Free Roofing Invoice Template for Efficient Billing

Managing financial transactions efficiently is crucial for any service provider, especially in the construction and repair industry. Clear and professional billing not only ensures timely payments but also helps in maintaining a trustworthy relationship with clients. Streamlining the invoicing process can save valuable time and minimize errors, allowing contractors to focus on their work rather than administrative tasks.

By utilizing customizable documents for billing, contractors can ensure that all necessary details are included without the need to recreate paperwork for every new job. These documents provide a structured approach, ensuring that payments are tracked properly and all agreed-upon terms are reflected accurately. The ease of editing and adaptability makes these tools an invaluable resource for professionals in the field.

Optimizing the billing process allows service providers to maintain consistency across all projects, ensuring that no essential information is overlooked. Whether you are a freelancer or run a larger team, adopting this system will make financial management more efficient and less time-consuming. Furthermore, having a standardized approach can help in enhancing the overall professionalism of the business.

Free Roofing Invoice Template for Contractors

For contractors in the construction industry, simplifying the billing process is essential. Having a standardized format for all client payments helps save time and reduces the chances of errors. A structured document that can be quickly filled out for each project ensures consistency and clarity in financial transactions, making it easier to manage payments and avoid confusion.

Key Benefits of Using a Standardized Billing Format

- Time-Saving: Quickly fill in essential details without having to design new documents for every job.

- Consistency: Maintain uniformity in all transactions, ensuring clients receive professional and clear records.

- Improved Accuracy: Reduce the likelihood of missing crucial information or making calculation errors.

- Professional Appearance: Present a polished and organized document that reflects well on your business.

