Freelance Creative Invoice Template for Designers and Artists

For independent professionals in the design, art, and content industries, clear and efficient payment systems are essential to maintaining a successful business. The ability to present detailed financial documents to clients not only ensures timely payments but also reflects the professionalism of your work. An organized document that outlines the specifics of the services provided, costs, and payment terms is crucial for both you and your clients.

Creating a customized financial document helps streamline transactions, making it easier to track earnings and maintain a transparent relationship with clients. By using an adaptable format, you can ensure that each client receives accurate and consistent billing information, regardless of the project size or scope. A well-structured document is a reflection of your attention to detail and can help avoid common issues, such as delayed payments or misunderstandings about charges.

In this guide, we’ll explore how to craft the perfect financial statement for your business needs, covering everything from layout options to essential details. Whether you’re just starting out or looking to optimize your billing process, a solid approach will support the growth of your independent career while keeping your finances organized and professional.

Freelance Creative Invoice Template Essentials

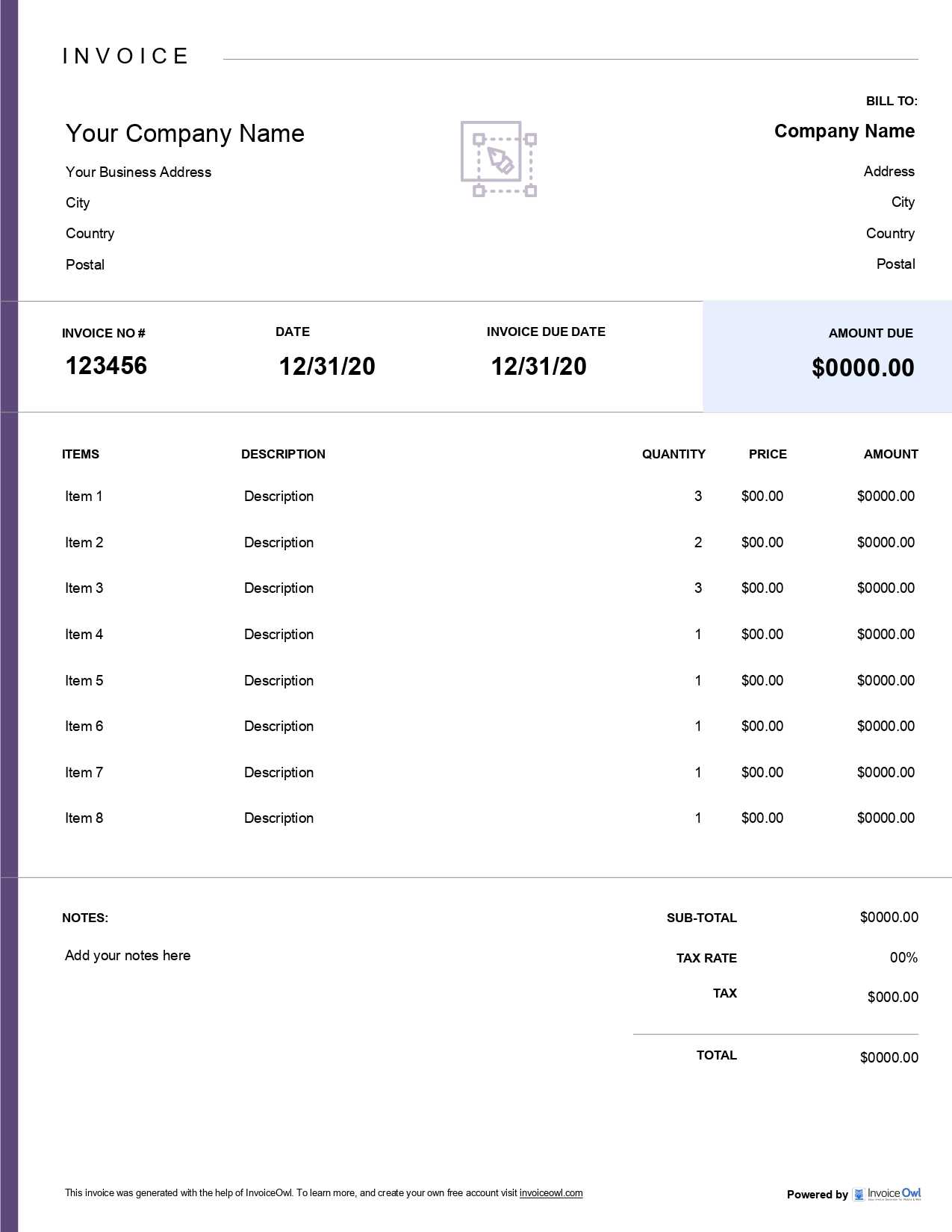

When running an independent business, having a well-structured document to request payment is a key part of maintaining professional relationships. A comprehensive financial document not only ensures clarity but also helps avoid confusion regarding the amount owed and the services rendered. It should be simple to understand, yet detailed enough to include all necessary information. Below are the essential components that every professional billing statement should contain to guarantee smooth transactions and clear communication with clients.

| Section | Description |

|---|---|

| Contact Information | Include your name or business name, address, and contact details along with the client’s information for easy reference. |

| Document Number | Assign a unique reference number to each document to keep track of all issued bills and organize them effectively. |

| Services Provided | List the specific tasks completed or products delivered, including a short description and the time spent or quantity delivered. |

| Payment Terms | Clearly state when payment is due, accepted payment methods, and any late fees or discounts for early payments. |

| Total Amount | Break down the total cost, including any applicable taxes or fees, and ensure it’s easy to calculate at a glance. |

| Due Date | Specify the exact date by which the payment should be made to avoid delays or confusion. |

By including these essential sections in every financial statement, you provide your clients with clear expectations and minimize the likelihood of misunderstandings. An organized and professional document not only helps with timely payments but also demonstrates that you value your work and your client’s time.

