Free Printable Business Invoice Template for Easy Use and Customization

Efficient financial management is essential for any organization, whether large or small. One of the most crucial tasks is preparing clear and accurate payment requests. A well-organized billing document not only ensures timely payments but also reflects professionalism in client relationships. Having the right tools can simplify the process and save valuable time.

Customizable solutions allow entrepreneurs and freelancers to design documents tailored to their needs. By choosing a format that aligns with their workflow, they can ensure that every detail, from payment terms to client information, is presented clearly. This approach also allows for flexibility when dealing with various services or products.

Efficient documentation streamlines the overall financial process, minimizes errors, and helps maintain consistency in transactions. Whether you’re just starting out or refining your accounting practices, creating well-structured billing forms is an important step toward professional growth and improved cash flow management.

Free Printable Invoice Templates for Businesses

Effective billing is a cornerstone of any company’s financial operations. Simplifying the process of creating payment documents allows companies to focus on growth while ensuring that transactions are transparent and professional. Having access to easily customizable forms can save valuable time and reduce errors when requesting payments from clients or customers.

Key Benefits of Using Pre-designed Billing Documents

- Time-saving: Ready-to-use formats eliminate the need to design new forms for every transaction.

- Professionalism: Customizable templates help ensure that every document looks polished and formal.

- Consistency: Templates guarantee uniformity across all financial documents, making it easier to track payments and keep records organized.

- Accuracy: Pre-made structures reduce the risk of missing critical details such as tax rates, due dates, or payment terms.

How to Choose the Right Billing Document Format

- Ensure the form includes all necessary fields, such as client information, a breakdown of services or products, and payment instructions.

- Select a design that reflects the tone and branding of your company, whether formal or casual.

- Check for compatibility with your existing accounting system, whether digital or manual, to make tracking easier.

- Consider the ability to edit or update the form in the future as your business grows and needs evolve.

By choosing the right structure, businesses can streamline their financial management, maintain clear communication with clients, and reduce administrative burdens. Ready-made billing forms are an essential tool for entrepreneurs and professionals aiming to manage payments efficiently and accurately.

Why Use a Printable Invoice Template

Creating consistent and accurate payment requests is a vital task for any organization, ensuring both professionalism and clarity in financial transactions. Having a structured format for these documents can greatly simplify the process, making it faster and more efficient while minimizing errors. By using a pre-designed structure, companies can maintain uniformity and reduce the time spent on manual document creation.

Here are a few key reasons why businesses choose to use pre-designed billing formats:

| Benefit | Description |

|---|---|

| Efficiency | Ready-made forms save time by eliminating the need to create new documents for each transaction. |

| Accuracy | Structured designs ensure that all necessary fields are included, reducing the risk of missing important details. |

| Professionalism | Using a formal format helps enhance your business image and ensures that clients view your communication as reliable and organized. |

| Consistency | Templates ensure that all documents follow the same layout, making it easier to track payments and manage financial records. |

| Flexibility | Customizable structures allow adjustments for different clients, services, or payment terms while keeping a consistent look. |

Overall, utilizing these ready-to-use formats not only improves the efficiency of daily operations but also enhances your company’s credibility in the eyes of clients, fostering better financial management practices.

How to Create Your Own Payment Request Document

Designing your own billing document allows you to tailor the structure to your specific needs, ensuring that all necessary information is included in a clear and professional manner. Whether you’re managing a small project or handling larger transactions, creating a custom payment form can simplify the process, reduce mistakes, and enhance communication with your clients.

Here are the key steps to follow when crafting your own payment request:

