Free Simple Invoice Template Excel for Quick and Easy Billing

Managing financial transactions with accuracy is essential for any business or freelancer. One of the key elements in this process is ensuring that billing statements are clear, professional, and easy to create. Using well-designed tools for generating payment requests can save valuable time while maintaining a high standard of professionalism.

There are various tools available that allow users to craft effective payment records quickly. These tools are especially useful for individuals or businesses that do not require complex accounting software but still want to produce polished and reliable documents. By leveraging a straightforward method for preparing financial statements, anyone can streamline their workflow without compromising quality.

Whether you’re running a small business or handling freelance work, having access to an intuitive and flexible system for creating payment records can make all the difference. With the right approach, generating clear and error-free documents can be done with minimal effort, ensuring that your clients are always satisfied with the billing process.

Free Simple Invoice Template Excel for Businesses

For any company, creating accurate and professional billing documents is crucial for maintaining cash flow and fostering trust with clients. Businesses need an efficient way to generate payment requests quickly, ensuring all necessary details are included and presented in a clear manner. Using an easy-to-adopt system for creating these records can help avoid errors and improve the overall efficiency of the billing process.

Businesses of all sizes can benefit from utilizing ready-made tools that streamline this task. These solutions allow users to quickly input essential data, customize fields as necessary, and produce well-structured statements that meet business needs. Whether you’re a small startup or a growing enterprise, these tools save time and ensure that no important details are overlooked in the billing process.

Key Features for Business Use

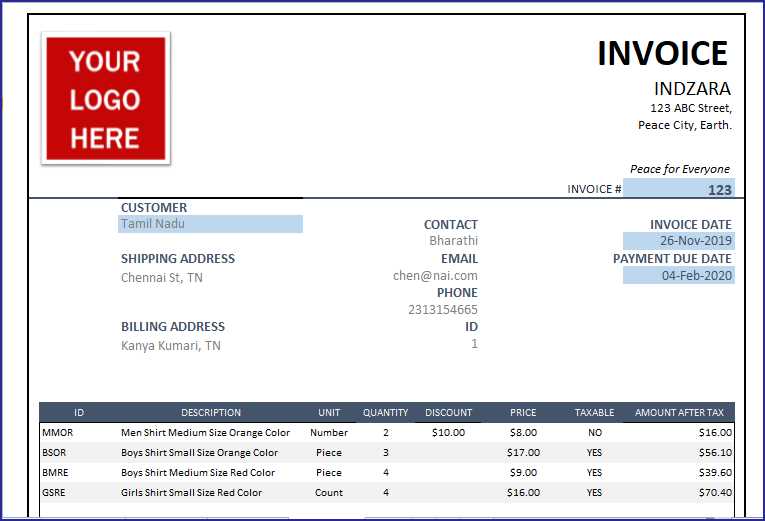

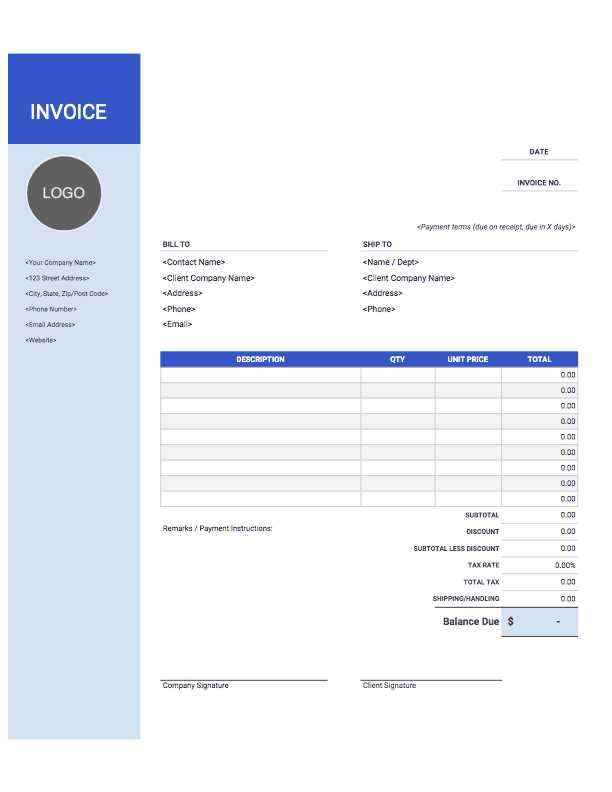

- Customization – Tailor fields for company name, client information, products or services, and payment terms.

- Time-Saving – Pre-designed formats eliminate the need for manual layout adjustments.

- Consistency – Maintain a uniform appearance across all documents, helping with brand recognition.

- Easy Calculation – Built-in formulas for tax, discounts, and totals reduce the risk of human error.

How This Helps Your Business

- Professionalism – Present polished billing records that reflect your business’s credibility.

