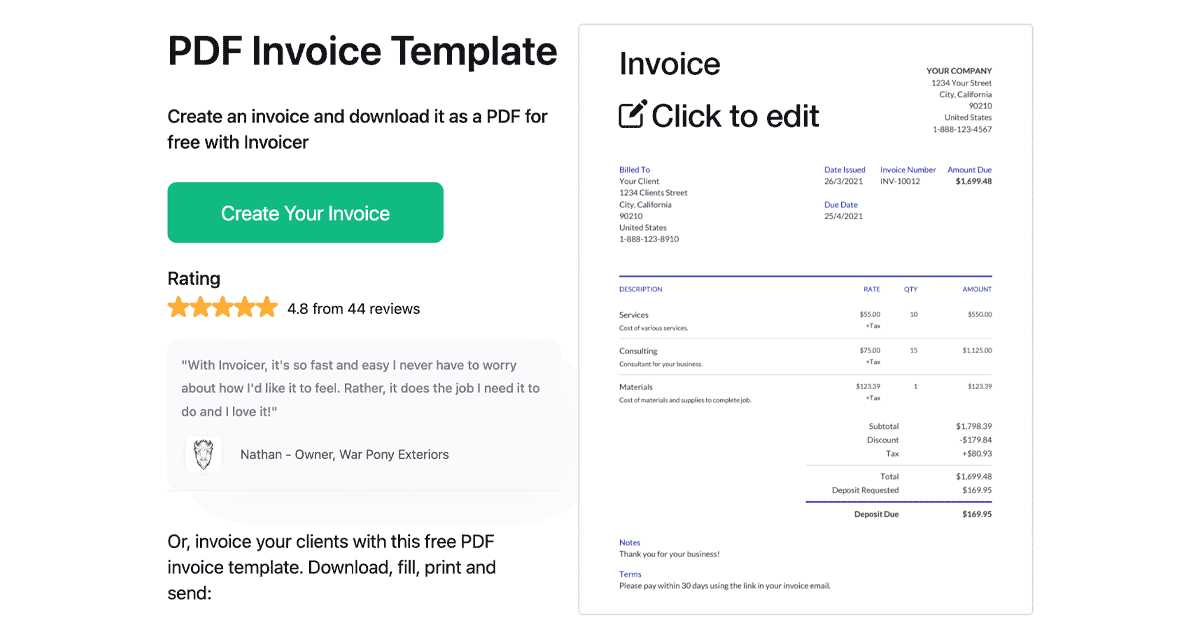

Free PDF Invoice Template for Easy and Professional Invoicing

Running a business or managing client relationships often involves creating and sending formal documents. For smooth transactions, it’s essential to have a reliable and simple method of crafting these important records. With the right tools, generating professional files becomes a straightforward task that saves time and ensures accuracy.

By utilizing customizable formats, you can ensure consistency and clarity in every document you send. Whether you’re a freelancer, small business owner, or part of a larger organization, having an easy-to-use design that suits your needs is crucial. These resources are versatile and can be tailored to your specific requirements, offering a professional touch to all your correspondence.

Streamlining the process with pre-designed layouts eliminates the guesswork and ensures your documents look polished. From adding logos and contact details to adjusting fields for various services, these solutions are designed to make the task as simple as possible, leaving you with more time to focus on your work.

Free PDF Invoice Template Guide

Creating professional financial records doesn’t have to be complicated. With the right resources, you can easily craft well-structured documents that look polished and communicate all necessary details clearly. Whether you’re working with clients or managing internal transactions, these documents serve as vital tools for maintaining transparency and organization.

To get started, it’s important to understand what elements should be included in any formal document. Key components like itemized services, payment terms, and contact information ensure clarity and make the process of tracking payments and due dates more efficient.

