Free Downloadable Invoice Template for Services

Managing client payments can often be a complex task, especially for independent contractors and small business owners. The need for accurate, professional documents to request compensation is crucial in maintaining a smooth workflow and ensuring timely payments. Using the right tools can simplify this process, reducing the risk of errors and enhancing efficiency.

Having a well-structured document that clearly outlines payment expectations is a must for any professional. With the right format, you can easily track your work, specify the agreed-upon amounts, and avoid misunderstandings with clients. Whether you’re just starting out or looking to streamline your operations, knowing how to create and personalize these documents is a key step toward success.

Why Use a Free Invoice Template

When managing your business’s financial transactions, having a reliable document format can save you time and reduce errors. Instead of creating a new bill from scratch each time, using a pre-designed structure simplifies the process and ensures consistency. This not only helps in maintaining a professional appearance but also improves efficiency in your workflow.

Choosing an accessible and customizable solution eliminates the need for expensive software or complicated setups. By having a ready-made document that you can quickly modify for each client, you can focus on what really matters–delivering excellent work and ensuring timely payments. Whether you’re an entrepreneur or a freelancer, using such a tool streamlines the entire billing process.

Moreover, these tools typically include all the necessary sections that clients expect to see, reducing the likelihood of missing important information. Features such as space for project details, payment terms, and tax calculations are often built in, making it easier to comply with business standards and legal requirements.

How Invoice Templates Save Time

Time is a valuable resource, especially for small business owners and freelancers who juggle multiple tasks. One of the most time-consuming activities is creating documents to request payment from clients. Having a ready-made structure significantly cuts down on the time spent on repetitive tasks, allowing you to focus on other aspects of your work.

By using a pre-designed format, you no longer need to manually input the same details every time, such as your business information, payment terms, or the general layout. This not only saves you time but also reduces the chances of mistakes in the document, ensuring that you don’t waste time correcting errors or chasing down missing details.

Key Time-Saving Features

Ready-made billing documents often come with all the essential sections, allowing you to simply fill in client-specific data. This streamlining process can help reduce the preparation time drastically, as shown in the table below:

| Manual Process | Using a Pre-Designed Structure |

|---|---|

| Inputting business and client details every time | Pre-filled business details, only client info needs updating |

| Formatting document layout | Standardized format that requires minimal adjustments |

| Including payment terms and tax calculations | Automatic fields for terms and tax, pre-calculated |

| Checking for missing details or mistakes | Minimal errors due to preset structure and fields |

Reducing Stress and Increasing Productivity

By cutting down the time spent on administrative tasks, you can increase your overall productivity. This also helps reduce stress, as the process becomes faster and more reliable. With fewer details to worry about, you can focus on your core tasks and maintain a healthy work-life balance.