- Accuracy – Automated calculations and clear structure reduce the chance of mistakes in financial records.

How to Download Excel Invoice Templates

When it comes to creating billing documents, having a reliable tool that can be quickly accessed and easily used is essential for businesses of all sizes. Many people prefer downloading pre-made files to avoid spending time designing or formatting from scratch. These ready-to-use files can be downloaded directly from various sources, offering an efficient way to manage financial records.

To access these resources, you simply need to find trusted platforms that offer downloadable files in the desired format. Once located, the download process is straightforward, providing immediate access to a customizable solution for managing billing statements.

Steps to Download Billing Files

- Search for Trusted Sources – Look for reputable websites that offer secure and high-quality documents.

- Select the Right Document – Browse through available options and choose the one that suits your business needs.

- Download the File – Click the download link, and the document will be saved to your computer or cloud storage.

- Open and Customize – Open the file in your preferred software, fill in relevant details, and adjust as needed.

Where to Find Reliable Downloads

- Official Business Platforms – Many trusted business websites offer downloadable resources for their users.

- Online Marketplaces – So

Why Choose a Simple Invoice Template

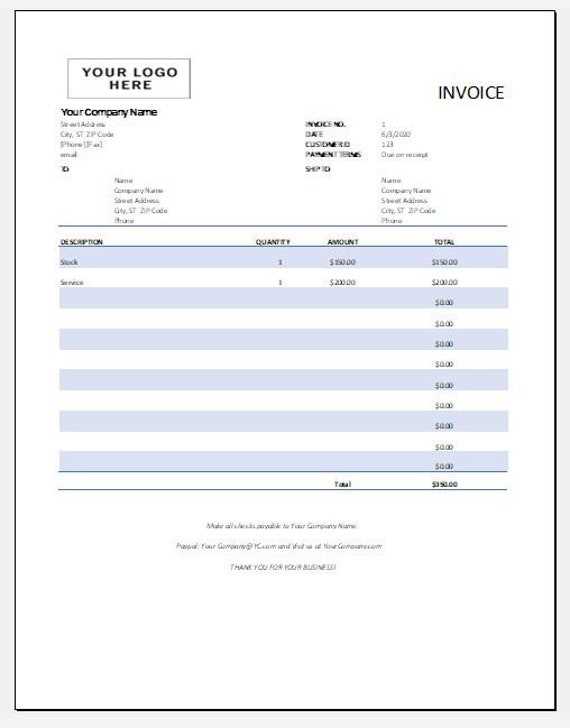

For businesses and freelancers alike, the need to create clear, organized, and professional payment documents is crucial. While there are many sophisticated options available, opting for a straightforward solution can often be the most efficient approach. A minimalist design allows for quick generation and easy customization, without unnecessary complexity or distractions.

Choosing a basic format offers several key benefits. It ensures that the important details are front and center, reducing the risk of missing key information. Moreover, it allows users to focus on the essentials, making the process of preparing billing records faster and more reliable.

Benefits of a Simplified Approach

- Time Efficiency – Quickly input data and generate documents without complicated formatting.

- Ease of Use – A clean and intuitive layout ensures anyone, regardless of experience, can create accurate statements.

- Clarity – Present only the necessary details in a well-organized manner, making it easier for clients to understand.

- Flexibility – Easy to modify or adjust for different projects, clients, or payment terms.

Why Less is More

- Professional Appearance – Minimalistic designs often convey a polished and trustworthy image.

- Fewer Errors – Less complicated layouts reduce the chance of making mistakes when entering details.

- Better Focus – By limiting unnecessary fields or distractions, both the creator and the client can focus on what matters most.

In summary, a simple approach to creating payment documents can enhance productivity, ensure accuracy, and offer a clean, professional presentation for both

Key Features of Excel Invoice Templates

When managing financial transactions, having an efficient tool to create billing records is essential for any business. Tools designed for generating payment requests offer several key features that not only make the process faster but also ensure the accuracy and professionalism of each document. These features allow users to streamline their work while maintaining a high level of organization and clarity.

One of the main advantages of using a structured document system is its ability to automate many aspects of the billing process. From automatic calculations to customizable fields, these tools help reduce errors and ensure all required information is included. Here are some of the standout features that make these tools so valuable for businesses:

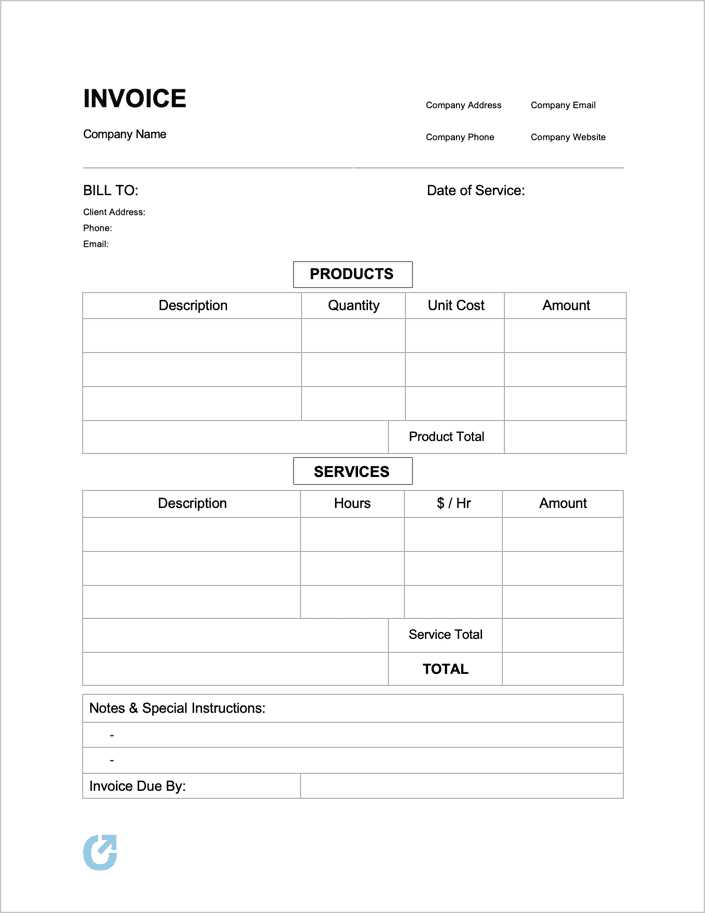

Customizable Fields and Layout

- Editable Sections – Easily modify the layout to fit the needs of your business, including logos, client information, and payment terms.

- Flexible Input Areas – Adjust fields for services or products, quantities, rates, and taxes based on each transaction.

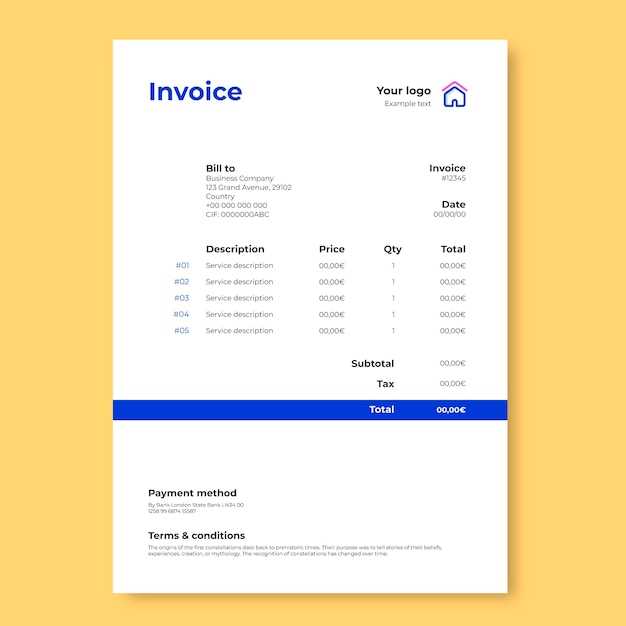

- Professional Formatting – Maintain a clean, consistent structure that reflects your company’s brand and image.

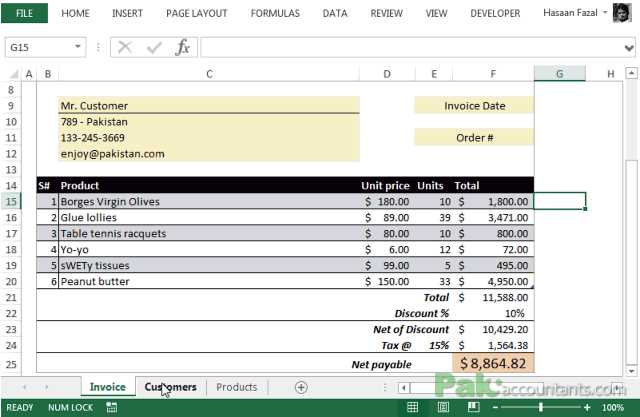

Automation and Calculation Tools

- Built-in Formulas – Pre-programmed calculations for totals, taxes, and discounts save time and ensure accuracy.

- Real-Time Updates – Instantly adjust totals as data is entered, allowing for quick edits and updates without the risk of manual errors.

- Instant Calculations – Automatically calculate and apply sales tax, service charges, or discounts, ensuring precise billing every time.

These features not only simplify the billing process but also reduce the potential for human error, making it easier to create polished and professional documents in a fraction of the time.

