Free Printable Catering Invoice Template for Easy Customization

Managing payments for event-related services can often become a tedious task without the right tools. A well-structured document that helps track services provided and payments due is essential for staying organized and professional. This simple yet effective tool can save both time and effort, ensuring that transactions are smooth and clear.

Organizing business transactions is vital for maintaining healthy relationships with clients. By using a customizable document, you can outline the costs and details of the event, providing your clients with an easy-to-understand summary of what has been delivered. This allows both parties to have a clear understanding of the terms agreed upon.

In this guide, we will explore how to design and use such a document, focusing on efficiency, customization, and accuracy. Whether you’re starting a new venture or streamlining your current process, this tool will assist you in enhancing your financial management.

Why Use a Document for Billing Services

Utilizing a well-organized document for managing payments and services is essential for any event-based business. This structured approach ensures that all financial transactions are clear, precise, and professional. Without a proper tool, confusion can arise, leading to missed payments or misunderstandings with clients.

Here are some key reasons why having such a document is crucial:

- Professionalism: A detailed document reflects your commitment to maintaining clear and transparent business practices.

- Efficiency: Streamlining the billing process reduces time spent on manual calculations and minimizes errors.

- Organization: Keeping track of multiple clients and events becomes easier when you have a consistent format for billing.

- Customization: Tailoring the document to fit the specific needs of each client or event helps ensure that all required details are included.

- Legal Protection: A formal document serves as a record for both parties, protecting you in case of disputes or payment issues.

Incorporating this kind of document into your workflow can lead to smoother operations, ensuring that both you and your clients are satisfied with the financial aspects of your services.

How to Create a Billing Document

Designing an effective document for recording payment details involves more than just filling in numbers. It requires a structured approach that includes all necessary information to ensure clarity for both you and your clients. Creating such a document allows you to maintain a professional standard and avoid any confusion regarding services rendered and payment terms.

