Free Product Invoice Template for Your Business Needs

Managing financial transactions efficiently is essential for any business. A well-organized system for documenting payments and purchases helps ensure clarity and consistency in all dealings. Whether you’re a freelancer, small business owner, or part of a larger enterprise, having a reliable method to outline charges is crucial for smooth operations.

One effective way to accomplish this is by utilizing an easy-to-use document that allows you to specify the details of a transaction. This document provides a clear record of services rendered or items sold, as well as important payment information, ensuring both parties have a mutual understanding of the agreement.

With the right approach, you can improve your overall workflow, avoid confusion, and maintain professional standards when handling financial exchanges. These tools can be customized to fit any type of business, allowing you to manage your finances with ease and confidence.

Free Product Invoice Template

For businesses of all sizes, having a simple and clear method to outline transactions is key to maintaining financial clarity. A well-designed document can significantly simplify the process of tracking sales, purchases, and payments. By organizing essential details into an easy-to-read format, both parties involved can refer to the record for future reference, avoiding misunderstandings or confusion.

With the right structure, creating such a document becomes effortless. Below is a basic structure that helps you organize the critical details of any transaction:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Example Item 1 | 2 | $10.00 | $20.00 |

| Example Item 2 | 1 | $15.00 | $15.00 |

| Total Amount Due | $35.00 | ||

Such documents are adaptable to a variety of industries, and with the right information in place, you can ensure an efficient and professional approach to your billing process. Whether you’re just starting out or looking to refine your system, utilizing an organized format helps streamline financial operations.

Why Use an Invoice Template

Using a structured document for managing financial transactions is essential for any business. It simplifies the process of documenting exchanges, ensuring that all relevant details are clearly presented. This approach not only enhances professionalism but also improves the accuracy and efficiency of your billing system.

Here are some key reasons to use such a document:

- Consistency: Having a standardized format ensures that each record follows the same structure, making it easier to read and understand for both parties.

- Time-saving: Pre-designed formats eliminate the need for creating a new document from scratch each time, saving valuable time.

- Accuracy: By including all essential information in a clear layout, the risk of errors or missing details is minimized.

- Professionalism: Presenting a well-organized document conveys a professional image to clients and partners, enhancing trust and credibility.

- Legal Clarity: Properly documented transactions help ensure that all terms are agreed upon and easily referable, reducing the potential for disputes.

Adopting this practice can help streamline business processes, making it easier to manage payments and maintain accurate financial records. Whether for a small startup or a large company, using a clear and structured document for each transaction is a smart choice.

