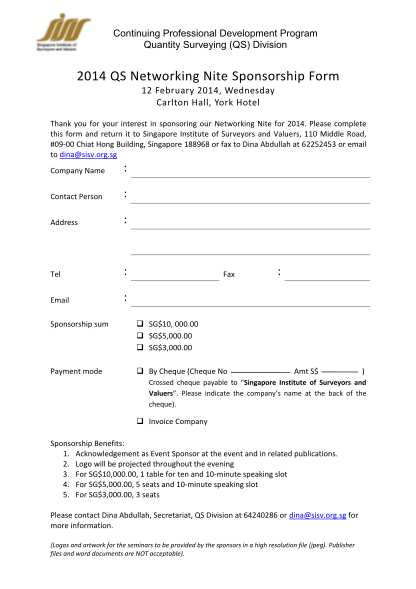

Free Sponsorship Invoice Template for Easy Customization

Managing financial transactions for collaborative ventures requires a clear and efficient way to document agreements. When working with sponsors or partners, it is essential to ensure that all payment details are professionally recorded and easy to process. Having the right document in place can streamline the entire process, helping both parties stay on track with expectations.

Designing a custom billing sheet allows for flexibility and personalization while ensuring all necessary details are included. By using a pre-designed structure, you can focus on the important aspects of your business relationship without worrying about formatting or missing key information. This simple approach saves time and helps maintain clarity throughout the project.

For those seeking an easy way to manage transactions, utilizing a ready-made structure can be a game-changer. It ensures that all critical elements–such as amounts, due dates, and contact information–are neatly organized. This makes it easier to maintain professionalism and reduce the risk of confusion or errors in financial dealings.

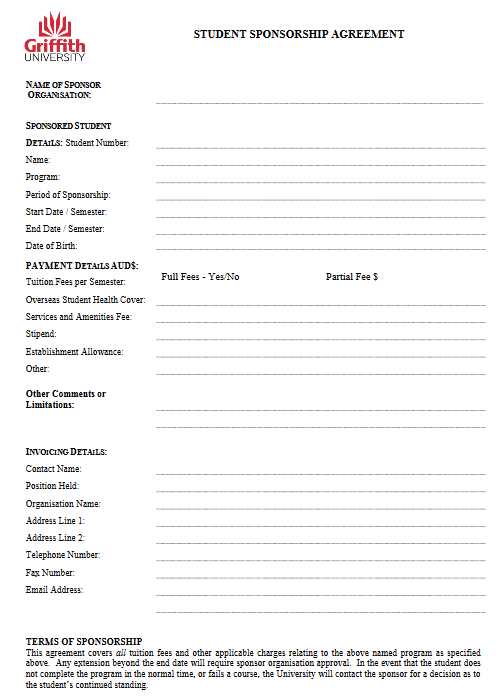

Free Sponsorship Invoice Template Overview

For businesses engaged in partnerships or financial agreements, keeping accurate records of payments and transactions is crucial. A well-structured document serves as a formal acknowledgment of the terms agreed upon and ensures both parties are clear on the amounts, deadlines, and responsibilities involved. Using a ready-made document format can significantly simplify this process, providing a consistent structure that is easy to customize according to specific needs.

Utilizing a ready-made format offers a streamlined solution for managing payment requests. These formats typically include all the necessary sections such as recipient details, amounts due, payment methods, and due dates. With a professional layout, the document ensures that no important information is overlooked, making it ideal for those who need an efficient and organized way to manage financial exchanges.

With the right structure in place, creating these records becomes a simple task. You can focus on tailoring the document to reflect the unique aspects of each collaboration, while the pre-set design handles the rest. This approach saves time, reduces errors, and enhances the overall professionalism of the financial transactions between parties.

Why Use a Sponsorship Invoice Template

Creating financial documents for business partnerships can be time-consuming and prone to errors if done manually. Using a pre-designed document format simplifies the process by providing a structure that includes all the necessary details, saving time and reducing the likelihood of mistakes. Whether you’re managing one project or multiple collaborations, having a standardized format can help streamline the entire process.

