Download Free Invoice Template Sample

Creating professional billing documents can be a time-consuming task, but having the right structure can make all the difference. When you need to send a payment request to clients, a well-organized document ensures clarity and accuracy. It also helps maintain a polished, professional image for your business.

Accessing a ready-made design can save you time and effort, allowing you to focus on what matters most. Instead of starting from scratch, you can quickly personalize a pre-designed layout that fits your needs. Whether you’re a freelancer, small business owner, or managing a larger company, having a reliable framework at your fingertips is essential.

Efficiency is key when managing finances, and having a format that suits your business is crucial. Customize it with your company’s information, payment terms, and itemized details for seamless transactions. With a ready-to-use option, you can enhance your workflow and streamline the billing process without worrying about formatting or errors.

Free Invoice Template Download

Accessing a ready-made structure for your billing needs is crucial for anyone looking to streamline their payment processes. A pre-designed document not only saves time but also ensures consistency and professionalism in every transaction. Whether you’re managing a small business or handling freelance work, a well-organized form can simplify your financial documentation.

The ability to download a professional framework without any cost can help you avoid the hassle of starting from scratch. With just a few clicks, you can have a fully customizable version that fits your specific requirements. This is especially valuable for entrepreneurs who need to stay on top of their finances but don’t have time for complex designs.

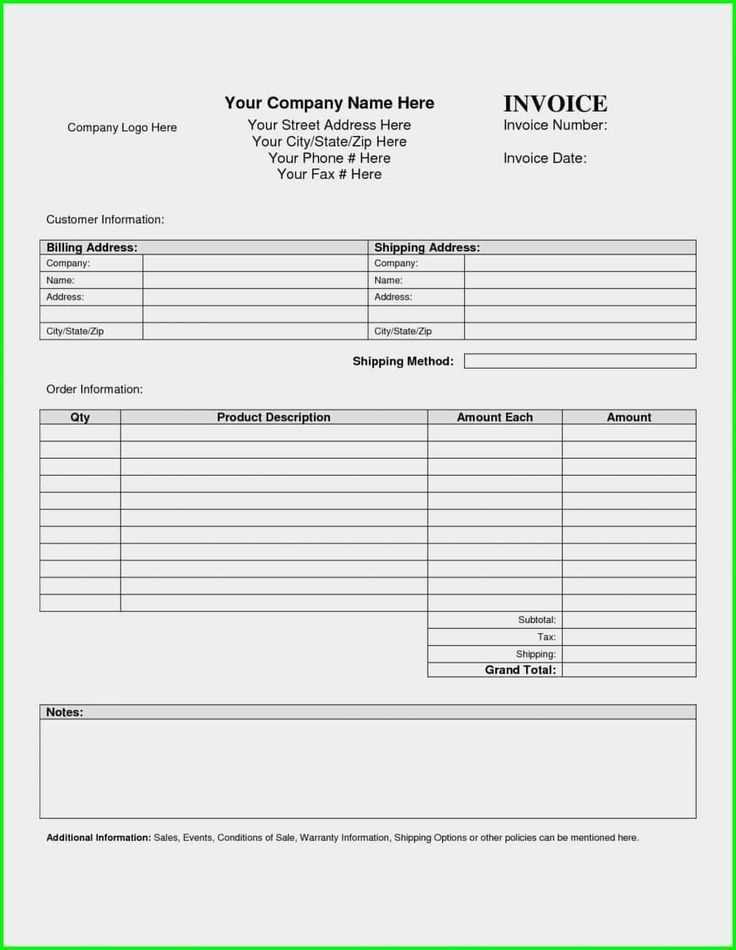

Below is a basic example of what such a document might look like, showcasing essential fields that should be included for effective billing:

| Field | Description |

|---|---|

| Client Name | The person or company being billed. |

| Issue Date | The date the billing document is created. |

| Due Date | The date by which payment is expected. |

| Amount Due | The total sum owed for services or products rendered. |

| Payment Terms | The conditions under which the payment should be made (e.g., net 30 days). |

| Description of Services | A detailed breakdown of the work or products provided. |

With such a framework, you can easily fill in your specific details, ensuring that every transaction is clearly documented and professionally presented. This not only enhances the client’s experience but also helps you maintain accurate records for your business.