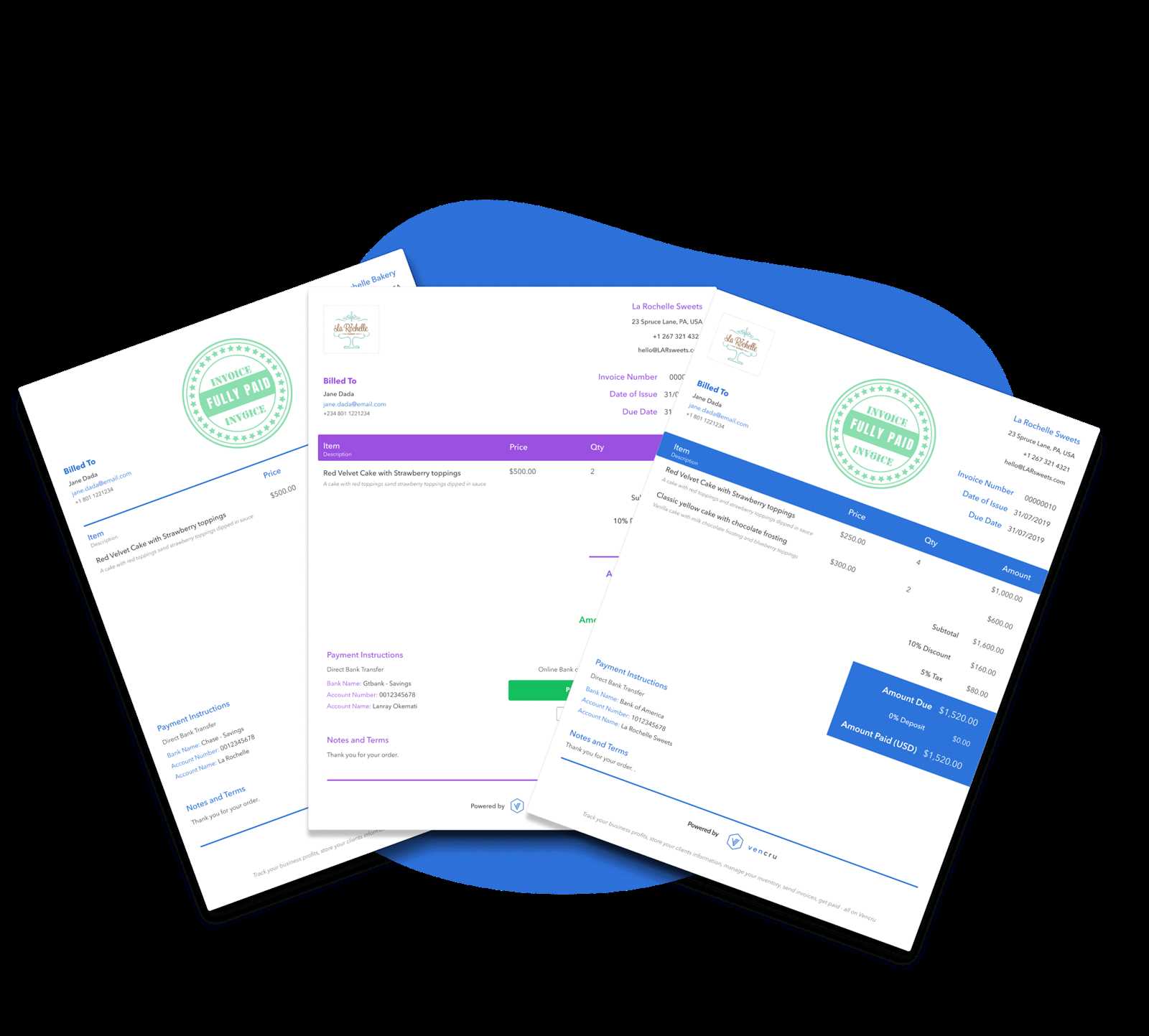

Benefits of Free Invoice Templates

Using a pre-designed document for managing business transactions provides numerous advantages for companies of all sizes. It allows for consistent, organized, and efficient record-keeping, which is essential for smooth financial operations. By using a ready-made format, businesses can reduce time spent on administrative tasks and focus on growth and customer relations.

Here are some key benefits of utilizing such documents:

| Benefit | Description |

|---|---|

| Cost-Effective | No need to purchase expensive software or hire professionals to design documents; ready-made formats are available at no cost. |

| Time-Saving | Pre-designed formats eliminate the need to create documents from scratch, speeding up the billing process. |

| Customization | These formats can be easily adjusted to meet specific business needs, making them flexible for various industries. |

| Accuracy | Pre-built structures ensure that important details are included, reducing the chances of mistakes and missed information. |

| Professional Appearance | Using a clean, organized document enhances a business’s professional image, helping to build trust with clients and partners. |

By adopting this approach, businesses can streamline their processes and improve the overall management of financial records, while maintaining a professional image and increasing efficiency.

