Free Printable Blank Invoice Template for Easy Billing

Managing payments and transactions can be a time-consuming task, but having the right tools can significantly streamline the process. With a well-designed form at your disposal, you can ensure that your financial records are accurate and clear. This approach not only saves time but also helps maintain a professional image with clients and partners.

Whether you’re a small business owner, freelancer, or running a side hustle, having a structured format for issuing charges is essential. These documents serve as both a receipt for your services or goods and a formal request for payment. The ability to quickly customize and produce a clean, detailed bill ensures that you can focus on what matters most–growing your business.

In this guide, we will explore how to easily create and use these documents, including what fields to include and tips on customizing them for your specific needs. By the end, you’ll have everything you need to generate professional and effective billing forms with minimal effort.

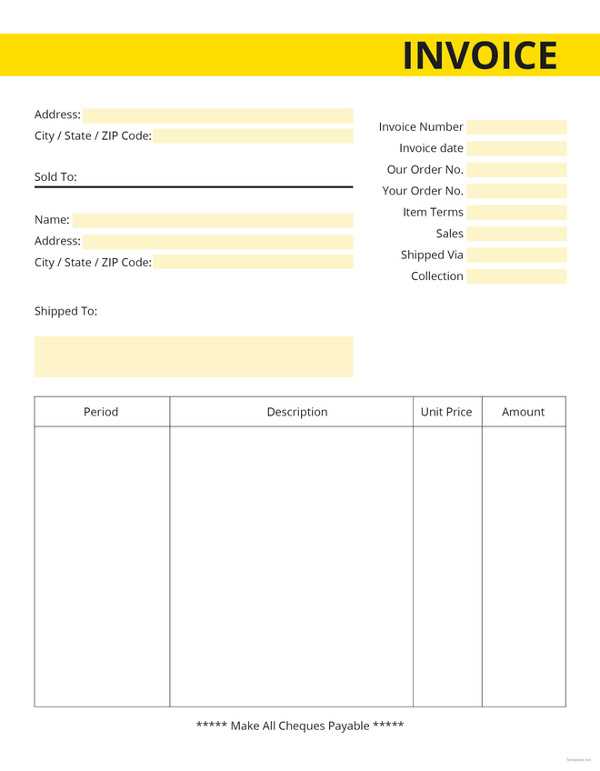

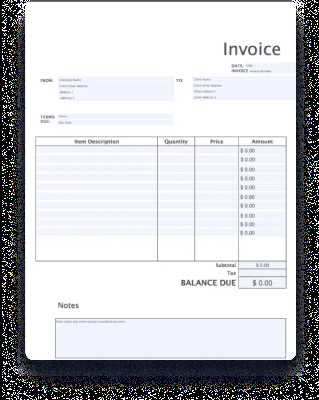

Free Printable Blank Invoice Template

Having an efficient and customizable document for billing purposes is crucial for businesses of all sizes. This resource allows you to easily create clear and professional records for each transaction, ensuring both you and your clients are on the same page regarding the services provided or products sold. A well-structured document can help reduce errors, speed up the payment process, and improve your business’s overall professionalism.

Why Use a Structured Billing Form

Using a prepared document with designated fields for key information allows you to focus on the details without worrying about layout or design. It helps in maintaining consistency across all your business transactions and ensures you don’t miss any important elements, such as pricing or payment terms. Here are the key advantages:

- Time-saving: Quickly fill out necessary fields without starting from scratch.

- Accuracy: Reduces the chances of missing vital details, ensuring clarity for your clients.

- Professionalism: A clean, easy-to-read format makes a strong impression on clients.

- Flexibility: Easily adapt it to suit the unique needs of any transaction.

How to Use This Resource

To make the most of your customizable document, follow these simple steps:

- Download: Obtain the document from a reliable source and ensure it’s formatted for your preferred software.

- Fill in the Details: Enter your business name, client details, list of products or services, and payment terms.

- Customize: Adjust the style and structure to match your brand’s tone and preferences, such as adding logos or changing fonts.

- Review: Double-check all information to ensure everything is accurate a

Why Use a Blank Invoice Template

Having a well-organized and consistent way of documenting transactions is essential for any business. A structured document not only ensures that all the necessary details are included, but it also saves time by providing a pre-made format that can be easily customized. Whether you’re managing a small business, freelancing, or handling personal projects, using such a document can streamline your workflow and enhance the professionalism of your billing process.

Benefits of Using a Standardized Format

Utilizing a pre-designed structure helps eliminate errors and ensures consistency across all your financial records. This approach brings several advantages:

- Efficiency: Speed up the process of creating detailed records for each transaction.

- Accuracy: Minimize the chances of missing crucial information, such as payment terms or item descriptions.

- Professional Appearance: A uniform layout helps your business appear more organized and trustworthy to clients.

How It Simplifies the Billing Process

By eliminating the need to start from scratch with every transaction, you can focus on the essential details. Customizing a pre-built structure to fit each client’s specific needs makes the entire process smoother. Key fields, such as client contact information, service details, pricing, and payment deadlines, are all clearly outlined, leaving little room for oversight.

In the long run, this consistency helps avoid confusion and disputes, ensuring that clients understand exact