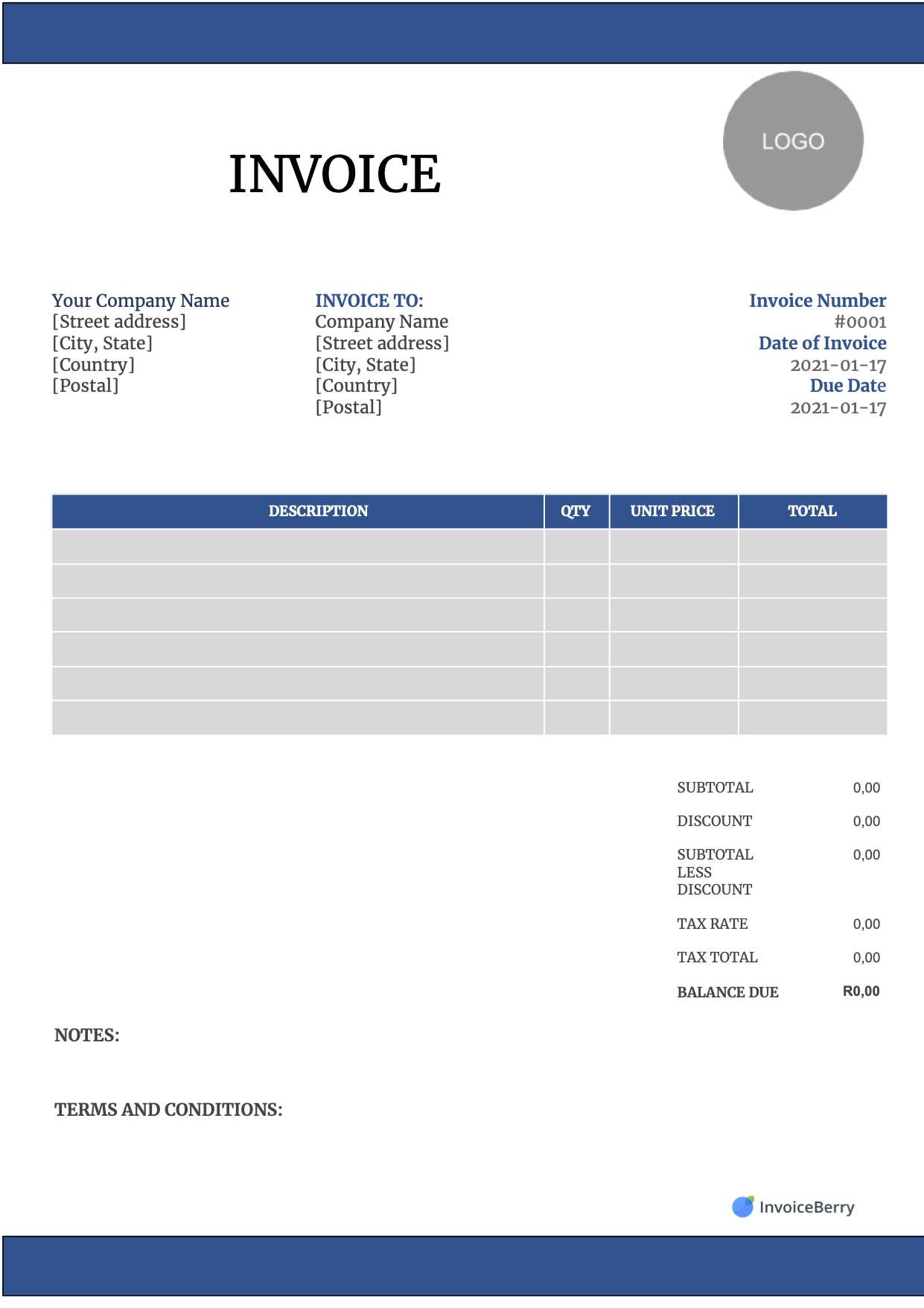

Benefits of Customizable Invoice Templates

Having the ability to adjust billing documents according to your specific needs provides numerous advantages. Customization allows you to create a unique, professional look that reflects your business’s identity while also ensuring all necessary information is clearly presented. This flexibility not only enhances your brand image but also ensures accuracy in every document you send.

One of the key advantages of customizable billing documents is that they can be tailored to accommodate the unique aspects of each project or client. Whether it’s adding additional fields, changing the layout, or incorporating specific terms, customization ensures that you provide all relevant details in a way that makes sense for your business.

