Free Simple Invoice Template for Easy and Quick Billing

Managing financial transactions can be time-consuming, but with the right tools, the process becomes much smoother. Whether you’re a freelancer, a small business owner, or just someone in need of efficient documentation, having a well-structured method for creating payment requests is essential. A well-designed document not only ensures clarity but also enhances your professionalism and helps maintain organized records.

There are various solutions available that simplify the creation of these important documents. By using customizable formats, you can quickly generate professional-looking statements that include all necessary details. This method saves you from the hassle of designing a new layout from scratch every time and ensures consistency in your communication.

In this guide, we’ll explore how to get started with these tools and discuss their key benefits. You’ll learn how to effectively integrate them into your workflow, saving time while keeping your financial records organized and accurate.

Free Simple Invoice Template for Everyone

When it comes to billing and financial documentation, having an accessible solution is crucial for individuals and businesses alike. Many professionals and entrepreneurs require a straightforward way to issue payment requests without the complexity of specialized software or the need for expensive tools. A streamlined approach allows anyone to quickly create detailed statements with minimal effort.

There are multiple options available that cater to a wide range of needs. Whether you’re managing a small business, working as a freelancer, or handling personal transactions, these resources can help you stay organized and maintain accurate records. By providing essential features and easy-to-use designs, they ensure that creating a payment request remains hassle-free, even for those with limited experience in document creation.

These tools can be particularly beneficial for individuals who don’t require advanced functionality but still need reliable and professional documents. With intuitive formats that focus on key details, anyone can get started in minutes and make sure that their financial communications are both clear and effective.

Why Use a Simple Invoice Template

Creating payment requests from scratch can be time-consuming and complex, especially if you’re not familiar with document design. By using a pre-designed solution, you can save valuable time and focus on the core aspects of your business. These tools provide a clear structure for essential details, ensuring that all necessary information is included in each document without overwhelming the user with unnecessary features.

Key Benefits of Using Pre-Designed Formats

- Efficiency: Quickly create professional-looking statements without having to start from scratch.

- Consistency: Maintain a uniform style across all communications, which enhances your credibility.

- Ease of Use: Most solutions are user-friendly, allowing even beginners to generate effective documents without difficulty.

- Focus on Essentials: These formats guide you to include only the most important details, making it easier to track payments and stay organized.

How It Helps Different Users

- Small Business Owners: Quickly generate accurate records that reflect your services or products.

- Freelancers: Streamline client billing and improve professional communication with minimal effort.

- Personal Use: Ideal for individuals who need to issue payment requests for various personal transactions.

By relying on these practical tools, you can ensure that your financial documents are consistent, professional, and easy to manage, saving you both time and effort in the long run.

