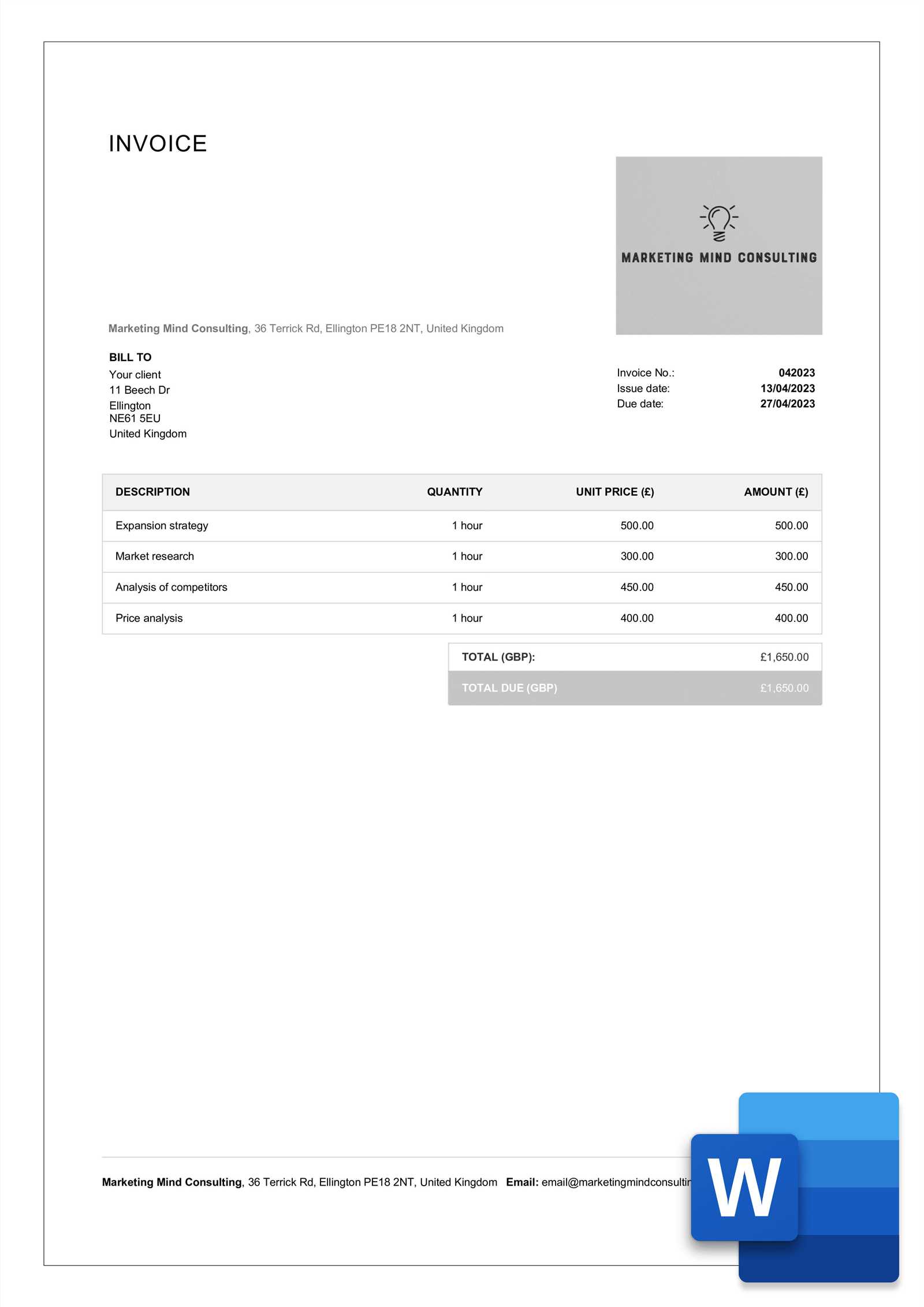

Free Word Invoice Templates for Your Business

In the modern business world, efficient documentation is essential for smooth financial transactions. Simplifying how you create and manage business statements can save valuable time and effort. With the right tools, generating professional-looking records becomes quick and easy.

Customizable formats allow businesses of any size to maintain consistency and accuracy. These ready-to-use documents help ensure that all necessary details are included without the need for complex software or excessive preparation. Whether you are a freelancer, small business owner, or part of a larger organization, having a practical system in place is key to maintaining organized finances.

By selecting an appropriate layout and filling in the required fields, it’s possible to produce accurate records that clearly communicate payment terms. This approach can also foster trust and professionalism with clients. Understanding how to optimize these documents for your unique needs can make a significant difference in both speed and reliability.

Why Use Word Invoice Templates

Having the right tools to manage your financial paperwork is crucial for maintaining smooth operations in any business. A well-organized document can not only save time but also ensure that you present a professional image to clients. Using an adaptable document format offers several advantages, particularly when it comes to ease of customization and accessibility.

