Free Payroll Invoice Template for Effortless Employee Payment Processing

Managing employee compensation can be a time-consuming process for businesses of all sizes. However, having a well-structured system in place to document and track payments can significantly reduce the workload and prevent errors. A simple solution lies in using pre-designed documents that help businesses maintain organization and accuracy when handling worker payments.

These tools offer a straightforward way to outline hours worked, payment rates, and deductions, ensuring transparency and efficiency. With customizable options, they cater to various industries and can be tailored to specific needs. Embracing such solutions allows companies to save time and minimize the risk of mistakes, all while maintaining professionalism.

Whether you’re a small business owner or managing a larger team, adopting these practical resources can be an essential step toward simplifying your financial management and improving overall productivity.

Free Payroll Invoice Template Overview

Managing employee compensation requires precision and organization. For businesses looking to maintain accuracy and consistency, having the right tools to document payments is essential. By using standardized documents, companies can simplify the process of tracking hours, wages, and deductions while ensuring that everything is clearly laid out for both employees and employers.

What Makes These Resources Valuable

Such resources are invaluable for small and medium-sized businesses, offering a streamlined way to handle worker compensation. They help in organizing payment records, ensuring that each entry is accurate, which ultimately reduces the chances of errors. Additionally, using ready-made documents allows for quick customization, fitting the specific needs of the business.

How to Integrate Into Your Workflow

Incorporating these documents into your regular financial routine is simple. They can be easily adapted to match the company’s payment structure, whether for hourly workers or salaried employees. By integrating them into your system, you create a more efficient workflow, reducing the time spent on manual calculations and paperwork.

How Payroll Invoices Simplify Payments

Keeping track of employee compensation can be a complicated process, but having a structured way to document payments can make it much easier. By using organized records that outline all the details of each payment, businesses can reduce the chance of errors and ensure that workers are paid accurately and on time. These well-structured documents not only help in tracking hours and wages but also make the entire payment process more transparent and efficient.

With a clear format, employers can quickly calculate pay rates, deductions, and overtime, ensuring all figures are correct before issuing payments. This saves time spent on manual calculations and minimizes the risk of miscalculations. Automating these processes helps reduce administrative burden and allows businesses to focus more on growth and development rather than spending excessive time on financial tasks.

Additionally, having a standardized document helps build trust with employees. When all necessary details are outlined clearly, workers have a better understanding of their pay, and any potential discrepancies can be easily addressed. This increases transparency and fosters better communication between employers and their teams.

Benefits of Using a Payroll Invoice

Implementing a well-structured payment record system offers a wide range of advantages for businesses. These tools provide a streamlined approach to calculating and documenting employee earnings, reducing the potential for mistakes while enhancing efficiency. By utilizing such resources, companies can ensure smooth and timely payments, keeping their operations running smoothly and their workers satisfied.

Key Advantages for Businesses

For businesses, these records offer significant time savings and reduce the administrative burden of managing compensation. With a clear format in place, payroll tasks are simplified, making it easier for accounting departments to process payments. In addition, such resources help businesses maintain compliance with labor regulations by providing a clear, auditable trail of all financial transactions.

Employee Trust and Transparency

For employees, these documents provide clarity and transparency regarding their earnings. When all payment details are outlined, workers can better understand how their compensation is calculated, which helps foster trust between employers and staff. Clear records also make it easier for employees to address any concerns or discrepancies in their pay.

| Benefit | Description |

|---|---|

| Accuracy | Reduces errors in calculations and ensures correct payment processing. |

| Efficiency | Simplifies the documentation and processing of employee compensation. |

| Transparency | Provides employees with clear and detailed information about their pay. |

| Compliance | Helps maintain records for legal and regulatory purposes, ensuring business compliance. |

Key Features of Payroll Invoice Templates

Well-designed payment records offer essential features that simplify the process of documenting and tracking employee compensation. These elements ensure that businesses can efficiently manage worker payments while maintaining accuracy and transparency. Key aspects of these resources make them a valuable tool for organizations seeking to streamline their financial processes.

Essential Elements for Accuracy

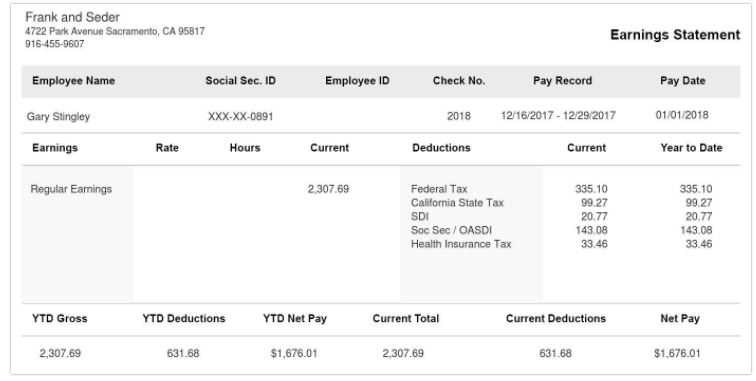

One of the most important features is the ability to include comprehensive details of each payment, such as hours worked, hourly rates, deductions, and bonuses. Clear sections for calculations ensure that everything is accurately documented, reducing the likelihood of errors and making it easier to verify pay details. Additionally, these tools can handle different pay structures, whether for hourly, salaried, or commission-based employees, providing versatility for various business types.