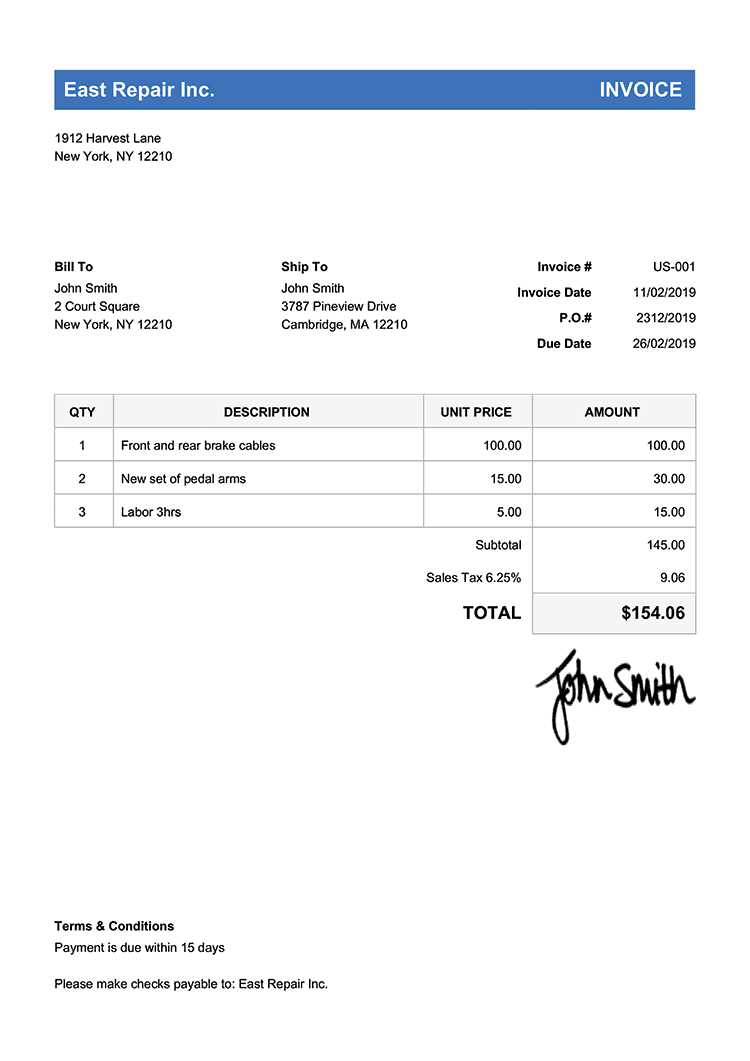

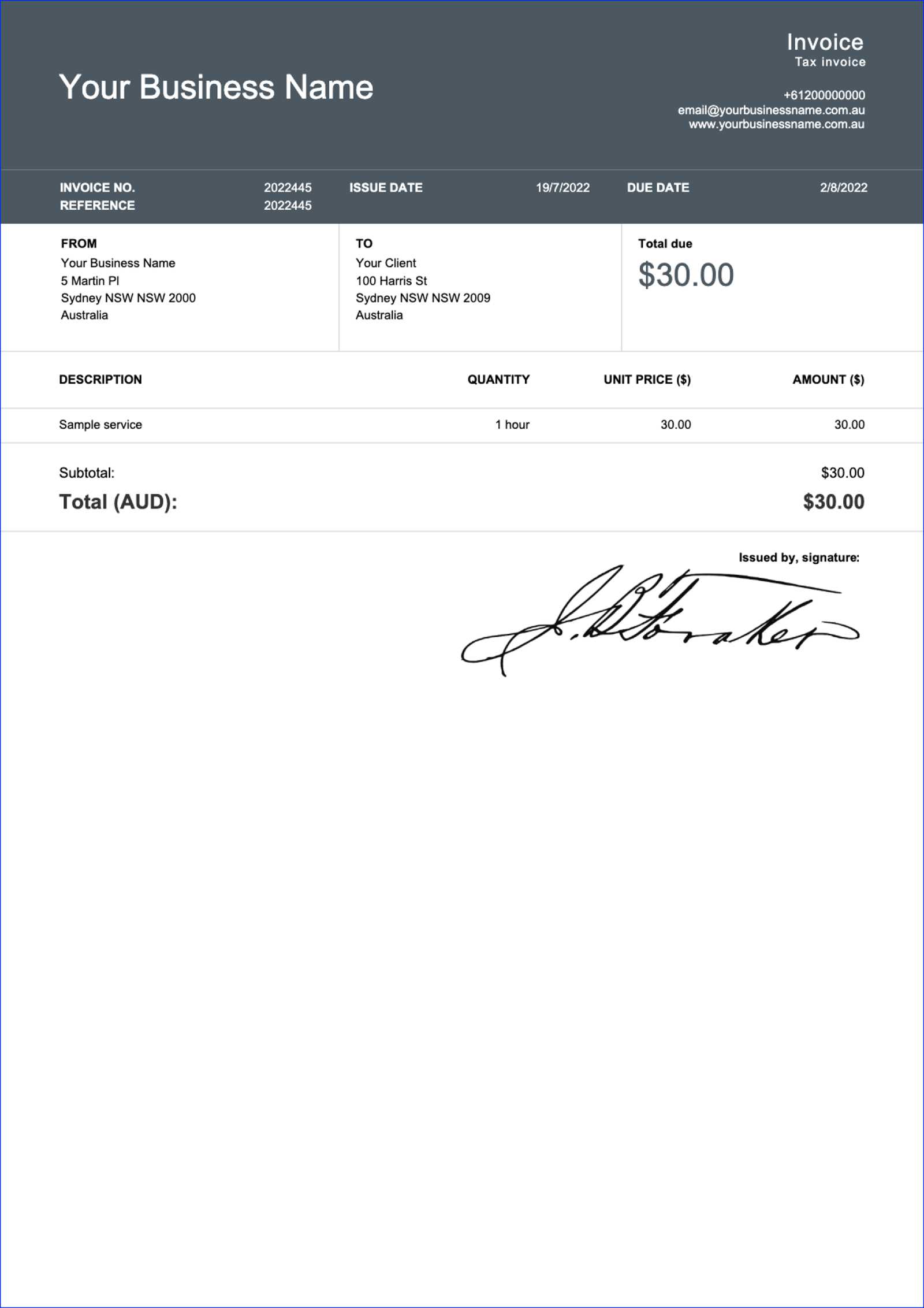

- Include Essential Information: Start with your contact details, the client’s contact details, a unique reference number, and the date of the request.

- Describe Products or Services: List the items or services provided, including quantities, rates, and any applicable taxes.

- Specify Payment Terms: Clearly outline the due date, payment methods, and any late fee policies to avoid confusion.

- Design for Clarity: Use a simple and organized layout, with enough space between sections for easy readability.

- Incorporate Branding: Add your logo, business name, and any colors or fonts that match your company’s visual identity.

By following these steps, you can create a functional and professional document that will help streamline your financial processes and ensure that your clients know exactly what they are being charged for and when payment is expected.

Benefits of Customizing Your Payment Request Form

Customizing your payment documents provides several advantages that can help streamline your operations and strengthen your relationship with clients. By adjusting the layout, details, and overall design, you can create a more tailored experience that aligns with your company’s specific needs and branding. This flexibility ensures that all relevant information is presented clearly and professionally, reducing confusion and improving communication.

Brand Identity: Customizing your forms allows you to incorporate your company’s logo, colors, and fonts, reinforcing your brand’s presence and making your documents instantly recognizable. This added professionalism enhances your reputation and builds trust with clients.

Personalization: Tailoring the content to reflect the nature of the service or product you’re offering allows for a more accurate and relevant presentation of the information. Whether it’s adjusting descriptions, payment terms, or even payment methods, a personalized approach helps ensure that nothing is overlooked.

