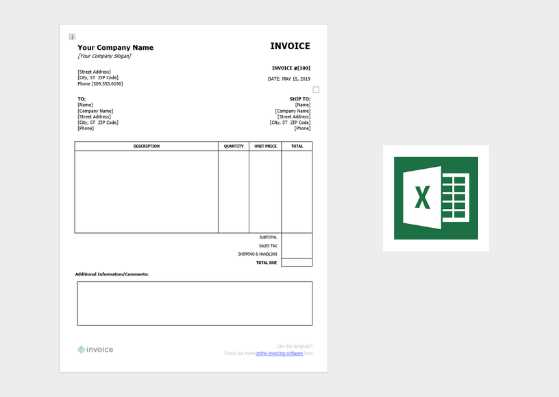

Free Online Invoice Templates for Microsoft Excel to Simplify Your Billing

Managing finances and handling client payments efficiently is a key task for any business. One of the most effective ways to simplify this process is by using ready-made solutions that allow you to quickly create and manage billing records. Whether you’re a freelancer, a small business owner, or a larger organization, having the right tool at your disposal can save you time and help avoid costly errors.

Instead of starting from scratch, many find it easier to rely on pre-designed structures that are fully customizable. These tools can be adapted to suit your specific needs, ensuring that every document looks professional and includes all necessary details. The ability to modify and update data with ease makes them an ideal choice for anyone looking to stay organized and maintain a smooth cash flow.

By utilizing a simple, powerful software tool, you can track payments, manage client details, and even automate certain aspects of the billing process. This approach reduces the likelihood of mistakes and ensures consistency across all your financial documents. Whether you’re invoicing one client or hundreds, this solution helps keep everything in order and professional.

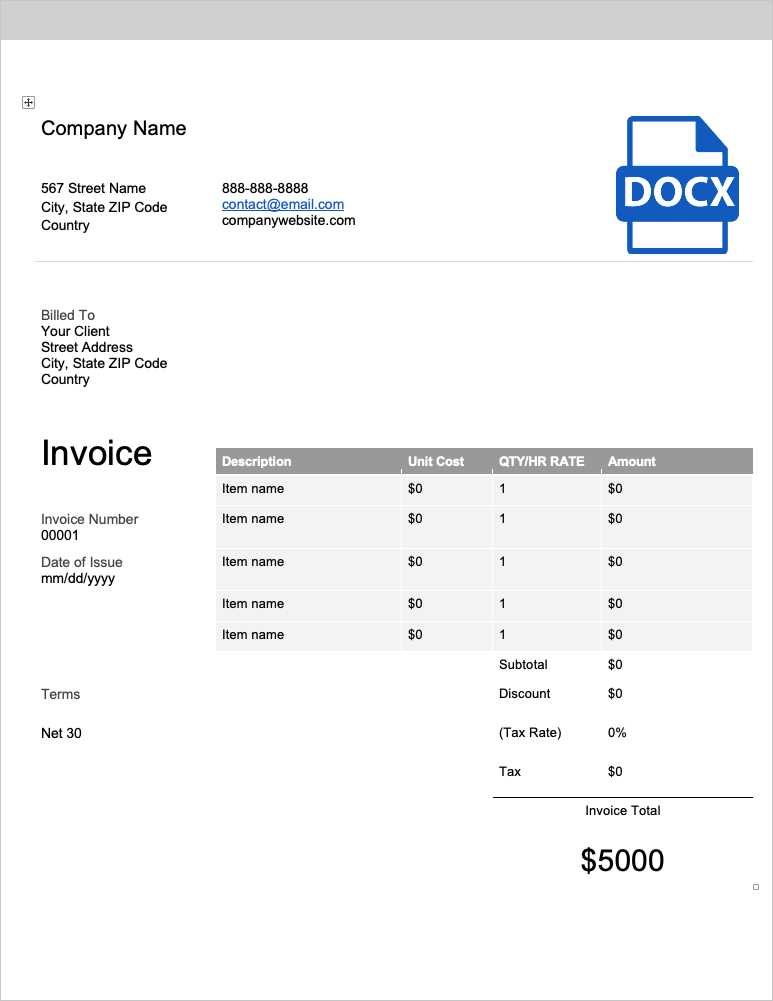

Free Online Invoice Templates for Microsoft Excel

Efficient billing is essential for any business, and having a ready-to-use structure to create payment requests can save both time and effort. By leveraging simple, customizable documents, businesses can ensure accuracy and consistency in their financial records. Whether you’re a freelancer or managing a small enterprise, utilizing these readily available tools can streamline the billing process significantly.

There are various options available for generating payment requests that are easy to fill out and adapt according to individual needs. These solutions allow you to include all necessary details, such as item descriptions, quantities, pricing, and payment terms. Below are some key benefits of using such documents:

- Customizable Layouts: Adjust fields to reflect your business model, whether you’re invoicing for services or physical products.

- Ease of Use: These solutions are designed to be user-friendly, so you don’t need advanced technical skills to create professional documents.

- Consistency: Maintain a standardized format across all your documents, which can enhance your company’s professionalism and reliability.

- Time Efficiency: With pre-built structures, you can generate documents quickly, freeing up time for other essential tasks.

With the ability to modify and save documents, businesses can handle their billing needs without having to invest in expensive software or services. Moreover, many platforms provide an array of designs that are fully adaptable to fit your

Why Use Excel for Invoices

When it comes to managing billing tasks, many businesses turn to spreadsheets as a reliable solution. This versatile tool offers a wide range of features that simplify the process of creating, organizing, and tracking financial documents. Its user-friendly interface and extensive customization options make it an ideal choice for those looking to streamline their billing operations while maintaining control over the details.

Benefits of Using Spreadsheets for Billing

Spreadsheets offer significant advantages when handling payment requests. Here are some key reasons why they are a popular choice:

- Flexibility: Spreadsheets allow full customization, so you can tailor documents to meet your specific needs, whether you’re billing for services or products.

- Efficiency: You can create and manage multiple records quickly, with tools to automate calculations, saving you time and reducing errors.

- Accessibility: These tools are widely accessible and can be used across different devices, ensuring you have access to your records wherever you go.

- Cost-Effective: Unlike specialized software, spreadsheets are often part of standard office suites, so there’s no need for extra investment in expensive programs.

Features That Make Spreadsheets Ideal for Billing

Beyond the basic benefits, spreadsheets also come with a variety of powerful functions that are particularly useful for invoicing:

- Automated Calculations: Built-in formulas allow you to calculate totals, taxes, and discounts with just a few clicks, reducing the risk of manual errors.

- Customization Options: You can easily adjust columns, rows, and fonts to create a document that fits your brand and meets legal requirements.

- Data Tracking: Spreadsheet

Benefits of Free Invoice Templates

Using pre-designed structures for managing financial documents offers numerous advantages to businesses of all sizes. These solutions enable users to quickly create professional-looking records without needing advanced design or accounting skills. By eliminating the need to start from scratch, businesses can streamline their workflow, reduce errors, and ensure consistency across all communications with clients.

Cost Efficiency and Accessibility

One of the biggest advantages of utilizing ready-made documents is that they are often available at no cost, making them an accessible option for businesses with limited budgets. In addition, these resources are easily downloadable and can be used on most office software, providing immediate access without the need for expensive software purchases. The time saved in creating documents from scratch or investing in complicated billing systems can instead be used to focus on core business activities.

