Freelance Contractor Invoice Template for Efficient Billing

Managing payments and ensuring smooth transactions is a key aspect of working independently. Whether you are offering services or completing specific tasks, having a clear and structured document to outline charges is crucial. This guide will help you create a professional billing system that ensures clarity and reduces the risk of misunderstandings with clients.

A well-structured financial record not only reflects professionalism but also ensures timely payments. With the right approach, you can avoid common errors and confidently track your earnings. This article covers the necessary components to include in your billing paperwork, making it easy to customize based on the unique nature of each project.

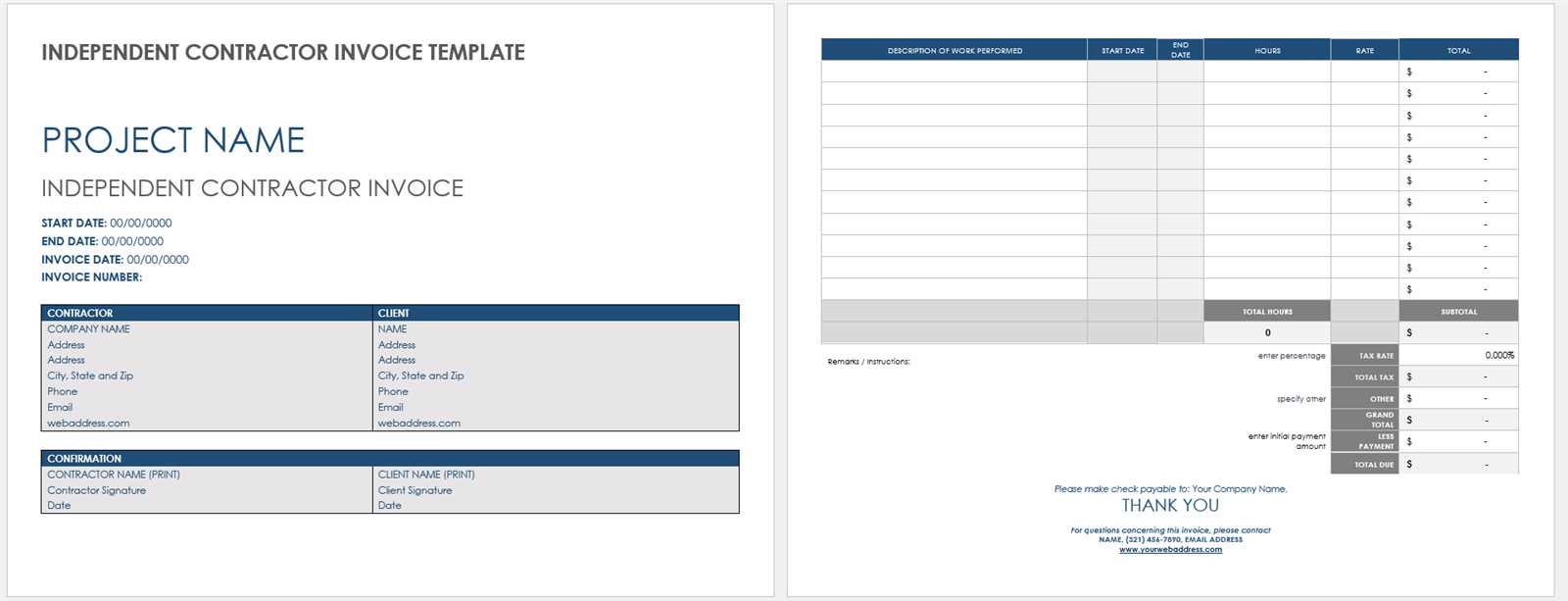

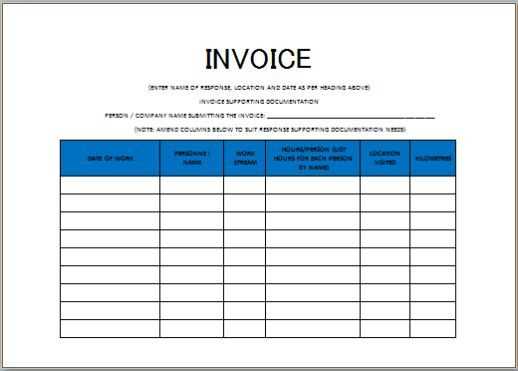

Freelance Contractor Invoice Template Overview

When working independently, having a clear and professional document to request payment is essential for smooth transactions. A properly crafted payment request helps to avoid confusion, ensures that all necessary details are included, and provides a transparent overview of the work completed and the amounts owed. This document not only serves as a reminder for the client but also acts as a formal record for both parties.

For many independent professionals, using a pre-designed structure can simplify the process of billing clients. These structures often include sections for essential information, such as the nature of the work, the payment terms, and the total amount due. By customizing this framework to your needs, you can create an efficient and professional system for managing payments without having to start from scratch each time.

