Free Sales Invoice Template for Excel to Simplify Your Billing

Efficiently managing client transactions and keeping track of payments is essential for any business. Using a well-structured document can save you time and reduce errors, ensuring smooth operations. Whether you’re a freelancer, small business owner, or part of a larger organization, the right tool can help you create professional records with ease.

There are many ways to organize and format your records, but a simple, adaptable solution can make all the difference. With the right tool, you can customize the layout, add necessary details, and generate invoices quickly without the need for expensive software. It’s all about flexibility and efficiency when it comes to handling your financial documents.

Organizing transactions and keeping everything in order becomes much simpler when you have a clear structure. A customizable document allows you to include all relevant information, such as dates, amounts, and client details, while ensuring everything looks polished and professional.

Whether you need to track payments, apply taxes, or add personal branding, having the right structure allows you to adapt to different client needs and billing scenarios. By using a versatile, easy-to-manage format, you can enhance productivity and focus more on growing your business rather than getting bogged down with administrative tasks.

Free Sales Invoice Template for Excel

Creating organized financial documents is crucial for maintaining a professional image and ensuring smooth operations in any business. With the right format, you can efficiently track transactions, communicate clearly with clients, and keep records for future reference. Using a versatile document that can be easily modified allows you to adapt to various business needs without complicated software or systems.

Key Advantages of Using a Simple Document Format

- Easy customization: Tailor the layout and content to suit your business requirements.

- Time-saving: Quickly generate professional records with minimal effort.

- Cost-effective: No need for expensive software or ongoing subscriptions.

- Flexible: Adapt the structure for different billing scenarios and client needs.

What to Include in Your Document

To ensure accuracy and completeness, a few essential elements should be included when generating any financial record:

- Client Details: Name, address, and contact information.

- Transaction Date: The day the service was provided or the product was delivered.

- Description of Products/Services: A brief list of what was purchased or provided.

- Amount: The total cost of the transaction, including taxes or discounts if applicable.

- Payment Terms: Information on payment methods, deadlines, and any late fees.

By including these crucial details, you ensure clarity for your clients and streamline your financial workflow. This simple yet comprehensive structure can help maintain accurate records and foster professional relationships with customers.

Why Use Excel for Invoicing?

Using a widely available spreadsheet program can simplify the process of managing financial records, allowing for quick creation, customization, and tracking of transactions. This approach provides businesses with a flexible and efficient tool that doesn’t require specialized software or complex systems, making it ideal for small and medium-sized enterprises.

One of the key benefits of using a spreadsheet tool is its ease of use. With familiar grid structures and built-in formulas, you can automate many aspects of the billing process, such as calculating totals, applying taxes, and even tracking payments. This reduces the chance of human error and saves time, which is especially valuable for entrepreneurs and small teams.

Another advantage is the level of customization available. You can adjust the document layout to fit your specific needs, add company branding, and include or remove fields based on the type of services or goods provided. Whether you need a basic format or a more detailed breakdown, a spreadsheet offers the flexibility to tailor it to your business model.

Moreover, spreadsheets are highly compatible with other software and formats. You can easily export your records to different file types, such as PDF, for sharing or printing, making the process of delivering documents to clients seamless. The ability to store and organize your files efficiently also makes it easier to retrieve past transactions when needed.

How to Download a Free Template

Getting access to a customizable document layout for financial records is simple and straightforward. Many websites offer ready-to-use formats that can be downloaded instantly. By following a few simple steps, you can quickly acquire the right structure for your business needs.

Steps to Download the Document

- Step 1: Search for a trusted website offering customizable document formats.

- Step 2: Choose the format that best suits your requirements, ensuring it’s compatible with your software.

- Step 3: Click the download button, usually available in a prominent location on the page.

- Step 4: Save the file to a designated folder on your computer for easy access.

- Step 5: Open the document in your preferred program and start customizing it as needed.

Things to Consider Before Downloading

- Compatibility: Ensure the file can be opened and edited with the software you are using.

- Customization Options: Look for documents that allow flexibility in terms of layout and content.

- Support and Updates: Check whether the site provides any ongoing support or updates for the document format.

By following these steps, you can quickly obtain a professional layout to help manage your financial transactions without spending unnecessary time or money.