Follow these steps to get the most out of your document design:

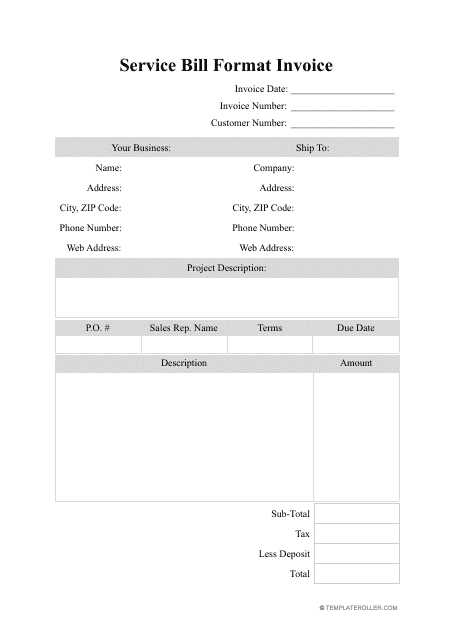

- Choose the right format: Make sure the layout fits your business needs. It should be easy to read, professional, and customizable to include any specific information.

- Fill in the essential fields: Include sections for services rendered, payment amounts, due dates, and any relevant terms and conditions.

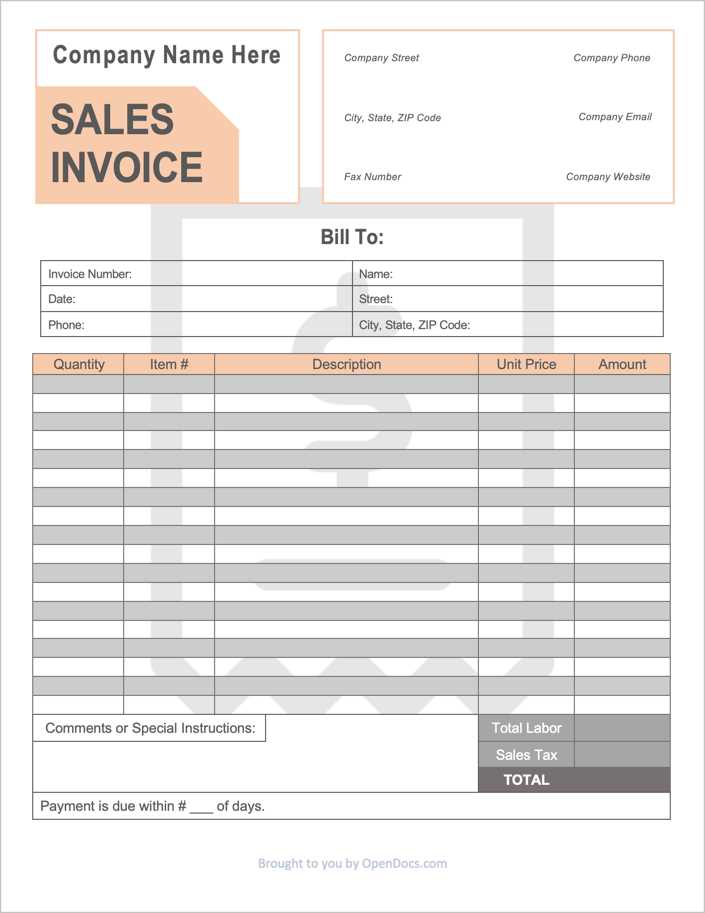

- Incorporate branding: Personalize your design with your company logo, color scheme, and contact details to maintain a consistent brand image.

- Ensure clarity: Avoid clutter and focus on clear, concise information. Use bullet points or lists where appropriate to make data easier to understand.

- Save and share: Once completed, save the document in a universal format that can be easily accessed and shared with clients or colleagues.

Utilizing ready-made layouts can greatly reduce the time spent on document creation while still ensuring a high standard of professionalism. Whether for a single project or ongoing business needs, these tools help keep your transactions organized and efficient.

Why Use a PDF Invoice Template

Having a structured approach to creating business documents ensures consistency and professionalism. With the right tools, you can quickly generate polished, clear records that are easy to understand and legally sound. Using a well-designed format reduces the chances of errors, simplifies the process, and saves time. These resources help standardize your workflow and ensure all necessary details are included without overlooking critical information.