Why You Need an Invoice Template

Having a well-organized document to request payment is crucial for anyone working independently. It ensures that both you and your client have a clear understanding of the work completed, the fees involved, and the agreed-upon payment terms. Using a structured format makes the entire process more professional and reduces the chances of errors or misunderstandings.

Key Reasons for Using a Structured Billing Document

- Professional Appearance: A well-designed payment request gives a polished and professional impression, helping to build trust with clients.

- Time-Saving: With a pre-made structure, you can quickly fill in the necessary details, saving valuable time on every transaction.

- Clarity and Accuracy: A standardized format helps you avoid missing important information, ensuring that all terms are clear and correct.

- Consistency: Repeating the same format helps to maintain uniformity in your communications, reducing the risk of confusion over time.

How It Benefits Both You and Your Client

- Clear Payment Expectations: When all the necessary details are laid out, it sets expectations clearly, helping to avoid payment delays.

- Tracking and Record Keeping: With a consistent format, it’s easier to track payments and maintain records for future reference or tax purposes.

- Faster Payments: Clients are more likely to process payments promptly when all information is presented in a clear and professional manner.

How to Customize Your Invoice

Adapting your payment request document to reflect your unique business style and client needs is essential for creating a more personalized and professional experience. Customization allows you to include specific details relevant to the services rendered and any special terms you’ve agreed upon with your client. By tailoring the structure, you ensure that your document accurately represents the transaction and aligns with your branding.

Essential Customization Elements

| Section | What to Include |

|---|---|

| Your Contact Information | Your name, business name, phone number, email address, and physical address (if necessary). |

| Client’s Details | Client’s full name, company name (if applicable), contact information, and billing address. |

| Project Description | A detailed summary of the services or work completed, including any deadlines or milestones. |

| Payment Terms | Due date, payment method, any late fees, and discounts (if applicable). |

| Logo and Branding | Include your business logo and select a design that matches your brand’s colors and style. |

Personalizing the Design

Consider the layout and visual elements of your document. Choose fonts, colors, and a style that align with your brand’s identity. A simple and clean design is always effective, but feel free to incorporate your unique style to make the document stand out. Keep in mind that a clutter-free layout improves readability and ensures that all details are easily accessible for your client.

