Free Tax Invoice Template for Australia

Managing financial transactions smoothly is a crucial part of running any business. One of the key components in this process is ensuring that the documents you send to clients are clear, professional, and meet all necessary legal requirements. Having the right tools to generate accurate and well-organized billing statements can save time and avoid potential errors. This section explores how to create such documents with ease, providing businesses with everything they need to stay compliant and efficient.

In today’s fast-paced business environment, using well-structured documents helps maintain trust with clients and improves overall workflow. With customizable documents readily available, entrepreneurs and small business owners can focus more on what matters most – growing their business. From detailing services to specifying payment terms, it’s essential to get each part of your paperwork right. Below, we highlight the benefits of having access to flexible options that can be tailored to your specific needs.

Effective Billing Documents for Your Business

Having reliable and professional billing documents is essential for maintaining smooth financial operations. When it comes to managing payments, it’s important to have the right structure in place to ensure accuracy and compliance with local regulations. By utilizing customizable documents, businesses can streamline their accounting processes, saving valuable time and reducing the risk of errors. This section will explore how you can easily access and personalize these documents for your specific needs.

Why Use Customizable Billing Solutions?

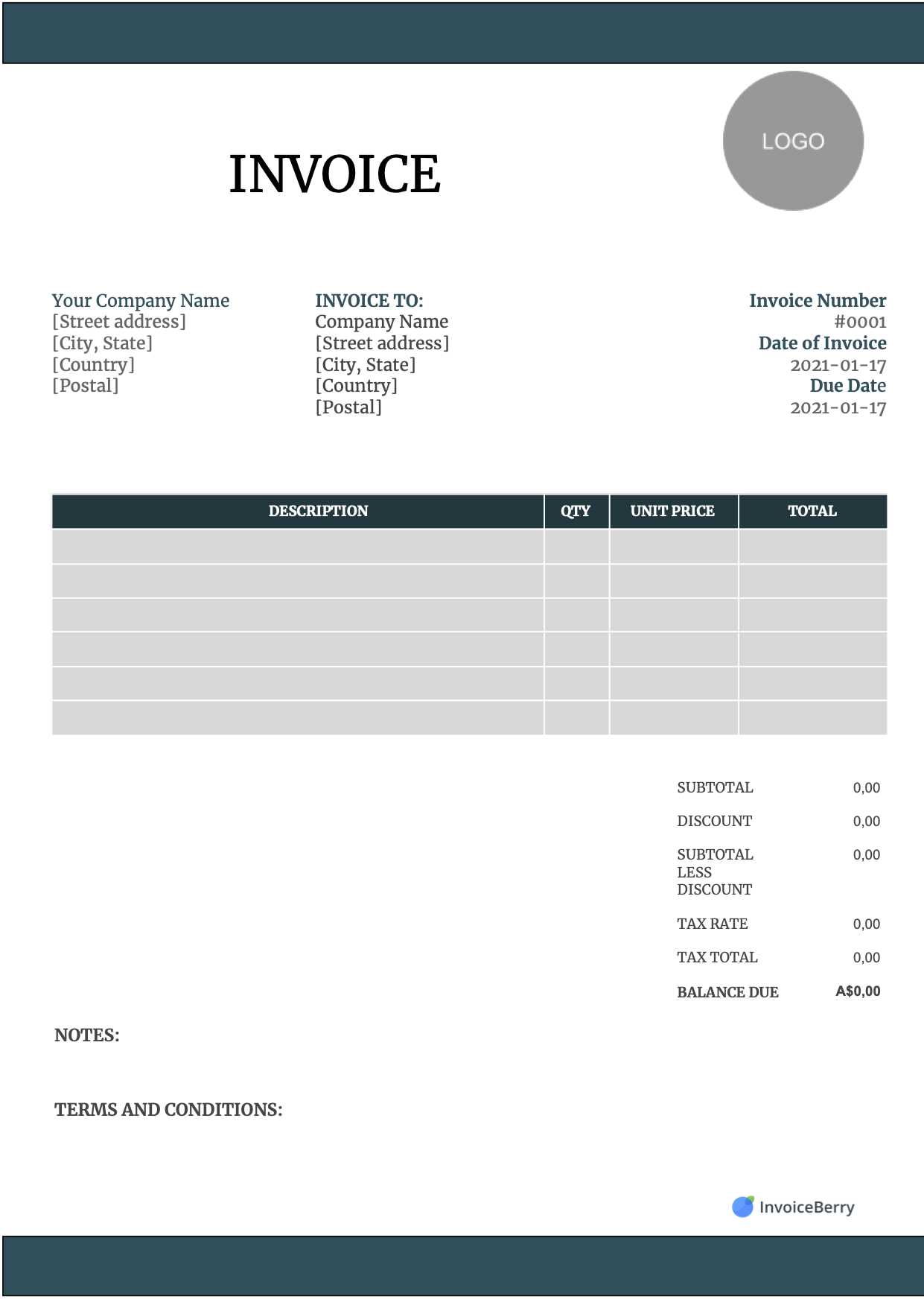

Customizable billing solutions allow you to adjust the format and details according to your business’s requirements. This flexibility ensures that your clients receive clear, well-structured documents that outline the services provided, the payment due, and any relevant terms. With the ability to include your business information, logo, and specific payment instructions, you can create documents that reflect your company’s professionalism and style.