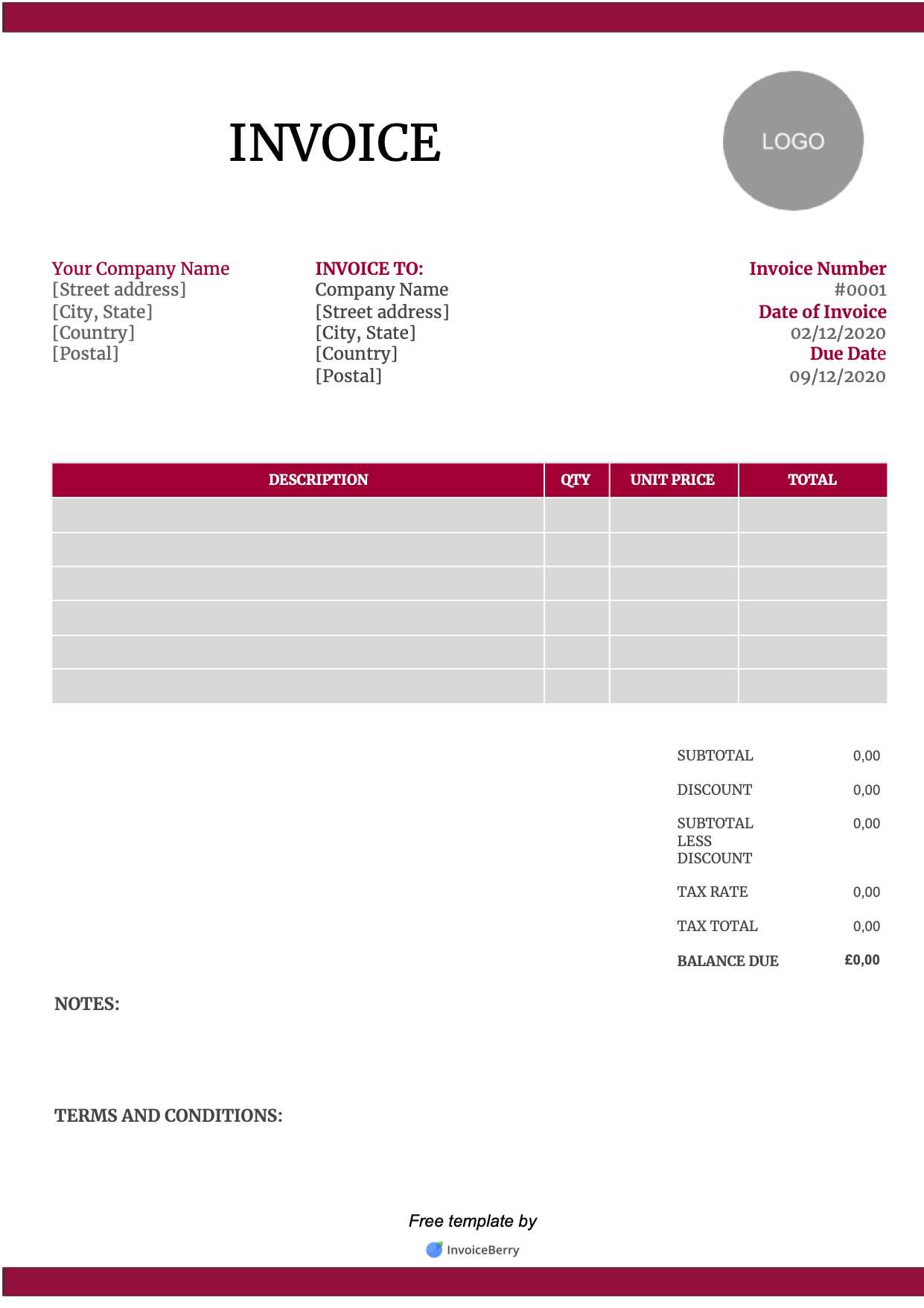

How to Customize Your Invoice

Customizing your billing document allows you to tailor it to your specific needs, ensuring that all essential details are accurately reflected. By adjusting key elements such as your logo, contact information, payment terms, and item descriptions, you can create a document that not only looks professional but also serves as a clear and comprehensive record for both you and your client.

Adjusting Key Sections

- Header Information: Add your business name, logo, and contact details at the top to establish your brand identity.

- Client Details: Include your client’s name, address, and any other relevant contact information to ensure accuracy.

- Itemized List: Provide a clear breakdown of services or products offered, including quantities, rates, and totals.

- Payment Terms: Clearly specify the due date, payment method, and any late fees or discounts for early payment.

Additional Customization Tips

- Design Elements: Choose a color scheme and layout that matches your business style, making the document visually appealing and aligned with your branding.

- Personalized Notes: Add a personal touch by including a thank-you note or any additional instructions to create a positive customer experience.

- Tax Information: If applicable, ensure you include tax rates or VAT numbers to comply with legal requirements.

By making these simple adjustments, you can create a document that reflects your unique business needs, maintains professionalism, and fosters clear communication with your clients.

Advantages of Free Invoice Templates

Using pre-designed billing documents offers numerous benefits for both individuals and businesses. These resources can simplify your administrative tasks, reduce the time spent on creating formal requests, and ensure consistency across all financial communications. Whether you are a freelancer, small business owner, or managing personal transactions, these tools can help streamline your workflow without the need for expensive software or extensive design skills.

Cost-Effectiveness

- No Upfront Costs: Many accessible solutions come at no charge, making them ideal for small business owners and freelancers on a budget.

- Reduce Software Expenses: By using ready-made formats, you can avoid the need for premium software that may come with unnecessary features.

