Free Freelance Billing Invoice Template for Easy Payment Management

Managing finances is one of the most important aspects of working independently. Whether you’re offering services in design, writing, or consulting, ensuring that you get paid on time and in full is essential for maintaining a sustainable career. A professional approach to invoicing can help you stay organized and reduce confusion when it’s time to settle payments.

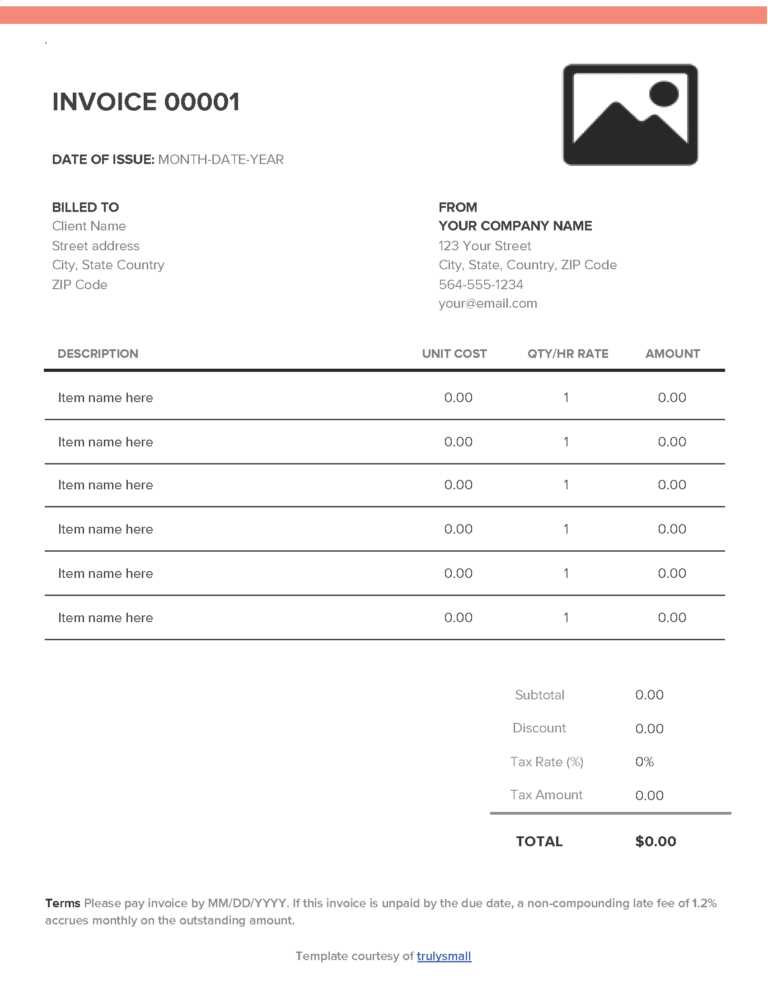

Creating clear and well-organized documents for each project is crucial for both you and your clients. A well-designed payment request ensures that all the necessary details are included, such as payment terms, project specifics, and amounts due. This not only fosters trust but also helps avoid misunderstandings during the payment process.

By using an efficient and customizable format, you can easily create these documents to suit your needs. The right structure makes it easier to track payments, manage multiple clients, and maintain professionalism in your business interactions. A simple yet effective solution can be the key to achieving financial stability and a smooth workflow in your day-to-day operations.

