Free Word Invoice Template for UK Businesses

Managing financial transactions efficiently is essential for any business, regardless of size. One of the key aspects of this process is creating clear and professional records for payments and services. Having a reliable system in place to produce well-structured documents can help streamline your operations, save time, and ensure that all necessary information is included.

For UK businesses, having the right tools to generate these records quickly and without hassle is important. There are many customizable resources available to help create tailored documents that meet legal requirements and enhance professionalism. These resources can be easily adapted to fit different business needs, making them a valuable asset for both new and established enterprises.

In this guide, we will explore various options for obtaining and personalizing documents that are designed to simplify your financial record-keeping. From layout to essential information, you’ll find everything you need to make the process as straightforward as possible. Whether you’re a freelancer, small business owner, or part of a larger organization, the ability to generate professional documents with ease is a crucial advantage.

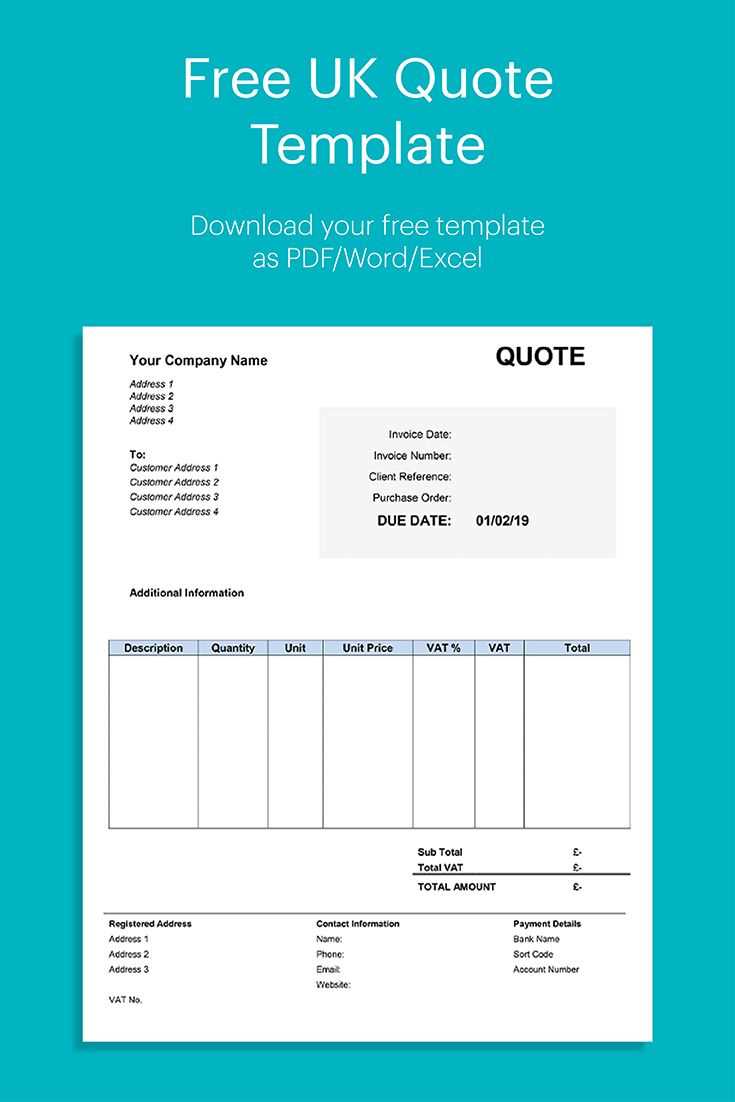

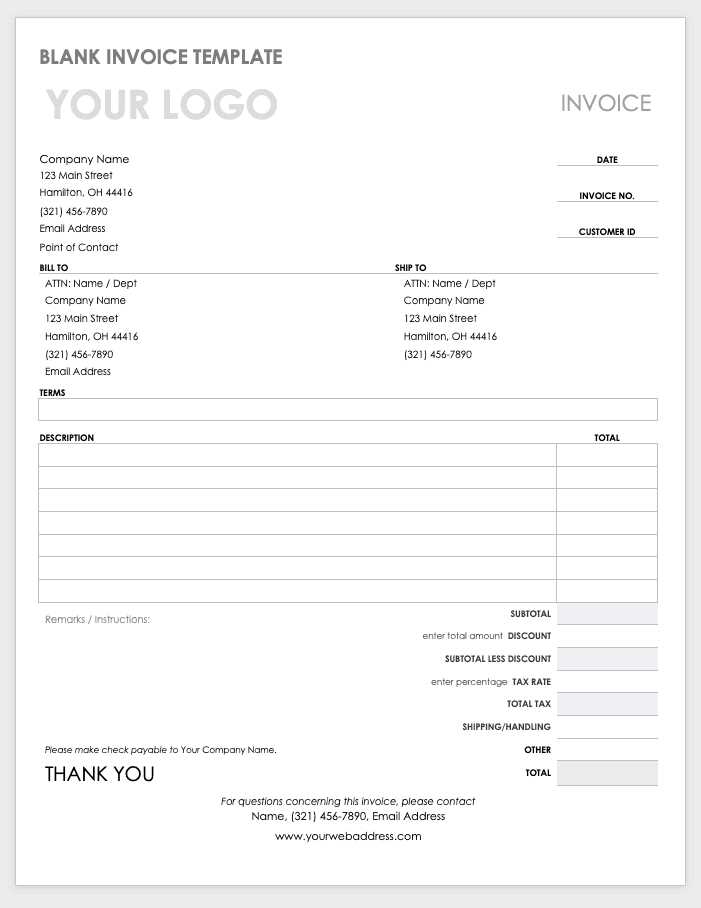

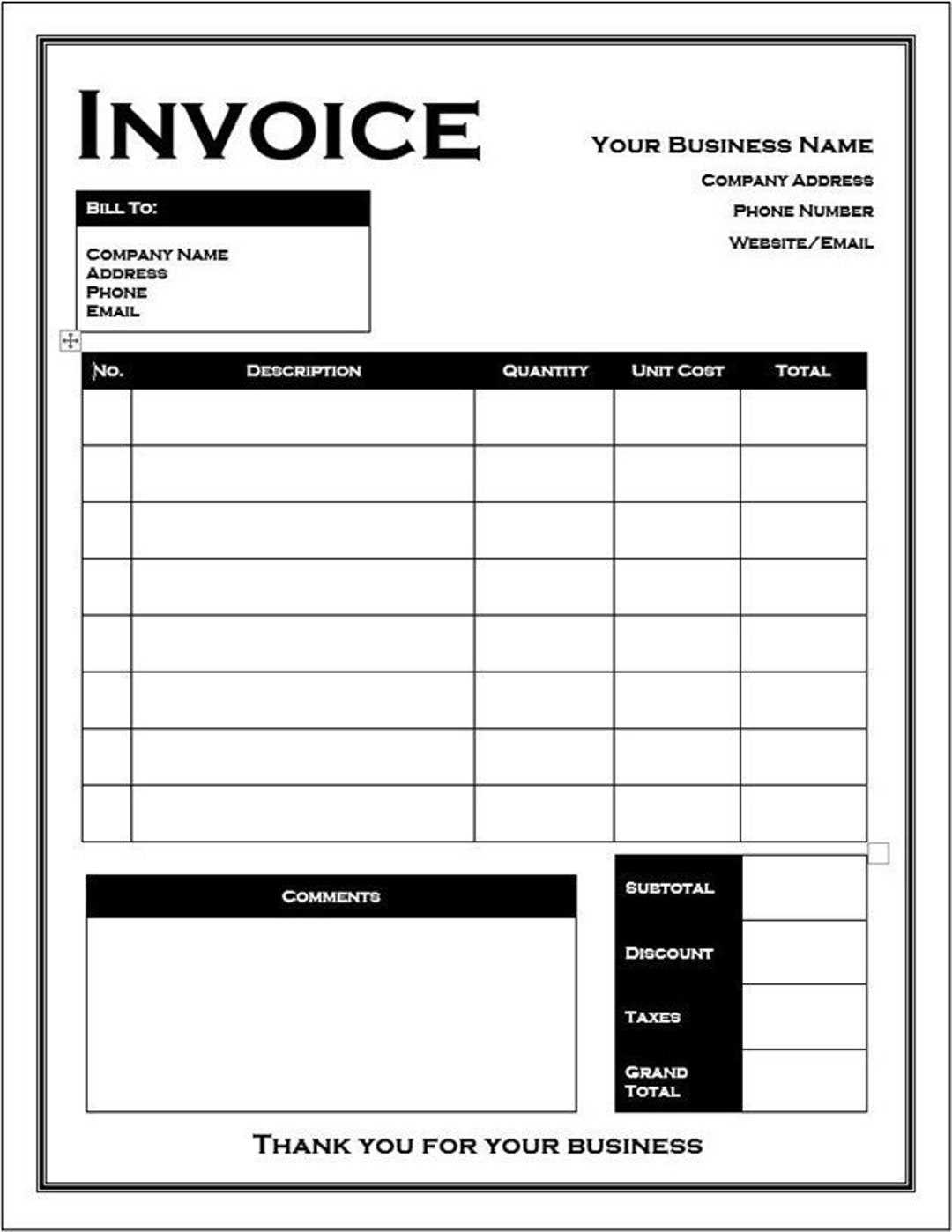

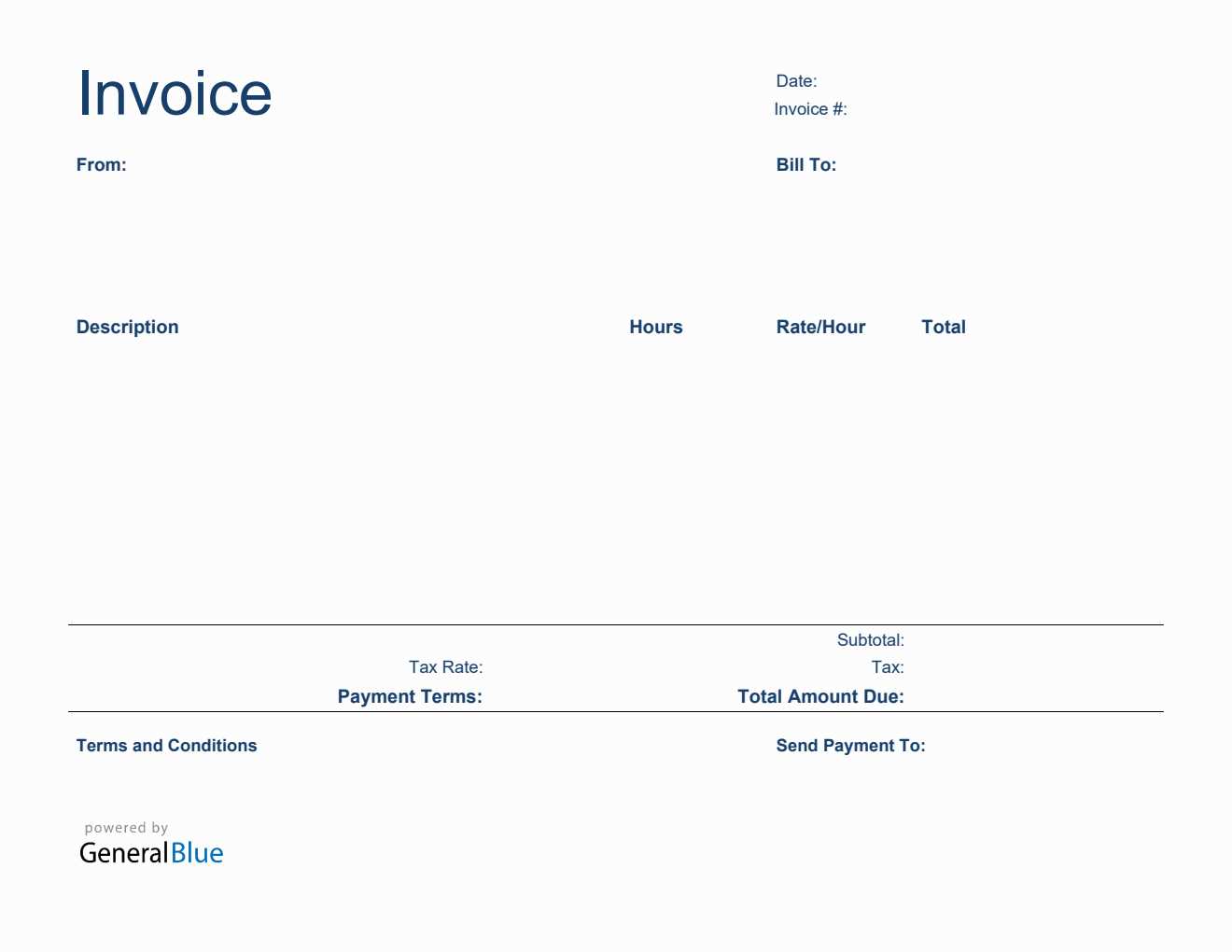

Free Word Invoice Template UK

For any business, having a professional document format to manage payments and services is essential. Whether you’re a freelancer, contractor, or running a small business, using a consistent format for billing ensures clarity and professionalism. An effective tool for this is a customizable document that can be adjusted to meet your specific needs while complying with UK standards.