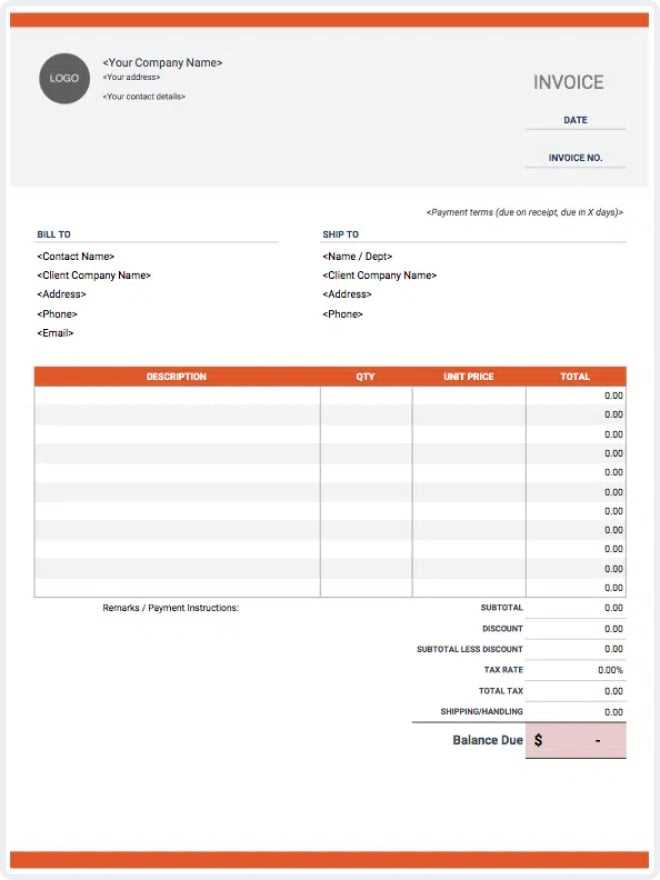

How to Customize Your Invoice

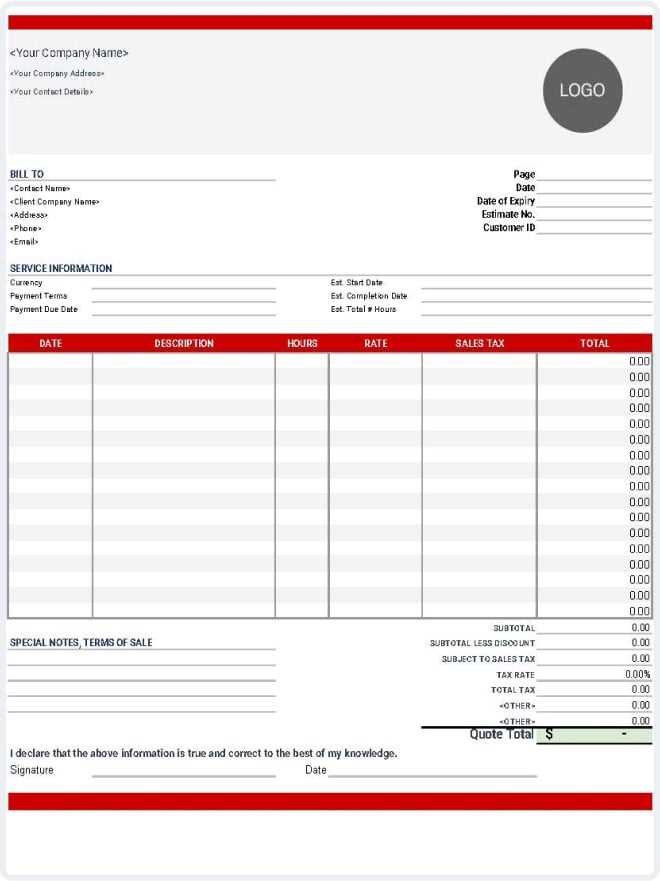

Adapting a pre-designed document to fit your business’s needs is a straightforward process that ensures consistency and professionalism. Customization allows you to tailor the document’s appearance and content to reflect your brand and provide all the necessary details for each transaction. This flexibility makes it easier to track payments, ensure accuracy, and maintain a clear financial record.