Here are some key reasons why this approach is beneficial:

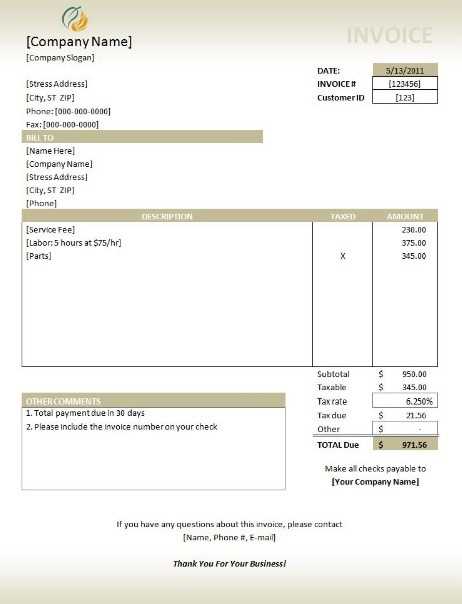

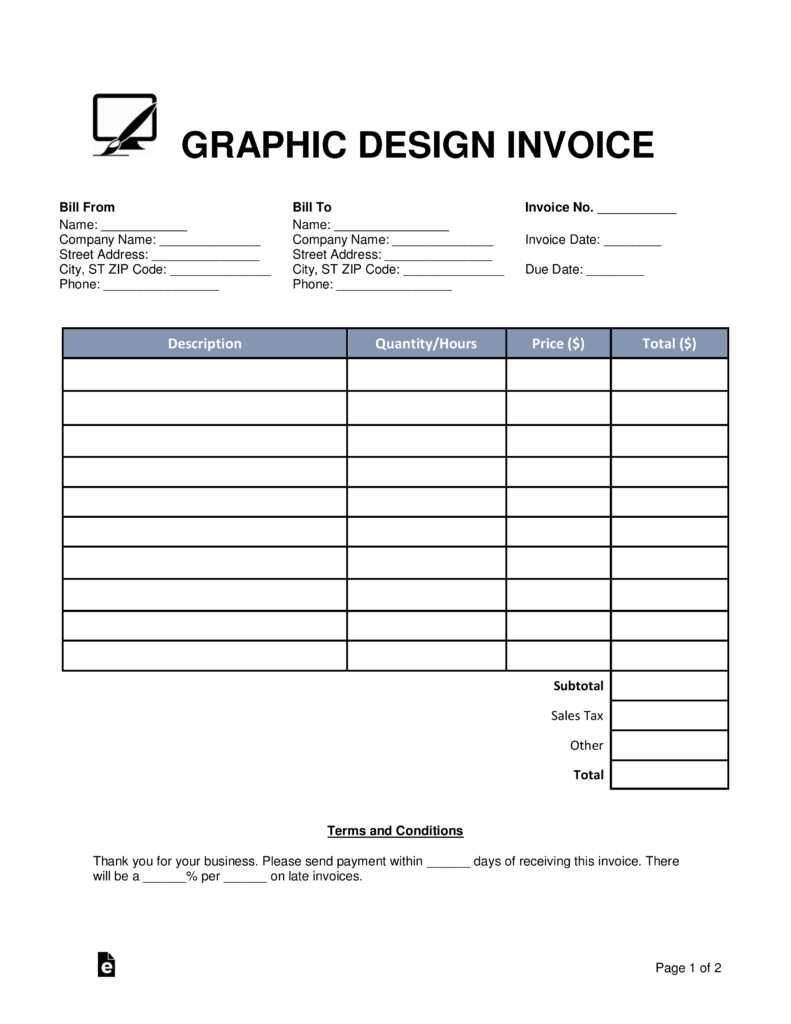

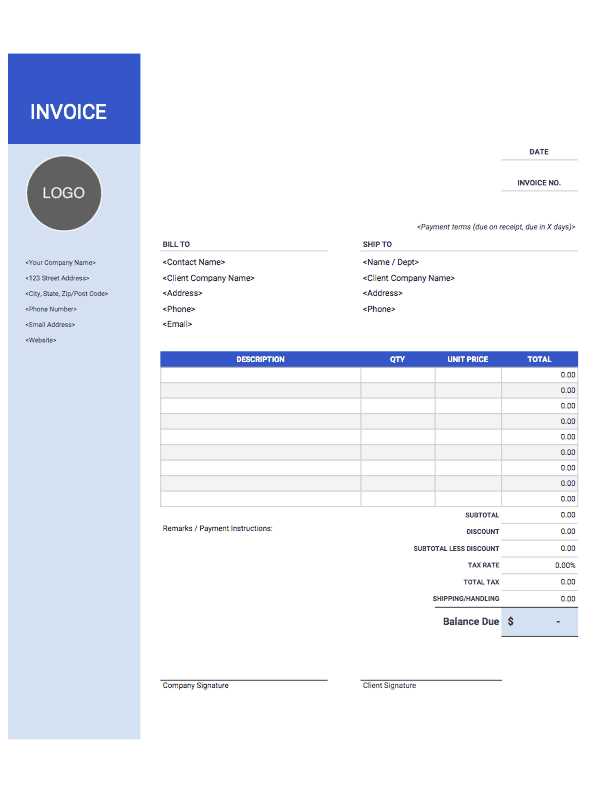

- Easy Customization: With adjustable layouts, it’s simple to tailor the document to fit your specific needs, from adding your logo to modifying payment terms.

