Free Invoice Templates for Quick and Professional Billing

Managing financial transactions efficiently is crucial for any business. Whether you’re a freelancer, small business owner, or large enterprise, keeping track of payments and ensuring smooth documentation can be time-consuming. With the right resources, this task can become quicker, simpler, and more professional. By utilizing ready-made formats, you can easily create well-organized documents that help maintain clarity and consistency in your financial dealings.

These easy-to-use tools provide a simple way to structure your charges, ensuring that all the necessary details are included without the need to start from scratch each time. No matter your industry, having a standardized approach to recording payments can boost your credibility and make the whole process smoother. The flexibility and customization options available make it easy to tailor the documents to fit your unique needs.

By integrating such solutions into your workflow, you’ll save time, reduce errors, and ensure that your clients receive professional-looking paperwork promptly. Moreover, these resources are widely accessible, making them an excellent option for businesses of any size. Embracing these efficient methods can lead to improved cash flow and better financial organization.

Free Invoice Templates for Your Business

Running a business involves a lot of paperwork, and one of the most important tasks is ensuring that your billing process is efficient and professional. By using ready-to-go document designs, you can easily create structured, clear records of transactions without spending time formatting each document from scratch. These solutions help you save valuable time while maintaining consistency and accuracy in your business operations.

Why You Need Simple Billing Solutions

As a business owner, keeping track of payments and ensuring that each transaction is properly documented is key to maintaining healthy cash flow. Using easy-to-edit layouts helps you stay organized and prevents errors that could lead to misunderstandings or delays in payment. Whether you’re handling small-scale operations or working with multiple clients, having a streamlined process in place for creating payment documents is essential.

