Freelance Copywriter Invoice Template for Easy Billing

Managing payments efficiently is crucial for those who work on a project basis. Creating clear and organized documents that reflect the work done and ensure prompt payment can help maintain smooth financial operations. These documents serve as official records, outlining terms and providing a transparent overview of completed tasks.

For those who provide services on a flexible schedule, having a well-structured financial document is essential. It not only helps in maintaining clarity with clients but also simplifies the process of tracking earnings and handling tax requirements. A correctly formatted document can streamline this process, ensuring that every detail is covered and payments are made on time.

With the right approach, managing finances can be effortless and professional. Tailoring a suitable form for each client will lead to improved communication and ensure both parties are on the same page. By taking advantage of various available tools, creating these documents can be fast and straightforward, allowing you to focus more on your craft.

Professional Billing Document Guide

Creating a structured document to request payment for services is essential for any independent professional. A well-organized payment request not only ensures clarity but also builds trust with clients by outlining the specifics of the work completed and the amount due. This section will guide you through the key elements that make up an effective financial document for your projects.

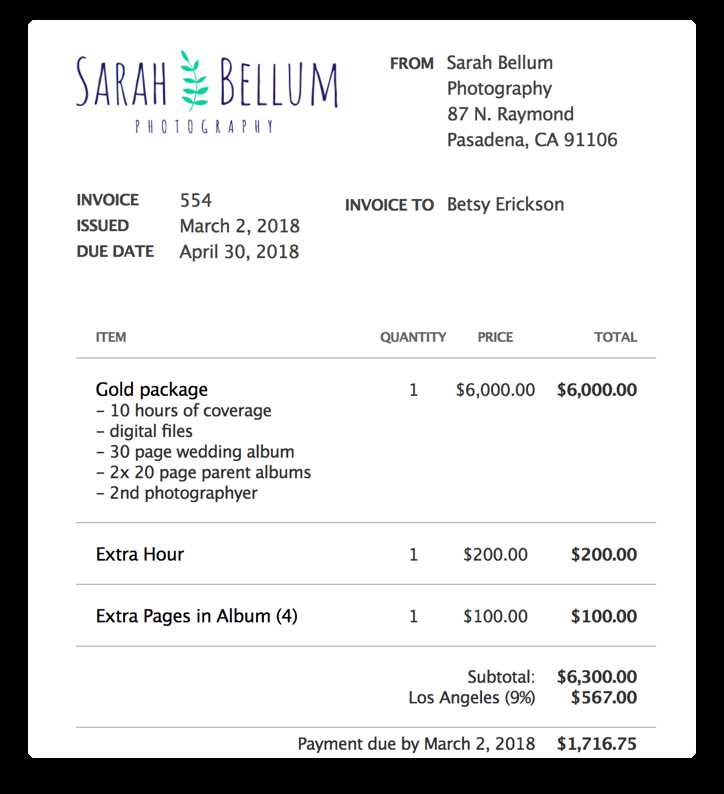

When preparing a payment request, it’s important to include all necessary details that reflect the scope of the work and the agreed terms. Each document should clearly display the client’s information, your services, the amount owed, payment terms, and due dates. A well-designed format allows clients to easily review the terms and make payments without confusion.

| Element | Description |

|---|---|

| Client Information | Include the full name, address, and contact details of the client to ensure proper identification. |

| Your Details | Provide your name or business name, address, and payment contact information. |

| Service Description | List the services you provided with clear descriptions and the corresponding rates. |

| Payment Amount | Clearly state the total amount due for the completed work, including any applicable taxes or discounts. |

| Payment Terms | Outline the payment method, due date, and any late payment penalties if applicable. |

Having a standardized approach for each project not only helps in organizing your financial documentation but also fosters professionalism. With the right structure, the process of requesting payment becomes more efficient and ensures that all essential information is communicated clearly to your clients.

Why You Need a Payment Request Document

Having a structured payment request form is crucial for anyone offering services on a contract basis. It ensures that both you and your client are on the same page regarding the work completed and the amount due. A clear, professional document helps streamline the payment process, reduces misunderstandings, and enhances your credibility.

Without a proper format, managing payments can become chaotic. It may lead to delays, confusion, or even missed payments. By using a standardized approach, you provide your clients with all the necessary details, making it easier for them to process the payment promptly. Additionally, it serves as an official record for both parties, which can be helpful for tax purposes and future reference.

Efficiency is one of the main reasons to use a prepared form. When you don’t have to create a new document from scratch every time, you save time and reduce the chance of errors. Instead, you can quickly input specific details related to the project, ensuring that all necessary information is included.

