Free Roof Invoice Template for Easy and Professional Billing

When it comes to managing finances for a roofing business, having a streamlined system for issuing payment requests is crucial. Whether you’re a small contractor or a large enterprise, it’s important to maintain professionalism and clarity in all financial documents. Using a well-organized form can save you time, reduce errors, and improve your cash flow.

In the fast-paced world of roofing services, clear and accurate billing is key to maintaining customer trust and ensuring timely payments. A structured document not only helps with tracking your work but also makes it easier for clients to understand the costs involved. A professionally designed document can also reflect the quality and reliability of your services.

In this guide, we will explore various ways to create, customize, and utilize financial documents that support your business operations. From the essential details to include, to tips for formatting, this article will provide you with the tools to enhance your bil

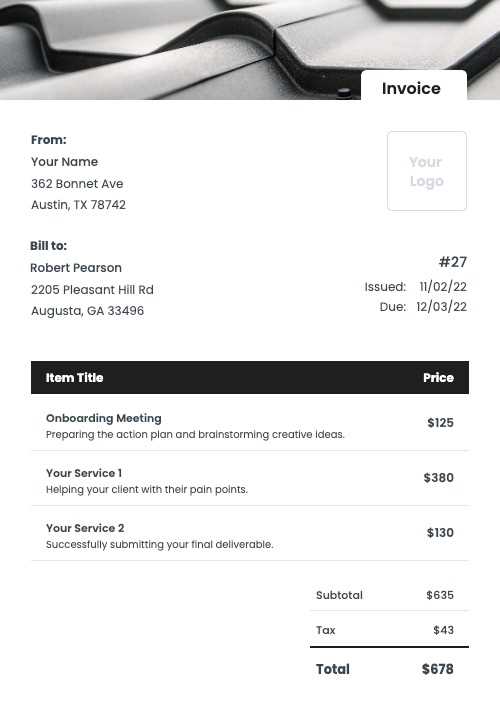

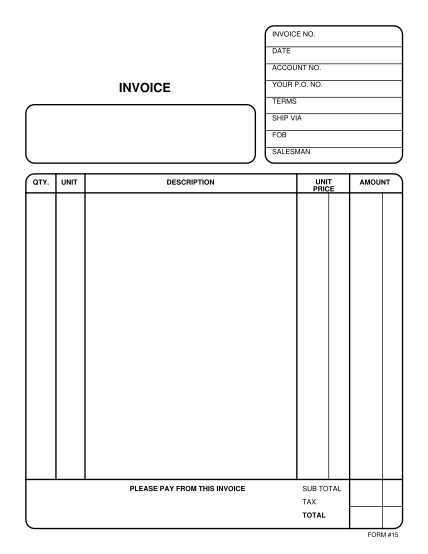

Free Roof Invoice Template for Contractors

For contractors in the construction and repair industry, simplifying the billing process is essential for managing time and improving cash flow. An efficient document that clearly outlines the services provided, costs, and payment terms is a powerful tool for any business. By using a well-organized format, contractors can maintain professionalism while ensuring clarity for their clients.

Why Contractors Need a Well-Designed Billing Document

Creating a professional-looking document for payments is not just about appearance–it’s about functionality. A properly structured file can help contractors avoid confusion and disputes, making it easier for clients to understand exactly what they are being charged for. This type of record-keeping also ensures that payments are processed faster, reducing delays and ensuring smooth business operations.

Key Elements for a Contractor’s Billing Document

A comprehensive document should include all necessary details such as service descriptions, hours worked, materials used, and any applicable taxes or discounts. By including a breakdown of each cost, contractors can provide transparency and build trust with their clients. Additionally, a professional layout can enhance the credibility of your business.

Why You Need an Invoice Template

For any business, having a consistent and organized way to document transactions is essential. A structured form not only helps streamline the billing process but also ensures that all necessary details are included, reducing the chance of confusion or errors. Whether you’re a contractor, service provider, or small business owner, using a standardized approach for billing makes both your workflow and communication with clients much more efficient.

Benefits of Using a Standardized Document

- Consistency: Using a set format ensures that each transaction is documented in the same way, making it easier for you and your clients to reference past work.

- Professionalism: A well-organized form communicates your attention to detail and enhances your business image.