How to Customize Your Billing Documents

When you download a ready-made billing document, you have the option to fill in key information such as client details, services rendered, and amounts due. Many platforms offer easy-to-use formats that enable you to adjust the layout and design. Whether you’re handling one-time transactions or recurring payments, these tools ensure that you meet all necessary legal requirements while maintaining a polished appearance for your communications. Simply enter the required fields and your document is ready to send.

Incorporating essential details, such as business name, ABN (Australian Business Number), and payment terms, helps to create a document that meets all professional standards. These documents not only serve as a request for payment but also act as a record for your financial transactions.

Why Use a Billing Document Format?

Having a consistent and organized method for generating financial statements is essential for any business. A structured format simplifies the process of creating professional and legally compliant documents that clearly outline the terms of transactions between you and your clients. Using a predefined structure can save valuable time, reduce errors, and ensure that every necessary detail is included in each document.

Streamlining the Billing Process

By using a ready-made document format, businesses can quickly generate detailed records for every transaction. This reduces the time spent manually designing each document and ensures consistency across all communications. Additionally, this approach helps avoid missing crucial information that could lead to misunderstandings or payment delays. It’s a simple yet effective solution for maintaining accurate financial records.

Ensuring Professionalism and Compliance

A standardized document format enhances your business’s professional image. It shows clients that you are organized and committed to clear communication. Furthermore, such formats are often designed to comply with local regulations, helping you avoid legal issues. Including essential information like payment terms, service descriptions, and due dates ensures that your documents meet both client expectations and legal requirements.

How to Download Billing Document Formats

Finding and downloading the right document format for your business needs is easier than ever. Many online platforms offer a variety of options that can be quickly accessed and customized. These formats are designed to make your billing process more efficient, allowing you to focus on other important aspects of your business. Below is a simple guide to help you get started with downloading the right formats for your financial records.

Step-by-Step Guide

| Step | Action |

|---|---|

| 1 | Visit a trusted website offering document solutions |

| 2 | Select the format that fits your business requirements |

| 3 | Click the “Download” button to get the file |

| 4 | Open the downloaded file and customize it with your details |

| 5 | Save the document and use it for your transactions |

Most websites provide these formats in popular file types like Word, Excel, or PDF, so you can easily open and edit them with software you’re already familiar with. Make sure to review each format carefully to ensure it includes all the necessary fields for your specific business needs.