These resources allow you to create clear and accurate records with ease. By utilizing these ready-made formats, businesses can quickly adapt the layout, insert client details, and ensure that all relevant terms and payment instructions are included. This streamlines the process, saving valuable time and reducing the risk of mistakes in communication.

Benefits of Using Customizable Documents

Using a flexible document system provides several advantages. The main benefit is the ability to personalize the design and content based on each transaction. You can add details such as payment terms, item descriptions, or taxes without needing to start from scratch every time. This level of customization is crucial for ensuring that all transactions are tailored to meet specific requirements.

How to Edit and Customize Your Document

Editing and personalizing your document is straightforward. Once you have selected a suitable layout, you can easily adjust the fields for client names, services rendered, or payment instructions. Most platforms allow you to download these files in a format that can be opened and edited with common software, making it accessible for businesses of all sizes. Regular updates to your document ensure that it reflects any changes in your services or payment structures.

Why Use a Word Invoice Template

For any business, having a standardized format to create financial records is crucial. A consistent, organized approach not only ensures accuracy but also enhances professionalism when dealing with clients and suppliers. By using a pre-designed document, businesses can save time and avoid the hassle of starting from scratch with each transaction.

Customizable formats allow businesses to easily modify details for every job or sale, ensuring all relevant information is included, such as payment terms, services provided, or due dates. This makes the process of issuing bills both efficient and reliable, reducing the risk of errors while improving communication with clients.

Time-Saving and Efficiency

One of the biggest advantages of using ready-made formats is the time saved. By having a system in place that is easy to update, businesses can focus on more important tasks, such as client communication and service delivery. The simplicity of filling in the required fields means less time spent on administrative work, which translates to increased productivity.

Consistency and Professionalism

Consistency is key in maintaining a professional image. Using a pre-made design ensures that every document issued follows the same structure, which helps build trust with clients. When each transaction looks the same, it reflects an organized, reliable business that values its clients and operates with transparency.

Benefits of Free Invoice Templates

Using ready-made document formats for billing and payment management offers numerous advantages for businesses of all sizes. These pre-designed files can streamline the entire process, saving time and ensuring consistency in financial transactions. Below are some of the key benefits that businesses can enjoy by utilizing such resources:

- Cost-Effective Solution: Many customizable resources are available at no cost, eliminating the need for businesses to invest in expensive software or hire external professionals for basic document creation.

