Freelance Hourly Invoice Template for Efficient Billing

When you’re working independently, keeping track of your earnings and ensuring you get paid on time is essential. A well-structured document that outlines the work completed and the agreed-upon compensation is crucial for maintaining a smooth financial workflow. Regardless of your industry or the type of services you provide, having a clear and professional billing process can significantly reduce misunderstandings with clients and ensure timely payments.

Creating a clear payment record involves more than just listing the hours worked. It requires understanding the key elements that should be included in a statement, such as detailed descriptions of services rendered, payment terms, and tax considerations. This ensures that both you and your client have a clear understanding of the transaction, reducing confusion and increasing trust.

Managing your financial paperwork doesn’t have to be a time-consuming task. With the right tools and an organized approach, you can streamline the billing process and focus more on the work that drives your business forward. In the following sections, we’ll explore how to create an effective and professional payment request that meets your needs and helps you get compensated fairly and promptly.

Billing Document Guide for Independent Professionals

For independent workers, having a well-organized method of documenting work and requesting payment is essential. A clear and professional payment record helps ensure that both parties understand the terms of the agreement and prevents potential confusion. In this guide, we’ll walk through the key elements you should include in your billing document and explain how to craft one that reflects your professionalism and protects your interests.

Key Information to Include in any financial request document includes the description of services provided, the total amount due, payment terms, and contact details. Each section of the document serves a specific purpose, helping to clearly communicate the work completed and the payment expectations. Ensuring that all these details are correctly outlined will foster trust and increase the likelihood of timely payments.

Creating an efficient billing document doesn’t need to be complex. With the right structure and a few simple tools, you can generate a document that looks professional and is easy to understand. We’ll discuss how to customize this record based on the nature of your work and your client’s preferences, making the process smoother for both parties.

Why You Need a Detailed Billing Document

When working on a project where payment is tied to the time spent on tasks, it’s important to have a clear and organized way to request payment. A well-crafted billing document helps ensure both you and your client are on the same page regarding the scope of work and compensation. Without a structured approach, misunderstandings can arise, potentially leading to delayed payments or disputes.

Benefits of Using a Structured Payment Request

- Clear Communication: A well-documented record ensures both parties understand the agreed-upon rates, terms, and hours worked.

- Professionalism: Providing a clear breakdown of work shows that you are serious and organized, which helps build trust with clients.

- Timely Payments: With an accurate statement, clients are more likely to process your payment on time, avoiding confusion and delays.

- Legal Protection: In the event of a dispute, a detailed document can serve as evidence of the terms you both agreed to.

How This Document Helps You Stay Organized

By breaking down the hours worked, the tasks completed, and the rate charged, you make it easier to track your income. This approach not only simplifies the payment process but also allows for easier financial planning. Additionally, it gives you a consistent way to manage multiple projects at once, ensuring that no hours or payments are overlooked.

How to Create a Payment Request as an Independent Worker

Creating a payment request document is a critical part of managing your income as an independent worker. It not only ensures you get paid for your time and effort but also helps maintain a professional relationship with your clients. A well-structured request will make it easier for your client to understand the services provided and how much they owe, reducing the chances of payment delays or confusion.