Why Freelancers Need Custom Invoice Templates

When managing an independent business, having a tailored billing document is crucial for ensuring smooth financial transactions with clients. A standard, one-size-fits-all approach often lacks the personalization needed to reflect the unique nature of the services provided. Customizing your financial records allows you to maintain professionalism and keep track of payments effectively. By creating a document that suits your specific business needs, you streamline communication with clients and avoid potential misunderstandings over pricing or services rendered.

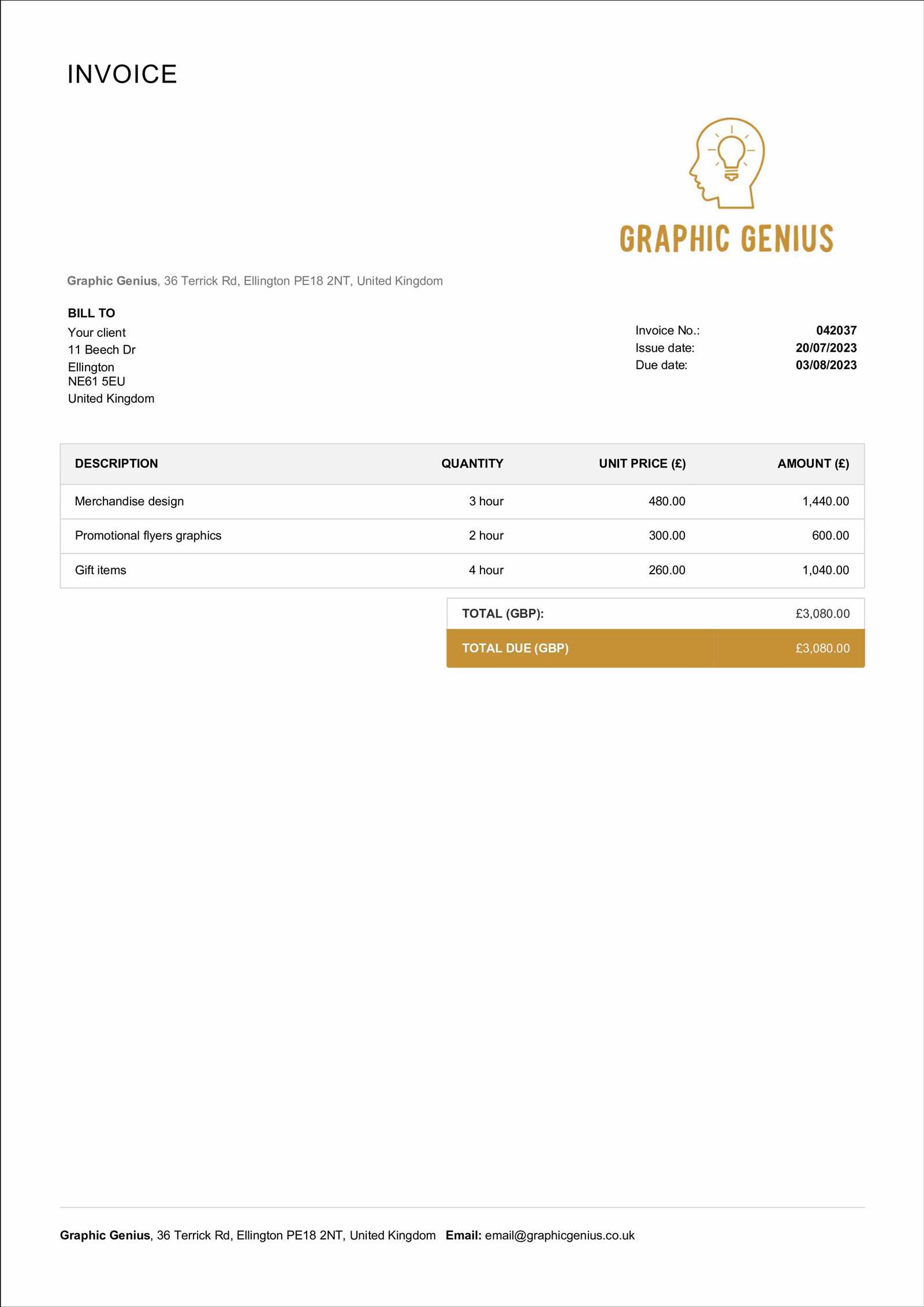

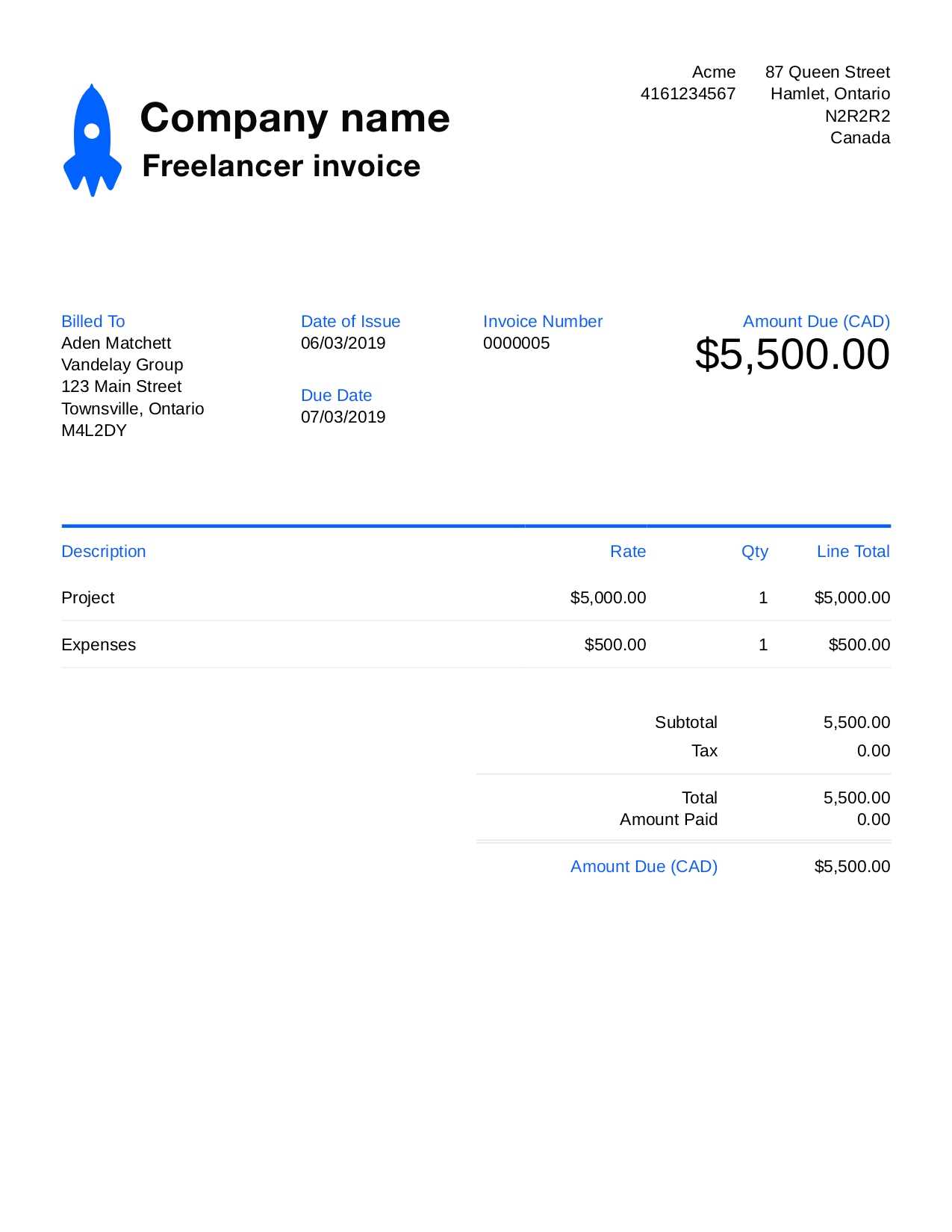

Personalized Layout for Efficiency

Custom billing documents can be structured to suit your working style and the preferences of your clients. For example, certain clients may prefer a more detailed breakdown of tasks, while others may need a simple summary. By designing your own layout, you can include only the information that’s relevant to your business, helping clients quickly understand what they’re being billed for and why. This customization can significantly speed up the approval process and reduce the time spent clarifying any issues.