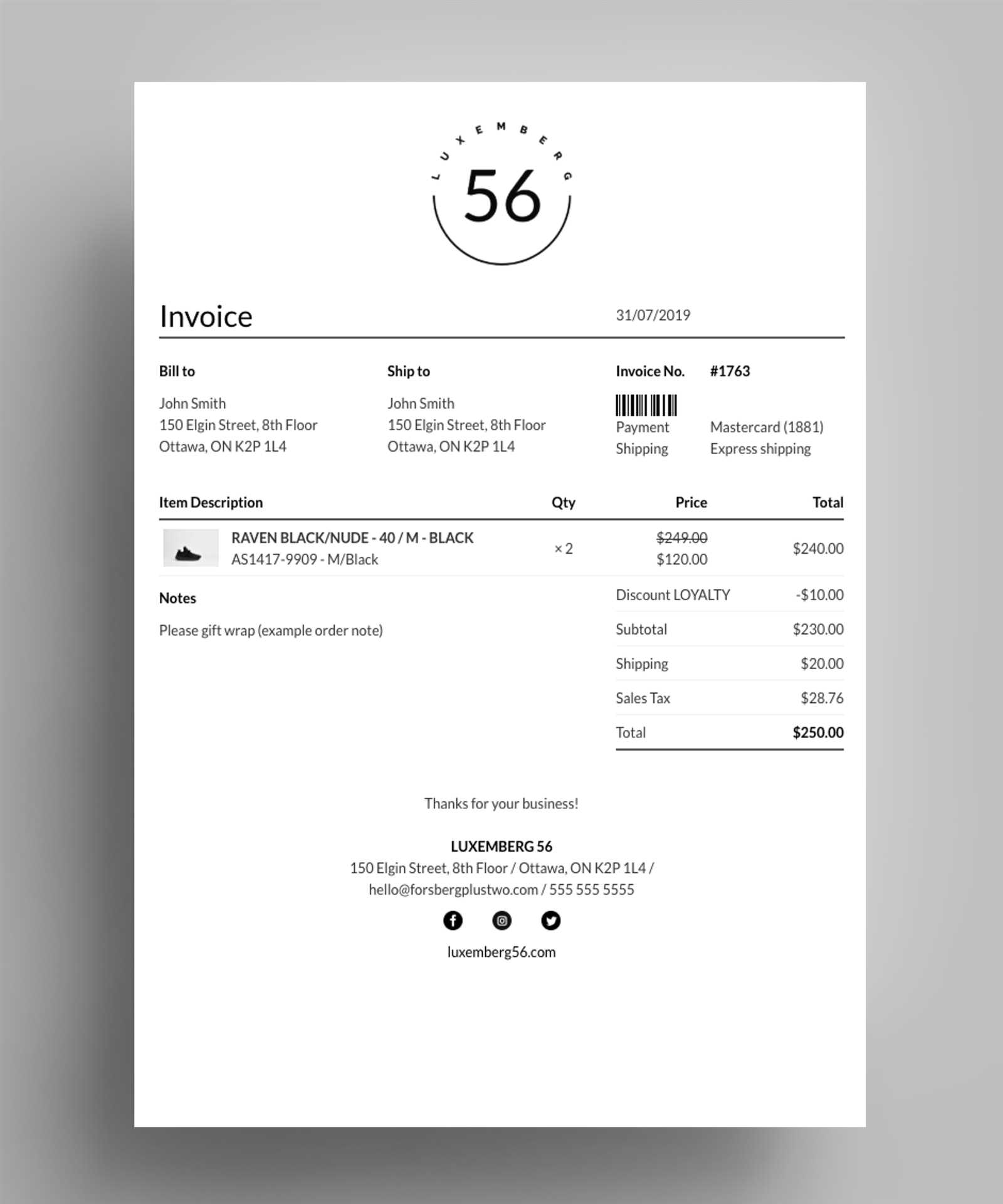

Personalizing the Layout

The first step in customization is adjusting the layout to suit your style and preferences. This can include changing font styles, colors, or adding your business logo for a more personalized touch. Make sure the layout is clear and easy to follow, with enough space for all necessary information such as transaction details, dates, and totals.

Adjusting the Content

Next, you can modify the content to reflect the specifics of your transactions. You may want to add additional fields for discounts, taxes, or shipping charges, depending on your business model. It’s also essential to include your company’s contact information, payment terms, and any other relevant terms or conditions.

| Field | Customization Option |

|---|---|

| Company Logo | Upload your logo for brand recognition. |

| Item Description | Modify the description to include specific products or services. |

| Payment Terms | Add your preferred payment methods or terms (e.g., net 30 days). |

| Discounts | Include any applicable discounts for customers or promotions. |

| Tax Rates | Adjust tax rates to meet local requirements. |

Customizing the document allows you to maintain consistency with your business branding while ensuring that all necessary transaction details are clear and properly formatted. With these simple changes, you can create a document that is both functional and professional for your needs.

