Free Invoice Template for Easy and Professional Billing

Managing finances and ensuring smooth transactions is essential for any business. One of the most important aspects of this process is ensuring that all payment requests are clear and professional. Crafting the right document not only helps in maintaining professionalism but also speeds up the payment process.

With the right approach, businesses can streamline their billing process, reduce errors, and make the task of creating professional payment requests much easier. Many businesses, especially smaller ones, can benefit from using pre-designed documents that allow for customization and quick preparation.

Efficient solutions provide a simple way to generate detailed, accurate documents that cover all necessary information without the need for complex software. This allows anyone, regardless of their technical knowledge, to produce polished and reliable statements.

By using a structured document, you can easily add essential elements like item descriptions, amounts, and payment terms, all while ensuring a neat and uniform presentation. Whether you’re a freelancer, entrepreneur, or part of a larger organization, having access to these tools simplifies an otherwise time-consuming task.

How to Use a Free Invoice Template

Creating professional payment requests doesn’t have to be complicated. With the right document format, you can easily structure all the necessary information in a clear and organized manner. Whether you’re just starting out or looking for an efficient way to handle billing, having a pre-designed document can save you time and effort.

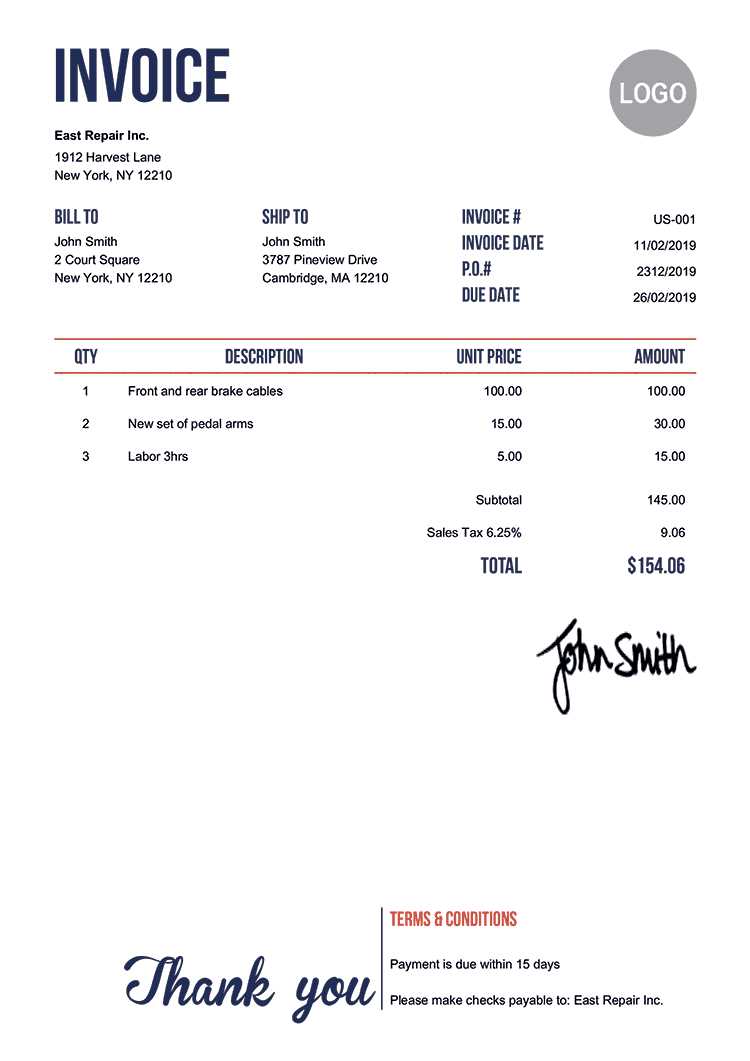

To get started, first choose a document that aligns with your needs. Look for a structure that allows you to input details such as the amount due, services rendered, and payment terms. Many platforms offer customizable files, so you can tailor them to suit your business style and requirements.

