Free Printable Invoice Template PDF for Easy Billing

Managing business finances requires a streamlined approach to generating clear and organized payment requests. Having a structured format for detailing transactions can significantly improve your workflow, ensuring accuracy and consistency with every client interaction.

There are numerous resources available for creating these documents, which can be customized to fit various business needs. Whether you are a freelancer, small business owner, or working in a larger company, using a pre-designed format can save time and eliminate common errors associated with manually drafting payment records.

With the right tools, you can quickly produce documents that look professional and contain all the necessary details, from transaction amounts to payment terms. These documents help maintain a smooth communication channel with clients while also supporting your financial records for future reference.

Free Printable Invoice Template PDF

Creating a document for client payments is essential for maintaining a professional business image and ensuring accurate financial records. With a properly structured document, you can easily outline payment details, track transactions, and keep all parties informed of the terms involved. Utilizing ready-made designs helps streamline this process, allowing you to focus on other important tasks.

Why Use Pre-Designed Documents?

By choosing a pre-built design, you can save time and avoid errors that might arise from creating your own from scratch. These designs typically include all the essential fields, such as client information, amounts due, payment due dates, and more. With customizable options, you can adjust the content to suit your business needs while maintaining a professional appearance.

How to Access and Customize the Documents

These ready-to-use formats can be found online, often available for quick download. Once you have chosen the right layout, you can easily customize it by adding your business logo, adjusting payment terms, or including specific product or service details. The process is simple, and you can begin using these documents almost immediately to enhance your billing practices.

Why You Need an Invoice Template

Having a consistent and organized method for generating billing documents is crucial for any business. A standardized format ensures that all necessary information is captured accurately, preventing confusion and delays in payments. It also promotes a professional image and fosters trust with clients, making the payment process smoother for both parties.

Using a structured design helps you keep track of all your financial transactions, making it easier to manage and reference past payments. Moreover, it reduces the chance of missing important details such as due dates, amounts, or client information, which could lead to misunderstandings or errors in billing.

| Key Benefits | Description |

|---|---|

| Consistency | Ensures all billing documents follow the same structure, reducing mistakes. |

| Professionalism | Creates a polished, business-like appearance that enhances your credibility. |

| Time-Saving | Pre-made designs allow quick customization and faster document creation. |

| Legal Protection | Helps ensure that all necessary terms are included for clarity and legal purposes. |

Benefits of Using Printable Invoice Templates

Utilizing ready-made formats for creating billing documents offers numerous advantages for businesses of all sizes. These structured designs help ensure that essential details are always included and reduce the likelihood of mistakes that could delay payments or cause confusion. By relying on pre-designed formats, you save time and maintain a high level of professionalism with each client interaction.

Key Advantages

- Time Efficiency: Ready-to-use documents can be quickly customized, allowing you to focus on other important tasks without having to start from scratch.

- Consistency: Using a standardized format ensures that all your billing records are uniform, reducing the risk of missing critical information.

- Professional Appearance: Pre-designed layouts help maintain a polished, cohesive look that enhances your business’s credibility.

- Easy Customization: These formats can be easily modified to reflect your unique business requirements, such as adding your company logo or adjusting payment terms.

Practical Benefits for Business

- Clear Communication: Well-organized documents ensure that clients fully understand the details of the transaction, making the payment process smoother.

- Record Keeping: These formats make it easier to store and track past payments, helping you stay on top of your financial management.

- Legal Protection: Including all necessary information in a structured format can help avoid disputes by providing clear terms and conditions for both parties.

How to Customize Your Invoice PDF

Customizing your billing document is an essential step to make sure it aligns with your business identity and meets the specific needs of each transaction. Personalization helps reinforce your brand while ensuring that all relevant details are clear and accurate. Whether you’re adjusting the layout or adding specific fields, making changes to these documents is simple and can be done in just a few steps.

The first step is to select a design that closely matches your business style. Most formats offer flexibility, allowing you to edit text, change fonts, and even insert logos or images. Customizing the fields is another critical aspect; you may need to adjust sections such as payment terms, item descriptions, or tax rates to fit your particular requirements.

Another important element of customization is adjusting the colors and layout. For example, you might want to use your company’s official color scheme or rearrange the sections to highlight the most important information. Making sure the document is visually clear and easy to read ensures that clients can quickly find the necessary details, leading to faster payments and fewer misunderstandings.

Top Features to Look for in Templates

When selecting a design for your billing documents, it’s essential to choose one that offers both functionality and flexibility. A well-structured layout not only ensures that all necessary details are included, but it also improves the overall client experience. The right features can make your financial documents clear, professional, and easy to use, allowing you to focus on growing your business.

Key Elements to Consider

- Clear Sectioning: The format should divide the document into logical sections, such as client information, itemized charges, and payment terms. This makes the document easier to read and prevents any confusion.

- Customizable Fields: Look for a design that allows you to modify sections to suit your business needs, such as adding specific product details, changing tax rates, or adjusting the payment deadline.

- Space for Branding: Choose a format that lets you incorporate your company logo and colors. Personalizing your document reinforces your brand identity and gives your clients a sense of trust and professionalism.

- Automated Calculations: Some designs offer the ability to automatically calculate totals, taxes, and discounts, reducing the chance of human error and speeding up the document creation process.

Additional Considerations

- Ease of Use: The template should be easy to fill out, with fields that are simple to access and modify, whether you’re creating a new document or updating an existing one.

- Compatibility: Ensure the layout works seamlessly across different devices or platforms, allowing you to generate and send documents without technical issues.

- Space for Notes: A well-designed document should provide room for additional comments or special instructions that may be necessary for certain transactions.

Best Free Invoice Templates for Small Business

For small businesses, having access to a structured billing document is essential for maintaining a professional image and ensuring that payments are processed smoothly. The right format can make the billing process quicker and more efficient, allowing business owners to focus on serving clients rather than getting bogged down in paperwork. There are numerous designs available, each offering unique features to suit different business needs.