Why Use an Invoice Template

Using a pre-designed structure for billing documents can simplify your workflow and ensure consistency. Instead of creating each document from scratch, you can rely on a format that already includes the essential elements, saving time and reducing the chances of errors. This approach not only improves efficiency but also helps maintain a professional appearance in all financial dealings.

Key Advantages

- Time-Saving: A ready-made layout allows you to focus on filling in specific details rather than worrying about design and formatting.

- Professional Appearance: Pre-designed forms ensure your documents look polished and consistent, enhancing your brand image.

- Accuracy: Reduces the chances of missing critical information or making mistakes in calculations.

- Customization: Easily adjust the content to reflect your business needs, including payment terms, service descriptions, and contact details.

How It Benefits Your Business

- Better Organization: Storing and tracking your records becomes easier with a consistent format for each transaction.

- Legal Compliance: Many countries have specific requirements for financial documents. A structured format ensures you meet those obligations.

- Enhanced Client Trust: Providing clients with clear, organized documents helps establish credibility and reliability.

Ultimately, using a structured format for billing documents allows you to focus on your core business while maintaining smooth financial operations. With a few simple adjustments, you can ensure every document is accurate, professional, and easy to understand.

Benefits of Using Templates for Billing

Utilizing a pre-built format for financial documents can significantly streamline your business processes. By adopting a standardized approach, you can ensure that each bill or payment request is created quickly and with the proper details. This method helps you avoid the repetitive task of designing documents from scratch while maintaining consistency across all your transactions.

Improved Efficiency

One of the major benefits is the time-saving aspect. With a ready-to-use structure, you eliminate the need to manually arrange the layout every time you need to send a bill. This lets you focus on the more important tasks within your business while ensuring that the document is completed in an efficient manner.

Consistency and Professionalism

Using a standardized design helps maintain a consistent look across all your financial correspondence. Consistency is key when it comes to building a professional image, and a polished, uniform document conveys trustworthiness to your clients. The clean, organized layout of such formats provides clarity and enhances the overall impression of your business.

Additionally, customizable fields allow you to easily add unique details, such as company branding, contact information, and payment instructions, ensuring that every document is perfectly aligned with your business’s requirements.

Overall, relying on a pre-structured approach to managing payments can improve your workflow, reduce mistakes, and help ensure that your financial dealings are both professional and efficient.

How to Customize Your Invoice

Personalizing your billing documents is essential for ensuring that each one reflects your business’s unique style and specific needs. By adjusting key elements within the structure, you can create a document that aligns perfectly with your company’s branding and the nature of the transaction. Customization can also help you include all the necessary details that are relevant to each client or project.

Basic Customization Steps

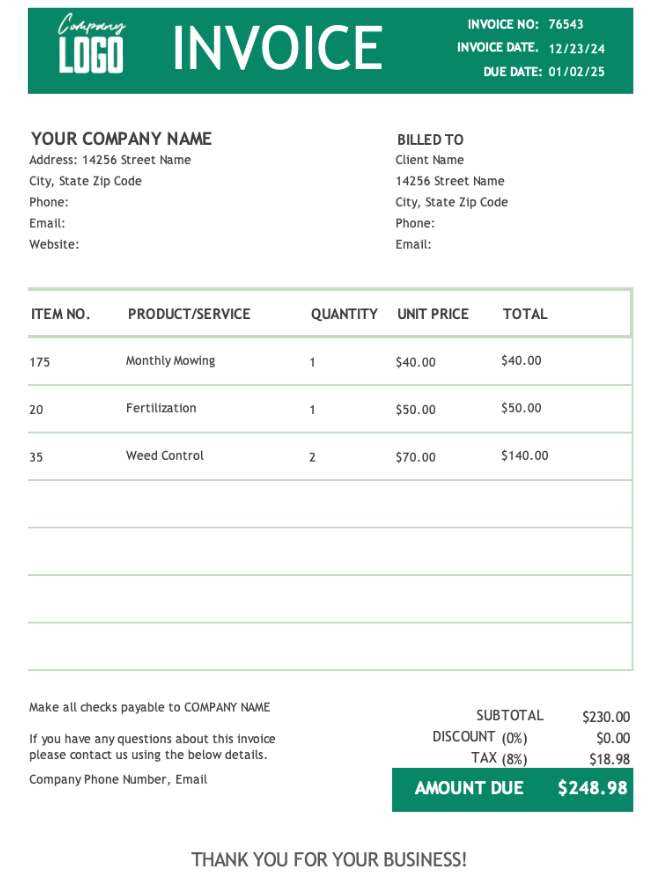

First, start by adding your business information, including the company name, address, contact details, and logo. This gives your document a professional and branded appearance. Next, adjust the section for the recipient’s details to reflect the correct client name and billing address.

