Free Painting Invoice Template for Easy and Professional Billing

Managing finances in any service-based business can be a daunting task. One of the key components to staying organized and professional is having an efficient way to bill your clients. Using pre-designed documents that allow for customization can help simplify this process significantly. With the right structure in place, you can ensure that all necessary information is included and presented clearly to clients.

Whether you’re an independent contractor or part of a larger team, having a reliable document for detailing services rendered is essential for maintaining a smooth workflow. These resources allow you to list items, calculate totals, and add additional charges like taxes or discounts. By using a well-organized format, you can avoid mistakes and make sure your clients understand the charges clearly.

Instead of starting from scratch each time you need to bill a customer, leveraging a ready-made structure can save you time and effort. With easy-to-use and flexible designs, these documents help maintain a professional image, ensuring that your business operations run smoothly. Whether you’re looking to keep things simple or add more details, customizing these forms to your needs can make all the difference.

Free Painting Invoice Template Overview

When it comes to billing for services, having a well-structured document is essential for maintaining professionalism and ensuring clarity. Such documents help both service providers and clients stay on the same page regarding costs, work completed, and payment terms. The right format not only saves time but also ensures that all necessary details are included, reducing the likelihood of disputes or confusion.

Why a Structured Document Matters

Using a ready-made structure for your billing makes the entire process more efficient. It allows you to:

- Ensure all essential details are covered

- Present information in a clear and organized manner

- Save time when creating documents for multiple clients

- Maintain consistency across all your transactions

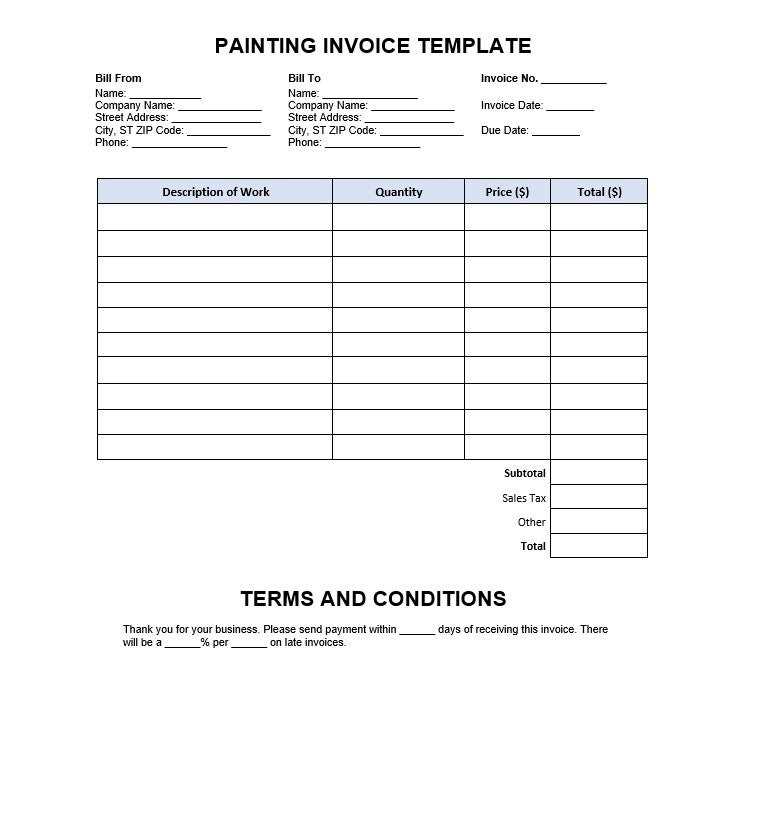

What to Expect from a Customized Billing Form

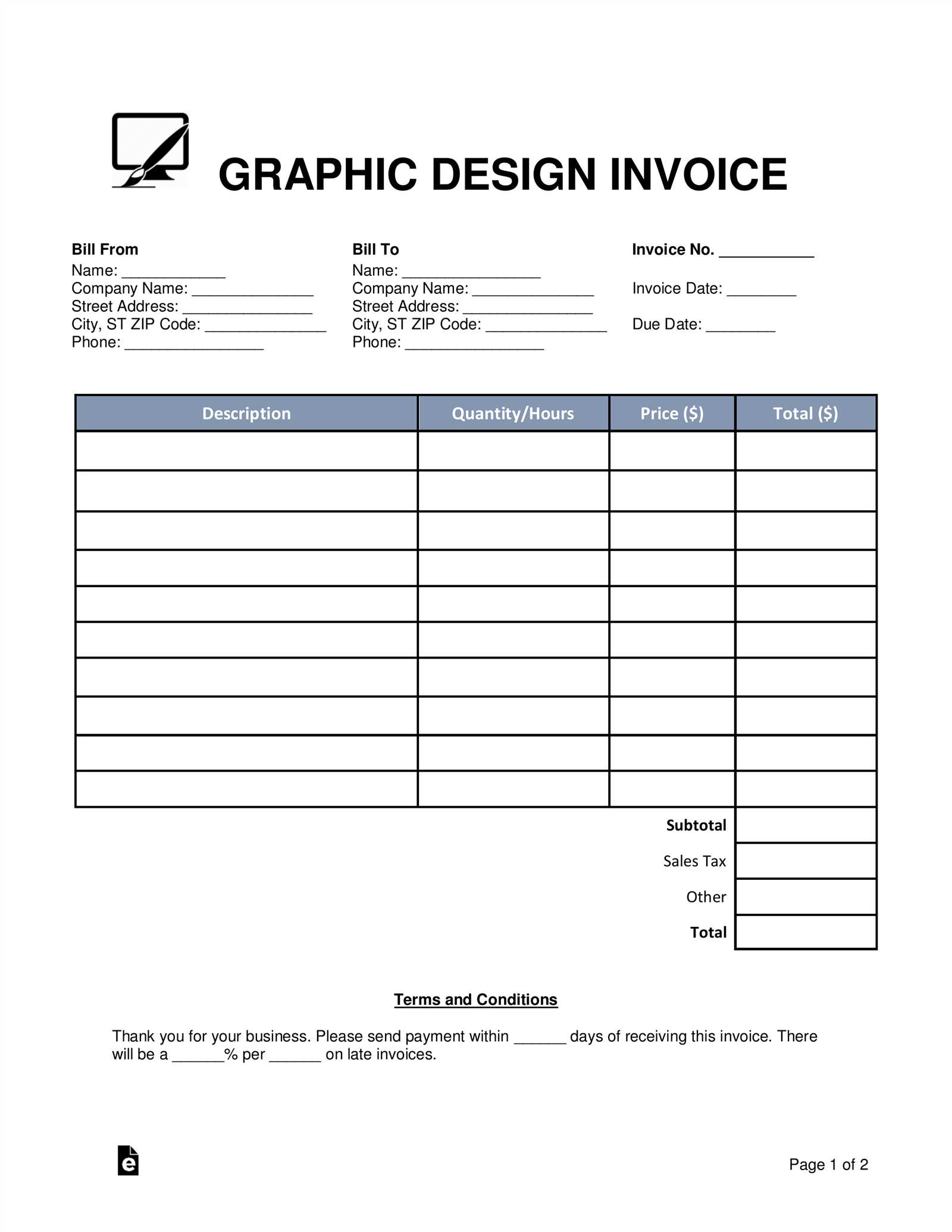

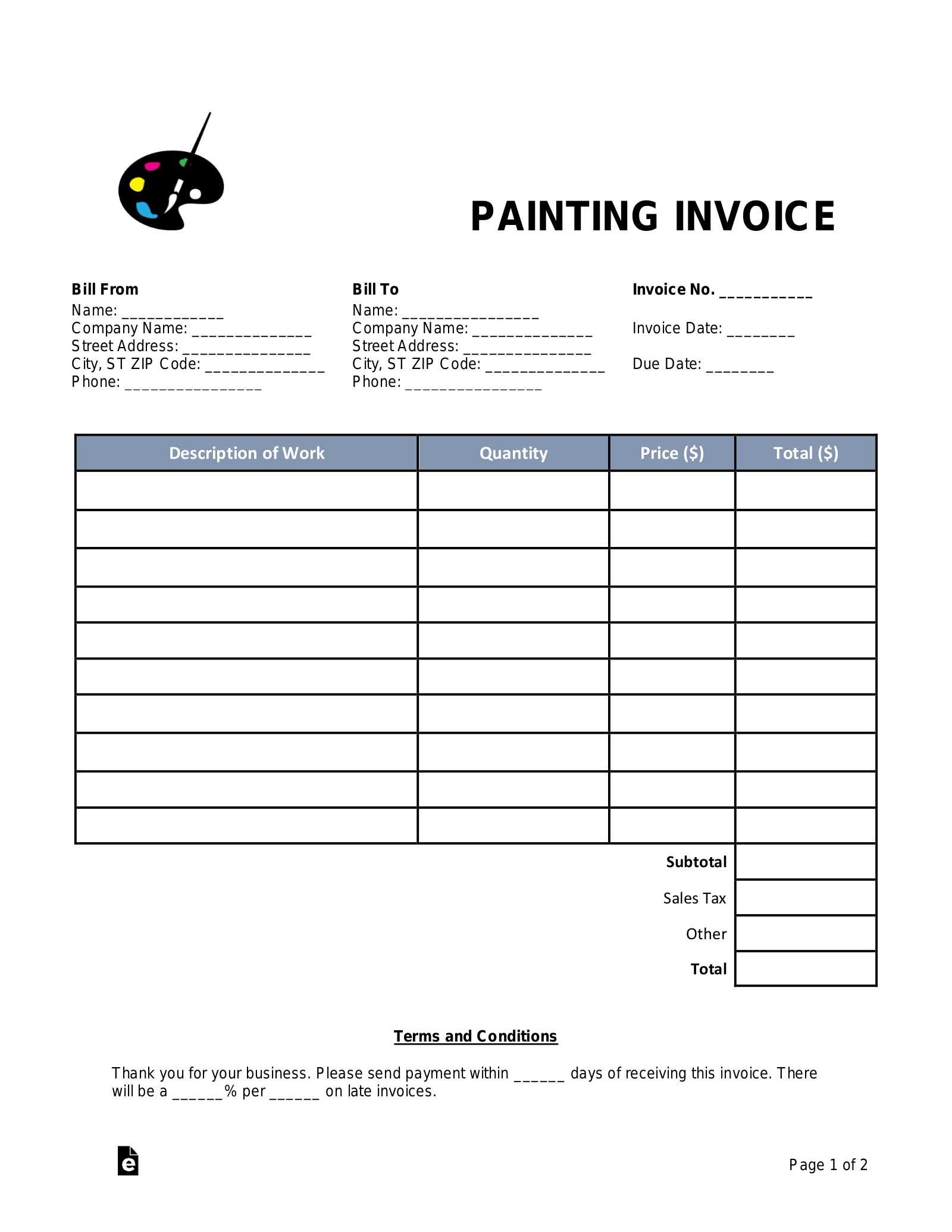

A properly designed document should cover several key elements. The most important parts typically include:

- Service Description: Clear breakdown of what was done or provided.

- Cost Calculation: Accurate pricing for each item or service listed.

- Payment Terms: Clear instructions on payment deadlines, methods, and any applicable late fees.

- Client Details: Name, address, and contact information of the client receiving the service.

By utilizing such a format, you can create a smooth transaction experience, leaving no room for ambiguity and ensuring both parties are satisfied with the billing process.

Why You Need a Painting Invoice

In any service-based business, clear communication and proper documentation are vital for maintaining professionalism and ensuring smooth transactions. A well-structured record of the work completed not only helps clarify charges but also serves as a legal document in case of disputes. This record ensures both the service provider and the client are aligned on expectations, terms, and payment deadlines.

Having a detailed account of services performed allows you to:

- Track payments and outstanding balances

- Maintain transparency with clients regarding the costs of work done

- Enhance your credibility and professionalism

- Stay organized and streamline the billing process

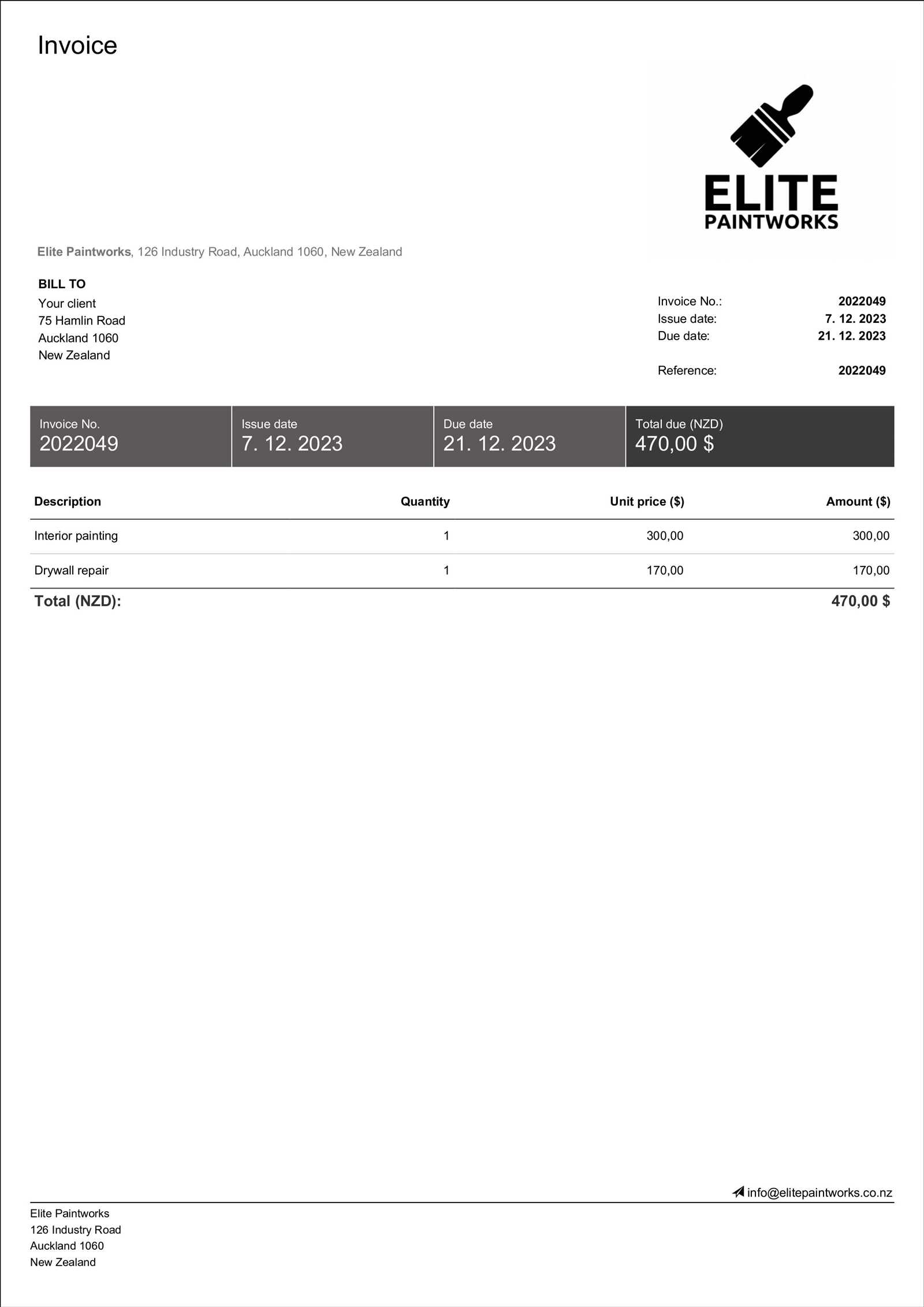

To further illustrate the importance of proper documentation, consider the following example of key details that should be included in every document:

| Section | Description |

|---|---|

| Client Information | Name, address, and contact details of the recipient of services. |

| Service Breakdown | Detailed list of tasks or items provided, including descriptions and quantities. |

| Cost Breakdown | Clear pricing for each item or task, with subtotals and taxes if applicable. |

| Payment Terms | Terms specifying due dates, accepted payment methods, and penalties for late payment. |

These components make it easier to manage your financial records, reduce misunderstandings, and keep everything in order for future reference. A simple yet comprehensive record protects both your business and your clients, allowing for smooth and efficient transactions every time.

Benefits of Using Invoice Templates

Using pre-designed documents for billing brings numerous advantages to any business, especially for those in service-oriented industries. These ready-to-use forms not only save time but also ensure consistency and professionalism across all transactions. By simplifying the process, they allow you to focus on delivering quality work rather than spending excessive time on administrative tasks.

Here are some key benefits that come with using a preformatted document for billing:

- Time Efficiency: With a structured form, you can generate accurate billing records quickly without starting from scratch each time.

- Consistency: Having a uniform format for all transactions ensures that all important details are included and presented in a professional manner every time.

- Reduced Errors: Predefined fields guide you in entering the right information, helping to minimize mistakes in calculations or missing details.

- Improved Client Relationships: Providing a clear and easy-to-understand document builds trust and enhances your image as a professional.

- Legal Protection: A well-detailed form serves as a binding document that can help resolve disputes and provide proof of agreed terms.

- Customization: These forms are flexible and can be adapted to fit different services, payment structures, or client requirements.

By integrating such documents into your routine, you ensure that all financial aspects of your business are properly managed and documented, making it easier to maintain healthy cash flow and strong business relationships.

