Free Printable Invoice Template for Word

Creating professional payment requests can be a time-consuming task, but it doesn’t have to be complicated. With the right tools, you can quickly generate polished, organized forms that reflect your brand and streamline your financial transactions. Whether you are a freelancer, a small business owner, or managing a large company, having access to a customizable form is essential for smooth operations.

Customizing your billing documents allows you to add all the necessary information such as business details, client data, and payment terms. This ensures clarity and helps in avoiding any confusion. With a simple setup, you can create personalized requests that fit your business style while remaining clear and professional.

Instead of starting from scratch every time, using an adaptable document saves you time and effort. It allows for easy adjustments to suit different types of transactions. Whether you need to adjust the pricing, add discounts, or include taxes, this flexibility ensures that your financial documents meet all your specific requirements.

Free Printable Invoice Template for Word

For those looking to simplify their billing process, having a ready-made, customizable form can make a significant differe

Why Use an Invoice Template

Using a ready-made document for billing can save valuable time and effort. It allows for quick creation of accurate and consistent payment requests, reducing the chances of errors. By simply filling in the relevant details, you ensure that every communication with your clients is professional and uniform.

Streamlining the process is one of the main advantages. Rather than manually setting up each document from scratch, you can focus on other aspects of your business while knowing that your financial records are neatly organized and error-free. This reduces the workload significantly, especially for small business owners or freelancers who need to manage multiple clients.

Maintaining consistency across all your transactions is another benefit. When you rely on a standard format, you create a cohesive look that reinforces your brand identity. Clients will quickly recognize the professional structure, which enhances trust and facilitates smoother communication.

Benefits of Customizing Your Invoices

Personalizing your billing documents offers numerous advantages, from enhancing professionalism to simplifying communication with clients. Customization allows you to tailor each request to meet the unique needs of your business and your customers, ensuring clarity and efficiency in every transaction.

Improved Professional Appearance

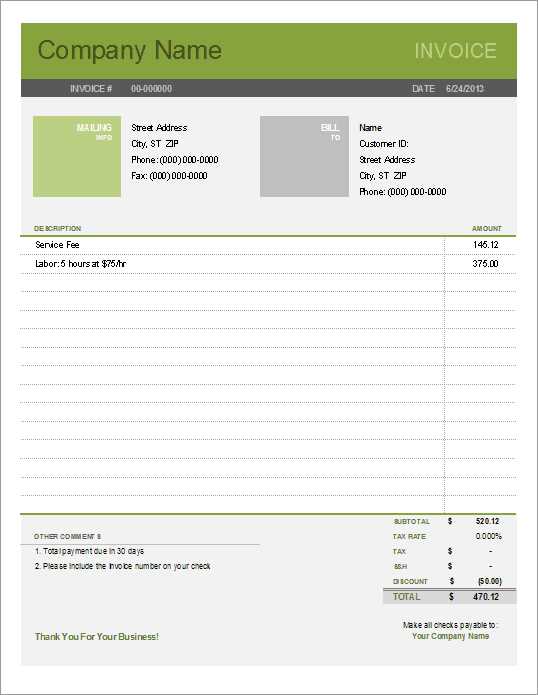

Customizing the layout gives your documents a polished, branded look that makes a strong impression on your clients. By incorporating your logo, business colors, and specific design elements, you create a cohesive identity that reflects your company’s professionalism. This can help establish trust and set the tone for a positive business relationship.

Flexibility and Personalization

Being able to adjust the details of each document allows you to provide relevant and accurate information, such as specific products, services, or payment terms. Customization helps avoid confusion and ensures that all necessary data is clearly presented. Additionally, you can adapt the document to different client needs, making each request more relevant and effective.

How to Download Free Invoice Templates

Accessing a pre-designed billing document is a simple and efficient process. Many online resources offer these documents for quick download, allowing you to get started with minimal effort. By choosing a suitable layout, you can easily adapt it to fit your specific needs without spending time on creating one from scratch.

To begin, search for websites that provide ready-to-use forms. These platforms often offer a range of designs that cater to different industries and preferences. After selecting the format that best suits your business, simply click on the download button, and the document will be saved to your device for easy access.

Once downloaded, the document can be customized according to your requirements. Whether you need to add or remove details, adjusting the format is straightforward. This ensures you have full control over the final look, while still benefiting from a professional starting point.