Customization is key. After selecting your preferred layout, input all relevant details such as client information, product descriptions, pricing, and due dates. Ensure all fields are filled in correctly to avoid any confusion. Double-check for accuracy before sending it out to clients.

Once your details are added, save the document and export it in a suitable format like PDF, ensuring that it maintains its professional appearance. Sending a well-organized document can not only improve communication but also enhance your reputation as a reliable professional.

Benefits of Using Invoice Templates

Utilizing pre-designed billing documents offers numerous advantages, especially for small businesses and freelancers. These ready-made solutions help save time, reduce errors, and ensure consistency in all your financial communication. By streamlining the billing process, you can focus more on growing your business and less on administrative tasks.

Time Savings

One of the biggest benefits is the significant amount of time saved. With a structured layout already in place, you can fill in the necessary information quickly and efficiently. This eliminates the need to design a new document each time a payment request is required. Here’s how it helps:

- Quick customization with fields for relevant details.

- Predefined sections for payment terms, dates, and item descriptions.

- No need for repeated formatting or design work.

Professional Appearance

Another key advantage is the ability to maintain a polished and professional appearance for all your billing documents. A well-designed structure enhances your credibility and ensures that clients receive clear, easy-to-understand payment requests. The use of consistent layouts helps build trust and a positive reputation. Some additional benefits include:

- Uniform formatting that matches industry standards.

- Easy-to-read fonts and clear separation of information.

- Space for all necessary details without clutter.

Steps to Customize Your Invoice

Personalizing your billing documents is essential to ensure they accurately reflect your business and maintain a professional appearance. Customization allows you to adjust the layout and content to fit your specific needs while providing a seamless experience for your clients. Follow these simple steps to tailor your document effectively.

Step 1: Add Your Business Information

Start by including your business details at the top of the document. This should include your company name, address, contact information, and logo if available. Clearly displaying this information helps clients easily recognize the source of the document and enhances your business’s credibility.

- Business name and logo

- Contact details, such as phone number and email

- Address or location of the business

Step 2: Include Client Information

Next, input your client’s details. This includes their name, company name (if applicable), and contact information. This section ensures that the billing document is directed to the correct individual or organization, avoiding any confusion regarding payment responsibilities.

- Client’s name and company name

- Billing address

- Contact information for follow-up

Step 3: Customize the Description and Payment Terms

Finally, adjust the sections where you describe the services or products provided, including quantities, pricing, and any applicable taxes. Ensure the payment terms are clear, such as due date and preferred payment method, to avoid misunderstandings later on.

Choosing the Right Invoice Format

Selecting the appropriate layout for your billing documents is crucial for ensuring clarity and professionalism. The right structure helps present your payment requests in a way that is easy to understand and visually appealing. Different formats serve various business needs, so it’s important to choose one that best matches the nature of your services and client expectations.

