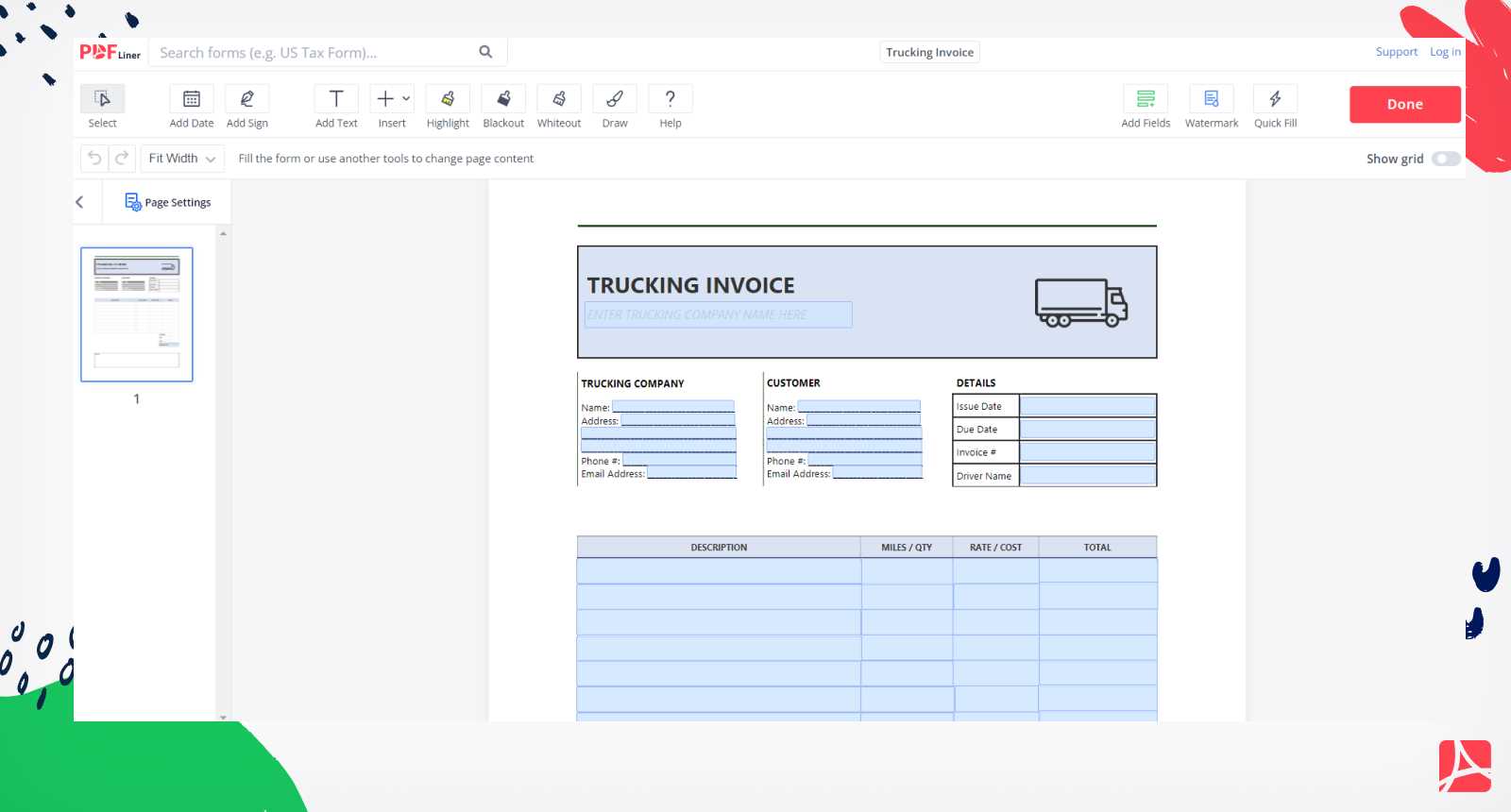

Free Trucking Company Invoice Template to Streamline Your Billing Process

Managing finances can be a time-consuming task for transportation services. Ensuring accurate and timely payment processing is essential for maintaining smooth operations and keeping cash flow steady. Using well-structured documents for payment requests can simplify this process and reduce the chances of errors or delays.

Streamlining the billing process with customizable forms helps service providers maintain professionalism and consistency. These documents are designed to include all necessary details, from service descriptions to payment terms, in an organized manner. This reduces confusion and ensures that both parties are clear about the terms of the transaction.

By utilizing reliable tools to create billing documents, businesses in the transportation sector can save valuable time. These resources not only save effort in crafting professional forms from scratch but also help keep a consistent record of services rendered, making future reference and financial tracking easier.