Efficiency: By creating a custom layout that suits your workflow, you can minimize the time spent on repetitive tasks and avoid mistakes. Having a consistent structure means you can quickly generate documents for different clients, without worrying about formatting errors.

Flexibility in design also makes it easier to adapt as your business evolves. Whether you add new services, update payment options, or change terms, a personalized form can grow with your needs, ensuring it stays relevant over time.

Top Features of an Ideal Payment Request Document

An effective payment request form should be clear, comprehensive, and easy to use. The key is to provide all the necessary information in a well-organized and professional manner, ensuring that both you and your client have all the details required to process payments without confusion. The ideal structure not only facilitates accurate billing but also helps maintain a positive and professional relationship with clients.

Here are the essential features that make a payment request document stand out:

| Feature | Description |

|---|---|

| Clear Contact Information | Both the sender’s and recipient’s details should be easy to locate, ensuring smooth communication. |

| Unique Reference Number | A distinct number or code helps track each request, reducing confusion when managing multiple transactions. |

| Itemized Breakdown | Each product or service should be listed separately with its corresponding cost, quantity, and taxes, offering full transparency. |

| Payment Terms | Clear payment instructions, including due dates and acceptable payment methods, should be easy to find and understand. |

| Professional Design | The layout should be clean and visually appealing, making it easy for the client to read and interpret all the information. |

| Customization Options | The form should be flexible enough to accommodate changes in payment terms, services, or discounts as needed. |

With these features, a payment request form not only meets functional requirements but also enhances the professionalism and trustworthiness of your transactions. A well-designed document helps ensure that payments are processed smoothly and clients are satisfied with the experience.