Time-Saving Features

- Quick Setup: Pre-designed formats allow you to create professional-looking documents in minutes without the need to design them from scratch.

- Consistency: Using the same layout for every document helps save time and ensures that all essential information is always included.

These pre-built solutions not only help save time and money but also enhance the professionalism of your financial records. With minimal effort, you can create organized, clear, and accurate statements every time.

Best Practices for Invoice Design

Effective document design plays a crucial role in ensuring that financial statements are clear, professional, and easy to understand. Well-structured documents help avoid confusion, facilitate prompt payments, and reflect the professionalism of the business. The design should focus on clarity, organization, and consistency, making it simple for recipients to navigate key details. Here are some important principles to follow when creating such documents.

- Prioritize Readability: Ensure the text is easy to read by using a clean, legible font. Avoid overly ornate styles and opt for standard fonts like Arial or Helvetica, keeping the font size consistent and appropriate for each section.

- Use Clear Hierarchy: Organize information in a logical order. Use headings, subheadings, and bullet points to break down complex details, and make sure the most important elements, such as amounts and dates, stand out.

- Include Essential Information: At a minimum, every document should contain the date of issue, the recipient’s details, payment terms, and a clear breakdown of charges. This information should be easy to locate.

- Brand Consistency: Align the design with your company’s branding guidelines. Use your logo, color palette, and fonts to maintain consistency with other materials and reinforce your brand identity.

- Legible and Balanced Layout: Avoid overcrowding the page with too much text or too many graphics. Keep enough white space between sections to give the document an open, clean appearance.

- Clear Payment Instructions: Make sure that payment methods and instructions are visible and easy to follow. Include bank account details, online payment options, and due dates in a prominent place.

- Accurate and Precise Data: Double-check all calculations, numbers, and contact details. Even a small error can damage your credibility and cause delays in payment.

By following these design principles, you can create professional documents that leave a positive impression, foster trust, and support smooth financial transactions.

Common Invoice Mistakes to Avoid

When creating financial documents, even small errors can lead to delays, confusion, and damaged professional relationships. To ensure smooth transactions and prompt payments, it’s crucial to avoid common pitfalls. By being aware of frequent mistakes, you can take steps to prevent them and maintain accuracy in every transaction.

- Missing or Incorrect Contact Information: Ensure that both your details and those of your client are up-to-date and accurate. Failing to include correct addresses, emails, or phone numbers can cause issues with communication and payment processing.

- Incorrect Payment Terms: Always double-check the payment due date and terms. Misunderstandings about deadlines or payment methods can lead to late payments or confusion.

- Omitting Tax Information: Failing to include applicable taxes or not specifying tax rates can lead to misunderstandings or legal complications. Always ensure that the correct tax details are clearly visible.

- Not Detailing Products or Services: A vague description of what is being billed can create confusion. List each product or service with a clear breakdown, including quantities and unit prices, to avoid disputes.

- Math Errors: Simple arithmetic mistakes can have serious consequences. Always double-check your calculations, including subtotals, tax amounts, and final totals, to ensure accuracy.

- Failure to Include Reference Numbers: Lack of a unique identifier or reference number can make it difficult for both you and your client to track payments, leading to unnecessary back-and-forth.

- Overcomplicated Design: An overly complex or cluttered layout can make important details hard to find. Keep the design clean, straightforward, and organized to improve readability and efficiency.

- Inconsistent Formatting: Inconsistent font styles, sizes, or alignments can create a sense of unprofessionalism. Maintain a consistent format throughout the document for clarity and professionalism.

By avoiding these mistakes, you can create accurate and professional documents that foster trust, reduce misunderstandings, and ensure timely payments.

How to Download a Free Template

When looking for an easy way to streamline your financial document creation, downloading a ready-to-use format can save time and effort. Whether you need a customizable document for regular use or a one-time need, the right resource can help you get started quickly. Here’s a step-by-step guide to obtaining a suitable document from various online sources.

Finding a Reliable Source

The first step is locating a trustworthy platform that offers high-quality and downloadable files. Many websites offer a wide range of formats that cater to different needs and industries. To ensure you’re selecting a reputable source, look for platforms that provide user reviews or ratings. Be cautious of sites that require excessive personal information or payment without clear benefits.

