Download Free Paid Invoice Template for Easy and Professional Billing

Creating and managing financial documents can be a time-consuming task for any business. Having a structured and organized method to request payments ensures that everything is clear and professional. With the right tools, you can streamline this process, making it faster and more reliable, allowing you to focus on other important aspects of your work.

Utilizing pre-designed documents for requesting payment offers numerous advantages. Not only does it save you from starting from scratch, but it also ensures consistency in your records. Whether you’re a freelancer, small business owner, or part of a larger organization, using standardized forms can help maintain accuracy and save valuable time in the long run.

Automating the billing process with the right documents reduces errors and simplifies accounting. It can be as simple as customizing a document to suit your needs, ensuring every detail is correct before sending it out. This approach enhances your professionalism and helps establish trust with clients by presenting a polished, clear, and effective way to handle financial transactions.

Free Paid Invoice Template Guide

When managing financial transactions, having an organized document for requesting payment is essential. This guide will walk you through the process of using a structured document to ensure that all the necessary details are included, helping you maintain clear and professional communication with your clients. Whether you’re creating your own or customizing a pre-designed option, it’s important to understand how to set up a document that covers all your needs.

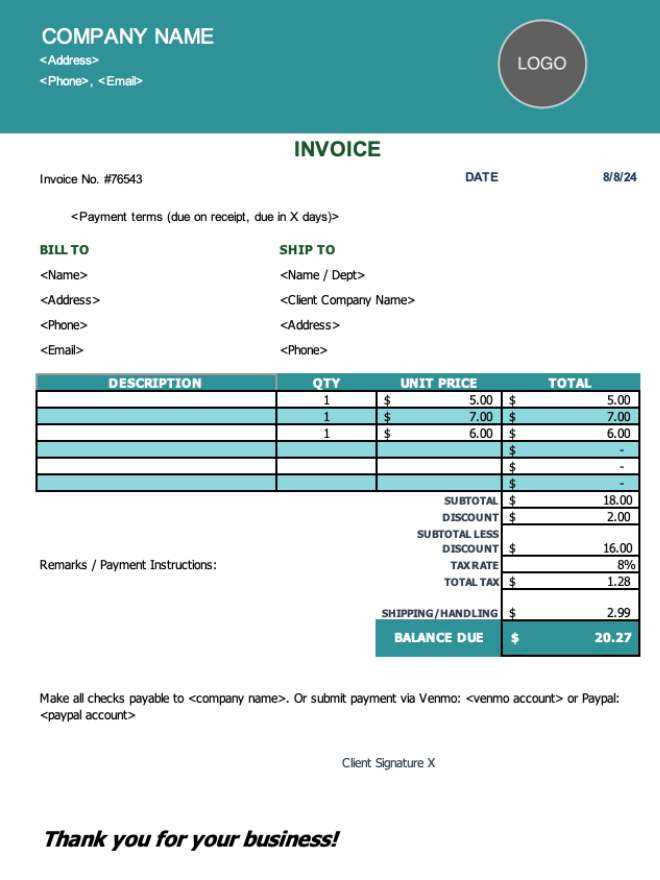

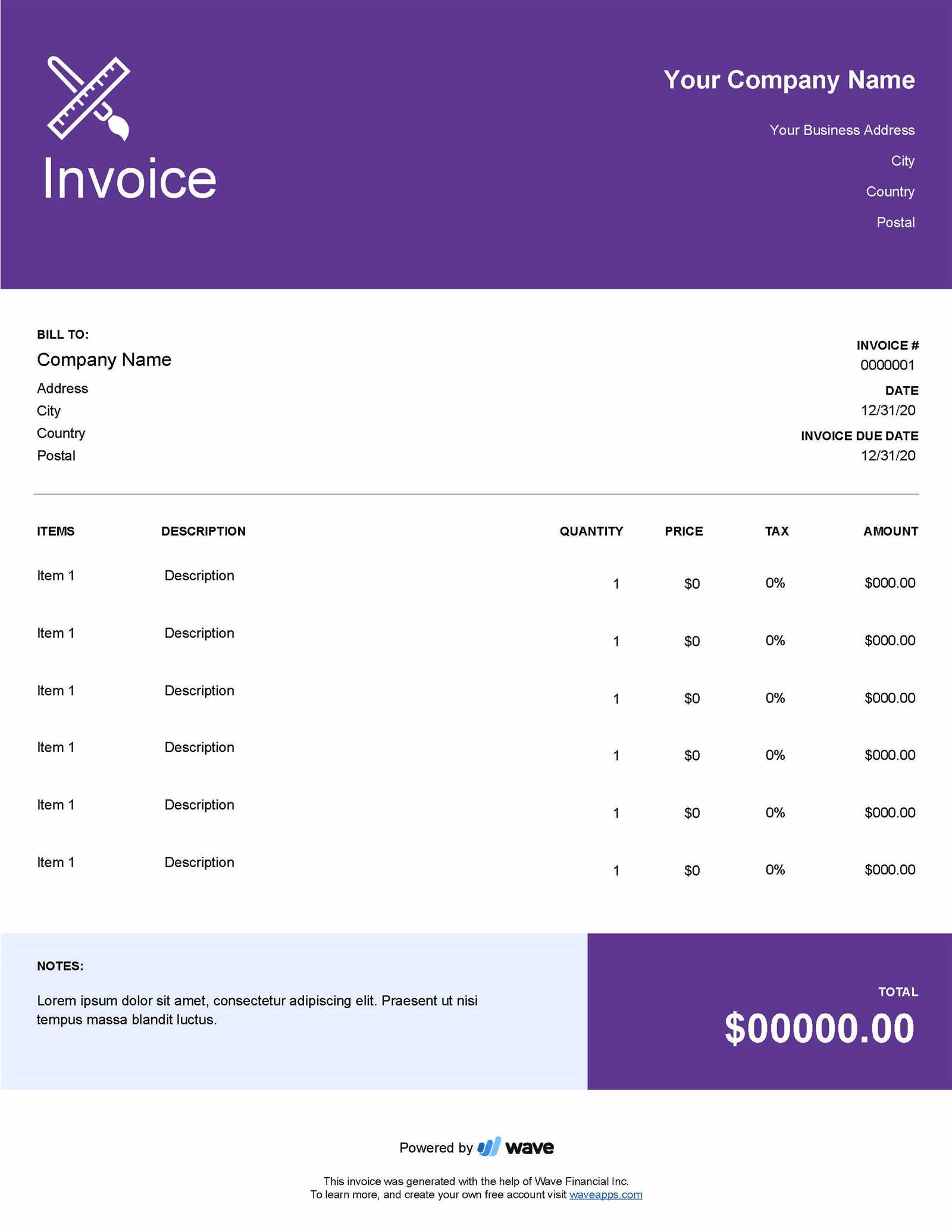

The key to an effective document for requesting payment lies in its clarity and accuracy. It should include crucial details such as the amount owed, the services or products provided, and the payment due date. Below is an example structure of what should be included in your document to keep everything organized:

| Section | Description |

|---|---|

| Contact Information | Include your name, business name, and contact details, as well as the client’s information. |

| Unique Identification | A unique reference number or code for the document to help track payments easily. |

| Description of Services or Goods | A brief summary of the services or products provided, including quantity and pricing. |

| Amount Due | The total amount that the client owes, along with any applicable taxes or discounts. |

| Payment Terms | Details about payment methods, due dates, and any late fees or penalties. |

| Notes or Additional Information | Any special instructions or terms that are relevant to the transaction. |

By structuring your document with these sections, you ensure that all necessary details are provided and easy to find. This will reduce confusion and help you maintain a professional appearance wi

What is a Paid Invoice Template?