Customizing Your Sales Invoice Template

When using a document structure to manage financial transactions, personalizing it to fit your business needs is essential. A customizable format allows you to modify key details, design elements, and layout to ensure consistency with your brand and streamline your billing process. Adjusting the format to suit your specific requirements can make it more efficient and professional.

Layout Adjustments: One of the first things you may want to modify is the overall design. You can change the width of columns, add or remove rows, and adjust spacing to fit the content more effectively. For example, you can make product or service descriptions more prominent or move the total cost section to a more visible location.

Branding Elements: Adding your company’s logo, color scheme, and contact details ensures that each document aligns with your brand identity. This can help create a consistent experience for clients and make the document look more polished and professional. Customizing fonts and header styles will also give your files a unique, branded touch.

Content Flexibility: A well-structured document allows you to add or remove fields based on your needs. You might want to include extra columns for discounts, item codes, or special instructions for clients. Conversely, if some fields aren’t necessary for your transactions, you can remove them to keep the layout simple and clutter-free.

By customizing every aspect of your document, you create a tool that not only reflects your business needs but also enhances the customer experience. The more tailored the document, the more professional it will appear, which in turn boosts credibility and trust with clients.

Key Features of an Invoice Template

When using a structured document to manage payments and transactions, it’s essential that the format includes all necessary elements to ensure clarity and professionalism. A well-designed layout can simplify the billing process, reduce errors, and improve communication with clients. There are several key features that should be present to make any document effective for tracking business transactions.

Essential Components

- Business Information: Your company name, address, phone number, and email should be clearly visible at the top to ensure easy identification.

- Client Details: Including the customer’s name, address, and contact information ensures accurate communication and record-keeping.

- Transaction Date: The date when the service was provided or product delivered is critical for record-keeping and payment tracking.

- Itemized List: A detailed breakdown of products or services provided, including quantity, unit price, and total cost for each item, is crucial for transparency.

- Payment Terms: Clear instructions on payment due dates, methods, and any applicable late fees help set expectations for clients.

Customization and Flexibility

Customizable Fields: Depending on your business, you might need additional fields such as tax rates, discounts, or order numbers. A flexible format allows you to adjust the structure to suit specific needs.

Professional Design: A clean and organized layout with consistent fonts, colors, and spacing ensures that the document looks professional and is easy to read. Customizing the design with your brand’s logo and colors helps reinforce your identity.

These key elements, when incorporated into your financial documents, help to keep your transactions clear and accurate. They also contribute to a more professional relationship with clients, fostering trust and improving communication.

Benefits of Using Excel for Invoices

Utilizing a well-known spreadsheet tool for managing transaction records brings a range of benefits. This type of software offers simplicity, flexibility, and a variety of built-in features that help streamline the billing process. Whether you’re a small business owner or part of a larger enterprise, using a spreadsheet for financial documentation can significantly enhance efficiency and accuracy.

Key Advantages of Spreadsheet Software

- Ease of Use: Most people are familiar with spreadsheet programs, making it easy to get started without the need for complex training or specialized knowledge.

- Customization: You can adjust the layout, font, and structure to meet your specific business needs, ensuring that the document aligns with your company’s branding and preferences.

- Cost-Effective: There’s no need to invest in expensive software. Spreadsheets are often included in standard office software packages, offering a budget-friendly solution.

- Built-in Formulas: Automating calculations, such as totals, taxes, and discounts, can reduce errors and save valuable time during the billing process.

- Storage and Access: Files can be easily stored, organized, and accessed from any device, ensuring that you always have your documents at hand when needed.

Efficiency and Accuracy

Automation: By setting up formulas for calculations, you eliminate the need for manual input, which not only speeds up the process but also ensures greater accuracy.

Organization: Spreadsheet tools provide an easy way to track, sort, and filter data, helping you keep a well-organized record of all transactions and payments. This is particularly useful when handling multiple clients or large volumes of transactions.

Incorporating a simple, efficient structure into your workflow can significantly reduce time spent on administrative tasks and improve overall business productivity. The power of spreadsheets lies in their ability to streamline processes, minimize errors, and provide clear, professional results with little effort.