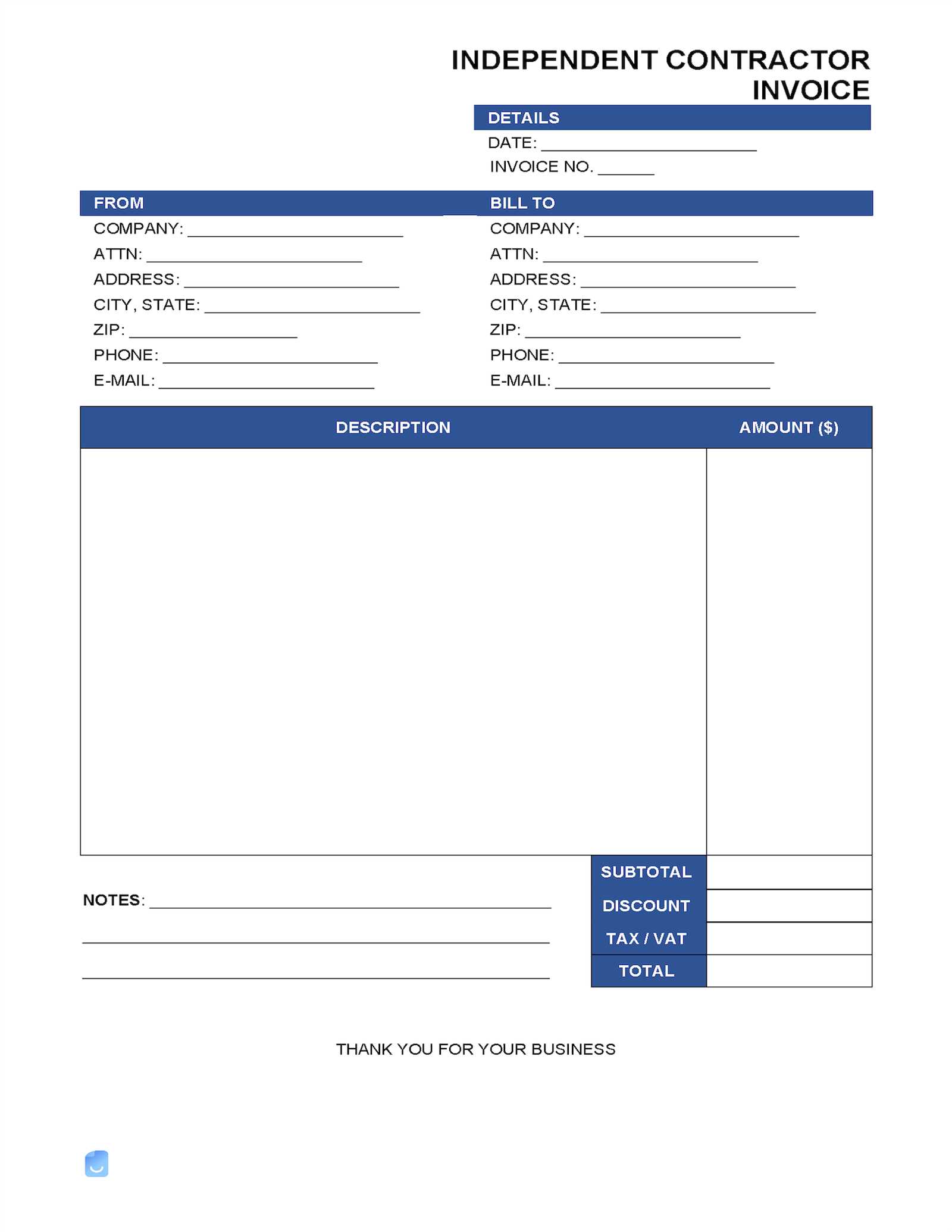

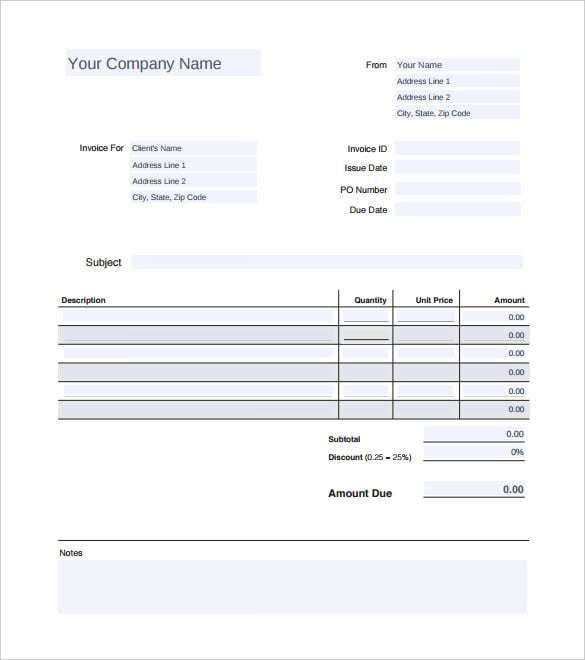

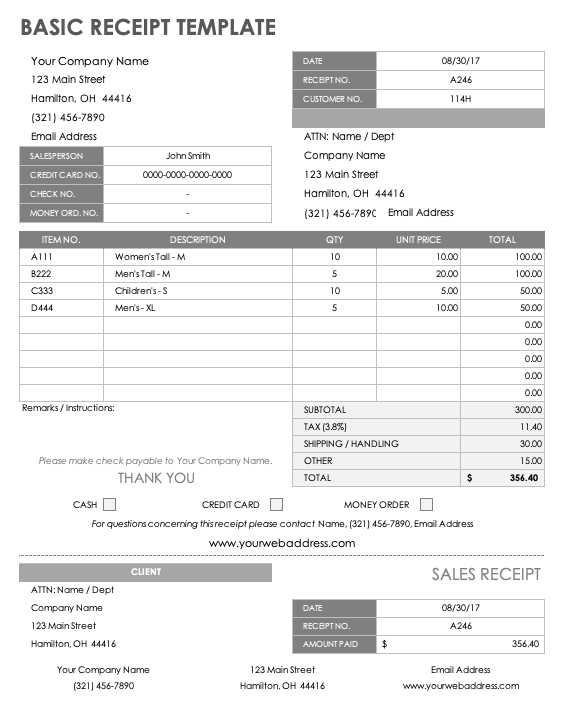

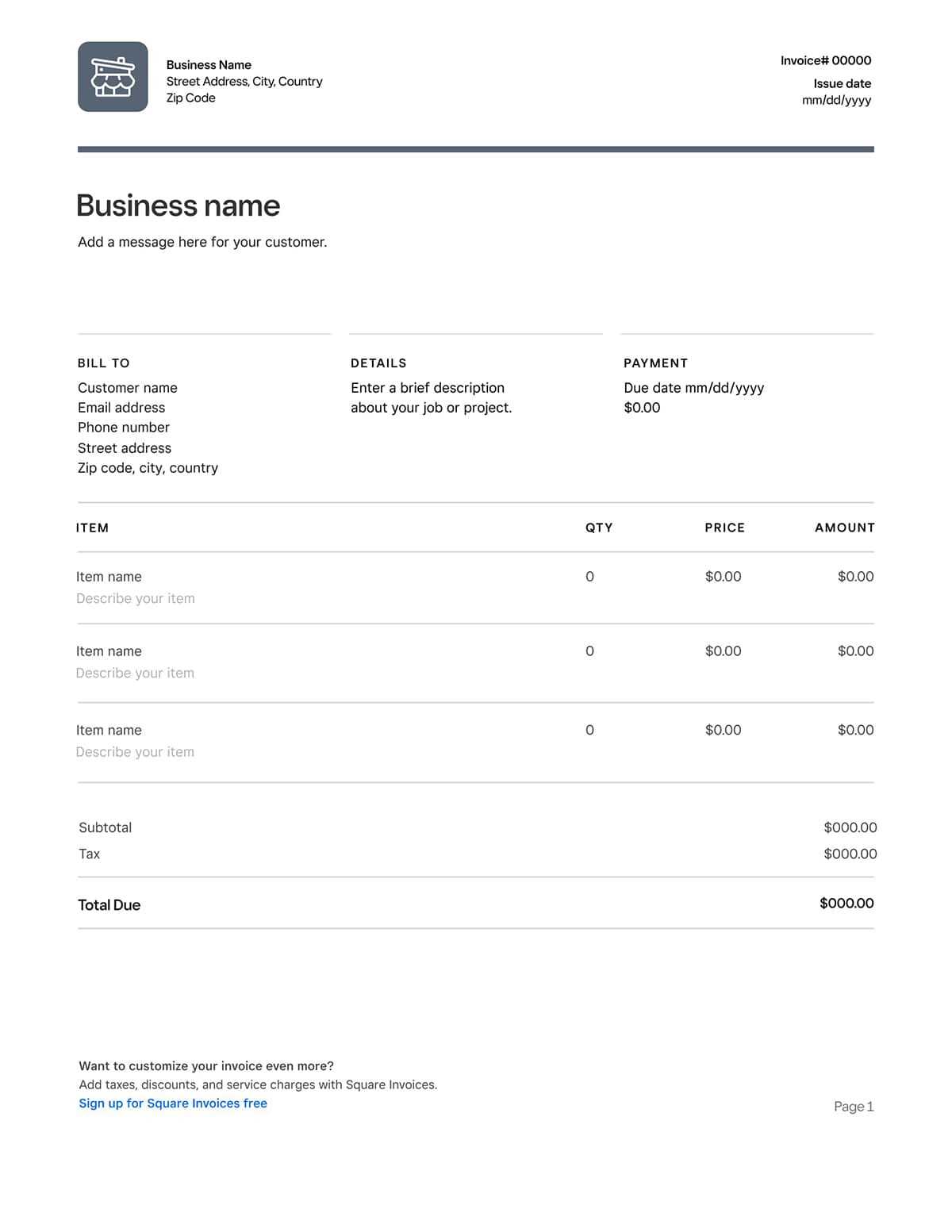

Customizable and User-Friendly Design

Another key feature is the customizable layout. These resources are typically designed to be flexible, allowing businesses to add their own branding, payment terms, and company-specific details. This customization helps create a professional appearance, which is essential for maintaining credibility and trust with employees. Easy-to-use formats ensure that even small business owners with limited experience in finance can quickly implement them without requiring advanced skills.

Steps to Create a Payroll Invoice

Creating an accurate and organized document for employee compensation involves several important steps. These steps ensure that all necessary information is captured, calculations are correct, and the document is clear and professional. By following a structured approach, businesses can simplify the payment process and avoid errors.