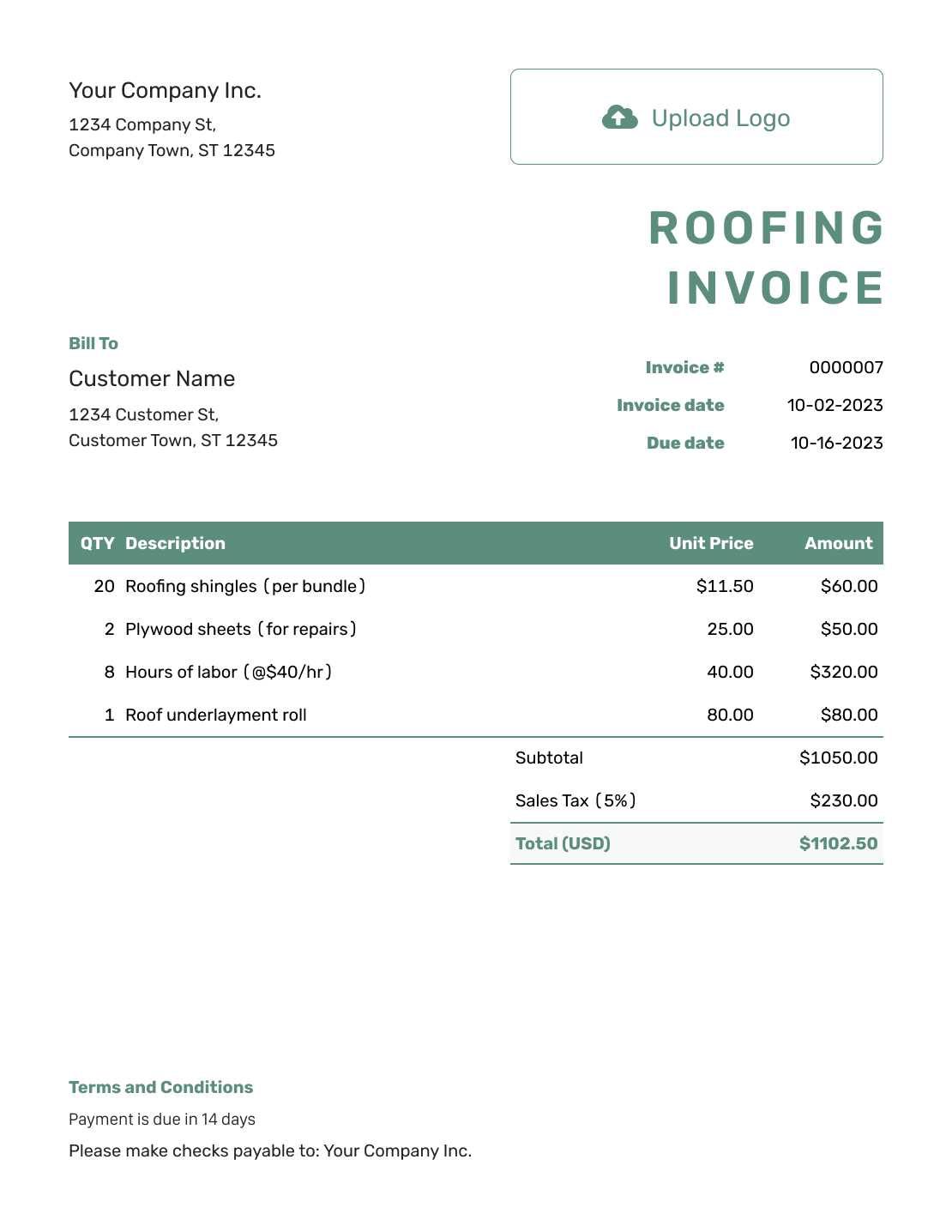

What to Include in Your Billing Document

- Client Information: Name, address, and contact details of the client.

- Service Description: A clear breakdown of the services provided, including labor and materials.

- Payment Terms: Specify due dates, accepted payment methods, and any applicable late fees.

- Project Dates: Include the start and completion dates for clarity.

- Total Amount Due: List the final cost and ensure it matches the agreed price.

By using a convenient, pre-made format, contractors can ensure that they meet all their financial obligations and keep a professional relationship with clients. Whether for small projects or larger contracts, a well-organized financial record helps maintain trust and ensure smooth transactions.

Why You Need a Billing Document

In any service-based business, maintaining clear and professional financial records is vital for ensuring smooth transactions between you and your clients. A well-organized financial document is more than just a request for payment; it serves as a formal agreement, outlining the services rendered and ensuring both parties are on the same page regarding costs and expectations.

Benefits of Having a Structured Payment Record

- Clarity: Clearly define the work completed and the associated costs, preventing misunderstandings.

- Legal Protection: In case of disputes, a detailed document can serve as proof of the agreed terms.

- Professionalism: Providing a neat, organized document reflects positively on your business, building client trust.

- Payment Tracking: Easily track the status of payments and manage overdue balances.

When to Use a Billing Document

- Upon Completion of Work: Always issue one after finishing a project to ensure timely payment.

- For Large or Ongoing Projects: Use it to outline milestones and keep track of partial payments.

- For Clients Who Require Proof: Some clients may request a formal breakdown of costs for their records.

By providing a detailed, structured record of work and costs, contractors can streamline their operations, avoid disputes, and enhance their professional reputation in the industry.

How to Customize Your Billing Document

Creating a tailored document for your financial transactions ensures that all relevant details are captured in a professional and clear format. Customizing such a document allows you to reflect your business’s unique identity, ensure accurate payment tracking, and streamline your accounting processes. By adjusting certain sections to fit your specific needs, you can create a document that is both functional and reflective of your company’s professionalism.

Steps to Tailor Your Document

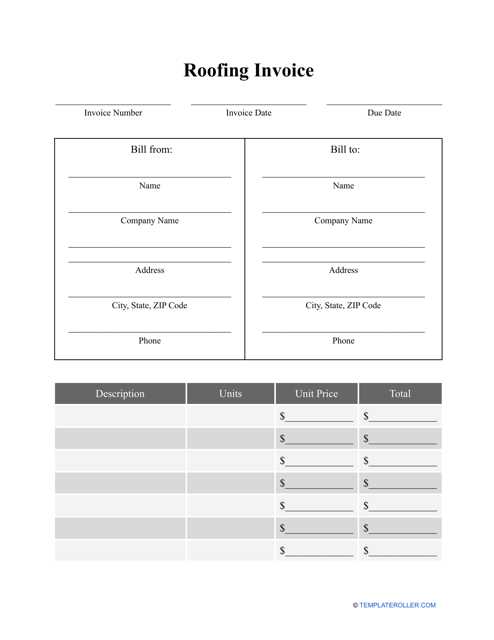

- Adjust the Header: Add your business name, logo, and contact information at the top for easy identification.

