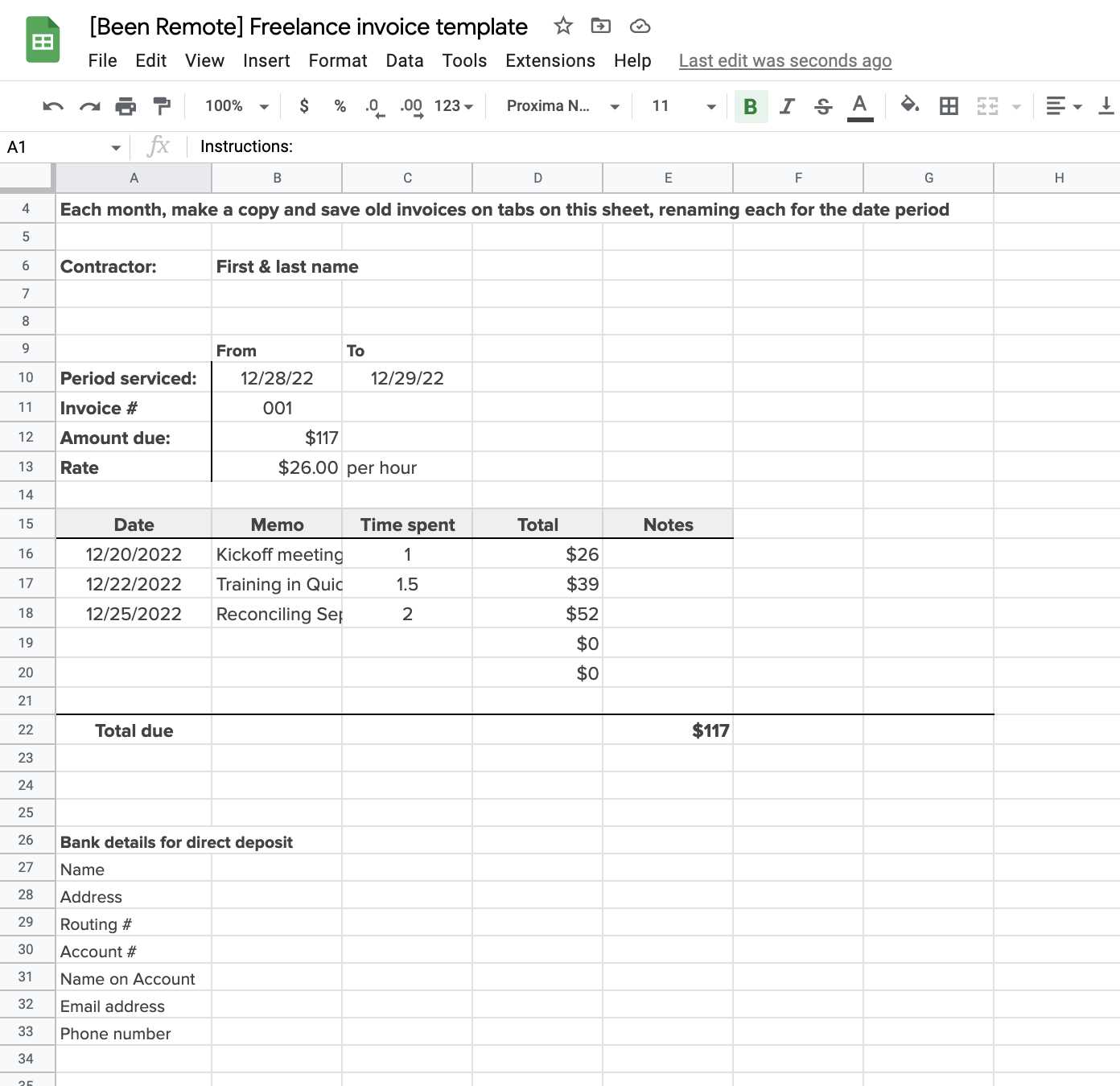

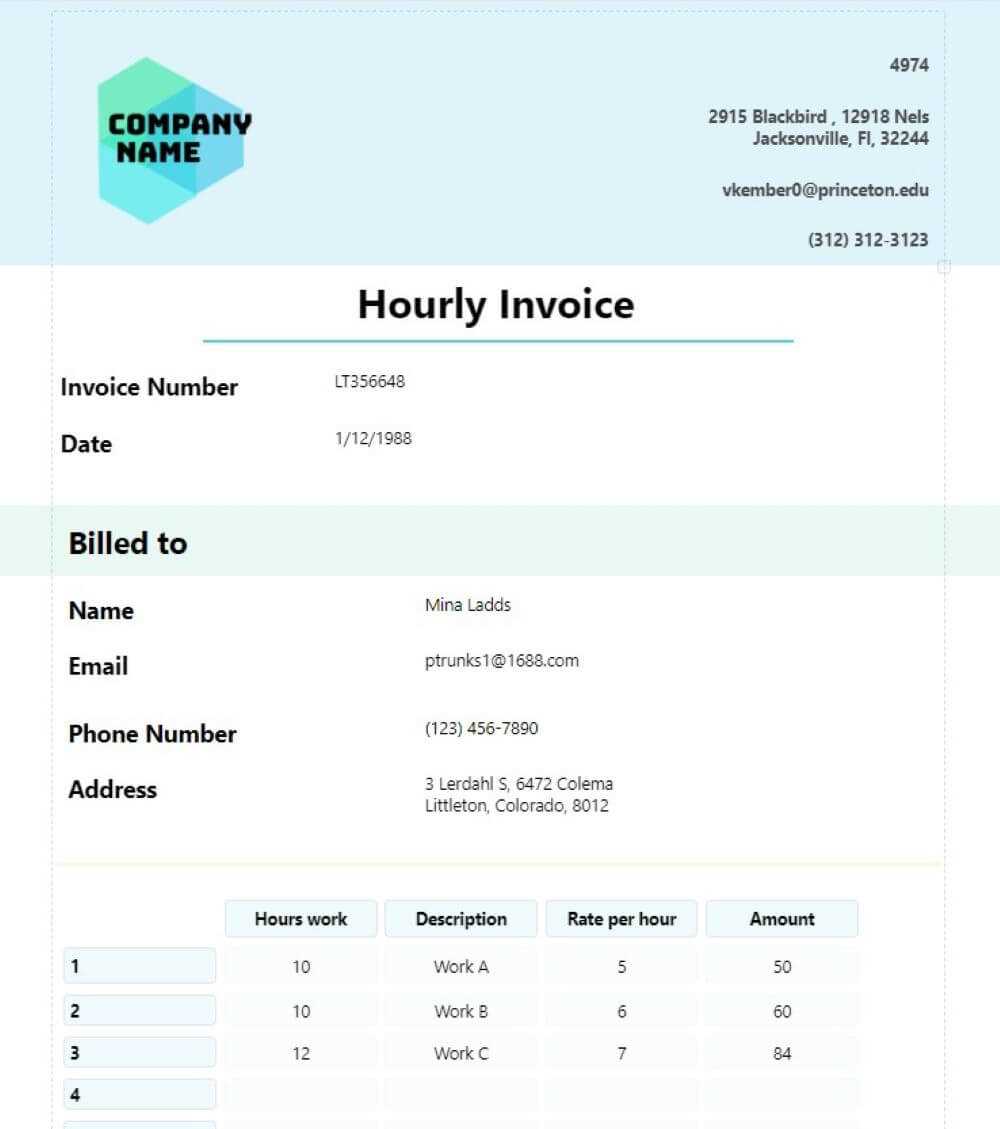

How to Create an Invoice for Work Completed

Creating a document that reflects the work you’ve done is an essential part of being compensated fairly for your time and skills. A well-structured statement outlines all relevant details about the tasks performed, the time spent, and the agreed-upon compensation, ensuring both clarity and professionalism. This document serves as a clear request for payment and a record of the services provided.

To begin, you should include key information such as the recipient’s name and contact details, your own information, and a unique reference number for the record. Next, list the specific tasks completed, the time dedicated to each task, and the rate for your services. Be sure to also include the total amount due, and consider providing a breakdown of the charges so that your client can see how the amount was calculated. Lastly, ensure that the payment terms and due date are clearly stated to avoid any confusion later on.

Example Breakdown:

- Task Description: Design Website Layout

- Time Spent: 10 hours

- Rate: $50 per hour

- Total Amount Due: $500

Including all relevant details like this not only helps prevent misunderstandings but also establishes you as a professional who values both their time and their client’s business. Remember to keep your document clear, concise, and free of any unnecessary information, so that your client can easily review and process the payment.