Professionalism is another key benefit. A well-designed document reflects your attention to detail and your commitment to running a serious business. It sets the right tone with your clients and shows that you value their time and money.

Key Features of an Effective Payment Request

For any service provider, a well-structured financial document is essential to ensure clear communication and a smooth transaction. The document should include all relevant details that leave no room for confusion or delay. It needs to be clear, professional, and easy for both parties to understand, ensuring timely payment and maintaining a positive relationship.

An effective payment request document serves as a formal agreement between you and the client. It outlines what work was completed, the agreed-upon price, and any other terms related to the transaction. Below are the key elements that should be included in every document to ensure its effectiveness.

| Feature | Description |

|---|---|

| Clear Client Details | Include the client’s full name, contact information, and billing address to avoid any confusion. |

| Your Information | Ensure your name, business name, contact details, and payment information are clearly visible. |

| Service Description | Provide a concise list of services performed, with the rate for each service and the total amount for each section. |

| Payment Amount | State the total amount due, including applicable taxes, discounts, or additional charges. |

| Payment Terms | Specify the due date, acceptable payment methods, and any late payment penalties. |

| Unique Reference Number | Assign a unique number to the document to help track the transaction and make record-keeping easier. |

Including these key elements in your payment request ensures that all the essential information is available at a glance. This not only speeds up the payment process but also strengthens your professional image by presenting a thorough and organized document.

How to Customize Your Payment Request Document

Customizing your payment request form allows you to tailor it to your specific needs and client requirements. By adjusting the layout, adding relevant information, and including any special terms, you can create a document that is both professional and effective. Customization helps maintain consistency in your communications and ensures that all necessary details are present for each transaction.