Choosing the Right Format for Your Payment Request Document

Selecting the appropriate structure for your payment request is crucial for ensuring clarity and ease of use. The format you choose should suit both your workflow and the expectations of your clients. Whether you prefer a digital format or a physical document, the right choice can streamline your billing process, reduce errors, and promote professional communication.

Consider Your Client’s Needs

Different clients may have varying preferences when it comes to how they receive and process payment requests. For example, larger corporations may prefer digital files for easy integration into their accounting systems, while smaller clients may appreciate paper forms for simplicity. Understanding your client’s needs can help determine whether you should use a more formal or casual design, and whether a digital or paper format will be more convenient.

Choose Between Digital and Physical Formats

When deciding on a format, think about how you manage your documents. Digital formats allow for quick adjustments, easy sharing, and automatic tracking, while paper forms might be better suited for in-person transactions or those who prefer hard copies. The key is to pick a structure that is both efficient for your workflow and adaptable for your clients’ preferences.

How Payment Request Documents Improve Efficiency

Using well-structured payment forms can significantly enhance the efficiency of your financial processes. By streamlining the way transactions are recorded and communicated, these forms reduce manual effort and the likelihood of errors. With the right design, you can automate key tasks, such as calculation of totals or applying tax rates, saving valuable time and effort.

Time Savings: A pre-designed document structure allows for quick customization and minimizes the time spent on creating new forms from scratch. The ability to fill in fields and adjust details on a ready-made form speeds up the overall process, letting you focus on other important aspects of your work.

Accuracy: With a standardized format, critical information such as quantities, rates, and payment terms are consistently included. This consistency reduces the chances of missing key details or making manual calculation errors, ensuring that every transaction is processed accurately.

Improved Record Keeping: Using a uniform approach helps in tracking payments and managing records more effectively. By maintaining a consistent format, it’s easier to organize and retrieve past records, which makes audits or financial reviews faster and less cumbersome.

Incorporating these efficient practices into your routine helps you stay organized, saves time, and ensures that your financial transactions are clear and reliable for both you and your clients.

Steps to Customize Your Payment Request Document

Customizing a standard payment request form allows you to tailor it to your specific needs, ensuring it meets your business requirements and reflects your professional style. Whether you’re a freelancer, a small business owner, or part of a larger organization, creating a personalized document can improve your workflow and ensure that all important information is included. Here’s how to effectively customize your form.

1. Include Essential Contact Information

The first step in personalizing your form is to include your company

Best Practices for Professional Billing

For any organization, creating clear and professional payment requests is essential to maintaining a positive relationship with clients and ensuring timely payments. Properly formatted and well-structured documents reduce confusion and prevent delays, making the entire financial process smoother for both parties. By following a few key guidelines, you can elevate your billing process and present your business in the best light possible.

1. Be Clear and Detailed: Always provide a thorough breakdown of the services or products provided, along with the quantities, rates, and taxes applied. This transparency helps clients understand exactly what they are being charged for and prevents disputes over the charges.

2. Include All Relevant Information: Ensure that all necessary details are included, such as your company’s name, contact information, the client’s details, and a unique reference number for tracking. These elements help both you and your client keep records straight and organized.

3. Set Clear Payment Terms: Always include explicit terms for payment, including the due date, accepted methods, and any penalties for late payments. This clarity helps clients know exactly when and how to pay, reducing the chances of late or missed payments.

4. Maintain Professional Design: Your billing document should look polished and easy to navigate. Choose a clean, organized layout with a logical flow, and ensure that the font and color choices align with your brand’s image. A well-designed document reflects your company’s professionalism and instills confidence in your clients.

5. Send Invoices Promptly: Send your payment request as soon as the service or product is delivered. Delaying the submission can lead to delayed payments and can create confusion about when the payment is actually due. Timely invoicing demonstrates reliability and efficiency.

By incorporating these best practices into your billing process, you can streamline financial transactions, reduce errors, and build stronger, more trusting relationships with clients. A professional approach to billing not only ensures prompt payment but also reinforces your reputation as a competent and reliable service provider.