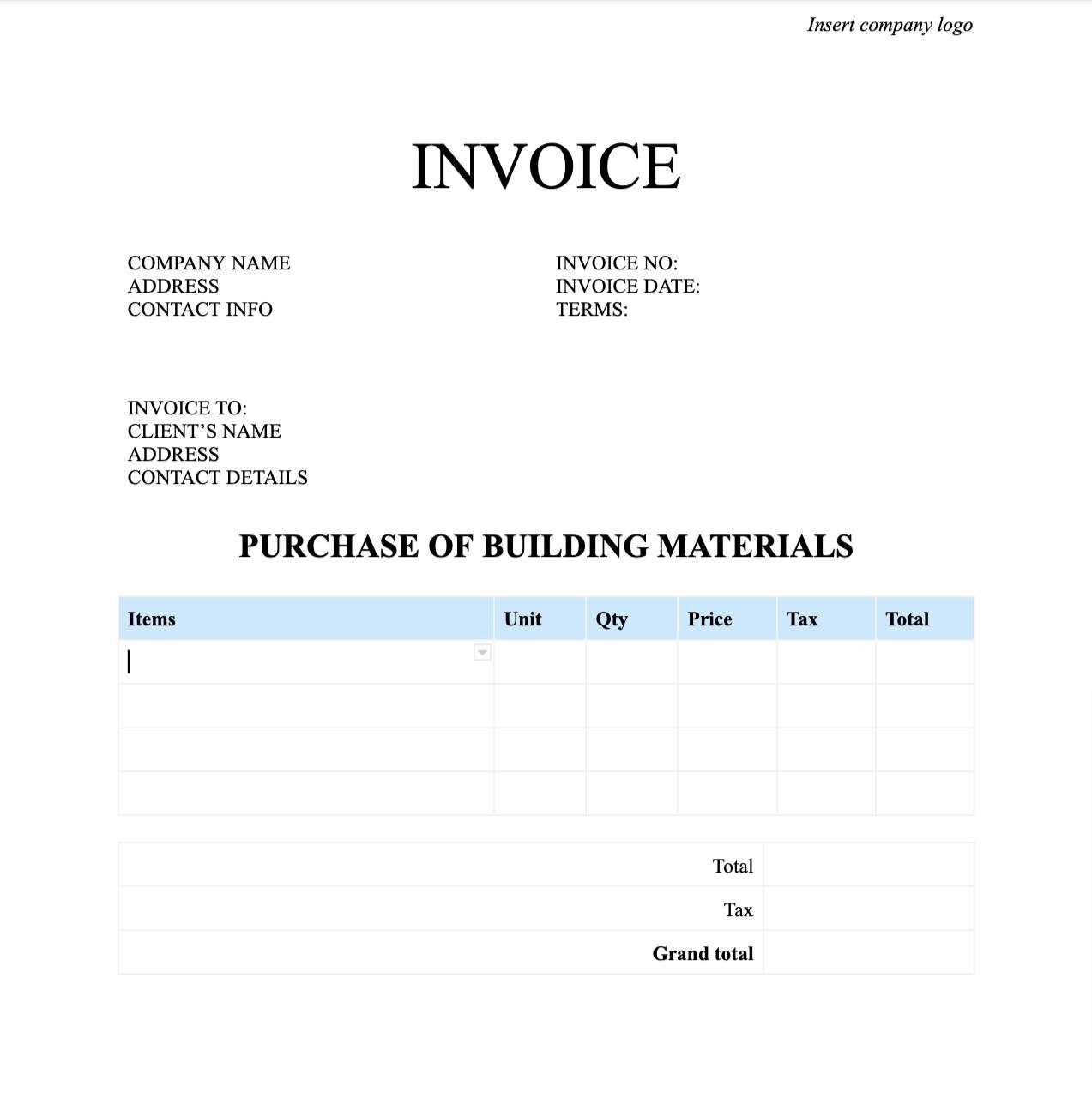

Essential Elements of an Invoice

A well-structured payment request should contain key information to ensure clarity and accuracy. Without the right details, a request may confuse the recipient, causing delays or disputes over payment. The essential components help both parties understand the terms of the transaction and ensure the process runs smoothly.

Key Information to Include

- Header with Your Business Details: Include your name or business name, contact information, and logo if applicable.

- Client’s Information: Clearly state the client’s name, company (if relevant), and contact details.

- Unique Identification Number: A reference number or code for tracking purposes is important for both you and your client.

- Detailed Description of Work: Describe the services or products provided, including dates and any agreed-upon milestones.

- Total Amount Due: Clearly specify the amount owed, including any taxes, fees, or discounts.

- Payment Terms and Due Date: Specify the payment method, any late fees, and the due date for payment.

Formatting and Clarity

Maintaining a clear and professional layout is key to making the payment process as smooth as possible. Use a structured format that highlights the important sections, such as payment amount and due date, making it easy for your client to find the necessary details. This clarity not only speeds up the payment process but also helps prevent misunderstandings down the line.

Common Invoice Mistakes to Avoid

Even a small mistake in a payment request can cause delays, confusion, or frustration for both you and your client. It’s essential to ensure that all details are correct and clearly presented. Avoiding common errors can save time and prevent potential issues, making the payment process smoother and more efficient.

- Missing or Incorrect Contact Information: Always double-check that both your and your client’s details are accurate. Incorrect information can delay payment processing.

- Not Including a Clear Payment Due Date: Without a specified due date, clients may not know when payment is expected, potentially leading to late payments.

- Ambiguous Descriptions of Work: Vague descriptions can lead to confusion. Be specific about what services were provided and the agreed-upon terms.

- Forgetting to Add Taxes or Fees: Always account for taxes and any additional charges. Omitting these can result in a lower payment than expected.

- Using Inconsistent Formats: A cluttered or inconsistent layout can make the document hard to read. Stick to a clear, easy-to-follow format that highlights the important sections.

- Not Providing a Payment Method: Clearly state how you prefer to receive payment. Whether it’s through bank transfer, PayPal, or another method, including payment options makes the process quicker.

- Failing to Include an Invoice Number: Without a unique reference number, it becomes difficult to track and manage multiple requests.

By being mindful of these common mistakes and ensuring every detail is correct, you can streamline your payment requests and maintain a positive relationship with your clients.

How to Add Payment Terms

Clearly stating payment conditions is vital to ensure both you and your client are on the same page. These terms set expectations regarding when and how payment should be made, which helps avoid confusion and late payments. Defining these conditions upfront helps create a transparent and professional agreement between both parties.

There are various ways to express payment terms, including specifying due dates, payment methods, or penalties for delays. By including these details in your payment request, you create a clear framework for completing the transaction.

| Payment Term | Description |

|---|---|

| Due Date | Specify the exact date by which payment should be made. For example, “Payment is due within 30 days of receipt.” |

| Late Fees | Outline any penalties for late payments, such as “A 5% fee will be applied for payments received after the due date.” |

| Payment Method | Indicate acceptable methods of payment, such as bank transfer, credit card, or PayPal. |

| Discounts for Early Payment | Offer an incentive for early payment, like “A 2% discount applies if payment is made within 10 days.” |

By specifying these terms, you create a structured approach to payments, ensuring that both parties are clear about expectations and avoiding potential misunderstandings.