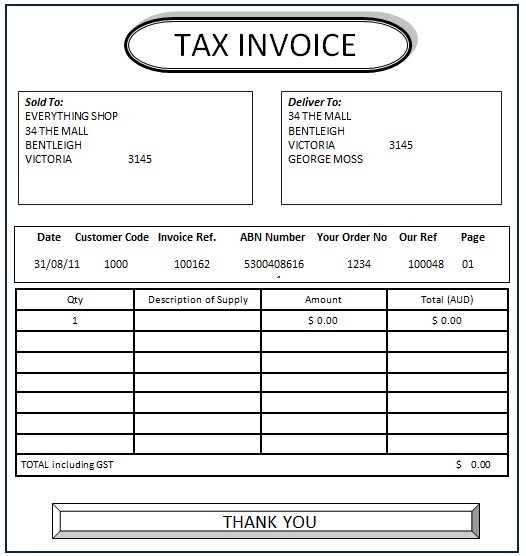

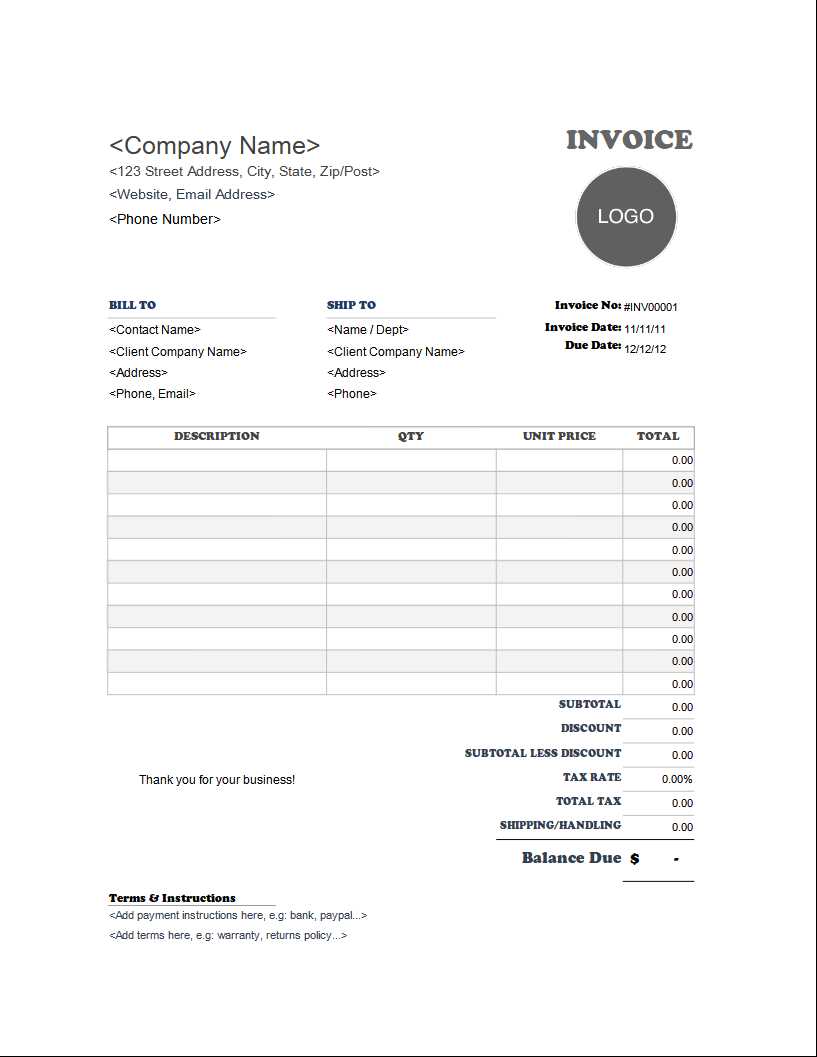

Key Features of Australian Billing Documents

When creating professional financial records, it’s important to ensure that all necessary elements are included for clarity and compliance. In many regions, including Australia, certain details are required by law to validate the document and protect both businesses and clients. Understanding these essential features can help you create documents that are both functional and legally sound. Below, we explore the key components that every well-structured billing document should have.