Choosing the Right Invoice Format

Selecting the correct structure for your billing document is crucial for clear communication with your clients. The right format ensures that all necessary information is presented in an organized manner, helping to avoid confusion and promoting prompt payment. Different formats serve different purposes, so it’s important to choose one that aligns with your business needs and the preferences of your clients.

Consider Your Business Type

Different industries have varying requirements for their billing documents. Consider the following when selecting a structure:

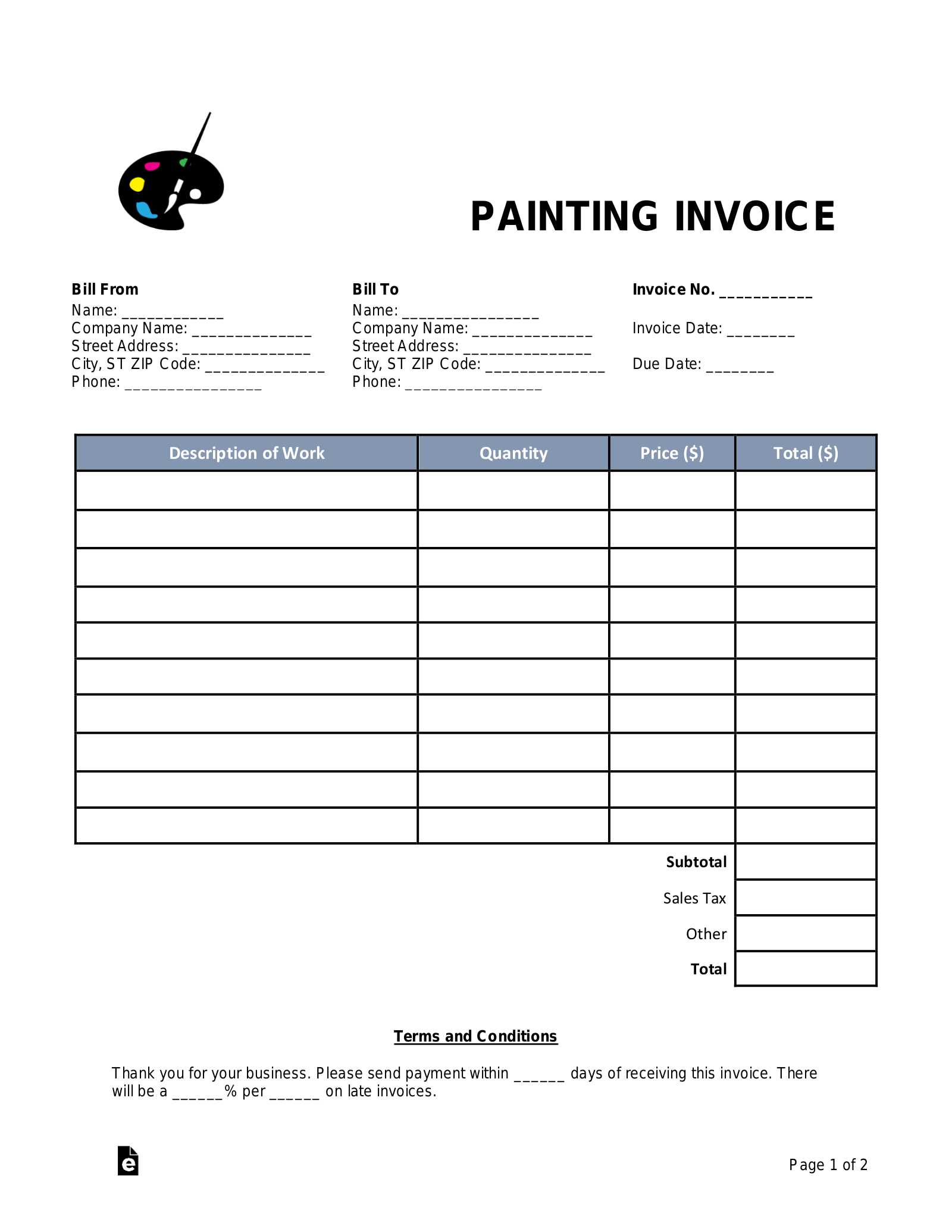

- Service-based businesses: Opt for a format that clearly outlines services, hourly rates, and the total cost for each task completed.

- Product-based businesses: Choose a format that includes detailed product descriptions, quantities, unit prices, and totals.

- Freelancers: A simple, clean format that includes hourly rates, tasks completed, and overall charges works best.