Choosing the Right Document Layout for Your Business

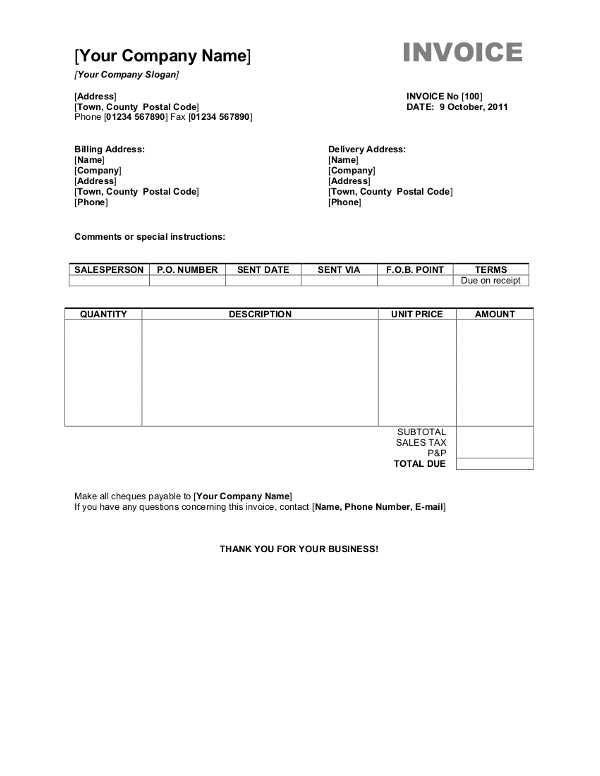

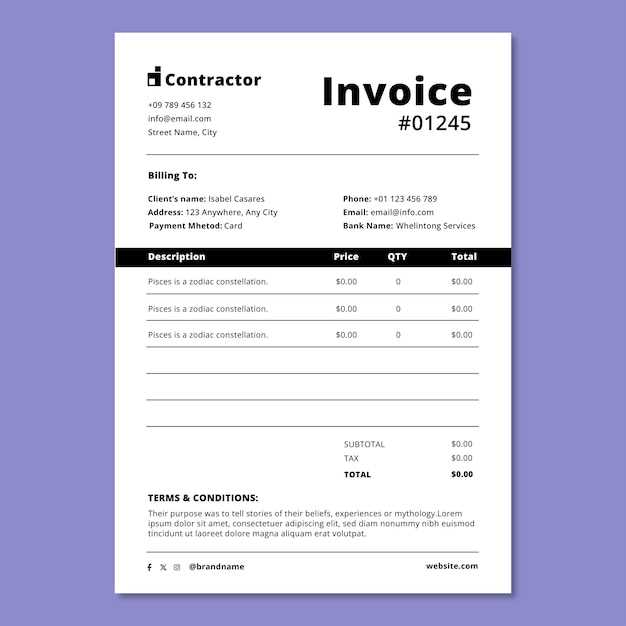

Different industries may require specific details to be included in the payment documentation. For example, service-based businesses might need to break down hours worked, while product-based companies could focus on itemized lists of purchased goods. Regardless of your niche, selecting a design that reflects your business style and meets your needs is important for presenting a professional image to your clients.

| Feature | Benefit |

|---|---|

| Customizable Fields | Allows you to add client-specific information quickly and easily |

| Clear Structure | Ensures all necessary details are included without clutter |

| Easy Formatting | Saves time by eliminating the need to design documents from scratch |

| Professional Appearance | Boosts your business credibility and enhances customer trust |

Why Use Free Invoice Templates?

Managing financial documentation can often feel like a daunting task, especially when you’re trying to ensure accuracy and professionalism. By adopting ready-made document formats, you can streamline the process and eliminate the need for repetitive manual entry. These pre-designed solutions save valuable time and allow you to focus on what matters most–running your business efficiently.

Save Time and Effort

One of the key advantages of using a ready-made format is the time saved in document creation. Instead of building each record from scratch, these resources allow you to quickly plug in the necessary details, minimizing the time spent on administrative tasks. This increased efficiency not only helps you meet deadlines but also frees up resources for other important business activities.

Maintain Consistency and Professionalism

Having a standardized format ensures that every document you create maintains the same level of professionalism. It reflects positively on your business and shows clients that you take their transactions seriously. Whether you’re dealing with a single customer or managing numerous accounts, a consistent format helps avoid confusion and ensures all required information is included.

