Freelance Artist Invoice Template for Easy Billing

Managing payments and ensuring timely compensation is crucial for anyone working independently in the creative field. Organizing financial transactions can quickly become overwhelming without the proper tools. However, having a structured document to track services and fees can simplify the process significantly.

By using a well-organized billing document, professionals can present a clear record of the work completed, the cost of each task, and the payment terms. This not only helps in maintaining professionalism but also minimizes the risk of disputes over financial matters.

In this guide, we will explore how such a document can be easily customized, used to track payments, and adjusted to suit individual needs, ensuring smoother financial management for those in creative industries.

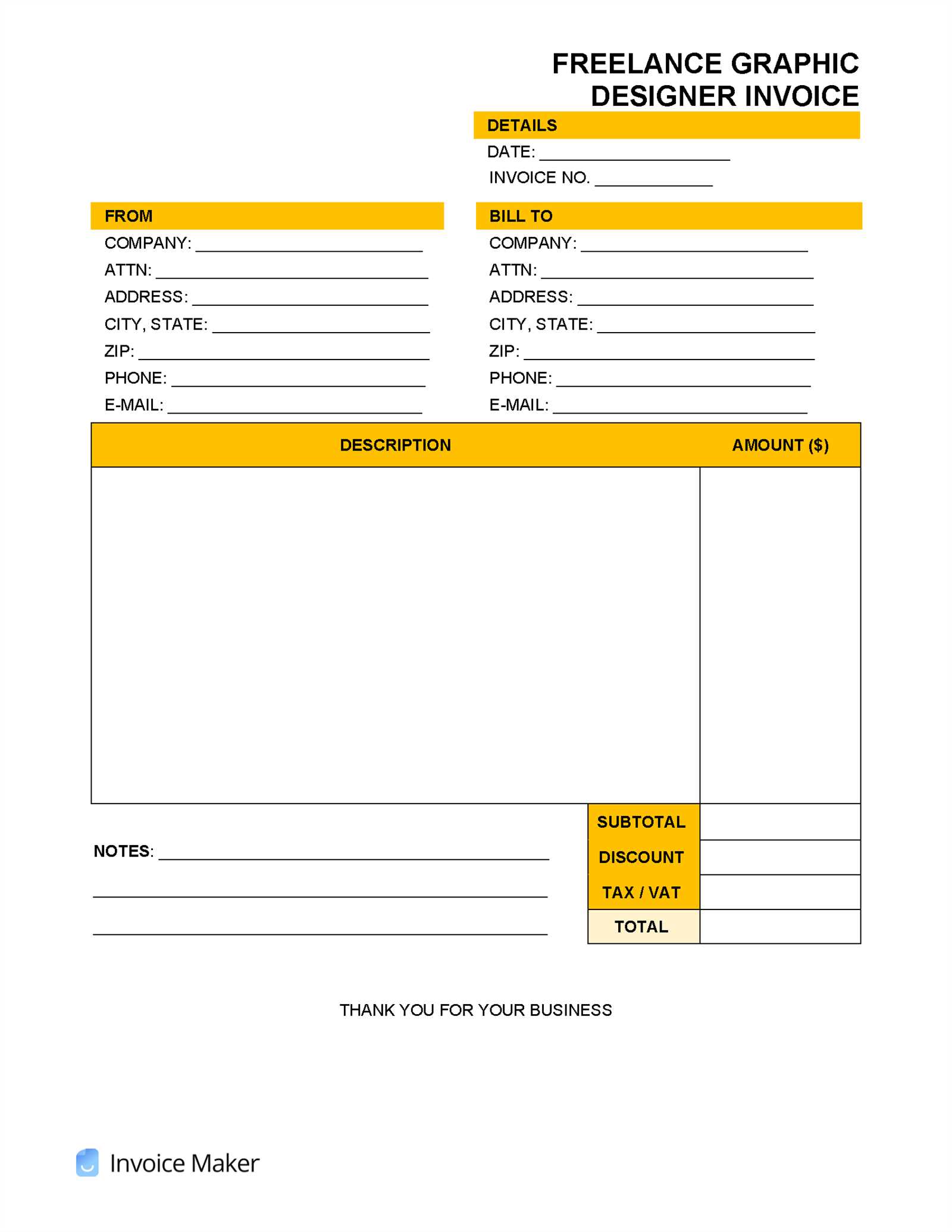

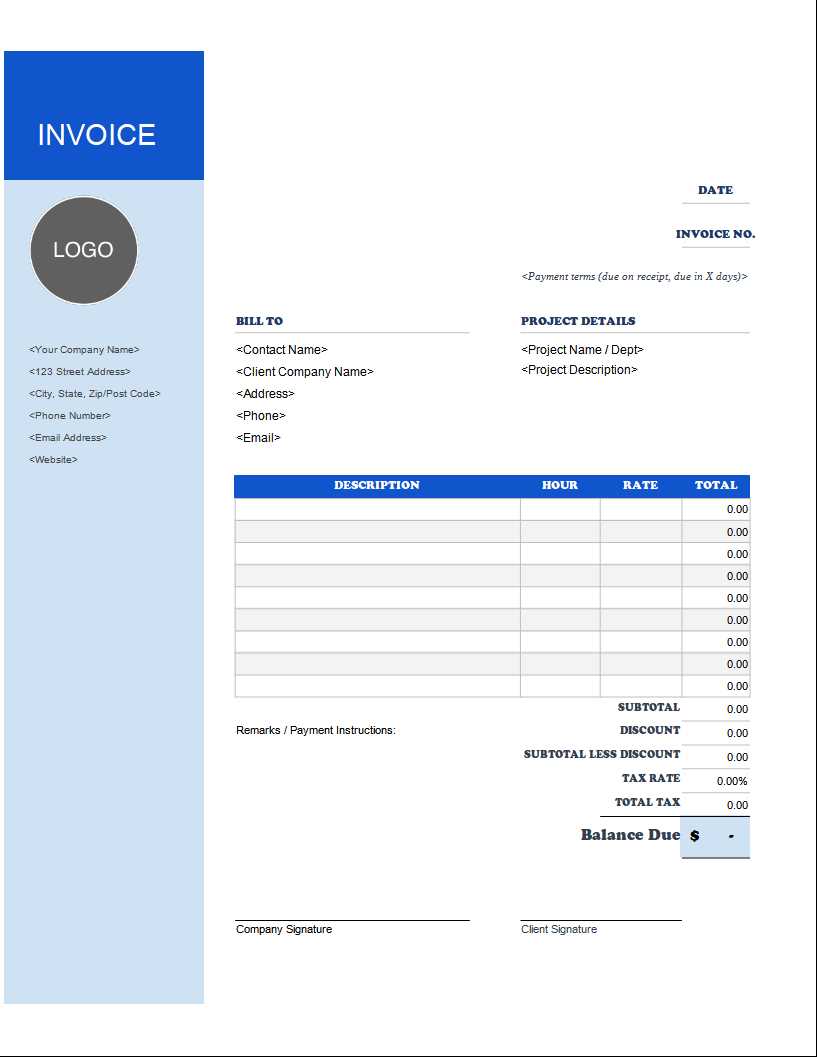

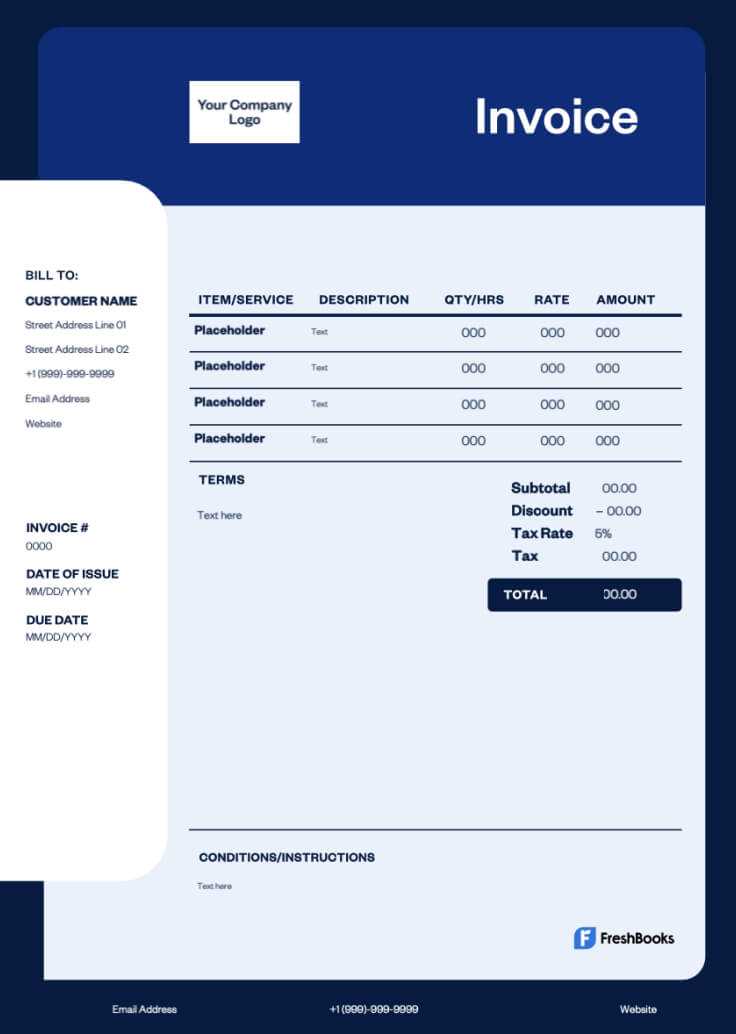

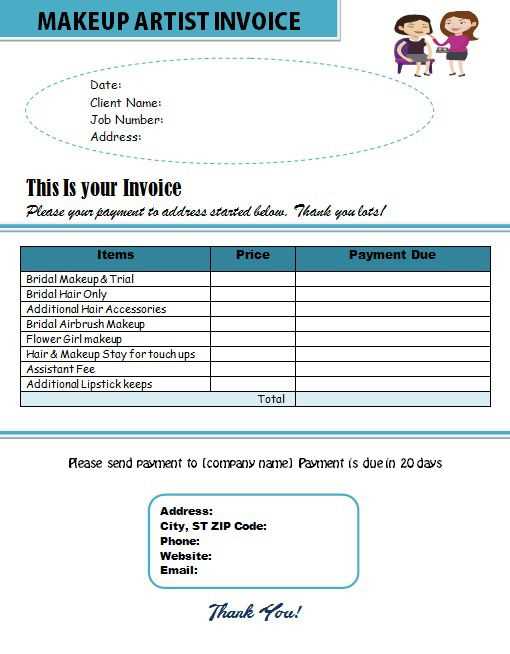

Freelance Artist Invoice Template Overview

For independent professionals, having an organized document to manage payments is essential for ensuring clarity in financial transactions. This document serves as a formal record that details the services provided, the costs involved, and the agreed-upon payment terms. It acts as a foundation for maintaining transparent communication between the creator and client, helping to avoid misunderstandings and delays in compensation.