- Time-Saving: With a predefined structure, you can quickly fill in the required details without reinventing the wheel each time.

- Clarity: A clear breakdown of costs helps avoid misunderstandings and builds trust with your clients.

How It Helps with Payment Management

In addition to providing a professional appearance, having a standardized document makes payment tracking easier. By clearly outlining payment terms, amounts due, and due dates, you can ensure that both you and your clients are on the same page, reducing the likelihood of missed payments or confusion over charges.

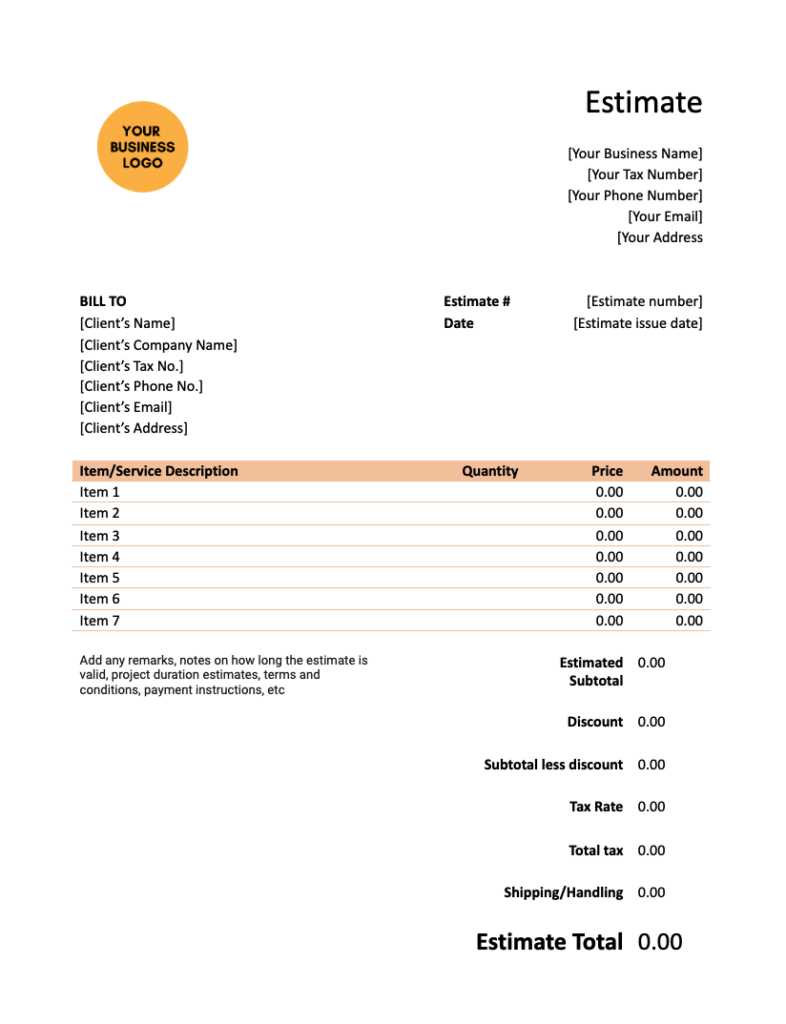

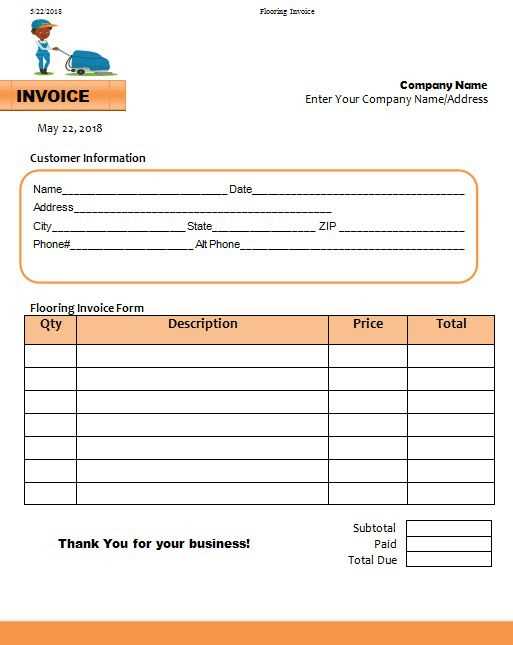

How to Customize Your Invoice

Customizing your billing documents allows you to align them with your business needs and make them more professional. A tailored format can reflect your branding, ensure clarity for your clients, and meet any specific requirements for your industry. Personalizing your records is simple and can be done in a few easy steps.