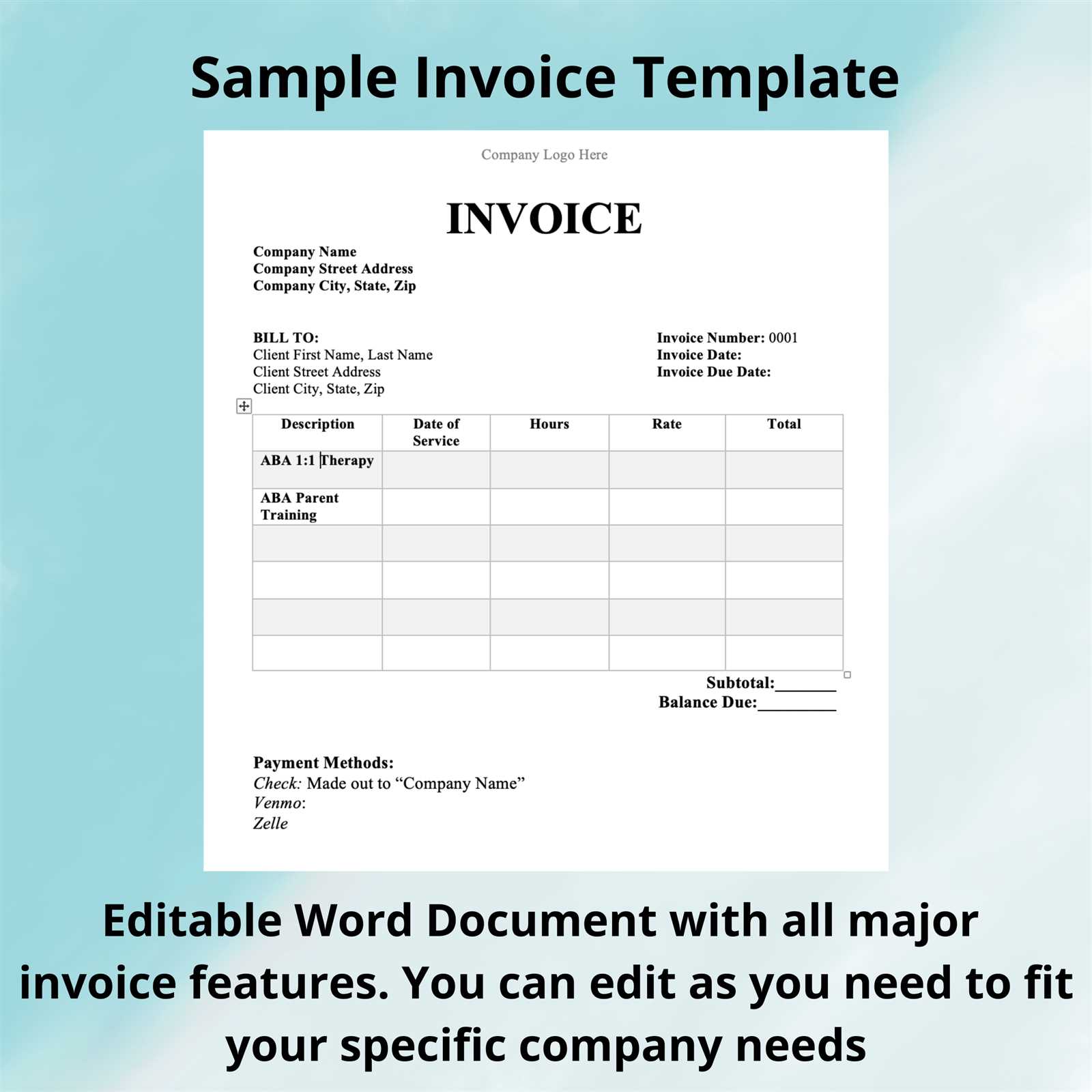

How to Customize Your Invoice Template

Personalizing your billing document is key to creating a professional and efficient process for your business. Customization allows you to tailor the document to your specific needs, ensuring it reflects your brand while including all the necessary information for each transaction. This simple adjustment not only saves time but also helps present a consistent, clear message to your clients.

Steps to Customize Your Document

Follow these steps to adjust the document according to your business requirements:

- Logo and Branding: Add your business logo and customize the color scheme to match your brand identity.

- Client Information: Ensure that fields for client names, addresses, and contact details are included and easily editable.

- Service or Product Descriptions: List the items or services provided in a clear, detailed manner, with prices and quantities.

- Payment Terms: Specify payment deadlines, late fees, or any other terms that are important for each transaction.

- Additional Fields: Depending on your business type, you may want to add sections for discounts, taxes, or special instructions.

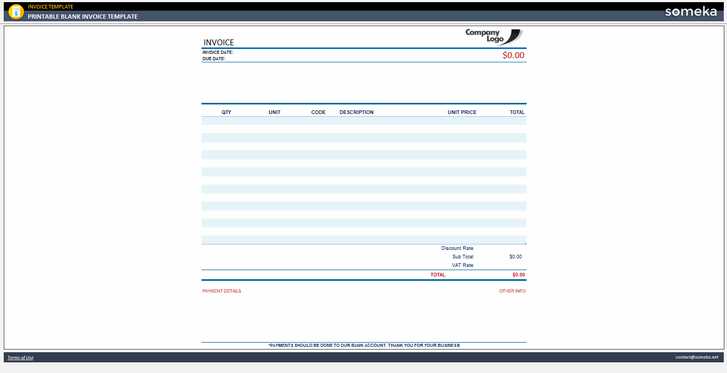

Choosing the Right Format for Customization

Consider the software or platform you use to customize your document. Most word processors or spreadsheet programs allow you to easily modify the structure, fonts, and layout. Choose a format that enables you to save and reuse the document for future transactions, making your process even more efficient.

Once customized, you can quickly adapt the document for different clients or projects, keeping your records organized and professional with minimal effort.

Benefits of Printable Invoice Templates

Having a ready-to-use document for billing offers numerous advantages, especially for businesses and freelancers who need a quick and efficient way to manage transactions. By using a standardized format, you can ensure that all relevant details are included, and the process remains consistent every time. This approach reduces the chances of mistakes and saves valuable time, allowing you to focus on what matters most–delivering quality products or services to your clients.

Time Efficiency

One of the most significant benefits is the time saved by not having to create a document from scratch for each transaction. With a predefined structure, all you need to do is enter specific details such as the client’s information, items or services provided, and payment terms. This streamlined process allows you to send out bills quickly and efficiently.

Consistency and Accuracy

Using a pre-designed structure ensures that every transaction is documented in the same clear and consistent way. This consistency minimizes errors and ensures that nothing is overlooked, such as essential information like payment due dates, prices, or tax calculations. Clients appreciate the clarity of well-organized documentation, which helps prevent misunderstandings or disputes.