Benefits of a Structured Approach

By choosing a pre-designed format, you ensure that all essential information is included and presented in a professional manner. This consistency can enhance your reputation and make it easier for your partners to understand the terms. With all elements in place, there is less need for back-and-forth communication, which speeds up the payment process.

Key Features of a Well-Organized Format

A well-structured document format typically includes the following sections, ensuring that all relevant details are covered:

| Section | Description |

|---|---|

| Recipient Information | Contact details for both parties involved |

| Payment Amount | Clear breakdown of the total amount due |

| Due Date | Specific date when payment is expected |

| Payment Method | Details on how the payment should be made |

| Terms & Conditions | Any additional agreement or clauses |

With these sections pre-arranged, all you need to do is fill in the unique details for each partnership. This approach ensures that your documents are both professional and complete, reducing the risk of missing critical information.

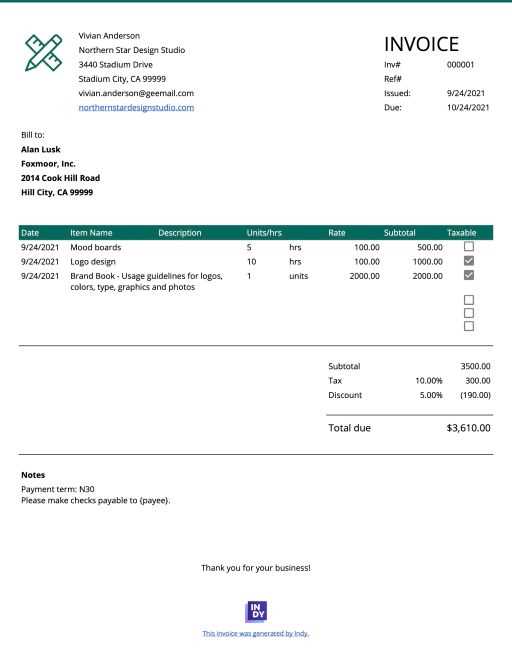

How to Customize Your Invoice

Personalizing your financial document is essential to ensure it accurately reflects the terms of your agreement and the specific details of your business relationship. Customization allows you to adjust the content to suit the unique needs of each project or collaboration, making your document not only professional but also aligned with your brand’s identity.

Adjusting Basic Information

The first step in customization is adding the essential details. This includes the name and contact information of both parties, as well as any project identifiers or reference numbers that help distinguish this particular transaction. Ensuring that these basics are clearly presented will make the document easier to understand and more professional.

Tailoring Payment Terms and Amounts

Modifying the payment section is another key part of the customization process. Adjust the amount due, specify any payment methods, and set the deadline for when the payment should be completed. If necessary, you can also add any discounts, late fees, or special terms that apply to the agreement. Including these details clearly reduces confusion and ensures that both parties are on the same page when it comes to financial expectations.

Once the fundamental elements are in place, you can also incorporate your branding, such as adding your company logo, color scheme, or font preferences. This helps reinforce your brand’s identity while maintaining a professional appearance throughout the document.

Key Elements of a Sponsorship Invoice

For any financial document related to a partnership or agreement, it is crucial to include specific details that ensure transparency and clarity. The right components not only make the document easy to understand but also ensure that both parties are aware of their responsibilities. Each section plays a critical role in communicating the terms, amounts, and expectations, helping to avoid misunderstandings or delays in payment.

At the core of a well-structured document, several key elements need to be included:

Essential Information

First, ensure that all necessary contact information is clearly visible. This includes the names, addresses, and contact details of both parties involved in the transaction. Without this, it could be difficult to identify who is responsible for payment or to whom the funds are due. Additionally, reference numbers and project identifiers help link the document to a specific agreement.

Payment Breakdown

One of the most important aspects is the clear breakdown of the amounts due. This section should detail the total amount, any applicable taxes, discounts, and payment terms. Providing a detailed summary of charges not only reduces confusion but also ensures that both parties are aligned on the financial aspects of the arrangement. Additionally, specify the due date for payment and acceptable payment methods.

Finally, always include a section for additional terms or notes, such as late fees, special conditions, or reminders about the payment schedule. These additions provide a comprehensive overview and reinforce the expectations for both sides.