Here are some key areas to focus on when customizing your billing document:

| Section | Customizing Tips |

|---|---|

| Business Information | Include your company logo, contact details, and business address to make the document uniquely yours. |

| Client Details | Ensure you have the correct client name, address, and contact information for accurate communication. |

| Description of Services | Provide clear descriptions of the work done, including quantity, rate, and unit cost, to avoid confusion. |

| Payment Terms | Include your payment due date, accepted methods, and any late fees or discounts for early payment. |

| Branding Elements | Use your brand’s colors and fonts to make your documents consistent with your business image. |

By focusing on these key sections, you can create a professional and personalized billing document that helps both you and your clients stay organized and informed.

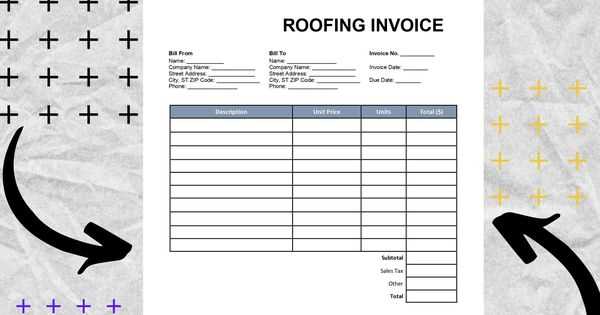

Key Features of a Roofing Invoice

When it comes to documenting payments for roofing services, it’s important to include all the relevant details in a clear and organized manner. A well-structured document ensures that both the contractor and the client understand the charges, services provided, and payment expectations. Several key elements are essential for creating a professional and accurate document that avoids confusion and facilitates timely payments.

The following features are crucial for any effective billing record in the roofing industry:

- Contact Information: Include the contractor’s and client’s names, addresses, phone numbers, and email addresses for easy communication.

- Job Description: Provide a detailed description of the work performed, including the type of services provided, materials used, and labor involved.

- Itemized Costs: Break down the total charge into individual components, such as labor, materials, and any additional fees, to give transparency to the client.

- Payment Terms: Clearly outline the payment due date, accepted methods of payment, and any applicable discounts or late fees.

- Invoice Number: Assign a unique reference number to each document for tracking and record-keeping purposes.

- Tax Information: Include any taxes applied to the charges and ensure they are calculated correctly to avoid future disputes.

- Company Branding: Add your company logo, colors, and branding to make the document professional and consistent with your business identity.

Incorporating these features into your payment documentation will help ensure accuracy, professionalism, and a smoother transaction process with your clients.

Benefits of Using a Template

Using a predefined format for documenting services and payments can significantly streamline the billing process. Rather than starting from scratch every time, a well-structured document helps ensure that all necessary information is included, saving time and reducing the chance of errors. By utilizing a consistent structure, businesses can improve efficiency, maintain professionalism, and avoid misunderstandings with clients.

The key advantages of utilizing such a system include:

- Time Efficiency: With a predefined structure, you no longer need to worry about formatting each document. This allows you to focus on the actual details of the service provided, speeding up the process.

- Consistency: Using a set format guarantees that every document follows the same structure, making it easier for clients to understand and process, and ensuring that no critical details are overlooked.

- Professionalism: A polished and organized document reflects positively on your business. It shows clients that you are detail-oriented and serious about your work, which can strengthen your brand’s image.

- Accuracy: By using a standardized approach, you minimize the risk of errors such as missing information or incorrect calculations. This helps prevent disputes or confusion with clients.

- Improved Record Keeping: Consistent formats make it easier to track past transactions, review client histories, and maintain accurate financial records for tax purposes or future reference.

Overall, adopting a consistent method for documenting transactions can save time, reduce errors, and enhance the professionalism of your business, ultimately leading to smoother operations and happier clients.

Common Mistakes in Roofing Invoices

When it comes to documenting services and requesting payments, contractors often make mistakes that can lead to confusion, delayed payments, or even disputes. It’s essential to be aware of common errors that may arise in the billing process. Understanding these pitfalls can help ensure your records are accurate, clear, and professional, which ultimately benefits both you and your clients.