Time Efficiency and Customization

By utilizing pre-structured formats, you can save time on document creation. Instead of starting from scratch each time, simply adjust the sections as needed. Customization options allow you to tailor the content according to your unique business needs, offering flexibility while maintaining a uniform appearance across all records.

Professional Appearance

A well-structured document creates a trustworthy impression with clients and partners. It demonstrates attention to detail and professionalism, which can lead to improved client relations and more successful business dealings.

| Benefit | Description |

|---|---|

| Consistency | Standardized design ensures every document maintains a professional appearance. |

| Clarity | Clear sections and organized layout make it easy to understand important details like services and payment terms. |

| Ease of Use | Pre-built sections save time and reduce errors by eliminating the need to create documents from scratch. |

| Customization | Adjustable fields allow you to tailor documents to meet specific requirements for different clients or projects. |

Using this approach simplifies the document creation process, making it easier to handle large volumes of transactions while maintaining accuracy and professionalism.

Benefits of PDF Invoices for Businesses

For businesses, maintaining a smooth and efficient transaction process is essential. Having a well-organized and reliable way to issue official records helps streamline communication with clients, track payments, and maintain professionalism. The digital format offers a range of advantages over traditional methods, from ease of distribution to enhanced security.

Here are some key benefits of using a digital format for business documentation:

- Speed and Efficiency: Digital files can be created, saved, and shared in a matter of minutes, significantly reducing the time spent on document handling.

- Cost Savings: Eliminating the need for physical paper and postage cuts down on overhead costs, allowing businesses to allocate resources elsewhere.

- Easy Accessibility: Electronic documents can be accessed from anywhere, making it easier to manage and retrieve important records.

- Environmentally Friendly: By reducing the use of paper, businesses can contribute to sustainability efforts and minimize waste.

- Professional Appearance: Well-structured, clear documents enhance a company’s reputation and ensure a positive impression with clients and partners.

Furthermore, digital formats offer various customization options, making it simple to include specific information tailored to the needs of each client. Adjustments can be made quickly and efficiently, ensuring each transaction is accurately documented and easy to understand.

In summary, adopting this method can greatly improve the workflow, save time and money, and present a polished and professional image to clients and stakeholders.

How to Customize Your Invoice Template

Personalizing your business documents is essential for maintaining a consistent brand image and ensuring that all necessary details are included. Customization allows you to tailor the content, layout, and style of your records to suit your specific business needs. With a few simple adjustments, you can create a professional and organized document that reflects your company’s identity and meets your clients’ expectations.

Here are the key steps to customize your document design:

- Add Your Branding: Include your business logo, colors, and contact information at the top of the document. This helps clients easily identify your company and ensures consistency across all materials.

- Adjust Layout and Structure: Modify the layout to include all necessary sections such as services, payment terms, and due dates. Organize the fields so they are easy to navigate and ensure that important information stands out.

- Include Business-Specific Details: Customize sections for specific services or products you offer. Add any necessary tax information, discounts, or unique terms that may apply to your business.

- Choose Fonts and Colors: Select fonts and colors that align with your brand’s style. Keep the design simple and professional to maintain clarity and readability.

- Save Custom Settings: Once you’ve made your changes, save your design as a reusable file. This way, you can quickly access it for future transactions, without needing to start from scratch.

Customization is a powerful way to ensure your documents are not only functional but also aligned with your business’s image. A well-designed, personalized document can make a positive impact on clients and improve the overall experience of working with your company.

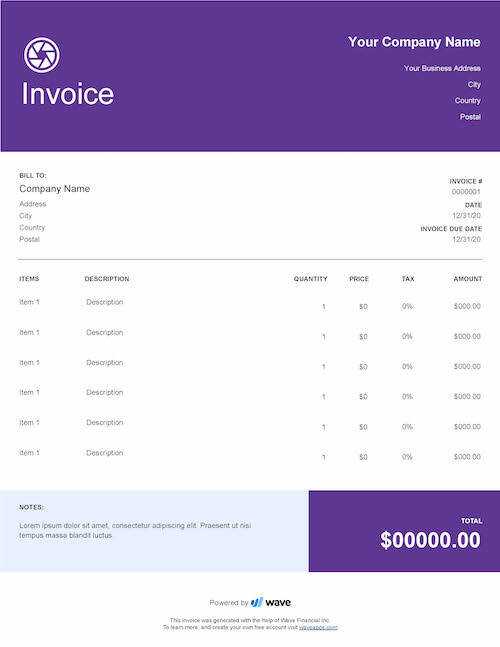

Choosing the Best Free Template

Selecting the right document design is crucial for ensuring that all necessary information is presented clearly and professionally. The right format can help streamline the creation process, making it easier to generate accurate and consistent documents. When choosing a suitable layout, it’s important to consider several factors, from customization options to overall style.