Step-by-Step Guide

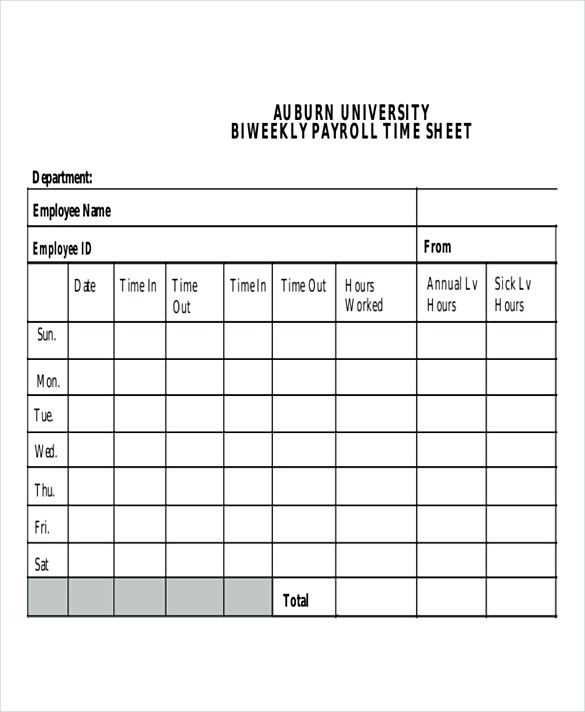

- Gather Employee Information: Collect the necessary details such as the employee’s name, address, and payment period. This will ensure that the document is personalized and specific to each worker.

- List Hours Worked and Pay Rates: Include the total number of hours worked or salary details, along with the agreed-upon pay rate. If applicable, also note overtime hours or special bonuses.

- Apply Deductions: Include any deductions for taxes, insurance, or other withholdings. Make sure to clearly outline these deductions to avoid confusion.

- Calculate Total Payment: After adding any bonuses and applying deductions, calculate the total amount due for the employee. This is the final figure that will be paid out.

- Include Payment Terms: Specify the payment due date and any other relevant payment details, such as the method of payment.

Finalizing the Document

- Review for Accuracy: Double-check all calculations, ensuring that all hours, rates, and deductions are correctly listed.

- Format for Clarity: Use a clean, easy-to-read layout. Make sure all sections are clearly labeled, and avoid unnecessary clutter.

- Save and Distribute: Save the finalized document in a secure format (e.g., PDF) and distribute it to the employee, either electronically or in print.

Customizing Your Payroll Invoice Template

Personalizing the payment record for your business ensures that it aligns with your company’s specific needs while maintaining a professional appearance. Customization can include altering sections to fit your business structure, adding company branding, and tailoring the layout to suit both the style and clarity required for efficient use. By making these adjustments, you not only streamline your processes but also present a polished document to employees.

| Customizable Element | How to Modify |

|---|---|

| Company Information | Add your company logo, name, address, and contact details at the top of the document for a personalized and professional touch. |

| Employee Information | Ensure fields for employee names, job titles, and payment periods are clearly labeled to provide specific details for each payment. |

| Pay Calculation | Adjust the format to reflect your business’s pay structure, including hourly rates, bonuses, and applicable deductions. |

| Payment Terms | Include your preferred payment method, due date, and any other relevant details, such as late fees or payment schedules. |

| Design Layout | Modify fonts, colors, and spacing to match your company’s branding and ensure easy readability for the recipient. |

By customizing each section, you ensure that the document is not only functional but also tailored to your specific operational needs. This attention to detail improves accuracy, efficiency, and overall employee satisfaction.