Top Excel Templates for Businesses

Businesses of all sizes rely on various document formats to track operations, manage finances, and communicate with clients. Using pre-designed layouts can greatly enhance productivity by providing a structured approach to these tasks. With the right format, business owners can easily manage records, analyze data, and ensure accuracy while saving valuable time. Below are some of the most commonly used and effective layouts for businesses looking to streamline their workflow.

| Document Type | Description | Key Benefits |

|---|---|---|

| Financial Record Sheet | A layout for tracking income, expenses, and profits. | Helps organize business finances, makes tax preparation easier, and offers a clear financial overview. |

| Project Management Planner | A tool to organize tasks, deadlines, and resources for project tracking. | Improves task delegation, keeps deadlines on track, and ensures effective team collaboration. |

| Expense Report | A document to track business expenses, including purchases, travel, and overheads. | Helps monitor cash flow, ensures accurate reimbursement claims, and simplifies expense audits. |

| Client Contact Sheet | A list of client information, including addresses, emails, and communication preferences. | Facilitates client relationship management, improves communication, and keeps business contacts organized. |

| Inventory Tracker | A sheet used to track stock levels, product orders, and deliveries. | Reduces stockouts, keeps inventory levels optimal, and ensures better order management. |

By utilizing these layouts, businesses can stay organized and improve their operations. Whether it’s for keeping track of finances, managing projects, or communicating with clients, using pre-designed structures makes it easier to stay on top of important tasks and minimize errors.

Creating Professional Invoices in Minutes

Generating polished, professional documents to request payment can be quick and simple with the right tools. Instead of spending hours on design and formatting, you can streamline the process and create an effective billing document in just a few minutes. By using customizable formats, you can ensure that each record looks consistent and meets the needs of your clients while also saving valuable time.

Step-by-Step Process

To create a high-quality financial document in minutes, follow these straightforward steps:

- Step 1: Open a pre-designed structure, which already includes necessary fields like client details, product descriptions, and payment terms.

- Step 2: Customize the details by adding your company’s branding, adjusting fonts, and changing the layout to suit your business style.

- Step 3: Fill in the transaction details such as the services provided, quantities, rates, and any applicable taxes or discounts.

- Step 4: Double-check for accuracy, ensuring all fields are correctly filled in, and that the totals are calculated correctly.

- Step 5: Save the document and send it to your client via email or print it for physical delivery.

Time-Saving Features

Pre-built Calculations: Many formats come with formulas already set up to automatically calculate totals, taxes, and discounts. This reduces the time spent on manual calculations and minimizes errors.

Branding Consistency: Customizing your document with your logo and business details ensures that every document sent to clients is aligned with your brand image. This enhances professionalism and recognition.

By following these simple steps, you can generate professional, error-free documents quickly, allowing you to focus more on your core business tasks while maintaining an organized and efficient billing system.

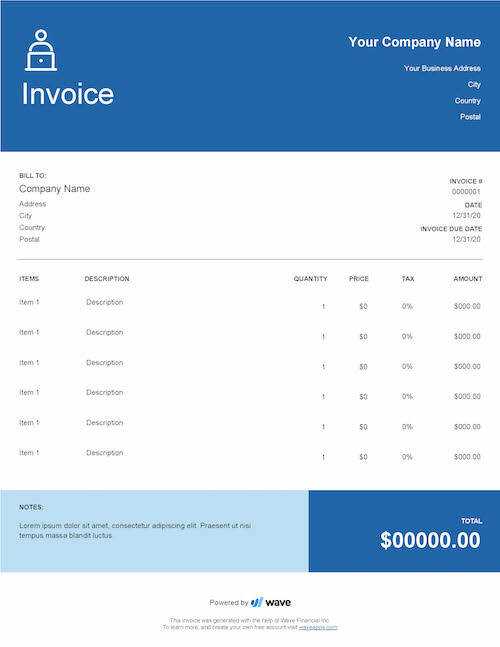

How to Add Branding to Invoices

Incorporating your company’s branding into business documents not only helps establish a professional image but also makes your materials easily recognizable to clients. Customizing the design of your financial records can strengthen your brand identity and ensure consistency across all communications. By adding key elements such as logos, fonts, and color schemes, you create a cohesive and polished look that reflects your business values.