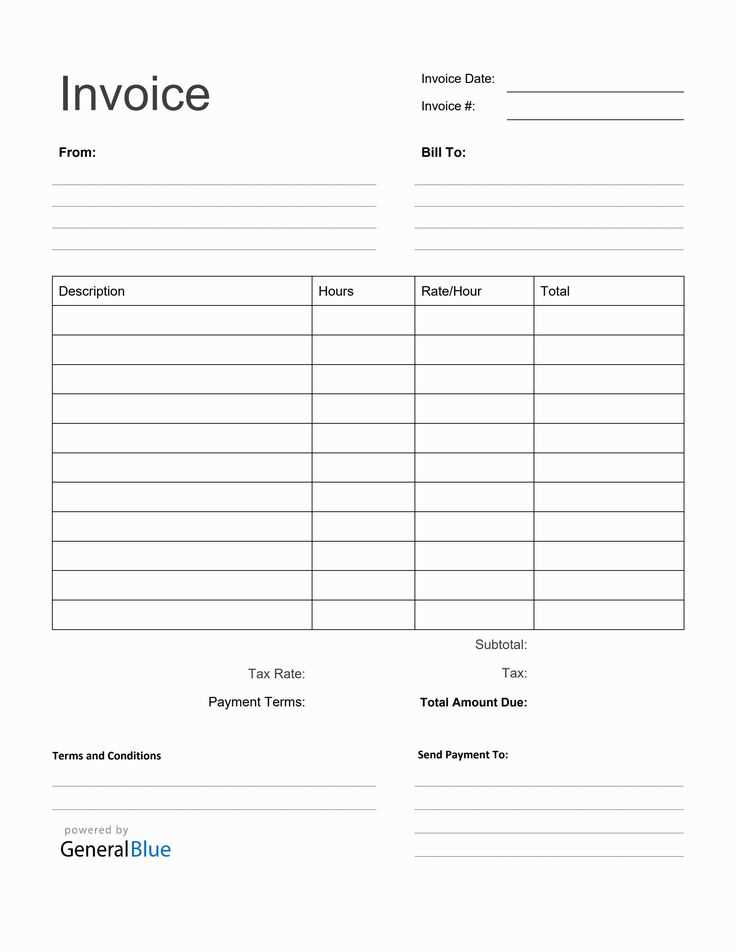

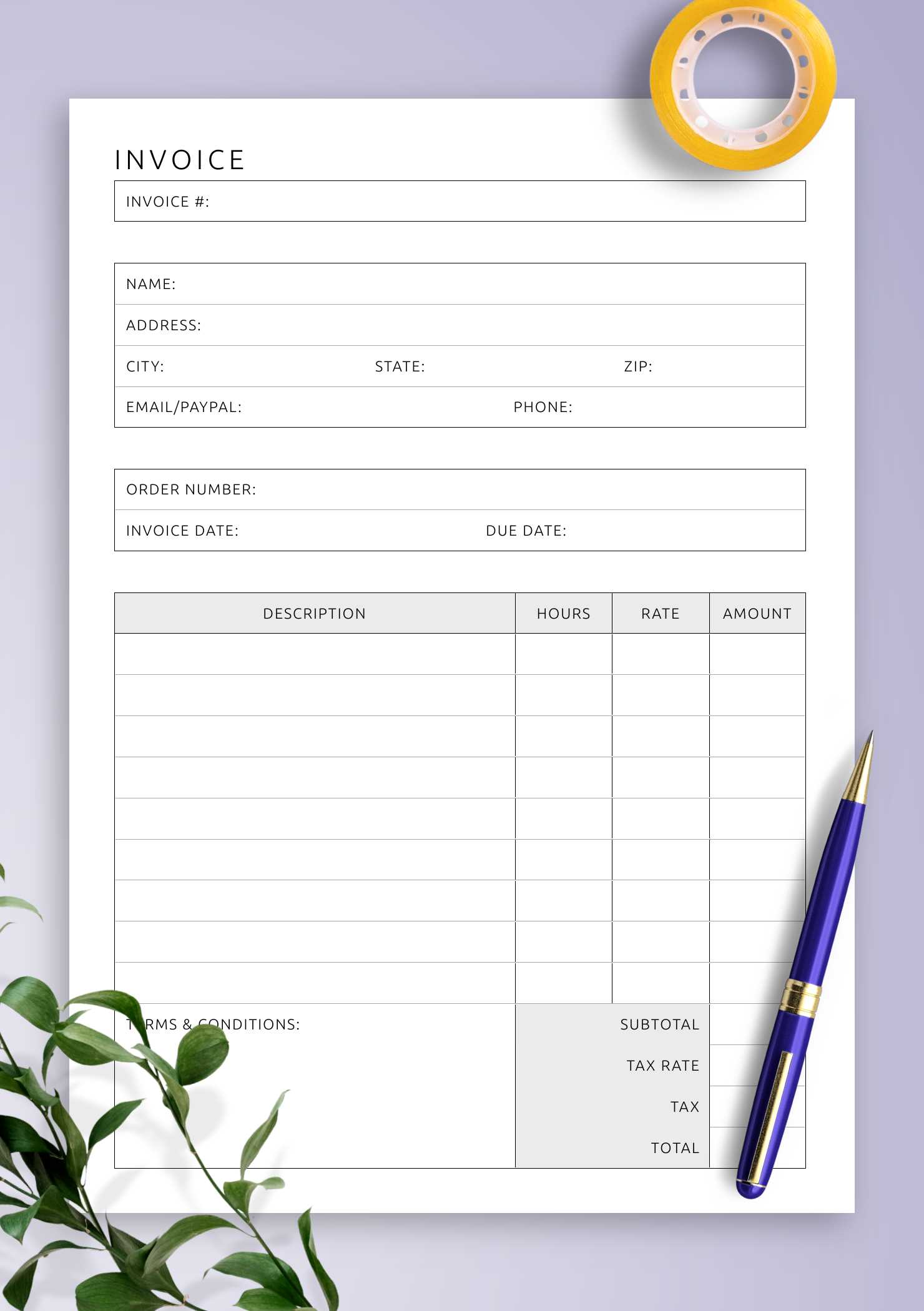

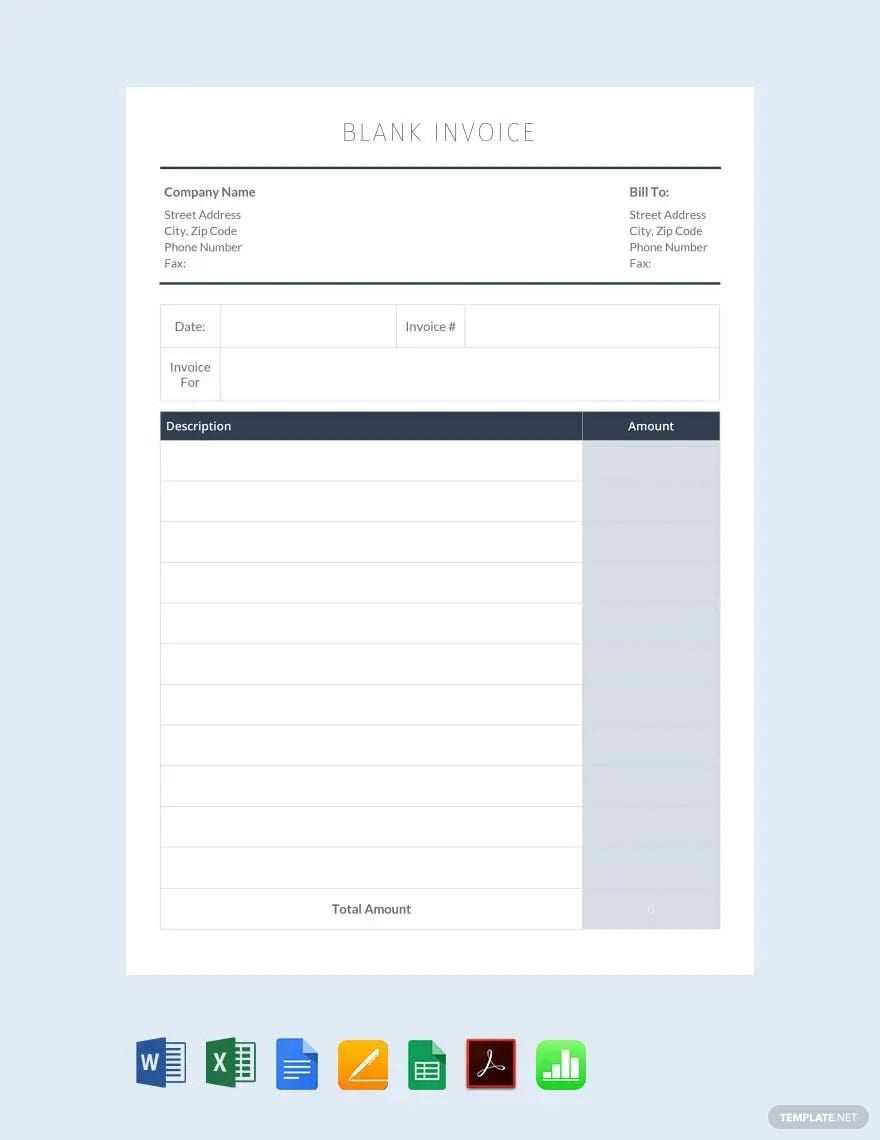

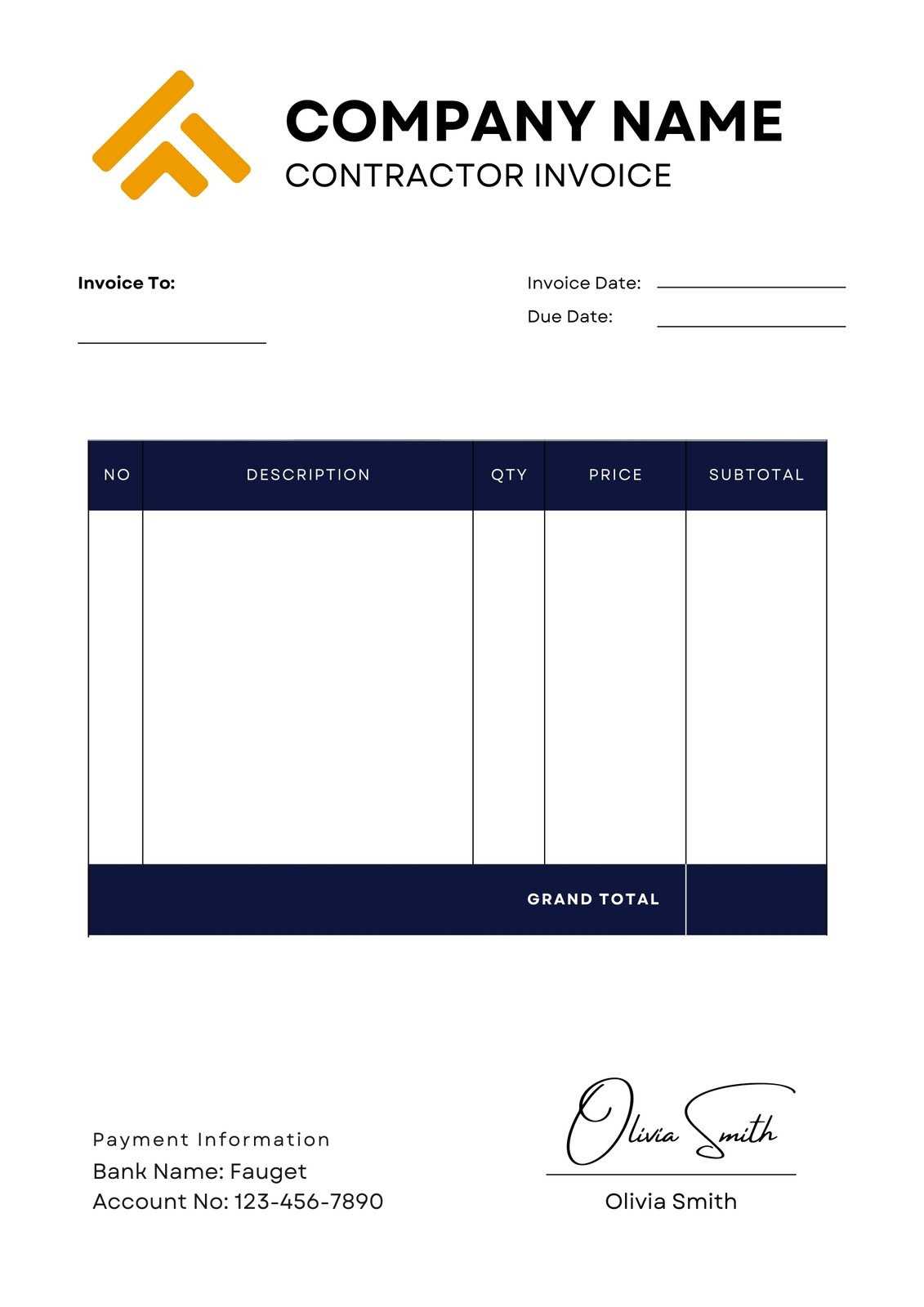

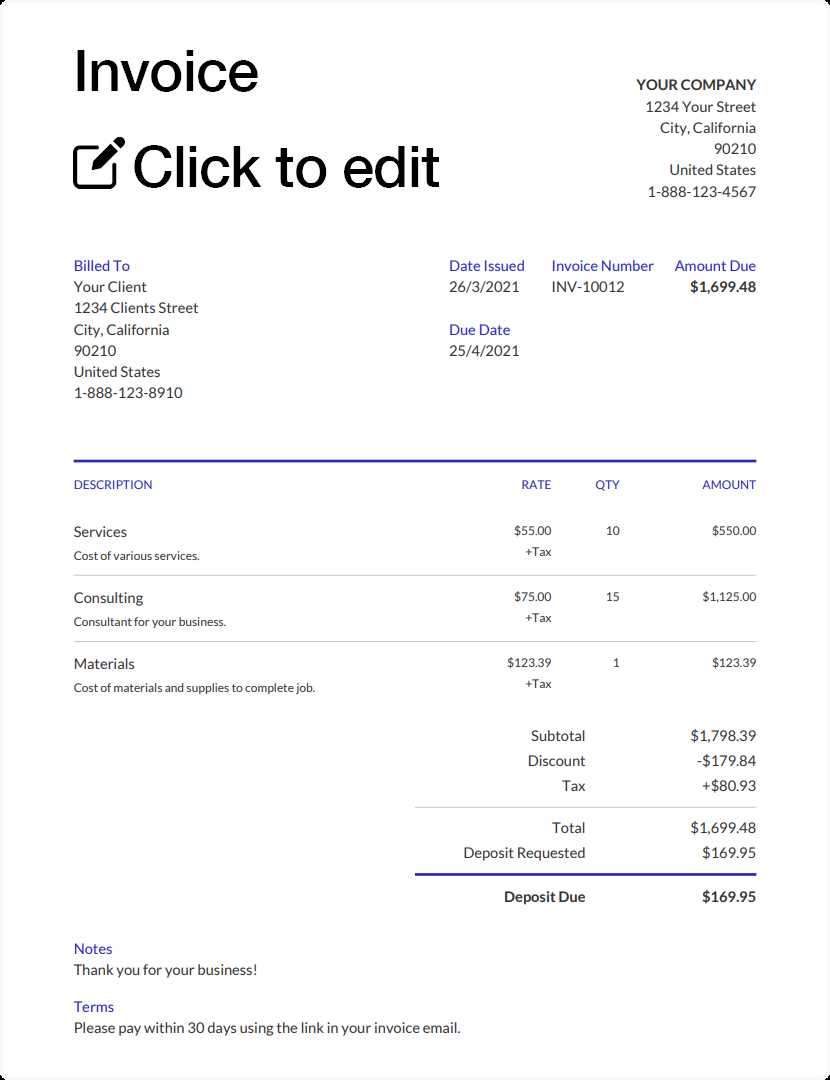

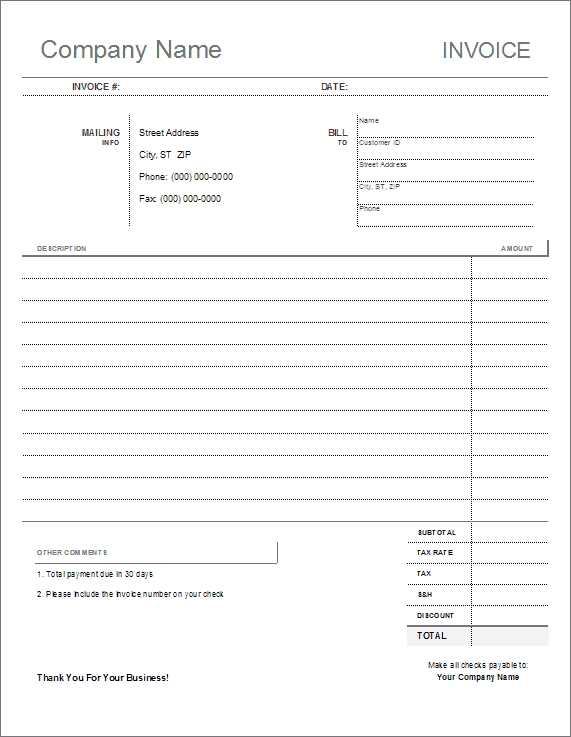

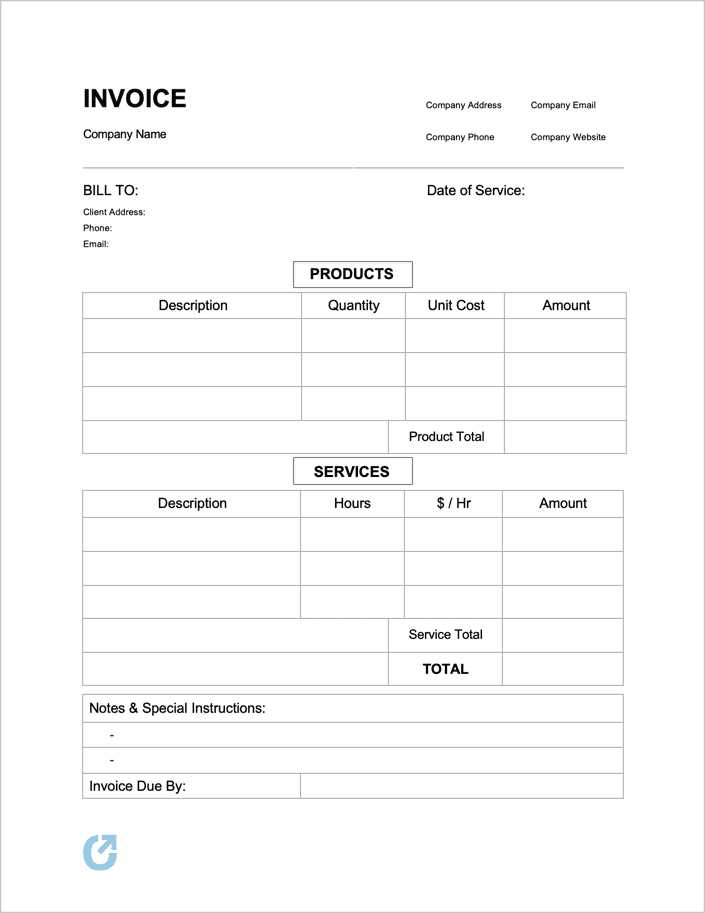

Simple and Professional Designs

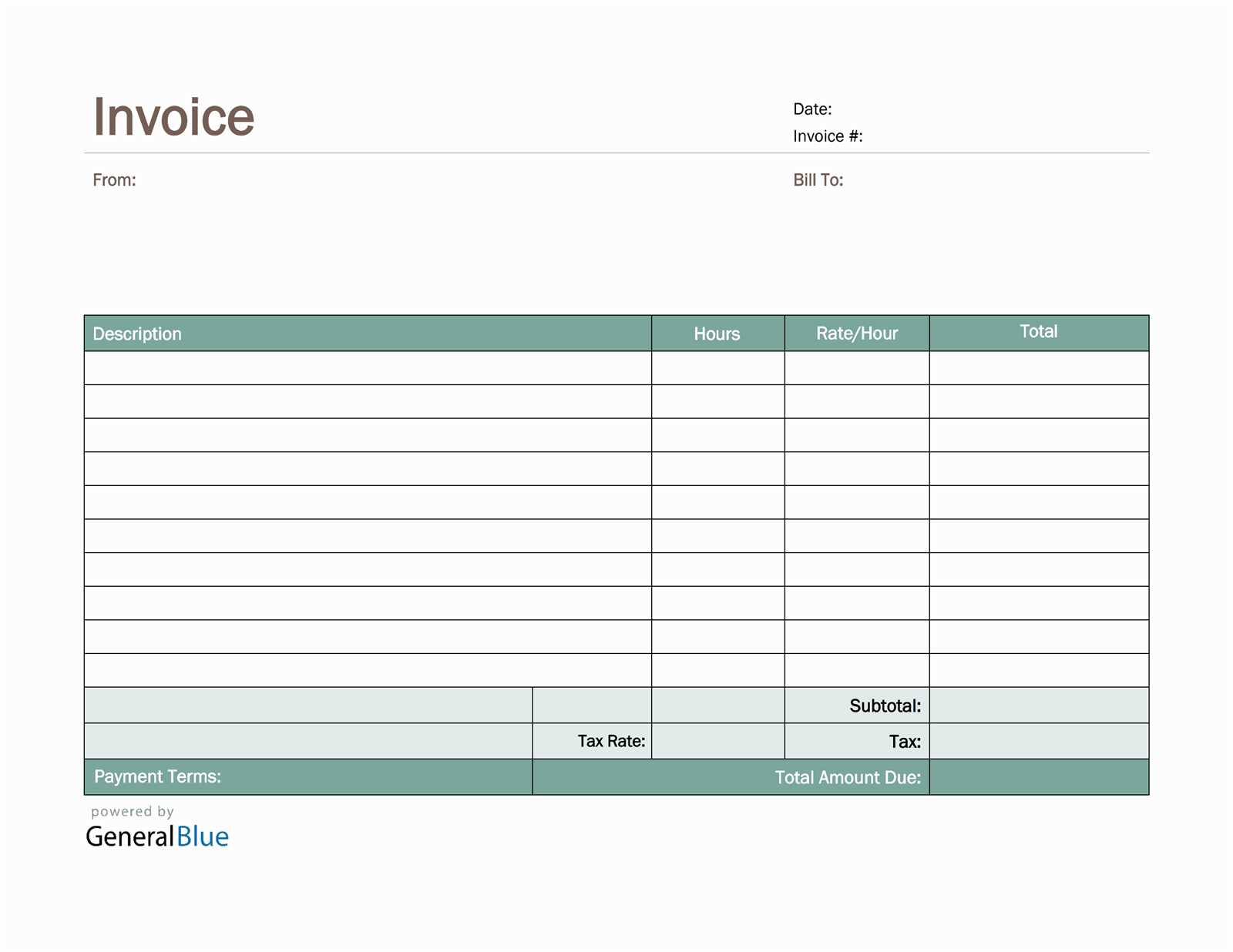

Some small businesses may prefer a clean and minimalist approach to their billing documents. These formats