Free Online Invoice Templates for Excel Download

Managing financial transactions efficiently is a key aspect of running a successful business. One of the most important elements of this process is having the right tools to create accurate and professional-looking financial records. With the right resources, you can streamline your billing process, improve client relations, and stay organized.

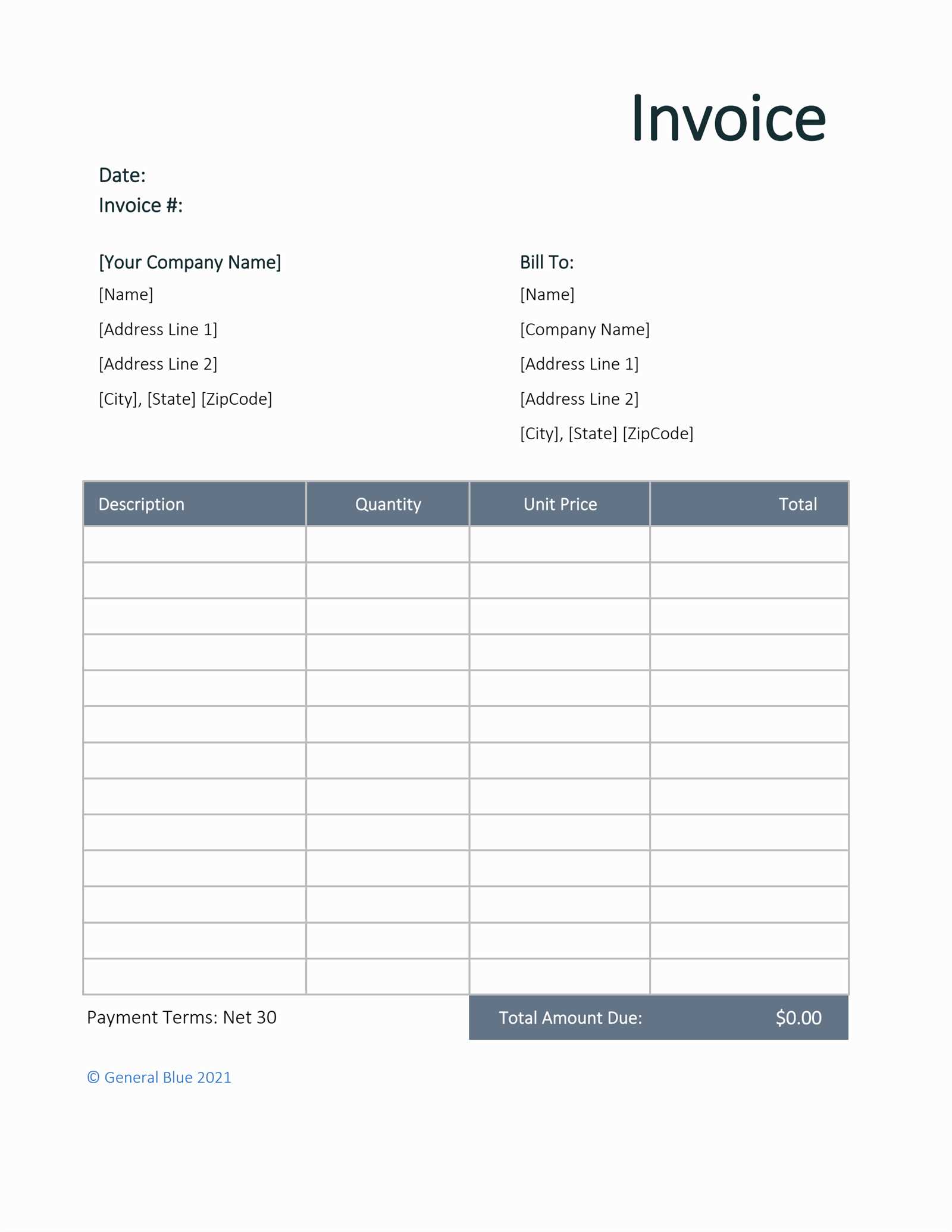

When it comes to preparing detailed payment statements, customizable options are essential. You need a solution that allows you to input relevant data, adjust formatting, and tailor it to your company’s branding. The availability of accessible and easy-to-use solutions can save time, reduce errors, and create a polished image for your business.

In this article, we’ll explore how to take advantage of ready-to-use resources that allow you to generate financial documents quickly and without hassle. Whether you’re a freelancer, a small business owner, or managing a larger enterprise, having the right framework to manage billing is crucial to maintaining smooth financial operations.