When conducting business transactions, it’s essential to have a standardized document for confirming the completion of a service or the delivery of products. This document serves as a formal request for payment and helps both the seller and the buyer keep track of financial dealings. It not only outlines the transaction details but also serves as an official record for accounting purposes. Such documents ensure clarity and transparency in financial exchanges, fostering trust between parties.

Core Features of a Billing Document

A well-structured document should contain all the relevant information, including a unique reference number, details of the transaction, the amount due, and payment instructions. Additionally, it should clearly state the payment status, ensuring both parties are aware of whether the amount has been settled or is still outstanding. The primary goal is to maintain a clean and professional record of the financial arrangement.

Why This Document Matters for Businesses

For small businesses and freelancers, using a properly formatted document for requesting payment can streamline operations. It reduces confusion, prevents disputes, and ensures that payments are tracked efficiently. Using consistent documentation not only helps manage cash flow but also reinforces the business’s professionalism and reliability. By maintaining organized financial records, companies can ensure smooth transactions and a solid reputation.

Why Use a Free Invoice Template?

Using pre-designed documents to request payments can significantly simplify your financial management process. Instead of creating a new record from scratch each time, having access to a ready-made format saves both time and effort. This allows you to focus on delivering your product or service, rather than worrying about the details of document creation. With the right structure in place, you can ensure consistency and professionalism across all transactions.

One of the major benefits of these ready-made solutions is efficiency. You no longer need to spend time designing or organizing the layout, as the core structure is already in place. All that’s required is to input the specific details for each transaction. This approach not only speeds up the billing process but also reduces the likelihood of errors or omissions.

Additionally, using pre-built documents ensures that you stay organized. These resources often include all the essential elements necessary for proper record-keeping, making it easier to track payments and maintain a clear financial history. Consistency in your documentation helps build trust with clients, as it shows a professional approach to handling financial matters.