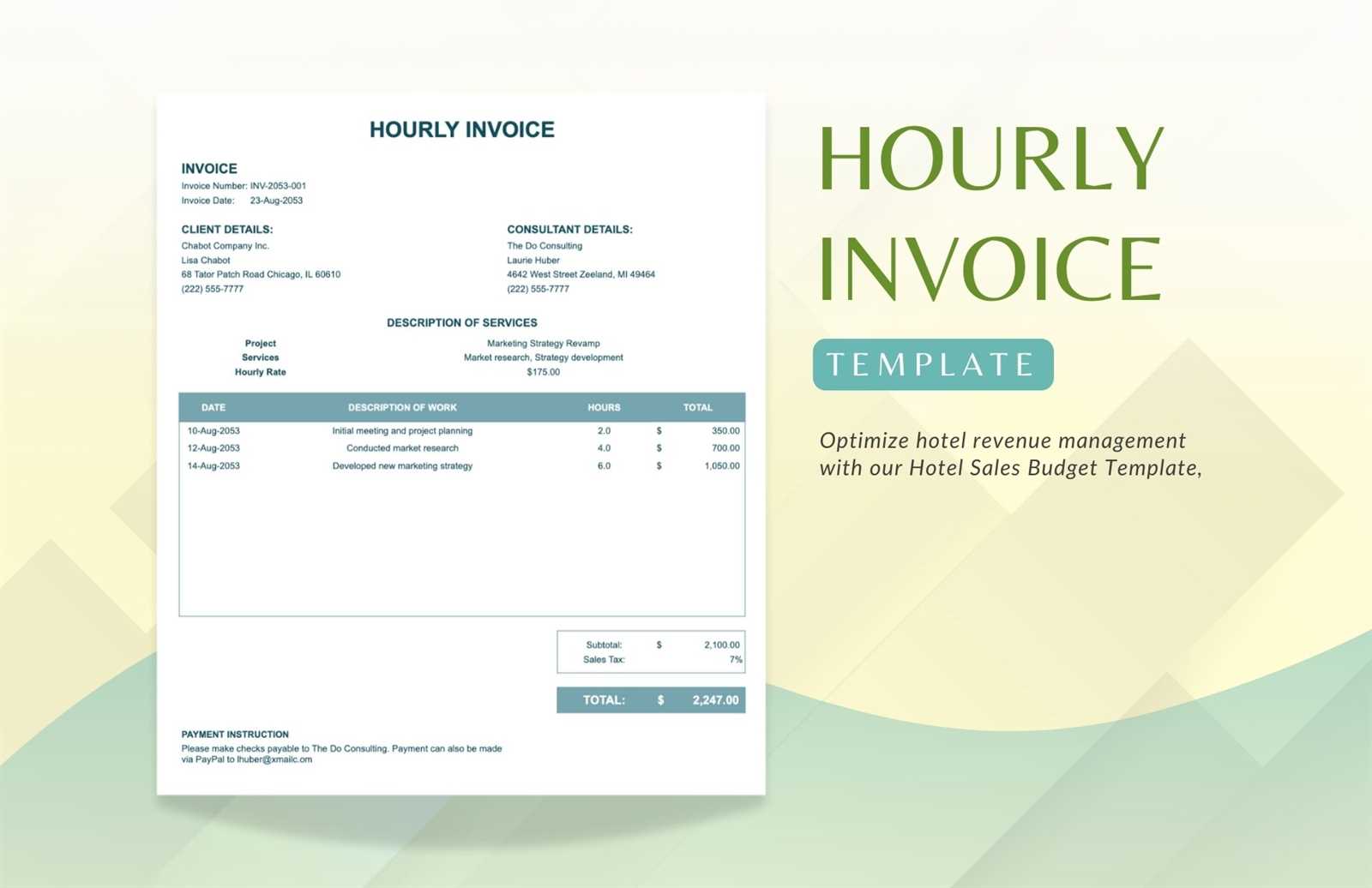

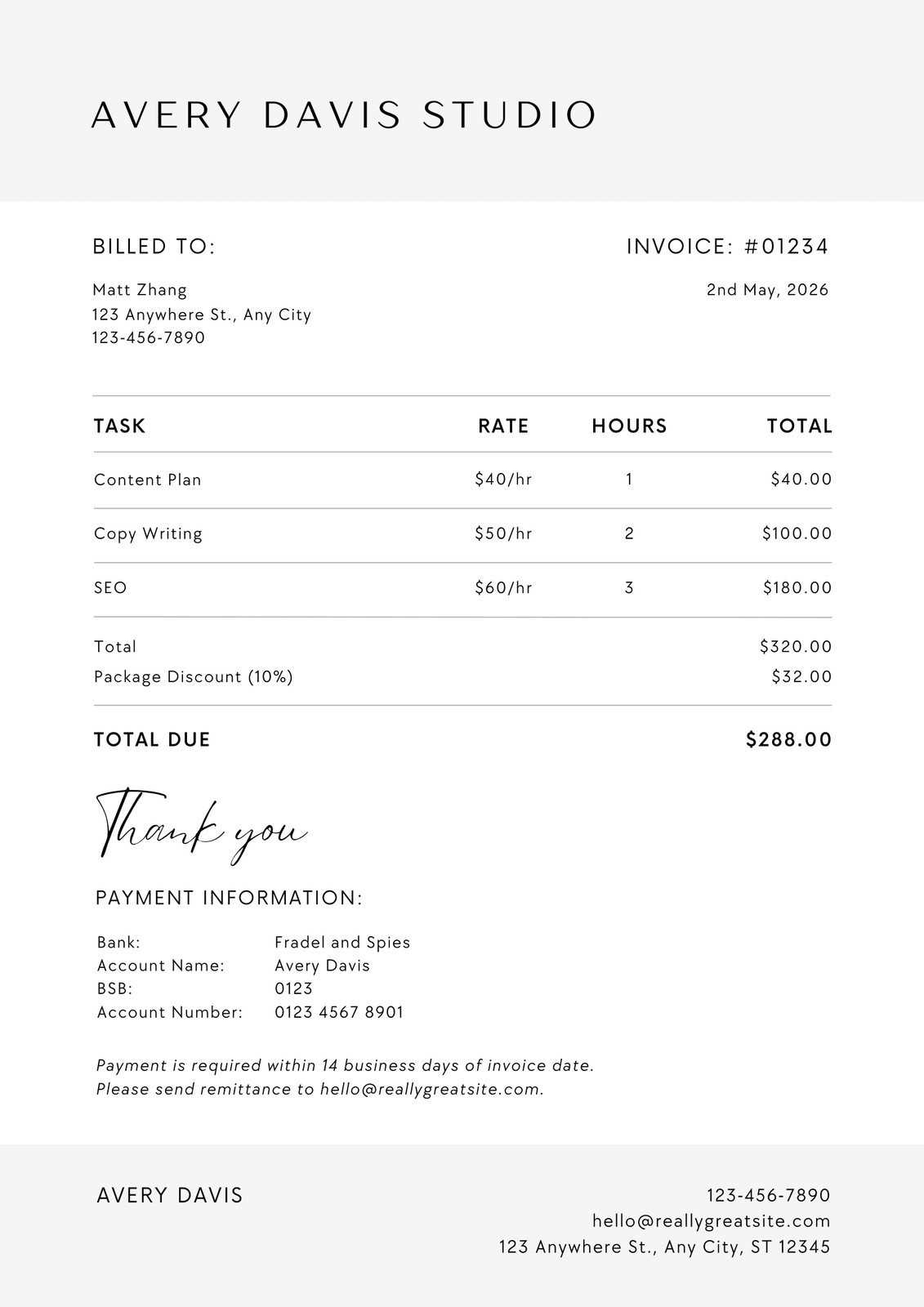

To create an effective payment request, follow these key steps:

- Include Your Contact Information: Start with your name, business name (if applicable), phone number, email, and address. This ensures your client can reach you if they have questions about the payment.

- Provide Client Details: Include the name, business name, and contact information of your client. This helps avoid confusion if the document is passed to someone else in the organization for processing.

- Define the Work Performed: Clearly describe the tasks or services completed. Be as detailed as possible to avoid any misunderstandings. You can list each project separately if you’ve worked on multiple tasks.

- Specify the Payment Amount: Indicate the total amount due for each service. If you charge by the hour, list the number of hours worked along with the applicable rate. If you work on a project basis, provide the agreed-upon price.

- Set Payment Terms: Mention the payment due date and any late fees or penalties for overdue payments. Clearly state the preferred method of payment (e.g., bank transfer, PayPal, check) and any necessary account details.

- Include an Invoice Number: Assign a unique reference number to your request. This makes it easier for both you a

Essential Elements of a Billing Document

To ensure smooth and timely payments, it’s important that your billing document includes all the necessary information. A well-structured request helps both you and your client understand the financial details clearly, minimizing confusion and potential disputes. Below are the key components that should always be included in a comprehensive payment request.