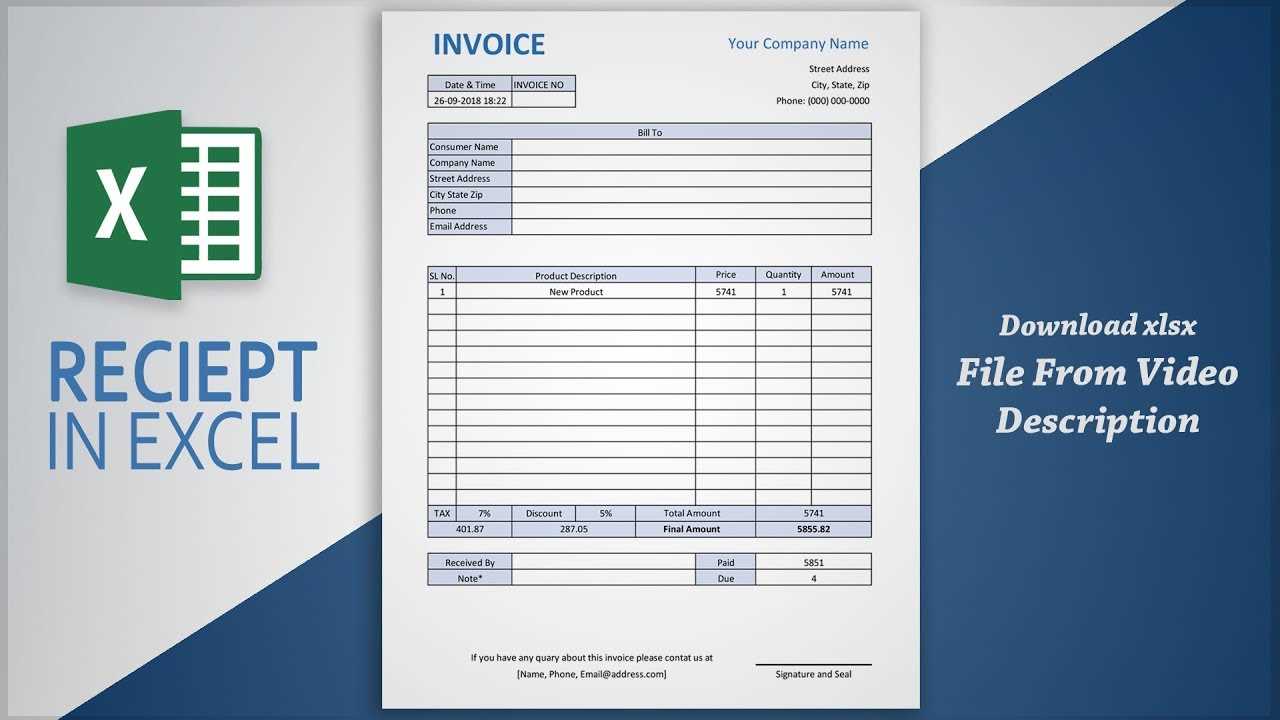

Free Excel Invoice Templates for Business

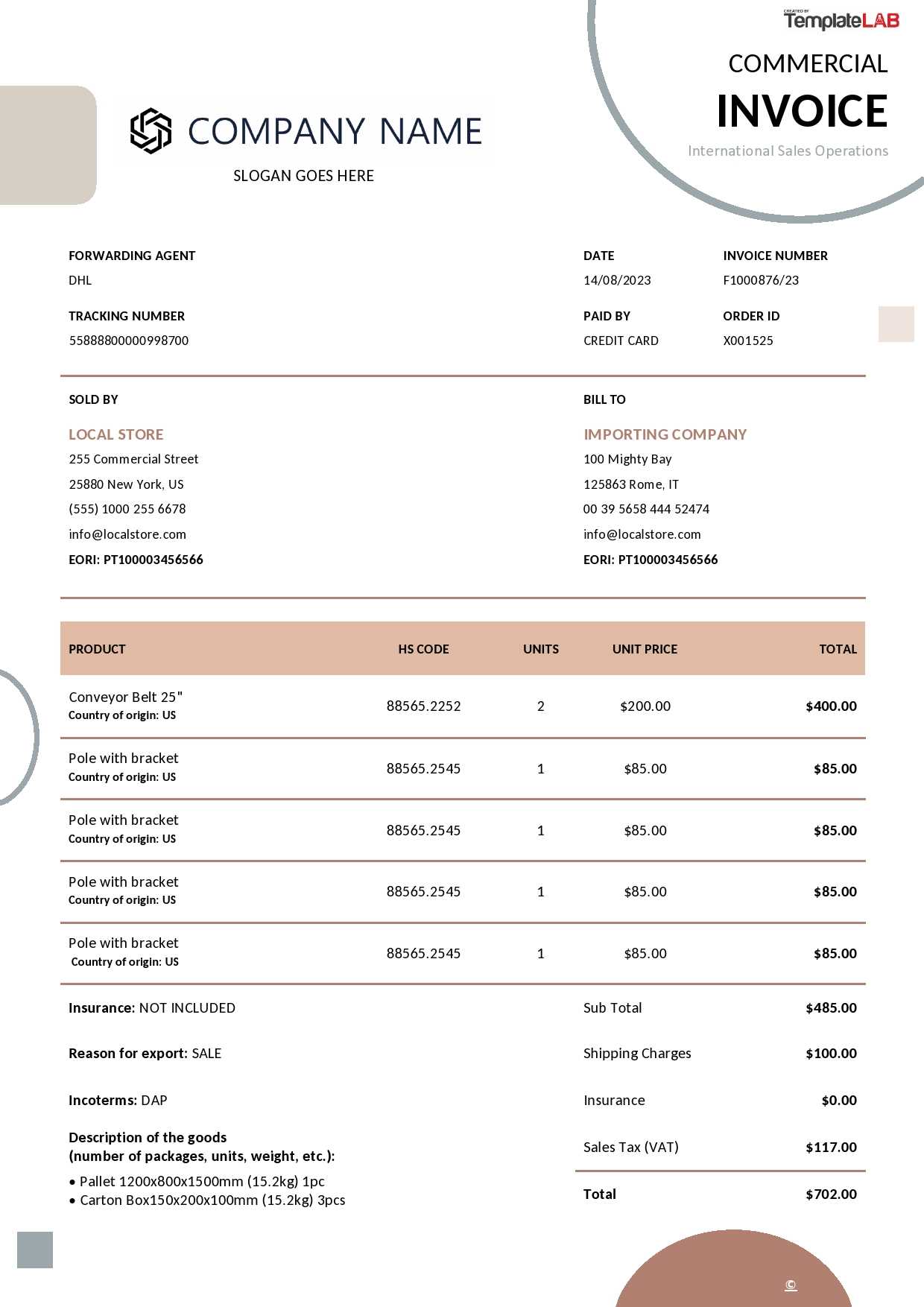

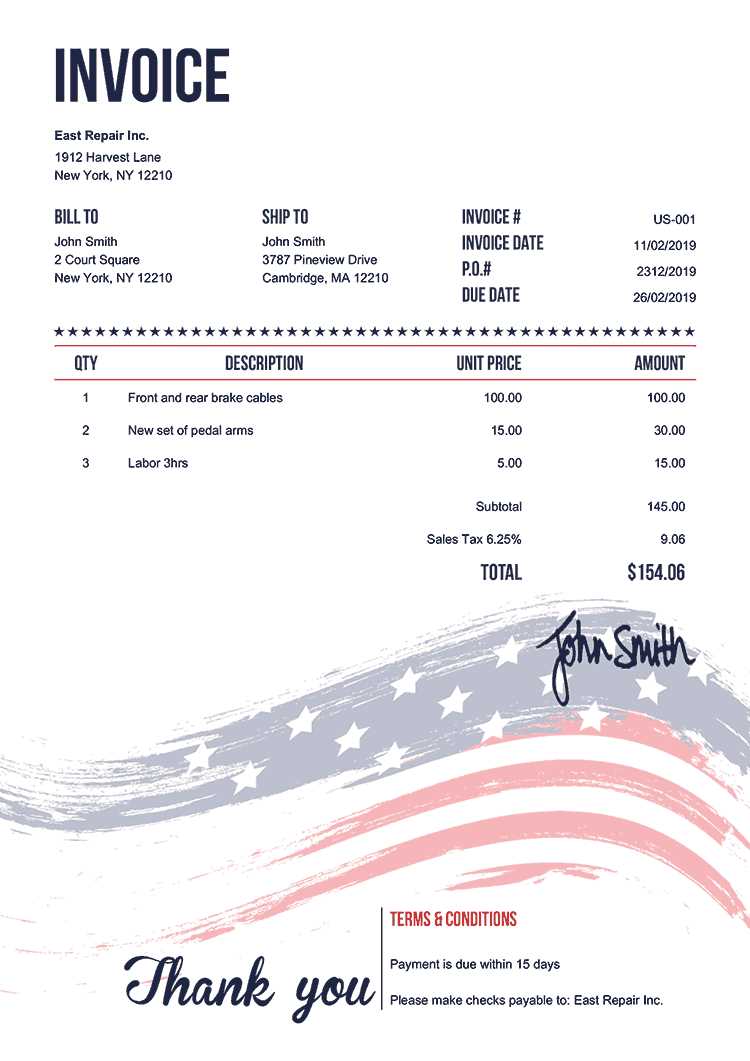

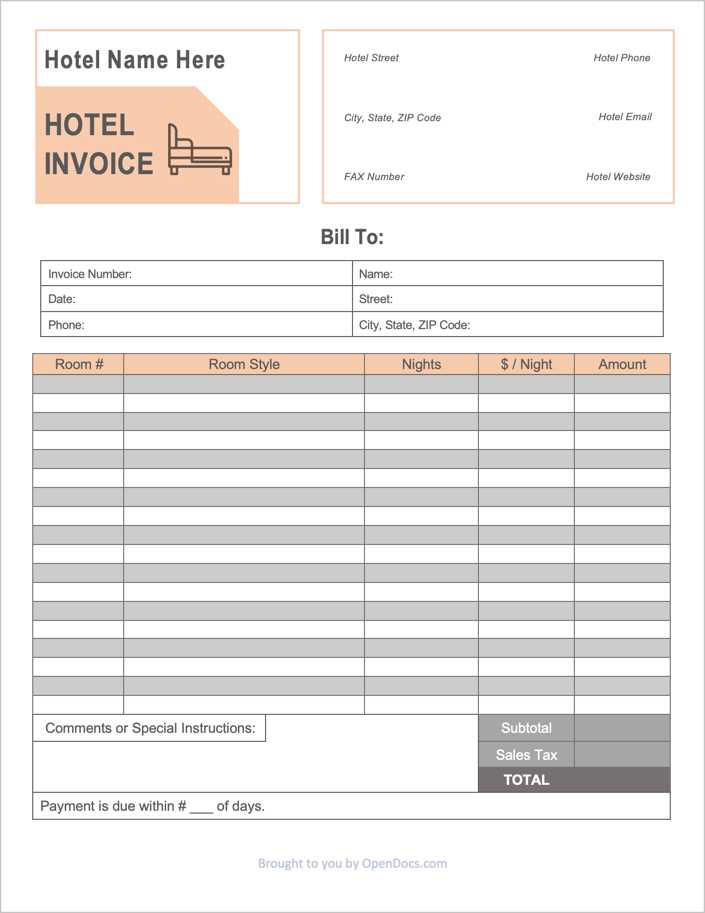

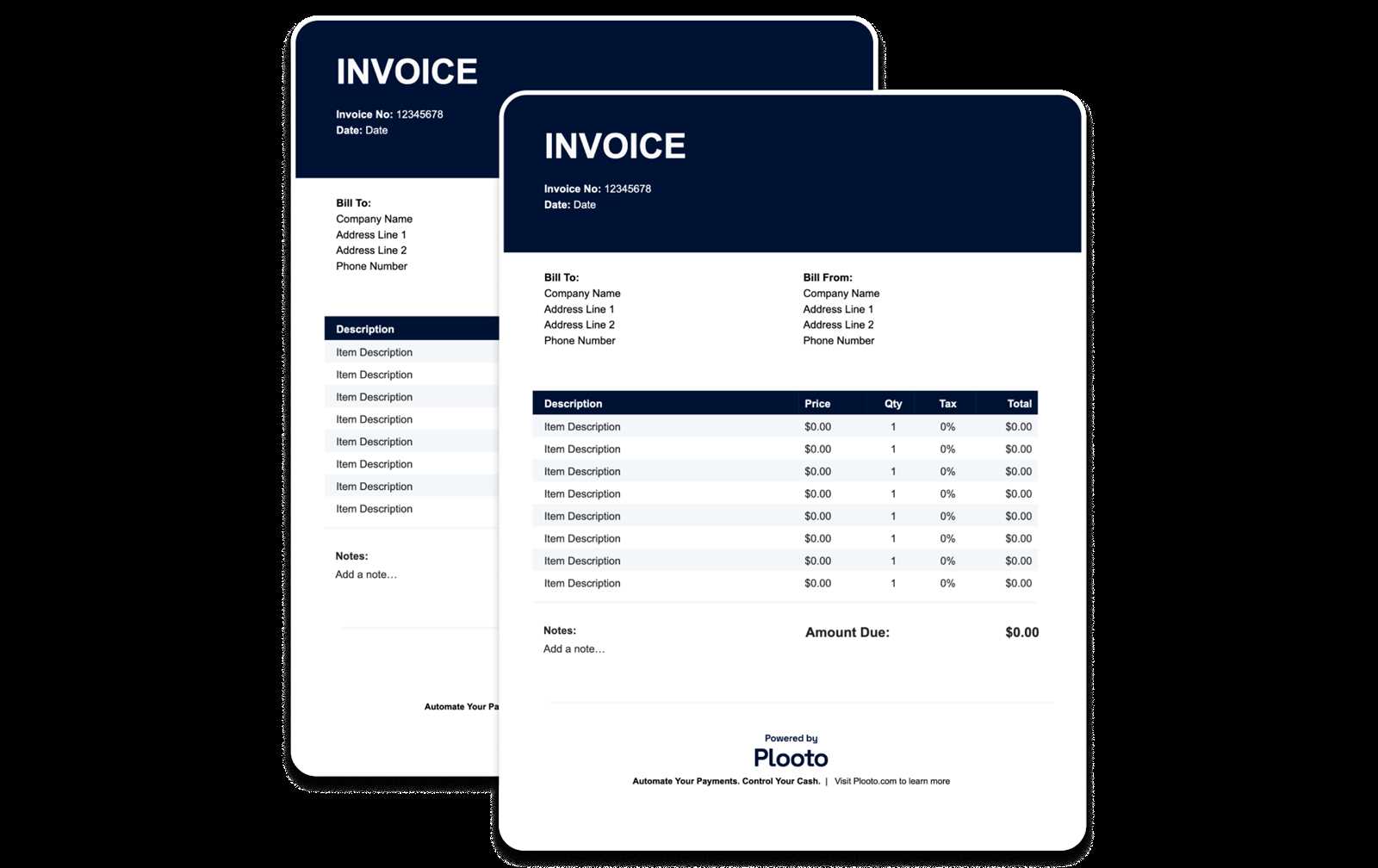

For any business, having a structured way to request payments is essential for maintaining cash flow and ensuring prompt transactions. Using pre-designed documents can simplify this process, allowing companies to quickly generate professional-looking bills. These customizable tools are designed to meet the unique needs of different industries and clients, making it easy to create accurate and well-organized financial statements.

Benefits of Using Ready-Made Billing Documents

One of the biggest advantages of these ready-made solutions is their ability to save time. Instead of manually designing a new document for each transaction, you can simply input the necessary information into an existing framework. This eliminates the need for tedious formatting and ensures consistency across all billing records. Additionally, these documents often come with built-in formulas for calculations like taxes, discounts, and totals, reducing the risk of errors.

