Free Standard Invoice Template for Efficient Billing

Managing payments and transactions efficiently is crucial for any business, large or small. One of the most effective ways to ensure consistency and accuracy in your financial dealings is by using a well-structured document for requesting payments. These documents help maintain professionalism, clarity, and transparency between parties involved in a transaction.

Using a pre-designed format can save time and effort while ensuring all the necessary information is included. With the right structure, these documents provide clear breakdowns of services rendered, amounts due, and payment terms. Whether you are running a startup or handling personal projects, a reliable document format can streamline your workflow and reduce errors.

Customizing such a format to match your brand and needs can add an extra level of professionalism. By incorporating essential elements such as contact details, payment methods, and due dates, you can create an organized and efficient system for tracking payments and managing financial records.

Free Standard Invoice Template Overview

Having a pre-designed format for billing can significantly enhance your business operations. It ensures that all the necessary details are included, reducing the risk of errors and making your payment requests more professional. Such a structure not only saves time but also maintains consistency across all financial documents, helping both the sender and the recipient keep track of transactions with ease.

These customizable documents typically include all the essential elements needed for clear communication, such as payment terms, amounts owed, and contact information. With a simple yet effective design, they can be tailored to reflect your branding while ensuring the document serves its primary purpose–facilitating seamless transactions.