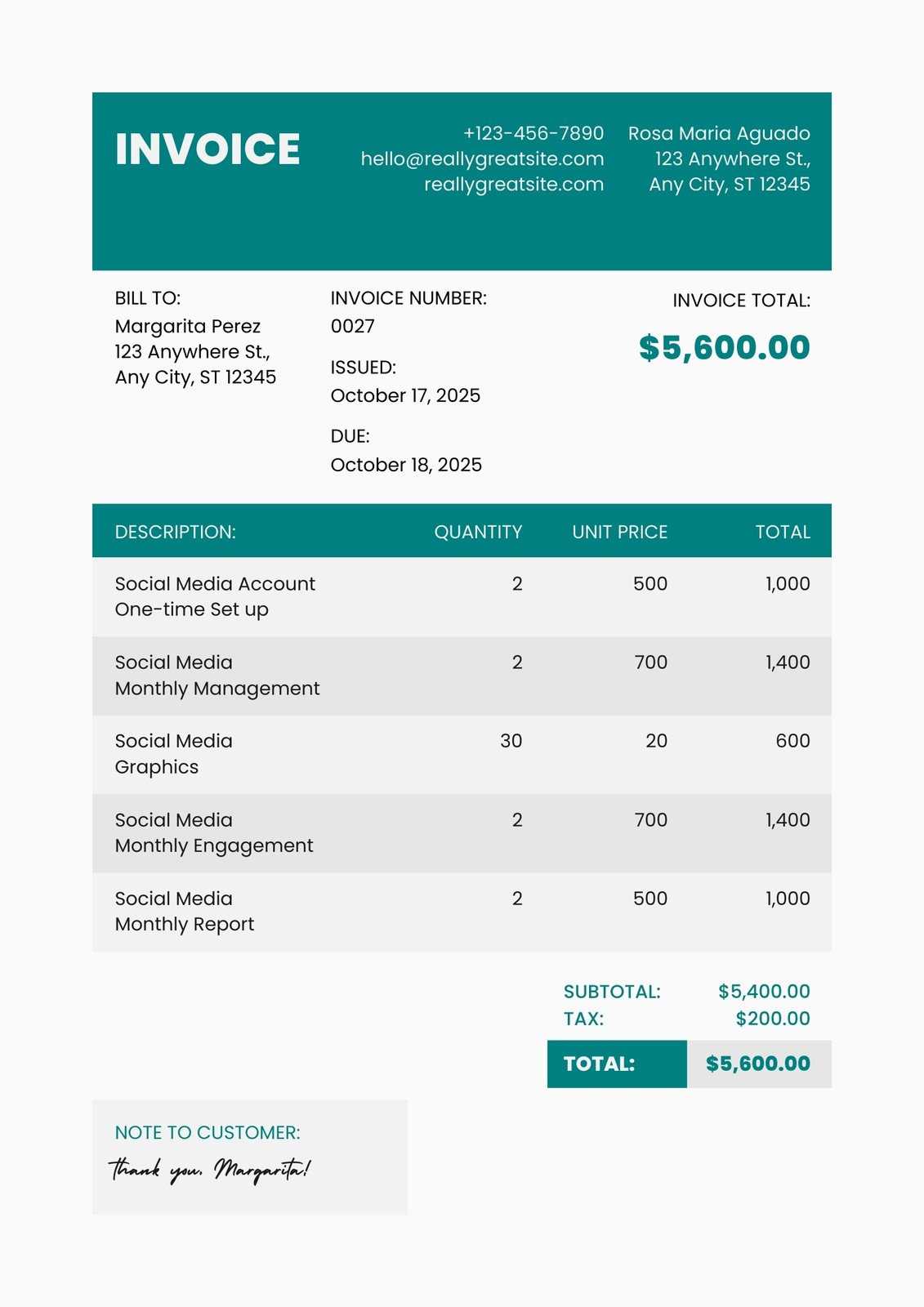

Incorporating Branding into Your Invoice

Creating a personalized and professional payment request document not only ensures clarity but also provides an opportunity to reinforce your brand’s identity. Including elements of your branding in these documents helps maintain a consistent image across all business communications. It also sets you apart from others by presenting your services in a more polished and professional way.

Key Elements to Include for Strong Branding

- Logo: Adding your logo at the top of the document instantly identifies the payment request as coming from your business.

- Color Scheme: Use your brand’s color palette to enhance the document’s look and make it visually appealing. Consistent colors help reinforce your business identity.

- Fonts: Choose fonts that match your brand’s style. Avoid using too many different fonts to maintain a clean, cohesive design.

- Tagline or Slogan: If your business has a memorable tagline, including it on your payment request can further promote your brand and make the document feel more personal.

Maintaining Professionalism with Branding

While incorporating your branding, it’s important to maintain a balance between personalization and professionalism. The goal is to enhance the document’s look without making it too flashy or overwhelming. Keep the layout clean and easy to read, ensuring that the content remains the focus, while your brand elements subtly elevate the overall presentation.