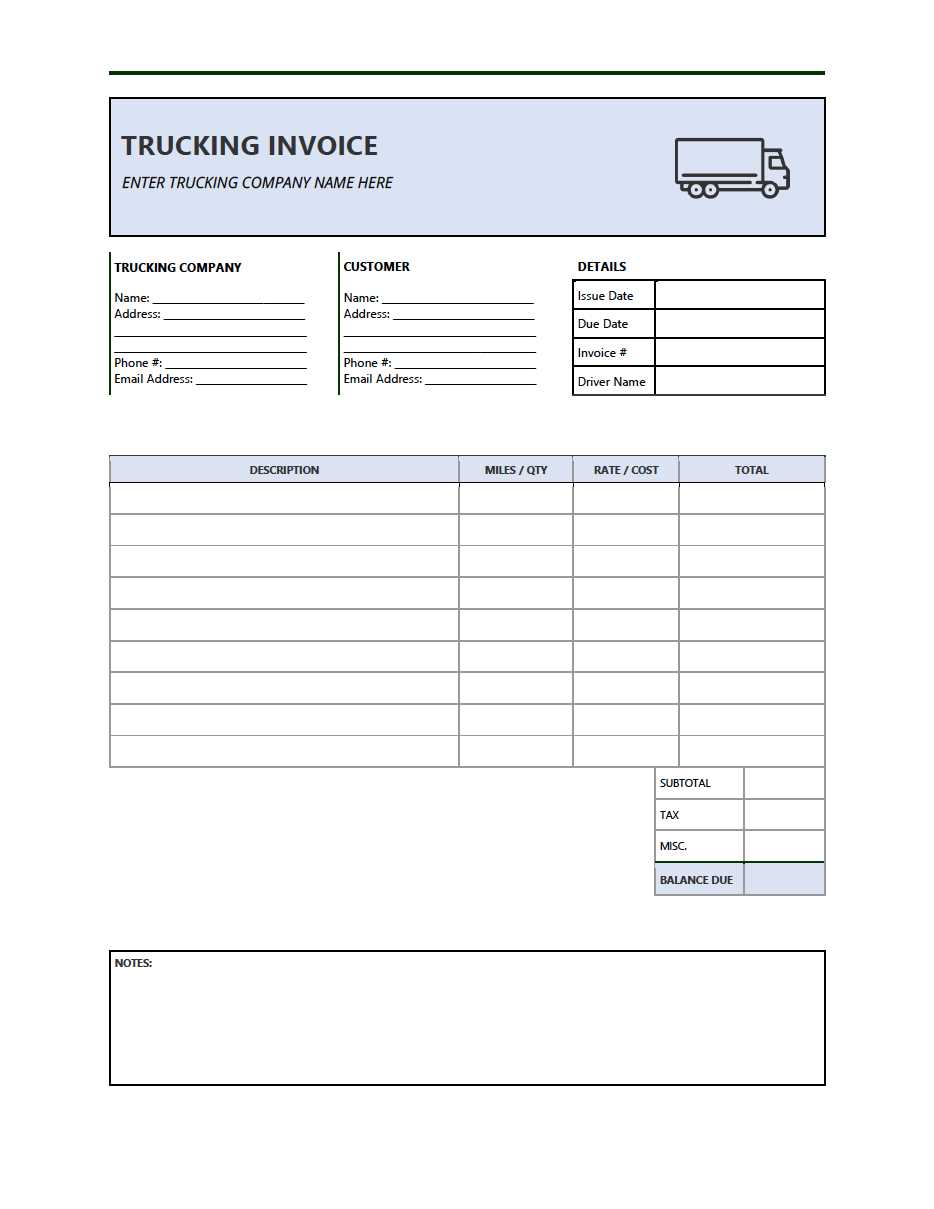

Free Trucking Invoice Template for Business

Having access to a ready-made document for billing can significantly simplify the financial side of transportation services. With the right form, service providers can quickly outline the details of completed tasks, ensuring that clients receive clear, professional payment requests. These forms typically include all necessary fields, from business information to a breakdown of services rendered, making the process seamless for both parties.

Key Features of a Well-Designed Billing Document

A well-structured payment request should feature clear sections that include company details, client information, and an itemized list of services or deliveries. It should also outline the total amount due and the payment terms, leaving no room for ambiguity. This clarity helps build trust with clients and ensures there is no misunderstanding about fees or due dates.

How to Use the Document Effectively

Once downloaded, it’s easy to personalize this form with specific business details. With a few simple adjustments, such as adding the business logo and adjusting payment terms, this document can be tailored to meet your needs. Additionally, keeping a consistent format for all billing documents improves record-keeping and streamlines the payment tracking process.

How to Customize Your Trucking Invoice

Adapting a billing document to your business needs is essential for ensuring accuracy and professionalism in financial transactions. Customization allows you to tailor the form to reflect your specific services, payment terms, and branding. By personalizing key elements, you can streamline the process and create documents that align with your company’s identity and customer expectations.