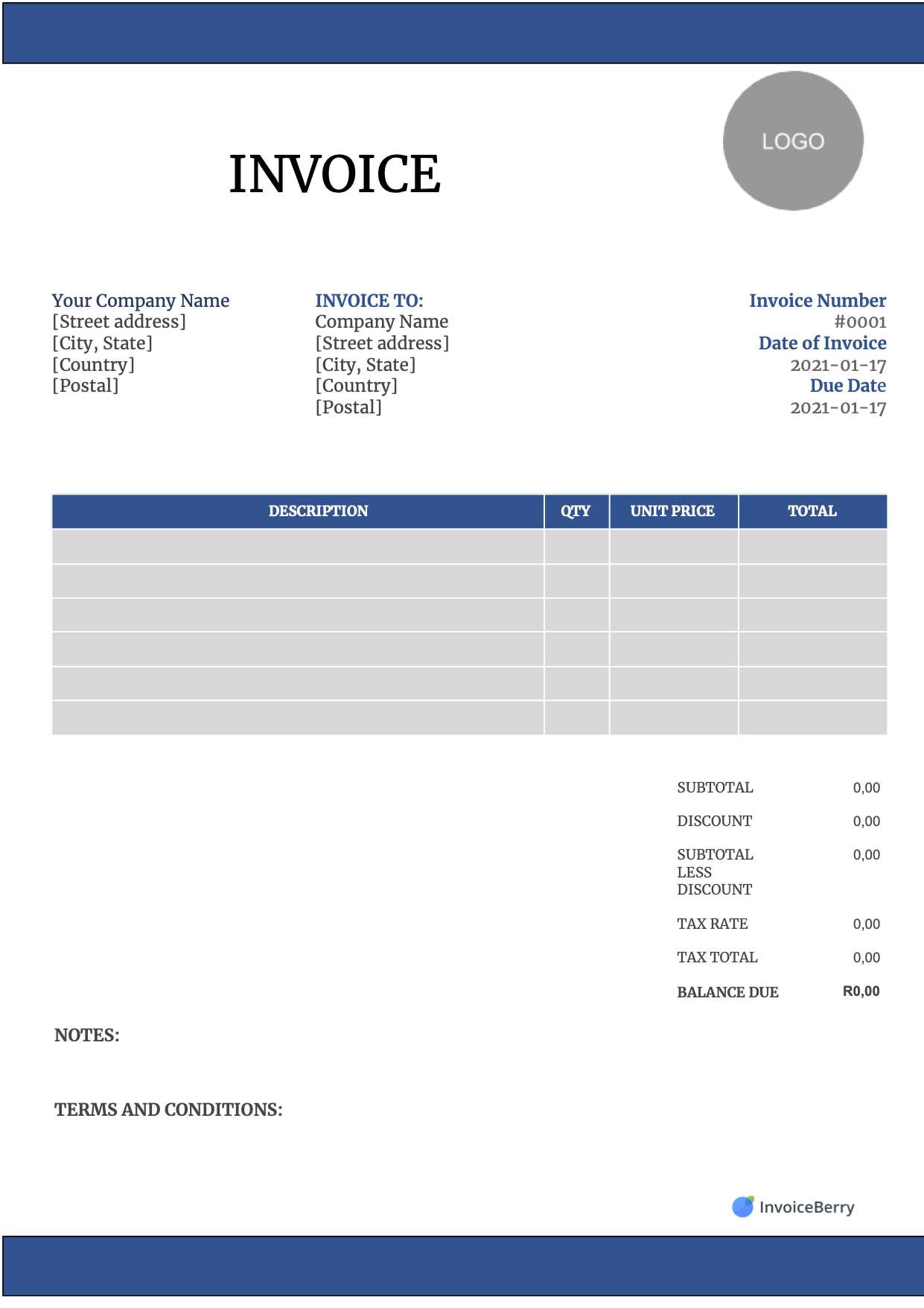

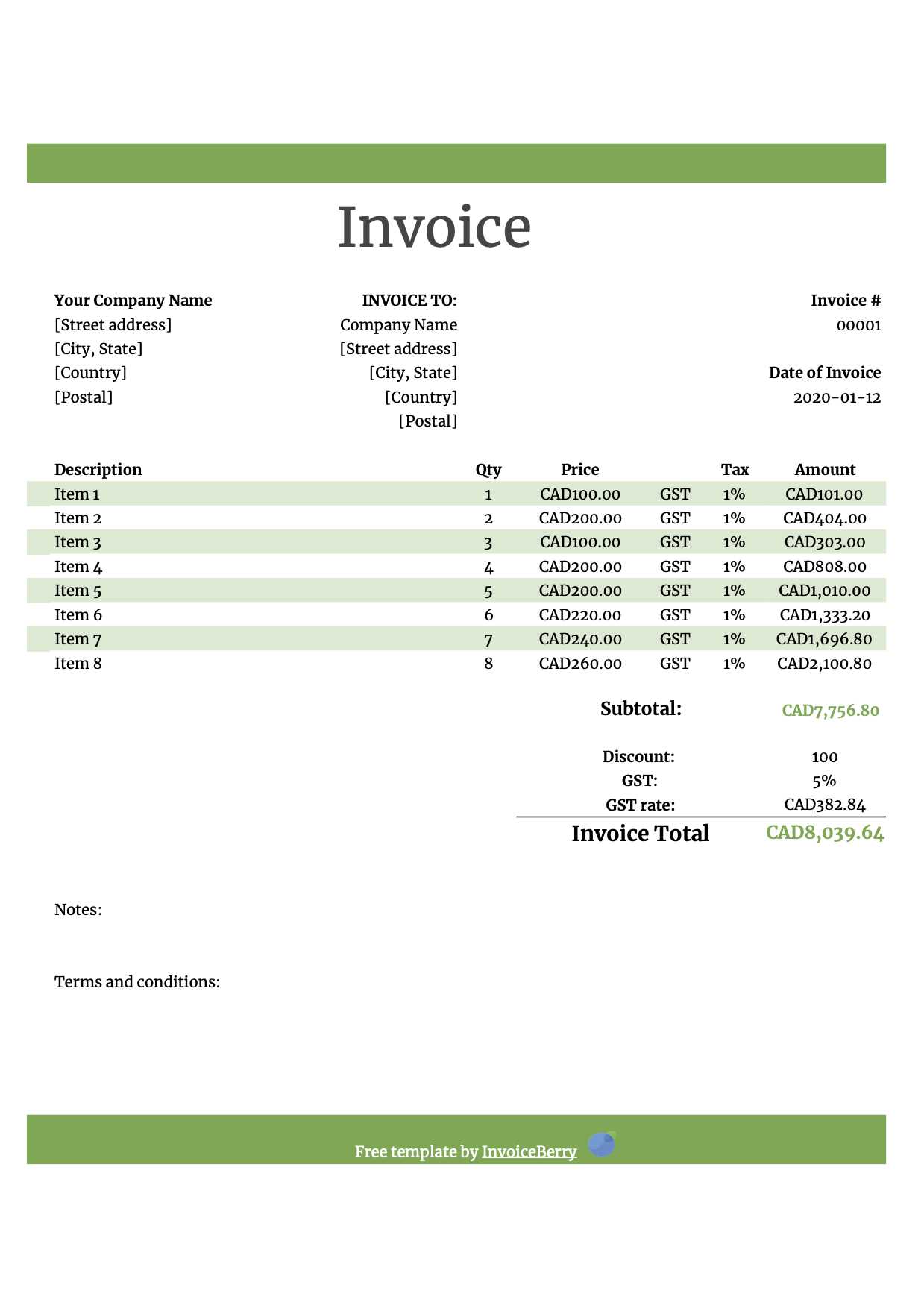

The following table outlines the key sections commonly found in such a document:

| Section | Description |

|---|---|

| Sender Information | Details of the individual or company issuing the document, including name, address, and contact information. |

| Recipient Information | Information of the party receiving the payment, similar to the sender’s details. |

| Services or Products | A clear description of the goods or services provided, along with their individual costs. |

| Amount Due | The total sum to be paid, including any applicable taxes or discounts. |

| Payment Terms | Details on when the payment is due and accepted methods of payment. |

| Notes | Additional remarks, such as thank-you messages or instructions for the payment process. |

Benefits of Using an Invoice Template

Using a pre-designed document for billing offers numerous advantages that streamline your business processes and ensure consistency. By relying on a fixed structure, you reduce the chances of missing important details and ensure that your financial documents maintain a professional look. This not only improves the clarity of communication with clients but also helps in maintaining accurate records for future reference.