Ensure that the payment terms section is customized according to your agreement with the client. This may include details such as the due date, late fees, or discounts for early payment. You can also modify the description of goods or services to accurately reflect what was provided, including item numbers, quantities, and prices.

Advanced Customization Tips

For a more personalized touch, consider adding a custom message to thank the client for their business or to include any special notes regarding the transaction. You can also choose to include additional fields that may be specific to your industry or company policies, such as tax identification numbers, project codes, or payment instructions for online transfers.

By tailoring each document, you ensure that it serves both as a legal record and a professional communication tool that reflects the unique aspects of your business relationship with each client.

Common Features in Invoice Samples

When creating a billing document, there are several essential elements that are commonly included to ensure clarity and accuracy. These features help to structure the document in a way that both the sender and the recipient can easily understand the transaction details. Including the right information not only improves communication but also helps in maintaining organized records for both parties.

Typically, such documents will feature sections for the business’s contact details, including the name, address, phone number, and email. This ensures that the recipient can easily reach out if they have any questions. Along with that, the recipient’s contact information is also included to specify where the payment is directed.

Another key aspect is the inclusion of a unique reference number for each document, which helps in tracking and organizing financial records. Additionally, it’s important to specify the date of issuance, as well as the due date for payment, which establishes the timeline for the transaction.

Details regarding the goods or services provided are usually broken down with itemized descriptions, quantities, and the corresponding prices, allowing for transparent billing. Payment instructions, such as accepted methods or bank details, are also commonly listed to guide the recipient on how to make the payment.

Finally, payment terms are included to outline any agreed-upon conditions, such as late fees, early payment discounts, or specific payment arrangements. These features create a comprehensive and understandable document that ensures both parties are on the same page regarding the transaction.

Understanding Invoice Format and Structure

Having a clear understanding of the structure and format of a billing document is essential for both accuracy and professionalism. A well-organized layout ensures that all important information is easily accessible and that the document serves its purpose effectively. It allows both the sender and the recipient to quickly review the details of the transaction, preventing any confusion or errors.

The format typically starts with the business’s contact information at the top, which includes the company name, address, and other relevant details like phone numbers or email addresses. This is followed by the recipient’s contact details, ensuring that the communication line is clear in case there are any questions or issues with the transaction.

Next, a unique reference number or billing number is usually included, helping both parties track the document for future reference. This is typically followed by the issue date, which marks the day the document is created, and the due date, which indicates the timeline for payment.

Another important section is the detailed list of items or services provided. Each line typically includes a brief description, the quantity or hours worked, and the unit price, followed by the total for that line item. This detailed breakdown ensures transparency and helps avoid misunderstandings about charges.

Finally, the document concludes with a section for payment instructions and terms. This may include the total amount due, accepted payment methods, and any conditions such as late fees, early payment discounts, or specific payment terms. This clear structure helps both parties stay organized and ensures that the transaction is processed smoothly.

Choosing the Right Template for Your Business

Selecting the right design for your billing documents is crucial for maintaining professionalism and ensuring clarity. The format you choose should reflect the nature of your business, the type of transactions you handle, and the expectations of your clients. An ideal structure not only enhances the overall customer experience but also helps in maintaining an organized and efficient financial record-keeping system.

Factors to Consider

- Industry Requirements: Different industries may have specific needs when it comes to billing. For example, service-based businesses may require more detailed descriptions of work performed, while product-based businesses focus on itemized pricing.

- Client Expectations: Some clients prefer more detailed documentation, while others may prefer a simpler, straightforward design. Understanding what your clients expect can help in selecting the best format.

- Branding: The design should align with your company’s branding. Consistent use of logos, colors, and fonts will reinforce your business identity and present a professional image.

Types of Formats

- Simple Layout: Ideal for small businesses or freelancers who need to send basic billing information without unnecessary details.

- Detailed Design: Suited for businesses that require more in-depth explanations of services or products, including hours worked, materials used, or long-term projects.

- Customizable Format: Perfect for businesses that need flexibility to modify certain fields, such as payment terms or service descriptions, depending on the client or job.