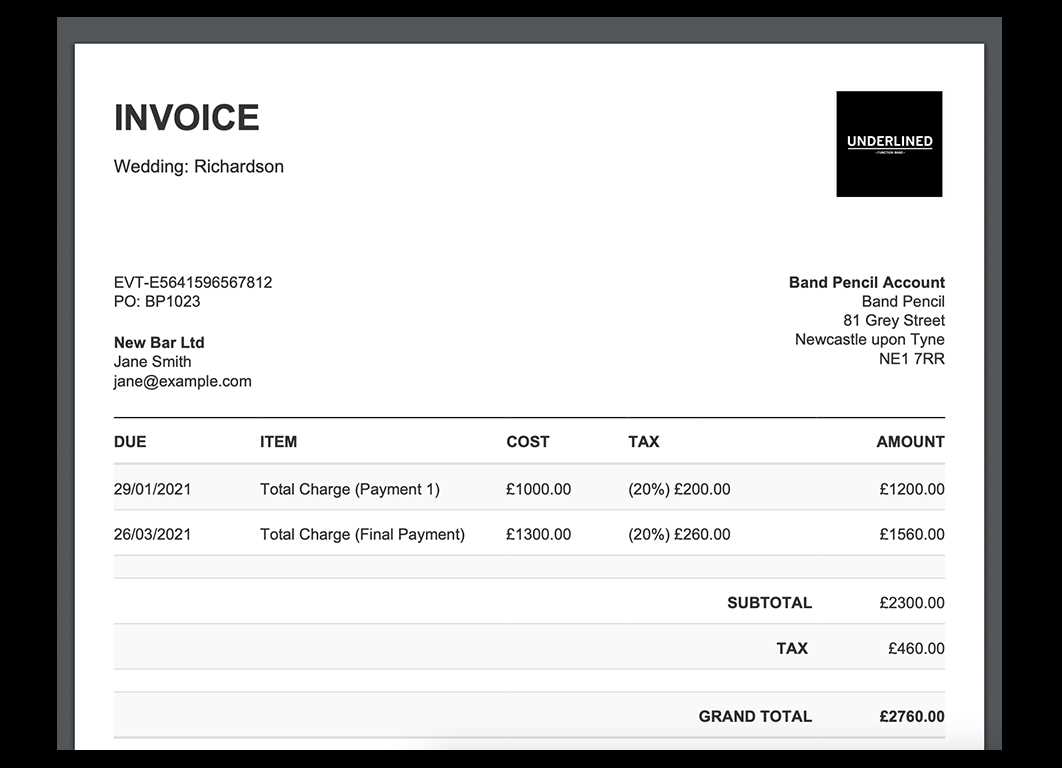

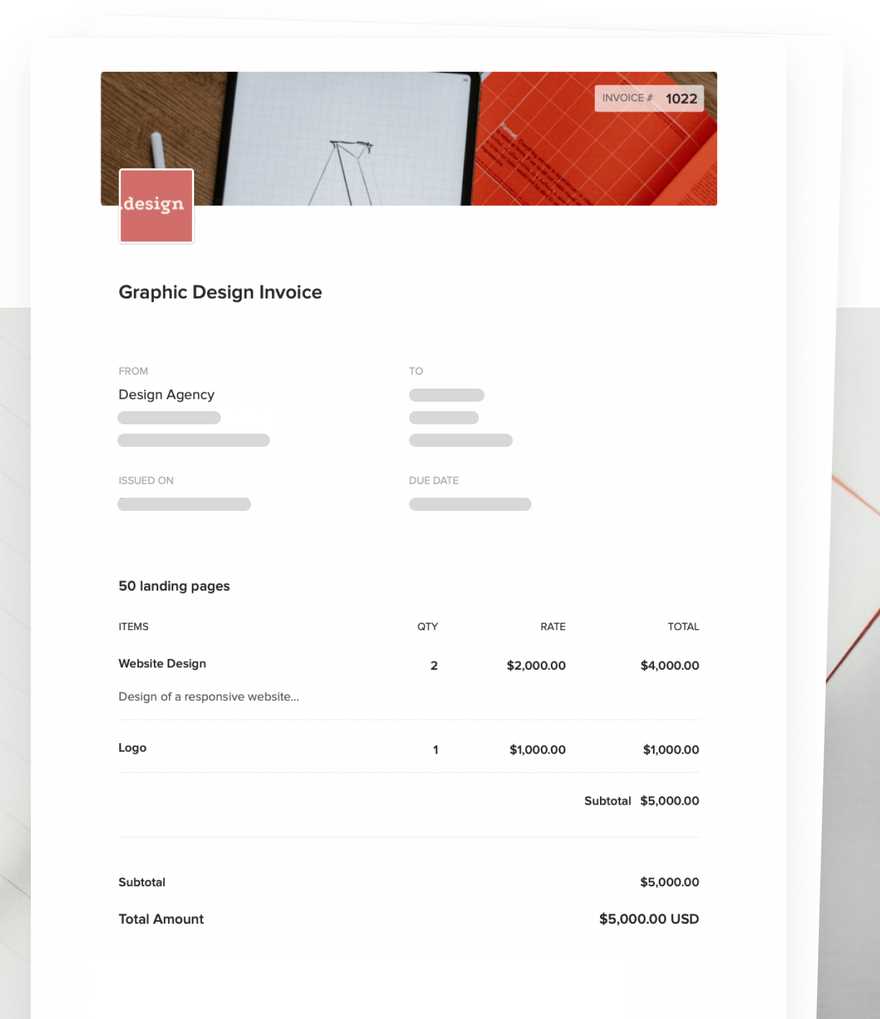

Key Components of the Document

The structure of such a document is designed to be simple yet comprehensive. It includes important details such as contact information, project description, pricing breakdown, and payment instructions. By standardizing this process, professionals can focus more on their work rather than worrying about administrative tasks.

| Section | Description |

|---|---|

| Contact Information | Both the professional’s and client’s details are clearly listed for easy reference. |

| Work Description | A brief explanation of the services rendered, including any specifications or terms agreed upon. |

| Pricing | A detailed breakdown of charges for each task or service, ensuring both parties understand the cost structure. |

| Payment Terms | Defines when and how payment should be made, including any penalties for late payments. |

Benefits of Using This Format

Adopting this approach provides several advantages. It not only saves time but also enhances professionalism, making financial dealings smoother. Additionally, a well-structured document minimizes the chances of errors and provides a solid legal basis should any issues arise in the future.

Why Creatives Need a Payment Document

For those working independently in creative fields, managing compensation can quickly become complex. Without a clear, standardized method for detailing services and payments, the risk of confusion or delay increases. A well-structured record ensures that both the professional and client are on the same page regarding expectations and financial arrangements.

Having a reliable way to track payments offers several key benefits:

- Clarity: A clear breakdown of services and costs ensures both parties understand exactly what is being paid for.

- Professionalism: Presenting a polished document elevates the overall perception of your work and helps establish credibility.

- Efficiency: Standardized records reduce time spent managing transactions and minimize administrative tasks.

- Dispute Prevention: A well-documented payment schedule helps avoid disagreements regarding the scope of work or fees.

- Legal Protection: In the event of a payment dispute, a written record can act as evidence of the agreed terms.

By using a professional document, creators can streamline the payment process, focus on their craft, and maintain positive client relationships.

Key Elements of a Freelancer Payment Record

When documenting financial transactions, it’s essential to include specific information that ensures clarity and smooth processing. A properly formatted record serves as both a receipt and a clear outline of the agreed-upon terms. By organizing this information effectively, both the service provider and the client can easily reference and track payments.

Essential Information to Include

A comprehensive payment record should contain the following key details:

- Contact Details: The names and addresses of both the provider and the client for easy identification.

- Work Description: A brief summary of the services or products provided, ensuring both parties are on the same page.

- Pricing Breakdown: Clear pricing for each service or product, including quantities and rates where applicable.

- Payment Terms: The expected timeline for payment and any associated late fees or penalties for delays.

- Unique Identification Number: A unique reference number for the transaction to aid in tracking and record-keeping.

Additional Features to Consider

Some payment records may also benefit from additional information, such as:

- Tax Information: Any applicable tax rates or exemptions.

- Method of Payment: Specifying whether payment is to be made via bank transfer, check, or another method.

- Discounts or Adjustments: Any special pricing or modifications that apply to the final total.

By ensuring all these elements are included, you help avoid misunderstandings and ensure smooth financial transactions.