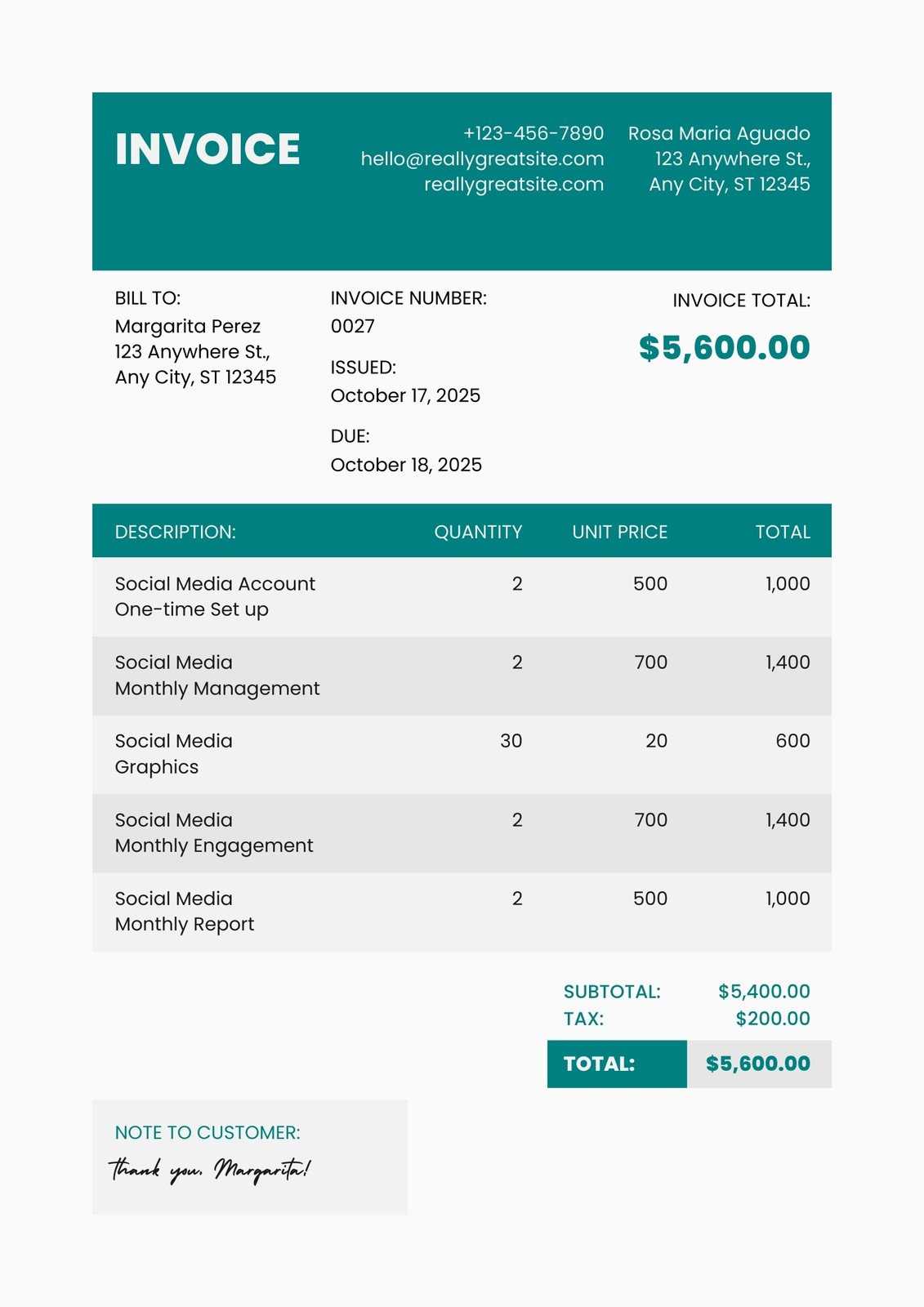

Improved Branding and Professionalism

When you create a unique billing document, it’s also an opportunity to reinforce your brand identity. A well-branded financial document featuring your logo, colors, and contact details helps set you apart from competitors and leaves a lasting impression. It signals to clients that you take your work seriously and that you are committed to delivering high-quality services. This level of professionalism can help build trust and strengthen client relationships over time.

Having a custom billing format is not just about aesthetics; it’s about creating a functional, professional tool that supports your business operations and enhances client interactions. A tailored approach to managing payments is an essential part of running a successful independent career.

Key Elements of a Professional Invoice

To ensure a smooth payment process and maintain professionalism, it’s crucial to include all the necessary components in your billing document. A well-structured record not only ensures that your client understands the cost of services provided but also prevents potential disputes or confusion regarding payments. By incorporating key elements into your financial document, you establish trust and clarify expectations for both you and the client.