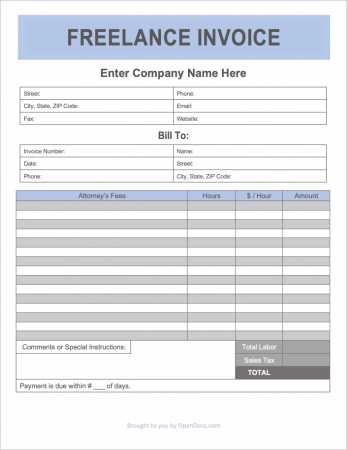

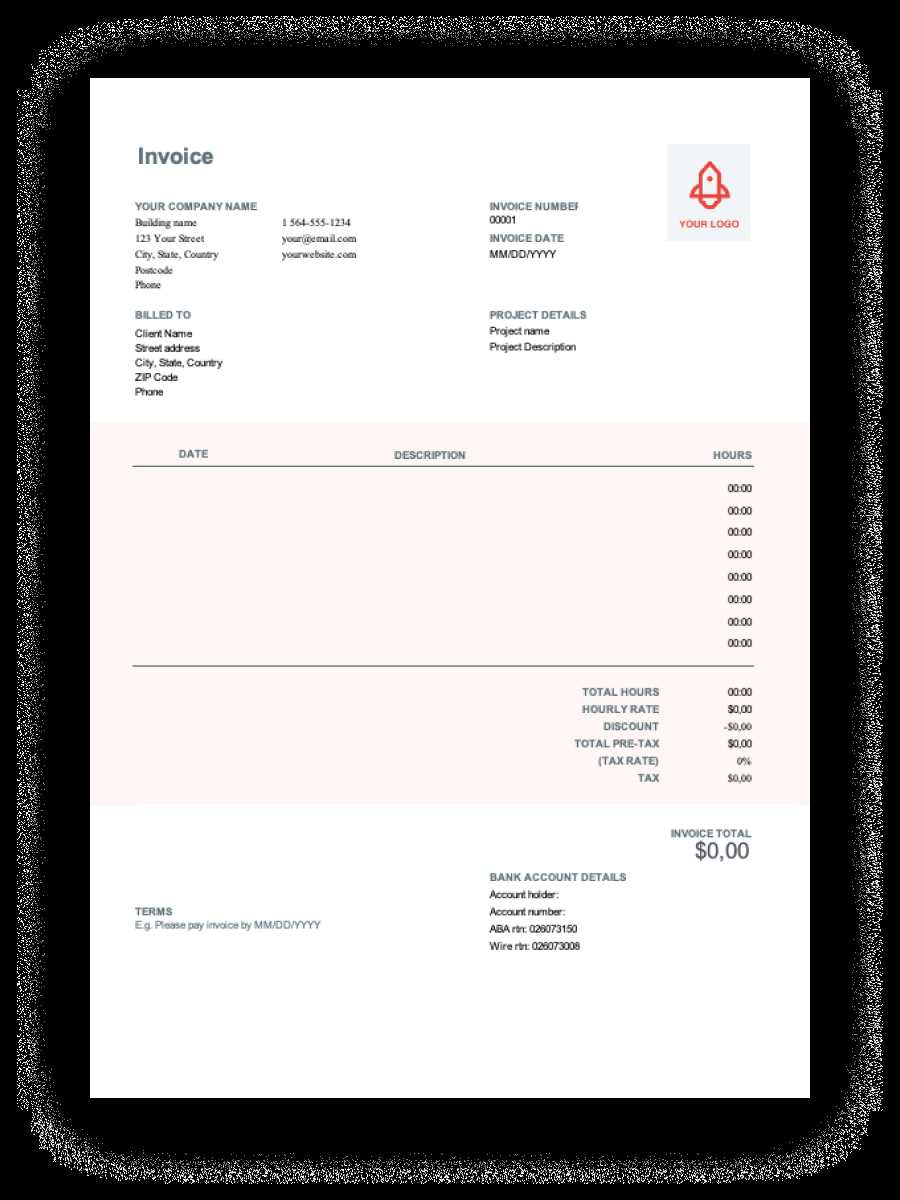

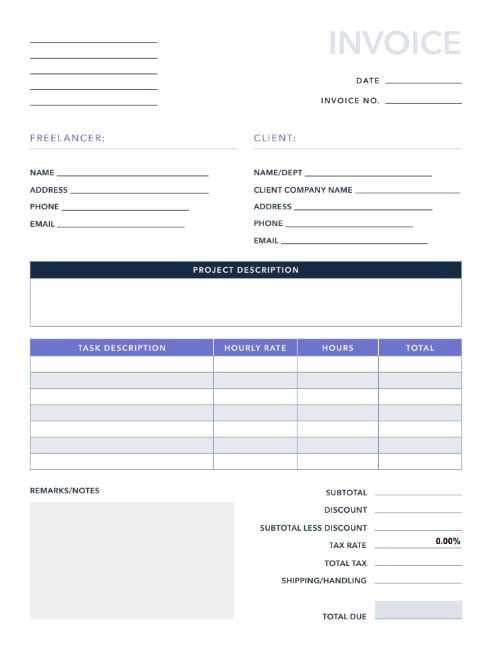

Essential Features of an Invoice Template

When creating a document to request payment for services rendered, it’s important to include key components that make the information clear and easy to understand. A well-designed structure helps both the service provider and the client to review the terms quickly, ensuring a smooth transaction. The following elements are crucial for making this document professional and effective.

- Contact Information: Clearly display the names, addresses, and contact details of both parties involved–yours and the client’s.

- Unique Identification Number: Each request should have a unique reference number for easy tracking and record-keeping.

- Task Descriptions: List the specific work completed, providing a concise explanation of each task for clarity.

- Service Duration and Rate: Include how long the work took and the agreed-upon payment rate, ensuring the details are clear for both sides.

- Total Amount Due: The sum to be paid, calculated from the rate and time or quantity, must be prominently displayed.