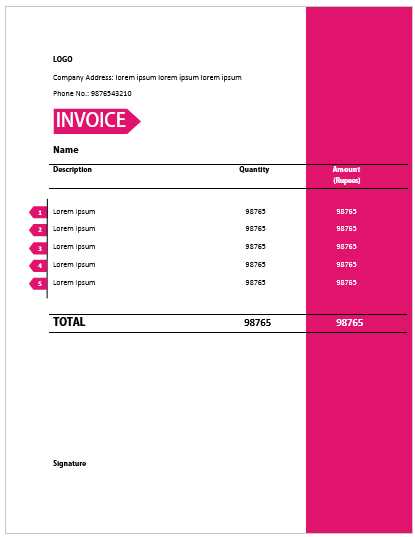

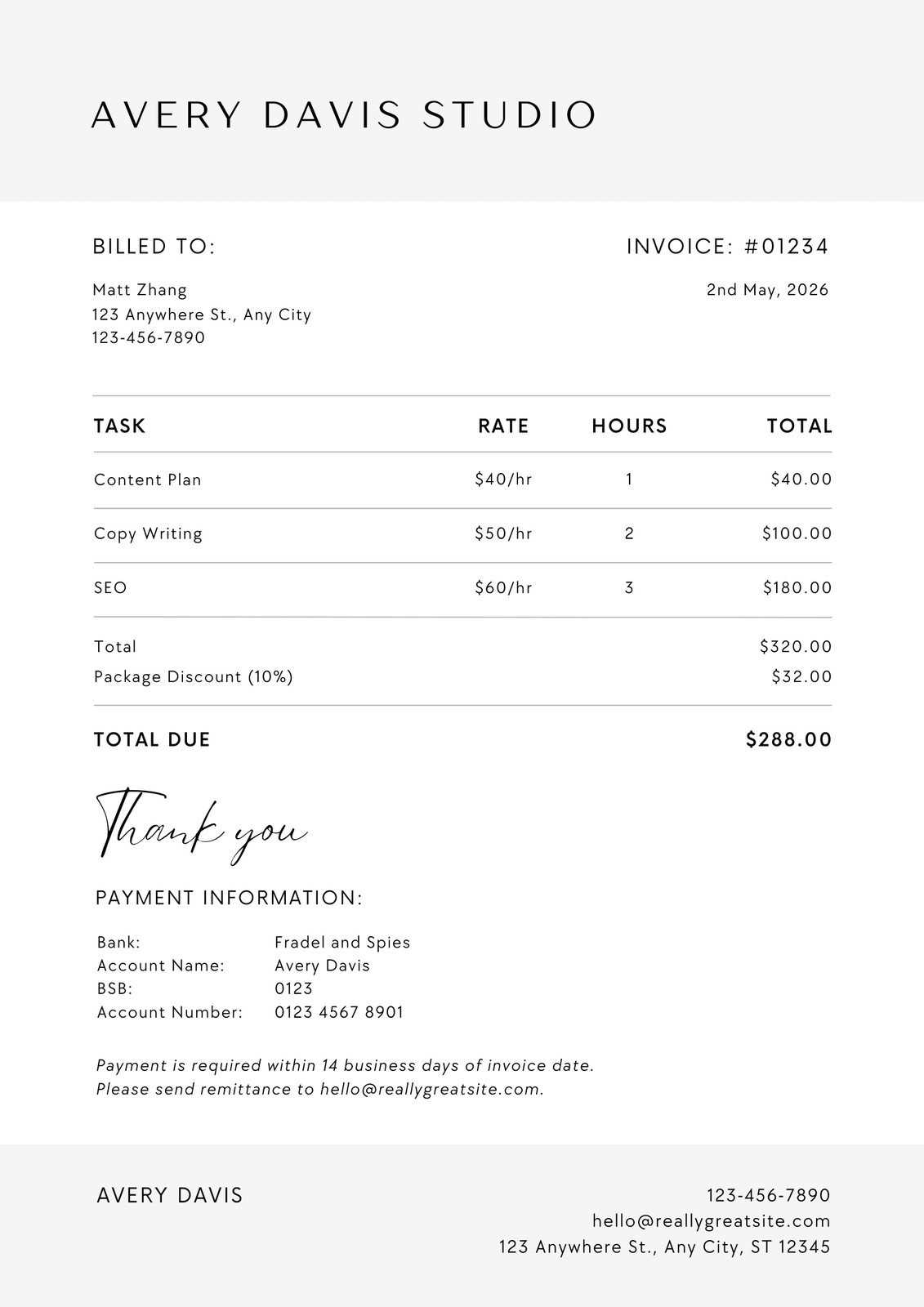

How to Customize Your Payment Record Design

Personalizing your financial document not only enhances its visual appeal but also reinforces your brand identity. A well-designed payment record reflects professionalism and ensures that essential information is easy to find. Customizing the layout and style can make your document stand out, leaving a positive impression on your clients.

Steps to Personalize Your Design

Here are some key steps to consider when customizing your financial document layout:

- Logo and Branding: Include your logo or brand colors to make the document instantly recognizable and aligned with your business identity.

- Clear Sectioning: Organize the document into clearly defined sections such as contact details, services, payment terms, and total due. This improves readability.

- Fonts and Typography: Choose professional fonts that are easy to read. Avoid using too many different font styles to maintain a clean, cohesive look.

- Colors: Use a simple color scheme that complements your brand. Stick to a few colors to keep the document professional while still visually appealing.

- Whitespace: Ensure there is enough space between sections and text to make the document easy to scan. Avoid clutter by leaving sufficient margins and padding.

Additional Customization Tips

In addition to basic design elements, consider the following to make your payment record more functional and unique:

- Custom Fields: If necessary, add specific fields relevant to your industry or service, such as project numbers, delivery dates, or unique reference codes.

- Detailed Descriptions: Provide enough space to describe each service or product in detail, ensuring that clients understand exactly what they are being charged for.

- Payment Instructions: Customize the section outlining payment options to suit your preferences, such as bank details or online payment links.

By tailoring the design to suit your style, you can make your financial documents both functional and visually appealing, enhancing both your professionalism and client experience.