Customizing Your Billing Documents

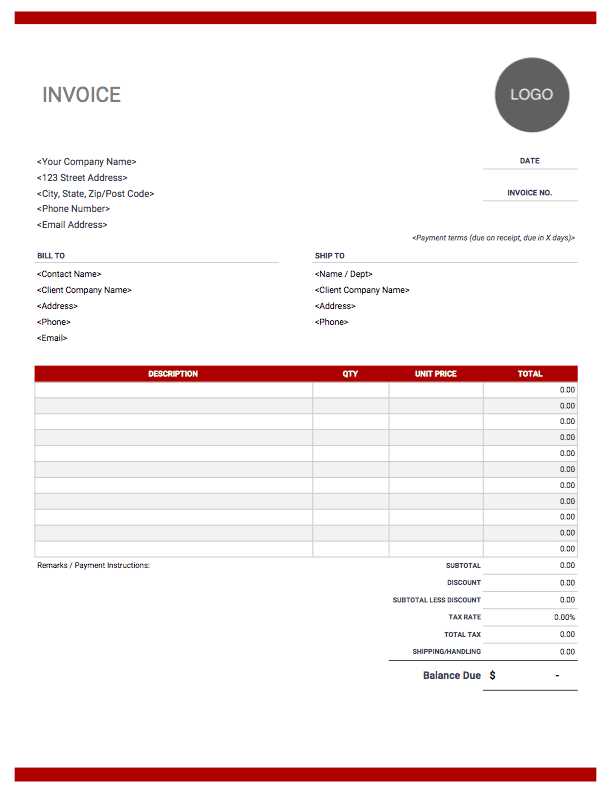

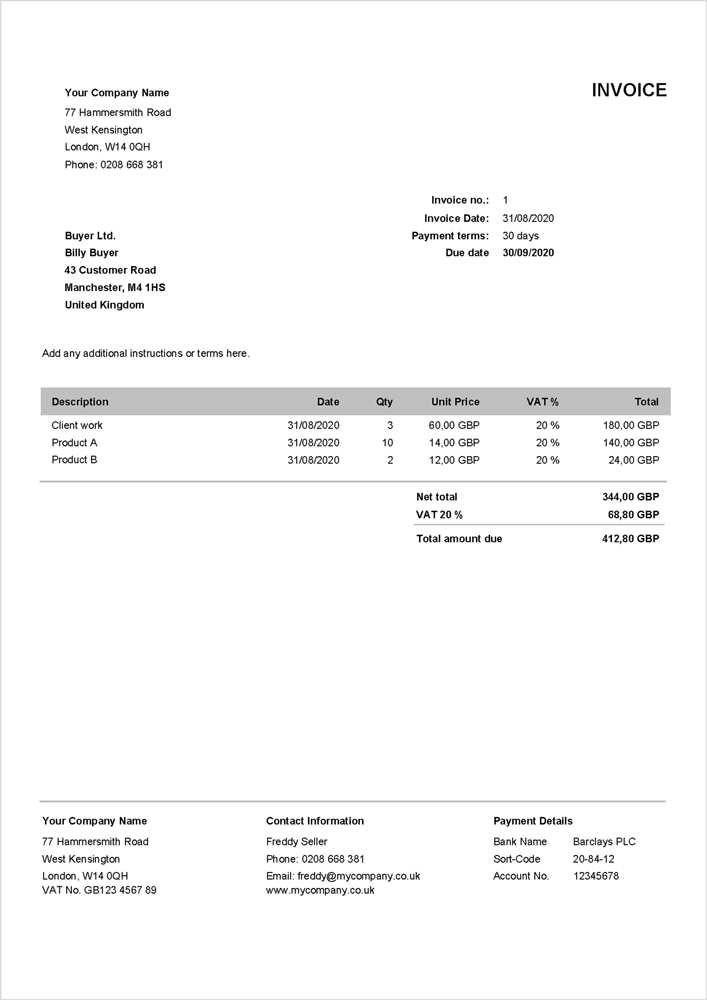

Even though these tools are pre-designed, they offer flexibility. You can easily adjust the design to match your company’s branding, including logos, color schemes, and fonts. Whether you’re working with a basic structure or a more detailed layout, these resources can be tailored to fit your business’s needs. Customizing these documents ensures that your bills are not only functional but also reflect your brand identity.

Incorporating these tools into your workflow helps to keep your billing process smooth and professional. With just a few clicks, you can create comprehensive financial records that are both efficient and visually appealing.

Why Use Online Invoice Templates

Efficiently managing financial records is essential for businesses of all sizes. Using pre-designed structures for payment requests not only streamlines the billing process but also ensures accuracy and consistency across all transactions. These resources are designed to save time, reduce human error, and enhance the overall professional appearance of your communications with clients.

Time-Saving Benefits

Creating payment documents from scratch for each transaction can be time-consuming and prone to mistakes. With ready-made solutions, the process becomes much quicker. You only need to input the relevant details, and the document is instantly ready for use. This allows business owners to focus more on their core activities and less on administrative tasks.

Enhanced Professionalism and Consistency

Using a structured format for your financial records ensures that every document looks polished and follows the same design principles. This consistency helps build trust with clients and presents your business as organized and reliable. A professional approach to financial dealings can go a long way in maintaining positive relationships with customers and partners.

| Benefit | Impact |

|---|---|

| Time efficiency | Quicker document creation, more focus on business tasks |

| Reduced errors | Minimized risk of mistakes in calculations and formatting |

| Professional appearance | Improved client perception and credibility |

Incorporating such systems into your workflow can significantly improve how you handle financial transactions, offering both functional and aesthetic benefits.

How to Download Excel Invoice Files

Obtaining pre-designed billing documents for your business needs is a simple process. These files are easily accessible and can be downloaded directly from various sources on the internet. Once you have selected a suitable format, the download process is straightforward and can be completed in just a few clicks.

To begin, you’ll want to find a reliable source that offers the document style you need. Many platforms provide a wide range of pre-built formats, allowing you to choose one that aligns with your business requirements. After locating the right file, you simply click the download button, and the document will be saved to your computer.

Here’s a step-by-step guide to help you:

- Visit a trusted website that offers these financial document formats.

- Browse through the available options and select a layout that suits your needs.

- Click on the download link or button next to your chosen file.

- Save the file to a location on your computer where you can easily access it.

- Open the file with your preferred spreadsheet software to begin customizing it.

By following these steps, you can quickly access the tools necessary to create detailed and accurate billing records for your business.

Benefits of Customizable Excel Invoices

Customizable financial documents offer significant advantages for businesses, providing the flexibility to tailor each record to specific needs. This adaptability allows companies to adjust the structure, appearance, and functionality of their billing documents to align with their brand identity and industry requirements. The ability to modify these resources ensures that every document is not only accurate but also professional and relevant to each transaction.

One of the main benefits of customizable solutions is the ability to adjust the layout and design. Businesses can easily incorporate their logo, select color schemes that match their branding, and even customize the fonts used in their documents. This personal touch enhances the overall customer experience and reinforces brand consistency across all communications.

Another key advantage is the flexibility to update and modify calculations based on specific business needs. Whether you need to apply special pricing, adjust for discounts, or include taxes, customizable billing structures allow for real-time changes. This reduces the risk of errors and ensures that every transaction is processed with complete accuracy, without the need for manual adjustments.

By using adaptable billing resources, businesses not only save time but also improve their ability to present clear, error-free documents that are tailored to their specific needs and client preferences.

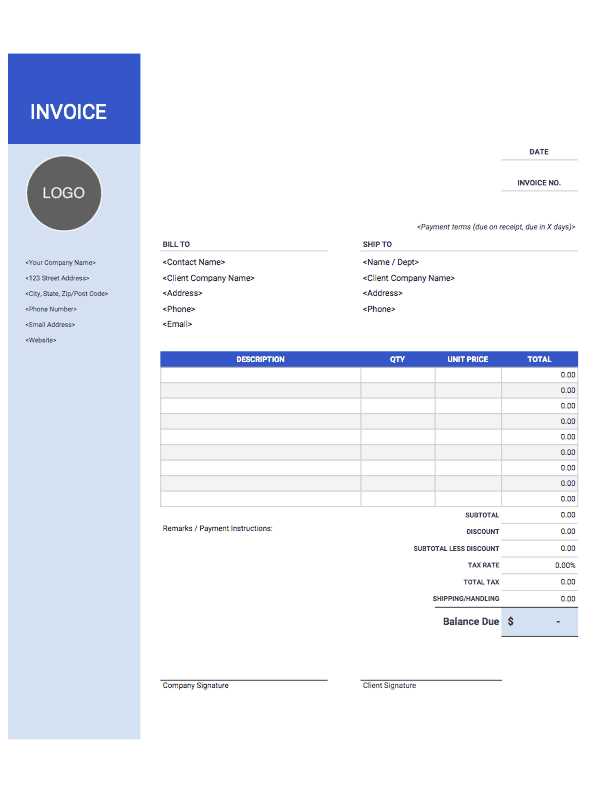

Creating Professional Invoices with Excel

Generating polished and well-organized payment documents is essential for maintaining a professional image. With the right tools, businesses can easily create clear, structured records that reflect their brand and provide all necessary details to clients. Using a spreadsheet program for this purpose allows for flexibility and customization, making it possible to design documents that meet your specific requirements while keeping everything accurate and organized.