Professional Image

Sending a polished, well-formatted document conveys professionalism to your clients. A structured layout not only helps with readability but also demonstrates that you are organized and detail-oriented. This can enhance trust and improve relationships with your clients, ultimately contributing to long-term success for your business.

Easy Customization

Most pre-made documents are fully customizable, allowing you to adjust the design to suit your business needs. Whether you want to add your logo, modify the layout, or change the colors to align with your brand, these documents offer flexibility. This ensures that the end result not only meets your functional requirements but also represents your business’s unique identity.

Overall, using a pre-built structure for billing simplifies the process, saves time, and ensures that every transaction is documented professionally and accurately.

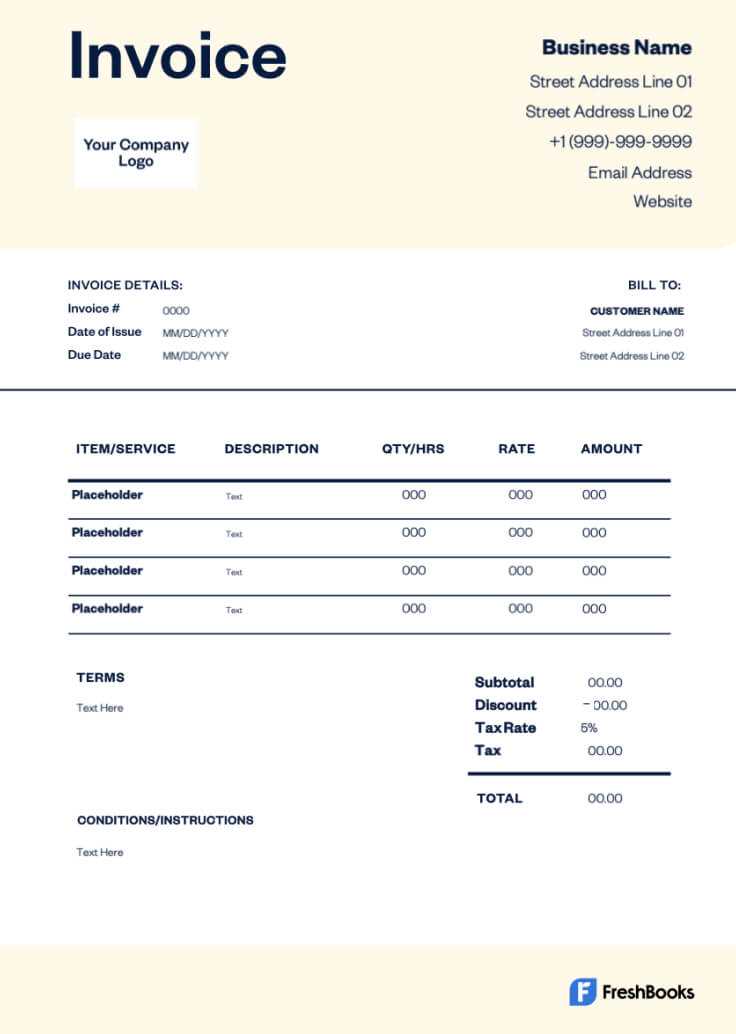

Choosing the Right Invoice Design

When it comes to financial documents, the design plays a crucial role in how the information is perceived. A well-structured and professional appearance not only makes a statement about your business but also ensures clarity and ease of understanding for your clients. Choosing an appropriate layout can simplify the billing process, streamline communication, and help maintain a polished image.

Branding and Consistency

The design of your billing document should align with your company’s branding. Incorporating elements such as your logo, color scheme, and fonts reinforces your brand identity. Consistency across all documents, from proposals to final statements, helps establish trust and professionalism. Keep in mind that simplicity often communicates more effectively than excessive details.

Clarity and Functionality

While aesthetics matter, functionality is paramount. A clean, organized layout that clearly separates essential information–such as client details, service descriptions, and payment terms–ensures that your document is easy to read and understand. Proper spacing, legible fonts, and intuitive sections enhance both the usability and impact of the document.

How to Fill Out an Invoice Properly

Properly completing a financial document is crucial to ensure clear communication and avoid potential misunderstandings. Every field on the document serves a specific purpose, providing both you and your client with essential details about the transaction. Following a structured approach and including all necessary information can help streamline the process and maintain professionalism.