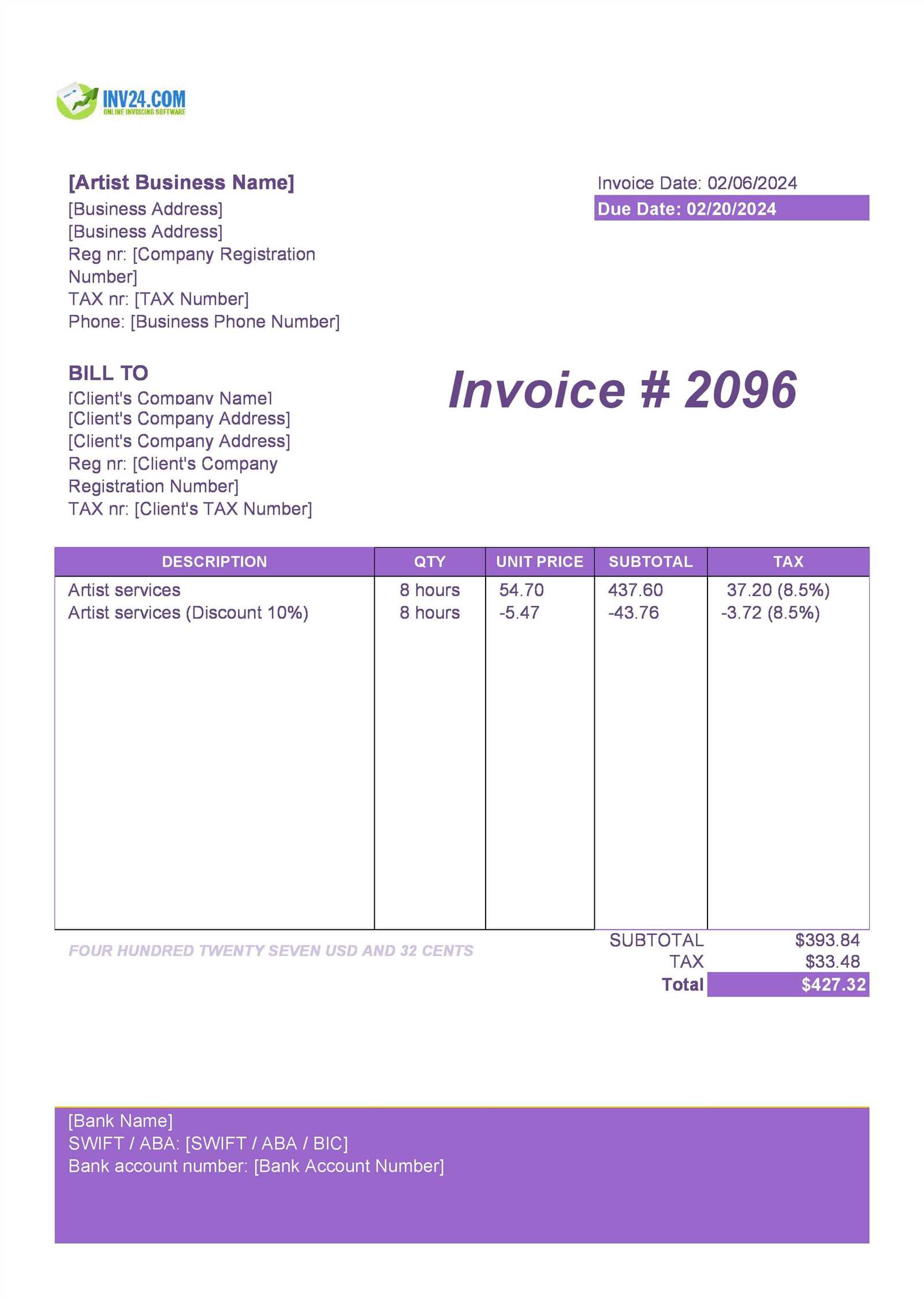

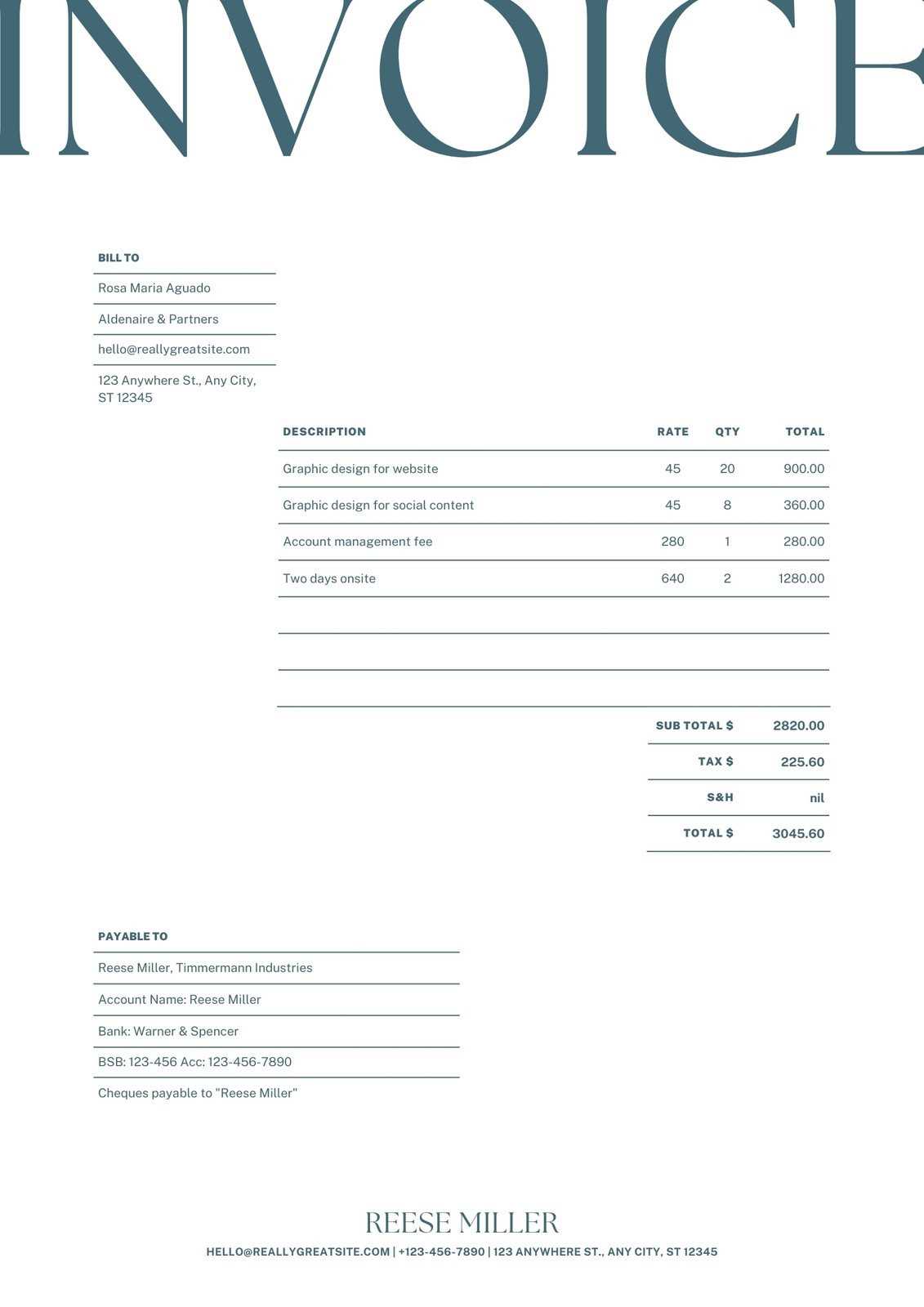

Best Practices for Writing Payment Descriptions

Clear and precise descriptions are vital for ensuring that both parties fully understand the work completed and the associated costs. A well-written description not only avoids confusion but also helps to establish transparency and trust. By following a few key practices, you can ensure that the details in your payment records are both informative and professional.

Key Elements of an Effective Description

When writing descriptions for services rendered, make sure to include the following elements:

| Element | Description |

|---|---|

| Clarity | Use simple, straightforward language that leaves no room for misinterpretation. Avoid jargon or overly technical terms. |

| Specificity | Be specific about the work completed, including details such as the scope, duration, or any additional requirements that were fulfilled. |

| Quantities and Rates | Clearly list the number of units or hours worked, along with the corresponding rates, so the client understands how charges are calculated. |

| Completion Milestones | If applicable, mention milestones or stages of the project that were completed. This helps the client track progress. |

| Additional Notes | Provide any relevant extra information, such as adjustments, discounts, or special terms, to avoid confusion later on. |

Examples of Clear Payment Descriptions

Here are a few examples of well-written payment descriptions:

- Web Design: “Design of homepage layout and 5 subpages with responsive features, including custom graphics and SEO optimization. 15 hours at $50 per hour.”

- Consulting: “Consulting services for project management strategy, 10 hours of meetings and reporting, billed at $100 per hour.”

- Photography: “Event photography, 8 hours of shooting with digital editing included, 200 edited photos delivered.”

By adhering to these best practices, you can ensure that your payment descriptions are both clear and professional, helping to maintain smooth business relationships with clients.

Choosing the Right Payment Terms

Establishing clear payment terms is essential for maintaining healthy professional relationships and ensuring timely compensation for work. Selecting the right terms can prevent misunderstandings and streamline the financial side of your projects. By defining how and when payments should be made, both you and your client will have a mutual understanding of expectations.