- Time-Saving: Pre-designed formats allow businesses to quickly fill in necessary details and avoid spending valuable time designing each document from scratch.

- Professional Appearance: Using a polished, consistent layout gives a more professional look to your business communications, helping to build credibility and trust with clients.

- Customization Flexibility: These documents can be easily tailored to suit specific needs, allowing businesses to add or remove sections, change the design, and adjust for particular requirements.

- Ease of Use: The majority of these files are simple to edit and don’t require advanced technical skills, meaning they can be used by anyone in the business without specialized knowledge.

Enhanced Efficiency in Billing

With a ready-made structure, businesses can streamline the process of sending out financial documents. These resources ensure that all necessary fields, like client information, payment terms, and product descriptions, are included. The speed of completion allows for quicker payments, helping to maintain healthy cash flow.

Compliance with Legal Standards

Many pre-designed documents are created with specific country or industry regulations in mind. This ensures that businesses can remain compliant with tax laws and other legal requirements, reducing the risk of errors or penalties when submitting financial records.

How to Customize Your Invoice Template

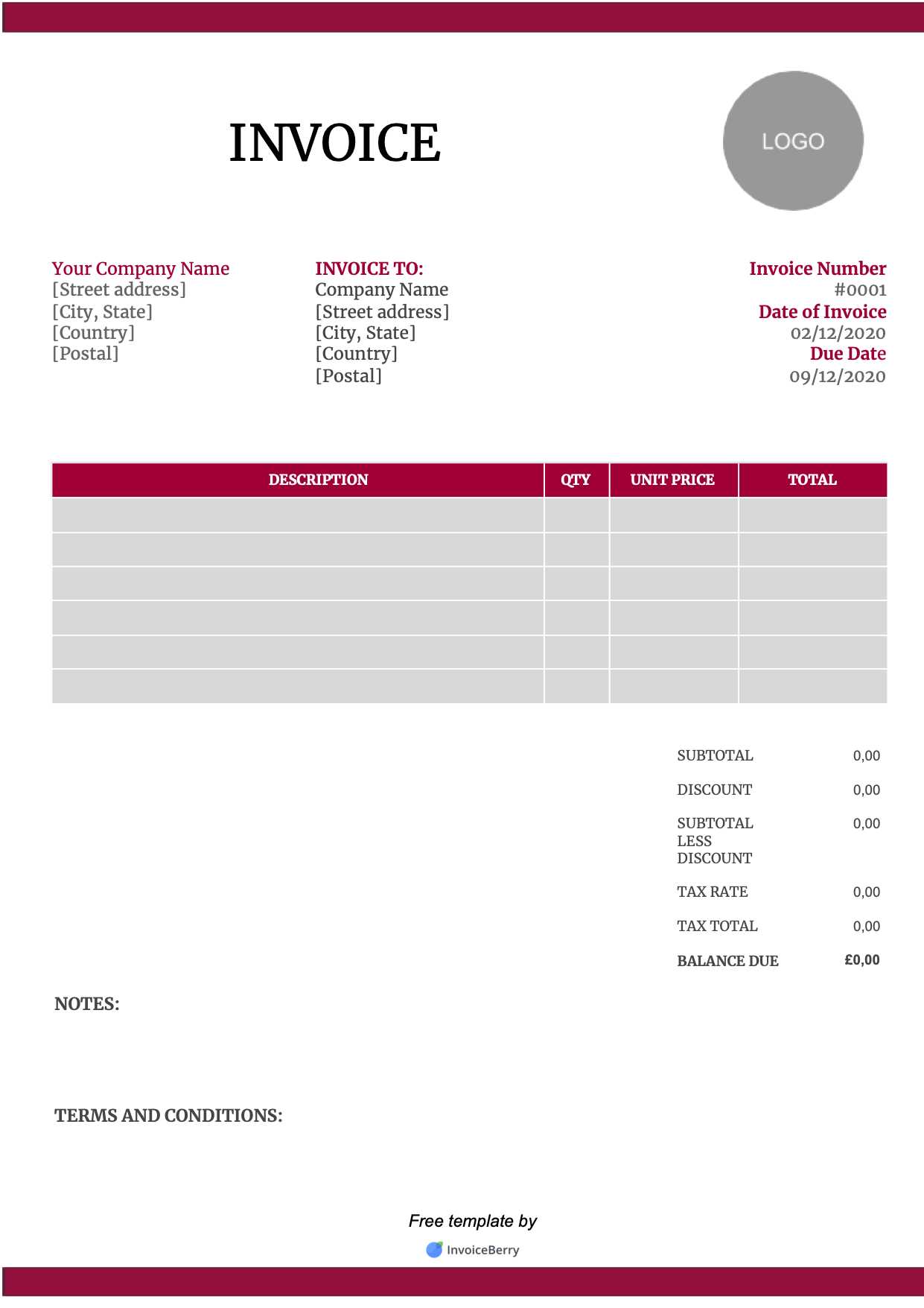

Customizing a document for billing is a simple yet effective way to ensure it meets your specific business needs. By adjusting certain fields and sections, you can tailor the layout to include relevant details such as company information, payment terms, and services rendered. Here’s how you can make the most of a customizable billing document:

- Update Company Information: Make sure your company’s name, address, phone number, and email are clearly visible at the top of the document. This helps clients quickly identify who the bill is from.

