Free Small Business Invoice Template for Easy and Professional Invoicing

Managing financial transactions efficiently is crucial for any service provider. A well-structured document for requesting payment ensures clarity between you and your clients, preventing misunderstandings and delays. With the right document, you can streamline your process, reduce errors, and present a professional image to your customers.

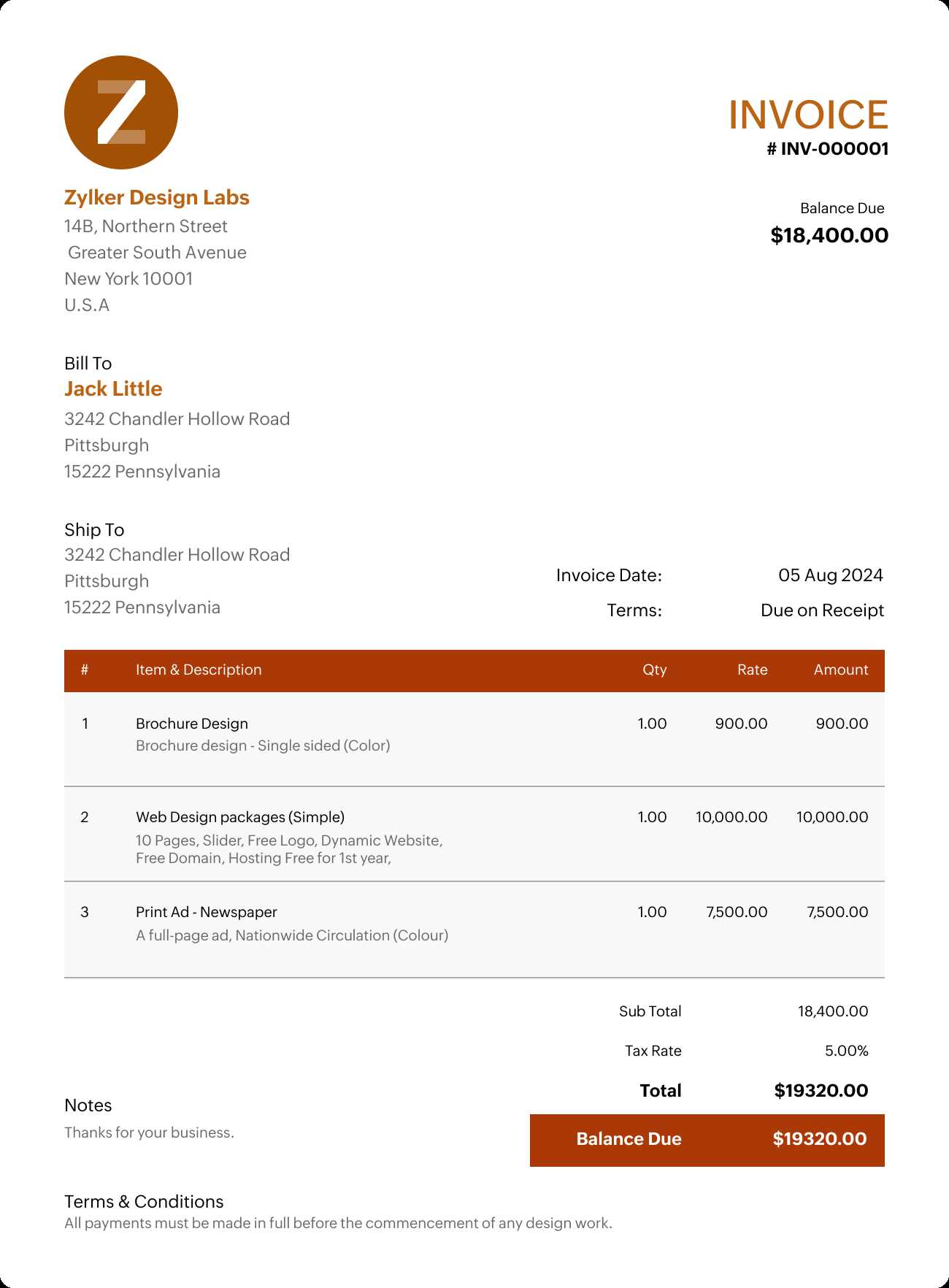

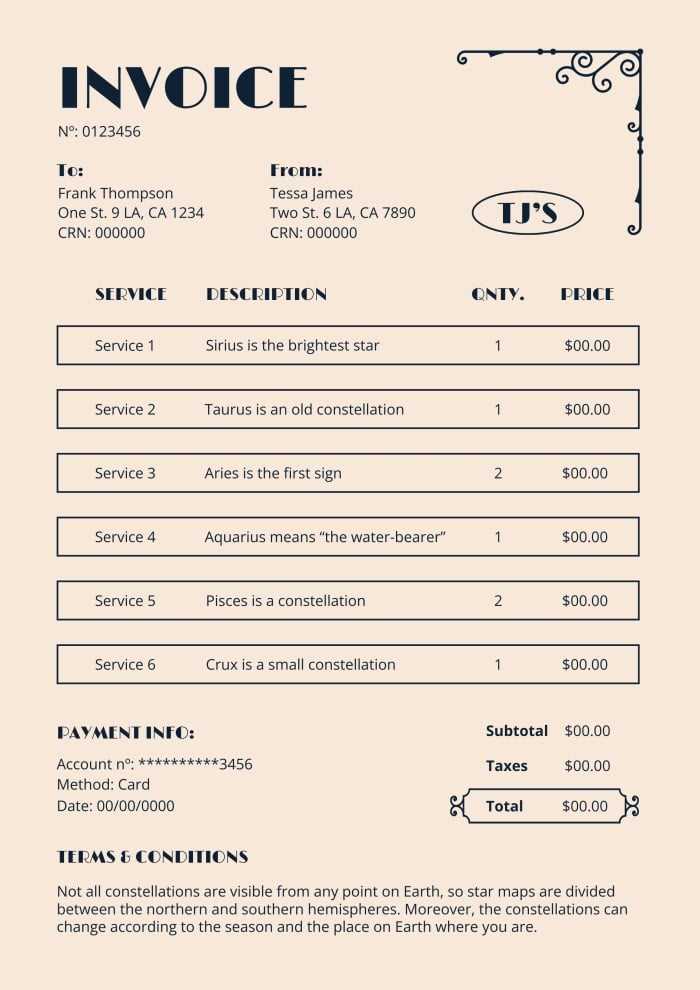

Customizing such a document according to your needs offers flexibility, allowing you to add specific details that match your work and client relationships. Whether you need to include itemized lists, payment terms, or tax information, a well-crafted form can make a significant difference in how your financial dealings are perceived.

There are numerous options available that allow you to generate these documents quickly and easily. From simple designs to more detailed layouts, you can choose the one that best fits your style and requirements, ultimately saving time and ensuring accuracy.

Free Invoice Templates for Small Businesses

For any service provider, having access to a structured, easy-to-use document for requesting payments is essential. Such a document ensures that both parties are on the same page regarding the terms of the transaction, and it minimizes the risk of confusion or disputes. The availability of pre-designed, customizable forms makes it possible to create a professional-looking request with little effort.

Why Use Pre-Designed Forms

Pre-designed forms offer a straightforward solution for individuals who need to focus on their work rather than spending time on creating billing documents from scratch. These options come with essential fields, such as client details, descriptions of services or products provided, and payment instructions. They help ensure that all necessary information is included, making the process faster and more efficient.