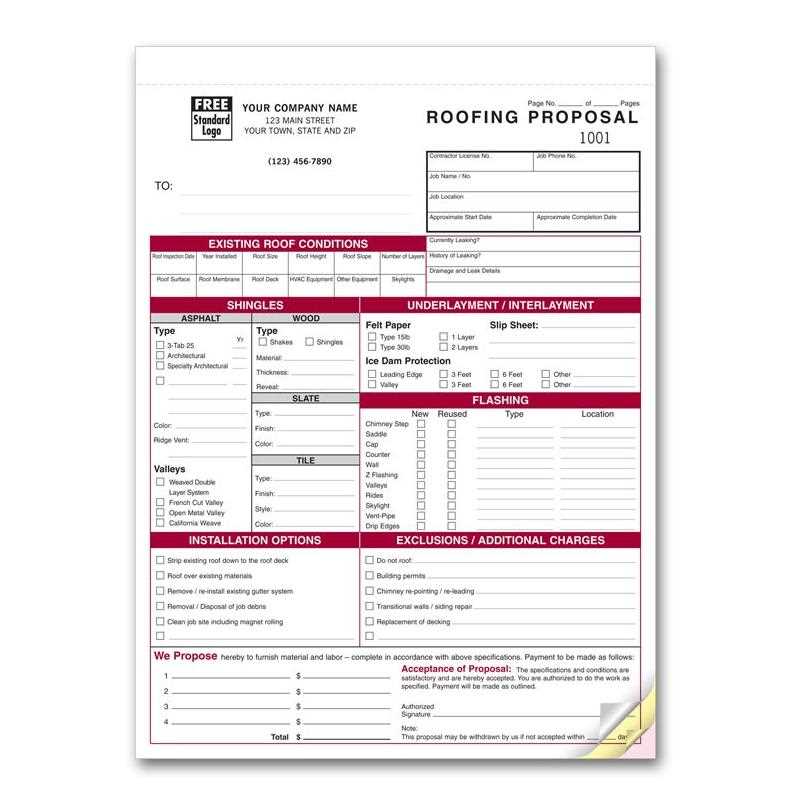

- Define Service Categories: Create sections for different types of work provided, whether it’s labor, materials, or other charges.

- Include Payment Terms: Clearly state payment due dates, accepted payment methods, and any late fee policies.

- Customize the Layout: Adjust fonts, colors, and overall design to match your business branding and make the document visually appealing.

Essential Fields to Include

- Client Information: Ensure the client’s name, address, and contact details are properly listed.

- Job Details: Describe the work done in detail to avoid ambiguity.

- Final Amount: Provide a clear breakdown of all charges, including any taxes or additional fees.

- Project Timeline: Include the start and completion dates to reflect the duration of the project.

Customizing this document not only enhances its accuracy but also reinforces the professional image of your business, helping to build strong, long-lasting relationships with clients.

Benefits of Using a Free Template

Adopting a ready-made solution for financial documentation brings significant advantages, especially when managing multiple projects. By utilizing a pre-designed format, businesses can save time, avoid mistakes, and streamline their administrative tasks. Instead of starting from scratch, these tools provide a reliable foundation that can be customized to suit each client and job, ensuring efficiency and consistency in all transactions.

Time-Saving: With a structured document at hand, you can eliminate the need for manual formatting and focus on the details of your work. It enables you to quickly input project-specific information and send out billing records without delay.

Consistency: A standardized approach ensures that every client receives the same professional and organized document. This uniformity helps build a trustworthy reputation as clients will know what to expect with each transaction.

Cost-Effective: Using a ready-made solution eliminates the need for paid software or design services, offering an affordable option for small businesses or individual contractors to manage their finances effectively.

Flexibility: These tools can be easily customized to suit specific business needs, making them suitable for a variety of service providers. Whether you’re dealing with different types of charges or offering unique payment terms, these resources are adaptable to your requirements.

By leveraging these ready-made documents, you can focus on delivering high-quality work while ensuring that your financial transactions are both efficient and professional.

Step-by-Step Guide to Invoice Creation

Creating a well-structured document for requesting payment involves several key steps to ensure that all necessary details are captured clearly. By following a simple process, you can ensure that your financial records are accurate and that clients have a clear understanding of the services rendered and the amount due. This guide outlines the essential steps involved in crafting an effective financial request for your services.

Follow these steps to create a professional and comprehensive document:

| Step | Action | Description |

|---|---|---|

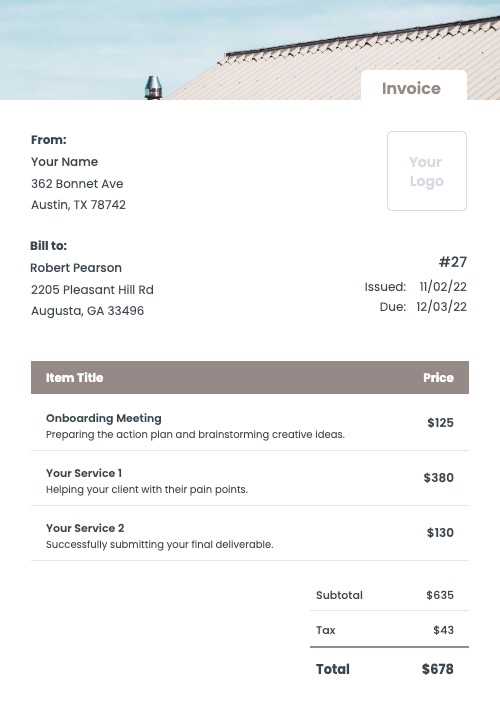

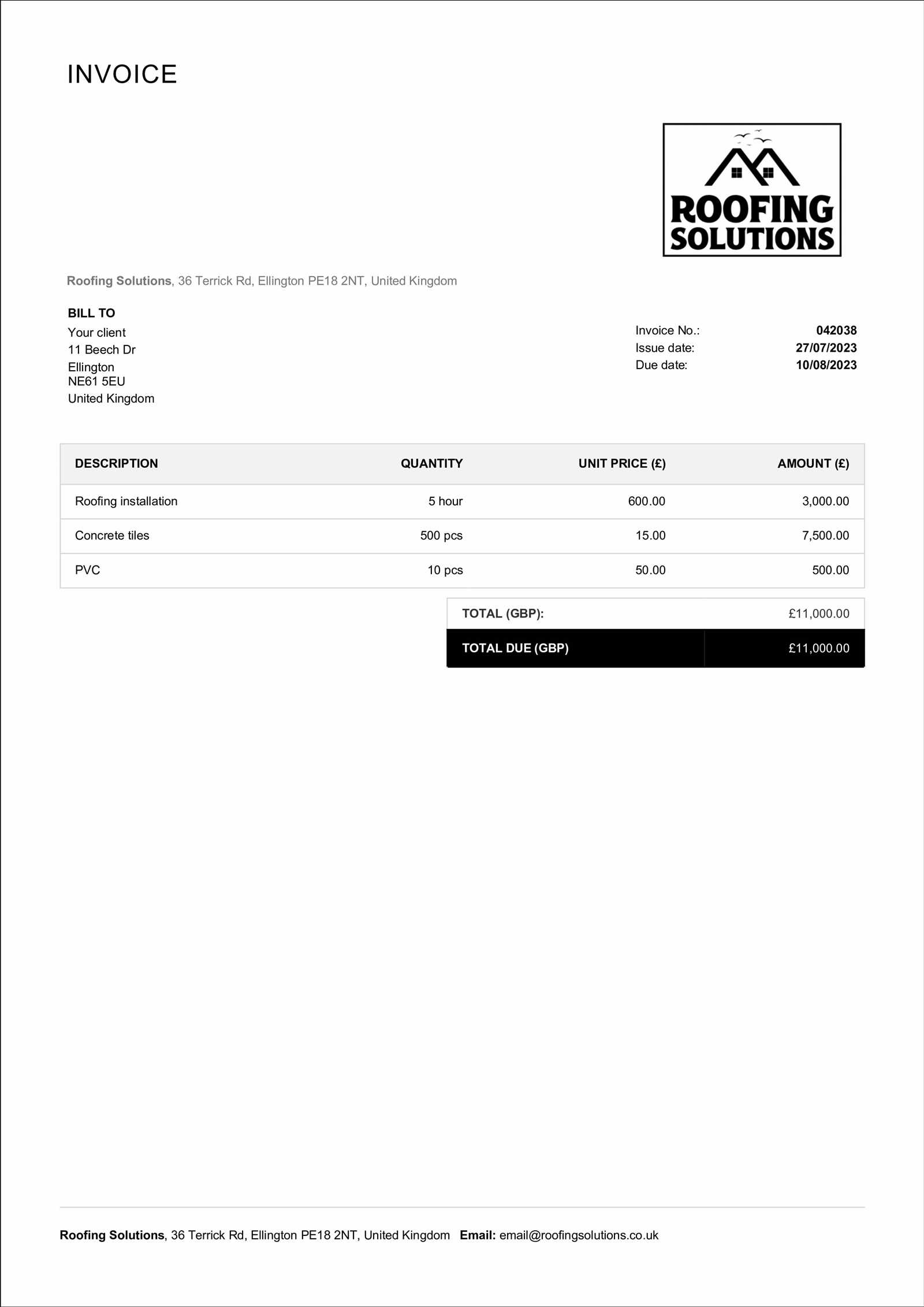

| 1 | Header Information | Include your business name, logo, and contact details at the top, as well as the client’s information. |

| 2 | Project Details | Clearly describe the services provided, including a breakdown of labor, materials, and any additional charges. |

| 3 | Dates | List the start and completion dates for the work to ensure clarity on the timeline of services. |

| 4 | Total Amount | Include a clear breakdown of the total cost, showing the individual charges and the final amount due. |

| 5 | Payment Terms | Specify when payment is due, acceptable payment methods, and any penalties for late payments. |

By following these steps, you will be able to create a professional document that ensures both you and your clients are on the same page, helping to avoid misunderstandings and ensuring prompt payment for your services.