Key Elements to Include

Here are some of the most effective ways to incorporate your branding into transaction documents:

| Element | Description | Why It Matters |

|---|---|---|

| Company Logo | Position your logo at the top of the document, typically in the header area. | It immediately establishes your business identity and makes the document look professional. |

| Brand Colors | Use your brand’s color scheme for text, headings, and borders. | Colors reinforce your brand identity and create a visually appealing layout. |

| Custom Fonts | Apply fonts that match your brand style for headings and text. | Custom fonts create a unique and consistent look that aligns with your company’s overall aesthetic. |

| Contact Information | Ensure your phone number, email, and website are clearly visible. | Providing easy access to contact details strengthens client relationships and encourages future engagement. |

Additional Customization Tips

- Headers and Footers: Add custom text in the header or footer with a business slogan, tagline, or additional contact information.

- Saving and Managing Your Invoices

Properly storing and organizing your billing records is essential for maintaining accurate financial data, ensuring smooth operations, and meeting legal requirements. With the right system in place, you can easily retrieve past documents, track payments, and ensure that no important details are overlooked. Efficiently managing these records also helps streamline your workflow, reduce clutter, and prevent mistakes in the future.

Organizing Your Documents

Once you create your financial documents, the next step is to ensure they are stored in an accessible and secure manner. Here are some effective ways to organize and manage your records:

- Use Descriptive Filenames: Save each document with a unique and easily identifiable name that includes the client’s name, the date of the transaction, and an identifier (e.g., “JohnDoe_2024_03_15”).

- Create Folders: Organize your files into folders by month, client, or project, making it easier to locate specific records when needed.

- Cloud Storage: Consider using cloud-based storage services for easy access from any device, as well as for extra security and backup.

- Automated Systems: If possible, automate the storage process so that files are saved and organized according to your set preferences.

Tracking Payments and Status

In addition to storing your documents, it’s important to track the payment status of each transaction. Keeping this information organized will help ensure timely follow-ups and minimize confusion:

- Payment Status Updates: Keep a record of when payments are received, and flag unpaid documents to follow up with clients.

- Use Accounting Software: Consider using accounting tools that integrate with your stored documents, allowing you to track payments and expenses in real time.

- Manual Tracking: If you’re managing your records manually, maintain a separate log (either digital or physical) to track due dates and payment confirmations.

By adopting effective methods to save and manage your financial records, you can reduce stress, improve workflow efficiency, and maintain a clear overview of your business’s financial health.