Customization Options to Suit Your Needs

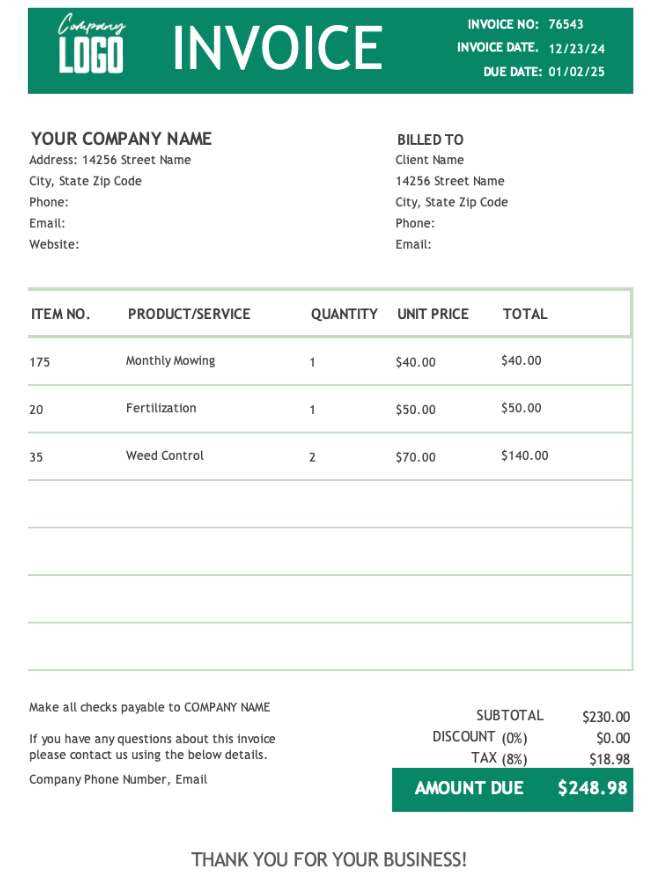

Even though pre-designed documents can save time, they are also highly customizable. You can adjust the layout, fonts, colors, and fields to match your specific needs and preferences. This flexibility ensures that the document aligns with your brand identity and communicates professionalism while maintaining accuracy.

Flexibility is one of the key benefits of using such tools, as they can be tailored to suit different industries and pricing structures. From hourly rates to flat fees, the forms can easily accommodate any pricing model, making them suitable for a wide range of professionals.

Why Use an Invoice Template

Having a well-organized document for payment requests offers numerous advantages, especially when managing multiple clients or projects. It saves valuable time by eliminating the need to manually create a new layout for every transaction. Instead, a pre-designed structure ensures that all required details are consistently included, reducing the chance of errors.

One of the key reasons for using a ready-made structure is the increased professionalism it brings. Clients are more likely to take your services seriously when they receive clear, easy-to-read billing documents that are formatted correctly. A polished, organized approach to billing also reflects positively on your brand, building trust and fostering long-term business relationships.

Additionally, utilizing such documents helps streamline the process of tracking payments. When all transactions are recorded in a consistent format, it’s easier to manage accounts and monitor outstanding amounts. This simplicity can be especially helpful for freelancers or independent contractors who handle their own financial management.

How to Customize Your Invoice

Personalizing your payment request document allows you to tailor it to your specific needs, ensuring that it aligns with both your business practices and your brand identity. Customization options range from modifying the layout and design to adjusting the fields included, giving you full control over the appearance and functionality of the form.

One of the first steps in customizing is to incorporate your logo and brand colors to make the document reflect your company’s unique style. This small touch helps make the document feel official and can leave a lasting impression on your clients.

You can also modify the fields to suit the type of service or product you’re offering. For example, you might want to include specific sections for tracking hours worked, materials used, or any additional fees. Customizing these details ensures that all the necessary information is provided for clear and transparent transactions.

Don’t forget to include payment terms and due dates in the customization process. These elements help avoid confusion and ensure that both parties understand when payments are expected and how they should be made.