How to Customize Your Invoice Template

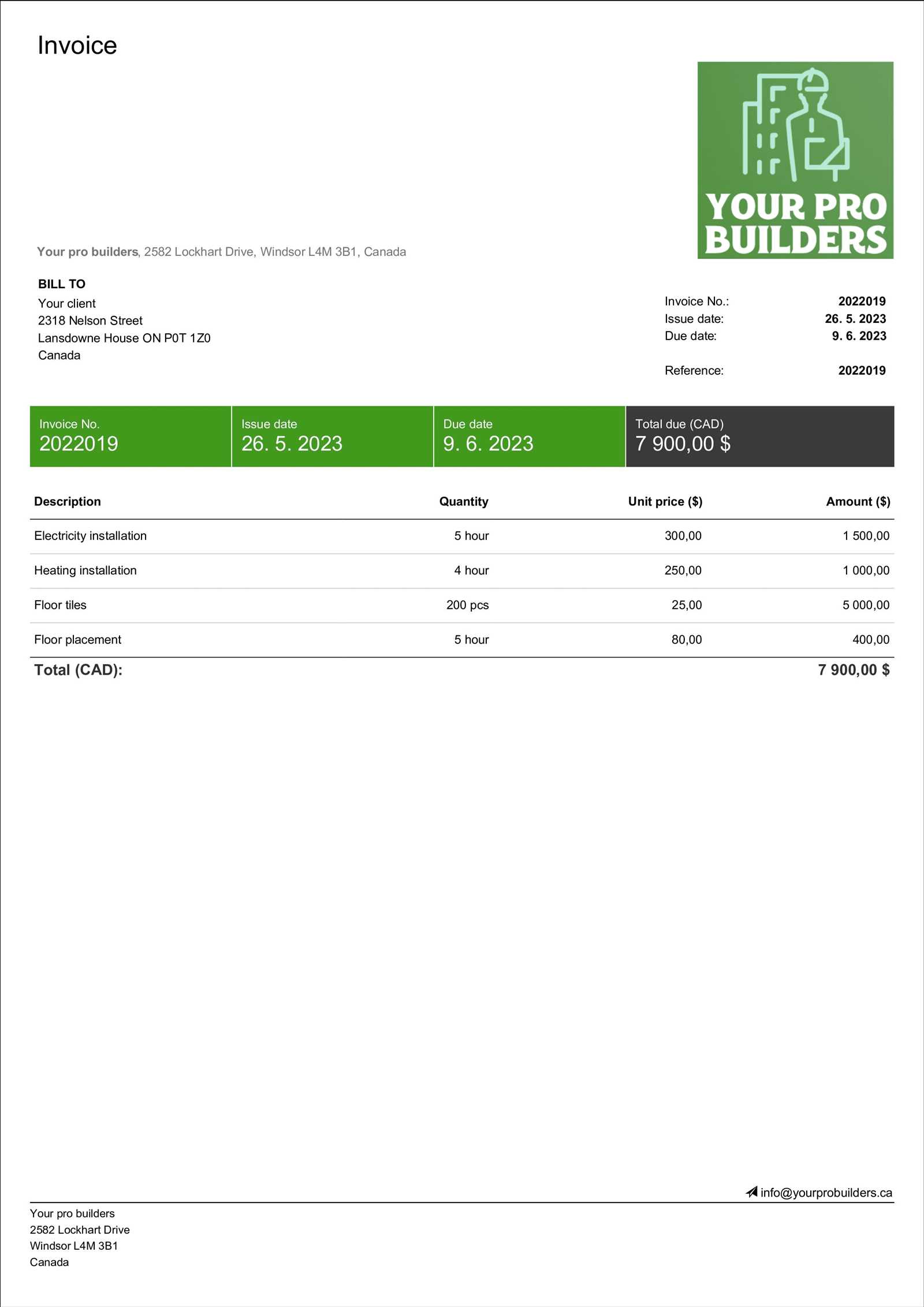

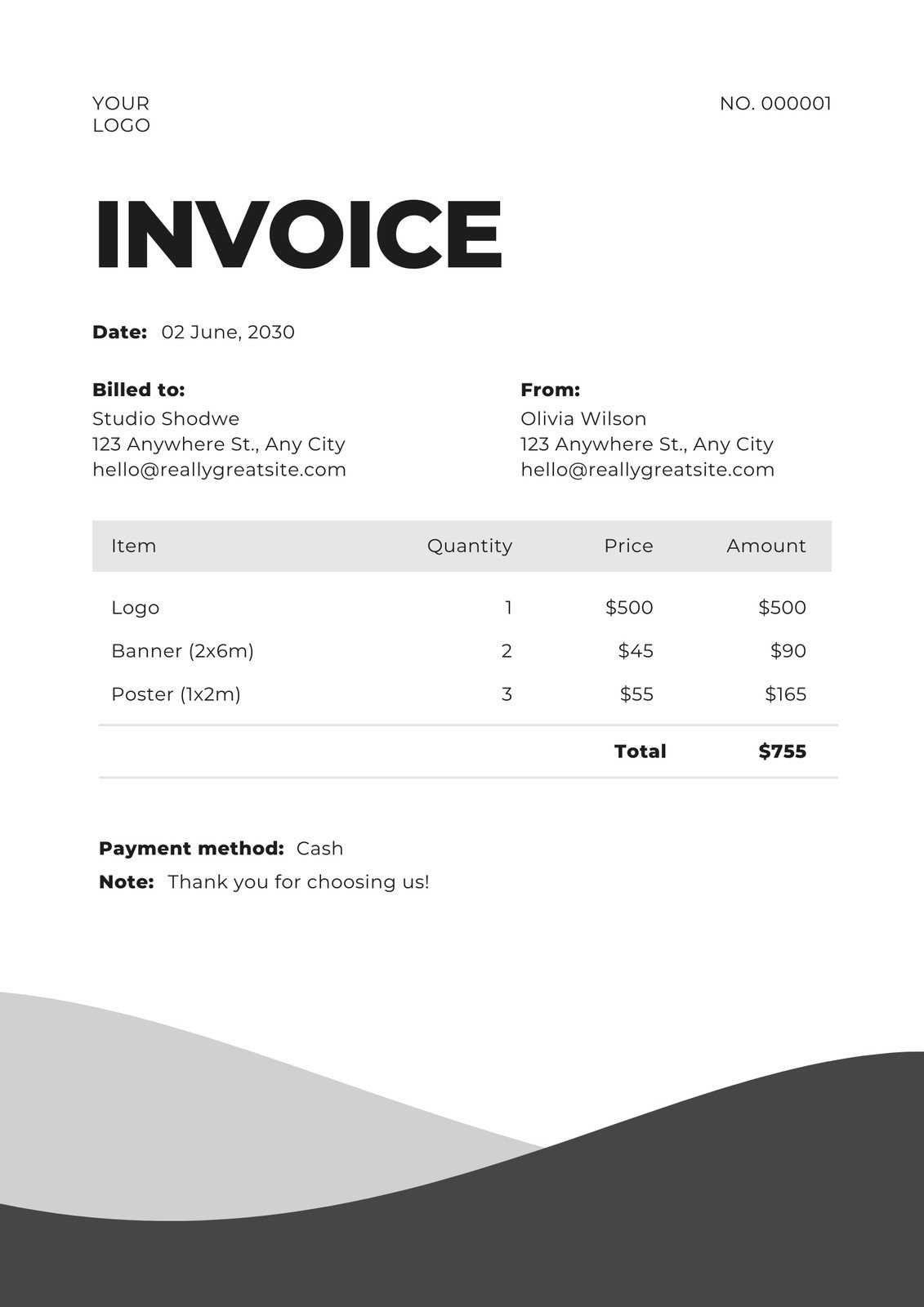

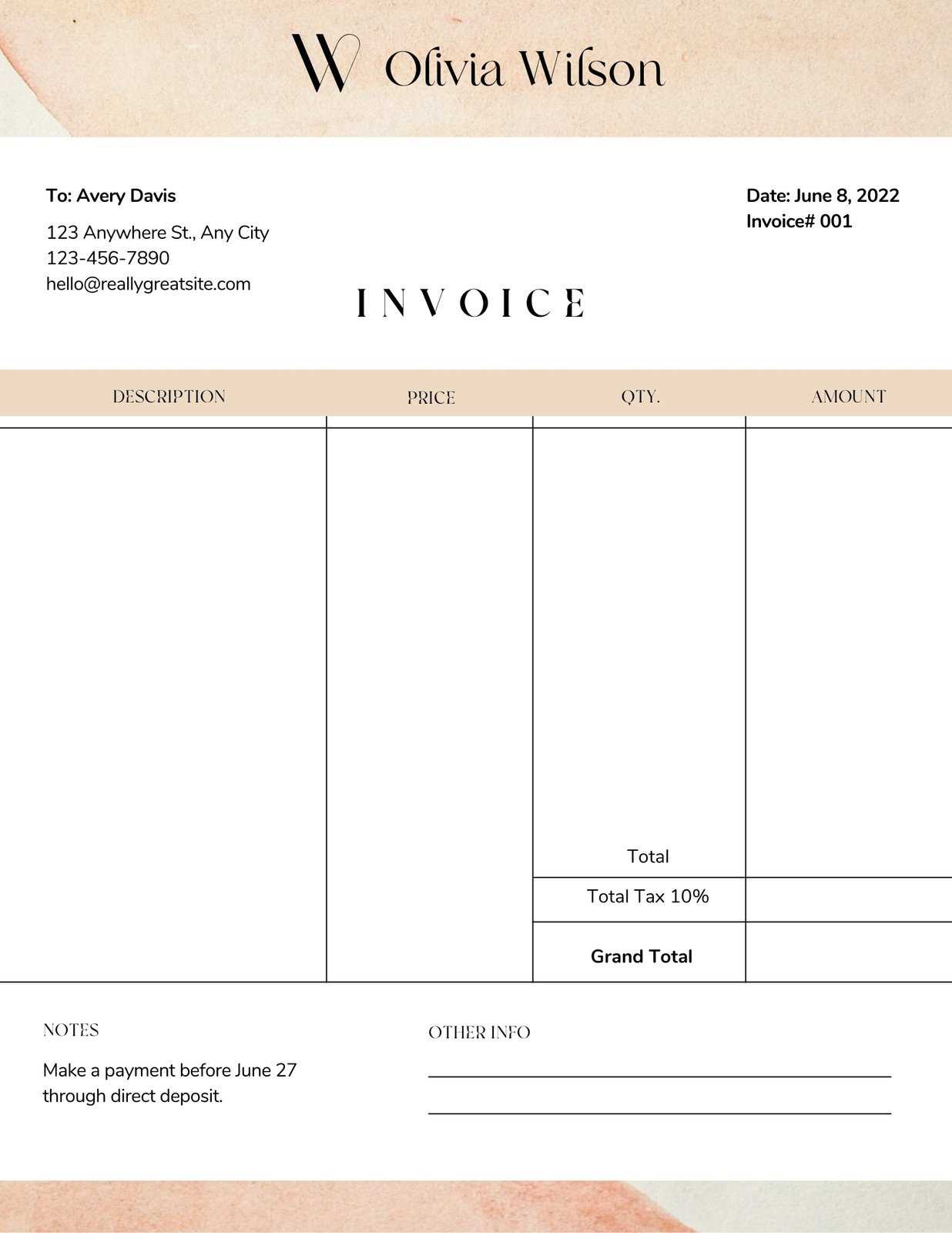

Personalizing your billing document is a great way to make it align with your business identity and meet specific needs. Customization ensures that your document is clear, professional, and reflective of your brand. By adjusting certain elements, you can make sure that the format works best for both you and your clients, while also presenting a polished image.