- Professional Presentation: Pre-designed formats ensure that your documents look polished and consistent, reflecting well on your business.

- Time-Saving: Ready-to-use structures eliminate the need to design a new document from scratch, allowing you to focus on other essential tasks.

- Compatibility: This format is universally accessible and can be opened on various devices and platforms without the need for specialized software.

By incorporating these structured documents into your workflow, you can streamline your billing process, ensuring that important details are never overlooked. These documents also help maintain clarity in your transactions, contributing to smoother communication with clients and partners.

Benefits of Customizing Your Invoices

Personalizing your financial documents can bring significant advantages to both your business and client relationships. Customization allows you to align the look and feel of your paperwork with your brand, making the entire process more streamlined and professional. This small change can have a big impact on how your business is perceived.

Here are some notable benefits:

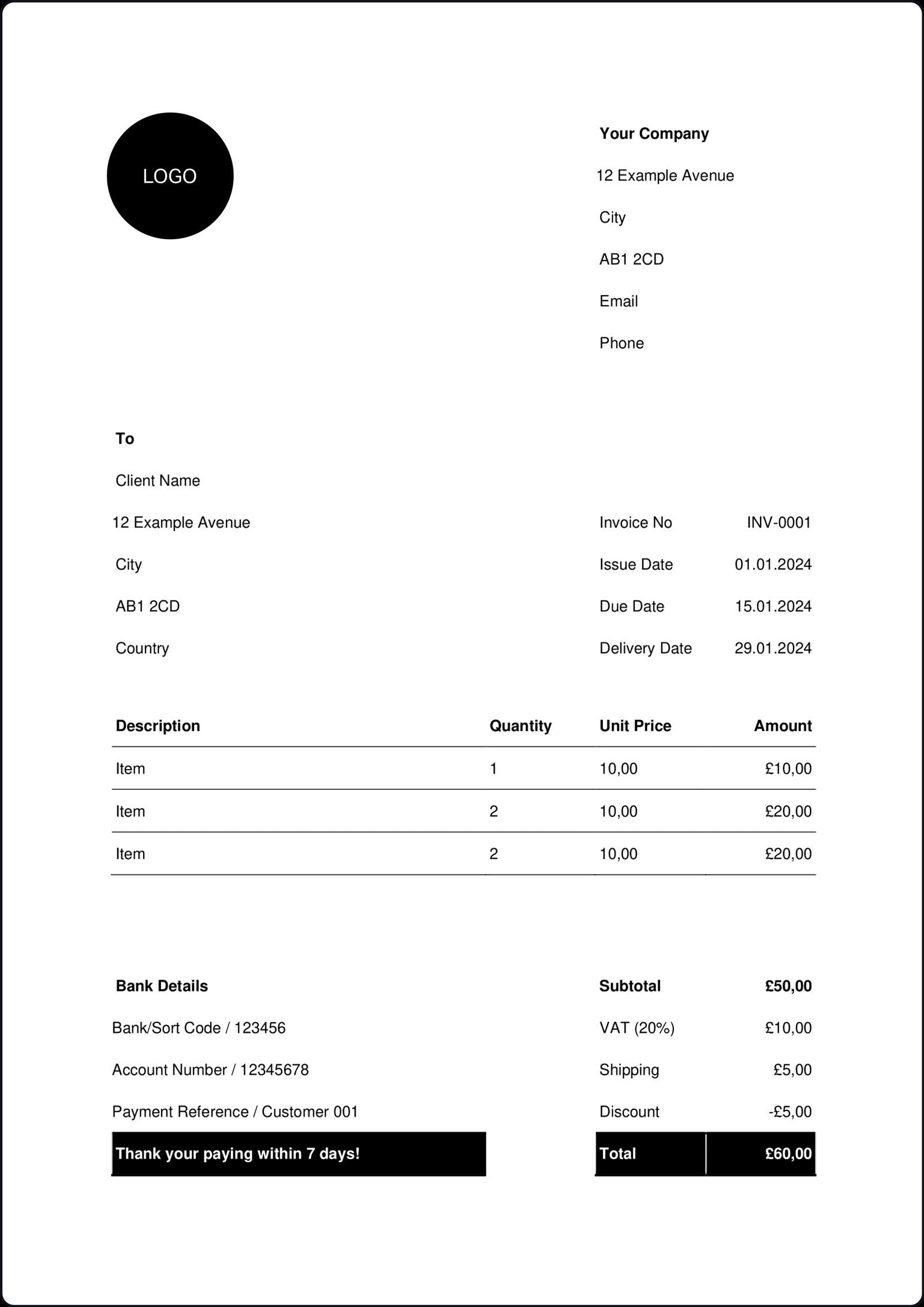

- Brand Consistency: Adding your logo, company colors, and specific fonts helps reinforce your brand identity in every transaction.