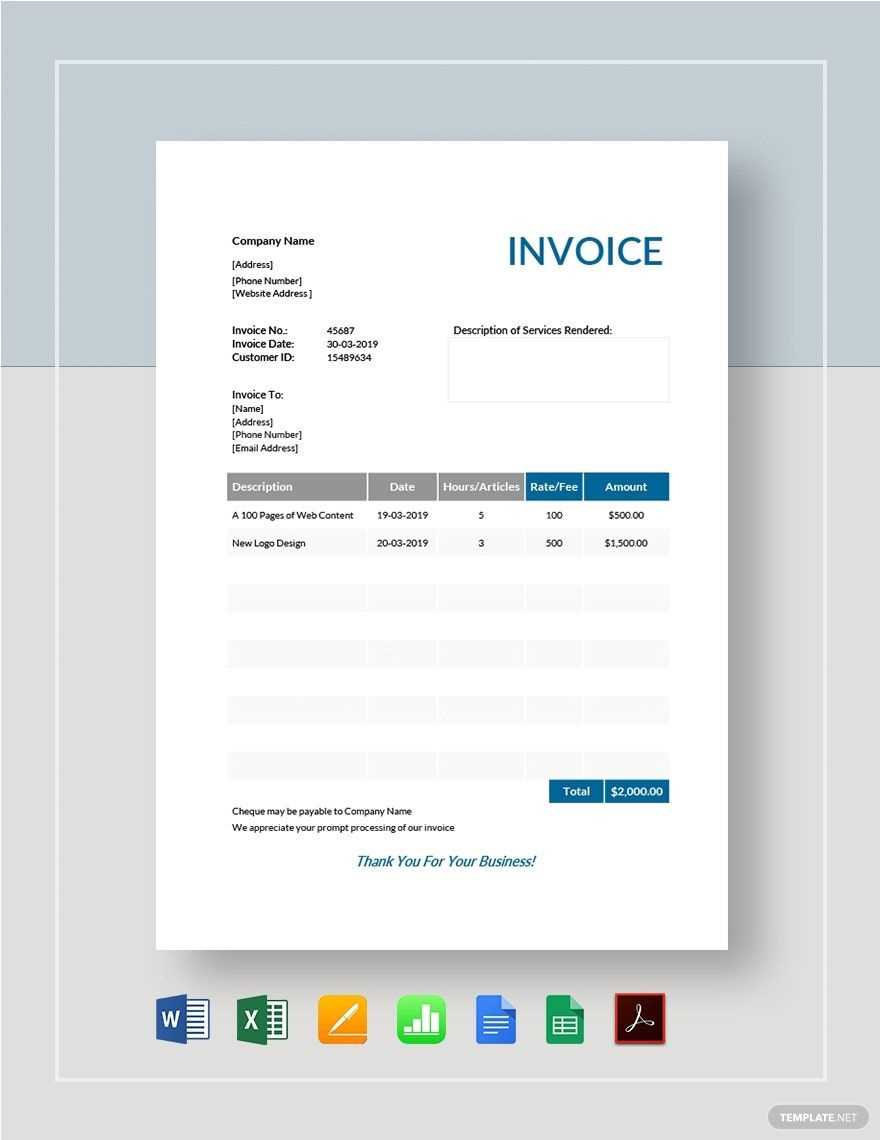

Adjusting Layout and Design

The layout of your payment document is important for both clarity and professionalism. A clean and organized format will make it easier for clients to process the payment without confusion. You can choose from various designs, whether you prefer a simple text-based format or a more detailed, graphical style. Many online tools and software allow you to modify fonts, colors, and sections to match your brand or personal style.

Including Specific Details

While there are essential components that every document should have, you may also want to add custom sections depending on the nature of your work. For example, if you offer discounts for early payments or have specific terms regarding revisions, you can include these in a dedicated section. Additionally, you can add your business logo or other branding elements to reinforce your professional image.

| Section | Customizable Option |

|---|---|

| Client Information | Modify the fields to include additional contact details or account numbers if required. |

| Service Description | Add custom sections for project milestones, hourly rates, or special terms based on the project. |

| Payment Terms | Specify any special payment conditions such as discounts, penalties, or payment plans. |

| Additional Notes | Include any project-specific notes, such as deadlines, milestones, or revision limits. |

By customizing your document, you ensure that each request is tailored to your unique business needs while maintaining a professional and consistent approach with all clients.

Understanding Payment Terms

Clear payment terms are crucial for ensuring that both parties are aligned on expectations regarding the timing and method of payment. These terms specify when and how the payment should be made, providing clarity and avoiding misunderstandings. By including well-defined payment conditions in your financial documents, you create a transparent framework that benefits both you and your clients.

Payment terms are typically agreed upon before the work begins and should be clearly stated in the document. Common terms include the due date, the accepted payment methods, and any penalties for late payments. It is essential to communicate these terms upfront to ensure that both sides are on the same page and that payment is received promptly.

| Term | Description |

|---|---|

| Due Date | The date by which the payment must be completed, often set a few days or weeks after the document is issued. |

| Payment Methods | The acceptable methods for making the payment, such as bank transfer, PayPal, or credit card. |

| Late Payment Penalties | Fees or interest charges that are applied if the payment is not received by the due date. |

| Early Payment Discounts | A discount offered to clients who pay before the due date, encouraging timely settlement. |

| Payment Installments | Agreed-upon breakdowns of payment in stages, commonly used for large projects. |

By establishing clear payment terms, you ensure a smooth and efficient transaction process. These terms set the foundation for a professional and respectful working relationship, making it easier to resolve any potential disputes that may arise regarding payments.

Essential Information for Every Payment Request

To ensure smooth transactions, it’s important to include all the necessary details in your payment request document. These key elements provide clarity for both you and your client, making it easier to process the payment without any confusion. From personal contact details to a clear breakdown of services, every part plays a role in making the process efficient and professional.

Key Elements to Include

When drafting your payment request, certain information must be present to guarantee that the transaction goes as planned. These elements help ensure that your client has all the details they need to process the payment quickly and correctly. Let’s look at some of the most important sections to include:

| Element | Description |

|---|---|

| Client Information | Include the full name, address, and contact details of the client for clear identification. |

| Your Information | Provide your business or personal name, address, and contact details to ensure easy communication. |

| Work Description | Clearly describe the services provided, including the quantity, rates, and any other specifics related to the work. |

| Amount Due | State the total amount owed, including any taxes or additional charges that apply. |

| Due Date | Set a clear due date for when the payment should be made, helping to avoid late payments. |

| Payment Terms | Outline the payment methods accepted, such as bank transfer, credit card, or PayPal, as well as any conditions like discounts for early payment. |

Why These Details Matter

Including these details ensures that there is no ambiguity in the payment process. It establishes clear expectations for both parties and reduces the risk of disputes. A professional and thorough document demonstrates your attention to detail and helps to maintain a good working relationship with your clients.