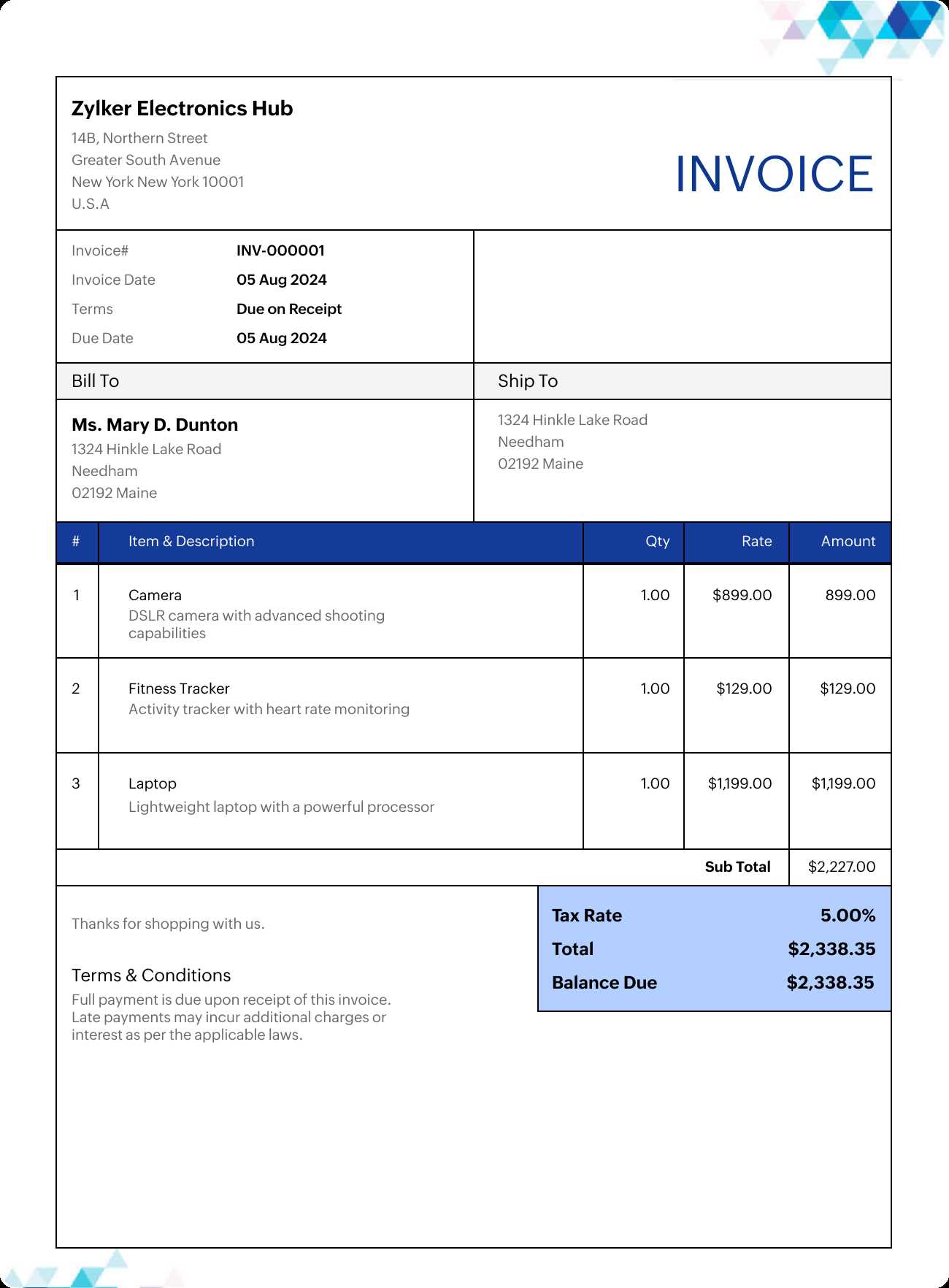

Essential Elements in a Payroll Invoice

To ensure clarity and accuracy when documenting employee compensation, certain key components must be included in the record. These essential elements provide a complete breakdown of hours worked, payment details, and any deductions or adjustments, making the document easy to understand for both the employer and the employee. Including all necessary information in a structured format is crucial for maintaining transparency and preventing misunderstandings.

Here are the critical elements that should always be present:

- Employee Information: Include the employee’s full name, job title, and contact details to ensure the document is clearly tied to the correct individual.

- Work Period: Specify the dates or time range for which the employee is being compensated. This helps track payments and ensures accuracy in reporting.

- Hours Worked: List the total number of hours worked during the specified period, distinguishing between regular hours, overtime, and any special working conditions.

- Pay Rate: Clearly state the agreed hourly rate or salary for the employee, along with any adjustments, such as bonuses or commissions.

- Deductions: Include any withholdings, such as tax deductions, insurance premiums, or retirement contributions. These details should be transparent to avoid confusion.

- Total Amount Due: Calculate the final amount to be paid to the employee, after factoring in all hours worked, pay rates, bonuses, and deductions.

- Payment Terms: Outline the method and timing of payment, as well as any additional terms that may apply, such as payment due dates or late fees.

By including these fundamental components, businesses ensure that their payment records are both comprehensive and professional, helping to maintain smooth financial operations and good relations with employees.

Where to Find Free Payroll Invoice Templates

Finding a suitable document for employee compensation records doesn’t have to be complicated or costly. Many online platforms offer ready-to-use resources that can help businesses create professional payment records quickly and without spending money. These resources are available in various formats and can be easily downloaded, customized, and integrated into your workflow.

Here are a few places where you can find reliable and free resources:

- Online Document Libraries: Websites such as Google Docs and Microsoft Office offer a variety of downloadable business documents, including those for compensation tracking. Many of these are customizable and easy to adjust to your business’s needs.

- Accounting Software Providers: Some accounting platforms provide free resources for users, including payment tracking documents. These can be particularly helpful as they integrate with the software’s other features.

- Business Resource Websites: There are several websites dedicated to offering free templates for small businesses. These resources often come with simple instructions, making them accessible for users with varying levels of experience.

- Template Sharing Platforms: Platforms like Canva or Template.net offer free and customizable options that can be downloaded and personalized. Many of these resources also provide design features, allowing businesses to add branding elements easily.

By exploring these options, businesses can find an appropriate solution that fits their needs without incurring additional costs, ensuring a seamless and professional approach to managing employee compensation records.

How to Use a Payroll Invoice Template Effectively

To make the most of a pre-designed document for tracking employee compensation, it’s essential to understand how to use it properly. These resources can save you time and reduce errors when documenting payments, but only if you follow the right steps. With proper customization and organization, you can streamline the payment process and maintain a high level of accuracy.

Steps to Follow for Maximum Efficiency

- Customize the Layout: Before using the document, adjust it to fit your business’s needs. Add your company logo, modify payment structures, and adjust any sections related to taxes or benefits.

- Input Employee Data: Ensure that you correctly input all relevant employee information, including name, job title, payment period, and contact details. This ensures clarity and avoids confusion.

- Update Payment Information: Always double-check hours worked, rates of pay, and any bonuses or deductions before finalizing the document. Accuracy here is key to preventing errors in compensation.

- Use a Consistent Format: Maintain consistency in your documents to ensure that they’re easily understood by your accounting team and employees. This also helps in maintaining proper records for future reference.

Best Practices for Ongoing Use

- Review Regularly: Make it a habit to review all entries before finalizing payments. Double-check calculations to prevent any discrepancies.

- Store Documents Securely: After creating and distributing the payment records, save them in a secure location. This is essential for legal and accounting purposes, as well as for future reference.

- Keep it Updated: As your business grows, remember to update the document structure or formulas to reflect any changes in employee compensation, tax rates, or company policies.