- Add Your Logo: Personalizing the document with your logo enhances brand visibility and creates a more professional appearance.

- Modify the Date and Due Date: Ensure that the date of issue and the payment due date are correctly entered. This is crucial for maintaining clear financial records and managing cash flow.

- Adjust Payment Terms: Clearly state the payment terms, including the methods of payment accepted, late fees, and any early payment discounts.

- Include Detailed Descriptions: Provide specific information about the goods or services provided. This will help avoid misunderstandings and provide clarity for your client.

Using Custom Fields for Personalization

Most customizable documents allow you to add extra fields or sections. If needed, you can insert custom clauses, discounts, taxes, or additional charges, ensuring that the document fully reflects the nature of the transaction. This flexibility allows you to keep everything organized and transparent for both parties.

Saving and Reusing Your Custom Layout

Once you’ve adjusted the layout to your liking, save it as a reusable file. This way, you can quickly generate similar documents in the future without needing to reformat everything. You can even create multiple versions for different services or pricing structures, further improving efficiency.

Best Practices for Professional Invoices

Creating clear, accurate, and professional documents for billing is essential for maintaining positive relationships with clients and ensuring timely payments. By following best practices, businesses can present a polished and organized record of transactions that builds trust and minimizes confusion. Below are some key guidelines for crafting high-quality billing documents:

- Use a Clear, Structured Layout: A well-organized document helps clients easily locate important information. Use headings, bullet points, and sections to ensure clarity.

- Include Essential Details: Always include critical information, such as your company name, client details, payment terms, service descriptions, and the total amount due.

- Be Transparent with Payment Terms: Clearly state when payments are due, preferred payment methods, and any penalties for late payments. Transparency reduces misunderstandings.

- Provide Itemized Lists: Break down services or products in detail to avoid confusion. Clients should understand what they are paying for, including individual prices and quantities.

- Check for Accuracy: Double-check all information, including client names, dates, and amounts. Mistakes can delay payments and harm your credibility.

Timely and Consistent Billing

Sending documents promptly and regularly is a crucial practice for smooth cash flow. Always issue a bill as soon as possible after completing the work or delivering the product. Delaying invoices can lead to missed payments and disrupt your financial management. Setting up a routine for issuing documents consistently helps maintain organization and predictability in your cash flow.

Professional Presentation

Ensure your document looks polished by using a professional design. This includes having a clean, easy-to-read font, appropriate spacing, and a simple layout that reflects your business’s brand. A visually appealing document reinforces the professionalism of your company and boosts your reputation in the eyes of clients.

Where to Download Free Templates

Finding customizable and professional resources for creating billing and payment documents is easier than ever. Many websites offer downloadable files that can be adjusted to suit your business needs. These documents are available for various formats, allowing businesses to select the one that fits their preferred system. Below are some of the most popular platforms where you can obtain these ready-made resources:

- Microsoft Office Templates: A reliable source for customizable business documents. You can find a variety of layouts that meet UK standards and can be edited with common software tools.

- Google Docs: For those who prefer working online, Google Docs offers customizable document options that can be easily modified and stored in the cloud for easy access.

- Template.net: This platform provides a wide range of business forms, including billing formats, which can be downloaded and tailored for your needs.

- Canva: Known for its user-friendly design tools, Canva also offers customizable document formats that include layouts for payment management. It’s ideal for those looking for both functionality and creative freedom.

- Small Business Websites: Many small business resources or blogs provide downloadable files, often specifically tailored to UK businesses, ensuring that they are compliant with local regulations.

Most of these platforms offer both free and premium options, allowing you to select a document style that fits your budget and requirements. Once downloaded, you can easily personalize them to match your branding and specific business needs.

How to Edit an Invoice in Word

Editing a billing document in Microsoft Word is a straightforward process that allows you to quickly update important details for each transaction. Whether you’re modifying client information, adding services, or adjusting payment terms, the flexibility of the program makes it easy to create customized documents. Here’s a simple guide to help you get started:

First, open the document you want to edit. If you are working with a pre-designed format, the basic structure will already be in place, allowing you to focus on the specific details of the current transaction. To update the content, simply click on the relevant sections, such as the client’s name, the service description, and the amount due. You can easily delete or add fields as necessary to reflect the specifics of each job.

Once you’ve filled in the necessary details, make sure to review the document for accuracy. Check for spelling errors, correct dates, and accurate pricing before finalizing. After completing the document, save the file in the desired format, such as .docx or .pdf, for easy sharing with clients.

Invoice Template Features You Need

When creating billing documents for your business, it’s important to ensure that the layout includes all the necessary features for both clarity and compliance. A well-designed format should not only present the information in an organized way but also provide the flexibility to meet specific business and client needs. Below are key elements that every billing document should have to ensure accuracy and professionalism:

- Company Information: Include your business name, address, phone number, and email. This makes it easy for clients to contact you if needed.

- Client Details: Ensure the recipient’s name, address, and other relevant contact information are clearly listed for proper communication.

- Unique Identification Number: Assign a unique number to each document to help keep track of your financial records. This also helps clients reference the document easily.

- Clear Breakdown of Services: Provide an itemized list of services or products, including descriptions, quantities, unit prices, and totals for each item.