- Zero cost: Save money by avoiding the need to purchase specialized billing software.

- Immediate access: Download and start using the structure right away without setup time or complex installations.

- Ease of use: Simple to fill out, making them suitable for anyone regardless of technical expertise.

Time-Saving Features

Ready-to-use formats often come equipped with predefined fields, making the process of creating documents significantly faster. With key information like contact details, dates, and payment terms already set up, you only need to input specific data for each client. This efficiency helps businesses manage multiple clients simultaneously, reducing the overall time spent on administrative tasks.

- Pre-filled fields: Save time on basic details that don’t need to be altered.

- Faster document generation: Quickly create multiple records without starting from scratch.

- Consistency: Maintain uniformity in all communications, ensuring that your documents look polished every time.

By using these practical solutions, businesses can manage their financial processes with greater efficiency, organization, and professionalism–all without a steep learning curve or costly investment. Whether you’re a startup or an established business, these tools provide a straightforward and reliable approach to handling financial documentation.

How to Download Free Templates

Getting started with ready-made billing solutions is quick and easy. Many platforms offer these tools with just a few clicks, allowing you to download and start using them immediately. Whether you’re looking for a basic format or something more specialized, there are plenty of options available for businesses of all types. The process of obtaining these documents is straightforward and doesn’t require any technical expertise.

Here’s a step-by-step guide to help you find and download the right structure for your needs:

- Search for the Right Platform: Start by browsing trusted websites or services that offer customizable documents for business needs. Many office software providers or dedicated document resources feature these files as part of their offerings.

- Choose Your Desired Format: Once on the site, browse through different available styles and select the one that best fits your requirements. Pay attention to the customization options and layout.

- Download the Document: After making your selection, look for the download button or link. Typically, these files can be saved directly to your computer or cloud storage with just one click.

- Open and Customize: Once downloaded, open the file in your preferred software. From there, you can begin filling in the necessary details such as client information, payment terms, and other specifics relevant to your business.

By following these simple steps, you can quickly access a variety of professional layouts designed to help you manage financial transactions with ease. The download process is typically very user-friendly, with no need for additional software or subscriptions. Just pick a design, download it, and get started!

Many platforms even offer additional customization features, such as adding your company logo, adjusting fonts, or tweaking column widths to fit your needs. This makes it even easier to create documents that align perfectly with your branding and business requirements.

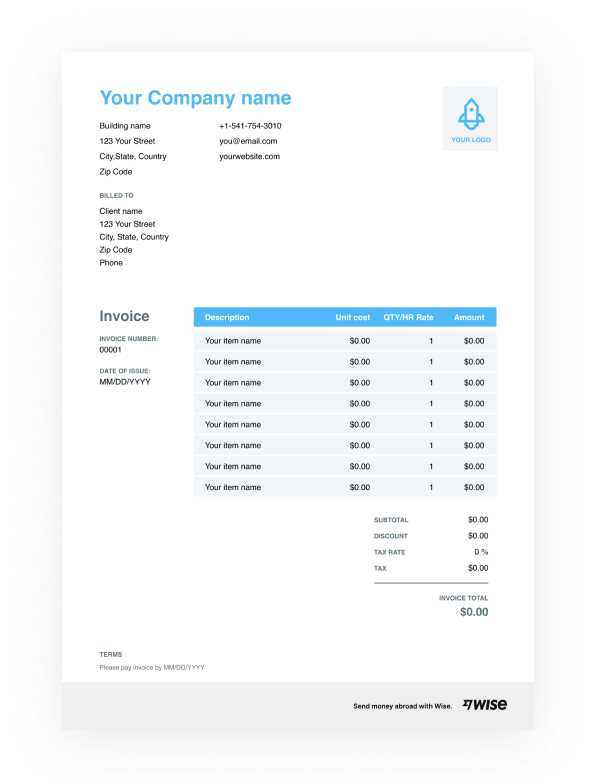

Customizing Excel Invoice Templates

One of the key advantages of using pre-made billing structures is the ability to tailor them to your specific business needs. Customization ensures that each document accurately reflects your branding, business practices, and payment terms. Whether you’re adjusting colors, adding logos, or modifying layout sections, the process is simple and can be done in just a few steps.

Key Customization Options

Here are some essential elements that can be modified to create a document that fits your business perfectly:

- Company Branding: Include your business logo, brand colors, and contact information to maintain consistency in your communications.

- Payment Terms: Adjust fields for payment due dates, discounts, and late fees to match your standard policies.

- Itemization Details: Modify columns to better represent the products or services you offer, including quantities, prices, and descriptions.

- Currency and Taxes: Easily change currency symbols and tax rates based on your location or client requirements.

How to Modify Key Fields

Here’s how to customize a typical structure for your business:

Field Customization Header Section Add your company logo, name, and contact details to create a professional header that matches your brand. Itemized List Adjust columns to include specific details such as product or service descriptions, quantities, unit prices, and totals. Footer Customize the footer with your payment terms, company policies, or a thank-you note to clients. Taxes & Discounts Modify tax rates and apply discount fields to align with your pricing strategy or regional tax laws. These changes allow you to craft a document that is tailored to your unique business needs, helping to enhance the professionalism and consistency of your communications. Whether you’re sending a one-time request or managing multiple clients, customization ensures that every financial do