Choosing the Right Invoice Format

Selecting the appropriate structure for your payment request is essential for ensuring clarity and professionalism. The right format not only makes it easier for your client to understand the details of the transaction but also helps streamline the payment process. Depending on the nature of the services provided and your relationship with the client, the format can vary to best suit the situation.

Factors to Consider When Choosing a Format

- Business Type: For more formal businesses, a structured, detailed layout with clear headings and sections may be ideal. For creative or smaller businesses, a more minimalistic approach may work better.

- Client Preferences: If your client has specific expectations, understanding their preferred format can help avoid miscommunication and improve the likelihood of prompt payment.

- Amount of Detail: If the work involved is complex or itemized, choose a detailed format that breaks down services, rates, and hours worked. For simple tasks, a more straightforward format may suffice.

- Payment Method: Some formats are designed with specific payment methods in mind. Make sure the structure you choose accommodates the way the payment is expected to be received.

Popular Formats to Consider

- Basic Layout: This format includes essential details like business information, payment amount, and due date, and is best suited for simpler transactions.

- Itemized Layout: Best for projects with multiple components, this format allows for a breakdown of each service or product and its cost, giving the client a clear understanding of what they are paying for.

- Professional Template: Designed for businesses looking to maintain a high level of professionalism, this format often includes branding elements, such as logos and color schemes, while keeping the document structured and easy to follow.

Choosing the right format depends on the nature of your work and the expectations of your client. By selecting the format that best suits your needs, you can ensure a smoother transaction and enhance the professional presentation of your business.

Digital vs Printed Invoices

When it comes to requesting payment for services rendered, there are two primary formats: digital and printed. Both methods have their benefits and drawbacks, and the choice between them often depends on personal preference, business needs, and client expectations. Understanding the advantages of each can help you decide which option is best for you and your clients.

Benefits of Digital Payment Requests

- Speed: Sending payment requests electronically allows for quicker delivery, meaning clients receive them instantly and can respond faster.

- Cost-Effective: Digital documents eliminate the need for paper, printing, and postage costs, which can add up over time.

- Ease of Storage: Digital formats can be saved, organized, and backed up easily, allowing for easy access and better record-keeping.

- Environmentally Friendly: By using digital files, you reduce the amount of paper used, helping to minimize your business’s carbon footprint.

Advantages of Printed Payment Requests

- Personal Touch: Printed requests can offer a more personal and tangible feel, which may be appreciated by some clients.

- Professional Appearance: Physical documents can look more formal and can be used in settings where digital communication is less common or desired.

- Better for Clients Without Digital Access: In some cases, clients may not be as comfortable with digital methods or may prefer receiving documents in paper form for easier handling.

Digital vs Printed Comparison

| Aspect | Digital Format | Printed Format |

|---|---|---|

| Delivery Speed | Instant | Slower (requires mailing) |

| Cost | Free or low cost | Costs for printing and postage |

| Storage | Easy to store and organize digitally | Requires physical storage space |

| Client Preferences | Preferred by tech-savvy clients | Preferred by clients who prefer physical documents |

| Environmental Impact | Eco-friendly | Less environmentally friendly (requires paper) |

Ultimately, the decision to choose between digital or printed payment requests depends on your business style and the preferences of your clients. Some may appreciate the speed and ease of digital formats, while others may value the formality and personal touch of a printed document. Consider the pros and cons carefully to ensure you meet both your needs and those of your clients.

How to Track Payments Using Invoices

Tracking payments is crucial for maintaining financial clarity and ensuring that you are paid on time for the services you provide. A structured payment request document can serve as a tool to monitor outstanding balances, received payments, and due dates. Proper tracking also helps you keep accurate records for tax purposes and financial planning.

Steps to Effectively Track Payments

- Assign Unique Numbers: Each payment request should have a unique identifier to easily track its status. This number can be referred to by both you and your client to ensure clear communication.

- Clearly Indicate Due Dates: Make sure the due date for each payment is clearly marked on the document. This helps in tracking when payments are expected and monitoring if they are delayed.

- Monitor Payments as They Arrive: Record when a payment is received and match it to the appropriate request document. This step ensures you can track progress and follow up if necessary.

- List Payment Methods: Include the payment method used (bank transfer, check, online platform, etc.) to help you track different payment types and verify transactions more easily.

Tracking Payment Status

Creating a simple system to record the status of each payment request can help you quickly see which payments have been completed, which are still pending, and which are overdue. Keeping these records updated will also allow you to follow up with clients promptly if needed.

Payment Tracking Table Example

| Payment Request Number | Due Date | Amount Due | Amount Paid | Payment Date | Status |

|---|---|---|---|---|---|

| 001 | 2024-11-01 | $500 | $500 | 2024-11-02 | Paid |

| 002 | 2024-11-10 | $750 | $0 | – | Unpaid |

| 003 | 2024-11-15 | $300 | $300 | 2024-11-16 | Paid |

By consistently using this method of tracking, you ensure that you have accurate records of all transactions. This helps to avoid confusion, minimizes errors, and improves communication with your clients.