Comprehensive Contact Information

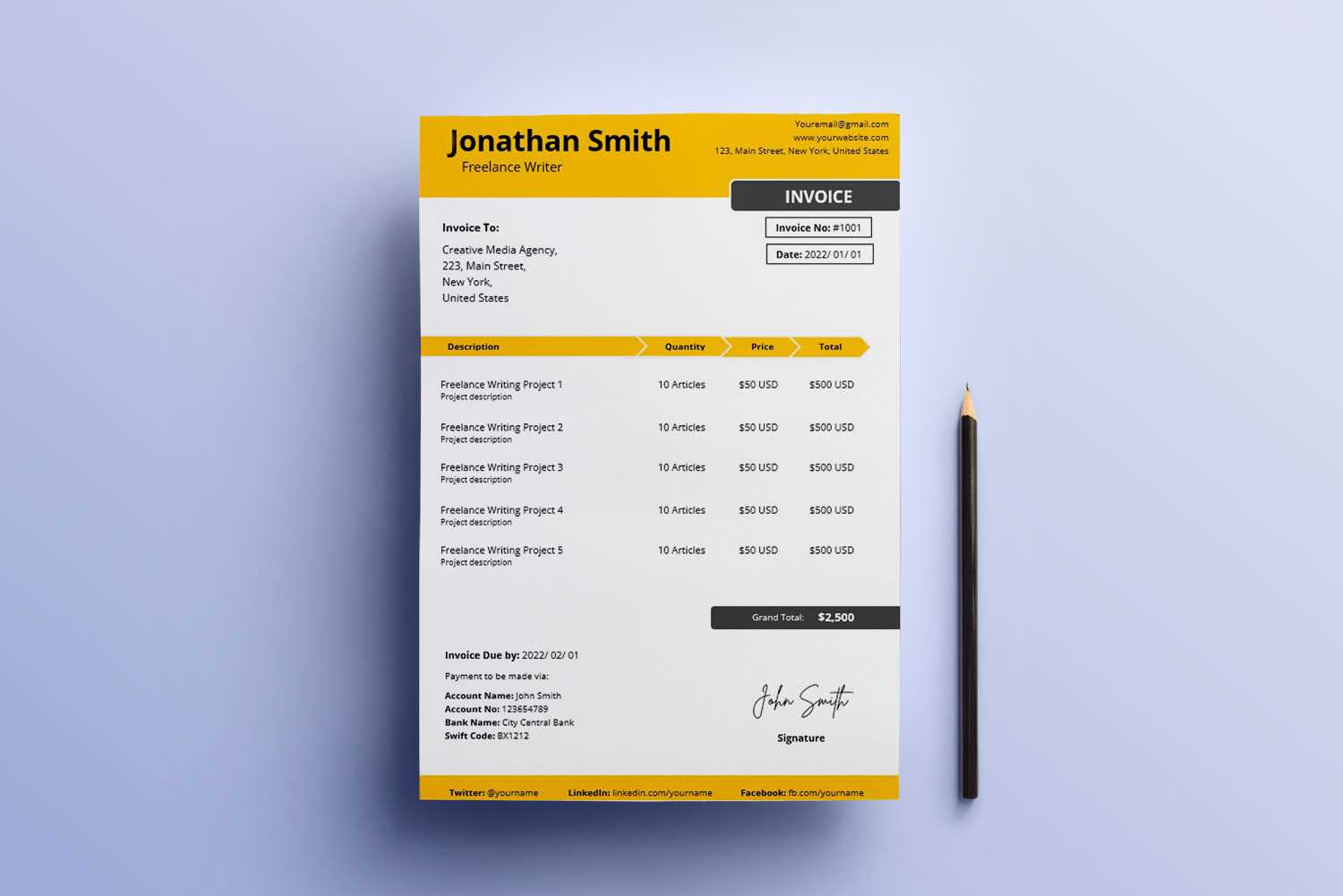

Every billing record should start with clear contact information. This includes your name or business name, address, phone number, and email address, along with your client’s details. Having this information easily accessible helps both parties stay in communication and ensures that any issues related to the payment can be addressed quickly. Make sure to include any relevant business registration or tax identification numbers if required in your industry.

Detailed Breakdown of Services

One of the most important parts of any billing document is the clear breakdown of the services or products provided. This section should include a detailed description of the work completed, the time spent, or the quantity of goods delivered. Each entry should be accompanied by the agreed-upon rate and the total for each individual service or item. By being transparent and specific, you minimize the chance for confusion and help your client understand exactly what they are paying for.