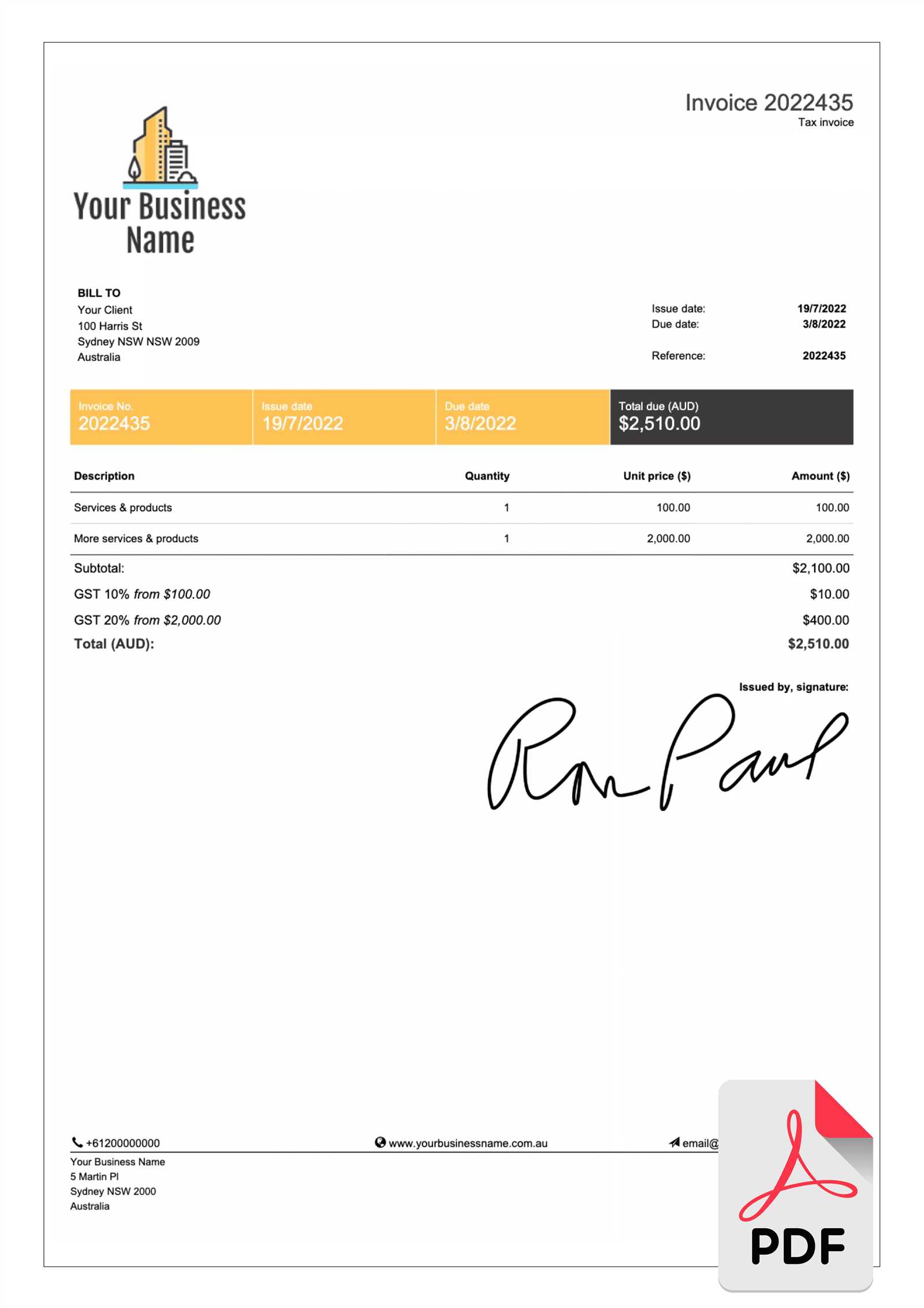

The first step in customizing is adjusting the layout and design. Ensure your logo, business name, and contact details are prominently displayed, as these help build your brand’s recognition. You can also modify the font, colors, and overall style to match your business’s aesthetic. This not only adds a personal touch but also gives your documents a cohesive, professional look.

Next, tailor the content to suit your specific offerings. For example, include a section for specific services or products, and make sure the pricing structure reflects your standard rates. Including clear payment terms and due dates will also help prevent confusion and ensure that your clients understand when and how to settle the amount. Finally, review all sections to ensure that all necessary information is included for each transaction.

Benefits of Digital Invoice Templates

Switching to digital documents for payment requests offers numerous advantages over traditional paper methods. With digital solutions, businesses can streamline the entire billing process, improving efficiency and reducing the time spent on administrative tasks. Whether you are a freelancer or part of a larger company, going digital can make managing financial records more organized and less prone to errors.

Time and Cost Efficiency

One of the most significant benefits of using digital documents is the amount of time saved. You can quickly generate and send requests to clients with just a few clicks, eliminating the need for manual creation or physical delivery. Additionally, digital formats eliminate the costs associated with paper, ink, and postage. By reducing these operational costs, businesses can allocate more resources to other important areas.

Easy Tracking and Organization

Digital documents make it easier to track and store financial records. You can organize your payment requests by client, date, or project, ensuring you have quick access to past transactions when needed. Advanced digital systems often allow you to add reminders, track outstanding amounts, and generate reports, further enhancing your financial management. This level of organization can be a game-changer for businesses that need to maintain clear and detailed records for tax purposes or future reference.