- Improved Professionalism: Customizing your documents ensures that all necessary information is clearly presented, enhancing your reputation as a detail-oriented business.

- Better Client Communication: Including specific terms, payment deadlines, and additional notes can reduce confusion and help clients understand their obligations more easily.

- Increased Efficiency: Customization allows you to pre-fill repetitive information, reducing the time spent on creating documents for each new project.

- Tailored Payment Options: Custom forms can accommodate specific payment methods, including discounts for early payments or instructions for bank transfers.

Overall, the ability to customize these documents allows you to maintain control over your business communications, improving accuracy and consistency while presenting a polished image to clients.

How to Download Free Templates

Getting started with professional-looking documents doesn’t need to be complicated. With just a few simple steps, you can access pre-designed formats that can be customized to fit your needs. These ready-made files are available from various sources, allowing you to quickly download and start using them for your business.

Steps to Access Templates

Follow these easy steps to obtain the document format you need:

- Visit Trusted Websites: Look for reliable platforms offering a wide selection of documents that can be downloaded directly to your device.

- Select Your Preferred Layout: Browse through various options and choose the one that best suits your requirements, whether it’s for a small business, a freelancer, or a large enterprise.

- Download the Document: Once you’ve selected the desired format, simply click the download button. The file will be saved in a compatible format for easy editing.

What to Keep in Mind

When downloading pre-designed files, make sure the website is reputable and offers safe downloads. Always double-check the compatibility of the file with the software you plan to use, ensuring that it works seamlessly on your device.

Top Features of Word Invoice Templates

When choosing a format for your financial documents, there are several important features that can make your work easier and more efficient. Pre-designed options offer flexibility, allowing you to quickly generate clear, professional paperwork that meets your needs. These features are especially beneficial for businesses that need to create accurate records without spending too much time on customization.