typically emphasize clarity, using straightforward layouts that include only the most essential details. Such designs are perfect for service-based businesses where the focus is on the amount due, the client’s contact information, and payment terms. The simplicity ensures that clients can quickly review the document and process the payment without distractions.

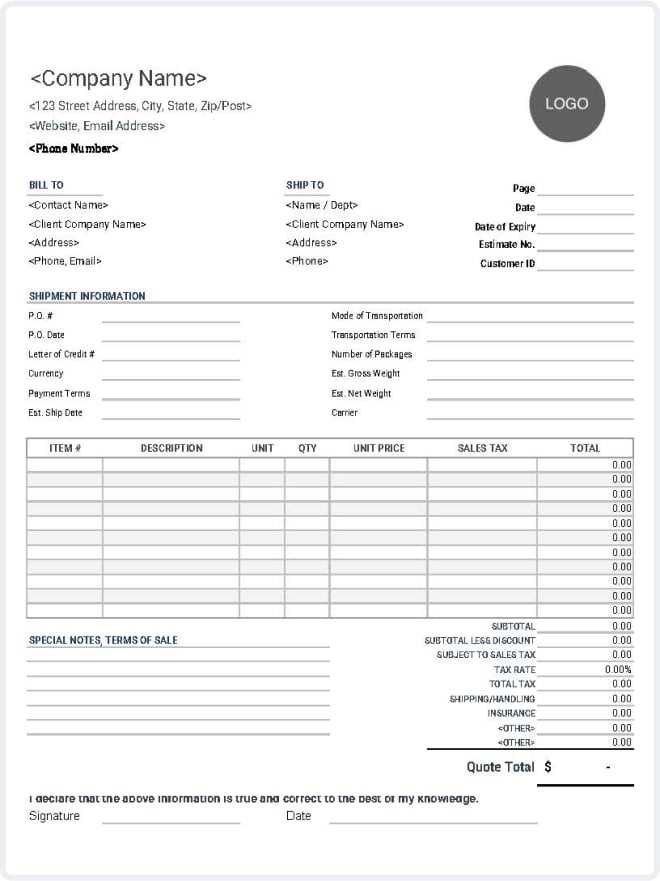

Feature-Rich Layouts for Complex Needs

Other businesses with more complex billing requirements may benefit from designs that include multiple fields for additional details, such as itemized lists, tax calculations, or discounts. These layouts allow business owners to customize the document to suit their industry and add special terms, like late fees or payment schedules. These feature-rich formats provide flexibility, ensuring that all the necessary information is included while keeping the document easy to read and understand.