Key Errors to Avoid

- Incomplete Client Information: Failing to include the correct name, address, and contact details of your client can result in miscommunication or delays in payment. Always double-check that the information is accurate.

- Vague Descriptions: Not clearly outlining the work performed or the materials used can lead to confusion and questions from clients. Make sure to be specific about each service provided, including quantities and pricing.

- Missing Payment Terms: Not stating payment due dates, methods, or late fees can create confusion regarding when and how payments should be made. Ensure that these details are prominently included in your document.

- Incorrect Calculations: Simple math errors can cause significant problems. Always double-check the totals for accuracy, including labor, materials, and taxes, to prevent disputes.

- Lack of Professional Appearance: Using unorganized or informal formats can make your business seem less professional. A polished document with your branding gives a more reliable impression to clients.

How to Avoid These Mistakes

The best way to avoid these common errors is to use a consistent approach for each billing document. Review all the details carefully before sending out a request for payment, and consider creating a checklist of the necessary components. With practice, you’ll minimize the risk of mistakes and enhance the accuracy of your billing process.

Essential Information for Roofing Invoices

To ensure clarity and avoid confusion when requesting payment, it’s crucial to include all the necessary details in your billing documents. A well-crafted record should cover everything from the scope of work to payment terms. By providing clients with a comprehensive breakdown, you can establish trust and make the payment process smoother.

Here are the key elements that must be included in every document:

- Business Information: Include your company’s name, contact details, and business address. This ensures clients know exactly who the billing is from and how to reach you for any questions.

- Client Information: Always add the client’s full name, address, and contact details for accurate record-keeping and easy communication.

- Detailed Service Description: Clearly explain the work completed, such as the type of services, materials used, and labor hours. This helps clients understand exactly what they are paying for.

- Itemized Charges: Break down the cost of each service, including labor, materials, and any other fees. This transparency helps avoid disputes and clarifies the charges for the client.

- Payment Terms: Specify when the payment is due, accepted payment methods, and any penalties for late payments. This ensures that there’s no confusion about how and when to pay.

- Unique Reference Number: Assign a unique reference number to each document for easy tracking and organization of your records.

- Tax Information: If applicable, include tax calculations and explain how they are applied to the total charge. Accurate tax details are vital for both your business and your client’s records.

- Additional Notes: Any other relevant information, such as warranty terms or future maintenance services, should be noted clearly to avoid any misunderstanding.

Including all of these elements ensures that your payment requests are clear, professional, and complete. This will help foster trust with your clients and expedite the payment process.

How to Create Professional Invoices

Creating a professional document for payment requests is essential for maintaining a positive image and ensuring smooth transactions with clients. A well-organized and clear bill not only reflects your attention to detail but also makes it easier for clients to understand the charges, reducing the chances of disputes or delays. By following a few simple steps, you can produce a professional and effective payment record every time.

Here’s how to create a professional payment document:

- Use a Consistent Format: Consistency is key when creating billing documents. Whether you’re using software or a manual format, make sure each document follows the same structure to avoid confusion.

- Clearly Label Your Sections: Divide the document into clear sections, such as service description, itemized costs, and payment terms. This makes it easy for your clients to find the information they need at a glance.

- Include Your Branding: Add your company’s logo, colors, and fonts to maintain a professional look. This not only helps with recognition but also strengthens your business identity.

- Ensure Accurate Calculations: Double-check your math to avoid any errors in pricing, taxes, or total amounts. Mistakes in calculations can lead to disputes and undermine your professionalism.

- Provide Payment Details: Clearly state the payment due date, accepted payment methods, and any late fees or discounts for early payments. This helps set expectations and encourages timely payments.

- Keep It Simple: Avoid cluttering the document with unnecessary information. Focus on the most important details and keep the language simple and to the point.

By following these steps, you can create professional payment requests that reflect your business’s values, maintain transparency with clients, and ensure faster, smoother payments.