Prioritize Client Preferences

Each client may have specific requirements for how they prefer to receive billing documents. Some may request detailed breakdowns, while others may prefer a straightforward summary. Keep these factors in mind when selecting the right structure:

- Detailed breakdown: This format is useful for clients who need transparency and a full overview of services or products provided.

- Simple summary: A streamlined format may be more appropriate for clients who prefer a quick overview without excessive details.

Designing a Professional Invoice in Word

Creating a polished and professional billing document is essential for presenting your business in a credible light. With the right tools and design elements, you can craft a statement that reflects your brand while ensuring clarity and professionalism. A well-designed payment request not only helps in organizing details but also builds trust with clients, encouraging prompt payment.

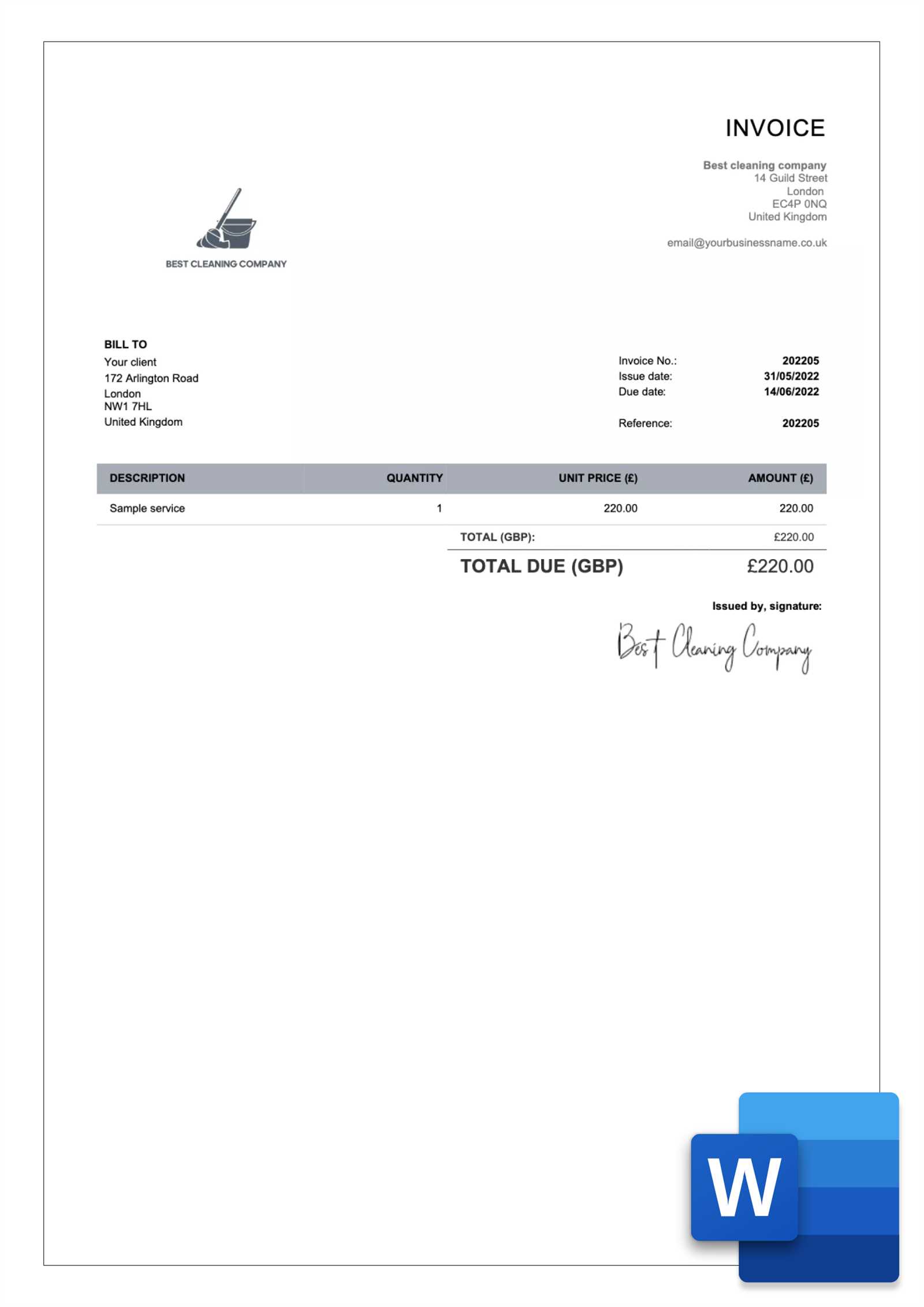