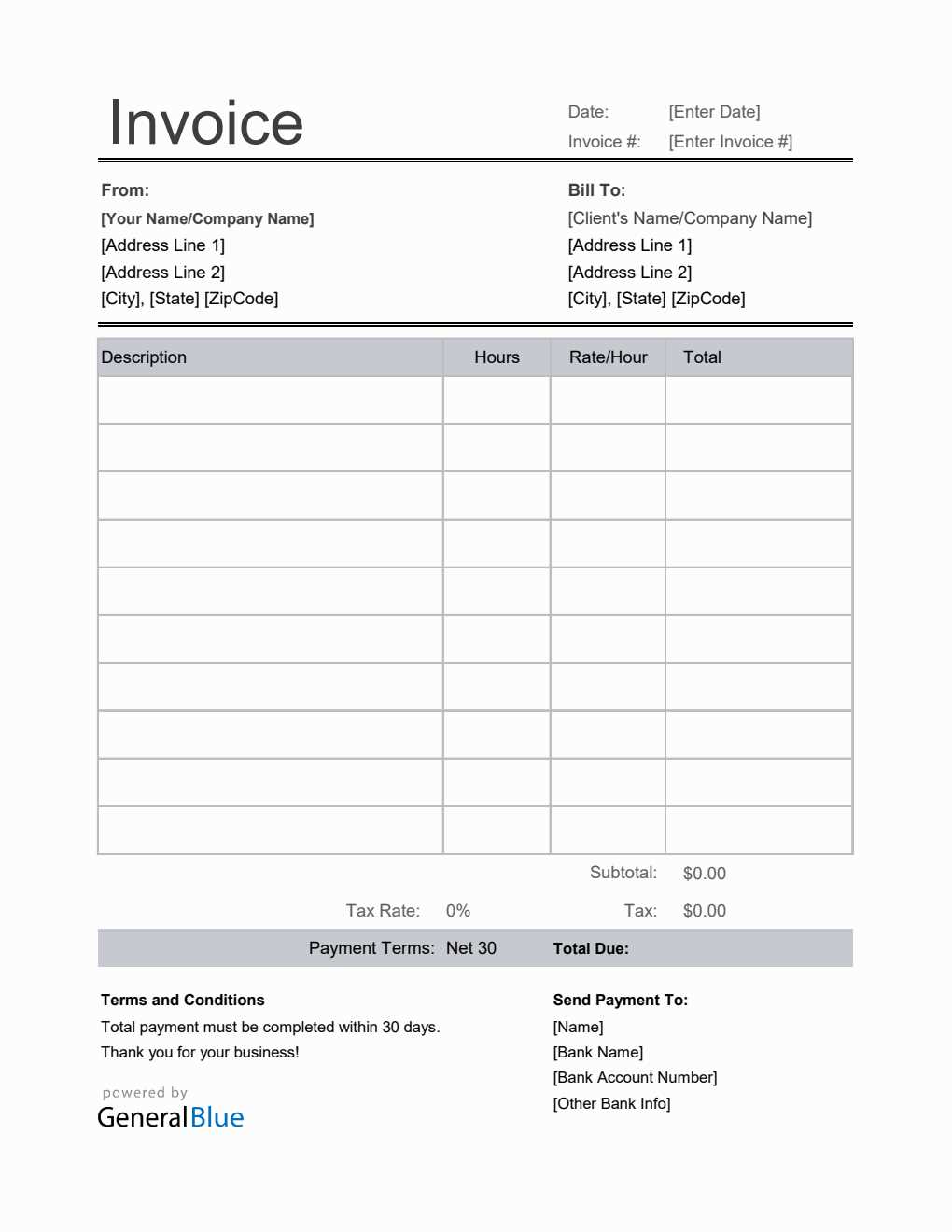

Freelance Billing Invoice Template Overview

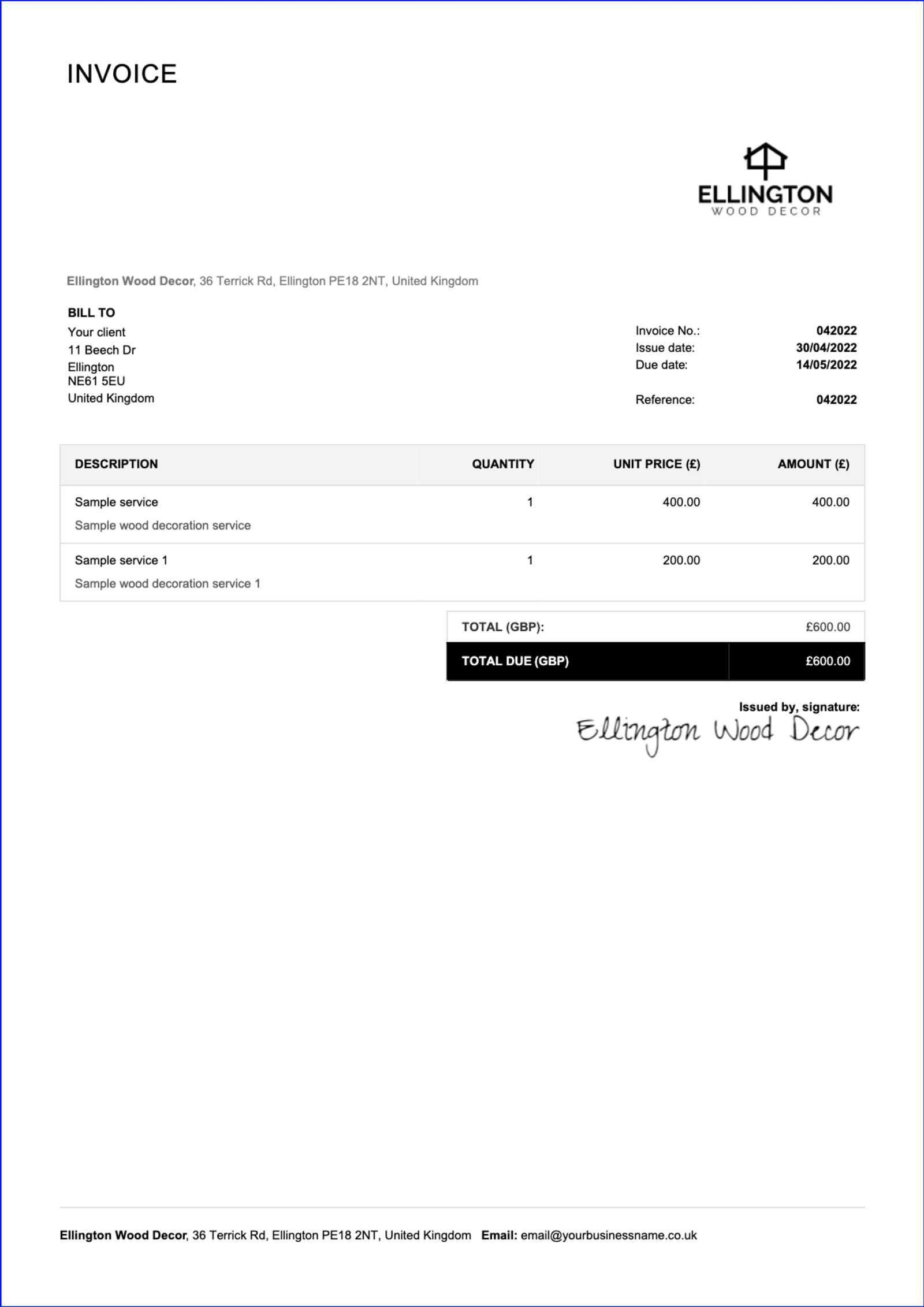

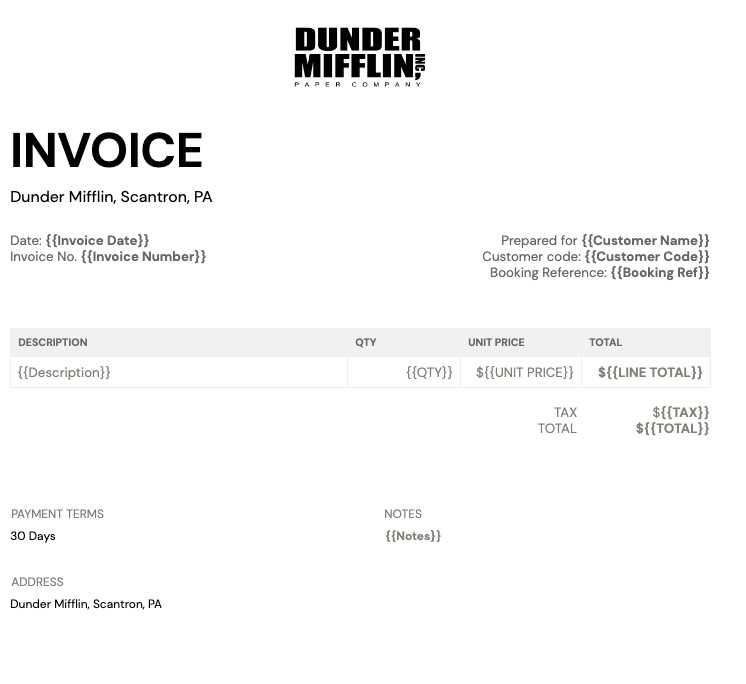

When it comes to requesting payment for services rendered, having a structured and professional document can make all the difference. These documents serve as formal requests, outlining the work completed, payment amount, and the terms of compensation. They ensure clarity between the service provider and the client, which is essential for maintaining a smooth and professional working relationship.