Benefits of Using Templates for Invoices

Utilizing pre-designed formats for financial documents offers a variety of advantages that can significantly streamline the billing process. These ready-made structures eliminate the need to create a new document from scratch each time, ensuring consistency and efficiency. By using a standardized format, businesses can focus on the essential details rather than worrying about design or missing important sections.

Time-Saving and Efficiency

One of the primary benefits of using a pre-designed format is the amount of time saved. Instead of starting from scratch, you can quickly input the relevant details and finalize the document in a fraction of the time. This efficiency is especially valuable for businesses with frequent transactions, as it reduces the administrative workload and speeds up the entire process.

Consistency and Professionalism

Another advantage is the consistency and professionalism it brings to your financial dealings. With a standardized format, you ensure that all documents maintain the same level of quality and organization, regardless of the transaction. This consistency helps build trust with clients and partners, as they can easily recognize the layout and know exactly where to find the necessary information.

Additionally, using a set structure minimizes the risk of missing key details, reducing errors and potential disputes. As a result, the relationship with business partners becomes smoother, and the payment process is more transparent and reliable.

Step-by-Step Guide to Sponsorship Billing

Managing financial documentation for business collaborations can be straightforward when you follow a structured process. A clear and organized approach ensures that all terms are properly recorded, payments are accurately tracked, and both parties are satisfied with the terms. By following a simple step-by-step guide, you can effectively handle the billing process, making it efficient and transparent for everyone involved.

Step 1: Gather Necessary Information

The first step is collecting all essential details before drafting your document. This includes the contact information of both parties, a description of the collaboration, and any reference numbers that may help identify the specific agreement. Having these details ready ensures that you won’t miss any important information when creating the document.

Step 2: Calculate the Amounts Due

The next step is to calculate the total amount due. This should include the agreed-upon fees, taxes, and any additional charges that apply. If there are discounts or payment plans, these should be clearly outlined as well. Be sure to double-check the figures to ensure accuracy before finalizing the document.

Once the amount is confirmed, you can proceed with completing the document, making sure to include payment terms, deadlines, and other necessary information. This will make the billing process smooth and professional, ensuring timely payments and clear communication.

Common Mistakes to Avoid in Invoices

Creating accurate and professional financial documents is essential for maintaining smooth transactions and strong relationships with business partners. However, errors in these documents can lead to confusion, delayed payments, and potential disputes. It’s important to be aware of common mistakes that can undermine the clarity and effectiveness of your financial records.

Missing or Incorrect Information

One of the most frequent mistakes is failing to include all the necessary details or inputting incorrect information. Whether it’s the contact information, payment amounts, or reference numbers, leaving out any critical element can lead to confusion and delays. Always double-check for completeness and accuracy before sending the document.

Unclear Payment Terms

Another common issue is the lack of clarity in payment terms. Not specifying due dates, payment methods, or additional charges can result in misunderstandings between the involved parties. Clear communication is key to ensuring both parties are aligned on the financial terms of the agreement.

Here are some mistakes to be mindful of when creating your document:

| Mistake | Impact |

|---|---|

| Missing Contact Information | Leads to confusion about who should make or receive the payment. |

| Incorrect Amounts | Can result in payment delays or disputes over the owed sum. |

| Unclear Terms | May cause delays due to misunderstandings about payment deadlines or conditions. |

| Lack of Reference Numbers | Creates difficulties in identifying the specific project or agreement. |

Avoiding these common errors ensures your documents are professional and that financial transactions are smooth and efficient.

Choosing the Right Format for Invoices

Selecting the appropriate structure for your financial documents is crucial to ensure that they are easy to understand, professional, and meet your business needs. Different formats cater to various types of transactions and clients, so it’s important to consider the most effective option for each specific case. The right format can streamline the process, reduce errors, and enhance communication between all parties involved.

Factors to Consider When Choosing a Format

When deciding on the structure of your document, several factors should influence your choice:

- Business Type: Different industries may require different types of documents, so consider the specific needs of your business.

- Payment Terms: If your agreement involves complex payment conditions, a detailed format with clear sections for each term will be beneficial.

- Client Preferences: Some clients may prefer digital formats while others may request paper documents. Adapt your format accordingly.

- Legal Requirements: Make sure your chosen format complies with any local laws or regulations regarding documentation and payments.