- Payment Terms: Clearly state the payment due date, accepted payment methods, and any applicable late fees or discounts for early payments.

- Tax Information: Include relevant tax rates or VAT details, especially for businesses that are required to collect taxes on goods and services in the UK.

- Total Amount Due: Always display the total amount due clearly at the bottom, ensuring no confusion over the final payment amount.

Customizable Fields for Flexibility

It’s important to have the ability to customize the document for specific needs. For instance, depending on the nature of your business, you might need to add fields for delivery dates, order numbers, or specific client instructions. Customizable features ensure that each document accurately reflects the terms of each unique transaction.

Professional Design and Branding

In addition to functionality, the design of your billing document plays a key role in how your business is perceived. A clean, easy-to-read layout with your company’s branding, such as logos and colors, creates a cohesive professional appearance. This consistency helps build credibility with your clients and reinforces your brand image.

Common Mistakes to Avoid on Invoices

Creating accurate and professional billing documents is essential for maintaining smooth business operations. However, even small errors can lead to confusion, delayed payments, or damaged client relationships. Below are some of the most common mistakes that businesses make when issuing payment records and how to avoid them:

- Incorrect Client Details: Failing to include accurate contact information or misspelling client names can lead to confusion. Always double-check client details before sending.

- Missing or Wrong Dates: Not including the correct issue date or payment due date can cause unnecessary delays. Ensure both are clearly displayed and accurate.

- Unclear Payment Terms: If payment terms, such as deadlines or late fees, are not clearly outlined, clients may not understand when or how to make a payment. Always specify due dates and payment methods clearly.

- Lack of Item Descriptions: Simply listing a price without explaining what the charge is for can create confusion. Always provide clear descriptions for all products or services.

- Failure to Include Taxes: Incomplete or incorrect tax calculations can cause legal issues. Make sure to include applicable taxes and explain how they are calculated.

- Not Using a Unique Reference Number: Failing to assign a unique identifier to each document can make it difficult to track payments. Always use a unique number for each transaction.

- Wrong Total Amount: Simple math errors can lead to incorrect totals, which may delay payment. Double-check all calculations before sending the document.

Double-Check for Typos and Formatting Issues

It’s easy to overlook small errors, but spelling mistakes and poor formatting can negatively affect the professionalism of your business. Always proofread your documents carefully to ensure they are error-free and well-organized.

Ensure Consistent Branding

Inconsistent fonts, colors, or logos can make your billing documents look unprofessional. Stick to a consistent format that reflects your brand identity, ensuring the document looks polished and aligned with your business image.

Saving Time with Invoice Templates

Efficient document management is crucial for businesses looking to save time and stay organized. By using pre-designed formats for billing and payment requests, you can eliminate the repetitive task of creating a new document from scratch each time. These ready-made resources can streamline the entire process, allowing you to focus on more important aspects of your business operations. Below are some ways in which these tools help save time:

- Quick Data Entry: Pre-set fields for client names, services, dates, and totals allow you to fill in information in just a few minutes, reducing time spent on manual entry.

- Consistent Layout: Using the same structure for every transaction eliminates the need to adjust formatting or layout each time, ensuring a professional and uniform appearance with minimal effort.

- Predefined Calculations: Many resources come with built-in formulas that automatically calculate totals, taxes, or discounts. This reduces the risk of errors and saves time on manual math.

- Reduced Administrative Effort: With a standardized process, you don’t need to spend time figuring out what to include in each document. The structure is already in place, allowing for quicker generation and sending of payment requests.

Streamlined Workflow for Repeated Use

Once you’ve customized your document layout, you can save it for repeated use. This means you don’t need to start from scratch every time you need to create a new billing request. Simply open the saved file, update the client information and details, and it’s ready to go. This time-saving approach makes the entire invoicing process much more efficient and predictable.

Reduced Chances of Errors

By using a consistent format, you reduce the risk of omitting important details or making errors that could cause delays in payment. With fields already defined and easy-to-understand sections, there’s less room for mistakes, which saves you time in the long run by avoiding the need for revisions or follow-ups.

How to Include Tax Information on Invoices

Including tax details on billing documents is essential for compliance with local regulations and ensuring transparency in transactions. Properly displaying tax rates, amounts, and calculations not only helps maintain accuracy but also builds trust with clients. Here are the key steps to ensure that tax information is correctly included in your financial documents:

- Specify the Tax Rate: Clearly indicate the applicable tax rate for each item or service. For example, if the tax rate is 20%, state it next to the relevant line item or in a dedicated section.

- Show the Tax Amount: Calculate the tax amount for each item and list it separately, allowing clients to see exactly how much tax they are being charged. This can be shown either as a percentage or in a separate line under the subtotal.

- Include a Tax Identification Number (TIN): If required, make sure to list your business’s Tax Identification Number. This is often necessary for businesses that need to collect VAT or other taxes on behalf of the government.

- Itemize Tax Details for Multiple Items: If you provide various products or services at different tax rates, break down the tax for each item or service. This helps avoid confusion and ensures that clients can easily understand how the tax is applied.

- State Tax Jurisdiction (if applicable): In some regions, taxes vary depending on the location of the sale or service. It’s useful to mention the tax jurisdiction, particularly if you operate in multiple regions with different rates.