By selecting the right design, you ensure that your documents not only serve their functional purpose but also help to maintain a consistent and professional image across all your financial dealings.

Free Invoice Templates for Small Businesses

For small businesses, managing billing can often be a challenging and time-consuming task. Having access to pre-designed formats can significantly streamline the process, ensuring that every transaction is documented correctly and professionally. These ready-to-use documents help businesses save valuable time, reduce errors, and ensure consistency in all financial communications.

When choosing a format, it is important to find one that suits the specific needs of your business. A straightforward structure works well for simple transactions, while a more detailed layout might be necessary for businesses that offer a wide range of services or products. By using a structured format, even small businesses can maintain a professional image and stay organized.

Benefits of Using Pre-Designed Formats for Small Businesses:

- Time-Saving: Ready-made designs help you avoid starting from scratch with every billing cycle, allowing you to quickly generate and send documents.

- Consistency: Using a uniform structure for all transactions creates a cohesive and professional look across all communications.

- Reduced Errors: With key fields already structured, there is less chance of missing important details like pricing or payment terms.

- Easy Customization: Most pre-designed documents can be easily tailored to reflect your specific business needs, whether you need to add a logo, adjust payment terms, or include custom messages.

Whether you are just starting or looking to streamline your billing process, utilizing a well-organized format can make all the difference in running your small business efficiently and professionally.

How to Fill Out an Invoice Template

Completing a billing document requires accurate input of essential details to ensure that the transaction is clearly documented and understood by both parties. The process involves filling in key information such as business contact details, service or product descriptions, payment terms, and amounts. Ensuring that all sections are correctly filled out will help avoid confusion and ensure timely payments.

Step-by-Step Guide to Completing Your Document

First, input your business information, including your company name, address, and contact details. This ensures that the recipient knows where to direct any questions or payments. Then, add the recipient’s details, ensuring that the name and address are correct to avoid any issues with delivery or payment.

Next, enter the unique reference number for the document. This number serves as an identifier for the transaction and is helpful for tracking and record-keeping. Make sure to include the date the document is issued and the due date for payment. This helps establish the timeline for when the recipient should make the payment.

Itemizing Services or Products

In the section for itemized goods or services, provide clear descriptions of what was provided, along with the quantities and prices. This section ensures transparency and prevents any misunderstandings about the charges. You can break down the total cost into smaller line items to make it easier for the recipient to review each part of the transaction.

Finally, include the payment terms at the bottom of the document. This section might include accepted payment methods, bank details for wire transfers, or any other instructions regarding how the recipient should proceed with the payment. Don’t forget to include any discounts, late fees, or additional notes that are relevant to the transaction.

Invoice Templates for Different Industries

Every business has its unique needs when it comes to documenting transactions. The structure of a billing document can vary depending on the type of industry, the services or products offered, and the expectations of clients. Customizing the format to fit the specific demands of your industry ensures that all relevant details are accurately captured and that both you and your clients have a clear understanding of the transaction.

Here are some examples of how different sectors might benefit from a tailored billing document:

- Freelance and Consulting: Professionals offering services on a contract basis may require a format that includes hourly rates, project milestones, or specific terms for ongoing work. This structure helps to itemize the services rendered and ensures that payment terms are clearly defined.

- Retail: Businesses that sell products typically need a document that includes item descriptions, quantities, and prices. A straightforward layout with a breakdown of each item is essential for clear communication and transparency.

- Construction and Trades: Companies in this sector often need to list labor hours, materials used, and specific tasks completed. An organized, detailed document can help ensure that both parties are on the same page regarding work completed and costs incurred.

- Event Planning and Hospitality: These businesses may require detailed entries for services provided, including venue rental, catering, and entertainment. A clear breakdown of costs ensures clients understand exactly what they are being charged for.

- Creative Industries (Design, Photography, etc.): Creatives may benefit from a format that allows for project-based pricing, including time spent on work, usage rights for images, or other creative services. This flexibility helps clients understand the scope of work being done and the associated costs.

Using a specific structure that aligns with your industry helps you stay organized, maintain professionalism, and ensure that all necessary details are captured for future reference or audits.

Download Options for Invoice Templates

When looking for a billing document structure, having multiple options for downloading the format that fits your business needs can be incredibly helpful. There are various ways to obtain these pre-designed documents, depending on your preferences for customization, functionality, and software compatibility. Understanding the available download methods allows you to select the one that best suits your requirements.