Popular Formats to Consider

There are several widely accepted formats that businesses commonly use for financial documentation:

- Standard Layout: A simple structure that includes basic details like amounts, payment terms, and contact information.

- Detailed Itemized List: Ideal for transactions involving multiple products or services. Each item is listed separately with its own price and quantity.

- Custom Branding: Some businesses prefer to customize the format with their logos, colors, and unique design to reinforce their brand identity.

Choosing the right layout not only enhances clarity but also ensures that all necessary information is easily accessible for quick processing and payment.

Legal Considerations for Sponsorship Invoices

When preparing financial documents for business agreements, it’s essential to be aware of the legal aspects to ensure compliance with local laws and regulations. Properly structured records not only reflect professionalism but also protect both parties in case of disputes. Understanding the legal requirements that govern these transactions will help prevent misunderstandings and provide a solid foundation for future dealings.

Key Legal Factors to Consider

There are several important legal elements to consider when creating a financial document related to a partnership:

- Clear Payment Terms: Define payment deadlines, methods, and late fees clearly to avoid potential legal issues if payments are delayed.

- Tax Compliance: Ensure that the document includes applicable taxes and meets the required tax laws for your jurisdiction. This is particularly important if you operate internationally.

- Agreement Reference: Including a reference to the signed agreement or contract is vital for confirming the terms of the deal.

- Incorporating Legal Clauses: Specify any legal clauses that are relevant, such as dispute resolution procedures, refund policies, and penalties for non-payment.

What to Avoid in Legal Documentation

When drafting your documents, it is important to avoid the following:

- Vague Language: Ambiguous terms can lead to legal challenges or confusion. Ensure everything is clear and specific.

- Failure to Include Key Details: Missing information such as payment terms, the full amount due, or important references may invalidate the agreement.

- Non-compliance with Local Laws: Be sure to check the legal requirements in your country or region, including tax rates, reporting requirements, and terms of agreement.

By keeping these legal considerations in mind, you ensure that your financial documents are not only professional but also legally sound, protecting both you and your business partners in all transactions.