Downloading and Customizing Your Document

- Choose a Format: Once you’ve found the ideal site, select the format that fits your needs. Most platforms offer several types of documents, including Word, Excel, or PDF formats, which can be easily edited or printed.

- Click on the Download Link: After selecting the correct format, locate and click the download button. The file will either download automatically or direct you to a page where you can save the document to your device.

- Customize the Content: Open the downloaded document in your preferred software. Fill in the necessary details such as names, dates, and amounts, ensuring all sections are complete and accurate.

With just a few clicks, you can have a well-organized and professional document ready for use in no time. Simply follow the steps above to download and adapt it for your business needs.

Simple Invoice Template Features

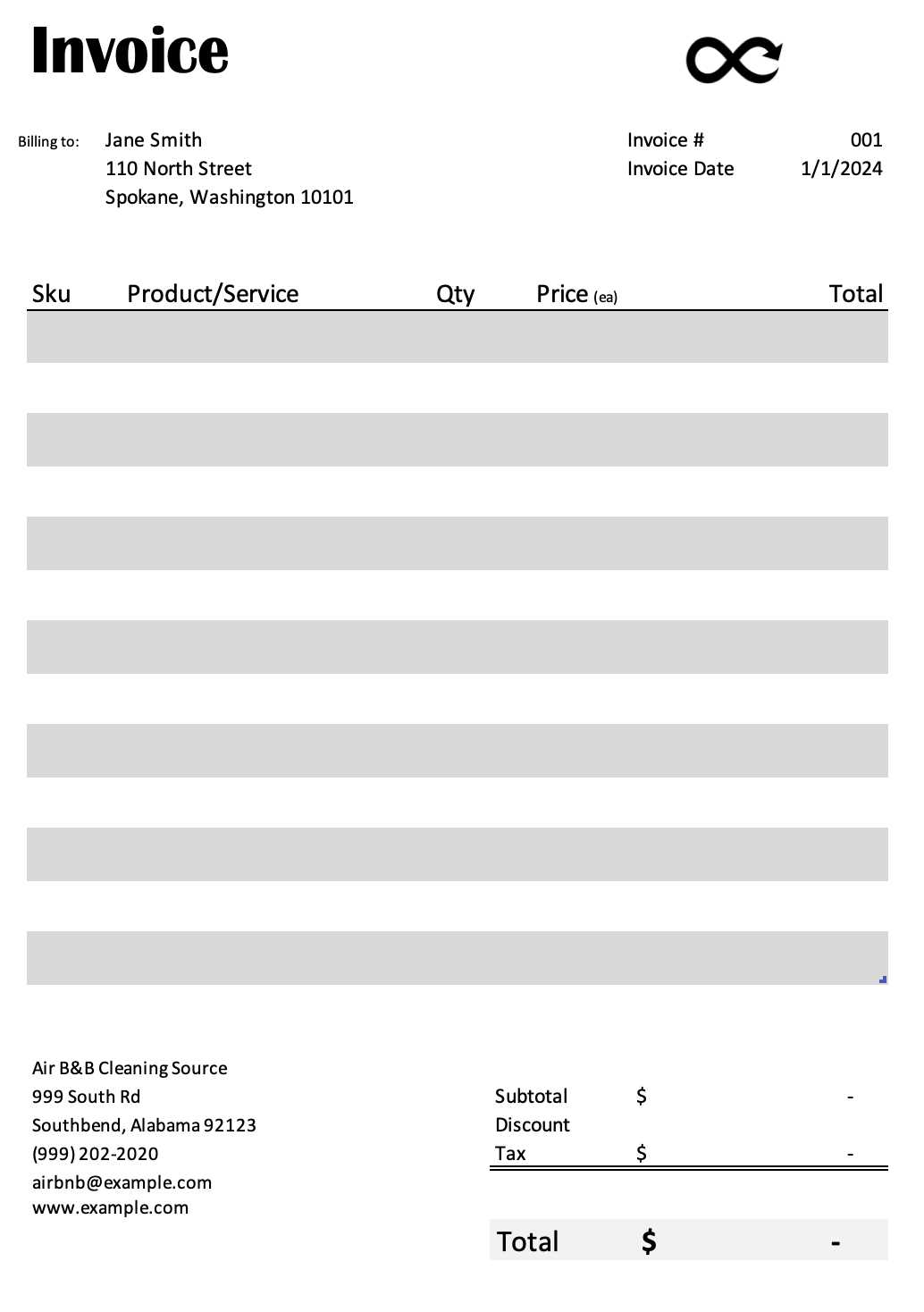

When creating a professional document to request payment, certain key elements make the process smoother for both you and your clients. A well-designed format includes sections that facilitate clear communication, accurate calculations, and easy navigation. Here are the main features you should expect in a well-structured document.