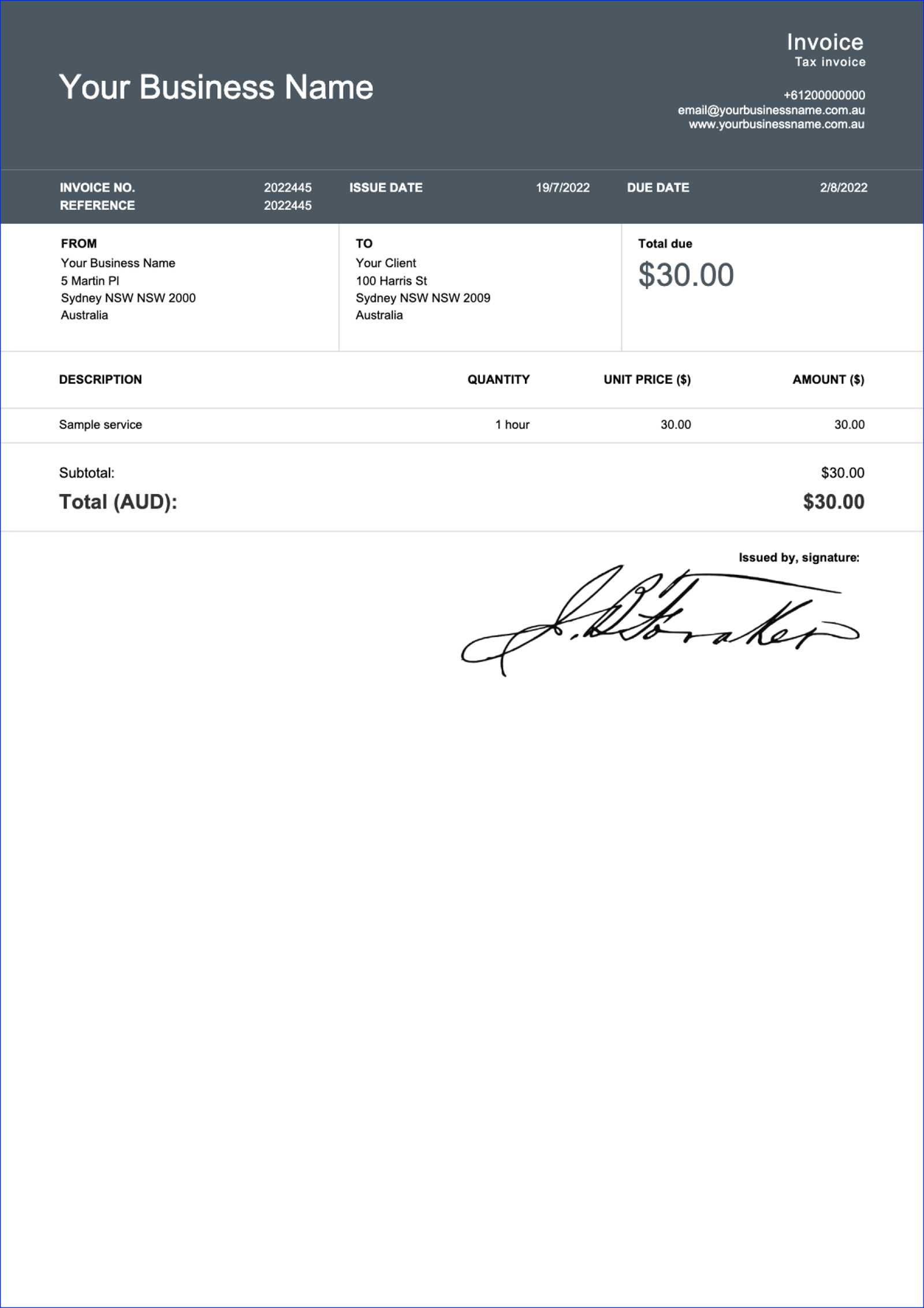

Choosing the Right Invoice Template

Selecting the right document for requesting payment is crucial for ensuring that all necessary details are communicated clearly and professionally. The format you choose should reflect the nature of your business, the complexity of the services you provide, and the preferences of your clients. A well-chosen document not only streamlines your billing process but also enhances your credibility and ensures timely payments.

Assessing Your Business Needs

The first step in choosing the appropriate document is to consider the specific needs of your business. For example, if you’re a freelancer, a simple layout with clear descriptions and payment terms may be sufficient. However, if you run a larger business or handle multiple clients, you may need a more detailed document with sections for taxes, discounts, or multiple line items. Matching the complexity of your services to the structure of your billing document ensures it covers all necessary aspects without overwhelming the client.

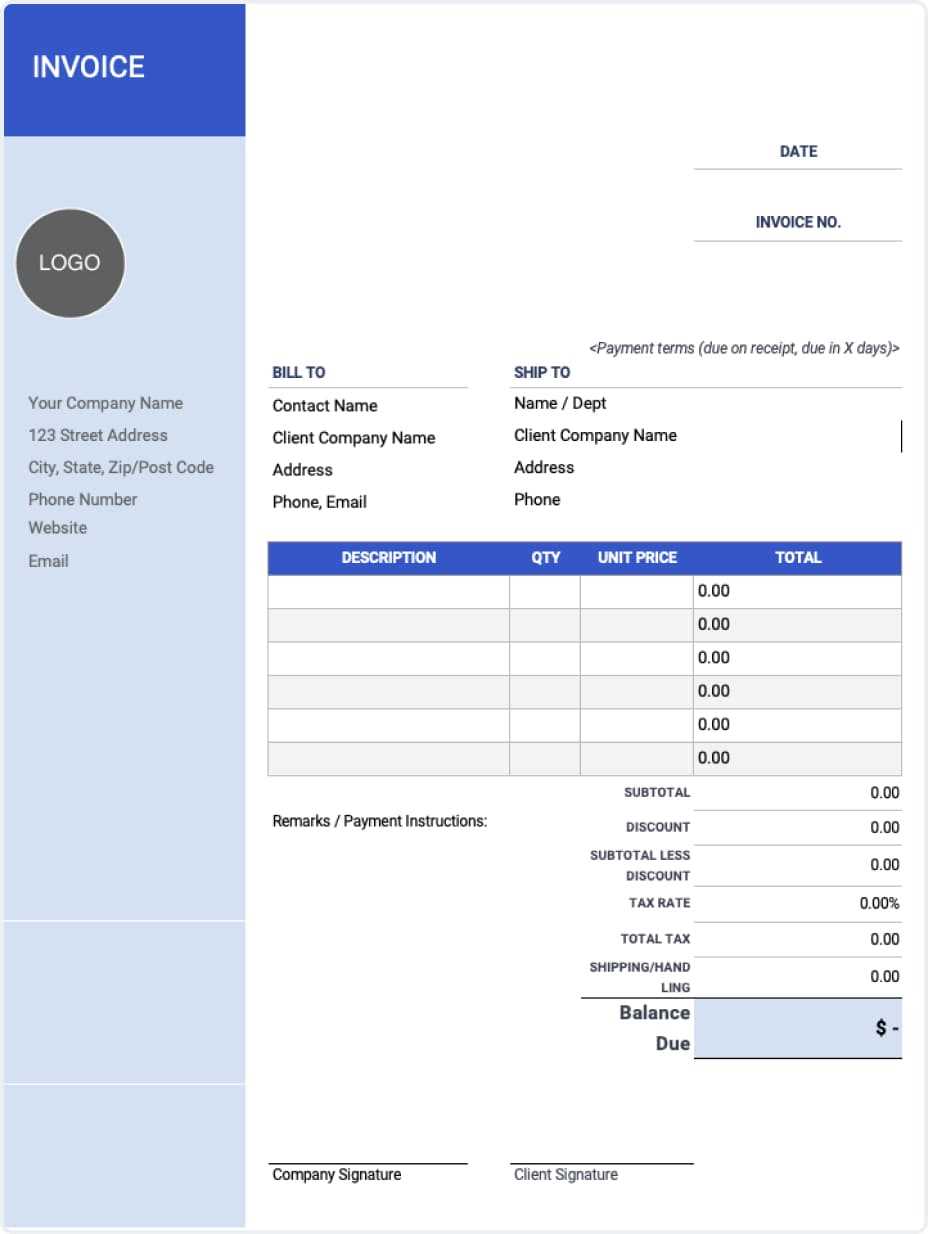

Design and Usability

Another important factor is design. A clean and easy-to-read layout can make a huge difference in how your document is perceived. Choose a format that allows you to easily input information without cluttering the page. Additionally, make sure the style aligns with your brand’s identity. Consistency in design across your documents helps maintain a professional image, fostering trust with your clients. Ensure the design is simple enough for both you and the client to navigate without confusion.