Essential Elements of a Billing Document

Creating a detailed and comprehensive billing document is crucial for ensuring clear communication with clients and a smooth payment process. Certain key components are essential to make sure that all necessary information is included and easy to understand. Each part serves a unique purpose in maintaining professionalism and reducing confusion during the transaction.

- Business Information: Your company’s name, logo, address, phone number, and email are the first things that should appear at the top, making it easy for the client to identify who the document is from.

- Client Information: Clearly list the customer’s name, address, and contact details. This ensures the document is properly addressed and reduces the chance of errors.

- Unique Identification Number: Assign a unique number or reference code to each document to help track transactions efficiently, especially when dealing with multiple clients or projects.

- Service Description: Provide a detailed breakdown of the work completed, including the materials used, labor charges, and any other relevant services rendered. This section should be clear and thorough to avoid confusion later on.

- Dates: Include both the date the document was created and the specific timeline of services, including the start and completion dates. This helps clarify when the work was performed.

- Payment Amount: List the total charges for services rendered, broken down into itemized parts (e.g., labor, materials, taxes) and clearly indicate the total amount due.

- Payment Terms: Specify when the payment is due and the accepted methods of payment, such as credit card, bank transfer, or check. It’s also helpful to include late payment penalties if applicable.

- Notes: Any additional information, such as warranty details or disclaimers, should be included here to ensure transparency and avoid future disputes.

By including these essential elements in your billing document, you create a clear, professional record that helps maintain trust with your clients while ensuring prompt payment for your services.

Common Mistakes to Avoid in Billing Documents

While preparing a payment request, it’s easy to overlook certain details that could lead to confusion or delayed payments. Common errors in these financial records can cause unnecessary disputes and delay the payment process. By understanding and avoiding these mistakes, you ensure smoother transactions and maintain professionalism in your business dealings.

- Missing Client Information: Failing to include the client’s full name, address, and contact details can lead to confusion and complicate the payment process.

- Incorrect Dates: If the date of service or the document creation date is missing or incorrect, it can cause confusion regarding payment terms and timelines.

- Unclear Item Descriptions: Vague or incomplete descriptions of the work performed can result in misunderstandings about what the client is being charged for. Always provide clear and specific details.

- Not Including a Payment Deadline: Leaving out the due date for payment can cause delays as clients may not have a clear understanding of when payment is expected.

- Omitting Payment Terms: Without specifying acceptable methods of payment or late fees, clients may delay payments or face confusion over how to pay.

- Calculations Errors: Double-checking the total cost and individual charge breakdown is critical. Errors in math can create trust issues with clients and delay payments.

- Overlooking Professional Branding: A lack of your company’s branding (e.g., logo, contact details) makes the document seem less professional and can impact your reputation.

- Failure to Include Unique Identifiers: Not assigning a unique number or reference code to each document can make tracking payments difficult, especially for accounting purposes.

By being mindful of these common mistakes, you can create clear, professional payment requests that facilitate timely and accurate payments from clients.

How to Save Time with Pre-designed Documents

Using pre-designed documents can significantly streamline the process of creating professional records, allowing you to focus more on the actual work rather than formatting. These ready-made solutions help you avoid starting from scratch each time, saving both time and effort. By utilizing templates, you can ensure consistency, reduce errors, and speed up the administrative side of your business.

Advantages of Using Pre-designed Documents

- Efficiency: With a structured format already in place, you can quickly fill in the necessary information without worrying about layout or design.

- Consistency: Using the same format for all your documents helps create a professional and cohesive appearance, enhancing your business’s image.

- Reduced Risk of Errors: Pre-built formats ensure that key details are always included, helping to minimize mistakes like missing client information or incorrect calculations.

- Faster Turnaround: Completing and sending documents becomes much quicker when the structure is already set, leading to faster client processing.

How to Maximize Time Savings

- Personalize Each Document: Even with a pre-designed structure, take the time to add specific details, such as personalized notes or custom pricing, to cater to each client’s needs.

- Reuse the Same Layout: Stick to the same format for all your documents to maintain consistency and avoid unnecessary adjustments for each new task.

- Store Templates for Easy Access: Keep your ready-made documents in a well-organized folder for easy access, making it simple to retrieve them when needed.

By adopting pre-designed solutions for your business processes, you can save valuable time, improve accuracy, and maintain a professional image, all while focusing on growing your business.

Incorporating Tax and Fees in Documents

When creating professional billing documents, it is essential to properly include any applicable taxes and service charges to ensure both transparency and accuracy. Accurately representing these charges not only prevents misunderstandings with clients but also ensures compliance with local laws and regulations. A clear breakdown of all charges helps maintain trust and avoid disputes regarding the final amount due.