How to Ensure Your Payment Request Is Legally Compliant

When creating a document for requesting payment, it’s crucial to ensure that it meets legal standards and includes all the necessary details to comply with regulations in your region. Failure to include required information or misinterpreting local laws can result in legal issues, disputes, or delayed payments. By understanding the essential elements of a compliant document, you can avoid these complications and protect your business interests.

Here are key elements to include in your payment document to ensure compliance with legal requirements:

| Required Element | Description |

|---|---|

| Legal Entity Information | Ensure your legal business name, registration number, and tax identification number are clearly visible. This confirms the authenticity of your business. |

| Client Details | Provide the client’s name, address, and contact details. This ensures that both parties have the correct information for reference and communication. |

| Service Description | Clearly describe the goods or services provided, including quantities, rates, and dates. This level of detail helps avoid disputes over what is being charged. |

| Tax Information | In many jurisdictions, tax rates (e.g., VAT) must be listed on the document. Be sure to include the appropriate tax amount and specify the rate applied to each item or service. |

| Payment Terms | Include clear payment terms, including due dates, payment methods, and penalties for late payment, as these may vary by jurisdiction. |

| Legal Disclaimers | Some regions require specific legal disclaimers or notes, such as a clause about late payment fees, refunds, or warranty terms. |

Ensuring these elements are included will help you stay compliant with legal requirements and avoid any potential issues that could arise from improper documentation. Staying informed about local tax laws, business registration rules, and client agreements is essential to maintaining a professional and legally compliant approach to financial transactions.

Free Payment Request Documents for Small Businesses

For small enterprises, managing finances efficiently is essential, and having the right tools can make a significant difference. Ready-made forms can simplify the process of requesting payments from clients while maintaining professionalism and organization. These forms are designed to be easy to use, customizable, and cost-effective, making them an excellent solution for small-scale operations looking to streamline their financial workflows.

Benefits of Using Ready-Made Payment Request Forms

- Time-Saving: Instead of creating a new document from scratch for every transaction, small business owners can use pre-structured forms, filling in only the necessary details.

- Consistency: These forms ensure that every payment request is presented in a standardized format, which helps maintain a professional appearance and reduces errors.

- Easy Customization: Ready-made documents allow you to add your company’s branding, such as logos, colors, and fonts, making it easy to adapt the design to reflect your identity.

- Cost-Effective: Many of these documents are available at no cost, which is particularly beneficial for small businesses that need to reduce operational expenses.

Where to Find Ready-Made Payment Request Forms

There are numerous online resources where you can download pre-made forms, both in editable and printable formats. Here are some common places to find them:

- Accounting Websites: Many accounting platforms offer free document options for managing transactions, including payment requests.

- Freelancer and Contractor Sites: Platforms for freelancers often have free resources that can be adapted to your specific needs.

- Online Document Repositories: Websites dedicated to templates often have a variety of customizable options for different industries and business sizes.

By utilizing these tools, small businesses can ensure that payment requests are clear, professional, and easy to manage, ultimately helping to streamline operations and improve cash flow management.

Common Mistakes When Using Payment Request Documents

While ready-made forms can greatly simplify the process of requesting payments, there are common pitfalls that can undermine their effectiveness. These mistakes can lead to confusion, delayed payments, and potential disputes with clients. Understanding and avoiding these errors ensures that your documents remain clear, professional, and legally compliant.

1. Missing or Incorrect Client Information: One of the most common mistakes is neglecting to include accurate client details, such as their full name, address, or contact information. Incorrect or missing information can lead to confusion, delayed payments, or even misdirected documents. Always double-check that all client information is correct before sending out any requests.

2. Failing to Include Clear Payment Terms: A lack of clarity in payment instructions can cause misunderstandings about due dates, acceptable payment methods, or penalties for late payments. Clearly stating when payment is due, how it should be made, and any late fees or interest charges will help prevent delays and ensure clients know exactly what is expected of them.

3. Overlooking Tax Details: For many businesses, tax rates (such as VAT or sales tax) must be specified on the document. Failing to include the correct tax amount or not clearly stating whether tax is included in the price can lead to confusion and potentially legal issues. Always ensure that any applicable taxes are clearly indicated and calculated correctly.