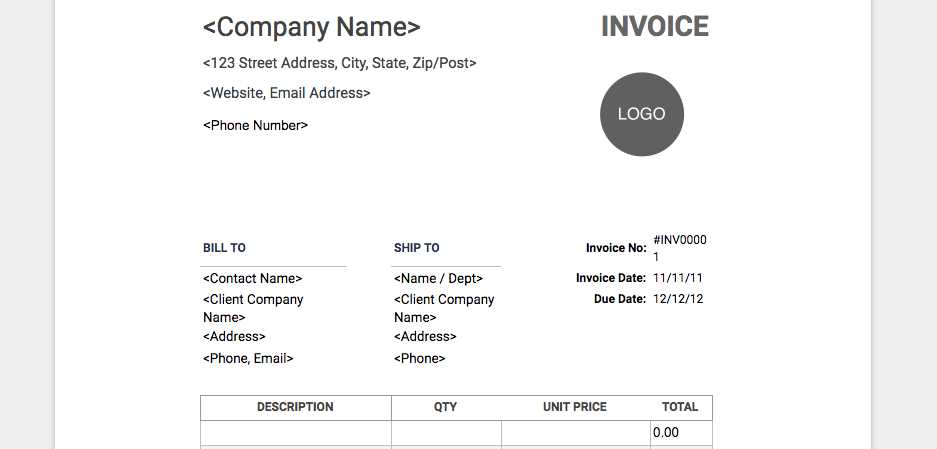

There are several key elements that should be included in such documents to avoid confusion and facilitate timely payments. Understanding these components can help you create an effective and comprehensive record for every project. Below is a basic overview of the sections commonly found in these essential business tools.

| Section | Description |

|---|---|

| Service Details | Clearly outlines the services provided, including descriptions and quantities, to avoid any ambiguities. |

| Payment Amount | Shows the total amount due for the work completed, including any taxes or additional charges. |

| Payment Terms | Specifies the deadlines for payment and any conditions, such as late fees or early bird discounts. |

| Contact Information | Includes both the provider’s and the client’s contact details for communication purposes. |

| Unique Reference Number | Provides a tracking number for each document, which helps both parties manage records. |

By using a well-structured document that includes these essential components, you can ensure a transparent and professional exchange, making it easier for clients to process payments quickly and accurately. A clear and organized approach also minimizes potential misunderstandings and helps maintain a positive relationship with clients.

Why Use a Billing Template

Using a well-organized document for requesting payment provides both the service provider and the client with clear expectations and terms. It simplifies the process of tracking payments and ensures all relevant information is included in a single, easy-to-understand format. This helps eliminate errors, saves time, and improves overall professionalism.

By adopting a standardized format for each project, you can focus more on your work and less on the paperwork. A structured document reduces the risk of leaving out important details, such as due dates, amounts, or payment instructions. It also ensures consistency, so clients always know what to expect and how to proceed with payment.

Time Efficiency and Consistency

Creating a fresh document for every project can be time-consuming and prone to mistakes. By using a pre-designed structure, you save time while maintaining a consistent and professional appearance. This not only streamlines your workflow but also helps create a positive and reliable image in the eyes of your clients.

Reduced Risk of Mistakes

Without a structured approach, it’s easy to forget important details or make errors in calculations. A ready-to-use document helps you include all necessary elements, such as payment terms, services rendered, and tax calculations, minimizing the risk of confusion or disputes later on.

| Benefits | Explanation |

|---|---|

| Clarity | Clearly defines terms and payment amounts, reducing the chance of misunderstanding. |

| Professionalism | Maintains a consistent, polished appearance that reflects well on your business. |

| Time Savings | Speeds up the process of preparing payment requests, allowing you to focus on other tasks. |

| Accuracy | Reduces the chances of errors in amounts, tax calculations, and payment details. |

Incorporating a standard structure into your payment process not only ensures efficiency but also promotes trust and reliability with your clients. A well-prepared document makes it easier to maintain a smooth workflow and positive relationships, benefiting both you and your customers.