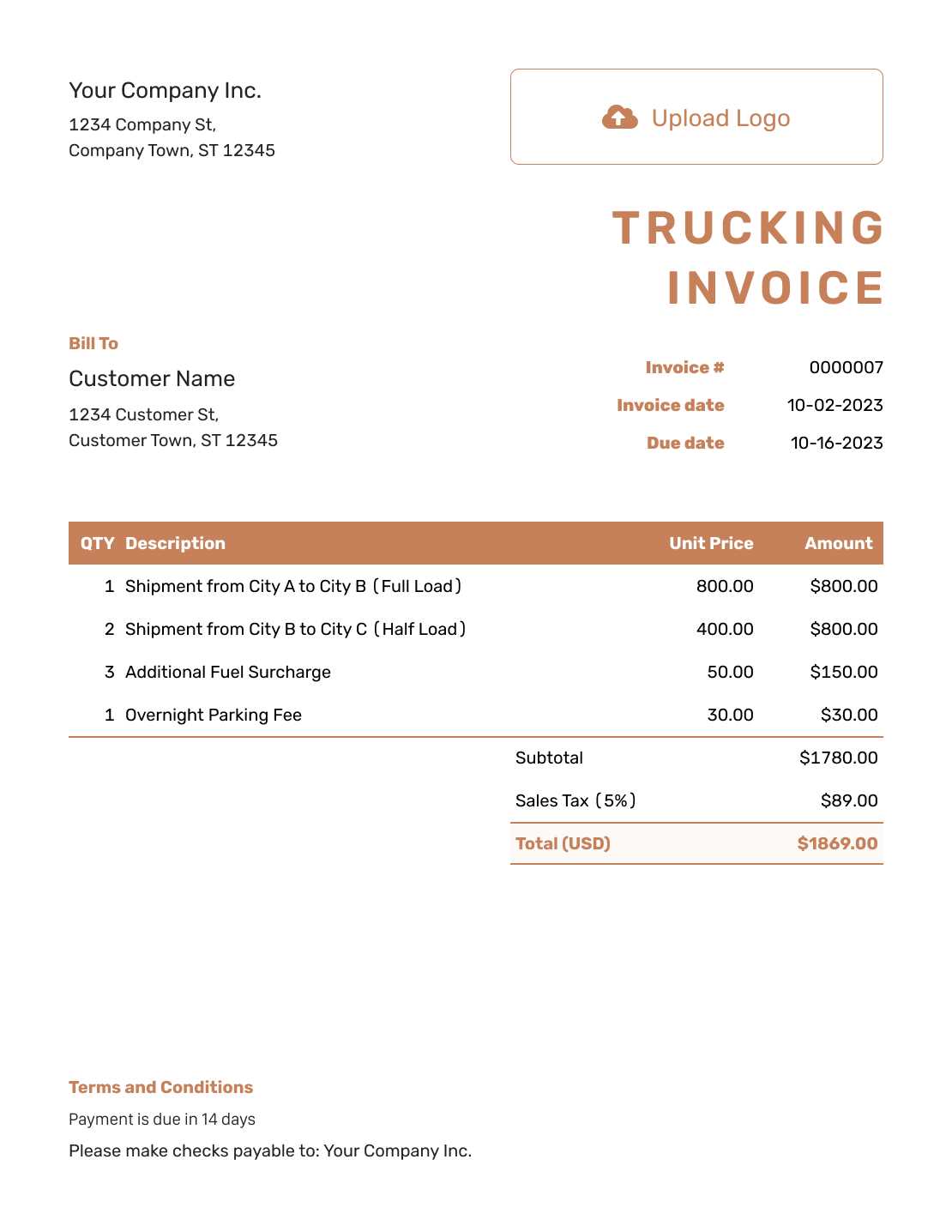

Editing Key Sections

The first step in customizing the document is adjusting the header to include your business name, logo, and contact details. This information should be clearly visible at the top of the form, making it easy for clients to recognize and contact you. Additionally, ensure that the customer’s information–such as their name, address, and service description–is accurate and properly aligned with the corresponding details for each transaction.

Adjusting Payment Terms and Details

Next, modify the payment sections to suit your business practices. Include terms such as the payment due date, acceptable payment methods, and any late fees if applicable. You can also add any specific terms related to the services provided, such as hourly rates, mileage, or additional charges for expedited services. Clear, customized payment instructions reduce misunderstandings and help ensure timely payments.

Benefits of Using an Invoice Template

Utilizing a pre-designed billing document can bring numerous advantages to any service-oriented business. By adopting a standardized format, businesses can save time and reduce errors in their payment requests. These tools not only help streamline the financial process but also ensure consistency across all transactions, making it easier to maintain professional relationships with clients.

