Free Restaurant Invoice Template for Effortless Billing

Managing financial transactions is a crucial aspect of any successful enterprise, ensuring that services rendered are accurately documented and payments are collected without hassle. Having a structured approach to billing can streamline operations and enhance customer satisfaction. An effective billing system is not just about requesting payments; it involves creating a professional image that reflects your business values.

Utilizing an organized method for documenting charges provides clarity and transparency, which can significantly improve the overall experience for both service providers and clients. By adopting a standardized approach to billing documents, businesses can reduce errors and avoid misunderstandings regarding payments. This is essential for maintaining positive relationships with customers, as clear communication regarding costs fosters trust and reliability.

In this section, we will explore various options available for crafting these essential documents. You’ll discover practical solutions that facilitate easy customization and provide guidance on best practices for effective billing management. Whether you’re a small business or a larger enterprise, these resources will equip you with the tools needed to optimize your financial transactions.

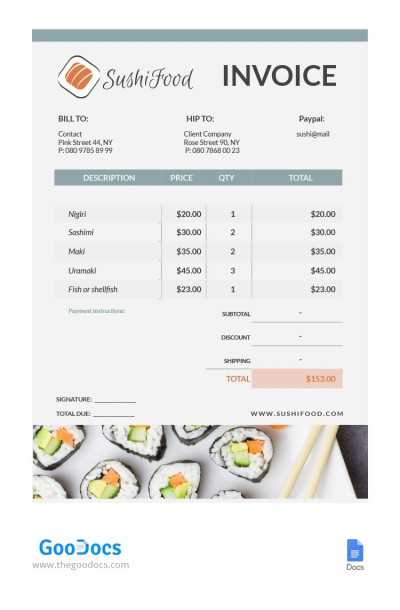

Billing Document Sample

Having an efficient billing document is essential for any business that provides services or products. A well-structured form not only simplifies the process of collecting payments but also enhances professionalism and organization. Utilizing a customizable layout allows businesses to adapt the document to their specific needs, ensuring clarity and effectiveness in communication with clients.

Key Components of a Billing Document

When creating a billing document, it’s important to include several key elements to ensure it serves its purpose effectively. Below are the fundamental components that should be incorporated:

| Component | Description |

|---|---|

| Business Information | Name, address, and contact details of the service provider. |

| Client Information | Name and contact details of the client receiving the bill. |

| Date | The date when the service was provided or the document was issued. |

| Service Description | Detailed description of the services or products rendered. |

| Pricing | Individual prices for each service or item, along with totals. |

| Payment Terms | Information regarding payment methods and due dates. |

Customization Options

To cater to unique business requirements, many customizable formats are available. Users can modify colors, fonts, and layouts to match their branding while ensuring that all essential information is prominently displayed. This flexibility enhances not only the aesthetic appeal but also the practicality of the document, making it easier for clients to understand their charges and payment obligations.

Benefits of Using an Invoice Template

Implementing a structured document for billing purposes offers numerous advantages that enhance operational efficiency and improve client interactions. By utilizing a standardized form, businesses can streamline their processes, reducing the time spent on administrative tasks while ensuring accuracy in their financial communications. This approach fosters professionalism and instills confidence in clients regarding their transactions.

One significant advantage is the reduction of errors. A pre-designed format minimizes the likelihood of missing critical information or miscalculating totals. This reliability not only simplifies record-keeping but also facilitates timely payments. Additionally, utilizing such a format allows for easy tracking of transactions, helping businesses maintain accurate financial records.

Customization is another key benefit. A well-structured document can be tailored to reflect the unique branding of a business, including logos, color schemes, and specific service details. This personalization enhances the overall client experience and reinforces brand identity.

Furthermore, using a pre-made design can save time, as businesses can quickly fill in the necessary details without starting from scratch each time. This efficiency allows owners and staff to focus on core operations rather than getting bogged down in paperwork. Overall, a well-crafted billing document can significantly improve the financial management aspect of any business.