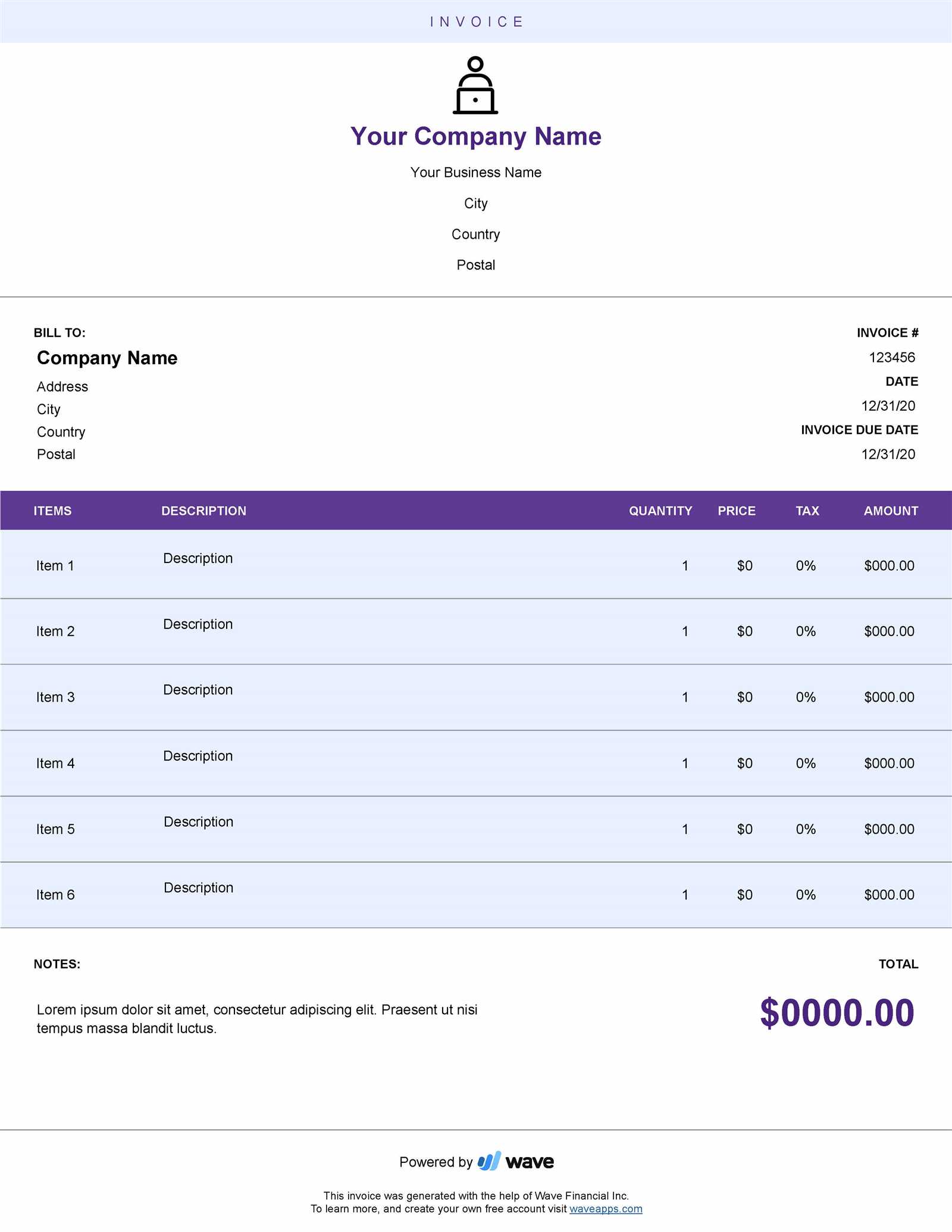

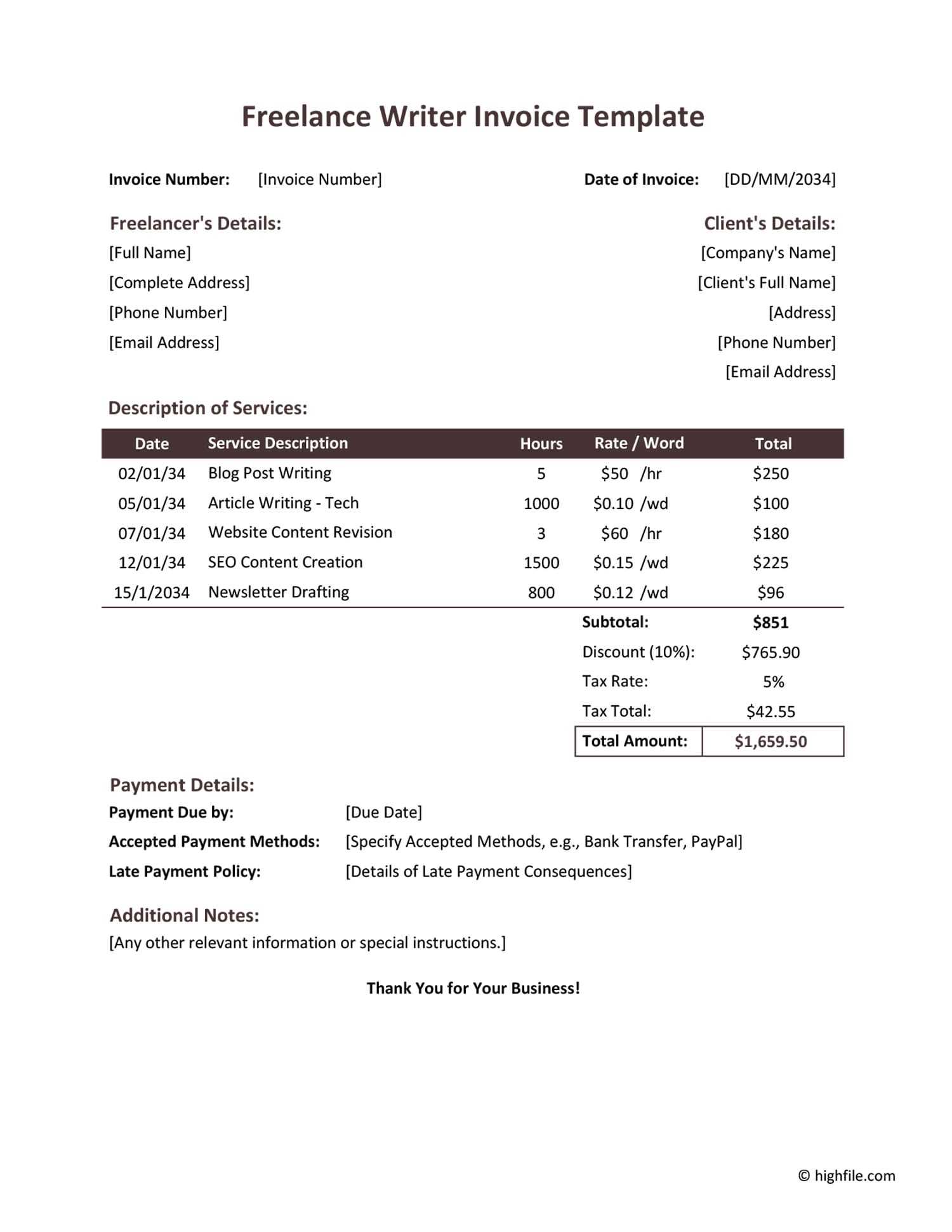

Essential Elements of an Invoice

Creating a clear and comprehensive document for payment requests requires including all the necessary details to ensure that both you and your clients have the information needed for a smooth transaction. Each document should contain specific elements that provide clarity, avoid confusion, and facilitate prompt payment. These key components help establish transparency and professionalism in your business dealings.

Without these essential details, the document may lack the structure required to ensure timely payments or cause unnecessary back-and-forth with clients. Below are the core sections that should always be included to maintain a clear and efficient payment process.

Basic Contact Information

One of the most important aspects of any payment request is clear identification. This includes both your contact details and those of your client. By including the full names, addresses, and phone numbers of both parties, you ensure that there is no confusion about who the payment is for or where it should be sent. This simple but essential step helps keep communication efficient and organized.