Choosing the Right Template for You

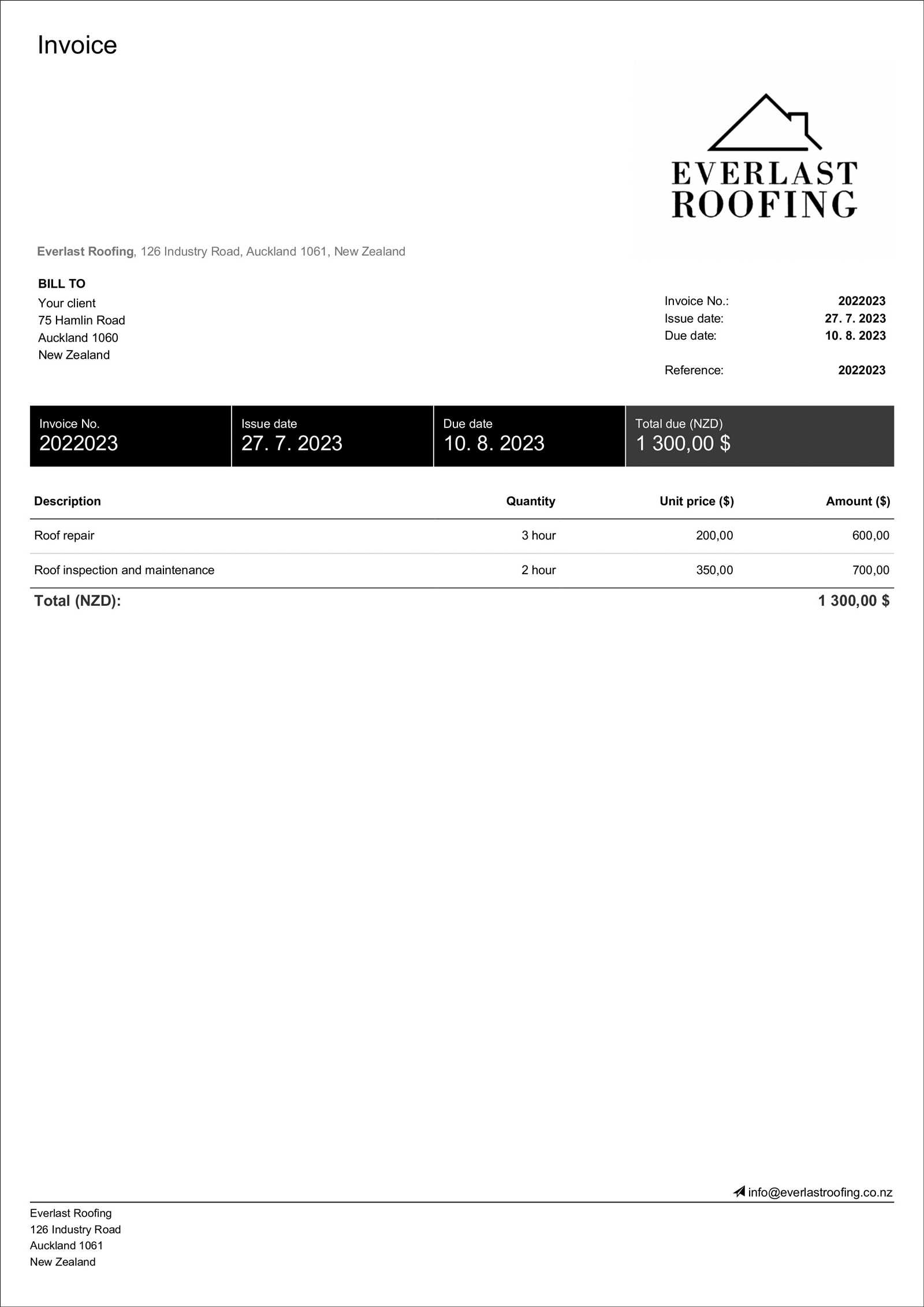

Selecting the ideal format for your payment request documents is an important step in ensuring smooth transactions. The right structure not only helps you present clear and concise details to your clients but also reflects the professionalism of your services. It’s essential to consider both your specific needs and the nature of the services you offer when choosing a design.

Start by assessing what information you need to include. If your work involves multiple components, such as products and services, a more detailed layout with itemized sections might be necessary. On the other hand, if you offer a single service or product, a simpler format may suffice.

Design plays a significant role in how your payment requests are perceived. Choose a clean, organized structure that is easy to read. A professional look can foster trust and improve client relationships. Additionally, you may want to select a design that can be easily modified as your needs evolve over time.

Don’t forget to consider functionality. Some formats allow you to track payments or include recurring billing options, which can be especially useful for ongoing contracts or subscriptions. Choose a structure that helps streamline your workflow and supports the way you manage your finances.

Common Invoice Mistakes to Avoid

Even with a well-structured payment request, it’s easy to make mistakes that can lead to delays, confusion, or even loss of revenue. Understanding the most common errors can help you avoid them and ensure smooth financial transactions. Accuracy and clarity are key to maintaining professional relationships and managing your finances effectively.

Incorrect Information

One of the most common errors is missing or incorrect details. Whether it’s the client’s name, address, or service description, inaccurate information can create confusion and delay payments. Always double-check all fields before sending out a request to ensure everything is correct.

Not Including Payment Terms

Without clear payment terms, clients may not know when and how to make the payment. This can lead to misunderstandings and missed deadlines. It’s essential to clearly state the payment due date, methods of payment accepted, and any penalties for late payments.

| Error | Impact | Solution |

|---|---|---|

| Missing Client Details | Confusion and delays | Double-check all fields |

| Unclear Payment Terms | Late or missed payments | Specify due dates and payment methods |

| Not Itemizing Charges | Unclear cost breakdown | Provide a detailed list of services/products |

Ensuring all the details are correct and clearly outlined will help avoid these co

Benefits of Using Digital Invoices

Switching to electronic payment requests offers several advantages over traditional paper methods. Digital documents streamline the entire process, from creation to submission, and provide numerous benefits that enhance efficiency, organization, and sustainability. With digital options, you can manage your financial transactions faster, with greater accuracy and convenience.