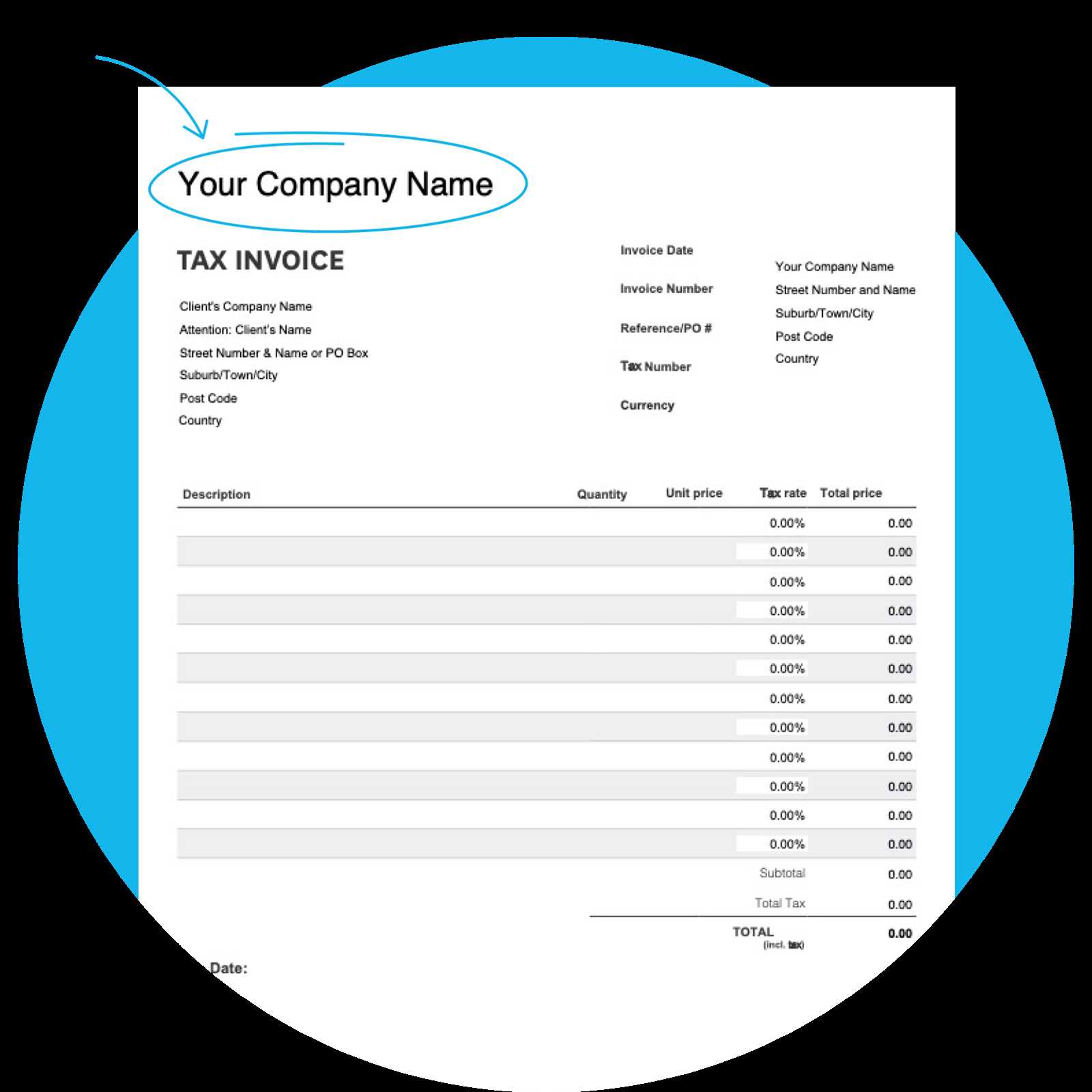

Invoice Tips for International Clients

When working with clients across borders, it’s essential to adapt your payment requests to account for different regulations, currencies, and payment methods. Understanding these differences ensures smoother transactions and prevents misunderstandings. In this section, we’ll discuss the key considerations to keep in mind when handling payments from international clients.

Key Considerations for International Payments

- Currency: Specify the currency in which the payment is expected. This is crucial to avoid confusion, especially if you’re working with clients from countries with different currencies. It’s advisable to use internationally recognized currencies such as USD, EUR, or GBP.

- Payment Methods: Be clear about the acceptable payment methods. International clients may use wire transfers, credit cards, or online payment platforms like PayPal or TransferWise. Indicating the preferred method ensures the payment process is streamlined.

- Tax Considerations: Different countries have varying tax laws. Ensure that you understand and apply any necessary taxes or VAT (Value Added Tax) that may apply to international transactions, and mention them explicitly in your payment request.

- Time Zones and Payment Deadlines: When setting deadlines, remember that your client is in a different time zone. Allow for sufficient time based on the time zone differences, and clearly state the expected payment date with the correct time zone.