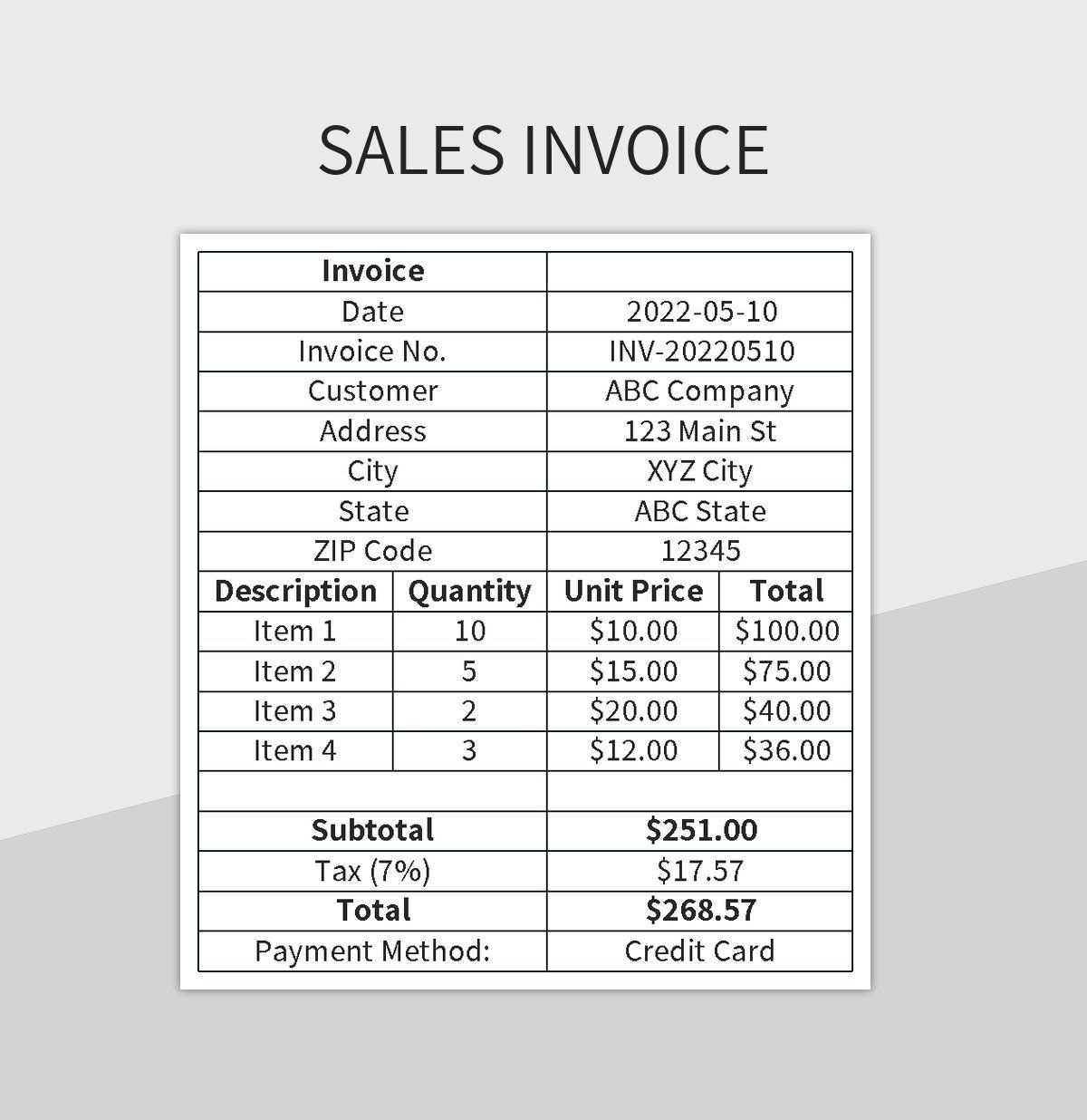

How to Include Taxes on Invoices

Incorporating taxes into business documents is an important step in ensuring compliance with local laws and providing transparency to clients. Accurately calculating and displaying applicable tax amounts can prevent confusion and avoid potential legal issues. Whether it’s sales tax, VAT, or other types of taxes, it’s essential to clearly show the amounts so clients know exactly what they are paying for.

Steps to Include Taxes

Here are the steps to correctly include tax information on your financial documents:

- Determine the Applicable Tax Rate: Identify the correct tax rate for your location and the type of goods or services provided. Rates can vary by region and product category.

- Calculate the Tax Amount: Multiply the subtotal (the cost before tax) by the tax rate. For example, if the subtotal is $100 and the tax rate is 5%, the tax amount would be $5.

- Add Tax to the Total: Include the calculated tax amount in the total sum that the client will pay. Make sure the subtotal and the tax are clearly separated on the document.

- Show Tax Breakdown: List the specific tax amount alongside the subtotal and total, so the client can see exactly how much tax is being applied.

Displaying Taxes Clearly

It’s important to display tax details in a way that is both clear and easy to understand. Here are some tips:

- Label the Tax Section:Tracking Payments with Excel Invoices

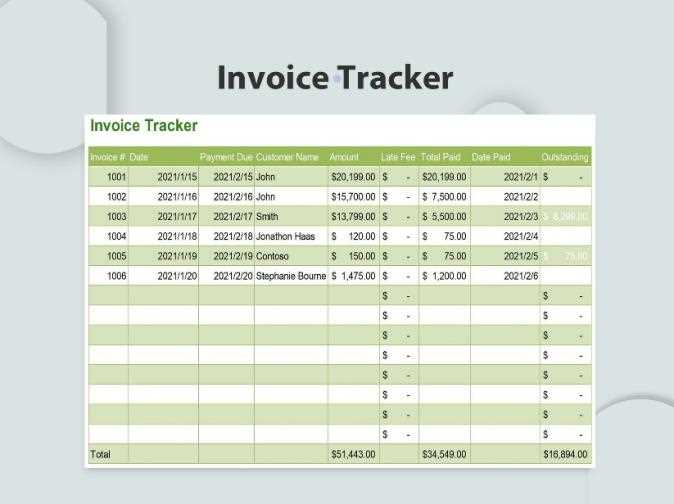

Effectively managing payments is essential for maintaining cash flow and keeping financial records up to date. Using a digital document system allows businesses to easily track the status of payments and reduce the risk of overdue or missed transactions. With the right setup, you can quickly monitor what has been paid and what remains outstanding, improving both organization and customer relations.

Setting Up a Payment Tracking System

One of the simplest ways to keep track of payments is by setting up a clear and structured system within your digital documents. Follow these steps:

- Include a Payment Due Date: Clearly list the due date on each document to set expectations for when the payment is expected. This helps in tracking overdue payments.

- Track Payment Status: Add a column to mark whether the payment is pending, completed, or overdue. This provides an at-a-glance view of the payment status for each transaction.

- Record Payment Dates: When payments are received, note the payment date in a separate column. This allows for easy reference if clients inquire about payment history.

- Add Payment Method: Include a section for the payment method (e.g., bank transfer, credit card, cash). This can help with financial reconciliation later on.

Advanced Payment Tracking Features

If you want to take payment tracking to the next level, you can implement some additional features:

- Automatic Calculations: Use built-in formulas to calculate outstanding balances. For example, subtract the amount paid from the total amount to automatically update the remaining balance.

- Multiple Payment Installments: If a client is paying in installments, track each payment and update the balance accordingly. This is especially useful for large transactions that require partial payments.

- Conditional Formatting: Use color codes to visually indicate overdue payments or completed transactions. For example, overdue amounts can be highlighted in red, while paid amounts can b

Setting Up Your Invoice Layout

Designing a well-organized billing document is crucial for ensuring clarity and professionalism. The structure of your financial document should be easy to read, with key information clearly highlighted. A clean, consistent layout allows both you and your clients to quickly find the necessary details and ensures no important data is overlooked. By setting up a layout that balances functionality with aesthetics, you can improve your workflow and enhance client relationships.

Essential Sections for Your Document

When creating a billing document, it’s important to include the following sections for clarity and organization:

Section Description Why It Matters Header Include your business name, logo, and contact information (address, phone number, and email). This gives the document a professional look and ensures the recipient knows who issued it and how to contact you. Recipient Information Include the name, address, and contact details of the client or customer. Helps avoid confusion and ensures the document reaches the correct person or company. Itemized List Provide a detailed list of products or services, including quantity, price, and any applicable taxes or discounts. Ensures transparency and allows the client to see exactly what they are being charged for. Total Amount Clearly display the total amount due, including any taxes or discounts. Helps avoid misunderstandings and makes it easy for clients to see the total payment expected. Payment Terms Specify the payment due date and acceptable payment methods (e.g., bank transfer, credit card, PayPal). Sets clear expectations and helps ensure timely payment. Layout Tips

- Alignment: Ensure all text and

Automating Repetitive Invoice Tasks

Automating routine tasks can save valuable time and reduce the risk of errors, especially when it comes to managing financial documentation. Many aspects of the billing process, such as generating documents, calculating totals, and sending reminders, can be automated to improve efficiency. By automating these repetitive tasks, you free up time to focus on other important aspects of your business while ensuring consistency and accuracy in your financial records.

Common Tasks to Automate

Several tasks within the billing cycle can be automated, helping streamline your workflow:

- Document Creation: Use pre-built systems or tools to automatically generate documents based on client details and products or services rendered.

- Calculations: Automatically calculate totals, taxes, and discounts based on predefined formulas, eliminating the need for manual calculations.

- Reminders: Set up automated payment reminders for clients, notifying them when a payment is due or overdue.

- Recurring Billing: For subscription-based services, automate the generation of regular billing statements on a set schedule.

Tools and Techniques for Automation

Here are some methods to implement automation for your billing process:

- Accounting Software: Many accounting platforms offer built-in automation features, such as auto-generation of documents, tax calculations, and payment tracking.