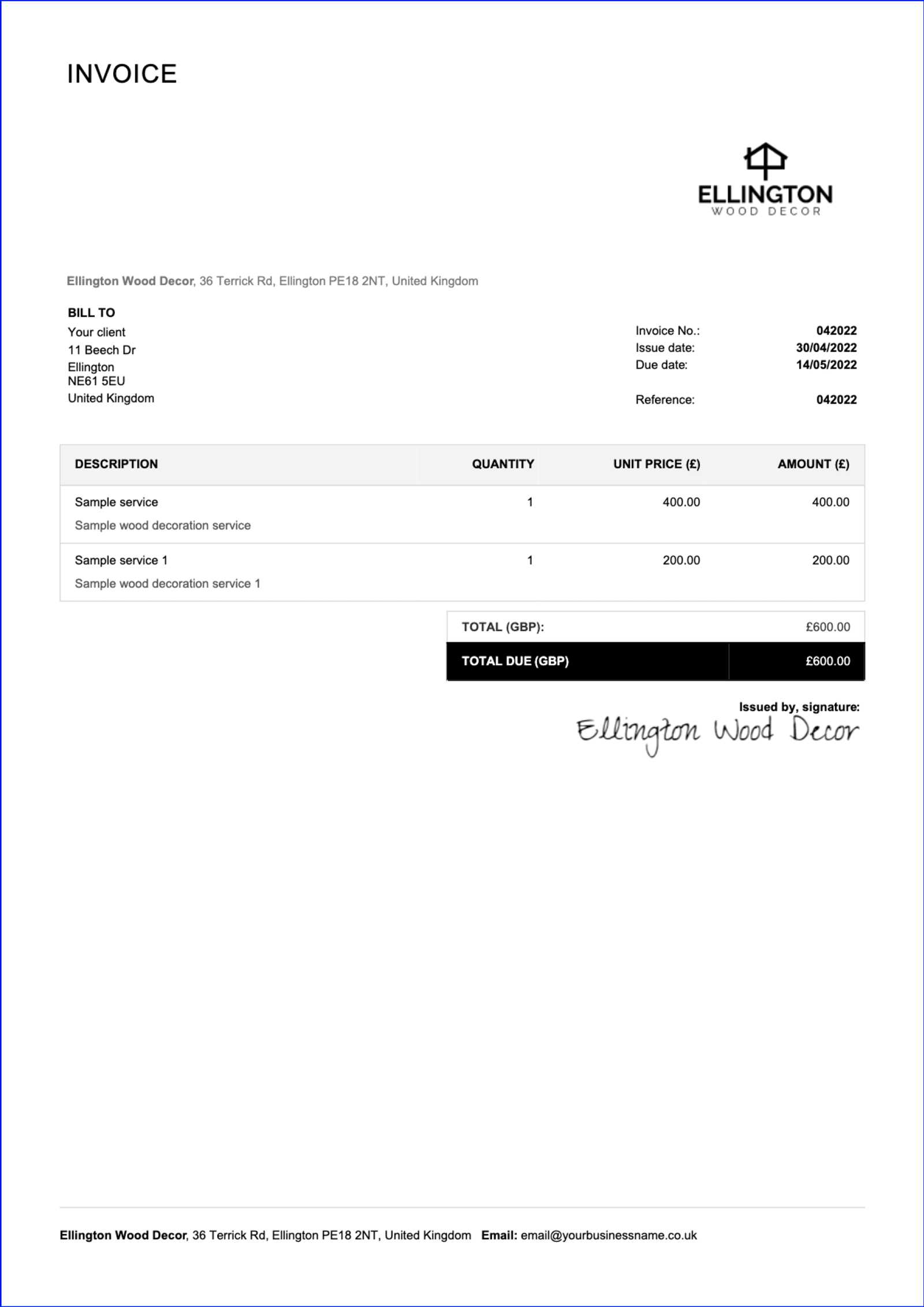

Customizing Your Free Invoice Template

Creating billing records that reflect your unique business needs is essential for both clarity and professionalism. While many pre-designed solutions provide a solid foundation, customization options allow you to adapt the layout and fields to better suit your specific requirements. Customizing these documents ensures that they not only look professional but also contain all the relevant information your clients need.

From adjusting company logos and color schemes to modifying sections for products, services, or payment terms, tailoring these files offers numerous benefits. The more personalized the document, the more aligned it will be with your branding and operational practices.

Essential Customization Options

- Company Branding – Add your logo, company name, and colors to reflect your business’s identity.

- Client Information – Modify the fields for client details, such as address, contact, and project specifics.

- Product or Service Details – Customize descriptions, quantities, and pricing to match the items or services you provide.

Advanced Customization Features

- Payment Terms – Adjust fields for payment due dates, early payment discounts, and late fees.

- Tax Calculations – Set up automated calculations for local taxes or region-specific rates.

- Additional Notes – Include a section for custom terms, special instructions, or project-specific details.

