Download Free Service Invoice Template in Word Format

Managing financial transactions effectively is a critical aspect of running any business. Whether you’re an independent contractor, a freelancer, or a small business owner, having a streamlined method to issue payment requests is essential. A well-structured document that outlines the work performed, along with payment details, ensures clarity and professionalism in all your dealings.

With customizable options, you can create a document that not only meets legal and financial requirements but also reflects your brand identity. By using accessible tools, you can easily design an itemized statement that looks polished, providing your clients with the information they need in a clear and organized format.

In this guide, we’ll explore how to create such documents quickly, ensuring that every important detail is included while maintaining a professional appearance. Whether you’re new to creating these records or looking to improve your current process, you’ll find simple steps to help you succeed.

Free Service Invoice Template Word

For business owners and freelancers, having a ready-made document to request payment is essential for maintaining smooth operations. A customizable document can simplify billing, save time, and ensure all necessary details are included. With just a few adjustments, you can adapt this resource to fit the specific needs of your company, whether you’re offering consulting, design, or technical work. The flexibility of such a document allows you to tailor it to any project or client.

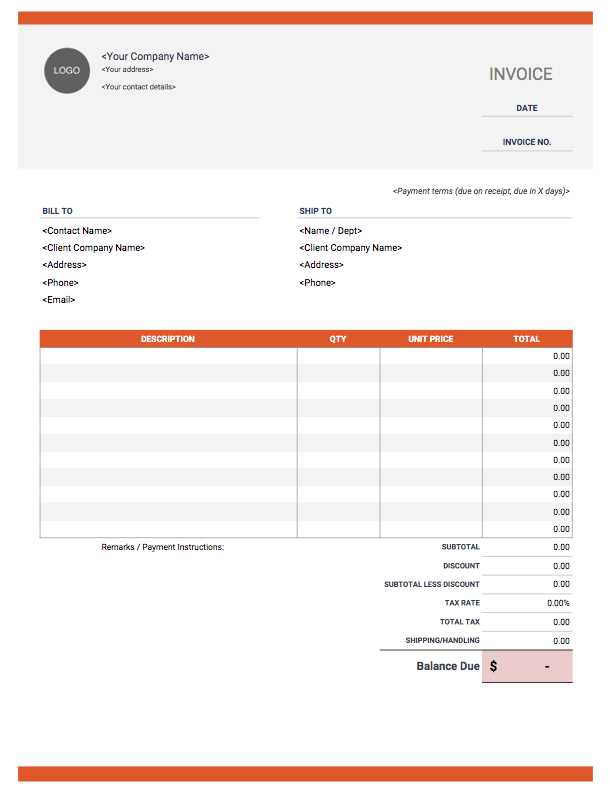

This essential tool can include sections for your company’s contact details, a breakdown of the work completed, payment terms, and more. It helps both parties to stay on the same page and avoid any confusion regarding what is due. Below is a sample layout to give you an idea of how such a document might appear:

| Item | Description | Quantity | Rate | Total |

|---|---|---|---|---|

| Consultation | Initial business strategy consultation | 1 | $100 | $100 |

| Design Work | Custom logo design | 2 | $150 | $300 |

| Subtotal | $400 | |||

| Tax (10%) | $40 | |||

| Total Due | $440 | |||

This structure ensures that every aspect of your billing is organized and transparent. You can modify it further, adding your branding and making it more personalized for your clients. The simplicity of the format also allows for quick edits and instant generation of new documents as your business grows.

Why Use a Free Invoice Template

Using a pre-designed document for billing offers numerous advantages, particularly for small business owners and independent professionals. These ready-to-use resources save valuable time and ensure that every essential detail is included without requiring you to start from scratch. Whether you’re just beginning your career or managing multiple clients, a well-structured document helps maintain consistency and professionalism.