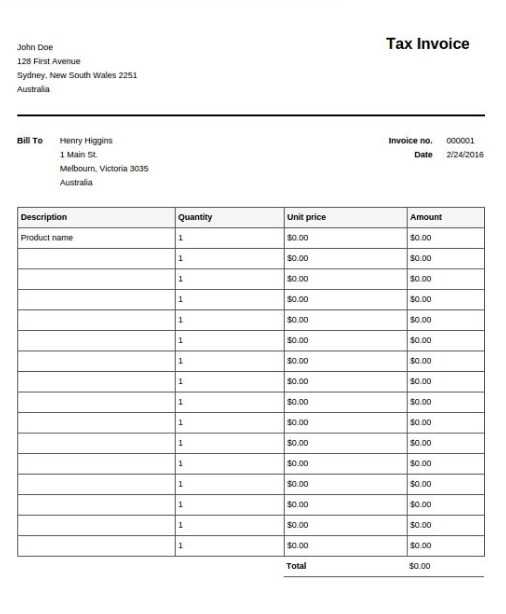

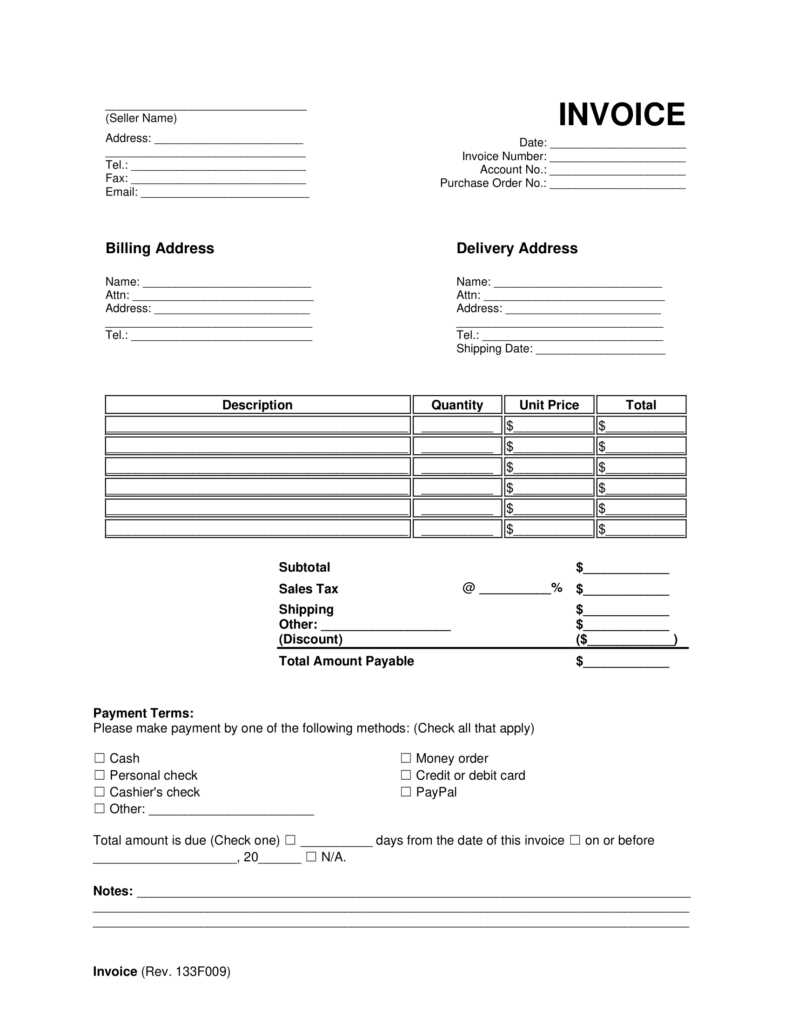

Start by filling in the basic details such as your business name and contact information, followed by the client’s details. Then, include the description of goods or services provided, the quantity, pricing, and any applicable taxes. Be sure to specify the payment terms and the due date to avoid confusion later on.

Item Description Quantity Unit Price Total 1 Product/Service Name 5 $20.00 $100.00 2 Product/Service Name 3 $50.00 $150.00 Subtotal $250.00 Tax (10%) $25.00 Essential Elements of an Invoice To ensure smooth transactions and clear communication, it’s important to include certain key components in every financial document you issue. These elements not only provide clarity but also ensure both you and your client have a shared understanding of the details of the business agreement. Properly organizing these elements helps prevent confusion and ensures accurate payments.

Key Details

At the top of the document, always include essential information such as your company name, contact details, and a unique identifier for the document, such as a reference number. Also, ensure the recipient’s information is clearly listed, including their business name and contact details. This helps both parties easily identify the transaction and verify the details when necessary.

Transaction Information

Clearly outline the services or products provided, including descriptions, quantities, and prices. Make sure to indicate the total cost for each item and provide a breakdown of any taxes or discounts applied. Don’t forget to include payment terms, due date, and preferred payment methods to avoid delays or confusion.

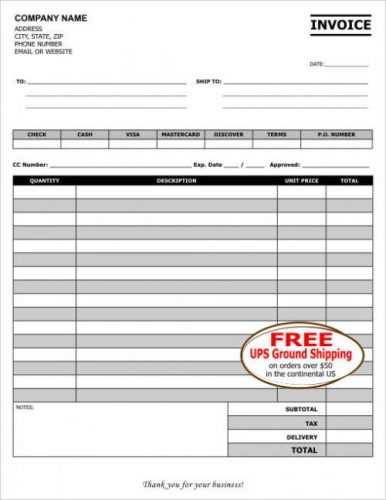

Printable Invoice vs Digital Invoice

When it comes to managing business transactions, the method of sending billing documents can significantly impact efficiency and convenience. While traditional hard copies have been the standard for many years, digital options are becoming increasingly popular due to their speed and flexibility. Understanding the advantages and drawbacks of both methods can help businesses make the right choice based on their needs and preferences.

Advantages of Physical Documents

For some businesses, a hard copy of the financial document may feel more formal and professional. It offers a tangible record that can be kept for reference, and for clients who prefer paper, it might be a more familiar and comfortable option. Additionally, physical documents can be useful when dealing with industries or clients that are not as tech-savvy or those who prefer to keep paper trails for compliance or accounting purposes.

Benefits of Electronic Documents

On the other hand, digital billing documents offer several notable benefits. They can be delivered instantly via email, eliminating the need for postal services or waiting for physical mail. Electronic versions can also be easily stored, searched, and managed, making them more eco-friendly and cost-effective. Furthermore, online payment links can be included in the document, facilitating faster transactions and reducing administrative overhead.

How to Save Time with Templates

Managing financial paperwork can be a time-consuming task, especially when you’re handling multiple clients or transactions. However, by utilizing pre-designed structures for your documents, you can significantly reduce the time spent on repetitive tasks. These ready-to-use designs allow you to focus more on the details that matter, while automating the layout and format of your paperwork.

By using a structured layout, you eliminate the need to start from scratch each time you need to issue a new document. The key fields, such as client information, pricing details, and payment terms, are already included. With minimal adjustments, such as updating the amounts or services, you can quickly generate a polished and professional document. This not only saves time but also ensures consistency across all your transactions, reducing the chance of errors.

Automation is another significant time-saver. Many pre-designed solutions allow you to store client data and reuse it, avoiding the need to input the same information repeatedly. Additionally, integrating with accounting software or invoicing platforms can automatically calculate totals, taxes, and discounts, further streamlining the process.

How to Make Your Invoice Look Professional

A well-designed document not only ensures clear communication but also enhances your business’s credibility. Presenting a polished, professional-looking document helps build trust with clients and reflects your attention to detail. The design should be clean, organized, and easy to read, conveying the necessary information without overwhelming the recipient.