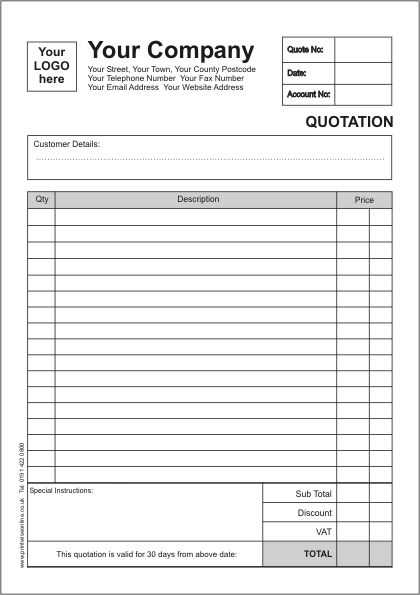

Choosing the Right Format for Your Template

Selecting the appropriate format for your billing documents is essential for both functionality and ease of use. A well-chosen format can make it easier to manage your financial records, communicate clearly with clients, and ensure that all necessary details are included. Whether you prefer a digital or physical format, understanding your needs and business workflow will help you make the right choice.

Here are the key factors to consider when choosing the right format:

| Format Option | Advantages | Best For |

|---|---|---|

| Digital Formats (e.g., Word, Excel, PDF) |

|

Contractors or businesses that need quick updates and electronic communication with clients |

| Cloud-Based Solutions (e.g., QuickBooks, FreshBooks) |

|

Businesses that want to streamline their accounting and client interactions |

| Paper-Based Formats |

|

Small businesses or contractors working with clients who don’t use digital systems |

Choosing the right format depends on your business model, client preferences, and the level of automation you need. By considering these factors, you can select the most efficient way to create and manage your billing documents.

Understanding Numbering Systems for Billing Documents

A well-organized numbering system for your payment requests is essential for managing and tracking your financial records effectively. A unique and sequential numbering method helps both you and your clients easily reference past transactions, reduces the risk of duplication, and ensures that every document is properly categorized. Whether you run a small business or a larger operation, setting up a clear and logical system for numbering your records is crucial for maintaining order and efficiency.

Here are a few common approaches to numbering your billing records:

- Sequential Numbering: The most basic and widely used method, sequential numbering assigns a unique, consecutive number to each document. This system makes it easy to track the order of transactions and maintain a clear record history.

- Date-Based Numbering: This system incorporates the date into the document number, typically in the format of YYYYMMDD-XXX. This helps you quickly identify when the document was created and organize your records chronologically.

- Client-Based Numbering: For businesses working with multiple clients, you can use a numbering system that includes the client’s identifier or name. This helps you quickly associate billing records with specific clients and maintain clear tracking for each one.

- Project-Based Numbering: If you manage multiple projects or types of work, incorporating project numbers into the billing reference can be an effective way to track documents related to specific jobs or contracts.

By adopting a consistent numbering system, you can simplify your administrative work, reduce errors, and create a more organized approach to managing payment requests and client records.

How to Avoid Payment Delays

Late payments can disrupt your cash flow and create unnecessary stress for your business. To minimize delays, it’s crucial to establish clear communication with your clients, set expectations upfront, and create a structured process for requesting payment. Taking proactive steps can help you avoid payment issues and ensure a steady flow of income.

Here are some effective strategies to prevent delays in payments:

- Set Clear Payment Terms: Define payment deadlines and methods early in the contract or agreement. Clearly stating your expectations helps eliminate confusion later and encourages clients to pay on time.

- Send Accurate and Detailed Documents: Ensure that all charges are itemized, with no missing information or unclear descriptions. Clients are more likely to pay promptly if the document is easy to understand and free of errors.

- Offer Multiple Payment Options: Provide clients with different ways to pay, such as credit cards, bank transfers, or online payment platforms. The easier you make it for them to pay, the quicker you’ll receive your funds.

- Send Reminders: If the payment due date is approaching or has passed, send friendly reminders to your clients. Regular follow-ups show that you’re keeping track of payments and help keep the process on their radar.

- Establish Late Fees: Including a penalty for late payments can encourage clients to settle their bills on time. Be sure to clearly outline late fees and their terms in your initial agreement.

- Build Strong Relationships: Maintaining positive relationships with clients can help foster trust and encourage timely payments. Clear communication and a professional attitude often lead to better payment habits.

By implementing these strategies, you can reduce the likelihood of delayed payments, improve your cash flow, and maintain smooth financial operations for your business.