Key Factors to Consider

When looking for the ideal format, here are some essential features to evaluate:

- Ease of Use: Choose a layout that’s intuitive and simple to customize. The fewer the steps required to edit and fill in information, the better.

- Customization Options: Look for designs that allow you to add your company’s branding, including logos and contact details, and that can be tailored to different client needs.

- Clear Structure: Ensure the design has a clean layout that organizes the information logically. Important details such as pricing, terms, and due dates should stand out for easy reference.

- Professional Appearance: The design should reflect your business’s professionalism. Opt for formats with a polished, modern look that aligns with your brand.

- Compatibility: Make sure the design is compatible with your preferred software and can be easily edited and saved in various formats.

Where to Find the Best Designs

There are many places online where you can find suitable options, including free resources, online document creators, and websites offering downloadable designs. When selecting, ensure the design offers the necessary features and aligns with your business’s needs. Read reviews or test a few different designs before committing to one that works best for your workflow.

Choosing the best layout can save you time, improve the quality of your transactions, and enhance your overall professional appearance with clients. A carefully selected design can be a valuable asset to your business communication strategy.

Top Features to Look for in Invoices

When creating official business documents, it’s essential to ensure they include all necessary elements that make the transaction clear, transparent, and easy to process. A well-designed document should cover everything from payment details to terms of service. The right features help avoid confusion, streamline the payment process, and maintain professionalism in every transaction.

Here are the key features to look for when choosing or designing your documents:

- Clear Contact Information: Your business name, address, phone number, and email should be easy to find. This makes it simple for clients to reach out with questions or concerns.

- Unique Identification Number: Assigning a unique number to each document helps keep records organized and ensures easy tracking of transactions.

- Itemized List of Services or Products: A detailed breakdown of the goods or services provided ensures clients know exactly what they’re being charged for, reducing the chances of disputes.

- Payment Terms and Due Date: Clearly stating the payment terms, including due dates, late fees, and any discounts for early payments, helps clients understand their obligations and avoid missed deadlines.

- Subtotal, Taxes, and Total: Ensure that the subtotal is shown, taxes are calculated, and the total amount due is clearly highlighted. Transparency in this area helps prevent misunderstandings and fosters trust.

- Professional Design: The layout should be clean and well-organized, making it easy for the recipient to navigate and find the relevant details quickly.

- Terms and Conditions: Including any relevant terms of service, return policies, or contractual obligations will help set clear expectations between you and your clients.

Having these features in place ensures that your business documents are not only functional but also communicate professionalism and attention to detail. These elements can make the process smoother for both parties and contribute to better financial management.

How to Download a Free Template

Getting the right document design for your business needs can be simple and quick. Many online platforms offer downloadable formats that can be easily customized to suit your specific requirements. The process is typically straightforward, allowing you to access a variety of styles without hassle. Here’s a step-by-step guide to help you download and use a suitable design for your transactions.

Follow these steps to obtain the perfect layout:

| Step | Description |

|---|---|

| 1. Choose a Platform | Search for reputable websites that offer downloadable documents. Some platforms allow you to choose from multiple designs, while others may have customization options to tailor the format to your needs. |

| 2. Select a Design | Browse through the available choices and pick a layout that fits your business style and requirements. Ensure it contains all necessary sections such as payment details, terms, and itemized lists. |

| 3. Download the File | Once you’ve selected a format, click the download button. Many websites offer direct downloads or send the file to your email for easy access. |

| 4. Customize the Document | Open the downloaded file in the appropriate software and input your specific details. This could include your company’s information, pricing, and payment terms. |

| 5. Save and Use | After editing, save the document in your preferred format. You can then use it for your transactions, ensuring you always have a professional document ready to go. |

Once you have the document, you can easily adapt it to your needs for any future transactions. This method saves time, ensures consistency, and simplifies the process of managing business records.