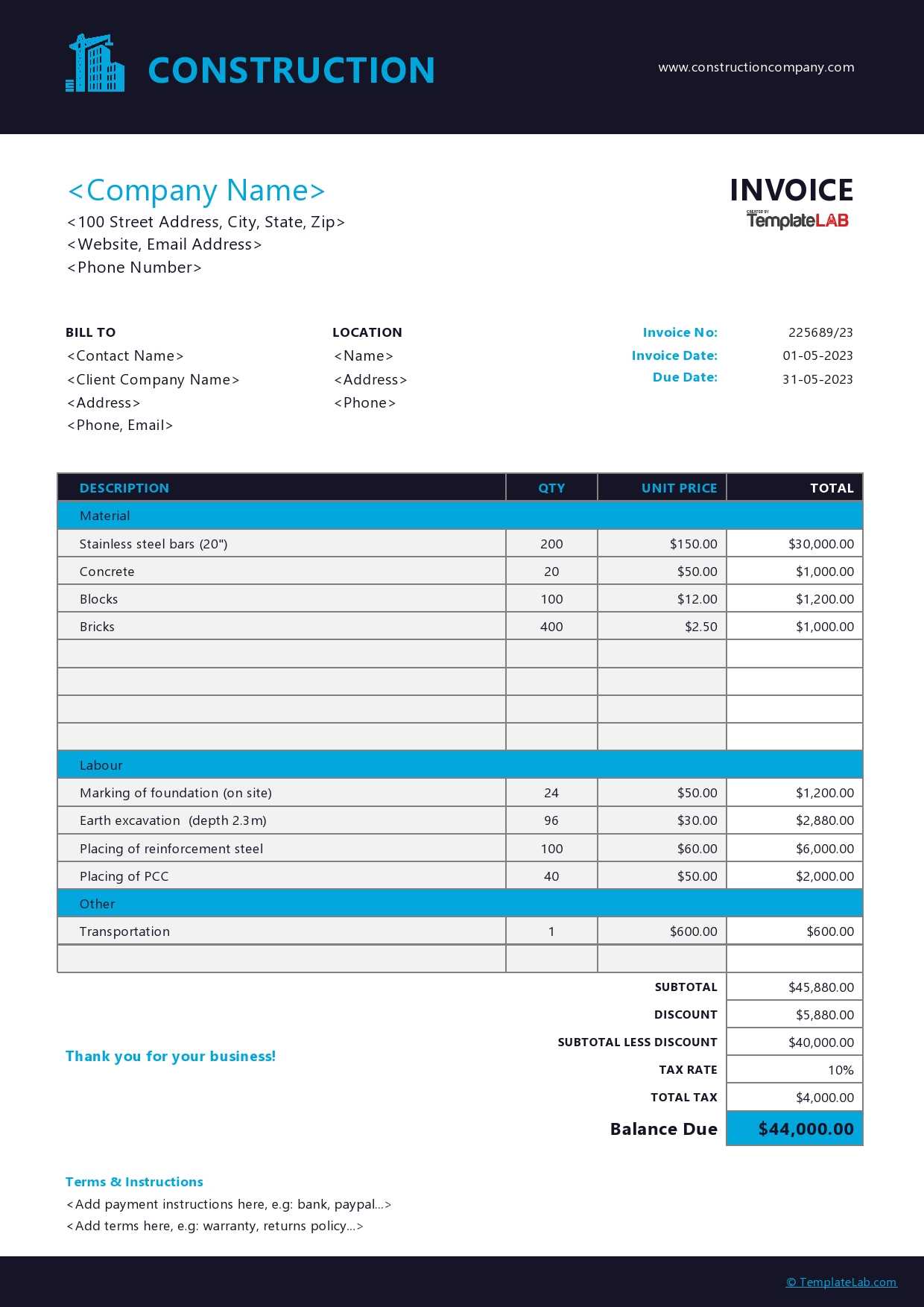

Consider the Type of Business

Your business type plays a significant role in determining the format you should use. For instance, a service-based business might require a more detailed breakdown of services, while a product-based business might focus more on item descriptions and quantities. Here are some factors to consider:

- Service-based businesses need sections for hours worked, rates, and detailed descriptions.

- Product-based businesses should emphasize itemized lists, prices, and quantities.

- Freelancers may benefit from simple, easy-to-read formats that highlight individual project milestones.

Match Client Preferences

Understanding your client’s preferences and industry standards is equally important. Some clients may expect a more formal, detailed document, while others might appreciate a simpler, straightforward format. Ensuring that your document aligns with these expectations can help foster better communication and timely payments.

- Ensure compatibility with accounting systems or preferred file formats.

- Choose clean and professional layouts to maintain a positive impression.

How to Add Payment Details

Including payment information in your billing document is essential to ensure smooth transactions and avoid delays. By clearly stating the methods of payment, due dates, and any other relevant instructions, you provide your clients with everything they need to settle their balances without confusion.