Best Practices for Invoice Creation

Creating clear and accurate transaction records is essential for both businesses and clients. A well-structured document ensures that the details of each exchange are properly communicated and easily referenced. Adhering to best practices when drafting these records can help maintain professionalism, reduce errors, and streamline financial processes.

Here are some key practices to follow when crafting such a document:

- Include All Relevant Details: Make sure to list all essential information such as the transaction date, a clear description of the items or services, the amount owed, and payment terms.

- Use a Consistent Layout: A uniform layout makes it easy for clients to understand the charges and ensures that the document is visually organized and professional.

- Be Clear with Terms and Conditions: Always specify payment deadlines, late fees (if any), and accepted payment methods to avoid confusion.

- Include a Unique Reference Number: This makes it easier to track and reference specific transactions, especially when managing multiple records.

- Double-Check for Accuracy: Before sending, carefully review the document for any typos, errors in pricing, or missing details. Accuracy helps to maintain trust and prevent misunderstandings.

- Keep it Professional: Use clear, concise language and avoid unnecessary jargon. A professional appearance helps reinforce your business’s reputation.

By following these best practices, you can create effective documents that are not only legally sound but also strengthen your business’s financial management. A well-prepared document contributes to smooth transactions and fosters long-term trust between parties.

Essential Information on Product Invoices

For a transaction document to be clear and legally binding, it must contain specific details that both parties can reference. These key components not only provide clarity but also ensure that all aspects of the exchange are documented accurately. By including the necessary information, you can avoid misunderstandings and ensure that payments are processed smoothly.

Key Elements to Include

The following information is crucial when creating a detailed record of a transaction:

- Transaction Date: The date when the sale or service was completed.

- Unique Reference Number: A distinct identifier for easy tracking and referencing of the transaction.

- Details of Goods or Services: A clear description of the items or services exchanged, including quantities and unit prices.

- Total Amount Due: The final amount owed, including any applicable taxes or fees.

- Payment Terms: Any agreed-upon payment deadlines, methods, and late fee policies.

Why These Details Matter

Including the correct information helps ensure smooth communication between both parties. By specifying the payment terms and itemized list of charges, you help prevent potential disputes. A well-documented record not only serves as proof of transaction but also helps in maintaining proper financial records for future reference.

Common Invoice Mistakes to Avoid

When creating transaction documents, even small errors can lead to confusion, delays in payment, or potential disputes. Ensuring accuracy in all aspects of the document is crucial for maintaining professionalism and ensuring that both parties are on the same page. Avoiding common mistakes can help streamline your billing process and maintain positive relationships with clients.

Key Mistakes to Watch Out For

- Incorrect Contact Information: Ensure that both your business and the client’s contact details are accurate, including addresses, phone numbers, and email addresses.

- Missing Payment Terms: Always include payment deadlines, accepted methods, and any applicable late fees to avoid confusion or delays in payment.

- Unclear Item Descriptions: Be specific when describing the items or services provided, including quantities, prices, and any relevant details to prevent misunderstandings.

- Not Including a Unique Reference Number: Without a reference number, it may be difficult to track and identify transactions, leading to confusion when discussing payments or issues.

- Failure to Double-Check Calculations: Small errors in calculations can lead to incorrect totals, potentially damaging your credibility and causing delays in payment processing.

Why Accuracy is Crucial

Accurate documents not only help maintain a smooth transaction process but also ensure that both parties are legally protected. By avoiding these common mistakes, you can foster trust and reliability, ultimately ensuring timely payments and maintaining a professional business image.

How to Track Payments Efficiently

Efficient payment tracking is essential for maintaining a smooth cash flow and ensuring that transactions are completed as agreed. By keeping accurate records of all incoming payments, businesses can easily identify overdue accounts, plan financial activities, and maintain a healthy relationship with clients. Adopting systematic methods for monitoring payments can help minimize errors and reduce administrative workload.

Here are a few strategies to track payments effectively:

- Use a Clear Record System: Maintain an organized database or spreadsheet to log each transaction, including details such as the payment amount, date, method, and client information.