Tips for Easy Invoice Creation

Creating business documents doesn’t have to be a complex or time-consuming task. With the right approach, you can streamline the process and ensure accuracy every time. By following a few simple tips, you can create professional-looking records quickly and efficiently, saving time while maintaining a high standard of quality.

Here are some helpful tips to simplify the creation of your business documents:

- Use Pre-Formatted Designs: Starting with a pre-made layout can save you a lot of time. Choose one that is easy to customize and already includes the necessary fields, such as payment details, itemized lists, and terms of service.

- Set Up a Template: Once you’ve created a few documents, save the layout as a reusable template. This allows you to avoid having to start from scratch each time, simply filling in the new details for each transaction.

- Automate Regular Information: If you frequently use the same pricing or terms, consider automating those sections. This reduces the need for manual input and helps ensure consistency across your documents.

- Double-Check Your Information: Accuracy is key. Before sending any document, verify that all details–such as client contact information, pricing, and payment terms–are correct to avoid any misunderstandings later on.

- Keep It Simple: A cluttered document can be difficult to read and understand. Stick to a clear, concise layout that makes it easy for the recipient to find the most important information, such as the amount due and due date.

- Save and Backup Your Work: Always save your documents in an organized folder and create backups. This way, you can easily retrieve past records for reference or future use without the risk of losing important data.

By applying these straightforward tips, you’ll be able to quickly generate the necessary paperwork without compromising on quality. Simplifying the process not only saves you time but also helps maintain professionalism and organization in your business operations.

Free Invoice Templates for Freelancers

Freelancers often face the challenge of creating professional documents for their clients without the support of a large administrative team. Having a clear and efficient design for billing is crucial, as it ensures that payments are made on time and that the terms of the work are easily understood. Fortunately, there are many resources that offer customizable designs that can be tailored to the specific needs of independent contractors.

Why Freelancers Need Professional Billing Documents

For freelancers, having the right format for documenting completed work is essential for maintaining a professional reputation and ensuring smooth financial transactions. Whether you’re offering consulting, design, writing, or other freelance services, a well-structured document helps you establish clear terms for your clients. By including essential information such as project descriptions, payment schedules, and contact details, you can avoid confusion and establish trust with your clients.

Where to Find the Best Formats

There are several platforms and online resources where freelancers can access pre-made documents that can be edited and personalized with ease. Many of these designs come with sections for your business name, client contact details, a breakdown of services rendered, and payment terms. When selecting a design, make sure it includes all the elements you need to ensure clarity in your billing process.

Key features to look for:

- Clear Layout: A simple and well-organized design that makes it easy to navigate important sections such as pricing and deadlines.

- Customizable Fields: Editable sections for adding client-specific details, such as their name, services provided, and payment instructions.

- Professional Aesthetics: A modern and clean style that aligns with your personal brand and enhances your professional image.

Utilizing the right design for your billing process can save time, reduce errors, and ensure your payments are processed efficiently. By choosing the right structure, freelancers can spend less time on administrative tasks and more time focusing on their work.

How to Add Your Business Logo

Incorporating your company’s logo into your business documents is a simple yet powerful way to maintain a professional appearance and reinforce your brand identity. Whether you’re creating a document for clients, partners, or vendors, a well-placed logo can enhance the credibility of the document and make it stand out. The process of adding a logo to your document is straightforward and can be done in just a few steps, regardless of the software you’re using.

Steps to Add Your Logo

To ensure your logo is placed correctly and looks professional, follow these simple steps:

- Step 1: Prepare Your Logo File

Before inserting your logo, ensure that it’s in the right format (preferably .png or .jpg) and of good quality. A high-resolution image will look sharper, even when scaled down.