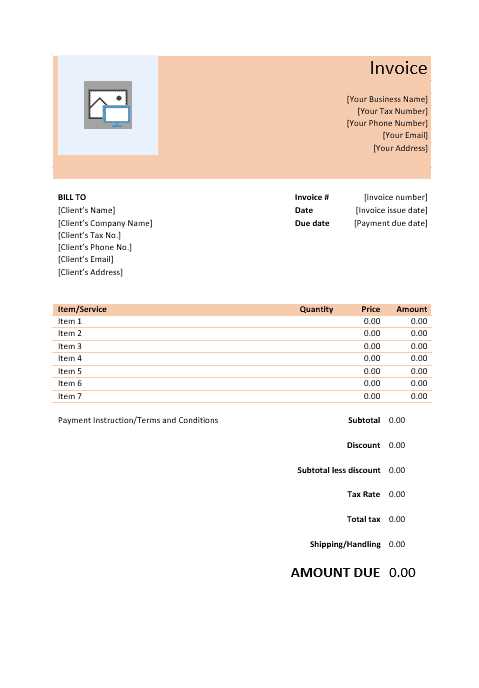

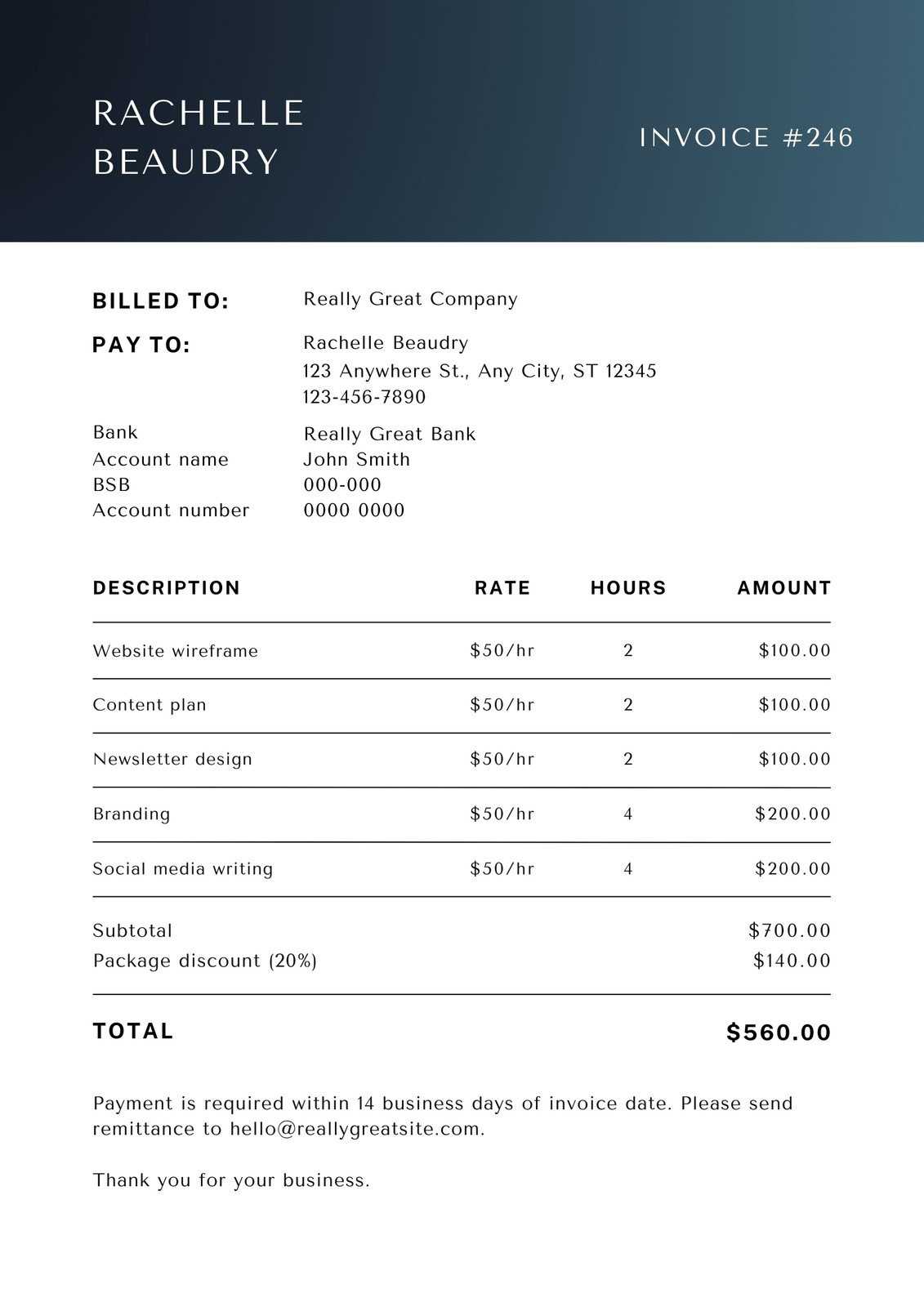

Clear Breakdown of Charges

A well-structured document should provide a detailed list of the work performed or services provided. This breakdown should include descriptions, quantities, rates, and any additional fees. By listing everything explicitly, you avoid disputes or misunderstandings regarding the work done and the payment required.

| Element | Purpose |

|---|---|

| Service Description | Provides clarity on what work was completed, reducing the chance of confusion or disputes. |

| Payment Amount | Clearly states the total due, ensuring both parties are aligned on the payment required. |

| Payment Terms | Outlines the due date and conditions for payment, including late fees or discounts for early payment. |

| Unique Reference Number | Helps track and organize payments, ensuring easy identification for both you and your client. |

Including these elements in your payment request not only ensures a smoother transaction but also strengthens your professional image. When all information is presented clearly and accurately, you reduce the likelihood of misunderstandings and help establish a more reliable and efficient process for both parties involved.