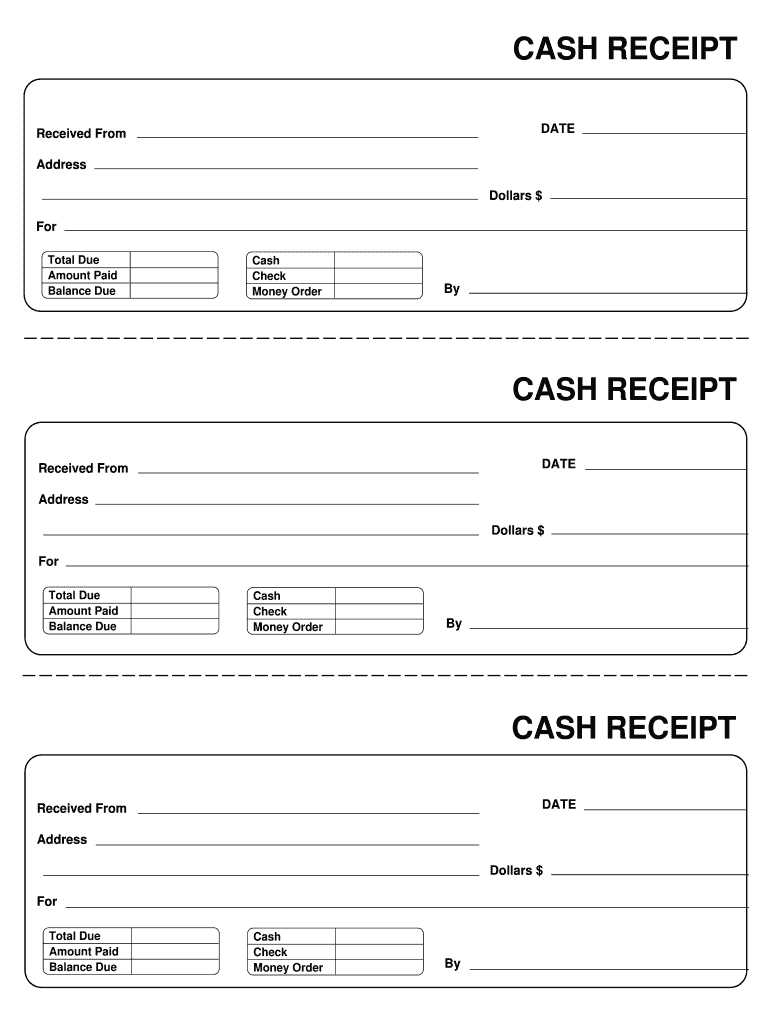

Simple Steps to Download a PDF Invoice

Downloading a well-designed billing document is a straightforward process that can save you a significant amount of time and effort. With just a few simple steps, you can have a professionally formatted file ready for customization and use. Whether you are working on a single transaction or managing multiple clients, this process allows you to quickly generate accurate documents with minimal hassle.

Steps to Download

- Choose the Right Format: Browse through available designs and select one that best fits your business needs and the nature of the transaction.

- Click the Download Link: Once you have selected a layout, locate the download button or link, typically displayed prominently on the page.

- Save to Your Device: After clicking the link, the file will automatically begin downloading to your computer or mobile device. Ensure you save it in a location you can easily access later.

- Open and Customize: Once the document is saved, open it with a suitable program and begin adding specific details, such as client information, services, amounts due, and any other necessary information.

Additional Tips

- Check for Compatibility: Ensure that the downloaded file is compatible with the software you intend to use for customization.

- Save a Copy: Always save a copy of the final document for your records after making the necessary changes.

- Secure the Document: To avoid accidental alterations, consider converting the final version to a read-only format once you’ve finished customizing it.

How to Create Your Own Invoice Template

Creating your own billing document can be a rewarding process, allowing you to tailor the format to meet the specific needs of your business. By designing a custom layout, you can ensure that all the necessary information is included and presented in a way that aligns with your branding. Whether you’re new to this or looking to update your current system, the process can be both simple and effective.

Step-by-Step Guide

The first step is to determine the key elements you want to include. Most billing documents should feature essential details such as:

- Client’s name and contact information

- List of products or services provided

- Price per unit and total amount due

- Payment terms and due date

- Your business details (name, address, logo)

Once you’ve outlined these elements, you can begin designing your layout. Choose a clear, easy-to-read format and arrange the sections logically. Ensure there is enough space between sections to avoid overcrowding the document, and make sure important information stands out, such as the total due amount and payment deadline.

Personalizing Your Document

After setting up the basic structure, consider adding your personal touch. Customize fonts, colors, and logos to match your company’s branding. This not only makes your documents look more professional but also reinforces your brand identity. Additionally, if your business requires specific information like tax rates or discount codes, include custom fields to accommodate these details.

Finally, save the design in an easily accessible format, ensuring that it’s ready to be used for future transactions. Regularly update your document if your business details or payment terms change to keep it accurate and relevant.

Legal Considerations When Using Invoices

When creating and using billing documents, it’s important to be aware of the legal requirements that apply to them. A well-structured document not only serves as a record of the transaction but can also protect both parties in case of disputes. Ensuring that your documents meet legal standards helps prevent misunderstandings and ensures compliance with local laws regarding business transactions.

Essential Legal Information

There are certain details that must be included in any billing document to make it legally binding. Depending on your location and the nature of your business, these requirements can vary, but some common elements include:

| Required Information | Description |

|---|---|

| Business Information | Include the name, address, and contact details of your business, as well as any relevant registration or tax identification numbers. |

| Client Details | Ensure that the client’s full name, address, and contact information are correctly listed. |

| Transaction Details | Provide a clear description of the goods or services provided, along with pricing, quantity, and total amounts. |

| Payment Terms | Clearly state the payment due date, any late fees, and acceptable payment methods. |

| Tax Information | Include applicable taxes, such as sales tax or VAT, and make sure to mention the tax rate if required by law. |

Keeping Records for Legal Protection

Maintaining accurate records of all transactions is critical for both financial and legal purposes. These documents may be required as evidence in case of audits, disputes, or legal claims. Be sure to store your billing documents securely, whether in physical or digital form, and retain them for the required period as per local regulations.

In addition to providing legal protection, well-maintained records can also help you avoid fines or penalties for non-compliance. It’s important to stay up to date with the relevant laws and adjust your document format accordingly to ensure that all necessary legal elements are included. This can help safeguard your business from potential issues down the road.

Common Mistakes in Invoice Creation

When creating billing documents, small errors can lead to significant issues, including delayed payments, misunderstandings with clients, or even legal complications. It’s important to avoid common mistakes to ensure that your records are clear, professional, and legally sound. Recognizing and addressing these mistakes before sending the document can save time and prevent costly revisions later.

Frequent Errors in Document Creation

- Missing or Incorrect Client Information: Failing to include accurate client details, such as the full name, address, or contact information, can lead to confusion or delays in payment.

- Incorrect Billing Details: Ensure the services or products provided are correctly listed, including accurate quantities and pricing. Mistakes in this area can result in clients being overcharged or undercharged.

- Omitting Payment Terms: Failing to clearly state payment due dates, late fees, and accepted payment methods can create confusion and lead to delayed payments.

- Not Including Tax Information: If applicable, make sure taxes are clearly stated, including the tax rate and the total amount charged. Incomplete tax details can lead to legal issues or confusion for both parties.

Other Pitfalls to Avoid

- Using Inconsistent Formats: Inconsistency in the layout and structure of your documents can make them difficult to read and unprofessional. Stick to a clear, organized format.

- Failing to Number Documents: Not assigning unique numbers to each document can lead to confusion in tracking payments and referencing past transactions.

- Not Saving or Storing Properly: Always save your completed documents securely, whether digitally or physically, to ensure they are easily accessible when needed.

By avoiding these common mistakes, you can create billing documents that are accurate, professional, and legally compliant, ensuring smoother business operations and better client relationships.