- Assign Reference Numbers: Assign unique reference numbers to each transaction to easily identify and track payments throughout the process.

- Monitor Due Dates: Set reminders for payment deadlines to prevent overdue accounts. Regularly check and follow up on pending payments.

- Utilize Accounting Software: Use software tools to automate payment tracking. These tools can send reminders, generate reports, and update records in real time.

- Reconcile Regularly: Reconcile your payment records with your bank statements to ensure that all payments are accounted for and discrepancies are quickly addressed.

By following these steps, businesses can stay on top of their payments, reduce errors, and ensure timely transactions, ultimately enhancing their financial stability and client satisfaction.

Tips for Professional Invoice Design

A well-designed transaction document not only conveys important financial information but also reflects the professionalism of your business. The layout, font, and organization can significantly impact how your clients perceive your brand. By paying attention to design details, you ensure that the document is easy to read, looks polished, and aligns with your business’s image.

Here are several key tips to consider when designing your transaction documents:

- Maintain a Clean Layout: Keep the design simple and uncluttered, with clear sections for each type of information. This will make it easier for clients to find what they need quickly.

- Use Your Branding: Incorporate your company logo, colors, and fonts to create a cohesive visual identity that reinforces your brand’s professionalism.

- Choose Readable Fonts: Select fonts that are easy to read both on screen and in print. Avoid overly decorative or complicated fonts that may make the document harder to follow.

- Organize Information Logically: Structure the content in a way that follows a natural flow, with key details like transaction date, total amount, and payment terms placed prominently.

- Highlight Important Details: Use bold text or colored elements to draw attention to key information, such as total amounts due or payment due dates.

- Provide Clear Contact Information: Ensure that your business’s contact details are easy to locate in case clients need to reach out for questions or concerns.

By following these design tips, you can create professional and visually appealing transaction records that not only facilitate smooth transactions but also strengthen your brand image.

How to Download a Free Template

Obtaining a ready-to-use document for your business needs is a simple process when you know where to find the right resources. Many online platforms offer easily accessible options for downloading customizable documents that fit your requirements. This allows you to streamline your administrative tasks while maintaining consistency in your financial records.

Steps to Download

Follow these simple steps to get your customizable document:

- Choose a Trusted Source: Look for reputable websites or platforms that provide reliable and secure downloads. Many websites offer free resources for businesses.

- Review the Available Options: Browse through various options to find one that suits your specific needs. Many websites provide different layouts and styles to cater to different business types.

- Download the File: Once you’ve found the right document, simply click the download button. You will typically have the option to download it in a variety of formats such as PDF, Word, or Excel.

Customizing Your Document

After downloading, you can easily edit and personalize the document with your company details, transaction information, and other necessary elements. The document is often designed to be user-friendly, allowing you to make adjustments quickly and efficiently.

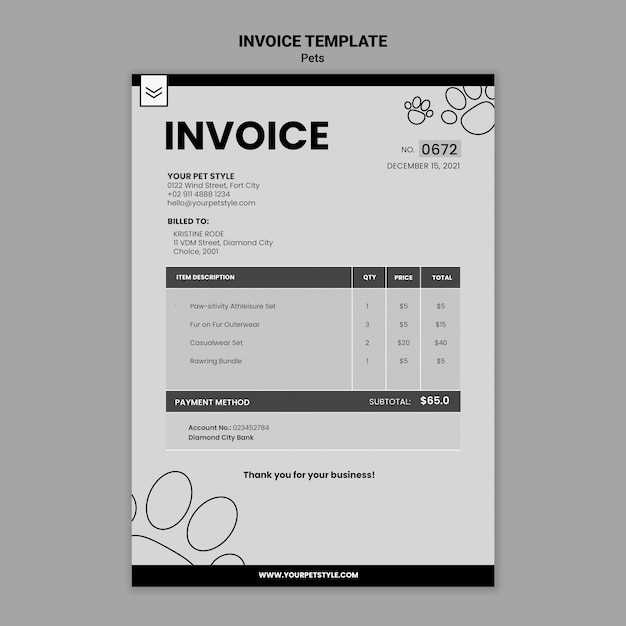

Using Templates for Different Industries

Every industry has its unique requirements when it comes to documenting financial transactions. Whether you’re in retail, construction, or consulting, customizing a document to fit the specific needs of your business is essential. Many businesses opt for ready-made solutions that can be tailored to match the standards and practices of their particular field, helping to save time and ensure consistency.