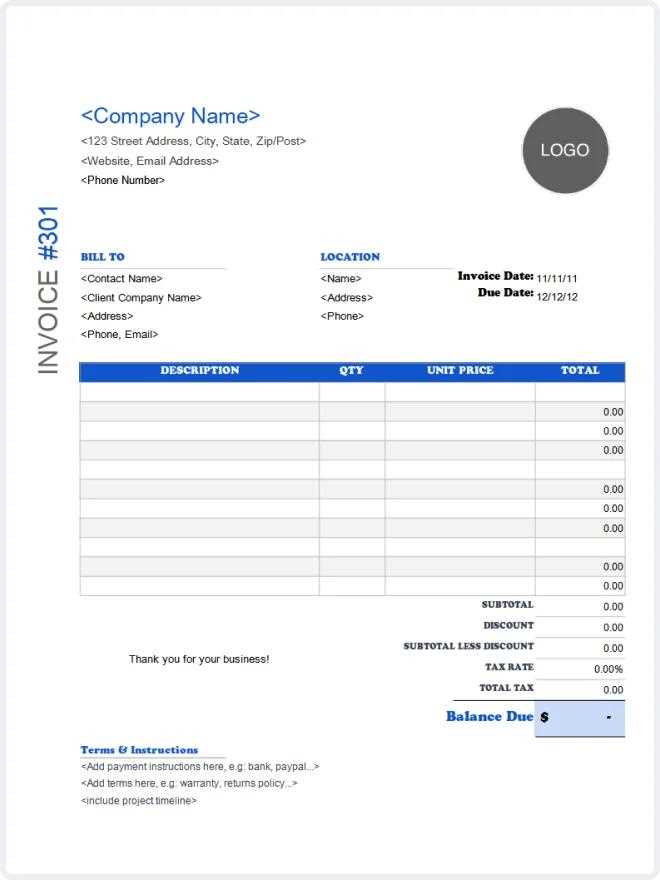

How to Customize Your Invoice

Personalizing your billing document is essential for reflecting your brand identity and ensuring clarity in communication with clients. A well-customized layout can significantly enhance the professional appearance of your financial documents while making it easier for customers to understand their charges. Here are some key steps to effectively tailor your billing forms to meet your specific needs.

Selecting the Right Format

Choosing an appropriate format is the first step in customization. Various styles are available, ranging from minimalist designs to more elaborate layouts. Consider what best suits your brand image and the preferences of your clients. For instance, a modern, clean design may resonate well with a tech-savvy audience, while a classic format might appeal to more traditional businesses. Ensure that the format you select allows for easy modification of content.