Incorporating these key elements into your financial documents not only enhances their clarity but also reflects a high level of professionalism. With accurate and detailed information, you’re more likely to be paid on time and maintain positive relationships with your clients.

How to Personalize Your Billing Statement

Personalizing your financial documents is an essential step in creating a professional and memorable experience for your clients. A customized billing record not only helps reflect your brand but also makes the process of payment clearer and more organized. By adding personal touches and tailoring your documents to match your business style, you can make your statements more attractive and easier for clients to navigate.

Steps to Customize Your Financial Documents

- Include Your Branding – Adding your logo, brand colors, and contact information to the document helps establish a professional image and reinforces your identity as a business.

- Use a Unique Layout – Tailor the format to highlight the key sections you want to stand out. Whether it’s the list of services, payment terms, or total due, make sure the most important details are easy to find.

- Add Personalized Notes – A short, friendly message or thank-you note at the bottom can go a long way in building strong client relationships. Personalize each document by including specific references to the project or collaboration.

- Customize Payment Terms – Adapt payment deadlines, methods, and any applicable discounts or fees to match your specific business agreements with each client.

Additional Features to Enhance Customization

- Include Project-Specific Details – For each billing document, list the exact services you’ve provided, including relevant descriptions and timelines. This helps clients easily verify the work that was completed.

- Track Previous Payments – Adding a section that shows prior payments or outstanding balances helps both you and your client stay on top of finances and avoid confusion.

- Highlight Due Dates Clearly – Emphasize the due date to ensure clients are aware of the timeline and avoid late payments.

By incorporating these personalized elements into your financial documents, you can create a streamlined, professional, and branded experience that fosters positive client relationships while ensuring timely payments.

Best Practices for Freelance Invoicing

Efficient billing is crucial for maintaining smooth cash flow and strong professional relationships. Adopting best practices for financial documentation ensures that you receive timely payments, minimize disputes, and present a professional image to your clients. With the right approach, invoicing becomes a straightforward task that enhances your business operations and helps you stay organized.

Timeliness and Consistency

One of the most important aspects of managing your billing process is sending documents on time. Clients are more likely to make prompt payments when they receive well-organized records right after the completion of a project or milestone. Sending invoices consistently and on a regular schedule also establishes a sense of professionalism and helps you manage your cash flow effectively. Aim to send invoices within a few days of finishing a job, or as agreed upon in the contract.

Clear and Transparent Information

Providing clear, concise, and accurate information is essential for avoiding confusion and potential delays. Make sure each entry on your document is well-explained, and include the following:

- A detailed list of the services provided, including time or quantity spent

- Agreed-upon rates for each service

- Payment terms, including the due date and preferred payment methods

- Tax details, if applicable, and any other fees

The more transparent you are about the work completed and the costs involved, the less likely your clients will need to ask questions or request clarifications.

By following these best practices, you not only streamline your billing process but also foster trust with clients, making future collaborations more efficient and enjoyable for both parties.

Choosing the Right Invoice Format for Creatives

Selecting the appropriate format for your billing documents is an essential step in ensuring that your clients easily understand the payment details and that your business runs smoothly. A clear and professional structure not only showcases your work but also makes the process of requesting payments efficient. The right layout can help prevent confusion, reduce the risk of errors, and streamline your financial operations.

When choosing the best format for your billing records, it’s important to consider several factors, such as the nature of your business, the complexity of the services you provide, and the preferences of your clients. Some may prefer a simple, clean layout, while others might appreciate more detailed breakdowns of the services rendered. Below is a table outlining key features to consider when selecting the right format:

| Feature | Description | Recommended For |

|---|---|---|

| Simple Layout | A clean, minimal design that focuses on the essentials such as the services, total cost, and payment terms. | Clients who prefer quick, straightforward billing without too much detail. |

| Detailed Breakdown | Includes itemized descriptions of each service or task, hours worked, and hourly rates or unit costs. | Complex projects where clients need a detailed explanation of how costs were calculated. |