One of the key benefits of utilizing such a tool is its simplicity. You can easily personalize the layout with your company logo, payment terms, and client information. Additionally, these resources are often customizable, allowing you to add specific line items, adjust pricing, or change the design to better align with your brand. Efficiency is greatly enhanced, reducing the chance of errors and the time spent on administrative tasks.

Another important factor is the cost-effectiveness. Many businesses, especially startups, are working with limited budgets, so opting for a free solution can be a practical and affordable way to manage financial records. By using an accessible, no-cost option, you can focus on growing your business while keeping your accounting streamlined and organized.

How to Download a Word Template

Accessing a pre-made document for creating billing statements is a quick and simple process. The first step is to find a reliable source that offers customizable documents. Many online platforms provide these resources for download, giving you the flexibility to choose a design that best fits your needs. Once you have located a suitable file, the next steps are straightforward.

To start, click on the download link, which will typically initiate an automatic download or redirect you to a page where you can save the file. Once the document is on your device, simply open it using a compatible program. From there, you can make changes such as adding your contact details, adjusting the payment terms, and modifying the layout to match your business style.

Efficiency is key when it comes to managing client payments, and downloading such resources allows you to create documents quickly without sacrificing quality. After customizing the layout, save it on your device or cloud storage for future use, ensuring you have an efficient solution for all your billing needs.

Benefits of Customizing Your Invoice

Personalizing your billing document offers numerous advantages for your business, helping to establish a professional image while ensuring clarity and accuracy. By tailoring the design, layout, and content, you can create a statement that reflects your brand identity and meets the specific needs of your clients. This customization not only improves communication but also enhances the overall client experience.

Enhanced Professionalism

When you make adjustments to your document, such as adding your logo, using a consistent color scheme, or including personalized payment instructions, it presents your business in a more professional light. A custom layout with well-organized details helps build trust with clients, making them more likely to respond positively and promptly to payment requests.

Improved Accuracy and Clarity

Customizing the document allows you to include only the relevant details for each project. You can specify the exact services rendered, pricing, taxes, and terms of payment, which reduces the likelihood of misunderstandings. With clear and precise information, both you and your clients are on the same page, leading to smoother transactions and faster payments.

Understanding the Key Elements of an Invoice

For an effective billing process, it’s important to include all necessary components in the document that requests payment. By ensuring every key detail is present, you avoid confusion and provide clients with everything they need to understand the charges. Each part of the document plays a crucial role in making the transaction clear and professional.

Here are the essential elements to include in your payment request document:

- Header Information: This section should feature your business name, logo, and contact details. It identifies who the bill is coming from and makes it easier for your client to reach out if necessary.

- Client Information: Include the client’s name, address, and any other relevant details that clearly identify the recipient of the document.

- Unique Reference Number: Every billing document should have a unique number or code for tracking purposes. This makes it easier to manage records and prevents confusion with previous or future requests.

- Description of Work: Provide a detailed list of the work or products provided, including quantities, rates, and any other necessary specifics. This ensures transparency and helps the client understand exactly what they’re paying for.

- Payment Terms: Clearly state your payment expectations, such as the due date and any late fees or discounts that may apply. This helps set clear guidelines for both parties.

- Total Amount Due: Include the subtotal, taxes, and final amount to be paid. This section should be easy to read and clearly show the total amount owed.

Each of these elements is vital for clear communication, reducing disputes, and ensuring prompt payment. By structuring your billing request with these key components, you can maintain a professional standard and foster trust with your clients.

How to Add Your Business Details

Including accurate business information in your billing document is essential for establishing credibility and ensuring your clients can contact you easily. This section typically appears at the top of the document and includes all the necessary details to identify your company, such as your business name, address, and communication methods. Providing this information helps maintain professionalism and allows your clients to reach out if there are any questions or issues regarding the payment.

Here are the key steps to adding your business details:

- Business Name: Start with your official business name. This should be the name registered with your company and clearly identifiable to your clients.

- Address: Include your physical address or the location from which you conduct business. This adds legitimacy and helps clients verify the origin of the bill.