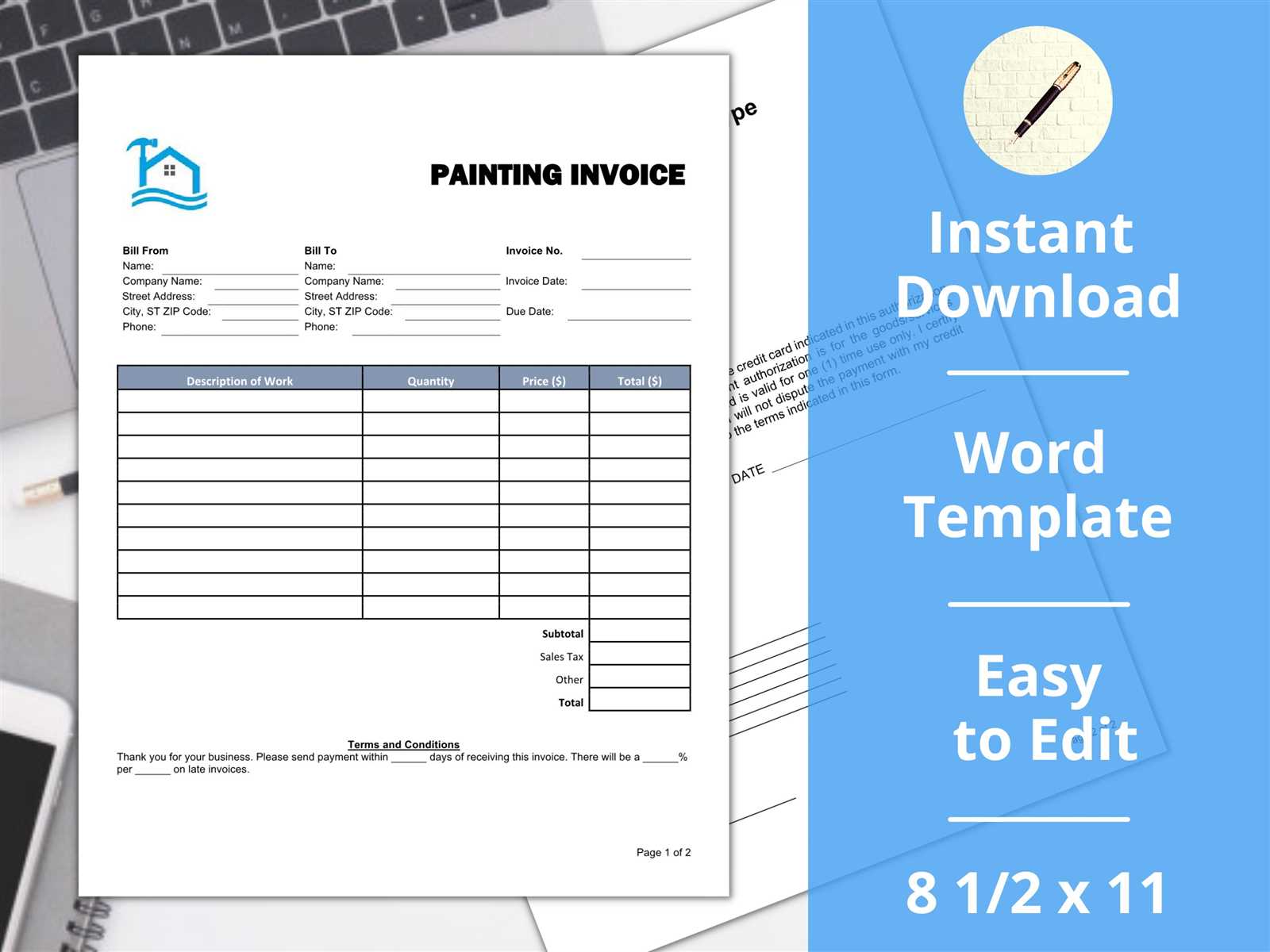

How to Customize Your Invoice Template

Customizing your billing form is essential for tailoring it to your business needs and ensuring it aligns with your branding. A personalized document helps maintain consistency in communication with clients and reflects your professionalism. Making adjustments to an existing structure can also streamline the billing process, saving you time while ensuring that all necessary details are covered.

Steps to Personalize Your Billing Document

Follow these simple steps to adjust the structure and content of your document:

- Branding: Add your company logo, color scheme, and contact information at the top. This helps clients recognize your business immediately and reinforces your brand identity.

- Service Details: Modify the section where you describe the work performed. Ensure it reflects the specific services you offer and adjust language to be clear and precise for each project.

- Payment Terms: Customize the terms of payment to fit your preferences, whether that includes deposits, discounts, or specific due dates.

- Currency and Taxes: Include the correct currency and tax rates based on your location. Make sure to adjust the subtotal, tax, and total sections accordingly.

Additional Customization Options

Beyond the basics, you can further tailor your document by:

- Adding Fields: Include custom fields such as client project references or order numbers if needed for specific clients or jobs.

- Setting Up Payment Methods: Specify the payment methods you accept, whether by credit card, bank transfer, or check.

- Adjusting Layout: Tweak the layout to suit your needs, such as adding more space for itemized charges or highlighting special terms.

By customizing the form in a way that reflects both your services and business style, you can ensure that every billing process is smooth, clear, and professional.

Where to Download Free Templates

Finding ready-made, customizable documents for billing is easier than ever. Several online platforms offer free resources to help you create professional records quickly and efficiently. These websites provide various formats, from simple designs to more detailed ones, allowing you to select one that best suits your business needs.

Here are some of the best places to download customizable documents:

- Microsoft Office Templates: Microsoft offers a range of downloadable forms for various business needs, including service records. Simply search their template library for easy access to customizable options.

- Google Docs: Google provides free, editable documents in its template gallery. You can access and modify these documents directly from your browser, making them easy to update and share.

- Canva: Known for its design tools, Canva also offers free downloadable billing forms. Their easy-to-use platform allows for quick customization with a wide range of templates.

- Template.net: This site provides a variety of professional documents, from simple forms to more detailed ones. All are easy to download and personalize.

- FreshBooks: While primarily a paid service, FreshBooks offers free downloadable versions of their forms to give users a taste of their invoicing tools. Great for a quick start.

Many of these platforms allow for easy modification, ensuring that you can adapt the documents to your business style and needs. Most importantly, you can start using them immediately without any cost or software requirements.

Choosing the Right Template for Your Business

Selecting the right document for billing is crucial for ensuring that your records are both professional and aligned with your business practices. A well-chosen structure not only reflects your brand but also simplifies the transaction process for both you and your clients. The key is finding a layout that is straightforward, yet flexible enough to handle all the details of your specific services.

Factors to Consider When Choosing

When selecting a billing form, keep the following factors in mind:

- Business Type: Depending on whether you’re a freelancer, small business owner, or part of a larger organization, your needs may vary. Simple service records might work for small jobs, while more detailed forms could be necessary for larger projects or ongoing services.

- Customization Options: Choose a structure that allows you to easily add or remove fields depending on the specifics of each job. You may need to adjust the layout for different services or clients.

- Clarity and Simplicity: Opt for a design that is easy for clients to read and understand. Clear itemization, straightforward terms, and legible fonts go a long way in maintaining professionalism.

- Legal Requirements: Make sure the form complies with local regulations, such as tax rates or required client information. This ensures that all your documentation is valid and accepted in case of disputes.

Where to Find the Best Options

Once you know what to look for, there are many online resources that offer a wide range of customizable options. Consider trying out several options to determine which one best fits your workflow and client expectations.

By carefully evaluating your business needs and client expectations, you can select the most effective document that helps streamline your processes and maintain a high level of professionalism.

Common Mistakes to Avoid in Invoicing

Proper billing is a crucial part of running a business, yet many professionals make avoidable errors that can lead to confusion, delays, or even disputes with clients. These mistakes can undermine your professionalism and affect your cash flow. Understanding common pitfalls and how to avoid them is essential to ensure smooth transactions and maintain strong client relationships.

Typical Errors and How to Prevent Them

Here are some of the most common mistakes that service providers often make when creating their billing records:

| Error | Consequence | How to Avoid |

|---|---|---|

| Missing Contact Information | Delays in communication and payments | Always include accurate details for both parties at the top of the document. |

| Unclear Service Descriptions | Client confusion and disputes over charges | Provide detailed descriptions of all services rendered, including quantities and rates. |

| Incorrect Payment Terms | Late payments and financial stress | Clearly specify payment methods, due dates, and any penalties for late payments. |

| Failure to Include Taxes or Fees | Unexpected surprises for clients | Double-check that taxes and additional charges are included and clearly outlined. |

| Not Double-Checking Calculations | Overcharging or undercharging clients | Review all figures before sending to ensure accuracy in totals and calculations. |

Why Attention to Detail Matters

By taking the time to carefully craft your billing documents, you prevent misunderstandings and ensure that payments are made promptly. Clients appreciate clarity, and by avoiding common mistakes, you demonstrate your commitment to professionalism. Paying attention to these details will also help you manage your finances better and build long-term trust with your clients.