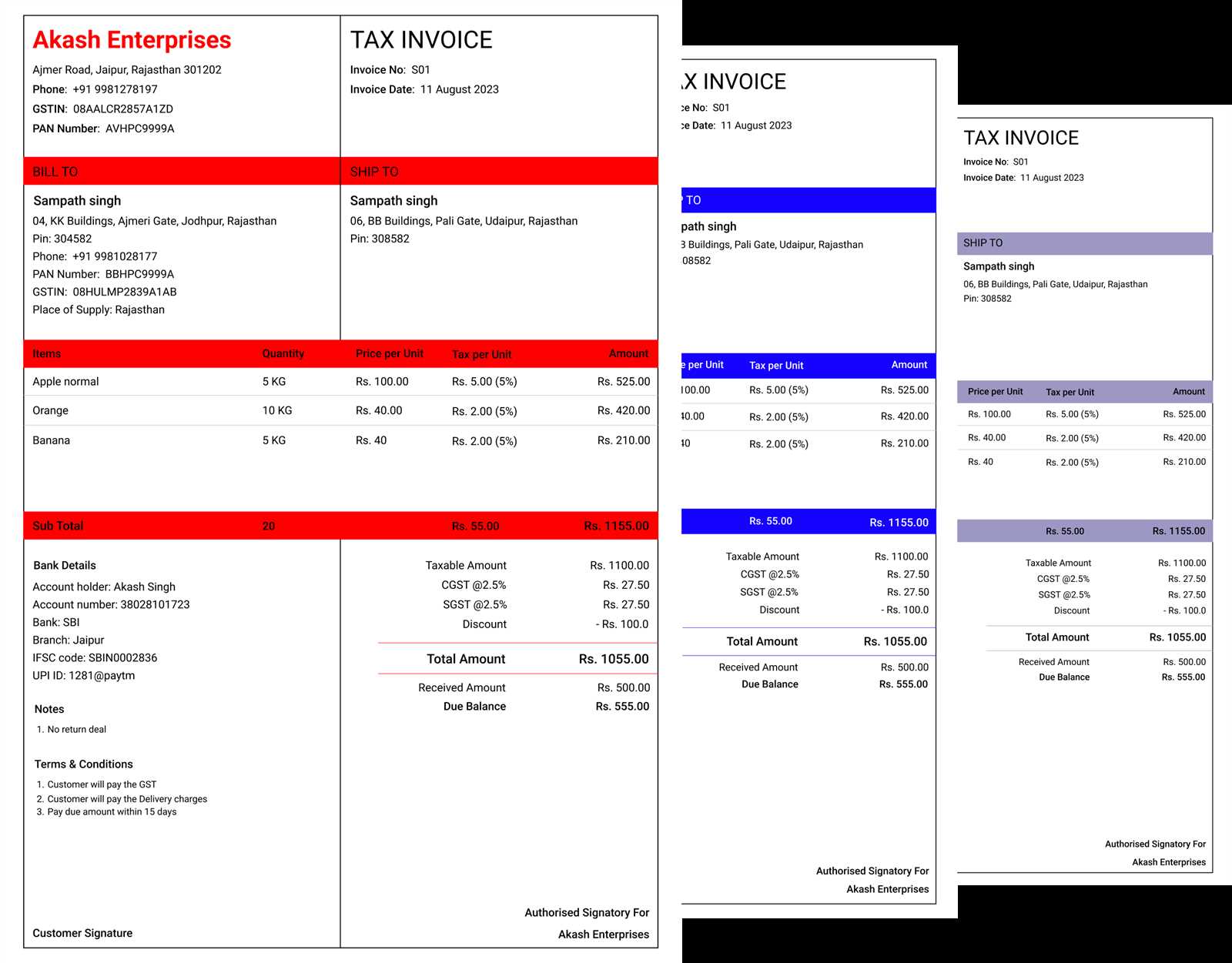

Incorporating Branding Elements

Integrating your brand’s identity into the document is crucial. This includes adding your logo, using your brand colors, and selecting fonts that align with your overall aesthetic. Additionally, including contact information prominently at the top helps clients quickly identify the source of the document. By making these adjustments, you enhance recognition and reinforce your professional image in every transaction.

Essential Features of Billing Documents

Creating an effective billing document requires incorporating several key elements that ensure clarity and efficiency in transactions. These fundamental characteristics not only facilitate the payment process but also enhance the overall experience for clients. By understanding and integrating these essential features, businesses can maintain professionalism and accuracy in their financial communications.

Itemized Charges are crucial for transparency. Clearly detailing each service or product along with its corresponding cost allows clients to see exactly what they are paying for. This practice minimizes confusion and fosters trust between the service provider and the customer.

Payment Terms should also be explicitly stated. Including information about accepted payment methods, due dates, and any late fees ensures that clients are aware of their obligations. Clear communication regarding these aspects can prevent misunderstandings and delays in payment.

Furthermore, a well-designed document should include business branding, such as logos and color schemes, to reinforce brand identity. This not only enhances the visual appeal but also creates a sense of legitimacy and professionalism. Additionally, incorporating contact information makes it easy for clients to reach out with any questions or concerns regarding their charges.

Lastly, it’s essential to have a unique identification number for each document. This allows for easy tracking and referencing, aiding both the business and the client in managing their financial records effectively.