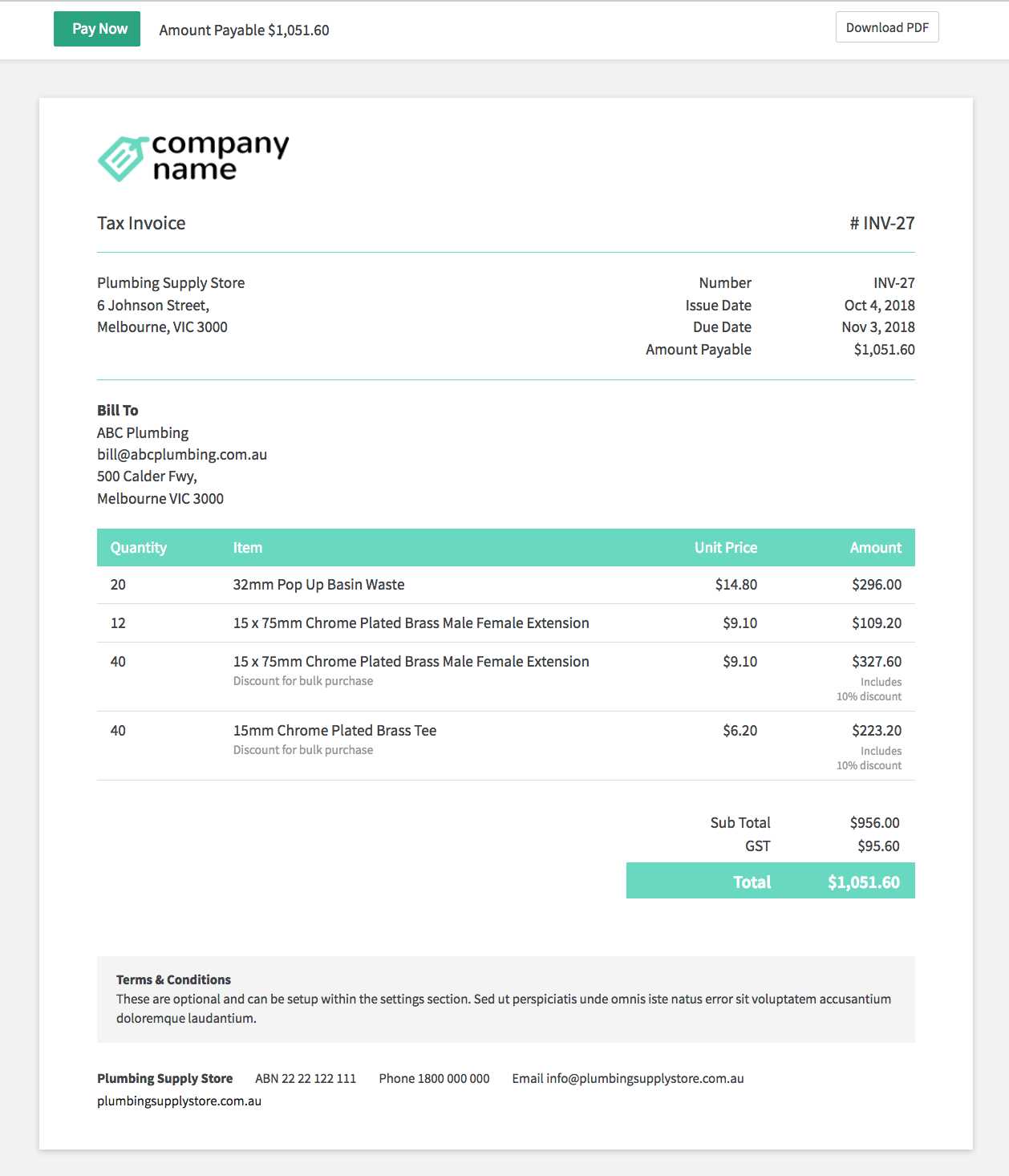

Essential Information to Include

Each billing document must clearly state critical details that identify both the business and the client. Key elements include the business’s name, address, and unique identification number, as well as the customer’s contact information. Additionally, the document should list the products or services provided, along with the corresponding prices and any applicable taxes or fees. A breakdown of these details ensures that both parties are fully informed about the transaction.

Legal and Compliance Requirements

Compliance with local laws is another vital feature of any formal document. In many regions, it is mandatory to include a specific identification number, such as a Business Number (ABN) in Australia, to verify the legitimacy of the transaction. Including accurate payment terms and a due date also ensures that both businesses and clients understand when payment is expected. These legal requirements help businesses stay transparent and avoid any future disputes regarding payments.

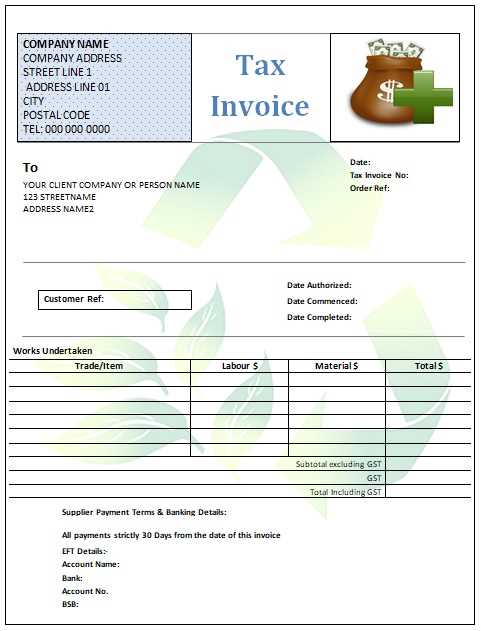

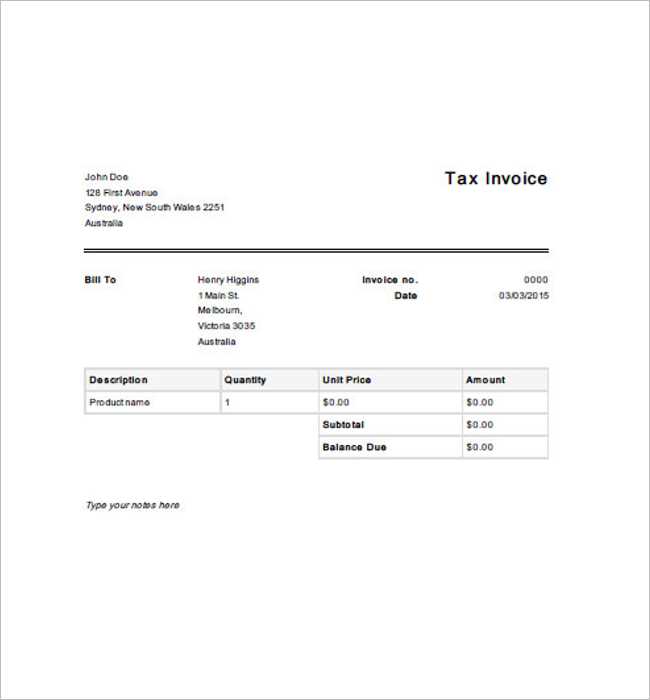

Customizing Your Invoice Template

Creating a document for billing purposes that reflects your business’s identity and meets legal requirements is essential. Customization allows you to tailor the layout, design, and content to suit your specific needs while ensuring clarity and professionalism. Whether you’re adding your company logo, adjusting fonts, or modifying the section for itemized charges, personalizing the structure can enhance its effectiveness and improve customer perception.

The first step in customizing such a document is to ensure that all the necessary fields are present. These may include your business details, client information, a breakdown of services or goods provided, payment terms, and any other legal statements or requirements specific to your region. Once the essentials are covered, you can focus on making the layout visually appealing, keeping it clear, organized, and easy to read.