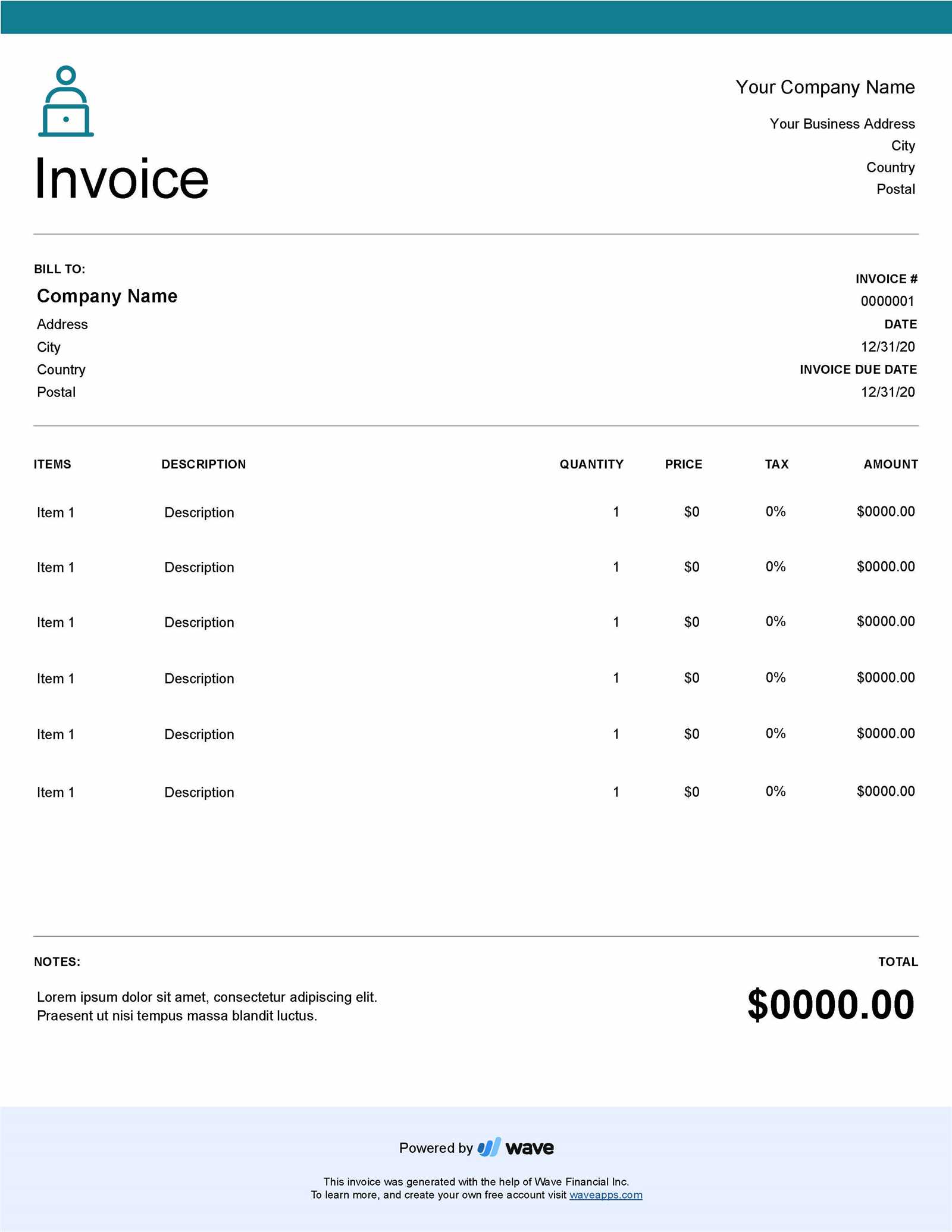

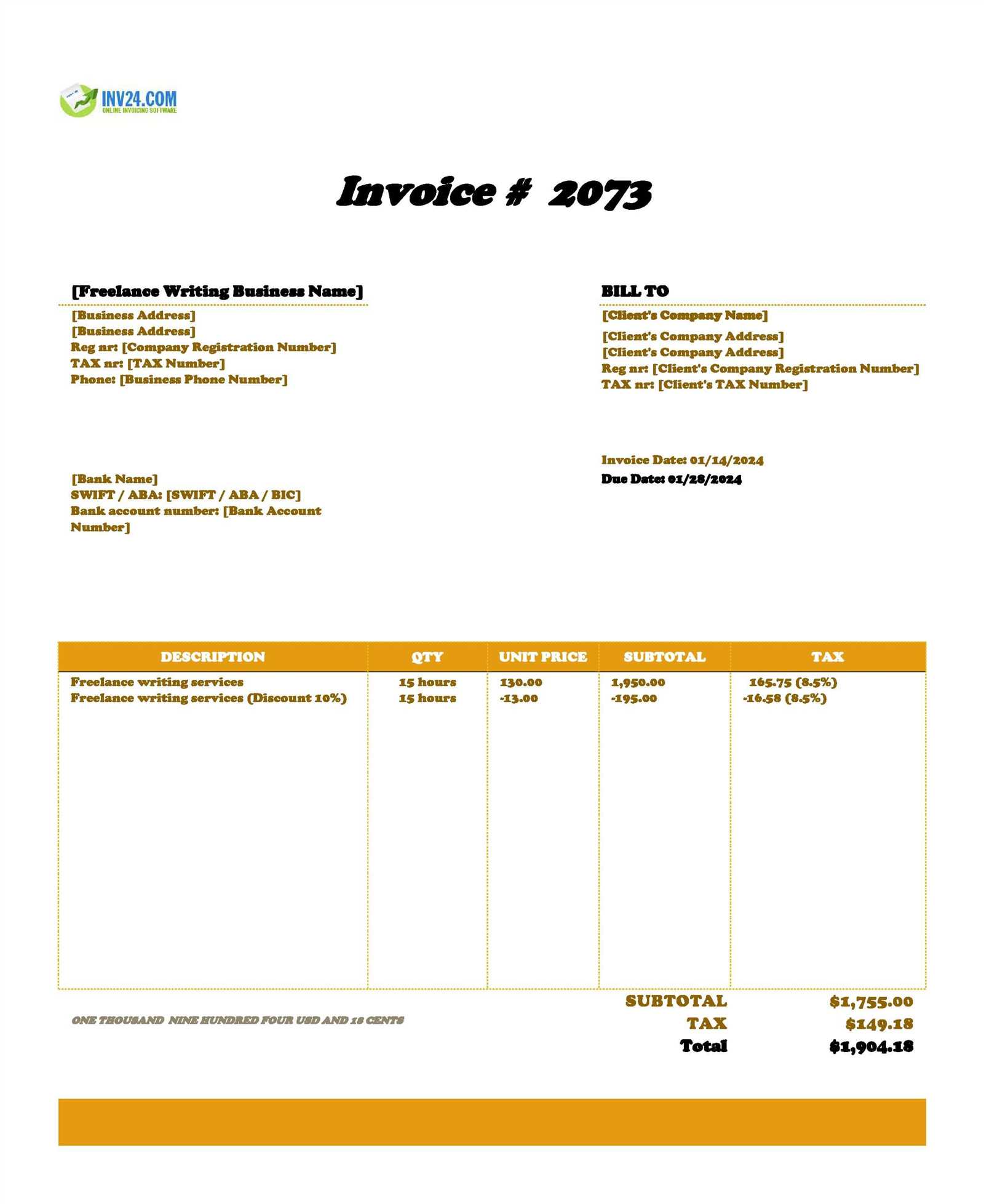

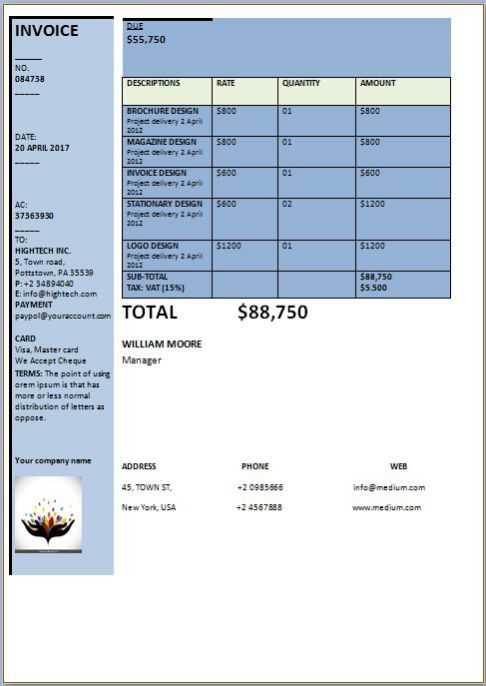

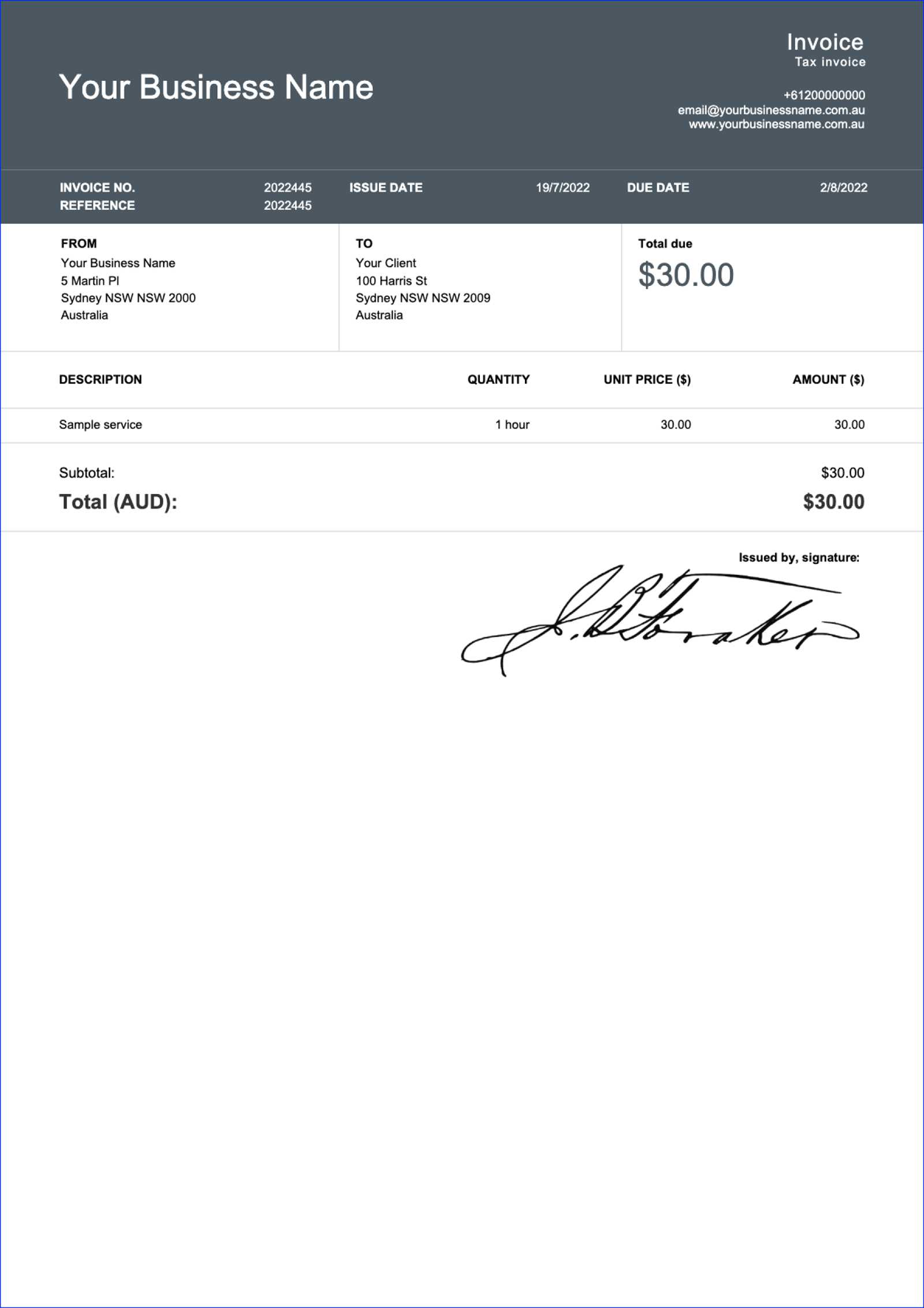

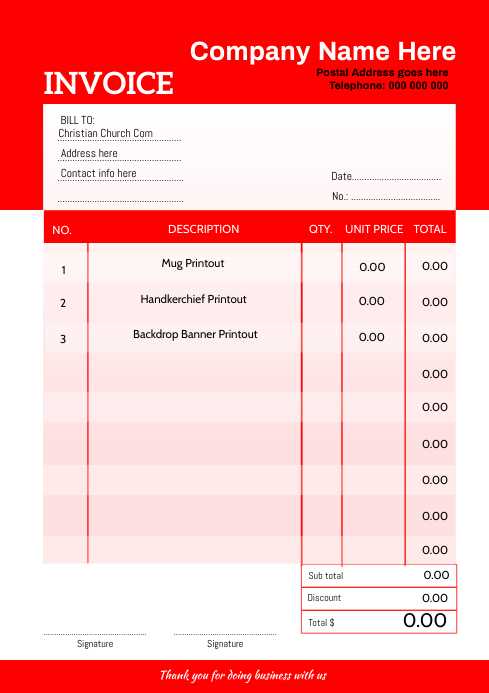

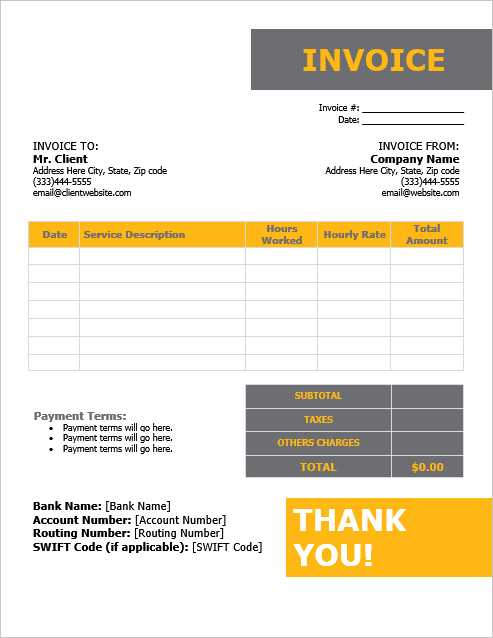

Element Description Contact Information Include your full name or business name, address, phone number, and email address. Add the client’s details as well for clarity. Document Number Assign a unique reference number to each request for easier tracking and future reference. Date of Issue Include the date when the request is generated. This helps both parties track the timeline of payments. Description of Services Clearly list the work completed or services provided, along with relevant details such as hours worked or milestones reached. Amount