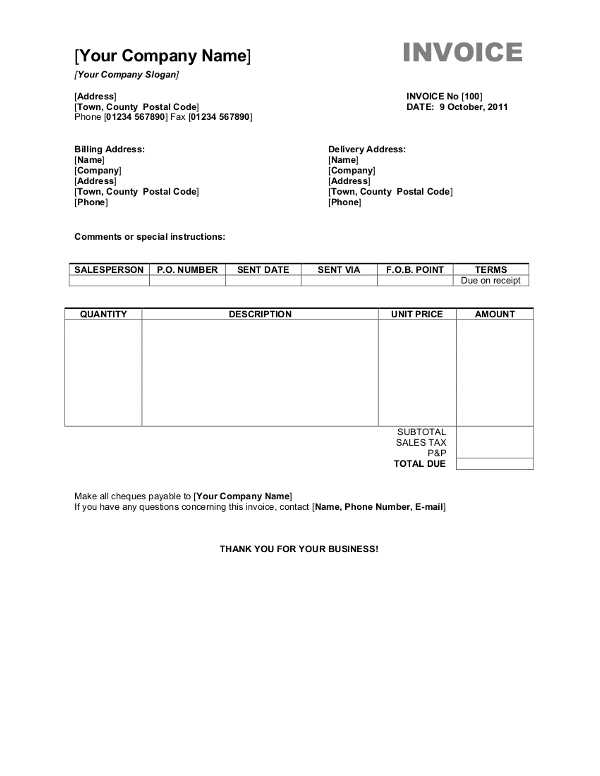

Steps to Create a Professional Payment Record

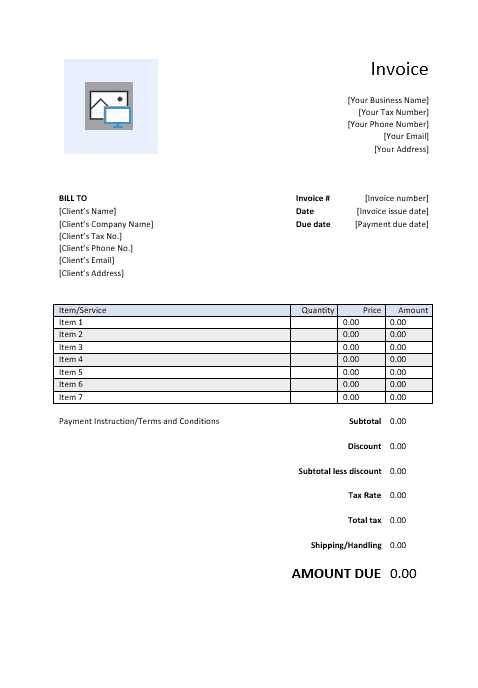

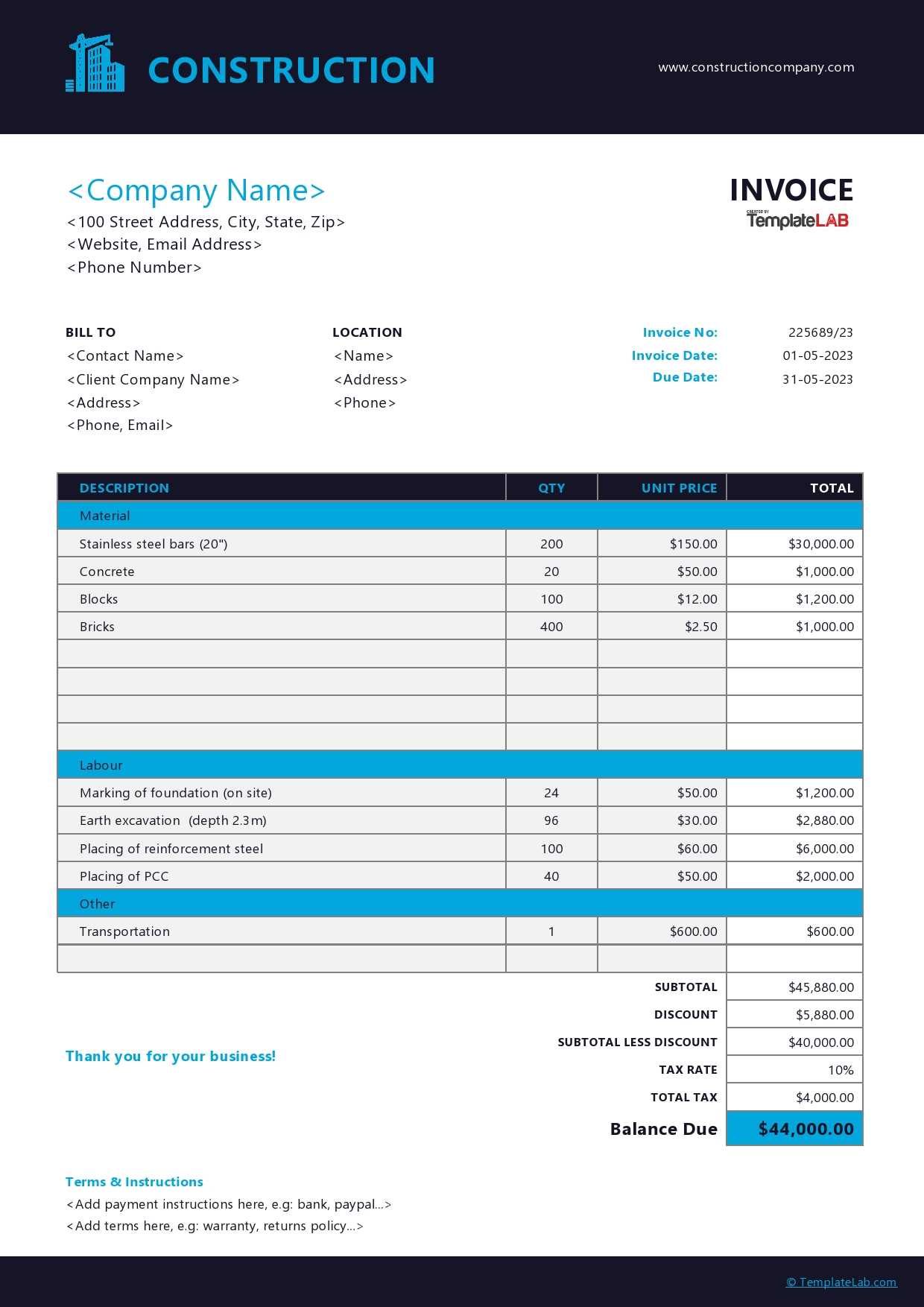

To start, choose a layout that suits your business needs, whether it’s a simple design or something more detailed with various sections for services, taxes, or discounts. Once the layout is chosen, input the necessary fields such as company name, client information, item descriptions, quantities, and prices. You can also incorporate formulas to calculate totals, taxes, or other fees automatically, ensuring accuracy with every use.