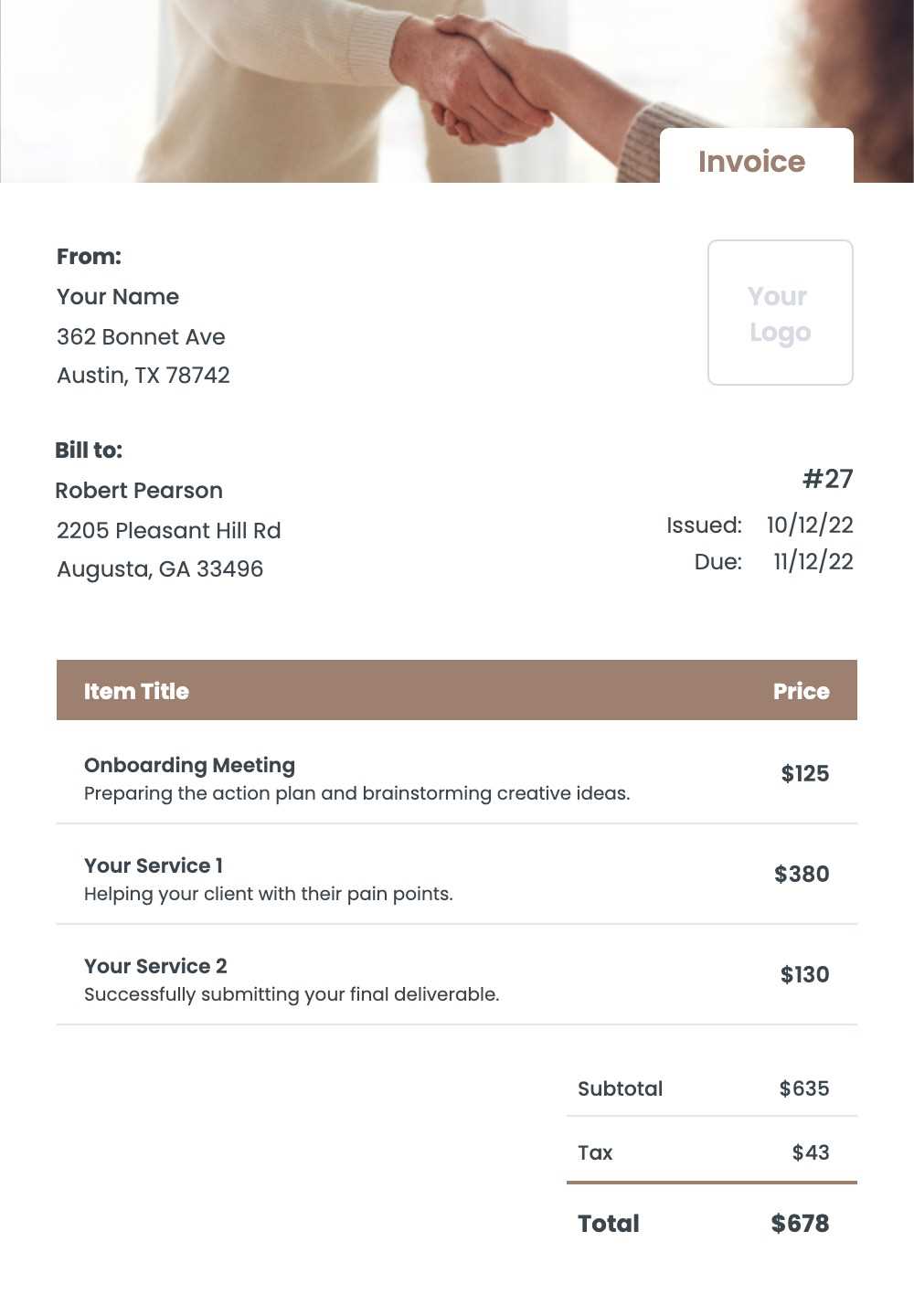

How to Organize Invoice Information

Properly organizing the details in your financial documents is crucial for clarity and efficiency. A well-structured document not only ensures that all required information is easily accessible but also helps in processing payments without delays. By grouping and presenting the necessary data in a logical order, you can avoid confusion and ensure smooth transactions.

The first step in organizing your financial document is to break it down into clear sections, each serving a distinct purpose. This way, both you and the recipient can quickly locate specific details when needed. Below are some key elements to include and how to organize them effectively.

Key Sections to Include

Here are the primary sections that should be included in any well-organized document:

- Header: Include your business name, contact information, and logo (if applicable). This section also includes the recipient’s details.

- Description of Services: Clearly list the services or products provided, including any necessary details such as quantities, prices, or hours worked.

- Payment Details: Specify the amount due, the payment method, and any applicable taxes or additional charges.

- Terms and Conditions: Include payment terms, deadlines, and penalties for late payments. Make sure these terms are clear and easy to understand.

How to Format the Information

Once you’ve identified the sections, the next step is formatting them in an easily digestible manner. Use consistent headings, bullet points, and tables to organize the details. For example, itemizing services or products in a table makes it easy for both parties to review and confirm the charges.

Using bold and italic text for emphasis and separating each section with clear lines or spacing can help visually break down the information and improve readability.

By keeping the structure simple and clean, you ensure that your documents are professional and easy to navigate, making the payment process smoother for everyone involved.

Tracking Payments Using Invoices

Monitoring payments is essential for any business to ensure timely collection and maintain accurate financial records. A well-structured document serves as an important tool for tracking transactions, providing a clear reference point for both parties. By systematically recording and updating payment statuses, businesses can manage their cash flow and minimize the risk of missed payments or discrepancies.

One of the most effective ways to track payments is by maintaining detailed records within your financial documents. These records not only serve as a confirmation of services rendered but also allow you to monitor outstanding payments and follow up on any overdue amounts.

How to Track Payments Effectively

To track payments accurately, consider including the following details in your documents:

| Field | Description |

|---|---|

| Payment Due Date | The date by which payment is expected, making it easy to track overdue amounts. |

| Payment Status | A section to update whether the payment is pending, partially paid, or fully paid. |

| Amount Paid | Record the amount that has been paid so far, along with the date of payment. |

| Balance Due | Keep track of the remaining amount that needs to be paid after each transaction. |

By updating these fields regularly, you will have an organized system that allows you to monitor payments and follow up promptly if necessary. This method also provides a clear financial overview, which is useful for budgeting and forecasting.