Payment Request Structure for Global Clients

To help ensure clarity and avoid confusion, it’s important to have a clear structure in your document. Below is an example of how you could structure the payment request to address international considerations:

| Item Description | Amount | Currency | Payment Method | Tax (If Applicable) | Due Date |

|---|---|---|---|---|---|

| Web Design Services | $1,000 | USD | Bank Transfer | 15% | 2024-11-30 |

| Marketing Consultation | $500 | EUR | PayPal | 20% | 2024-12-05 |

By ensuring the payment structure is clear and includes important details such as currency, tax rates, and payment methods, you can avoid confusion and make it easier for your international clients to process payments. This approach can also foster a more professional relationship, ensuring smoother transactions in the future.

When to Send Your Invoice

Knowing the right time to send a payment request is essential for maintaining a steady cash flow and ensuring timely payments. Timing can influence how quickly a client processes the payment and whether they encounter any issues. Understanding the best moments to send your request, based on the type of work and client expectations, will help you stay organized and professional.

Factors to Consider When Timing Your Request

- Project Milestones: If you’re working on a long-term project, it’s a good idea to send requests after reaching significant milestones or at agreed-upon intervals. For instance, after completing a portion of the work or at the end of each month.

- After Completion: For smaller tasks or one-off services, it’s best to send the request once the work has been completed. This ensures you’re requesting payment for services rendered and avoids confusion about what was delivered.

- Client’s Preferred Schedule: Some clients may have a preferred invoicing schedule, such as weekly, bi-weekly, or monthly. It’s always wise to confirm these preferences early to align expectations and streamline the process.

- After a Signed Agreement: When you’ve agreed on terms with a client in writing, it’s critical to send the payment request shortly after work begins or at the agreed-upon timeframes. Having clear terms ensures you are within your rights to request payment at a certain point.

Best Practices for Timing Your Requests

Timing can be critical to ensuring prompt payments, so consider sending your request as soon as possible once the work is completed or after any agreed milestone. Always keep track of deadlines, and be mindful of the client’s payment cycle to maintain a professional approach and foster trust in your business relationship.

How to Handle Late Payments

Late payments can be frustrating and may disrupt your business’s cash flow. It’s important to have a clear approach to manage these situations professionally while maintaining good relationships with your clients. Knowing how to address late payments promptly and effectively is crucial for your business’s stability and growth.

Steps to Take When Payments Are Late

- Send a Friendly Reminder: Often, late payments are due to oversight or forgetfulness. Start by sending a polite and friendly reminder, including the payment details and the due date. Be sure to keep the tone professional and non-confrontational.

- Follow Up with a Formal Notice: If the payment remains outstanding, send a more formal reminder. Clearly state the original due date and include any late fees or interest charges as specified in your agreement. Reiterate the terms of payment to emphasize the importance of timely settlement.

- Contact the Client Directly: If reminders are ignored, consider reaching out directly through a phone call or video conference. This allows for a more personal touch and provides an opportunity to resolve any issues or miscommunications that may be causing the delay.

- Offer Payment Plans: In some cases, clients may be facing financial difficulties. Offering a payment plan or installment options can help them manage the payment while still ensuring you receive what you’re owed over time.

- Seek Legal Action: If all attempts to collect payment have failed, you may need to seek legal action. This should be considered a last resort, as it can damage your business relationship. Be sure to consult a legal professional before taking this step.

Best Practices for Avoiding Late Payments

- Clear Payment Terms: Clearly outline payment terms in your agreement before starting any work. This includes the due date, preferred payment methods, and any penalties for late payments.

- Set Expectations Early: Discuss your payment expectations upfront with your clients and ensure they understand the importance of paying on time.

- Require Deposits: For larger projects, consider requiring a deposit or advance payment to reduce the risk of late payments.

By addressing late payments with professionalism and having clear policies in place, you can protect your business from cash flow issues while maintaining positive client relationships. Promptly addressing overdue payments also helps set a clear precedent for future transactions.

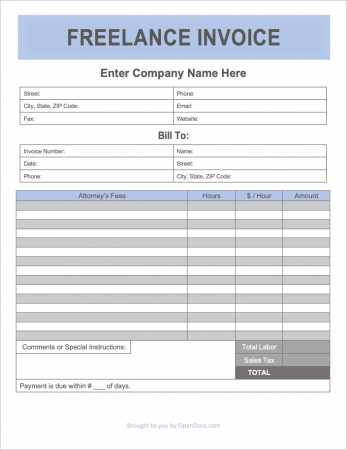

Free Invoice Templates for Freelancers

For independent professionals, having access to well-designed documents for payment requests can make a significant difference in maintaining efficiency and professionalism. While custom-built documents can be expensive, there are numerous free resources available online that provide ready-made options suitable for different types of work. These resources help streamline the billing process and ensure that important details are not overlooked.