- Contact Information: Provide an email address, phone number, or other methods of communication where clients can reach you regarding the bill. This ensures they can ask questions if there’s a need for clarification.

- Business Number or Tax ID: In some cases, including your tax identification number or business registration number is important, especially for larger businesses or those with international clients.

By including these key elements, your document will appear more official and transparent, making the payment process smoother for both you and your clients.

Tips for Formatting Your Invoice in Word

Proper formatting is essential when creating a billing document. A well-organized and visually appealing layout not only enhances professionalism but also ensures that all the relevant details are easy to find. When using a text editing program, you can take advantage of simple tools to make your document clear, polished, and client-friendly. Here are some helpful tips to format your document effectively:

- Use Clear Headings: Organize sections with bold, larger text for headings such as “Client Details,” “Payment Terms,” and “Total Amount Due.” This makes it easier for the reader to navigate the document.

- Ensure Consistent Fonts: Stick to one or two professional fonts throughout the document. Use a larger font size for the heading and a standard size for the body text, ensuring readability.

- Align Text Properly: Align the text and numbers consistently. For example, align dates and amounts to the right, while descriptive text or service descriptions can be aligned to the left. This creates a neat and orderly document.

- Use Tables for Breakdown: A table is an excellent way to organize line items. Include columns for quantity, description, rate, and total amount, making the breakdown clear and easy to follow for your client.

- Include Adequate Spacing: Make sure there’s enough space between sections and line items. Crowded text makes the document difficult to read, so use line breaks and spacing to separate different sections.

- Highlight Important Information: Use bold text or italics for crucial details such as due dates, payment amounts, and payment instructions. This will draw the client’s attention to the most important aspects of the document.

- Keep It Simple: Avoid cluttering the document with too many design elements or unnecessary graphics. The focus should be on clarity and professionalism, not excessive decoration.

By following these formatting tips, your billing document will be more functional and user-friendly, ensuring a better experience for your clients and improving the chances of timely payments.

How to Include Service Descriptions Effectively

Including clear and concise descriptions of the work performed is essential in any billing document. It not only helps the client understand what they are being charged for but also provides transparency and prevents potential disputes. A well-written description ensures that all aspects of the project are clearly communicated, making the document both professional and easy to follow.

Be Specific and Detailed

When describing the work completed, avoid vague language. Instead, be specific about the tasks performed, including any relevant details such as hours worked, materials used, or special considerations. For example, instead of writing “Design work,” specify “Custom logo design for branding, including three revisions and final digital files in multiple formats.” This level of detail ensures the client understands exactly what is being billed.

Keep It Clear and Concise

While details are important, brevity matters as well. Keep descriptions clear and to the point, using simple language that is easy to understand. Clients may not be familiar with technical jargon, so explain the work in terms that are straightforward and easy to digest. By striking a balance between detail and clarity, you can create a document that is both informative and professional.

Consistency is also key. Use the same format and terminology throughout the document, making it easy for the client to compare line items and understand what they are paying for.

By following these practices, you can create descriptions that help build trust, reduce confusion, and facilitate smoother transactions.

Using Payment Terms in Your Invoice

Clearly outlining payment expectations is crucial for any business transaction. By including specific payment terms in your billing document, you ensure that both you and your client are on the same page regarding when and how the payment should be made. Setting clear guidelines helps prevent misunderstandings and encourages timely payments.

Payment terms typically cover several key aspects, such as:

- Due Date: Clearly state the deadline for when payment is expected. For example, “Payment due within 30 days of receipt.” This sets a clear timeline for the client to follow.

- Late Fees: If applicable, include any penalties for delayed payments. For instance, “A late fee of 2% per month will be charged on overdue amounts.” This encourages timely payment and protects your business.

- Accepted Payment Methods: Specify the methods of payment you accept, such as credit card, bank transfer, or online payment platforms. This helps the client know their options for submitting payment.