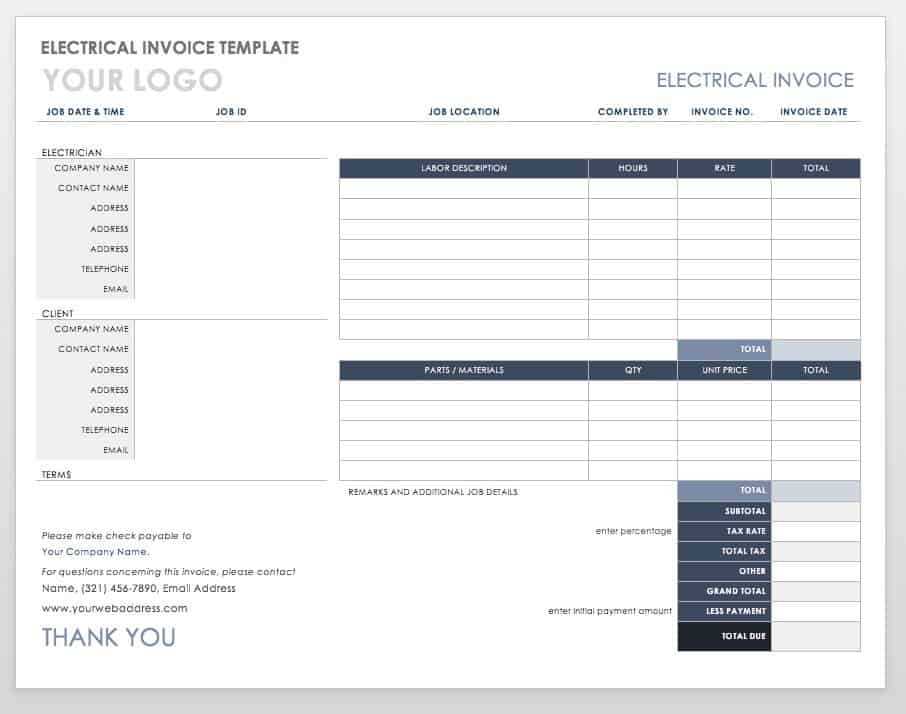

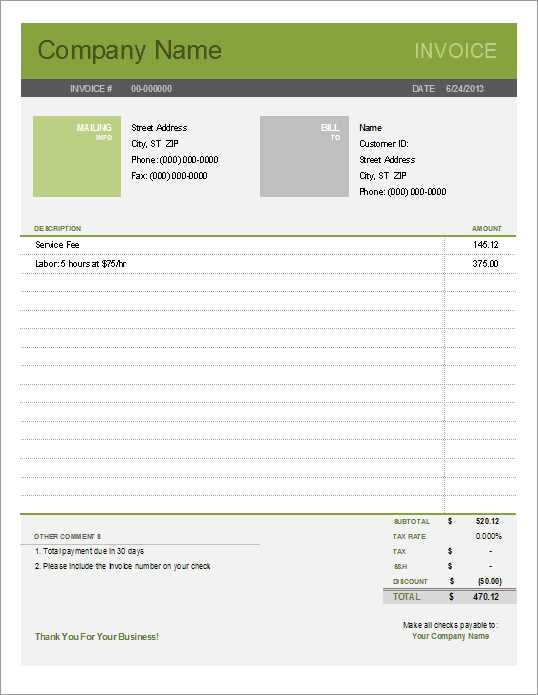

Choosing the Right Template for Your Business

Selecting the right document layout is essential to ensure that your financial records reflect your business needs while maintaining professionalism. A well-chosen format can improve the clarity and consistency of your billing process, help build trust with clients, and streamline administrative tasks. The key is to find a solution that fits both the type of products or services you offer and the unique requirements of your business operations.

When deciding on a layout, consider factors such as the complexity of your transactions, the frequency of your billing, and the level of detail required in your documents. A simple, straightforward design may work well for smaller, one-time transactions, while a more detailed format may be necessary for recurring services or projects with many line items. Below are some factors to keep in mind when making your selection:

- Business Type: For service-based businesses, a format that allows for detailed descriptions of services provided will be important. For product-based businesses, an itemized list with quantity and price fields may be more appropriate.

- Customization Needs: Consider whether you need to add specific sections such as taxes, discounts, or payment terms. Choose a layout that allows easy editing to incorporate these details.

- Frequency of Use: If you frequently bill clients, a more efficient, reusable format that saves time is crucial. Look for a design that can be quickly updated with minimal effort for recurring transactions.

- Brand Consistency: A professional document should reflect your business branding. Look for a layout that allows customization, including logos, colors, and font choices, to maintain a cohesive brand identity.

By understanding your specific needs and preferences, you can choose a solution that supports your billing practices and aligns with your business goals. Whether you are a freelancer, a small business owner, or a larger company, selecting the right format can make your billing process smoother, more efficient, and more professional.