- Custom Excel Macros: For more customized automation, you can create macros in spreadsheet software to handle repetitive tasks like document formatting and data entry.

- Cloud-Based Solutions: Cloud services often integrate with your business tools, offering automation features like invoicing, payment tracking, and client communication.

- Payment Gateways: Payment platforms can automatically update the status of payments and send receipts, reducing the need for manual follow-ups.

By integrating automation into your billing process, you not only reduce time spent on administrative tasks but also increase the accuracy and reliability of your financial records, leading to smoother operations and improved client satisfaction.

Free Templates vs Paid Alternatives

When selecting tools for creating billing documents, businesses often face the choice between using no-cost options and investing in premium solutions. Both free and paid options have their merits, and the decision largely depends on the specific needs of the business. While free options may seem attractive, paid alternatives often offer enhanced features, support, and customization options that can improve efficiency in the long run. Understanding the key differences between these two choices can help businesses make informed decisions.

Advantages of Free Options

Free tools can be a great starting point for small businesses or those with limited resources. Some of the benefits of using no-cost solutions include:

- Cost Savings: The most obvious advantage is that they come at no expense, which can be crucial for startups or small enterprises operating on tight budgets.

- Simplicity: Free solutions often provide basic functionality that is easy to use, with minimal setup required.

- Basic Features: Many free options include the essentials like itemized lists, basic formatting, and simple calculations, making them suitable for businesses with straightforward needs.

Benefits of Paid Solutions

While free options can be functional, paid solutions typically offer more robust features that can benefit businesses as they grow. Here are some advantages of investing in premium tools:

- Advanced Customization: Paid alternatives often allow for greater customization, enabling businesses to create more personalized and professional-looking documents that reflect their branding.

- Enhanced Functionality: Premium tools typically offer additional features such as automated calculations, tax rate updates, payment tracking, and integration with accounting software.

- Customer Support: Paid solutions often come with dedicated customer service, helping resolve issues or questions quickly and efficiently.

- Regular Updates: Premium tools are regularly updated, ensuring you have access to the latest features, security patches, and improvements.

Ultimately, the choice between free and paid options depends on your business’s specific needs, the complexity of your transactions, and your available resources. While free tools are a good starting point, paid solutions offer scalability, reliability, and features that may prove invaluable as your business grows.

Common Mistakes to Avoid in Invoices

Creating accurate and clear billing documents is essential for maintaining a professional relationship with clients and ensuring timely payments. However, even small errors in these documents can lead to confusion, delayed payments, and dissatisfaction. It’s important to be aware of the most common mistakes and take steps to avoid them in order to maintain a smooth financial process.

1. Missing or Incorrect Contact Information

One of the most frequent errors is failing to include complete or accurate contact details. Whether it’s your business information or the client’s, missing details can cause confusion and delays. Double-check the names, addresses, phone numbers, and email addresses to ensure everything is correct.

2. Incorrect Pricing or Calculation Errors

Another common issue is errors in pricing or calculations. Failing to accurately calculate totals, taxes, or discounts can result in clients being overcharged or undercharged. Always double-check your calculations, and use formulas to automate the math whenever possible to reduce the chances of human error.

3. No Clear Payment Terms

It’s essential to clearly define your payment terms to avoid misunderstandings. Not specifying when the payment is due, the accepted methods of payment, or any late fees can lead to confusion. Always state the due date, acceptable payment options, and any penalties for late payments upfront.

4. Lack of Item Descriptions

Simply listing product or service names without providing detailed descriptions can leave your client unsure of what they are being charged for. Include brief but clear descriptions for each item or service to ensure transparency and avoid disputes later.

5. Forgetting to Add a Unique Reference Number

Each billing document should have a unique reference number. This number helps both you and your clients keep track of payments and correspondence. Without it, keeping organized records becomes challenging, especially for large transactions or repeat clients.

6. Poor Formatting and Organization

A cluttered or disorganized layout makes it difficult for the client to quickly find the necessary information. Keep the design simple, with clearly defined sections and readable fonts. Use enough spacing to avoid a cramped appearance, and ensure all important details stand out clearly.

Avoiding these common mistakes can help ensure that your billing do

- Alignment: Ensure all text and