To make your document truly unique, consider incorporating colors, logos, and fonts that align with your brand. This not only adds a professional touch but also reinforces your brand’s identity. Additionally, you can adjust the placement of elements to create a balanced and aesthetically pleasing design, ensuring that the key information stands out.

Finally, remember to review any local regulations regarding document presentation and information requirements. Customizing the layout is important, but the integrity of the information and adherence to legal standards should always remain the priority.

Common Mistakes to Avoid with Invoices

When preparing documents for payment, it’s easy to overlook certain details that can lead to misunderstandings or delays. Small errors in these documents can cause confusion, missed payments, or legal issues. Being aware of common mistakes can help ensure smooth transactions and maintain professional relationships with clients.

One of the most frequent issues is incorrect or missing contact information. Always double-check that your business details, such as name, address, and contact number, are accurate and up to date. Similarly, ensure the recipient’s information is correct to avoid any miscommunication or delivery issues.

Failure to specify clear payment terms is another common pitfall. Without clear instructions on when and how payments should be made, clients may be unsure of your expectations. Be sure to include payment due dates, acceptable methods of payment, and any penalties for late payments to avoid unnecessary disputes.

Another mistake is leaving out a detailed breakdown of services or products. Failing to list items or services with clear descriptions, quantities, and prices can create confusion and potentially delay payment. A transparent and itemized list makes it easier for clients to understand what they are paying for and speeds up the approval process.

Lastly, not numbering your documents sequentially can lead to disorganization, especially when keeping track of payments or dealing with multiple clients. Properly numbering each document ensures both you and the client can easily refer to and track past transactions.