Step 1: Specify Payment Methods

First, decide which payment methods you will accept. Whether it’s bank transfers, online payment systems, or checks, make sure to include the necessary details such as account numbers or links. This will ensure your client has no trouble making the payment in the preferred manner.

| Payment Method | Details |

|---|---|

| Bank Transfer | Bank name, account number, and routing code |

| PayPal | Your PayPal email address or link |

| Check | Payable to: [Your Name/Business Name] |

Step 2: Set Clear Payment Terms

Along with payment methods, it’s important to specify the due date and any late fees if applicable. You can also include early payment discounts, if offered. Clear payment terms ensure there are no misunderstandings regarding when and how the client should make the payment.

| Payment Terms | Details |

|---|---|

| Due Date | Specify the exact due date (e.g., 30 days from the date of issue) |

| Late Fee | State any charges for overdue payments (e.g., 5% of total after 30 days) |

| Discount | Offer a discount for early payment (e.g., 10% off if paid within 7 days) |

Ensuring Accurate Tax Calculations

Properly calculating taxes is a critical component of any financial document. Accuracy in tax calculation not only ensures compliance with local laws but also helps build trust with clients. Understanding how to calculate and apply the correct tax rate for your products or services is essential to avoid errors and potential legal issues.

Step 1: Determine the Correct Tax Rate

The first step in ensuring accurate tax calculations is identifying the appropriate rate based on your location and the nature of your business. Different regions have varying tax rates, and some products or services may be exempt or subject to special tax categories. Research local tax laws or consult with an accountant to ensure you’re using the correct percentage.

Example: Sales tax rates may vary from state to state, and certain items may be taxed differently, such as food or medical supplies.

Step 2: Apply the Tax to the Total Amount

Once you have determined the correct rate, it’s time to apply it to the subtotal of the charges. To do this, multiply the subtotal by the tax rate, and ensure the result is clearly listed on the document. It’s also important to break down the tax amount separately from the total due, so clients can easily understand the charges.

| Item | Amount |

|---|---|

| Product A | $100 |

| Sales Tax (5%) | $5 |

| Total | $105 |

Tip: Some accounting tools and software can automatically calculate taxes, helping ensure that you stay compliant with tax laws.

Why Free Templates Are Perfect for Small Businesses

Small businesses often need to balance a tight budget while ensuring their financial documentation is both professional and accurate. Using pre-designed solutions can be a game changer, providing a cost-effective way to maintain high standards without the expense of custom designs or paid tools. These solutions allow small business owners to focus more on growing their businesses rather than spending valuable time on document creation.

Cost-Effective Solution

For small businesses, minimizing costs is essential. Using ready-made options significantly reduces the need for hiring a designer or investing in expensive software. This cost-saving approach can be applied across various business areas, helping entrepreneurs maintain their financial stability while still looking professional in their operations.

- No upfront costs

- No ongoing subscription fees

- Access to various formats and styles

Time-Saving Convenience

Creating detailed and accurate financial documents can take a lot of time. Pre-made options simplify the process by providing a structure that only requires the addition of specific details. This streamlines the task and allows business owners to focus on other critical tasks.

- Quick customization with business details

- Ready to use in minutes

- No need to design from scratch

For small business owners, these solutions are not only a way to save money but also a time-efficient approach to maintaining professional documentation that reflects their business’s credibility.

Best Invoice Templates for Freelancers

Freelancers often juggle multiple projects and clients, making it essential to have efficient tools that help manage their business operations. When it comes to billing, using a well-structured document can make a big difference in ensuring timely payments and maintaining a professional image. The right design can also help freelancers avoid confusion and make it easier for clients to understand the breakdown of services and charges.

Minimalistic Design: A clean and simple layout is ideal for freelancers who want to keep things straightforward. These designs typically focus on the essentials, such as service descriptions, pricing, and due dates, without unnecessary clutter. A minimalistic approach ensures clarity and easy navigation for clients.

Professional Look: Professional templates convey trustworthiness. Look for layouts that are polished, include branding options (such as a logo), and are easy to customize with personal details. This can help build your brand identity and set you apart in competitive markets.

Key Features to Look For

- Customizable Fields: Ensure the document allows easy entry for services rendered, payment terms, and other important client details.

- Clear Payment Instructions: It’s essential to include detailed instructions for clients on how to make payments to avoid delays.

- Tax Calculation: Make sure the document has a field for applying applicable taxes to ensure accuracy in final amounts due.