Factors to Consider When Setting Payment Terms

There are several factors that should influence your choice of payment terms:

- Payment Timeline: Determine when you expect to receive payment. Common options include “upon completion,” “net 30,” or “50% upfront.”

- Late Payment Penalties: Decide whether you will include penalties or interest fees for late payments. This encourages clients to pay on time.

- Payment Methods: Specify how you will accept payments, such as via bank transfer, PayPal, or checks, to avoid confusion later.

- Partial Payments: If the project is large, consider setting up a payment plan where the client pays in installments based on milestones or deadlines.

- Currency: Ensure you specify the currency you wish to receive payments in, especially for international transactions.

Common Payment Terms Used in Creative Projects

Here are some common payment terms you may encounter or choose from:

- Upon Completion: Full payment is expected once the project or service has been delivered.

- 50% Upfront: A deposit is required before work begins, with the remaining balance due upon project completion.

- Net 30: Payment is due within 30 days after the work has been completed or an invoice has been issued.

- Milestone Payments: Payments are made at agreed-upon stages or milestones of the project, with a final balance due upon completion.

Choosing the right payment terms depends on the nature of the work, your relationship with the client, and your preferences. Setting clear and fair terms upfront will help ensure smooth transactions and avoid potential payment issues down the line.

Tracking Payments on Your Document

Keeping track of payments ensures that you stay organized and are able to monitor any outstanding balances. Accurately recording which payments have been made and when is crucial for maintaining clear financial records and avoiding confusion. By systematically tracking payments, you can easily follow up on any overdue amounts and keep your cash flow under control.

Essential Details to Include for Payment Tracking

To effectively track payments, it’s important to include the following information on your financial document:

- Payment Date: Record the date when each payment is received to maintain an accurate timeline of transactions.

- Amount Paid: Clearly note the specific amount that was paid for each transaction or installment.