Due Specify the total amount due, broken down by service or task, and include any applicable taxes or additional fees. Payment Terms State the payment method (e.g., bank transfer, PayPal) and payment due date. Also, mention any late fees for overdue payments. Notes Provide any additional information or instructions, such as a thank-you note or instructions for processing the payment. By including these essential elements, you ensure that your billing document is professional, comprehensive, and easy to understand. This will help avoid delays and ensure that you get paid accurately and on time.

Customizing Your Invoice Template for Clients

When working with different clients, tailoring the document you send for payment is crucial to maintaining professionalism and ensuring clarity. Customizing each document not only helps with providing accurate information but also strengthens your business relationship. By adjusting the format and details to suit each project or client, you can make the payment process smoother and more transparent.

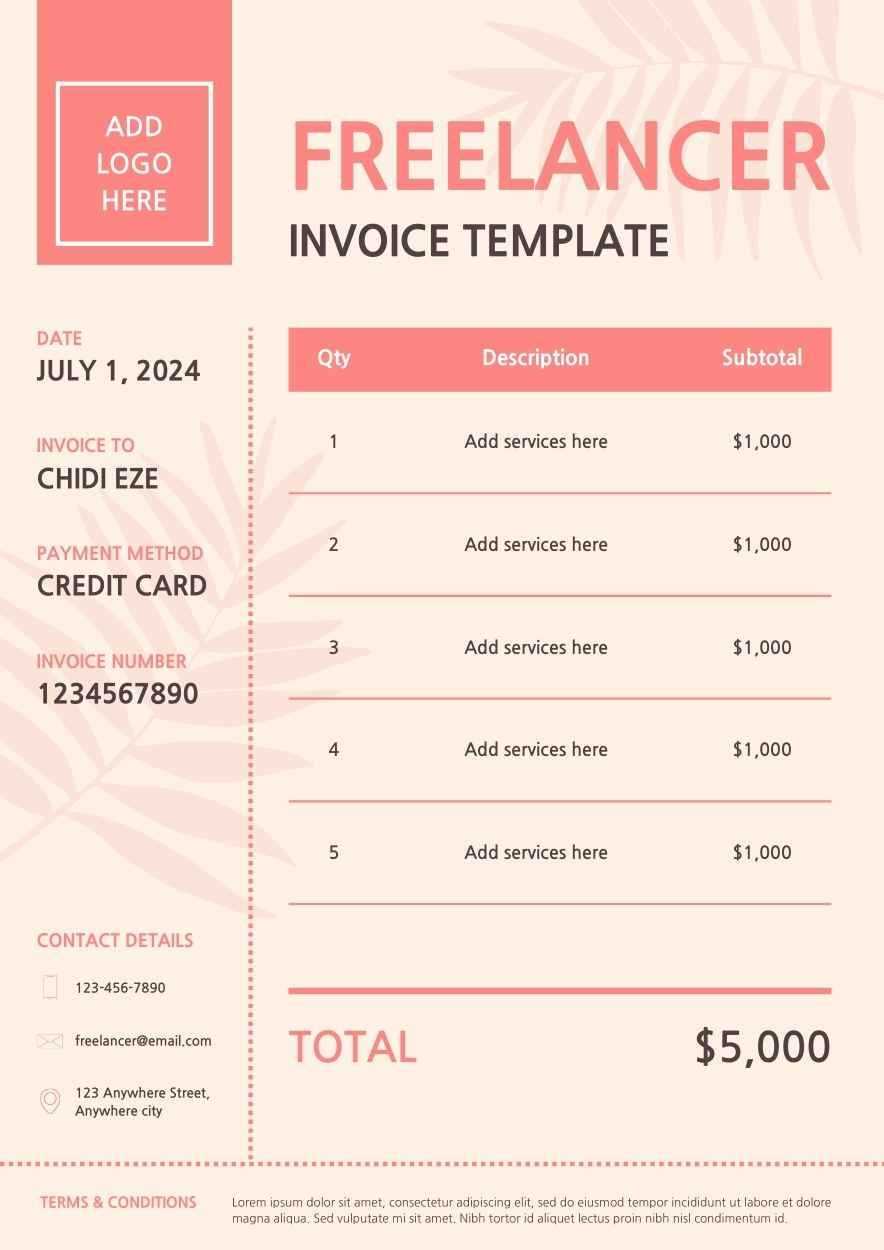

Personalizing the Design

One of the first steps in adapting your document is adjusting its design to reflect your brand or the specific needs of your client. Using your company colors, logo, and consistent fonts can help create a cohesive and professional look. Customization doesn’t have to be overly complex–just ensuring that the layout is clean, easy to read, and reflects your unique style can make a big difference. A personalized approach builds trust and helps establish credibility with the client.