One of the key benefits is the efficiency they offer. Rather than creating a new form for each payment request, you can simply fill in the required details, allowing for faster preparation and dispatch. This is particularly useful for businesses handling frequent transactions, as it reduces administrative overhead.

Another significant advantage is accuracy. A well-structured document ensures that all necessary details are included, such as service descriptions, payment terms, and amounts due. By using a consistent format, businesses minimize the risk of overlooking important information, which can help avoid disputes or confusion with clients.

Essential Information for Trucking Invoices

Creating clear and effective billing documents requires including all relevant details to ensure that both the service provider and client understand the terms of the agreement. Essential information helps to avoid confusion and ensures timely payments. Each payment request should include key components that accurately reflect the services rendered and the agreed-upon terms.

Key Components to Include

- Business Information: Include your business name, address, phone number, and email for easy contact.

- Client Details: Clearly state the client’s name, address, and contact information.

- Service Description: Provide a detailed breakdown of the services offered, including quantities, rates, and any additional fees.

- Payment Terms: Specify the due date, accepted payment methods, and any late fees for overdue payments.

- Unique Reference Number: Assign a unique identifier to each billing document for easy tracking and record-keeping.

- Total Amount Due: Ensure the total amount due is clearly visible and includes any taxes or extra charges.

Why These Details Matter

Including all the necessary components in your billing documents helps build trust with clients and reduces the likelihood of disputes. It also ensures that you have a complete record of each transaction for accounting and legal purposes. This level of transparency is vital for maintaining smooth financial operations and fostering long-term business relationships.