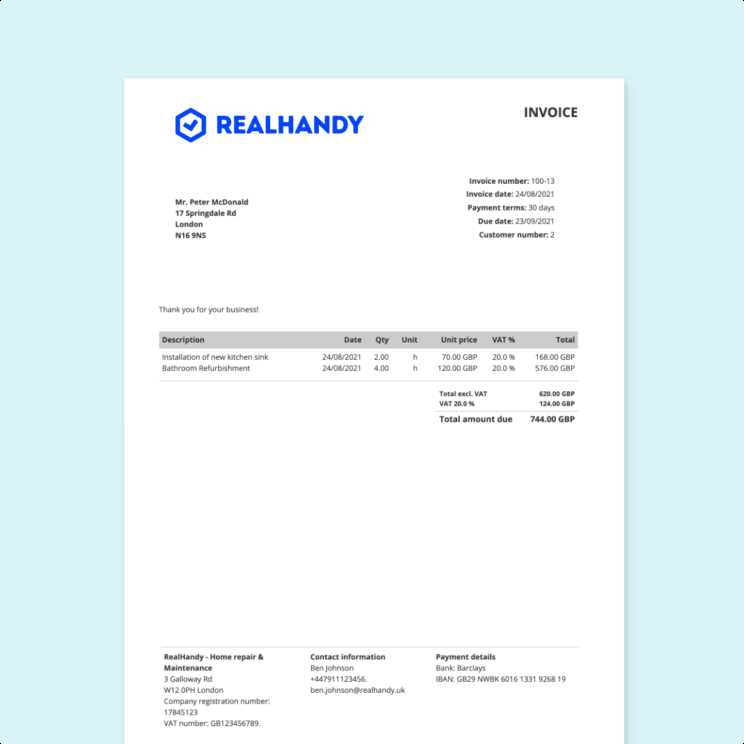

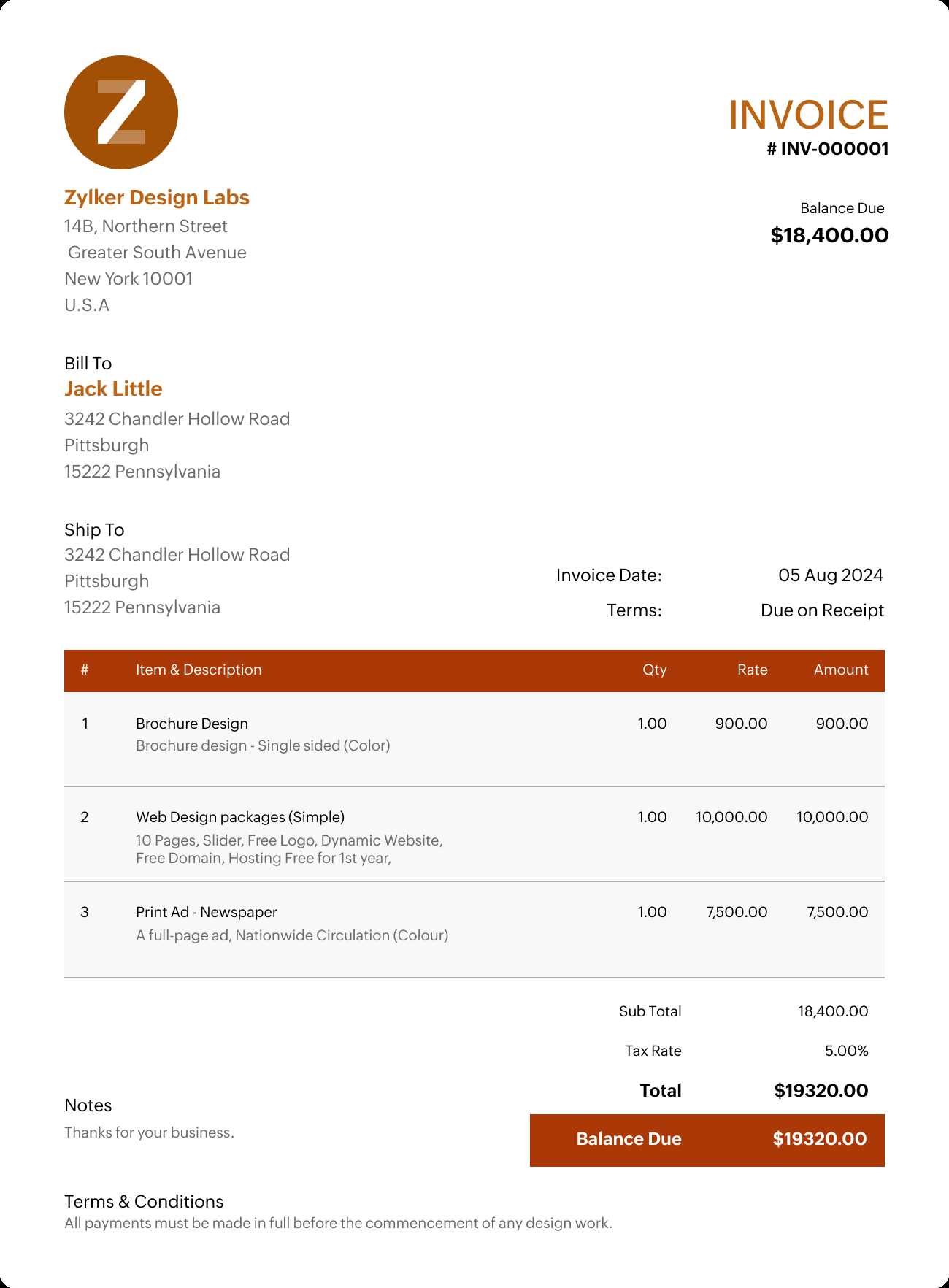

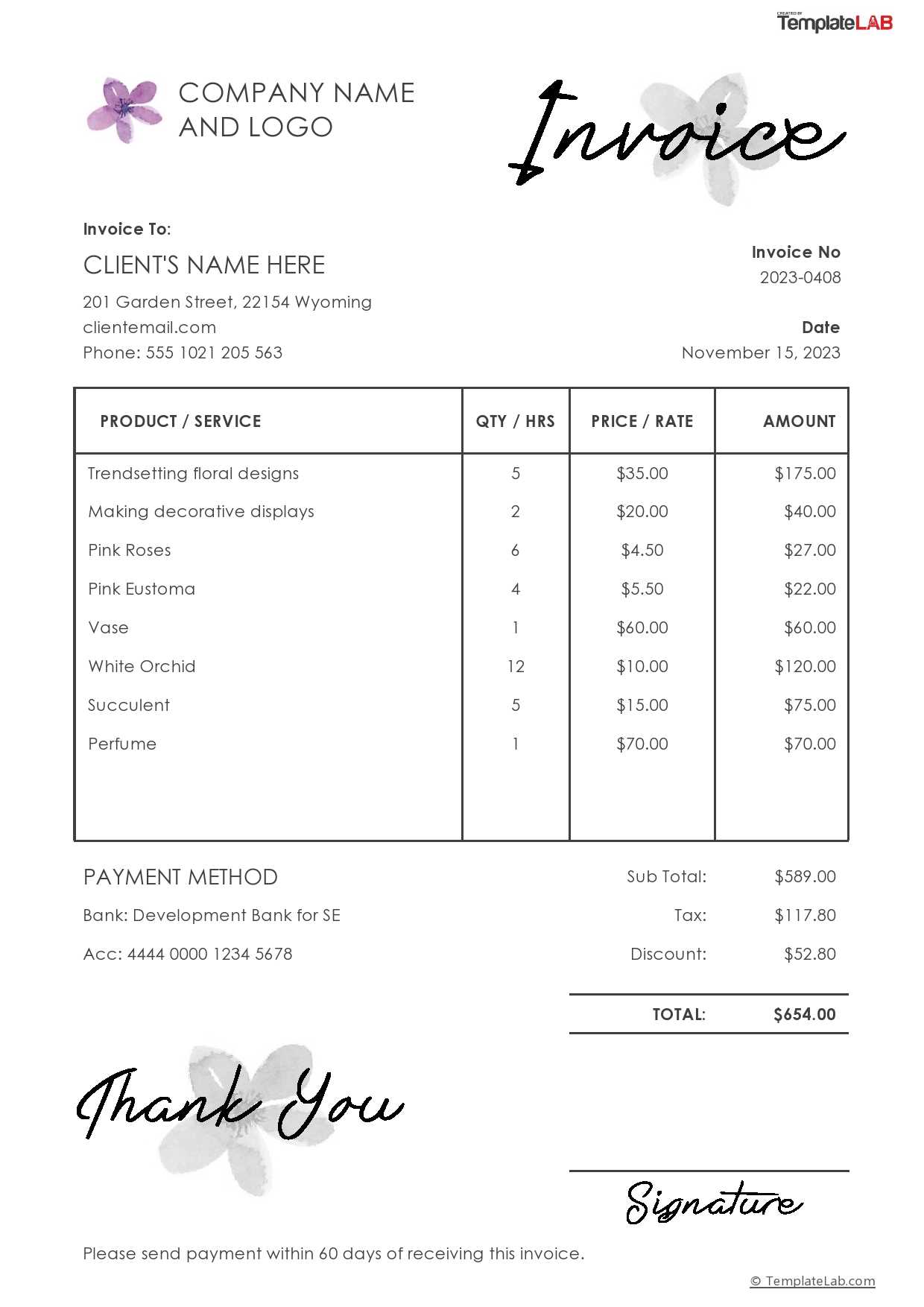

Top Features of a Good Invoice

Creating clear and well-structured billing documents is essential to ensure smooth transactions and maintain a professional image. A good document should contain all the necessary information in a clear, easy-to-read format. This helps to avoid misunderstandings and delays while improving the overall efficiency of your financial processes.

| Feature | Description |

|---|---|

| Unique Identification Number | A distinct number helps track and reference each document easily, ensuring no confusion with past or future transactions. |

| Clear Client and Seller Information | Includes names, addresses, and contact details to make sure both parties are easily identifiable. |

| Detailed List of Products/Services | Breakdown of items or services provided with quantities and pricing for transparency and clarity. |

| Accurate Payment Terms | Clear terms such as due dates, accepted payment methods, and any late fees help avoid confusion regarding payment expectations. |

| Tax Information | Properly calculated taxes (if applicable) should be clearly listed to avoid legal issues and ensure compliance. |

| Professional Design | A clean, organized layout creates a polished and trustworthy appearance, enhancing your business image. |