Including Client-Specific Details

Every client has unique requirements, so including specific details such as their contact information, the nature of the work performed, or the agreed-upon terms is essential. For instance, if your agreement includes particular milestones, deadlines, or payment schedules, be sure to note these clearly on the document. Also, if your client has specific instructions or preferences for how the payment is to be processed, incorporating these into the layout will prevent any confusion and streamline the transaction process.

Pro Tip: Always double-check the information provided to ensure accuracy. Incorrect details can lead to delays and miscommunication, which may affect timely payments.

Best Tools for Creating Invoices

Choosing the right software to generate payment documents can save you time and ensure accuracy in your financial transactions. With the right tools, you can easily create professional-looking statements that clearly outline the details of your work and facilitate faster payments. There are many options available, each offering unique features that cater to various needs and preferences. From simple templates to advanced automation, the right tool can streamline your workflow and improve your client interactions.

Top Online Platforms

Several cloud-based platforms provide easy-to-use interfaces that allow you to generate customized payment documents quickly. These tools often include pre-designed formats, customizable fields, and features for tracking payments. They are ideal for individuals and businesses who prefer a hands-off approach, where automation handles most of the document generation process.

FreshBooks is a highly popular choice, offering a range of templates, integrated time tracking, and automated reminders for clients. It’s especially useful for managing ongoing projects and recurring payments.

Software with Advanced Features

For those who need more control over the design and functionality of their documents, desktop software may be the best option. These applications provide advanced customization options and often include additional tools for managing accounting, generating reports, and integrating with other business systems.

QuickBooks offers robust financial management features, allowing you to not only create detailed payment requests but also track expenses and generate comprehensive reports. It’s perfect for those looking for a more holistic approach to managing their business finances.

Pro Tip: When choosing a tool, consider your long-term needs. Some platforms may have more features than others, but it’s important to pick one that fits your workflow and offers the right balance between ease of use and functionality.

How to Calculate Hourly Rates for Invoicing

Determining the appropriate rate for your time is an essential part of getting paid fairly for your work. It requires a careful balance between your skills, industry standards, and the value you provide to clients. Whether you’re offering specialized services or general assistance, setting a reasonable price ensures that you are compensated adequately while remaining competitive in the market. Here’s a step-by-step guide to help you calculate your rate accurately.

Factors to Consider When Setting Your Rate

There are several key elements to keep in mind when determining how much to charge per hour. These include your level of expertise, overhead costs, market demand, and any other business expenses you may have. Understanding these factors will help you set a price that covers your costs and reflects your value.

Factor Details Experience & Skills More expertise or specialized knowledge allows you to charge a higher rate. Overhead Costs Factor in the costs of running your business, such as software, equipment, and office supplies. Market Rates Research industry standards to ensure your pricing is in line with competitors. Project Complexity Adjust your rate based on the difficulty or scope of the task. Simple Formula for Calculating Your Rate

A straightforward formula can help you establish a fair rate based on your needs. Here’s a quick breakdown:

Invoice Payment Terms and Deadlines Explained Clear payment terms and deadlines are essential to ensure a smooth financial transaction between you and your clients. By outlining these details in your documents, you set clear expectations, reduce misunderstandings, and help avoid payment delays. Knowing how to effectively communicate these terms can also foster a sense of professionalism and trust, contributing to a more positive client relationship.

When specifying payment terms, it’s important to decide on the timeframe within which the client must settle the amount due. Commonly, businesses use terms such as “Net 30” or “Due on Receipt,” but these can vary based on the nature of the work and the agreement with the client. Additionally, understanding how to handle late payments and whether you offer any early payment discounts can also help manage cash flow effectively.

Common Payment Terms

Below are some of the most commonly used payment terms in business transactions:

- Due on Receipt: Payment is expected immediately upon receiving the document.

- Net 30: Payment is due within 30 days of the issue date.

- Net 60: Payment is due within 60 days of the issue date, often used for larger projects or ongoing work.

- Installment Payments: Payment is broken down into smaller amounts due over a set period, commonly used for larger projects.

Setting Deadlines and Managing Delays

It’s also important to set a clear deadline for when the payment should be made. This helps both parties plan and avoid any misunderstandings. If a payment is not received by the d

How to Handle Late Payments Effectively

Dealing with overdue payments can be challenging, but it’s an inevitable part of managing your business. When clients fail to pay on time, it can affect your cash flow and create unnecessary stress. However, it’s essential to address late payments in a professional and organized manner to maintain positive relationships while ensuring you get paid for your work. Understanding how to handle delays effectively will help you stay on top of your finances and avoid future payment issues.

Set Clear Expectations Upfront

One of the best ways to avoid payment delays is to establish clear terms from the start. Outline the due dates, payment methods, and any penalties for late payments in your agreement. This makes it easier to hold clients accountable and minimizes the chances of miscommunication. Having a documented agreement helps ensure that both parties understand their responsibilities.

Tip: Be sure to remind clients of the agreed-upon payment terms before the due date. A simple reminder can often prevent overdue payments from happening.

Sending Payment Reminders

If the payment deadline has passed, sending a polite reminder is often the first step in addressing the issue. Your reminder should be courteous, professional, and clear about the outstanding amount and the new payment deadline. Keep the tone friendly but firm, emphasizing the importance of settling the amount promptly.

Example Reminder: “I wanted to kindly remind you that payment for [work/project] was due on [date]. Please let me know if there are any issues or concerns regarding the payment.”

Charging Late Fees

If you find that clients continue to miss deadlines, introducing late fees can be an effective deterrent. Clearly state in your agreement that overdue payments will incur an additional fee, and ensure that this information is communicated upfront. A reasonable late fee can encourage prompt payment, while also compensating for the time and effort spent chasing overdue amounts.