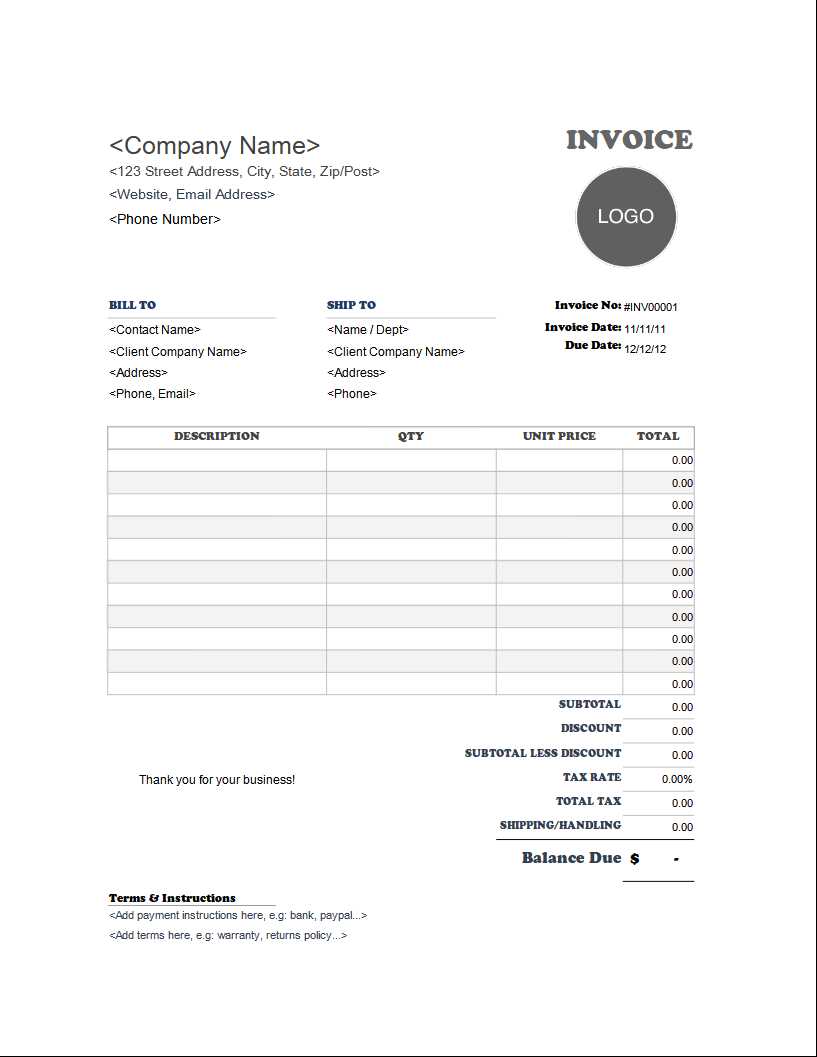

Essential Elements of a Paid Invoice

To ensure smooth financial transactions, a well-constructed document for requesting payment must include key information that both the business and the client can easily reference. These details not only help clarify the terms of the transaction but also serve as an official record for accounting purposes. A properly designed document will include all necessary elements to avoid confusion and ensure both parties are on the same page.

Here are the essential components that should be included in every payment request document:

- Header Information – The document should prominently display the name of your business or personal details, along with your contact information. Including your logo and address further enhances the professional appearance.

- Client Information – Ensure the recipient’s details, including their name, address, and contact information, are clearly stated.

- Unique Reference Number – Each document should have a unique identifier or number that helps both parties track the transaction in the future.

- Clear Description of Goods or Services – This section should detail what has been provided, including the quantity, rate, and specific dates of service if applicable.

- Total Amount Due – Clearly list the total amount owed, including any taxes, discounts, or additional fees. The breakdown should be transparent.

- Payment Terms – Outline the terms regarding due dates, accepted payment methods, and any penalties for late payment.

- Notes or Special Instructions – Any additional details that may apply to the transaction, such as payment instructions or specific terms, should be included here.

Including all of these essential elements ensures that your payment request is professional, complete, and easy to understand, helping you maintain smooth relationships with clients and avoid payment delays.

How to Save Time with Templates

Using pre-made formats for payment requests can significantly speed up your billing process. By eliminating the need to create a new document from scratch each time, you can focus more on your core business tasks. Customizable layouts provide a structured framework that simplifies the process of generating and sending out payment requests, allowing you to spend less time on administrative work and more on delivering your products or services.

Here are a few ways templates can help you save time:

| Benefit | How It Saves Time |

|---|---|

| Predefined Structure | The format is already organized, so you don’t have to spend time setting up sections like contact information, item descriptions, and totals. |

| Faster Data Entry | With fields that are clearly labeled, you can quickly input necessary details such as client names, services rendered, and amounts due. |

| Reusability | You can reuse the same layout for different clients and projects, simply adjusting the details without redesigning the entire document. |

| Consistency | A consistent format ensures all documents are correctly structured, reducing the need for proofreading and minimizing errors. |

By using these pre-designed resources, you streamline your workflow, improve accuracy, and ensure a quicker turnaround time for all payment-related activities.

Free Templates vs Premium Options

When it comes to choosing a layout for payment requests, businesses often face the decision of using either no-cost options or investing in more feature-rich, paid solutions. Each approach offers its own set of benefits and drawbacks, depending on the specific needs of your business. Understanding the differences between the two can help you make an informed decision based on your budget, time constraints, and the complexity of your requirements.

Advantages of No-Cost Options

Using no-cost resources can be an excellent choice for small businesses or freelancers just starting out. These solutions are easily accessible and can be quickly downloaded or customized to fit your needs. The simplicity of most free formats makes them suitable for straightforward transactions and basic billing, allowing you to get started with minimal effort.

Benefits of Premium Solutions

On the other hand, premium resources often provide advanced features and a higher degree of customization, making them more suitable for businesses with complex needs. These paid options typically come with additional tools such as automated payment tracking, integrations with accounting software, and the ability to generate detailed reports, making them valuable for growing businesses that require more functionality.

| Feature | No-Cost Options | Premium Solutions | |||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Customization | Limited to basic edits | Highly customizable with advanced features | |||||||||||||||||||||||||||||||||||

| Ease of Use | Simple to use, with basic layouts | More intuitive, but may require a learning curve | |||||||||||||||||||||||||||||||||||

| Additional Features | Basic functionality only | Integration with accounting tools, payment tracking | |||||||||||||||||||||||||||||||||||