Time-Saving and Efficiency

One of the primary benefits of adopting a structured billing format is the amount of time it saves. With a predefined layout, you no longer need to start from scratch for each transaction. Simply input the relevant information, and the document is ready to be sent. This reduces administrative overhead and enables you to focus on other critical aspects of your business.

Improved Professionalism and Consistency

Consistent use of a well-organized document enhances your professional image. Clients and partners appreciate clear and concise communication, and a polished billing document helps convey trust and reliability. Additionally, these documents help maintain consistency across all transactions, ensuring that your business operations remain organized and streamlined.

How to Customize Your Invoice

Personalizing your billing documents is a crucial step in maintaining a professional image and ensuring the document aligns with your business needs. Customization allows you to add elements such as your company logo, specific payment instructions, or preferred fonts, giving the document a unique look while ensuring all necessary details are included. By tailoring the structure, you ensure that the document reflects both your brand identity and your specific transaction requirements.

Adding Your Branding

One of the easiest ways to personalize your document is by incorporating your company logo and colors. This helps create a cohesive brand identity across all business communications. You can place your logo at the top or in the header section, making sure it’s visible but not overwhelming. Additionally, using your brand colors for headings or text highlights can make the document visually appealing and consistent with your overall branding strategy.

Modifying Key Sections

While the basic structure of the document is important, you can modify key sections to suit your business model. For example, if you offer multiple services, you can include detailed descriptions for each one or adjust payment terms to reflect your business practices. Personalizing these sections ensures that the document provides clear and relevant information, making the payment process smoother for both you and your client.

Top Features in a Standard Template

Effective billing documents come with a set of essential features that ensure clarity, professionalism, and ease of use. These key components are designed to provide all the necessary information while maintaining a clean and organized structure. Whether you are a freelancer or a business owner, these features help facilitate seamless transactions and create a solid foundation for record-keeping.

Some of the most important elements include fields for sender and recipient information, a detailed breakdown of products or services, the total amount due, and clear payment terms. Additionally, incorporating space for notes or terms and conditions can help clarify any special instructions or agreements. These features are crucial for ensuring that both parties fully understand the transaction details, promoting transparency and reducing the likelihood of disputes.

Choosing the Right Invoice Format

Selecting the appropriate structure for your billing documents is an essential step to ensure clarity and professionalism in your financial transactions. The right format helps convey all the necessary details in an organized manner, making it easier for both you and your clients to track payments and services rendered. It’s important to choose a format that suits the size of your business, the type of services you offer, and the preferences of your clients.

When choosing the correct layout, consider factors such as the number of fields required, the space needed for detailed descriptions, and the overall visual appeal. A simple and clean design is often more effective than a cluttered one, ensuring that key details, such as payment terms and amounts due, are easy to find. Additionally, an easily editable format allows you to adjust specific sections based on the needs of each transaction.

Take into account how the format will be shared. If you plan on sending documents digitally, ensure that the chosen structure is compatible with email or online invoicing platforms. If physical copies are required, make sure the format is easily printable without losing clarity or essential information.

Why Free Templates Save Time

Using pre-designed documents can significantly reduce the amount of time spent on administrative tasks. By eliminating the need to create a new format from scratch for each transaction, you can focus more on the core aspects of your business. These ready-to-use structures are already organized with all the essential sections in place, making the process of documenting payments quick and efficient.

Pre-Formatted Structure for Quick Setup

With a well-organized design, you only need to input relevant details such as amounts, dates, and services rendered. The majority of the layout is already set up, meaning you don’t have to spend time deciding on formatting or layout elements. This simplicity allows you to generate professional documents quickly, saving hours compared to creating one from scratch each time.

Consistency Across Documents

Using a consistent structure across all your billing communications ensures that each document looks professional and contains the same key information. This uniformity minimizes the chances of errors, such as forgetting essential fields, which could result in delays or misunderstandings. The time you save from not having to review or correct documents repeatedly can be put to better use, allowing for faster processing of payments and better business efficiency.