Here are a few examples of how different industries can benefit from using customizable documents:

- Retail: In retail, it’s important to include clear details about the quantity and type of goods being purchased, as well as any discounts or promotions. A well-structured document can help maintain transparency with customers.

- Construction: For the construction industry, documents often need to outline labor costs, materials, project timelines, and detailed payment schedules. A specialized document helps ensure accuracy and prevents misunderstandings.

- Consulting: Consulting businesses benefit from clearly defining hourly rates, consulting fees, and project deliverables. A structured document helps clients understand the scope of services and agreed-upon fees.

- Freelancers: Freelancers in fields like graphic design or writing typically need a document that reflects their rates per project or hour, as well as milestones and deadlines. Customizable options are ideal for this flexibility.

- Manufacturing: In the manufacturing sector, it’s crucial to include information on production schedules, batch numbers, and part costs. A tailored solution can assist in tracking product shipments and payments.

By using a customizable document, businesses in any sector can ensure that they meet industry standards, improve accuracy, and provide clear communication with clients.

Why Accuracy is Key in Invoicing

When documenting financial transactions, precision is crucial for maintaining clear communication and ensuring that both parties are on the same page. Inaccurate records can lead to confusion, delayed payments, or even disputes between businesses and clients. Ensuring that every detail is correct from the start helps avoid complications and fosters trust with clients and stakeholders.

Here are several reasons why accuracy matters in financial documentation:

- Prevents Payment Delays: Errors in amounts, dates, or payment terms can lead to delayed payments. Clear and accurate details help clients process payments on time.

- Reduces Disputes: Accurate documentation reduces the chances of misunderstandings regarding services or costs, which can often result in disputes or client dissatisfaction.

- Builds Professionalism: A well-organized and accurate document reflects professionalism and attention to detail, enhancing the credibility of your business.

- Improves Cash Flow: When you provide error-free details, payments are less likely to be postponed or contested, leading to smoother cash flow management.

- Ensures Legal Compliance: Inaccurate financial records can lead to compliance issues, particularly if the documents are needed for tax purposes or audits.

Maintaining accuracy in financial records not only helps to keep transactions smooth and timely but also ensures the long-term success and reputation of your business.

Integrating Invoices with Accounting Software

Streamlining your financial processes is essential for efficiency, especially when dealing with numerous transactions. By linking financial documents with accounting software, businesses can automate data entry, track payments more effectively, and reduce the risk of errors. This integration allows for a seamless flow of information between documents and your financial systems, making it easier to manage accounts and ensure accurate record-keeping.

Benefits of Integration

Integrating your documents with accounting tools offers several key advantages:

- Automated Data Entry: By syncing documents directly with your accounting software, you eliminate the need for manual entry, reducing time spent on administrative tasks.

- Real-time Tracking: You can monitor payments and outstanding balances in real time, giving you better control over your cash flow.

- Improved Accuracy: Integration helps eliminate common human errors, ensuring that the information in your financial system is up-to-date and accurate.

- Efficient Reporting: With automatic synchronization, generating reports becomes simpler, allowing you to assess your financial status without manually compiling data.

How to Integrate

Most accounting software tools allow for easy integration with popular document management systems. To begin the integration process, follow these steps:

- Select Compatible Software: Choose an accounting software that supports document integration, either through direct syncing or by importing files in common formats like CSV or Excel.

- Configure Settings: Set up the integration by connecting your document source to the accounting platform. Ensure that all relevant fields, such as payment terms and amounts, are correctly mapped.

- Automate Syncing: Enable automatic syncing of documents to streamline the process and ensure that data is always up-to-date.

By integrating your financial documents with accounting software, you can save time, reduce errors, and improve your overall financial management efficiency.