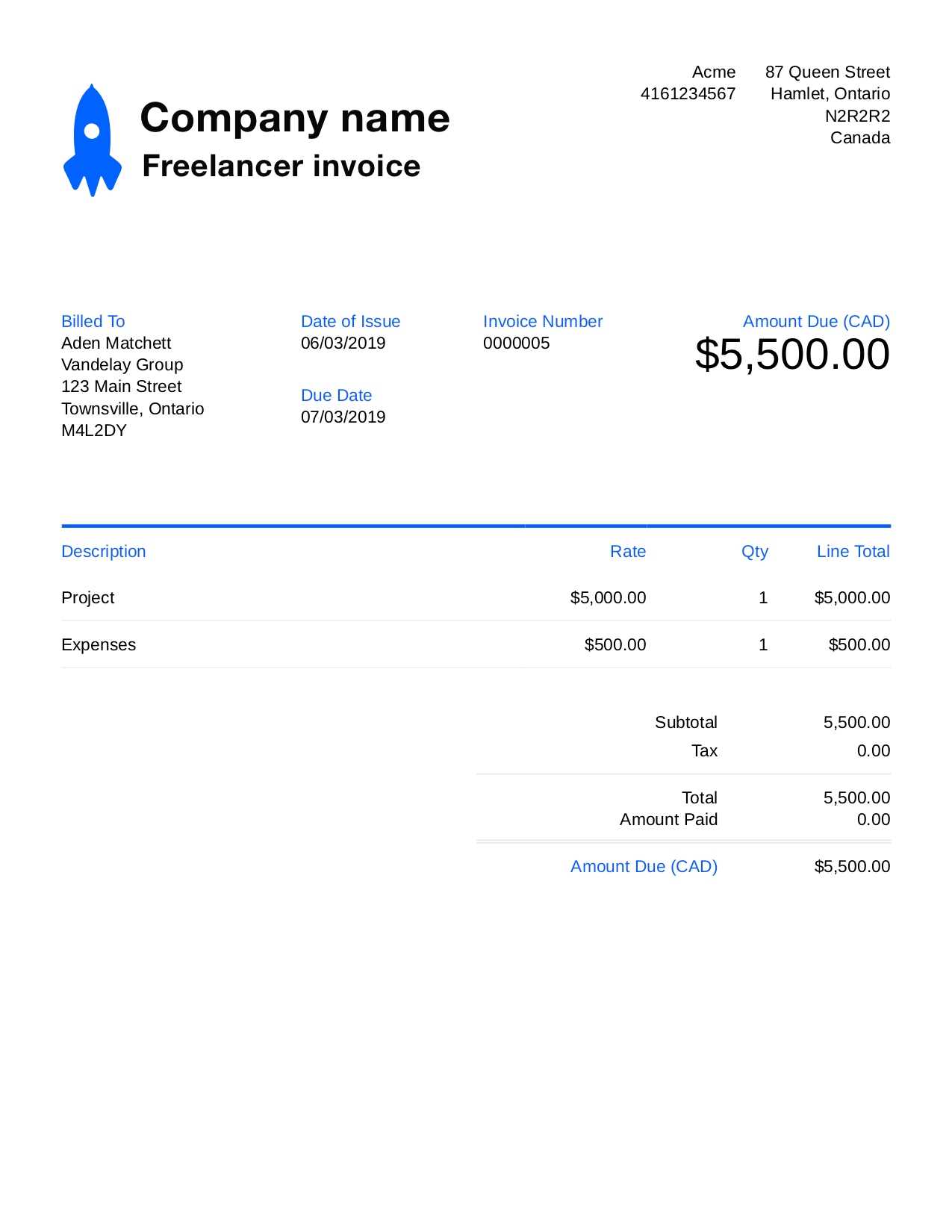

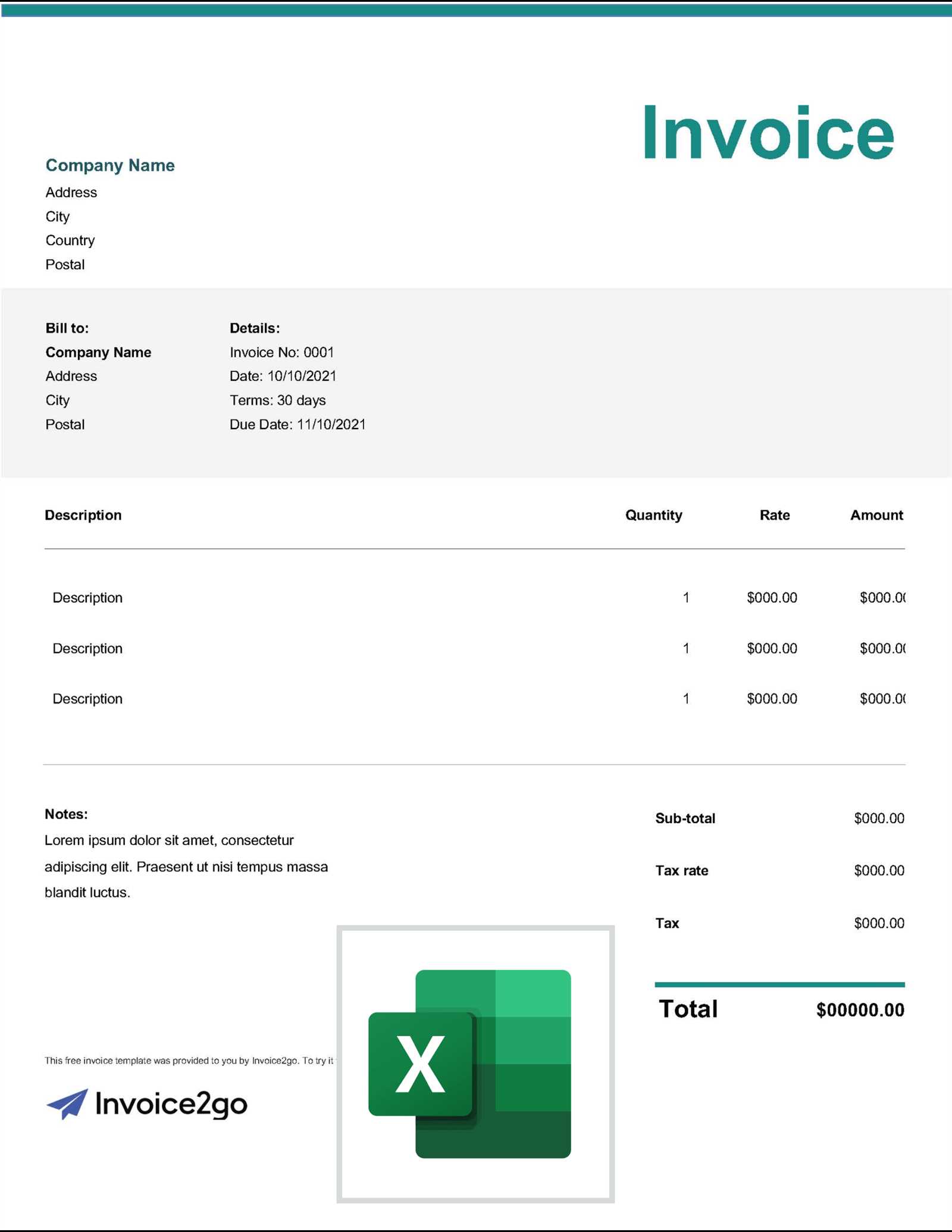

Customizing Your Freelance Invoice

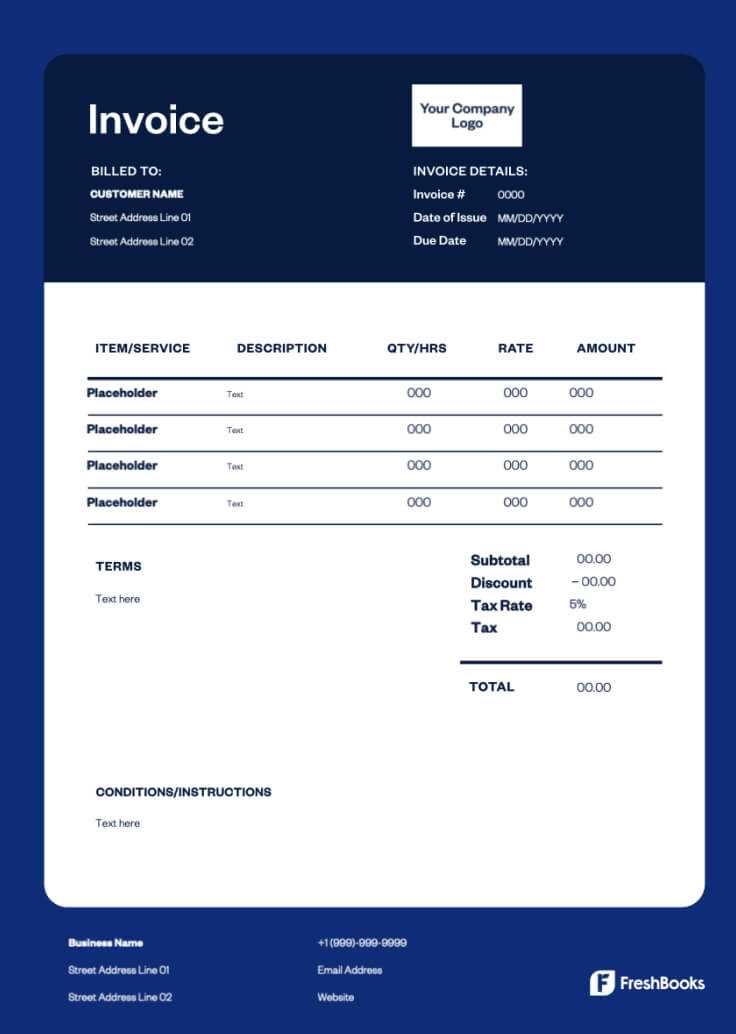

When it comes to creating a payment request document, customization plays a crucial role in making the document reflect your unique brand and professional approach. Tailoring the layout, design, and content allows you to make the document more functional, while also aligning it with your business style and client expectations. A personalized payment request not only stands out but also helps create a lasting impression of professionalism.

By adjusting specific elements, such as your logo, color scheme, or the way information is displayed, you can make your documents both visually appealing and easy to understand. Customization can also extend to how you present the breakdown of services or handle specific payment terms. This flexibility ensures that each document suits the nature of the work and the relationship you have with each client.

Branding and Design Adjustments

Adding your business logo and choosing colors that align with your brand identity are essential for making your document feel professional and personalized. This small design adjustment not only enhances visual appeal but also reinforces your brand’s presence. A cohesive look across all business documents, including payment requests, strengthens your professional image.