By personalizing these files, you can ensure each billing document aligns perfectly with your business’s operations and communication style, enhancing the overall experience for both you and your clients.

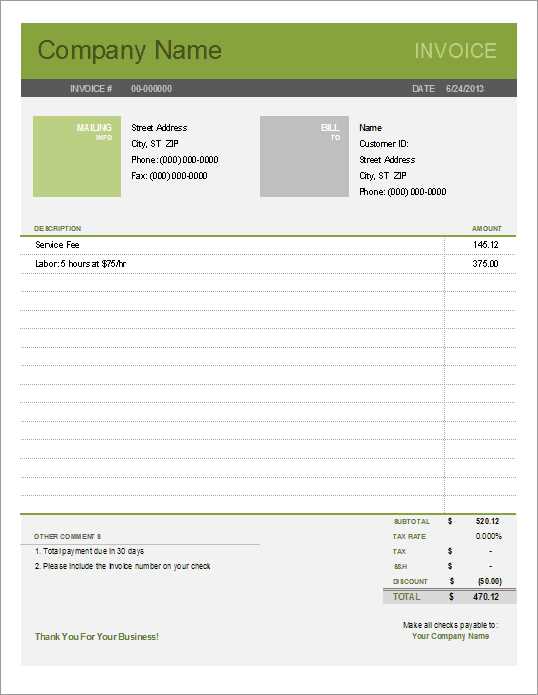

Advantages of Using Excel for Invoices

Using a spreadsheet application to create and manage billing documents offers a variety of benefits, especially for small businesses and freelancers. The flexibility, ease of use, and powerful features of these applications make them an ideal choice for organizing financial transactions. With the ability to automate calculations, store data, and customize layouts, this solution simplifies the process of preparing professional payment records.

One of the main advantages is the built-in functions that allow users to calculate totals, apply taxes, and generate subtotals with ease. This reduces the risk of human error and speeds up the entire process. Additionally, spreadsheet software offers a range of formatting options, making it easy to design clear, structured, and branded documents without needing advanced technical skills.

Key Benefits of Using a Spreadsheet

Feature Advantage Automation Automatic calculations for totals, taxes, and discounts save time and improve accuracy. Customization Design the layout to match your brand, from logo placement to color schemes and font styles. Data Management Easily store past records, track payments, and make updates as needed without additional software. Ease of Use Intuitive and user-friendly interface, suitable for users with minimal technical exp Best Practices for Creating Invoices in Excel

Creating clear and professional billing records is essential for businesses to maintain accurate financial records and ensure prompt payment. When using a spreadsheet application to manage this task, following best practices can help avoid errors and improve efficiency. The goal is to produce documents that are easy to read, well-organized, and reflect your business’s professionalism.

By focusing on layout, consistency, and accuracy, you can ensure that each financial document you create is both effective and reliable. The following best practices will guide you in setting up a streamlined process for preparing your records while maintaining high standards of clarity and professionalism.

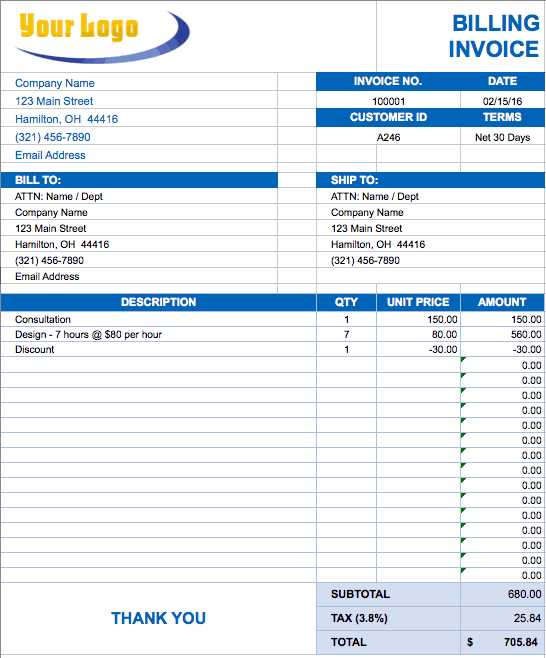

Key Elements for Professional Billing Documents

- Use Clear Headers: Label each section of your document clearly–such as client details, itemized charges, and payment terms–so that important information is easy to find.

- Keep Formatting Consistent: Use a consistent font, color scheme, and layout throughout your documents. This helps in presenting a professional image and makes it easier for clients to read.

- Provide Complete Information: Include all necessary details, such as item descriptions, quantities, unit prices, total amounts, and due dates. Ensure no essential data is missing.

- Double-Check Calculations: Before sending any document, verify that all totals, taxes, and discounts are calculated correctly to prevent mistakes that could lead to confusion or delayed payments.

Additional Tips for Streamlining the Process

- Use Pre-Formatted Sheets: Leverage pre-designed structures that include essential formulas for easy calculations, saving you time and effort.