Formatting for a Polished Look

Formatting plays a significant role in the overall appearance of the document. Clean, easy-to-read fonts, proper alignment, and clear headings help ensure that the recipient can easily navigate and understand the payment details. A visually appealing design helps reinforce your brand’s professionalism and makes a positive impression on clients.

| Element | Purpose |

|---|---|

| Company Logo | Reinforces brand identity |

| Client Information | Personalizes the document and ensures proper communication |

| Automatic Calculations | Ensures accurate totals and reduces errors |

By following these steps and focusing on clean, professional formatting, businesses can produce documents that are not only functional but also project a polished and trustworthy image to clients.

Top Features of Free Invoice Templates

When it comes to managing payment requests and financial records, having well-designed, customizable documents is essential. The best pre-made tools provide a variety of features that streamline the billing process, ensuring accuracy, professionalism, and ease of use. These key features are designed to meet the needs of businesses across various industries, making it simple to create and manage financial documents quickly and efficiently.

Essential Features for Effective Payment Documents

Among the most important qualities of an ideal billing document, the following features are critical for ensuring smooth and accurate transactions:

- Customizable Layout: The ability to modify the structure and design of the document allows businesses to match their branding and personal preferences.

- Automatic Calculations: Built-in formulas for totals, taxes, and discounts make calculations quick and accurate, reducing the risk of human error.

- Client and Company Information Fields: Pre-designed fields for contact details, business information, and service descriptions allow for easy customization.

- Clear Formatting: Well-organized sections, readable fonts, and professional spacing make the document easy to navigate and understand.

- Multi-Currency Support: Some documents allow you to easily switch between different currencies, making them ideal for international business.

Additional Benefits of Advanced Features

In addition to the essential features, many tools offer extra functionalities that further enhance the usefulness of your financial documents:

- Recurring Billing Options: For businesses with regular clients, some formats offer the ability to create recurring payment schedules automatically.

- Digital Payment Links: Many pre-designed documents include options to add payment links, allowing clients to pay directly through the document.

- Cloud Integration: Certain solutions enable saving and sharing of documents via cloud storage, ensuring access from multiple devices.

By incorporating these advanced features, businesses can create documents that not only meet their immediate needs but also enhance overall efficiency and professionalism.

How to Personalize Your Invoice Template

Customizing your billing documents to reflect your brand and business needs is essential for creating a professional and cohesive look. Personalizing these resources not only improves the overall appearance but also enhances the client experience by making each document feel tailored and specific to them. Whether you are adding your company logo or adjusting the layout to highlight particular details, the customization process is simple and offers many possibilities.

Steps to Personalize Your Billing Document

Here are the main ways to customize your financial records, making them unique and aligned with your business identity:

- Insert Your Logo: Uploading your logo at the top of the document ensures your brand is immediately visible, reinforcing your company’s identity.

- Adjust Fonts and Colors: Change the font style and color to match your branding guidelines. This simple adjustment can make your document more appealing and consistent with other company materials.

- Modify Section Headers: You can rename sections to better fit your services, such as changing “Description” to “Service Provided” or “Total Due” to “Amount Payable.”

- Include Additional Information: Customize the fields to include extra details relevant to your business, such as payment terms, order numbers, or client reference numbers.

Adding Special Features for Better Clarity

In addition to basic changes, several other features can make your billing document clearer and more functional:

- Adjust Column Widths: Make sure that all your information fits neatly within the document. Adjust the width of columns to ensure that text isn’t cut off and everything is readable.

- Set up Calculations: Customize formulas for taxes, discounts, or shipping fees, ensuring automatic updates whenever the numbers change.

- Change Currency Symbols: For international businesses, changing the currency symbol or formatting helps avoid confusion and keeps the document relevant for clients in different regions.

Personalizing these documents is not only about aesthetics; it’s also about making sure your billing process is efficient and aligned with your company’s unique needs.

Saving Time with Ready-Made Templates

Using pre-designed tools for creating financial documents can significantly reduce the time spent on administrative tasks. Instead of starting from scratch, businesses can access a variety of ready-to-use formats that are already structured and designed to include all necessary fields. This allows you to focus on the core aspects of your business rather than spending time formatting and organizing each document individually.

Quick Document Creation

With pre-built solutions, the process of generating a payment request becomes a matter of filling in relevant details rather than designing the layout and calculating totals from scratch. The fields are already set up, and many have formulas integrated to automatically calculate amounts, taxes, and discounts. This makes it easy to generate accurate records in just minutes, reducing the overall time spent on billing tasks.

Streamlined Workflow

Having ready-to-use resources also creates a more efficient workflow. By standardizing your billing process, you eliminate the need for repetitive tasks, such as constantly adjusting layout or recalculating totals. This consistency across documents not only saves time but also ensures that every record looks professional and is error-free.

By implementing these ready-to-use resources, businesses can dramatically speed up their billing process, allowing more time to focus on growing and managing their operations.

Managing Client Payments Using Excel Templates

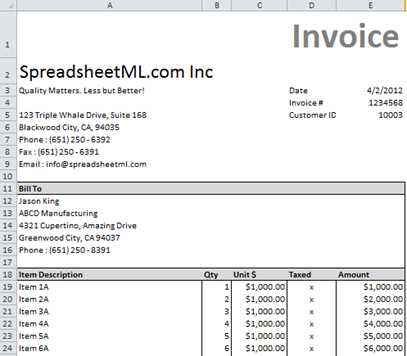

Efficiently tracking and managing payments from clients is crucial for maintaining healthy cash flow and ensuring business operations run smoothly. Using structured resources designed for this purpose can simplify the process and help businesses stay organized. By inputting payment information into a predefined framework, companies can easily monitor due amounts, received payments, and outstanding balances without the need for manual calculations or complex record-keeping systems.

These customizable frameworks allow for seamless tracking of each transaction, ensuring that no payment goes unnoticed. Key fields can be designed to track important details, such as client names, payment amounts, due dates, and payment status, all in one place. This organized approach not only saves time but also minimizes the risk of missing payments or errors in calculations.

In addition, many of these tools allow for quick updates to reflect payments received, making it easier to mark transactions as paid, partially paid, or pending. This feature helps you maintain an accurate financial overview and ensures you are always up-to-date with your client’s payment status.

By using such structured frameworks, businesses can streamline their payment management process, reducing administrative effort and improving overall financial accuracy. This allows more time to focus on other critical aspects of the business while keeping financial records in order.

How to Add Taxes and Discounts

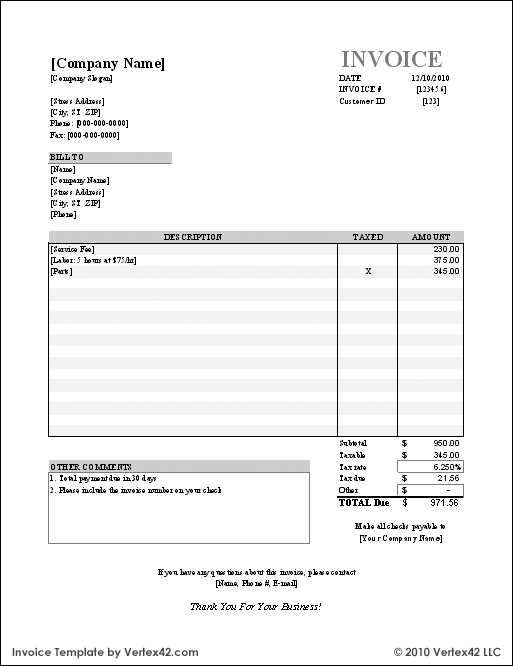

Incorporating taxes and discounts into payment documents is an essential part of ensuring accurate billing. Whether your business operates in a region with a fixed tax rate or offers periodic discounts to clients, it’s important to include these elements in a way that is both transparent and precise. Fortunately, most pre-designed frameworks allow for easy customization, including the ability to calculate and apply taxes or discounts automatically.