- Step 2: Open Your Document

Open the document where you’d like to insert your logo. If you’re using a pre-designed layout, this will usually be near the top of the page.

- Step 3: Insert the Logo

Navigate to the “Insert” or “Add Image” option in your document editor. Choose the file from your computer and adjust its size to fit your page layout. Make sure the logo is clear and doesn’t overpower the rest of the content.

- Step 4: Position the Logo

Typically, the logo is placed in the header area of the page, aligned either to the left, center, or right. You can also use design tools to adjust its position for a cleaner look.

- Step 5: Save Your Document

After adding and positioning your logo, save the document to ensure that the changes are stored. You can also save the layout as a new template for future use.

Additional Tips

- File Size: Make sure your logo file size is optimized for fast loading and sending. Avoid using excessively large files, as this could slow down the document’s performance.

- Consistency: Keep the size of your logo consistent across all documents. This ensures that your branding remains uniform and professional.

- Color & Contrast: Make sure your logo’s colors are appropriate for the document’s background. High contrast ensures that it’s visible and prominent.

By following these simple steps,

Common Mistakes to Avoid in Invoices

When creating billing documents, small errors can lead to confusion, payment delays, or even loss of business credibility. It’s important to ensure that every detail is accurate and clear to avoid misunderstandings with clients. While the process of preparing documents may seem straightforward, there are several common mistakes that can easily be overlooked. Being aware of these pitfalls can help you maintain professionalism and ensure smooth transactions.

Key Mistakes to Watch Out For

Here are some of the most frequent errors that occur when preparing billing documents:

- Incorrect Contact Information: Always double-check the client’s contact details. An incorrect address or email can delay payment or cause the document to go unnoticed.

- Missing Dates: Ensure that you include both the issue date and the payment due date. Without clear dates, clients might misunderstand the timeline for payment, leading to delays.

- Unclear Descriptions of Services: Be specific when listing the work completed. Vague descriptions can confuse clients and make it difficult for them to understand the value of what they are being billed for.

- Wrong Calculations: Always double-check your math. Incorrect totals, taxes, or discounts can cause delays in payment or disputes with your client.

- Omitting Payment Instructions: Clients need to know how to pay you. If you forget to include details like bank account information or payment links, you may experience delays or non-payment.

- Not Including Terms and Conditions: Always outline your payment terms clearly, including late fees or discounts for early payment. This can help prevent any misunderstandings down the road.

How to Avoid These Mistakes

To ensure your documents are error-free, consider the following tips:

- Use a Structured Format: A clean, well-organized design minimizes the chances of missing important details.

- Review Every Detail: Take the time to carefully review each document before sending it. A second set of eyes can help catch mistakes that you may overlook.

- Use Automation: Many invoicing systems have built-in error checks that can help you catch common mistakes, such as missing fields or incorrect math.

By being mindful of these common mistakes and following the best practices outlined above, you can ensure that your billing process runs smoothly and professionally, helping to avoid delays and maintain good relationships with your clients.

Creating Invoices for International Clients

When dealing with clients from different countries, it’s crucial to understand the specific requirements for billing and payment. International transactions often involve unique considerations such as currency differences, tax regulations, and varying payment methods. By ensuring that your documents meet these requirements, you can avoid confusion and delays in payments. Tailoring your billing statements for international clients ensures both clarity and professionalism.

There are several factors to keep in mind when creating documents for clients in other countries, as each region may have specific standards or practices. To ensure smooth and efficient transactions, the following guidelines should be followed.

Key Elements to Include

When preparing your documents for clients abroad, make sure to include the following essential details:

- Currency: Clearly specify the currency in which the payment is expected. This is especially important if you are working with clients in countries with different currencies.

- Tax Information: Include the correct tax rates, considering whether value-added tax (VAT) or other duties apply in the client’s country. Ensure that you are compliant with international tax regulations.

- Payment Methods: Offer multiple payment options that are accessible to your international clients, such as wire transfers, online payment platforms, or international checks.

- Client Address and Contact Information: Accurately list the full address of your international client, including the correct country and postal code, to ensure proper documentation and communication.