- Early Payment Discounts: Offering discounts for early payments can be a good incentive. For example, “5% discount if paid within 7 days.” This motivates clients to pay sooner and helps with cash flow.

Including these terms not only helps you maintain control over your financial transactions but also fosters a sense of professionalism. It ensures that your client knows what to expect and can avoid any confusion down the line. Clear payment terms protect both parties and contribute to smoother, more efficient business operations.

Including Taxes and Discounts in the Template

When creating a billing document, it’s essential to account for any taxes or discounts that may apply to the final amount due. Properly including these elements ensures accuracy in your calculations and provides transparency to your client. Whether you’re required to charge sales tax or offer a promotional discount, these adjustments should be clearly stated to avoid any confusion.

Here’s how you can effectively include taxes and discounts:

- Sales Tax: If your business is required to charge sales tax, be sure to calculate and display it clearly. Specify the tax rate applied (e.g., “Sales tax (10%)”) and show the exact amount calculated on the total cost. This ensures that the client understands the additional charge and why it’s being added.

- Discounts: Discounts can be a great way to incentivize prompt payment or reward loyal customers. If you’re offering a discount, clearly mention the percentage or amount being deducted from the total (e.g., “10% early payment discount”). Make sure this is subtracted from the subtotal before taxes are calculated.

- Clear Breakdown: Include a separate section for both taxes and discounts so that they are easy to identify. This breakdown ensures that your client can see exactly how each element affects the final total.

By including these details in your document, you help maintain transparency and ensure that both you and your client have a clear understanding of the payment structure. Properly accounting for taxes and discounts also helps avoid potential disputes and fosters trust in your business practices.

How to Save and Share Your Invoice

Once you’ve created your billing document, the next important step is saving it correctly and sharing it with your client in a way that ensures they can access and review it easily. Proper file management not only helps keep your records organized but also ensures your client receives the document promptly and securely. Here’s how to save and share your document effectively:

Saving Your Document

- Choose a Descriptive File Name: When saving your document, give it a clear and descriptive name, such as “JohnDoe_Consulting_Feb2024,” to make it easy to find and track later. Avoid generic names like “Document1” or “Untitled.” This helps both you and your client stay organized.

- Save in a Common Format: Save the document in a format that your client can easily open, such as PDF or DOCX. PDFs are often preferred because they preserve the layout and formatting across different devices, ensuring that the client sees the document exactly as you intended.

- Back Up Your Files: Always store a copy of the document in a secure location. This could be on your computer, cloud storage, or an external drive. Having backups ensures that you won’t lose important records due to unexpected technical issues.

Sharing Your Document

- Email: The most common way to share a billing document is through email. Attach the saved document to your email and include a polite message with instructions on how the client can make payment. Ensure that the file size is not too large for email attachments.

- File-Sharing Services: If the document is too large to send via email, you can use file-sharing platforms like Google Drive, Dropbox, or OneDrive. Simply upload the document and share the link with your client. This method is especially useful for sending large files or when you want to provide ongoing access to the document.

- In-Person Delivery: If you’re working locally, you might opt to deliver the document in person. In this case, printing a hard copy or saving it to a USB drive can be a more appropriate option.

By saving and sharing your document properly, you make sure your client receives the necessary information in the right format, keeping the transaction smooth and professional.

Creating Multiple Invoice Templates for Different Services

In some businesses, it’s necessary to create different billing documents to suit various types of work. Whether you’re offering consulting, product sales, or project-based services, having separate formats tailored to each situation helps maintain clarity and professionalism. Customizing each document for specific transactions ensures that your clients receive accurate and relevant details every time, without the risk of confusion.

Here’s how you can create multiple billing documents for different types of work:

- Assess Your Needs: Begin by identifying the different types of transactions your business handles. For example, a document for hourly-based work may differ from one for a flat-fee project or a product sale. Understanding the unique elements of each service will help you tailor your documents effectively.

- Create Specific Layouts: Each type of transaction may require a different layout. For example, for product-based work, include columns for item descriptions, quantity, unit price, and total cost. For project work, you might focus more on milestones, deadlines, and individual task descriptions.