How to Add Tax to Your Bill

One of the key components when structuring any financial document is tax inclusion. Here are some important steps to keep in mind:

- Identify Applicable Tax Rates: Different regions and types of services may have varying tax rates. Ensure you are aware of the correct rates for your business location or the client’s jurisdiction.

- Separate Tax from Service Charges: Clearly list the tax as a separate item to show transparency in your charges. This allows clients to easily see how much is attributed to tax and how much to the service provided.

- Display Tax Percentage: Include the percentage rate used for calculation to provide complete clarity to your clients about how the tax was determined.

Including Service Fees or Additional Charges

In some cases, there may be extra charges for certain services, materials, or administrative fees. These should also be clearly indicated to avoid any confusion or dissatisfaction:

- List Additional Charges: Include any service-related fees, like delivery or setup costs, as separate line items with a clear description of what the fee covers.

- Specify Conditions for Charges: Mention if there are any conditions under which additional fees apply, such as special requests, expedited services, or unforeseen expenses.

- Ensure Accuracy: Double-check the amounts of service fees and taxes to prevent mistakes that could lead to overcharging or undercharging.

By carefully including taxes and extra charges in your documents, you create a more professional and transparent billing process that fosters good relationships with clients and ensures the smooth operation of your business.

Document Design Tips for Professional Look

A well-structured and visually appealing billing document can leave a lasting impression on your clients. The design not only reflects the professionalism of your business but also enhances clarity, making it easier for clients to understand the charges and information. By paying attention to layout, fonts, and overall presentation, you can create a document that stands out and fosters a positive client experience.

Key Design Elements for a Professional Appearance

Incorporating clean and simple design elements can make a significant difference in the presentation of your billing document:

- Clear Layout: Organize information logically, with sections for your contact details, the client’s information, the services provided, and the total amount due. Ensure there is enough white space between sections to avoid clutter.

- Consistent Font Choice: Use professional and easy-to-read fonts like Arial or Times New Roman. Avoid decorative fonts that may reduce readability, especially for important details like the amount due.

- Branding: Include your company logo, business name, and consistent color schemes to enhance your brand identity. This provides a sense of professionalism and makes your documents recognizable to clients.

Practical Tips for Formatting

Formatting plays an essential role in making your document both aesthetically pleasing and functional:

- Use a Logical Flow: Structure the document in a way that naturally guides the reader’s eye. Start with the essential details like your business name, followed by client information, services, and total cost.

- Highlight Key Information: Make the total amount due prominent and easy to locate. Using bold text or a larger font size can make it stand out without overdoing it.

- Consistent Spacing: Ensure even spacing between rows, columns, and sections. This improves readability and gives your document a polished look.

By following these design tips, you can create a professional document that is visually appealing, easy to read, and effectively communicates the necessary details to your clients.

How to Track Payments and Outstanding Balances

Efficiently monitoring payments and keeping track of any unpaid balances is crucial for maintaining cash flow and ensuring that business operations run smoothly. A clear and organized system for tracking payments not only helps in managing finances but also minimizes the risk of overlooking unpaid amounts. In this section, we will explore effective strategies for monitoring client payments and managing outstanding balances.

Set Clear Payment Terms and Deadlines

Before you can track payments, it is important to establish clear payment terms with your clients. Setting expectations early on helps both parties understand when payments are due and what happens in the case of late payments. Some key steps to consider include:

- Specify Payment Due Dates: Clearly state when payments are expected, whether it’s within 30 days, 60 days, or a set period after the service is rendered.

- Outline Late Fees: If applicable, include details about late fees or interest charges for overdue payments.

- Offer Multiple Payment Methods: Make it easier for clients to pay by offering various payment options, such as credit card, bank transfer, or online payment systems.

Use a Payment Tracking System

To effectively manage payments and outstanding balances, consider using a system to track each transaction. Here are some tools and practices to help:

- Spreadsheets: For small businesses, a simple spreadsheet with columns for client name, service details, payment amount, and due dates can be an effective way to monitor transactions.

- Accounting Software: Invest in accounting or invoicing software that provides automated tracking of payments and outstanding balances. These tools can send reminders for upcoming payments and alert you to overdue amounts.

- Payment Logs: Keep detailed records of each payment, including date received, amount, and payment method. This will help when reconciling your accounts at the end of the month.

By implementing these strategies, you can effectively track payments, follow up on overdue balances, and maintain a healthy financial situation for your business.

Best Software for Editing Roofing Templates

Choosing the right software for customizing professional documents can make a significant difference in efficiency and presentation. Whether you need to modify an existing design or create a new one, using the appropriate tools can streamline your workflow. Below, we explore some of the best software options for editing and personalizing your business documents.