How to Customize Invoice Templates

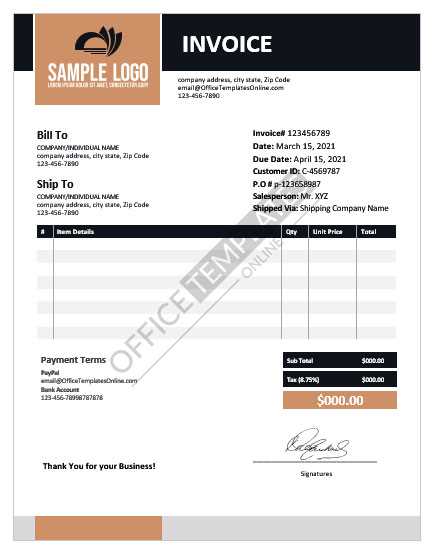

Personalizing your billing documents ensures that they reflect your business identity while meeting the specific needs of your transactions. Customization allows you to modify various elements such as layout, colors, and included details, creating a document that is both functional and in line with your brand. This flexibility can also help you meet the unique requirements of different clients or industries.

| Customization Aspect | How to Adjust It |

|---|---|

| Branding Elements | Add your company logo, color scheme, and contact details to reflect your brand identity. |

| Payment Details | Include clear instructions on payment methods, bank details, or other payment options relevant to your business. |

| Item Descriptions | Modify the layout to include specific descriptions of goods or services offered, along with quantities, unit prices, and any discounts. |

| Terms and Conditions | Update terms, such as payment deadlines, late fees, and delivery conditions, based on client agreements or business practices. |

| Legal Requirements | Ensure that all necessary legal information is added, such as tax identification numbers and applicable taxes, according to local regulations. |

Where to Find Reliable Invoice Templates

Finding trustworthy and professional document designs is crucial for ensuring consistency and accuracy in your billing processes. There are several resources available online that offer easy access to well-crafted solutions, whether you’re looking for something simple or more advanced. The key is to choose platforms that offer high-quality, customizable formats that suit the needs of your business.

Reputable websites, accounting platforms, and even word-processing software provide a wide range of options that can be tailored to your specific requirements. Many of these resources offer downloadable formats, often with the flexibility to modify elements like layout, style, and content. Whether you’re a freelancer, small business owner, or part of a larger organization, exploring trusted sources can help you find the right fit quickly and easily.

Benefits of Using Invoice Templates

Utilizing ready-made document formats can significantly improve your billing process, making it more efficient and organized. These structured layouts not only save time but also reduce the risk of errors, ensuring that all necessary information is included in a professional manner. By relying on a standardized approach, you can streamline your workflow and focus more on growing your business.

Time Efficiency and Consistency

One of the main advantages of using pre-designed formats is the time saved in creating documents. Instead of designing each record from scratch, you can quickly enter details, ensuring consistency in the structure and presentation. This is especially beneficial when managing multiple clients or handling frequent transactions, as it reduces the administrative workload.

Professional Appearance and Accuracy

Using a polished, organized layout improves the overall look of your financial records, helping you present a professional image to clients and partners. It also ensures that all necessary details–such as payment terms, tax information, and contact details–are correctly included, minimizing the risk of mistakes that could cause confusion or delay payments.

Choosing the Right Template for Your Business

Selecting the right document design is key to ensuring that your billing process is both efficient and professional. The right layout not only reflects your business style but also makes it easier to capture all relevant details required for each transaction. Different industries may require different approaches, so it’s important to find a solution that suits your specific needs.

| Business Type | Recommended Design Features |

|---|---|

| Freelancers | Simplified format with hourly rates, project descriptions, and payment terms for easier tracking of services provided. |

| Retailers | Clear breakdown of items with quantities, unit prices, and total amounts, along with applicable taxes and discounts. |

| Consultants | Detailed lists of consulting hours, rates, and project milestones with an emphasis on clear payment schedules. |

| Contractors | Itemized breakdown of materials, labor, and any additional expenses, along with due dates for partial payments or deposits. |

By understanding the unique needs of your business, you can choose a format that best supports your workflow, ensuring clear communication with clients and minimizing the potential for errors or misunderstandings.

How to Save Time with Templates

Efficient management of your financial records is crucial for streamlining operations and ensuring quick turnaround times. By using pre-designed formats, you can significantly reduce the amount of time spent on creating each document manually. These ready-made solutions help you focus on other important tasks while ensuring accuracy and consistency in your billing process.