Brand Consistency

One of the easiest ways to give your paperwork a professional touch is by incorporating your company’s branding elements. Use your logo, color scheme, and fonts consistently throughout the document. This not only reinforces your brand identity but also makes the document feel like a part of a larger, cohesive business strategy. Simple and elegant designs are often the most effective in conveying professionalism.

Clear Structure and Layout

A cluttered or disorganized document can leave a poor impression. Make sure that the key details–such as client information, items or services provided, and payment terms–are clearly separated and easy to find. Use headings, bullet points, or tables to organize the content logically. Whitespace is equally important; it helps to avoid a cramped appearance and makes the document easier to read. A clean layout allows clients to quickly locate and verify important details, which can reduce the risk of errors or confusion.

Invoice Template Options for Small Businesses

For small businesses, finding the right document design can significantly impact efficiency and professionalism. With various styles and formats available, it’s important to choose one that suits both the needs of your business and the preferences of your clients. The right format can help streamline your billing process and enhance communication, while also ensuring your documents are clear and well-organized.

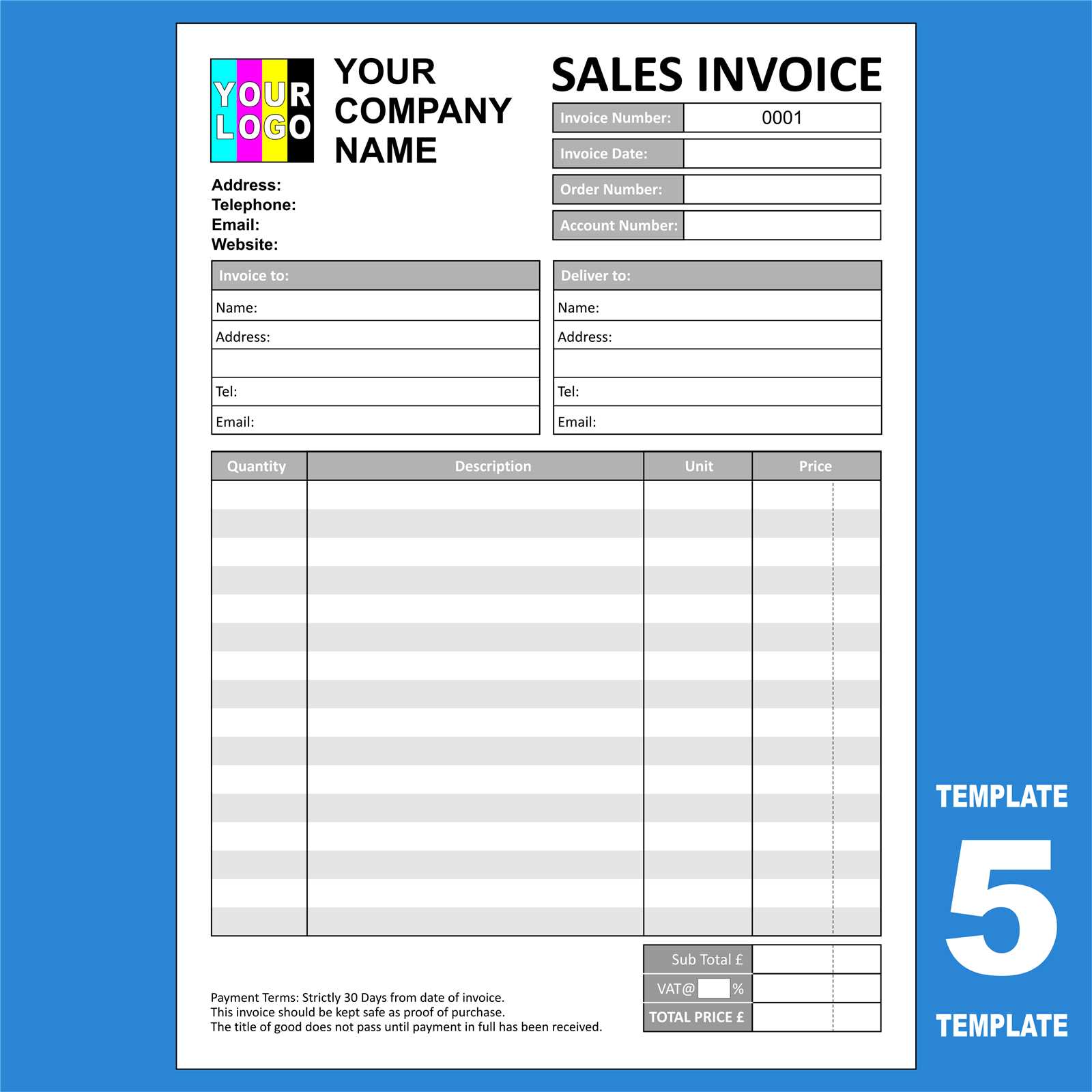

Simple and Clean Designs

For small businesses just starting out, a straightforward, minimal design is often the best choice. These basic layouts typically include all necessary information without any unnecessary complexity. The simplicity of the design makes it easy to read and understand, while still looking polished. This type of format works well for businesses that want to present a professional image without overwhelming their clients with excessive details. Additionally, customization options allow you to add your business logo, payment terms, and contact information, ensuring the document reflects your brand.