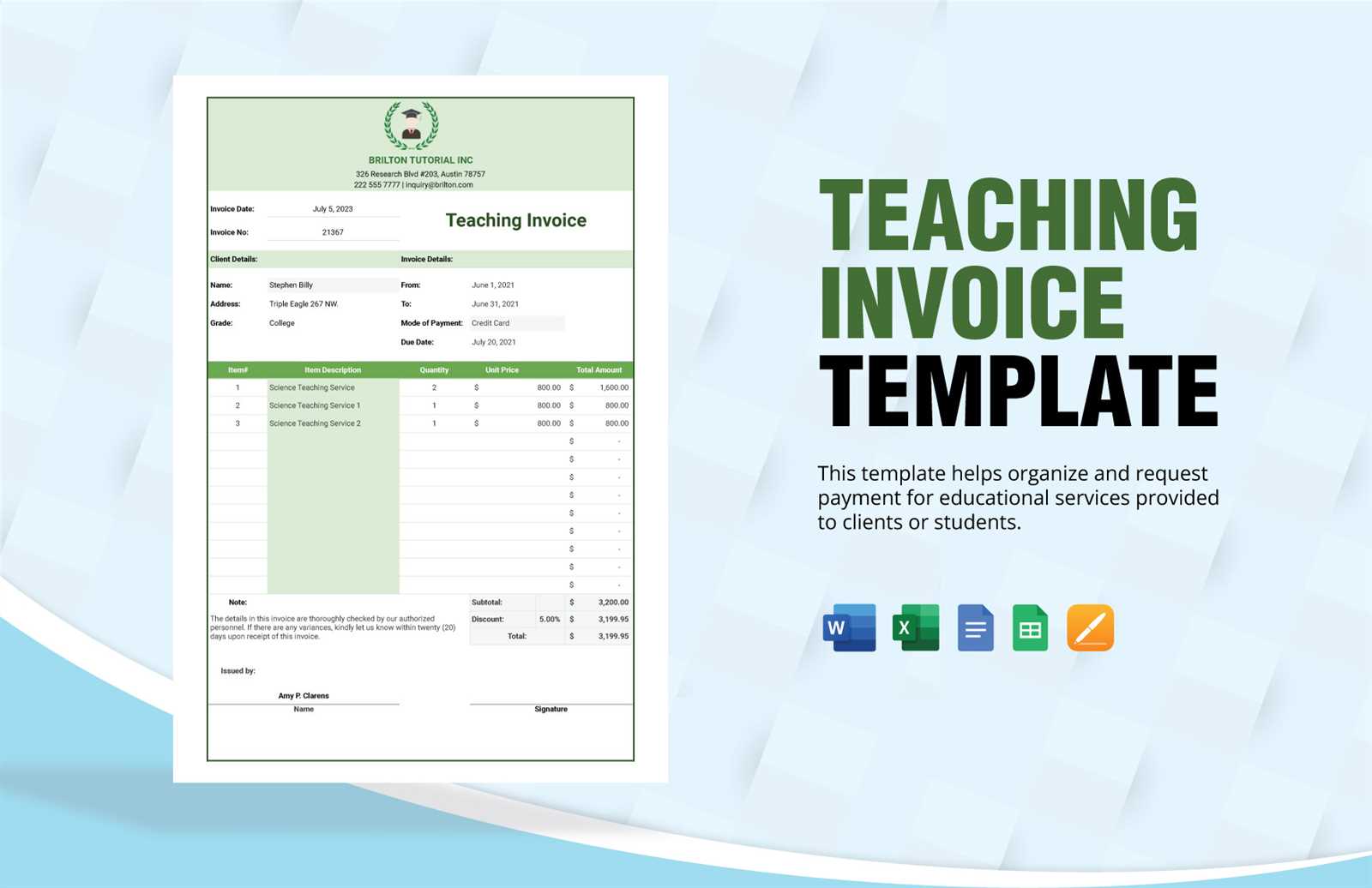

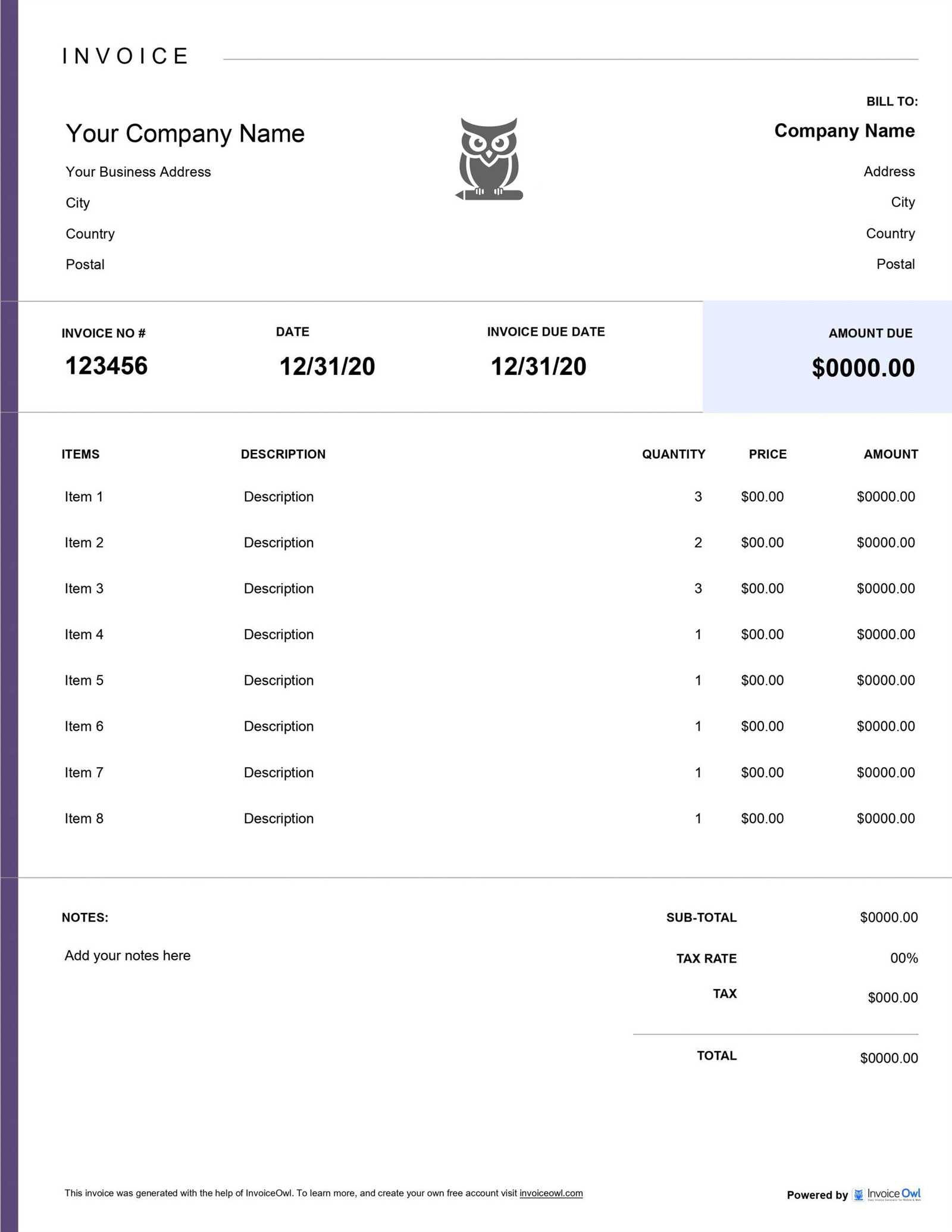

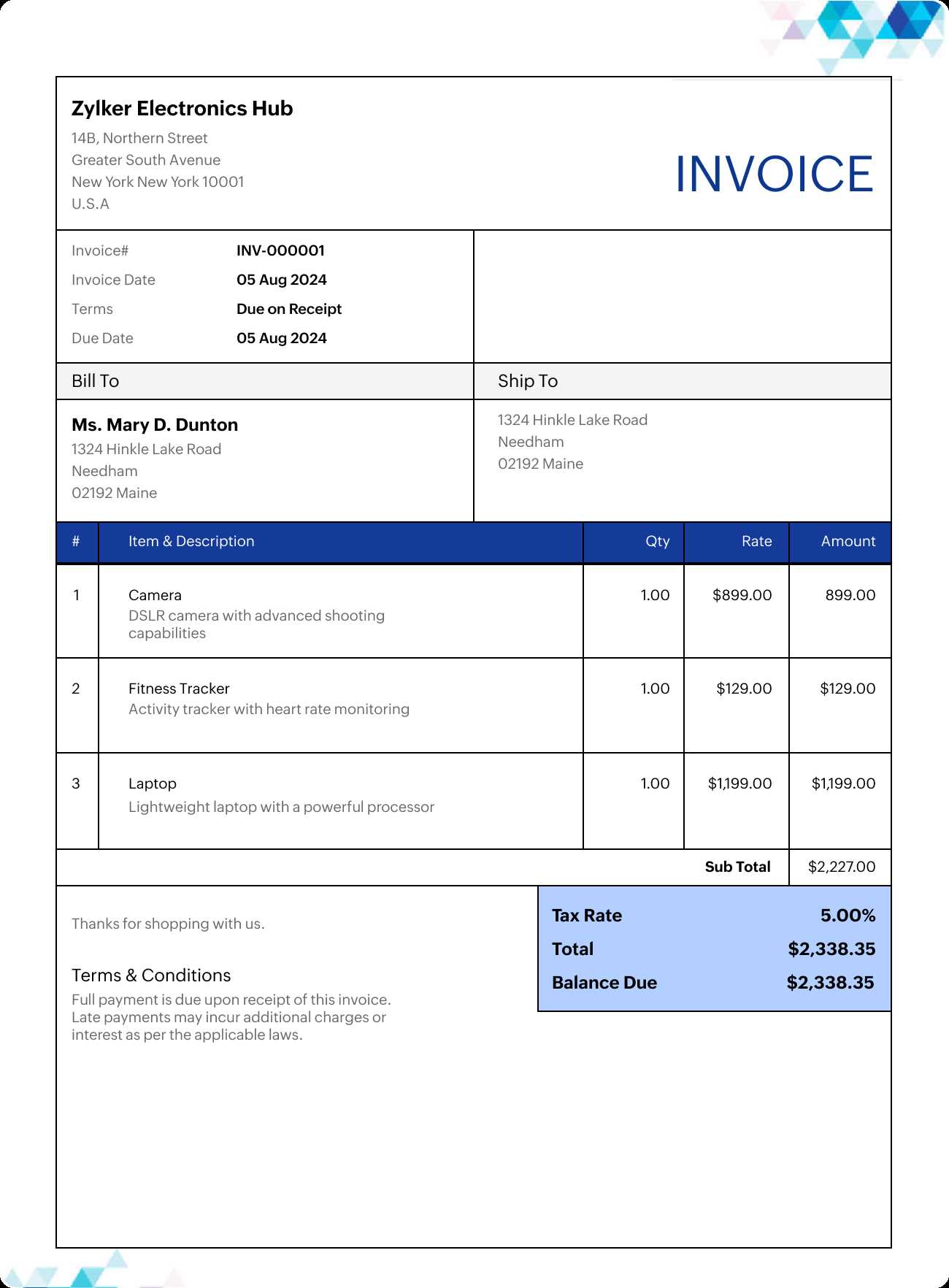

Essential Elements of an Invoice

Creating a comprehensive billing document requires including certain key information to ensure clarity, professionalism, and accuracy. Each section serves a specific purpose, ensuring that both the client and the business are on the same page regarding payment terms, services rendered, and other critical details. The essential components of a financial document help facilitate a smooth transaction and provide the necessary legal and financial information to both parties.