Efficiency and Speed

One of the key benefits of using electronic documents is the speed with which you can create, send, and receive payment requests. Unlike paper forms, which require physical mailing or hand-delivery, digital versions can be sent instantly via email or payment platforms. This reduces waiting time, ensuring that transactions are processed faster and payments can be received sooner.

Reduced Errors and Increased Accuracy

Digital systems often come with built-in checks that help reduce human error. With automated fields, calculations, and reminders, it’s easier to ensure that all the necessary details are included correctly. This accuracy reduces the chances of mistakes that can lead to payment delays or client disputes.

Additionally, digital documents are easily stored and accessible. You can keep an organized record of all transactions, making it easier to track payment history, reconcile accounts, and manage finances over time. These systems also support search functions, so finding specific documents is quick and simple.

Simple Steps to Create Invoices

Creating a payment request doesn’t have to be a complicated process. By following a few straightforward steps, you can quickly generate a clear and professional document that outlines the terms of the transaction. Whether you’re working with clients on a one-time project or ongoing contract, these basic steps ensure that all the necessary information is included and properly formatted.

Step 1: Include Your Details

Start by adding your contact information, including your name or company name, address, phone number, and email address. This makes it clear who the payment is coming from and ensures that clients can easily reach out if they have any questions. Including your tax ID number or business registration number is also important for legal purposes, depending on your location.

Step 2: Specify the Services or Products Provided

Next, clearly list the services rendered or products delivered. For each item, include a description, quantity, rate, and total amount due. You can also add specific notes or details about the work, such as project timelines or milestones. Being detailed and precise helps avoid confusion and makes it clear what the client is being charged for.

By following these steps, you ensure that your payment requests are complete, accurate, and easy for clients to understand. This approach will not only speed up the payment process but also help maintain a professional reputation.

Tracking Payments with Invoices

Efficiently managing and tracking payments is crucial to maintaining healthy cash flow and avoiding missed or late payments. A well-structured payment request not only helps clarify the transaction but also serves as an important tool for monitoring outstanding balances. Keeping track of payments ensures that you stay on top of your finances and can quickly identify any overdue amounts.

By including key information on the payment request document, such as the due date, payment methods, and a unique reference number, you can easily track the status of each transaction. Digital versions of these documents often allow you to mark when a payment has been made, offering a simple way to monitor what’s been settled and what’s still pending.

| Reference Number | Client Name | Amount Due | Due Date | Status |

|---|---|---|---|---|

| #12345 | John Doe | $500 | 2024-11-15 | Paid |

| #12346 | Jane Smith | $350 | 2024-11-20 | Pending |

| #12347 | Mark Lee | $120 | 2024-11-18 | Overdue |

By maintaining a clear record of payment status, you can ensure that you are always aware of your outstanding balances and avoid any unnecessary confusion when reconciling accounts.

How Templates Save Time and Money

Utilizing pre-designed documents can greatly enhance your efficiency and reduce costs. By streamlining the process of creating payment requests, you save time that would otherwise be spent formatting or drafting new documents for each transaction. This efficiency leads to quicker turnaround times, enabling you to focus on more important aspects of your work.

Time-Saving Benefits

Creating professional documents from scratch for every payment can be time-consuming. Instead, using a ready-made format allows you to:

- Quickly input details such as client information and services provided without having to adjust layout or design.

- Eliminate errors by using standardized fields that ensure you don’t miss important details.

- Reduce repetitive work by simply updating the information for each new transaction rather than starting from zero.

Cost-Effective Solutions

In addition to saving time, using pre-designed documents can help you save money in several ways:

- Lower administrative costs: Less time spent on document creation means fewer hours billed to clients for administrative tasks.

- Fewer mistakes: With a professional layout, errors that could result in disputes or rework are minimized.

- Reduce outsourcing costs: There’s no need to hire external help for document creation when you have ready-to-use formats.

By investing time in selecting the right format and customizing it to your needs, you can improve workflow and reduce costs in the long run.