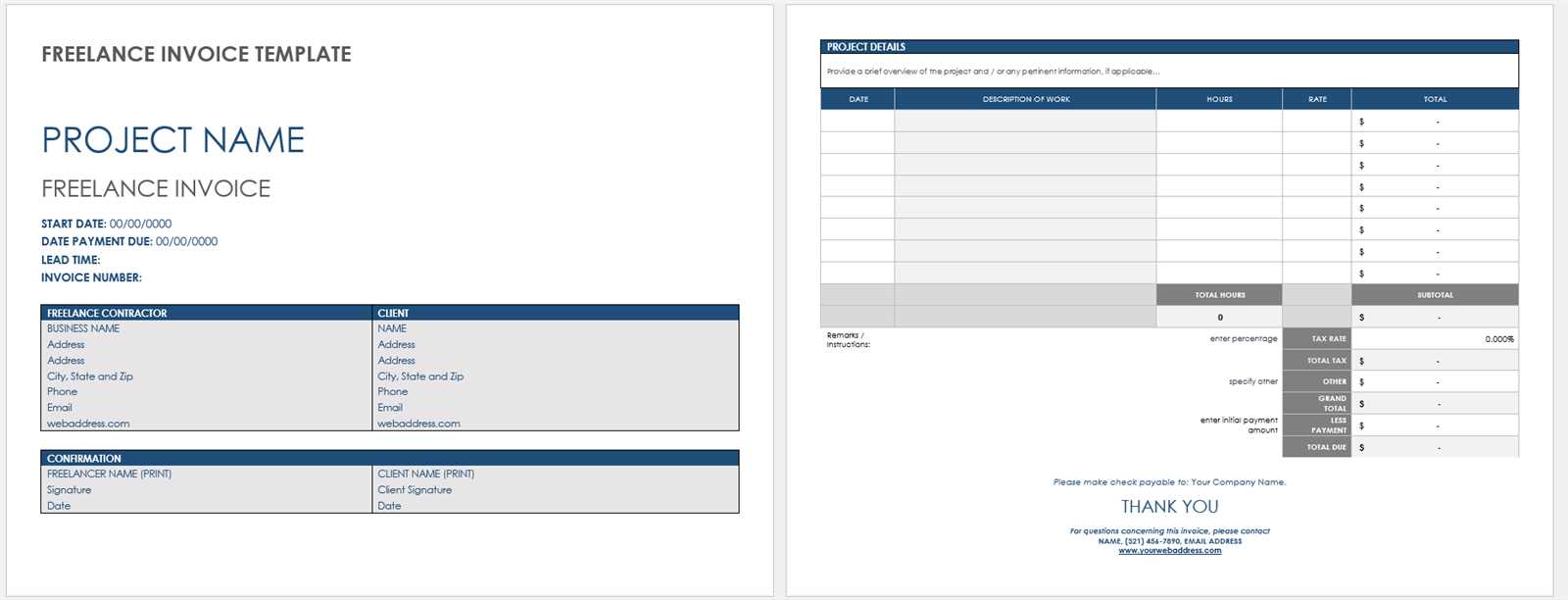

Flexible Payment Terms and Details

Customizing payment details such as due dates, payment methods, and late fee structures is another way to make your document fit your business needs. You might want to offer discounts for early payments or provide specific instructions for electronic transfers. These custom terms can be adapted depending on the project or client, ensuring a smooth and flexible payment process.

| Customizable Element | Purpose |

|---|

| Benefit | Description |

|---|---|

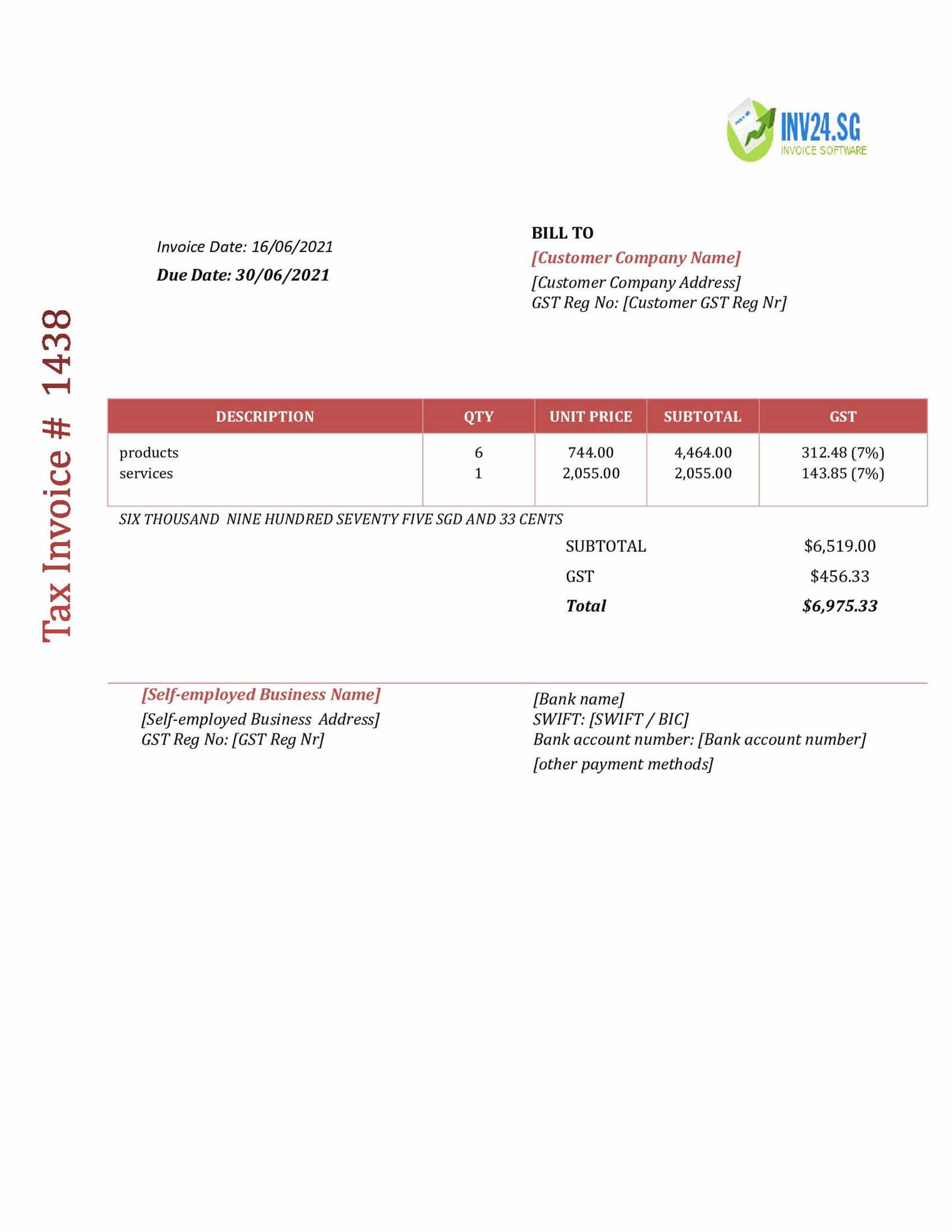

| Accurate Reporting | Organized records ensure your earnings and expenses are reported correctly, minimizing the risk of underreporting or overreporting. |

| Tax Deductions | Clear records make it easier to identify deductible expenses such as office supplies, software, or equipment purchases. |

2. Helps Manage Cash Flow

Tracking all payments and pending requests is critical for effective cash flow management. By keeping detailed records, you can identify overdue payments, predict future income, and plan your finances more accurately. This allows you to avoid cash shortages and ensures you can meet your financial obligations on time.

- Monitor outstanding payments: Easily spot which clients still owe money and follow up accordingly.

- Plan for future expenses: Accurately track incoming payments to predict your future financial stability.

3. Provides Evidence in Case of Disputes

When disputes arise, having detailed records can provide the necessary proof to resolve the issue quickly. Whether it’s a misunderstanding about the terms or the payment amount, well-maintained records ensure that you have all the documentation needed to defend your case effectively.

- Clear proof of services rendered: Having a record of what was agreed upon and delivered can help settle disagreements.

- Dispute resolution: Organized records show the agreed terms, which can speed up negotiations in case of a conflict.

In conclusion, maintaining accurate records of payment requests not only helps you manage your finances efficiently but also protects you legally. Whether for tax purposes, cash flow management, or resolving disputes, keeping thorough records is essential for any business operation.