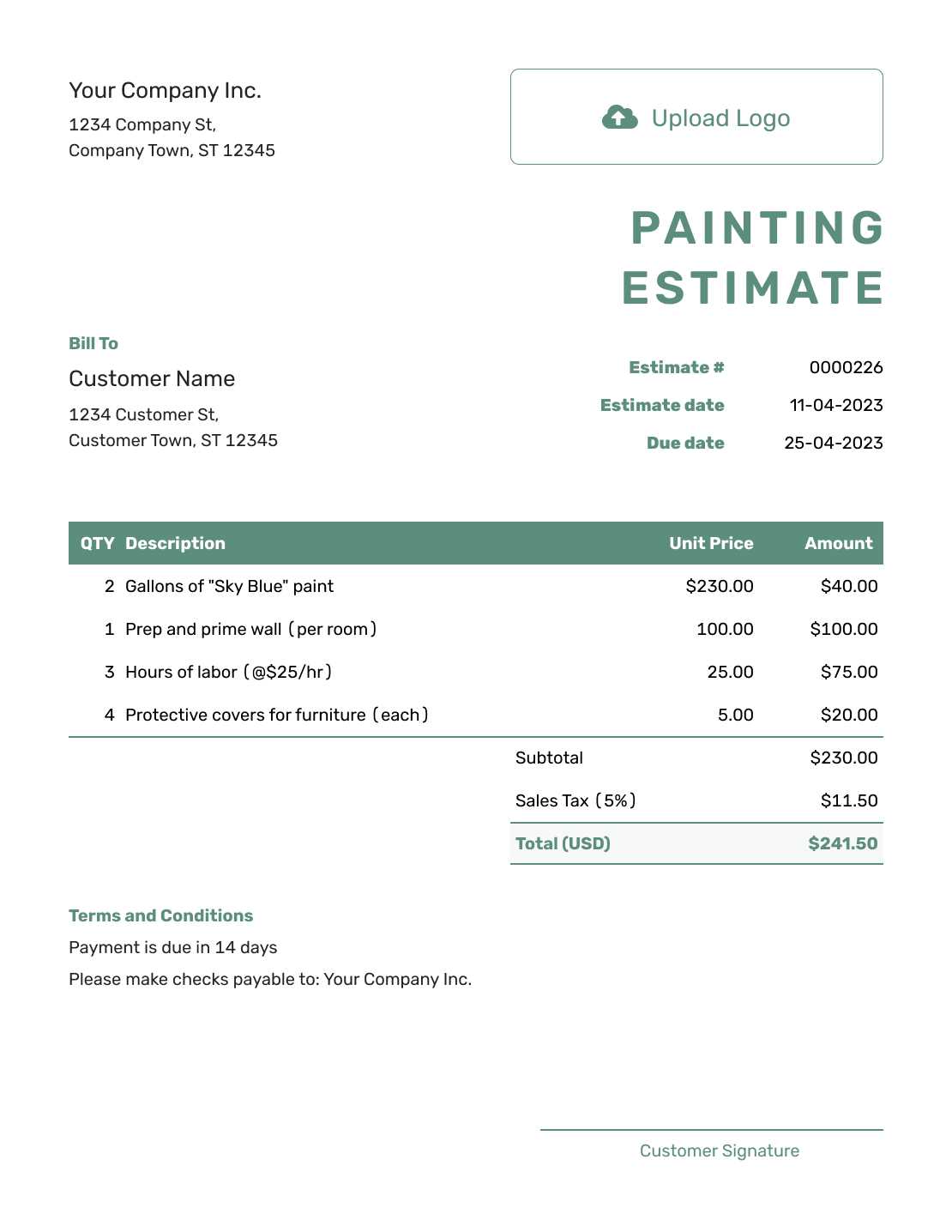

How to Add Taxes and Discounts

Incorporating taxes and discounts into your billing documents is essential for ensuring that all charges are accurate and compliant with local regulations. Whether you’re applying a sales tax, offering a discount for early payment, or including a promotional offer, these adjustments can significantly affect the final amount due. Properly adding these elements ensures transparency and helps maintain good client relationships by clearly communicating the costs involved.

Adding Sales Tax

To apply taxes to your services or products, you need to calculate the appropriate rate and include it clearly in the document. Here’s how to do it:

- Determine the correct tax rate: Research your local tax laws to determine the applicable rate for your goods or services.

- Apply the rate to the subtotal: Multiply the subtotal (before tax) by the tax rate to calculate the amount of tax due.

- Include the tax on the document: List the tax amount separately and add it to the subtotal to show the total amount due.

Example: If the subtotal is $500 and the tax rate is 8%, the tax would be $40, making the total amount due $540.

Applying Discounts

Discounts can be a great way to encourage prompt payments or reward loyal customers. To add discounts:

- Specify the discount type: It could be a percentage off the total or a fixed amount. Clearly state the terms of the discount on the document.

- Subtract the discount from the subtotal: If offering a percentage discount, calculate the discount amount and subtract it from the subtotal before calculating tax. If it’s a fixed amount, deduct it directly from the subtotal.

- Show the discount clearly: Display the discount amount separately so that clients can see the adjustment made.

Example: If you offer a 10% discount on a $500 service, the discount would be $50, bringing the subtotal to $450. Then, calculate the tax on the new subtotal and add it to the total.

By accurately applying both taxes and discounts, you create an easy-to-understand document that helps avoid confusion and promotes trust with your clients.

Incorporating Payment Terms in Your Invoice

Clearly stating payment terms is an essential part of any billing process. By outlining the expectations for payment in advance, you ensure that both you and your client are on the same page regarding when and how the payment should be made. This not only helps with cash flow but also minimizes confusion and potential disputes over payment timelines.

Key Elements to Include in Payment Terms

When defining payment terms in your billing records, be sure to include the following components:

- Payment Due Date: Clearly specify the exact date by which payment is expected. For example, “Payment due within 30 days from the date of service.”

- Accepted Payment Methods: List the payment methods you accept, such as bank transfer, credit card, PayPal, or check. This gives clients clarity on how they can complete the payment.

- Late Payment Penalties: If applicable, include any late fees or interest charges that will apply if the payment is not received by the due date. This ensures clients understand the consequences of delayed payments.

- Early Payment Discounts: If you offer discounts for early payment, make sure to highlight the percentage or fixed amount off the total if the payment is made before a certain date.

How to Clearly Present Payment Terms

To avoid confusion, payment terms should be easy to spot and understand. Place them in a prominent section of the document, often at the bottom or in a specific “Payment Terms” area. Consider bolding important details, such as the due date or discount offers, to draw attention.