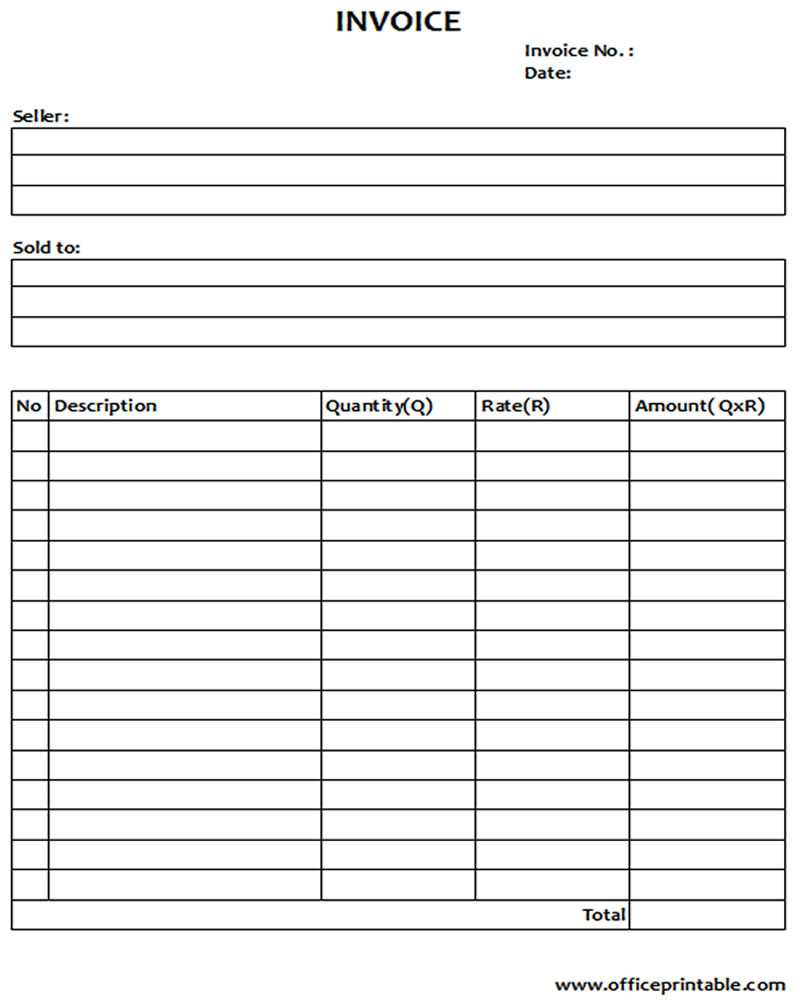

Detailed and Structured Formats

For businesses that provide multiple products or services, a more detailed layout may be necessary. These designs often include sections for item descriptions, quantities, rates, and totals. Clear tables or grids are commonly used to break down each aspect of the transaction. A detailed design helps ensure that both you and your client have a clear understanding of the billing breakdown, which is especially important for larger or more complex transactions. In this case, incorporating automated calculations or tax fields can save time and reduce errors.

Where to Find Free Invoice Templates

For small businesses and freelancers, finding reliable and accessible tools for managing transactions is essential. Fortunately, there are numerous resources online where you can easily access pre-designed documents that are ready to use. These resources allow you to save time while ensuring your financial paperwork is both professional and efficient. Whether you prefer to work offline or with cloud-based tools, there are various options available to meet your needs.

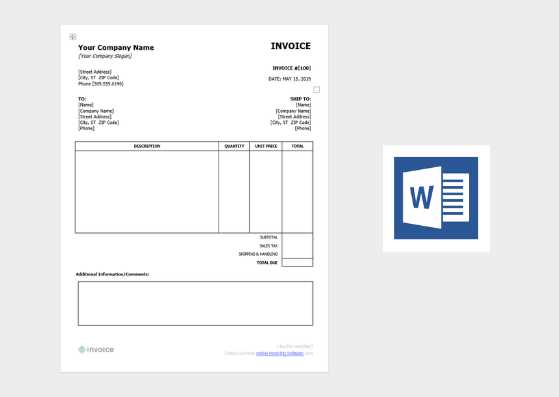

Online Platforms and Software

Many websites and software platforms offer free access to a wide range of document designs. These services often allow you to customize the layout, adding your own branding elements or adjusting the structure to fit your business. Platforms like Google Docs or Microsoft Word also feature pre-made documents that can be edited directly in the browser or offline. These solutions are especially convenient if you’re looking for a quick and easy way to generate a professional-looking document with minimal effort.

Specialized Websites and Marketplaces

There are also specialized websites dedicated to providing business forms, including detailed and customizable options for your transactions. These platforms often offer a variety of styles to suit different industries, from simple layouts for small businesses to more complex designs for larger transactions. Some popular resources provide a variety of design options that can be downloaded directly or used online. Websites like Canva or Zoho offer both free and paid options that can be tailored to your specific business needs. These sites typically offer easy-to-use interfaces and a range of customization tools, including the ability to add logos, change fonts, or adjust payment terms.

How to Edit an Invoice Template

Customizing a pre-designed document to fit your specific needs is an essential skill for any small business or freelancer. By adjusting key elements of the layout, you can ensure that the document aligns with your brand and contains all the relevant details for a smooth transaction. Editing a document allows you to personalize it with client-specific information, services provided, and your preferred payment terms, making the billing process more efficient.

Follow these steps to easily modify your document:

- Open the Document: First, open the file in the program or platform where it was created (e.g., Word, Google Docs, or an online platform).

- Edit Contact Information: Update the header with your business name, logo, and contact details. Make sure your client’s information is accurate as well.

- Modify the Breakdown: Replace the generic descriptions with specific services or products provided. Adjust the quantity, rate, and any applicable taxes to reflect the actual transaction.

- Set Payment Terms: Specify your payment due date, preferred methods, and any discounts or late fees that may apply.

- Review the Document: Before finalizing, double-check for any errors or missing information. Make sure everything is clearly laid out and easy to understand.

Once your document is edited and finalized, save it and send it to the client with all the updated details. By regularly updating the document for each new transaction, you can ensure that all your billing paperwork remains accurate and professional.