Including VAT Information

If your business is VAT-registered, you must include the VAT amount on your documents. Specify both the total amount of VAT charged and the rate applied. Additionally, you may need to highlight whether the price includes or excludes VAT, depending on your pricing structure and local laws.

Be Aware of Legal Requirements

Tax laws can vary depending on your location and the type of service or product you provide. Be sure to stay updated on local tax regulations to ensure your documents are compliant. Many businesses also choose to consult with an accountant to make sure their tax practices are accurate and aligned with current laws.

Improving Cash Flow with Invoices

Effective management of payment requests plays a critical role in improving cash flow and ensuring the financial health of a business. By streamlining the process of issuing billing documents and setting clear terms, businesses can accelerate payments and reduce the risk of delayed transactions. Here are several strategies to optimize cash flow through well-structured payment requests:

- Issue Documents Promptly: Sending payment requests immediately after the completion of a service or delivery ensures that the transaction is recorded and payment is expected. The sooner clients receive their billing documents, the sooner they can arrange payment.

- Set Clear Payment Terms: Clearly defined payment due dates, along with any late fees or early payment discounts, encourage clients to pay on time. Setting expectations up front helps avoid confusion and delays.

- Offer Multiple Payment Methods: Providing clients with various ways to pay, such as bank transfers, credit cards, or online payment systems, makes it easier for them to settle their debts quickly and efficiently.

- Automate Recurring Billing: If your business model involves subscription-based services or regular deliveries, automating recurring billing can ensure that payments are received on time, reducing administrative workload and preventing missed payments.

- Follow Up on Overdue Payments: Setting up automated reminders or personal follow-up communications can help ensure that clients don’t forget or neglect outstanding balances, improving the speed of payments.

Encouraging Faster Payments

Offering incentives for early payments, such as small discounts or bonuses, can motivate clients to pay ahead of the due date. This not only boosts cash flow but also strengthens relationships by showing appreciation for prompt payments. On the other hand, implementing clear consequences for late payments (like interest fees) can deter clients from delaying their payments.

Leveraging Digital Tools

Using digital tools to manage payment documents, send automatic reminders, and track payment status can reduce administrative burden and improve cash flow management. These tools often integrate with accounting software, providing a seamless way to monitor outstanding balances and quickly address overdue accounts.

Design Tips for Invoice Templates

When creating billing documents for your business, a well-designed layout is essential for ensuring clarity and professionalism. A clean, well-organized document not only makes it easier for clients to understand the charges but also enhances your business image. Below are some design tips to help you craft visually appealing and functional billing records:

- Keep It Simple and Organized: A cluttered document can overwhelm clients. Use clear sections for key details such as company information, client details, services/products, and payment terms. Leave enough white space between sections to improve readability.

- Use a Consistent Layout: Maintain a uniform structure for each billing document to ensure consistency and make the process more efficient. Consistency in fonts, colors, and arrangement helps convey a professional image and reduces confusion.

- Highlight Key Information: Make sure critical information like the total amount due, payment due date, and client details stand out. Use bold or larger fonts for these key sections to draw attention immediately.

- Choose Readable Fonts: Use simple, legible fonts such as Arial or Helvetica. Avoid overly decorative fonts, as they can be hard to read, especially when dealing with important financial details.

- Include Your Brand Elements: Incorporate your business logo, colors, and fonts to reinforce your branding. A well-designed document that matches your overall branding strategy helps maintain a cohesive and professional image.

- Incorporate Clear Itemization: Break down each service or product clearly with descriptions, quantities, unit prices, and totals. This transparency builds trust and reduces confusion over charges.

- Ensure Easy Calculation: The total amount due should be clearly stated, with any taxes or additional charges broken down in a simple format. This prevents misunderstandings and ensures clients can quickly verify the charges.

By focusing on these key design elements, you can create billing documents that are not only functional but also reflect the professionalism of your business. A well-designed payment request can foster trust and ensure that payments are processed smoothly and on time.

What to Include in Your Invoice

When creating a billing document for your clients, it’s essential to include all the necessary details to ensure clarity and prevent any confusion. A well-structured payment request provides all the information a client needs to process the payment efficiently and accurately. Below are the key elements that should be included in every payment request:

- Business Information: Your company name, address, contact details, and tax identification number (if applicable) should be prominently displayed at the top of the document. This helps establish legitimacy and allows clients to contact you easily if needed.

- Client Information: Include the client’s name, address, and any relevant contact details. This ensures the document is directed to the correct person or department and helps maintain clear communication.

- Unique Identification Number: Assign a unique number to each billing document for easy reference. This helps both you and your client track payments and manage financial records more efficiently.

- Issue and Due Dates: Clearly state the date the document is issued and the payment due date. This ensures the client knows when the payment is expected and helps avoid any confusion about deadlines.

- Itemized List of Goods or Services: Provide a detailed list of the goods or services rendered, including descriptions, quantities, unit prices, and the total amount for each item. This breakdown helps clients understand what they are being charged for.

- Taxes: Include any applicable taxes, such as VAT, and specify the tax rate and total amount. This ensures transparency and allows clients to understand how much they are paying in taxes.

- Total Amount Due: Clearly display the total amount that the client owes. This amount should include all charges, taxes, and any other fees, making it easy for clients to see the final payment amount.