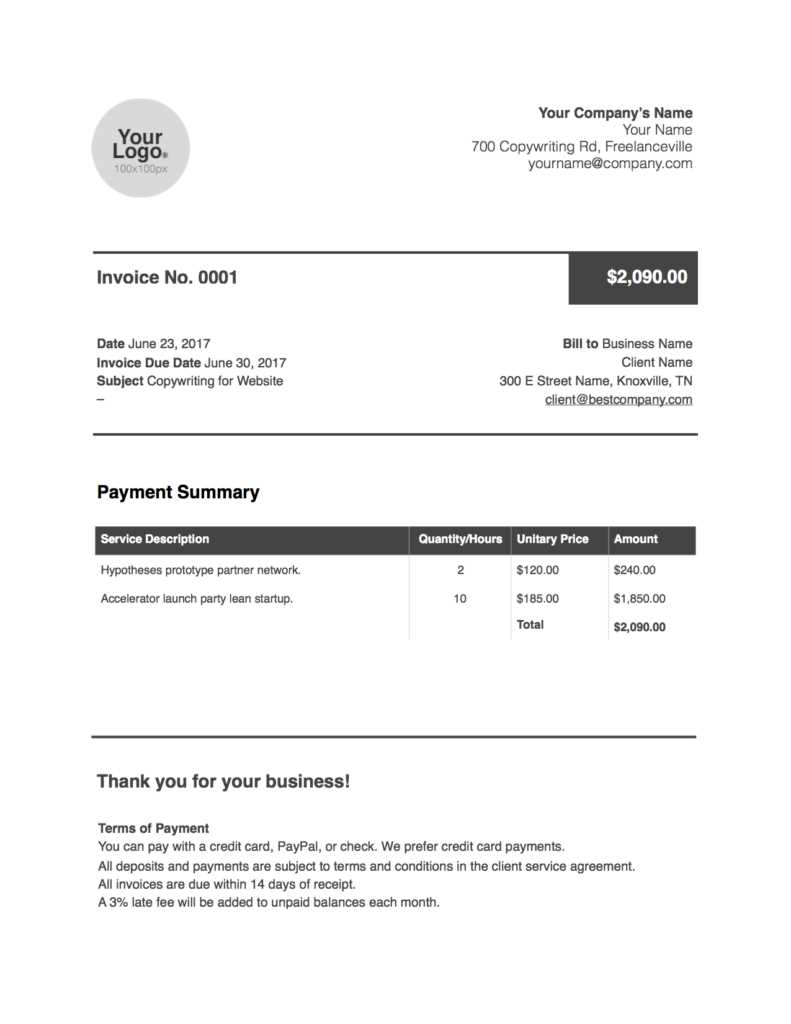

How to Choose the Right Format

When creating a formal payment document, selecting the right structure is crucial to ensure clarity and professionalism. The format should be easy to read, organized, and compatible with the tools both you and your clients are using. The right layout can improve communication, speed up the payment process, and reduce the chances of mistakes.

Consider Your Client’s Preferences

One of the first things to consider when choosing a format is your client’s preferences. Some clients may prefer digital formats such as PDFs, while others might request editable documents like Word files or Excel spreadsheets. Understanding their needs can help you decide whether a simple text-based format or a more detailed design with graphics is the best choice.

Professional Appearance and Functionality

The format should not only look professional but also serve the functional purpose of making the payment process as smooth as possible. Whether you are using a software tool, a document editor, or a physical paper form, the key is to have sections clearly marked for essential information such as client details, work description, and payment terms. A clean, structured layout will make the process more efficient for both you and your client.

Digital Formats such as PDF or Excel are often preferred due to their compatibility with various devices and easy sharing options. These formats also help preserve the layout, ensuring that your document appears exactly as you intended. On the other hand, Word Documents or editable Google Docs can allow for quick adjustments if necessary but may lose formatting consistency when opened on different devices.

Print-friendly formats might also be useful if you or your clients prefer physical records. However, in today’s digital age, most transactions are handled electronically, making PDF and Excel files the most common choices.

Payment Request Best Practices for Independent Contractors

Creating a clear and professional payment request document is an essential part of any independent worker’s business process. By following best practices, you ensure that all necessary information is included, helping to avoid confusion and delays. A well-structured request not only demonstrates professionalism but also streamlines the payment process, making it easier for your clients to pay on time.

Timeliness and Consistency

Sending your payment request promptly and on a consistent schedule is key to maintaining a healthy cash flow. It’s important to send the document as soon as the work is completed or at an agreed-upon milestone. Consistency helps establish trust with clients and reinforces your commitment to professionalism. Make sure to follow up if a payment is late and always keep a record of all sent requests for reference.