- Remaining Balance: Indicate the remaining balance if the full payment has not been made, helping both parties see what is still owed.

- Payment Method: Specify the method used for payment (e.g., bank transfer, PayPal, check), which helps in case of discrepancies.

- Transaction Reference Number: If applicable, include any reference numbers associated with the payment, such as a bank transaction number or payment ID.

How to Organize Payment Tracking

Here are a few ways to effectively track payments:

- Use a Payment Log: Maintain a separate log or spreadsheet where you can track each payment, along with the date, amount, and method. This will serve as a quick reference for any future inquiries.

- Update Regularly: Always update your records promptly after receiving a payment to prevent any confusion later on.

- Mark Paid Items: Visually mark each service or product as “paid” once the payment is received, either by checking off or highlighting the respective line item.

By carefully tracking payments, you ensure that all financial records are accurate and that any overdue payments are easily identifiable, helping you maintain a smooth workflow and healthy cash flow.

Handling Late Payments in Your Documents

Late payments can disrupt your cash flow and cause unnecessary stress. It’s important to have a clear strategy in place for managing overdue amounts. By setting clear expectations upfront and outlining consequences for delayed payments, you can mitigate potential issues and maintain a professional relationship with your clients.

How to Address Late Payments

There are several effective strategies for dealing with late payments while maintaining professionalism:

- Set Clear Terms: Ensure that payment deadlines and terms are clearly outlined before starting a project. Specify due dates and any late fees to avoid confusion later on.

- Send Payment Reminders: If a payment is overdue, send a polite reminder to your client. A gentle nudge can often encourage clients to settle their balance.

- Apply Late Fees: If you’ve communicated late fees in your payment terms, don’t hesitate to apply them to overdue amounts. This can act as a deterrent for clients who consistently miss deadlines.

- Offer Payment Plans: For clients facing financial difficulties, consider offering a payment plan. This allows them to settle their debt over time while still ensuring you receive compensation.

- Review Client History: If late payments are a recurring issue with a client, consider reassessing your working relationship or adjusting payment terms for future projects.

When to Take Further Action

If a payment is significantly delayed and reminders aren’t successful, you may need to escalate the situation:

- Formal Demand Letters: If necessary, send a formal letter demanding payment. This serves as an official notice and can show that you are serious about the matter.

- Legal Action: As a last resort, legal action may be required for unresolved payments. However, this is generally seen as a last resort and can harm client relationships.

By taking proactive measures and having clear policies in place, you can manage late payments effectively, ensuring that you receive the compensation you deserve while maintaining a prof

Adding Taxes to Your Billing Documents

Incorporating taxes into your financial documents is essential for ensuring compliance with tax regulations and maintaining accurate records. Depending on the jurisdiction, you may need to charge sales tax, value-added tax (VAT), or other applicable taxes for the services or products you provide. Understanding how to correctly add taxes to your bills will help you avoid legal issues and ensure that you are compensated properly.

Understanding Tax Requirements

Before adding taxes, it’s important to be aware of the specific tax laws that apply to your business. These can vary based on location, the type of service provided, and your earnings. Some key points to consider include:

- Sales Tax or VAT: Determine whether you are required to charge sales tax or VAT based on your location and the nature of your work.

- Tax Exemption: Some clients may be exempt from taxes, such as nonprofit organizations or government entities. Be sure to verify their tax-exempt status before excluding taxes from your bill.

- Tax Rates: Familiarize yourself with the applicable tax rate in your region, whether it’s a standard rate or a reduced rate for specific services or products.

- Thresholds for Registration: In some areas, small businesses or independent professionals may not be required to register for tax purposes unless they exceed certain income thresholds.

How to Add Taxes to Your Bills

Once you understand your tax obligations, here are steps to correctly apply taxes to your bills:

- Itemize Tax Amounts: Clearly list the tax amount separately from the cost of your services or products. This ensures transparency and avoids confusion for your clients.

- Include Tax Rate Information: Always state the applicable tax rate next to the tax amount, so your client can see how it was calculated.

- Use Tax Identification Numbers: If required, include your tax ID number or business registration number to comply with legal requirements.

- Verify Payment Methods: Ensure that your payment options support the proper tax charges. For example, PayPal or bank transfers should reflect the full amount, including taxes.

By accurately adding taxes to your financial documents, you protect both yourself and your clients from any legal complications while ensuring a smooth and professional transaction.