- Payment Terms: Include your payment terms, such as accepted methods of payment, any late fees, and discounts for early payment, if applicable. This sets clear expectations for how and when the payment should be made.

Optional Information to Include

While the above elements are essential, you may also want to include additional details depending on your business or client needs. These could include purchase order numbers, delivery dates, or any special notes or instructions relevant to the transaction.

Maintaining Professionalism and Clarity

Including all relevant details in a clear and organized manner helps ensure that your client can quickly understand the payment terms and amounts. A well-detailed document not only improves your chances of timely payments but also reinfor

Free vs Paid Invoice Templates

When choosing a billing document solution for your business, you’ll face a decision between using no-cost options or investing in paid versions. Each approach has its advantages and potential drawbacks. While free resources may be tempting, paid options often provide additional features and more customization. Understanding the key differences can help you make an informed choice based on your business needs. Below is a comparison of free and paid options for billing documents:

| Feature | Free Option | Paid Option |

|---|---|---|

| Customization | Limited, may require manual adjustments | Highly customizable with advanced design options |

| Ease of Use | Simple to use, but may lack certain functionalities | User-friendly with more automation and features |

| Professional Appearance | Basic design, may lack branding options | Polished, with the ability to incorporate branding elements |

| Support | Minimal or no support | Customer service or technical support available |

| Legal and Tax Features | May not include advanced features like automatic tax calculations | Can include built-in tax calculations and legal disclaimers |

| Cost | Free of charge | Requires a one-time fee or subscription |

Advantages of Free Billing Resources

The main benefit of free options is the lack of financial investment. These resources can be a great starting point for businesses that have minimal billing needs and want to test out different formats. They are often simple and easy to use, making them suitable for small businesses or freelancers just starting out.

Advantages of Paid Billing Solutions

On the other hand, paid solutions tend to offer more advanced features, such as tax calculations, customizable branding options, and integrations with accounting software. These resources are ideal for businesses that need a more professional or scalable solution, as they provide greater flexibility, support, and the ability to maintain a consistent brand image across all communications.

Understanding Invoice Terms and Conditions

When creating billing documents, it is important to include clear terms and conditions to ensure both parties are on the same page regarding payment expectations. These terms outline the rules governing the transaction and help prevent misunderstandings or disputes between the service provider and the client. A well-defined set of terms can also protect your business in case of late payments, disputes, or non-payment.

Below are some key elements to consider when drafting terms and conditions for your billing documents:

- Payment Due Date: Clearly specify when payment is expected. Whether it’s “due upon receipt” or “30 days from the issue date,” make sure both parties understand the deadline for payment.

- Late Fees: Outline any penalties for late payments. A common practice is to include a late fee (e.g., 2% per month) after the payment due date has passed. This encourages timely payments and helps mitigate the effects of delayed cash flow.

- Accepted Payment Methods: List the acceptable payment methods, such as bank transfers, credit card payments, or online systems. This removes any ambiguity and provides the client with clear instructions on how to settle the balance.

- Refund Policy: Include a refund policy if applicable, especially if your business provides services that could lead to disputes over the quality or timeliness of the delivery. Define under what circumstances refunds are available and the process for requesting one.

- Tax Information: Specify any relevant taxes, such as VAT, that may apply to the charges. Clarify whether the price includes tax or if the tax will be added on top of the quoted price.

- Dispute Resolution: In the event of a dispute, outline the process for resolving issues. This may include informal negotiations or formal methods, such as mediation or arbitration.

By clearly laying out your terms and conditions, you create a transparent and professional environment for both you and your clients. This not only helps reduce misunderstandings but also ensures that your business is legally protected in case of any disagreements.

How to Track Invoices in Word

Keeping track of your billing documents is essential for maintaining smooth business operations and ensuring timely payments. Whether you’re managing a small business or working as a freelancer, staying organized with your records helps prevent mistakes and delays. Tracking payment status and knowing when invoices are issued or paid allows you to follow up promptly with clients and maintain healthy cash flow.

Here are some effective strategies for tracking your billing records in a word processing program:

Organizing Your Billing Records

One of the simplest ways to track your records is by organizing them in an easily accessible file. Here are a few tips:

- Use a Naming Convention: Create a consistent naming structure for each document. For example, name your files with the client’s name and the date (e.g., “ClientName_Invoice_2024-01-15”). This will make it easier to find any specific record when needed.

- Maintain Separate Folders: Organize all your billing documents into separate folders for each client or by month. This can help you quickly locate any invoice, making the tracking process much simpler.

Using Spreadsheets for Tracking

Another useful way to track billing records is by integrating a simple spreadsheet. While word processors are good for creating documents, spreadsheets allow for more detailed tracking and automation. You can maintain a separate spreadsheet to record the details of each transaction.

| Column | Description |

|---|---|

| Invoice Number | A unique number for each billing document for easy reference. |

| Client Name | The name of the client being billed. |

| Issue Date | The date the document was created. |

| Due Date | The date by which the payment is expected. |

| Status | Indicates whether the payment has been made, is pending, or overdue. |

| Amount | The total amount due for the transaction. |

| Payment Date | The date the payment was received (if applicable). |

By inputting these details into a spreadsheet, you can quickly see the status of all your transactions and