- Set Up Payment Terms: Clearly define your payment expectations, such as due dates and late fees, so clients know exactly when and how to pay.

- Track Payments

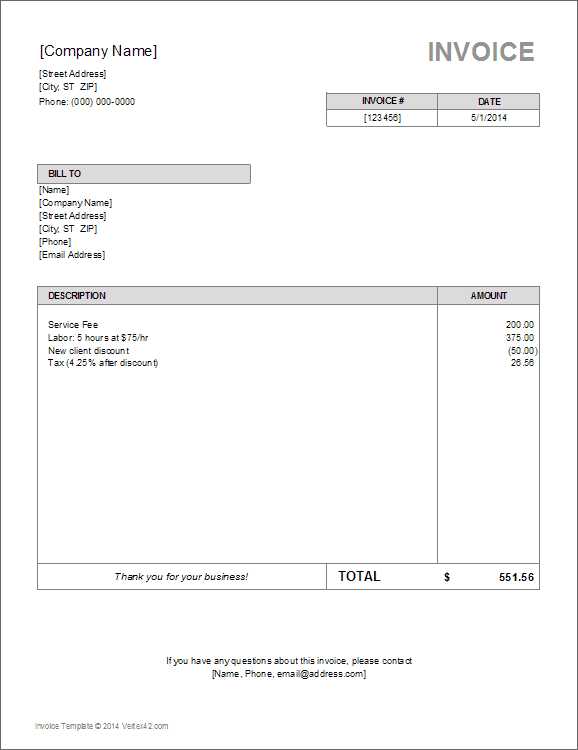

How to Add Tax and Discounts on Invoices

When preparing billing records, including taxes and discounts is essential for ensuring accurate charges and providing transparency to clients. By incorporating tax rates and offering promotional or volume-based discounts, businesses can maintain compliance with local regulations and improve customer satisfaction. Properly applying these adjustments ensures that clients understand exactly what they are paying for and that businesses accurately track revenue.

There are several straightforward methods for incorporating tax and discount values into your financial records. With the right setup, these calculations can be automated, minimizing manual errors and saving time during the document creation process. Below are some of the best practices for adding these essential components to your billing documents:

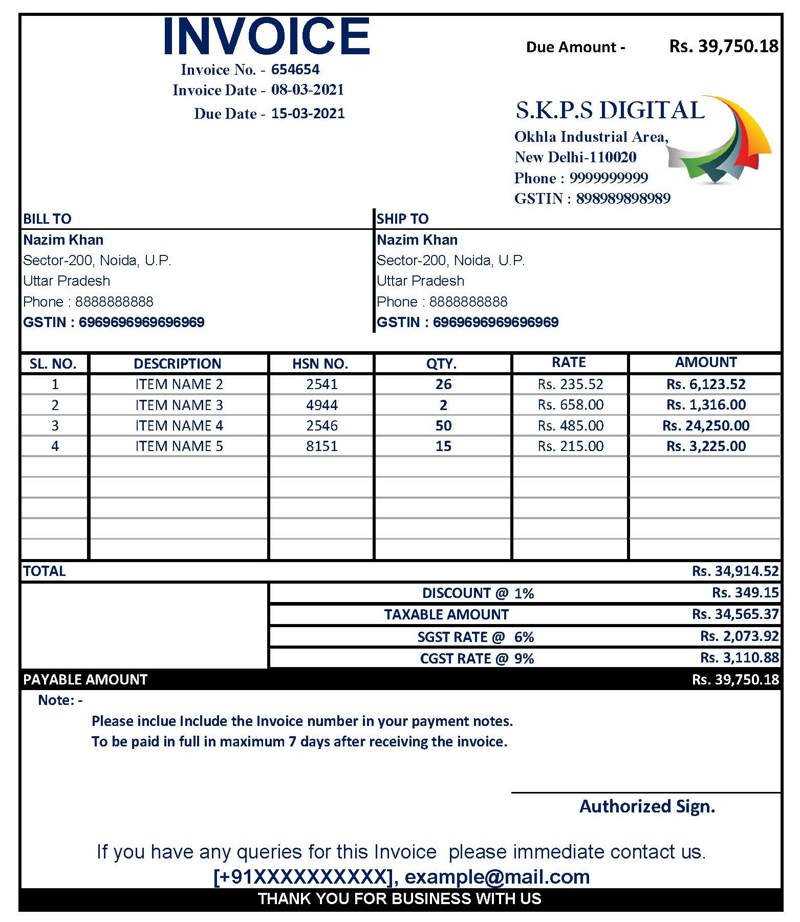

Steps to Add Tax

- Determine the Tax Rate: Research the appropriate tax rate based on your region and product/service type. Rates may vary based on location or type of goods and services.