By incorporating clear and concise payment terms into your billing records, you set professional expectations and increase the likelihood of timely payments, ensuring smoother transactions with clients.

How to Track Payments from Clients

Efficiently tracking payments is essential for maintaining healthy cash flow and ensuring that you stay on top of your financials. By systematically recording and monitoring each transaction, you can quickly identify which payments have been received, which are overdue, and which are still pending. This practice helps prevent missed payments and provides a clear financial overview of your business.

Methods for Tracking Payments

There are several approaches you can take to keep track of payments from clients. The method you choose will depend on the scale of your business and the tools available to you:

- Manual Record-Keeping: If your business is small, a simple spreadsheet or ledger can be a cost-effective way to monitor payments. Create columns for client names, payment dates, amounts, and outstanding balances.

- Accounting Software: Software like QuickBooks, FreshBooks, or Xero offers robust features to track payments automatically. These tools sync with your bank accounts and provide real-time updates on client balances and payment statuses.

- Online Payment Systems: Platforms such as PayPal or Stripe not only allow you to receive payments but also offer tracking features that automatically update your records when a payment is made.

Best Practices for Payment Tracking

To ensure accuracy and efficiency, follow these best practices when tracking payments:

- Update Your Records Promptly: As soon as a payment is received, log it in your system to avoid delays or forgotten transactions.

- Review Outstanding Balances Regularly: Regularly check for overdue payments and follow up with clients before they become too far behind.

- Keep Detailed Notes: Note payment methods, transaction IDs, or any special arrangements made with clients for future reference.

By adopting a consistent system for payment tracking, you can avoid financial confusion, reduce administrative stress, and ensure that your business operates smoothly.