Popular Download Formats

- PDF Files: Portable Document Format (PDF) is a widely used choice for its fixed layout and universal compatibility. It ensures that your document will appear the same on any device or platform and is easy to share with clients via email.

- Excel/Spreadsheet: If you need to calculate totals or manage multiple transactions, an Excel file offers flexibility. You can easily modify calculations, add more line items, and save your work for future use. It’s a great choice for businesses that require quick adjustments and data entry.

- Word Documents: Word files provide a more customizable format for users who want to adjust fonts, add logos, or modify layouts. While less structured than spreadsheets, Word formats are ideal for simple edits and creating personalized billing documents.

- Online Tools: Some websites and platforms allow you to create and download your customized document directly online. These tools often offer interactive fields and allow you to generate a new document instantly.

Which Format to Choose?

- For Quick Sharing: PDFs are ideal as they ensure that the document appears the same for both you and your clients, regardless of device or operating system.

- For Easy Customization and Editing: Excel and Word formats offer greater flexibility, allowing you to adjust calculations and layout as needed before sending out your document.

- For Frequent Use and Management: If you regularly create similar documents and need to track or modify entries, online tools or spreadsheet options may be best.

Choosing the right download option depends on the nature of your business and the level of customization and functionality you need. Select the format that will make your process smoother and more efficient.

Design Tips for Professional Invoices

Creating a polished and professional billing document not only ensures clarity but also reflects positively on your business. A well-designed format makes it easier for clients to understand the charges and improves the likelihood of timely payments. Focusing on organization, readability, and visual appeal can make a significant difference in how your documents are received and processed.

Key Design Elements to Consider

- Consistency in Branding: Incorporate your company’s logo, colors, and font styles to make your document recognizable. Consistent branding not only helps establish your identity but also provides a cohesive look that builds professionalism.

- Clear Layout: Ensure that the information is organized logically, with headings and sections that are easy to navigate. Group similar items together and use plenty of white space to avoid clutter.

- Readable Fonts: Use clear, legible fonts for both headings and body text. Stick to one or two fonts that are easy to read on both desktop and mobile devices. Avoid overly decorative or complicated fonts that can distract from the content.

- Aligned Information: Aligning text and numbers properly makes it easier for clients to scan the document. Consistent alignment of dates, amounts, and item descriptions ensures that everything is easy to follow.

Optimizing Functionality and Aesthetics

- Sectioned Information: Break down your document into logical sections like contact details, itemized list, and payment instructions. This will help the reader find what they need quickly.

- Highlight Key Information: Bold or underline crucial details such as the total amount due, due date, and payment methods. This draws attention to the most important information.

- Consider Mobile-Friendly Design: With many clients viewing documents on smartphones, make sure your format is easily readable on smaller screens. Avoid overly complex layouts that may not render well on mobile devices.

A well-structured and attractive billing document not only helps in making a lasting impression but also improves communication and fosters trust with your clients. Following these design tips will allow you to create a document that is both functional and professional.

How to Save Time with Templates

Using pre-designed structures for your billing or administrative documents can significantly streamline your workflow. By eliminating the need to start from scratch each time, you can focus on more important tasks while ensuring consistency across your records. The right approach to document creation can save you both time and effort, making your processes more efficient and reducing the likelihood of errors.

One of the main advantages of using pre-set formats is the ability to quickly populate the fields with the necessary details without worrying about the layout or structure. This saves you from reformatting the same information repeatedly, allowing you to process documents more quickly and efficiently.

- Consistency: Templates help maintain uniformity across your documents. Whether it’s the design, fonts, or layout, the elements are pre-set, so you don’t have to customize each document individually. This ensures a professional and cohesive look every time.

- Pre-filled Fields: Many templates allow you to save client information, pricing structures, or other recurring details. This lets you fill out key sections automatically, further speeding up the process and minimizing the risk of forgetting important information.

- Reduced Errors: By using a reliable format, you avoid mistakes that can occur from creating documents manually. This reduces the chances of omitting essential elements or misaligning content.

Additionally, having templates at your disposal allows you to quickly adapt them to different scenarios. Whether you’re handling different clients, projects, or transaction types, the process of adapting a pre-made format is quicker than starting from scratch every time.