- Include a Tax Column: Add a column specifically for taxes, where you can calculate the tax amount for each line item. This helps to clearly show the tax applied.

- Use Formulas for Automatic Calculations: Set up a formula that multiplies the item cost by the tax rate to automatically calculate the tax for each item or total amount.

- Include a Total Tax Section: At the bottom of the document, add a line to sum up all tax amounts to show the total tax due.

Steps to Apply Discounts

- Define Discount Criteria: Specify the terms for offering discounts–whether it’s a percentage or a fixed amount for specific products, services, or order sizes.

- Create a Discount Line: Add a line in the document where the discount will be applied. This can be listed as a flat amount or a percentage of the total.

- Use Discount Calculations: Apply the discount either as a percentage (e.g., 10% off) or a fixed amount (e.g., $20 off), depending on your pricing model.

- Show Net Amount: After applying the discount, ensure the document clearly displays the total amount after the discount, making it easy for the client to understand the adjusted price.

By incorporating tax and discount fields into your billing documents and automating these calculations, you can reduce the chance of errors and ensure that your clients are charged accurately. This helps to maintain professionalism and ensures that both the client and business are clear about the financial terms of the transaction.

Free Templates vs Paid Invoice Solutions

When managing financial records, businesses often face the decision between using free tools or investing in paid software for creating billing documents. Each option comes with its own set of advantages and limitations, and the right choice depends on the specific needs of the business. Free solutions may be appealing due to their low cost, but they can lack advanced features that paid options provide. On the other hand, premium software tends to offer more customization, automation, and support, but it may come with recurring costs. Understanding the differences between these two types of solutions can help businesses make an informed decision about which tool to use.

Advantages of Using Free Tools

- Cost-Effective: The most obvious benefit is that free tools incur no costs, making them an ideal choice for startups or small businesses with limited budgets.

- Ease of Use: Most free resources are user-friendly and require minimal setup, allowing businesses to create billing documents quickly and efficiently without a steep learning curve.

- Basic Functionality: These solutions cover the essential aspects of billing, such as formatting, basic calculations, and customization, which can be sufficient for many small-scale businesses.

- No Long-Term Commitment: There are no subscriptions or contracts, so businesses can easily switch to another solution if they outgrow the free tool.

Benefits of Paid Solutions

- Advanced Features: Paid software often includes advanced capabilities like automated tax calculations, integrated payment gateways, and recurring billing options, which can save time and reduce errors.

- Customization and Branding:

How to Save and Print Excel Invoices

Once you have created your billing documents, it’s essential to know how to save and print them for easy distribution to your clients. Saving your files in the right format ensures that they are accessible, well-organized, and ready for future reference. Printing them correctly allows you to present professional, clear records. This process is straightforward and ensures that your business can maintain a smooth workflow and proper documentation.

Saving Your Billing Documents

- Choose the Right File Format: For easy editing and future use, save your documents in the default format of the software you’re using (e.g., .xlsx). To ensure the document can be accessed by others who may not have the same software, consider saving it as a PDF, which preserves the layout and formatting.

- Organize Your Files: Keep your billing records in a dedicated folder for easy access. Consider creating subfolders for different clients, months, or years to maintain an orderly system.

- Use Descriptive Names: Save each file with a unique name that includes the client name or project details and the date. For example, “ClientName_Invoice_Sept2024” helps you quickly identify files without opening them.

Printing Your Billing Documents

- Check the Layout: Before printing, ensure your document fits correctly on the page. Preview the print layout to check margins, page breaks, and that no content is cut off.

- Choose the Right Printer Settings: Select the printer you will use and configure the print settings. Make sure to select the appropriate paper size (e.g., A4 or Letter) and check that the printer has sufficient ink and paper.

- Print a Test Page: To ensure everything appears correctly, print a test page before printing multiple copies. This will help catch any formatting issues or errors that might affect the final printed document.

Once the document is saved and printed, you can either send the printed copy to the client or email them the saved file. Keeping digital copies and printed records ensures you have proper documentat