Eliminate Redundant Tasks

One of the biggest time-savers is the ability to reuse the same structure repeatedly. Instead of starting from scratch with each new transaction, you can simply update the details, such as the client’s information, products or services provided, and payment terms. This eliminates the need to reorganize the layout every time, allowing you to generate documents quickly.

Focus on What Matters

By reducing the time spent on administrative tasks like formatting, you can devote more attention to growing your business or providing excellent service to your clients. Focusing on your core activities rather than tedious paperwork leads to improved productivity and a better overall experience for both you and your customers.

Utilizing structured solutions not only saves time but also improves your workflow, allowing you to maintain a consistent, professional approach to your billing process while reducing the chances of errors.

Best Practices for Professional Invoices

Creating well-organized and professional billing documents is essential for maintaining trust with clients and ensuring smooth financial transactions. A polished, accurate document not only reflects your business’s credibility but also helps avoid confusion or delays in payment. By following a few best practices, you can improve the overall efficiency and professionalism of your billing process.

Include All Necessary Details

Make sure your document includes all the critical information, such as your business name, contact details, and tax identification number. In addition, clearly specify the client’s information, a detailed description of the goods or services provided, and the total amount due. This level of detail helps prevent disputes and ensures that your client knows exactly what they are paying for.

Ensure Clarity and Simplicity

While it’s important to include all relevant information, the layout should be clean and easy to understand. A well-organized structure with clearly labeled sections and itemized charges ensures that the recipient can quickly find the details they need. Avoid clutter and complex language–clarity is key to professionalism.

Timely delivery of such documents and adherence to agreed-upon terms also helps maintain a positive relationship with clients, while reinforcing your commitment to professionalism.

Common Mistakes in Invoice Creation

When creating financial documents, it’s easy to overlook key details, which can lead to confusion, delays in payments, or even disputes. By being aware of the most common errors, you can ensure that your records are clear, accurate, and professional. Avoiding these mistakes will help maintain smooth transactions and foster trust with your clients.

Missing or Incorrect Contact Information

One of the most frequent errors is not including complete and accurate contact information. This includes your business name, address, phone number, and email address. Omitting any of these details can cause delays, especially if the client needs to reach you to clarify payment or shipping details. Always double-check that both your and the client’s contact details are correct.

Incorrect or Vague Payment Terms

Another common issue is not specifying clear payment terms. Whether it’s the due date, late fees, or accepted methods of payment, lack of detail can lead to misunderstandings. Make sure to clearly outline how and when you expect payment, as well as any penalties for late submissions. Ambiguity in this section can result in unnecessary confusion or late payments.

Paying attention to these small details can greatly improve the accuracy and efficiency of your financial documentation, making the billing process smoother for both you and your clients.

How Invoice Templates Improve Accuracy

Accuracy in billing is critical to maintaining strong business relationships and ensuring timely payments. Using structured formats significantly reduces the risk of human error, making it easier to include all necessary details and present them in a clear, consistent manner. With pre-designed layouts, the chances of overlooking important information or making calculation mistakes are minimized, allowing you to focus on delivering quality products or services.

Consistency is one of the main advantages. When you consistently use the same format for each document, you ensure that all fields are filled correctly and in the same order every time. This reduces the likelihood of missing out on key details, such as taxes, discounts, or payment terms.

Built-in calculations in many of these formats can automatically sum totals or apply tax rates, further minimizing the potential for math errors. This not only boosts the overall precision of your billing but also saves valuable time.

By relying on these reliable structures, businesses can increase their operational efficiency, reduce costly mistakes, and improve their financial management overall.

Free vs Paid Invoice Templates

When selecting a document layout for billing, businesses often face a choice between free options and premium, paid solutions. Both options offer advantages, but understanding their differences is essential to making the best decision for your business. The choice you make can influence not only the look of your documents but also the level of customization and support you receive.

Advantages of Free Solutions

Free layouts are widely available and easy to find, making them an attractive option for startups or small businesses operating on tight budgets. They typically cover basic needs, offering simple and functional structures that are easy to customize. For businesses that need a straightforward solution without extra features, free designs are a practical choice. However, these often come with limitations in terms of flexibility, design options, or support.