- Adjust Payment Terms: Payment terms can vary depending on the type of work. Hourly services may require weekly billing, while project-based work might have milestone payments or a single lump sum. Be sure to adjust your payment terms to match the nature of the work.

- Incorporate Relevant Details: Each type of service should have sections that make sense for the specific work. For instance, a consulting service invoice might need to include hours worked, while a product sale invoice would focus on item numbers, shipping details, and taxes. Tailor the content to reflect the service provided.

By creating multiple document formats for different types of work, you can ensure that your clients always receive a customized and professional billing statement. This also reduces the risk of missing key information, helping to keep transactions smooth and clear.

How to Ensure Professional Invoice Design

Creating a professional document for billing is essential for maintaining a credible and trustworthy image in business transactions. A well-designed document not only ensures that all the necessary information is clear but also makes a lasting impression on your client. Proper formatting and design help to enhance readability, create a sense of organization, and convey professionalism.

Key Elements for a Polished Look

- Clean Layout: Keep the layout simple and organized. Use clear headings, consistent font sizes, and enough white space to separate different sections. This helps your client easily navigate through the document without feeling overwhelmed by clutter.

- Consistent Branding: Incorporate your brand’s colors, logo, and font styles to make your document instantly recognizable. This creates a cohesive experience for your client and reinforces your business identity.

- Readable Fonts: Choose professional, easy-to-read fonts for your document. Stick to classic fonts like Arial or Times New Roman for the body text, and reserve more decorative fonts for headings if desired. Avoid using too many different fonts as it can make the document appear chaotic.

- Logical Structure: Organize the sections in a logical order, from the company and client information at the top to the payment details at the bottom. Group similar information together, such as pricing, taxes, and discounts, to make it easier for the client to follow.

Visual Appeal and Clarity

- Use Tables for Clarity: When listing items or services, using tables can help present the information in a clean and easy-to-read manner. Each row should represent an individual charge, with columns for description, quantity, rate, and total cost.

- Highlight Important Information: Use bold or larger text to highlight crucial details, such as the total amount due, due date, and payment instructions. This draws the client’s attention to the most important parts of the document.

- Avoid Overuse of Graphics: While it’s important to include your logo, avoid overloading the document with unnecessary graphics or design elements. The focus should be on the clarity of the information, not on excessive decoration.

By following these design principles, you can create a billing document that looks polished, professional, and trustworthy. A well-designed document not only communicates important details but also strengthens your professional image and builds client confidence.

Editing Your Invoice Template for Future Use

Once you have created a billing document, it’s important to ensure it is easy to modify for future transactions. By maintaining a flexible and editable format, you can quickly adjust details such as pricing, descriptions, or client information without needing to start from scratch each time. This approach saves time, reduces errors, and ensures consistency in your business documents.

Here are some tips for editing your document for future use:

- Keep Fields Editable: When creating your document, leave placeholders for variable information like client names, dates, or charges. This allows you to easily update details for each new transaction without altering the overall structure.

- Standardize Key Elements: Use standardized headings, sections, and formatting for common details. This way, you only need to adjust the specific fields, like item descriptions or total amounts, for each new document.

- Save as a Master Copy: Keep an original, unmodified version of your document to serve as a master copy. Whenever you need to create a new version, copy the master file and make the necessary updates. This ensures that the design and layout remain consistent across all documents.

- Utilize Templates: If you use a digital platform, such as an editing program, saving the document as a reusable model can streamline the process. With templates, you can quickly input updated information while maintaining the same structure and formatting.

- Review Before Saving: After editing your document for a new transaction, double-check for any errors or omissions. Ensure all client information, payment terms, and work details are correct before finalizing the document.

By following these strategies, you can create a billing document that is easy to modify and use for multiple transactions. This approach helps save time while maintaining a professional and consistent presentation for every client interaction.