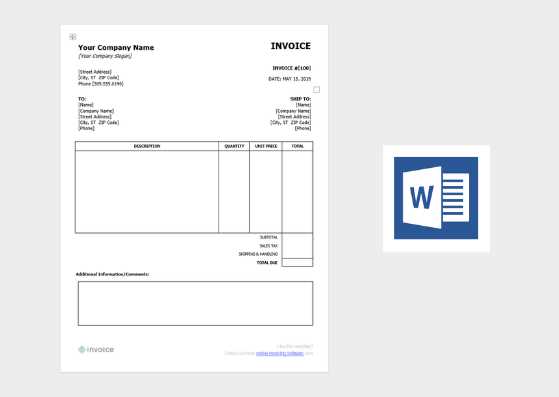

How to Download an Invoice Template

Downloading a ready-made document format for billing is a quick and straightforward process. Many platforms and websites offer easy access to various pre-designed layouts, allowing you to find the one that best suits your needs. By choosing the right source and format, you can have a functional and professional document ready to use in just a few clicks.

To download, simply visit a reliable provider offering these documents, select the desired format, and follow the prompts to obtain the file. Most sites allow you to download the layout in formats such as Word, PDF, or Excel, which can easily be edited and customized to fit your specific requirements. Once downloaded, you can save it to your computer and begin using it immediately for your billing needs.