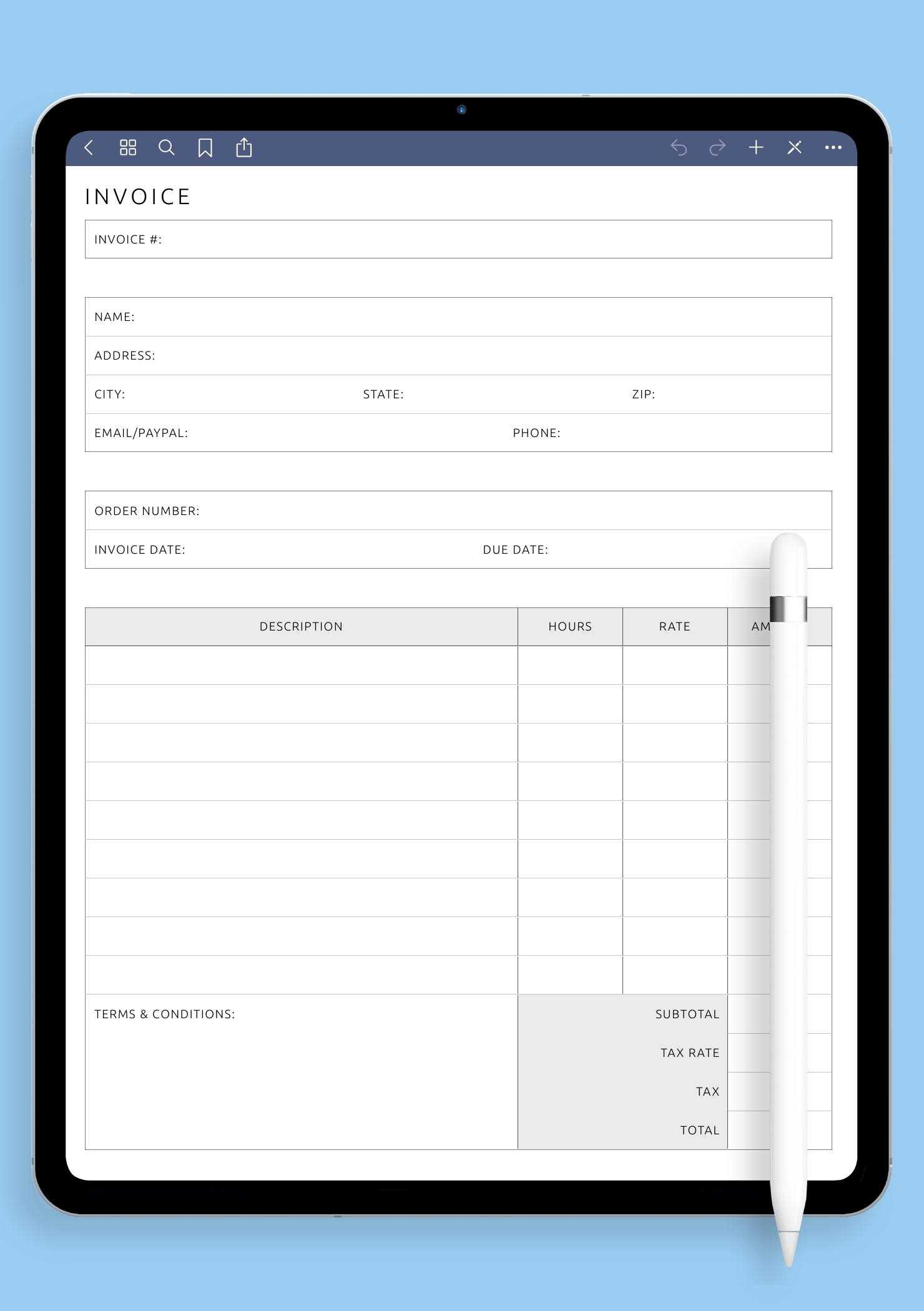

How to Format Your Invoice Properly

Formatting your billing document correctly is crucial for clarity and professionalism. A well-organized layout helps clients easily understand the charges and payment terms, which can lead to quicker payments and fewer misunderstandings. The key is to arrange all necessary details in a logical, easy-to-read manner while maintaining a clean and consistent design.

Here are some essential formatting tips to follow:

| Section | Description |

|---|---|

| Header | Include your business name, logo, and contact details at the top. It should be clear and easy for clients to identify your company. |

| Client Information | Below the header, provide your client’s name, address, and contact information. This helps to ensure the document is personalized and accurate. |

| Document Number | Assign a unique number to each document for easy tracking and reference. This is especially important for record-keeping and accounting purposes. |

| Date and Due Date | Clearly state the issue date and the payment due date. This sets clear expectations for when payment should be made. |

| Itemized List | Provide a detailed breakdown of goods or services, including descriptions, quantities, rates, and totals. This transparency helps avoid confusion. |

| Totals and Taxes | Ensure that subtotal, tax rates, and the total amount due are clearly listed. Separate tax amounts for clarity. |

| Payment Instructions | Include clear instructions on how to make the payment, including accepted methods (e.g., bank transfer, PayPal), and any late payment terms. |

By following these guidelines, you ensure that your billing documents are easy to read and professional, reducing the chances of errors and fostering better communication with your clients.

How to Ensure Accurate Billing

Ensuring that your billing documents are accurate is crucial for maintaining trust with your clients and keeping your business finances in order. Mistakes in billing can lead to delayed payments, confusion, and even legal issues. By taking a few essential steps and double-checking your details, you can minimize errors and ensure that your clients receive the correct charges every time.

Here are some key practices to follow for accurate billing:

| Best Practice | Description |

|---|---|

| Double-Check Client Information | Ensure that all client details–such as name, address, and contact information–are correct and up-to-date. Incorrect information can lead to delays in payments and miscommunication. |

| Verify Product or Service Descriptions | Be specific when listing the goods or services provided. Avoid vague descriptions, as this can lead to confusion. Double-check quantities, units, and pricing to ensure they reflect the actual transaction. |

| Accurate Tax Calculation | Make sure you apply the correct tax rates to the items listed. This is especially important if your business operates in multiple locations with varying tax rates. Always calculate taxes separately and clearly. |

| Track Payments and Adjustments | If a payment has already been made, or if there are any discounts or adjustments, update the document accordingly. Keep track of any credits or partial payments to prevent overcharging. |

| Review Payment Terms | Clearly outline payment terms, including due dates, accepted payment methods, and any late fees. Review this information before sending to avoid disputes over payment deadlines. |

By carefully following these practices, you can prevent costly mistakes and ensure that your billing documents reflect the true nature of the transaction. Regularly auditing your processes and reviewing details before sending documents will help maintain a professional and accurate approach to billing.