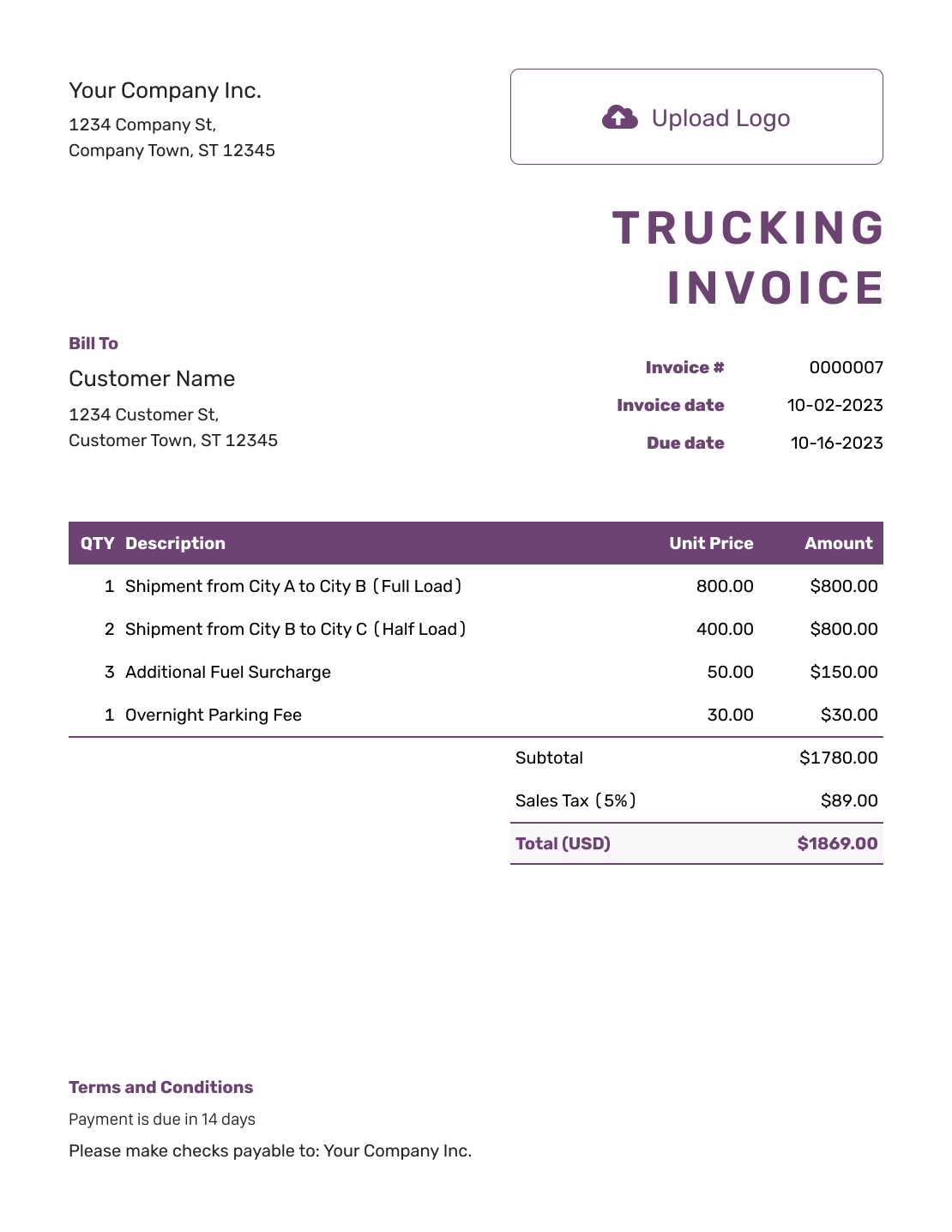

Downloadable Templates for Trucking Companies

Having access to downloadable documents that can be easily customized for billing purposes is a significant time-saver for businesses in the transportation industry. These pre-designed forms can be quickly filled out with the necessary details, making it easy to send accurate and professional payment requests to clients. Instead of creating each document from scratch, businesses can download and personalize these files, ensuring consistency and efficiency in their financial transactions.

There are various resources available online that offer these downloadable files in different formats, such as Word, PDF, or Excel. These resources make it easy for businesses to choose the one that best suits their needs and adjust it according to their specific requirements. Whether you need a simple layout or a more detailed document, there are plenty of options to ensure that your billing process is as smooth as possible.

By utilizing these pre-made files, businesses can streamline their operations, reduce the risk of errors, and present a professional image to clients. Customizing these resources only takes a few minutes and provides a consistent, reliable method of generating payment requests for all types of services rendered.

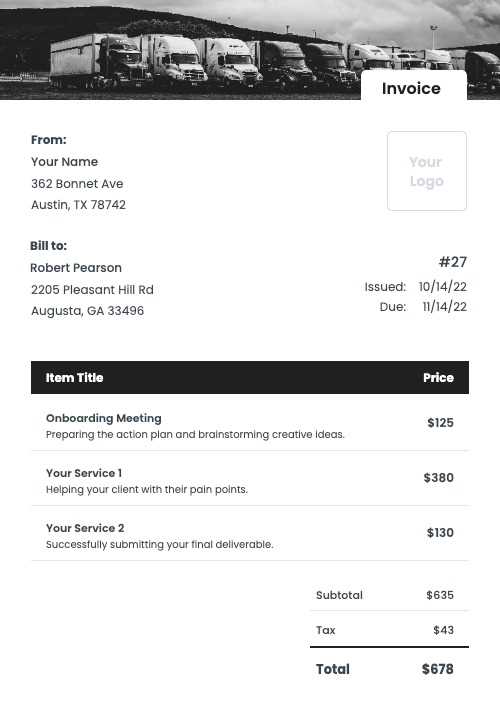

How to Create a Professional Invoice

Creating a professional payment request is essential for any business that wants to ensure timely payments and maintain a strong relationship with clients. A well-crafted document not only helps in securing payments but also reflects your business’s credibility and attention to detail. To create a professional form, it’s important to include all the necessary components while keeping the layout clean and easy to understand.

Start by including your business details at the top of the form, such as your name, address, and contact information. This helps the client immediately recognize the sender. Right below your information, clearly display the client’s name and contact details. The document number and issue date should also be easily visible for record-keeping and future reference.

Next, provide an itemized list of services or goods, along with the corresponding rates and quantities. Each item should be described in detail to avoid any confusion. Be sure to include the total amount due at the bottom of the page, along with payment terms, such as the due date and accepted methods of payment. A clear payment schedule can help prevent delays and ensure smooth transactions.

Common Mistakes in Trucking Invoices

Even small errors in payment requests can lead to confusion, delayed payments, and frustration for both businesses and their clients. It’s important to be aware of common mistakes that can arise during the creation of these documents. By identifying and correcting these issues, businesses can ensure that their financial transactions run smoothly and efficiently.

Frequent Errors to Avoid

- Missing Business Information: Failing to include your contact details can cause delays and make it harder for clients to reach you.

- Incorrect Client Information: Always double-check client names and addresses to prevent confusion and ensure that the document reaches the right person.

- Ambiguous Service Descriptions: Vague or unclear descriptions of services or products may lead to disputes. Be specific about what was provided.

- Omitting Payment Terms: Not including clear payment deadlines or accepted methods can lead to confusion and late payments.

- Calculation Mistakes: Double-check all totals, taxes, and additional fees to avoid incorrect amounts that could damage your credibility.

How to Avoid These Mistakes

To avoid these common mistakes, it’s essential to review your payment requests carefully before sending them out. Ensure all fields are filled in correctly, all amounts are accurate, and the document is clear and concise. This attention to detail will help maintain professionalism and foster trust with clients, ensuring that payments are processed on time.

Tips for Efficient Trucking Billing

Efficient billing is essential for maintaining healthy cash flow and ensuring that businesses are paid promptly for their services. A well-organized process can reduce delays and administrative overhead while improving client relationships. By adopting best practices for financial management, businesses can make the billing process smoother and more reliable.