Benefits of Paid Solutions

Paid formats generally offer greater flexibility, more professional designs, and a higher level of customization. They often come with additional features such as automated calculations, advanced formatting options, and even integrations with accounting software. Additionally, paid options often include customer support, which can be invaluable if issues arise. For businesses that require a more polished appearance or need to meet specific requirements, investing in a premium solution can be well worth the cost.

Ultimately, the choice between free and paid solutions depends on your business needs, budget, and the level of professionalism required for your billing process. Both options can be effective, but paid solutions tend to offer more advanced features and long-term value for growing businesses.

Popular Formats for Invoice Templates

When creating billing documents, the format you choose plays a significant role in how professional and easy to understand your records will be. There are several commonly used formats, each suited to different business needs and industries. Selecting the right structure helps ensure clarity, accuracy, and efficiency in your financial transactions.

Common Document Layouts

- Simple List Layout: This basic structure is ideal for freelancers or small businesses offering straightforward services or products. It typically includes itemized charges with corresponding prices, followed by a total amount due.

- Itemized Breakdown: Used by businesses that offer multiple products or services, this layout provides a detailed list of each item, its quantity, unit price, and total cost. This format is perfect for retail businesses or contractors.

- Time-Based Format: Commonly used by consultants or service-based businesses, this format lists hours worked, hourly rates, and totals. It’s an effective way to calculate payments for ongoing services or projects.

Other Formats to Consider

- Proforma Layout: Often used when providing preliminary quotes or estimates before a final transaction occurs, this format helps outline expected costs and terms.

- Credit Memo Format: This layout is used for issuing refunds or adjustments. It typically lists the original charge and the credit amount to be applied to the client’s balance.

Choosing the right format depends on the nature of your business and the level of detail you need to include in each transaction. By selecting the appropriate structure, you can enhance clarity, reduce errors, and maintain a professional image in all your financial dealings.

How to Edit Invoice Templates Easily

Editing your billing documents can be a quick and straightforward process if you have the right tools and knowledge. Whether you’re using an online platform, word processing software, or a spreadsheet, making adjustments to your document layout is easier than ever. Below are some simple methods and tips to help you customize and update your financial records efficiently.

Editing in Word Processing Software

- Open the document: Start by opening your existing layout in a word processing program like Microsoft Word or Google Docs.

- Modify text fields: Edit client information, services or products provided, and payment terms as needed. Simply click on the text and make the necessary changes.

- Adjust the layout: Move sections, change font styles or sizes, and adjust the alignment to suit your preference or business branding.

- Save as a new file: Once your document is updated, save it with a new name to preserve the original template for future use.

Editing in Spreadsheets

- Open the spreadsheet: If you’re using Excel or Google Sheets, open the file where your record is stored.

- Input new data: Replace any old client or transaction information with the updated details. Use built-in formulas to automatically calculate totals, taxes, and other figures.

- Customize the design: Change colors, borders, or row heights to enhance the appearance and readability of the document.

- Export as a PDF: After editing, export the finished document as a PDF for easy sharing and printing.

Using Online Platforms

- Log in to the platform: Access your account on an invoicing tool like FreshBooks, Zoho, or Wave.

- Select a template: Choose an existing design or start from scratch with a pre-built layout.

- Fill in details: Enter all required information, including client details, services provided, and payment terms. Most platforms allow you to save frequent entries as reusable templates.

- Download or email: After customization, download the document or send it directly to your client via email.

By following these easy steps, you can save time and ensure that your documents are always accurate, professional, and up-to-date.

Invoice Templates for Freelancers and Small Businesses

Managing financial documentation is essential for freelancers and small business owners, but it doesn’t have to be a time-consuming or complex task. By utilizing structured formats, these professionals can streamline the process of billing, making it quick, efficient, and easy to maintain accuracy. Simple, yet comprehensive layouts can help manage everything from one-time projects to recurring services, ensuring clear communication with clients and timely payments.

Simple and Effective Formats

For freelancers, simplicity is often key. A basic, easy-to-understand layout can include all necessary details without overwhelming clients. A typical document may include the freelancer’s name, services provided, rates, and payment due dates. With minimal design elements, the focus remains on the key elements of the transaction–ensuring both clarity and professionalism.