Overall, adopting a structured approach saves time, reduces effort, and enhances productivity, allowing you to focus on the core activities of your business.

Best Invoice Template Resources Online

When it comes to finding high-quality pre-made structures for your business documents, the internet offers a variety of platforms where you can access useful resources. These platforms provide a range of designs that can be customized to fit your needs, helping you save time and maintain a professional appearance. Whether you’re looking for simple, no-frills formats or something more sophisticated, there are options available for every type of business.

Here are some of the best places to find the perfect structures for your records:

- Microsoft Office Templates: Microsoft offers a wide range of downloadable forms for businesses. Whether you need something basic or more complex, their collection provides flexibility and customization options that can suit most industries.

- Google Docs: Google Docs offers free, customizable designs that can be accessed and edited directly in your browser. The ease of use and cloud integration makes it a convenient choice for those looking to create and share documents online.

- Canva: Canva is well known for its user-friendly design tools. The platform has a variety of professional document structures that you can customize with ease, whether you want to add a logo or adjust the colors to match your branding.

- Template.net: Template.net is another great source for business-related documents, offering a wide selection of styles that cater to different needs. You can download them in various file formats, making it easy to use them across different software platforms.

- Zoho: Zoho provides a suite of tools that includes customizable document designs for business use. It’s ideal for those who want a streamlined approach and prefer managing their documents in a cloud-based system.

These platforms make it easier to generate well-structured, professional records without the need to design them from scratch. They allow you to focus on content and details while leaving the formatting and structure to pre-designed resources.

How to Track Payments Using Templates

Managing financial transactions efficiently is crucial for maintaining a smooth workflow in any business. By utilizing pre-made documents designed to record payment details, you can easily track outstanding balances, due dates, and payment statuses. These organized systems help ensure that you never miss a payment and keep all your financial records in order.

When setting up a system for monitoring payments, the following key elements should be included:

- Payment Date: Clearly mark the date when the payment is made or when it is due. This helps you stay on top of deadlines and follow up promptly if payments are delayed.

- Amount Paid: Track the exact amount that was paid, including any partial payments, to ensure your records are up to date.

- Payment Method: Note the payment method used (bank transfer, credit card, cash, etc.) for each transaction. This can help with auditing and resolving any discrepancies.

- Outstanding Balance: Include a field for tracking any remaining balance after payment, so you can quickly identify whether any additional payments are necessary.

- Payment Reference: Provide space for a reference number or payment ID, which can help in reconciling payments with financial statements or records.

By organizing these elements, you can streamline your financial processes and reduce the risk of errors. Regularly updating the records and cross-referencing payments against invoices or receipts ensures that your accounts remain accurate and up to date.

Additionally, many platforms allow you to automate the tracking of payments, reducing manual effort and saving you valuable time. This digital approach can be particularly beneficial for small business owners who want to keep their financial management simple and efficient.

Legal Considerations for Invoice Templates

When managing business transactions, it is essential to ensure that the documents you use for financial reporting comply with legal requirements. The design and content of billing documents can impact their validity and the way they are perceived in legal contexts. Understanding the necessary components and regulations can help prevent disputes and ensure that all financial transactions are properly documented.

Key legal factors to consider when preparing business documents include:

- Accurate Details: Always include essential information such as the names and contact information of both parties, a clear description of the goods or services provided, and the agreed-upon terms. These details ensure that the document is recognized as a valid legal record.

- Payment Terms: Be clear about the payment due dates, any late fees, and the payment methods accepted. Specifying these terms can help avoid misunderstandings and legal issues related to overdue payments.

- Tax Compliance: Many countries require businesses to include tax information, such as tax rates and registration numbers. It’s crucial to ensure that all applicable taxes are included to comply with local tax regulations.

- Currency and Amounts: Indicating the currency and accurately stating the amount due prevents confusion, especially when dealing with international clients or transactions. Misstated amounts can lead to legal complications if the document is disputed.

- Legal Language: Use clear and precise language that leaves little room for interpretation. Ambiguities in the terms of an agreement can lead to legal challenges or disputes over payment terms.

By ensuring that your financial documentation adheres to legal standards, you protect both your business and your clients. Regularly reviewing and updating your practices to comply with changing laws can help avoid potential legal conflicts and improve overall business transparency.