4. Lack of a Unique Reference Number: Without a unique reference number or transaction ID, it becomes difficult to track payments, especially if you have multiple clients or regular transactions. A reference number not only helps you stay organized but also provides your clients with a way to easily reference the payment if they have questions or need clarification.

5. Using an Unprofessional Design: While it’s tempting to use a simple or overly stylized form, an unprofessional or cluttered layout can hurt your credibility. A well-organized and clean design is essential for making your document look polished and trustworthy. Avoid using distracting fonts, colors, or excessive graphics that might detract from the main information.

6. Not Keeping a Copy: Finally, always keep a copy of each document you send out. Failure to maintain accurate records can lead to problems if you need to reference a past transaction or address disputes later. Always save a digital or printed copy for your own records.

By being mindful of these common mistakes and ensuring your documents are accurate and professional, you can improve communication with your clients, streamline your payment collection process, and reduce the risk of any misunderstandings.

How to Track Payments with Your Payment Request Document

Tracking payments effectively is essential for maintaining cash flow and managing your finances. By incorporating a few key tracking elements into your payment request forms, you can easily monitor outstanding balances, due dates, and paid amounts. This practice ensures you stay organized and can quickly identify any overdue payments or discrepancies.

Key Payment Tracking Features

When customizing your document for payment requests, make sure to include specific tracking features that allow you to monitor each transaction with ease:

| Feature | Description |

|---|---|

| Unique Reference Number | Assign a unique reference number to each transaction. This helps you quickly identify specific payment requests when you need to check status or follow up. |

| Due Date | Clearly state the due date for payment. This allows both you and your client to know when the payment should be made and helps you track if it’s overdue. |

| Payment Status | Include a section for noting whether the payment has been completed, is pending, or is overdue. This keeps your records up to date and makes it easier to spot any outstanding balances. |

| Amount Paid | Ensure that the amount paid is recorded as soon as a payment is made. This can be used to track partial payments or indicate when the full balance has been settled. |

| Payment Method | List the payment method used (e.g., credit card, bank transfer, cash). This adds another layer of information to your tracking and can be useful in case of disputes. |

Storing and Managing Payment Information

Once your document is sent, it’s important to have a system in place to store and manage payment details. You can use digital tools like accounting software or spreadsheets to keep track of the status of all transactions. Ensure that each payment request is logged with its unique reference number, payment status, and date of payment. This way, you can quickly refer back to your records and follow up with clients if necessary.

By incorporating these tracking elements into your payment request forms and maintaining a reliable record-keeping system, you can efficiently manage your payments and stay on top of your financial processes.

Document Design Tips for Better Branding

Your payment request form is not just a tool for financial transactions; it’s also an opportunity to reinforce your brand’s identity and leave a lasting impression on your clients. The design of this document plays a critical role in how clients perceive your business. A well-crafted, branded form can convey professionalism and build trust, while a poorly designed one might have the opposite effect. By focusing on key design elements, you can enhance your branding and improve client experience.

Key Design Elements for Stronger Branding

When creating a payment request form, consider the following design elements to ensure it reflects your brand identity effectively:

| Design Element | Branding Tip |

|---|---|

| Logo Placement | Include your company logo at the top of the document to reinforce your identity. Ensure it’s placed where it’s easily visible, but not too large to overwhelm the content. |

| Color Scheme | Use your brand’s primary color palette. Consistent use of colors helps clients immediately recognize your business and creates a cohesive look across all documents. |

| Font Selection | Choose fonts that are aligned with your brand’s style. Stick to one or two complementary fonts to ensure the document is easy to read and professional. |

| Visual Hierarchy | Arrange information logically, using font size, bold text, and spacing to highlight key details (such as amounts due or deadlines). A clear structure helps clients quickly locate important information. |

| Consistency Across Documents | Ensure that the design of your payment request form aligns with your other branded documents, such as contracts, proposals, and receipts. Consistency builds a unified brand experience for your clients. |

Enhancing the Client Experience

Beyond the basics of branding, the layout of your form plays a key role in improving the overall client experience. An intuitive and easy-to-understand design reduces the likelihood of confusion or missed payments. Keep the document clear, concise, and focused on the necessary information. Avoid unnecessary design elements that may distract from the key content.