Common Mistakes in Document Creation

Creating an effective billing document is crucial for ensuring smooth financial transactions, yet several common pitfalls can undermine this process. Recognizing these mistakes can help businesses avoid unnecessary complications and foster better relationships with their clients. Here are some frequent errors that should be addressed during the creation of these important documents.

Neglecting to Itemize Services

One of the most significant errors is failing to provide a detailed breakdown of services or products rendered. Without clear itemization, clients may be confused about what they are being charged for, leading to disputes or delayed payments. An itemized list not only promotes transparency but also reinforces trust, allowing clients to understand the value they are receiving.

Inaccurate or Missing Information

Another common mistake is providing incorrect or incomplete details, such as the service provider’s name, contact information, or payment terms. This can create misunderstandings and may result in clients not knowing how to address questions or concerns regarding their charges. Ensuring that all information is accurate and comprehensive is essential for maintaining professionalism and facilitating timely payments.

Additionally, not including a unique identifier for each document can complicate tracking and referencing, making it harder for both the business and clients to manage records effectively. By addressing these common errors, businesses can enhance their billing processes and improve overall client satisfaction.

Importance of Clear Payment Terms

Establishing well-defined payment conditions is essential for maintaining healthy business relationships and ensuring timely compensation for services provided. Clear guidelines regarding financial obligations help set expectations for both parties involved, reducing the likelihood of misunderstandings or disputes. By communicating these terms effectively, businesses can foster trust and reliability.

Benefits of Clear Financial Guidelines

- Enhanced Clarity: Clearly outlining payment terms provides clients with a thorough understanding of what is expected, including due dates and accepted payment methods.

- Timely Payments: When clients are aware of the payment schedule and any penalties for late payments, they are more likely to fulfill their obligations on time.

- Reduced Disputes: Explicit financial conditions minimize the chances of conflicts arising from misunderstandings, as both parties have a clear reference point.

- Improved Cash Flow: By encouraging timely payments through clear guidelines, businesses can maintain a healthier cash flow, which is vital for operations and growth.

Key Elements to Include

- Due Dates: Specify when payments are expected to ensure clients are aware of their timelines.

- Accepted Payment Methods: List all the payment options available, such as credit cards, bank transfers, or online payment platforms.

- Late Fees: Clearly state any penalties for overdue payments to encourage promptness.

- Discounts for Early Payment: Consider offering incentives for clients who pay ahead of schedule, promoting faster transactions.

By prioritizing clear payment terms, businesses can enhance their financial processes and establish stronger relationships with clients, ultimately leading to greater success and stability.

Choosing the Right Format for Invoices

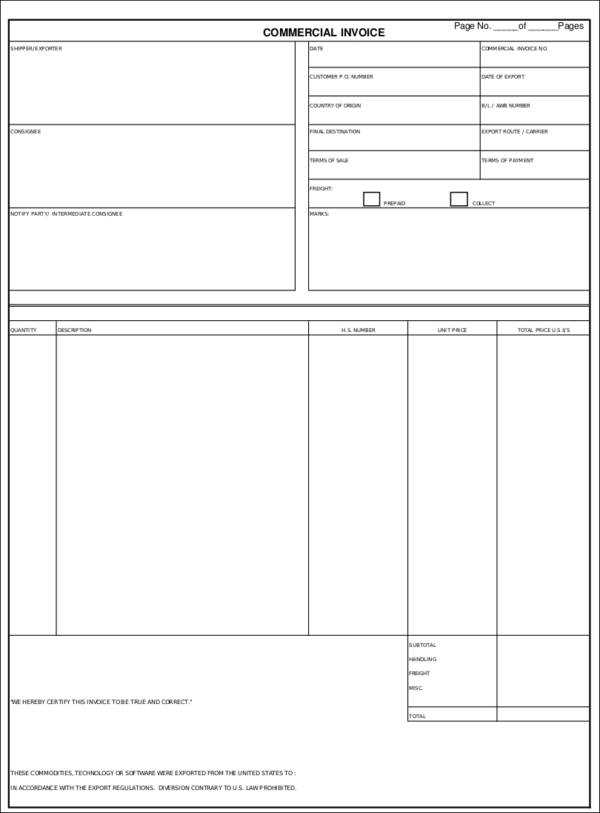

Selecting the appropriate structure for billing documents is crucial for ensuring clarity and professionalism in financial communications. The right format can enhance readability, streamline the payment process, and reflect the brand’s identity. Understanding the various options available can help businesses make informed decisions that best suit their operational needs.