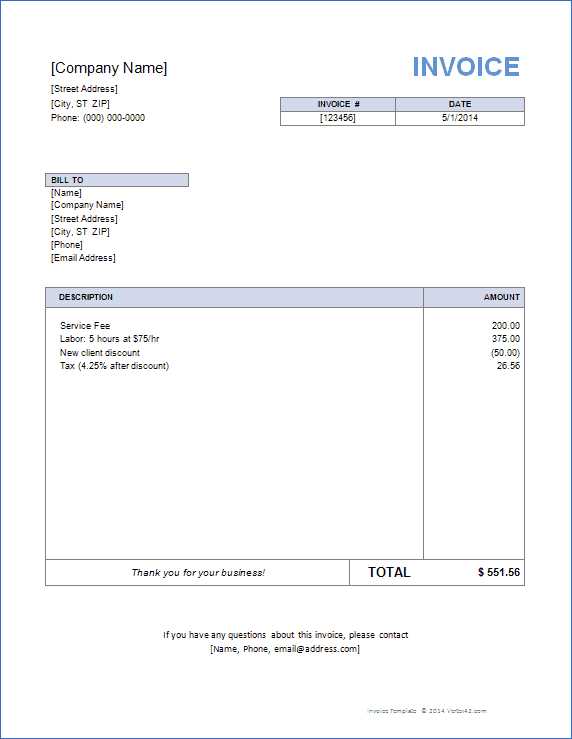

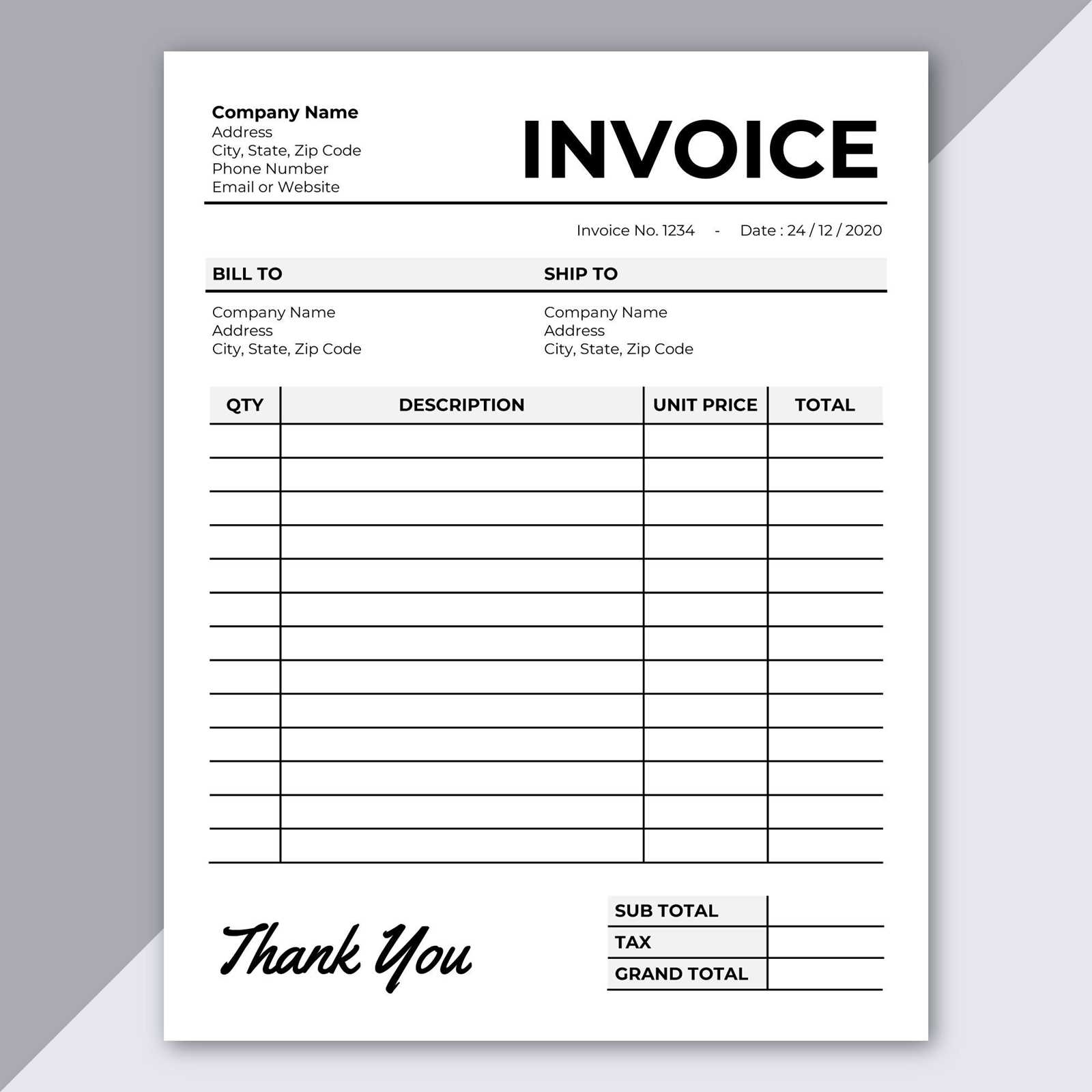

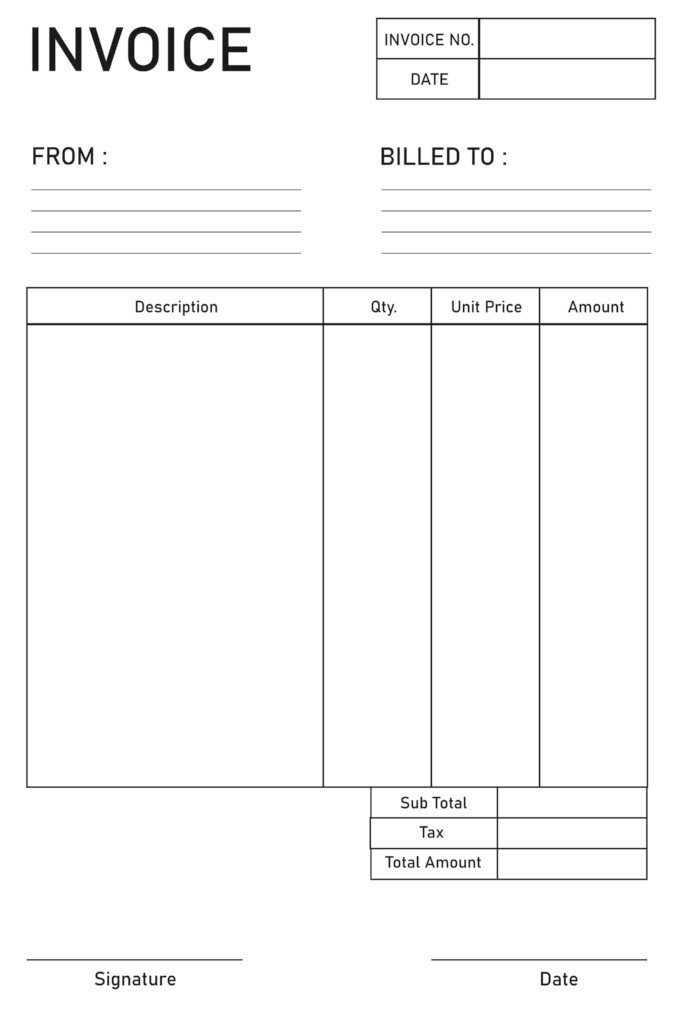

Start by choosing a clean, easy-to-read layout. Use consistent fonts, align text neatly, and ensure that all necessary information is clearly visible. This includes your business name, client details, description of products or services, payment terms, and total amount due. Simple design elements, such as bold headings or lines to separate sections, can help enhance readability without overwhelming the document.

Incorporating your company logo and color scheme can further personalize the document. Customizing these elements helps strengthen your brand identity and makes your billing look more professional. By maintaining consistency across all communication materials, you reinforce your company’s image while ensuring a seamless experience for your clients.

Essential Elements of an Invoice

Every billing document should include key information that ensures both parties–business and client–are clear about the details of the transaction. Including all relevant data not only helps avoid confusion but also supports transparency in your business dealings. A well-structured document provides both clarity and professionalism, facilitating smoother payment processes.

Key Information to Include

There are several essential elements that must be present in any professional payment request:

- Business Details: Your company’s name, address, contact information, and tax identification number should be clearly stated.

- Client Information: Include the client’s full name, address, and contact details to ensure that the document is addressed correctly.

- Unique Reference Number: Every document should have a unique identifier to help both you and your client track and reference the transaction.

- Clear Breakdown of Services or Products: List each product or service provided, along with quantities, unit prices, and total costs.

- Payment Terms: Clearly state the due date, any late fees, and acceptable payment methods.