Key Information to Include

To ensure that your billing document is complete and effective, make sure to include the following elements:

- Business Information: Your company name, address, phone number, and email should be clearly displayed at the top to help clients easily contact you.

- Client Details: Include the client’s name, address, and contact information to personalize the document and ensure proper delivery.

- Document Number: Assign a unique identifier to each document. This helps track and organize billing records, especially for recurring or multiple transactions.

- Item Descriptions: Clearly outline the goods or services provided, including quantities, individual prices, and any relevant details to avoid confusion.

- Payment Terms: Define payment deadlines, late fees, and any discounts that may apply if the payment is made early or by a certain date.

- Total Amount Due: Clearly state the total sum that the client needs to pay, including taxes, discounts, or additional charges.

Additional Elements for a Professional Touch

For a more polished and professional look, consider adding the following:

- Logo and Branding: Incorporate your company logo and brand colors to make the document align with your corporate identity.

- Payment Methods: Clearly list accepted payment methods, such as bank transfer, credit card, or online payments, to make it easy for the client to settle their balance.

- Notes or Terms: If applicable, include a brief message or additional terms that might apply to the transaction, such as return policies or delivery details.

Including all these elements in your billing documents not only makes them more effective but also demonstrates profess

Creating Professional Invoices in Minutes

Generating clear and professional financial documents doesn’t have to be time-consuming or complicated. With the right structure, you can create polished, accurate billing records in just a few minutes. The key is to choose a format that suits your business needs and allows for easy customization, so you can focus more on delivering your services and less on administrative tasks.

Here’s a step-by-step guide to help you create a professional document in no time:

- Choose a Layout: Select a well-organized design that aligns with your business type, whether you’re billing for services, products, or a combination of both.

- Input Key Information: Quickly add essential details such as your company name, client information, a description of the products or services, and payment terms.

- Calculate Totals: Use built-in calculation tools to automatically sum up the amounts, apply taxes, and include discounts if necessary.

- Double Check for Accuracy: Before sending, ensure all information is correct and clearly presented to avoid confusion or errors.

The beauty of this process is in its simplicity. The structure does most of the work for you, allowing you to generate documents quickly, even for large or complex transactions. Here’s an example of how a typical billing document might be organized:

Item Description Quantity Unit Price Total Consulting Services 10 hours $50.00 $500.00 Software License 1 $150.00 $150.00 Total $650.00 With a few simple steps and basic details, you can generate a complete and professional document in just a few minutes. This approach saves time and ensures that your billing process remains efficient and organized, helping to maintain a positive experience for your clients.

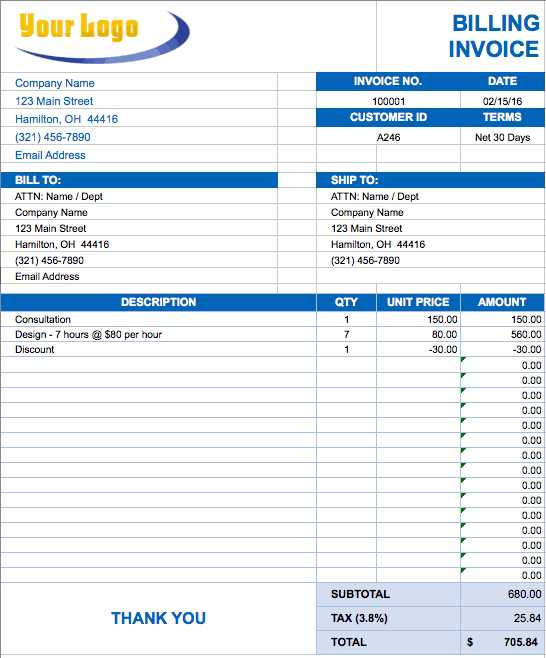

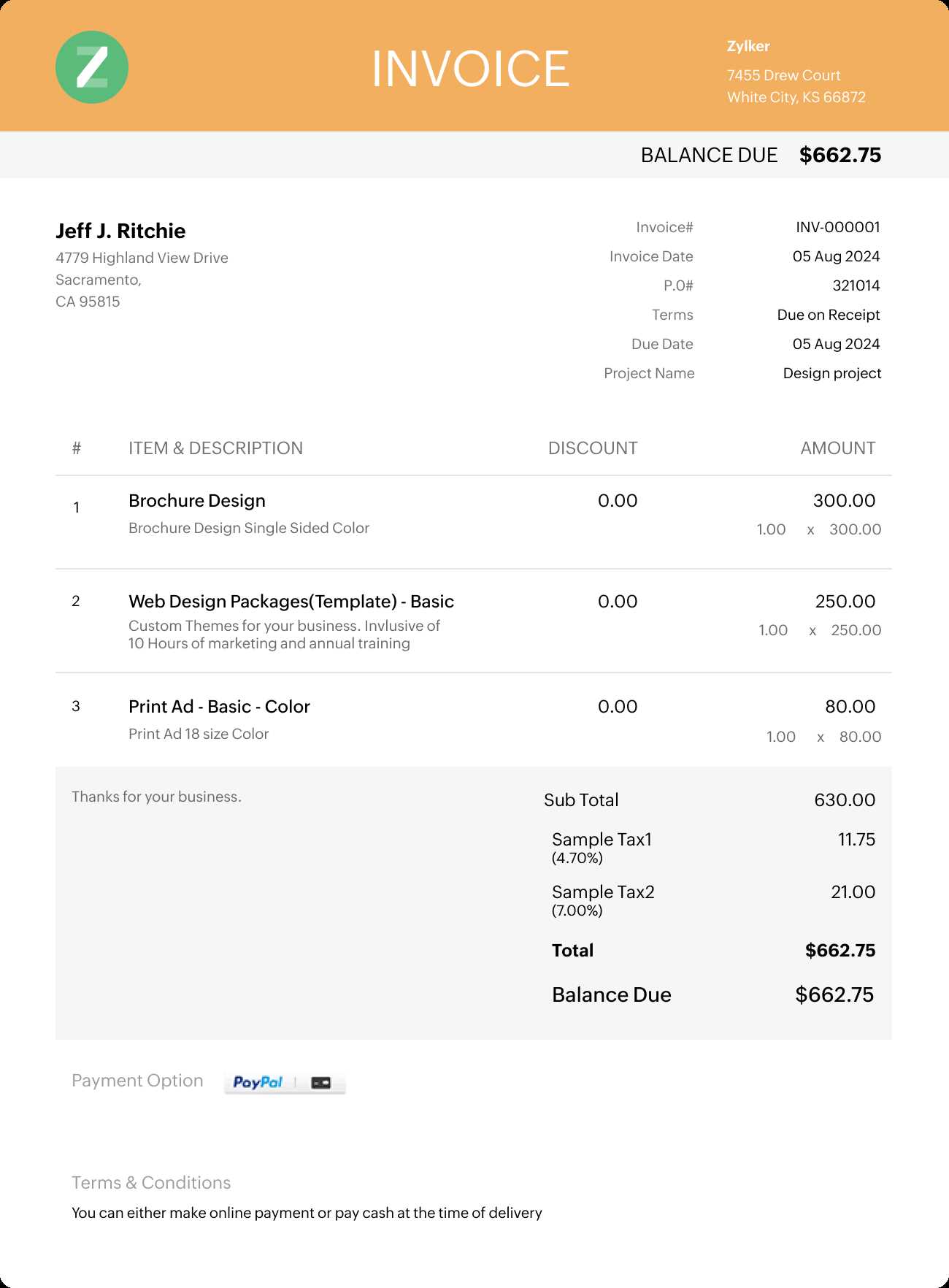

How to Add Taxes to Invoices

Including taxes in your billing documents is a crucial step to ensure compliance with local regulations and provide clarity to your clients. By accurately adding taxes, you can avoid misunderstandings and keep your financial records in order. Fortunately, adding taxes to your documents is a straightforward process, and there are several methods to calculate and display tax amounts depending on your region or business needs.