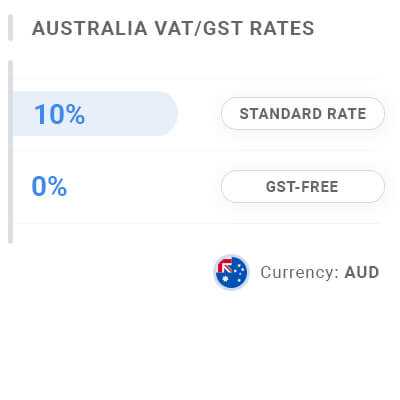

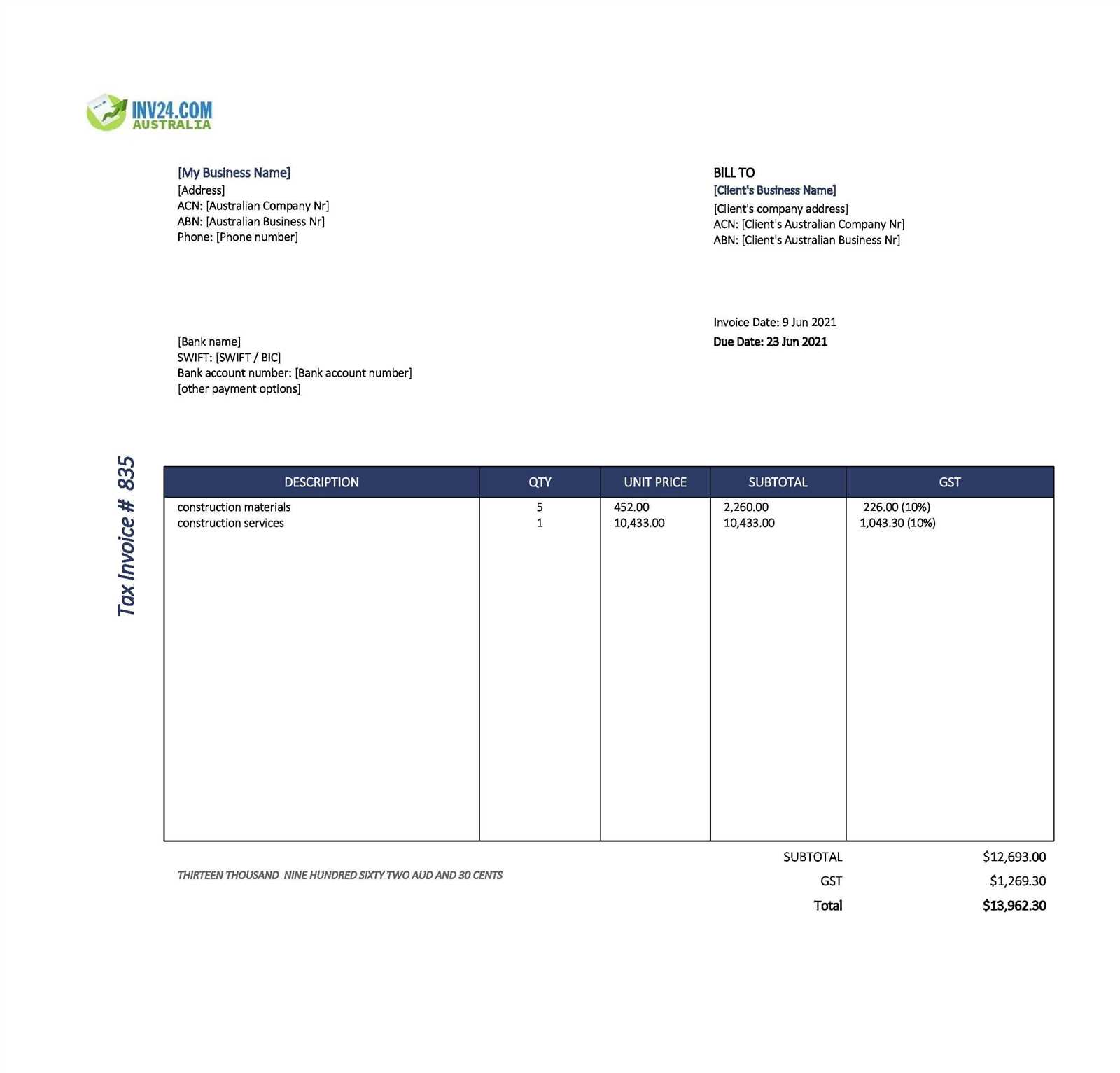

Understanding GST on Tax Invoices

When issuing documents for payment, it’s important to understand how certain taxes are applied and displayed. Goods and Services Tax (GST) is a significant factor for businesses, and correctly applying it ensures compliance with regulations and avoids complications with clients or authorities. Knowing when and how to include GST on payment requests can help you maintain transparency and prevent any misunderstandings.

GST is a consumption tax that is added to the price of most goods and services. As a business owner, it’s essential to determine whether your transactions are subject to this tax and whether you need to charge it on your sales. Typically, GST is calculated as a percentage of the total amount and must be clearly stated on the document for both the seller and buyer to see.

It is crucial to include GST details separately on the document, as this helps the client understand the full cost breakdown. Be sure to indicate the tax rate applied, the amount of tax charged, and the total amount due, including the tax. This clear breakdown ensures both parties are on the same page regarding the financial transaction.

Another key point is that businesses registered for GST can often claim back the tax they’ve paid on business-related purchases. To do this, you must issue and keep proper documentation that complies with legal requirements. Failing to include the necessary GST information may prevent your clients from claiming back the tax, potentially causing dissatisfaction or issues.

When to Issue a Tax Invoice

Knowing the right time to issue a document requesting payment is crucial for both businesses and clients. Issuing it too early or too late can lead to confusion, delays, or legal issues. There are specific guidelines that determine the appropriate timing for generating such documents, ensuring that both parties comply with regulations and maintain clear communication.

Upon Completion of Goods or Services

Typically, these documents are issued after the goods or services have been delivered or completed. This ensures that the payment request reflects the actual transaction, with all items or services provided as agreed. Issuing a document too early, before delivery or completion, can lead to disputes about the scope of the work or the quality of the goods, potentially complicating the payment process.

When Payment is Due or Agreement Stipulates

Another common scenario for issuing such documents is when the payment terms outlined in the agreement are met. Whether it’s an agreed-upon due date or the completion of a milestone, the document should be sent promptly to keep the payment process on track. The timing of this document is important in helping clients stay aware of their obligations and ensuring timely settlement of accounts.

Legal Requirements for Australian Invoices

When preparing payment requests, it’s essential to ensure that all necessary legal details are included to comply with local regulations. Proper documentation not only helps facilitate smooth transactions but also prevents potential issues with authorities or clients. There are specific elements that must be present in every document to ensure legal compliance, especially when dealing with business transactions within the country.

Essential Elements for Compliance

To meet legal standards, certain pieces of information must be included in every payment request. These include:

- Business Details: The name and ABN (Australian Business Number) of the business issuing the document.

- Recipient Information: The name and address of the client or recipient of the goods or services.

- Document Identification: A unique identification number or reference for the document.

- Date: The issue date of the document and the due date for payment.

- Description of Goods/Services: A clear and detailed list of what was provided, including quantities and prices.

- Amount and GST: The total amount due, including the GST amount if applicable.

Additional Legal Considerations

In addition to the required elements above, there are further considerations to keep in mind to ensure compliance:

- GST Status: If GST is applicable, it must be clearly stated, along with the amount being charged.

- Payment Terms: Clear instructions regarding when and how payment should be made, including penalties for late payments.

- Record Keeping: Businesses must retain copies of documents for a specified period, typically five years, as required by Australian law.

By following these guidelines and ensuring that all required details are present, businesses can avoid potential legal issues and mai

Benefits of Using Digital Invoice Templates

Adopting digital solutions for creating payment requests offers numerous advantages for businesses. From increasing efficiency to improving accuracy, digital tools streamline the entire billing process, making it faster and more reliable. By leveraging customizable digital formats, businesses can maintain consistency, save time, and reduce the likelihood of errors, all while ensuring compliance with financial regulations.