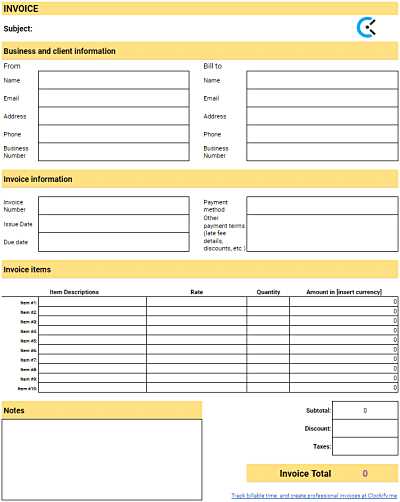

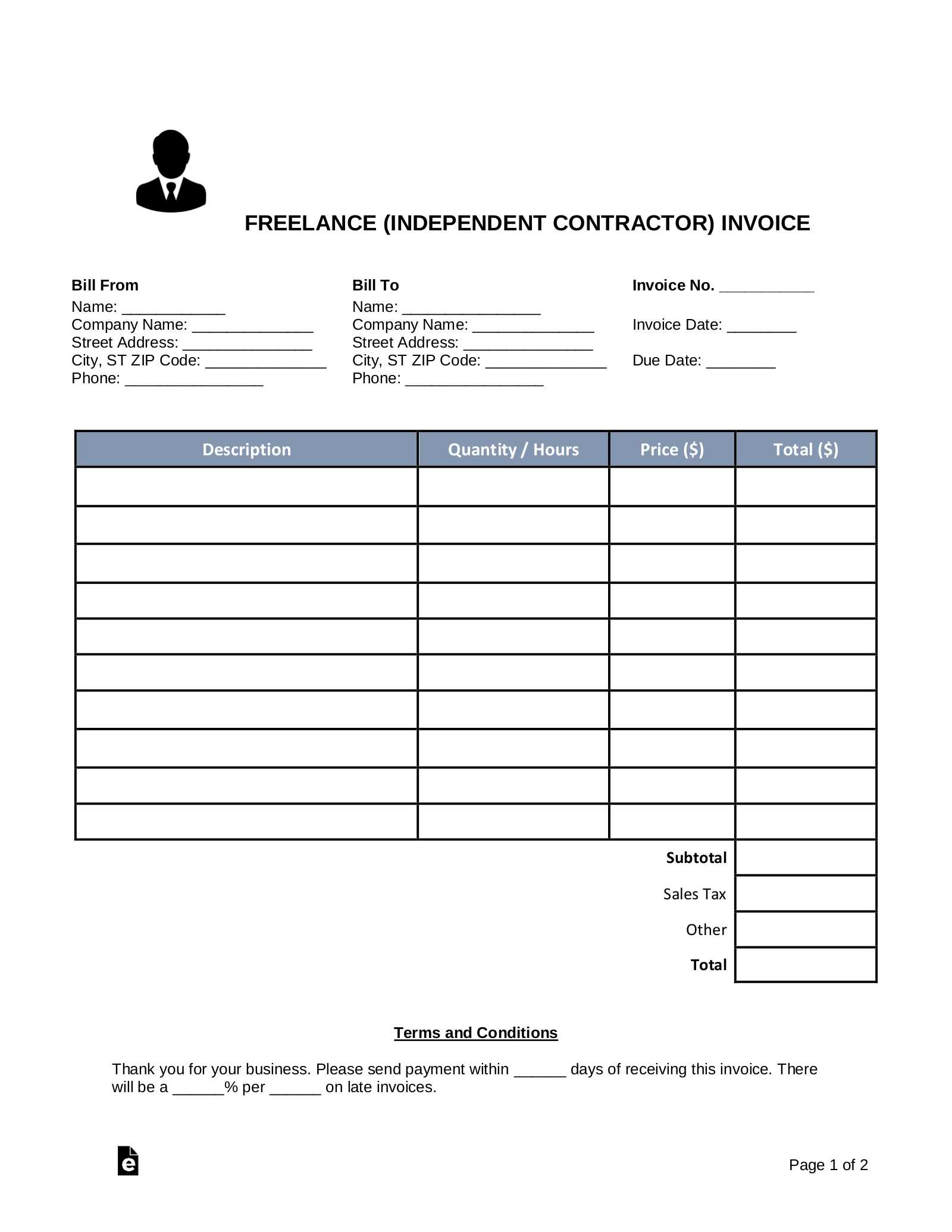

Step-by-Step Guide to Invoice Creation

Creating a professional billing document is a simple process when you follow a structured approach. By ensuring that each necessary detail is included and properly formatted, you can ensure that the document is clear, accurate, and easy to understand. This guide walks you through the key steps for creating a polished document from scratch or from a pre-designed layout.

- Include Your Business Information

- Start by adding your business name, address, and contact details at the top of the document.

- This ensures the recipient knows who the payment is for and how to reach you if needed.

- List the Client’s Information

- Include the name and contact details of the client or company you’re billing.

- This helps ensure the document is correctly associated with the right party.

- Describe the Products or Services

- Provide a detailed description of what was provided, including quantity, unit prices, and any relevant terms.

- Make sure this section is clear to avoid confusion during payment.

- Specify the Payment Amount

- Clearly state the total amount due, taking into account any taxes, discounts, or additional fees.

- Double-check your calculations to ensure accuracy.

- Set Payment Terms

- Specify the due date and acceptable methods of payment.

- Make sure the client understands any late payment penalties or early payment discounts.

- Include Notes or Special Instructions

- If necessary, include any additional remarks or payment instructions that may be helpful for the client.

- This could include thank-you messages or reminders about your payment preferences.

Once all these steps are complete, review the document for accuracy and completeness before sending it to your client. This ensures a smooth transaction and professional communication between you and the recipient.

Integrating Your Logo on Invoices

Including your company’s logo on billing documents is a simple yet effective way to enhance your brand presence and establish professionalism. By placing your logo on these documents, you reinforce your business identity and create a cohesive look across all communications. This small detail can make a big difference in how your clients perceive your company and ensure that your brand stands out even in transactional paperwork.

Placement of Your Logo

When integrating your logo, it’s important to choose an appropriate spot that ensures visibility but doesn’t overwhelm the document. A common practice is placing it at the top of the page, either in the center or aligned to the left. This allows it to be one of the first things your clients see, making your business easily recognizable without distracting from the important details.

Ensuring High-Quality Appearance

Make sure your logo is displayed in high resolution to maintain a professional and polished look. Avoid using overly large or pixelated images, as they can detract from the overall quality of the document. By using a clean and clear logo, you reinforce the professionalism of your company and provide clients with a consistent visual experience.

Essential Fields in a Standard Invoice

For any billing document to be effective, certain key sections must be included to ensure both the sender and recipient have all the necessary information. These fields help clarify the terms of the transaction, making the process of payment straightforward and reducing the chances of confusion. Here are the most important fields to include when creating a billing document.

| Field | Description |

|---|---|

| Sender Information | Details about the person or business issuing the bill, including name, address, and contact information. |

| Recipient Information | The name and contact details of the individual or company being billed. |

| Invoice Number | A unique identification number that helps track the transaction. |

| Date of Issue | The date when the document is created or issued. |

| Description of Products/Services | A clear list of what was provided, including quantities and unit prices. |

| Total Amount Due | The total payment due, including any taxes, discounts, or additional fees. |

| Payment Terms | Details about how and when payment should be made, including due dates and accepted payment methods. |

| Notes or Special Instructions | Any additional comments or instructions that may be important to the recipient, such as late fees or discounts for early payment. |

By including these essential fields, you ensure that both you and your clients have a clear understanding of the terms and details of the transaction, promoting smoother and faster payments.