Steps to Include Taxes in Your Billing Documents

Follow these steps to easily incorporate taxes into your financial records:

- Determine the Tax Rate: The first step is to know the applicable tax rate for your products or services. This could vary by location, product type, or service provided. Check local tax laws to ensure you are using the correct rate.

- Calculate the Tax Amount: Once you have the rate, multiply the subtotal of the goods or services by the tax percentage. For example, if the subtotal is $500 and the tax rate is 8%, you would calculate: $500 x 0.08 = $40.

- Apply the Tax: Add the calculated tax amount to the subtotal to determine the total amount due. If the subtotal is $500 and the tax is $40, the total becomes $540.

- Display the Tax Information: Clearly show the tax amount and rate on the document, usually in a separate line beneath the subtotal. This ensures transparency and provides a breakdown for your client.

Example of Tax Calculation

Here’s an example of how taxes would appear in a typical document:

Item Description Quantity Unit Price Subtotal Consulting Services 10 hours $50.00 $500.00 Sales Tax (8%) $40.00 Total Amount Due $540.00 In this example, the tax amount is clearly listed along with the subtotal and the final total. This transparency helps your clients understand the breakdown of the charges and fosters trust in your billing process.

By following these steps, you can easily and accurately add taxes to your documents, ensuring y

Tracking Payments with Excel Templates

Effectively managing and tracking payments is crucial for maintaining healthy cash flow and staying on top of outstanding balances. By using a well-organized document structure, businesses can easily record payments, monitor due amounts, and ensure timely follow-ups with clients. With the right format, you can easily track which invoices have been paid, which are pending, and which require further action. This process helps you stay organized and reduces the risk of missed payments or errors.

Steps to Track Payments

Here’s how you can set up and use a payment-tracking system to monitor all outstanding and completed transactions:

- Create a Payment Status Column: Add a “Payment Status” column to your document to easily mark whether each transaction is paid, pending, or overdue. This will help you quickly identify which invoices still require attention.

- Record Payment Dates: For each paid item, include a “Payment Date” column. This allows you to keep track of when each transaction was completed, providing a clear payment history for reference.

- Track Partial Payments: In cases where clients make partial payments, include a “Payment Amount” column to indicate the amount that has been paid. This helps you track the remaining balance and calculate the amount due.

- Set Reminders for Due Dates: Mark due dates for payments and set reminders for overdue amounts. This helps you stay proactive in following up with clients to ensure timely payments.

Example of Payment Tracking Table

Here’s an example of how a payment-tracking table might look:

Invoice Number Client Name Amount Due Amount Paid Payment Status Payment Date #00123 John Doe $500.00 $500.00 Paid 01/15/2024 #00124 Jane Smith $350.00 $175.00 Partial 01/10/2024 #00125 Acme Corp. $750.00 $0.00 Pending 01/30/ Design Tips for Invoice Templates

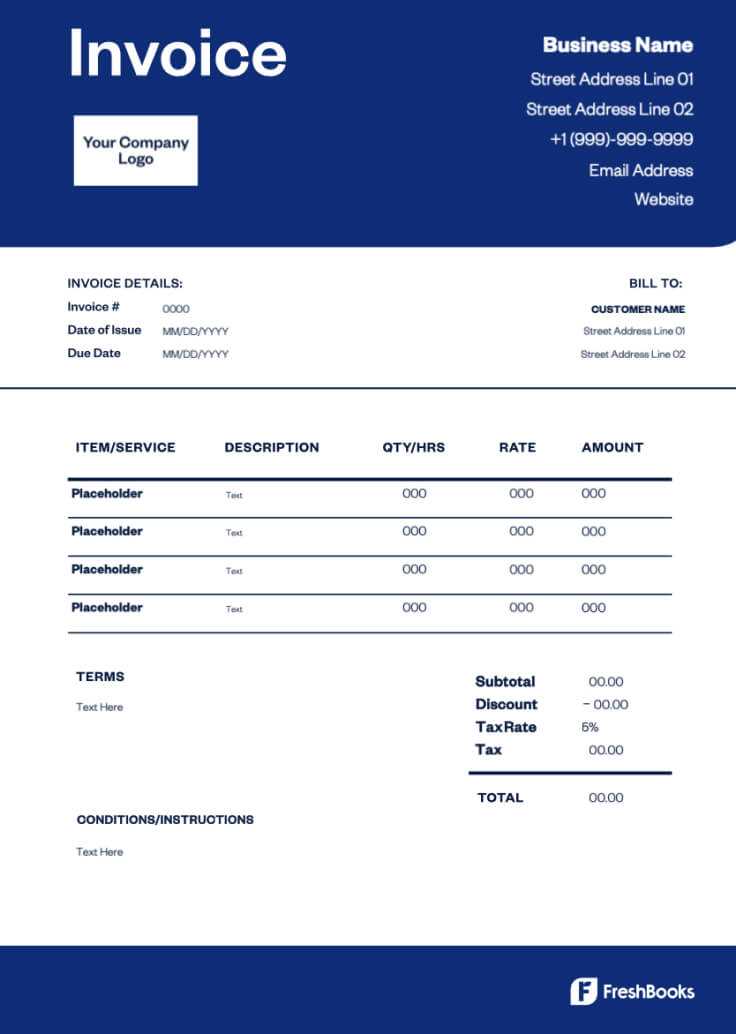

Creating a visually appealing and functional billing document goes beyond just filling in the necessary details. The design of your financial records plays an important role in how professional and organized your business appears to clients. A well-designed document helps ensure that all the necessary information is easily accessible, and it can enhance the overall client experience. With a few simple design tips, you can make sure that your financial documents are clear, professional, and easy to read.

Here are some design suggestions to help you create effective and aesthetically pleasing documents:

Keep It Simple and Clean

A cluttered design can make it difficult for clients to quickly understand the key details. Stick to a minimalist approach by using plenty of white space and clear, well-organized sections. This will allow the recipient to easily navigate through the document, finding important information like payment due dates and itemized charges at a glance.

- Use Clear Sections: Divide your document into distinct sections for business details, client information, services/products provided, and payment terms. This structure ensures clarity.

- Avoid Overuse of Colors: Limit the number of colors to maintain a professional look. Stick to one or two accent colors that align with your brand identity.