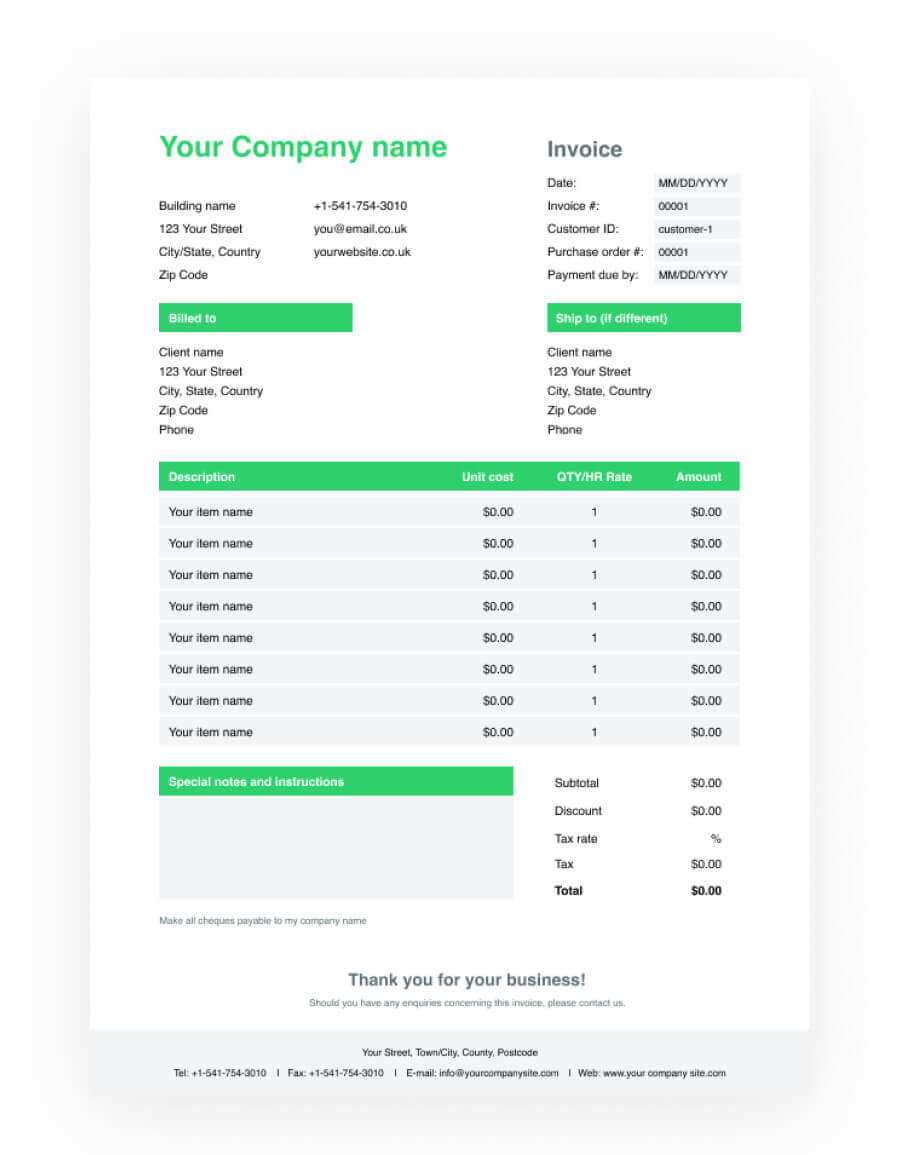

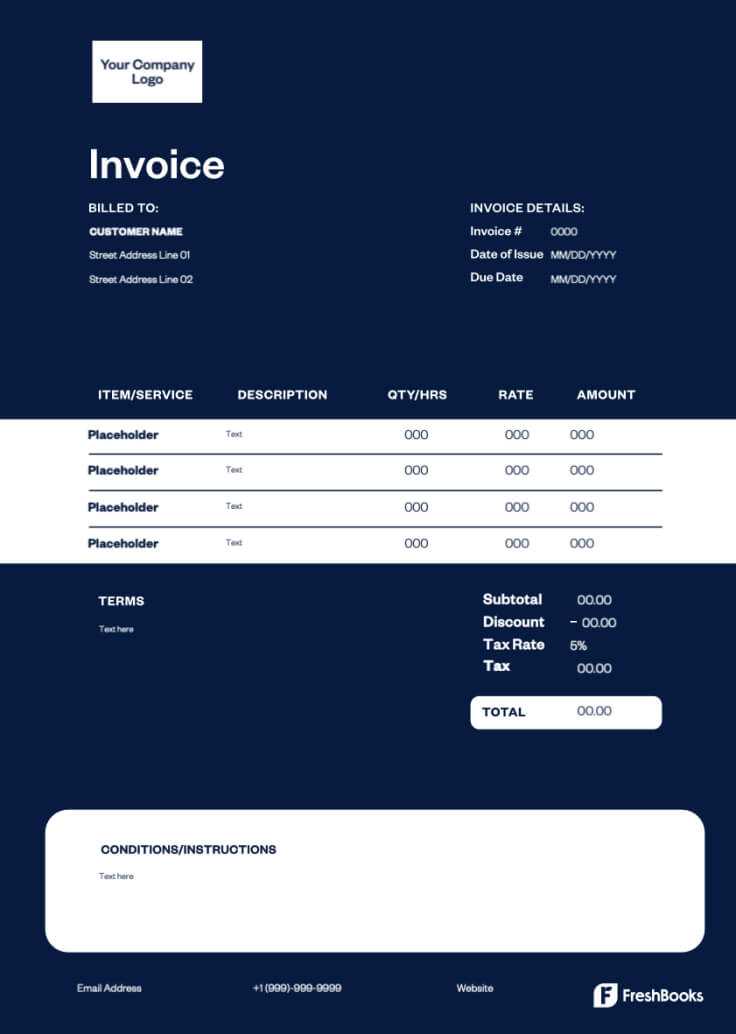

How to Format Your Billing Document Professionally

A well-structured and clearly formatted document is crucial for making a positive impression and ensuring prompt payment. The way you present your charges and details can convey professionalism and credibility. By organizing your document in a clean, readable, and consistent manner, you help clients understand exactly what they are being charged for and how to proceed with payment.

Essential Components of a Professional Document

When preparing a billing document, certain elements must be included to ensure clarity and professionalism:

- Your Contact Information: Include your name or business name, address, phone number, and email so clients can easily reach you with any questions or concerns.

- Client’s Information: Clearly list the client’s name, company (if applicable), and contact details. This ensures that the bill is correctly addressed.

- Invoice Number: Assign a unique number to each document for easy tracking and reference. This helps both you and your client keep accurate records.

- Date of Issue: Include the date when the document is issued to establish the timeline for payment terms.

- Due Date: Always specify the payment due date so the client knows when to settle the outstanding balance.

- Description of Services: Break down the services or products provided, including quantities, rates, and a clear description of each item.

- Total Amount Due: Provide a final amount that clearly outlines all costs, including taxes or additional fees if applicable.

Formatting Tips for Clear Presentation

Proper formatting ensures your document is easy to read and navigate. Here are some tips to help you present a professional document:

- Use a Clean Layout: Keep the design simple with enough spacing between sections to make it easy to follow.

- Highlight Important Information: Use bold text for key details such as totals, due dates, and client names. This draws attention to the most important elements.

- Use Consistent Fonts: Choose a professional font such as Arial or Times New Roman and stick with it throughout the document. Avoid using more than two fonts to maintain a cohesive look.

- Incorporate a Professional Logo: If you have a logo, include it at the top of the document to reinforce your brand identity.

By adhering to these formatting guidelines, you ensure that your billing document is clear, professional, and easy for your clients to understand, helping to foster a trustworthy business relationship.

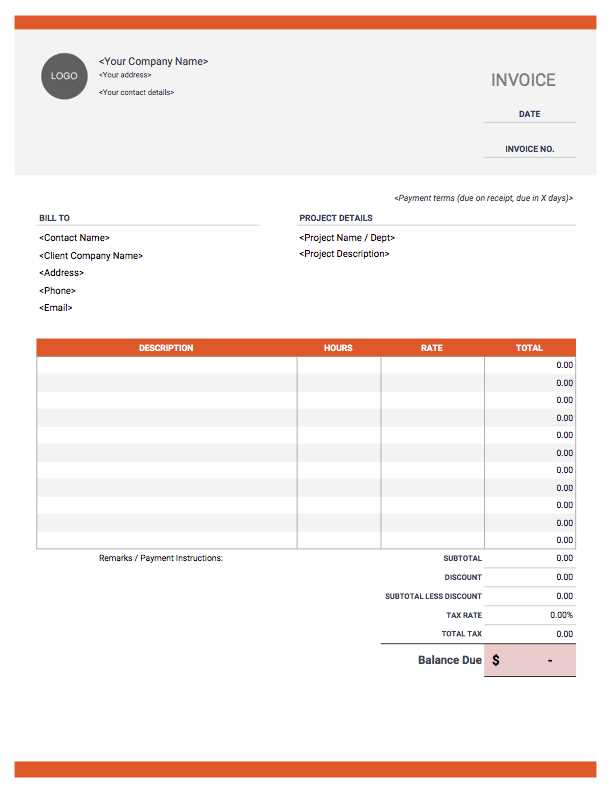

How to Save Time with Pre-Formatted Documents

Using pre-designed forms and layouts can significantly reduce the amount of time spent on administrative tasks. Instead of starting from scratch with each new transaction, you can rely on ready-to-use documents that already include the necessary fields and sections. These ready-made formats allow you to quickly customize and fill in the required details, streamlining the entire process.

By implementing these tools, you can cut down on repetitive work and avoid errors that might occur when creating documents manually. They offer consistency and organization, ensuring that all necessary information is included without the need to recreate the structure every time. This approach allows you to focus more on your work and less on paperwork, leading to greater efficiency and more time for your projects.

Understanding Numbering Systems for Billing Documents

Properly numbering your financial documents is essential for maintaining an organized and professional record-keeping system. A well-structured numbering system not only helps with easy reference and tracking, but it also ensures that all transactions are properly documented and easily accessible. By using a consistent numbering method, you can avoid confusion and ensure that both you and your clients can easily track payments and services provided.

Types of Numbering Systems

There are several approaches to numbering your financial documents. The choice of system depends on your preferences, the size of your business, and how detailed you want your records to be:

- Sequential Numbering: The most common method, where each document is assigned a unique number that follows the previous one in numerical order. This system is simple and efficient for small businesses or independent professionals.