| Cost | No cost involved |

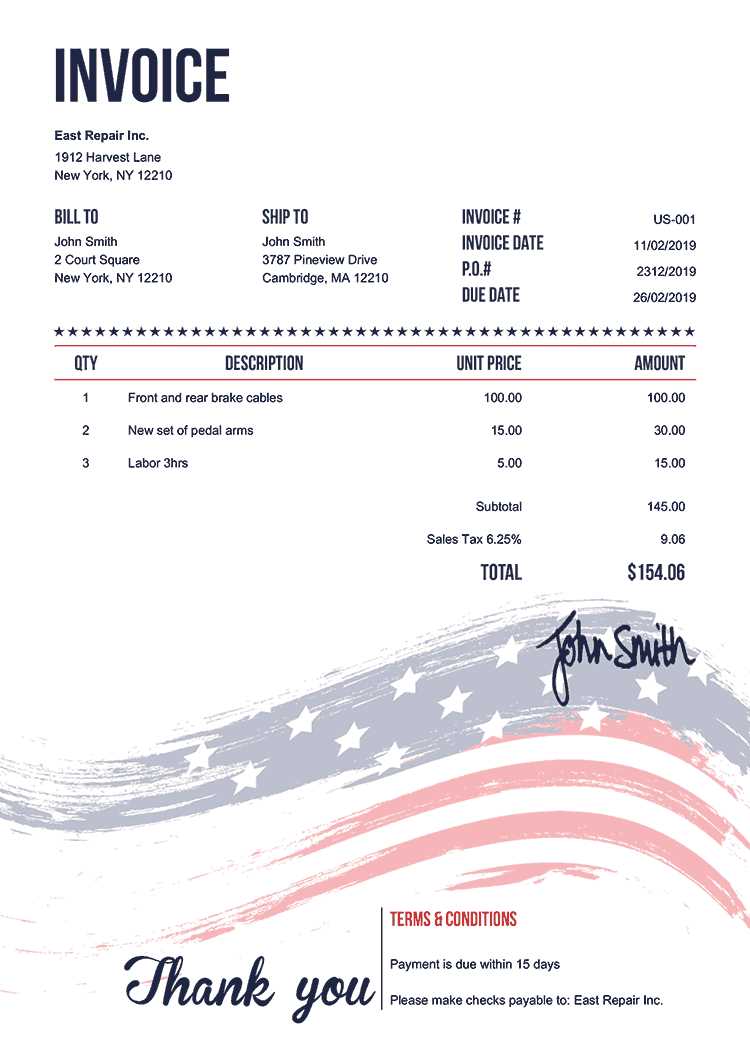

| Software | Key Features | Best For |

|---|---|---|

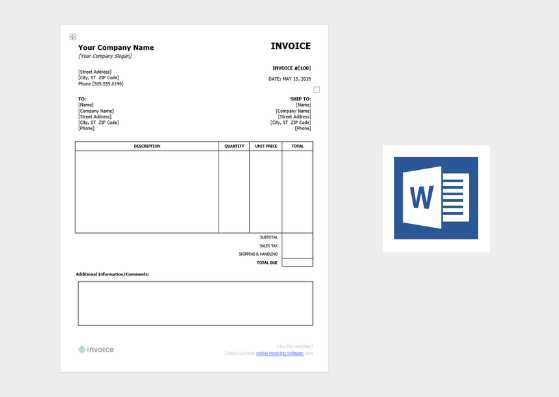

| Microsoft Word | Easy-to-use interface, customizable layouts, offline access | Businesses that need a simple, customizable solution without extra features |

| QuickBooks | Automated billing, accounting integration, customizable formats | Small to medium-sized businesses that need full accounting functionality |

| Zoho Invoice | Cloud-based, recurring billing, client management | Freelancers and businesses looking for a versatile cloud solution |

| FreshBooks | Time tracking, project management, automatic reminders | Service-based businesses and freelancers who need project and time management |

| Wave | Free cloud-based accounting, invoicing, and receipt scanning | Freelancers and small businesses that need a free, easy-to-use solution |

Each of these software options has its strengths, and the best choice will depend on the specific needs of your business. If you’re looking for simplicity, Microsoft Word offers a straightforward, customizable option. However, for more advanced features like automated billing and client management, solutions like QuickBooks or Zoho Invoice provide comprehensive tools to streamline your financial processes.

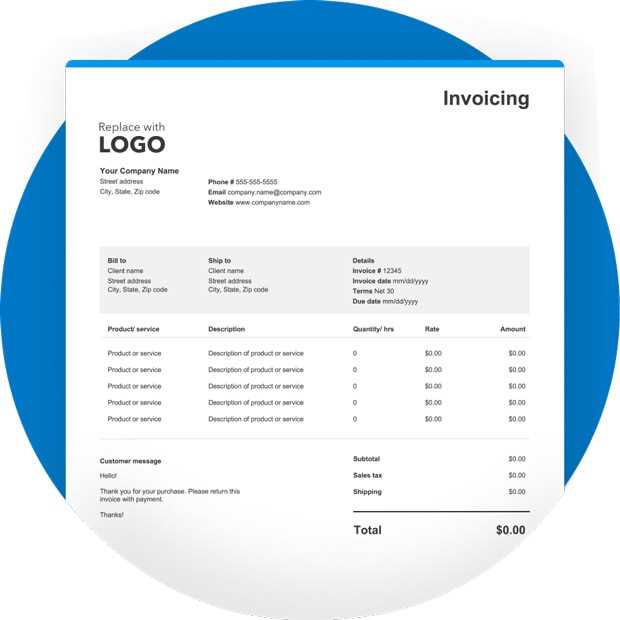

How to Send Invoices Professionally

Sending a payment request is more than just a necessary task–it’s an opportunity to maintain a positive and professional relationship with your clients. The way you deliver your request can reflect your business’s attention to detail and commitment to professionalism. Ensuring that the document is well-organized, timely, and sent through the proper channels can make a significant difference in how your client perceives your business.

1. Use Clear and Concise Communication

When sending a payment request, clarity is key. Avoid ambiguity by providing all relevant information in a straightforward manner. This includes a detailed breakdown of services, amounts, due dates, and payment methods. Ensure that any terms, such as late fees or discounts, are clearly outlined to prevent confusion.

2. Choose the Right Delivery Method

Choosing an appropriate delivery method is essential for ensuring your payment request is received on time. While traditional mail is an option, email is typically faster and more reliable. If you’re using email, ensure the subject line is clear, such as “Payment Request for Services Rendered” to ensure it stands out in the recipient’s inbox.

Bonus Tip: For a more formal approach, consider using an online invoicing platform that can securely send the request and track its status. This option also provides a professional look and a streamlined process for clients.

3. Include a Personal Touch

While a payment request is a formal document, adding a brief personal note can go a long way. A simple thank-you for the client’s business or a polite reminder of the due date helps maintain a friendly and respectful tone. Personalization shows that you value the client, and it can help strengthen your working relationship.

By following these steps and ensuring your communication is professional, you can create a seamless billing experience that helps ensure timely payments and enhances your business’s reputation.

Invoice Templates for Different Industries

Different industries have specific needs when it comes to creating payment requests. Whether you’re in the creative field, providing professional services, or running a product-based business, the structure and details required for payment documents can vary. Understanding how to tailor these documents to suit the unique requirements of your industry ensures that the request is clear, professional, and complete, facilitating timely payments and positive client interactions.

Industry-Specific Requirements

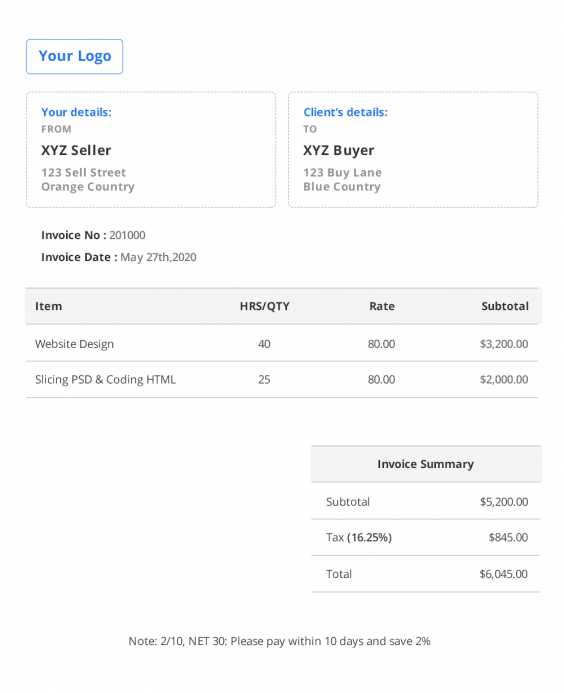

Each industry has its own set of standards when it comes to billing. For instance, creative freelancers may need to include details about hours worked and project milestones, while product-based businesses may need to list specific items with quantities and prices. Below are some examples of what you might include in payment documents for different sectors:

| Industry | Key Information | Special Considerations |

|---|---|---|

| Freelance & Creative Services | Hourly rates, project milestones, detailed descriptions of work completed | Including payment terms for different stages of the project and revisions |

| Consulting | Consulting hours, retainer fees, project-based pricing | Clear descriptions of services rendered, especially for ongoing engagements |

| Retail & E-Commerce | Itemized list of products, quantities, individual prices, and applicable taxes | Discounts, shipping costs, and return policies should be clearly stated |

| Construction & Contracting | Project phases, labor and material costs, timelines | Detailed breakdowns of work completed and any permits or licenses involved |

| Health & Wellness | Service type, session length, product sales, insurance or self-pay options | Include any prepayment or cancellation policies |

Tailoring to Your Industry

By adjusting the structure of your payment requests to match your industry’s standards, you ensure that clients receive all the necessary information in a clear and professional manner. Customizing these documents not only helps streamline your billing pr

Protecting Your Templates from Fraud

With the rise of digital transactions, protecting your payment request documents from fraud has become a critical concern for businesses. Fraudulent activity can lead to financial losses, damage to your reputation, and potential legal complications. Ensuring that your business’s documentation is secure and protected against unauthorized alterations is essential to maintaining trust and safeguarding your financial transactions.