Tips for Accurate Billing in Roofing

Accurate billing is crucial for maintaining transparency and trust with clients. Whether you’re handling small repairs or large-scale projects, making sure your payment requests reflect the true scope of work is essential for avoiding disputes and ensuring prompt payment. By following a few key practices, you can minimize errors, improve your financial tracking, and enhance your professional image.

Here are some helpful tips for accurate billing in the construction industry:

- Track Time and Materials Carefully: Always log the time spent on each job and the materials used. This will prevent errors in billing and ensure that all costs are accounted for. Consider using software or apps to track this data in real-time.

- Be Detailed in Your Descriptions: Provide specific details about the work completed, including the type of materials, labor involved, and any special tasks. This transparency helps clients understand exactly what they are paying for and reduces the likelihood of misunderstandings.

- Break Down Costs: Itemize all costs separately, such as labor, materials, and additional fees. A breakdown gives your client a clearer picture of the charges and helps avoid confusion over the total amount due.

- Double-Check Calculations: Always verify your calculations, including the cost of materials, labor hours, and any taxes or fees. Even small mistakes can lead to significant discrepancies, so take the time to ensure everything is correct.

- Set Clear Payment Terms: Define your payment expectations from the outset. Be clear about due dates, accepted payment methods, and any late fees. When terms are set upfront, clients are more likely to pay on time.

- Maintain Consistent Formatting: Use a consistent format for all your payment documents. This makes it easier to manage your records and ensures that clients can easily navigate and understand the details of each billing request.

- Stay Organized with Records: Keep all documentation, receipts, and records organized. This makes it easier to reference past transactions, follow up on payments, and address any disputes that may arise.

By implementing these strategies, you can improve the accuracy of your billing process, enhance client satisfaction, and ensure that your business maintains a professional image in every transaction.

Incorporating Taxes and Discounts

When preparing payment requests, it’s essential to consider how taxes and discounts affect the final amount due. Properly calculating and including these elements not only ensures accuracy but also helps build trust with clients by providing transparent and fair pricing. Whether your business is subject to sales tax or you offer discounts for early payment or bulk orders, understanding how to incorporate these adjustments is crucial for smooth transactions.

Calculating Taxes

Taxes are often a necessary part of the billing process, depending on your location and the type of services provided. Be sure to include the applicable tax rate and clearly specify the amount in your documentation. The following steps can help ensure accuracy:

- Know the Tax Rate: Research and apply the correct sales tax rate based on your location and the nature of your business. Tax rates can vary by state, region, or country, so it’s essential to stay informed about the correct rate.

- Apply Taxes to the Right Items: In some cases, certain services or materials may be exempt from tax. Ensure that you apply taxes only to the items that are taxable, and double-check if any tax exemptions apply to your services or products.

- Show Taxes Clearly: Clearly separate taxes from the base price of services or goods on your document. This helps clients understand exactly how much they are being charged for tax and prevents confusion.

Incorporating Discounts

Offering discounts is a great way to encourage timely payment or reward loyal customers. However, it’s important to structure and document discounts carefully to avoid errors. Here are some best practices:

- Specify Discount Terms: Always state the conditions for any discounts offered. For example, if a discount is offered for early payment, clearly mention the due date and the percentage discount the client will receive.

- Apply Discounts Before Tax: Generally, discounts are applied to the total amount before taxes are calculated. This ensures the discount is based on the service or product price rather than the taxed amount.

- Provide Clear Discount Information: Highlight the discount applied and clearly show the amount deducted from the total cost. This transparency will ensure clients understand the benefits they are receiving.

By accurately calculating taxes and incorporating discounts into your payment requests, you can provide clear, fair, and transparent billing that encourages timely payments and fosters positive client relationships.

Best Free Billing Document Formats Online

Finding high-quality, customizable formats for your payment requests can save time and help ensure professional and accurate transactions with clients. Many online platforms offer easy-to-use, ready-made solutions that cater to various business needs. Whether you’re looking for something simple or a more detailed design, these resources can assist in creating organized and clear financial records without the need for complicated software.

Here are some of the best options for customizable billing formats available online:

- Microsoft Office Templates: Microsoft offers a variety of customizable documents through Word and Excel. These formats are great for businesses looking for simple, professional designs with the ability to tailor the structure to their needs.

- Google Docs and Sheets: Google provides free, easy-to-edit templates for creating billing records. These can be accessed and shared online, allowing seamless collaboration for businesses working remotely or with clients across locations.