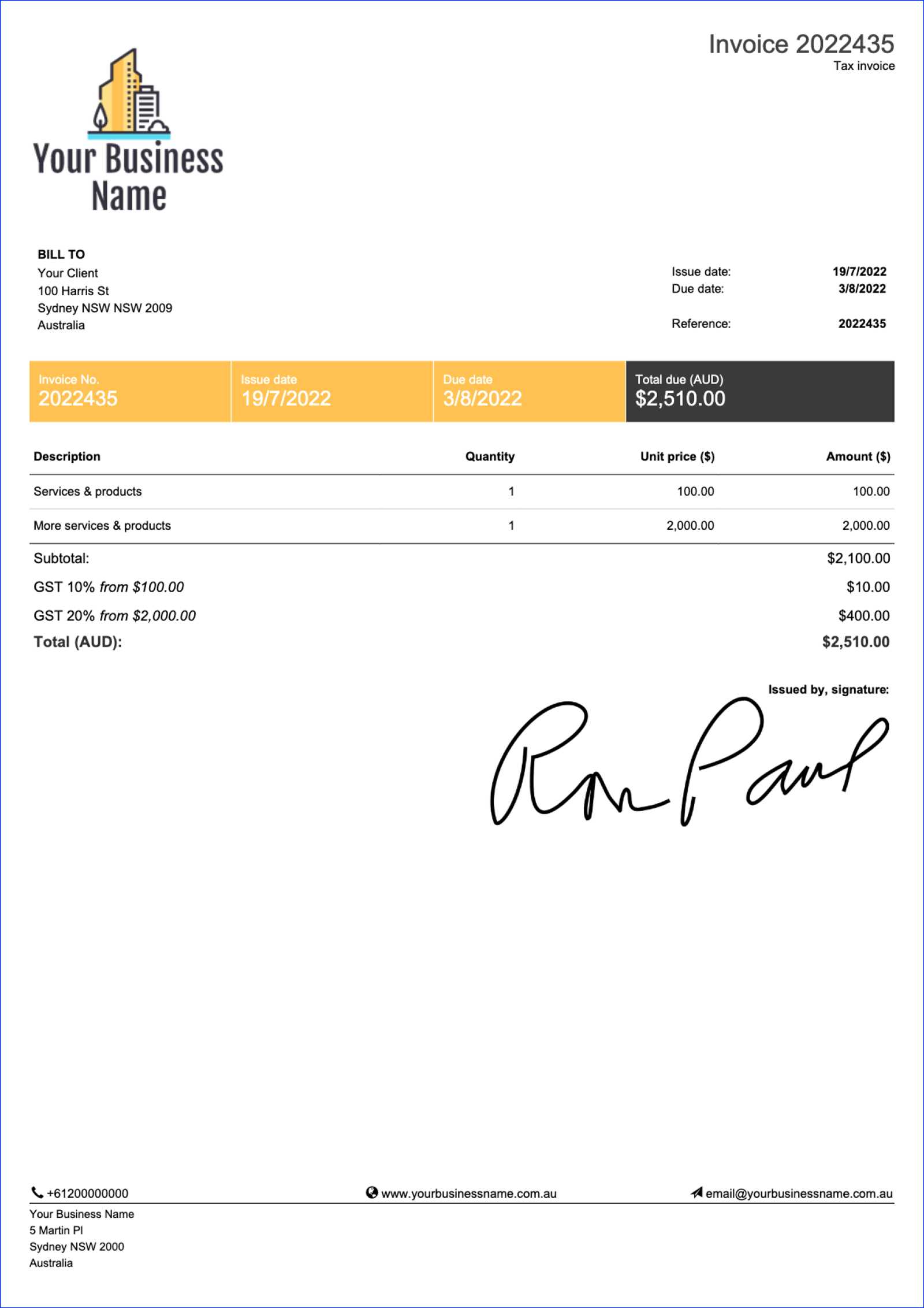

Aligning With Your Brand

With customizable billing options, you can align the design and format with your company’s branding. This includes adding logos, choosing brand colors, and adjusting fonts to create consistency across all your business materials. A professional, branded document adds credibility and shows clients that you take your business seriously.

Improved Accuracy and Flexibility

Customizable options also help eliminate errors by allowing you to include only the information relevant to each transaction. You can easily adjust payment terms, item descriptions, or tax rates based on the specific work done, ensuring your bills reflect the agreed-upon terms. This flexibility also allows for quick modifications without starting from scratch each time.