Enhanced Efficiency and Time Savings

Using digital formats eliminates the need for manual entry, allowing businesses to generate payment requests quickly and consistently. The automation of repetitive tasks, such as adding business details or calculating totals, not only saves time but also reduces administrative workload. This efficiency is especially beneficial for businesses with a high volume of transactions, enabling them to focus on core activities rather than paperwork.

Improved Accuracy and Professionalism

Digital tools help eliminate human errors, such as incorrect calculations or missing information. Many digital solutions include built-in validation checks, which ensure that all required fields are filled in and that totals and taxes are calculated correctly. This increased accuracy leads to fewer disputes or payment delays. Furthermore, the polished and uniform design of digital documents enhances the professional image of a business, which can leave a positive impression on clients and partners.

Additionally, digital files are easy to store, search, and access, making it simpler to manage past transactions and track payments. With the ability to instantly update or modify any details, digital solutions offer greater flexibility than traditional paper methods, ultimately improving overall business operations.

How to Add Business Information to Invoices

Including the correct business details on payment documents is essential for ensuring clear communication and legal compliance. Whether you’re issuing a document for a product sale or a service rendered, providing your company’s information ensures that both you and your client can easily identify the transaction and reference it in the future. Properly displaying your business details also enhances professionalism and helps maintain transparency in your financial dealings.

Key Business Details to Include

When adding business information to your payment documents, make sure to include the following essential details:

- Business Name: Ensure your registered company name is clearly displayed at the top of the document.

- ABN (Australian Business Number): Include your ABN for proper identification and compliance with regulations.

- Contact Information: Provide your phone number, email address, and physical business address for easy communication.

- Website: If applicable, include your business website URL for clients who may wish to explore your services or products further.

- Bank Account Details: If relevant, add your payment account information to facilitate direct deposits or transfers.

Formatting Tips for Clear Presentation

To ensure the information is easily readable and accessible, follow these tips:

- Positioning: Place your business details at the top of the document, preferably in a header section, to make them prominent.

-

How to Include Payment Terms on Invoices

Clearly stating payment terms on your billing documents is essential to ensure that both you and your clients are aligned on expectations. Well-defined terms help avoid confusion, ensure timely payments, and establish a professional framework for your business relationships. By outlining payment conditions, due dates, and late fees upfront, you reduce the chances of payment delays or disputes.

Key Information to Include

To create clear and effective payment terms, ensure the following elements are covered:

- Due Date: Clearly specify the date by which the payment must be made. This helps clients know when to settle the amount and avoids unnecessary delays.

- Accepted Payment Methods: List all payment options available, such as bank transfers, credit cards, or online payment platforms, so clients know how to pay you.

- Late Payment Penalties: If applicable, mention any penalties or interest charges that will be applied if the payment is late. This encourages timely settlement.

- Early Payment Discounts: If offering a discount for early payment, include the percentage and timeframe in which it applies, incentivizing clients to pay ahead of schedule.

Best Practices for Displaying Terms

For optimal clarity and transparency, consider these tips when formatting your payment terms:

- Positioning: Place the payment terms at the bottom of the document or in a dedicated section after the itemized charges. This makes them easy to find and reference.

- Simple Language: Use straightforward, easy-to-understand language to ensure there are no ambiguities about the terms. Avoid jargon or overly complex clauses.

- Highlight Important Details: Bold or underline critical information such as the due date

Free vs Paid Tax Invoice Templates

When choosing a format for your billing documents, businesses often face the decision between using free or paid solutions. Each option offers its own set of advantages and drawbacks, and the right choice depends on your specific needs, budget, and the scale of your business operations. Understanding the differences between free and premium formats can help you make an informed decision that aligns with your goals.

Advantages of Free Formats

Free billing formats can be a good starting point for small businesses or startups with limited budgets. Here are some of the benefits:

- Cost-Effective: As expected, there are no upfront costs or subscription fees, making this an ideal choice for businesses just starting out.

- Basic Functionality: Free options typically provide the essential features needed to create a document, such as fields for business details, items, and totals.

- Ease of Use: Many free tools are simple and intuitive, allowing you to quickly create professional-looking documents without much technical knowledge.

Benefits of Paid Formats

While paid options require an investment, they often offer more advanced features and customization. Here’s why you might consider opting for a premium solution:

- Customization: Paid formats often allow for greater flexibility, letting you tailor the design and structure to better fit your brand or business require

Template Compatibility with Accounting Software

Ensuring that document formats seamlessly integrate with accounting software is essential for businesses to maintain accuracy and efficiency in their financial management. When creating a document that interacts with accounting tools, compatibility becomes a key factor in streamlining operations and minimizing errors. The right design not only provides consistency in data entry but also simplifies the process of generating reports, tracking expenses, and reconciling accounts.