- Wave: Wave is an online platform that offers invoicing tools designed for small businesses. It provides a straightforward and user-friendly approach, including the option to create detailed billing documents, track payments, and manage client data all in one place.

- Zoho: Zoho offers both free and paid solutions, with customizable billing document formats. It is ideal for freelancers and small businesses looking to streamline their financial operations. The platform also integrates with other Zoho applications for full business management.

- Canva: For those seeking more creative and visually appealing designs, Canva offers free templates with an intuitive drag-and-drop interface. These templates are fully customizable, allowing you to incorporate branding and design elements into your documents.

- FreshBooks: FreshBooks offers both free trials and paid versions for businesses of all sizes. Its user-friendly design helps create detailed, professional billing documents and offers additional features such as tracking and financial reporting.

By exploring these options, you can find the right solution to create professional and accurate payment requests that fit your business’s needs. Whether you require simplicity or more advanced features, these online platforms provide everything necessary to ensure smooth financial transactions.

How to Save Time with Pre-Made Formats

Utilizing pre-made formats for your billing and financial documents can significantly reduce the time spent on administrative tasks. Instead of starting from scratch with each new client or project, these ready-to-use solutions allow you to quickly input necessary details, ensuring consistency and accuracy in your records. With customizable options, you can adapt these documents to your specific business needs while still maintaining a professional appearance.

Here are some ways you can save time using pre-designed solutions:

- Eliminate the Need for Repetitive Data Entry: Pre-made formats often come with placeholders for client details, service descriptions, and pricing. This allows you to simply fill in the necessary information rather than writing everything from the ground up each time.

- Streamline Workflow: By using a standardized format, you ensure that each document follows the same structure. This consistency not only speeds up the process but also reduces the chance of errors or missed details, allowing for faster approvals and payments.

- Quick Customization: With many formats, you can quickly adjust sections to suit the unique needs of different clients or projects. Whether you need to add extra services, adjust pricing, or apply discounts, you can do it all in minutes without starting from scratch.

- Improve Professionalism: Pre-made formats are often designed with a polished and professional look, saving you time on design and formatting. This helps you maintain a consistent image across all your documents, which is key for client trust and satisfaction.

- Automate Calculations: Many digital formats, like those in Excel or Google Sheets, offer built-in formulas that automatically calculate totals, taxes, and discounts. This removes the need for manual math, reducing the risk of errors and saving you valuable time.

- Maintain Organized Records: When using standardized formats, it’s easier to track and organize documents. You can store them in a consistent way, making it quicker to find and reference any past transactions or communications.

By adopting pre-made solutions, you can cut down on time spent creating documents, streamline your billing process, and increase efficiency in your day-to-day operations. With the added benefit of professionalism and organization, these tools can help you focus on growing your business instead of getting bogged down in administrative tasks.

How to Use Templates in Accounting Software

Using pre-configured documents within accounting software can greatly enhance efficiency in managing finances. These digital formats streamline the creation of financial records by automating repetitive tasks, minimizing errors, and saving time. Whether you’re tracking payments, issuing receipts, or handling tax calculations, these pre-set options make it easier to maintain organized and professional records. Here’s how to make the most of them within accounting systems.

Setting Up and Customizing Your Documents

Most accounting platforms offer customizable templates that allow you to tailor your documents to suit your specific business needs. Here’s how to get started:

- Select the Right Format: Choose the type of document you need, such as a payment request, receipt, or financial summary. Accounting software typically offers a variety of options, so pick one that best matches your requirements.

- Customize Fields: Adjust the document fields to include your business name, address, tax information, and any other relevant details. This ensures that each document reflects your brand and complies with local regulations.

- Save Pre-Set Options: Once you’ve set up the document layout and fields, save your settings as a default. This allows you to reuse the format for future transactions, ensuring consistency across all documents.

Automating Calculations and Adding Custom Details

One of the major advantages of using templates within accounting software is automation. Many platforms include built-in formulas for tax, totals, and discounts, which can save time and reduce the risk of errors. Follow these steps for effective automation:

- Apply Built-In Calculations: Use automatic fields for calculations like tax rates, discounts, and final totals. This ensures accurate amounts and reduces manual input.