Formatting and Readability

In addition to including the necessary details, it’s important that the layout is easy to read and visually clear. Well-organized sections with headings, bullet points, and clean spacing allow the reader to quickly navigate the document and locate the information they need.

How to Add Your Logo to Invoices

Incorporating your brand logo into billing documents is an excellent way to reinforce your company identity and make your payment requests look more professional. The addition of a logo not only strengthens your branding but also creates a more polished and cohesive look for your business communication. Fortunately, adding your logo to your payment forms is a simple process that can be done quickly with the right tools.

Follow these easy steps to add your logo:

- Prepare Your Logo: Make sure your logo is in a high-quality format, such as PNG or JPEG. Ideally, it should have a transparent background to blend seamlessly into your document.

- Choose the Right Placement: The most common spot to place a logo is at the top of the page, either centered or aligned to the left. This ensures it’s the first thing your client notices.

- Insert the Logo: In your document editing software, find the “Insert” option, select “Picture,” and upload your logo file. Resize the logo if necessary to fit without overwhelming the document.

- Adjust Position and Size: Ensure that the logo doesn’t crowd other important details. Leave enough space around it so that all other text remains easy to read.

- Test and Finalize: Before sending or printing the document, make sure the logo appears correctly and doesn’t affect the readability or overall design.

By following these simple steps, you can easily integrate your logo, making your billing forms not only functional but also an extension of your brand’s image.

Invoice Template for Small Businesses

For small business owners, having a streamlined and professional way to request payments is crucial for maintaining cash flow and ensuring smooth operations. A customized billing form designed to meet the specific needs of small businesses can make the entire process easier and more efficient. This tool helps organize essential information in a clear and simple manner, providing both the business owner and their clients with a smooth transaction experience.

Key Features for Small Business Billing Forms

When selecting or creating a billing document for a small business, certain features should be prioritized to meet the unique needs of the company and its clients:

- Simplicity: Small businesses often benefit from straightforward designs with easy-to-read fonts and minimalistic layouts.

- Clear Breakdown: Be sure to include detailed descriptions of products or services, quantities, and prices to avoid any confusion.

- Payment Terms: Clearly state when payments are due and any late fees that may apply.

Customizing for Your Brand

For a small business, personalizing the billing document with your logo, business name, and contact details creates a professional impression. Customizing these elements not only helps your clients identify your business, but it also reinforces brand recognition each time they receive a payment request.

Making Invoices Look More Professional

Creating a polished and professional payment request is essential for businesses of all sizes. A well-designed billing document not only ensures clarity but also leaves a positive impression on clients. The appearance of your payment requests can affect how clients perceive your business, influencing their confidence in your services and their willingness to pay on time.

Focus on Clean Design

The layout of your document plays a significant role in making it look professional. A cluttered or overly complex design can confuse clients and make the payment process more difficult. To enhance the look and feel:

- Simplify the layout: Keep the structure clear and straightforward. Use consistent fonts, plenty of white space, and logical section breaks.

- Use professional fonts: Stick to easy-to-read, formal fonts like Arial or Times New Roman to maintain a clean and professional appearance.

- Align text properly: Ensure that text and numbers are aligned consistently, which helps with readability.

Include Branding Elements

Integrating your company’s logo and brand colors can help reinforce your business identity and make the document look more cohesive. It’s important that these elements are subtly integrated, without overwhelming the core content. A simple logo at the top, along with your company name and contact details, helps create a polished and recognizable look.

Tips for Adding Payment Terms

Clearly defined payment terms are crucial for ensuring both parties understand the expectations and deadlines associated with a transaction. By establishing these terms in advance, businesses can reduce confusion and help maintain positive relationships with clients. Well-stated payment conditions also improve cash flow by setting clear deadlines and penalties for late payments.

Here are some tips for adding payment terms to your billing documents:

| Tip | Description |

|---|---|

| Set Clear Deadlines | Specify the exact date when the payment is due to avoid ambiguity and ensure timely transactions. |

| Include Late Fees | Clearly outline any penalties for late payments, such as an interest charge or flat fee, to encourage timely settlement. |

| Offer Early Payment Discounts | Encourage clients to pay ahead of schedule by offering a small discount for early payments. |

| Be Specific with Payment Methods | Specify acceptable payment methods such as bank transfer, credit card, or online payment platforms to avoid confusion. |

| Clarify Consequences for Non-Payment | Outline the steps that will be taken if payment is not received by the due date, such as halting services or pursuing legal action. |

By including these key payment terms, businesses can help ensure a smooth and professional transaction process, minimizing misunderstandings and protecting their financial interests.