By following these simple guidelines, you can ensure that your financial documentation is efficient, accurate, and professional every time you process payments.

Free vs Paid Payroll Invoice Templates

When deciding which document format to use for managing employee compensation, businesses often face the choice between free and paid options. Both types offer their own set of advantages and limitations. Understanding the key differences can help companies make an informed decision based on their specific needs, budget, and desired features.

Advantages of Free Resources

- Cost-Effective: As the name suggests, these resources come with no cost, making them ideal for small businesses or startups with tight budgets.

- Simple to Use: Free documents are usually straightforward and easy to implement, without the need for complex configurations or learning curves.

- Basic Functionality: These resources typically include the essential elements needed to document compensation, such as employee details, hours worked, and total amounts due.

Advantages of Paid Resources

- Advanced Features: Paid options often come with additional functionalities, such as automated calculations, integration with accounting software, and customizable reporting features.

- Professional Design: Premium resources typically offer a more polished and professional appearance, which can enhance the credibility of your business when presenting payment records.

- Better Support: With paid resources, businesses often receive customer support for troubleshooting and assistance, ensuring a smoother experience during use.

Ultimately, the choice between free and paid options depends on the complexity of your business’s needs. Smaller companies with straightforward compensation structures may find free resources sufficient, while larger businesses or those with more complex payment requirements may benefit from the added features and support offered by paid solutions.

Common Mistakes to Avoid in Payroll Invoices

When creating documents to track employee compensation, it’s crucial to be aware of common mistakes that can lead to confusion, inaccuracies, and potential legal issues. Even small errors can have a significant impact on both your employees and your business’s financial health. By understanding these pitfalls, you can take steps to avoid them and ensure that your payment records are both accurate and professional.

Here are some of the most common mistakes to watch out for:

- Missing Employee Information: Failing to include essential details, such as the employee’s name, job title, or contact information, can lead to confusion and errors in documentation.

- Incorrect Hours or Pay Rates: Double-check the total hours worked and the agreed-upon pay rate. Even a small mistake here can result in overpaying or underpaying employees, which can lead to dissatisfaction or legal disputes.

- Failure to Account for Deductions: Forgetting to include taxes, benefits, or other withholdings can make your payment records inaccurate and may lead to compliance issues with local tax authorities.

- Omitting Payment Terms: Failing to clearly specify payment dates, methods, or any relevant terms can create misunderstandings between employers and employees and cause delays in payments.

- Lack of Clarity: A cluttered or hard-to-read format can make it difficult for employees to understand how their compensation was calculated. A clear, organized structure is essential to ensure transparency.

By paying attention to these details and avoiding these common errors, you can create accurate, reliable payment records that build trust with your employees and protect your business from costly mistakes.

How Payroll Invoices Ensure Accuracy

Maintaining accuracy in employee compensation is essential for both business operations and employee satisfaction. By using detailed records to track working hours, rates, and deductions, companies can significantly reduce the risk of errors. These payment records help streamline the calculation process, ensuring that both employers and employees are on the same page regarding the amount due.

One key way to ensure accuracy is by breaking down all components of the payment clearly, such as regular hours worked, overtime, bonuses, and deductions. With each element clearly defined, it’s easier to verify that no steps were missed and that the final calculation is correct. This level of transparency helps minimize the chance of overpayments or underpayments.