Additional Tips for Effective Payment Tracking

- Automate reminders: Set up automated payment reminders to notify clients of upcoming or overdue payments.

- Document all communications: Keep a record of all emails or messages related to payment discussions for reference in case of disputes.

- Use digital tools: Consider using accounting software or online platforms that allow you to track payments and generate reports automatically.

Implementing these strategies will help streamline your payment tracking process, ensuring a smooth workflow and reducing the chances of payment delays or errors.

Free vs Premium Invoice Templates

When choosing a document design for financial transactions, you’ll typically encounter two main options: basic, no-cost versions and more advanced, paid versions. Each type has its advantages and drawbacks, depending on your needs and the complexity of your business operations. Understanding the differences between these options can help you make an informed decision about which approach works best for your situation.

Basic options are often suitable for small businesses or individuals who require simple solutions, while paid versions are typically more comprehensive, offering additional features and customization possibilities. Below is a comparison of both types to help you determine which fits your business needs.

Comparison of Key Features

| Feature | Basic Option | Premium Option |

|---|---|---|

| Customization | Limited options for personalizing design and structure | Wide variety of customizable elements, including branding |

| Ease of Use | Simple, straightforward layout with fewer options | User-friendly interface with advanced features for customization |

| Additional Features | Basic fields for name, amount, and date | Advanced fields like payment tracking, automated reminders, and multiple currency options |

| Support | Limited or no customer support | Comprehensive customer support and assistance for troubleshooting |

| Cost | Free of charge | Requires a one-time fee or subscription |

Which Option Is Right for You?

The choice between basic and paid solutions largely depends on the scale of your operations and the specific features you require. For small, one-time projects, the free option may be sufficient. However, if you run a growing business or require specific customization and advanced features, investing in a paid version could provide you with significant value in terms of both functionality and efficiency.