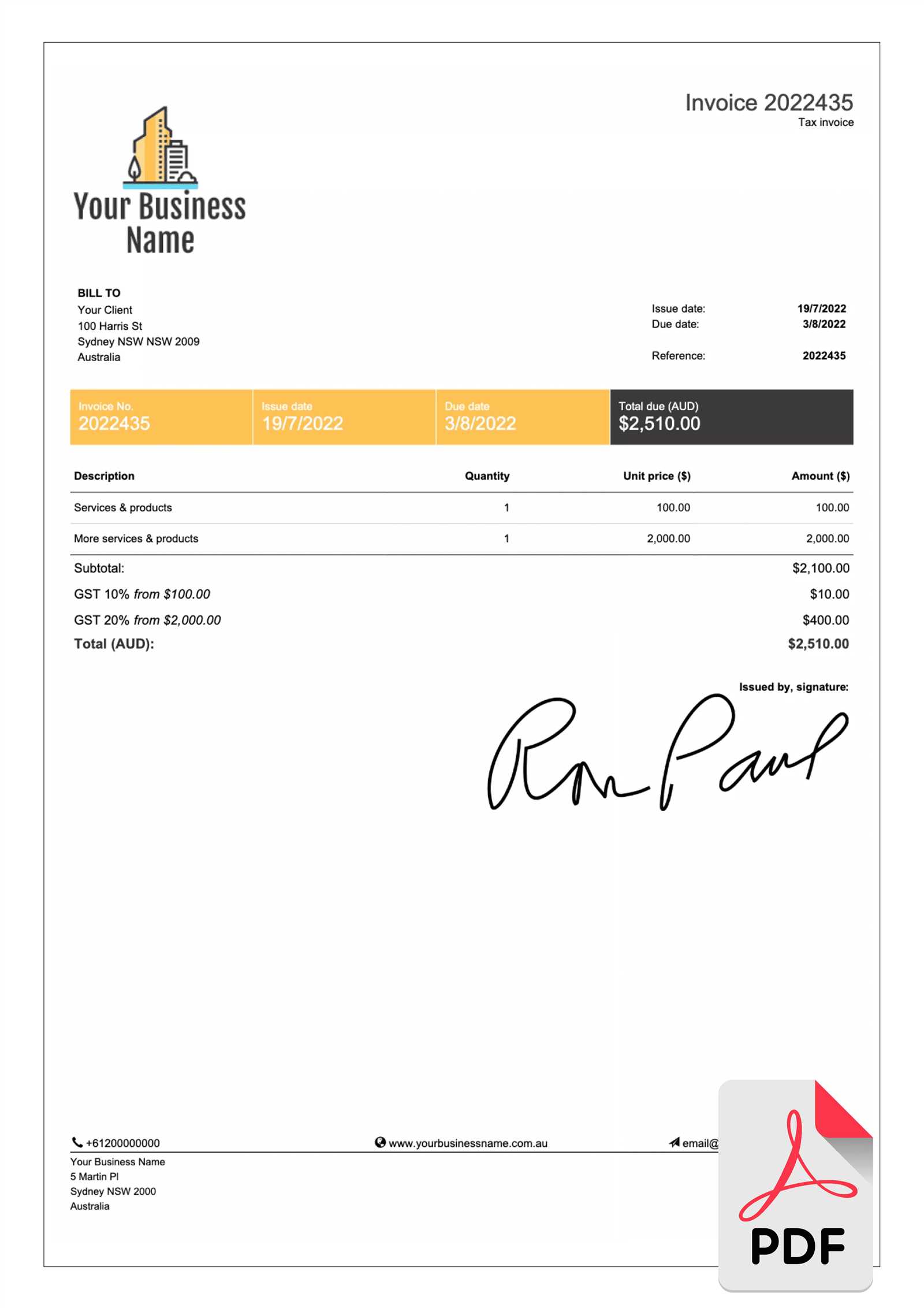

How to Add Taxes to Invoices

Including taxes in a billing document is essential for ensuring that the transaction complies with local tax regulations. Adding taxes correctly helps maintain transparency with clients and avoids potential legal issues. The process of including taxes involves understanding the tax rate, calculating the correct amount, and clearly presenting it on the final document.

Step-by-Step Guide to Tax Calculation

- Identify the Tax Rate: Research and determine the applicable tax rate for your region or industry.

- Calculate the Tax Amount: Multiply the total value of the goods or services by the tax rate to determine the tax amount.

- Add the Tax to the Total: Once the tax is calculated, add it to the subtotal of the transaction to find the final amount due.

Formatting Taxes on the Document

- Separate Tax Section: Display the tax amount as a separate line on the document to ensure clarity.

- Label the Tax Clearly: Use clear headings such as “Sales Tax” or “VAT” to make the tax easily identifiable.

- Total Amount Due: Ensure the final total reflects the sum of the original amount plus the tax, providing the total payment expected from the client.

By following these steps, you can ensure that your billing documents are accurate and professional, keeping your transactions clear and compliant with tax laws.

Tracking Payments with Invoice Templates

Efficiently tracking payments is crucial for maintaining healthy cash flow and ensuring that your business operates smoothly. By using properly structured billing documents, you can easily monitor outstanding payments, keep clients informed of their balances, and streamline the entire payment process. A well-organized record of transactions not only helps you stay on top of payments but also simplifies financial reporting.