Why You Should Avoid Overcomplicating Templates

Keeping your business documents simple and easy to understand is crucial for ensuring smooth transactions and communication with clients. Overcomplicating your billing or financial forms can lead to confusion, errors, and delays. By maintaining a straightforward approach, you not only enhance the user experience but also increase the efficiency of your business operations.

Here are some key reasons why simplicity is important:

- Improved Clarity: Complicated designs or excessive details can confuse your clients and cause misunderstandings. Simple, clean forms allow both parties to quickly grasp the essential details, making payment processing more efficient.

- Faster Processing: When a document is too complicated, it may require more time to complete, review, and approve. A clear, easy-to-understand layout can reduce delays, allowing you to focus on your core business tasks.

- Less Room for Error: The more elements you include, the higher the chance for mistakes. Simplified documents reduce the chances of errors in data entry or calculations, minimizing the risk of financial discrepancies.

- Better Professional Image: A cluttered document can appear unprofessional, which may undermine your reputation. Clean, well-structured forms communicate organization and professionalism to your clients.

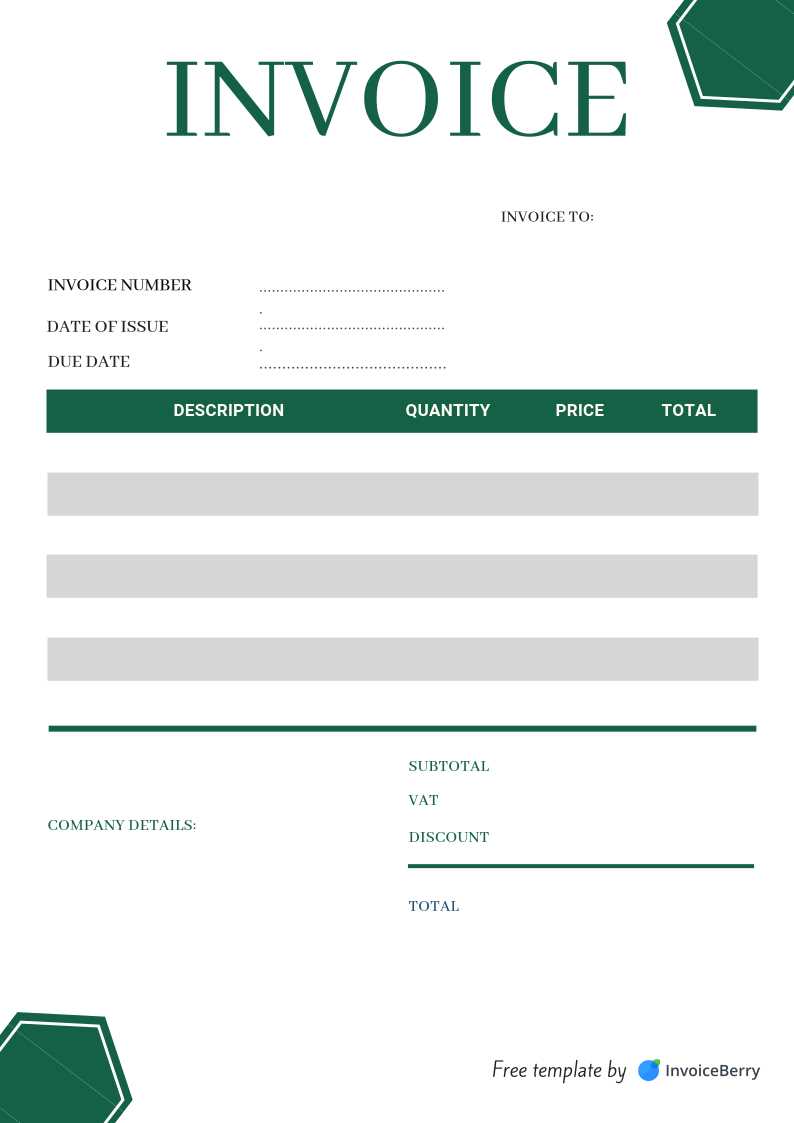

It’s also important to remember that a well-designed document doesn’t need to be overly complex. Below is an example of how a streamlined design might look:

| Item | Quantity | Price |

|---|---|---|

| Product A | 2 | $20 |

| Product B | 1 | $15 |

| Total | $55 | |

By focusing on the essentials and avoiding unnecessary details, you can create documents that serve their purpose efficiently, while leaving a positive impression on your clients.