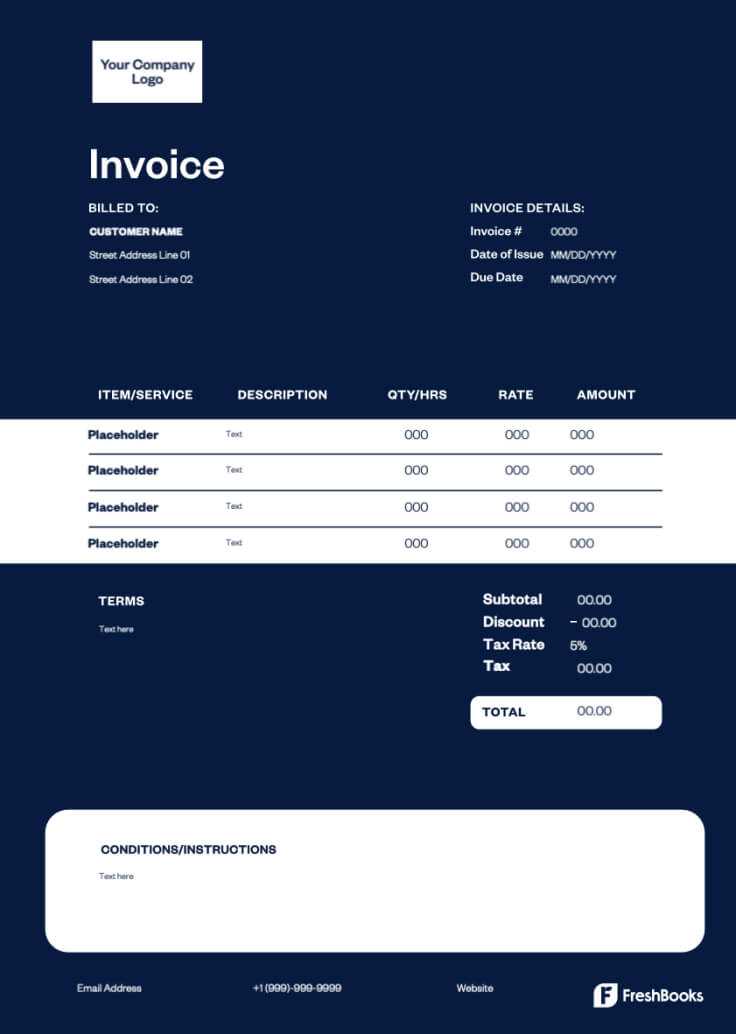

| Branded Format | A customized layout featuring your logo, business name, and other branding elements to strengthen your professional image. | Businesses looking to present a polished, professional image and maintain brand consistency. |

| Digital-Friendly Format | A format that is easy to fill out digitally, share via email, and track online payments. | Modern clients who prefer electronic records and payment methods. |

Choosing the right format ultimately depends on your business style, the needs of your clients, and the level of detail required. By customizing your billing structure, you make the process easier for both parties and maintain a professional image throughout your transactions.

Top Billing Tools for Independent Professionals

When managing an independent business, using the right tools can greatly simplify the billing process and help you stay organized. The right software or platform can automate many aspects of payment tracking, from generating financial documents to monitoring due dates. Whether you’re just starting out or looking to optimize your workflow, choosing the right solution can save you time, reduce errors, and make your financial processes more efficient.

There are a variety of tools available that cater to different business needs. Some offer basic features for quick and easy billing, while others provide advanced functionalities for managing multiple clients, tracking payments, and even sending reminders. Below are some of the best options for independent professionals:

- QuickBooks – Ideal for businesses looking for an all-in-one accounting solution. QuickBooks allows you to create customized billing documents, track expenses, and manage taxes seamlessly.

- FreshBooks – Known for its user-friendly interface, FreshBooks makes it easy to create and send professional invoices, track time, and set up automatic payment reminders.

- Wave – A free tool that offers basic billing functionality, making it a great choice for small businesses. Wave allows you to create customized billing records and accept online payments.

- Zoho Invoice – Perfect for professionals who want to automate their billing. Zoho Invoice includes features like recurring billing, time tracking, and multi-currency support for global clients.

- AND CO – Designed for freelancers, AND CO simplifies billing with features like automated expense tracking, invoicing, and contract management. It also integrates with payment gateways for seamless transactions.

Using one of these tools can help streamline your workflow, making it easier to manage your finances and focus on growing your independent business. With the right software, you can spend less time on paperwork and more time doing what you do best.

How to Organize Your Billing Information

Properly organizing your financial documentation is key to maintaining efficiency and ensuring that your clients can easily understand the charges. Whether you are managing a single project or handling multiple clients, a well-organized structure can save time, reduce errors, and help you stay on top of payments. A clear and consistent format allows you to quickly reference any necessary details when following up with clients or reviewing past transactions.

To achieve an organized and effective approach, it’s essential to structure your records in a way that is both logical and easy to navigate. Here are some strategies to keep your information orderly:

Key Components to Organize

- Client Information: Keep each client’s name, contact details, and payment terms clearly listed for easy access.

- Project Details: Make sure to include specific descriptions of the work or products provided, including dates and deliverables.

- Rates and Charges: Clearly outline the pricing for each service or product, including any applicable taxes or additional fees.

- Payment Status: Keep track of whether a payment has been made, is due, or is overdue.

Tips for Organizing Financial Documents

- Use a Consistent Format: Whether you choose a digital tool or manual system, make sure that your format remains consistent across all records for easier tracking.

- Store Documents Securely: Whether digital or paper, ensure that your financial documents are stored safely. Consider using cloud-based platforms for easy access and secure backup.

- Track Payment Deadlines: Keep a calendar or reminder system for due dates. This helps you avoid missed payments and maintain positive client relationships.

- Label Files Clearly: Name each file or document in a way that includes the client name, project, and date for quick identification (e.g., “ClientName_ProjectDate”).

By following these steps, you can ensure that your financial documentation is always organized, making it easier to manage your projects and stay on top of payments.

Understanding Payment Terms in Billing Documents

Clearly outlining payment terms in your financial records is essential for both you and your clients. By specifying when and how you expect to be paid, you set clear expectations and avoid confusion. These terms not only protect you but also help maintain a professional and transparent relationship with your clients. Whether it’s establishing deadlines, setting payment methods, or detailing late fees, a solid understanding of payment terms ensures that both parties are on the same page throughout the transaction process.

Common Payment Terms to Include

Below are some of the most common payment terms to include in your financial documents, along with explanations of their importance:

| Payment Term | Description |

|---|---|

| Due Date | Specifies the exact date by which payment is expected. This is typically set based on project milestones or completion date. |

| Payment Methods | Details the accepted forms of payment (e.g., bank transfer, PayPal, credit card). This helps ensure that the client knows how to settle the bill. |

| Late Fees | Indicates the penalty for overdue payments, often as a percentage of the total amount due. This encourages clients to pay on time. |

| Deposit Requirements | Specifies if an upfront deposit is required before work begins. This is particularly common for larger projects and helps secure the commitment of the client. |

| Net Terms | Refers to the length of time a client has to pay. For example, “Net 30” means payment is due 30 days after the document is issued. |

Why Payment Terms Matter

By clearly outlining these terms in every billing document, you protect both yourself and the client. Payment terms help prevent misunderstandings, ensure timely payments, and establish a professional framework for all transactions. Furthermore, having these terms in writing gives you legal protection in case of disputes or non-payment.

Setting clear, precise payment terms is not just about managing finances; it’s about fostering trust and transparency with your clients while ensuring that your business operations run smoothly.