1. Microsoft Word

Microsoft Word remains one of the most versatile and widely used tools for document creation and editing. With its user-friendly interface and powerful features, it is ideal for small businesses and contractors looking to personalize their records. Key benefits include:

- Ease of Use: A familiar interface makes it easy to edit, format, and customize content.

- Professional Templates: Word offers numerous built-in designs, which can be tailored to fit your specific needs.

- Cloud Storage: Seamlessly save and share files with Microsoft OneDrive, making collaboration simple.

2. Google Docs

Google Docs is another powerful tool, especially for teams looking for cloud-based solutions. It allows real-time collaboration and easy editing from any device. Some of the advantages include:

- Real-Time Collaboration: Multiple users can work on the same document simultaneously, making it perfect for team-based projects.

- Free Access: It’s completely free to use, which is perfect for businesses on a budget.

- Cloud Integration: Automatic saving and easy sharing via Google Drive ensures your documents are always accessible.

3. Adobe Acrobat

For those who require more advanced editing options, Adobe Acrobat offers a range of features that allow you to modify PDF documents. Ideal for businesses that often deal with contracts or finalized documents, Adobe Acrobat’s benefits include:

- Advanced Editing Tools: Acrobat lets you add text, modify images, and edit document layout with ease.

- Secure Sharing: Documents can be encrypted and password-protected for enhanced security.

- Professional Output: Final versions can be polished and ready for printing or digital distribution.

4. Canva

If you’re looking for a more creative and visually appealing approach, Canva is a popular online tool for designing documents. While it offers a variety of templates, its customization features are especially useful for those who want to add a personal touch. Notable features include:

- Drag-and-Drop Interface: Easily design and customize your documents using pre-made elements or start from scratch.

- Visual Design Focus: Canva specializes in creating eye-catching documents, perfect for marketing materials.

- Collaboration: Multiple users can work together on the same design in real-time.

Choosing the best software depends on your needs–whether you require simple editing, advanced functionality, or a combination of both. These tools can help you produce polished, professional documents efficiently.

How to Share Your Invoice with Clients

Once you’ve prepared a professional document for your services, it’s essential to share it in a way that’s both efficient and secure. There are multiple ways to deliver your document to clients, each offering distinct advantages depending on the nature of your business and the preferences of your customer. Below are several methods for sharing your completed documents.

1. Email Delivery

One of the most common and convenient methods for sending documents is via email. This allows for immediate delivery and provides a digital copy that can be easily saved or printed. To do this efficiently:

- Attach the Document: Ensure the file is properly named (e.g., service completed or project name) to avoid confusion.

- Use a Secure File Format: PDFs are ideal as they can be opened on most devices without altering the format.

- Include a Clear Message: Provide a short note to explain the attached document, especially if it requires further action from the client.

2. Online Payment Systems

If you use an online payment system such as PayPal, Stripe, or another platform, many offer built-in options for sharing documents along with payment requests. This can streamline the process for clients and ensure a smooth transaction. The steps typically include:

- Upload Your Document: Most platforms allow you to upload documents directly to the payment system’s portal.

- Include Payment Instructions: Make sure to indicate the amount due and any relevant payment deadlines.

- Send the Link: After uploading, you can simply share the link to the document and payment page via email or message.

3. Cloud Storage Services

For clients who prefer having access to their documents online, cloud storage platforms like Google Drive, Dropbox, or OneDrive can be an excellent choice. This option allows you to store your document and share it with a specific link. To use this method:

- Upload the File: Place the document in a clearly labeled folder to make it easy for the client to find.

- Set Permissions: Adjust the sharing settings to ensure that the client has access to view or download the document.

- Share the Link: Copy and send the sharing link through email or message for quick access.

4. Physical Delivery

In some cases, you may prefer to deliver the document in person or through traditional mail. This method is typically reserved for more formal transactions or where electronic communication isn’t suitable. When using this option:

- Print a Hard Copy: Ensure the document is printed clearly and professionally.

- Use Secure Delivery: For important documents, consider sending them via certified mail or another secure delivery service to ensure safe arrival.

- Keep a Copy: Retain a copy of the document and tracking information for your records.

Selecting the right method depends on your client’s preferences and the nature of your business. Using these strategies can help ensure prompt and secure delivery of your completed records.

Legal Considerations for Roofing Invoices

When preparing a document to request payment for services rendered, it’s important to be aware of the legal aspects that ensure the document is not only clear but also binding. Understanding the required elements and regulations surrounding payment requests is essential for protecting both your business and the customer. Below are key legal considerations to keep in mind when drafting payment requests.