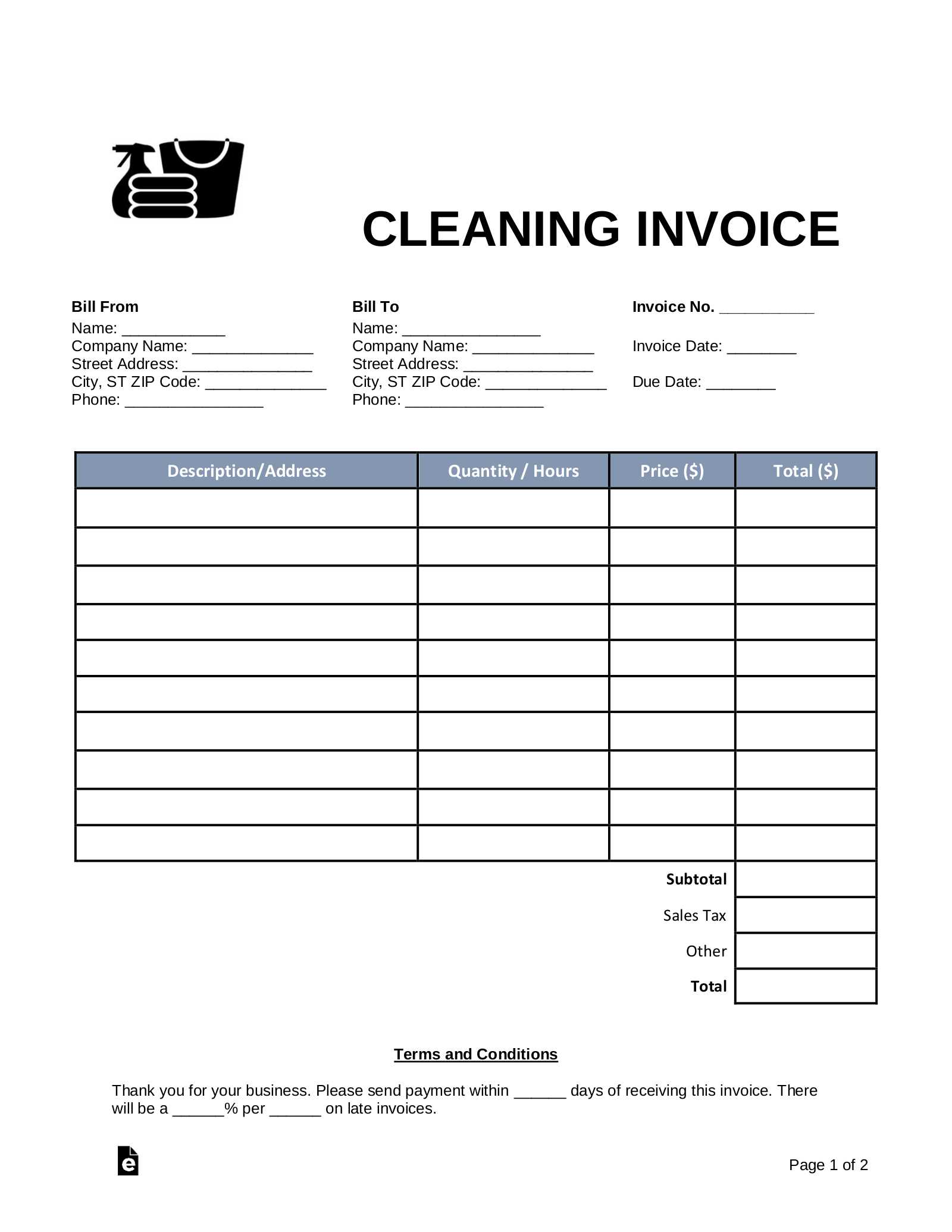

Essential Features of an Invoice Template

A well-designed billing document should contain several key components to ensure clarity and accuracy. These elements not only help in providing the necessary details for payment but also ensure that both the sender and the recipient have a clear understanding of the terms of the transaction. Whether you’re working with long-term clients or one-off projects, the following features are essential in any effective document.

At the core of every effective billing document is the inclusion of your business details, the client’s information, and a comprehensive breakdown of the goods or work delivered. Having a space to list these components clearly prevents confusion and ensures the recipient understands what they are being billed for, along with the associated costs. Additionally, clear payment instructions and deadlines are crucial to avoid delays in settlement.

Another important aspect is the incorporation of tax information and the total amount due. Proper tax calculations, along with applicable rates, should be included to comply with local regulations and avoid any legal issues. A detailed payment schedule or due date can help maintain cash flow and ensure timely payments from clients.

Step-by-Step Guide to Using an Invoice

Creating a professional document to request payment might seem complicated, but it’s actually a straightforward process when you follow a few simple steps. By breaking down the task into manageable parts, you can ensure that your document is accurate, clear, and ready for your client. This guide will walk you through each step, making the process easy and efficient.