Enhance Readability with Fonts

The font you choose can have a big impact on the readability of your document. Use easy-to-read fonts like Arial, Helvetica, or Times New Roman, and avoid decorative or overly complex typefaces. Ensure there is enough contrast between the text and the background to make it legible in both printed and digital formats.

- Font Size: Use larger font sizes for headings and smaller sizes for item descriptions. Typically, headings should be between 14-16pt, while the body text can be between 10-12pt.

- Bold Important Details: Emphasize key information, such as the total amount due, by using bold or larger text to make it stand out.

Consistency with Branding

Your billing documents should reflect your business’s identity, so it’s important to maintain consistency with your overall branding. Include your logo, use your brand colors, and ensure that the overall style aligns with your company’s visual appearance.

- Brand Logo: Add your company logo at the top to create a professional impression and reinforce your brand identity.

- Color Palette: Select colors

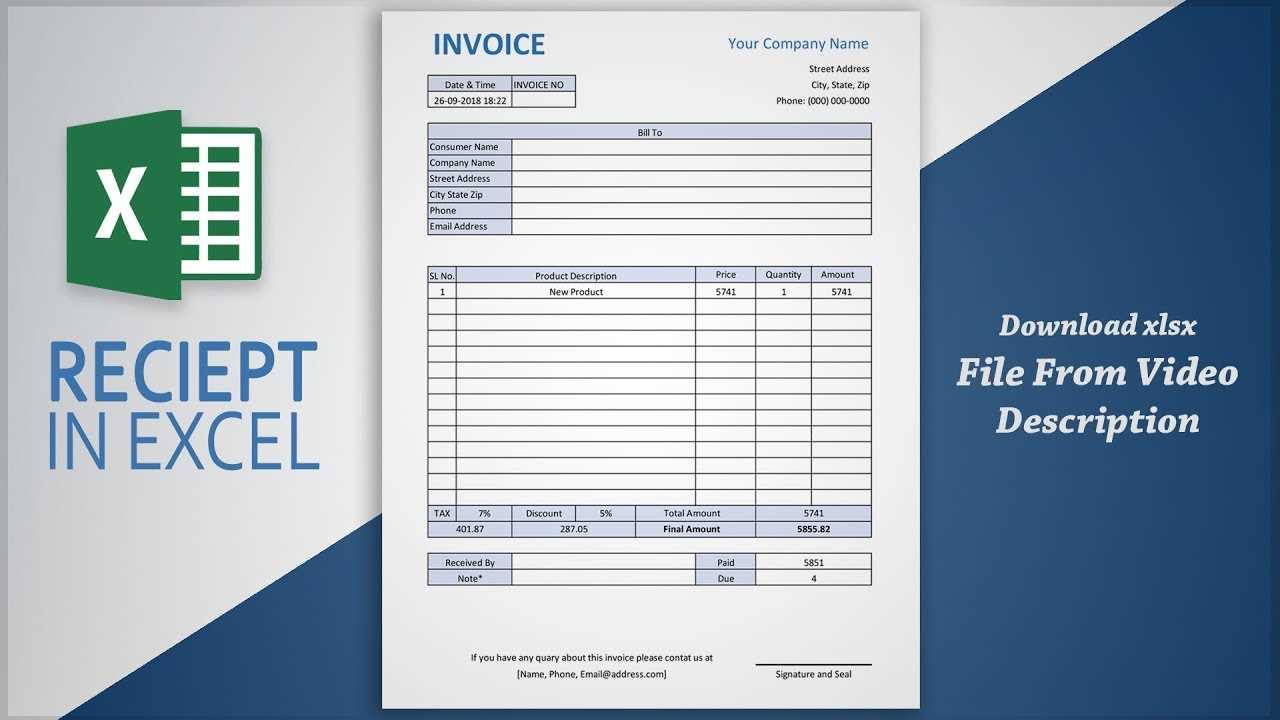

Automating Invoice Creation in Excel

Automating the creation of billing documents can significantly streamline your business processes, saving both time and effort. By leveraging automation features, you can quickly generate accurate and consistent records without having to manually input the same details repeatedly. This approach reduces the likelihood of human error and ensures that your documents are always up-to-date with the correct information.

Using built-in formulas, drop-down lists, and other automation tools, you can create a system that automatically calculates totals, applies taxes, and tracks payment statuses. This way, each time you need to issue a document, all you have to do is input the relevant data, and the system will take care of the rest.

Steps to Automate the Process

Here’s a simple guide on how to set up an automated billing system:

- Create Data Fields: Set up the main data fields in your document, such as customer name, item descriptions, quantity, price, and tax rate. These will be the fields you input on each new document.

- Use Formulas for Calculations: Implement formulas to automatically calculate totals, taxes, and any discounts. For instance, you can use the formula =Quantity * Price to calculate the total for each item, and =Subtotal * TaxRate to calculate taxes.

- Apply Conditional Formatting: Set up conditional formatting to highlight overdue payments or flag any discrepancies. This helps you stay on top of your financial records without manually checking each entry.

- Drop-down Lists for Easy Selection: Use drop-down lists for repetitive entries, such as payment terms, client names, or products. This saves time by reducing the need for manual data entry and helps maintain consistency across your documents.

Example of Automated Billing System

Here’s an example of how an automated system might work:

Item Description Quantity Unit Price Total Consulting Service =Quantity1 * Price1 Security Features in Excel Invoices

When it comes to handling financial documents, ensuring the security of your records is essential. Protecting sensitive information such as client details, payment amounts, and other confidential data from unauthorized access is a priority. By utilizing various security features, you can prevent tampering, safeguard your data, and maintain a professional level of confidentiality in your business transactions.

There are several ways to enhance the security of your billing documents. From password protection to limiting access, these features help ensure that only authorized individuals can view, edit, or share your documents.

Common Security Measures for Financial Documents

Here are some of the most effective security features you can use to protect your financial records:

- Password Protection: Adding a password to your documents is one of the simplest ways to prevent unauthorized access. You can set a password that’s required to open the document, ensuring that only authorized users can view or edit it.

- Cell Locking: Lock specific cells or ranges to prevent accidental or intentional changes to key information, such as totals, client details, or tax calculations. This feature ensures that only authorized users can modify certain parts of the document.

- Encryption: Use file encryption to further protect the contents of your documents. Encryption ensures that even if someone gains access to the file, the contents remain unreadable without the correct decryption key.

- Permissions Control: Set permissions to limit who can edit or view your documents. You can choose to allow some users to only view the file, while others can have editing rights, ensuring that sensitive data is handled properly.

- Audit Trail: Enable features that track changes made to the document. This allows you to keep a record of who edited the file and what changes were made, helping you monitor any unauthorized alterations.

Example of Securing Data in a Financial Record

Here’s an example of how you can use some of these security features:

Data Type Security Feature Client Details Password Protection, Cell Locking Financial Totals Cell Locking, Permissions Control File Access Password Protection, Encryption Document C Managing Multiple Clients with Excel

Effectively managing multiple clients can be a challenging task, especially when handling billing, payment tracking, and correspondence for each client separately. However, with the right tools, you can streamline your workflow, ensuring that no client gets overlooked, and every financial detail is properly organized. A well-structured system within a spreadsheet application can help you manage all client-related information in one place, making it easy to track progress and maintain accuracy across multiple accounts.