Utilizing free tools for creating payment requests can save time and reduce errors, allowing you to focus more on delivering high-quality services. Many of these options include customizable fields to suit your needs, and they come in a variety of formats to fit your preferences. Whether you’re handling short-term tasks or long-term projects, these documents can help present your requests in a clear and organized manner.

Advantages of Using Free Resources

- Cost-Effective: These resources provide a no-cost solution for creating professional documents, which is ideal for individuals starting out or those with a limited budget.

- Easy Customization: Many of these tools offer user-friendly interfaces that allow you to personalize the document quickly, including adding your business name, logo, and payment terms.

- Variety of Options: Whether you’re looking for a simple format or a more detailed request, free resources offer different styles and layouts that you can choose from based on your specific needs.

Where to Find Free Payment Request Resources

There are many online platforms that offer free documents for professional use. Some popular options include:

- Google Docs: Provides free, customizable templates that can be accessed and edited directly within your Google Drive.

- Microsoft Office Online: Offers a variety of free document templates available for download or online editing via OneDrive.

- Invoice Generator Tools: Websites like Invoice Generator or Wave offer quick and easy ways to create payment requests online with a few clicks.

By taking advantage of these free resources, you can ensure that your payment requests are both professional and efficient, all while minimizing the time and cost associated with custom document creation.

Using Invoice Templates with Accounting Software

Integrating pre-designed payment request formats with accounting platforms can significantly streamline the financial management process. Many software tools today offer the ability to automatically generate and manage documents, saving time while keeping everything organized. By using ready-made layouts within these systems, professionals can ensure that their documents are both accurate and compliant with their financial tracking needs.

When paired with accounting software, these formats can automatically populate fields with relevant information, like client details, payment amounts, and due dates. This integration helps reduce human error, improves the speed of billing, and ensures a consistent look across all business documents. Here’s how you can make the most of this combination.

Benefits of Using Accounting Software for Document Creation

- Time-Saving: Automating the generation of payment requests speeds up the process, allowing you to focus on your core business activities rather than spending time manually filling out forms.

- Accuracy: By using data already stored in the system, accounting software ensures that client details and financial information are always correct and up to date.

- Consistency: These systems apply a uniform style to all documents, maintaining a professional appearance across all client interactions.

- Tracking and Reporting: Many accounting platforms allow you to monitor payments and generate financial reports based on the data collected from generated documents, helping you stay on top of your finances.

How to Use Pre-Built Layouts in Software

To take full advantage of these systems, follow these basic steps:

- Choose the Right Software: Select a platform that integrates with your preferred layout formats. Popular options like QuickBooks, FreshBooks, or Wave offer these features.

- Customize Your Document: Many software tools allow you to modify the look and feel of your documents to include branding, specific payment terms, and your business logo.

- Integrate Client Data: Once your layout is ready, link the client and project information to automate field population, saving you time when creating each document.

- Send Directly: Many tools allow you to email the completed document directly to your clients, making the process even more efficient.

By integrating ready-made layouts with accounting platforms, you create a seamless workflow that reduces manual effort, improves accuracy, and ensures your financial processes remain organized and professional.

Best Practices for Professional Invoicing

Creating clear, accurate, and professional payment requests is crucial for maintaining good client relationships and ensuring timely payments. A well-structured billing document not only helps you get paid faster but also reflects the quality and professionalism of your work. Implementing best practices in how you present and organize payment requests can enhance your reputation and streamline your financial processes.

Whether you’re a small business owner or an independent worker, following a few key guidelines can make all the difference in how your payment requests are received and processed. Below are some essential practices to keep in mind when preparing your documents.

Keep it Clear and Organized

Clarity is paramount in any business document. A payment request should be easy to read and understand. Include the following elements to make it clear:

- Contact Information: Always include both your details and those of your client, ensuring they are clearly visible at the top of the document.

- Itemized List: Break down the services or products provided with clear descriptions and corresponding charges. This helps avoid confusion and disputes.

- Due Dates: Be explicit about the payment due date, as well as any late fees or penalties for overdue payments.

- Payment Methods: Provide your preferred methods of payment, making it as easy as possible for clients to pay you.

Ensure Timeliness and Consistency

Being punctual with your requests reflects professionalism. Send the document promptly after completing the work, ideally as soon as the project is finished or as agreed upon in the terms. Consistency is also key in ensuring clients recognize your professionalism:

- Timely Billing: Stick to a regular schedule for submitting your requests, whether it’s weekly, monthly, or upon completion of a project.

- Consistent Formatting: Use a uniform layout and design for all your payment requests. This consistency builds a recognizable brand and makes it easier for clients to process payments.

- Follow-up Reminders: If payments aren’t received by the due date, send a friendly reminder to encourage prompt action without seeming too aggressive.

By adhering to these best practices, you can streamline your financial management and improve the likelihood of timely payments, all while maintaining a professional image with your clients.