Essential Sections

- Header with Business Information: A section at the top of the document should clearly display your business name, logo, address, and contact details. This ensures your client knows exactly who the document is from and how to reach you.

- Client Information: Include a space for the recipient’s name, company name (if applicable), and contact information. This helps avoid any confusion and ensures that the document is directed to the right person or department.

- Itemized List of Products or Services: A detailed table or list should break down the goods or services provided, including quantities, unit prices, and totals. This section allows clients to understand exactly what they are paying for.

- Total Amount Due: A clearly marked total amount at the bottom, including taxes and other fees, ensures that the payment expectation is easy to find. This prevents misunderstandings and facilitates prompt payment.

Additional Features

- Payment Instructions: A section outlining how and where to make the payment, including bank account details or online payment options, should be easily accessible.

- Due Date: It’s crucial to specify the date by which payment is expected. This helps to set clear expectations for both parties and can improve cash flow.

- Unique Reference Number: Including a unique identifier helps both you and your client keep track of the document, which can be especially useful for larger businesses or in case of future inquiries.

These features ensure clarity and professionalism while minimizing the chances of errors or confusion. Whether you’re handling small-scale transactions or larger orders, these elements help maintain smooth and efficient communication.

How to Edit Your Invoice Easily

Customizing a financial document to reflect the specifics of each transaction is essential for maintaining clarity and professionalism. With the right tools, editing can be done quickly and without hassle. Whether you need to adjust the amounts, update client details, or make stylistic changes, these steps will help you tailor your document to suit each need effectively.

Using Software for Editing

Most people use word processors or spreadsheet software to make edits, as they provide a flexible and user-friendly interface. Here’s how you can modify your document easily:

- Open the Document: Use any program that supports the file format, such as Microsoft Word, Excel, or Google Docs. For spreadsheet files, Excel or Google Sheets works best.

- Edit Text Fields: Click on the text you wish to modify, such as client information, items, or pricing. Simply delete or type over the existing content to make changes.

- Adjust Layout: If the formatting needs tweaking, you can move text boxes, change font sizes, or adjust column widths to accommodate new information without disrupting the layout.

Saving and Exporting the Edited Document

- Save Your Work: Once all the changes are made, save the file on your computer or cloud storage. It’s a good idea to save a new version to preserve the original copy for future reference.

- Export in the Desired Format: After editing, you can export your document as a PDF or any other format suited for sharing or printing. PDFs are particularly useful for preserving the layout and preventing accidental modifications.

Editing your document is a quick and straightforward process. By following these steps, you can ensure that each request for payment is accurate, professional, and ready for immediate use.

Invoice Templates for Small Businesses

For small business owners, keeping track of payments and ensuring clear communication with clients is essential. Using a well-organized document for requesting payment can help you maintain professionalism, reduce errors, and speed up the payment process. With the right format, you can easily create personalized records that reflect your brand while providing all necessary details for the transaction.

Why Small Businesses Need Customizable Formats

Customizable formats allow business owners to quickly adjust the document to fit the specifics of each transaction. Whether it’s a one-time service or a recurring order, a flexible format ensures that all important information is included, such as payment terms, services rendered, and any additional charges. This also minimizes the risk of mistakes, helping to build trust with your clients and ensuring that payments are processed smoothly.

Key Features for Small Business Documents

- Clear Branding: Your document should include your business name, logo, and contact details at the top, ensuring clients know exactly who the payment is for.

- Detailed Breakdown: Include a line-by-line breakdown of the services or products provided. This transparency prevents confusion and makes the payment request easy to understand.