Consider Payment Plans

In some cases, a client may be unable to pay the full amount at once. Offering a payment plan can be a good compromise, allowing them to pay off the debt in manageable installme

Tracking Billable Hours Accurately

Accurately tracking the time spent on each task or project is essential for ensuring that you are compensated fairly for the work you do. Without precise records, it can be easy to overlook important details, leading to underpayment or disputes with clients. Implementing a consistent system for logging time allows you to capture every minute spent on a project, ensuring that nothing is missed and clients are billed correctly.

Best Practices for Tracking Time

To maintain accuracy and avoid mistakes, there are several best practices to follow when recording the time spent on different tasks. Using a reliable time-tracking method, whether manual or digital, is the first step toward building a transparent and efficient workflow. Below is a simple overview of key practices to follow:

Practice Description Use Time Tracking Software Software can automate time logging and make it easier to track tasks in real-time, reducing the chance of forgetting to record hours. Track in Real-Time Start the timer as soon as you begin a task and stop it once you’re done. This ensures you capture every minute worked. Break Tasks Into Small Segments Break down larger tasks into smaller, measurable segments to ensure that time is logged accurately for each part of the work. Review Logs Regularly Regularly reviewing your time logs helps to catch any discrepancies early and correct them before finalizing your records. Tools to Help Track Time

There are various tools available to help you track the time spent on each task. These tools come with features that allow you to categorize work, set reminders, and generate reports for clients. Some popular time-tracking software includes:

- Harvest: Offers time tracking, expense logging, and project management all in one platform.

- Toggl: A simple, intuitive tool that allows you to track time manually or automatically and categorize tasks for detailed reports.

- Clockify: A free time-tracking tool with powerful reporting and team management features.

Pro Tip: Consider using t

Common Mistakes to Avoid on Invoices

When creating payment documents, small errors can lead to confusion, delays, and frustration for both you and your clients. It’s essential to ensure that all the information is accurate, clear, and professional. Even minor oversights can lead to misunderstandings or missed payments, affecting your cash flow. Understanding the most common mistakes and how to avoid them will help you streamline the billing process and maintain a positive relationship with your clients.

1. Missing or Incorrect Contact Information

One of the most basic yet crucial elements is ensuring that the contact details for both parties are correct. Double-check that your name, business name, address, email, and phone number are accurate. Additionally, verify that the client’s information is also correct, including their billing address and contact details. Missing or incorrect contact information can delay communication and payments.

2. Failing to Include Clear Payment Terms

It’s important to specify when the payment is due, the accepted methods, and any late fees or penalties for overdue amounts. If these details are vague or missing entirely, it may lead to confusion or delayed payments. Always include a specific due date and clearly state any terms about penalties or discounts for early payments. This helps set expectations from the start.

3. Lack of Detailed Descriptions

Vague descriptions of the work completed can lead to misunderstandings. Always provide a detailed breakdown of the services or products provided, including the hours worked, the scope of the project, or the specific deliverables. This not only justifies the amount being charged but also helps the client understand exactly what they are paying for.

4. Incorrect Calculations o

Common Mistakes to Avoid on Invoices

When creating payment documents, small errors can lead to confusion, delays, and frustration for both you and your clients. It’s essential to ensure that all the information is accurate, clear, and professional. Even minor oversights can lead to misunderstandings or missed payments, affecting your cash flow. Understanding the most common mistakes and how to avoid them will help you streamline the billing process and maintain a positive relationship with your clients.

1. Missing or Incorrect Contact Information

One of the most basic yet crucial elements is ensuring that the contact details for both parties are correct. Double-check that your name, business name, address, email, and phone number are accurate. Additionally, verify that the client’s information is also correct, including their billing address and contact details. Missing or incorrect contact information can delay communication and payments.

2. Failing to Include Clear Payment Terms

It’s important to specify when the payment is due, the accepted methods, and any late fees or penalties for overdue amounts. If these details are vague or missing entirely, it may lead to confusion or delayed payments. Always include a specific due date and clearly state any terms about penalties or discounts for early payments. This helps set expectations from the start.

3. Lack of Detailed Descriptions

Vague descriptions of the work completed can lead to misunderstandings. Always provide a detailed breakdown of the services or products provided, including the hours worked, the scope of the project, or the specific deliverables. This not only justifies the amount being charged but also helps the client understand exactly what they are paying for.

4. Incorrect Calculations or Missing Totals

It may seem obvious, but miscalculating the total or missing key amounts can cause significant problems. Be sure to double-check your math, whether you’re calculating the total price, taxes, or any applicable discounts. Including subtotals for individual items or hours worked can also help clarify the charges for the client.

5. Not Including an Invoice Number

Every payment document should have a unique identifier for easy reference. Without an invoice number, tracking payments or addressing disputes becomes much harder. Make sure to assign a distinct number to each document and keep a record of it for your own reference. This is especially important if you’re working with multiple clients or handling a large volume of transactions.

6. Overlooking Tax Information

If taxes apply to your services, it’s critical to include the correct tax rates and the total tax amount in the document. Failing to do so can cause confusion and may result in the client refusing to pay the full amount. Be clear about which taxes are applicable, whether they are state, federal, or international taxes, and include any relevant tax identification numbers if needed.

7. Using a Generic or Unprofessional Format

A poorly designed or generic document can make a negative impression. Always use a clean, professional layout that reflects your brand and makes the document easy to read. Clients may be hesitant to pay if the document looks unprofessional or lacks structure. A polished design builds trust and reflects the quality of your work.

8. Forgetting to Follow Up

Even with a perfectly crafted document, sometimes clients forget or delay payments. If the payment hasn’t been received by the due date, don’t hesitate to send a polite reminder. Failing to follow up on overdue payments can lead to cash flow issues and potentially damage client relationships.

Remember: It’s essential to maintain clear and open communication with your clients. Avoiding these common mistakes will not only help you get paid on time but also foster stronger business relationships moving forward.

Setting Up Payment Methods for Clients

Choosing the right payment methods is a crucial step in ensuring smooth and timely transactions with your clients. The easier and more convenient it is for clients to pay, the more likely they are to settle their accounts quickly. Offering a variety of payment options can cater to different preferences, enhancing your professionalism and encouraging faster payments. In this section, we’ll explore how to set up and manage payment methods effectively.