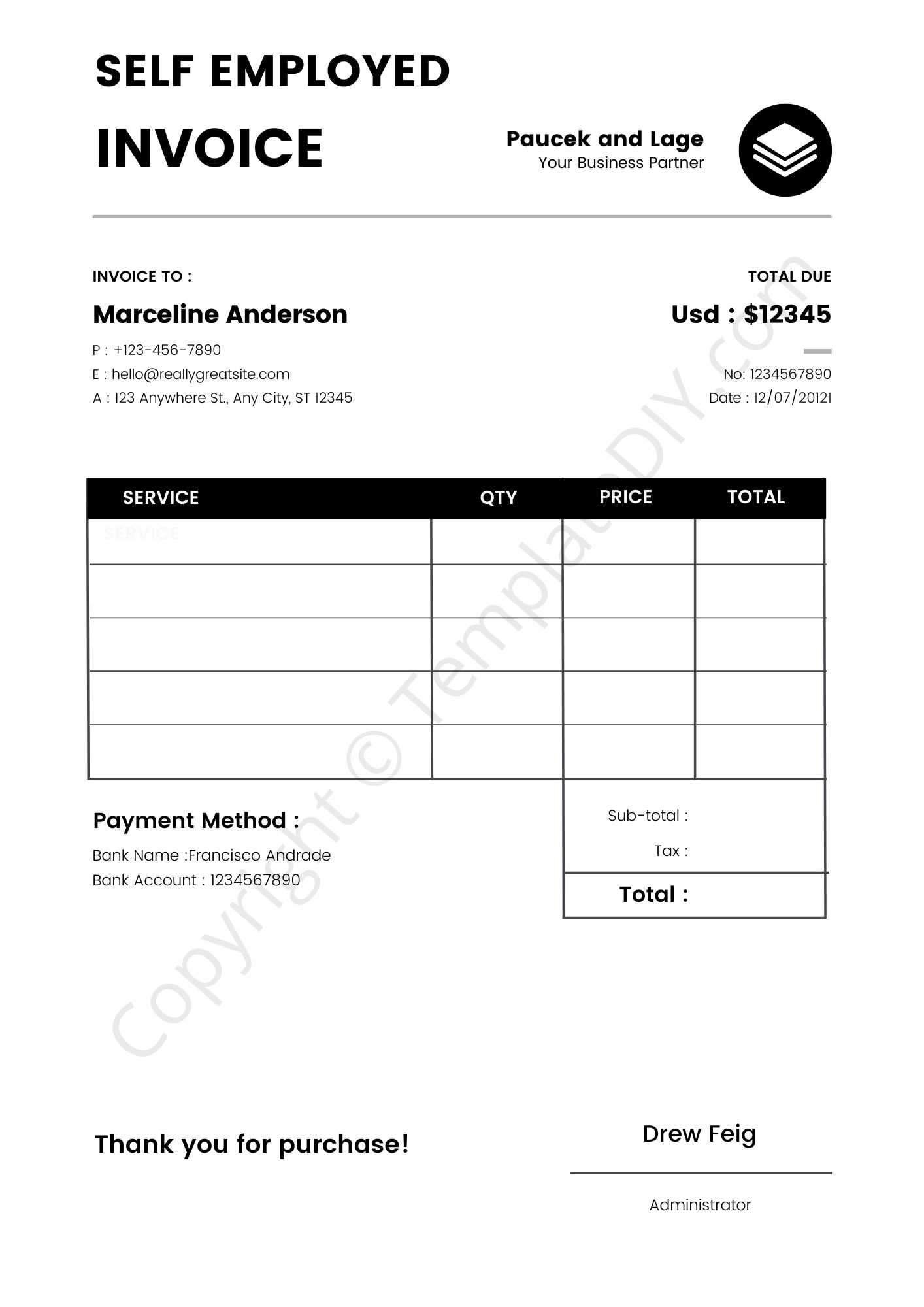

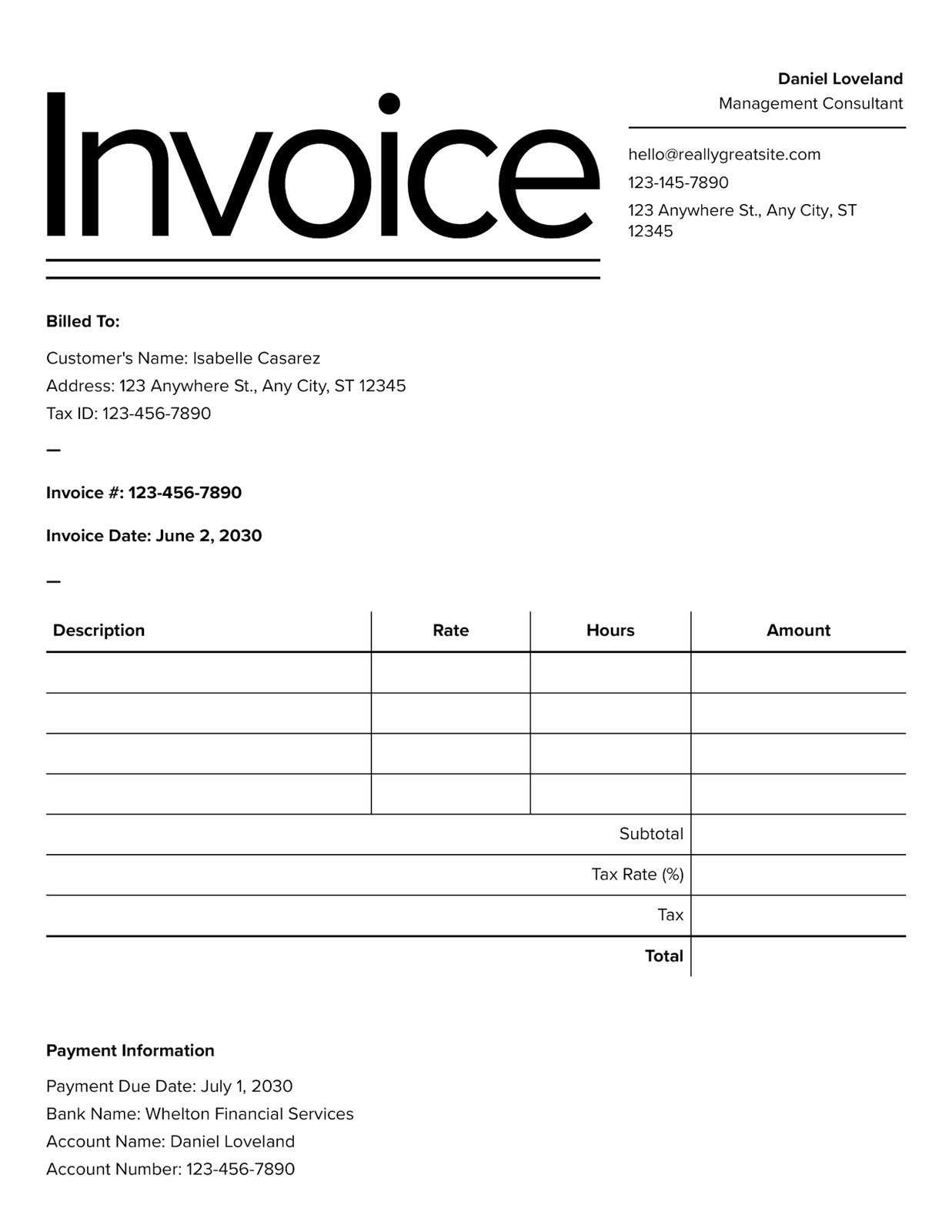

Invoice Template for Freelancers

As a freelancer, managing payments and ensuring clarity in financial transactions with clients is crucial. Having a well-structured document that outlines the services provided, payment terms, and due amounts can help maintain professionalism and prevent misunderstandings. This tool serves as an essential item for smooth business operations, providing a clear summary of the work completed and the amount due for payment.

When creating such a document, it’s important to include specific details such as the names and contact information of both parties, a breakdown of services or products rendered, and the agreed-upon amount. Also, terms like payment due date and any additional notes regarding taxes or late fees should be clearly stated. This ensures transparency and helps freelancers stay organized.

Description Details Freelancer’s Name John Doe Client’s Name Acme Corp Date of Service October 15, 2024 Service Provided Web design and development Amount Due $1500 Due Date November 15, 2024 Payment Method Bank transfer By using such a detailed format, freelancers can ensure all key aspects of the transaction are addressed, making the process of requesting and receiving payments more straightforward.

Common Mistakes in Invoice Creation

Creating a document to request payment for services or products is a fundamental task for any professional. However, even experienced individuals can make errors that lead to confusion, delayed payments, or disputes. Ensuring that all necessary details are included and formatted correctly is essential to avoid common pitfalls. Below are some of the most frequent mistakes to watch out for when preparing such financial documents.

Omitting Key Information

One of the most common mistakes is failing to include essential details. A clear breakdown of the work completed, the correct amount due, and the agreed-upon payment terms are critical. Missing elements like contact information, payment deadlines, or descriptions of services can lead to confusion and make it harder for the client to process the payment efficiently.

Incorrect or Unclear Payment Terms

Another issue is providing unclear or incorrect payment terms. This includes leaving out specific information such as the due date, late fees, or acceptable payment methods. It’s also important to specify whether taxes are included in the total amount or if they need to be added. Without this clarity, clients may delay payment or misunderstand the expected amount.

How to Avoid Invoice Errors

Ensuring accuracy in payment requests is essential for smooth transactions and maintaining good client relationships. Errors can lead to delays, confusion, and sometimes even lost payments. By following a few best practices and being diligent during the creation process, professionals can significantly reduce the risk of mistakes. Below are some practical tips to help avoid common issues.

Double-Check All Information

One of the simplest ways to prevent errors is to carefully verify every detail before sending a document for payment. Mistakes can often occur when information is rushed or overlooked. Here’s a checklist to follow:

- Ensure the names and contact details of both parties are correct.

- Verify the services or products listed are accurately described.

- Confirm the amount due matches the agreed-upon figure.

- Check payment terms, including the due date and method.