- Payment Instructions: Clearly state how and when the payment should be made. Include relevant bank details or links for online payments, and outline any late fees or discounts for early payment.

- Client Information: Ensure the recipient’s name, company, and contact details are correctly included, so there’s no ambiguity about who is being billed.

By using a well-structured format, small businesses can streamline their payment requests, make a professional impression, and ensure that all transactions are completed without hassle.

How to Save Time with Templates

Streamlining administrative tasks is key for any business looking to improve efficiency and reduce unnecessary effort. Using pre-designed documents can drastically cut down the time spent on repetitive tasks, allowing you to focus on more important aspects of your work. By utilizing a structured format, you can quickly customize and send documents without having to start from scratch each time.

Benefits of Pre-Designed Documents

- Quick Customization: Instead of designing a new document every time you need one, a pre-made layout allows you to simply fill in the necessary details like client information, dates, and amounts. This saves valuable time, especially for routine tasks.

- Consistency and Accuracy: Templates ensure that you maintain a consistent look and structure, which reduces errors in formatting or missing sections. It’s easier to double-check a document when the layout remains the same every time.

- Professional Appearance: Using a clean and organized layout gives your documents a polished, professional feel, enhancing your business’s image without requiring extra effort on your part.

How to Implement Pre-Designed Formats in Your Workflow

- Set Up a Collection: Gather a set of commonly used documents and save them in easily accessible locations. These can include billing requests, contracts, quotes, or any other paperwork you frequently need.

- Personalize as Needed: Each time you need to create a new document, open one from your collection and fill in the specific details. Modify fields like the recipient’s name, services or products, payment terms, and any other relevant information.

- Automate with Software: If you use software that supports document automation, you can set up fields that auto-fill with client or project information, making the process even faster.

By incorporating pre-made formats into your routine, you’ll significantly cut down on the time spent creating documents and increase the overall efficiency of your business processes.

Choosing the Right Invoice Format

Selecting the appropriate document format for requesting payment is essential to ensure that all necessary details are clearly communicated and organized. The right structure not only helps avoid errors but also ensures your client understands the charges and payment terms easily. Different formats cater to various business needs, so understanding the features you require will help you make an informed decision.

Factors to Consider When Selecting a Format

- Business Type: The nature of your business plays a significant role in determining the format. Service-based businesses may require detailed descriptions of work completed, while product-based businesses might focus more on quantities and itemized prices.

- Frequency of Use: If you create similar documents frequently, a standardized format with customizable fields can save time. For one-off transactions, a more detailed format might be necessary.

- Level of Detail: Choose a format that provides the level of detail needed for your transactions. Some formats are basic, while others allow for more complex information such as multiple line items, discounts, taxes, or payment terms.

Common Formats for Different Needs

| Format Type | Best For | Features |

|---|---|---|

| Basic Layout | Small businesses with straightforward services or products | Minimal fields, easy to fill, quick to generate |

| Itemized Breakdown | Businesses selling multiple products or services | Detailed list of items/services with prices, quantities, and total costs |

| Professional Template | Businesses requiring a polished look for client relationships | Logo, consistent formatting, clear sections for terms, and payment options |

| Recurring Format | Service-based businesses with ongoing clients | Auto-filled fields for recurring charges, set payment terms |

| Detail | Description |

|---|---|

| Business Information | Name, address, and contact details of the business issuing the document |

| Client Information | Name, address, and contact details of the client or recipient |

| Document Number | A unique identifier for the document, e.g., INV-00123 |

| Itemized List | Each product or service provided, including descriptions, quantities, and prices |

| Total Due | The total amount owed, including any applicable taxes or discounts |

| Payment Instructions | Details on how to pay, including payment methods, bank account details, or online payment links |

By including these essenti

Invoice Templates for Freelancers

For independent professionals, keeping track of payments and ensuring timely compensation is essential. A well-organized document that outlines services rendered, payment terms, and client information helps streamline the process and maintain clarity between both parties. Having a ready-to-use format can save time, reduce errors, and present a polished, professional image.