How to Include Tax Information

Including accurate tax details in your billing documents is essential for legal compliance and ensuring that both you and your clients understand the total amount due. Properly presenting tax information not only avoids misunderstandings but also helps establish trust with your clients. Whether you need to include sales tax, VAT, or other types of taxation, it is important to make this information clear and transparent.

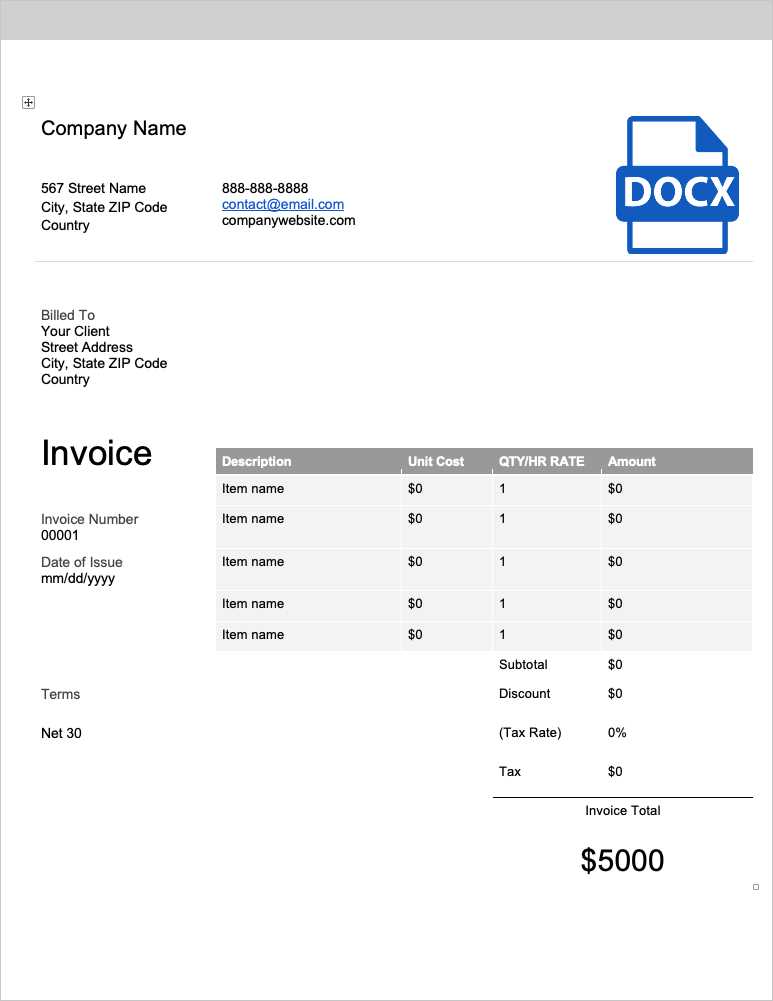

Specify the Tax Rate

First, clearly state the applicable tax rate for the products or services provided. This allows clients to understand how much they are being charged in taxes. It’s important to note whether the tax is a percentage of the total or a flat rate, depending on your jurisdiction.

Break Down the Tax Amount

To make the payment request as clear as possible, break down the tax amount separately from the product or service charges. This helps the client see exactly how much of the total is attributed to tax, which improves transparency. For example:

- Subtotal: The total amount before taxes.

- Tax: The specific amount of tax being charged based on the subtotal.

- Total Due: The final amount, including the tax charge.

Including tax information in this manner helps maintain clarity and can be particularly useful for businesses that need to provide detailed records for accounting or auditing purposes. Make sure to stay updated on the tax laws in your region to ensure accuracy.

Common Mistakes to Avoid in Invoices

When creating payment requests, even small mistakes can lead to confusion, delays, or even missed payments. A well-structured and error-free document reflects professionalism and helps maintain smooth business relationships. To avoid complications, it’s crucial to be aware of the most common errors people make when drafting these important documents.

Here are some of the key mistakes to avoid:

- Missing Contact Information: Always include both your and your client’s full contact details. This ensures clarity and enables both parties to communicate easily if there are any issues with payment.

- Unclear Payment Terms: Make sure the terms of payment are explicit. Failing to specify deadlines, penalties for late payments, or accepted payment methods can cause confusion and delays in settling bills.