- Payment Terms: Define when payment is due, including any late fees or discounts for early payment, if applicable.

- Payment Methods: Specify accepted payment methods (e.g., bank transfer, PayPal, check) to avoid confusion.

By including these essential features, the document not only serves as a request for payment but also as a clear record of the services provided. This approach improves both transparency and professionalism, making it easier for clients to process and for service providers to track their earnings effectively.

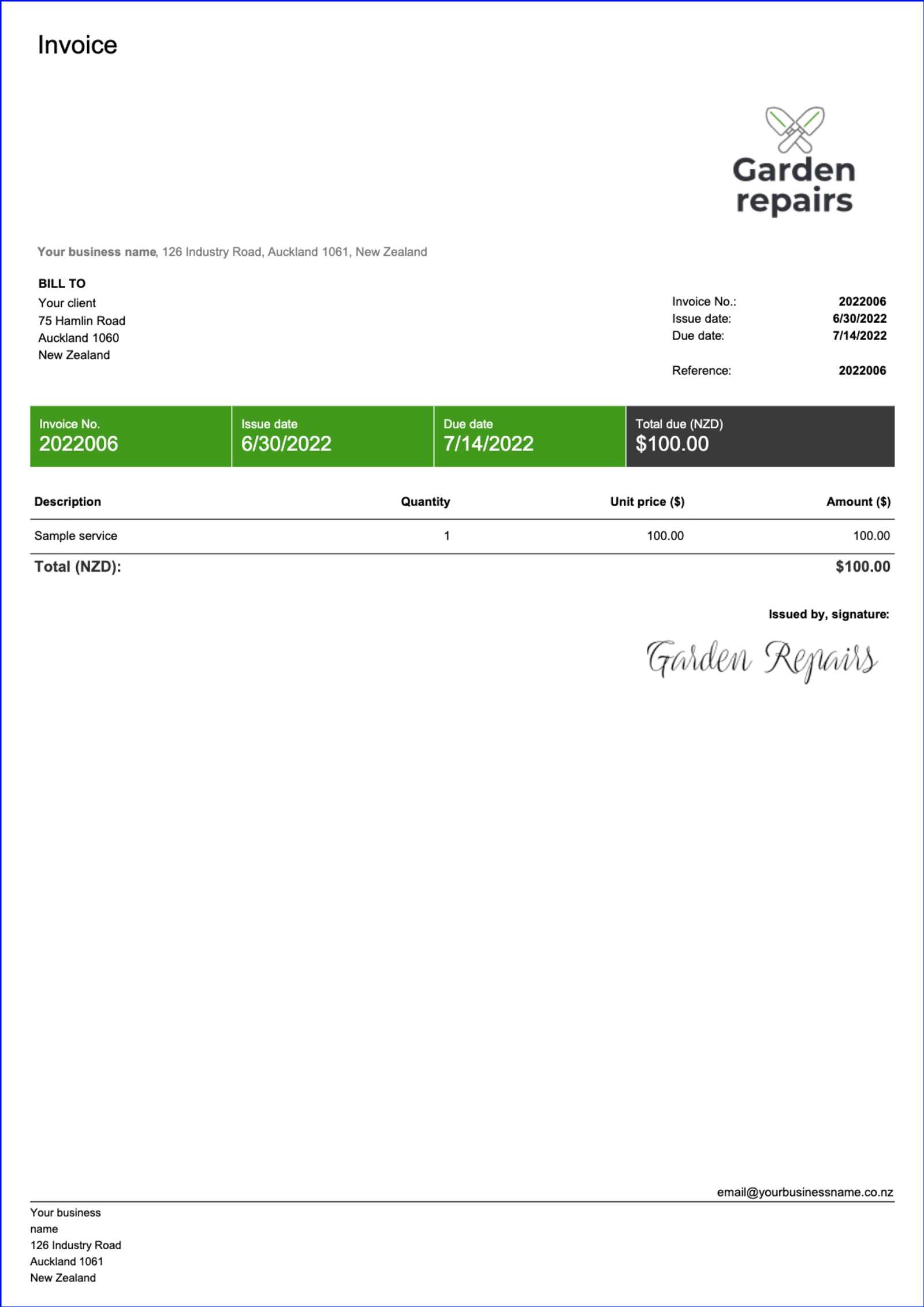

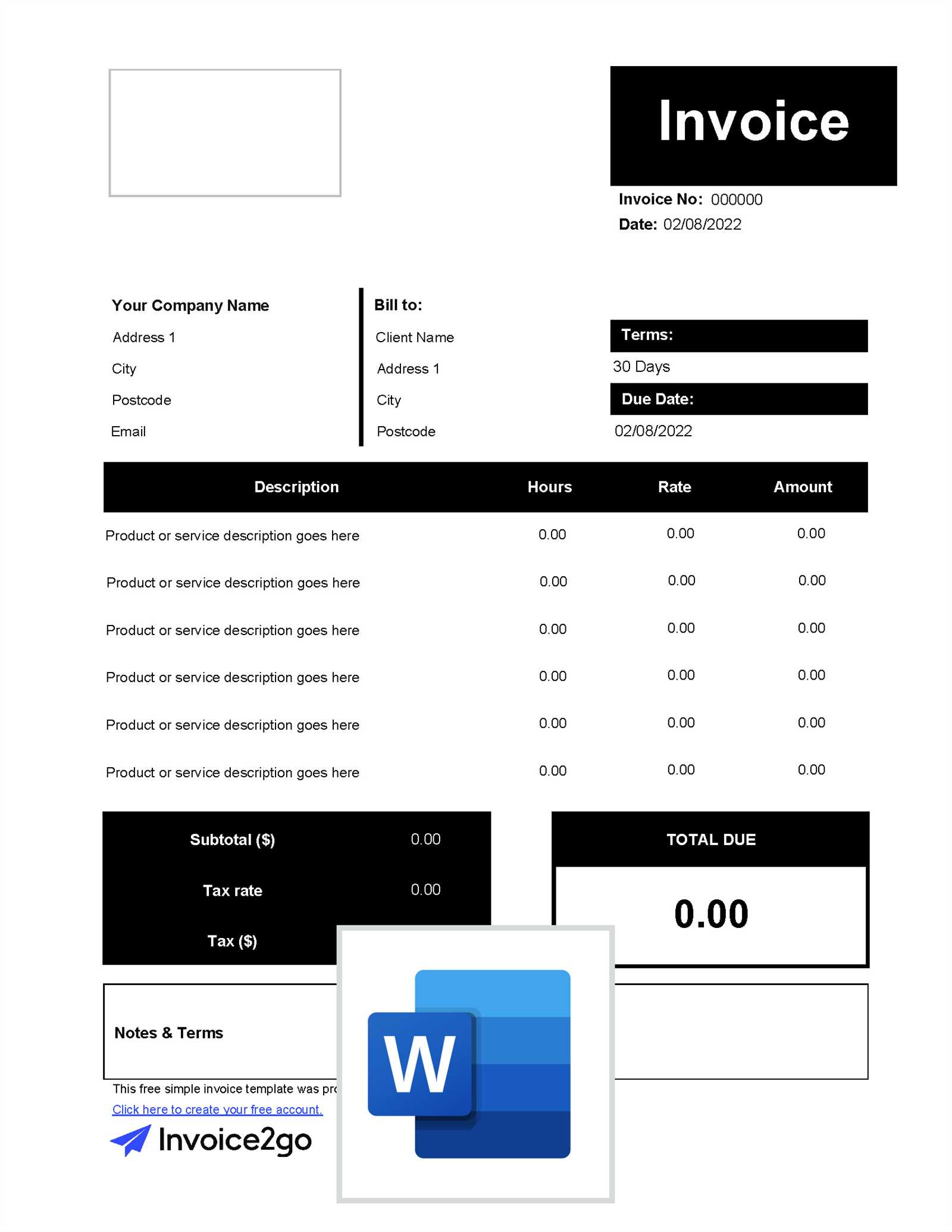

Customizing Your Billing Document

Personalizing the structure used to request payment can help reflect your unique style and approach to business. Tailoring the format to suit your specific needs not only makes the document feel more professional but also allows for easy adaptation across different projects. By adjusting certain elements, you can ensure that all important details are highlighted and that the document aligns with your branding and business practices.

- Branding Elements: Include your logo, company colors, or any specific design elements that align with your brand identity.

- Task Descriptions: Modify the sections for task details to suit the types of services you offer, ensuring clients can quickly understand what was completed.

- Payment Terms: Adjust the payment terms to fit your typical agreements, whether it’s upfront payments, net terms, or milestone-based payments.

- Custom Sections: Add any relevant sections specific to your industry, such as project milestones, expenses, or additional terms.

- Additional Contact Information: Provide alternative contact methods like your social media, website, or business email for smoother communication.

Customization not only improves the visual appeal but also ensures that your document includes the necessary details in a format that is both functional and professional. This personalized approach makes it easier for clients to review and process payments, reducing the likelihood of confusion and making your transactions more efficient.

Common Mistakes to Avoid in Invoicing

When preparing a document to request payment for services provided, it’s easy to overlook certain details that can cause confusion or delays in processing. Small errors in the way information is presented can lead to misunderstandings or missed payments. Avoiding these common mistakes will help ensure that your requests are clear, professional, and efficiently handled by your clients.

- Missing Contact Information: Failing to include your contact details or the client’s information can create confusion, especially if there are issues that require follow-up.

- Unclear Task Descriptions: Vague descriptions of the work completed can make it difficult for clients to understand what they are paying for, leading to unnecessary disputes.

- Not Including Payment Terms: Omitting payment terms, such as the due date or late fees, can result in delayed payments and unclear expectations.