Free Tools for Invoice Creation

Creating well-structured and professional documents for payments is essential for smooth transactions. Fortunately, there are several free online resources available that make this process easier and faster. These tools offer a variety of features, from customizable layouts to automated calculations, making it possible to generate clear and accurate documents without needing specialized software or design skills.

Many platforms allow you to create and send payment request documents directly from your browser. With just a few clicks, you can input necessary details, adjust the format, and even track the status of your transactions. Some of these tools are especially helpful for individuals or small operations who don’t need a complex invoicing system but still want to maintain a professional appearance.

Key Features to Look For:

- Customizable Fields: Adjust the document to fit your needs by adding specific details, such as payment terms or service descriptions.

- Automated Calculations: Some tools automatically calculate totals, taxes, and discounts, reducing the chance of errors.

- Templates: Choose from a range of pre-designed layouts that can be quickly adapted to suit your branding and requirements.

- Easy Sharing: Most platforms allow you to send your document directly via email or link to your client, speeding up the payment process.

By taking advantage of these free tools, you can simplify the creation of professional payment requests while saving time and ensuring accuracy. Whether you’re an independent freelancer or managing a growing venture, these resources can help you maintain a streamlined workflow.

Best Invoice Templates for Freelancers

As a freelancer, creating clear and professional payment requests is key to maintaining positive client relationships and ensuring timely payments. The right format can save time and help you present your work in a polished manner. From simple designs to more detailed layouts, various options cater to different needs, ensuring that freelancers can easily customize documents while keeping their workflow efficient.

When selecting a format, it’s important to look for designs that are both functional and customizable. Freelancers often deal with different types of projects, so having the ability to adjust details–such as hourly rates, project timelines, and payment terms–can make a big difference. Below are a few essential elements to look for when choosing the best layout for your needs:

- Clean Design: A simple, professional look with a logical structure helps ensure that clients can quickly find the information they need.

- Customizable Fields: The ability to add specific services, rates, or discounts allows for flexibility with each project.

- Tax Calculation: Some designs include automatic tax calculations, which can help you stay compliant with regulations and ensure accuracy.

- Personal Branding: Choose a format that lets you add your logo, business name, or color scheme, so your requests reflect your personal brand.

By selecting a layout that fits your style and needs, you can streamline your financial processes and focus on what matters most–delivering great work to your clients.

Importance of Clear Payment Terms

Setting clear expectations regarding payment is essential for maintaining a professional relationship and ensuring timely compensation for services rendered. When clients understand the payment structure, deadlines, and consequences of late payments, it helps reduce misunderstandings and conflicts. Clearly defined terms not only streamline the process but also protect both parties involved in the transaction.

Key Elements of Clear Payment Terms

To avoid confusion, include the following important details in your agreements:

- Due Date: Always specify the exact date when payment is expected. This prevents any ambiguity and sets a clear deadline for your clients.

- Payment Methods: Clearly state what methods are accepted, whether it’s bank transfer, credit card, or online payment platforms. This allows clients to choose the most convenient option for them.

- Late Fees: Define the consequences of delayed payments, such as interest charges or fixed penalties. This encourages prompt payment and protects your cash flow.

- Discounts for Early Payment: Offering discounts for early settlements can motivate clients to pay sooner and improve your cash flow.

Why Clear Payment Terms Matter

Having transparent payment terms builds trust and professionalism. When clients are aware of the terms upfront, they’re more likely to adhere to them, and you can avoid unnecessary disputes. Additionally, it ensures that both parties are on the same page regarding financial expectations, leading to smoother business transactions.

Design Tips for Professional Invoices

A well-designed payment request is not just about aesthetics; it reflects your professionalism and helps make the payment process more efficient. The layout and style you choose can leave a lasting impression on clients, making it easier for them to understand the details of the transaction. A clean, organized design can also speed up payment processing and reduce errors.

Here are some key design tips to ensure your requests look professional and are easy for clients to read:

- Use a Clear Structure: Organize information in a logical flow. Start with your contact details, followed by the client’s information, itemized services or products, totals, and payment instructions.

- Highlight Key Information: Make important details like the total amount due and due date stand out by using bold or larger fonts. This draws the client’s attention to critical information and helps avoid confusion.

- Keep It Simple: Avoid cluttering the page with excessive text or graphics. A minimalist approach with plenty of white space improves readability and gives the document a more polished look.

- Consistency is Key: Use consistent fonts, colors, and styles across all your payment documents. This creates a unified look that reflects your brand and makes it easier for clients to recognize your materials.