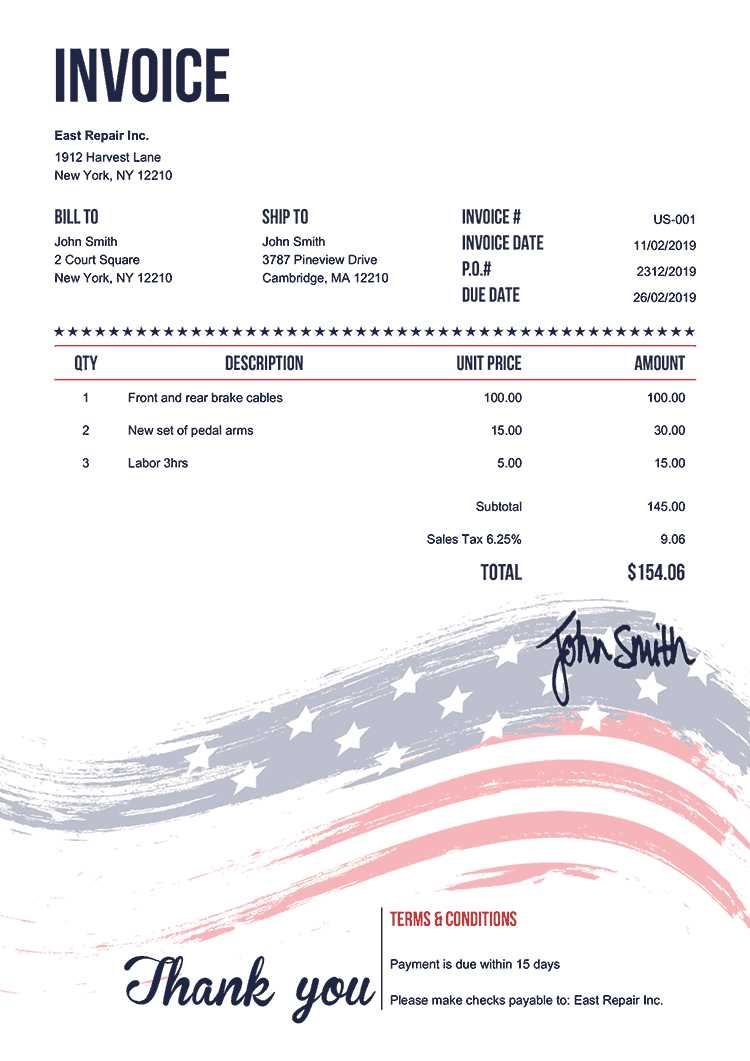

Popular Styles

- Modern and Clean: Often used by creative freelancers, with bold fonts and a sleek design.

- Classic and Professional: Typically used by consultants or service providers who want to maintain a formal, traditional look.

Choosing the right document layout can simplify billing processes and reflect a freelancer’s professionalism, ensuring clients are satisfied with both the work and the billing experience.

Key Features of a Good Invoice

Creating a professional document that reflects accurate charges and terms is crucial for businesses of all sizes. A well-structured record not only helps in maintaining clarity but also ensures prompt payments. The key to an effective document lies in the details it presents and the ease with which clients can understand the billing process.

Essential Elements

A well-organized record should include several important features that make it both professional and functional. Below is a table summarizing the critical components every document should have:

| Feature | Description |

|---|---|

| Contact Information | Both the business and client’s name, address, and contact details should be clearly stated to avoid confusion. |

| Invoice Number | Each document should have a unique identifier for easy reference and tracking. |

| Itemized List of Services | A detailed breakdown of services or products provided, including individual costs and quantities, ensures transparency. |

| Payment Terms | Clear terms regarding payment methods, due dates, and any late fees should be specified. |

| Tax Information | Properly calculated taxes should be listed, especially in regions where they apply. |

| Total Amount Due | The total sum to be paid, including taxes, should be clearly highlighted at the bottom of the record. |

Additional Features

- Due Date: A clear indication of when the payment is expected helps prevent delays.