When to Update Your Invoice Template

As your business evolves, the need to update your billing document becomes inevitable. Changes in your offerings, payment terms, or even legal requirements can affect how you need to present your financial documents. Keeping your billing format up to date ensures that you maintain clarity and professionalism in your transactions while staying compliant with current regulations.

Key Indicators for Updating Your Billing Document

- Change in Business Information: Whenever you update important business details like your business address, contact number, or tax identification number, you must modify your document to reflect these changes. This ensures that all the information presented to your clients is accurate.

- Changes in Tax Rates: If the local or national tax rates change, you’ll need to update your document to reflect the new percentages. This is essential to ensure that your clients are charged the correct amount of tax and that you’re compliant with tax regulations.

- Revisions to Payment Terms: If you alter your payment terms–such as offering different deadlines, introducing discounts for early payments, or adjusting your late fee policy–your billing documents should be updated accordingly. This helps avoid confusion with clients and keeps your agreements consistent.

- Introduction of New Products or Services: If you expand your offerings, you may need to add new sections to your billing document. For example, you might introduce a new column to list additional charges, or you may need to revise the description section to accommodate new products or services.

- Legal or Compliance Changes: Any change in regulations, such as updated invoicing requirements or tax laws, means you should review and adjust your document accordingly. This ensures that your billing practices are always in line with the latest legal standards.

How to Implement Changes Effectively

| Change | Action Required | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Business Information | Update contact info, business name, or address | ||||||||||||||||||||

| Tax Rates | Adjust tax calculations and rates | ||||||||||||||||||||

| Payment Terms | Modify payment due dates, late fees, and discount structures | ||||||||||||||||||||

| New Products/Services | Update item descriptions and add new charge field

Common Mistakes to Avoid with InvoicesWhile creating billing documents may seem straightforward, there are several common mistakes that can lead to confusion, delayed payments, or even disputes with clients. Ensuring that your document is clear, accurate, and professional is crucial for maintaining a good relationship with clients and ensuring timely payment. By being aware of potential errors, you can avoid issues that might hinder your business operations. Key Mistakes to Watch Out For

How to Avoid These Mistakes

By staying vigilant and avoiding these common mistakes, you can ensure that your billing documents are accurate, clear, and professional. This not only reduces the risk of payment delays but also helps you maintain positive client relationships and a smooth business operation. How to Organize and Track Your InvoicesManaging and monitoring your financial documents is essential for maintaining smooth business operations. Organizing and tracking billing records ensures you stay on top of payments, avoid errors, and can easily retrieve past transactions when necessary. With a well-organized system, you can improve your cash flow management and reduce the risk of overlooking important details. Here are some strategies to help you efficiently organize and track your billing documents: Effective Organization Methods

Tracking Payments and Deadlines

Tracking the status of each document is key to keeping your business operations running smoothly. Using tools like spreadsheets, accounting software, or even manual ledgers allows you to monitor when payments are due and ensure that no transaction is missed. A clear, up-to-date record of your financial documents will also help you when it comes to tax preparation or financial reporting. By establishing an effective organizational system and diligently tracking each document, you ensure that all payments are received on time and that you maintain a professional, efficient business environment. Free Resources for Customizing Invoice TemplatesCustomizing your financial documents can significantly enhance your business’s professionalism and streamline your billing process. Many online resources offer customizable designs, allowing you to tailor documents to fit your branding, specific services, and unique business needs. Whether you’re looking for simple adjustments or more advanced customization options, these resources can help you create documents that reflect your business’s identity while maintaining clarity and precision. Here are some valuable resources you can explore to customize your financial forms: Online Tools and Platforms

Design Software and Customization Options

Using these resources, you can easily create documents that not only look professional but also cater to your business’s specific needs. Customizing your forms ensures that you present a consistent brand image to your clients, while also providing all necessary details in a clear and organized manner. Whether you’re a small business owner or a freelancer, these tools help streamline your workflow and make financial record-keeping much more efficient. |