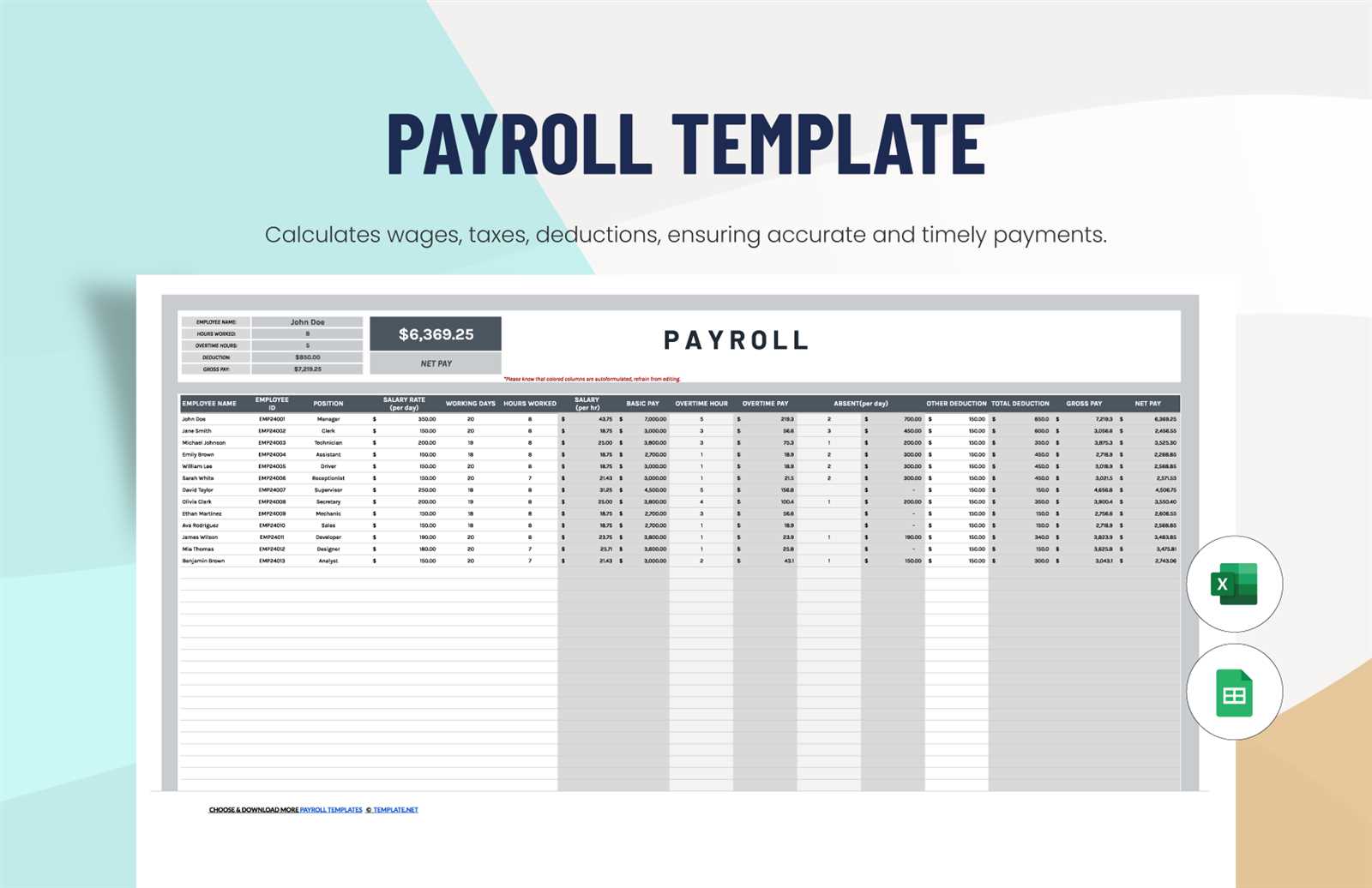

Automated Calculations in these resources often reduce the potential for human error. By using built-in formulas for total hours, rates, and deductions, businesses can avoid manual mistakes that are common when calculations are done by hand. This automated process also saves time, allowing companies to process payments more efficiently.

Another important factor in ensuring accuracy is the ability to double-check and compare different components. Payment records allow businesses to quickly verify that every section, from employee information to the final amount, aligns with internal records. This kind of auditability creates a safeguard against inaccuracies that could lead to legal or financial issues.

By utilizing a well-structured payment record, businesses can maintain precision in their financial operations and foster trust with their workforce.

Improving Payroll Efficiency with Templates

Efficiency is a crucial factor in managing employee compensation, and using pre-designed documents can significantly speed up the process while reducing the likelihood of errors. A well-organized document helps to automate calculations, maintain consistency, and track payments easily, ultimately leading to a more streamlined workflow. By using an appropriate document structure, businesses can focus on other important tasks without sacrificing accuracy or time.

Here are some ways in which pre-structured records can enhance efficiency:

- Automation of Calculations: Pre-built formulas can automatically calculate totals, deductions, and taxes, saving time and eliminating the risk of human errors in complex calculations.

- Consistency Across Records: Using the same document format for all employees ensures consistency, making it easier to track payments and generate reports. This is especially useful for businesses that manage multiple workers or have changing pay rates.

- Faster Documentation Creation: With predefined sections for all necessary details, creating compensation records becomes a faster process, allowing for quicker payment disbursement and reducing administrative burden.

- Ease of Customization: Many resources allow you to tailor the document to suit specific business needs, such as adjusting for overtime, benefits, or unique compensation plans, without starting from scratch each time.

By implementing well-organized documentation systems, businesses can handle compensation more efficiently, freeing up valuable time for other essential tasks while maintaining accuracy and transparency in their financial processes.

Legal Considerations for Payroll Invoices

When managing employee compensation records, it’s important to ensure that the documentation complies with legal standards. Properly structured records not only protect your business from potential legal issues but also provide transparency for employees. Failing to meet legal requirements can lead to disputes, fines, or other legal complications. Therefore, understanding the legal aspects of compensation records is crucial for businesses of all sizes.

Key Legal Requirements to Keep in Mind

- Accurate Record-Keeping: Employers are legally required to maintain accurate records of all payments made to employees. These records should include the number of hours worked, rates of pay, and any deductions or adjustments made. Inaccurate records can lead to disputes and legal consequences.

- Compliance with Tax Laws: Compensation records must reflect correct tax withholdings. Employers must comply with federal, state, and local tax laws when documenting earnings and deductions, ensuring that the proper amounts are withheld and reported.

- Clear Payment Terms: It’s important to specify the terms of payment, such as due dates, payment methods, and any other relevant details. Clear terms help prevent misunderstandings and are often required by law to ensure that employees are paid promptly and correctly.

- Retention of Records: Employers are typically required to keep compensation records for a specified period (often 3-7 years) in case of audits or legal inquiries. Be sure to retain these records for the required time to stay in compliance with labor laws.

- Transparency with Employees: Providing employees with clear and detailed compensation records helps to build trust and avoid confusion. This includes clearly outlining the breakdown of hours worked, any overtime, bonuses, deductions, and the final amount due.

How to Ensure Compliance

- Stay Informed: Regularly review local, state, and federal regulations to ensure that your compensation records meet all legal requirements. Labor laws can change, and it’s important to stay updated.

- Consult Legal Advisors: If you’re unsure about the legal aspects of compensation records, it’s always a good idea to consult with legal or accounting professionals who can provide guidance and help ensure compliance.

- Use Trusted Resources: When creating payment records, use reliable resources or software that are designed to comply with legal standards. Many software solutions come with built-in compliance checks to help you stay on track.