Step 1: Include Business and Client Details

The first thing you need to do is enter your business information and the client’s details. This includes your name or company name, contact details, and payment address. On the client’s side, include their full name, company (if applicable), and billing address. Having this information clearly listed at the top of the document ensures that the correct parties are identified, and there’s no confusion about who is responsible for payment.

Step 2: Add Service Details and Costs

Next, you should list all the work provided, along with a description of the services rendered and the corresponding costs. It’s important to break down each task or item clearly, so the client understands exactly what they’re being charged for. Each entry should include a quantity, unit price, and total amount. This breakdown helps ensure transparency and reduces the likelihood of disputes over charges.

Step 3: Specify Payment Terms and Due Date

Once the work and amounts are outlined, it’s essential to include payment terms and a due date. This section should specify when the client is expected to pay and whether any late fees will apply. Clear terms help set expectations and encourage timely payment.

Step 4: Review and Send

Finally, double-check all the details to make sure everything is accurate before sending the document. Once you’ve confirmed the amounts and client information, you can either send the document via email or print and mail it, depending on your preferred method of communication.

Where to Find Free Invoice Templates

When it comes to creating billing documents, there are plenty of options available to access ready-made formats that you can use without any cost. Whether you’re just starting your business or need a quick solution for a client, finding a reliable document is easier than ever. Many online platforms provide tools and pre-designed structures that can be downloaded or customized according to your needs.

Online Document Platforms

One of the best places to find customizable billing formats is through online document platforms. Websites like Google Docs, Microsoft Office Online, and others offer free access to various document types, including payment requests. These services often allow you to edit the structure in real-time and save it for later use. This flexibility is ideal for those who want a fast and convenient way to generate documents.

Accounting and Finance Websites

Many accounting and financial websites offer downloadable options for creating professional billing statements. These platforms cater to businesses of all sizes and often include additional features, such as expense tracking or tax calculations, which can be helpful when managing finances. Some of these resources allow for basic editing, so you can easily adapt the format to your own business needs.

Free vs Paid Invoice Templates: What’s Better

When it comes to creating billing documents, businesses often face the decision between using a no-cost solution or opting for a paid version. Both options have their advantages and drawbacks, and the right choice depends on your specific needs. Some people prefer free options due to the absence of initial costs, while others opt for paid versions because they offer advanced features and greater customization.

Advantages of No-Cost Options

Free options typically offer simplicity and accessibility, making them ideal for small business owners or freelancers just starting out. They can quickly generate basic documents without the need for software installation or complex setup. For many, these basic features are more than enough to fulfill the task at hand.

Benefits of Paid Solutions

On the other hand, paid solutions often come with additional features that can help streamline the billing process. These may include advanced customization, automated tax calculations, integration with accounting software, and enhanced security. For businesses that require a high level of detail or want a more professional presentation, a paid option can provide a significant advantage.

| Feature | No-Cost Solution | Paid Solution |

|---|---|---|

| Customization Options | Limited | Extensive |

| Automation | Manual | Automated (tax calculations, reminders) |

| Integrations | None | Accounting software, payment gateways |

| Professional Design | Basic | Customizable, professional layout |

| Support | Community-based | Customer support |

Ultimately, the choice between free and paid options depends on the size and nature of your business. If you’re a freelancer with a limited client base and minimal needs, a free option may suffice. However, if you’re running a larger operation or require more features, investing in a paid solution might be the better long-term decision.

How to Customize an Invoice Template

Customizing a billing document is a simple but crucial step to ensure that it aligns with your business’s needs and reflects your professional image. Whether you’re adjusting the layout or adding specific terms, personalization helps you maintain consistency across all communications with clients. This guide will walk you through the key customization steps to make your document uniquely yours.

Step 1: Edit Business Information

One of the first things to change is the business information section. This typically includes your company name, logo, contact details, and address. Here’s what you should do:

- Add your company name and logo for branding.

- Enter your contact details, including phone number and email address.

- Include your business address to help clients identify your location.