Integration with Popular Accounting Tools

Most widely used accounting platforms, such as QuickBooks, Xero, and MYOB, offer functionality to import and process various document formats. It’s crucial that your chosen format aligns with these platforms to ensure smooth transfer of data, whether you’re recording transactions or preparing financial statements. Compatibility features typically include the ability to automatically populate fields with client information, item details, and pricing from previous records, reducing the need for manual entry.

Streamlining Workflow through Automation

When a design is optimized for use with accounting software, it allows for greater automation. This integration speeds up tasks like generating statements and updating ledgers. With automated data synchronization, businesses can avoid potential discrepancies, ensuring that all financial records are up-to-date across different tools. Furthermore, this automation reduces the time spent on repetitive administrative duties, enabling employees to focus on more critical tasks.

Creating Recurring Tax Invoices for Clients

Establishing a system for regularly generated financial documents can significantly streamline billing processes for businesses offering subscription-based or long-term services. By automating this process, companies can ensure timely and consistent payments from clients, while reducing the administrative burden associated with manual document creation. This approach is particularly beneficial for clients with ongoing contracts, where invoicing follows a predictable pattern each billing cycle.

Steps to Set Up Recurring Billing

To set up an effective recurring invoicing system, follow these key steps:

- Identify the Billing Cycle: Determine the frequency at which clients will be billed (e.g., weekly, monthly, quarterly). Ensure the cycle aligns with the terms of the agreement.

- Set Up Payment Terms: Define the payment due date, any late fees, and early payment discounts, if applicable.

- Use Automation Features: Leverage accounting software or invoicing platforms that support automation to generate and send invoices on the set schedule.

- Monitor Transactions: Track payments and follow up on any overdue balances automatically, using reminders or alerts within your system.

Benefits of Recurring Billing Systems

Adopting a recurring billing approach brings numerous advantages to businesses, including:

- Consistency: Regularly generated documents ensure your business can predict cash flow and reduce manual efforts.

- Efficiency: Automation minimizes human error and the time spent on creating individual records.

- Client Convenience: Clients appreciate the convenience of having predictable, automated payments without the need to manually process each transaction.

How to Format Your Tax Invoice Professionally

Creating a well-structured document is essential for maintaining professionalism and ensuring clarity in your financial communications. A properly formatted document not only facilitates understanding for your clients but also ensures that all necessary information is clearly presented and easy to find. The right layout can enhance your business image and foster trust, making it easier for clients to process payments promptly.

Essential Components of a Well-Formatted Document

A professional document should include key details that are critical for both the client and your accounting system. Ensure the following elements are clearly displayed:

- Your Business Information: Include your business name, address, contact details, and ABN (Australian Business Number) to confirm legitimacy.

- Client Details: Clearly list the client’s name, company, address, and any relevant reference numbers.

- Document Number and Date: Assign a unique reference number and provide the date the document was issued for easy tracking.

- Itemized List of Services or Products: Include a clear breakdown of services rendered or goods provided, along with individual prices, quantities, and total amounts.

- Payment Terms and Due Date: Clearly specify the terms of payment, including the due date and any late fees or discounts for early payment.

Layout and Design Considerations

In addition to the required details, the overall layout and visual appeal of the document play a significant role in professionalism. Consider the following tips:

- Use Clear Headings: Organize the document into sections with bold headings to make it easy to navigate.

- Consistent Font and Size: Stick to professional fonts like Arial or Times New Roman, and ensure the tex

Where to Find More Tax Invoice Resources

For businesses seeking to improve their financial documentation processes, there are a variety of sources where you can find additional tools, guides, and examples to help you create effective and compliant documents. These resources can offer templates, detailed instructions, and best practices that align with the specific needs of your business. Whether you’re looking for software solutions, downloadable formats, or educational content, there are numerous places to explore.

Online Platforms and Software

Many online platforms provide easy-to-use tools and resources that integrate directly with your accounting system. These platforms can help you streamline the document creation process and ensure all necessary details are included. Here are some popular options:

- Accounting Software: Tools like QuickBooks, Xero, and FreshBooks offer built-in features to generate and manage financial records with ease.

- Online Document Generators: Websites like Invoice Ninja and Zoho allow users to create professional records using customizable templates that are available for download or direct use.

- Cloud Storage Solutions: Platforms like Google Drive or Dropbox offer templates that can be easily stored and accessed for future use.

Educational Resources and Guides

If you’re looking for comprehensive guides or educational materials to understand the nuances of creating professional documents, consider the following options:

- Government Websites: Official resources from government bodies often provide guidelines on compliance, legal requirements, and how to structure your records.

- Online Learning Platforms: Websites like Udemy, Coursera, and LinkedIn Learning offer courses that can teach you the best practices for managing business finances and creating professional documentation.

- Industry Blogs and Forums: Many accounting and business-related blogs provide valuable tips and real-world examples for creating accurate and professional records.