Popular Payment Options

There are several payment options available to you, each with its advantages. It’s important to select the ones that best suit both your business model and your clients’ needs. Some of the most commonly used methods include:

- Bank Transfers: A reliable and direct method, especially for larger amounts. Clients may prefer this for its security and simplicity.

- Credit and Debit Cards: Widely accepted and convenient for clients. You can process card payments through third-party services like PayPal, Stripe, or Square.

- Online Payment Platforms: Platforms such as PayPal, Venmo, or TransferWise allow for quick, easy payments and can be integrated with your invoicing system for seamless transactions.

- Checks: Though less common today, some clients still prefer to pay by check. If you choose to accept this method, be sure to clarify the processing time in advance.

- Cryptocurrency: For businesses that operate in the tech space or with international clients, accepting digital currencies like Bitcoin can provide added flexibility and security.

Setting Up Payment Methods

Once you’ve decided which methods to offer, it’s important to set them up properly to ensure a sm

Freelance Invoice Templates: What to Look For

When creating payment documents for clients, it’s important to choose a format that is not only professional but also efficient and easy to use. The right structure ensures that all necessary details are included, reduces confusion, and promotes timely payments. When selecting a document format, there are several key features to consider to ensure it meets both your needs and your clients’ expectations.

Key Features to Include

To create a payment document that is clear and complete, ensure that the following elements are present:

- Contact Information: Both your contact details and those of your client should be easy to find. Include your name, business name, address, phone number, and email, along with your client’s corresponding information.

- Unique Identifier: Each document should have a unique number for reference. This helps with organization and tracking, especially for clients who work with multiple contractors.

- Service Descriptions: Clearly outline the services provided or work completed, including specific tasks or milestones. This ensures that your client understands exactly what they are being charged for.

- Clear Payment Terms: Specify the payment due date, any early payment discounts, or penalties for overdue payments. This will help set clear expectations.

- Payment Breakdown: Include a breakdown of costs, including rates, hours worked (if applicable), or itemized charges. This helps clients understand the specifics of the amount owed.

- Taxes and Additional Fees: Make sure to account for taxes and any extra fees that may apply to the project.

Managing Multiple Invoices at Once

Handling several billing documents simultaneously can quickly become overwhelming if not managed efficiently. When you juggle multiple payments, the risk of errors increases, and tracking outstanding balances becomes more challenging. Organizing your records, setting up a systematic approach, and utilizing digital tools can streamline this process and reduce confusion.

One effective method is to categorize all requests by client or project, allowing you to easily track deadlines and payment statuses. Using a digital system to store and update these records can save valuable time and ensure accuracy. A well-structured approach also allows you to manage recurring tasks, monitor trends in client payments, and predict cash flow more accurately.

For example, if you are working on several contracts with different payment schedules, you can create a table to track each one’s specifics, such as the agreed amount, due date, and payment status. Here’s how such a table might look:

Client Name Amount Due Date Status Client A $500 15/11/2024 Pending Client B $750 20/11/2024 Paid Client C $300 22/11/2024 Pending With a well-maintained table like this, it’s easy to see which payments are still due and which have been processed. Additionally, setting up reminders or automated notifications can help ensure that nothing falls through the cracks, keeping your financials organized and up to date.

How to Write a Professional Invoice

Creating a clear, concise, and professional document that requests payment for services rendered is essential for maintaining a positive relationship with clients and ensuring timely compensation. A well-structured document not only communicates the amount owed but also reinforces your professionalism and attention to detail. It’s important to include all necessary elements to avoid confusion and help facilitate prompt payments.

Start by including your contact details at the top of the document, followed by the client’s information. This ensures both parties can easily identify the sender and recipient of the payment request. Next, add a unique reference number for the document. This number is helpful for tracking purposes and serves as a point of reference for both you and your client.

List the services or products provided, clearly detailing the work completed. For each item, indicate the price and the quantity, if applicable. Ensure that the descriptions are clear and accurate to avoid misunderstandings. Afterward, include the total amount due, taking into account any discounts or taxes if applicable.

Finally, include the payment terms. Specify the due date and any late fees that may apply if payment is not made on time. It’s also advisable to include your preferred payment methods, whether it be bank transfer, online payment platforms, or other means. Ending the document with a polite thank-you note can leave a positive impression and strengthen your client relationship.

Legal Considerations for Freelance Invoices

When requesting payment for services provided, it’s essential to ensure that all aspects of your payment request comply with relevant laws and regulations. Properly formatted documents not only safeguard your interests but also help avoid potential disputes or legal issues with clients. Understanding your obligations and rights as a service provider can help you maintain a professional approach and ensure that you are paid fairly and on time.

Essential Legal Elements

To ensure your payment requests are legally sound, make sure to include certain key elements. First, always include your business or personal information, including your tax ID number if applicable. This makes it clear who is issuing the request. Additionally, it is important to specify the legal agreement under which the services were provided, whether it is a contract, a written agreement, or a verbal understanding. By doing so, you create a formal record that can be referred to if disputes arise.

Tax and Compliance Requirements

Depending on your location, you may be required to collect and remit taxes on payments received. It is important to check local tax regulations to ensure you are in compliance with VAT, sales tax, or other applicable taxes. Clearly state any tax amounts on the payment request to avoid confusion. Additionally, if you are working with clients internationally, you should be aware of any cross-border tax regulations or withholding requirements that may apply to the payments you receive.

How to Follow Up on Unpaid Invoices

Dealing with overdue payments can be frustrating, but it’s a necessary part of managing your financials. Following up professionally and tactfully increases the likelihood of receiving payment while maintaining a good relationship with your clients. It’s important to remain polite and organized throughout the process, ensuring that your communication is clear and respectful.

The first step in following up is to review the details of the outstanding payment and check if any terms, such as a grace period or payment plan, were previously agreed upon. Once you’ve confirmed the amount and due date, send a polite reminder to the client, providing them with all the relevant information and a new due date if necessary.

If the payment is still not received after the initial reminder, consider sending a second follow-up. At this point, you can emphasize the importance of timely payment and mention any potential late fees or consequences outlined in your agreement. Here’s an example of how you could structure a table to track overdue payments:

Client Name Amount Due Due Date Follow-up Date Status Client A $500 15/10/2024 22/10/2024 Pending Client B $750 18/10/2024 25/10/2024 Paid Client C $300 20/10/2024 27/10/2024