Clear and Accurate Details

Each payment document should clearly outline the details of the work performed, the amount due, and the payment terms. This helps avoid any confusion or disagreements down the line. Ensure that all information, including the payment deadline, accepted methods of payment, and any additional charges, is easy to understand and unambiguous. Clear communication is key to ensuring timely payment.

| Best Practice | Why It Matters |

|---|---|

| Provide Complete Contact Information | Ensure both your details and the client’s are accurate, allowing for easy communication. |

| Break Down Services | A detailed breakdown helps clients understand what they are paying for and reduces disputes. |

| Set Clear Payment Terms | Define when and how payment is expected, including any early payment discounts or penalties. |

| Use a Professional Format | A well-organized, professional document reflects your business standards and encourages prompt payment. |

By adhering to these best practices, you can ensure that the process is smooth and efficient for both you and your clients, leading to positive relationships and timely payments.

Common Mistakes in Payment Requests

Even experienced independent workers can sometimes make mistakes when creating a formal payment document. These errors can lead to delays in payment, confusion, or strained client relationships. By being aware of the most common mistakes and addressing them proactively, you can ensure smoother transactions and avoid unnecessary complications.

One of the most frequent errors is failing to include all necessary details. Missing contact information, incorrect payment terms, or unclear descriptions of services can cause misunderstandings and lead to delayed payments. Another mistake is not specifying the payment deadline clearly, which may result in confusion over when the payment is due.

Another issue is the use of inconsistent or unprofessional formatting. A poorly structured document can give the impression of disorganization or carelessness, which may affect how seriously your client takes the payment request. It’s important to use a consistent and professional format to enhance readability and ensure that all key sections are easily identified.

Lastly, overlooking taxes or additional charges is a common mistake. Whether it’s VAT, service fees, or any other applicable charges, failing to include them can result in short payments and frustration. Always be thorough and check that all charges are accounted for before sending the document.

Setting Up Payment Request Documents in Word

Creating a structured payment document in Microsoft Word allows you to have a customized, reusable format for your transactions. With Word’s versatile editing features, you can design a professional document that meets your specific needs, whether for one-time projects or regular work. Here’s how to efficiently set up such documents for your business.

Step-by-Step Guide to Setting Up

To set up a payment document in Word, follow these steps to ensure a well-organized and professional appearance:

- Open a New Document: Start by creating a new document in Microsoft Word.

- Add Your Branding: Include your name, logo, or business details at the top of the document to make it more personalized.

- Insert Table for Service Details: Use a table to clearly list the services provided, rates, quantities, and total amounts.

- Format Payment Information: Clearly outline the payment terms, methods, and deadlines in a separate section to avoid confusion.

- Include Contact Information: Make sure your and the client’s contact information are easy to find in the document.

- Save as a Template: After setting up the document, save it as a template so you can reuse it in the future for new transactions.

Customizing Your Document

To further personalize your document, consider adjusting the layout and design to match your style or business identity. You can do the following:

- Use Clear Fonts: Choose legible fonts like Arial or Times New Roman for readability.

- Set Margins and Spacing: Ensure that your document has proper margins and spacing for a clean look.

- Add Custom Sections: If you have specific needs, add custom sections for discounts, payment history, or additional fees.

By setting up a clear and professional payment document in Word, you can streamline your billing process and maintain consistency across all your transactions.

Using Excel to Create Payment Request Documents

Microsoft Excel is an excellent tool for creating organized and easily manageable payment documents. With its built-in calculation features and customizable formatting options, Excel allows you to efficiently track work details, calculate amounts, and generate professional-looking documents. Here’s how you can use Excel to streamline your billing process and ensure accuracy in your financial records.

First, start by setting up a basic structure for your document. Excel offers a grid system that makes it simple to organize different sections, such as the client’s information, services rendered, and payment terms. With the ability to use formulas, you can automatically calculate totals, taxes, and discounts, saving time and reducing the risk of errors.

One of the key advantages of using Excel is the flexibility it offers in customizing your document layout. You can easily adjust column widths, add rows for additional services, and format the cells to ensure all information is clear and easy to read. This level of customization helps maintain a professional appearance while meeting your specific business needs.

Additionally, Excel allows you to save the document as a reusable template, which makes creating future payment documents quick and efficient. You can update the details, such as dates, amounts, and client names, while maintaining a consistent format. Excel also lets you track and manage payments over time by storing multiple records in a single workbook.

With its combination of structure and flexibility, Excel is a powerful tool for anyone looking to create and manage payment request documents with ease and professionalism.