Key Features to Look For

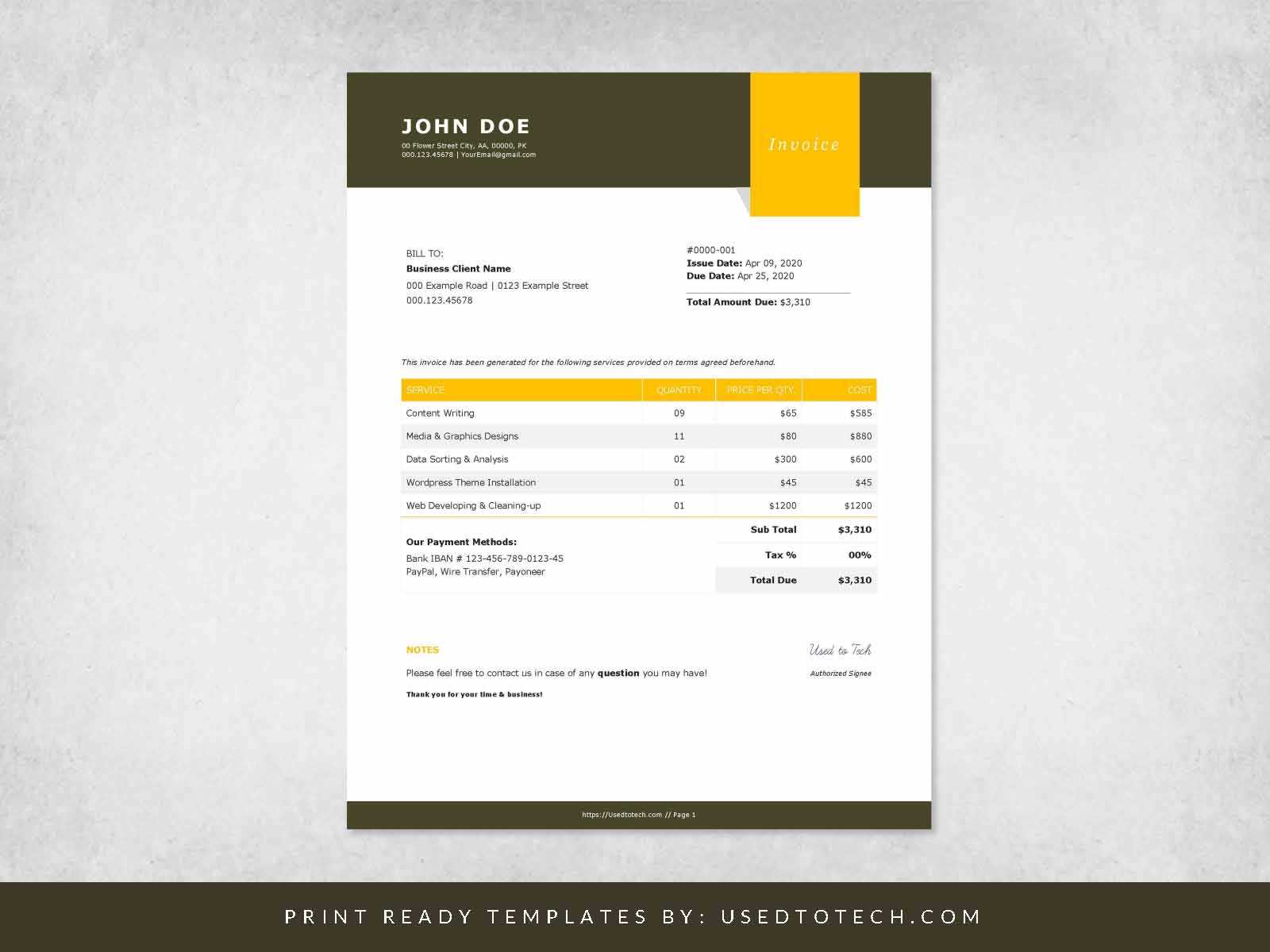

- Easy Customization: The ability to modify text, logos, and layouts ensures that the document can be tailored to suit your brand and specific transaction requirements.

- Clear Layout: Pre-made structures are designed to be visually clean and well-organized, making it easy for clients to understand payment terms and item details.

- Pre-filled Sections: Many formats include placeholders for common information, such as company details, payment terms, and itemized services, allowing for faster completion.

- Compatibility with Multiple Software: These files are often designed to work across various platforms, meaning you can open and edit them with popular software tools.

- Variety of Styles: Different designs are available, allowing you to choose one that best aligns with your company’s image, whether you’re looking for something formal or casual.

Additional Benefits

- Integrated Calculations: Some formats come with built-in features that help automatically calculate totals, taxes, and discounts, reducing the chance of manual errors.

- Reusability: Once you download and customize the layout, you can use it repeatedly for future transactions, saving time on creating new documents from scratch.

By utilizing these features, businesses can ensure their documents are both functional and professional, providing clients with clear and accurate information with every transaction.

Steps to Edit Your Invoice Template

Once you have chosen the right layout for your business documents, it’s essential to customize it to fit your specific needs. Editing a pre-designed document is a straightforward process that allows you to adjust details like company information, services rendered, and payment terms. Below are simple steps to help you modify the document and ensure it’s ready for use in your next transaction.

Step-by-Step Guide

- Open the Document: Start by opening the file in the compatible software of your choice, such as a word processor or text editor.

- Update Contact Information: Replace the default company details with your own, including business name, address, phone number, and email.

- Modify Payment Terms: Adjust the payment conditions according to your agreements with clients, specifying due dates, discounts for early payments, or any late fees.

- Add or Edit Items: Update the list of goods or services provided. Ensure that the descriptions, quantities, and prices are accurate.

- Insert Your Logo: If needed, add your company logo to the document for branding purposes. Ensure it fits well within the layout without crowding other important information.

Example of a Basic Table Structure

Here’s an example of how to structure your items and prices clearly:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Service | 5 hours | $50 | $250 |

| Website Maintenance | 1 month | $100 | $100 |

| Total | $350 |

After making these edits, save your changes and the document will be ready for use in your next billing cycle. By keeping the layout clear and structured, you can ensure that your clients easily understand the details of the transaction.

Best Practices for Creating Invoices

Creating clear, accurate, and professional documents is crucial for maintaining good relationships with clients and ensuring timely payments. A well-structured record not only reflects your professionalism but also helps avoid misunderstandings. By following some key practices, you can streamline your billing process and make it easier for your clients to understand their obligations.

Key Best Practices

- Use Clear and Simple Language: Avoid jargon or complicated terms. The document should be easy to read and understand by anyone, even if they are unfamiliar with your business.

- Include All Necessary Information: Make sure to provide essential details such as your company name, client’s details, service description, payment terms, and due date.

- Be Accurate with Pricing: Ensure that item descriptions, quantities, and prices are accurate. Double-check calculations to avoid any errors that could lead to confusion or delays in payment.

- Organize Information Effectively: Structure your document in a way that’s easy to follow. Use clear headings, bullet points, and tables to present data such as services provided and their corresponding costs.

- Set Clear Payment Terms: Define the payment method, due date, and any late fees in a prominent place. This ensures that both parties are on the same page regarding when and how payments should be made.