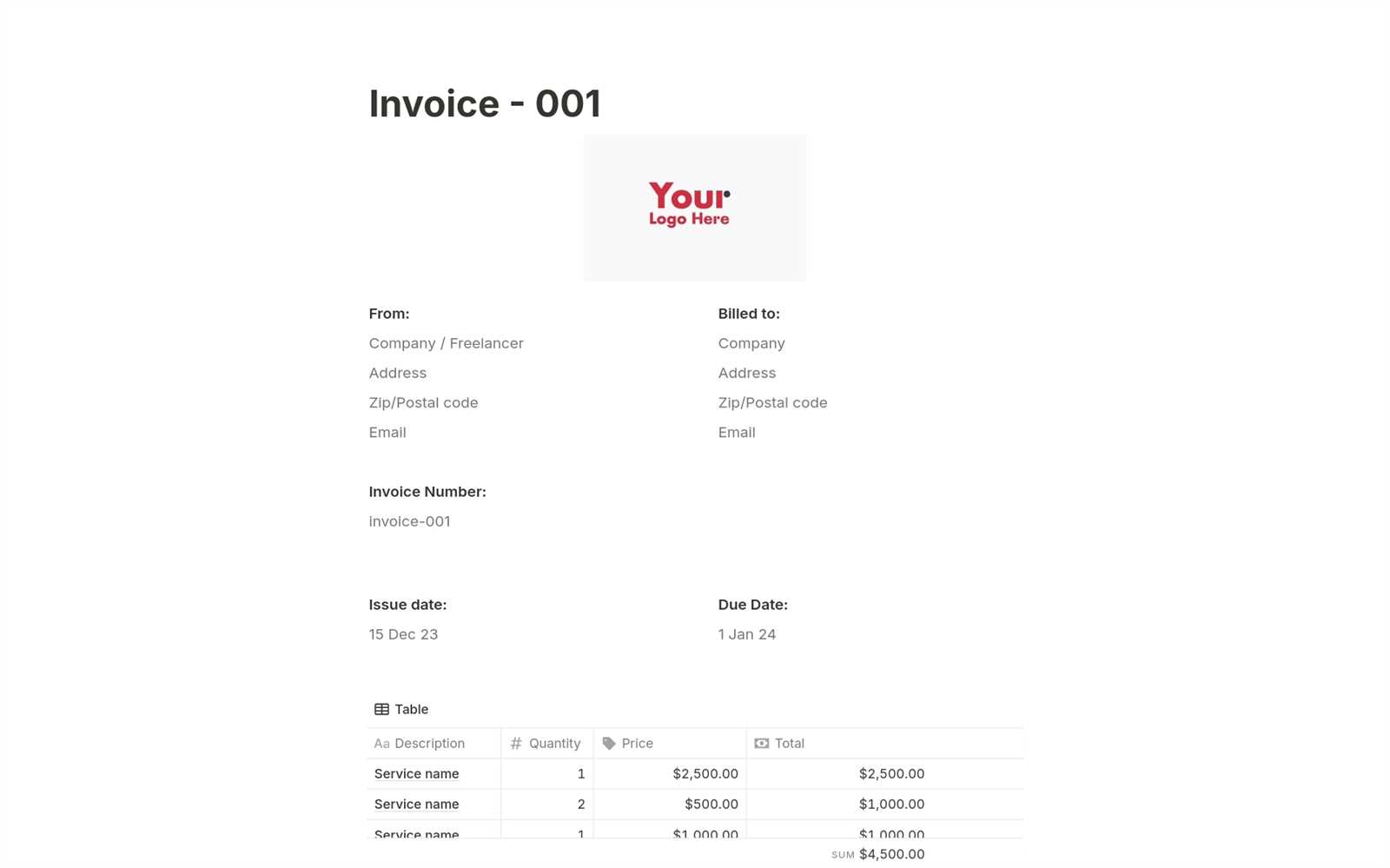

Where to Find Free Templates Online

If you’re looking to simplify your financial processes, there are many online platforms offering downloadable forms without any cost. These resources can save time and effort, providing ready-made designs that you can easily customize for your needs. Whether you’re managing a small business or handling personal transactions, knowing where to find these helpful tools is crucial.

There are various websites and online libraries that offer a wide range of customizable documents, making it easy to find the right format for your purposes. Here are some popular sources where you can access these essential documents:

Popular Online Sources

- Google Docs – A free resource offering editable, shareable document formats that can be customized to suit your business needs.

- Microsoft Office Online – Provides a variety of basic, easy-to-edit designs that can be accessed directly through the browser.

- Canva – Known for its user-friendly design interface, Canva offers a variety of pre-designed forms that are free to use and modify.

- Template.net – A platform offering a selection of no-cost formats for various business purposes, from basic designs to more complex structures.

- FreshBooks – While primarily a paid service, FreshBooks offers a few free downloadable documents suitable for simple needs.

By exploring these resources, you can quickly find the necessary materials to manage financial transactions effectively. These platforms often include helpful features, such as pre-filled fields and automated formatting, making them easy to adapt and use for different situations.

How to Save Time with Templates

Utilizing pre-designed formats can significantly streamline your workflow, allowing you to focus on the core aspects of your business. By relying on ready-made structures, you eliminate the need to create documents from scratch each time, reducing the time spent on repetitive tasks. This approach helps in maintaining consistency and efficiency in your financial documentation process.

Instead of manually entering information in every document, you can simply adjust key fields to suit your needs. The built-in organization of these forms ensures that essential details are always included, which minimizes the risk of overlooking important information. Below are a few ways these ready-made formats can help save time:

Key Time-Saving Features

- Pre-filled Fields – Many documents come with standard fields like names, dates, and amounts, which can be quickly adjusted to fit your specific situation.

- Consistent Layout – Using the same structure for all your documents helps reduce decision-making time and ensures uniformity in your communication.

- Easy Customization – Most formats allow you to edit and personalize them with minimal effort, so you don’t have to start from scratch every time.

- Quick Sharing and Printing – Once customized, these documents can be easily saved, printed, or shared electronically, speeding up the overall process of distribution.

By incorporating ready-made documents into your workflow, you’ll not only save time but also enhance your productivity, making it easier to focus on other critical tasks in your business.