One key tip is to automate the billing process as much as possible. Using software that can generate and send payment requests automatically ensures that nothing is overlooked and that documents are delivered promptly. This reduces the risk of human error and ensures consistency in every transaction.

Clear documentation is another important factor. Make sure every payment request includes all the necessary details such as service descriptions, amounts, and payment terms. The clearer the document, the less likely clients are to question charges or delay payments. Always use an itemized list to break down services, making it easier for clients to understand what they are paying for.

Lastly, establish a set payment schedule and communicate it to clients upfront. Clearly state payment due dates and outline any late fees to prevent misunderstandings. By setting expectations from the start, businesses can encourage timely payments and avoid unnecessary delays.

How to Format Your Trucking Invoice

Proper formatting is crucial for ensuring that payment requests are professional, clear, and easy to understand. A well-organized document not only reflects well on your business but also helps avoid misunderstandings and delays in payments. The goal is to present all necessary information in a logical, accessible way, making it easy for clients to process and pay.

Structuring the Document

Start with a clean layout that clearly separates different sections of the document. Begin with your business details at the top, followed by the client’s information. Then, create a section for a unique reference number and the date of issue. This structure helps both parties quickly locate key information.

Key Sections to Include

- Business Information: Your business name, address, contact details, and logo should be prominently displayed.

- Client Details: Include the client’s name, address, and relevant contact information.

- Service Breakdown: List each service provided, including rates, quantities, and any additional charges. Ensure this section is clearly itemized.

- Payment Information: Include the total amount due, payment terms, and methods accepted. Clearly state the due date and any applicable late fees.

Ensure all information is aligned and formatted consistently, using a clear font and appropriate spacing. A simple, professional design will make your payment requests easier for clients to process and pay in a timely manner.

Best Practices for Invoice Accuracy

Ensuring the accuracy of payment requests is essential for maintaining a professional image and avoiding disputes with clients. Even small mistakes can lead to delays or confusion, which can affect cash flow and client trust. By following best practices for accuracy, businesses can minimize errors and ensure smooth financial transactions.

First and foremost, double-check all numbers. Whether it’s the total amount due, the rate per service, or the tax calculation, even a small arithmetic mistake can create significant issues. Take time to review each figure carefully before sending out the document.

Provide clear descriptions for all services rendered. Vague or incomplete descriptions can lead to misunderstandings and disputes. Each service should be itemized with sufficient detail so that clients can easily understand what they are paying for. This transparency not only promotes accuracy but also helps in building trust.

Another critical step is to verify client details and ensure that all contact information, including the billing address, is up-to-date and correct. Mismatched information can delay payments and cause unnecessary confusion. Also, always include a unique reference number for each document to help both you and the client track payments easily.

Finally, standardize your process. Using a consistent format for all your payment requests makes it easier to spot mistakes and ensures that all necessary information is included every time. Whether you use a software tool or a pre-designed document, consistency in layout and terminology can help reduce errors over time.