- Errors in Pricing: Double-checking your rates and the total amount due is essential. Miscalculations or inconsistent pricing can cause frustration and delay payments.

- Ignoring a Unique Reference Number: Every request for payment should have a unique reference number to help both you and the client track and manage the transaction efficiently.

- Not Specifying Accepted Payment Methods: Be sure to include the different payment options available to your client. Not doing so can cause delays or confusion when they attempt to pay.

Paying attention to detail and making sure all necessary elements are included in your document will help streamline the process and maintain good relationships with your clients. By avoiding these mistakes, you ensure that your requests are handled smoothly and promptly.

How to Calculate Time Efficiently

Accurately calculating the time spent on various tasks is essential for maintaining productivity and ensuring that you are compensated fairly for your work. An efficient approach to tracking time helps prevent errors, avoids overestimating or underestimating your effort, and makes it easier to communicate the value of your services. Here are several strategies to help you track your time more effectively.

Methods for Tracking Time

- Manual Logging: Keep a detailed record of each task you complete, noting the start and end times. This method requires discipline but gives you full control over the process.

- Digital Tools: Utilize time tracking software or apps that automatically track the time spent on specific tasks, helping to reduce the possibility of human error.

- Pomodoro Technique: Break your work into focused intervals (typically 25 minutes), followed by short breaks. This method improves productivity while providing a clear breakdown of how much time is spent on each segment of work.

Optimizing Time Calculations

- Track Task Segments: For larger projects, break the work down into smaller tasks and calculate the time spent on each segment. This helps to identify areas that may require more time or attention.

- Account for Breaks: Don’t forget to account for breaks or interruptions in your time tracking. This gives a more accurate view of your workday and helps to avoid underreporting your efforts.

- Review and Adjust: Regularly review your time logs to ensure they are accurate. Adjust your methods if you notice discrepancies or patterns that suggest you are over- or underestimating the time spent.

By implementing these time tracking methods, you will not only improve your workflow but also gain a better understanding of how long certain tasks take. This will allow you to plan your schedule more effectively and ensure you are billing correctly for the time you spend on each project.

Choosing the Right Software for Billing

Selecting the right software to manage your payment requests is an essential step in streamlining your administrative tasks. The right tool can simplify the process, ensuring that you maintain accurate records, create professional documents, and automate repetitive tasks. When evaluating different options, it’s important to consider features that match your needs, as well as ease of use and scalability as your business grows.

Key Features to Look For

- Customization Options: Ensure the software allows you to tailor documents to reflect your business style, including adding your logo, adjusting layout, and personalizing terms.

- Automation: Choose software that automates recurring tasks, such as sending reminders or generating new payment requests, which can save you time and reduce human error.

- Payment Integration: Look for tools that allow easy integration with payment systems like PayPal, bank transfers, or credit cards, so clients can pay directly from the document.

- Expense Tracking: Some software includes features for tracking expenses and managing projects, helping you stay organized and see the full picture of your financial activity.

- Reports and Analytics: Software with built-in reporting features can help you track earnings, outstanding balances, and overall financial health.

Popular Options to Consider

- QuickBooks: A comprehensive tool for small businesses, offering invoicing, accounting, and payment tracking features.

- FreshBooks: Known for its user-friendly interface, FreshBooks offers simple invoicing, expense tracking, and time management features.

- Zoho Invoice: A cost-effective solution with strong customization and automation features, perfect for freelancers and small businesses.

Choosing the right software can significantly improve your workflow, making payment requests smoother and more efficient. By selecting a tool that suits your needs, you can ensure that your payment process is as seamle

Best Practices for Document Presentation

Creating a well-presented document to request payment is key to establishing professionalism and ensuring clarity. How you organize and format this document can influence how quickly and efficiently it is processed. By following best practices for presentation, you can make it easier for clients to review and pay, as well as reflect your commitment to high standards in all aspects of your business.

Clarity and Structure

- Clean Layout: Use clear headings, well-defined sections, and enough white space to make the document easy to read. Avoid cluttering the page with too much information.

- Consistent Formatting: Stick to a consistent font style and size throughout the document. Make sure that important sections like payment amounts, terms, and deadlines stand out visually.

- Organized Information: List items in a logical order, such as task descriptions followed by rates, totals, and payment instructions. This allows the reader to follow the document easily.

Professional Design Elements

- Branding: Incorporate your logo and any business colors or fonts that align with your brand. This adds a professional touch and helps clients easily recognize your materials.

- Header and Footer: Include your business name, contact information, and document reference number at the top and bottom for easy access and identification.

- Client Personalization: Add a personalized greeting and tailor the document to reflect the specific services you provided for that client. This shows attention to detail and reinforces your professional relationship.

By following these best practices, you ensure that your payment requests are not only professional in appearance but also easy to navigate and understand. This improves your client’s experience and helps foster positive ongoing relationships.