By understanding and adhering to these legal considerations, businesses can avoid costly mistakes and ensure that their employee compensatio

How to Track Payroll Payments with Invoices

Tracking employee payments is an essential part of managing a business, ensuring that employees are compensated accurately and on time. A well-organized system for recording payments helps maintain transparency, simplifies financial reporting, and ensures compliance with tax and labor laws. By using detailed payment records, businesses can easily track the amounts paid, identify any discrepancies, and stay on top of their financial responsibilities.

Here are key steps for effectively tracking payments:

- Record Every Payment: Each time an employee is paid, create a record detailing the amount, the hours worked, the pay rate, and any deductions. This will give you a complete history of payments that can be referenced later.

- Include Payment Dates: Always note the date of payment in each record. This is important for tracking when payments were made and can help resolve any potential disputes regarding payment timing.

- Specify Deductions and Bonuses: If applicable, clearly indicate any deductions (such as taxes, benefits, or retirement contributions) and any bonuses or incentives that were included in the payment. This ensures that the records are complete and easy to understand for both the business and the employee.

- Organize by Employee: Maintain separate records for each employee to easily track their individual compensation history. This makes it easier to access specific payment information whenever needed.

- Use Consistent Formatting: Whether you are using digital software or manual records, consistency is key. A standardized format makes it easy to track payments over time, identify trends, and generate reports without confusion.

Automating the Process: Many businesses turn to software solutions that automate the process of tracking payments. These tools can help generate and store detailed records, making it easier to retrieve payment history and ensuring that all calculations are accurate. Additionally, automation reduces the risk of human error, improving the reliability of your payment tracking system.

By following these steps, businesses can maintain accurate and organized payment records, which not only ensures that employees are compensated fairly but also provides a reliable system for financial audits, tax fi

Best Practices for Using Payroll Templates

Using pre-designed documents to track employee compensation and benefits can significantly improve the accuracy and efficiency of financial record-keeping. However, to fully leverage their benefits, it is essential to follow best practices. A well-structured document ensures that all necessary information is captured, calculations are accurate, and the process remains streamlined. Adhering to these practices also reduces the likelihood of errors and improves overall management of employee compensation.

Key Best Practices

- Ensure Consistency: Use the same format for every employee record to create uniformity and avoid confusion. Consistent documentation makes it easier to track compensation, compare different pay periods, and generate reports.

- Include Detailed Breakdown: Be sure to clearly outline each component of the payment, including hourly rates, overtime, bonuses, and any deductions. A transparent breakdown allows employees to easily verify their pay and helps avoid potential disputes.

- Regularly Update Information: Keep all employee details up to date, such as job titles, pay rates, and benefits. If any changes occur, make sure to adjust the document to reflect the most current data, ensuring accuracy for future payments.

- Double-Check Calculations: Whether you’re calculating hours worked or deductions, always double-check the numbers before finalizing the record. This helps avoid errors that could lead to overpayments or underpayments.

- Maintain Confidentiality: Compensation information is sensitive. Store the documents securely, and restrict access to authorized personnel only. Always ensure compliance with privacy regulations to protect both the business and its employees.

Additional Tips for Efficiency

- Automate Where Possible: Use software or digital tools to automate the calculation of pay rates, hours, and deductions. This minimizes the chance of human error and speeds up the entire process.

- Back-Up Data Regularly: To safeguard against data loss, always back up compensation records, either in cloud storage or an external system. This ensures the business has access to the information even in case of unexpected issues.

- Use Clear, Simple Language: Ensure that the language in the records is easy to understand for all employees. Avoid jargon and be clear about how compensation is calculated and paid.

By following these best practices, businesses can create reliable, professional records that help maintain accuracy, prevent mistakes, and foster trust with employees. Properly organized compensation documents contribute to smoother financial management and a more transparent workplace.

Why Small Businesses Need Payroll Invoices

For small businesses, accurate financial documentation is essential to maintain smooth operations and ensure compliance with tax and labor laws. One key aspect of this is properly documenting employee compensation. Clear and well-organized payment records help businesses track expenses, manage employee relations, and protect themselves during audits or legal inquiries. Additionally, having detailed compensation records fosters transparency and trust with employees.

Importance of Accurate Compensation Records

Maintaining clear records is crucial for small businesses, as it ensures the following:

- Tax Compliance: Small businesses must comply with federal and state tax regulations, and having accurate records of employee earnings and deductions makes tax reporting and filings much easier.

- Legal Protection: Properly documented payments help protect businesses in case of disputes. If an employee claims they were underpaid or their compensation was incorrectly calculated, detailed records can quickly resolve the issue.

- Transparency: Providing employees with clear and understandable compensation details builds trust and encourages open communication between employers and their staff.

How Payroll Records Help Manage Costs

Documenting employee payments helps small business owners manage and predict costs more accurately. By using organized records, business owners can:

- Track Labor Expenses: With organized records, it’s easier to monitor how much the business is spending on employee compensation, helping manage budgets and control expenses.

- Plan for Growth: As small businesses expand, having detailed payment records allows owners to adjust budgets accordingly and prepare for the increased financial demands of hiring more employees.

- Prepare for Audits: Having comprehensive records ensures that businesses are prepared in the event of an audit. Clear documentation will allow for smoother interactions with tax authorities and minimize the risk of penalties.

Key Elements of Payroll Records

Here’s a summary of essential components that should be included in every compensation record for small businesses:

| Element | Description |

|---|