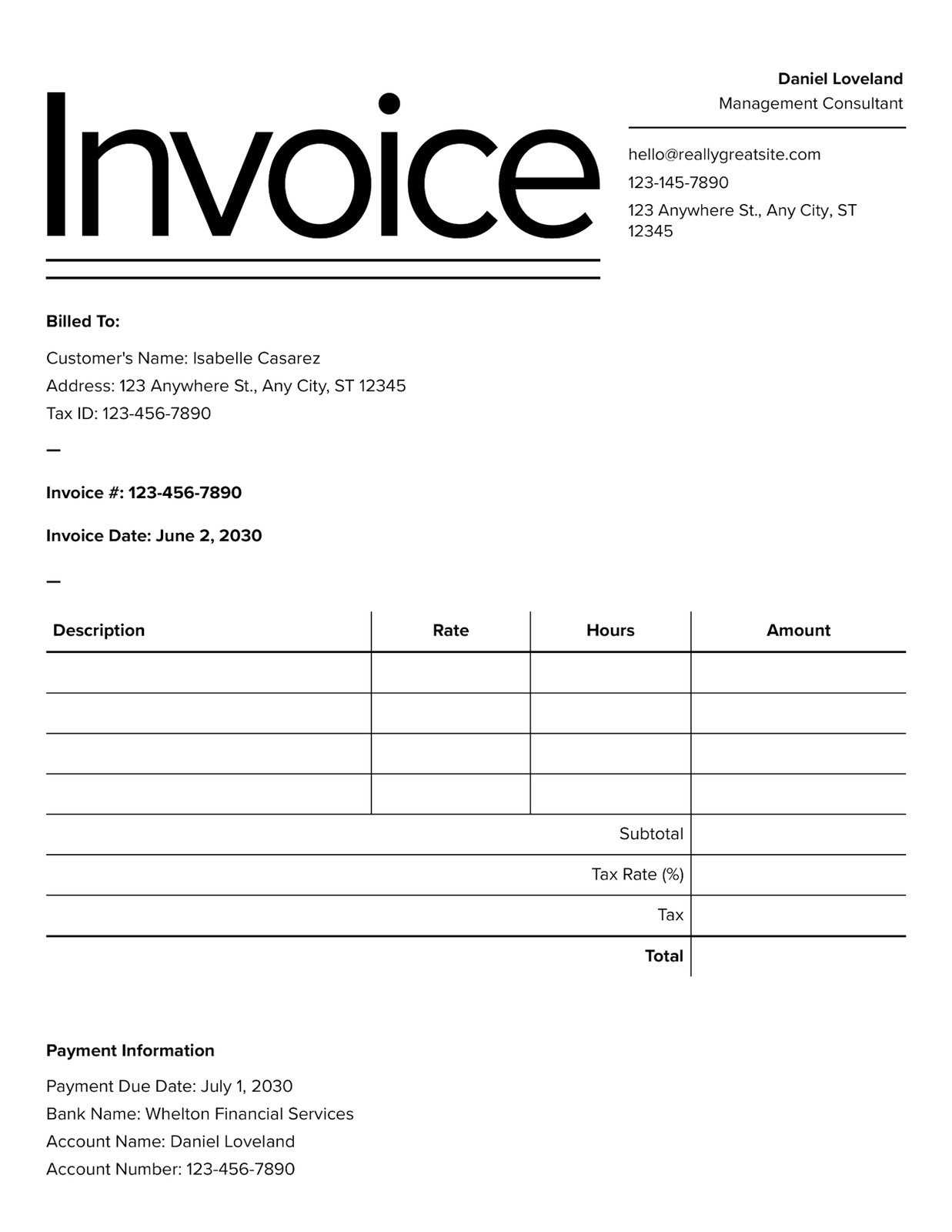

Step-by-Step Guide to Invoice Creation

Creating an accurate and professional billing document is essential for ensuring smooth transactions with clients. Whether you’re running a small business or freelancing, the process of generating a payment request requires careful attention to detail. This step-by-step guide walks you through the key stages of preparing a billing document that clearly outlines services, products, payment terms, and amounts due. By following these steps, you can ensure that all necessary details are included and that your client receives clear, concise information about the transaction.

Step 1: Gather Necessary Information

Before starting, collect all the details you need for the document. This includes the client’s contact information, a description of the work completed, the prices, any applicable taxes or discounts, and the payment terms. Make sure to have your business’s contact details and banking information handy as well.

Step 2: Input Key Details

Section Description Business Information Include your How

Creating effective billing documents is a fundamental part of maintaining clear financial records. Whether you are managing a small business, freelancing, or providing services to clients, the process of crafting a clear and professional payment request can streamline transactions and ensure that both you and your clients are on the same page. This section focuses on the essential steps and tips to effectively generate these financial records, making the process easy and error-free.

Understanding the Basics

Before you begin, it’s important to understand the key components that must be included in any financial document. These typically involve identifying the client, listing the services or products provided, and specifying the payment terms. Ensuring that all necessary information is clearly presented can prevent misunderstandings and simplify payment processing.

Setting Up for Success

- Organize Your Data: Ensure you have all relevant details, including the client’s contact information, service descriptions, quantities, and prices.

- Choose the Right Format: Select a format that suits your needs–whether it’s for digital distribution or printing. Some prefer using editable spreadsheets, while others opt for PDFs to prevent changes after sending.

- Incorporate Calculations: Make sure any necessary calculations, such as taxes, discounts, or shipping fees, are included. Automating these calculations can reduce the chance of errors and speed up the process.

By following these steps, you will create accurate and professional documents that meet both your business needs and your client’s expectations, ensuring smooth transactions and clear communication on payments due.