Creating Professional Invoices with Ease

Designing polished and well-organized financial documents doesn’t need to be complicated. With the right tools, you can create professional forms that reflect the quality of your business in just a few steps. Whether you are handling client transactions or business expenses, having a clear, structured format is essential for maintaining professionalism and building trust.

By using pre-designed layouts, you can easily generate customized documents that include all necessary details while maintaining a clean, professional appearance. These forms typically feature essential components like contact information, terms of payment, and breakdowns of services provided, making it easier for both parties to understand and process the details.

Key Elements of a Professional Document

| Element | Description |

|---|---|

| Clear Heading | Use a prominent title to indicate the purpose of the document, such as “Payment Summary” or “Transaction Details”. |

| Company Details | Ensure your business name, address, and contact information are clearly listed for easy reference. |

| Client Information | Include your client’s details for proper identification and easy communication. |

| Breakdown of Services | Clearly itemize the services or products provided, along with their corresponding prices and quantities. |

| Payment Terms | State your payment terms, including due dates, late fees, and accepted payment methods. |

With these key elements in place, you can easily create documents that not only meet the legal and business standards but also help streamline your financial management process. Customizing pre-designed documents ensures efficiency while maintaining a professional appearance with minimal effort.

Best Practices for Sponsorship Invoicing

Managing financial transactions with clients or partners requires a well-structured and efficient approach to ensure that all details are clear and transparent. Adopting best practices for creating and sending billing documents can save time, reduce errors, and improve professionalism. Here are some effective strategies to follow when handling billing for business arrangements or services provided.

Clear and Detailed Information

- Accurate Contact Information: Always include correct and up-to-date contact details for both parties. This ensures that any follow-up inquiries can be easily addressed.

- Comprehensive Breakdown: Clearly list the services, products, or benefits provided, along with corresponding costs, quantities, and any applicable taxes.

- Precise Dates: Specify the service period, payment due date, and the date the document was created. This helps in setting expectations and avoids confusion.

Maintain Consistency

- Standardized Format: Use a consistent layout and format for all documents to help both you and your clients quickly understand the information presented.

- Uniform Terminology: Use familiar and professional terms to ensure clarity. Avoid ambiguous language that could create misunderstandings.

- Simple and Professional Design: Keep the design clean, with legible fonts and adequate white space. This makes the document easier to read and more approachable.

Timely Delivery and Follow-up

- Send Promptly: Deliver your documents in a timely manner to avoid delays in payment. Clients appreciate quick and efficient service.

- Follow-up Reminders: If a payment is overdue, gently remind the client with a polite follow-up message. Setting up reminders in advance can be helpful.

By following these best practices, you will ensure that your billing process is streamlined, efficient, and professional. This not only improves client relationships but also supports smoother financial operations in your business.

How to Send and Follow Up on Invoices

Once a billing document is prepared, it’s crucial to send it correctly and follow up to ensure timely payment. An efficient process for sending and tracking payments helps maintain good business relationships and keeps your finances organized. Below are the essential steps to follow when dispatching and following up on your financial documents.

Sending the Billing Document

- Choose the Right Delivery Method: You can send the document via email, postal service, or through an online payment platform, depending on the preferences of the recipient. Ensure you use the most reliable method to avoid delays.

- Provide Clear Instructions: In your message, briefly explain the payment terms, the total amount due, and the due date. This makes it easier for the recipient to understand the document.

- Attach Necessary Supporting Documents: Include any additional documents such as contracts, agreements, or receipts that might help clarify the payment details. This provides transparency and reduces the chance of disputes.

Following Up on Payments

- Send Reminders Before the Due Date: A gentle reminder a few days before the due date ensures that the recipient is aware of the upcoming payment and can plan accordingly.

- Be Professional and Polite: If the payment is overdue, always remain polite and professional when following up. A courteous approach strengthens your business relationships.

- Set Up Automated Follow-ups: Consider using a billing software or system that automatically sends payment reminders or overdue notifications. This saves you time and ensures consistency.

- Offer Flexible Payment Options: If the recipient is unable to pay the full amount at once, offer payment plans or alternative solutions that could facilitate quicker payment.

Following these steps not only improves the chances of receiving timely payments but also maintains professionalism and strengthens client trust. A well-structured follow-up process can streamline your financial operations and help you avoid late payment issues in the future.