When to Send an Invoice

Timely billing is critical for maintaining healthy cash flow and keeping business operations running smoothly. Knowing when to issue a payment request is essential for ensuring that both you and your clients stay on the same page regarding financial obligations. Whether you are billing for completed work or ongoing services, understanding the best time to send a request for payment can impact your payment cycle and overall business efficiency.

Factors to Consider

Several factors determine the optimal time to send a payment request:

- Completion of Work: The most common time to issue a request is once the work or service is completed. This ensures that clients are invoiced for exactly what was delivered, avoiding confusion or disagreements.

- Payment Terms: If you have agreed-upon payment terms, such as 30 days after the job is finished, it’s important to send the request on or around that time to ensure prompt payment.

- Milestones or Progress Payments: For longer-term projects, it’s often best to send partial requests at key milestones, ensuring you receive payments throughout the course of the work.

- Client Preferences: Some clients may prefer to receive payment requests at specific times of the month or after certain phases of a project. Be sure to understand your client’s needs and align with their expectations.

Common Scenarios for Sending a Payment Request

Here are a few common scenarios when businesses typically issue payment requests:

- After Project Completion: When all deliverables are completed and the client is satisfied, it’s the right time to issue a payment request.

- Monthly Billing: For ongoing services or subscriptions, it’s often best to send requests on a regular basis, such as monthly, to keep finances predictable for both parties.

- Upon Delivery of Goods: For businesses that sell physical products, it’s customary to send the payment request once the goods have been shipped or delivered.

- After Service Rendered: If you provide consulting or other time-based services, it’s best to send a request as soon as the service has been rendered, unless otherwise specified in a contract.

By carefully considering when to send a payment request, you ensure that your business maintains a smooth and timely cash flow, while also building good relationships with your clients.

Legal Considerations for Invoices

When issuing payment requests, it’s essential to ensure that all the necessary legal requirements are met to protect both parties involved. These documents are not only essential for accounting and tax purposes but also carry legal weight in the event of disputes or non-payment. Being aware of the key legal elements can help businesses stay compliant with regulations and prevent potential legal issues.

There are several important considerations to keep in mind when preparing a payment request:

- Clear Terms and Conditions: Every document should outline the terms of the agreement, including payment deadlines, interest rates for late payments, and any other conditions agreed upon by both parties.

- Accurate Details: The document should contain accurate details about the buyer, seller, services or goods provided, and agreed-upon prices. Inaccuracies can lead to disputes or delays in payment.

- Legal Requirements for Specific Regions: Different countries and regions have specific legal requirements for such documents. For example, certain jurisdictions may require that a tax identification number or specific language be included on the document.

- Contractual Obligations: If the payment is based on a contract, it’s vital that the request aligns with the terms stipulated in that contract. Deviations can result in legal complications.

- Retention of Records: Both businesses and clients should retain copies of all such documents for legal and tax purposes, often for several years, depending on local laws.

Ensuring that these key elements are incorporated will reduce the likelihood of disputes, increase professionalism, and help maintain a transparent financial relationship with clients.

How to Manage Multiple Invoices

Handling numerous payment requests can become overwhelming, especially for businesses with a large client base. Without a proper system in place, tracking payments, deadlines, and discrepancies can lead to missed opportunities and financial errors. Efficient management of such documents is crucial for maintaining organization and ensuring timely payments.

Here are some practical tips to effectively manage multiple requests for payment:

Organize and Categorize

- Use Folders or Digital Systems: Whether physical or digital, organizing your records into folders by date or client helps you quickly locate specific documents when needed.

- Label Clearly: Ensure that each request is clearly labeled with relevant details, such as the client name, date, and amount due. This reduces confusion and helps you track each payment easily.

- Group by Status: Categorize requests based on their status, such as “pending,” “paid,” or “overdue.” This system helps prioritize actions and follow-ups.

Automate Where Possible

- Use Accounting Software: Many tools and software can automate the creation and tracking of payment requests. These tools often allow you to set up reminders for due dates, helping to avoid missing payments.

- Recurring Billing: If you offer services or goods on a subscription basis, set up recurring billing cycles to automatically generate new requests and reduce manual work.

By implementing these strategies, you can streamline the process and minimize errors, ensuring that you can focus on growing your business without worrying about missed payments or disorganization.