Additional Considerations

- Stay Consistent: Use a consistent format for all your documents to build a strong, professional brand image. This consistency will also help clients recognize your documents quickly.

- Include Contact Information: Make sure clients can easily reach you for any questions or concerns. Include a phone number, email, or other contact options.

- Review Before Sending: Always double-check the document for accuracy before sending it out. A quick review can save time and prevent potential mistakes that could affect your business’s credibility.

By following these practices, you can ensure that your records are not only professional but also clear and effective in conveying payment expectations to your clients.

Choosing the Right Template for Your Business

Selecting the ideal layout for your financial documents is an essential step in maintaining a professional and efficient billing system. A well-suited document format not only streamlines your process but also enhances your company’s image. The right choice can save you time and ensure accuracy, while also meeting your specific business needs.

Factors to Consider

- Business Type: Different industries may require different document formats. A service-based business may need a detailed breakdown of hourly rates, while a product-based business may focus on itemized lists and quantities.

- Brand Identity: Choose a layout that aligns with your brand. The document should reflect your company’s image and style, ensuring it’s consistent with other branding elements like your website and marketing materials.

- Ease of Use: Pick a format that’s user-friendly and easy to customize. The simpler it is to update, the quicker you can issue records without spending too much time on formatting.

Customizing for Your Needs

- Detail Level: Depending on your client relationship and transaction type, you might need to customize the level of detail. Ensure that the format can accommodate everything from simple listings to more complex descriptions.

- Payment Terms: Select a document that allows you to clearly state your payment conditions, including due dates, discounts, and penalties for late payments. The clearer this section, the fewer issues you’ll have with delayed payments.

By carefully considering your business type, branding, and specific needs, you can choose a format that will simplify the billing process and leave a lasting impression on your clients.

How to Add Your Logo to Invoices

Incorporating your company’s logo into your financial documents helps reinforce your brand identity and adds a professional touch. Whether you’re sending digital or printed versions, a well-placed logo can make your paperwork instantly recognizable and more visually appealing. Here are simple steps to help you integrate your logo into your business records.

Step-by-Step Process

- Choose the Right File Format: Ensure that your logo is in a high-quality file format (such as PNG, JPG, or SVG) that can be easily inserted into the document.

- Open Your Document: Begin by opening your document in the software you use to manage your records.

- Select the Placement Area: Decide where you want to position your logo–typically at the top of the document, either centered or aligned to the left or right, depending on your preference.

- Insert the Logo: Use the insert function in your software to place the logo in your chosen area. Ensure the image size is appropriate and doesn’t overpower the text or other important details.

- Adjust the Size and Position: Resize and reposition the logo as necessary to ensure that it fits well within the layout without distorting or cluttering the page.

Additional Tips

- Maintain High Resolution: Make sure the logo maintains its resolution quality even when resized. A blurry or pixelated logo can diminish the professional appearance of the document.

- Use Transparent Backgrounds: If possible, use a logo with a transparent background to blend seamlessly into the document without leaving a white box around it.

By adding your logo, you not only make your documents more visually appealing but also strengthen your company’s branding, leaving a lasting impression with clients and partners alike.

Formatting Your Invoice for Clarity

Properly organizing your financial documents is key to ensuring they are both professional and easy to understand. A well-formatted document not only helps convey information clearly but also reduces the likelihood of confusion, payment delays, or disputes. When designing your record, it’s essential to structure it in a way that’s both visually appealing and straightforward for the reader.

Essential Formatting Tips

- Use Clear Headings: Clearly label each section, such as client information, services rendered, and payment terms. Bold or underline headings to make them stand out for easy navigation.

- Maintain Consistent Fonts: Stick to one or two fonts for the entire document. Using too many fonts can make it look cluttered and unprofessional.

- Choose Readable Font Size: Ensure that the text is large enough to read easily, especially for key details such as payment amounts and due dates.

- Organize Data into Sections: Break your document into clear sections, using lines or spacing to separate different categories like itemized services, totals, and payment instructions.

- Align Text for Readability: Align text to the left for consistency, especially in tables. This will help avoid awkward spacing and create a clean, readable document.

Structuring the Information

- Itemized Breakdown: List each service or product separately with a brief description, quantity, unit price, and total. This helps clients understand exactly what they are being charged for.

- Clear Payment Terms: Position payment terms prominently. Make sure due dates, accepted payment methods, and any late fees are easy to spot.

- Use Tables for Clarity: Organize data, such as pricing details, into tables for easier reading. Tables help break up long paragraphs and present financial information clearly.

By following these formatting best practices, you ensure that your document is clear, professional, and effective in conveying all necessary information to your client. A well-structured record not only makes a good impression but also speeds up the payment process.