Step 2: Modify Client Information

The next step is adjusting the client’s details. This ensures the document is accurate and personalized. Follow these steps:

- Enter the client’s name or company name.

- Provide the billing address to avoid confusion.

- Include any relevant reference number or order ID for better tracking.

Step 3: Adjust Payment Details

After updating the client’s information, you should focus on the payment section. Customizing this ensures that your client understands exactly what they are being charged for. Here’s how:

- List the specific tasks, services, or products provided.

- Indicate the quantity and price for each item.

- Adjust the tax rate, if applicable, based on your location or industry standards.

- Set the payment due date and terms (e.g., late fees or discounts for early payment).

Step 4: Add Personal Notes or Instructions

Finally, you can include any special instructions or notes at the bottom of the document. These can be anything from a thank-you note to a reminder about payment policies.

- Add a “thank you” message to build customer relationships.

- Include payment methods accepted (bank transfer, PayPal, etc.).

- Provide any additional information that may be helpful for the client.

Common Mistakes in Invoice Creation

Creating a billing document might seem like a straightforward task, but there are several common errors that can lead to confusion, delayed payments, or even legal issues. Avoiding these mistakes is essential to maintaining a professional image and ensuring that you receive payments on time. Below are some of the most frequent mistakes that can occur when preparing payment requests, along with tips for avoiding them.

| Error | Impact | Solution |

|---|---|---|

| Incorrect Client Information | Delays in payment or disputes due to miscommunication | Double-check client details, including name, address, and contact info. |

| Missing or Wrong Dates | Confusion over payment deadlines | Ensure that both the issue date and due date are clearly listed and accurate. |

| Unclear Descriptions of Work | Clients may question charges, leading to delayed payments | Be specific when describing services or products provided and include quantities if applicable. |

| Failure to Include Payment Terms | Late payments and misunderstandings | Always outline payment terms (due date, late fees, etc.) clearly in the document. |

| Not Including Tax Information | Potential legal and financial issues | Always add applicable taxes, including tax rates and amounts due. |

By being mindful of these common errors, you can ensure that your billing documents are accurate, professional, and clear. This will not only help maintain positive relationships with clients but also avoid unnecessary delays in payment processing.

Types of Invoices for Service Providers

When it comes to requesting payment, different businesses and industries may require different formats or structures. Depending on the type of work you do, the way you present your billing request can vary. Understanding the different types of payment documents available can help ensure that you choose the most appropriate one for your situation and maintain professionalism with your clients.

Standard Billing Statement

The most common type of billing document is the standard one-time request, often used for completed projects or services rendered in a single transaction. This format includes details like the work description, total amount due, and payment terms. It’s straightforward and easy to understand, making it ideal for one-off or short-term projects.

Recurring Payment Requests

For long-term engagements, such as monthly retainer agreements or ongoing support contracts, recurring billing is often used. This document type can be sent periodically, typically on a weekly, monthly, or quarterly basis, with the same terms and amounts due each time. Customizing this type of document to automatically reflect payment intervals can help clients stay on track with payments without having to create a new request each time.

Progress or Milestone-Based Billing

When working on large projects, it’s common to request payments based on specific milestones or phases of completion. This structure allows you to bill as certain portions of the work are completed, which helps maintain cash flow during longer-term projects. Each milestone invoice will reflect the portion of the work completed and the amount due, helping clients understand the progress of the project.

Time-Based Billing

For service providers who charge hourly or daily rates, time-based billing is often the most appropriate choice. This type of document includes detailed time logs that show the number of hours worked, the hourly rate, and the total amount due. It’s particularly useful for freelancers, consultants, or anyone offering services on an hourly basis.

Understanding Different Invoice Formats

In the world of billing and payments, there are various document formats that can be used depending on the nature of the transaction and the specific needs of your business. Each format serves a different purpose and can be tailored to match the structure of your financial dealings. Understanding the differences between these formats is essential to ensure that you’re using the right one for every situation.