- Incorrect Calculations: Double-check all amounts to ensure accuracy, including subtotal, taxes, discounts, and the final total. Even small calculation errors can lead to disputes or delayed payments.

- Omitting an Invoice Number: Every payment request should have a unique reference number for tracking and record-keeping purposes. This helps both parties track payments and resolves any confusion that may arise.

- Not Including Tax Information: If taxes are applicable, make sure to clearly state the tax rate, the amount, and the total due. Failing to include this information can result in misunderstandings and non-compliance with tax regulations.

Avoiding these mistakes ensures that your payment requests are clear, professional, and legally sound. A well-prepared document reduces the risk of payment delays and fosters trust between you and your clients.

How to Track Payments with Invoices

Effective tracking of payments is a critical component of managing business finances. By maintaining organized and accurate records, you can ensure that all payments are processed on time and discrepancies are easily resolved. One of the best ways to track payments is through a structured approach to managing the documents sent to clients. Each payment request should be designed in a way that allows for easy follow-up and tracking, minimizing the risk of missed or forgotten payments.

Use a Unique Reference Number

Assigning a unique reference number to each request you send allows you to track the payment status and provides a point of reference in case there are any questions. This number should be clearly visible on both the document and any related communications. By keeping track of these numbers, you can easily match payments to their corresponding requests, preventing confusion and ensuring proper record-keeping.

Mark Payments as “Paid”

As payments are received, it’s essential to mark the relevant documents as “paid.” This helps you stay on top of outstanding amounts and avoid sending duplicate payment requests. When marking a payment as received, include the date of payment, the amount paid, and any relevant payment method or transaction reference. Regularly updating this status allows you to monitor overdue amounts and follow up with clients who have yet to pay.

By utilizing these techniques and staying organized, you can streamline the process of tracking payments, ensuring that your cash flow remains stable and your financial records are accurate.

How to Use Invoices for Record Keeping

Maintaining accurate financial records is vital for any business. Keeping track of all transactions not only helps you manage your cash flow but also ensures that you stay compliant with tax regulations. One of the most effective ways to do this is by using documents sent to clients as part of your record-keeping system. These documents can serve as proof of services provided or goods delivered, while also helping you track outstanding payments and monitor your business’s financial health.

Organizing Financial Records

To make sure your records are organized and easy to access, consider the following steps:

- Create a separate folder or file system – Use a digital or physical filing system to store each document in chronological order. This will make it easier to retrieve any information if needed.

- Label each document clearly – Ensure that each entry has a clear and consistent naming system, including the reference number, client name, and the date issued. This will allow you to quickly identify and locate documents.

- Sort by payment status – Separate documents into categories such as “paid,” “pending,” or “overdue.” This will help you keep track of what’s been settled and what needs attention.

Tracking Business Expenses and Income

Using these records to track your income and expenses provides a clear overview of your financial performance. Regularly updating and reviewing your files allows you to:

- Stay on top of outstanding payments and follow up when necessary.

- Monitor cash flow trends and make informed business decisions.

- Prepare accurate tax returns by using organized records of sales and purchases.

By integrating these practices into your day-to-day operations, you can ensure that your business stays financially organized, saving time and effort when it comes to budgeting, tax filing, and financial planning.

Free Invoice Templates vs Paid Options

When it comes to creating professional documents for billing purposes, business owners often face the decision of whether to use free resources or invest in premium options. While both types of solutions offer benefits, they come with distinct differences that can impact the efficiency and quality of your work. Understanding the pros and cons of each option is key to choosing the best solution for your business needs.

Comparing Key Features

Here is a breakdown of the differences between no-cost and premium choices, helping you evaluate which one suits your business better:

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Basic customization, limited design choices | Advanced customization, fully tailored designs |

| Support | Limited or no support available | Customer support available, often 24/7 |

| Features | Limited functionality, may lack essential elements | Additional features, integrations with accounting software |

| Quality | Basic design and layout | High-quality, professional design options |

| Cost | No charge | Requires a subscription or on

How to Save and Print Your InvoiceOnce you have completed your billing document, it’s essential to know how to properly save and print it for distribution. This process ensures that your document is easily accessible for future reference and can be physically provided to clients. Below is a guide on how to save and print your document in the most efficient way. Saving Your DocumentSaving your document properly is crucial to prevent any data loss and ensure you can access it anytime. Here are a few key steps to follow:

Printing Your DocumentOnce you have saved your file, you can print it for physical distribution. Here are the steps to follow:

|