Understanding Invoice Payment Terms

Clearly outlining payment expectations is a crucial aspect of any financial document. Setting clear payment terms helps prevent misunderstandings, ensures timely payments, and fosters professional relationships. Whether you are working with new or long-term clients, it’s important to specify how and when payments should be made. This section will cover the key components of payment terms and why they matter for both parties involved.

Payment terms typically include important details such as the due date, the method of payment, any applicable discounts or penalties, and the consequences of late payments. Being specific about these terms reduces the risk of confusion and helps ensure that clients understand their obligations right from the start.

Some common payment terms include “Net 30,” which means the full amount is due within 30 days of the document’s issue, or “Due on Receipt,” indicating that payment is expected as soon as the record is received. Depending on your business type and agreement with your client, you may also include early payment discounts or fees for late payments. Being transparent about these terms from the outset can help build trust and improve your cash flow management.

How to Include Taxes on Invoices

Including the correct tax information on your financial documents is essential for compliance and clarity. Taxes are a significant part of business transactions, and it’s important to display them properly to avoid any confusion or legal issues. This section will guide you through the steps to ensure that taxes are included accurately on your records.

Steps to Add Taxes to Your Document

- Determine the Applicable Tax Rate: Identify the tax rate that applies to your goods or services. Tax rates may vary depending on your location, the type of products or services, or specific agreements with clients.

- Clearly Label the Tax Section: Dedicate a specific area of the document to taxes. Clearly label the section with terms like “Tax,” “Sales Tax,” or “VAT” to make it easy for the client to understand.

- Calculate the Tax Amount: Multiply the total amount of the goods or services by the applicable tax rate. Make sure the math is accurate and reflects the correct tax percentage.

- List the Tax Amount Separately: Display the calculated tax amount separately from the total cost. This helps the client see the breakdown of the charges and understand how much they are paying for taxes.

- Include the Total After Tax: Show the final amount due, including taxes. This is the amount your client will be required to pay.

Common Tax Practices

- Use Itemized Tax Rates: If your business involves multiple items with different tax rates, list them separately to avoid confusion.

- Ensure Consistency with Local Regulations: Always verify the tax rates with local or national tax authorities to ensure compliance with tax laws.

By following these simple steps, you can ensure that the tax information on your documents is clear, accurate, and easy for your clients to understand. Properly displaying taxes helps maintain transparency and professionalism in your business transactions.

Essential Information Every Invoice Needs

To ensure smooth business transactions, it’s important that your financial documents contain all the necessary details. A comprehensive record provides clarity for both the business and the client, making it easier to track payments and maintain proper accounting. This section covers the key elements that must be included in every document to ensure accuracy and professionalism.

Key Details to Include

- Business Information: Include your company’s name, address, and contact details. This helps clients easily identify the sender and reach out for any questions.

- Client Information: Clearly state the recipient’s name, address, and contact information. This ensures that the document reaches the correct party and provides a point of contact if needed.

- Unique Document Number: Assign a unique reference number to each document. This allows for easier tracking and ensures that each record is distinguishable from others.

- Issue and Due Dates: The document should clearly specify the date it was issued and the date by which payment is due. This provides both parties with a clear payment schedule.

- List of Products or Services: Include a detailed breakdown of what is being charged, including quantities, descriptions, and unit prices. This transparency helps avoid misunderstandings.

- Total Amount Due: Clearly show the total amount due, including any applicable taxes or additional fees. This helps the client understand the final payment required.

Additional Information to Consider

- Payment Instructions: Provide clear instructions on how to make the payment. Include your bank details, accepted payment methods, and any other relevant information.

- Terms and Conditions: If there are specific terms related to the sale, such as refund policies or late payment fees, make sure to include them in the document for full transparency.

Including these essential elements will not only help you maintain accurate records, but also establish trust with your clients by providing them with all the information they need to process payments smoothly and on time.

Common Mistakes to Avoid with Invoices

Creating a clear and accurate financial document is crucial for any business transaction. Even small errors can lead to confusion, delayed payments, or disputes. To help you avoid these issues, it’s important to be aware of the most common mistakes that can occur when generating financial documents. This section highlights some of the key pitfalls to watch out for and how to prevent them.

- Incorrect Contact Information: Always double-check the details of both your business and your client. Incorrect addresses or phone numbers can delay communication and payment processing.

- Missing or Incorrect Dates: Failing to include the issue and due dates, or listing them incorrectly, can cause confusion about payment deadlines. Make sure to clearly indicate when the document was issued and when payment is expected.

- Not Including a Unique Reference Number: Every financial record should have a unique identifier for easy tracking. Without this, it becomes harder to locate specific documents or track payments.

- Failure to Itemize Charges: A vague description of the products or services provided can lead to misunderstandings. Always include clear details, including quantities, prices, and descriptions of each item or service.

- Not Accounting for Taxes: Forgetting to apply or calculate taxes correctly can result in undercharging or overcharging the client. Always ensure that taxes are calculated based on the applicable rate and clearly displayed on the document.