To add taxes: You first need to identify the applicable tax rate for your product or service. Once the rate is determined, you can create a field in the document where the total tax amount is calculated based on the subtotal of the items or services provided. Many tools already have built-in fields for tax calculations, but if not, you can easily set up a formula that multiplies the subtotal by the tax rate.

To apply discounts: Discounts can be calculated as a percentage or fixed amount. If the discount is percentage-based, it’s important to set up a field that calculates the discount amount by multiplying the total amount by the discount percentage. Similarly, for a fixed discount, you can simply subtract the specified amount from the total. This ensures that the client sees the adjusted price clearly, without any confusion.

Both taxes and discounts can be shown clearly in their own sections within the document. This not only helps to keep everything organized but also allows for full transparency, as the client can see exactly how much they are being charged for each element of the transaction.

By using these tools, businesses can ensure their financial documents are both accurate and easy to understand, ultimately improving customer trust and satisfaction.

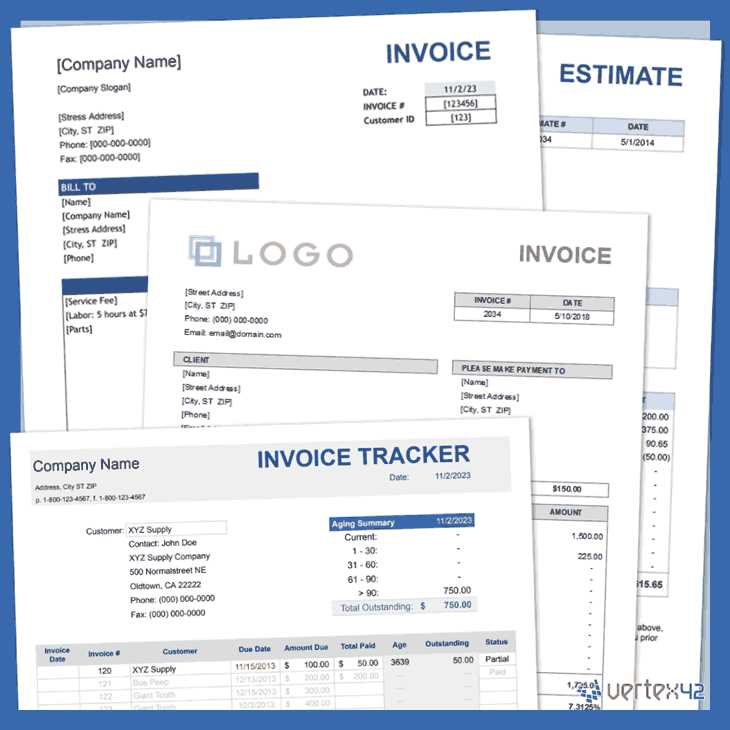

Tracking Your Invoices in Excel

Efficient tracking of financial records is crucial for any business. Keeping a close eye on payments, due dates, and outstanding balances ensures smooth cash flow management and minimizes the risk of missing payments. Using a spreadsheet program to manage your billing information allows you to track and organize all transactions in one place, providing you with real-time updates on the status of your financial dealings.

Essential Steps for Tracking Payments

Tracking financial records can be streamlined by following a few basic steps:

- Record Transaction Details: Start by documenting key details of each transaction, such as the client’s name, invoice number, payment due date, and total amount. This makes it easy to refer to specific records when needed.

- Update Payment Status: Once a payment is received, update the status of the record to “paid,” or “partial payment” if applicable. Keeping this information current helps you monitor your outstanding balances and avoid confusion.

- Use Automatic Calculations: Set up formulas to calculate totals, taxes, and balances, so you can track outstanding amounts automatically. This feature saves time and ensures accuracy.

Organizing Your Financial Records

In addition to recording individual payments, organizing your entire financial overview is key for effective tracking:

- Sort by Due Dates: Organize your records by due date to quickly identify which payments are overdue. This can help you prioritize follow-ups with clients.

- Filter by Client: Group payments by client to see a clear picture of each client’s payment history. This is helpful for managing multiple transactions and maintaining client relationships.

- Use Color Coding: Implement color codes to indicate the status

How to Print and Email Your Invoice

Once you’ve created and customized your financial document, the next step is to share it with your client. Printing and emailing the document ensures that it reaches the recipient in a timely and professional manner. Both options are straightforward, but understanding how to properly format and send the document can enhance your business communication and avoid errors.

Printing Your Document

Printing your payment document is a simple process, but it’s important to ensure that it looks professional when printed. Follow these steps to ensure the document is correctly formatted for printing:

- Preview Before Printing: Always use the preview function to check how the document will appear when printed. This step helps you identify any formatting issues, such as text that is too close to the edges or large spaces between sections.

- Set the Correct Paper Size: Ensure your document is set to the appropriate paper size, typically A4 or Letter, to avoid any part of the document being cut off.

- Print a Test Page: Before printing multiple copies, test the print with one page to verify that the text is clear and the layout is correct.

Emailing Your Document

Sending your document via email is an efficient and eco-friendly way to deliver payment requests. Here’s how to email it effectively:

- Save the Document in PDF Format: To ensure the formatting remains intact and the document is easily readable on any device, save your file as a PDF before attaching it to your email.

- Write a Professional Email: Craft a clear and polite message, briefly explaining the attachment and any payment instructions. Be sure to include your contact details in case the client has questions.

- Attach the Document: Attach the saved PDF file to the email, ensuring the file name is clear and includes relevant information, such as the client name or invoice number, for easy reference.

By following these steps, you can ensure that your payment documents are presented in a professional manner and delivered to your clients efficiently, whether in printed or digital form.

Ensuring Accuracy in Excel Invoices

Accurate financial records are essential for any business, as even small errors can lead to misunderstandings or financial discrepancies. When generating payment documents, it’s critical to ensure that all numbers, calculations, and details are correct to maintain professionalism and trust with clients. Using built-in features and strategies can help avoid common mistakes, allowing you to create error-free records that reflect your business’s standards.

Utilizing Built-in Calculation Features

One of the greatest advantages of using a spreadsheet program for financial documents is the ability to automate calculations. By setting up formulas, you can ensure that totals, taxes, discounts, and other relevant values are calculated correctly every time.

- Automatic Totals: Use the SUM function to automatically calculate the total amount of products or services provided. This eliminates the need for manual addition and reduces the chance of errors.

- Tax and Discount Calculations: Set up formulas to calculate tax rates and apply discounts based on the original total. This ensures that the correct amounts are added or subtracted without needing manual intervention.

- Consistent Currency Formatting: Always use consistent currency formatting for all monetary amounts. This prevents confusion and ensures that amounts are properly represented.

Double-Checking Key Information

Even with automated calculations, it’s still important to double-check other critical details in your financial documents to avoid any mistakes that might affect client relationships.