Common Formats Used in Billing Documents

There are several widely recognized formats that businesses use when issuing payment requests. Each format can be adjusted to accommodate specific business needs, but it’s important to know which one is best suited to your industry and the type of work you do. Below are some of the most common types:

| Format Type | Description | When to Use |

|---|---|---|

| Simple Payment Request | A basic format that includes a list of items or services provided, along with the total amount due. | Use for one-time or straightforward transactions with minimal complexity. |

| Recurring Billing | This format includes the same charges for each period (monthly, quarterly, etc.), often with automatic renewal. | Ideal for subscription-based services or ongoing projects where the charges remain the same. |

| Pro Forma | A preliminary document sent to the client before the actual payment request, often used to outline expected charges. | Use when you need to give clients an estimate or provide advanced notice before issuing the final bill. |

| Time-Based Billing | A format where the charges are based on the amount of time spent on a task or project, such as hourly or daily rates. | Perfect for consultants, freelancers, or any service providers who charge by the hour. |

Choosing the Right Format

Each type of billing document is suited to different circumstances, and choosing the right format depends on your business model and the nature of the work. For instance, a recurring billing format is ideal for ongoing services, while a simple payment request works well for one-off tasks. Understanding these formats will help streamline your financial processes and ensure that your clients are clear on the charges and expectations from the beginning.

Legal Requirements for Service Invoices

When preparing a billing statement, it’s important to ensure that it complies with the legal standards and regulations that apply to your region or industry. Certain information must be included to make the document valid and enforceable. Failing to meet these requirements can lead to confusion, delayed payments, or even legal complications. Understanding the mandatory components of a payment request can help protect your business and ensure timely transactions.

Essential Information to Include

In most jurisdictions, there are specific details that must be present in a legally binding payment document. These include:

- Business Identification: Include your company name, legal address, and tax identification number (TIN) to verify your business.

- Client Information: Ensure the client’s name, address, and any other relevant contact details are included.

- Unique Document Number: Every billing document should have a unique reference number for tracking purposes.

- Description of Work: A clear description of the work or products provided is essential for transparency.

- Dates: Include the date the work was completed or delivered and the payment due date.

- Tax Information: If applicable, list the tax rates and total tax charged on the amount due.

- Total Amount: The final amount owed should be clearly stated, along with a breakdown of any charges.

Additional Legal Considerations

Depending on the country or state, there may be additional legal considerations. For example, certain jurisdictions require invoices to specify payment terms, such as late fees or discounts for early payment. In some cases, businesses may also need to provide specific language regarding the collection of debt or credit terms, especially for larger transactions. Always stay informed about the local laws to ensure compliance.

By meeting these legal requirements, you can avoid potential disputes and make your billing process smoother and more professional.

How to Add Taxes to Your Invoice

When creating a billing document, it’s essential to include the correct tax information. Adding taxes ensures that both you and your clients are in compliance with local laws and regulations. Properly applying tax rates can prevent misunderstandings and keep your business operations transparent and professional. This section will guide you on how to calculate and add taxes to your payment request accurately.

Understanding Tax Rates and Categories

Before adding taxes to your document, it’s important to understand which tax rates apply to your specific industry and region. Depending on your location, the tax rate may vary, and you may need to consider whether you’re required to charge sales tax, value-added tax (VAT), or other applicable fees. Make sure to research the tax regulations in your area to ensure you’re applying the correct rate.

Typically, taxes can be categorized into:

- Sales Tax: Applied to goods and certain services, varying by state or country.

- VAT: Common in many countries outside the U.S., this tax is applied to the value added at each stage of production or distribution.

- Service Tax: Applied to professional services in some countries, such as consultancy, legal, or financial services.

Steps to Add Taxes to Your Payment Request

Follow these steps to ensure taxes are added correctly:

- Identify the Applicable Tax Rate: Research and determine the correct tax rate based on your location and the nature of the work you’ve provided.

- Calculate the Tax: Multiply the total amount of your services by the tax rate. For example, if the service cost is $500 and the tax rate is 10%, the tax will be $50.

- Include the Tax Amount: Add the calculated tax amount to the total amount due on the document. Make sure to clearly indicate the tax rate and amount separately from the subtotal.

- Provide Tax Breakdown: For clarity, break down the tax applied in your document. List the tax type, rate, and the amount applied, so your client understands the charges clearly.

| Description | Amount |

|---|