Best Practices for International Billing

In addition to the necessary elements, consider these best practices when preparing documents for clients across borders:

- Include Clear Payment Terms: Be explicit about the due date and late payment penalties. International clients might have different payment cycles, so clear communication is essential.

- Provide Multilingual Support: If you work with clients in non-English-speaking countries, consider offering your documents in their native language to reduce confusion.

- Account for Time Zones: Understand the time difference between your location and that of your client, and factor that into the timeline for payment or delivery.

By addressing these specific needs and making adjustments for cultural and legal differences, you can create clear, professional, and accurate billing documents that ensure timely payments from your international clients.

How to Save and Share Your Invoice

Once you have created your billing document, it’s essential to know the best practices for saving and sharing it with clients. Properly managing your files ensures that they are easy to access, secure, and delivered in a professional manner. Whether you’re sharing the document via email, cloud storage, or another method, having a clear process in place is important for timely payments and maintaining good client relationships.

There are several options for saving and sharing your billing documents, depending on the tools you use and the preferences of your clients. The following steps outline effective ways to handle these tasks efficiently.

Saving Your Document

Before sharing, it’s important to save your document correctly. Here are some tips for organizing and storing your files:

- Use Descriptive Filenames: When saving your document, use a clear and descriptive file name that includes the client’s name or project number, along with the date. For example, “JohnDoe_Invoice_2024-04-10.” This makes it easier to locate and reference in the future.

- Choose the Right File Format: Save your billing document in a widely accessible format. Many people prefer files that are universally readable and can be opened on different devices. Common formats include Word, Excel, or image files, but ensure your client can easily open it.

- Organize by Folders: Use folders to categorize your documents based on year, client, or project. This helps you maintain an orderly file system and easily access previous billing records when needed.

Sharing Your Document

After saving your document, it’s time to send it to the client. There are multiple methods for sharing your document securely and efficiently:

- Email: One of the most common ways to share billing documents is via email. Attach the file and include a polite message explaining the details. Always use a clear subject line like “Invoice for [Project/Service] – Due [Date].”

- Cloud Storage: If the file is too large to email, consider uploading it to a cloud storage service like Google Drive, Dropbox, or OneDrive. Then, send a link to the client for easy access. Ensure that the sharing settings are correct to avoid unauthorized access.

- Online Payment Platforms: Some online payment platforms allow you to directly send billing statements to clients through their system. These platforms may also offer additional features like payment tracking and reminders.

By following these steps for saving and sharing your documents, you can ensure that your billing process is smooth and professional. Proper file management will also help streamline your workflow and make it easier to track and f

Integrating Templates with Accounting Software

Integrating your billing documents with accounting software can significantly streamline your financial management processes. By syncing your prepared documents with your accounting system, you ensure that your records are accurate, up-to-date, and easier to manage. This integration also reduces the risk of manual errors, saving you valuable time and effort while improving overall efficiency.

Many modern accounting platforms allow you to customize and upload various document formats, ensuring that you can generate accurate statements directly within your accounting system. Below are the key steps and benefits of integrating these documents with your software:

Key Steps for Integration

Integrating your documents with accounting software typically involves the following steps:

- Choose Compatible Software: Ensure that your accounting software supports document integration. Many popular accounting platforms offer built-in functionality for creating and managing financial records.

- Upload Your Document Format: Check the types of formats your accounting software accepts, such as Word, Excel, or custom document formats. Upload your customized document accordingly.

- Automate Data Entry: After uploading your document, configure your software to auto-fill relevant fields such as client name, services rendered, and amounts due, reducing the need for repetitive data entry.

Benefits of Integration

There are several advantages to integrating your billing records with your accounting software:

| Benefit | Description |

|---|---|

| Accuracy | Automating the transfer of billing data minimizes human errors, ensuring the accuracy of your financial records. |

| Efficiency | Integrating documents saves time by eliminating the need for manually entering information into your accounting software. |

| Real-time Updates | Your accounting system will always reflect the most recent billing information, allowing for real-time tracking and reporting. |

| Better Reporting | Integration enables more comprehensive financial reports, as all your data is centralized in one system, improving analysis and decision-making. |

By integrating your documents with accounting software, you can streamline your billing process and gain better control over your financial operations. This connection allows for seamless data flow, enhancing both accuracy and efficiency, while also providing valuable insights into your business performance.