- Include Your Logo: Adding your company logo to the document not only strengthens your brand identity but also adds a touch of professionalism.

By following these design tips, you can ensure your payment requests are both functional and visually appealing, improving client satisfaction and encouraging timely payments.

How to Send Invoices Electronically

In today’s digital world, sending payment requests electronically is both convenient and efficient. Whether you’re a freelancer or a service provider, electronic submission speeds up the process, reduces paper waste, and ensures that your documents are easily accessible to clients. By using the right tools and understanding best practices, you can streamline the payment process and avoid common errors.

There are various ways to send your documents electronically, each offering its own advantages. Here are some of the most common methods and the steps involved in using them:

| Method | Advantages | Steps |

|---|---|---|

| Direct and quick, allows for easy tracking and confirmation of receipt. | 1. Attach your document to an email. 2. Add a clear subject line (e.g., “Payment Request for [Project Name]”). 3. Write a brief message explaining the document. 4. Send to the client’s email address. |

|

| Online Payment Platforms | Streamlines payments with integrated invoicing features, automatic reminders, and payment tracking. | 1. Sign in to your platform account (e.g., PayPal, Stripe). 2. Create a new payment request. 3. Add details like amount, due date, and services provided. 4. Send the request via the platform’s messaging system. |

| Cloud Storage Links | Great for sharing large files or when using custom formats not supported by other tools. | 1. Upload the document to a cloud storage service (e.g., Google Drive, Dropbox). 2. Generate a shareable link. 3. Send the link to your client via email or messaging app. |

When sending electronic payment requests, always ensure that your documents are well-organized and include all relevant details. Double-check that the file format is compatible with your client’s software to avoid issues with opening the document.

Incorporating Tax Information in Invoices

Including the correct tax details in your payment requests is essential for maintaining transparency and complying with local regulations. Properly calculating and displaying taxes ensures that both parties are clear about the total amount due and avoids any future disputes or misunderstandings. Whether you’re dealing with sales tax, VAT, or other forms of taxation, it’s important to follow legal requirements and provide all necessary information.

Key Tax Elements to Include

Here are the crucial tax-related details that should be included in your requests:

- Tax Identification Number (TIN): Your TIN, as well as the client’s, should be listed if applicable. This is important for tax reporting purposes and demonstrates your compliance with local tax laws.

- Tax Rate: Clearly indicate the percentage applied to the total amount. This allows clients to understand how much of the total is attributable to tax.

- Tax Amount: Specify the exact amount of tax charged. This helps clients to see the breakdown of the total charges.

- Tax Registration Number: If you’re registered for tax purposes, include your registration number to validate the legitimacy of the tax charges.

How to Display Tax Information Clearly

It’s important that tax details are displayed clearly to avoid confusion. Present taxes in a separate section or line on your payment request to make it easier for clients to distinguish between the pre-tax total and the final amount due. By doing so, you ensure your clients can easily verify that the proper tax has been applied.

Using Invoice Templates for Small Business Growth

Efficiently managing financial documentation is a key component of any company’s growth strategy. By streamlining the process of creating payment requests, entrepreneurs can save valuable time, reduce errors, and focus on expanding their operations. A consistent and professional approach to invoicing not only enhances cash flow management but also contributes to building a trustworthy reputation with clients.

Here are several ways that utilizing well-designed payment request formats can help fuel your company’s growth:

- Improved Efficiency: Using pre-structured documents allows for faster processing. Rather than spending time manually formatting each request, you can simply fill in the necessary details and send it off, freeing up time for other important tasks.

- Professional Appearance: A polished, organized payment request reflects well on your company and establishes credibility. Clients are more likely to pay on time when they perceive your company as professional and trustworthy.

- Consistency: A uniform structure helps clients to quickly understand payment terms and total amounts due, minimizing confusion and errors. Consistent use of a payment format helps maintain clarity and reduces follow-up inquiries.

- Better Financial Tracking: Keeping all requests in a standardized format makes it easier to track payments, monitor overdue amounts, and analyze trends. With organized records, you can gain insights into cash flow and identify areas for improvement.

- Scalability: As your company grows, so will the volume of payment requests. Using a standardized format allows you to scale your invoicing process seamlessly without compromising accuracy or efficiency.

By incorporating effective financial documentation practices, entrepreneurs can ensure smooth operations and foster growth, all while maintaining strong relationships with clients.