Use Automation Tools

Another way to minimize mistakes is by using software or tools designed to create professional payment requests. These platforms often come with built-in features that help reduce human error:

- Auto-fill client details based on saved information.

- Generate itemized lists with proper calculations.

- Automatically apply tax rates or discounts if necessary.

By utilizing such tools, the risk of making manual errors is significantly reduced, and the process becomes more efficient.

Legal Requirements for Invoices

When creating a payment request document, it is essential to ensure that it meets legal standards. Depending on the region and the nature of the business, specific details must be included to comply with tax laws and regulatory requirements. These legal obligations help protect both the service provider and the client, ensuring that transactions are transparent and properly documented. Failure to adhere to these rules could lead to penalties or complications in case of audits.

Different jurisdictions may have varying rules, but there are several common elements that generally need to be present in any payment request document. Below are the key elements that are typically required by law:

Requirement Description Unique Reference Number A distinct number or code for each request to ensure easy tracking. Service Provider’s Information Full name or business name, address, and contact details of the provider. Client’s Information The name, address, and contact information of the client receiving the goods or services. Description of Goods or Services A detailed explanation of what was provided, including quantity and unit price if applicable. Amount Due The total amount that is owed, including taxes, fees, and any discounts applied. How to Organize Your Invoices Effectively

Staying organized is key to managing payments and maintaining a clear financial overview. An efficient system for tracking requests for payment not only helps ensure timely collections but also makes it easier to manage taxes, audits, and client relations. By implementing a structured approach, you can save time, reduce errors, and ensure that nothing slips through the cracks.

Create a Categorized Filing System

One of the first steps in organizing payment requests is to categorize them properly. This can be done both digitally and physically, depending on your preference. Here are a few ideas to structure your filing system:

- By Client: Keep separate folders for each client or project to easily locate specific documents.

- By Date: Organize by month or quarter to track due dates and payment history.

- By Status: Create sections for “Paid,” “Pending,” and “Overdue” to quickly assess the current state of each request.

Use Digital Tools for Better Management

In today’s digital world, taking advantage of software can greatly improve efficiency. Automated tools not only help with organizing but can also provide additional benefits:

- Cloud Storage: Use cloud platforms like Google Drive or Dropbox to store and back up documents securely.

- Accounting Software: Tools like QuickBooks or Xero can automatically track payments, generate reports, and remind you of upcoming due dates.

- File Naming Convention: Establish a consistent naming system, such as “ClientName_ServiceDate_Amount,” to easily search and retrieve specific documents.

By setting up an organized and efficient system, you can keep your financial records in order, reduce stress, and ensure you stay on top of payments.