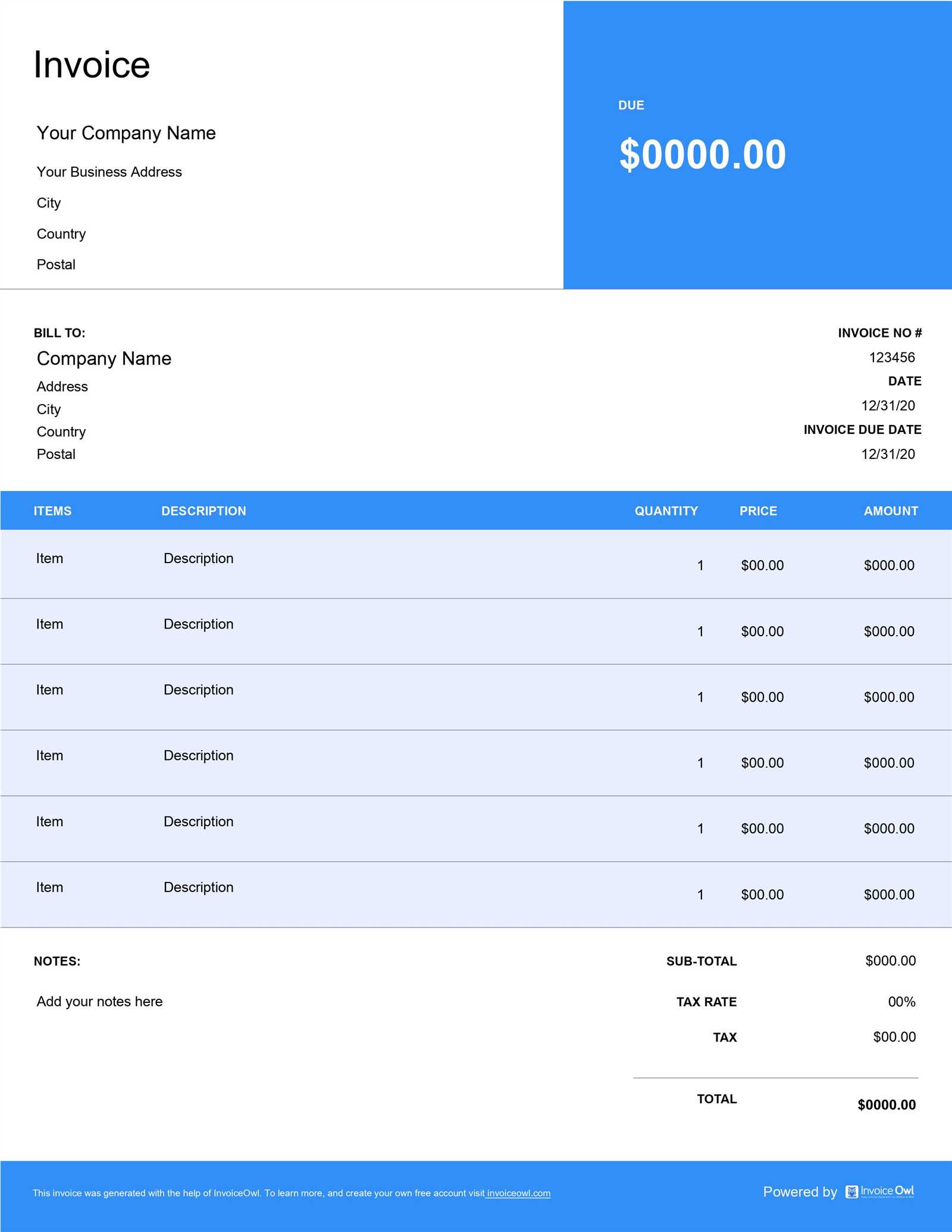

Online Tools for Payment Request Management

There are a variety of online platforms designed to help independent professionals manage their payment documents quickly and efficiently. These tools often come with user-friendly interfaces, automated features, and customizable options that simplify the process of creating, sending, and tracking payment requests. With the help of these services, you can stay organized and ensure that your financial transactions are handled smoothly.

Online tools can assist with tasks such as calculating totals, setting up recurring payments, and storing past records. Additionally, many of these platforms integrate with other business management systems, making it easier to keep all your financial information in one place. Here are some of the key features of online platforms that can help improve the way you handle payment requests:

- Customizable Layouts: Choose from pre-designed formats or customize fields to suit your business needs.

- Automated Calculations: Easily calculate totals, taxes, discounts, and other relevant charges.