Tailored Solutions for Small Business Owners

Small businesses, on the other hand, often require more detailed formats. A typical business layout might include additional fields for itemized products or services, quantities, taxes, and shipping fees. Customization options allow business owners to create an invoice that suits their specific needs–whether they deal with a variety of products, offer subscription services, or work on long-term contracts. Clear, itemized breakdowns foster trust and ensure that clients fully understand the charges.

By using organized and flexible formats, freelancers and small businesses can improve efficiency, reduce errors, and create professional, polished documents that help build lasting client relationships.

Legal Requirements for Invoice Templates

When creating billing documents, it’s crucial to ensure that they meet legal requirements. In many countries, there are specific details that must be included to ensure that the document is legally valid and can be used for tax and accounting purposes. Failing to include these mandatory elements can lead to complications, such as delayed payments, fines, or audits. Understanding these requirements helps businesses maintain compliance and avoid legal issues.

Essential Information to Include

Each document should contain key pieces of information, including both the supplier’s and the customer’s details, a clear description of the goods or services provided, and the total amount due. The following table outlines some common legal requirements that businesses must include when creating their records:

| Required Information | Description |

|---|---|

| Invoice Number | A unique identifier for each transaction to ensure proper record-keeping and tracking. |

| Supplier’s Details | Business name, address, tax identification number (TIN), and contact information. |

| Customer’s Details | The name and address of the client or customer receiving the goods or services. |

| Date of Issue | The date the billing document is generated, which helps track payment deadlines. |

| Description of Goods/Services | A detailed description of the products or services provided, including quantities and unit prices. |

| Payment Terms | Specific terms about when payment is due, such as net 30 or immediate payment upon receipt. |

| Tax Details | Applicable taxes, including tax rates and tax identification number if required by local laws. |

| Total Amount Due | The sum total that is to be paid, clearly itemized and including any applicable taxes or discounts. |

Additional Legal Considerations

In addition to the basic requirements, some countries or industries may have additional regulations, such as including payment methods, late payment fees, or specific legal disclaimers. Depending on where your business is located, it’s important to consult with an accountant or legal advisor to ensure full compliance with local laws. Failure to meet these standards could result in penalties or challenges in enforcing payment agreements.

By adhering to legal guidelines, businesses can avoid common pitfalls and ensure their billing practices remain transparent, efficient, and legally sound.

How to Automate Your Invoicing Process

Streamlining the process of generating and sending payment requests can save time and reduce errors. Automating your billing process ensures that records are consistent, up-to-date, and sent promptly without requiring manual intervention each time. With the right tools and setup, businesses can increase efficiency, improve cash flow, and reduce the risk of mistakes that could delay payments.

Key Steps to Automating Billing

- Select an Automation Tool: The first step is choosing a suitable software or platform that allows you to automate the process. Many online accounting tools offer automated billing features, such as QuickBooks, Xero, or FreshBooks.

- Set Up Recurring Billing: For businesses with regular clients, setting up recurring billing can save time. This feature automatically generates and sends payment requests at pre-defined intervals, such as weekly, monthly, or yearly.

- Integrate with Payment Systems: To streamline the payment process, integrate your billing system with payment gateways (e.g., PayPal, Stripe). This allows clients to pay directly through the document, speeding up the payment cycle.

- Customize Reminders: Many platforms allow you to set automatic reminders for unpaid balances, which helps reduce late payments and ensures your clients are aware of upcoming deadlines.

Benefits of Automation

| Benefit | Description |

|---|---|

| Time Savings | Automation eliminates manual data entry, reducing the time spent creating and sending documents. |

| Reduced Errors | By removing the human factor, the chances of making mistakes, such as incorrect calculations or missed details, are minimized. |

| Improved Cash Flow | Automating reminders and recurring billing helps ensure timely payments, leading to better cash flow management. |

| Professionalism | Consistently using the same structured format enhances your business’s image, presenting a more professional approach to clients. |

By implementing automation in your billing system, you not only save time but also ensure greater accuracy, consistency, and better financial management. With minimal manual input, your business can operate more efficiently, leaving you with more time to focus on other important tasks.