Using organized sheets, filters, and sorting tools, you can keep track of each client’s payments, due dates, and services provided, all while ensuring you maintain a professional and efficient approach. By customizing your workspace to suit your specific needs, you can create a centralized hub for managing clients, reducing the time spent on administrative tasks.

Organizing Client Data

Start by creating a structured layout for your client records. Here’s how you can organize essential information for easy access and management:

- Client Information: Include key details like client names, contact information, and billing addresses. You can set up a table with columns for each piece of information, making it easy to update as needed.

- Project/Service Details: Track the services provided or projects completed for each client. Create columns for service descriptions, completion dates, and specific costs associated with each project.

- Payment History: Set up a section that records each payment made by the client, including dates, amounts, and the remaining balance. This allows you to monitor outstanding balances and send reminders when necessary.

Automating Client Data Tracking

To save time and reduce human error, you can automate several aspects of client data tracking:

- Use Formulas for Calculations: Set up formulas to calculate totals, taxes, and balances automatically. For example, =AmountDue – PaymentsReceived can help you track how much is still owed.

- Conditional Formatting: Apply conditional formatting to highlight overdue payments or upcoming due dates. This will make it easier to spot any clients requiring immediate attention.

- Drop-down Menus: Use drop-down lists for easy selection of common options, such as payment status (paid, pending, overdue) or service types. This can speed up data entry and reduce errors.

By organizing client data and using automation tools, you can keep track of all interactions and payments in an organized

How to Avoid Common Invoice Mistakes

When managing business transactions, accuracy and attention to detail are critical. Small mistakes in your billing documents can lead to confusion, delayed payments, and strained client relationships. It’s essential to understand common errors that occur during the creation of financial records and take proactive steps to avoid them. By focusing on precision and consistency, you can ensure smooth and efficient payment processes.

Here are some of the most common mistakes people make when preparing billing documents and how you can avoid them:

Common Billing Errors and How to Avoid Them

- Incorrect Client Information: Ensure that you have the correct client name, address, and contact details. Mistakes in this area can lead to documents being sent to the wrong address or clients not receiving the necessary information. Always double-check this data before finalizing the document.

- Missing or Wrong Payment Details: Double-check the payment terms, including the amount due, due dates, and any applicable discounts or taxes. Incorrect amounts or dates can lead to confusion and delays. Make sure the figures are clear and accurate, and highlight them for easy reference.

- Omitting Key Information: Leaving out crucial details such as the service description, payment terms, or due dates can lead to misunderstandings. Always include all the necessary fields to give a comprehensive picture of the transaction. This ensures the recipient has everything they need to process the payment.

- Inconsistent Formatting: Consistency is key in professional documentation. Inconsistent fonts, spacing, or alignment can make your billing documents look unprofessional and harder to read. Stick to a clean, organized format with easy-to-read fonts and well-spaced sections.

- Failing to Follow Up on Unpaid Bills: It’s easy to forget to follow up on overdue payments. Implement a system to track the status of each transaction and send timely reminders. Using automated reminders or a payment tracking system can help reduce the chances of missed payments.

Steps to Ensure Accuracy

- Review Before Sending: Always double-check the information on your billing documents before sending them. A quick review can help you catch any errors and ensure everything is in order.

- Use Automated Tools: Take advantage of automated systems for calculations and tracking. This helps minimize human error in calculations and makes it easier to manage multiple clients or p

Exporting and Printing Invoices in Excel

Once your billing document is complete and all information has been verified, the next steps are to either print the document or export it to share with clients. These processes are important for creating professional, polished records that can be easily distributed or stored. Whether you need a physical copy for client meetings or a digital version to send via email, knowing how to properly export and print documents is essential for smooth business operations.

By using the built-in tools available in most spreadsheet applications, you can easily convert your billing records into various formats, including PDF or other file types, and prepare them for printing. Both options allow for a streamlined workflow and ensure that you can distribute your billing documents quickly and efficiently.

Exporting Documents to Different File Formats

Exporting your document allows you to save it in a format that’s suitable for sharing, whether you prefer to send it via email or upload it to a cloud storage system. Some common formats you can export your financial records to include PDF, CSV, or even a Word document. Here are the steps to follow for exporting:

- Export to PDF: This format is ideal for preserving the integrity of your document’s layout and design. When you save as PDF, the document will appear the same across all devices, making it perfect for client distribution.

- Export to CSV: This format is helpful for clients who may need to import the data into their own systems for further processing. CSV files contain raw data without formatting, which can be useful for analysis and record-keeping.

- Export to Word: If you need to include additional explanatory text or terms, exporting to Word can be a good choice. It allows you to combine data with narrative content in a more flexible document format.

Steps for Printing Documents

When you need a hard copy of your billing document, printing it in the right format and quality is essential. Here’s how to ensure your document prints clearly and correctly:

- Set Page Layout: Before printing, adjust the page layout to make sure everything fits properly. Check the margins, page orientation (portrait or landscape), and ensure that all content is visible and not cut off.

- Preview Before Printing: Always use the print preview feature to ensure everything looks as it should before printing the final copy. This helps prevent paper wastage and ensures no information is omitted.

- Select Printer Settings: Choose the correct printer and ensure that the quality settings are set to high for a clear printout. If you’re printing multiple copies, be sure to set the number of copies in the

Why Free Templates Are a Good Choice

For businesses looking to streamline administrative tasks, choosing ready-made tools that require minimal customization can be an excellent decision. These tools help save time and effort, especially for small business owners or freelancers who may not have the resources for custom solutions. By opting for accessible and no-cost options, businesses can create professional documents without breaking the budget.

Using pre-designed solutions also eliminates the need for advanced technical skills, making it easier for anyone to generate accurate and consistent records. They offer a balance of simplicity and professionalism, which is ideal for individuals or companies who need quick results without the hassle of creating everything from scratch.

Cost Efficiency

One of the most significant advantages of choosing readily available options is cost savings. Developing a customized solution or purchasing specialized software can be expensive. By opting for free solutions, businesses can allocate their resources to other areas, such as marketing or product development, without sacrificing quality. Here’s how they contribute to reducing costs:

- No Upfront Costs: Many ready-made tools come at no charge, which eliminates the need for any financial investment upfront. This is especially beneficial for startups or small enterprises with limited budgets.

- Reduced Development Time: By using existing designs, you avoid the time-consuming process of creating your own documents. This enables faster document creation, allowing you to focus on other business tasks.

Ease of Use and Customization

Another reason to choose ready-to-use solutions is their simplicity and ease of use. Most free tools are designed to be intuitive, making them accessible even to those without advanced knowledge of design or document creation. Users can easily input their information, adjust details, and generate professional documents without hassle.

- Simple Customization: Even with pre-designed options, customization is often straightforward. You can modify elements like fonts, colors, and layout to align with your brand, all while maintaining a polished and professional look.

- Instant Availability: Free resources are often available immediately and don’t require long setup times or technical configurations, allowing you to get started right away.

By choosing ready-made, no-cost solutions, businesses can create effective and professional documents in a fraction of the time and cost of custom-built alternatives. These tools allow for quick adaptation while maintaining a high standard of quality, making them an excellent choice for many organizations.