- Client and Service Details: Verify that the client’s name, address, and other contact information are accurate. Also, check that the service description matches the work provided.

- Due Dates and Payment Terms: Ensure that due dates and payment terms are correct, and that they align with the agreed-upon terms with the client.

- Review for Typos: Look for any spelling or grammatical errors that may affect the document’s professionalism. A clean, well-organized record reflects well on your business.

By leveraging the built-in tools and double-checking the details, businesses can ensure that their financial records are both accurate and professional, reducing the chan

Using Excel to Automate Invoice Creation

Automating the creation of billing documents can save significant time and effort, allowing businesses to generate accurate records with minimal manual input. By setting up a system that automatically populates certain fields and performs calculations, companies can streamline the process, reducing the risk of errors and ensuring consistency across all documents.

Steps to Automate the Creation Process

Here are some key steps for using a spreadsheet program to automate the creation of your financial records:

- Create a Master Template: Set up a master version of your document, with predefined fields for client details, item descriptions, quantities, and pricing. This will serve as the foundation for all future documents.

- Use Drop-Down Lists: Implement drop-down lists for fields like client names, payment terms, or product descriptions. This allows for quick selection of predefined values, reducing the risk of errors from manual typing.

- Set Up Automatic Calculations: Leverage built-in formulas to calculate totals, taxes, discounts, and final amounts. For example, using a SUM function will automatically add up item prices, while custom formulas can apply taxes or discounts based on inputted values.

- Auto-Generate Invoice Numbers: Use a formula or script to generate unique invoice numbers automatically each time a new document is created. This ensures there is no duplication and helps with organizing records.

Benefits of Automating Invoice Creation

By automating your billing process, you can enjoy several benefits:

- Efficiency: Automated systems can generate multiple documents in a fraction of the time it would take to manually create each one.

- Accuracy: Reducing human input minimizes the chances of mistakes, ensuring the integrity of financial records.

- Consistency: Automation ensures that every document follows the same format and includes the same key information, creating a uniform and professional look across all client communications.

By utilizing automation tools in spreadsheet programs, businesses can simplify their administrative tasks, enhance accuracy, and ultimately improve workflow efficiency.

Compatibility of Excel Templates with Other Software

When managing financial documents, it’s essential to ensure that your data can be easily shared and integrated across various platforms and software. While spreadsheet programs are popular for creating and organizing records, compatibility with other applications can significantly enhance workflow efficiency. Understanding how your documents work with different systems helps you make the most of your resources and prevents data transfer issues.

Key Considerations for Compatibility

To ensure seamless integration, consider the following factors:

- File Formats: Most spreadsheet programs support common formats such as CSV, XLSX, and ODS. These formats can be opened by various other applications, allowing for easy sharing and importing of data between different platforms.

- Data Export Options: When working with customer relationship management (CRM) or accounting software, check if the spreadsheet system allows direct export of data to these tools. Many modern accounting programs can directly import data from CSV or XLSX files, streamlining the process of updating client records.

- Cloud-Based Compatibility: Many cloud services support the same file formats used by traditional desktop spreadsheet programs. By saving your files in the cloud, you can access and edit documents across multiple devices and applications, making collaboration easier.

Popular Software That Supports Spreadsheet Files

Several well-known software applications are designed to work well with data created in spreadsheet programs:

- Accounting Software: Programs such as QuickBooks and Xero allow users to import and export data from spreadsheet files, making it easier to sync billing details and client information with your accounting system.

- Customer Management Tools: CRM platforms like Salesforce can accept data from spreadsheet files to update customer records, track transactions, and generate reports.

- Cloud Platforms: Google Sheets and Microsoft OneDrive offer compatibility with traditional spreadsheet files, allowing easy sharing and real-time collaboration.

Ensuring compatibility between spreadsheet files and other software can improve efficiency, reduce manual data entry, and make it easier to manage client records and financial reports across different tools and platforms.

Free Invoice Templates vs Paid Options

When selecting tools to generate billing documents, businesses are often faced with the choice between using no-cost resources or investing in paid solutions. Both options have their advantages, but it’s essential to understand how they compare in terms of functionality, customization, and long-term value. While free resources can be sufficient for some, paid solutions may offer additional features that justify the investment, especially for businesses with more complex needs.

Advantages of Using No-Cost Resources

No-cost resources provide a quick and accessible way to create financial records without incurring any extra expenses. Some key benefits include:

- Low or No Cost: The most obvious advantage is that free options come at no expense. Small businesses or freelancers can benefit from immediate access to usable tools without any upfront cost.

- Simplicity: Free resources are often simple and straightforward to use. They typically come with basic features, making them ideal for businesses with minimal invoicing requirements.

- Easy Access: Many free solutions are readily available and don’t require subscriptions or long-term commitments, making them convenient for short-term or occasional use.

Benefits of Paid Solutions

While free tools may suffice for basic needs, paid options offer more advanced features, customization, and integration capabilities. Here are some of the benefits of opting for a paid solution:

- Customization and Flexibility: Paid services often allow for more extensive customization options. This means businesses can tailor billing documents to their specific branding and unique requirements.

- Advanced Features: Many paid tools come with additional functionality, such as automatic tax calculations, recurring billing options, and detailed reporting, which can help streamline financial management.

- Integration with Other Software: Paid solutions are often designed to integrate seamlessly with accounting systems, CRM tools, and other business software, reducing the need for manual data entry and improving accuracy.

In conclusion, while free resources can be an excellent starting point for individuals or small businesses with basic needs, paid solutions offer more robust features and long-term benefits that can help businesses scale and maintain efficiency in their financial processes.

Where to Find Quality Invoice Templates Online

Finding reliable resources for creating billing documents is essential for any business. Whether you’re a freelancer, small business owner, or part of a large enterprise, having access to well-designed and functional templates can help streamline your administrative tasks. While there are numerous platforms offering templates, it’s crucial to choose sources that provide both professional designs and flexibility to suit your needs.

Top Platforms to Access Billing Document Templates

Several reputable websites offer templates that can be easily customized for your business needs. Here are some of the best places to start your search:

- Microsoft Office Templates: Microsoft provides a variety of pre-designed document formats that can be downloaded and customized. These options are often compatible with other software and are easy to use, making them a popular choice for business owners.

- Google Docs and Sheets: Google’s suite of tools offers a range of free document formats that are cloud-based, allowing you to easily edit and share your files. Their templates can be customized and accessed from any device, providing great flexibility.

- Template Marketplaces: Platforms such as Etsy or Template.net offer high-quality, professionally designed files for purchase. These often come with advanced features and customization options, ideal for businesses looking for a more polished appearance.

Where to Find Specific Features and Customization

If you’re looking for templates with specific features like automated calculations or the ability to handle recurring payments, consider exploring the following:

- Accounting Software Platforms: Many accounting programs provide templates that are specifically designed to integrate with their system, ensuring seamless data flow between your financial records and software.

- Freelancer and Small Business Websites: Websites catering to small businesses, like FreshBooks or Zoho, often have tools to generate invoices with a variety of designs and customizable options.

- Design Platforms: Websites like Canva or Adobe Spark offer visually appealing designs that can be easily adapted for billing purposes. These platforms allow you to create a unique look for your records while maintaining professional quality.

By exploring these resources, you can find high-quality document templates that suit your business needs and ensure smooth, professional transactions