Clear Payment Tracking Features allow you to identify whether a payment has been made, is overdue, or is yet to be processed. Most documents include a section where you can mark the payment status, including options like “Paid,” “Unpaid,” or “Partially Paid.” By updating this section after each transaction, you create a clear history of payment activity.

Using a consistent system for tracking payments also reduces the risk of errors, ensures better communication with clients, and provides you with a reliable record for audits or future reference. Furthermore, incorporating a due date and payment terms directly into the document helps avoid misunderstandings and ensures that both parties know exactly when payments are expected.

Common Mistakes to Avoid in Invoicing

Creating billing documents requires attention to detail, as even small mistakes can cause confusion, delays in payment, or lead to disputes. Understanding common errors can help ensure that your documents are accurate, professional, and free from issues that may hinder the payment process. Here are some of the most frequent mistakes people make and tips on how to avoid them.

Top Mistakes to Avoid

- Incorrect Payment Details: Ensure that your payment terms, including due date and accepted methods, are clearly stated. Ambiguities in these areas can cause delays or misunderstandings.

- Missing Contact Information: Always double-check that both your details and your client’s contact information are up-to-date and accurate.

- Failure to Include Tax Information: If applicable, make sure taxes are calculated correctly and listed separately, so there’s no confusion about the total amount due.

- Not Numbering Documents: Every document should have a unique identifier for tracking and reference purposes. Failing to number them can lead to confusion, especially with multiple transactions.

- Omitting a Clear Breakdown: Include a detailed description of the products or services provided, along with quantities and prices. Lack of clarity in this section can cause disputes over what was delivered.

- Incorrect or Overlooked Dates: Always check that the issue date and due date are correct. Missing or incorrect dates may affect payment timelines.

Tips for Avoiding Mistakes

- Proofread Before Sending: Review all information carefully to spot potential errors in numbers, terms, or contact details.

- Use Consistent Formats: Consistency in design and layout can prevent confusion. Stick to a clear, professional format for all your documents.

- Automate Where Possible: Utilize tools or software that help generate accurate and consistent documents, reducing the risk of human error.

By avoiding these common mistakes, you can improve the efficiency of your billing process, build trust with your clients, and reduce the chances of delays in payment.

How Free Templates Compare to Paid Options

When choosing a design for creating billing documents, you’ll often face the decision between using no-cost designs and investing in a premium option. Both approaches have their benefits and drawbacks, depending on your business needs, volume, and desired features. While free options may offer simplicity and ease of access, paid designs tend to come with added features, flexibility, and support. Understanding the differences can help you make a more informed choice for your business.

Advantages of Using Free Designs

- Cost-Effective: As expected, free designs don’t cost anything, which makes them an ideal choice for small businesses or individuals on a tight budget.

- Quick and Easy Setup: Free options are often simple and straightforward to use, allowing you to start generating documents without any technical skills or setup time.

- Basic Functionality: For simple needs, free designs usually provide all the essential fields, such as payment terms and service descriptions, without unnecessary complexity.

Benefits of Choosing Paid Options

- More Customization: Premium designs often allow greater flexibility in terms of layout, style, and branding, helping you create a more personalized look that matches your company’s identity.

- Advanced Features: Paid designs frequently come with additional functionality, such as automatic calculations, integrated payment processing, or options to track payments over time.

- Better Support: With a paid option, you often gain access to customer service or technical support, which can help you resolve any issues or address specific needs.

Ultimately, the choice between free and paid options comes down to your specific requirements and budget. If you only need basic functionality and don’t mind doing the work manually, a free design could be sufficient. However, if you require more customization, advanced features, or ongoing support, investing in a paid design may be the better solution for your business.

Legal Considerations for Invoices

When creating payment documents for your business transactions, it’s essential to ensure that they comply with legal requirements. Whether you’re a freelancer or a business owner, understanding the key legal aspects of these documents can help you avoid disputes and ensure you are following the law. Legal considerations cover various aspects, from including the correct details to adhering to regional tax rules and payment deadlines.

Key Legal Elements to Include

In most regions, there are specific details that must appear on any official billing document to ensure it is legally valid. These elements vary depending on local laws, but there are common requirements that most businesses must adhere to:

| Required Information | Description |

|---|---|

| Business Name and Contact Details | Make sure your company name, address, and contact information are clear and legible. |

| Recipient Information | The name and contact details of the person or company you are billing should be listed correctly. |

| Unique Identification Number | Each document should have a unique reference or identification number to track it properly. |

| Transaction Date | The exact date when the product or service was provided, as well as when payment is due, must be stated. |

| Payment Terms | Clearly outline the payment terms, including the total amount due, accepted payment methods, and any applicable taxes. |

Tax and Legal Compliance

It’s also essential to understand the tax obligations related to your billing documents. Depending on your jurisdiction, certain taxes may need to be applied to the amounts billed. You may also be required to include tax numbers, such as VAT identification, and follow specific rules regarding tax rates, which vary by country or region.