- Chronological Numbering: In this system, documents are numbered based on the date they are issued, such as including the year and month in the document number (e.g., 2024-001, 2024-002). This method is helpful for keeping track of when documents were created.

- Client-Based Numbering: This system assigns a unique number for each client. For example, you could start numbering from “CL001” for the first client, and then each subsequent document for that client would follow in order, such as CL001-01, CL001-02, etc.

Best Practices for Numbering

To keep things organized and ensure your document numbers are meaningful, consider these best practices:

- Start with a Clear Structure: Begin numbering from “1” or a specific starting point, and ensure that the numbers increase in sequence without gaps to avoid confusion.

- Avoid Repeating Numbers: Each document should have a unique number. Reusing numbers for different transactions could create confusion and make it difficult to track payments or services.

- Include Key Information: Depending on your preference, you might include relevant details such as the year, month, or client name in the document number for easy identification.

By implementing a clear and consistent numbering system, you streamline your business processes, reduce errors, and maintain a high level of professionalism in your documentation.

How to Send Billing Documents Securely

Ensuring the security of your financial documents when sending them to clients is critical to protect sensitive information. Whether you’re transmitting payment requests or contract details, safeguarding the privacy and integrity of your documents is a priority. With digital communication becoming more prevalent, it’s important to adopt methods that prevent unauthorized access and ensure that the information reaches the intended recipient safely.

Methods for Secure Transmission

There are various ways to ensure that your documents are sent securely, each with its own level of protection:

- Email Encryption: One of the most straightforward ways to send secure documents is through email encryption. By using secure email services or encrypting the attachments, you ensure that only the recipient can open and view the file.

- Secure File Sharing Services: Platforms such as Dropbox, Google Drive, or OneDrive allow you to upload and share documents via a private link. These services often offer additional encryption layers and password protection to prevent unauthorized access.

- Password-Protected Documents: Adding a password to the document itself is another way to ensure security. Tools like PDF editors or office suites allow you to encrypt a file and require a password to open it, ensuring that only the intended recipient can access it.

Best Practices for Sending Documents

In addition to choosing a secure method of transmission, consider the following tips to further protect your documents:

- Verify Recipient Information: Double-check the email address or contact details of the recipient before sending any sensitive documents. A small mistake can result in sending the information to the wrong person.

- Use Secure Networks: Always ensure that you are using a secure internet connection, especially when sending sensitive information. Avoid using public Wi-Fi networks, which may be vulnerable to hacking.

- Limit Access: If possible, only share necessary details with the client and avoid including too much sensitive data in one document. You can share invoices and payments in separate communications if necessary.

By following these security practices, you can ensure that your financial communications remain private and protected from potential threats, helping to build trust with your clients.

Freelancer Billing Software vs Pre-made Forms

When managing billing for your work, two main options are available: using software specifically designed for generating billing documents or relying on pre-made forms. Both options come with their advantages and disadvantages, depending on the nature of your business and your specific needs. Understanding the differences between these two methods can help you choose the one that best suits your workflow and ensures smooth financial transactions with clients.

Advantages of Billing Software

Billing software provides a more automated and comprehensive solution for managing your payments and invoices. Here are some benefits:

- Automation: Many billing software solutions automate the creation of financial documents, saving time by generating them instantly and sending them to clients with minimal manual input.

- Tracking and Reporting: Most software includes features to track payments, manage overdue accounts, and even generate financial reports, helping you keep a detailed record of your transactions.

- Customization and Integration: Billing software often allows for deeper customization options, such as adding your logo, adjusting the design, and integrating with other tools like accounting or payment platforms.

- Security: With encryption and cloud storage, billing software typically offers better protection for your financial data compared to standard document formats.

Advantages of Pre-made Billing Forms

Pre-made forms, on the other hand, offer a more simple and manual approach to creating billing documents. While they may not have the automation features of specialized software, they still come with distinct advantages:

- Cost-Effective: Pre-made forms are often free or low-cost, making them an ideal option for individuals or small businesses on a tight budget.

- Simplicity: If your needs are minimal, pre-made forms can be a simple and quick solution without the need for additional software or subscriptions.

- Immediate Access: You can start using pre-made forms immediately, without needing to sign up, learn software, or deal with any technical setup.

Ultimately, the choice between billing software and pre-made forms depends on your specific requirements. If you are looking for a quick and affordable solution, forms might be the best choice. However, if you need more comprehensive features and greater control over your billing system, billing software may be the right fit for you.

Common Mistakes to Avoid on Billing Documents

When creating financial documents for clients, accuracy is key. Mistakes can lead to confusion, delays in payments, and even damaged professional relationships. To ensure that your billing process runs smoothly, it is essential to avoid common errors that can make your documents unclear or incomplete. Here are some mistakes to watch out for when preparing payment requests.

Missing or Incorrect Information

One of the most frequent mistakes is leaving out important details or entering incorrect information. This can create unnecessary delays or confusion about the transaction. Make sure to double-check the following:

- Client Details: Always verify that the client’s name, address, and contact details are correct.

- Your Information: Ensure your business name, address, and contact info are accurately listed.

- Payment Terms: Clearly define your payment terms, such as due dates, late fees, and any applicable taxes.

Unclear Descriptions

Another issue is providing vague or incomplete descriptions of the work or services performed. Ambiguous language can lead to misunderstandings. To avoid this:

- Be Specific: Include clear, detailed descriptions of the work, including the time spent, tasks performed, and any relevant project information.

- Use Itemized Lists: Break down your services or products into line items with corresponding prices to make the document easy to understand.

Incorrect Amounts or Calculations

Errors in calculations are one of the easiest mistakes to make but also one of the most costly. Double-check your numbers to ensure everything is correct, including:

How Billing Documents Help Maintain Financial Records

Proper record-keeping is essential for any business or individual managing financial transactions. Having clear and accurate payment requests plays a significant role in organizing and tracking income. These documents provide a structured way to keep track of payments, ensuring that all financial dealings are documented for future reference. By maintaining well-organized records, you can easily manage your finances, file taxes, and stay on top of outstanding payments.

Tracking Payments and Income

One of the primary ways that payment requests assist in managing finances is by helping you track income. Each document serves as a record of a completed transaction, which can be referenced later for financial planning, tax reporting, or even resolving disputes. Here’s how billing records help:

- Clear Financial Overview: Every transaction is documented with a date, amount, and description, allowing you to easily monitor cash flow over time.

- Payment Tracking: By indicating whether payments are made or pending, these documents help you track outstanding balances.

- Tax Filing: Having a clear history of your earnings makes it easier to calculate taxable income and avoid missing any necessary deductions.

Organizing Financial Documents

Financial management is much easier when you have a well-organized system for storing your records. Using consistent formats for your billing documents allows you to categorize and sort them in a way that works best for your business. Consider the following benefits:

- Easy Retrieval: Organized billing records allow for easy retrieval when you need to review past transactions or resolve discrepancies.

- Financial Reports: By grouping documents by date, client, or service type, you can quickly generate financial reports, which are useful for tracking performance or applying for loans.

- Consistency: Regularly maintaining these records ensures that nothing is overlooked or lost, and that your accounting remains up-to-date.

Overall, the use of structured payment records is a powerful tool for maintaining control over your finances. It supports tax compliance, assists with budgeting, and helps ensure that your financial activities are transparent and well-documented.