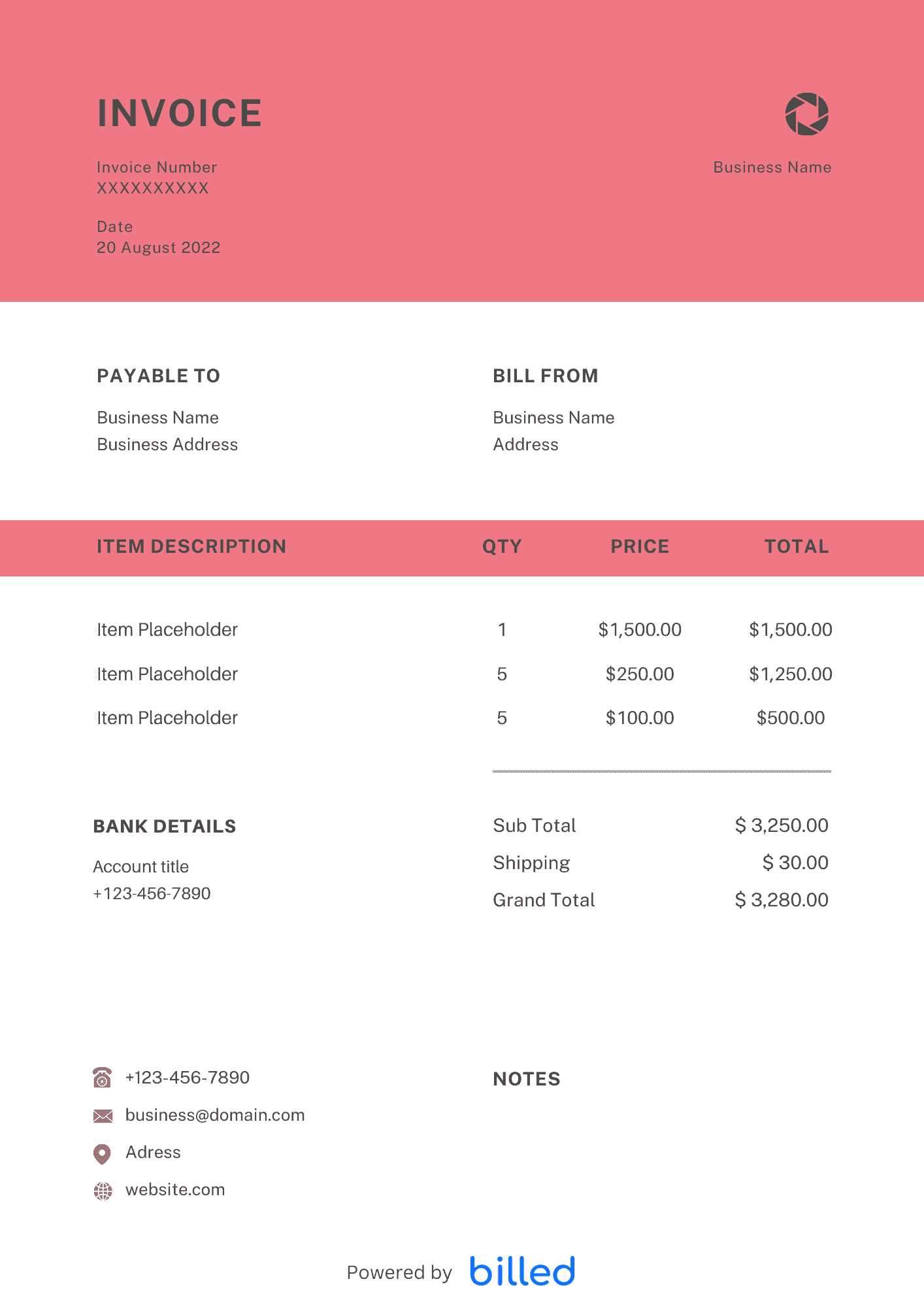

Free Resources for Trucking Invoices

Access to useful tools and resources can significantly improve the billing process for any business, especially in the transportation sector. Many online platforms offer downloadable forms and documents that can be customized to suit the needs of service providers. These resources help streamline the payment request process, saving time and reducing the chances of errors or omissions.

One valuable resource is online document generators. These tools allow businesses to quickly create professional payment requests by filling in essential details like client information, services rendered, and payment terms. With a few clicks, you can have a properly formatted document ready to send, reducing the time spent on manual formatting.

Cloud-based invoicing software is another great option. Many of these platforms offer free basic plans that allow businesses to manage and send payment requests directly from their dashboard. These tools often come with added features like automated reminders, payment tracking, and easy-to-use templates, making them highly efficient for small to medium-sized businesses.

There are also online marketplaces where you can download a variety of pre-designed payment request forms in multiple formats (PDF, Word, Excel). These resources often offer customization options, allowing you to adapt the document to match your specific needs and branding style. Using these ready-made forms can save time and ensure that all required information is properly included.

Automating Your Trucking Invoice System

Automating the billing process can significantly improve efficiency and accuracy for any business. By implementing automated systems, companies can reduce manual errors, save time, and ensure timely payment requests. Automation also provides better control over the invoicing process, making it easier to track transactions and stay on top of due payments.

Benefits of Automation

- Time Efficiency: Automating routine tasks such as generating and sending payment requests can save valuable time, allowing businesses to focus on more critical tasks.

- Consistency: Automated systems ensure that every document follows the same format and includes all required details, reducing the risk of missing or incorrect information.

- Improved Cash Flow: With automatic reminders and scheduled payments, businesses can reduce delays in payment and ensure they get paid on time.

- Better Record-Keeping: Automated systems can easily track every transaction, keeping an accurate record of all payment requests sent and received, which is useful for audits and financial reporting.

How to Automate Your System

There are several tools available to help automate the billing process. Cloud-based software and invoicing platforms can integrate with your accounting system and automatically generate and send payment requests. These tools allow you to input client details once and use them for all future transactions, eliminating the need to re-enter information each time.

- Choose an Automation Tool: Select a software solution that fits your business needs, whether it’s a comprehensive accounting system or a dedicated invoicing platform.

- Set Up Recurring Payments: For clients with ongoing contracts, configure recurring billing cycles to automatically generate payment requests at predefined intervals.

- Integrate with Payment Gateways: Link your automated system to payment processors to enable seamless online transactions directly from the payment request.

By automating the invoicing system, businesses can streamline their financial operations, improve efficiency, and reduce the chances of errors or missed payments.

How to Add Payment Terms to Invoices

Including clear and concise payment terms in your billing documents is essential for ensuring that both parties understand when and how payments are expected. Properly outlining payment expectations helps avoid confusion and potential disputes, ensuring that payments are made on time. Payment terms provide clarity about deadlines, late fees, and acceptable payment methods, contributing to smoother financial transactions.