- Add Client-Specific Details: Many accounting systems allow you to save client information, including addresses, payment terms, and preferences. This feature enables quick auto-fill, speeding up the process when creating new documents.

- Include Payment Terms and Due Dates: Pre-set terms such as payment deadlines and late fees can be added to your templates, which makes it easier to enforce your payment policies without having to manually adjust each document.

By using templates within your accounting software, you can create professional documents in minutes while ensuring consistency, accuracy, and efficiency in your financial operations. Automation features help prevent common errors, leaving you with more time to focus on other areas of your business.

What to Do After Sending an Invoice

Once you’ve submitted a payment request, the process doesn’t end there. It’s important to stay proactive in following up and managing communication to ensure timely payments and to maintain a professional relationship with your clients. While waiting for payment, there are several steps you can take to ensure everything is handled smoothly.

Track and Monitor Payment Status

After sending your document, it’s essential to keep an eye on its status to avoid missed payments or delays. Tracking tools can help you monitor when the payment is made or if there are any issues. Here’s how to stay on top of things:

- Set Reminders: Use a reminder system or accounting software to set a follow-up date if the payment is not received by the due date. This will prompt you to reach out and check on the status of the payment.

- Track Payment History: Keep a record of all past transactions. Knowing whether a client tends to pay on time or if there have been previous delays can help you manage future payments more effectively.

- Monitor Payment Methods: Ensure you’re aware of the method your client intends to use. Some methods take longer to process than others. Knowing this can help you manage expectations and prevent confusion.

Follow Up and Communicate

If the payment is not received on time, follow up with a polite reminder. Communication is key to maintaining a good working relationship. Here’s what to do:

- Send a Friendly Reminder: Send a gentle reminder a few days after the payment due date. Ensure your message is polite and professional, acknowledging that sometimes payments can be delayed.

- Clarify Payment Details: If there was an issue with the payment, clarify any discrepancies promptly. Check if there was any misunderstanding regarding the amount or payment terms and address the matter professionally.

- Offer Flexible Solutions: If a client is experiencing financial difficulties, consider negotiating a new payment plan. This flexibility can help maintain a positive relationship and ensure you’re paid in full over time.

Staying organized, tracking payments, and communicating clearly after sending a request will help ensure that your business runs smoothly. Proactive follow-ups can prevent delays and avoid any misunderstandings, allowing you to focus on the next project without worrying about outstanding payments.

How to Stay Organized with Billing Documents

Staying organized with your financial records is crucial for both efficiency and accuracy. Properly managing payment requests ensures that you can track payments, avoid mistakes, and maintain a professional relationship with your clients. Keeping everything well-organized also makes it easier to handle future audits, taxes, or client inquiries. Here are several strategies to help you stay on top of your documents and financial transactions.

Use a Digital System for Storing Documents

One of the most effective ways to stay organized is to use a digital document management system. This method not only saves physical space but also allows for quick access to any document when needed. Here are some tips for managing your records digitally:

- Cloud Storage: Utilize cloud-based storage services like Google Drive or Dropbox to securely store your financial documents. These platforms also allow for easy sharing with clients or collaborators and provide access from any device.

- Organized Folders: Create a clear folder structure for storing your documents. Use categories like “Completed Projects,” “Pending Payments,” and “Client Records” to organize files by status or project type.

- File Naming Conventions: Establish a consistent file naming system for easy searching. Include the client name, date, and project details in the file name to quickly locate the document later.

Implement an Automated Tracking System

Automation tools can make a big difference in managing multiple financial records. Many software solutions allow you to track payments, send reminders, and generate reports without needing to manually update each document. Here’s how automation can help:

- Automatic Reminders: Set up automated payment reminders that will send clients gentle nudges when payments are due. This reduces the need for manual follow-up and ensures clients are always informed.

- Real-Time Tracking: Use accounting software with built-in tracking features to keep tabs on payment statuses. This allows you to see which payments have been made and which are still pending at a glance.

- Recurring Billing: For clients with ongoing services, automate recurring billing to save time. This eliminates the need for you to create new requests each month while ensuring that payments are consistent.

By implementing a digital storage system and taking advantage of automation tools, you can significantly reduce the time spent on managing financial records. Staying organized not only helps you stay efficient but also creates a professional image for your business, making it easier to focus on growth and client relationships.