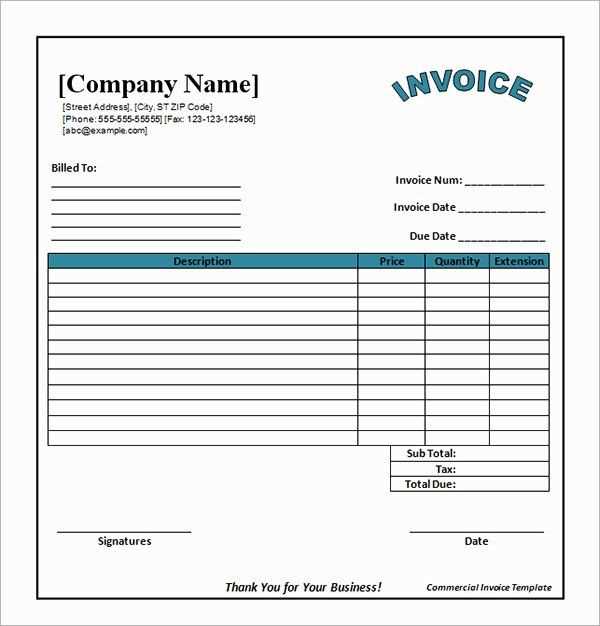

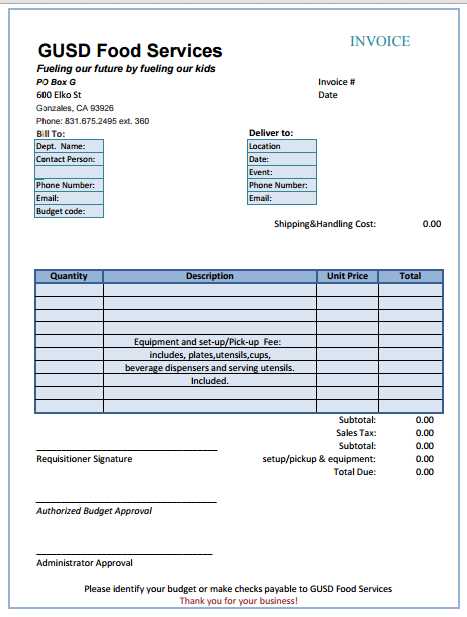

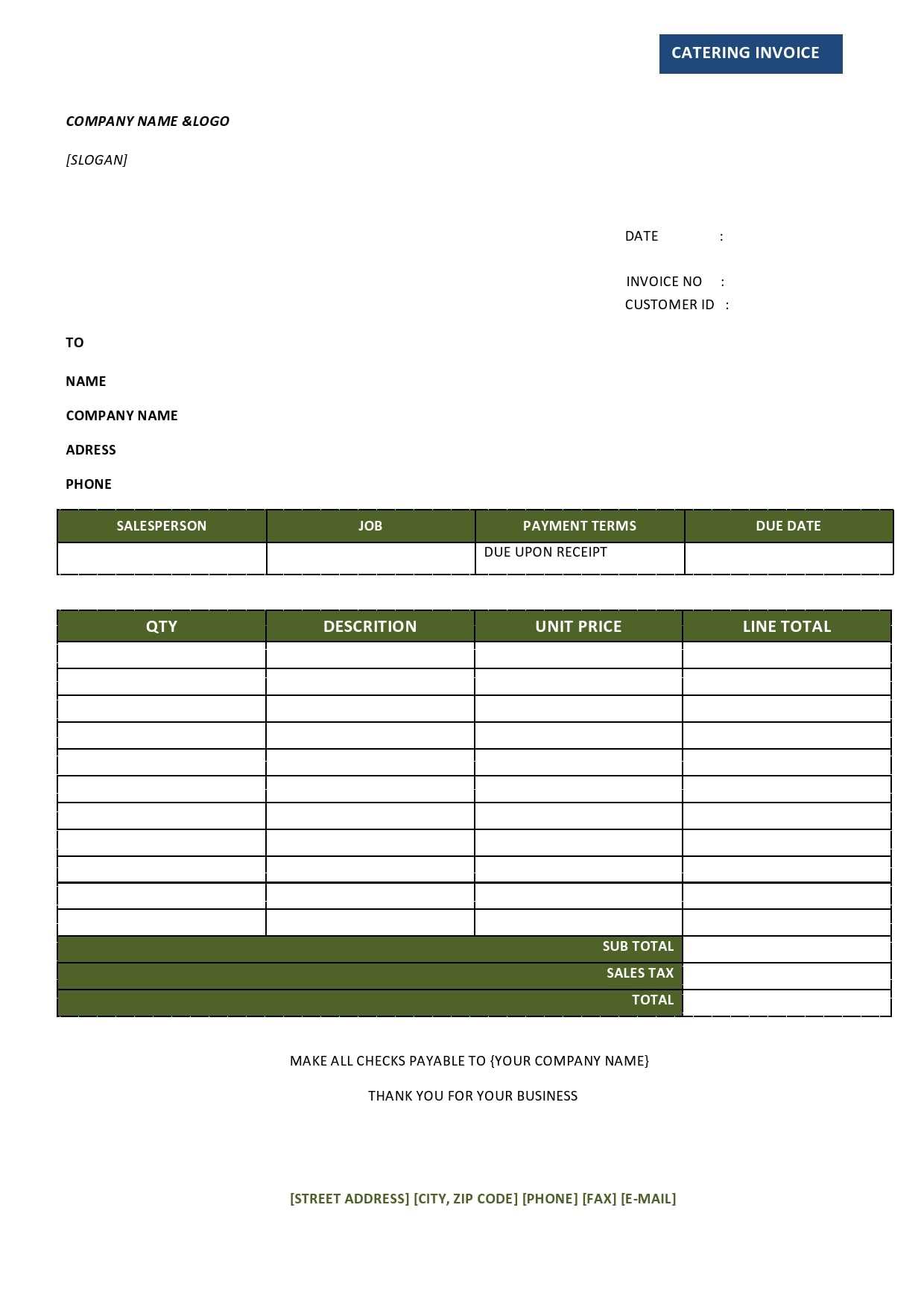

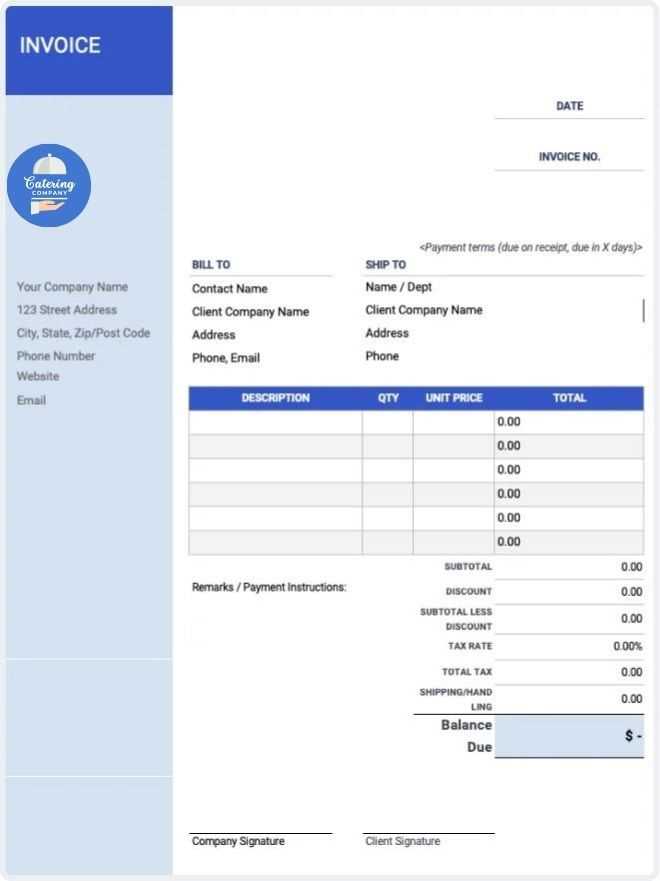

Key Elements to Include

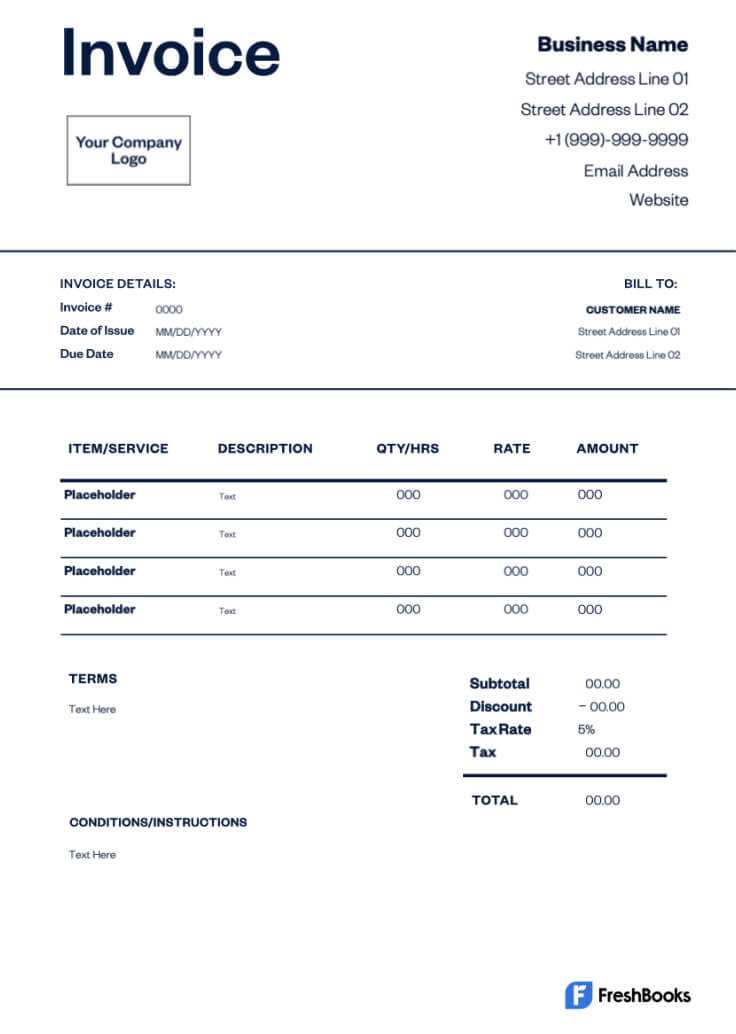

When designing a billing document, make sure to include the following essential details:

- Business Information: Include your company name, contact details, and logo if applicable.

- Client Information: Ensure that you have the correct name, address, and contact details for the client.