Incorporating Branding in Your Billing Documents

Incorporating your brand identity into your financial records not only helps you stand out but also creates a professional and cohesive experience for your clients. By adding personalized elements such as your logo, colors, and unique design features, you reinforce your brand’s presence and make your documents look polished and reliable. This attention to detail enhances your professional image and makes the payment process feel more official and aligned with your business values.

When integrating branding into your financial records, it’s important to strike a balance between professionalism and creativity. The goal is to make your document easily recognizable while still focusing on the clarity and functionality of the content. Here are a few ways to incorporate branding effectively:

Key Branding Elements to Include

- Logo: Place your logo prominently at the top of the document. This ensures immediate recognition of your business and reinforces your brand identity.

- Color Scheme: Use your brand colors throughout the document, especially for headings, borders, or accents. Consistent use of color helps create a cohesive look across all your business materials.

- Typography: Choose fonts that align with your brand’s personality. Keep the text clear and legible while staying consistent with the style used in other business documents or your website.

- Tagline or Business Name: Include your tagline or business name in a prominent location, such as the header or footer, to further establish your brand identity.

In addition to these elements, ensure that your document is still easy to read and professional. While branding is important, clarity and simplicity should always be the priority in financial documentation. The combination of a strong visual identity and clear, well-organized information will help you build trust with your clients and present yourself as a credible, reliable professional.

Common Mistakes to Avoid in Billing Documents

Properly formatted financial records are crucial for ensuring timely payments and maintaining professional relationships. However, errors in these documents can lead to confusion, delays, and even lost income. It’s important to avoid common pitfalls that can undermine the clarity and professionalism of your financial communications. By staying mindful of these mistakes, you can streamline the payment process and build stronger client trust.

Top Mistakes to Watch Out For

- Missing or Incorrect Client Information: Failing to include accurate client details such as the correct name, address, or contact information can cause delays in payment and create confusion. Always double-check client details before sending your documents.

- Unclear Payment Terms: Leaving payment terms vague or not specifying due dates, payment methods, and late fees can result in misunderstandings. Be precise about when and how you expect payment, and always outline penalties for overdue amounts.

- Omitting Itemized Descriptions: Not listing the services or products provided in detail can lead to confusion. Be specific about what you’re charging for, including the time spent, rate, and any other relevant breakdowns.

- Failure to Include Tax Information: If applicable, neglecting to include tax rates or calculations can lead to disputes. Ensure you account for taxes in your billing records to avoid issues with clients or tax authorities.

- Not Tracking Payments: Forgetting to mark whether a payment has been received or is still due can complicate follow-ups and cause payment delays. Keep a clear record of the payment status to track your finances accurately.

How to Avoid These Mistakes

- Review Your Documents Carefully: Before sending out any financial records, take the time to review them thoroughly for accuracy. Checking for simple mistakes, such as incorrect totals or missing information, can save you from unnecessary issues down the line.

- Use Digital Tools: Consider using billing software to automate calculations, reminders, and formatting. This can help eliminate human errors and ensure your documents are always consistent and professional.

- Provide Clear Communication: If you ever need to clarify anything in your billing documents, communicate with your clients early on. Clear, open communication helps build trust and prevents confusion in the future.

Avoiding these common errors will not only make your financial records more professional but also ensure a smoother, more efficient payment process with your clients.

How to Handle Late Payments on Billing Documents

Late payments can be a frustrating part of doing business, but they don’t have to disrupt your workflow or create tension with clients. Knowing how to effectively address overdue payments is essential for maintaining a healthy cash flow and professional relationships. By establishing clear expectations and following a structured process, you can minimize the impact of delayed payments and encourage clients to pay on time in the future.

Steps to Take When Payments Are Late

If a payment is overdue, it’s important to stay calm and professional. Here are some steps you can take to handle late payments effectively:

- Send a Friendly Reminder: Often, a simple reminder email or phone call is all that’s needed. Politely remind your client of the payment due date and provide them with any necessary details, such as the amount due and available payment methods.

- Review Your Payment Terms: Before taking further action, make sure that the terms were clear and agreed upon. If your client missed a payment due to confusion or miscommunication, this step can help clear up any misunderstandings.

- Offer Payment Flexibility: In some cases, clients may be facing cash flow issues or other challenges. Consider offering an alternative payment plan or negotiating a new deadline if appropriate. This shows understanding and may help you get paid more quickly.

Dealing with Persistent Late Payments

If the payment continues to be delayed despite multiple reminders, you may need to take stronger actions:

- Charge Late Fees: If you’ve specified late fees in your payment terms, apply them consistently. This encourages clients to pay on time and compensates you for the inconvenience.

- Send a Formal Demand Letter: If reminders aren’t effective, send a formal letter outlining the overdue amount, the consequences of non-payment, and a final deadline. This adds a level of seriousness to the matter.

- Consider Legal Action: As a last resort, you may need to explore legal options, such as sending the debt to collections or pursuing a small claims court case. This step should only be taken after exhausting all other avenues.

By addressing late payments in a professional, consistent manner, you can encourage clients to prioritize payments while protecting your business interests. Setting clear terms from the outset and communicating openly when delays occur helps ensure you maintain positive relationships and secure timely payments in the future.

Benefits of Using a Billing Document Format

Having a predefined structure for your financial records offers numerous advantages, making the process of tracking and managing payments more efficient and organized. By using a standardized format, you can save time, reduce errors, and ensure consistency in your communications with clients. Whether you’re a small business owner or an independent professional, implementing a well-organized system for your billing documents helps maintain professionalism and streamlines the payment process.

Here are some of the key benefits of using a consistent format for your financial paperwork:

Time-Saving Efficiency

One of the main advantages of using a structured billing document is the time it saves. Instead of creating a new document from scratch every time, you can quickly fill in the necessary details for each transaction. This not only speeds up the process but also ensures that you don’t forget important information.