How to Handle Late Payments

Dealing with delayed payments is an unfortunate but common challenge in business. When clients don’t pay on time, it can disrupt cash flow and cause unnecessary stress. However, managing these situations professionally and efficiently can help maintain good relationships with clients while ensuring you’re compensated fairly for your work. The key is to approach these situations with a clear plan and strong communication skills.

Steps to Take When Payments Are Late

- Send a Reminder: If the payment deadline has passed, send a polite reminder. Sometimes, clients simply forget, and a gentle nudge can resolve the issue quickly.

- Follow Up with a Formal Request: If the reminder doesn’t work, follow up with a more formal request. Be clear about the amount due, the services rendered, and the overdue date.

- Offer Payment Options: Make it easy for clients to pay by offering various payment methods. Providing options like bank transfers, online payment platforms, or credit card payments can expedite the process.

When to Take Further Action

- Late Fees: Introduce late fees as a deterrent for future delays. Be sure to inform clients of this policy upfront to avoid confusion later on.

- Negotiate Payment Plans: If a client is struggling financially, consider negotiating a payment plan to ease the burden. This approach can help you maintain the relationship while still ensuring payment.

- Legal Action: In extreme cases, consider pursuing legal action. While this should be a last resort, it may be necessary to ensure you receive payment for the work you’ve completed.

By taking a proactive approach to handling late payments, you can ensure smoother financial operations and maintain positive client relationships. Clear communication and professionalism are key to resolving these situations efficiently and with minimal stress.

Tracking Overtime in Your Billing

Accurately documenting additional work beyond the standard time frame is crucial for ensuring fair compensation. When you provide extra services or work more than initially planned, it’s important to track and reflect those extra efforts clearly in your billing. Properly accounting for overtime not only helps you get paid for the extra work but also helps maintain transparency and trust with clients.

How to Track Overtime Effectively

- Document Additional Work: Keep a detailed log of the extra time spent on a project, including specific tasks and dates. This will help you calculate the total amount owed for overtime.

- Set Clear Rates: Ensure that your overtime rate is agreed upon upfront with the client. This will avoid any misunderstandings when the extra time is billed.

- Break Down Time: Divide the extra hours into manageable blocks, specifying the time spent on each task. This makes it easier for the client to understand what they are paying for.

- Use Time-Tracking Tools: Use software or apps that track your work in real-time to ensure accuracy. These tools can provide detailed reports that you can use to justify your billing.

Communicating Overtime to Clients

- Be Transparent: Let your client know as soon as it becomes clear that you will exceed the initial scope. This will help avoid surprises when the final payment is requested.

- Provide Clear Descriptions: In your document, outline exactly what additional tasks were completed and why they required extra time. This creates clarity and shows your client that you’re keeping track of the details.

- Offer Flexible Payment Terms: If the additional work was substantial, consider offering flexible payment terms or breaking up the overtime costs into smaller, more manageable payments for the client.

By following these practices, you can effectively track and communicate additional work, ensuring that both you and your clients are satisfied with the final outcome. Accurate tracking and clear communication are essential for maintaining a professional working relationship and ensuring you’re fairly compensated for all your efforts.

Legal Considerations for Billing Statements

When it comes to documenting and requesting payment for services, understanding the legal aspects is crucial. Properly structuring your payment requests not only helps ensure you are compensated but also protects your interests and maintains professional credibility. Adhering to legal standards can avoid misunderstandings and disputes, ensuring smooth financial transactions with your clients.

Key Legal Elements to Include

- Clear Contract Terms: Always have an agreement in place that outlines the terms of service, including payment schedules, rates, and any extra charges. This document serves as a reference in case of disputes.

- Tax Compliance: Be aware of tax requirements for the work you perform. Ensure that you are accounting for sales tax, income tax, or any other applicable levies based on your location or the type of services provided.

- Accurate Payment Details: Include all relevant payment information, such as your banking details or preferred payment platforms. This minimizes confusion and helps clients make timely payments.

How to Handle Disputes

- Clearly Define Late Fees: Specify the conditions under which late fees apply and the amount of interest charged on overdue payments. This will help you enforce timely payments.

- Document Communications: Keep a record of all communications with your clients regarding payments. This documentation will be helpful if legal action is needed.

- Know Your Rights: Familiarize yourself with the legal regulations in your country or state concerning unpaid balances and the steps you can take to recover the funds. Legal options might include collections or small claims court.

By ensuring that all legal aspects are covered, you can protect yourself and your business from potential risks. Clear agreements, accurate records, and an understanding of your legal rights will allow you to focus on the work while minimizing financial and legal complications.

How to Improve Your Cash Flow

Managing a steady cash flow is essential for maintaining a healthy and sustainable business. To ensure that you always have the resources needed to cover expenses, it is important to adopt strategies that help you control income timing and expenses. By staying organized and proactive, you can reduce financial strain and maintain a smooth operational process.