By incorporating these essential details and being aware of your legal obligations, you can ensure that your billing documents not only look professional but also protect you from potential legal issues and disputes with clients.

Updating and Storing Your Invoices

Maintaining accurate and organized financial records is crucial for any business or individual managing transactions. Updating and storing these documents properly ensures that all payment requests are tracked, discrepancies can be addressed quickly, and legal compliance is maintained. Regularly reviewing and saving your financial documents not only helps streamline your operations but also secures your business interests in the event of audits or disputes.

Updating Your Payment Documents

Updating your financial records is an essential task to ensure that all details are accurate and reflect the most current transaction status. This includes making corrections if any errors are identified, adjusting payment terms if necessary, and noting any additional charges or discounts applied after the initial document was issued. Keeping your records up to date can prevent future confusion and disputes with clients or suppliers.

Storing Financial Records Securely

Once updated, it is essential to store these documents in a safe and organized manner. Digital storage solutions, such as cloud storage or encrypted file systems, are excellent choices for keeping your records secure and easily accessible. It’s also crucial to have a clear system for categorizing these files, whether by date, client name, or project number, to quickly find specific documents when needed. Regular backups should also be performed to ensure no data is lost.

In addition to digital storage, physical copies may still be necessary in some jurisdictions for tax and legal purposes. In such cases, a well-organized filing system will help ensure that you can access the required documents without delay. Regardless of your storage method, ensuring proper organization will save time and effort when managing and retrieving important documents.

Tips for Creating Professional Invoices

Creating well-designed and clear payment documents is essential for maintaining professionalism and building trust with clients. A properly formatted document ensures that all necessary information is included, reduces the chances of misunderstandings, and helps avoid delays in payment. Below are some key strategies for producing professional payment requests that stand out.

1. Include All Necessary Information

Ensure that your document contains all critical details, such as the names and addresses of both the sender and the recipient, the unique document number, the issue date, and the payment due date. Additionally, be sure to list the products or services provided with clear descriptions, quantities, and rates to avoid confusion.

2. Use Clear and Consistent Formatting

A clean and structured layout makes your document easy to read. Organize the content into logical sections, such as client details, itemized services or goods, and payment terms. Use consistent fonts, alignments, and spacing to create a professional appearance. Ensure that there is enough white space for clarity without overcrowding the page.

3. Set Clear Payment Terms

Clearly state your payment terms, including the due date and any late fees or discounts for early payment. This sets expectations and helps clients know when to settle their balance. Being transparent about your payment policy can lead to quicker payments and fewer payment disputes.

4. Add a Personal Touch

While maintaining professionalism, adding a personal note or thank-you message can create a positive impression. A simple “Thank you for your business” or “We appreciate your prompt payment” can help foster a good client relationship.

By following these guidelines, your payment documents will be more likely to convey professionalism, facilitate clear communication, and ensure timely payments.

When to Upgrade Your Invoice Template

As your business grows and evolves, the documents you use to request payments should also adapt. It’s important to recognize when it’s time to enhance your payment request forms to keep up with changing needs and ensure that your communication remains clear, professional, and efficient. Below are several key indicators that suggest it’s time for an upgrade.

1. Expanding Business Needs

When your business offerings grow, or you begin to serve a larger and more diverse clientele, your payment forms may need more customization. Adding new sections, such as discounts, taxes, multiple payment methods, or more detailed descriptions of products or services, can ensure that your documents reflect the full scope of your business activities.

2. Outdated Design or Functionality

As design trends evolve and software tools improve, your current format may start to look outdated or become difficult to use. An inefficient layout or lack of compatibility with modern tools (like online payment platforms) can make the process of creating and sending documents slower or less professional. Upgrading your document layout can streamline operations and enhance its visual appeal.

3. Increased Client Expectations

If your business begins to deal with high-profile clients or large contracts, it’s crucial to present your payment forms in a way that reflects the professionalism expected in these industries. A polished, fully branded, and clearly formatted document can improve client relationships and instill confidence in your services.

4. Legal and Tax Changes

Changes in laws or tax regulations might require you to modify the information you include in your payment forms. Whether it’s adding new fields to account for different tax rates, or ensuring compliance with new financial reporting requirements, it’s essential to stay up to date with the latest legal obligations.

Recognizing when to upgrade your payment request documents can lead to smoother transactions, improved client relations, and a more professional image for your business. An upgrade ensures that your payment forms stay relevant, effective, and aligned with your growing needs.