Professional Appearance

Having a clear, consistent format gives your financial records a polished, professional look. A well-designed document can help build trust with clients, showing that you pay attention to detail and take your business seriously. This professional appearance can set you apart from others and may even encourage clients to pay faster.

Reduced Errors and Omissions

By using a predefined structure, the chances of missing important information are greatly reduced. A template ensures that all necessary fields are included, minimizing human error. Whether it’s client details, project descriptions, or payment terms, a consistent format helps you remember and double-check every detail, ensuring accurate billing.

Consistency Across Documents

Maintaining uniformity in your financial documents is key to presenting a cohesive image of your business. By using the same format for all transactions, you create a recognizable style that clients will come to associate with your brand. Consistency also helps you stay organized, as it becomes easier to reference previous records and track your financial history.

Incorporating a standardized system for your financial documents not only improves efficiency but also enhances the client experience. With faster processing, professional-looking paperwork, and fewer errors, using a structured format is a simple but powerful way to optimize your business operations.

How to Make Your Billing Documents Stand Out

In a world where every detail counts, making your financial records stand out can leave a lasting impression on your clients. A well-designed, unique document doesn’t just communicate numbers–it reinforces your professionalism, brand, and attention to detail. By elevating the appearance and clarity of your paperwork, you show that you value both your work and the client’s experience. Below are strategies to make your billing documents not only functional but memorable.

Design with Purpose

The design of your financial records should be clear, organized, and visually appealing. A clean layout with structured sections makes it easy for clients to find the information they need. Use colors, fonts, and logos that align with your brand identity. This adds a personal touch that helps your documents stand out without compromising readability. A visually appealing document also suggests that you take your business seriously and are invested in providing an excellent client experience.

Include Personal Touches

Adding small personal touches can make your documents feel more tailored to each client. This might include addressing the client by name, including a thank you note, or adding a small branding message or slogan that reinforces your business’s personality. Personalizing your documents helps to create a connection with the client, making the transaction feel more like a partnership than a mere business exchange.

- Use Clear, Bold Headings: Make the key sections of your document easy to navigate with bold, easily readable headings. This shows attention to detail and helps your clients find what they’re looking for quickly.

- Ensure Consistent Branding: Consistency in colors, logos, and fonts across all your business materials–whether it’s your website, contracts, or financial records–reinforces your brand identity and enhances client trust.

- Provide Additional Information: Consider adding a brief message about your business, upcoming offers, or relevant updates. This can add value to your document and encourage clients to stay engaged with your services.

By investing a little extra effort into the design and presentation of your financial documents, you can significantly improve the client experience, encourage prompt payments, and differentiate yourself from the competition. Making your documents stand out is not just about aesthetics–it’s about demonstrating professionalism and ensuring your work is remembered.

Legal Considerations for Billing Documents

When managing financial transactions, it’s crucial to understand the legal aspects involved in documenting payments. Properly structured paperwork is not only a way to request compensation for services but also serves as a legal record of the agreement between you and your clients. Ensuring that your documents include the necessary legal elements protects both parties and reduces the risk of disputes or misunderstandings. In this section, we will explore the key legal factors to keep in mind when drafting your billing records.

Essential Legal Elements to Include

There are several important legal elements that should be present in your billing documents to ensure they are compliant with the law and effective in protecting your rights. The following table outlines these key components:

| Legal Element | Description |

|---|---|

| Clear Payment Terms | Specify the payment due date, acceptable methods, and any late fees or interest that may apply for overdue payments. |

| Client Information | Include the full legal name, address, and contact information of the client to establish a clear contract between the parties. |

| Service Description | Clearly outline the services or products provided, including dates, rates, and quantities, to avoid misunderstandings. |

| Tax Details | Ensure taxes are applied in compliance with local laws, and include tax rates and amounts clearly on the document. |

| Payment Receipt Confirmation | Include a section that allows for acknowledgment of payment once received, reducing potential future disputes over payment status. |

Protecting Your Rights and Interests

In addition to the key components listed above, consider including the following to safeguard both parties:

- Terms of Service: If you have standard terms or contracts for your services, include a brief reference or link to the full terms in your b

Creating and Storing Digital Billing Documents Efficiently

In today’s digital age, creating and managing your financial records electronically is not only more efficient but also environmentally friendly. Moving away from paper records allows for quicker processing, easier storage, and faster access to important documents. By adopting a streamlined approach to creating and storing these records, you can reduce administrative overhead, minimize the risk of errors, and stay organized. Below, we discuss best practices for creating and securely storing your billing documents in a digital format.

Best Practices for Creating Digital Billing Documents

When creating electronic records, it’s important to maintain consistency, clarity, and professionalism. The following table outlines key steps to efficiently create and manage your digital documents:

Step Action Use Reliable Software Choose a trusted software tool that allows you to easily create and customize your documents. Options range from word processors to specialized invoicing programs that automate calculations. Save in Common File Formats Store your documents in widely accepted file formats such as PDF, which ensure compatibility across different devices and operating systems. Ensure Consistency Maintain a consistent format for all your documents. This helps reinforce your brand and makes it easier to navigate your records. Include All Necessary Details Be sure to include all relevant client information, payment terms, and service descriptions in each document to avoid confusion later. Efficient Storage of Digital Documents

Once your billing documents are created, it’s essential to store them securely and in an organized manner. Consider the following best practices for managing your records:

- Cloud Storage: Use cloud-based storage solutions like Google Drive, Dropbox, or specialized accounting software that offers secure storage and easy access to documents from any device.

- Organize by Client and Date: Set up a well-structured file system with folders for each client and subfolders for different months or years. This makes it easier to retrieve past documents when needed.

- Back Up Your Data: Always back up your documents to avoid loss of important records. Regular backups ensure that even if you lose access to your primary storage, your files remain safe.

- Use Password Protection: Protect sensitive billing records with passwords or encr