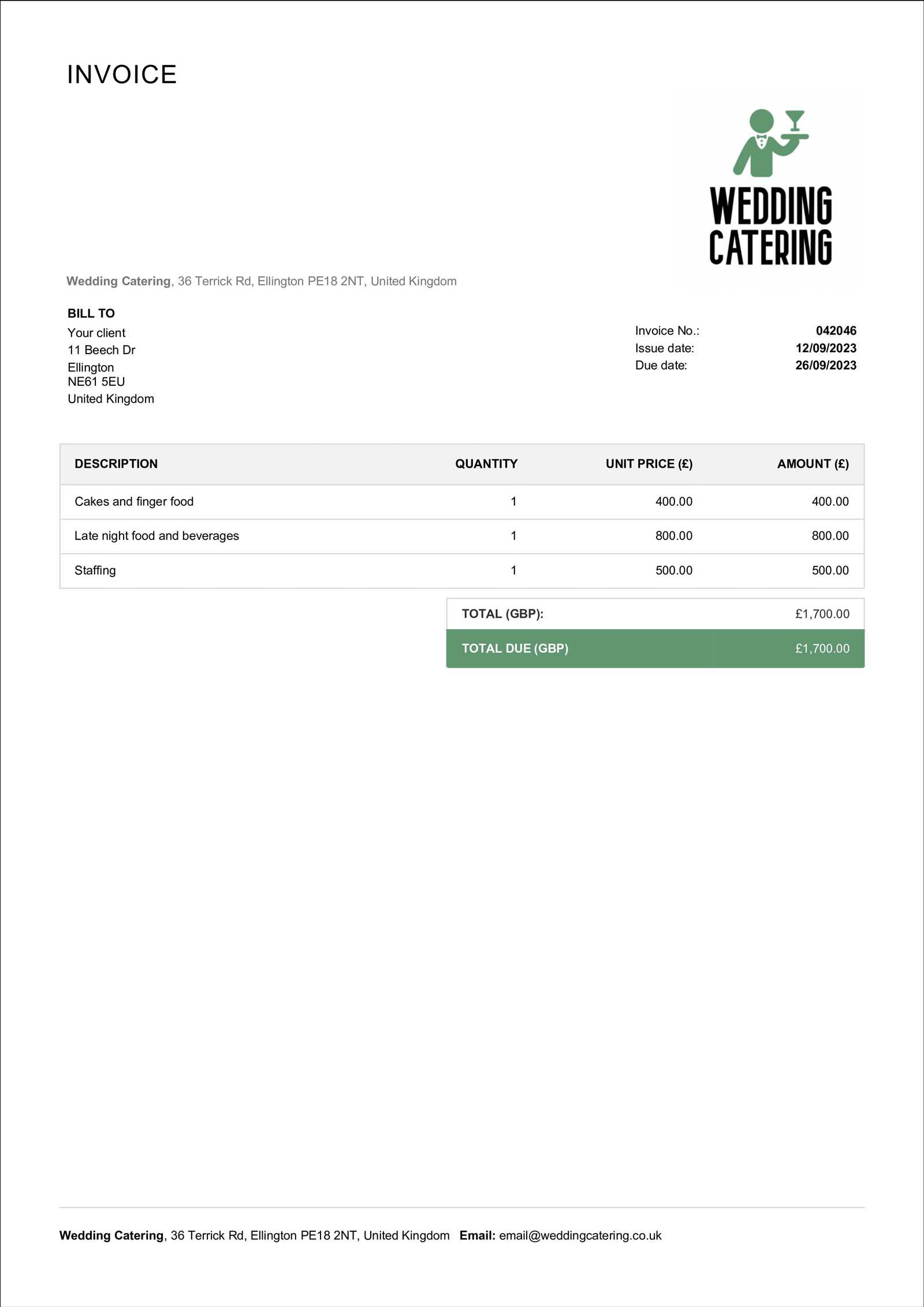

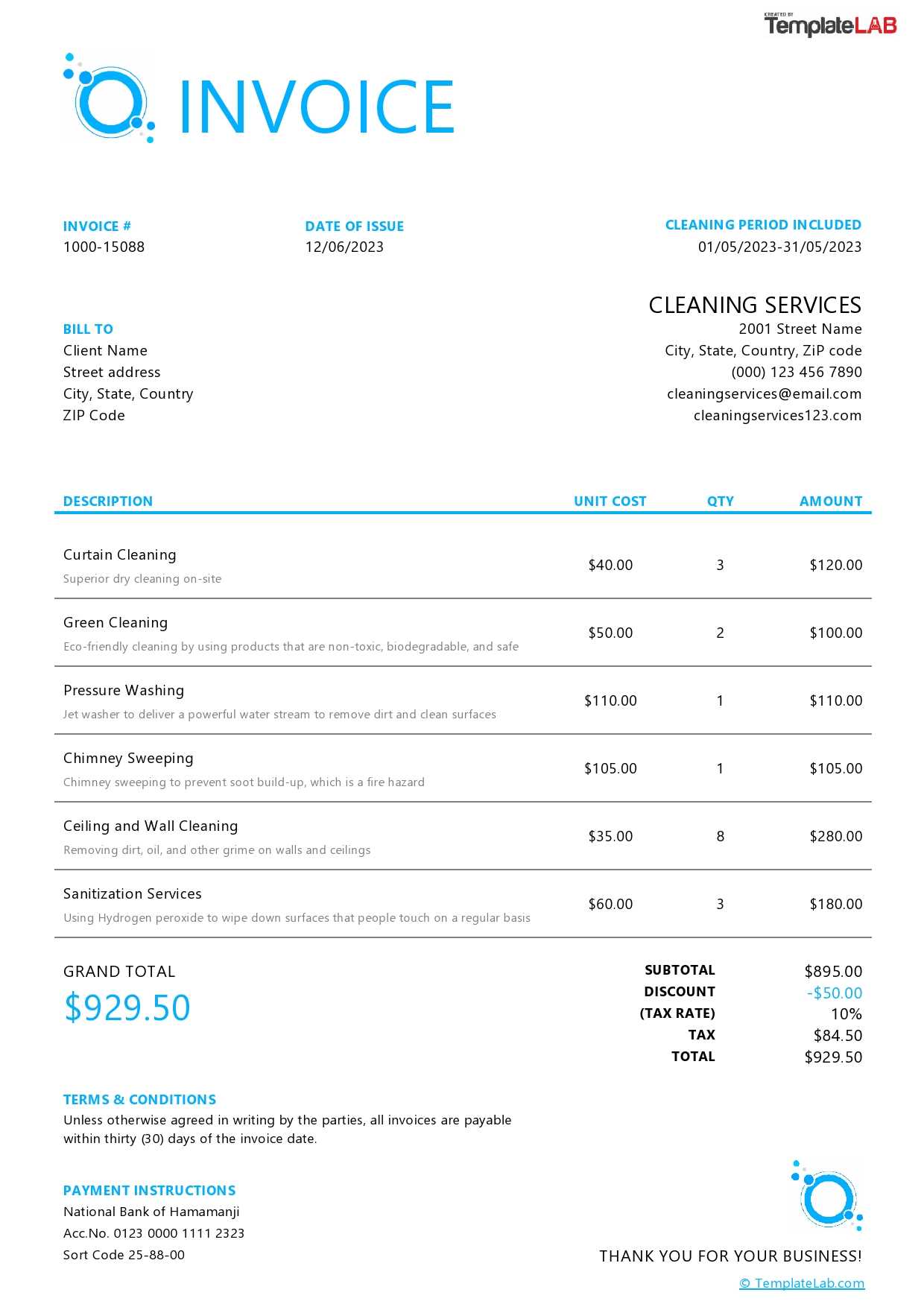

- Service Details: List all the services provided, including dates, quantities, and any relevant descriptions.

- Cost Breakdown: Clearly show the cost for each service or item provided.

- Payment Terms: Outline when payment is due and any penalties for late payments.

- Unique Identifier: Assign a reference number for easy tracking and future reference.

Steps to Follow

- Choose a layout that is easy to read and professionally organized.

- Start with the business and client details at the top for quick reference.

- Include a detailed description of the services provided along with the corresponding costs.

- Double-check all calculations for accuracy and ensure that the document is free of errors.

- Provide a space for payment confirmation or any additional notes related to the transaction.

By following these steps, you’ll be able to create a functional and professional document that clearly communicates the payment details to your clients, minimizing confusion and streamlining your business processes.

Benefits of Using Billing Documents

Having a well-structured document for recording payments offers numerous advantages for businesses. It not only simplifies the process of tracking transactions but also ensures that everything is clearly documented, which helps to avoid misunderstandings with clients. With this tool, businesses can maintain a professional image while ensuring accuracy in financial dealings.

The benefits of using such a document include:

| Benefit | Description |

|---|---|

| Time Efficiency | Automation of calculations and a standardized format reduces the time spent on each transaction. |

| Professional Appearance | Presenting a formal document reflects a high level of professionalism, improving client trust and satisfaction. |

| Clear Payment Records | Tracking payments becomes easier, ensuring that both parties are aware of amounts owed and paid. |

| Customization | Documents can be adjusted to fit specific needs, making it easier to include all necessary details for each client. |

| Legal Protection | By keeping detailed records, you protect yourself from potential disputes and ensure you have a reference for all transactions. |

By utilizing such a document, you enhance your financial management, ensuring smoother operations and more reliable client relationships.

Customizing Your Billing Document

Personalizing your payment record can significantly improve how you communicate with clients and present your business. Customizing this document allows you to reflect your brand, ensure all relevant details are included, and adapt it to the unique needs of each transaction. A well-tailored document can create a lasting impression and make the billing process smoother.

To customize your payment document effectively, consider the following aspects:

- Branding: Include your company logo, color scheme, and other visual elements that reflect your brand identity.

- Contact Information: Make sure your business contact details are clearly visible for any client inquiries or follow-ups.