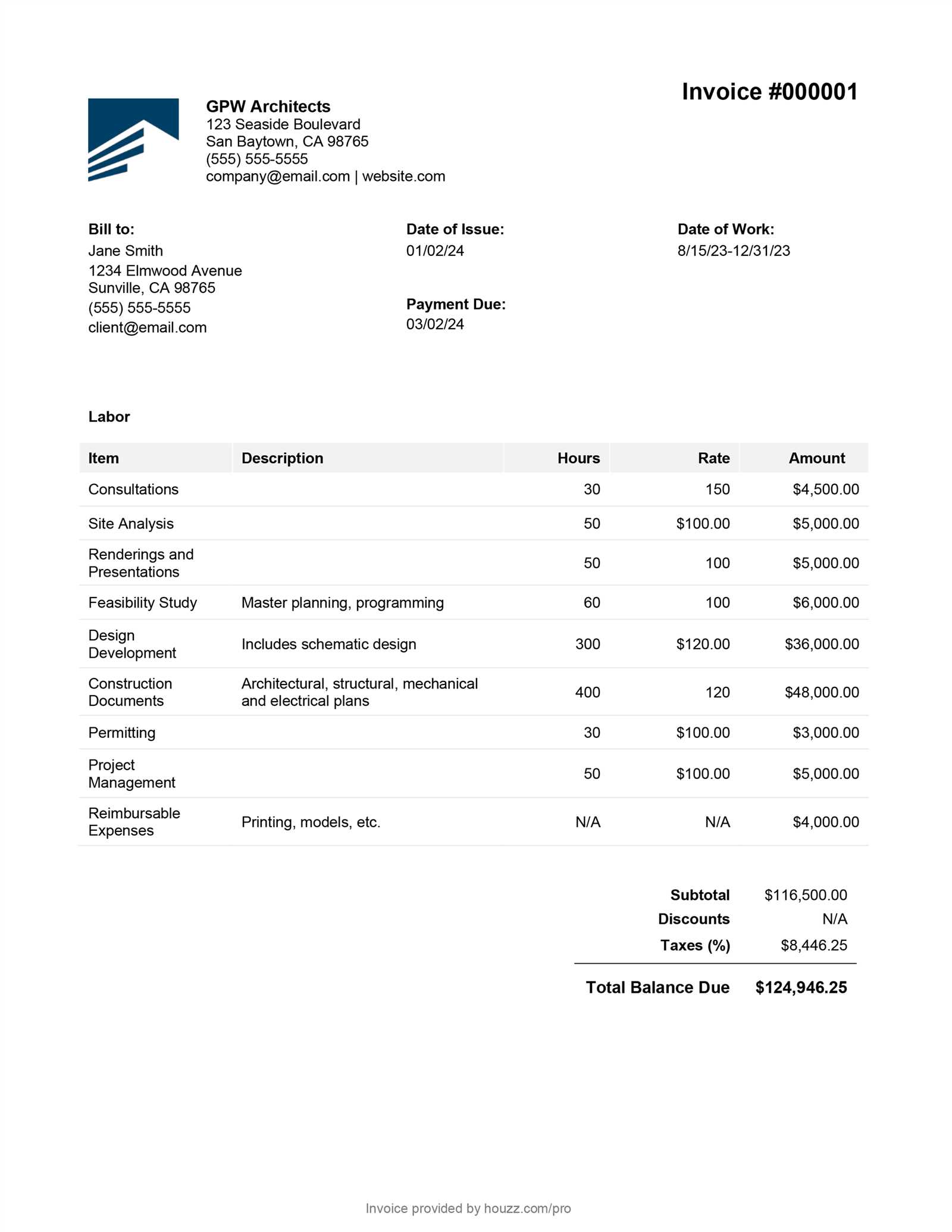

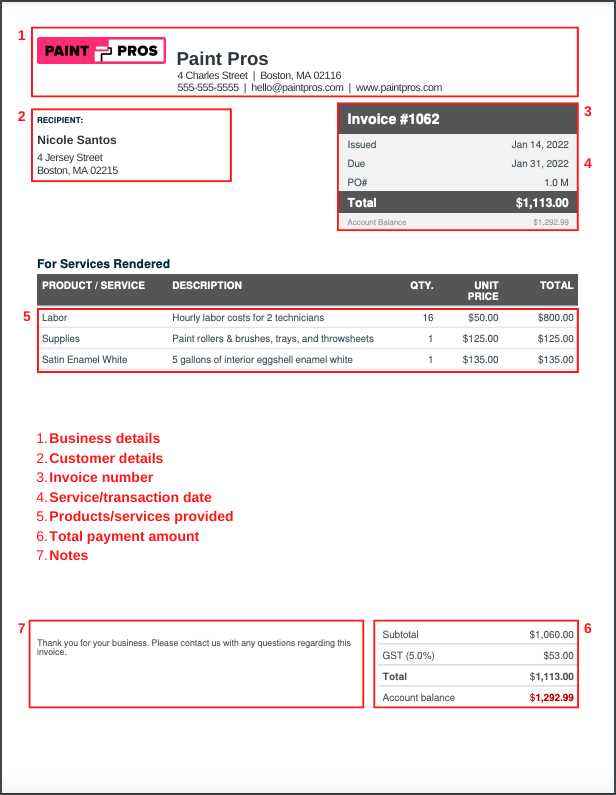

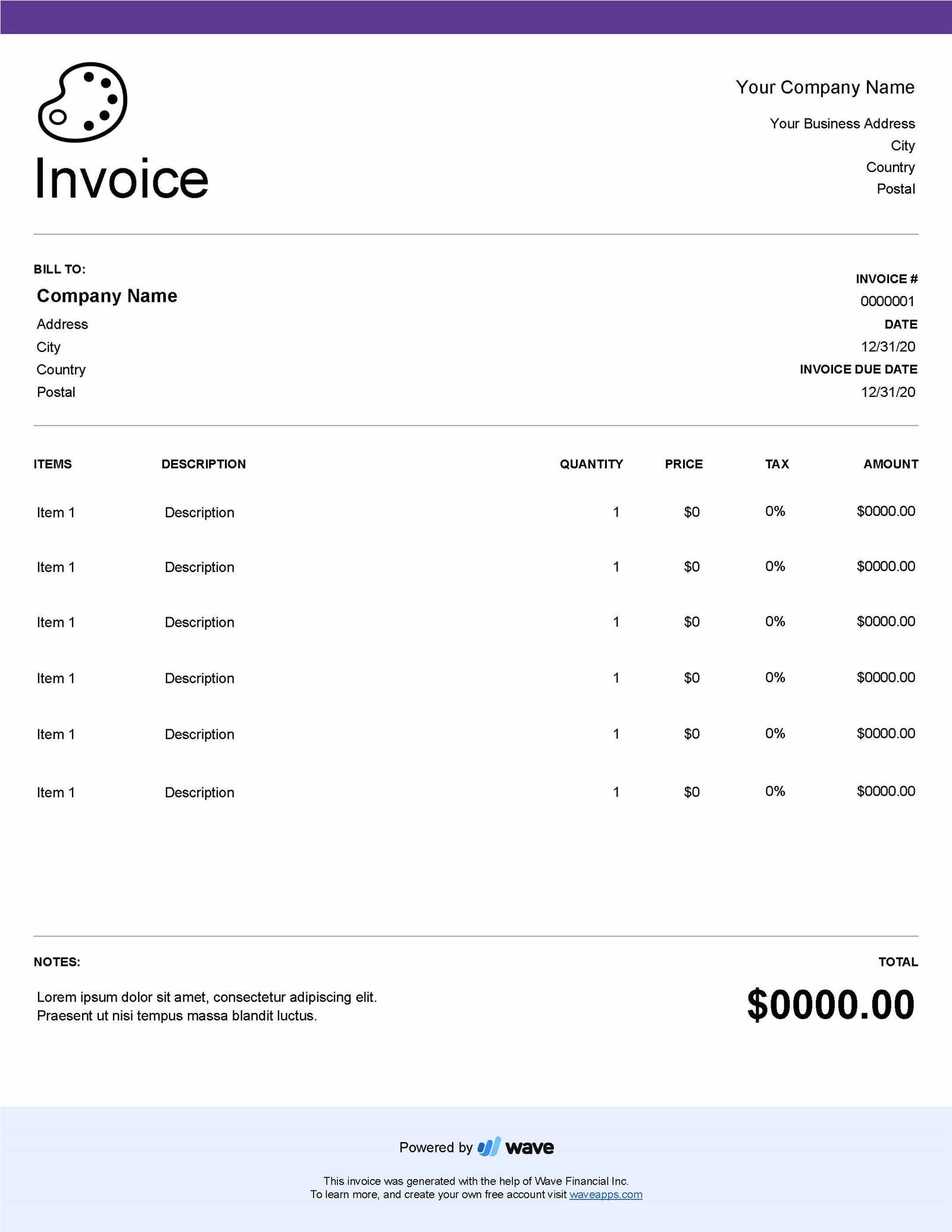

Creating a Professional Invoice Design

Designing a professional billing document goes beyond just listing services and costs; it’s about creating a visually appealing and easy-to-read layout that reinforces your business image. A well-designed record not only ensures clarity but also leaves a lasting impression on your clients, reflecting your attention to detail and professionalism.

Key Elements of a Professional Design

To craft a polished and effective billing document, consider the following elements:

- Clear Branding: Include your logo, business name, and contact information at the top. This ensures clients can easily identify your business and reach out if necessary.

- Organized Structure: Use headings, sections, and clear spacing to divide the document into easy-to-read sections such as service details, payment terms, and contact information.

- Readable Fonts: Choose clean, professional fonts that are easy to read. Avoid overly decorative fonts that may make the document difficult to interpret.

- Color Scheme: Use a simple, consistent color palette that matches your branding. Too many colors can distract from the content, so it’s best to stick with two or three complementary colors.

- Logical Flow: The document should flow in a logical order, with the most important information–such as due dates and amounts–clearly highlighted.

- White Space: Ensure enough white space around text and sections to make the document less cluttered and more readable.

Additional Design Tips

- Include Icons: Icons can help visually break up sections and make the document more user-friendly. For example, a small calendar icon next to the payment due date.

- Consistency is Key: Maintain consistent margins, font sizes, and headings throughout the document. This creates a clean and uniform appearance.

- Use Tables for Clarity: For itemized charges or lists of services, use tables to present the information clearly, making it easier for clients to understand.

A well-structured, professional design enhances your credibility and

Tips for Timely Invoice Submission

Submitting your billing records on time is essential for maintaining a steady cash flow and building a reputation for professionalism. Late submissions can lead to delayed payments, causing unnecessary stress for both you and your clients. By developing a streamlined process for sending your records, you can ensure that payments are received promptly and maintain good client relations.

Best Practices for On-Time Submission

Here are some strategies to help you submit your records on time:

- Set Clear Deadlines: Always establish a clear due date for when you will send your billing documents. Having a set schedule will help you stay on track and prevent last-minute delays.

- Use Automated Reminders: If you use accounting software, take advantage of automated reminders for upcoming billing dates. This can help you remember to send out your records consistently.

- Submit Immediately After Completion: As soon as a job is finished or a service is rendered, generate and send the document. This ensures that no time is wasted, and you can keep your workflow moving smoothly.

- Batch Process: If you have multiple clients, consider processing and sending all your records at once to avoid missing anyone. Scheduling this process at a specific time each week or month can help you stay organized.