Strategies to Enhance Cash Flow

- Set Clear Payment Terms: Establish specific payment deadlines with your clients and ensure that both parties are aware of the agreed terms. Clear expectations lead to fewer delays and disputes.

- Offer Payment Incentives: Consider offering discounts or incentives for early payments. This encourages clients to settle their accounts sooner, improving your liquidity.

- Automate Billing: Use automated systems to send payment requests on time. This reduces the risk of missing deadlines and makes it easier to track unpaid balances.

- Manage Expenses Wisely: Regularly review your expenses and find ways to reduce unnecessary costs. Keep track of any recurring payments and identify areas where savings can be made.

- Diversify Your Client Base: Relying on a single client for the majority of your income can be risky. Work to diversify your clientele to ensure more consistent income streams.

Tracking Your Cash Flow

Maintaining accurate records is crucial for understanding your financial position. Use tools or software that allow you to track payments, outstanding balances, and expenses. This data will give you valuable insights into your financial health and help you predict future cash flow needs.

| Action | Description |

|---|---|

| Set Payment Deadlines | Clearly state when payments are due to ensure timely receipts. |

| Offer Early Payment Discounts | Encourage quicker payments with financial incentives. |

| Automate Billing | Use automated systems to ensure consistent invoicing and follow-ups. |

| Monitor Expenses | Regularly review your financial outflows and reduce unnecessary costs. |

By implementing these strategies and staying organized, you can significantly improve your cash flow. This will allow you to maintain stability and focus on gr

Integrating Billing Documents with Payment Systems

Efficiently connecting your billing documents to payment platforms streamlines the process of receiving payments and reduces administrative overhead. By automating this integration, you ensure faster and more reliable transactions, which benefits both you and your clients. This synergy between billing and payment systems allows for smoother operations, reducing the chances of human error and accelerating cash flow.

Modern payment systems offer the flexibility to seamlessly integrate with various types of billing documents, making it easier to track and manage financial transactions. The following points highlight the benefits and process of such integrations.

Key Benefits of Integration

- Faster Payments: Integration ensures that clients can make payments immediately after receiving the billing document, which accelerates cash flow.

- Reduced Errors: Automating the process minimizes the risk of human error during manual data entry and payment tracking.

- Improved Record-Keeping: With integrated systems, all financial data is stored in one place, making it easier to track payments, due amounts, and reconciliations.

- Enhanced Client Experience: Clients appreciate a smooth and simple way to make payments, fostering positive relationships and encouraging timely settlements.

Steps to Integrate Billing with Payment Systems

Follow these steps to successfully link your billing documents with your preferred payment platform:

| Step | Description |

|---|---|

| 1. Choose a Payment Platform | Select a system that suits your needs, such as PayPal, Stripe, or others, depending on your business size and geographic location. |

| 2. Link Your Account | Connect your payment platform to your invoicing or billing software by entering your payment gateway details. |

| 3. Set Up Payment Options | Configure various payment options such as credit cards, bank transfers, or mobile payments, ensuring flexibility for your clients. |

| 4. Test the Integration | Before using the system live, test it to ensure that the billing document links correctly to the payment system and transactions process smoothly. |

By integrating billing documents with payment systems, you enhanc

Managing Multiple Projects in One Billing Statement

When working on several tasks or assignments for different clients, it can be efficient to combine the details of all your efforts into one unified billing document. This approach helps to maintain clarity for both you and your clients while also simplifying administrative work. A well-organized billing statement allows you to present the work for multiple projects cohesively, ensuring that each task is clearly outlined and appropriately compensated.

In this section, we will explore how to structure a billing document when managing various projects, making sure that each project is properly tracked, categorized, and invoiced. This method can save time, reduce confusion, and ensure clients understand the scope of the work completed for each individual project.

Key Steps to Organize Multiple Projects

- Group Projects by Client: If you’re working on different projects for the same client, list them under a single section with clear labels for each project.

- Itemize Services and Deliverables: Clearly specify the work done for each project, including services rendered, timelines, and deliverables. This provides transparency for your clients.

- Use Separate Categories: If you’re handling multiple clients, it’s best to separate each client’s work into distinct sections. This reduces confusion and makes it easier to track payments per client.

- Include Relevant Dates: Specify the dates when each task was completed. This helps to establish a timeline for each project and assists with payment scheduling.

- Summarize Total Amounts: At the end of the billing statement, provide a summary of the total amounts due for each individual project, as well as the grand total.

Example Breakdown for Multiple Projects

- Project 1: Web Design for Client A

- Service: Website layout design

- Amount: $500

- Completion Date: June 15, 2024

- Project 2: SEO Optimization for Client B

- Service: Keyword analysis and content optimization

- Amount: $300

- Completion Date: June 18, 2024

- Project 3: Branding for Client C

- Service: Logo and brand style guide

- Amount: $400

- Completion Date: June 20, 2024

- Total Due: $1200