- Recurring Billing Options: Set up automatic billing for ongoing projects to save time on repetitive tasks.

- Client Management: Track client details and communication history for a more personalized experience.

- Payment Tracking: Monitor when payments are made and keep a record of outstanding balances.

Using online tools can help streamline the process of managing your payment documents, making it more efficient and professional. Whether you’re just starting out or managing multiple clients, these platforms provide all the essential features needed to ensure a seamless workflow.

How to Track Payments with Documents

Keeping track of payments is an essential aspect of managing any business. Whether you are working with a few clients or handling multiple projects, knowing the status of each payment ensures that you can maintain cash flow and follow up on overdue balances. By utilizing well-structured documents, you can efficiently monitor and manage payments over time.

To effectively track payments, it is crucial to include the right information in your records. Key details such as due dates, payment amounts, payment status, and transaction dates will help you keep track of what has been paid and what is still outstanding. Below is an example of how to organize these details for easy tracking:

Payment Tracking Table

| Client Name | Amount Due | Amount Paid | Payment Date | Status |

|---|---|---|---|---|

| Client A | $500 | $500 | 2024-10-15 | Paid |

| Client B | $300 | $0 | 2024-10-18 | Pending |

| Client C | $450 | $450 | 2024-10-16 | Paid |

By organizing this information in a table, you can clearly see which payments have been made and which ones need follow-up. This method ensures you don’t miss any payments and can easily manage your financial records. If you are using digital documents, many tools allow you to automatically update payment statuses and send reminders to clients when necessary.

Tracking payments with well-organized documents helps maintain professionalism and ensures timely cash flow. By consistently updating your records, you can stay on top of payments and avoid misunderstandings with clients.

How to Address Late Payments

Managing delayed payments is a common challenge for many independent professionals. It’s crucial to handle late payments in a professional and respectful manner while ensuring that you protect your business interests. Addressing overdue payments requires a balance of clear communication, firm follow-ups, and offering solutions that work for both you and your clients.

The first step in dealing with late payments is ensuring that your clients are aware of their outstanding balance. A polite reminder can often resolve the issue. If the payment is still not received after the initial reminder, more formal actions may be needed. Here are some effective steps to address overdue payments:

- Send a Friendly Reminder: After the payment due date has passed, send a polite reminder email or message to your client, asking them to settle the outstanding balance.

- Be Clear and Direct: Clearly state the amount owed, the original due date, and any additional late fees if applicable. Provide clear instructions on how they can make the payment.

- Offer Payment Plans: If the client is facing financial difficulty, offer a payment plan or installment option to make it easier for them to pay off the debt.

- Follow Up Consistently: If the payment still isn’t made after the first reminder, send a follow-up message every few days or weeks, depending on your agreement.

- Enforce Late Fees: Consider applying late fees if your payment terms include them. This can encourage clients to pay on time in the future.

By addressing late payments in a structured and professional manner, you can avoid conflicts and maintain good relationships with your clients while ensuring that your business remains financially healthy. Remember, consistent communication is key to resolving payment issues effectively.

Creating Recurring Invoices for Clients

For businesses providing ongoing services or products, setting up regular billing is essential to ensure consistent cash flow. Automating the process can save time and effort while providing your clients with the clarity they need. Creating recurring billing documents allows you to streamline your workflow, eliminate manual reminders, and ensure that payments are received on time without the need for constant invoicing.

Recurring billing is especially useful for long-term clients who require regular services. By setting up a recurring payment structure, you can reduce administrative work, making the process more efficient and transparent for both parties. Here are some important steps to follow when creating recurring billing documents:

- Define the Payment Schedule: Establish clear payment terms by deciding how often payments will be made (e.g., weekly, monthly, or annually). Make sure the schedule aligns with your service agreement with the client.

- Set the Amount: Clearly specify the agreed-upon amount for each billing cycle, including any discounts or changes that might occur throughout the contract period.

- Provide Detailed Descriptions: Include a breakdown of the services provided during each cycle, so clients understand exactly what they are being charged for. This transparency helps build trust.

- Include Start and End Dates: Ensure the billing period is clearly stated, including the start and end date for each cycle. This helps avoid confusion regarding when payments are due.

- Offer Payment Options: Allow clients to choose from various payment methods, such as bank transfer, credit card, or online payment platforms, for added convenience.

By setting up recurring billing, you ensure that clients are reminded of their obligations automatically. This reduces the need for constant follow-ups and helps both you and your clients stay organized. Additionally, it can help maintain steady revenue, providing peace of mind for your business operations.