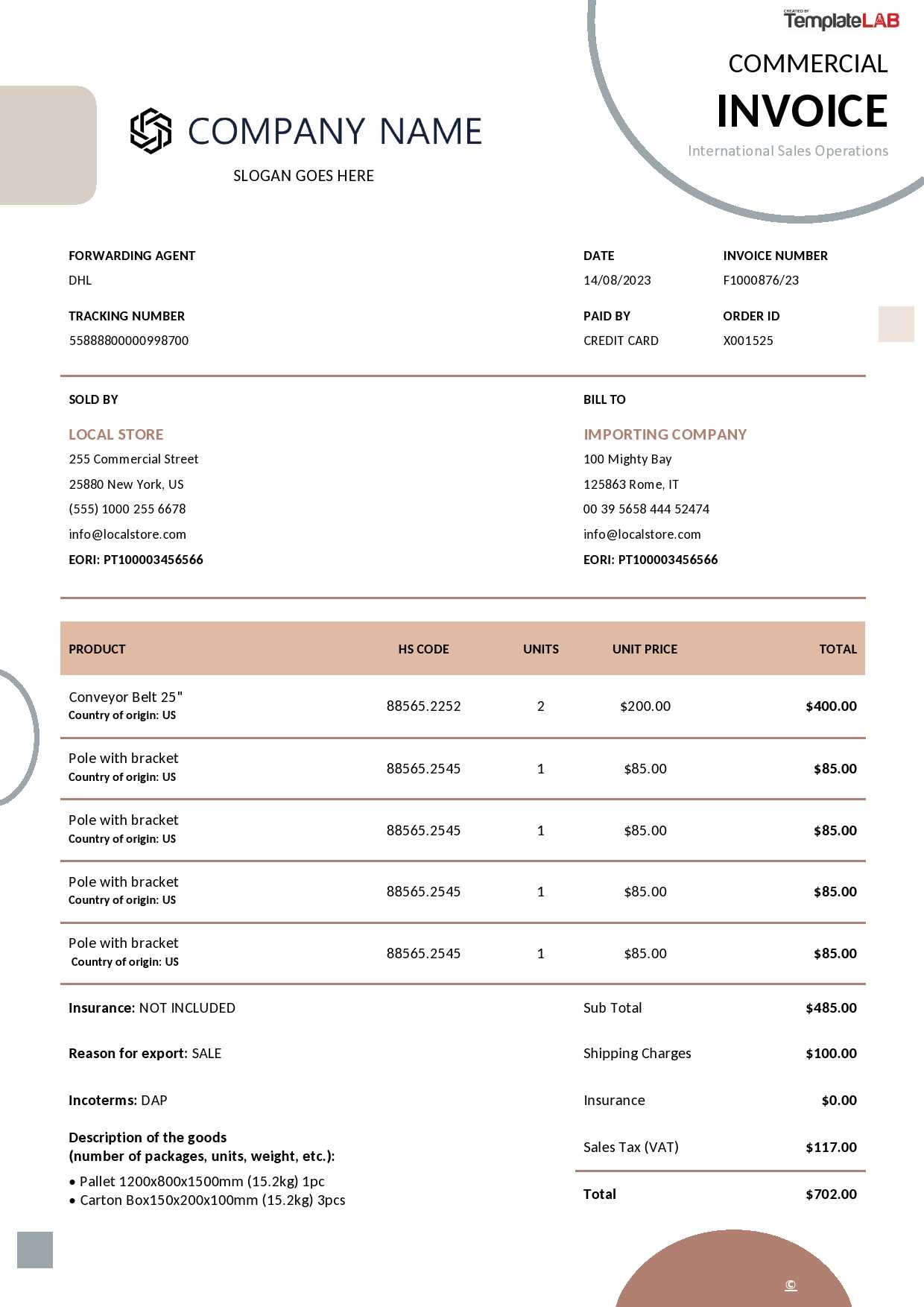

How to Add Branding to Your Invoice

Incorporating your brand identity into your billing documents not only enhances professionalism but also helps reinforce your company’s image. A branded document can make a lasting impression on clients, showing attention to detail and consistency across all business communications. By adding elements such as your logo, color scheme, and typography, you can create a visually cohesive and memorable experience for your clients.

Here are some effective ways to incorporate branding into your billing documents:

- Logo Placement: Place your company logo at the top of the document. This serves as the first point of recognition for clients and helps them identify your business at a glance.

- Consistent Color Scheme: Use your brand colors throughout the document. This includes headings, borders, and any call-to-action sections. Maintaining consistency in color helps strengthen your brand’s visual identity.

- Typography: Choose fonts that align with your brand style. Whether you prefer a professional serif font or a modern sans-serif, using consistent typography across your documents will contribute to a cohesive brand presentation.

- Business Tagline: If your company has a tagline or slogan, consider adding it to your billing document, either near your logo or in the footer. This further emphasizes your brand messaging.

- Contact Information: Display your business’s phone number, email, and website using your brand fonts and colors to create consistency and make it easy for clients to get in touch.

Adding these simple yet powerful branding elements to your documents not only strengthens your business’s identity but also elevates the overall client experience. A well-branded billing document is a reflection of the quality and professionalism your business provides.

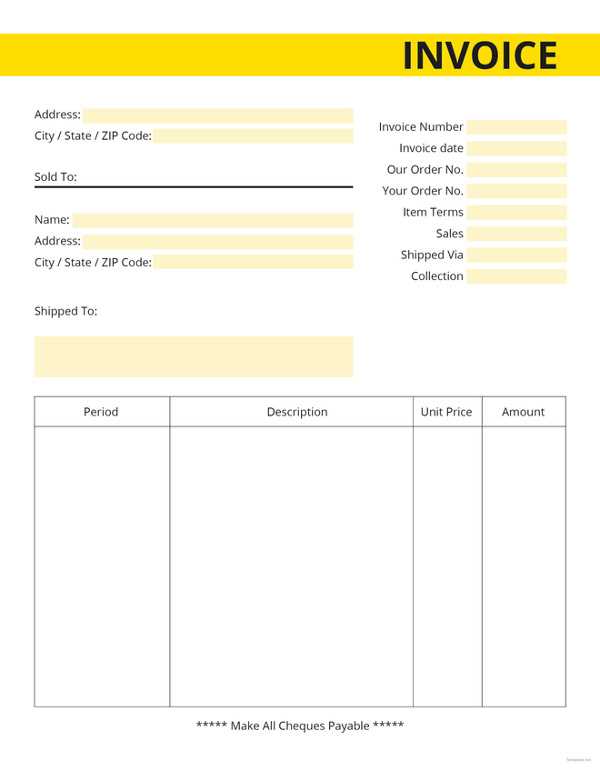

Invoice Templates for Different Industries

Every industry has unique requirements when it comes to billing documents. From the way services are described to the specific payment terms, tailoring your documents to suit the particular needs of your industry can make a significant difference in how your clients perceive your business. Whether you’re in construction, retail, consulting, or another sector, it’s important to customize your billing records to reflect the nature of your work and streamline the payment process.

Here are some examples of how billing records might differ across industries:

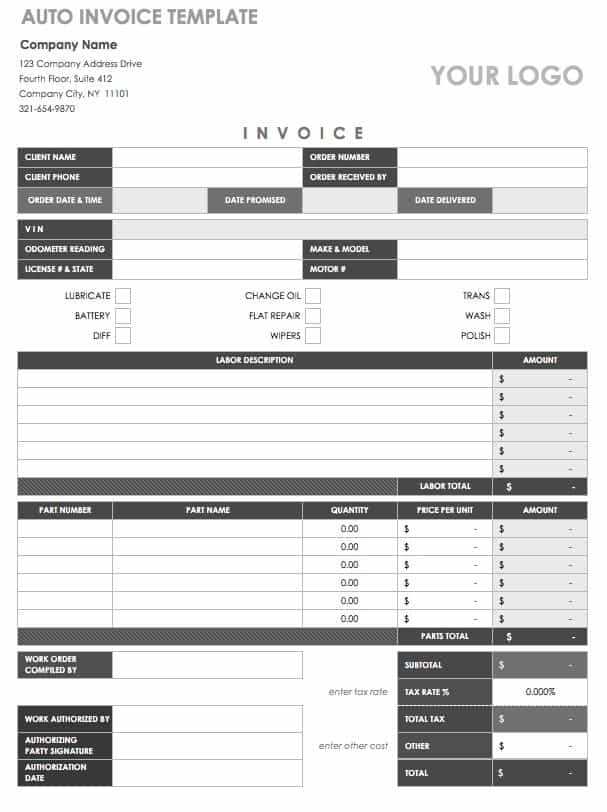

1. Construction and Contracting

In construction, detailed descriptions are key. Work is often billed in stages or based on specific milestones. Billing documents in this industry need to clearly list the type of work completed, hours worked, materials used, and any applicable permits or licenses. It is also common to include a section for change orders, which outline any modifications to the original agreement.

2. Retail and E-commerce

For businesses in retail or e-commerce, the billing document should include itemized lists of products, quantities, and unit prices. It’s also important to highlight shipping charges, taxes, and any applicable discounts. These documents should be easy for clients to quickly review, ensuring clarity around the items purchased and the final total due.

3. Consulting and Professional Services

Consulting businesses and other service providers often bill based on hourly rates or project-based fees. In these cases, it’s essential to provide a breakdown of the hours worked or the specific services rendered. Including a clear payment schedule and any terms for additional fees or late payment penalties is also vital in this industry.