- Branding: Including your business logo and color scheme can enhance professionalism.

By including these essential elements, businesses can ensure that their financial documents are both clear and comprehensive, which ultimately aids in maintaining a smooth and professional relationship with clients.

Common Mistakes to Avoid in Invoices

While creating financial documents, it’s easy to overlook certain details that can lead to confusion, delayed payments, or even disputes. Understanding the common mistakes to avoid can help businesses ensure that their billing is clear, professional, and efficient. By paying attention to these potential pitfalls, companies can maintain positive client relationships and streamline their payment processes.

Frequent Errors to Watch Out For

Below are some of the most common mistakes made when preparing billing records and how to avoid them:

| Mistake | Explanation |

|---|---|

| Incorrect or Missing Contact Details | Failing to include the correct business or client information can lead to communication issues. Ensure both addresses and contact information are accurate. |

| Unclear Payment Terms | Vague terms about due dates, payment methods, or late fees can cause confusion. Clearly state when and how payments should be made. |

| Lack of Unique Reference Number | Without a unique identifier, tracking and referencing documents becomes difficult. Assign a unique number to each record. |

| Failure to Itemize Charges | Not breaking down the services or products provided can cause misunderstandings. List each item with its cost and quantity. |

| Omitting Tax Information | If taxes are applicable, leaving them out can lead to disputes. Ensure tax rates are included and clearly calculated. |

Additional Pitfalls

- Incorrect Calculations: Double-check the math, especially for total amounts and tax computations.

- Unclear Formatting: A cluttered or hard-to-read document may frustrate clients. Use clean, easy-to-understand layouts.

By avoiding these common mistakes, businesses can create clear, professional billing documents that encourage timely payments and foster good relationships with their clients.

Where to Find Reliable Free Templates

When looking to streamline your billing process, finding trustworthy and well-designed documents can make a significant difference. There are various online sources that offer easy-to-use resources, helping businesses save time and reduce the effort involved in creating professional records. However, it’s important to choose reputable sites to ensure the materials are both functional and secure for business use.

Trusted Websites Offering Resources

Here are some popular platforms where you can find high-quality documents to suit your business needs:

- Business Resource Websites: Many websites dedicated to business tools offer a wide variety of downloadable documents. These sites often provide professional-looking options tailored to different industries.

- Document Sharing Platforms: Websites where individuals and companies share their work can be a great resource. Make sure to choose those with user reviews or ratings to ensure quality.

- Online Office Suites: Popular office software providers often offer easy access to various record-keeping documents. These platforms might include built-in options to customize templates according to your specific needs.

- Freelancer and Entrepreneur Blogs: Many freelancers and small business experts share their tools and resources on blogs. These often include step-by-step guides on customizing and using such documents for your business.

Considerations When Downloading

While finding a wide range of options, it’s important to verify the credibility of the source to avoid poorly formatted or potentially insecure resources. Always check reviews, ratings, and the reputation of the site before downloading anything.

How to Save Time with Templates

Efficiency is key for any business, and streamlining administrative tasks like record-keeping can free up time for more important work. Using pre-designed documents can significantly cut down on the time it takes to create accurate and professional records. By leveraging these ready-made resources, you can avoid repetitive work and reduce errors in your billing process.

- Instant Setup: With ready-made formats, there is no need to start from scratch. Simply fill in the necessary details and save time on formatting and layout decisions.

- Consistency in Design: Using a standardized layout ensures that all your documents look professional and cohesive, which is important for brand recognition and client trust.

- Quick Customization: Most pre-made documents allow easy modification. You can quickly add your business details and personalize them without the need for design skills.

- Error Reduction: These resources often come with built-in fields and calculations, reducing the risk of errors in the billing process. This ensures more accurate records with minimal effort.

- Focus on Core Activities: By automating the creation of business records, you can focus more on your core activities and grow your business without getting bogged down in paperwork.

By utilizing these tools, you not only save time but also improve the efficiency and accuracy of your processes, helping your business run smoother and more professionally.