Tax Considerations for Billing Documents

When working as an independent contractor or business owner, it’s crucial to understand the tax implications of your financial transactions. Properly managing taxes ensures compliance with local regulations and helps avoid potential penalties. By including the necessary tax-related details in your billing documents, you maintain transparency and protect both yourself and your clients.

Below are key tax considerations to keep in mind when generating billing documents:

- Tax Identification Number (TIN): Ensure your tax identification number is included on each billing document. This number identifies you as a taxpayer and is necessary for both you and your clients to report earnings accurately.

- Sales Tax: Depending on your location and the nature of your services, you may be required to charge sales tax. Research local tax laws to determine if you need to add this tax to your payments and include it in your documents.

- Tax Rates: Clearly state the applicable tax rates in your documents. If sales tax or VAT (Value-Added Tax) is required, make sure the amount is itemized separately to maintain clarity for your clients.

- Deductible Expenses: Certain expenses related to your work may be deductible from your taxable income. These could include office supplies, software subscriptions, or business travel. Keep detailed records of your expenses and mention them in your financial summaries.

- Payment Terms and Tax Deadlines: Clearly communicate payment deadlines, taking into account when taxes are due. This ensures both you and your client are aligned with local tax regulations and avoid late payment fees.

- Tax Filing Documentation: Maintain accurate records of all financial transactions and billing documents for tax filing purposes. This will make it easier to file your returns and demonstrate your income and expenses when necessary.

Incorporating tax-related details into your billing practices is an essential part of managing your business finances. By staying informed and organized, you can ensure smooth financial operations and compliance with relevant tax laws.

How to Improve Client Relationships with Billing Documents

Building strong and lasting relationships with clients goes beyond the work you deliver–it also involves how you manage financial transactions. A clear and professional approach to financial documents can foster trust, transparency, and improve communication with your clients. When done right, your billing practices can be an opportunity to strengthen these bonds and ensure a smooth working relationship.

Here are a few ways you can enhance client relationships through well-managed financial documents:

- Clarity and Transparency: Provide detailed and easy-to-understand documents that break down the costs. Clients will appreciate transparency about what they are paying for, as it builds trust and eliminates confusion.

- Consistent Communication: Use your financial documents as a tool to stay in touch with clients. Timely and clear invoicing helps manage expectations, reducing misunderstandings and fostering a reliable relationship.

- Professional Appearance: A well-organized and polished document reflects your professionalism. Clients will view you as a serious business partner, which can encourage repeat business and positive referrals.

- Personalization: Including personalized notes or messages in your documents shows clients that you value them. A simple “thank you” or message about the next steps in the project can go a long way in nurturing the relationship.

- Flexible Payment Terms: Offering flexible payment options or terms that suit your client’s preferences demonstrates understanding and can create a more positive experience.

- Quick Turnaround Times: Timely submissions of financial documents reflect your efficiency and respect for the client’s time, which enhances your professional reputation.

By integrating these strategies into your billing practices, you not only ensure that payments are processed smoothly but also build a stronger, more positive relationship with your clients. Clear and thoughtful financial communication is an essential part of maintaining long-term partnerships.

When to Send Your Payment Request Document

Timing plays a crucial role in the process of receiving payments. Sending your financial request at the right moment can influence how quickly and efficiently you get paid. It’s not just about completing your work; it’s also about knowing when to submit the necessary documentation to ensure a smooth transaction for both you and your client.

Understanding Payment Cycles

The first step in determining when to send your payment request is understanding the agreed-upon payment terms. Depending on your contract, payment might be due upon completion of the work, after a certain milestone, or on a set schedule, such as monthly or quarterly. It’s important to align the submission of your payment request with these terms to avoid delays and confusion.

When to Submit the Request

Here are some key moments when you should consider sending your payment document:

- Upon Project Completion: If the agreement states payment is due once the work is completed, it’s important to send the document immediately after final approval or delivery of the work.

- After Milestones: For long-term or ongoing projects, sending a payment request after reaching a pre-agreed milestone ensures a steady cash flow throughout the project’s duration.

- On a Regular Schedule: If you’ve established a recurring billing arrangement with your client, set reminders to send your financial request at the same time each billing period–this could be weekly, bi-weekly, or monthly.

- After Client Feedback: If revisions are needed, ensure the final payment request is sent after any necessary changes have been made and the client is satisfied with the final product.

By knowing the right time to submit your payment request, you not only ensure timely payments but also create a clear and predictable process for both parties, enhancing the overall professional relationship.