1. Clear and Accurate Details

For a document to be legally valid, it must contain accurate and comprehensive information. This ensures that both parties understand the terms of the agreement and avoids confusion. Key details to include:

| Element | Description |

|---|---|

| Service Description | Provide a detailed description of the work completed, including the scope, type of materials used, and time spent on the job. |

| Payment Amount | Clearly state the total amount due, including any applicable taxes, fees, or discounts applied. |

| Due Date | Specify the date by which payment must be received to avoid any late fees or penalties. |

| Payment Terms | Include any terms regarding payment methods, late fees, or installment plans if applicable. |

2. Legal Compliance with Local Regulations

Depending on your location, there may be specific regulations that govern payment requests for services. These can include requirements for including certain tax rates, terms of contract, or even what information must be displayed. Always ensure your documents are compliant with the relevant laws in your area. Here are some key compliance factors:

- Sales Tax: Ensure you include the appropriate sales tax percentage, if applicable, as per local tax laws.

- Licensing Information: If your business requires a license, include this number to show compliance with industry regulations.

- State-Specific Requirements: Some regions have specific mandates on how to present charges, late fees, or warranties in payment requests.

3. Payment Deadlines and Late Fees

To protect your business and avoid disputes, it’s essent

How to Handle Disputed Invoices

Disputes over payment requests are not uncommon in business transactions. When a client disagrees with a charge or the terms outlined, it’s crucial to approach the situation with professionalism and clear communication. Effectively managing disagreements can help maintain a positive relationship with clients while ensuring that payment is ultimately secured. Below are some steps to follow when faced with a disputed request for payment.

1. Stay Calm and Professional

The first step when a dispute arises is to stay calm and avoid becoming defensive. A professional approach demonstrates that you are willing to resolve the issue amicably. Maintain a neutral tone in all communications and ensure that the conversation remains respectful. This helps in creating a productive environment where both parties can work toward a solution.

2. Review the Details

Before responding to the dispute, thoroughly review all relevant details, including the work completed, the agreed-upon price, and any previous correspondence. Double-check the accuracy of the charges, payment terms, and any possible misunderstandings that may have led to the dispute. If necessary, gather supporting documentation, such as contracts, signed agreements, or emails, to clarify the situation.

3. Communicate Clearly with the Client

Once you have reviewed all the information, reach out to the client to address their concerns. Be transparent about the charges and explain how the amount was calculated. If there was a mistake on your part, admit it and offer to correct the issue promptly. If the charges are correct, kindly explain the reasoning behind them and provide any supporting documents to back up your claim.

4. Negotiate a Resolution

If the client is still dissatisfied, consider negotiating a resolution. Sometimes, offering a small discount or adjusting certain terms can help resolve the situation without damaging the business relationship. Always ensure that any agreements made are documented in writing, so both parties are on the same page.

5. Formalize the Agreement

After reaching a resolution, make sure the updated terms or corrected charges are clearly communicated to the client in writing. This may involve issuing a revised request or a formal letter confirming the changes. Both parties should sign and acknowledge the new terms to prevent further confusion in the future.

6. Legal Action (Last Resort)

If an agreement cannot be reached through negotiation and the client refuses to pay, you may need to consider more formal actions, such as involving a collections agency or seeking legal counsel. However, this should always be a last resort after all attempts to resolve the issue amicably have failed.

By following these steps, you can effectively manage disputed payments, maintain positive relationships with clients, and ensure that your business receives the payments it is owed in a professional manner.

Choosing Between Paid and Free Templates

When looking for tools to streamline administrative tasks, one common choice is to decide between complimentary and premium options. While both types serve similar purposes, there are distinct differences in terms of features, customization, and overall quality. Understanding what each option offers is crucial to making an informed decision that aligns with your business needs.

1. Advantages of Complimentary Options

Complimentary resources are easily accessible and can be a good starting point for individuals or small businesses with limited budgets. They provide basic functionality, making them a practical choice for simple needs. With these options, you can often find pre-designed layouts that are easy to use, reducing the time spent on formatting and structure. However, these solutions may have limitations in terms of customization and may not offer all the features that businesses require as they grow.

2. Benefits of Premium Solutions

Premium options generally offer enhanced features and greater flexibility. They often include advanced customization tools, better customer support, and a higher level of professional design. These products can save time and reduce errors, as they tend to be more polished and refined. Additionally, many premium options come with additional resources, such as templates tailored to specific industries or the ability to integrate with other business tools. Though they come at a cost, these options provide a more scalable solution for businesses looking to elevate their operations.

Ultimately, the decision between free and paid tools comes down to your specific needs, budget, and long-term goals. For simple tasks or occasional use, a complimentary option may suffice. However, for businesses seeking ongoing support, advanced features, and a more personalized experience, investing in a premium option could be the most beneficial choice.