Types of Formats to Consider

- Digital Formats: Electronic documents, such as PDFs or Word files, allow for easy sharing via email and can be stored for record-keeping.

- Printed Formats: Hard copies can be useful for clients who prefer physical documents or for businesses that conduct transactions in person.

- Online Billing Platforms: Using software solutions designed for creating and managing billing documents can simplify the process and offer additional features, such as tracking and reminders.

Factors to Consider When Choosing a Format

- Client Preferences: Understanding the preferred method of communication for clients can guide the choice of format, ensuring convenience for both parties.

- Business Model: Different industries may have specific requirements; for instance, some sectors may benefit from more detailed breakdowns of services.

- Branding Opportunities: A well-designed document can serve as a marketing tool. Consider how the format can reflect the brand’s image through logos, colors, and overall layout.

- Ease of Use: The selected format should be user-friendly for both the business and the clients to minimize complications in filling out and processing payments.

By thoughtfully considering these aspects, businesses can select a billing format that enhances communication, promotes professionalism, and facilitates smoother financial transactions.

Integrating Invoices with Accounting Software

Linking billing documents with financial management systems is a vital practice that enhances efficiency and accuracy in managing monetary transactions. This integration streamlines data entry, reduces errors, and allows for real-time financial tracking, ultimately supporting better decision-making for businesses. By automating the flow of information, organizations can save time and ensure consistency in their financial records.

When considering the integration of billing documents with accounting platforms, it’s essential to evaluate several key factors to ensure a seamless connection:

| Factor | Description |

|---|---|

| Compatibility | Ensure that the chosen billing format works smoothly with the existing accounting software to avoid compatibility issues. |

| Automation Features | Look for systems that offer automation to minimize manual entry, reducing the risk of human error and saving time. |

| Data Security | Prioritize software solutions that have robust security measures to protect sensitive financial information. |

| User-Friendly Interface | Select platforms that are easy to navigate, ensuring that all team members can utilize the system effectively. |

| Reporting Capabilities | Consider software that provides comprehensive reporting tools to analyze financial performance and trends. |

By thoughtfully integrating billing documents with financial systems, businesses can create a streamlined approach to managing their finances, leading to improved operational efficiency and enhanced financial insights.

Tips for Professional Invoice Design

Creating a well-organized billing document reflects positively on a business’s brand and aids in efficient transaction management. A polished design can enhance clarity, ensure essential details stand out, and convey a sense of professionalism. Here are some helpful strategies to develop an effective layout for billing records.

| Tip | Description | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Use a Clean Layout | Avoid clutter by organizing sections logically, making it easy for recipients to find the necessary details quickly. | ||||||||

| Highlight Key Information | Use bold fonts or color accents for important elements, such as the total amount or due date, ensuring they stand out. | ||||||||

| Incorporate Brand Elements | Include your logo, colors, and fonts that represent your brand, reinforcing your company’s id

How to Track Payments EffectivelyEnsuring consistent and timely payment tracking is essential for managing finances and maintaining smooth cash flow. Adopting organized methods can make it easy to monitor transaction status, identify overdue balances, and streamline overall financial management. Below are key strategies to enhance tracking practices.

Impl Legal Requirements for Restaurant InvoicesEnsuring that transaction records comply with legal standards is crucial for any business. Properly formatted and legally compliant records support transparency, streamline financial audits, and safeguard both the business and its patrons. Understanding the essential elements that must be included helps avoid potential issues with regulatory bodies. Mandatory Information for ComplianceA legally sound record should include basic identifying details that allow for clear communication between the business and its clients. Commonly required information includes:

|