- Track Your Submissions: Keep a log or use software to track when each document is sent and when payment is expected. This will help you follow up if necessary and avoid missed deadlines.

Why Timely Submission Matters

Sending your records on time not only ensures that you get paid promptly but also projects a professional image to your clients. By being punctual with your billing, you show that you are organized and dependable, which can help foster trust and encourage repeat business. Additionally, receiving payments on time keeps your business operations running smoothly and helps you avoid cash flow issues.

How Invoices Help Manage Cash Flow

Effective financial management is crucial for any business, and one of the most powerful tools for ensuring healthy cash flow is a well-organized billing system. By clearly documenting and tracking transactions, you can monitor when payments are due, track outstanding balances, and plan your finances more efficiently. A structured approach to billing can prevent delays and help you stay on top of your financial obligations, ensuring that your business continues to operate smoothly.

How Timely Billing Affects Cash Flow

Invoices play a direct role in the management of cash flow by ensuring that payments are requested in a timely manner. The ability to track when money is owed and when it is expected allows you to forecast your cash position, plan for upcoming expenses, and avoid liquidity issues.

| Step | Impact on Cash Flow |

|---|---|

| Prompt Billing | Helps accelerate payment and improves cash flow by ensuring clients receive timely requests for payment. |

| Clear Payment Terms | Establishes expectations for when payments are due, reducing the likelihood of late payments and cash shortages. |

| Itemized Statements | Ensures that clients understand the charges, leading to fewer disputes and faster settlements. |

| Regular Monitoring | Allows you to quickly identify outstanding payments and follow up with clients, reducing delays and improving cash flow predictability. |

Maintaining Healthy Cash Flow with Effective Billing

By consistently using structured billing documents, you can better manage your income and expenditures. This system allows you to predict your financial situation with greater accuracy and take proactive steps to maintain stability. In addition, regular invoicing creates a habit of financial discipline, helping you stay on top of your accounts receivable and avoid payment bottlenecks.

In conclusion, using detailed and timely billing records can significantly imp

Legal Considerations for Painting Invoices

When creating a billing document for your services, it’s important to ensure that it meets the legal requirements in your jurisdiction. Properly drafted records not only help ensure timely payments but also protect both you and your clients in case of disputes. Legal considerations may include specific details that need to be included, such as tax identification numbers, payment terms, and applicable laws that govern business transactions.

Key Legal Elements to Include

Here are several key components that should be incorporated into your records to ensure they comply with relevant legal standards:

| Element | Legal Importance |

|---|---|

| Business Name and Address | Ensures that your client can easily identify the party issuing the bill and allows for contact in case of disputes or questions. |

| Client’s Information | Includes the client’s full name, address, and other identifying details, which are required for legal purposes and potential enforcement of payment. |

| Tax Identification Number (TIN) | In some regions, businesses are legally required to include their TIN to comply with tax regulations and to verify the legitimacy of the business. |

| Clear Payment Terms | Outlines due dates, late fees, and penalties, which are essential to legally enforce any late payments and avoid disputes. |

| Applicable Taxes | Indicates any sales tax, VAT, or other taxes that must be charged, depending on the nature of the transaction and jurisdiction. |

| Work Description | Clearly detailing the services provided helps avoid disputes over what was agreed upon and establishes a legally binding contract. |

Understanding Local Laws and Regulations

It’s crucial to familiarize yourself with the local laws that govern business transactions in your area. Different regions may have specific requirements regarding taxes, payment terms, and dispute resolution. For instance, in some places, invoices must be issued within a specific time frame or must include a unique reference number for tracking purposes. Failing to comply with these regulations can lead to penalties or make it difficult

Best Practices for Invoice Recordkeeping

Proper recordkeeping is essential for maintaining an organized and efficient business. It ensures that you can track payments, manage your financials, and comply with tax regulations. By adopting the right practices for documenting transactions, you not only streamline your workflow but also avoid potential disputes with clients and issues with authorities. Effective recordkeeping provides a clear financial overview and simplifies accounting, making tax season less stressful.

Organizing Your Financial Records

To ensure that your business remains efficient and your records are easy to manage, consider the following best practices:

- Use a Consistent Naming System: Establish a standardized system for naming your financial documents. This will make it easier to find specific records when needed. For example, include the client’s name, date of service, and invoice number in each document’s file name.

- Store Records Securely: Whether you keep physical or digital copies, ensure that they are stored safely. Digital records should be backed up regularly, and physical copies should be organized in a secure filing system.

- Keep All Supporting Documents: Don’t just store the final document–keep any supporting documents, such as contracts, receipts, or emails, related to the transaction. This will help you resolve any discrepancies and provide proof of agreements if needed.

Managing and Tracking Payments

Accurate tracking is key to maintaining a smooth cash flow. Here are a few tips for managing payments:

- Log Payments Promptly: Update your records immediately when a payment is received. This prevents delays and reduces the chances of missing a payment.

- Use Software Tools: Accounting software can help automate the process of logging payments and tracking outstanding balances. This not only saves time but also reduces human error in manual recordkeeping.

- Follow Up on Late Payments: Set up a system for monitoring overdue payments. Regularly review your records to identify any outstanding balances and follow up with clients promptly.

By implementing these best practices, you can keep your financial records organized, reduce the risk of errors, and improve your overall business operations. Proper recordkeeping is a vital component of maintaining a professional and efficient business that clients trust and value.

How Free Templates Save Time and Money

Using ready-made documents for billing can significantly reduce both time and costs associated with generating professional records. These pre-designed formats streamline the entire process, eliminating the need for starting from scratch each time you need to bill a client. By using a standardized layout, businesses can focus on the core aspects of their work while ensuring their financial records are accurate and consistent.

Time-Saving Benefits

Ready-to-use documents help businesses save time in several ways:

| Time-Saving Factor | How It Helps |

|---|---|

| Pre-built Structure | No need to design a format from scratch; simply fill in the necessary details. |

| Consistent Layout | Reuse the same structure for every transaction, reducing the time spent on formatting each document. |

| Automation Capabilities | Many software tools allow you to automate key details like dates, amounts, and client information, making the process even faster. |

| Fewer Errors | With a standardized layout, the chances of missing important information or making mistakes are minimized. |

Cost-Saving Advantages

In addition to saving time, pre-designed records can help businesses reduce costs:

| Cost-Saving Factor | How It Helps |

|---|---|

| No Design Fees | There’s no need to hire a designer to create custom records. Free formats are available to use at no cost. |

| Reduced Software Expenses | If you use basic tools or software that offer free templates, you can save money compared to purchasing expensive accounting software. |

| Increased Efficiency | By minimizing the time spent on creating and formatting records, you can allocate resources to other aspects of the business that drive revenue. |

In conclusion, utilizin