- Service Breakdown: Adjust the layout to highlight specific services or products that were provided, with room for detailed descriptions.

- Additional Notes: Add a section for special terms, discounts, or custom agreements with the client.

- Payment Methods: Customize the payment options available for your clients, including bank details, online payment methods, or checks.

By adjusting these elements, you ensure that each document fits the needs of both your business and your clients, creating a more personalized experience and a smoother billing process.

Essential Elements of a Billing Document

Creating a comprehensive document for recording payments requires careful attention to detail. To ensure clarity and accuracy, it’s important to include key elements that outline the services provided, costs incurred, and payment terms. These components not only make the document professional but also help in avoiding confusion during the payment process.

Key Information to Include

The following elements are crucial in any payment document:

- Business Details: Include your company name, address, and contact information. This ensures the client knows how to reach you if necessary.

- Client Information: Clearly state the client’s name, address, and any other relevant contact details.

- Unique Reference Number: A unique number for each transaction makes it easier to track and reference past payments.

- Service Description: Provide a breakdown of the services or products offered, with clear dates and quantities.

- Cost Breakdown: Include the price for each service or item, along with any applicable taxes or discounts.

Additional Details for Clarity

- Payment Terms: State the expected due date and any late payment fees to ensure timely payment.

- Payment Methods: List the different payment options available to clients, such as bank transfers or online payment services.

- Special Instructions: Include any specific instructions or terms that are relevant to the current transaction.

By ensuring all these essential elements are present, you can create a well-rounded document that accurately reflects the services rendered and facilitates a smooth payment process for both you and your clients.

How to Edit Billing Documents

Customizing your payment documents is a straightforward process that ensures your records align with your business needs. Editing allows you to adjust the details, design, and format according to each transaction’s requirements. Whether you are working with a digital or physical version, understanding how to modify these documents helps to maintain consistency and professionalism in your financial dealings.

Here are the steps you can follow to edit these documents effectively:

- Choose the Right Software: Use word processors or spreadsheet programs like Microsoft Word, Google Docs, or Excel to easily edit your document.

- Adjust Business Information: Ensure that your business name, address, and contact details are up to date.

- Update Client Details: Make sure to add the correct client information, including their name, address, and contact details.

- Modify Service List: Edit the descriptions of the services or products provided, ensuring accuracy in quantities, dates, and costs.

- Change Pricing: Adjust the pricing fields, including taxes and discounts, to match the current transaction.

If you’re using a digital version, many programs allow you to save multiple versions for different clients, making it easy to edit and reuse the document when needed. After editing, save your document in a format that’s easy to share and print, such as PDF.

By following these steps, you can keep your documents up to date and tailored to your business’s needs, creating a smooth experience for both you and your clients.

Where to Find Free Billing Documents

When you need a ready-made document for recording payments, there are various platforms and resources where you can find well-designed options. These resources allow you to download and customize the documents to fit your business needs without the need to create one from scratch. Whether you’re a small business owner or a freelancer, these sources can save time and ensure consistency in your transactions.

Here are some places where you can find these documents:

- Online Document Libraries: Websites like Google Docs and Microsoft Office offer a range of templates that can be edited and customized to suit your business requirements.

- Accounting Software: Platforms such as QuickBooks and FreshBooks often provide built-in billing document creation tools, making it easy to generate and send professional records to clients.

- Freelance Platforms: Sites like Upwork and Fiverr offer downloadable document samples and sometimes even customizable versions for their users.

- Business Websites and Blogs: Many websites focused on business resources offer downloadable documents as part of their content, often with helpful guides on customization.

- Template Marketplaces: Websites like Template.net or Canva provide a variety of templates that can be tailored to your specific needs, from design to content.

By exploring these resources, you can find a document that suits your style and requirements, helping you to manage your business transactions more effectively and professionally.

Tips for Streamlining Your Billing Process

Making your payment process more efficient can save you both time and resources. By implementing a few strategic practices, you can simplify the way you manage transactions, ensuring faster payment cycles and fewer errors. Streamlining this process not only improves your cash flow but also enhances the professionalism of your business.

Organizing Your Payment Workflow

Here are some tips to help you optimize your billing system:

- Use Automated Tools: Leverage accounting software or digital tools to automatically generate, track, and send payment records, reducing manual effort and minimizing mistakes.

- Create a Consistent Format: Standardize the structure and design of your documents, making it easier for both you and your clients to read and understand the details quickly.

- Set Clear Payment Terms: Clearly communicate payment deadlines, methods, and late fees in your documents, so clients know exactly when and how to pay.