Why PDF is the Best Format for Invoices

Choosing the right file format for your business documents is crucial for maintaining professionalism and ensuring accessibility. A versatile file format offers security, compatibility, and easy sharing, which is essential for seamless transactions and efficient financial management. Among various options, certain file formats stand out as the best choices for generating and sharing financial documents with clients.

One format that consistently delivers reliable results for document sharing is highly regarded for its portability and consistency across different systems. This makes it ideal for exchanging important financial information securely. Let’s explore why this format is often considered the most effective choice.

Key Advantages of Using This Format

- Universal Compatibility: This format can be opened and viewed across all operating systems without formatting issues, ensuring that your documents appear exactly as intended, regardless of the recipient’s software.

- Security: Files in this format are easily encrypted or password-protected, allowing for secure transmission and minimizing the risk of unauthorized access to sensitive information.

- Professional Presentation: The format retains the integrity of the document layout, fonts, and graphics, ensuring that your documents are displayed clearly and professionally on all devices.

- Compact File Size: This format is highly efficient in terms of file compression, making it easy to share large documents without compromising quality.

Features to Look for in This Format

When choosing this format, there are several essential features that enhance usability and ensure your documents are easily accessible:

| Feature | Benefit |

|---|---|

| Cross-platform Compatibility | Works seamlessly on various platforms, from Windows and Mac to mobile devices, without the need for special software or plugins. |

| Document Protection | Allows encryption and password protection to safeguard your financial data and restrict access to authorized parties only. |

| Preserved Formatting | Maintains the original design and layout of your document, ensuring that text, images, and graphics appear consistently. |

| Easy Sharing | Can be easily shared via email or cloud storage services without worrying about compatibility or file size limitations. |

In conclusion, the versatility, security, and professional appearance of this file format make it the top choice for sending business documents. Its ease of use, combined wit

Best Practices for Professional Invoicing

Creating accurate and clear billing documents is essential for ensuring smooth business transactions and maintaining professional relationships with clients. A well-crafted financial document not only provides all necessary information but also reflects your company’s professionalism and attention to detail. By following established best practices, businesses can avoid common mistakes and ensure their documents are both effective and efficient.

There are several key aspects to consider when creating financial documents for clients. From structuring the layout to providing complete and accurate details, each element plays a role in ensuring your communication is both clear and legally sound. Here are some best practices to follow when preparing such documents.

1. Include Clear Contact Information

Always include both your business’s and the client’s contact details. This includes names, addresses, phone numbers, and email addresses. Clear identification ensures that the recipient knows exactly who the sender is and how to reach them in case of any queries.

2. Specify Payment Terms and Deadlines

Be clear about the terms of payment. Include the total amount owed, the due date, and any penalties for late payments. This helps to avoid confusion and ensures that both parties are on the same page regarding expectations and deadlines.

3. Provide a Breakdown of Charges

Offer a detailed breakdown of all charges. Whether it’s hourly rates, product costs, or any other expenses, this transparency helps to clarify how the final amount is calculated. This can prevent disputes and build trust with your clients.

4. Use a Professional Layout

Ensure that your financial document is visually appealing and easy to read. A clean layout with clearly defined sections, appropriate use of space, and easy-to-read fonts makes your document more professional and user-friendly. Avoid cluttering the page with unnecessary text or information.

5. Add a Unique Identification Number

Assign each document a unique number. This makes tracking and referencing easier for both you and the client. Having a clear system of sequentially numbered documents is vital for record-keeping and organization.

6. Proofread Before Sending

Before sending out any billing documents, double-check for errors. This includes verifying contact details, amounts, dates, and any other critical information. Small mistakes can lead to confusion and might damage your professional reputation.

By following these best practices, you ensure that your financial documents are clear, professional, and effective in ensuring timely payments. Establishing a consistent and organized approach to billing enhances both your internal processes and your client relationships.