When creating such documents, it is crucial to consider several key elements:

- Client’s details: name, address, and contact information

- A description of the work completed or services provided

- Payment terms, including due dates and accepted methods

- Total amount due and any applicable taxes or fees

- A section for both parties to sign or acknowledge receipt if necessary

Having a consistent structure not only ensures legal and financial clarity but also helps in tracking payments and managing client relationships. Additionally, using standardized formats reduces confusion, and eliminates the need to constantly create new documents from scratch.

For freelancers, a reliable structure is more than just a convenience–it’s a tool for maintaining professionalism and organization. With these essential components in place, you can ensure smooth transactions and secure timely payments for your hard work.

How to Handle Payment Terms in Invoices

Clearly defined payment expectations are crucial for maintaining a smooth working relationship with clients. By specifying due dates, late fees, and accepted methods of payment, you can avoid confusion and ensure timely compensation for your work. Setting clear terms from the outset helps both parties understand their responsibilities and reduces the likelihood of disputes down the line.

Key Elements to Include

When outlining payment conditions, certain details are necessary for both clarity and professionalism. These elements help ensure that clients know exactly what is expected of them:

| Element | Description |

|---|---|

| Due Date | Specify when payment is expected. Common options are 15, 30, or 60 days after the document is issued. |

| Late Fees | Outline any additional charges that will apply if payment is overdue. This encourages prompt payment. |

| Accepted Payment Methods | Clearly state how clients can pay (e.g., bank transfer, PayPal, check). |

| Deposit Requirements | If applicable, mention any upfront payments required before work begins. |

Effective Strategies for Enforcing Payment Terms

Incorporating effective practices into your payment procedures will help you maintain a steady cash flow. For instance, sending reminders before the due date, or following up promptly if a payment is missed, can encourage clients to adhere to agreed timelines. Additionally, using contracts or formal agreements that outline payment terms in detail can provide legal protection in case of disputes.

Tips for Professional Invoice Presentation

Presenting a polished and professional document not only helps convey your expertise but also enhances your credibility with clients. Clear structure, accurate details, and visual appeal are essential for creating a document that reflects your professionalism. When crafting such a document, the way it is presented can be just as important as the content itself.

Key Elements of a Well-Presented Document

Ensure that the document is easy to read and visually organized. A few important aspects to focus on include:

| Element | Description |

|---|---|

| Branding | Incorporate your logo, business name, and contact details to create a cohesive, branded document. |

| Clear Structure | Use sections with bold headings to separate important details like services provided, payment terms, and amounts due. |

| Legibility | Choose a clean, professional font and ensure there’s adequate spacing for easy readability. |

| Consistency | Maintain consistent formatting throughout, such as aligning numbers to the right and using the same font style. |

Additional Tips for an Effective Document

Aside from structure and appearance, it’s important to pay attention to the content and delivery. A few strategies include:

- Provide a personalized message or a thank-you note at the bottom to show appreciation for the client’s business.

- Ensure all numbers and amounts are double-checked for accuracy to avoid confusion or delays in payment.

- Keep the tone professional but friendly, and avoid overly complex language.

By focusing on these details, you can ensure your document leaves a strong, positive impression on clients and reinforces your professional image.

Best Tools to Create Invoices

For independent professionals and businesses, having the right tools to generate clear and accurate payment documents is essential. Using specialized software or online platforms allows you to save time, ensure accuracy, and maintain consistency across all client transactions. These tools often come with customizable features that cater to different needs, whether you’re handling multiple clients, projects, or payment methods.

Here are some of the most popular and efficient options available to help you streamline the process:

- QuickBooks – A comprehensive accounting tool that not only generates payment documents but also helps manage finances, track expenses, and sync with bank accounts.

- FreshBooks – Known for its user-friendly interface, this platform allows you to create customized documents, track billable hours, and set up automatic reminders for clients.

- Zoho Invoice – A versatile tool offering a range of customization options and automation features, ideal for freelancers and small businesses.

- Wave – A free accounting software that includes invoicing capabilities, as well as features for managing payments, transactions, and accounting reports.

- Invoicely – A cloud-based solution that lets you create professional payment records, track time, and manage multiple clients without complexity.

These platforms not only help you produce well-structured documents but also offer added benefits such as automatic payment reminders, tax calculations, and financial tracking. Choosing the right tool depends on the scale of your operations, the level of customization you need, and your overall business goals.