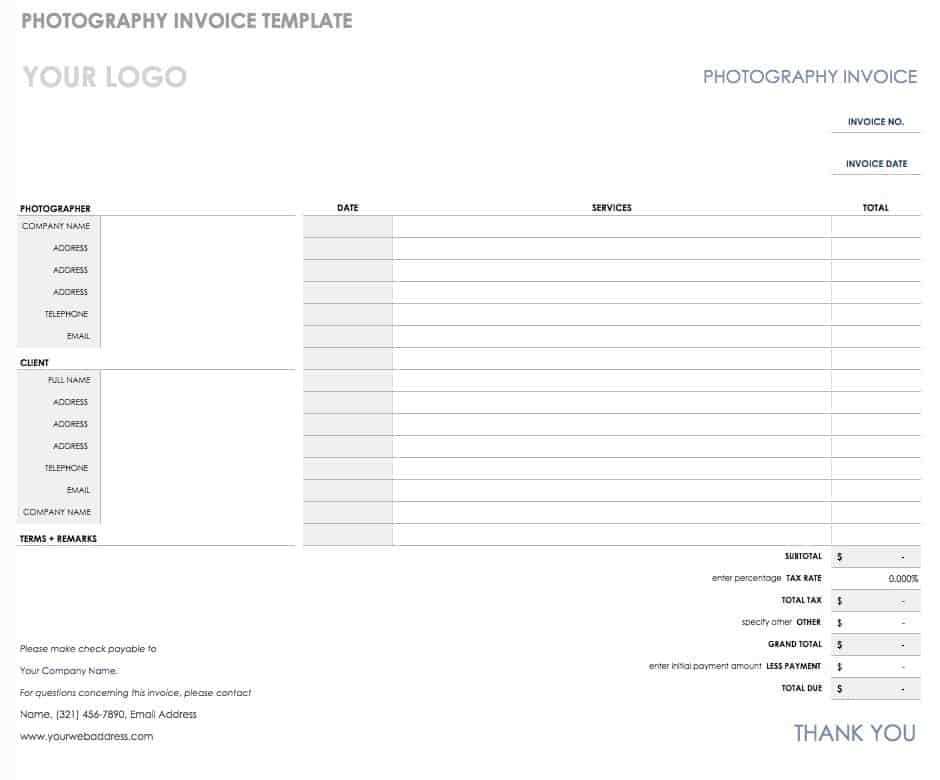

4. Creative Industries (Design, Photography, etc.)

For creatives, invoices may need to reflect both time and deliverables. This means that you should detail the specific work completed–whether it’s a logo design, photo shoot, or video editing–along with any milestones or drafts. Including usage rights, licensing details, and any other intellectual property considerations is also common in this field.

5. Healthcare and Medical Services

Healthcare providers need to include thorough descriptions of the services provided, including any consultations, treatments, or procedures performed. It’s important to include accurate billing codes, patient details, and insurance information if applicable. Medical bills may also need to be formatted in a way that complies with regulations like HIPAA in the United States.

By adapting your documents to the specific needs of your industry, you can enhance clarity, ensure compliance with industry regulations, and foster stronger relationships with your clients. Customization can streamline the payment process and reduce the likelihood of disputes or delays.

Where to Find Quality Free Templates

When looking to create professional and functional billing documents, finding high-quality resources is essential. While there are numerous options available online, it’s important to focus on platforms that offer reliable and customizable designs. Whether you are a freelancer, small business owner, or part of a larger company, there are many reputable sources where you can access well-designed documents to suit your needs.

Here are some great places to find quality resources:

1. Online Template Libraries

There are several websites that specialize in offering ready-to-use documents for a variety of business needs. Websites like Canva, Template.net, and Microsoft Office offer both free and premium resources. These platforms provide a wide range of customizable designs, from basic formats to more complex documents that align with specific industries.

2. Open Source Communities

Another great option for high-quality documents is open-source platforms. Websites like GitHub and OpenOffice allow users to download and modify templates created by other professionals. These resources are often free to use, and they can be customized to meet specific business requirements.

3. Business Software Providers

Many software tools offer templates as part of their free service or trial versions. For example, accounting software like Wave or Zoho often includes professional billing options that you can download and use. These are particularly useful if you need something that integrates with your business’s financial system.

4. Google Docs and Sheets

If you are looking for a simple and no-cost solution, Google Docs and Sheets provide several basic document templates that can be adapted for business purposes. With Google’s cloud-based tools, you can easily access, edit, and share your documents with clients from anywhere.

5. Graphic Design Platforms

Design-focused platforms like Crello and Visme also offer free customizable options for creating professional documents. While these platforms are typically used for graphic design, they allow for easy customization of business documents with personalized logos, colors, and layouts.

By exploring these sources,

How to Automate Invoice Creation

Automating the creation of billing documents can save significant time and reduce the risk of human error. With the right tools and strategies, you can streamline the entire process, from generating records to sending them to clients. By integrating automation, you can ensure consistent and accurate documents, while freeing up more time to focus on growing your business.

Here are some effective ways to automate the creation of your billing documents:

1. Use Accounting Software

One of the simplest ways to automate document creation is by using dedicated accounting software like QuickBooks, Xero, or FreshBooks. These platforms allow you to input client details, track products or services, and automatically generate billing records. They can also store recurring payment information, enabling the automatic creation of regular documents based on predefined schedules.

2. Integrate with Your CRM

Many businesses use a Customer Relationship Management (CRM) system to track client interactions and manage contact information. By integrating your CRM with billing software, you can automate the process of creating and sending records based on sales activities or contract terms. This eliminates manual data entry and ensures accuracy across all client communications.

3. Set Up Recurring Billing

If your business works with subscription-based services or ongoing contracts, recurring billing is an excellent way to automate document creation. Tools like Zoho Subscriptions and Recurly can automatically generate billing documents at regular intervals, ensuring consistency and timely payments without manual effort.

4. Automate Payment Reminders

Most automation tools allow you to set up payment reminders for clients. You can schedule email notifications to be sent before or after the due date, reducing the need for follow-up. This helps maintain cash flow by reminding clients of upcoming or overdue payments.

5. Use Zapier for Integration

If you want to connect different applications that don’t have built-in integrations, tools like Zapier can automate your workflow. For instance, you can create a “Zap” that automatically generates a billing document in Google Sheets or another platform whenever a sale is made in your e-commerce store or when a contract is signed.

By implementing these automation methods, you can save time and reduce the complexity of managing business finances. Automating document creation ensures consistency and accuracy, and with the right tools, you can optimize your

How to Store and Track Invoices Efficiently

Efficiently storing and tracking your business documents is crucial for maintaining organized financial records, ensuring smooth operations, and simplifying tax preparation. A systematic approach to managing these documents can help you stay on top of due payments, reduce the risk of errors, and improve cash flow management. Whether you are a small business owner or managing a larger enterprise, developing a solid process for document storage and tracking is essential.

Here are some strategies to help you manage your financial records more effectively:

1. Use Cloud Storage Solutions

One of the most convenient ways to store documents is by using cloud storage platforms such as Google Drive, Dropbox, or OneDrive. These services offer secure storage, easy access from anywhere, and automatic backups. You can create folders based on different categories such as client names, date ranges, or project types, making it easy to locate specific documents when needed.

2. Implement a Document Management System (DMS)

If your business requires a more advanced solution, consider using a document management system (DMS). Platforms like Zoho Docs and DocuSign provide tools for organizing, storing, and sharing documents securely. These systems allow you to track document history, control access, and add metadata, making it easier to categorize and retrieve your financial records when needed.

3. Maintain an Organized Folder Structure

For those who prefer using local storage or are managing smaller volumes of documents, maintaining a well-organized folder system on your computer or server can be effective. Create folders that are easy to navigate, such as by client, project, or year. This allows you to quickly find what you need without spending valuable time searching through disorganized files.

4. Track Payments with Financial Software

Using accounting or financial software such as QuickBooks, FreshBooks, or Xero can streamline both tracking and storage. These tools often come with built-in features that automatically track payments, send reminders for overdue amounts, and categorize transactions. This reduces the chance of lost or forgotten payments, and keeps all related data centralized in one system.

5. Automate Record Updates and Reminders

Set up automated reminders to keep track of important due dates, such as payment due dates or document review dates. Many accounting systems can automatically send notifications when payments are overdue, which helps you maintain an up-to-date record of outstanding balances. This helps prevent any lapses in tracking, especially for recurring payments or contracts.

By combining efficient storage techniques with tools for tracking, you can greatly improve your business’s financial organization. Whether you choose cloud-based solutions, local systems, or automated tracking software, the key is consistency and creating a process that fits yo