- Send Reminders: Set up reminders or automated follow-ups for clients who haven’t paid by the due date, reducing the need for constant manual tracking.

Optimizing Client Interaction

- Offer Multiple Payment Options: Provide clients with various ways to settle bills, such as bank transfers, online payments, or credit cards, for greater convenience.

- Organize Your Records: Keep detailed and organized records of every transaction to ensure smooth tracking and easy reference for future payments.

By adopting these tips, you can simplify the billing process, reduce administrative workload, and maintain better financial control in your business.

Free vs Paid Billing Documents

When choosing a format for your payment records, you often face the decision between using no-cost options or investing in premium versions. Each type has its own set of advantages and limitations, and understanding the differences can help you make the best choice for your business. While free resources are convenient and accessible, paid options often provide added features and greater customization, which can be crucial for businesses with specific needs.

Here’s a comparison of the key differences between no-cost and paid options:

Advantages of No-Cost Options

- Accessibility: Free documents are readily available online, requiring no investment, which is ideal for small businesses or startups with limited budgets.

- Basic Features: They often include all the essential elements you need for basic billing tasks, such as service descriptions, pricing, and payment terms.

- Simple Customization: Editing these documents is usually straightforward, allowing for minor adjustments to fit your business needs.

Advantages of Paid Options

- Advanced Features: Paid options typically offer extra tools, such as automated tax calculations, recurring billing, and detailed financial reporting.

- Better Customization: These documents can often be tailored to your brand’s specific style, with enhanced design options and more flexible formatting.

- Customer Support: With premium choices, you often have access to dedicated customer service for assistance with any issues or concerns.

While free options are sufficient for many, investing in a paid version might be worthwhile if you require more complex features or a professional touch for your records. Weighing the benefits of each can guide you toward the best choice based on your business’s scale and goals.

How to Save Time with Billing Documents

Efficiently managing payment records is essential for saving time and streamlining business processes. By adopting a few smart practices, you can minimize manual work, avoid errors, and focus more on growing your business. Automating and organizing the way you handle financial documents can help speed up transactions and ensure timely payments.

Automating Your Billing Process

- Use Digital Tools: Leverage software that can automatically generate and send payment records, reducing the need for manual input and increasing efficiency.

- Set Up Recurring Payments: For clients with regular payments, create recurring billing options that automatically send records at the designated intervals, saving you the time of creating them from scratch each time.

- Utilize Pre-built Formats: Take advantage of pre-designed documents that require minimal customization. These documents often contain most of the necessary fields, speeding up the process of generating records.

Organizing and Tracking Payments

- Track Payments Automatically: Use a tool that tracks payment status and sends reminders to clients who have overdue balances, reducing the need for follow-up communications.

- Store Records Digitally: Keep all documents in a digital format, organized by client or project, for quick access and to prevent wasting time searching for physical copies.

By integrating these time-saving practices, you can simplify the process of managing financial records and improve your overall efficiency, allowing you to focus on other important areas of your business.

Common Mistakes in Billing Documents

When managing payment records, it’s easy to overlook certain details that can lead to confusion or errors in the financial process. Common mistakes can cause delays in payments, misunderstandings with clients, or even legal issues. By being aware of these errors, you can ensure that your financial documents are clear, accurate, and professional.

Frequent Errors to Avoid

- Missing Client Information: Failing to include complete details, such as the client’s name, contact information, or billing address, can cause confusion or delays in payment processing.

- Incorrect Amounts: Simple arithmetic errors or incorrect pricing can lead to discrepancies. Always double-check calculations and ensure that all services are priced accurately.

- Omitting Terms and Conditions: Not clearly stating the payment terms, such as due dates or late fees, can result in delayed payments or disputes.

- Unclear Descriptions of Services: Vague or incomplete descriptions of what has been provided can leave clients unsure of what they are paying for, leading to potential disputes.

How to Prevent These Mistakes

- Review Each Document: Always take the time to proofread the document before sending it to ensure all details are correct.

- Use Automated Tools: Consider using software to generate documents automatically, reducing the chance of human error and ensuring consistency in formatting and calculations.

- Establish Clear Guidelines: Set up clear billing practices and ensure that everyone involved in creating the records follows the same guidelines, reducing the risk of errors.

By paying attention to these common mistakes and implementing strategies to prevent them, you can improve the accuracy and professionalism of your payment records, fostering better relationships with clients and ensuring smoother transactions.