- Omitting Payment Instructions: Clear payment instructions are essential. Without them, clients may not know how to pay, causing delays. Include information such as accepted payment methods, bank account details, or links for online payments.

By being aware of these common mistakes and taking the time to double-check your records, you can prevent costly errors and ensure a smoother transaction process for both you and your clients.

How to Save and Share Your Invoice

Once your financial document is complete, it’s important to know how to properly store and distribute it. Proper management ensures easy access for future reference and timely delivery to your client. This section will guide you through the best practices for saving and sharing your financial documents efficiently and securely.

Saving Your Document

First, ensure that your document is saved in an appropriate format for easy access and compatibility. The most common options include PDF or a standard document format. PDF is often preferred due to its universal readability and secure formatting, which prevents accidental edits.

- Choose a Clear File Name: Save the file with a descriptive and easily identifiable name, such as “ClientName_ServiceDate_Amount,” to avoid confusion and ensure easy retrieval.

- Organize by Folders: Keep your financial records organized by creating folders that are categorized by client or year. This will help you quickly find past documents when needed.

- Backup Your Files: Consider backing up your files to the cloud or an external hard drive to protect them from data loss due to hardware failure or accidental deletion.

Sharing Your Document

Once your document is saved, the next step is sharing it with your client. Here are a few methods to ensure your document reaches the right person securely:

- Email: Sending the document via email is one of the quickest and most reliable methods. Attach the file, ensure the recipient’s email is correct, and add a brief message to explain the purpose of the document.

- Online Payment Platforms: If you use a platform to manage transactions, you may be able to directly share the document through the system. Many platforms offer a secure way to upload and send documents to clients.

- Physical Copies: For clients who prefer physical copies, you can print and mail the document. This may take longer but can be necessary in certain industries.

By following these simple steps, you can ensure that your financial records are safely stored and easily shared with clients, contributing to smooth transactions and efficient business practices.

Why Word Templates are User-Friendly

When it comes to creating business documents, ease of use is a critical factor. Templates designed for common tasks provide a structured framework that simplifies the process, making it more efficient for users to complete their documents accurately and quickly. This section explores the reasons why such document formats are considered user-friendly and how they streamline workflows for professionals.

- Easy to Customize: One of the main advantages is the ability to personalize the document quickly. With pre-designed layouts, users can easily add their information, modify sections, and tailor the content to their specific needs without starting from scratch.

- Intuitive Layouts: Most document structures come with an intuitive design that follows common industry practices. The familiar format helps users know exactly where to place details such as contact information, dates, amounts, and descriptions, reducing the chance of missing crucial elements.

- Accessible on Multiple Platforms: These document formats are accessible across a range of software and devices, making them convenient for users regardless of the platform they use. Whether on a desktop, tablet, or smartphone, the design remains adaptable.

- Time-Saving: Templates save considerable time by eliminating the need for users to create layouts and structures from scratch. Once you have a template, you can quickly fill in specific details, allowing for fast document creation.

- Consistency: Using a template ensures consistency across all documents. Whether it’s for internal records or client-facing documents, the template ensures that all formats are uniform, which reflects professionalism and attention to detail.

- Predefined Sections: Many templates come with predefined sections that make it easier to organize the content correctly. This ensures that users don’t overlook important information or misplace it, helping to keep the document clear and organized.

By offering easy customization, intuitive design, and compatibility across platforms, document layouts provide an efficient solution for businesses looking to streamline their operations and maintain professional consistency. Whether you’re new to document creation or an experienced user, the simplicity of these formats helps save time and improve accuracy.

How to Automate Your Invoicing Process

Automating business tasks can significantly improve efficiency, and invoicing is no exception. By utilizing the right tools and systems, you can eliminate the repetitive aspects of billing and ensure timely, accurate payment requests. This section covers the key steps to automate your billing process, making it more streamlined and less prone to human error.

Here are the essential steps to automate your invoicing workflow:

| Step | Action |

|---|---|

| Step 1 | Choose an invoicing software that supports automation features such as recurring bills, payment reminders, and customizable templates. |

| Step 2 | Integrate your accounting system with the invoicing platform to automatically track transactions and generate invoices based on real-time data. |

| Step 3 | Set up automatic billing schedules for clients on subscription-based or recurring payment plans, ensuring they receive consistent invoices at the right intervals. |

| Step 4 | Configure automatic reminders for upcoming payments and overdue bills, reducing the need for manual follow-ups. |

| Step 5 | Ensure the system is able to send invoices via email or directly to clients’ accounts to speed up delivery and reduce delays. |

By automating your invoicing process, you can reduce administrative workload, increase accuracy, and ensure that your clients receive their bills promptly. The right tools help maintain a steady cash flow while minimizing the risk of errors, allowing you to focus more on growing your business.