There are several ways you can secure your documents and prevent fraudulent manipulation. Below are some key strategies to protect your business:

- Use Secure Document Formats – Choose formats that are harder to manipulate, such as PDF, which offers password protection and encryption options. This ensures that once the document is created, it cannot easily be changed without authorization.

- Watermark Your Documents – Adding a subtle watermark to your files can make it more difficult for others to use your documents fraudulently. It also helps identify the original creator of the document if it’s ever used without permission.

- Implement Digital Signatures – A digital signature verifies the authenticity of a document and proves that it hasn’t been altered after it was signed. This provides an additional layer of protection against fraud and helps maintain the integrity of your documents.

- Monitor Document Usage – Keep track of who has access to your payment request files and implement restrictions where possible. If you’re using cloud storage, take advantage of tracking tools that alert you when documents are opened or downloaded.

- Regularly Update Your Software – Ensure your accounting software, cloud storage, and any document creation tools you use are regularly updated. Software updates often include security patches that protect against new vulnerabilities.

- Limit Access to Sensitive Information – Protect your clients’ payment information by limiting access to it. Only share these details with trusted parties, and ensure that data is encrypted both in transit and at rest.

By adopting these practices, you can significantly reduce the risk of fraudulent activity surrounding your financial documentation. Implementing a secure system for creating, storing, and sharing your business documents not only protects your income but also strengthens the trust you build with your clients.

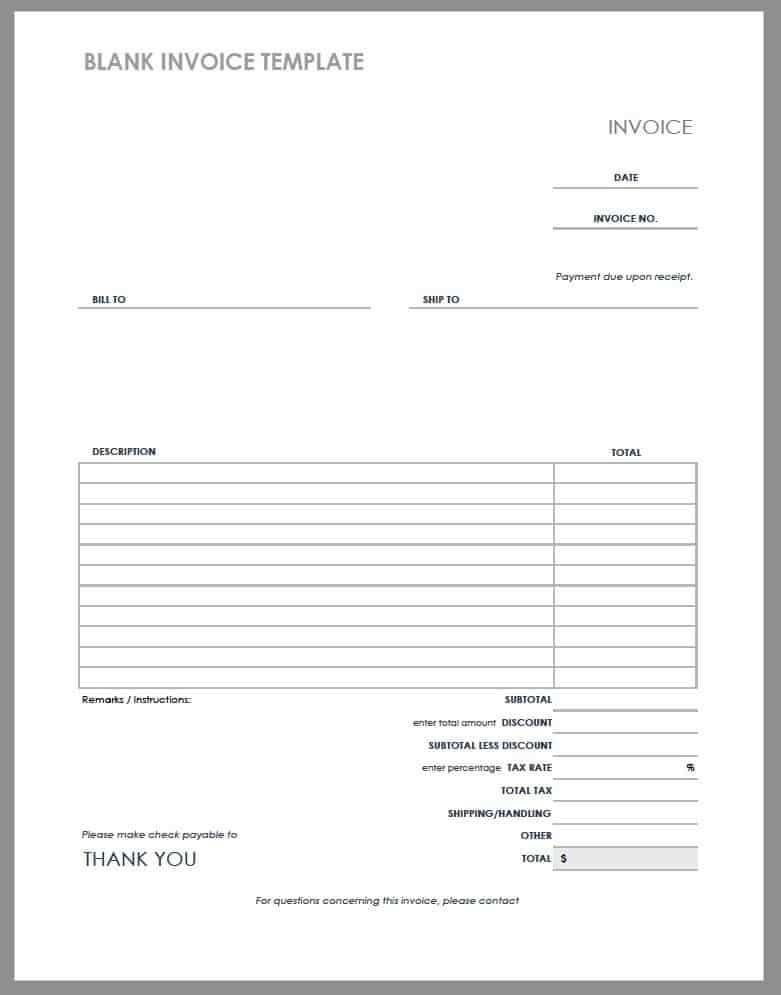

How to Create Your Own Template

Creating your own document layout for payment requests allows you to customize the format to fit your specific needs. This ensures that you can include all necessary details while reflecting your business’s branding and style. Whether you’re designing from scratch or customizing an existing layout, having full control over the document’s structure can improve both professionalism and efficiency in your billing process.

Steps to Create a Customized Layout

Follow these simple steps to create a professional and functional document for your business transactions:

- Choose the Right Software – Start by selecting the software that best suits your needs. Options like Microsoft Word, Google Docs, or more specialized accounting software offer flexible tools for building your layout.

- Define Your Structure – Decide on the key sections to include, such as the recipient’s details, a description of goods or services, payment terms, and a summary of charges. Organize these sections in a logical order that is easy for clients to follow.

- Incorporate Your Branding – Include your logo, business name, and any other branding elements to ensure consistency with your other documents and reinforce your brand identity.

- Choose Professional Fonts and Design – Opt for clean, easy-to-read fonts and ensure that the layout is simple yet professional. Avoid overly decorative styles that could make your document appear cluttered or difficult to read.

- Add Necessary Legal Information – Depending on your location or industry, you may need to include specific legal terms, tax information, or disclaimer

Free Resources for Invoice Templates

If you’re looking to streamline your payment request process without investing in premium tools, there are plenty of resources available to help you create professional documents at no cost. These resources provide customizable layouts that can be tailored to your business’s specific needs, saving you time and effort. Whether you’re a freelancer, small business owner, or service provider, you’ll find a variety of platforms that offer free document formats to get you started.

Here are some of the top resources where you can access customizable layouts:

- Google Docs – Google Docs offers a selection of easy-to-edit, professional formats that can be customized for your specific needs. Their cloud-based service also ensures that you can access and edit your documents from anywhere.

- Microsoft Office Online – Microsoft provides a range of free document layouts through its online suite. You can choose from a variety of professional designs and easily personalize them with your details.

- Zoho Invoice – While Zoho’s premium offerings are robust, their free plan includes access to basic document formats that are perfect for freelancers and small businesses looking to manage basic payment requests.

- Canva – Canva’s easy-to-use platform allows users to create visually appealing documents. They offer several free designs that can be edited and downloaded in multiple formats for professional-looking results.

- Invoice Generator – This online tool allows you to quickly create customized documents by filling out an easy-to-use form. It’s perfect for those who need a straightforward solution without too many complicated features.

By using these free resources, you can easily produce professional documents that maintain your brand’s image while also saving time and money. Customizing these layouts allows you to tailor the design to your preferences, ensuring that every