Legal Requirements for Billing Documents

When creating financial records, it’s important to ensure that they meet the legal requirements set by local laws and regulations. Properly formatted payment documents not only help facilitate smoother business operations but also prevent legal complications. Understanding the necessary details that should be included in these documents can save time, money, and effort in the long run.

Key Legal Details to Include

- Business Identification: Every document must include the full legal name and contact information of your business, such as the business address, phone number, and email address.

- Client Information: It is essential to include accurate details about the client, including their name, address, and any other relevant contact information.

- Date and Reference Number: All documents should clearly state the date of issue and a unique reference number for tracking and reference purposes.

- Clear Payment Terms: The terms of payment, including due dates and any penalties for late payments, must be clearly outlined to avoid misunderstandings.

- Legal Tax Information: Depending on your location, you may be required to include tax identification numbers, the applicable tax rates, and the total amount of tax applied to the services provided.

Why Legal Compliance Matters

- Prevents Legal Issues: By following legal requirements, you protect your business from potential fines or disputes related to incomplete or non-compliant documents.

- Ensures Client Trust: Clients are more likely to trust your business when they receive official and legally sound documents, improving your professional reputation.

- Facilitates Tax Reporting: Having accurate and complete financial records makes it easier to report your earnings and taxes to authorities.

Ensuring your payment records comply with all necessary legal requirements not only enhances professionalism but also ensures the smooth and lawful operation of your business.

Incorporating Branding in Billing Documents

Incorporating your business’s identity into financial records can make a significant impact on how your clients perceive your company. It’s an opportunity to reinforce your brand’s professionalism and consistency across all forms of communication. A well-branded financial document reflects your business’s values and can leave a lasting impression on your customers.

Key Elements to Include for Branding

- Logo and Business Name: Your logo and the name of your business should be prominently displayed at the top of the document, making it instantly recognizable to your client.

- Consistent Font and Colors: Use the same fonts and colors as your website or marketing materials to maintain visual consistency. This helps build brand recognition over time.

- Tagline or Mission Statement: If appropriate, including a short tagline or mission statement can reinforce your business’s core values and purpose.

- Custom Headers and Footers: Including personalized headers or footers with your contact information, website, or social media profiles can help maintain consistency across all your business documents.

Benefits of Branding Financial Documents

- Professional Image: A branded document looks more polished and well-thought-out, which helps your business appear trustworthy and competent.

- Recognition and Trust: A branded document is easier for clients to recognize and may encourage prompt payments due to the professionalism it conveys.

- Marketing Opportunity: Every document you send out is an opportunity to subtly promote your brand, reminding clients of your business each time they see it.

By incorporating branding elements in your financial documents, you elevate the client experience and create a cohesive, professional image that supports long-term business success.

Choosing the Right Document Format for Your Needs

When selecting a suitable document format for your business transactions, it’s important to consider the specific requirements of your operations. The right choice can simplify your processes, enhance professionalism, and ensure clarity in your communications. Whether you are a small business or a larger enterprise, tailoring your financial documents to match the nature of your work will help streamline the payment process and create a positive impression on your clients.

To select the most fitting format, assess the complexity of your services, the level of detail required, and how you want to present your information. Some businesses may need basic layouts with essential information, while others might require more comprehensive documents that reflect their unique offerings and branding. By carefully evaluating your needs, you can select a design that supports both functionality and aesthetic appeal.

How to Track Payments for Services

Tracking payments efficiently is an essential part of managing any business, especially in service-based industries. By keeping a clear record of all transactions, you ensure that all amounts are properly accounted for, reducing the risk of missed payments and providing transparency for both your business and clients. With accurate tracking, businesses can manage their cash flow, keep financial records in order, and improve the overall client experience.

Methods of Payment Tracking

There are several methods to track payments, each suitable for different business sizes and needs. Below are a few common methods to consider:

- Manual recording: A simple method where payments are logged in a spreadsheet or physical ledger.

- Software tools: Accounting or invoicing software can automate the tracking process and generate reports.

- Bank account monitoring: Regularly checking bank transactions can help ensure payments are received and matched with client orders.

Using a Payment Tracking Table

A payment tracking table can help keep everything organized and easy to follow. The table should include the following details:

| Client Name | Service Date | Amount Due | Amount Paid | Payment Date | Balance Due |

|---|---|---|---|---|---|

| John Doe | 10/15/2024 | $500 | $500 | 10/18/2024 | $0 |

| Jane Smith | 10/20/2024 | $350 | $150 | 10/22/2024 | $200 |

Using this method allows you to clearly see who has paid, what is still owed, and when payments were made, ensuring that everything is in order. It’s important to update this table regularly to keep the records current and accurate.