Key Payment Terms to Include

- Due Date: Specify the exact date by which the payment should be made. This helps set clear expectations and avoids misunderstandings about when the payment is due.

- Late Fees: Outline any additional charges for overdue payments. Be clear about the percentage or flat fee that will be added if payment is not received by the due date.

- Accepted Payment Methods: Indicate the types of payments you accept, such as credit cards, bank transfers, or online payment platforms. This ensures that clients know the available options for completing the transaction.

- Discounts for Early Payment: Some businesses offer discounts to clients who pay early. If you provide this option, clearly state the percentage off the total amount and the deadline to qualify for the discount.

How to Format Payment Terms on Your Document

When adding payment terms, it’s essential to make them prominent and easy to find. Place them near the bottom of the document or in a dedicated section clearly labeled “Payment Terms.” This ensures that the client can quickly locate and understand the conditions. Use bullet points or numbered lists to make the terms more digestible, and be specific about any penalties for missed deadlines or conditions for early payment discounts.

- Bold or Highlight Key Terms: Use bold text or other formatting styles to emphasize the due date and any penalties for late payments.

- Simple Language: Avoid using complicated legal jargon. Clear and simple language will make it easier for clients to understand the terms.

By adding payment terms to your documents in a clear and straightforward manner, you can prevent confusion, promote timely payments, and establish professional expectations with clients.

Legal Considerations for Trucking Invoices

When issuing payment requests, it is important to be aware of the legal aspects involved in ensuring that your documents are both accurate and enforceable. A well-structured and legally sound payment request not only improves professionalism but also protects both the service provider and the client in case of any disputes. Understanding the relevant regulations and including necessary legal clauses helps prevent misunderstandings and ensures that both parties’ rights are respected.

Essential Legal Information to Include

- Terms and Conditions: Clearly outline the terms and conditions of the service, including the scope of work, deadlines, and any penalties for non-compliance. This helps establish a legal foundation for the agreement between both parties.

- Payment Deadline: The due date should be specified to avoid ambiguity. Including late fees or interest charges for overdue payments ensures that clients understand the financial consequences of delayed payments.

- Tax Information: Depending on your location, certain taxes may need to be included on the payment request. Always ensure that applicable sales tax, VAT, or any other required levies are accounted for and clearly presented to avoid legal complications.

- Business Registration Details: Include your business registration number, tax ID, and other legally required information. This ensures that your business is recognized and compliant with local laws.

Legal Protections and Dispute Resolution

It is advisable to include a clause addressing dispute resolution in case of disagreements regarding the services provided or the payment terms. Specifying the method of resolution, whether through mediation, arbitration, or legal proceedings, can help resolve conflicts more efficiently. Having such a clause in place also demonstrates a proactive approach to managing potential issues.

- Jurisdiction: Specify the jurisdiction under which any legal disputes will be handled, ensuring clarity on where legal matters will be addressed.

- Non-payment Action: Outline the legal steps that will be taken in case of non-payment, including the involvement of debt collectors or legal action if necessary.

By incorporating these essential legal elements into your payment requests, you can safeguard your business and ensure that your financial agreements are both clear and enforceable, reducing the likelihood of disputes and improving your overall legal compliance.

Tracking Payments with Your Invoice Template

Accurately tracking payments is essential for maintaining a healthy cash flow and ensuring timely transactions. By using a well-structured payment request document, you can easily monitor the status of each payment and identify any overdue balances. A clear and organized system for tracking payments not only helps you stay on top of finances but also ensures that no payment goes unnoticed.

Key Features to Include for Payment Tracking

- Payment Status Field: Include a section in the document where you can mark the payment status, such as “Paid,” “Pending,” or “Overdue.” This helps you quickly track which payments have been processed and which are still outstanding.

- Due Dates: Clearly indicate the payment due date. This helps both you and the client understand when payment is expected and provides a reference point for any follow-up actions if the payment is delayed.

- Transaction Reference Number: Assign a unique reference number to each payment request. This makes it easier to match payments with their respective requests and track them in your accounting system.

- Partial Payments: If applicable, include a field to track partial payments made by the client. This ensures that you can record any received payments and clearly display the remaining balance.

Using Digital Tools to Streamline Tracking

- Automated Reminders: Set up automatic reminders within your software or invoicing tool to notify clients of upcoming or overdue payments. This reduces the need for manual follow-ups and helps ensure timely payments.

- Payment Integration: Link your payment request system with payment processors, such as PayPal or Stripe, to receive payments directly and update their status automatically.

- Reports and Analytics: Use invoicing software that generates payment reports and summaries. This can help you keep track of your outstanding balances and analyze your payment trends over time.

By including these features in your payment requests and utilizing digital tools for payment tracking, you can streamline the process and ensure that your business stays financially organized and on top of incoming payments.