Integrating Invoice Templates with Accounting Software

Seamless integration of billing documents with accounting platforms can transform the way businesses manage their financial operations. By connecting these resources to your financial management system, you can enhance efficiency, accuracy, and overall productivity. This streamlined approach allows for better tracking of transactions and simplifies the reconciliation process.

Benefits of Integration

Utilizing ready-made documents alongside accounting software offers several advantages:

- Automated Data Entry: Reducing manual input minimizes the risk of errors and saves time, as information can be automatically transferred from the billing documents to your financial system.

- Real-Time Updates: When you create or modify a billing document, changes are instantly reflected in your accounting records, ensuring you always have the most current data at your fingertips.

- Enhanced Reporting: Integrating these resources allows for improved reporting capabilities, as you can easily analyze financial data based on your transactions.

Steps to Integrate

To successfully integrate billing documents with your accounting software, follow these steps:

- Select Compatible Software: Ensure that your accounting platform supports integration with the document resources you intend to use.

- Follow Integration Guidelines: Refer to the software’s documentation for detailed instructions on how to link the two systems.

- Test the Integration: After connecting, perform test transactions to ensure that data flows accurately between the systems.

By incorporating these strategies, businesses can achieve a more organized financial workflow, enabling them to focus on growth and customer satisfaction.

Understanding Legal Requirements in Invoices

Being aware of the legal obligations associated with billing documents is essential for any business. These requirements not only ensure compliance with tax regulations but also protect the rights of both the seller and the buyer. Properly structured documentation serves as a vital record in case of disputes and audits, providing necessary evidence of transactions.

Different jurisdictions may have varying regulations regarding the information that must be included in these documents. Commonly required elements include the date of the transaction, detailed descriptions of goods or services provided, pricing, and payment terms. Additionally, it’s important to include the seller’s and buyer’s contact information, tax identification numbers, and any applicable taxes.

Businesses should also stay updated on changes in legislation that may impact their billing practices. Regularly reviewing local laws and consulting with a legal expert can help ensure that your documentation meets all necessary requirements, thus minimizing the risk of potential legal issues.

How to Track Payments Using Templates

Monitoring payments is crucial for maintaining healthy cash flow and ensuring that financial records are accurate. Utilizing structured documents can simplify this process, making it easier to keep track of incoming funds and outstanding balances. By incorporating specific sections dedicated to payment tracking, businesses can streamline their financial management.

Essential Elements for Tracking

When creating billing documents, consider including the following elements to enhance payment tracking:

- Payment Due Dates: Clearly indicate when payments are expected to avoid misunderstandings.

- Payment Status: Include a section to note whether a payment is pending, completed, or overdue.

- Transaction References: Provide unique identifiers for each transaction, making it easier to match payments with records.

- Notes Section: Use this area to document any relevant communication regarding payments.

Using Tools for Enhanced Tracking

Many software solutions allow for easy integration of billing documents with payment tracking features. By utilizing these tools, businesses can automate reminders for overdue payments, generate reports on payment history, and maintain a clear overview of their financial standing. This not only saves time but also reduces the chances of errors in manual tracking.

Creating Professional Invoices Without Effort

Generating polished billing documents can be a straightforward task when using the right approach. With the appropriate resources and a bit of organization, individuals and businesses can produce elegant statements that reflect their professionalism. Streamlining the process not only saves time but also enhances the overall impression on clients.

One effective strategy is to utilize organized formats that allow for easy customization. Start by defining the essential components that should be included in each statement, such as contact information, itemized services, and payment instructions. This structured approach ensures consistency across all documents.

Consider the Following Tips:

- Consistency: Use a uniform layout and design that aligns with your brand identity, reinforcing recognition.

- Simplicity: Avoid cluttering your documents with unnecessary details; clarity is key to effective communication.

- Automation: Leverage software that can pre-fill recurring details, minimizing repetitive tasks.

- Review and Adjust: Regularly assess your process and make adjustments based on feedback or changing needs.

By implementing these strategies, anyone can efficiently produce high-quality billing documents that leave a lasting impression on clients, ensuring smooth transactions and fostering professional relationships.