By applying these design tips, you not only enhance your brand’s visibility but also create a more professional and polished experience for your clients. A thoughtfully designed document reflects positively on your company and helps to establish long-term relationships

Where to Find High-Quality Payment Request Documents

When it comes to managing your payment processes, having access to high-quality, ready-made documents can save time and ensure that your requests are professional. Whether you are looking for a simple design or a more complex, detailed layout, there are various online resources that offer customizable solutions. These platforms provide a wide variety of options to suit different business needs, ensuring you can find a design that fits your style and requirements.

Top Resources for Finding Payment Request Documents

Here are some of the best places to find customizable and high-quality documents for your payment needs:

- Accounting Software Providers: Many accounting software platforms offer pre-designed, customizable forms that integrate seamlessly with your business’s financial systems. These are often built to handle various types of transactions and are highly functional.

- Document Creation Websites: Platforms like Canva or Adobe Spark provide a wide range of customizable templates. These tools allow you to design your own forms, adjusting colors, fonts, and content to match your brand identity.

- Online Template Libraries: Websites dedicated to templates (such as Template.net or Microsoft Office Templates) offer a vast selection of ready-made documents. These are usually available for download in various formats and can be edited according to your needs.

- Freelance Platforms: If you’re looking for a more personalized approach, you can find freelance designers who can create customized payment request documents tailored to your business. This option offers complete control over the design.

Factors to Consider When Choosing a Resource

When selecting where to find your documents, consider the following factors to ensure you get the best option for your needs:

- Customization Options: Choose a resource that allows you to easily modify the design, including adding your company logo, adjusting colors, and editing text.

- Format Compatibility: Make sure the document can be used in the format you need, whether it’s for digital use, printing, or integration with other software.

- Ease of Use: Look for platforms that provide user-friendly interfaces, making it easy to create or edit your documents quickly without technical skills.

By exploring these resources and keeping these factors in mind, you can find high-quality, functional documents that streamline your payment processes and present a professional image to your clients.

Why Digital Payment Requests Are Better Than Paper

In today’s fast-paced world, transitioning from physical forms to digital alternatives is becoming the standard for many businesses. Digital documents provide a range of benefits over paper-based ones, from convenience to efficiency, all while helping to reduce costs and environmental impact. The shift to digital can streamline operations and provide a more secure, accessible way to manage financial transactions.

1. Speed and Convenience: Digital documents can be created, sent, and received in minutes, compared to the longer processing times of paper forms. There’s no need to mail anything or wait for documents to arrive. Clients can receive their requests instantly via email or through a cloud-based system, allowing them to process payments quickly.

2. Cost Savings: With digital documents, you eliminate the costs of printing, postage, and paper. This is especially beneficial for small businesses or freelancers who need to keep overhead costs low. Over time, these savings add up and can be invested back into growing the business.

3. Easier Tracking and Organization: Managing digital forms is far easier than sorting through piles of paper. Digital documents can be stored in folders, categorized by client, date, or project, making it simple to track payment statuses and retrieve any necessary documents with a few clicks. Additionally, most accounting software or cloud storage platforms automatically sync and back up your documents for added security.

4. Reduced Risk of Errors: Digital forms often come with built-in fields and calculations that help reduce human error. Automated calculations for totals, taxes, or discounts ensure that the figures are correct every time, minimizing the chance of mistakes that can lead to payment delays or disputes.

5. Environmental Impact: By switching to digital forms, businesses can significantly reduce their environmental footprint. The reduction in paper usage not only saves trees but also decreases energy consumption and waste. Going paperless is an environmentally friendly option that can help your company improve its sustainability efforts.

6. Better Security: Digital documents can be encrypted, password-protected, and stored with backup options, making them far more secure than physical ones. If a paper document is lost or destroyed, it’s gone for good, but digital files can be recovered and protected against unauthorized access.

7. Easy Integration with Other Tools: Digital payment request forms can be easily integrated with accounting software, payment processors, and CRM systems. This streamlines the payment process and allows for automatic updates to financial records, saving time and effort when reconciling accounts.

In conclusion, digital alternatives provide an array of benefits that can greatly enhance business efficiency. From speed and cost savings to better organization and security, switching to digital forms is a practical choice that supports both operational goals and environmental responsibility.